Research Article: 2021 Vol: 25 Issue: 5

Priority Factor Analysis on Cash Waqf Linked Sukuk (Cwls) Utilization in Indonesian Shariah Capital Market

Citra Sukmadilaga, Universitas Padjajaran

Evita Puspitasari, Universitas Padjajaran

Devianti Yunita, Universitas Padjajaran

Lucky Nugroho, Universitas Mercu Buana

Erlane K Ghani, Universiti Teknologi MARA

Citation: Sukmadilaga, C., Puspitasari, E., Yunita, D., Nugroho, L., & Ghani, E.K. (2021). Priority factor analysis on cash waqf linked sukuk (cwls) utilization in indonesian shariah capital market. Academy of Accounting and Financial Studies Journal, 25(6), 1-14.

Abstract

The research will be focusing on CWLS's growth and development of its implementation by researching its potential utilization in the capital market and the challenges and setbacks that affect the growth and penetration of the instrument in the capital market. The research study utilizes a combination research method, which utilizes both qualitative research and quantitative research, which are achieved through conducting primary interviews with the critical interviewees within the related field of expertise to the topic of the research and utilizing Analytical Hierarchical Process (AHP), which enable the quantitative method to be utilized using the qualitative data inputs from the interviews. The results are shown that CWLS is still lagging in terms of regulations and laws conforming. In addition to the lack of socialization or education to introduce the CWLS instrument to the potential investors. Nevertheless, along with the challenge, the population's adaptation capabilities to information technology and financial literacy affect the lack of growth and development of CWLS to be implemented. On the other hand, the research has shown a confident perspective in regards to the potential utilization and the features with the diverse investment activities and Shariah compliance adaptation implemented through CWLS, opening more opportunity for a more varied scale of implementation as well as a variety of investment activities and asset under management.

Keywords

Cash Waqf, Sukuk, Islamic Instrument, Analytical Hierarchy Process.

JEL Classification Code

G10, G20, M21, M41.

Introduction

The advancement of Islamic finance in the modern world, developed in terms of the systematic knowledge of Islamic finance and its application into the economic system, has garnered a positive response globally. The fundamental highlights of Islamic finance focus not only on commercial transaction treatments but also stresses the importance of upholding the Shariah values in the ever-developing age, with the principal value focuses on economic and financial practices which condemn Riba (extracting money from money), Mayshir (Gambling and Speculation), and Gharar (uncertainty-based transactions), as upheld by Islamic values (Nugroho et al., 2017).

Shariah, banking and finance development, has been experiencing rapid growth, improving Shariah mutual funds, bonds, Shariah pawnshop practices, Shariah insurance, Shariah capital market, and Baitul Mal wat Tamwil-Islamic Microfinance (BMT), among many others. In this respect, the Shariah financial approach and economical approach have covered the financial and real sectors, including Shariah Hotels and Shariah Multilevel Marketing, among other things. The continuing growth of Islamic finance can be traced to developing its financial instruments throughout the world. This particular research would highlight specific financial instruments Sukuk or familiarly, referred to as Shariah bonds Waqf (Endowment fund).

In Indonesia, Bank Indonesia (BI) has valued Shariah finance's potential to contribute to commercial, financial instruments and develop its economy. In this respect, the Indonesian Waqf Board (IWB) focuses on the development of Sukuk and Waqf market, along with the development of State Shariah Securities, with each of which according to Mohammad Nuh, Head of IWB stated in 2018, there was Rp 199 billion worth of waqf funds utilization as per March 2018 (Saptono, 2019). One of the recent initiatives attempted through collaboration between IWB, Bank Indonesia (BI), and the finance ministry for the launch of Cash Waqf Linked Sukuk (CWLS).

CWLS serves as one of the new investment instruments in Indonesia's Shariah Capital Market. It is composed of a combination of the allocation funds through Cash Waqf and Sukuk. This incentive is supported by utilizing the investment instrument through several Banks in collaboration with IWB. In 2019, the number of funds managed and allocated was gathered through IWB as the nazir through BNI Shariah bank as the Islamic Financial Institution (IFI) recipient of cash waqf be issued by the ministry of finance. In response, the cash waqf accumulated was amounted to Rp 50 billion to be issued, which would be supported for Waqf Sukuk to develop a variety of Sukuk instruments (Utami, 2020).

In the recent discovery of this research, the amount of Cash Waqf Linked Sukuk is approximately Rp 54.623.851, managed by BNI Shariah bank, and Rp 62.244.101 managed by Muamalat Bank Indonesia. This amount was accumulated and issued due to the regulation, which established a waqf fund threshold of Rp 50 billion for issuance. Based on the CWLS issuance's perspective in the Indonesian capital market, the financial instrument has experienced several obstacles and challenges for its utilization and exposure in the Indonesian Shariah capital market (Fauziah et al., 2021).

Thoroughly studying the implementation of CWLS, which comprises Sukuk and Waqf as the supporting financial investment package, several research types focus on the potential investors' perspective and the capital market development experienced in the Indonesian Shariah Capital Market. In this respect, the Indonesian capital market research would represent Sukuk and Waqf development in Indonesia and its market potential (Musari, 2016; Nugroho et al., 2020). However, research conducted to study the utilization of the Waqf fund and its allocation system in Indonesia is relatively lacking, particularly in the socialization of Waqf, indicating the apparent lack of literacy of Waqf in the Indonesian population (Sardiana & Zulfison, 2018). Also, there have been several studies focusing on the investment risk and risk management in Cash Waqf, in which discovered that in identifying the underlying asset value of productive waqf fund allocation may be deducted during the investment period due to notable factors of loss that occurred from the business risk of the Waqf itself, natural depreciation on value, and potential loss due to the business and financial risk (Ahmed, 2007). Depreciation issue is also elaborated through the argument in which for fixed physical assets that are invested through Waqf (Buildings, for instance) are exposed to the potential risk of depreciating value due to lack of renovation/maintenance, natural disasters, deteriorating value due to inflation, force majeure occurrence and also mismanagement by the Nadzir can affect the risk (Hasanah, 2011).

Despite this, however, studies have also emphasized Waqf and Sukuk's potential implementation into the capital market to generate prospective investment through its various financial instruments and investment allocation. One of which regarding the potential of Waqf, particularly Cash Waqf, provides the opportunity of more dynamic Waqf fund allocation, with the apparent development of Fiqh concepts that are more approachable to the economic environment, thus enhancing waqf management and collaboration with Islamic Financial Institutions (IFI) and other shariah banks further to improve the Asset under Management (AUM) value of productive Waqf investment (Abdullah, 2018). Although this is also in acknowledgment of the apparent challenges of ensuring public trust in Waqf and the challenge in asset management in Waqf since most of the underlying assets are primarily on fixed assets such as land and building, thus imposing risks on administrative and land ownership issues (Anuar et al., 2019).

Furthermore, based on the potential implementation of CWLS, analysis is needed relating to (i) How is the potential for public acceptance of CWLS products based on aspects of financial literacy; (ii) What is the potential for public acceptance of CWLS products based on technological literacy aspects; (iii) What is the potential for public acceptance of CWLS products based on regulatory aspects; (iv) What is the potential for public acceptance of CWLS products based on the risk aspect; (v) What is the potential for community acceptance of CWLS products based on the aspect of utilization. Therefore, the purpose of this study is to analyze the potential implementation of the CWLS product. The implications of this research are as input for practitioners, regulators, and academics related to the development of waqf in the future. In addition, the novelty of this research is related to the topic of CWLS, which is viewed from aspects of financial literacy, technological literacy aspects, regulatory aspects, risk aspects, and utilization aspects.

Literature Review and Hypothesis Development

Al-Ghazali interpreted Maqashid al-Syariah in Shariah's perspective as "a means and objective of preserving for fundamental survival, maintaining damage factors, and encouraging prosperity." Therefore, Maqashid is upholding as it becomes the fundamental principle in developing Islamic finance and economy, represented through the mechanism of financial transactions, to encourage prosperity and preserve wealth, as classified by daruriyyat (Nugraha et al., 2020). Also, according to Nordin et al. (2017), in a discussion of Maqashid Syariah for assets, it becomes an essential highlight in achieving the highest objective, guidance in religious values (Hifzh al Din-Maintain the religion). According to Afiyana et al. (2019) and Sukmadilaga & Nugroho (2017), Maqashid al Syariah's principles emphasize ethics, moral, social, and religious values to ensure fairness, equality, and justice. Moreover, Islamic finance activities and investment also include waqf fund allocation and Sukuk issuance and management, with highlights in waqf investment on land assets as the underlying assets (Dewi et al., 2020). Therefore, the implementation of Islamic teachings must be totality or kaffah so that all human activities, including commercial activities, can impact increasing the welfare of the ummah or benefiting the community.

Sukuk is defined as Shariah bonds, and according to AAOFI (Accounting and Auditing Organization for Islamic Financial Institution), the definition of Sukuk are as follows: Investment Sukuk are certificates of equal value representing an undivided share in the ownership of tangible assets, usufructs, and services, or (in the ownership of) the assets of particular projects or unique investment activity; however, this is true after receipt of the value of the Sukuk, the closing of subscription and the employment of funds received for the purpose for which the Sukuk was issued. Based on this definition, Sukuk instruments are available on various instruments representing special investment activities or projects with the allocation of underlying assets, conversely related to bond markets, found through the causal relationship between Sukuk and conventional bonds (Rahman et al., 2020). Furthermore, the potential of Sukuk is closely comparable to Conventional Bonds (CB) in which comes from conventional Investment Banks (IB). In this respect, various studies focus on comparing each of the instruments' performance and risk factors. One factor studied about the topic is that the target return regarding the capital structure, in which Sukuk was studied to perform better than conventional bonds due to the variety of investment activities in underlying assets, provides more coverage than conventional bonds (Sherif & Erkol, 2017). Waqf is the word derived from the Arabic word “Waqafa," which translates to "sustain" or "stop" or "stationery." In this respect, in Islam, Waqf is not precisely mentioned in the Quran. However, Waqf in principles itself is highlighted in the Quran and the Sunnah. Waqf refers to establishing funds and administering the appointed trustee for charitable activities according to shariah compliance (Mahat et al., 2015). Waqf serves two general-purpose, in which it provides a medium to a perpetual cycle of rewards upon the donor while also contributing towards socio-economic benefits for the community. On the other hand, referring (Monzer Kahf & Amiirah Nabee, 2017) define Waqf as follows: holding particular property and preserving it for the confined benefit of specific philanthropy that prohibits any use or disposition outside that specific objective. Based on the interpretation and definition of Waqf, it suggests that Waqf not only represents donation for an immovable property but also includes a donation to movable property or charitable causes, comprising of donation through usufruct and cash, which indicated the means of Waqf is mainly for a nonprofit cause. The potential function and utilization of Waqf have put attention to the financial system to acknowledge the scale of utilization and potential of Waqf and its allocation towards the projects. In terms of its scale, Waqf can be implemented through every scale of activities, varying from small, microscale in which implemented for small scale waqf projects, emphasizing the maximum participation from targeted community or institutions through a minimum waqf contribution (Azha et al., 2013). Several countries in which the implemented Islamic microfinancing system have affirmed Waqf and Zakat's implementation to contribute and benefit economic activities in the targeted communities, which focuses more on the community's development instead of providing financial services required for the underprivileged community (Sait & Lim, 2005). There is also a more extensive implementation of Waqf, especially the implementation in IFI and Islamic banks to utilize the management of Waqf, which utilized to complement monetary instruments to be beneficial Shariah compliance investment and financing, unlocking the potential for waqf allocation for financial investment. In terms of its instruments, Waqf mainly comprises a variety of financial instruments utilized for the projects. One of the mainly accepted instruments is Cash Waqf, which has become the accepted instrument allocated on projects, both in terms of moveable properties and immovable properties in the community (Khaliq et al., 2019). The variation of Cash waqf instruments is primarily implemented and introduced by IFIs and Islamic banks in accordance to the respective Shariah compliance investment, which mainly includes but not limited to Mudarabah, Musharakah, Murabahah, Ijarah, and many more, which serves appropriately for the investment projects according to the Shariah compliance (Aziz et al., 2021). Furthermore, the research analysis within the research scope establishes relevant criteria and alternatives, which will be considered significant in studying the research objectives. In this aspect, the possible criteria are presented as follows:

- Utilization: Utilization refers to the potential of the available shariah investment alternatives are measured in terms of their utilization capabilities, which in terms of Shariah financial instruments, refer to the availability and capabilities of a variety of Shariah compliance to be implemented into each of every financial instrument, and to be implemented towards underlying assets (Bahari et al., 2021; Kasim, 2012). Besides, it also considers the scale of implementation, applicable to either small scale or large scale implementation

- Technological Literacy: Technological literacy refers to the level of technological literacy, indicated through the participation of potential investors and their adaptation in using the digital platform or technological gadgets to exercise investment decision, including on how to process information in the digital age as well as the capability to make decisions from Information and Communication Technology (ICT) (Metanfanuan et al., 2021).

- Financial Literacy: It is referred to as financial literacy in a targeted segment of the population. In this respect, the criteria are highly considered due to the distribution of education and information regarding the Indonesian population's financial investment and the significance of financial literacy in affecting Shariah financial instruments' investment decisions (Sudirman et al., 2020).

- Regulation: Regulation refers to the regulatory bodies or authorities with the established laws and regulations conform to the shariah financial instruments and IFIs financial practices. In this respect, in Indonesia, the regulation and law would refer to whether the shariah instruments being evaluated are properly regulated or not. The rules and regulations can adequately regulate the alternatives. Moreover, aside from regulation conforming to the investment alternatives, the laws and regulations regarding the financial practices of the institutions would also influence the business practice such as bank capital, ratios, market competition barriers, and sensitivity regarding credit lending (Saona, 2016)

- Risk: Risk refers to the level of risk exposed by each of the shariah investment instruments. The level of risk is measured by the exposure of each investment alternative to a degree of risk. The risk may refer to the business and financial risk, and the risk of investment on the underlying assets such as fixed asset depreciation, mismanagement, and deteriorating value (Hassan et al., 2013, pp.268; Lewis, 2008). Nevertheless, based on the available shariah investment alternatives studied within this research, the research decided on the three relevant alternatives to be further studied in terms of their relevance and comparable level of significance in terms of its influence on the research objective, which is the growth in CWLS introduction and implementation in Indonesian capital market. In this respect, the relevant alternatives are presented as follows:

- CWLS: CWLS refers to Cash Waqf's investment instruments linked with Sukuk instruments. These particular instruments apply to a variety of shariah compliance and investment activities following the investment in underlying assets

- Shariah Sovereign Securities (Surat Berharga Syariah Negara/SBSN): SBSN refers to government-issued Shariah securities that accommodated certain investment activities onto underlying asset investment. SBSN is closely related to government-issued bonds/obligations with distinctive shariah specifications

- Shariah Stocks: Shariah stocks refer to the common stock issued and publicly traded in the Indonesia Stock Exchange, in which Syariah stocks represent the stock composition of Syariah companies.

Research Methods

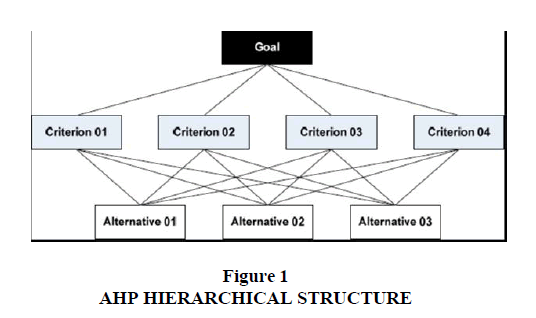

The qualitative method of research will be conducted through interviewing primary sources, which would be conducted through a semi-structured interview, to provide rigid responses in accordance to the research objectives, but also provide room for improvisation or extension on the progression of the research scope in which may be gained from additional interviewee's responses. In addition to the semi-structured interview, the research will also implement the Analytical Hierarchical Process (AHP). AHP is a research method that combines the essence of qualitative data inputs to be processed into a quantitative method and is often represented in terms of a matrix to allow comparison and association of criteria attributable to the apparent alternatives to be compared quantitatively. Founded and developed by Thomas L Saaty (Saaty, 2016) and this method is conducted by forming a hierarchical structure consisting of:

- Goal: represents the node of goal in which the research is trying to define as objective. The goal would represent the result and target to be achieved under the underlying criteria attributed to the alternatives;

- Criteria: Criteria represent the nodes that define the attributes or characteristics that affect the goal or target condition. Criteria are attributable to the available alternatives being researched, which may be measured over its importance, likeliness, probability of occurrence, and other types of measurement utilized to compare and measure one alternative over the other;

- Alternatives: Alternatives represent the available choice of alternatives/ options to be measured and compared in terms of the criteria' significance and how they affect the end goal.

The research team conducted the semi-structured interview involving the target interviewee with a professional background in Islamic finance and economics. As a result, the interviewees collected in this research regarding Cash Waqf Linked Sukuk in Indonesia are experts and practitioner in the institutions as follows:

- Financial Service Authorities (Otoritas Jasa Keuangan/OJK)

- Indonesian Waqf Board/ IWB (Badan Wakaf Indonesia/BWI)

- Bank BNI Shariah Headquarter, Jakarta.

The following interviewees interviewed are as follows:

- Prof. Dr. Ir. Mohammad Nuh: Head of IWB

- Much. Anwar Bashori: Chief Department of Syariah Finance and Economics, Indonesian Bank

- Muhammad Fuad Nasar: Director of Zakat and Waqf Utilization Department, Ministry of Religion

- Dwi Irianti Hadiningdyah: Ministry of Finance, Director of Shariah Financing

In terms of the illustration, the hierarchical structure of the AHP method is illustrated in figure 1 as follows:

The calculation of AHP criteria and alternatives regarding the significance or importance value will be measured with Saaty’s 9-point scale ratio. The scale will be representing the value of 1 to 9. The larger the value, the higher the significance of the attribute being measured. The outlines of the description of the significance of the value are shown as in Table 1, as follow:

| Table 1 SAATY’S 9-Point Scale |

|

| Definition | Intensity of Importance |

|---|---|

| Equal Importance | 1 |

| Weak | 2 |

| Moderate Importance | 3 |

| Moderate Plus | 4 |

| Strong Importance | 5 |

| Strong Plus | 6 |

| Very Strong or demonstrated importance | 7 |

| Very. Very strong | 8 |

| Extreme importance | 9 |

Source: Rozan, 2016 (The Analytic Network Process for Dependence and Feedback)

The intensity of each node's importance is measured and compared between criteria, and eventually, the attributed alternatives will be compared with matrix calculation to compare the importance of the values. The results will be eventually computed and compared as it represents the compared value of the significant factor in regards to the qualitative data inputs. For example, when criteria A is valued at 3 when compared with Criteria B, then it indicates that criteria A are three times more important than Criteria B, while Criteria B is 1/3 as critical as criteria A, and further on. The result obtained from each of the respondents' pairwise comparison would be calculated for the Geometric mean. Finally, the geometric mean calculation will represent the group's response, concluding the quantitative results.

Results and Discussion

The interview results with four respondents provide perspective and insights regarding the underlying challenges and obstacles revolving around CWLS and hampering its growth and penetration in the Indonesian capital market. On the other hand, there are several criteria in which CWLS may excel in its potential utilization in the capital market, generating potential competitive value and prospective investment instruments compared to the other observed investment instrument. In this respect, the summary of the qualitative response obtained from the respondents are as follow:

- CWLS is introduced and implemented to integrate between Cash Waqf instrument with Sukuk instruments, which would provide essential improvement to Shariah's capital market growth and appeal to the potential investors and participation of funds in the shariah capital market. Besides, Muhammad Fuad Nasar emphasized the potential utilization of Waqf funds implementation, which would support the large-scale financial activities such as government-supported projects, or the small scales such as supporting the financial incentives/programs of Small Medium Enterprises (SME).

- The potential utilization of CWLS will be utilizing the potential of Cash Waqf to be allocated to the potential Sukuk instruments, which would create value. Professor M. Nuh responded that the essential supporting program and regulation would provide CWLS with the potential of diversification and flexibility in terms of its capabilities to appeal for more extensive fund participation from retail investors.

- The challenges of CWLS and the implementation of its supporting program lies in regulation and laws conforming to the instrument. In this respect, according to Anwar Bashori, the aspect of governance and regulations imposed on CWLS are considerably lacking, thus would increase the potential risk, both in terms of business risk (such as mismanagement and deteriorating assets) and financial risk, which would negatively affect the growth of the instrument.

- The other underlying factor to CWLS penetration in the capital market lies inadequate technological and financial literacy in the Indonesian population. In this respect, the lack of financial literacy, especially regarding shariah financial instruments, which according to Professor Muhammad Nuh, and the survey conducted by BWI which revealed that the Indonesian community's literacy regarding basic knowledge and familiarity to Waqf investment is 50,67 low and 37,97 low, respectively. The index on waqf literacy was recorded at 50,48 low, which represents the low familiarity of the Indonesian citizens with Waqf. Furthermore, this condition is further affected due to the lack of adequate access and literacy to technology, which concerns investment activities relating to the lack of information technology, both in terms of access and literacy level.

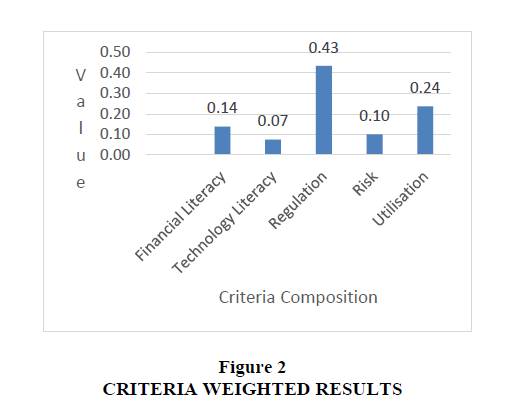

AHP Calculation Analysis- Criteria

Based on the AHP Matrix Calculation, under the AHP structure. The method utilizes the pairwise comparison, which compares and assesses the quantitative measurement between the elements structured in the cluster (e.g., a goal with the Criteria, Criteria, and Alternatives) measured through the 9-point scale value to compare to the significance in between the elements. In this respect, the results have shown the significance level of criteria in regards to achieve the goal, based on the geometric mean results of the four respondents, as shown in Figure 2:

Based on the result figure 2, the respondents' responses regarding the most critical criteria affecting the growth and utilization of CWLS in the Indonesian capital market are the Regulation criteria (0.43). The regulation represents the references and affirmation of interviewees. The majority of the interviewees responded strongly with regulation as the most significant criteria due to the Indonesian capital market condition. However, the regulation regarding CWLS has not been adequately established, issues regarding complex treatment and interpretation still an ongoing debate between Islamic institutions concerning the Nadzir and fatwa in which proclaimed by the representative in Islamic institutions, along with the consensus with the state regulators and Financial Service Authorities, as well as the Indonesian Bank. Besides, utilization is considered the second most significant criterion in affecting the growth of CWLS by considering the potential of fund allocation and investment activities capable of conducting over each of the shariah investment alternatives. In this respect, the utilization criteria refer mainly to each alternative's potential in applying for various Shariah compliance (e.g., Mudharabah, Murabahah, and Musharakah).

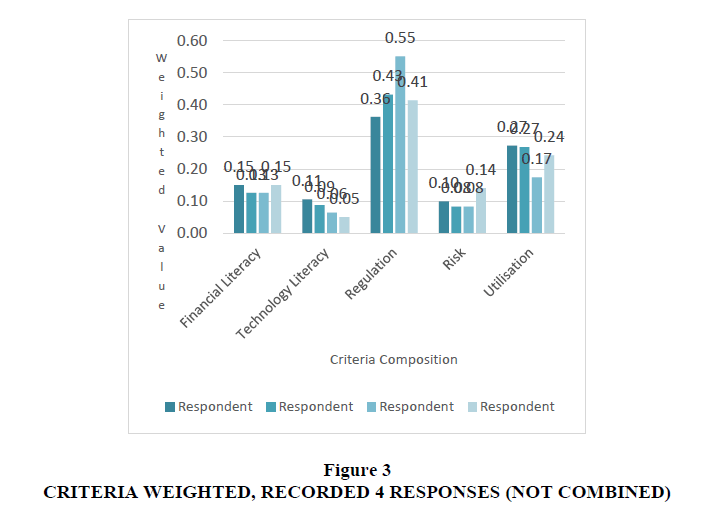

Below is also presented the results of the criteria weighted, in accordance to the respective respondents, as shown in Figure 3 below:

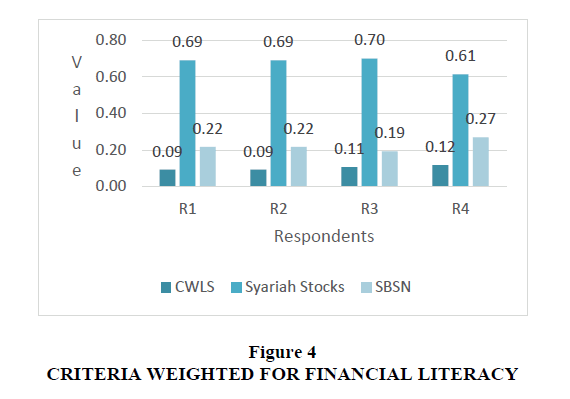

AHP Criteria Analysis- Financial Literacy

Based on the criteria of financial literacy, the compiled criteria weighted results obtained from four respondents are represented as follows:

Based on the criteria prioritization results in financial literacy, Shariah stocks are the most preferred based on the priority level counted from four of the respondents. This result indicates the lack of financial literacy and socialization regarding the other shariah investment alternatives (SBSN and CWLS). In this respect, the respondents stated that most Indonesian investors are well familiarized with Shariah Stocks, followed by Shariah Sovereign Securities (SBSN). However, most of them are not yet familiar with CWLS, thus indicating low participation and interest in investing in CWLS in the current financial market.

AHP Criteria Analysis- Technological Literacy

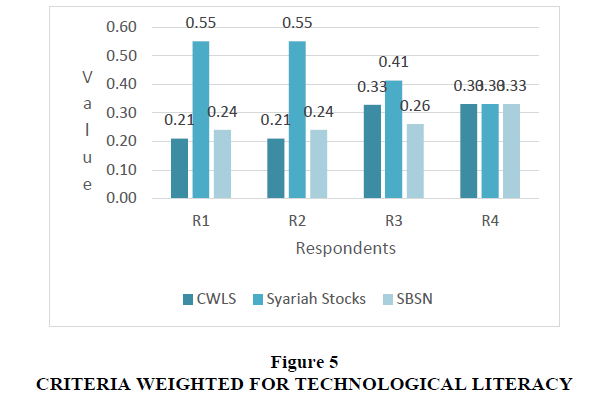

Technological literacy is considered the criteria with significance in utilizing and implementing technology, especially information technology, which is integrated into the investment practice and decision-making. In this respect, the criteria weighting of the four respondents are represented, as shown in Figure 5:

Based on the results above, the Shariah Stocks are the alternative to have the highest significant Technological Literacy aspect. Furthermore, based on three of the respondents (4th respondent agreed to confirm the equal level of importance of technological literacy factor attributed to each of the alternatives), Syariah Stocks are considered as the most attributed to the significance of technological literacy. In the current era of information technology, technological literacy is paramount in assisting and referencing investment practice and decisions and utilizing the technology to conduct financial investment practice as technology is becoming more implemented and integrated into the activities within the financial system.

AHP Criteria Analysis- Regulation

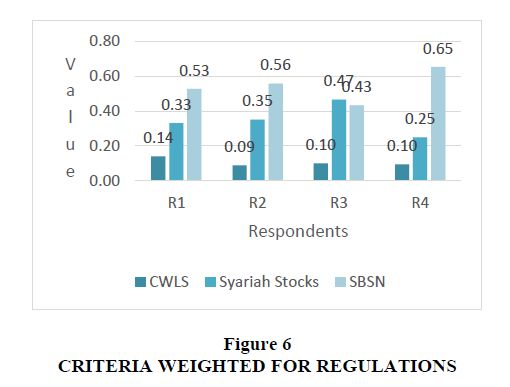

Regulation is considered significant in terms of the available and adopted laws and regulations exercised by the regulatory bodies to properly regulate the activities and financial practices in the capital market. Based on that factor, regulation serves as one of the essential criteria measured through the level of regulation established and exercised upon the utilization of each of the investment alternatives. In this respect, the results of the criteria weighting obtained from the four respondents are as follows in Figure 6:

Based on the results, Shariah Sovereign Securities (SBSN) has the highest level of prioritization in terms of regulation, as the respondents affirm that SBSN in the Indonesian Shariah capital market is the most regulated financial instruments. It is regulated by the Financial Service Authorities, Indonesian Bank, and the Islamic institutes regarding utilization, Shariah compliance, and the fund allocation and investment in underlying assets. Shariah Stocks followed as the second most regulated financial instruments, with the pre-existing common stocks practiced in the Indonesia Stock Exchange, with the Shariah compliance treatment in Shariah stocks following. CWLS, in this respect, are deemed to be less regulated and therefore are less favorable in terms of the level of regulation imposed in the financial instrument.

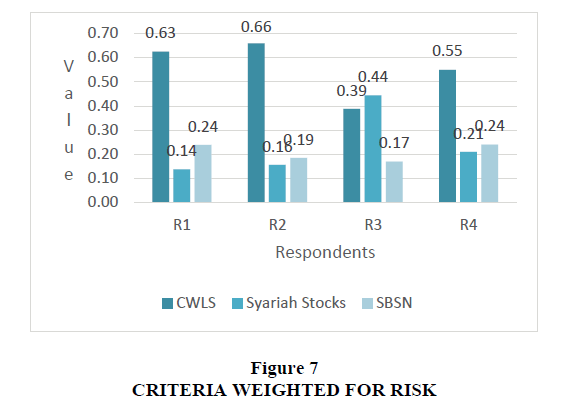

Risk refers to the criteria weighting of the level of risk imposed onto a specific investment alternative. The risk criteria are measured through how high or significant risk is attributed to the shariah investment alternative. The higher the results will be in which risk is positively correlated in the investment alternative. The results are presented as follows in Figure 7:

Based on the results obtained from 4 respondents, the results have shown that CWLS in the current condition imposed the highest risk level. The justification of risk is expressed through a low level of literacy and socialization regarding CWLS as an investment instrument. In addition, the unclear presentation of law and regulation regulates the financial instrument properly. In this respect, the risk is attributed to uncertainty regarding the instruments' potential and risk factors.

AHP Criteria Analysis- Utilization

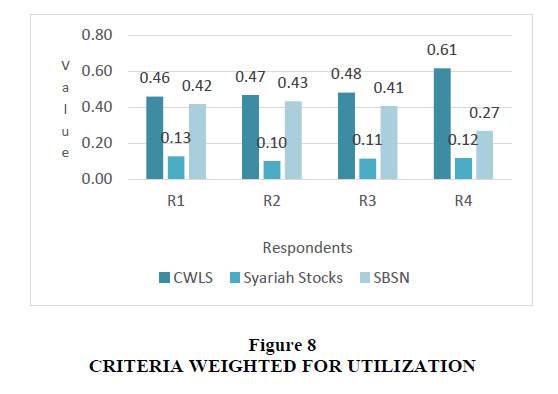

Utilization refers to the potential of utilization under the potential of each alternative in terms of criteria. In this respect, utilization is measured and weighted as criteria regarding how likely the investment alternative can utilize, both in terms of their investment potential and the potential of Shariah compliance to be implemented into the investment. In this respect, the response obtained from the four respondents are as follows in Figure 8:

Based on the results shown above, four of the respondents favor CWLS to have the highest likeliness regarding its utilization potential, followed marginally by Shariah Sovereign Securities (SBSN). In this respect, CWLS is favored. This is because it integrates Cash Waqf and Sukuk's instruments, which provide various investment opportunities, whether investment in underlying assets, fund investment allocation, and Shariah compliance imposed as the contractual agreement towards special investment activities.

Conclusion, Recommendation, and Evaluation

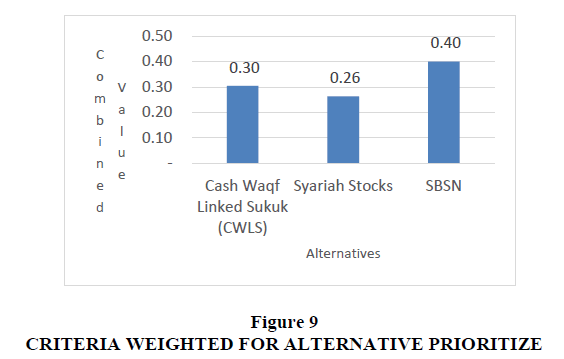

Based on the criteria analysis outlined, the results of the AHP calculation are synthesized using the AHP method, which provided with Normal values and adjusted for geometric mean to represent the collective results of all of the respondents, thus representing the overall results of the pairwise comparison of the criteria, attributed to the alternatives, and their influence towards achieving the goal. In this respect, the results of the alternative synthesized model are as follows in Figure 9:

Based on the research study results, research analysis concludes regarding the utilization of CWLS in the Indonesian Shariah capital market and the challenges and potential criteria that may affect the development of CWLS as a shariah investment instrument. In this respect, the research affirms the potential of CWLS in comparison to the available shariah investment instrument in the capital market, such as SBSN and Shariah Stocks, that CWLS holds the potential towards more extensive coverage in terms of its utilization and potential investment activities. Furthermore, based on the instruments' integration between Cash Waqf and Sukuk, more significant asset allocation and investment in the portfolio and more variety of risk assessment portfolios are required according to the shariah compliance imposed on the contractual agreement (e.g., Mudharabah, Murabahah, and Musharakah). Hence, CWLS would allow more extensive coverage, both in terms of the scale of implementation, and the investment activities, contributing to the financial activities and economic incentives towards the larger population in Indonesia.

However, the research also highlights the underlying challenges and obstacles which affect the development of CWLS. Several of the challenges studied in the research are the factor of lack of education and socialization regarding shariah investment instrument, significantly CWLS would hamper the rate of growth and participation of potential investors to CWLS. Also, the regulation factor that is still unclear in regulating CWLS would expose CWLS to potential risk and skepticism between the potential investors, thus affecting the rate of CWLS penetration in the Indonesian Shariah Capital Market.

In terms of risk assessment, CWLS still possesses several uncertainties regarding its implementation and investment coverage, which would impose doubt and skepticism among the investors to put interest and participate in CWLS investment. The research results would conclude in regards to the potential development of CWLS in the Indonesian capital market. These criteria and factors should be reviewed and properly evaluated to overcome the underlying challenges and further contribute to the full utilization of CWLS in the Shariah Capital Market.

References

- Abdullah, M. (2018). Evolution in Waqf Jurisprudence and Islamic Financial Innovation. Journal of Islamic Monetary Economics and Finance, 4(1), 161–182. https://doi.org/10.21098/jimf.v4i1.920

- Afiyana, I.F., Nugroho, L., Fitrijanti, T., & Sukmadilaga, C. (2019). Tantangan pengelolaan dana zakat di indonesia dan literasi zakat. Akuntabel, 16(2), 222–229. https://doi.org/10.29264/JAKT.V16I2.6013

- Ahmed, H. (2007). Waqf-Based Microfinance: Realizing The Social Role Of Islamic Finance. Singapore. Retrieved from https://www.findevgateway.org/sites/default/files/publications/files/mfg-en-paper-waqf-based-microfinance-realizing-the-social-role-of-islamic-finance-2007.pdf

- Anuar, A.S., Bahari, Z., Doktoralina, C.M., Indriawati, F., & Nugroho. (2019). The Diversity Of Waqf Implementations for Economic Development in Higher Education. IKONOMIKA, 4(1), 13–34.

- Azha, L., Baharuddin, S., Sayurno, Salahuddin, S. S., Afandi, M. R., & H., H. A. (2013). The Practice and Management of Waqf Education in Malaysia. In Procedia - Social and Behavioral Sciences (Vol. 90, pp. 22–30). Elsevier B.V. https://doi.org/10.1016/j.sbspro.2013.07.061

- Aziz, L.H., Malle, S., Ilham, A., Fatriansyah, A., Raya, F., Nugroho, L., … Wahyudi, A. B. (2021). Akuntansi Syariah (Sebuah Tinjauan Teori Dan Praktis) (First). Bandung: Penerbit Widina Bhakti Persada Bandung. Retrieved from www.penerbitwidina.com

- Bahari, N.P., Nugroho, L., Badawi, A., & Hidayah, N. (2021). Analisa Manfaat Pembiayaan Gadai Emas Syariah: Studi Kasus Bank Syariah Mandiri-Tomang Raya. Jurnal REKSA: Rekayasa Keuangan, Syariah, Dan Audit, 8(1), 15–30.

- Dewi, D.M., Nugroho, L., Sukmadilaga, C., & Fitijanti, T. (2020). Tinjauan Sukuk Korporasi di Indonesia dari Perspektif Penawaran, Permintaan dan Regulasi. Journal of Business and Economic Research, 1(1), 11–16.

- Fauziah, N.N., Rabiah, E., Engku, A., & Bacha, A.M. (2021). An Analysis of Cash Waqf Linked Sukuk for Socially Impactful Sustainable Projects in. Journal of Islamic Finance, 10(1), 1–10.

- Hasanah, U. (2011). Cash Waqf and People Economic Empowerment in Indonesia. Economics and Finance in Indonesia, 59(2), 215–232. https://doi.org/10.7454/efi.v59i2.64

- Ihwanudin, N., Maulida, S., Ilham Akbar Fatriansyah, A., Sari Rahayu, S., Nugroho, L., Widyastuti, S., … Arzhi Jiwantara, F. (2020). Pengantar Perbankan Syariah (Konsep, Regulasi & Praktis). Widina Bhakti Persada Bandung. Retrieved from www.penerbitwidina.com

- Kasim, N.A.A. (2012). Disclosure of Shariah compliance by Malaysian takaful companies. Journal of Islamic Accounting and Business Research, 3(1), 20–38. https://doi.org/10.1108/17590811211216041

- Khaliq, A., Hussin, N., Tahir, M., & Haji, S. (2019). Waqf Unit Trust As an Alternate Model To Realize Waqf Sustainability. European Journal of Islamic Finance, 0(13), 1–9. https://doi.org/10.13135/2421-2172/3623

- Mahat, M.A., Jaaffar, M.Y., & Rasool, M.S.A. (2015). Potential of Micro-Waqf as an Inclusive Strategy for Development of a Nation. In Procedia Economics and Finance (Vol. 31, pp. 294–302). Elsevier B.V. https://doi.org/10.1016/s2212-5671(15)01193-4

- Metanfanuan, T., Herlambang, M.A.T., Krishernawan, I.L.N.P., Ginting, S., Sutarman, … Nugroho, L. (2021). Konsep Pembangunan dan Pengembangan Desa Digital. Pengantar Manajemen Potensi Desa.

- Monzer Kahf, & Amiirah Nabee. (2017). Cash waqf: an innovative instrument of personal finance in Islamic banking. Journal of Islamic Economics, Banking and Finance, 13(3), 13–29.

- Musari, K. (2016). Economic Sustainability for Islamic Nanofinance through Waqf - Sukuk Linkage Program?: Case Study in Indonesia. International Journal of Islamic Economics and Finance Studies, 2(3), 73–93. https://doi.org/10.12816/0036630

- Nordin, N., Mohammad, M., Ahmad, A.A., Haron, M.S., & Daud, N. (2017). Commodity Futures: A Maqasid Al-Shariah Based Analysis. International Journal of Academic Research in Business and Social Sciences, 7(8). https://doi.org/10.6007/ijarbss/v7-i8/3265

- Nugraha, E., Nugroho, L., Lindra, C., & Sukiati, W. (2020). Maqashid Sharia Implementation in Indonesia and Bahrain. Etikonomi, 19(1), 155–168. https://doi.org/10.15408/etk.v19i1.14655

- Nugroho, L, Badawi, A., & Hidayah, N. (2020). The Contribution of Sukuk Placement and Securities to The Islamic Bank Profitability. Tazkia Islamic Finance and Business Review, 13(2), 175–192. Retrieved from http://tifbr-tazkia.org/index.php/TIFBR/article/view/184

- Nugroho, Lucky, Utami, W., Sukmadilaga, C., & Fitrijanti, T. (2017). International Journal of Economics and Financial Issues The Urgency of Allignment Islamic Bank to Increasing the Outreach (Indonesia Evidence). International Journal of Economics and Financial Issues, 7(4), 283–291. Retrieved from http:www.econjournals.com

- Rahman, M., Isa, C.R., Tu, T.T., Sarker, M., & Masud, M.A.K. (2020). A bibliometric analysis of socially responsible investment sukuk literature. Asian Journal of Sustainability and Social Responsibility, 5(1), 1–19. https://doi.org/10.1186/s41180-020-00035-2

- Saptono, I.T. (2019). Peluang dan Tantangan Wakaf di Era 4.0. Jakarta. Retrieved from www.poskotanews.com

- Sardiana, A., & Zulfison. (2018). Implementasi Literasi Keuangan Syariah Pada Alokasi Dana Ziswaf Masyarakat. Maqdis?: Jurnal Kajian Ekonomi Islam, 3(2), 171–180.

- Saaty, R.W. (2016). Decision making in complex environments, The Analytic Network Process (ANP) for dependence and feedback including a tutorial for the SuperDecisions software and portions of the encyclicon of applications. In Including a Tutorial for the SuperDecisions Software and Portions of the Encyclicon of Applications (Vol. 1). https://www.superdecisions.com/sd_resources/v28_man02.pdf

- Sherif, M., & Erkol, C.T. (2017). Sukuk and conventional bonds: shareholder wealth perspective. Journal of Islamic Accounting and Business Research, 8(4), 347–374. https://doi.org/10.1108/JIABR-09-2016-0105

- Sudirman, A. (Acai ), Alaydrus, S. (Syafika), Rosmayati, S. (Siti), Syamsuriansyah, S. (Syamsuriansyah), Nugroho, L. (Lucky), Arifudin, O. (Opan), … Rijal, K. (Khairul). (2020). Perilaku Konsumen Dan Perkembangannya Di Era Digital. Widina Bhakti Persada Bandung. Retrieved from www.penerbitwidina.com

- Sukmadilaga, C., & Nugroho, L. (2017). Pengantar Akuntansi Perbankan Syariah" Prinsip, Praktik dan Kinerja. (P. Media, Ed.) (First). Lampung, Indonesia: Pusaka Media.

- Utami, D.N. (2020). Pemerintah Tawarkan Instrumen Cash Waqf Linked Sukuk (CWLS) Ritel, Apa Itu? - Finansial Bisnis.com. Retrieved June 9, 2021, from https://finansial.bisnis.com/read/20201012/231/1303799/pemerintah-tawarkan-instrumen-cash-waqf-linked-sukuk-cwls-ritel-apa-itu