Research Article: 2022 Vol: 26 Issue: 4S

Productive Sectors and Economic Growth in Sudan (1980-2019)

Muawya Ahmed Hussein, Dhofar University

Omran AbbasYousif Abd Allah, Gezira University

Hanaa Mahmoud Sid Ahmed, University of Technology and Applied Sciences

Citation Information: Hussein, M.A., Abd Allah, O.A.Y., Ahmed, H.M.S. (2022). Productive sectors and economic growth in Sudan (1980–2019). Academy of Accounting and Financial Studies Journal, 26(S4), 1-18.

Keywords

Sudan, Agricultural Sector, Industrial Sector, Oil and Mining Sector, Economic Growth

Abstract

This paper’s emphasis is on the performance of, and the weak linkages between, the productive sectors in Sudan, namely, agriculture, industry, oil, and mining. The main objective of the paper is to test the impact of performance in these sectors on the growth of Gross Domestic Product (GDP) in Sudan during the period 1980–2019. Sudan is rich in natural and economic resources. The fact that it has been classified by the United Nations as a poor country is due to the lack of strategic plans and macroeconomic policies for the national economy. The productive capacity of Sudan is limited despite its natural resource potential and accumulation of human capital; this may be attributed to the absence of institutions that facilitate inclusive and sustainable economic growth. This paper uses the ARDL model for co-integration to estimate the impact of various productive sectors – agricultural, industrial, and oil and mining – on the real GDP for the period using secondary data collected from the Central Bank of Sudan (CBS) and the Central Bureau of Statistics. The findings show that in the long run, the real values of agriculture products, industrial output, and oil and mining products have positive and significant effects on Real GDP. This is completely consistent with the existing economic theory.

Introduction

The previous decade has been interrupted by a series of widely-felt economic crises and adverse shocks beginning with the international financial crisis of 2008–2009. This was followed by the European sovereign debt crisis of 2010–2012, and the universal commodity (oil) price changes of 2014–2016. As these crises and the continual drafts that accompanied them dwindle, the global economy has become stronger. This has provided more room for governments to redirect policy to address longer-term issues and factors that hold back advancement along the social, environmental, and economic dimensions of sustainable development. In 2017, worldwide economic growth was projected to reach 3.0%, a substantial increase in growth compared to the rate of just 2.4% in 2016, and the highest rate recorded since 2011. Approximately two-thirds of countries globally showed more robust growth in 2017 than in 2016. At the universal level, growth is anticipated to stay fixed at 3.0% in 2018 and 2019.

There is no doubt that the civil war in Sudan cast a negative shadow over the country’s economy over the years. That war, although it can be considered as connected to the so-called resource curse, was not a direct cause of the economic deterioration that led to the current crisis in Sudan’s economy. Many other factors coalesced to lead to this tragic situation. One of the most important of these factors is the instability of the country’s political situation over the past fifty years. The country fluctuated between democracy and military rule, each type with its own ideas, principles, and economic policies. This caused inconsistency and uncertainty in economic policies and impacted the performance of all economic sectors.

The oil, agricultural, industrial, and mining sectors and their development raise complex, interrelated, and overlapping issues in most oil-producing, developing countries. The situation becomes even more complicated if politics, peacebuilding, and state-building come into play. This could describe the recent situation in Sudan (now North Sudan) with the emergence of the newly established South Sudan and the complexities and conflicts of the relationship between the two countries – oil and border demarcation being at the top of their list of issues.

Sudan is an agricultural country endowed with enormous resources such as arable land, animal resources, freshwater sources, and an accommodating climate that qualify the country to contribute significantly to food security in the Arab world. Petroleum extraction began in 1999, and the 20-year civil war came to an end in 2005 with the signing of the Comprehensive Peace Agreement (CPA). These factors have created a climate that is conducive to foreign investment, and there has been a considerable increase in the volume of that investment, particularly from Arab countries (MOI, 2009).

Agriculture remains an important sector in the Sudanese economy, despite its share of total exports having decreased, because of increased oil exports, from 73% in 1998 to 5% in 2008. The sector contributed an annual average of 45% to total GDP during the last ten years and, together with agriculture-related activities, employed approximately 80% of the total labor force (Siddig, 2009). Moreover, agriculture contributes to other activities in transportation, agro-industries, and general commerce across the various sectors – industrial, trade, and service – which account for a large share of the GDP.

Nonetheless, the contribution to the GDP of agriculture has started to deteriorate in recent years. For instance, it fell from 48% of GDP in 1997 to 31% in 2009 (CBS, Annual Reports). Concerns have been raised recently about the emphasis on natural oil resources and the relative neglect of the agricultural sector – a situation reminiscent of the famous Dutch Disease. This situation results in increased pressure to import food from abroad, given the dramatic increase in food prices.

The industrial sector in Sudan has been confined to its manufacturing industries, whose contribution to the economy is weak. The focus of the economy has moved clearly to the mining sector following the secession of the south from the budget due to the secession of the south, the removal of oil from Sudan’s economy, and the decline of the agricultural sector.

Research Problem

Despite being rich in natural and economic resources, the United Nations classifies Sudan as amongst the world’s poorest countries. This is due to the lack of strategic plans and macroeconomic policies for the national economy, the weak performance of the productive sectors (agriculture, industry, oil and mining), and weak linkages between them. This research attempts to determine whether the agricultural, industrial, oil, and mining sectors affect GDP in Sudan during the period 1980–2014.

The Importance of the Research

The importance of this research is that agriculture, industry, and oil and mining are the largest productive sectors in any economy. They are the most important variables for realizing sustainable revenue, improving the balance of payments by increasing exports and reducing imports, supporting economic growth, and finally, leading to the economic well-being of Sudanese society.

The Objectives of the Research

General Objective

The main objective of this research is to examine the effect of the productive sectors on GDP.

Specific Research Objectives

There are three specific research objectives:

(1) To explore to what extent the agricultural sector contributes to the GDP in Sudan.

(2) To determine the contribution of the industrial sector to GDP in Sudan.

(3) To identify the contribution of the oil and mining sector to GDP in Sudan.

The Hypotheses

The research hypotheses are as follows:

(1) The agricultural sector positively affects economic growth in Sudan.

(2) The economic growth in Sudan responds positively to changes in the industrial sector.

(3) The oil and mining sector positively affects economic growth in Sudan.

Research Methodology

The empirical model specified takes into consideration the productive sectors (agricultural, industrial, and oil and mining) as independent variables, while GDP is used as a dependent variable. The research employs time-series data collected primarily from the Central Bank of Sudan (CBS) and the Central Bureau of Statistics, using autoregressive distributed lag (ARDL) model of co-integration is adopted for estimation purposes.

Literature Review

The Concept of Gross Domestic Product

Gross domestic product measures the total output produced within a country’s borders, whether produced by that country’s own firms or not, during a specific time period that is usually one year (Ajmair, 2014). It is defined by Zanoli, et al., (n.d) as “an aggregate measure of production equal to the sum of the gross values added of all resident, institutional units engaged in production (plus any taxes, and minus any subsidies, on products not included in the value of their outputs)” (2007).

In the theory of Adam (1776), income per capita or GDP is an indicator of the average level of a country’s prosperity. It is not necessary to consume the entire annual income during the year, but what is not consumed is saved and becomes another investment or an export surplus. In either case, GDP adds to the national wealth and becomes a source of future consumption and then growth (Sorensen & Whitta-Jacobsen, 2010). In the Fei-Ranis model, technological progress and aggregation of capital are significant in the growth of a country’s economy (Souza & Paulo, 2014).

In classical (Ricardian) economics, when enhancing production factors (capital or labor), and holding others fixed and assuming no technological change, the output will rise (Michael and Stephen, 2001). Additionally, according to the neoclassical Solow–Cass–Koopmans model, the rate of growth in an economy relies on the initial level of GDP (Acemoglue, 2009).

The Concept of Agriculture

Agriculture is considered to be a vital determinant of a country’s economic strength and development. In addition, it is a type of activity that involves land, labor, capital, and entrepreneurship to produce plants, animals, solar energy, and forest resources for consumption and providing the agrarian products demanded by other sectors (Lawrence & Salako, 2015). Accordingly, “beyond its primary function of producing food, agricultural activity can also shape the landscape, provide environmental benefits such as land conservation, the sustainable management of renewable natural resources and the preservation of biodiversity, and contribute to the socio-economic viability of many rural areas” (Ahluwalia, 1996).

Agriculture in developing economies is seen as the activity or occupation from which a livelihood can be derived by the greatest proportion of the country’s population (Anthony, 1995). Until the Industrial Revolution, the majority of the population depended on agriculture for their survival (Sahoo & Sethi, 2012).

The Concept of Industry

Industry is the manufacture of goods and services in well-organized plants with a high degree of specialization and automation. It can likewise include other commercial activities that contribute to the supply of goods and services like transportation and hospitality (Verspagen, 2000). In addition, such a sector also refers to mining, manufacturing, construction, gas, water, and electricity (Sahoo & Sethi, 2012).

The industrial sector is remarkably important for economic growth and poverty reduction. However, the pattern of industrialization affects how an economy benefits from growth, and expanding the industrial field is thus remarkably significant for economic development. Starting with the Industrial Revolution, technological evolution has played a crucial role in the industrial sector (Ahmed et al., 2015). Industrialization has enabled many to overcome poverty and allowed the people of developed countries like the U.S., UK, Canada, Germany, and Japan to enjoy a higher standard of living. The wave of industrialization has also been felt in the “newly industrializing countries” of the Far East (Ajmair, 2014).

The Concept of Mining

After agriculture, mining was the second of humankind’s earliest endeavors. The two industries ranked together as the primary or basic industries of early civilization. Little has changed in the importance of these industries since that time. If we consider fishing and lumbering as part of agriculture and oil and gas production as part of mining, then agriculture and mining continue to supply all the basic resources used by modern civilization. From prehistoric times to the present, mining has played an important part in human existence (LinkedIn, 2015).

Mining plays a vital role in the economic development of many countries. Historically this has been the case in many parts of the developed world. Furthermore, while mineral development is an important factor for economic growth, it can also, if done responsibly, be a catalyst for social growth in developing countries. The present economic impact of mining needs to be assessed from the perspective of the industry’s current trends. For example, emerging economies are now major players in the global production and availability of key commodities, accounting for 70% of copper and 40% of bauxite production and with their share of iron ore, precious metals, lead, and others also within this range. Also, the continuous declining trend of real-metal prices over the past 35 years represents a difficult challenge for mining companies who seek to reduce production costs through technical and financial management (W.B., 2017).

The Concept of Oil

Petroleum is a naturally occurring liquid found in rock formations. It consists of a complex mixture of hydrocarbons of various molecular weights, plus other organic compounds. It is generally accepted that oil is formed mostly from the carbon-rich remains of ancient plankton after exposure to heat and pressure in the Earth’s crust over hundreds of millions of years. Over time, the decayed residue was covered by layers of mud and silt, sinking further down into Earth’s crust and preserved there between hot and pressured layers, gradually transforming into oil reservoirs. Petroleum has been used by humans in its unrefined state for over 5,000 years, and oil has been in general use since early human history to keep fires ablaze and in warfare.

Its importance to the world economy, however, evolved slowly, with whale oil being used for lighting in the 19th century and wood and coal used for heating and cooking well into the 20th century. Although the Industrial Revolution generated an increasing need for energy, this was initially met mainly by coal, and from other sources, including whale oil. However, when it was discovered that kerosene could be extracted from crude oil and used as a lighting and heating fuel, the demand for petroleum increased greatly, and by the early twentieth century had become the most valuable commodity traded on world markets (Halliday, 2005).

Additionally, crude oil has grown universally in the ‘supply-demand equilibrium’. Consumer and producer countries have become aware of the strategic importance of oil for the world economy; growth, progress, and economic development have become oil-dependent worldwide, despite the volatile nature of oil prices (Kapusuzoglu, 2011). Furthermore, over the past three decades, oil has become one of the most significant energy resources worldwide and is known for wide price fluctuations, and has occupied a strategic position in macroeconomic activities (Kapusuzoglu, 2011).

The Contribution of the Agricultural and Industrial Sectors to GDP

The agricultural and industrial sectors are regarded as important elements, especially in the initial stages of a country’s economic growth. Such sectors play a vital role in the balanced economic development of an economy. It is well documented that both sectors have an essential role in accelerating GDP growth and hold the key for overall economic development by generating employment and revenue, ensuring self-reliance in food production and security, supplying tools to other fields, and contributing to foreign-exchange earnings (Ahmed et al., 2015).

There is an interdependency between the traditional agricultural and modern industrial sectors to a nation’s overall economic growth. Growth in agriculture relies on the industrial demand for agricultural products. Correspondingly, industrial growth relies on a rise in purchasing power in the agricultural field, on its demand for manufactured products, and its supplying raw materials for processing. Many emerging nations have realized the significance of the agricultural field and its role in industrialization for their economic development (Karshenas, 1996).

Several studies have outlined the potential contribution of the agricultural, industrial, and oil sectors to economic development. Their role has been a subject of controversy among development economists. For example, some argue that agricultural evolution is a prerequisite for industrialization, while others firmly disagree and see industrialization as a distinct path. Nevertheless, few believe that increasing the share of the oil sector in economic growth is more beneficial, particularly for oil-exporter nations. In favor of agriculture has a key role, several authors contend that growth in the entire economy relies on the evolution of the agriculture field (Gollin et al., 2002).

These analysts argue that growth in the agrarian sector can be a catalyst for the growth of domestic output because of its impact on rural incomes and its supplying resources for transformation into a manufacturing economy (Schneider & Gugerty, 2011). According to Awokuse (2009), agriculture indirectly affects aggregate economic growth – it can lead to better caloric nutrition for the poor, stability in the price of food, job opportunities (particularly in low-income nations), improvement in the quality of production factors, namely capital and labor, and poverty reduction. Additionally, growth theories have acknowledged the agriculture field as an excellent source of resources for financing the industrial sector’s development (Schultz, 1988).

In recent years, however, there has been increasing concern about the declining contribution of the agricultural sector to GDP, especially in developing countries. Although a country’s agriculture sector is expected to decline as it develops, more recently, this decline has been rapid rather than gradual. This decline has been taking place not only in developing countries but in developed countries such as the U.S. Yamashita (2008) provided statistics for Japan, showing that agriculture’s contribution to GDP fell by 8% between 1960 and 2005.

Another concern about the decline of the agricultural sector stems from the constant upward movement of food prices over the last few years, which is depicted using the international food price index. Global food prices peaked between March 2007 and March 2008, showing an increase of 43% over the period. This marked increase was felt most in developing countries and by the poorest members of the population, who spend the majority of their income on food. These high food prices not only reduced buying power but also threatened food and nutrition security (USAID 2009).

The Contribution of the Oil and Mining Sectors to GDP

There is a strong linkage between the oil sector and GDP growth. Crude oil is known as ‘black gold’, and especially for the economic growth of oil-exporter countries because they depend on oil revenues. It is important to note, depending on only the oil sector as the source of revenue, budget, and growth turns the economy into a mono-cultural economy. This is because the price of oil is beyond the country’s control and is subject to a high-level vulnerability as a result of political instability and global economic and financial crises. As a result, oil prices fluctuate, and oil revenue may fall (Ahmed et al., 2015).

Since the turn of the century, most low- and lower-middle-income, mineral-rich countries have had high growth rates led by their mining sectors, despite the global financial crisis. For most of these countries, the present decade will likely see more of the same. With respect to growth, the natural resource curse, as it pertains to mineral-rich countries, does not seem to have been widespread for the past two decades.

The rapid growth of the mining sector in these various countries was partly due to high mineral prices but was also a result of major revisions to mining policies, institutions, and capacities. The fastest-growing countries were those that reformed or began the reform of their mining sectors before the boom. Moreover, many of those countries saw their mining sectors begin to grow rapidly even before the boom in mineral prices, following comprehensive mining-sector reform. Few of these countries, however, can be said to have gotten definitively past some turning point where a decade of low mineral prices would not result in stagnation. In some cases, this may be because the country’s mineral-sector reform has outpaced its general socio-economic reform, and there is still a danger that the latter might pull down the former.

Nevertheless, many if not most mineral-dependent low- and lower-middle-income countries are putting emphasis on increasing the benefits from the mining sector. They are doing this, particularly through spin-off industries and using higher levels of fiscal revenues to build infrastructure and develop human capital. This will, in turn, lead to the development or expansion of other industries unrelated to mining. While there has been substantial progress on fiscal issues in recent years, programs and policies to increase linkages and employment and better manage large-scale infrastructure are just beginning in most of these countries (W.B., 2014).

There are many agricultural programs, but they do not benefit the majority of the population because there is no overall plan or roadmap for programs and investments in the agricultural sector (Amaral, 2018). The government has failed to recognize that as a small nation, the development of productive sectors like agriculture, tourism, and manufacturing is important.

Timor-Leste is a country whose economic structure and the majority of its state activities depend heavily on income and investments from the oil and gas sector. Nearly 80% of the annual budget comes from oil and gas revenues (La’o Hamutuk, 2018; Mahonye & Mandishara, 2015). Until 2016, the Government spent more than USD 8 billion from the Petroleum Fund to support government programs and activities implementing investment policies in various sectors (La’o Hamutuk, 2016). Unfortunately, despite the large quantity of money that has been spent, nearly half of Timor-Leste’s population still lives below the poverty line. Access to clean water is limited, malnutrition is high, health and education facilities remain limited, and the productive economic sector has not yet been well developed. The current government’s policies for economic diversification prioritize the oil and gas sector and focus on the development of mega-infrastructure projects (La’o Hamutuk, 2016). Productive economic sectors have not received adequate investment despite the fact that these relate directly to the lives of most of Timor-Leste’s people.

Performance of the Economy and Productive Sectors and Economic Growth in Sudan

The Performance of Sudan’s Economy

There have major transformations in the Sudanese economy during the last three decades. Full government control over economic activities characterized the period of the 1960s, while an inward-looking strategy dominated development policy during the early 1970s and mid-1980s. Economic difficulties assumed crisis proportions during the second half of the 1970s, following the ambitious development program launched in the early 1970s. The failure of the investment boom to increase the economy’s productive capacity accelerated the crisis. By the late 1970s, the government was confronted by falling export earnings, an increasing import bill, an accelerating budget deficit, and mounting foreign debts (Mahran, 2005).

Since independence in 1956, the economy of Sudan, with it is heavy reliance on a mono-crop (cotton) for export, has been on a turbulent course, reflecting a fluctuating pattern of growth. This necessitated the introduction of economic measures to mitigate pitfalls. As far back as 1970, Sudan initiated the first wave of economic reforms to try and address economic deterioration. The measures agreed to be not fully implemented, and second waves of measures were initiated under the umbrella of the salvation program, which was merged with the National Comprehensive Plan of 1992–2002. This program was also not successful, and there was deterioration in the balance of payments, escalating inflation rates, and persistent macroeconomic imbalances. Another reform program was introduced from 1997–2001 with a sharpened focus on macroeconomic and price stabilization.

The program encompassed four basic elements, including the introduction of stabilization measures and a macroeconomic environment that focuses on fighting escalating inflation by way of increasing collection of revenues, reduction of public expenditure and following balanced monetary policy; pursuing market-friendly measures and policies to abolish controls and providing incentives for domestic production and export; introduction of structural reforms to limit the role of government by privatizing enterprises and providing opportunities for the private sector in such areas as health, education and other utilities; and encouragement of savings by stabilizing the economy and introduction of reforms in the banking sector.

The macroeconomic indicators that started off with low levels of growth rates during 1986–90 showed signs of improvement. In addition, inflation rates, which peaked during the years 1991–95, tapered off during later years and were accompanied by a continued decline in government expenditures compared to GDP. This dramatic change in the performance of Sudan's economy since 1996 could be attributed to a number of factors including, economic reforms, favorable weather conditions affecting agriculture, and high levels of investment in oil sectors and related services.

While the stabilization measures and economic reforms have been carried out without external aid or technical assistance and achieved success in setting high growth rates for the economy, external debt and accumulated arrears remain a problem for future development. In this respect, it has to be stressed that stabilization measures have been achieved at the expense of drastically cutting public expenditures except for security. This has had an adverse impact on productive sectors, infrastructure, and human resources development. In addition, stabilization measures have been facilitated by oil exports, which increased from zero in 1998 to reach USD 276 million in 1999 and accounting for 35% of overall export earnings in that year. In 2004, oil exports reached USD 3.097 billion, accounting for 81% of exports. With the inflow of foreign direct investment and oil revenues, the economy of Sudan witnessed a boom in real-estate development in major towns, coupled with road construction, developments in telecommunications, improved electrical power supply, and investment in food-processing industries. However, most rural areas and national agricultural development have not directly benefited, resulting in accentuated poverty and continued rural migration (Karrar, 2006).

Disaster in Sudan expands on a daily basis. South Sudan secession deprived the country of 25% of its total area, 24% of the population, and more than 80% of its oil revenue. Moreover, Sudan has 75% of the vegetation and 30% of the land suitable for agriculture. In addition, Sudan has at least 25% of its water resources. The only viable sector is agriculture. The has been a demise of industry due to heavy taxes, high input prices, consumption of the Sudanese currency and, high foreign-exchange rates. The review of existing studies and updated information on the agricultural sector is important not just for the possibility of reviving and compensating for lost oil revenues but also to ensure food security for the remaining population. However, the agricultural sector cannot meet the economic requirements of the country. More economic resources are needed, as well as changes in the implementation of privatization policies (Ahmed, 2011).

The Agricultural and Industry Sectors in Sudan

The industrial sector in Sudan remains a comparatively small part of the economy. It produces primarily import-substitutes for consumption goods and uses imported machinery, equipment, and both local and imported raw materials. Unlike the modern agricultural sector, the industrial sector is dominated by private ventures (Abu Affan, 1984).

Sudan is primarily an agricultural country with a huge endowment of arable land and water resources. The contribution of agriculture to GDP is estimated at an average of 43.6% for the period (1961–1974). More than 80% of the country’s inhabitants rely, in one way or another, on agriculture and livestock raising for their living. The role of industry in the national economy has been negligible despite its recent expansion. In the period 1955/56, the contribution of the industrial sector to GDP was estimated at 3% only. It then gradually increased to 4% (by 1960/61) and to 9.4% by (1970/71), indicating a remarkable growth rate (El-Hassan 1976).

In subsequent years the contribution of the industrial sector to GDP decreased to an average of 8.3% over the period (1975/76–1988/89) and to 8.1% in (1998) (Bank of Sudan, 1998). The main reason for this decline is that the industrial sector continued to suffer from low-capacity utilization. This was due to a number of problems, including a lack of imported inputs as a result of scarcity of foreign exchange, poor infrastructure, lack of skills and technical training, a shortage of energy, lack of fuel and spare parts, and price controls that set prices below production costs. In recent years the government took care of the industrial and mining sector by rehabilitating some factories and privatizing others. The contribution of the industrial and mining sector to GDP increased from 7.5% in 1996 to 8.2% in 1997. The industrial growth rate also improved from 16% in 1996 to 19.4% in 1997 (CBS, 1997).

The agricultural sector witnessed an appreciable growth rate from an average of 0.6% per annum during the period from 1981–1991 to a peak of 10.8% per annum during the period from 1992–1999. It then declined to an average of 7.3% during the period from 2000–2004. However, the contribution of agriculture to GDP has recently begun to deteriorate, falling from 48% in 1997 to 31% in 2009 (CBS, 2007; 2008; 2009). Concerns have been raised about the decreased emphasis on the agricultural sector and the increased emphasis on natural oil resources, an example of the famous Dutch Disease. The share of agriculture in total exports has deteriorated as a result of an increase in oil exports, dropping from 73% in 1998 to 5% in 2008. Agriculture’s decreasing share of GDP will result in a need to increase food imports.

This decline in the sector’s contribution to total GDP is, of course, only in percentage terms: the value of agricultural GDP has increased. This implies that the agricultural sector is not deteriorating in value, but rather in importance since other sectors are growing faster. For example, the industrial sector’s share of total GDP grew from 15% in 1997 to 31% in 2008 (CBS, 2007; 2008; 2009). In Sudan, the agricultural sector is considered to be the backbone of industrial development, and it continues to contribute to GDP growth. In 2010, it accounted for 31.1% of the country’s total GDP. Sudan was widely regarded as the future breadbasket of Arab nations, a vast, fertile land with abundant water from the Nile watershed (FAO, 2014).

The Growth rate in GDP and Contribution of Productive Sectors to GDP

It is clear from the below table that overall economic growth, growth in the agricultural and industrial sectors, and the contribution of both sectors to GDP, have decreased with time, except for a few years in which there has been a slight increase in the growth rate and contribution.

| Table 1 Growth in GDP, and The Contribution of Productive Sectors to GDP |

|||||

|---|---|---|---|---|---|

| Year | Economic growth % | Growth rate of agriculture GDP % | Growth rate of industry to GDP % | Contribution of agriculture to GDP% | Contribution of industry to GDP % |

| 2000 | 8.3 | 0.8 | 77.4 | 46.4 | 15.0 |

| 2001 | 6.4 | 4.7 | 17.3 | 45.6 | 16.6 |

| 2002 | 6.5 | 7.6 | 6.3 | 46.6 | 16.3 |

| 2003 | 6.1 | 5.2 | 10.6 | 45.6 | 24.2 |

| 2004 | 7.2 | 4.5 | 12.9 | 44.5 | 25.4 |

| 2005 | 8.3 | 6.5 | 7.8 | 38.6 | 27.8 |

| 2006 | 9.3 | 8.3 | 9.0 | 39.2 | 28.3 |

| 2007 | 10.5 | 6.0 | 22.8 | 35.3 | 30.6 |

| 2008 | 6.0 | 5.1 | 0.8 | 35.9 | 31.4 |

| 2009 | 6.1 | 6.7 | 7.9 | 31.1 | 10.8 |

| 2010 | 5.2 | 6.7 | 8.0 | 31.3 | 11.0 |

| 2011 | 2.7 | 3.3 | 9.4 | 31.5 | 11.6 |

| 2012 | 1.1 | 6.4 | 10.8 | 30.4 | 15.0 |

| 2013 | 3.6 | 3.5 | 7.3 | 30.6 | 21.1 |

| 2014 | 3.5 | 4.1 | 15.2 | 28.2 | 24.0 |

| 2015 | 3.2 | 3.6 | 12.1 | 30.0 | 13.0 |

| 2016 | 3.4 | 3.9 | 9.8 | 29.0 | 14.0 |

| 2017 | 0.71 | 4.2 | 11.6 | 28.0 | 15.0 |

| 2018 | - 2.92 | 2.3 | 6.1 | 28.0 | 15.0 |

| 2019 | - 2.45 | 2.1 | 5.7 | 28.41 | 23.0 |

Source: Central Bank of Sudan, Annual Reports.

The Oil and Mining Sectors in Sudan

Oil has taken a cornerstone position within the united Sudanese economy since its exploitation started in 1999. This can be demonstrated by its weight in at least three major economic variables, namely: the GDP, foreign trade, and government revenue, as reflected in CBS Reports. Accordingly, its impact has spread over almost all aspects of the economy and society. The first economic variable impacted by petroleum and considered here is the GDP. Before 1999, and even in that year, which witnessed the beginning of Sudanese exports of oil, the petroleum sector's contribution to GDP was negligible. Prior to that date, the shortage of petroleum products and the negative repercussions of that on production and growth was a permanent handicap impeding the economy’s development. The structure of the economy has been changing from being dominated by the agricultural sector towards being dominated by the petroleum sector. However, the petroleum sector has not contributed in any significant way to the development of the other sectors. On the contrary, the dominance of the petroleum sector facilitated the continuing neglect of the agriculture and manufacturing sectors. The petroleum sector contributed more than 90% to total exports during the last five years, implying that the economy is becoming highly dependent on the exports of one product. Moreover, this indicates that oil has not played a positive role in the development of non-oil exports and particularly the export of agricultural products (Gadkarim, 2010).

The contribution of the oil sector to GDP increased from 2% in 1999 to 21% in 2007 and to an average of 9% thereafter. For the same periods, there was only a slight or no change in the contribution from other sectors (services, building and construction, and electricity and water) although services regained the lead in the post-2008 deterioration of oil revenue (Siddig, 2012).

Sudan is one of the largest countries in Africa, with diverse geology and large quantities of mineral resources. Sudan was one of the leading gold-producing countries in Africa in 2014. A small number of mineral commodities were mined in the country, and mine output was not proportional to the size of the country’s mineral resources and reserves. In 2014, crude oil and gold were the country’s main mineral exports, along with modest quantities of chromite, petroleum products, and scrap metals. Other mineral commodities produced in Sudan included cement, feldspar, fluorite, gypsum, iron and steel, kaolin, laterite, manganese, marble, salt, silver, and zinc (CBS, 2015).

Seven mineral districts in Sudan were identified by the Ministry of Minerals as having good potential for mining operations.

The Red Sea Hills area in northeastern Sudan has copper, gold, iron ore, rare-earth elements, silver, and zinc mineral occurrences, as well as black sands, garnet, gypsum, salt, and talc deposits. Estimates of major mineral resources in the Red Sea Hills area included 500,000 metric tons (Mt) of contained copper, 150 t of contained gold, 4,500 Mt of silver, and 1.9 million Mt of contained zinc. The Beyoda desert, which is located in north-central Sudan, contains feldspar, gold, iron ore, kainite (aluminum silicate), manganese, marble, mica, and silica deposits. The Jebel Marra volcanic field, which is located in western Sudan, hosts deposits of base metals, garnet, kainite, salt, and sulfur.

The Jebel Abyad and Jebel Wahib regions in northern Wadi Hawar have the potential to produce bauxite, chromite, gold, and platinum-group metals. The Ingessana polymetallic complex in the State of Blue Nile in southeastern Sudan has asbestos, chromite, gold, magnesite, marble, and talc occurrences. The Nuba Mountains, located in South Kordofan, host important mineral commodities, including such metals as chromium, copper, gold, iron, manganese, and nickel; such industrial minerals as graphite, marble, phosphate rock, and talc; and uranium as an energy mineral. The Copper Pit mineral district, which is located in the State of South Darfur in southwestern Sudan, is prospected for copper, gold, precious stones, and uranium mining (Ministry of Minerals, 2014).

In 2014, Sudan’s mineral exports, which included chromite, crude oil and refined petroleum products, gold, and ferrous and nonferrous scrap metals, accounted for about 59% of total exports. Crude oil exports decreased in value and volume to about USD 1.1 billion and 11.1 million barrels (Mb), respectively, from USD 1.6 billion and 15.8 Mb respectively, in 2013. Gold exports increased in value and volume to about USD 1.3 billion and 30.45 Mt, respectively, in 2014 from USD 1.0 billion and 24.81 Mt, respectively, in 2013. The United Arab Emirates purchased 88% of Sudan’s gold exports. Refined petroleum product exports increased to USD 163 million from USD 102 million, and other mineral commodity exports, which included chromite, decreased to USD 17.3 million from USD 18.9 million. Chromite exports by tonnage increased to about 42.9 Mt in 2014 from 17.3 Mt in 2013 and 2.6 Mt in 2012. Scrap metal exports, which comprised copper, iron, and lead scrap materials, totaled 10.4 Mt and were valued at USD 157,000 in 2014 compared with 50.0 Mt valued at USD 38,000 in 2013 (CBS, 2015; Hassan & Abdullah, 2014)

Economic Growth in Sudan

From 1960 to 1998, Sudan experienced alternating periods of positive and negative growth. Periods of negative growth were longer, and the rate of negative growth relatively low, whereas the shorter positive growth periods were characterized by relatively high per capita growth rates. However, the entire period was marked by a growth trend that was generally positive. From the late 1990s, and continuing for about a decade, the Sudanese economy recorded good GDP growth. However, even though the country witnessed periods of high growth, these could not be described as generating sustained development or as being pro-poor. Growth was, and still is, it could be argued, sectorally unbalanced, geographically concentrated, and coupled with widespread poverty and structural distortions in the economy.

The last recorded episode of high growth coincided with the era of oil production and exportation. Since 1999, oil had gradually assumed a cornerstone position in the Sudanese economy, as indicated by its contribution to the GDP, foreign trade, and government revenues. The significance of the contribution made by oil to one or all of these economic indicators equated with the sector’s considerable impact over almost all aspects of the economy and society. It could be argued that oil revenues have contributed substantially to maintaining a stable exchange rate and external balance, increasing government revenues and improving the fiscal situation, and cutting down inflation to the single digits.

These achievements could not be maintained after the secession of South Sudan in 2011, and the associated loss of oil revenues since most of the oil-producing fields are located in South Sudan. Sudan lost 75% of the oil production, 36% of budget revenues, more than 65% of foreign exchange revenues, and 80% of total exports. The result was a decline in its annual growth rate in 2011–2012, from which it has partially recovered (U.N., 2016).

Research Methodology and Empirical Results

In this research, we use the ARDL model for co-integration to estimate the impact of productive sectors (agricultural, industrial, and oil and mining) on the real GDP (1980–2014), using secondary data collected from the CBS and the Central Bureau of Statistics. The empirical model to be estimated takes the following general form

GDP = F(AGR, MAN, PM)-----------------(1)

Where:

GDP: Real gross domestic product

AGR: Real value of agriculture product.

MAN: Real value industrial output.

PM: Real value of oil and mining product.

Unit-Root Test

A time-series Y_t (t=1,2...) is said to be stationary (in the weak sense) if its statistical properties do not vary with time (expectation, variance, autocorrelation). The white noise is an example of a stationary time series, with, for example, the case where Y_t follows a normal distribution N(mu, sigma^2) independent of t.

Identifying that a series is not stationary makes it possible to study its non-stationary nature. A non-stationary series can, for example, be stationary in difference (also called integrated of order 1): Y_t is not stationary, but the Y_t − Y_{t−1} difference is stationary. It is the case of the random walk. A series can also be stationary in trend.

Stationary tests allow verification of whether a series is stationary or not. There are two different approaches: stationary tests such as the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test that takes as null hypothesis H0 that the series is stationary; and unit-root tests, such as the Dickey–Fuller test and its augmented version, the Augmented Dickey–Fuller test (ADF), or the Phillips-Perron test (P.P.), for which the null hypothesis is that the series possesses a unit root and hence is not stationary. XLSTAT currently includes four unit-root tests: the Dickey–Fuller test, the ADF test, the P.P. test, and the KPSS stationary test. In this research, we use the ADF test.

The ARDL Model for Co-integration

Recently, the ARDL approach to co-integration and Error-Correction Models (ECMs) was proposed by Pesaran, Shin & Smith (2001) as an alternative to Johansen’s multivariate co-integration test (Johansen & Juselius, 1990). The popular Johansen multivariate co-integration modeling technique is widely accepted as an improvement on the residual-based Engle & Granger (1987) test. The two-step co-integration test still has notable limitations because of its dependence on pre-tests for the order of integration and its inapplicability to systems with a mixed order of integration. Due to the limited power of existing unit-root tests, the Johansen co-integration testing procedure could result in inaccurate inferences regarding the causal structure and the nature of long-run relationships among variables.

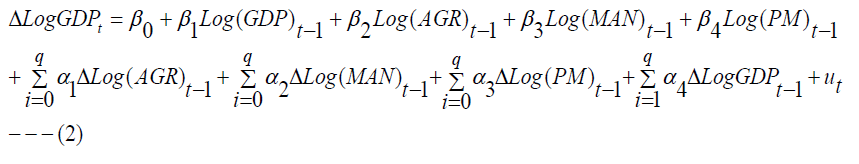

By contrast, the ARDL approach allows for causal inference based on ECMs and is a very good alternative to conventional co-integration tests because it bypasses the need for potentially biased pre-tests for the unit root. The ARDL technique is invariant to mixed orders of integration since the tests do not depend on whether the variables are I(0) or I(1) or a combination of the two (Morley, 2006). Thus, the determination of the existence of long-run relationships does not require that the variables be of the same order of integration. Also, this modeling approach yields desirable statistical properties in small samples. Pesaran, Shin & Smith (2001) show that long-run estimates from ARDL estimation are super-consistent and that valid inferences can be made using standard asymptotic theory. The error-correction version of the ARDL model to the variables of this research based on equation (2), which is:

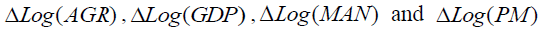

Where:

are the first differences of the logarithms of the respective variables.

are the first differences of the logarithms of the respective variables.

β1, β2, and β3 are long-run parameters.

α1, α2, and α3 are short-run parameters.

Ut: random variable.

The ARDL approach to co-integration analysis involves the estimation of the conditional error correction model by the ordinary least squares (OLS) method. A bounds test for co-integration (null Hypothesis of non-co-integration) is based on F-test restrictions of the joint significance of the estimated coefficients of the lagged level variables in equation (2). Since the asymptotic distribution of the F-statistics is non-standard, Pesaran, Shin, and Smith (2001) provide two sets of adjusted critical values that provide the lower and upper bounds used for inference. While the first set of critical values assume that the variables are I(0), the other assumes they are I(1).

Co-integration exists, and there is evidence of a long run relationship if the computed F-statistic exceeds the upper-bound critical value. However, we cannot reject the null hypothesis of no co-integration if the F-statistic is below the lower bound. The results will be deemed inconclusive for a value within the bounds. The adequacy of the specified models was also examined using various diagnostic tests for serial correlation (L.M. test), functional form (Ramsey’s RESET test), and structural stability (CUSUM and CUSUMSQ tests). According to the economic theory, it is expected that the real value of agricultural products, industrial output, and oil and mining products will be associated positively with the dependent variable, which is the Real GDP.

The Empirical Results

Unit-root Test

| Table 2 Unit-Root Test |

|||||||

|---|---|---|---|---|---|---|---|

| Name ofVariable | Lag Order | Level | 1st Difference | ||||

| Intercept | Trend | None | Intercept | Trend | None | ||

| Log(GDP) | 1(1) | 1.694 | −0.883 | 7.014 | −4.213 | −4.652 | −0.620 |

| 0.999 | 0.946 | 1.000 | 0.0023 | 0.0038 | 0.438 | ||

| Log(AGR) | 1(0) | 1.033 | −4.093 | 2.850 | −5.341 | −5.542 | −6.8811 |

| 0.995 | 0.0146 | 0.998 | 0.0001 | 0.0005 | 0.0000 | ||

| Log(MAN) | 1(1) | −0.640 | −2.083 | 1.1318 | −4.8811 | −4.0021 | −3.94 |

| 0.8483 | 0.5356 | 0.93 | 0.003 | 0.0185 | 0.0003 | ||

| Log(PM) | 1(0) | −6.951 | −7.389 | −6.762 | −2.751 | −5.890 | −3.475 |

| 0.0000 | 0.0000 | 0.0000 | 0.079 | 0.0002 | 0.0012 | ||

Source: Own calculation based on data.

Table 2 shows that the real value of agricultural products and of oil and mining products are stationary in the level and thus integrated from the zero grade, while the variables for the real value of industrial output and GDP are stationary in the first difference and, therefore, they integrated in the first class. The ARDL method for co-integration is thus the most suitable and was adopted for use in the present case.

A Bound Test for Co-integration

| Table 3 Ardl Bounds Test for Co-Integration |

||

|---|---|---|

| Variables | F- statistic ( calculated) | Co-integration |

| 7.948* | Co-integration | |

| Critical value | Lower bound | Upper bound |

| 1% | 4.3 | 5.23 |

| 5% | 3.38 | 4.23 |

| 10% | 2.97 | 3.74 |

| * Statistical significance at 1% level | ||

Source: Own calculation based on data in Appendix (1).

Therefore, the empirical findings lead to the conclusion that a long-run relationship between the variables in the model is significant at the 1% level.

Estimated Coefficient (Elasticity) in the Long and Short Run

To estimate the equilibrium relationship in the long and short-term, we used the Model (3,4,0,0) – with the figures in parenthesis being the t-ratios of the estimated parameters (elasticities). The results are set out in Tables 4 and 5.

| Table 4 Estimated Coefficients (Elasticities) in The Long Run |

||||||

|---|---|---|---|---|---|---|

| Variables | Co-efficient | P-value | R2 | R-2 | D.W | F-statistic |

| Log(MAN) | 0.275 | 0.0000 | 0.999 | 0.998 | 1.91 | 1770.7 |

| (10.48) | ||||||

| Log(PM) | 0.0176 | 0.0026 | ||||

| (3.471) | ||||||

| Log(AGR) | 0.203 | 0.0059 | ||||

| (3.096) | ||||||

| Trend | 0.022 | 0.0001 | ||||

| (5.199) | ||||||

Source: Own calculation based on the data.

Log RGDP is the dependent variable.

| Table 5 Estimated Coefficients (Elasticities) in The Short Run |

|||||

|---|---|---|---|---|---|

| Variables | Lag order | p-value | |||

| 0 | 1 | 2 | 3 | ||

| ΔLog(GDP) | ----------- | 0.128 (0.758) |

----------- | 0.457 | |

| ΔLog(GDP) | ------- | ------- | 0.241 (1.838) |

------- | 0.0817 |

| ΔLog(MAN) | 0.066 (1.378) |

------- | ------- | ------- | 0.1841 |

| ΔLog(MAN) | ------- | -.164 (-2.129) |

------- | ------- | 0.0465 |

| ΔLog(MAN) | ------- | ------- | -0.211 (-3.342) |

------- | 0.0034 |

| ΔLog(MAN) | ------- | ------- | ------- | -0.0971 (-1.938) |

0.0676 |

| ΔLog(PM) | -0.0068 (-0.977) |

------- | ------- | ------- | 0.3407 |

| ΔLog(AGR) | 0.040 (0.990) |

------- | ------- | ------- | 0.3346 |

| C | 2.40 (3.523) |

------- | ------- | ------- | 0.0023 |

| CointEq(-1) | -1.27 (-3.70) |

------------------------ | 0.0015 | ||

Source: Own calculation based on data.

It is clear from Tables 4 and 5 that the F-statistic measuring the joint significance of all regressors is statistically significant. It is obvious from Table 4 that in the long run, and in line with economic theory, the real values of agriculture product, industrial output, and oil and mining product have positive and significant effects on Real GDP. It is obvious from Table 5 that the effect of the real value of industrial output and of oil and mining products is negative and significant in the short run. This is contrary to economic theory, and this may be due to the higher production costs and the weak competitiveness of industrial products and that the oil sector was in the exploration period. The effect of the real value of agricultural products is positive but not significant, as evidenced by the result that the effect of all variables in the long term is significantly greater than their effect in the short term. The effect of the real value of industrial output on Real GDP is greater than the other variables in the long and short term. The coefficient of determination ( ) is 0.99. The results show that about 99% of the variation in GDP is caused by variations in the explanatory variables. The Durbin–Watson statistics is 1.91, which shows the absence of serial correlation. We note that the parameter of error correction is equal to −1.271 and significant at 1%. In addition, it has a negative sign. This indicates the increasing accuracy and validity of the equilibrium relationship in the long run and that the error correction mechanism is present in the model. This means any error in this model will be corrected after 0.78 years.

Based on the findings of this research – that industry is the most important contributor to GDP – the government should provide the necessary financing for establishing industry paying attention to feasibility studies, spare parts, follow modern methods in the management of industrial facilities, and rehabilitate factories that have stopped working. The government should establish clear and specific criteria for the mining sector, remove inconsistencies between the government institutions in this regard, develop specific laws with respect to civil mining and conclude specific agreements with foreign and domestic companies. These efforts would increase the production of the sector and increase exports.

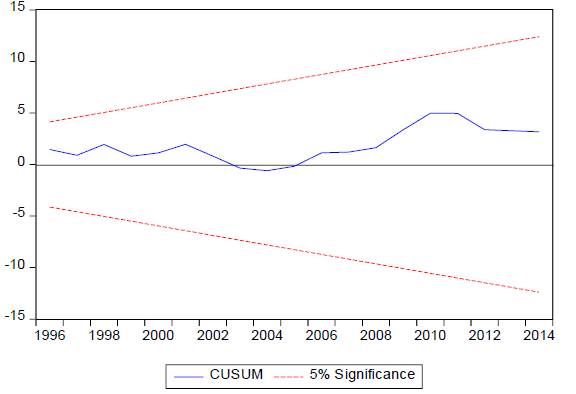

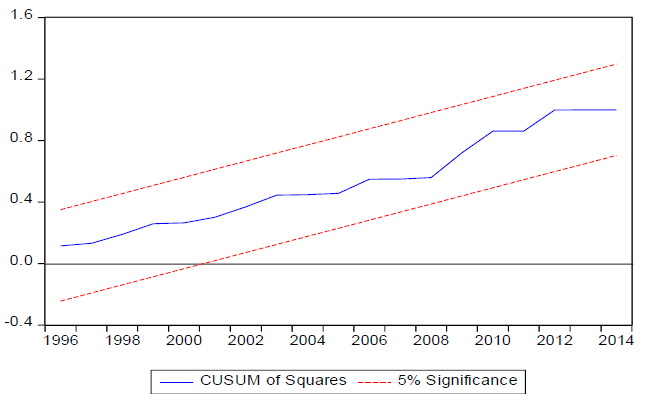

CUSUM and CUSUMSQ Tests

From Figures 1 and 2 we can conclude that the estimated coefficients are stable because the plot of CUSUM and CUSUMSQ statistics stayed within the two red lines at the 5% significance level.

Conclusion

This research investigated the impact of economic sectors on the GDP in the economy of Sudan. The variables included in the research are the real value of agricultural products, the real value of oil and mining products, the real value of industrial output, and real GDP. A log-linear regression model is employed and estimated using data over the period 1980–2014, which were obtained from the CBS and Central Bureau of Statistics. The ARDL method was applied to estimate the empirical model. The main findings are that the long-run real value of agricultural products, the real value of industrial output, and the real value of oil and mining products have a positive and significant effect on real GDP. This is completely consistent with the economic theory as evidenced by the results that the effect of the real value of industrial output and real value of oil and mining products in the short run were negative and significant. This is contrary to economic theory and may be due to higher production costs in the industrial sector, that the competitiveness of industrial products is weak, and that oil was in the exploration period, while the effect of the real value of agriculture product was positive, but it is not significant. This was evidenced by the results that the effect of all variables in the long term was significantly greater than their effect in the short term. The effect of the real value of industrial output on the real GDP was greater than the other variables in the long and short term. Also, the research found that any error in the model will be corrected after 0.78 years.

The recommendations are that the government should finance and pay attention to feasibility studies, spare parts, modern management methods, and rehabilitating factories in the industrial sector. They should establish clear and specific criteria for the mining sector, remove inconsistencies, develop specific laws with respect to civil mining, and conclude specific agreements with the foreign and domestic companies in the mining sector. Also, the government should attend to and encourage investment in the agricultural sector and address all impediments that face the sector, improving infrastructure, and facilitating trade services. In addition to that, the government should support efforts to increase the value-added of agricultural exports and add new markets. Also, the efforts should focus on improving social infrastructure to ensure the success of these recommended actions.

References

Abu Affan, B.O. (1984). Industrial policies in industrialization in Sudan, Ph.D. Thesis, Department of Business Administration, University of Khartoum, Khartoum, Sudan.

Acemoglu, D. (2009). “The solow growth model” introduction to modern economic growth. Princeton: Princeton University Press, 26–76.

Ahluwalia, M.S. (1996). “New economic policy and agriculture: Some reflections”. Indian Journal of Agricultural Economics, 51(3), 412–426.

SemanticScholar, GoogleScholar

Rostam, B.N., Mohammed, B.A., & Ahmed, Y.A. (2015). “Sharing the agriculture and industrial sectors in the economic growth of Iraq: An Ordinary Least Squares (OLS) application”. Journal of Emerging Trends in Economics and Management Sciences, 6(5), 340–353.

SemanticScholar, GoogleScholar

Ajmair, M. (2014). “Impact of Industrial Sector on GDP (Pakistan Case)”. European Journal of Contemporary Economics and Management, 1(1), 1–26.

SemanticScholar, GoogleScholar, Crossref

Amaral, F.E. (2018). Dezenvolvimentu Ekonomia Rural Agricultura Perpetiva Agro-Comercio. Seminar on Small Scale Agriculture Processing Industry, Dili, Timor-Leste.

Central Bank of Sudan (2009). “The 49th Annual Report of the Central Bank of Sudan (CBS)”.

Central Bank of Sudan (2014): “The 55th Annual Report of the Central Bank of Sudan (CBS)”.

FAO (2014). “Information System on Water and Agriculture”.

Gadkarim, H.A. (2010). “Oil, Peace and Development the Sudanese Impasse” Chr. Michelsen Institute, Sudan Working Paper SWP (2).

Gollin, D., Parente, S.L., & Rogerson, R. (2002). “The role of agriculture development”. American Economic Review, 92(2), 160–164.

Halliday, F. (2005). The Middle East in international relations, Cambridge University Press.

Hassan, K., & Abdullah, A. (2014). “Effect of oil revenue and the Sudan economy: Econometric model for services sector GDP”. Procedia – Social and Behavioral Sciences, 172, 223–229.

SemanticScholar, GoogleScholar, Crossref

Kapusuzoglu, A. (2011). “Relationships between oil price and stock market: An empirical analysis from Istanbul Stock Exchange (ISE)”. International Journal of Economics and Finance, 3(6), 99–106.

SemanticScholar, GoogleScholar

Karrar, A.B.A., & Ahmed, E.A (2006). “Brief overview of Sudan economy and future prospects for agricultural development”. Khartoum Food Aid Forum, 6–8.

SemanticScholar, GoogleScholar

Karshenas, S. (1996). “The role of agriculture in the early phase of industrialization: Policy implications of Japan’s experience”. In East Asian Development: Lessons for a new global environment, 5, 1–21.

SemanticScholar, GoogleScholar, Crossref

La’o Hamutuk (2018). “Right and Sustainability in Timor-Leste’s Development”.

La’o Hamutuk (2018): “Submission to Timor-Leste National Parliament from La’o Hamutuk on the Proposed General State Budget for 2017”.

La’o Hamutuk (2016). “South coast petroleum infrastructure project”

La’o Hamutuk (2016). “Special Economic Zone in Oecusse”.

La’o Hamutuk (2016). “Tibar Container Port”.

LaCour-Little, M., & Stephen M. (2001). “Gated communities and property values” Wisconsin-Madison CULER working papers 01–04, University of Wisconsin, Center for Urban Land Economic Research.

SemanticScholar, GoogleScholar

Lawrence, A., & Salako, M.A. (2015). “Agriculture economic growth and development nexus: VAR variance decomposition evidence from Nigeria”. International Journal of Economics, Commerce and Management United Kingdom, 3(6).

SemanticScholar, GoogleScholar

Mahonye, N., & Mandishara, L. (2015). “Mechanism between mining sector and economic growth in Zimbabwe, is it a resource curse?” Economic Research Southern Africa (ERSA), Working Paper 499.

SemanticScholar, GoogleScholar

Mahran, H.A. (1990). “Export expansion and growth: Case studies of the Arab Country” Elmansora, University Press Egypt.

Ministry of Minerals, Sudan (2014). “The field of mineral potential of the Sudan”.

Ministry of Investment, Sudan (2009): “Foreign Investment flows to Sudan by country” Unpublished.

Sahoo, K., & Sethi, N. (2012). “Investigating the Impact of Agriculture and Industrial Sector on Economic Growth of India”. OIDA International Journal of Sustainable Development, 5(5), 11–22.

SemanticScholar, GoogleScholar

Schneider, K., & Gugerty, M.K. (2011). “Agricultural Productivity and Poverty Reduction: Linkages and Pathways”. The Evans School Review, 1(1), 56–74.

SemanticScholar, GoogleScholar

Schultz, T.W. (1988). “Transforming traditional agriculture”. American Journal of Agricultural Economics, 70(1), 198–200.

SemanticScholar, GoogleScholar, Crossref

Siddig, K.H.A. (2012). “Oil and agriculture in the post-separation Sudan”, University of Khartoum, Agricultural Economics Working Paper Series, No.1 (2012).

SemanticScholar, GoogleScholar

Received: 02-Mar-2022, Manuscript No. AAFSJ-21-9930; Editor assigned: 10- Mar -2022, PreQC No. AAFSJ-21-9930 (PQ); Reviewed: 15- Mar-2022, QC No. AAFSJ-21-9930; Revised: 28-Mar-2022, Manuscript No. AAFSJ-21-9930 (R); Published: 07-Apr-2022