Research Article: 2018 Vol: 22 Issue: 1

Productivity Change in The Efficiency of The Insurance and Takaful Industry of Pakistan

Che Azlan Taib, School of Technology Management and Logistics, University Utara Malaysia

Muhammad Saleem Ashraf, Islamic Business School, University Utara Malaysia

Mohd. Shahril Bin Ahmad Razimi, Islamic Business School, University Utara Malaysia

Keywords

Insurance, Takaful, Pakistan Industry.

Introduction

As the other countries of the world, insurance industry of Pakistan is facing the changes and has encountered multiple issues. At the time of independence in 1947, there were 84 insurance companies operating in Pakistan, dominant by the foreign insurance firms. In 1972, Government of Pakistan nationalized all the insurance firms operating in the country and merges them into the State Life of Pakistan. However there was a major breakthrough in the 1990s, the financial reforms took into place and these reforms allowed private and foreign companies to establish their business in the insurance sector (Malik, Malik and Faridi 2011; "State Bank of Pakistan", 2005).

Although, takaful concept was there even before the evolution of Islam. The first time it was introduced in Sudan in 1979 and later on in Saudi Arabia. Now takaful is operating its business in more than 22 countries and getting popularity in other regions (Qureshi, 2011). Majma-al-Fiqh, the Grand Council of Islamic Scholars, Saudi Arabia, approved takaful as an alternate to insurance according to the shari’ah ruling in 1985. Currently, Takaful industry has its global volume US $25 billion with only 305 takaful-retakaful operators and windows. However, it is worthwhile to note that the growth of takaful industry is 12% per annum which higher than the conventional insurance industry which is only 4% per annum ("Annual Islamic Financial Services Industry Stability Report", 2017).

The Council of Islamic Ideology in Pakistan reviewed the model and alters it for Pakistan’s financial sector according to the shari’ah rulings on 29th April 1992 (Khan, 2016). Later on, the Government of Pakistan issued “Takaful Rules 2005” on 3rd September 2005, an Islamic compatible takaful operational model ("Securities and Exchange Commission of Pakistan", 2016).

This paper provides an in-depth analysis of the productivity change in the efficiency, reasons for this change for the insurance and takaful operators in Pakistan for the period of 2008 to 2016. Efficiency measurement has been developed as one of the growing areas for the researchers and decision makers. The financial sector is very crucial for any country. The measurement of efficiencies and productivity change in the efficiency of the insurance sector become the core issue for the policy makers and researchers (Eling and Luhnen, 2010). As Takaful industry is an infant in Pakistan, the productivity change analysis has been relatively less discussed in this context.

This study provides insight into the productivity change, decomposition the change into technical efficiency change and technological change. These changes provided the reasons for the change in the productivity of the insurance and takaful industry. This study will also establish the reason for the change in the technical efficiency and divide it into the Pure Efficiency change and scale efficiency change.

Literature Review

Financial sector always remains the matter of discussion for the researchers. Numerous international studies on the efficiency and performance of financial services industries, especially banking sector have been done but only a few studies have discussed the insurance industry. The insurance industry is facing the multiple challenges like risk management, diversified increasing competition, consolidation and fluctuating regulatory sanctions. It became very important to calculate the efficiency and the productivity changes of the industry to determine the response of the industry towards the said challenges, which predicted the survival of the firm in the industry (Berger, Hunter & Timme, 1993).

For the insurance firms, it is key to look for methods and ways so that they can improve their performance because of consolidation, changing regulatory environment and increased in competition. All of these three factors have played a key role in the characterization of the insurance sector since few years. The available literature of efficiency shows that it has the same impact in emerging and developed economies. Evaluation of efficiency helps the insurance firms to improve or gain the competitive advantage over the competitors which is beneficial for the overall improvement of efficacy in the financial system.

Most reliable and commonly used approach to measuring the efficacy, efficiency and productivity of any industry is the frontier approach. This technique of measuring the efficiency allows responding the multiple outputs and inputs of the firms to develop the frontier and compare the DMU’s with the efficient firm. Berger and Humphrey (1997) made a survey of 130 studies conducted in 21 different countries of the world, which use the frontier techniques and concluded that there is two frontier approaches known as a Parametric approach (Econometric Frontier Approach) and non-parametric approach (mathematical programming approach). Stochastic Frontier Approach (composed error), the Thick Frontier Approach and Distribution-Free Approach (different composed error) are the famous parametric approaches. Whereas, Data Envelopment Analysis and the Free Disposable Hull are the non-parametric approaches (Cummins, Tennyson and Weiss, 1999; Cummins and Zi, 1998).

Among the abovementioned techniques, Stochastic Frontier Analysis (SFA) and Data envelopment analysis (DEA) is mostly been used in the insurance industry. Aigner, Lovell and Schmidt (1977) developed the SFA which can manage the relationship between inputs and outputs of the firm to measure the cost, profit and production frontier. It is important to mention that SFA also distinguishes the random error from inefficiency (Berger & Humphrey, 1997). This frontier technique is used to evaluate the distance of the firm from the optimizing envelope (Sealey & Lindley, 1977).

Farrell (1957) developed a mathematical model in 1957 by using single input-output technical for the measurement of technical efficiency. But the Data Envelopment Approach (DEA) based on mathematical programming was introduced by Charnes, Cooper and Rhodes (1978), later on, known as CCR model. This model was developed for measuring the relative efficiency and taking the set of decision-making units (DMU) and having the identical set of input and output variables while Banker et al. (1984) developed variable returns to scale (VRS). This approach produces the frontier curve of the ratio of multiple inputs and outputs through linear programming. It assumes that linear substitution is possible between observed input combinations on an isoquant.

Among the various reason which make DEA preferable are: First, DEA is consistent and faster to make the frontier decision than the SFA (Grosskopf, 1996; Kneip, Park and Simar, 1998), second, DEA make unbiased calculation of the productivity as compare to SFA and Finally, comparison between DEA and SFA results of financial companies evident that, despite the two methods yielding parallel results (Casu, Girardone and Molyneux, 2004). The DEA estimates are more highly correlated with conventional performance measures (Cummins and Zi, 1998).

DEA has the ability to combine the results of input and output of a firm into productive efficiency which lies between zero (inefficient) and one (maximum efficient). Furthermore, through the results of the linear estimates by which the observed data is bound, the frontier is effectively estimated by DEA (Leong et al., 2003). DEA is a unique technique which ‘envelop’ the inefficient firm by producing the frontier of the efficient firm for the same input and output combination (Neal, 2004).

To date, DEA and Malmquist productivity indexes have been used in a number of studies. These studies include comparisons of aggregate productivity change for the time between countries, for example, Fare, Grosskopf, Norris and Zhang (1994) examined the change in productivity of 17 OECD countries for the period 1979-88 and concluded that growth in technical productivity of US insurer is higher than the average. However, Japan’s productivity growth was the highest amongst the participant countries for the specified period. Mansor and Radam (2000) analysed the productivity change of the 12 life insurers of Malay's insurers for the period of 1987-1997. They found that the productivity change was less in the insurance industry as compared to overall economic growth of Malaysian industry. Diacon, Starkey and O'Brien (2002) studied the productivity change in the insurance industry of 15 European countries over the period of 1996-99 and concluded that average technical efficiency declined during the estimated period of time. Bertoni and Croce (2011) investigated the elements of productivity change in the European life insurance industry for the period of 1997 to 2004. They decompose the productivity change into best-practice innovation and adaptation and concluded that the increase was mostly due to the innovation. Al-Amri, Gattoufi and Al-Muharrami (2012) analysed the performance of 39 insurance companies in GCC countries for the period of 2005 to 2007.

The results showed the high growth for the insurance sector and this growth was escorted by continuous development in the technical efficiency over the period of 2005 to 2007.

Some studies for productivity change within the country are made by the researcher including Cummins and Xie (2008) measured the productivity effects of mergers and acquisitions in the US property-liability insurance industry over the period 1994 to 2003 and constructed productivity indices. He found the change in productivity for acquirers, acquisition targets and non-merger and acquires firms. Javaheri (2014) measured the productivity change of the Iranian insurance industry for the period of 2003-2009 by using the output-oriented DEA Malmquist productivity index. He concluded that liberalization policy of the government and better competitive environment have a positive impact on the productivity of the industry. Alhassan and Biekpe (2015) studied the productivity change for non-life insurance market in South Africa from 2007 to 2012. The authors observed that productivity improvements are due to technological changes. Biener, Eling and Wirfs (2016) measured the productivity of Swiss insurance companies for 1997-2013 and concluded that efficiency and productivity of the property/casualty and reinsurer sectors have been improved, but not for the life insurers.

Data and Methodology

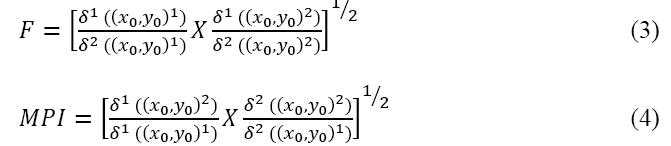

Malmquist Index is used in this study to measure the change in total factor productivity (TFP) change index over time. This index estimated the changes in production unit in two ways, change in production frontier with respect to technology (TCI) and second is a change in the efficiency frontier over the period of time (TECI). The other available methodologies for measurement of productivity change are the Fisher and Tornqvist indices; however, Malmquist Productivity index (MPI) is adopted because it allows separating the technical efficiency change from the technological change and also consistent with the Data envelopment Approach and both use the linear programming to measure the distance function (Färe, Grosskopf, Lindgren & Roos, 1989).

There are radial and non-radial measures of calculating the Malmquist productivity index (MPI). Since the radial measures suffer from neglecting the slacks, this article use input-oriented DEA and MPI slacks-based non-radial model. The MPI estimates changes in efficiency of a DMU amongst two time periods and defined as under,

MPI = (Catch-up) × (Frontier-shift) = TECI X TCI (1)

The catch-up (recovery) reflects the degree of efforts attained by a DMU for improving its efficiency, while the frontier-shift (innovation) term reveals the change inefficient frontiers surrounding the DMU between the two time periods say 1 and 2. The DMU0 at time period 1 is symbolized by  while at time period 2, it is denoted by

while at time period 2, it is denoted by  . The catch-up effect is

. The catch-up effect is

When C>1, it indicates increase efficiency from, if C =1, it reflects the no change while C <1 refers to a decline in efficiency. The frontier-shift effect at  is described as follows:

is described as follows:

The MPI consists of four terms:

. The first two terms replicate the changes w.r.t same time period, while the last two terms show the comparison over time. MPI>1 indicates improvement, while MPI =1 indicates status in quo and MPI<1 refers to a reduction in the total factor productivity. It would be pertinent to mention here that the MPI was calculated by using the non-radial measure of DEA where the outliers were excluded from the analysis to ensure normality of results.

. The first two terms replicate the changes w.r.t same time period, while the last two terms show the comparison over time. MPI>1 indicates improvement, while MPI =1 indicates status in quo and MPI<1 refers to a reduction in the total factor productivity. It would be pertinent to mention here that the MPI was calculated by using the non-radial measure of DEA where the outliers were excluded from the analysis to ensure normality of results.

This paper used the input-oriented Malmquist Productivity indices (MPI). The MPI can be decomposed under CRS and VRS assumption. This assumption of CRS and VRS does not affect the results of indices (Ray & Desli, 1997). The techniques we use allow us to decompose TFP growth into two components which are a change in technical efficiency over time and shift in technology over time. Then technical efficiency change is further decomposed into two different categories, change in pure technical efficiency and change in scale efficiency over time.

Three inputs and two outputs are utilized to investigate the efficiency of insurance and takaful firms in Pakistan in this study. The inputs are equity, net claims and management expenses and the outputs are premia and net investment income. These inputs and outputs are used to investigate the efficiency of 14 insurance and 5 takaful firms in Pakistan. The insurance firms involved in the study are State life insurance, Adamjee insurance, Alfalah insurance, Asia insurance, Askari insurance, Atlas insurance, Efu-General insurance, Efu-Life insurance, Habib insurance, IGI insurance, Jubilee Life insurance, New Jubilee insurance, Premier insurance, Shaheen insurance and five takaful operator having more than 80% (in terms of premium) of market share, i.e., Takaful Pak, Pak-Qatar(General), Pak-Qatar(Family), Pak-Kuwait, Dawood Takaful. The study uses secondary data for the takaful and insurance industry obtained for the period from 2008 to 2016. The period is chosen for the reason that although takaful operators start a business in 2005 all five takaful operators start a business in 2007. The data is collected from the annual financial statements of insurance and takaful firms. The Malmquist indexes are constructed using the Data Envelopment Approach (DEA) and estimated using Coelli (1996) DEAP version 2.1.

Results and Discussions

This section provides an insight of results of productivity growth, represented by Malmquist total factor productivity index (M), of the insurance sector of Pakistan over the period of time 2008 to 2016. This productivity change is disintegrated into Efficiency change Index (ECI) and Technology Change Index (TCI) to examine the reasons for the change in productivity. Similarly, Pure Efficiency Change Index (PECI) and Scale Efficiency Change Index (SECI) are computed to determine the causes of change in ECI. The value of TFP indices will reflect the change index. M>1 reflects the improvement, M=1 shows the status quo and M<1 explains the negative change in the factor productivity of the index.

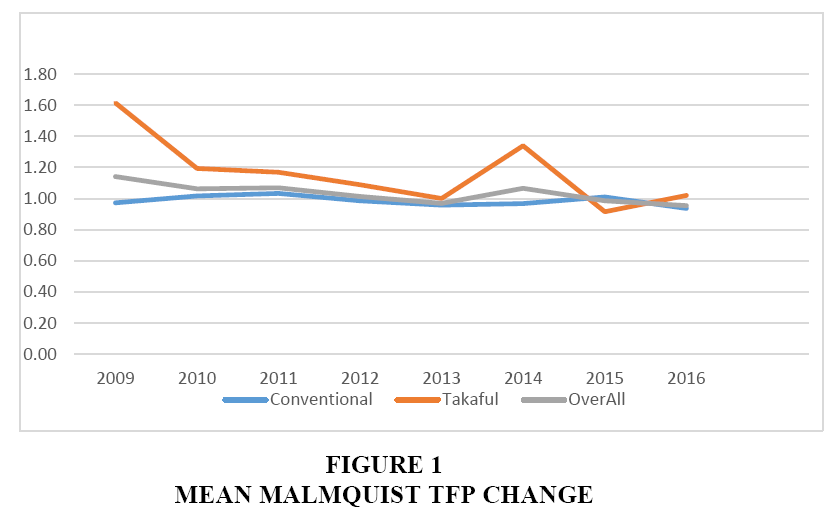

Error! Reference source not found displays calculated changes in the Malmquist-based Total Factor Productivity index (Table 1). 2008 is used as a bass year and factor productivity is calculated from 2009 to onwards. In 2009 Conventional insurance companies bear the 3% decrease in productivity whereas, Takaful companies enjoyed a tremendous increase of 62% increase in productivity. This increase in the productivity was due to the Dawood Takaful which started a business in 2008 and gets the appreciation from the market. Takaful concept was well appreciated by the market. Insurance companies succeeded to attain only 2% and 3% increase in 2010 and 2011 as compared to the takaful companies who secured 19% and 17% increase in the respective years. The insurance industry could not able to maintain the increasing trend and observed declining trend in their factor productivity, i.e., 1%, 4% and 3% respectively. On the other hand, comparatively takaful industry was continued to maintain improvement in productivity from 2012 to 2014. However, in 2015, due to certain reasons, one of the active takaful operators planned to quit from the market. Consequently, the productivity change of the takaful industry declined by 8% in the same year, though it was a temporary slump in the takaful industry, the industry again observed 2% increase in the productivity index.

| Table 1 Malmquist Tfp Change over Time |

||||||||

| Insurance Companies | ||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Adamjee Insurance Co. Ltd. | 0.88 | 1.06 | 0.79 | 1.08 | 1.12 | 1.21 | 1.04 | 1.13 |

| Alflah Insurance Co. Ltd. | 0.90 | 0.89 | 1.00 | 0.86 | 0.88 | 0.83 | 1.00 | 1.03 |

| Asia Insurance Co. Ltd. | 0.83 | 1.05 | 0.85 | 0.93 | 0.64 | 0.71 | 0.71 | 0.68 |

| Askari insurance | 0.97 | 1.12 | 0.71 | 0.98 | 0.87 | 0.84 | 1.05 | 0.95 |

| Atlas insurance | 0.94 | 1.17 | 1.05 | 1.46 | 0.76 | 0.97 | 1.07 | 1.00 |

| EFU-General insurance | 1.01 | 0.95 | 1.12 | 1.01 | 1.07 | 0.97 | 1.02 | 1.16 |

| EFU-Life insurance | 0.94 | 1.00 | 1.05 | 1.00 | 0.96 | 1.11 | 1.33 | 0.67 |

| Habib insurance | 1.08 | 1.04 | 0.99 | 0.95 | 1.01 | 0.90 | 0.95 | 0.93 |

| IGI insurance | 1.10 | 0.95 | 1.23 | 0.76 | 0.88 | 1.07 | 1.07 | 1.00 |

| Jublie Life Insurance | 1.02 | 0.79 | 1.18 | 1.17 | 1.07 | 0.91 | 1.09 | 0.97 |

| New Jublie insurance | 1.01 | 0.93 | 1.10 | 1.10 | 0.95 | 0.93 | 0.99 | 0.96 |

| Premier insurance | 1.04 | 1.07 | 1.50 | 0.68 | 0.85 | 1.04 | 0.99 | 0.58 |

| Shaheen insurance | 0.92 | 0.97 | 0.81 | 0.91 | 1.40 | 1.03 | 0.91 | 0.98 |

| State life insurance | 1.01 | 1.25 | 1.10 | 0.92 | 0.96 | 1.01 | 0.92 | 1.06 |

| Mean Conventional | 0.97 | 1.02 | 1.03 | 0.99 | 0.96 | 0.97 | 1.01 | 0.94 |

| Takaful companies | ||||||||

| Dawood Takaful | 3.92 | 1.07 | 1.19 | 1.07 | 1.08 | 0.59 | 1.09 | 1.08 |

| Pak-Kuwait | 0.77 | 1.58 | 1.01 | 1.14 | 1.01 | 3.23 | 0.81 | NA |

| Pak-Qatar(Family) | 1.28 | 1.43 | 1.39 | 1.30 | 1.16 | 0.99 | 0.96 | 0.87 |

| Pak-Qatar(General) | 0.93 | 0.90 | 1.15 | 0.95 | 0.89 | 0.89 | 0.92 | 1.19 |

| Takaful Pak | 1.19 | 0.98 | 1.10 | 0.99 | 0.87 | 1.00 | 0.79 | 0.95 |

| Mean Takaful | 1.62 | 1.19 | 1.17 | 1.09 | 1.00 | 1.34 | 0.92 | 1.02 |

| Mean Overall | 1.14 | 1.06 | 1.07 | 1.01 | 0.97 | 1.07 | 0.99 | 0.95 |

The improvement in productivity index of insurance firms was especially due to the three companies, for example, Atlas insurance, Efu-General insurance and State Life Insurance. State Life Insurance is the largest insurance company in the country and owned by the Government of Pakistan. Whereas, Dawood Takaful, Pak-Kuwait and Pak-Qatar secure the average 39%, 37% and 17% productivity increased respectively in the takaful sector.

Figure 1 explains the Total Factor Productivity Change trends of the industry. It is evident from the figure that except 2015, takaful operators showed the better productivity than the conventional insurance firms. Although the takaful operators are new in the market, they performed well in the study period with respect to their conventional counterpart. Every year they showed the improvement in their productivity.

Total factor productivity Index (TFPI) is now decomposed into two indexes, for example, technical efficiency change index (TECI) and Technology change index (TCI). TECI shows the contribution of change in technical efficiency change and TCI reflects that the factor productivity change is due to the change in technology.

The Technology change Index was positive for conventional insurance companies till 2013 which was 2%, 13%, 37% 21% and 2% for the understudy period. However, the takaful industry improved its technology index, i.e., 27%, 7%, 9%, 10%, 1% and 38% respectively from 2009 to 2014. The decline in technology change of 2%, 12% and 9% respectively for 2014-2016 was recorded respectively for the insurance industry. While takaful operators’ observed 9% and 5% in 2015 and 2016. AdamJee Insurance was most technological efficient amongst the Insurance companies furthermore, Pak-Qatar (Family) and Pak-Kuwait were efficient amongst the Takaful companies.

Error! Reference source not found explains the Total Factor Productivity Index (TFPI) which is the geometric mean of Technical Efficiency Change Index (TECI) and Technological Change Index (TCI) depicted in Error! Reference source not found. Now Technical Efficiency Change Index (TECI) is further decomposed into Pure Efficiency Change Index (PECI) and Scale Efficiency Change Index (SECI). The results of Pure Efficiency Change Index (PECI) are given in Table 2. Pure efficiency change index discusses the change in the productivity due to the efficiency of managerial staff and due to the efforts of human resources. The pure efficiency of the insurance companies was improved from 2013 to 2015, for instance, 1%, 2% and 6% respectively. Shaheen Insurance, IGI insurance and Askari insurance played a very significant role during the above mentioned period whereas, from 2009-2012, insurance companies faced a declining trend in the pure efficiency index as 1%, 5%, 9% and 10% respectively and moreover 6% decline in 2016. On the contrary, Takaful companies improve their pure efficiency index by 11%, 1% and 7% in 2010, 2015 and 2016 respectively. Pak-Kuwait improved 61% index in 2010 and Pak-Qatar (General) improved its index 6% in 2015 and 29% in 2016 (Table 3).

| Table 2 Technical Efficiency and Technological Change Index of Firms between Time 2008-2016 |

||||||||||||||||

| Company Name | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||

| ECI | TCI | ECI | TCI | ECI | TCI | ECI | TCI | ECI | TCI | ECI | TCI | ECI | TCI | ECI | TCI | |

| Insurance Companies | ||||||||||||||||

| Adamjee Insurance Co. Ltd. | 0.84 | 1.05 | 1.06 | 1.00 | 0.45 | 1.77 | 0.78 | 1.38 | 1.01 | 1.11 | 1.18 | 1.03 | 1.00 | 1.04 | 1.14 | 0.99 |

| Alflah Insurance Co. Ltd. | 0.94 | 0.96 | 0.83 | 1.07 | 0.85 | 1.19 | 0.70 | 1.23 | 0.94 | 0.94 | 0.86 | 0.97 | 1.17 | 0.85 | 1.16 | 0.89 |

| Asia Insurance Co. Ltd. | 1.00 | 0.83 | 1.00 | 1.05 | 1.00 | 0.85 | 1.00 | 0.93 | 1.00 | 0.64 | 1.00 | 0.71 | 1.00 | 0.71 | 0.71 | 0.96 |

| Askari insurance | 1.01 | 0.96 | 1.00 | 1.12 | 0.62 | 1.14 | 0.79 | 1.24 | 0.81 | 1.08 | 0.83 | 1.02 | 1.22 | 0.86 | 1.08 | 0.88 |

| Atlas insurance | 0.86 | 1.09 | 0.81 | 1.45 | 0.72 | 1.45 | 1.40 | 1.04 | 0.74 | 1.03 | 1.13 | 0.86 | 1.11 | 0.96 | 1.08 | 0.93 |

| EFU-General insurance | 0.96 | 1.05 | 1.00 | 0.95 | 0.63 | 1.77 | 0.74 | 1.38 | 0.97 | 1.11 | 0.96 | 1.01 | 1.06 | 0.96 | 1.46 | 0.80 |

| EFU-Life insurance | 1.00 | 0.94 | 1.00 | 1.00 | 0.91 | 1.15 | 0.72 | 1.40 | 0.77 | 1.24 | 1.00 | 1.11 | 1.44 | 0.92 | 0.73 | 0.91 |

| Habib insurance | 1.00 | 1.08 | 0.80 | 1.29 | 0.65 | 1.52 | 0.84 | 1.13 | 1.07 | 0.94 | 1.11 | 0.81 | 1.21 | 0.79 | 1.05 | 0.89 |

| IGI insurance | 0.97 | 1.13 | 0.69 | 1.38 | 0.74 | 1.66 | 0.63 | 1.21 | 0.88 | 1.00 | 1.19 | 0.91 | 1.28 | 0.84 | 1.15 | 0.87 |

| Jublie Life Insurance | 1.00 | 1.02 | 0.92 | 0.86 | 1.01 | 1.17 | 0.83 | 1.41 | 0.86 | 1.24 | 0.82 | 1.12 | 1.17 | 0.93 | 1.12 | 0.87 |

| New Jublie insurance | 1.00 | 1.01 | 0.98 | 0.95 | 0.62 | 1.77 | 0.80 | 1.38 | 0.86 | 1.11 | 0.90 | 1.03 | 0.95 | 1.04 | 1.18 | 0.82 |

| Premier insurance | 0.86 | 1.21 | 0.76 | 1.41 | 0.98 | 1.53 | 0.59 | 1.14 | 0.89 | 0.96 | 1.20 | 0.87 | 1.21 | 0.82 | 0.65 | 0.90 |

| Shaheen insurance | 1.00 | 0.92 | 1.00 | 0.97 | 0.74 | 1.10 | 0.81 | 1.13 | 1.50 | 0.93 | 0.97 | 1.07 | 1.15 | 0.79 | 1.00 | 0.98 |

| State life insurance | 1.00 | 1.01 | 1.00 | 1.25 | 1.00 | 1.10 | 1.00 | 0.92 | 1.00 | 0.96 | 0.83 | 1.22 | 1.20 | 0.76 | 1.00 | 1.06 |

| Mean Conventional | 0.96 | 1.02 | 0.92 | 1.13 | 0.78 | 1.37 | 0.83 | 1.21 | 0.95 | 1.02 | 1.00 | 0.98 | 1.15 | 0.88 | 1.04 | 0.91 |

| Takaful Companies | ||||||||||||||||

| Dawood Takaful. | 2.09 | 1.88 | 1.00 | 1.07 | 1.00 | 1.19 | 1.00 | 1.07 | 1.00 | 1.08 | 1.00 | 0.59 | 1.00 | 1.09 | 1.00 | 1.08 |

| Pak-Kuwait | 0.67 | 1.15 | 1.66 | 0.95 | 0.97 | 1.05 | 1.06 | 1.07 | 1.04 | 0.97 | 1.00 | 3.23 | 1.00 | 0.81 | Na | Na |

| Pak-Qatar(Family) | 1.00 | 1.28 | 1.00 | 1.43 | 1.00 | 1.39 | 1.00 | 1.30 | 1.00 | 1.16 | 1.00 | 0.99 | 1.00 | 0.96 | 1.00 | 0.87 |

| Pak-Qatar (General) |

1.00 | 0.93 | 1.00 | 0.91 | 0.94 | 1.23 | 0.87 | 1.09 | 0.91 | 0.98 | 0.83 | 1.07 | 1.06 | 0.87 | 1.30 | 0.92 |

| Takaful Pak | 1.05 | 1.13 | 1.00 | 0.98 | 1.00 | 1.10 | 1.00 | 0.99 | 1.00 | 0.87 | 1.00 | 1.00 | 1.00 | 0.79 | 1.00 | 0.95 |

| Mean Takaful | 1.16 | 1.27 | 1.13 | 1.07 | 0.98 | 1.19 | 0.99 | 1.10 | 0.99 | 1.01 | 0.97 | 1.38 | 1.01 | 0.91 | 1.07 | 0.95 |

| Overall Mean | 1.01 | 1.08 | 0.97 | 1.11 | 0.83 | 1.32 | 0.87 | 1.18 | 0.96 | 1.02 | 0.99 | 1.08 | 1.12 | 0.89 | 1.04 | 0.92 |

| Table 3 Pure Technical Efficiency and Scale Efficiency Change Index of Firms between Time 2008-2016 |

||||||||||||||||

| Company Name | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||

| PECI | SECI | PECI | SECI | PECI | SECI | PECI | SECI | PECI | SECI | PECI | SECI | PECI | SECI | PECI | SECI | |

| Insurance Companies | ||||||||||||||||

| Adamjee Insurance Co. Ltd. | 1.00 | 0.84 | 1.00 | 1.06 | 0.80 | 0.56 | 0.94 | 0.84 | 1.17 | 0.87 | 1.09 | 1.08 | 1.04 | 0.96 | 1.01 | 1.12 |

| Alflah Insurance Co. Ltd. | 0.95 | 0.99 | 0.83 | 1.00 | 0.84 | 1.01 | 0.70 | 1.00 | 0.94 | 1.00 | 0.86 | 1.00 | 1.18 | 1.00 | 1.15 | 1.01 |

| Asia Insurance Co. Ltd. | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.71 | 1.00 |

| Askari insurance | 1.00 | 1.01 | 1.00 | 1.00 | 0.63 | 0.99 | 0.79 | 1.00 | 0.81 | 1.00 | 0.83 | 1.00 | 1.22 | 1.00 | 1.07 | 1.01 |

| Atlas insurance | 0.91 | 0.95 | 0.84 | 0.96 | 0.94 | 0.77 | 1.18 | 1.19 | 0.93 | 0.79 | 1.03 | 1.09 | 1.09 | 1.02 | 0.84 | 1.29 |

| EFU-General insurance | 1.00 | 0.96 | 1.00 | 1.00 | 1.00 | 0.63 | 1.00 | 0.74 | 1.00 | 0.97 | 1.00 | 0.96 | 1.00 | 1.06 | 1.00 | 1.46 |

| EFU-Life insurance | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.91 | 1.00 | 0.72 | 0.89 | 0.87 | 1.12 | 0.89 | 1.00 | 1.44 | 0.94 | 0.78 |

| Habib insurance | 1.05 | 0.95 | 0.96 | 0.84 | 0.66 | 0.98 | 1.13 | 0.75 | 1.00 | 1.07 | 1.07 | 1.04 | 0.99 | 1.22 | 0.82 | 1.29 |

| IGI insurance | 1.00 | 0.97 | 1.00 | 0.69 | 1.00 | 0.74 | 0.64 | 0.98 | 1.06 | 0.83 | 1.43 | 0.83 | 1.03 | 1.24 | 1.00 | 1.15 |

| Jublie Life Insurance | 1.00 | 1.00 | 0.97 | 0.95 | 1.03 | 0.97 | 1.00 | 0.83 | 1.00 | 0.86 | 1.00 | 0.82 | 1.00 | 1.17 | 1.00 | 1.12 |

| New Jublie insurance | 1.00 | 1.00 | 1.00 | 0.98 | 1.00 | 0.62 | 0.98 | 0.81 | 0.81 | 1.07 | 0.82 | 1.09 | 0.89 | 1.07 | 0.83 | 1.43 |

| Premier insurance | 1.00 | 0.86 | 0.77 | 0.99 | 1.13 | 0.87 | 0.43 | 1.36 | 1.00 | 0.88 | 1.06 | 1.13 | 1.22 | 0.99 | 0.73 | 0.88 |

| Shaheen insurance | 1.00 | 1.00 | 1.00 | 1.00 | 0.75 | 0.99 | 0.81 | 1.00 | 1.50 | 1.00 | 0.96 | 1.00 | 1.15 | 1.01 | 1.00 | 1.00 |

| State life insurance | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.83 | 1.00 | 1.20 | 1.00 | 1.00 |

| Mean Conventional | 0.99 | 0.97 | 0.95 | 0.96 | 0.91 | 0.86 | 0.90 | 0.94 | 1.01 | 0.94 | 1.02 | 0.98 | 1.06 | 1.10 | 0.94 | 1.11 |

| Takaful Companies | ||||||||||||||||

| Dawood Takaful. | 1.09 | 1.92 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Pak-Kuwait | 0.68 | 0.98 | 1.61 | 1.03 | 0.98 | 0.99 | 1.07 | 0.99 | 1.02 | 1.02 | 1.00 | 1.00 | 1.00 | 1.00 | Na | Na |

| Pak-Qatar(Family) | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Pak-Qatar(General) | 1.07 | 0.94 | 0.94 | 1.05 | 0.92 | 1.02 | 0.87 | 1.00 | 0.91 | 1.00 | 0.83 | 1.00 | 1.06 | 1.00 | 1.29 | 1.00 |

| Takaful Pak | 1.04 | 1.01 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Mean Takaful | 0.97 | 1.17 | 1.11 | 1.02 | 0.98 | 1.00 | 0.99 | 1.00 | 0.99 | 1.00 | 0.97 | 1.00 | 1.01 | 1.00 | 1.07 | 1.00 |

| Overall Mean | 0.99 | 1.02 | 1.00 | 0.98 | 0.93 | 0.90 | 0.92 | 0.96 | 1.00 | 0.96 | 1.01 | 0.99 | 1.05 | 1.07 | 0.97 | 1.09 |

Scale efficiency change index defines the change in the efficiency due to the adaptation of the firm with modern technology, liquidity, the optimal level of capital; fulfil the requirement of new technology and IT etc. Insurance industry only improved its Scale efficiency change index in 2015 and 2016 by 10% and 11% respectively. Although takaful operators are in their infancy stage which is also a major constraint in obtaining the scale efficiency takaful operators improved their index by 17% and 2% in 2009 and 2010 respectively and have shown constant behaviour for the rest of the period.

Conclusion

The main objective of the current study was to measure the total factor productivity, technical and scale efficiency of insurance industry of Pakistan (conventional and takaful). For this purpose, the present study used the Malmquist index methodology. The period of study was from 2009-2016. The results have shown that overall insurance industry in Pakistan was enjoying the increase in the total factor productivity during the above mentioned period. Technical efficiency change index depicted that more or less, on the average the insurance industry in Pakistan observed a positive change and the index of technology change also depicts that on average takaful industry was more technically efficient than the insurance companies during the entire sample period. Technical efficiency index was further decomposed into pure technical efficiency and scale efficiency. It is also observed that the change in the total factor productivity is also due the purely technical and scale efficiency. Therefore, pure technical efficiency and scale efficiency made takaful operators more productive comparative to the conventional insurers. One can conclude that maybe most of the client of the takaful industry has more trust on the takaful operators so have more preferences for this industry. As a result, this should be the responsibility of the takaful operator to be more transparent, avoid moral hazards and adverse selection.

References

- Aigner, D., Lovell, C.K. & Schmidt, P. (1977). Formulation and estimation of stochastic frontier production function models. Journal of econometrics, 6(1), 21-37.

- Al-Amri, K., Gattoufi, S. & Al-Muharrami, S. (2012). Analyzing the technical efficiency of insurance companies in GCC. The Journal of Risk Finance, 13(4), 362-380.

- Alhassan, A.L. & Biekpe, N. (2015). Efficiency, productivity and returns to scale economies in the non-life insurance market in South Africa. The Geneva Papers on Risk and Insurance Issues and Practice, 40(3), 493-515.

- Annual Islamic Financial Services Industry Stability Report (2017). Islamic Financial Services Board. http://www.ifsb.org/docs/IFSB%20IFSI%20Stability%20Report%202017.pdf

- Berger, A.N. & Humphrey, D.B. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98(2), 175-212.

- Berger, A.N., Hunter, W.C. & Timme, S.G. (1993). The efficiency of financial institutions: A review and preview of research past, present and future. Journal of Banking & Finance, 17(2-3), 221-249.

- Bertoni, F. & Croce, A. (2011). The productivity of European life insurers: Best-practice adoption vs. innovation. The Geneva Papers on Risk and Insurance Issues and Practice, 36(2), 165-185.

- Biener, C., Eling, M. & Wirfs, J.H. (2016). The determinants of efficiency and productivity in the Swiss insurance industry. European Journal of Operational Research, 248(2), 703-714.

- Casu, B., Girardone, C. & Molyneux, P. (2004). Productivity change in European banking: A comparison of parametric and non-parametric approaches. Journal of Banking & Finance, 28(10), 2521-2540.

- Charnes, A., Cooper, W.W. & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429-444.

- Coelli, T. (1996). A guide to DEAP version 2.1: A data envelopment analysis (computer) program. Centre for Efficiency and Productivity Analysis, University of New England, Australia.

- Cummins, J.D., Tennyson, S. & Weiss, M.A. (1999). Consolidation and efficiency in the US life insurance industry. Journal of Banking & Finance, 23(2), 325-357.

- Cummins, J.D. & Xie, X. (2008). Mergers and acquisitions in the US property-liability insurance industry: Productivity and efficiency effects. Journal of Banking & Finance, 32(1), 30-55.

- Cummins, J.D. & Zi, H. (1998). Comparison of frontier efficiency methods: An application to the US life insurance industry. Journal of Productivity Analysis, 10(2), 131-152.

- Diacon, S.R., Starkey, K. & O'Brien, C. (2002). Size and efficiency in European long-term insurance companies: An international comparison. The Geneva Papers on Risk and Insurance. Issues and Practice, 27(3), 444-466.

- Eling, M. & Luhnen, M. (2010). Frontier efficiency methodologies to measure performance in the insurance industry: Overview, systematization and recent developments. The Geneva Papers on Risk and Insurance Issues and Practice, 35(2), 217-265.

- Färe, R., Grosskopf, S., Lindgren, B. & Roos, P. (1989). Productivity developments in Swedish hospitals: A Malmquist output index approach. Data envelopment analysis: Theory, methodology and applications.

- Fare, R., Grosskopf, S., Norris, M. & Zhang, Z. (1994). Productivity growth, technical progress and efficiency change in industrialized countries. American economic review, 84(1), 66-83.

- Farrell, M.J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, 120(3), 253-290.

- Grosskopf, S. (1996). Statistical inference and nonparametric efficiency: A selective survey. Journal of Productivity Analysis, 7(2), 161-176.

- Javaheri, A.S. (2014). Productivity evaluation of Iranian insurance industry: A non-parametric malmquist approach. Iranian Journal of Economic Research, 18(57), 85-95.

- Khan, A. (2016). Islamic insurance: Evolution, models and issues. Policy Perspectives: The Journal of the Institute of Policy Studies, 13(2), 29-61.

- Kneip, A., Park, B.U. & Simar, L. (1998). A note on the convergence of nonparametric DEA estimators for production efficiency scores. Econometric Theory, 14(6), 783-793.

- Malik, M.S., Malik, A. & Faridi, M.Z. (2011). An analysis of e-insurance practices in Pakistan: Current status and future strategies: The case of a state owned Pakistani company. International Journal of Business and Management, 6(2), 125.

- Mansor, S.A. & Radam, A. (2000). Productivity and efficiency performance of the Malaysian life insurance industry. Jurnal Ekonomi Malaysia, 34, 93-105.

- Neal, P. (2004). Efficiency and productivity change in Australian banking. Australian Economic Papers, 43(2), 174-191.

- Qureshi, A.A. (2011). Analyzing the sharia'ah compliant issues currently faced by Islamic insurance. Interdisciplinary Journal of Contemporary Research in Business, 3(5), 279-295.

- Ray, S.C. & Desli, E. (1997). Productivity growth, technical progress and efficiency change in industrialized countries: Comment. The American Economic Review, 87(5), 1033-1039.

- Sealey, C.W. & Lindley, J.T. (1977). Inputs, outputs and a theory of production and cost at depository financial institutions. The Journal of Finance, 32(4), 1251-1266.

- Securities and Exchange Commission of Pakistan. (2016). https://www.secp.gov.pk/media-center/annual-reports/, Anual Report, (pp. 35-40).

- State Bank of Pakistan. (2005).Developments in the insurance sector. Pakistan Financial Sector Assessment 2005, 105-111.