Research Article: 2020 Vol: 24 Issue: 2

Professional Specialization of Auditing Offices and Companies and Its Effect in The Quality of Accounting Earnings

Bushra Abdul Wahhab Al-Jawahry, University of Kufa

Ali Adnan Abbas, University of Kufa

Abstract

The research aims to measure the effect of the professional specialization of audit offices and companies in the quality of accounting earnings, and this goal is achieved by studying the subject of professional specialization of audit offices and companies in all its aspects, and identifying the effect relationship between professional specialization and the quality of accounting earnings, by relying on the annual financial reports data for a sample of the Iraqi banks listed in the Iraq Stock Exchange, which numbered (13) banks for the period from (2008-2017). For measuring the level of professional specialization of the offices and companies that practiced auditing the banks, the research sample. The researcher used the weighted market share measure, and the earning smoothing feature model was used. To measure the quality of the accounting earnings of the research sample, and for statistically testing the research hypotheses, the statistical program (SPSS) was used, to find out the size of the correlation, the effect and the level of significance between the research variables. The results concluded that there is an acceptable level of professional specialization in the audit offices and companies that practiced auditing the financial reports of banks. The research sample, with a high level of the quality of the accounting earnings of the banks, the research sample, as well as the existence of a statistically significant effect relationship between the professional specialization for auditing offices and companies and the quality of accounting earnings in a positive way. The researchers recommended support and promotion of professional specialization in audit offices and companies to practice their activity and encourage banks and other companies whose shares are listed on the Iraq Stock Exchange on the importance of contracting with professionally specialized auditing offices and companies, because they have the ability and competence to discover and assess the risks of the existence of cases of material misstatements and increased concern for the quality of the reported accounting earnings.

Keywords

Auditors Professional Specialization, Quality of Accounting Earnings.

Introduction

This The financial market reflects an important mechanism for achieving economic development, attracting investments and directing them optimally towards available investment opportunities, providing companies with their needs of those funds at the lowest possible cost, in addition to the availability of appropriate accounting information for decision-making and seeking to protect investors from the opportunistic behavior of management, reducing the risks of uncertainty surrounding investment decisions and enhancing the efficiency of the financial market, and the presence of auditors specialized in a specific activity is an important mechanism to monitor the incentives of corporate management in order to avoid opportunistic behavior and reduce the chances of smoothing earnings to contribute to enhancing the quality of the accounting earnings of these companies.

The professional specialization of any profession practically supports providing its members with high professional and experience knowledge that helps them to perform their work with a more efficient and effective level of performance. Therefore, many professions prevailing in society have sought to specialize in their work as a tool to achieve improvement and raise the efficiency of professional performance, and the auditing profession is one of the important and well-established professions. In all societies, it also sought to achieve specialization in auditing specific activities or sectors for its customers to keep pace with developments and changes in the contemporary business environment and the environment associated with the practice of the profession.

Therefore, professional specialization has become necessary to manage the tasks of the audit process. Because of the development in many aspects of the various activities, including the expansion of size and complexity of operations and the variation of knowledge, practices and standards related to each activity. As well as an increase in the degree of competition, which required the auditor to be familiar with all these aspects to contribute to enhancing the quality and reliability of the accounting information contained in the financial reports subject to auditing and which the stakeholders focus on in making their decisions, especially the earnings information. It can also enhance the quality of the accounting earnings reported by those companies subject to the audit of professionally specialized auditors who have experience and knowledge of the nature of these companies' activities and the environment. Surrounding them to contribute to minimizing or limiting the manipulation, fraud and malpractice associated with those earnings.

Research Problem

The basic problem is that the discrepancy in the accounting information reported between the parties with interests, especially between management and investors, has led to poor availability of equal opportunities for those parties to make their decisions properly and the need for professional specialization for audit offices and companies can support the quality of accounting earnings and protect investors from the opportunistic behavior of management. The problem was identified by several questions, including:

1. Is there an acceptable level of professional specialization in the audit offices and companies that audit the research sample banks?

2. Do the research sample banks have a high level of accounting earnings?

3. What is the nature of the relationship of the effect of the professional specialization of audit offices and companies on the quality of accounting earnings in the research sample banks?

Literature Review and the Developing Hypotheses

Auditors' Professional Specialization

The auditor of a specific activity (industrial, banking, service) needs to have a precise specialization in this activity, as it is one of the important tools to improve the efficiency of the auditor's professional performance, and it can also contribute to supporting the application and keeping up with international auditing standards related to knowledge and understanding of the nature of the customer’s activity and the environment. In other words, the auditor's control over the auditing process in a particular activity makes him the most in possession of the knowledge and experience in that activity. So that he directs his important investments to develop audit methods and techniques in that activity (which he works with and help the auditor to plan the audit process, discover fraud and errors (Karami et al., 2017).

Where we find that professional specialization has an important role in many professions, such as medicine, engineering, finance and other professions, especially in the auditing profession, because of its practical benefit in providing its members with great professional experience and knowledge, which helps them perform their tasks with a high level of efficiency and effectiveness (Wiyantoro & Usman, 2018). With the rapid development of the global economy and the accompanying development in information technology and competition in business activities, it was imperative that auditors possess practical experience and professional knowledge of a particular activity, so that they could provide excellent and high-quality audit services to their clients in that activity (Lowensohn et al., 2005).

Therefore, the specialized auditor is the one who possesses knowledge and professional content in a particular activity, and his possession of that content was done either directly through auditing that activity or indirectly through obtaining training courses for that activity. As well as having a high ability to assess work conditions and the effect these are conditions on their clients, including economic conditions, government regulations and change in technology, so that they can differentiate themselves from competitors in the auditing market (Chen et al., 2011). On the other hand, audit offices and companies are considered specialized when they have an integrated information system, effective control systems and professional standards when performing the audit service in a specific activity without others. So that they achieve competitive advantages over audit offices and companies that are not specialized in applying those systems and standards for that activity (Kommunuri, 2013). As professional specialization provides auditors with a competitive advantage over other non-specialists, by providing an audit service to a relatively large group of companies in a particular activity, which will push auditors to gain more experience and knowledge and direct their human resources and capabilities to the success of that competitive advantage (Li et al., 2010).

The Quality of Accounting Earnings

The users of financial reports view the "earning" number as the most important item in the financial reports, as that number contains information that expresses the current level of the company's performance and an indicator of future operational performance. In addition to its being, a useful measure to assess the value of the company for making future decisions (Almomani, 2015). In view of the different users of financial reports and the nature of their dependence on the earning number, we find some of them who depend on earnings as an absolute number, and some of them depend on the quality of earnings and the level of quality that they enjoy. So the concept of the quality of earnings differed according to the different objectives of the users of financial reports (Menicucci, 2019). The quality of earnings can be defined as the earnings that provide more information about the characteristics of the financial performance of the unit that are related to the decision made by the decision maker (Dichev et al., 2004).

The study of (Salerno, 2014) showed that the quality of accounting earnings is related to the extent of the continuity of achieving current earnings in future periods, and the ability of current earnings to reflect the current and future performance of the unit, that is, the extent to which the earnings announced by the unit honestly and fairly express the real earnings, and the extent of their relevance to cash flows. So that these earnings are of a tangible monetary presence, and are devoid of numbers and probable exaggerations, meaning that the level of high quality of earnings accurately reflects the current and future operating performance of the company, which is a useful measure for evaluating the value of the company, and earnings are considered high quality when accurately determining the intrinsic value of the company (Kamarudin, 2014). On the other hand, the quality of earnings is achieved when it is devoid of earning management practices, as the lower the percentage of voluntary receivables in earnings, so that the real position of the unit is reflected by providing information that achieves the common goals of most users of financial reports and helps them in making their important decisions (Imad et al., 2017).

The Impact of Professional Specialization of Auditors on the Quality of Accounting Earnings

The study of (Hegazy et al., 2015) indicated that the specialized auditor has the ability to minimizing or reduce the shadowing and ambiguity observed in the earnings disclosed in the financial reports in a more accurate and efficient manner than non-specialized auditors. When the study of (Havasi & Darabi, 2016) showed that professional specialization has an important impact on the quality of earnings, by increasing the level of the appropriate value of accounting earnings, and the predictive ability of earnings, and the elements of entitlement to companies that are audited by specialists. As it attributes this to that the specialized auditor has more knowledge and experience than others the risks of the financial statements and the rate of their occurrence in the activities that they have specialized in auditing, so that this enhances the quality of the information and the accounting earnings contained therein. On the other hand (Sun & Liu, 2013) found that one of the most important factors that lead to lowering the level of earning management and increasing its quality is the auditing of the financial statements, by specialized auditors with experience in the same activity that those companies belong to, meaning that there is an inverse relationship between the auditor's specialty and the possibility of applying company management of earning management methods.

Scientific Research Methods

Community and Sample Research

The research community represents all the Iraqi commercial banks whose stocks are listed in the Iraq Stock Exchange within the regular market only and during the period (2008- 2017). The reason for choosing this sector is as one of the most active sectors in the circulation of its stocks, and it is considered the essence of the financial system of any country and the clear importance of banks in supplying the national economy with the funds necessary for development. On the other hand, any crisis faced by banks will be reflected in the entire national economy.

Method of Taking the Research Sample

The research sample consisted of (13) banks out of (19) of the banks listed on the Iraq Stock Exchange during the period of research (2008-2017), where the selected banks formed (68%) of the research community. Where these banks were chosen because they fulfilled the search conditions, which are as follows:

1. It is listed on the Iraq Stock Exchange (the regular market) for the period mentioned.

2. Availability of the bank's financial reports for the relevant period.

3. Continuing to trade the bank’s stocks for the relevant period.

4. It is not an Islamic bank.

After the bank has fulfilled the above conditions, the information related to the bank’s variables is obtained.

Measuring Search Variables

Measure the professional specialization of auditors: The research uses the weighted market share measure in measuring the level of professional specialization of auditing offices and companies, which was suggested by researchers (Neal & Riley, 2004). It includes both measures (the market share scale and the portfolio share scale), and is reached by multiplying the market share ratio in the ratio of the share of the portfolio and that this measure allows its application in low-competing activities that do not have to be specialized according to the scale of the portfolio, with having a high market share, and vice versa, and in line with (Neal and Riley, 2004). The criterion used in the weighted market share measure is based on to weighted market shares. The two researchers have adopted the weighted market share measure in measuring the percentage of professional specialization of companies listed on the (Iraq Stock Exchange) that has been audited by audit offices and companies and during the specified research period between (2008-2017). It is measured by applying the equations next:

1. Market share of auditors: It is extracted by applying the following equation: Market share of auditors = market share of auditors in a specific activity / Market share of auditors working in the same activity

2. Portfolio share for auditors: It is extracted by applying the following equation: Portfolio share for auditors = Portfolio share for auditors in a specific activity / Portfolio share for auditors working in all activities

3. Weighted market share: It is extracted by applying the following equation:

Weighted market share of auditors = market share ratio * portfolio share ratio

Auditors are considered specialists in auditing companies listed on the stock market if they possess a weighted market share percentage equal to or greater than (20%) of the proportion of the auditors working in that market, and this percentage has been adopted by many studies and research as a basis for distinguishing between specialists from other than specialists (Kommunuri, 2013).

Measuring the Quality of Accounting Earnings

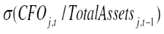

Measures based on the time series of earnings are among the most used measures in accounting research in measuring the quality of accounting earnings. So for measuring the quality of accounting earnings for the research sample, the researchers used the earning smoothing scale according to (Shabani, 2018; Menicucci, 2019) studies. Earnings introduction is defined as a set of procedures and practices followed by management to exploit the flexibility available to it in choosing accounting policies and procedures to limit or reduce earning fluctuations over successive years. In order to show the earning value in a more stable manner and it is one of the earning management practices used to distort the vision of users and parties the other is about the actual performance of the unit (Belkaoui, 2004). Where researchers adopt the earning smoothing measure in measuring the quality of accounting earnings, because it compares between the fluctuation of earnings to the fluctuation of cash flows from operating operations, and it is based on the idea that the goal of smoothing earnings is to reduce their volatility in which the possibility of manipulation is high compared to the fluctuation in cash flows and when earnings fluctuate less, this indicates the unit's practice of earning smoothing behavior, which leads to a low quality of earnings, and vice versa (Shabani, 2018). It is measured by the following equation:

Whereas:

= Smoothing the accounting earnings.

= Smoothing the accounting earnings.

= Standard deviation of net unit earning for the same year divided by total unit assets for the previous year.

= Standard deviation of net unit earning for the same year divided by total unit assets for the previous year.

= Standard deviation of the unit’s operating cash flows in the same year divided by the total unit’s assets for the previous year.

= Standard deviation of the unit’s operating cash flows in the same year divided by the total unit’s assets for the previous year.

Results of the first hypothesis test and analysis of the results

For the purpose of testing this hypothesis, the statistical analysis (one sample T-test) will be used. The idea of this test is to discover the extent to which there is a significant difference in the mean of the population from which the sample was withdrawn from a constant value. In addition to the possibility of estimating the confidence interval for the population mean, and since the variable what will be tested here is a result of the quantitative analysis and measurement to calculate the percentage of professional specialization of Iraqi auditing offices and companies, so that the cut-off limit will be used to judge the availability of professional specialization in the banking sector, amounting to (0.00272) as a test value) to conduct a (T-test) analysis, with the help of the program The Statistical Package for Social Sciences (SPSS), the results were as follows Table 1.

| Table 1 The First Hypothesis Test Results | |||||

| One-Sample Statistics | |||||

| Professional specialization | N | Mean | Std. Deviation | Std. Error Mean | |

| 130 | 0.09443 | 0.075785 | 0.006647 | ||

| Test Value = 0.00272 | |||||

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | |

| Lower | Upper | ||||

| 13.797 | 129 | 0 | 0.091708 | 0.07856 | 0.10486 |

The above Table 1 shows that the calculated value of (T) reached (13.797), which is much greater than its tabular value at the degree of freedom of (129) (n-1), which is (1.645), and that the mean standard deviation of the estimation error is )Std. Error Mean) reached (0.006647), which is a very low value, and the smaller this type of error, the better, and the table also shows that the level of significance of the test (Sig. 2-tailed)) was very high and reached (0.000), which is less than the acceptable level of error in social sciences, which is predetermined by (0.05). This means that the sample showed convincing evidence of rejecting the null hypothesis and accepting the alternative hypothesis, that is, there is an acceptable level. From professional specialization in audit offices or companies that audit (the research sample banks).

Results of The Second Hypothesis Test and Analysis of The Results

For the purpose of testing this hypothesis, a statistical analysis (one sample T-test) will also be used. The idea of this test is to discover the extent of a significant difference in the mean of the population from which the sample is drawn from a constant value, in addition to the possibility of estimating the confidence interval for the population mean, and since the variable that will be tested here is the result of the quantitative analysis and measurement to calculate the percentage of the quality of earnings in the sample banks, and in line with the developed hypothesis in this regard, a value of (0.75) will be used (this value has been adopted as a cut-off point for the high level of earning quality, i.e. the quality of earnings is high if it increases Its level is about (75%) as a test value to conduct a (T-test) analysis, and with the help of the Statistical Package for Social Sciences (SPSS) program, the results are as follows Table 2.

| Table 2 Test Results of the Second Hypothesis | |||||

| One-Sample Statistics | |||||

| Quality of earnings | N | Mean | Std. Deviation | Std. Error Mean | |

| 130 | 0.86318 | 0.162767 | 0.014276 | ||

| Test Value = 0.75 | |||||

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference |

|

| 7.928 | 129 | 0 | 0.113175 | Lower | Upper |

| 0.08493 | 0.14142 | ||||

The above Table 2 shows that the calculated value of (T) reached (7.928), which is much greater than its tabular value at the degree of freedom (129) (n-1), which is (1.645), and that the mean standard deviation of the estimation error (Std. Error Mean) was (0.014276) It is a very low value and the smaller this type of error, the better, and the table also shows that the level of significance of the test (Sig. 2-tailed) was very high and reached (0.000), which is less than the acceptable level of error in social sciences, which is predetermined by (0.05). This means that the sample showed convincing evidence of rejecting the hypothesis of the nihilistic study and accepting the alternative hypothesis, i.e. (that the research sample banks are possesses a high level of quality accounting earnings).

Results of The Third Hypothesis Test and Analysis of The Results

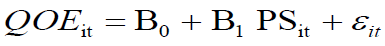

To test this hypothesis, the following "linear regression" model was formulated:

Whereas:

QOEit = Dependent variable (earnings quality).

B0 = The constant of the regression equation, which represents the value of the dependent variable when the value of the independent variable is equal to zero.

B1 = The slope of the regression function.

PSit = Independent variable (professional specialization of audit offices and companies).

εit = Miscalculations.

And by using the statistical program (SPSS), the results were as follows Table 3.

| Table 3 Summary of the Third Test Hypothesis Model | ||||

| Model Summaryb | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.376a | 0.142 | 0.135 | 6.785018 |

| Professional specialization a. Predictors: (Constant) | ||||

| Quality of earnings b. Dependent Variable | ||||

The above Table 3 shows the model summary that the value of correlation (R) between the variables amounted to (0.376) and that the coefficient of determination (R Square) reached (0.142), which represents the "explanatory power" of the model used, meaning that the professional specialization of audit offices and companies in Al-Iraqia explains what its value is (14.2%) of the quality of earnings, and that the standard deviation of (Std. Error of the Estimate) was (6.785018), which is a very low number. The lower this type of error, the better statistically.

The above Table 4 shows the variance above (anova) that the calculated value of (F) reached (21.123), which is greater than its tabular value calculated according to degrees of freedom (df (128.1), which is (3.84) at the level of significance (5%) amounted to (0.000), which is less than the value of the accepted error in social sciences, which is predetermined by (0.05). To prove the effect statistically, this means (that there is a statistically significant effect of the professional specialization of audit offices and companies in the quality of the accounting earnings of the research sample banks).

| Table 4 The Third Variation Hypothesis Test | ||||||

| ANOVAb | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 972.410 | 1 | 972.410 | 21.123 | 0.000a |

| Residual | 5892.668 | 128 | 46.036 | |||

| Total | 6865.078 | 129 | ||||

| Professional specialization a. Predictors: (Constant) | ||||||

| Quality of earnings b. Dependent Variable | ||||||

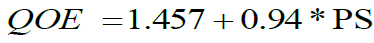

The Table 5 of coefficients of the regression function (Coefficients) shows that the value of the regression equation constant reached (1.457), and that the slope value of the regression equation reached (0.940), which shows the effect of the independent variable on the dependent variable (by the parameter B), and the positive value of the parameter indicates that there is a direct effect between the dependent and independent variables, or in other words, any increase in the independent variable (the professional specialization of auditing offices and companies) by one degree leads to an increase of (94%) in the dependent variable (the quality of earnings) with all other independent variables constant.

| Table 5 Function Regression Coefficients for the Third Hypothesis | ||||||

| Coefficientsa | ||||||

| Sig. | t | Standardized Coefficients | Unstandardized Coefficients | Model | ||

| Beta | Std. Error | B | ||||

| 0.030 | 2.192 | 0.665 | 1.457 | (Constant) | 1 | |

| 0.000 | 4.596 | 0.376 | 0.205 | 0.940 | Professional specialization | |

| Quality of earnings b. Dependent Variable | ||||||

The regression equation that was adopted in the hypothesis test can be reformulated in the light of the results obtained, which can be used for the purpose of prediction as follows:

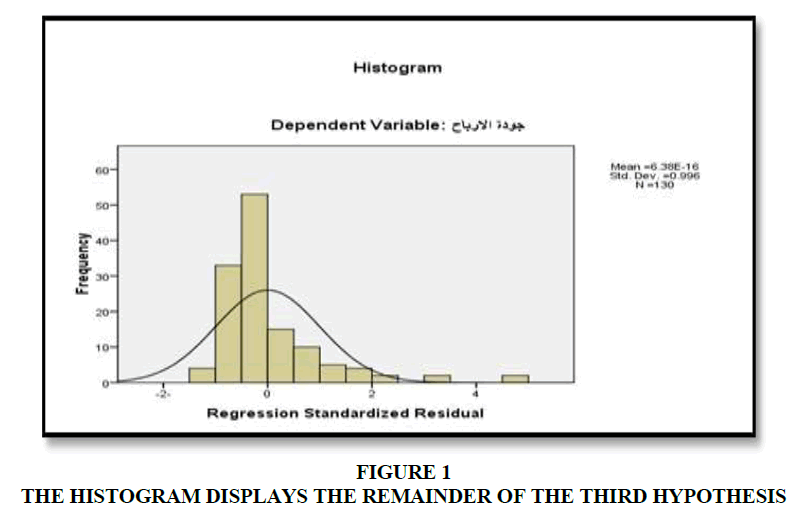

The following Figure 1 shows the histogram, which shows the normal distribution of the statistical residues of the regression equation, which shows the accuracy of the previous regression equation.

Conclusion

The results showed the determination of the extent of ownership of audit offices and companies that practiced bank auditing, the research sample, and professional specialization according to the weighted market share, as having a professional specialization in this activity, and its percentage (73%). This was also confirmed by the results of the statistical analysis that concluded that there is an acceptable level of professional specialization in auditing offices and companies that audit banks, the research sample, which is an important positive indicator to improve the professionalism of auditors, and may contribute to reducing risks and increasing the ability and competence of auditors in discovering or limiting manipulation of accounting earnings information that may be practiced by bank management. The results also reflected measurement the quality of the accounting earnings based on the earning smoothing feature that the accounting earnings were varied during the years of research in the banks, the research sample, but in general most of them enjoyed somewhat good rates, and this reflects that the practices of the earning smoothing process were at low rates in most years and that the banks of the research sample enjoyed earnings. Good reflects better its economic reality.

The professional specialization of auditors is one of the main factors that positively affect the quality of accounting earnings. And the results of the statistical analysis indicated that there is a positive, statistically significant effect to the professional specialization of auditing offices and companies in the quality of accounting earnings in the research sample banks, which reflects that the specialized knowledge possessed by the auditor enables him to discover the errors prevailing in the activity in his area of specialization, which makes him able to limit the practices of Introduction and management of earnings to contribute to the enjoyment of these earnings of high quality, and the researchers recommended the importance of activating the role of each of the Council of the Auditing and Auditing Profession, the Iraqi Accountants and Auditors Association and the Iraqi Association of Certified Public Accountants in following up, supporting and strengthening the professional specialization of the audit offices and companies to practice their activities in light of the developments in the profession of auditing and the different nature of the accounting and financial systems for companies, as well as encouraging banks and other companies whose stocks are listed on the Iraq Stock Exchange on the importance of contracting with professionally specialized auditing offices and companies, due to their having the ability and competence to discover and evaluate the risks of the existence of cases of material distortions and practices of manipulating earnings to contribute to strengthening confidence and credibility in financial reports and improving its reputation in the market a on the one hand, it can support the tendency of many investors to buy and hold their shares to contribute to maximizing their value in the market.

References

- Almomani, M.A. (2015). The impact of audit quality features on enhancing earnings quality: The evidence of listed manufacturing firms at amman stock exchange. Asian Journal of Finance & Accounting, 7(2), 255-280.

- Belkaoui, A.R. (2004). Accounting Theory. 6th Edition. USA:Thomson Learning.

- Chen, H., Chen, J.Z., Lobo, G.J., & Wang, Y. (2011). Effects of audit quality on earnings management and cost of equity capital: Evidence from China. Contemporary Accounting Research, 28(3), 892-925.

- Dechow, P.M., & Schrand, C.M. (2004). Earnings quality. The Research Foundation of CFA Institute. Reterived from: http://csinvesting.org/wp-content/uploads/2015/04/Defining-Earnings-Quality-CFA-Publication.pdf.

- Havasi, R., & Darabi, R. (2016). The effect of auditor’s industry specialization on the quality of financial reporting of the listed companies in Tehran stock exchange. Asian Social Science, 12(8), 92-103.

- Hegazy, M.A., Al Sabagh, A., & Hamdy, R. (2015). The effect of audit firm specialization on earnings management and quality of audit work. Journal of Accounting and Finance, 15(4), 143-164.

- Imad, A., Abughniem, M.S., Aljuboury, S.Z., AlAdham, A.A., & Alsheikh, E.Y. (2017). The impact of accounting factors on earning quality: a case study of commercial banks in Iraq. The Impact of Accounting Factors on Earning Quality: A Case Study of Commercial Banks in Iraq, 9(3), 2395-2210.

- Kamarudin, K.A., & Ismail, W.A.W. (2014). The risk of earnings quality impairment. Procedia-Social and Behavioral Sciences, 145, 226-236

- Karami, G., Karimiyan, T., & Salati, S. (2017). Auditor tenure, auditor industry expertise, and audit report lag: Evidences of Iran. Iranian Journal of Management Studies, 10(3), 641-666.

- Kommunuri, J. (2013). Audit firm industry specialization, discretionary accruals and stock price synchronicity. Doctoral dissertation. Auckland University of Technology.

- Li, C., Xie, Y., & Zhou, J. (2010). National level, city level auditor industry specialization and cost of debt. Accounting Horizons, 24(3), 395-417.

- Lowensohn, S., Johnson, L.E., Elder, R.J., & Davies, S.P. (2005). Auditor specialization, perceived audit quality, and audit fees in the local government audit market. Journal of Accounting and Public Policy, 26(6), 705-732.

- Menicucci, E. (2019). Earnings quality: Definitions, measures, and financial reporting. Springer Nature.

- Salerno, D. (2014). The role of earnings quality in financial analyst forecast accuracy. Journal of Applied Business Research, 30(1), 255-276.

- Shabani, N.A., & Sofian, S. (2018). Earnings smoothing as information signaling or garbling: A review of literature. Asian Journal of Finance & Accounting, 10(1), 131-142.

- Sun, J., & Liu, G. (2013). Auditor industry specialization, board governance, and earnings management. Managerial Auditing Journal, 28(1).

- Wiyantoro, L.S., & Usman, F. (2018). Audit tenure and quality to audit report lag in banking. European Research Studies Journal, 21(3), 417-428.