Research Article: 2020 Vol: 24 Issue: 6

Quality of Accounting Information Systems and Their Impact on Improving the Non-Financial Performance of Jordanian Islamic Banks

Adel Mohammed Qatawneh, Al-Zaytoonah University of Jordan

Ayman Bader, Al-Zaytoonah University of Jordana

Abstract

Current study aimed at examining the influence of quality of AIS outputs in improving non-financial performance of Jordanian Islamic banks, AIS outputs characteristics included (Relevance, Credibility, Procedures and instructions, Timelines, IT infrastructure and Feedback Value). In order to achieve aim, researcher adopted a quantitative approach utilizing a questionnaire. After application; (150) individuals within financial departments in Jordanian Islamic banks responded o he questionnaire; and analysis showed that the quality of AIS outputs plays a role in improving and defining non-financial performance. The influence mainly was attributed to credibility which appeared to be the most influential among all, followed by relevance and procedures and instruction in the 2nd and 3rd ranks respectively. Study recommended the necessity for Jordanian Islamic banks to prepare a strategic plan and implement it to develop electronic accounting information systems to achieve the continuity of the quality of that information and the principles of systems reliability in an integrated manner.

Keywords

AIS, AIS quality, Disclosure, Credibility, Relevance, Non-financial Performance.

Introduction

As it is known for being the working language; accounting is known as financial reporting, a process for measuring financial and non-financial information and processing it in different companies and institutions. It works to measure the results of economic activities that are practiced in the organization and transfer the information that results from this process to a group of users, such as: Investors, creditors and management (Mouritsen & Kreiner, 2016). According to O'Dwyer & Unerman (2016), accounting is divided into many areas of financial and administrative accounting, tax accounting, cost accounting and external audit, and to support the accounting functions, accounting information systems have been established for them, which must possess the characteristics of the quality of the required accounting information in order to work to meet the jobs with high quality, from preparing financial statements For external users, measure and prepare internal users, and provide summaries of these data with financial reports.

Generally speaking, accounting is based on many general rules that are defined as accounting principles that include basic accounting guidelines, which are used as a basis by the Financial Accounting Standards Board to include accounting rules and standards in a detailed and comprehensive way (Walker, 2016). According to Hall & O'Dwyer (2017), accounting history dates back thousands of years and many ancient civilizations until they were developed in the history of ancient Mesopotamia, where it was linked to developments in writing, counting and sorting, such as: bookkeeping in ancient Iran, and the existence of many evidence for early scrutiny in the history of ancient Egyptians And the Babylonians, until detailed financial information was provided in the era of Roman civilization, where bookkeeping was popular in the Middle East in the Middle Ages until it was improved in Europe.

Problem Statement

Current study aimed at evaluating the quality of accounting information systems and their impact on improving financial performance by identifying the availability of elements of quality of accounting information, which is the information systems (Sys trust) specified by the American Institute of Certified Public Accountants (AICPA) and the Institute of Chartered Accountants of Canada (CICA) which includes five principles (system security, system confidentiality, privacy, process integrity, system availability).

According to Sami (2011), accounting information systems outcomes and its quality not only influences the financial performance of organizations; it also has an influence on the nonfinancial performance indicators which includes aspects of customer focused approach and learning skills and talents of users within the financial department. Ali et al (2016) argued also that Appropriate accounting information, whether for internal or external use, is information that is appropriate to the needs of decision makers, and that has a high ability to influence decisionmaking, as it is not possible to reach a specific decision without using appropriate information. In general, the relevance is the correlation of accounting information with the user’s need to make a decision, and the understanding component remains an essential and necessary thing to achieve relevancy. Without understanding the information correctly by the user, it is difficult to determine the relevance, lack thereof, or even making a decision in the first place.

From that point, current study aimed at examining the influence of AIS outputs quality on the non-financial performance of Jordanian Islamic banks. This aim was realized through presenting the following set of hypotheses:

Main Hypothesis

H1: Quality accounting information system has an influence on non-financial performance of Jordanian Islamic Banks.

Sub-Hypotheses

1. Relevance has positive influence on non-financial performance of Jordanian Islamic Banks

2. Credibility has positive influence on non-financial performance of Jordanian Islamic Banks

3. Procedures and instructions has positive influence on non-financial performance of Jordanian Islamic Banks

4. Timelines has positive influence on non-financial performance of Jordanian Islamic Banks

5. IT infrastructure has positive influence on non-financial performance of Jordanian Islamic Banks

6. Feedback Value has positive influence on non-financial performance of Jordanian Islamic Banks

Literature Review

Accounting Information Systems or AISs are systems that include collecting and storing financial and accounting data in order to work on processing and presenting them to internal users, and reporting information about investors, creditors and taxes, It is a method that tracks the accounting activities through information technology resources in order to work towards achieving the characteristics of the quality of accounting information. The accounting information system combines the use of traditional accounting through the use of generally accepted accounting principles with information technology resources, accounting information system includes data related to revenue and expenses, customer and employee information, and tax information that must possess the quality characteristics of the required accounting information (Taiwo, 2016).

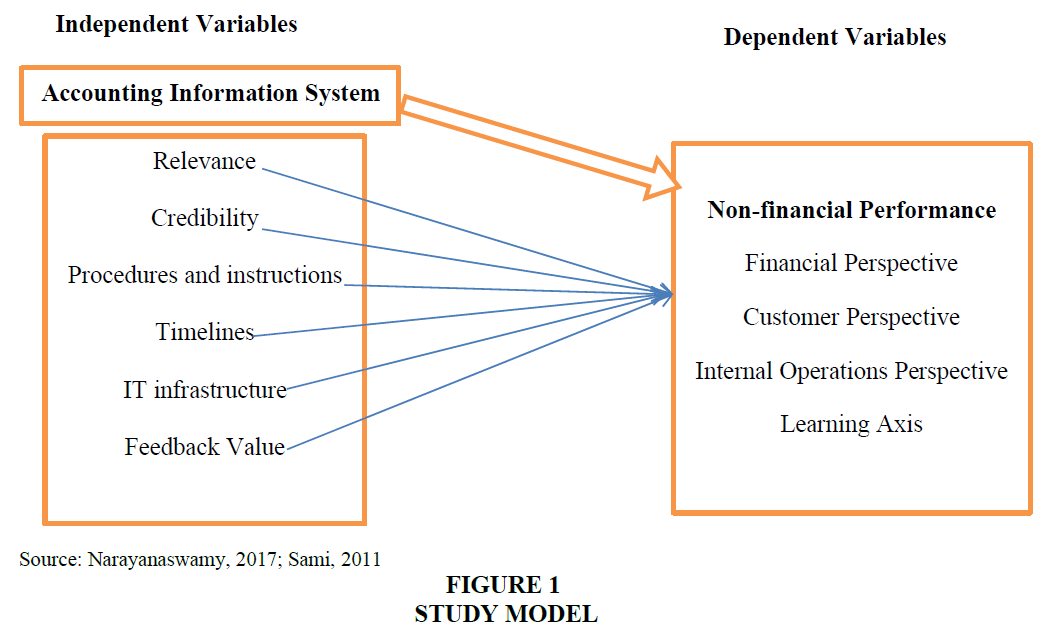

Relationship between variables was realized through following Figure 1 model:

Accounting Information Systems

According to Uyar et al (2017), accounting information systems of (AIS) is defined as a system that includes collecting and storing financial and accounting data in order to work on processing and presenting them to internal users, and reporting information about investors, creditors and taxes, as it is a method that works to track accounting activities through information technology resources in order to work on achieving the characteristics of the quality of accounting information, where the accounting information system combines the use of traditional accounting through the use of generally accepted accounting principles with information technology resources, and the accounting information system includes data related to revenue and expenses, customer and employee information, and tax information that must possess the characteristics of the quality of the required accounting information.

As for Fitrios (2016), it was argued that the data includes sales orders, analysis reports, purchase orders, invoices, verification records, inventory, payroll, ledger, trial balance and financial statement information, which are stored on the database of the accounting information system that was previously programmed in a way that this data is processed to benefit from, while Trofimova et al (2019) saw that this system also provides the ability to protect this information from viruses and intruders through cyber security that protects data stored electronically, while the outputs are in the form of reports that include debtors ’accounts, fixed asset depreciation schedules, and other information necessary to prepare financial reports. Budiarto et al (2018) stated that benefits of accounting information system are as follows:

Communication Between the Departments

The accounting information system provides the ability to provide communication between the different departments, where the sales department provides a budget for sales, so that this information is used by the inventory management team in order to work on inventory counting and the purchase of materials, and after doing the purchase of materials, the system is required to inform the Accounts Department of the bill payable, and any new orders for customers can be viewed and notified to the Manufacturing, Shipping and Customer Service Department, and these are characteristics of the quality of accounting information (Lutf & Mohamad, 2016).

Internal Controls of operations

To ensure customer, vendor and business information is preserved within companies, many policies and procedures are required to ensure the workflow within the various systems, in order to achieve the characteristics of the quality of the required accounting information, as it can be used to obtain approvals for any physical receipts, as well as providing licenses A distinction is made between the required duties, and the relevant information can be used for each job (Al- Hawari, 2016).

As for Trigo et al (2016), information that is used in accounting information systems must have a number of features in order to be included in the reports of the accounting department, to avoid any errors if this information does not have the required characteristics or do not provide the desired benefit from it, and the information features that follow Which must be included in the accounting information systems in order to ensure the achievement of the quality characteristics of the accounting information:

1. They are objectively prepared, recorded and reported without any bias.

2. The recording of information and results must be consistent for all of the periods presented.

3. Provide information that can be used to create reports that display specific information.

4. Preparing reports according to the reader's need. Comprehensiveness, routine collection and validation of information.

Components of AIS

According to Kanakriyah (2016), an accounting information system is a system that includes accounting and financial information and is based on storing and processing it, and creating reports that can be used to make decisions related to the management of the institution, and usually includes the use of electronic data processing equipment, which ensures the achievement of the quality characteristics of accounting information, integrated system and consists of the following:

Users

Refers to people who use the system, and may include professionals such as accountants, consultants, business analysts, managers, senior financial officials and auditors, where the accounting information system contributes to collecting these sections together in order to ensure the characteristics of the quality of accounting information, which in turn allows the authorized persons to access many of the information on the same system, and this information can also be delivered to people outside the organization, so the system should be easy to use and help to improve performance and increase its efficiency (Turner et al, 2020).

Procedures and Instructions

Refers to the methods that are used to work on collecting, storing, retrieving and processing data, and they may be either manual or automatic or both, as the data comes from internal sources, such as: employees or from external sources, such as: customer requests via the Internet, where Procedures and instructions are published either through accounting information systems programs, or through documentation and training of staff in them, and are constantly updated to be effective, and are characterized by the characteristics of the quality of the required accounting information (Bachmid, 2016).

Data

Data is defined as financial information that is related to business in the organization, and is entered in order to benefit from it and convert it to information, so a database must be available such as SQL language which is the computer language that is usually used for databases that work to meet the needs of users of different types of information Therefore, we must verify the characteristics of the quality of the accounting information as the type of data depends on the nature of the business, but it may be from (Sales orders, Customer billing information, Sales analysis reports, Purchase orders, Seller bills, Check records, General ledger, Stock data, Payroll information, Time setting, and Tax information) (Lak et al, 2016).

Accounting Information Systems Programs

Susanto (2018) stated that AIS programs are computer programs that is used in the storage and retrieval of financial data, processing and analysis, as all these operations were applied on paper, but with the development of technology many programs appeared to serve accountants and facilitate their business, such as: Intuit's QuickBooks or Sage's Sage 50 Accounting and to ensure the characteristics of the quality of accounting information, the components of the accounting information systems program must be characterized by quality, reliability, and security, as managers rely on existing information in order to make company decisions based on high-quality information.

Relevance

The usefulness of financial information appears during the decision-making process, so this information must be related to the decisions of end-users, as other information cannot be used, and it must be worked on to exclude it from the financial statements unless they will affect the future decisions of investors or lenders, so this information must , which must have three main characteristics: predictive value, feedback, and timing (Mancini et al, 2016).

On the other hand, Obi et al (2016) argued that for AIS outputs to be relevant means it must contribute to decision-making. Information that does not contribute to making a decision or creating a change in the opinion of the decision-maker is inappropriate. In order for the information to be described as appropriate, it must include three characteristics, namely:

1. The information has predictive value: I mean, we can predict it for the future

2. The information has a feedback value: that is, that we evaluate the past and work to correct its mistakes, as if we compare the result that we reached with the result that was planned .

3. The information has a temporal value: The information must be presented to the decision makers in a timely manner in order not to lose its ability to influence their decisions.

Predictive Value

This enables high-quality financial information to be used to establish forecasts and expectations. Previous financial records and financial data can be used to chart performance trends and set expectations about future performance and profitability (Handoko et al., 2017). Nallareddy and Ogneva (2017) saw that in order for the information to be appropriate it must be of value in the field of prediction, in the sense that it helps its users to predict the expected results of the various events, confirm their expectations, or help them to modify and correct them.

Feedback

It enables users to check financial information and confirm or adjust their expectations made on past performance trends, and based on feedback; users can make future decisions (Dillard et al, 2016). As according to Qiu et (2017), feedback is one of the most important components of the accounting information system because of the importance it represents in the continuation and development of the organization, so whenever the information provided by the system is available as a feedback feature, it has contributed to improving and developing awareness of future outputs, and the more the system is able to adapt to the constantly changing conditions, In other words, it leads to an improvement in the quality and quality of accounting information in general, and also increases the appropriateness of information to make decisions in particular.

TimeLine

One of the most important features of relevance is timing, as old information will not benefit investors or creditors in making current or future decisions, as any accounting information must be reported in a timely manner to achieve assurance of the quality of accounting information (Appelbaum et al, 2017). Susanto (2017) added that for AIS outputs to be in timeline means that information to be appropriate must be provided to its users at the appropriate time. This is achieved in light of the following:

1. The speed in providing information with a degree of accuracy is better than a high degree of accuracy with delay, as the information loses its value if not provided when it is needed .

2. Submitting regular reports at the specified time for that. As for information on important and urgent events, they should be provided to the decision-maker as soon as they happen and directly, even if this leads to the failure to follow the usual session of the report.

Credibility

One of the characteristics of the quality of accounting information is the credibility of financial data, as verification of financial information for investors and creditors must be consistent and return the same results, in order to be able to use it in decision-making, and for this financial information to be reliable it must have many Features, including what comes next (Turner et al, 2016).

Acen (2019) saw that in order for the information to be credible, it must have three properties:

1. Information is verifiable .

2. The information be neutral and impartial (Neutrality)

3. The information is presented faithfully (Representational faithfulness)

Procedures and Instructions

As according to Kocsis (2019), procedures and instructions are the security measures that must be included in the system in order to work to protect sensitive data, such as: the use of a password that can be easy or complicated, such as biological identification, and this ensures the access of authorized persons to computers and who are often users of the company itself, as well as It can include some data that relates to employees and customers, such as: social security numbers, salary information and credit card numbers, so all the data in it must be encrypted to ensure that all features of the quality of accounting information are met.

IT Infrastructure

Munteanu et al (2016) saw that IT infrastructure are devices that are used to operate the accounting information system, from computers, mobile devices, servers, printers and storage media, which must be characterized by speed and the ability to store large areas, and these devices must be compatible with the system, and to achieve this compatibility companies work on purchasing A turnkey system that means that businesses will get the perfect mix of hardware and software for an accounting information system, and it should include a plan for maintaining, replacing, developing, and disposing of disrupted devices.

Non-financial Performance

The change in the technological environment of modern manufacturing processes, and the accompanying increase in customer needs and intense competition led to the need to find new measures of the company's operational performance that are compatible with modern industrial goals such as quality measures, inventory performance, productivity, flexibility and innovations. Non-financial performance measures are considered an essential tool for strategic control, as they represent an attempt to emphasize the importance of directing internal operations. In addition, non-financial performance measures include quantitative measures such as production management based on the number of units produced, and there are measures of how to measure, for example, the reputation of a product or service, Consumer satisfaction and loyalty, manufacturing flexibility, and non-financial performance measures are critical to the company's long-term success (De Gorostiza et al, 2018). In current study, a group of the nonfinancial performance indicators were chosen in order to form the base of judging on the influence of quality of AIS outcomes within Islamic banks in Jordan. These indicators included:

Financial Perspective

According to Ciuhureanu (2017), financial perspective is made up of profits, operating returns, and investment returns in addition to the operating profit, which would increase the shareholder value and develop the financial performance of the organization in general. Here, it is necessary to point out that there is an urgent need for the financial axis related to organizations to be developed in order to reach the steady state of development and control of potential risks, especially financial risks from them. Shagari et al (2017) also noted that financial development can be the source of revenue growth, which can be achieved through deepening relationships with customers, especially for banks. As for the second case, it is through increasing revenue by developing products and services, increasing them, and dealing with additional products that are capable of collecting new revenue for the organization. Thus, the financial axis is controlled by ensuring the highest risk management methods and in a way that ensures the best means of strategic performance.

Customer Perspective

The customer axis is of the utmost importance in view of the great benefit that can be reached in the event of developing relationships that link the organization with its customers, in this way it has dominated the related marketing side and has ensured that marketing risks are addressed in a more effective way compared to organizations that do not develop rules And customer relations are an important part of its external operations (Reimsbach et al., 2018). While Ha et al. (2016) saw that customer, perspective is concerned with organizations that target market sectors within their field of interest in terms of trying to reach and deal with clients and focus on reaching the desired state of customer satisfaction. Determining the correct market segment that the organization wants to address properly helps the organization to develop strategies to maximize customer satisfaction, which increases market profitability and competitiveness.

Internal Operations Perspective

As Kpurugbara et al (2016) stated, internal operations axis, as one of the axes of nonfinancial performance, indicates the internal operations of the organization and the extent of its smoothness in business administration. The idea of internal operations refers to the state of efficiency in operating operations and ensuring their progress within the required frameworks in order to ensure the highest levels of achievement and facilitate the task of reaching goals, Fields (2016) indicates that the main axis of internal operations within the scope of the non-financial performance indicators is closely related to reducing waste, speeding things up, and ensuring more outputs at a lower cost. In addition, Sardo & Serrasqueiro (2017) has found that the most important requirements for internal operations are the answering of many questions by the manager, which include whether there are unnecessary obstacles that stand between new ideas and implementation and how to overcome these obstacles, which could be inherently traditional risks or strategy.

Learning Axis

Sotnichenko & Malei (2017) Believes that an axis for learning and growth within the non-financial performance indicators indicates the general culture of the company Organizational Culture. Through this axis, many questions are asked, including the degree of awareness of working individuals and their relationship with middle and higher departments, in addition to the degree Individuals' awareness within the organization of managing change and is it easy for organization members to collaborate and exchange knowledge. In addition, the idea of learning and growth within the balanced scorecard answers many questions related to the organization in terms of administrative chaos or the extent of bureaucracy in terms of issuing decisions and overlapping them, and also, the extent to which individuals can access training, education and continuous skills development opportunities in order to elevate the level of organizational performance at the level of individuals and the organization as a whole.

Methods

In order to achieve aim of study, researcher adopted the quantitative approach through utilizing a questionnaire; the questionnaire was distributed on managers and officers of financial departments within Jordanian Islamic banks. Population of study calculated (265) individuals working with Islamic banks in Jordan. A convenient sample was chosen to be (200) individuals, after the application process; researcher was able retrieve (150) properly filled questionnaire referring to a response rate of 75% as statistically accepted. In addition to that, researcher used the Cronbach Alpha in order to verify the study reliability. The alpha value = 0.962, which is an excellent ratio, being higher than the acceptable percentage 0.60.

Results

Demographics

Below are table of statistical analysis which took place on respondents' demographics and demonstrated the following:

Table 1 indicated a response rate based on gender for the benefit of males forming 64.7% of total sample with frequency of 97 individuals; compared to females who formed 35.3% of the sample with a frequency of 53 individuals.

| Table 1 Sample Characteristics According to Gender | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Male | 97 | 64.7 | 64.7 | 64.7 |

| Female | 53 | 35.3 | 35.3 | 100.0 | |

| Total | 150 | 100.0 | 100.0 | ||

In Table 2 below, sample characteristics according to age was calculated, it appeared that majority of respondent were individuals within age range of 31-36 years old forming 46% of total sample with frequency of 69 individuals, compared to the least age range which scored 12% of total sample for individuals above 43 years old.

| Table 2 Sample Characteristics According to Age | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 25-30 | 29 | 19.3 | 19.3 | 19.3 |

| 31-36 | 69 | 46.0 | 46.0 | 65.3 | |

| 37-42 | 34 | 22.7 | 22.7 | 88.0 | |

| +43 | 18 | 12.0 | 12.0 | 100.0 | |

| Total | 150 | 100.0 | 100.0 | ||

In Table 3, it was revealed that 66% of total sample held BA degree, while 32.7% held an MA degree and 1.3% held PhD degree.

| Table 3 Sample Characteristics According to Education | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | BA | 99 | 66.0 | 66.0 | 66.0 |

| MA | 49 | 32.7 | 32.7 | 98.7 | |

| PhD | 2 | 1.3 | 1.3 | 100.0 | |

| Total | 150 | 100.0 | 100.0 | ||

In Table 4, it was shown that majority of sample had an experience of 7-11 years forming 36% of the sample compared to those who had +17 years of experience forming 6% of total sample.

| Table 4 Sample Characteristics According to Experience | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 2-6 | 37 | 24.7 | 24.7 | 24.7 |

| 7-11 | 54 | 36.0 | 36.0 | 60.7 | |

| 12-16 | 50 | 33.3 | 33.3 | 94.0 | |

| +17 | 9 | 6.0 | 6.0 | 100.0 | |

| Total | 150 | 100.0 | 100.0 | ||

Questionnaire Analysis

Table 5 presented means of sample responses on statements, it appeared that respondents held a positive attitude toward above statements as their means were greater than mean of the scale 3.00. As in Table 6 below, it was seen through descriptive statistics of variables that there was a positive attitude towards variable of study as their mean scored higher than mean of scale 3.00 which was seen to be a positive result.

| Table 5 Descriptive Analysis of Questionnaire | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| AIS Quality Drivers | |||||

| Relevance | |||||

| The bank makes sure that all data provided by AIS is relevant to the decision-making process | 150 | 1 | 5 | 3.59 | 1.260 |

| All banks are committed to presenting data that matches reality | 150 | 1 | 5 | 3.49 | 1.214 |

| All generated data are related to current situation | 150 | 1 | 5 | 3.48 | 1.128 |

| Relevance possess the quality characteristics of the accounting-related relevance information | 150 | 1 | 5 | 3.39 | 1.146 |

| Credibility | |||||

| Data provided are credible and convincing | 150 | 1 | 5 | 3.38 | 1.053 |

| Most Islamic banks depend on AIS data to generate information | 150 | 1 | 5 | 3.20 | 1.099 |

| All generated data verify the financial performance | 150 | 1 | 5 | 3.27 | 1.034 |

| All generated data present the next step that supports decision making process | 150 | 1 | 5 | 3.23 | 1.011 |

| Procedures and instructions | |||||

| Internal procedures are well-organized | 150 | 1 | 5 | 3.32 | 0.958 |

| All operations are supportive for decision making based on AIS | 150 | 1 | 5 | 3.28 | 1.037 |

| Instructions are clear and works for the benefit of the bank | 150 | 1 | 5 | 3.24 | 1.047 |

| Management polishes procedures and instructions in the bank in order to meet AIS practices | 150 | 1 | 5 | 3.45 | 1.040 |

| Timelines | |||||

| AIS present data that matches current situations | 150 | 1 | 5 | 3.39 | 1.054 |

| AIS present data on time without delay | 150 | 1 | 5 | 3.55 | 1.185 |

| There is no gaps between AIS results and environmental timeline | 150 | 1 | 5 | 3.39 | 1.140 |

| IT infrastructure | |||||

| Technological infrastructure is well-built in the bank | 150 | 1 | 5 | 3.67 | 1.065 |

| The IT department keeps all devices up to date | 150 | 1 | 5 | 3.59 | 1.017 |

| There is a good level of technological vigilance in the bank | 150 | 1 | 5 | 3.64 | 1.005 |

| Network and connection are always supported by IT department | 150 | 1 | 5 | 3.49 | 1.015 |

| Feedback Value | |||||

| All generated data from AIS are dependable | 150 | 1 | 5 | 3.79 | .971 |

| Feedback from AIS is always valuable | 150 | 1 | 5 | 3.47 | 1.008 |

| Users have access to check results and evaluate feedback | 150 | 1 | 5 | 3.69 | .996 |

| Feedback is a major issue in decision making process | 150 | 1 | 5 | 3.70 | .995 |

| Non-Financial Performance | |||||

| Financial Perspective | |||||

| There is an improvement in the services that increase the profitability of the bank | 150 | 1 | 5 | 3.49 | 1.054 |

| There is an improvement in the services that increase the return on investment with the bank targeted banking market | 150 | 1 | 5 | 3.65 | 1.265 |

| The management of the bank is concerned with improving the level of operational efficiency | 150 | 1 | 5 | 3.54 | 1.230 |

| The management of the bank is keen to increase its share in the in the targeted banking market | 150 | 1 | 5 | 3.55 | 1.150 |

| Customer Perspective | |||||

| The bank is keen to encourage its customers to increase the size of their deposits with it | 150 | 1 | 5 | 3.45 | 1.185 |

| Bank management is concerned with handling customer feedback and complaints | 150 | 1 | 5 | 3.45 | 1.102 |

| The bank's management focuses on diversifying the banking services provided to clients | 150 | 1 | 5 | 3.29 | 1.137 |

| The bank adopts different policies to attract new clients | 150 | 1 | 5 | 3.37 | 1.065 |

| Internal Operations Perspective | |||||

| The bank management is interested in developing its internal operations | 150 | 1 | 5 | 3.34 | 1.048 |

| The bank’s management is committed to all the standards and procedures established by the central bank | 150 | 1 | 5 | 3.41 | .991 |

| Banking services provided to customers are characterized by a high level of quality | 150 | 1 | 5 | 3.33 | 1.079 |

| There is an interest in developing the various services provided to clients | 150 | 1 | 5 | 3.35 | 1.099 |

| Learning Axis | |||||

| Bank management encourages employees to be creative at work | 150 | 1 | 5 | 3.54 | 1.072 |

| The bank’s management adopts special policies to motivate employees to increase their performance level | 150 | 1 | 5 | 3.47 | 1.091 |

| The bank’s management links the employee’s promotion to the efficient completion of his work | 150 | 1 | 5 | 3.67 | 1.184 |

| The bank management is keen to keep its qualified employees | 150 | 1 | 5 | 3.49 | 1.145 |

| Valid N (listwise) | 150 | ||||

| Table 6 Descriptive Statistics of Variables | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Relevance | 150 | 1.00 | 5.00 | 3.4867 | 1.01117 |

| Credibility | 150 | 1.25 | 5.00 | 3.2683 | 0.87571 |

| Procedures and Instructions | 150 | 1.25 | 5.00 | 3.3233 | 0.83874 |

| Timelines | 150 | 1.00 | 5.00 | 3.4444 | 0.95042 |

| IT Infrastructure | 150 | 1.00 | 5.00 | 3.5983 | 0.86839 |

| Feedback Value | 150 | 1.00 | 5.00 | 3.6633 | 0.79848 |

| AIS | 150 | 1.52 | 5.00 | 3.4649 | 0.69194 |

| dep | 150 | 1.35 | 5.00 | 3.4792 | 0.76114 |

| Valid N (listwise) | 150 | ||||

Hypotheses Testing

Main Hypothesis

Quality accounting information system has an influence on non-financial performance of Jordanian Islamic Banks.

As it be seen within Tables 7-9, main hypothesis was tested using multiple regression, it was indicated that F value =77.389 was statistically significant at level 0.05, R value = 0.874 which reflects the strength of the relationship between the independent variables and the dependent variable, this confirmed that Quality accounting information system has an influence on non-financial performance of Jordanian Islamic Banks

| Table 7 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.874a | 0.765 | 0.755 | 0.37700 |

| Table 8 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 65.996 | 6 | 10.999 | 77.389 | 0.000b |

| Residual | 20.325 | 143 | 0.142 | |||

| Total | 86.321 | 149 | ||||

| Table 9 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 0.403 | 0.162 | 2.489 | 0.014 | |

| Relevance | 0.296 | 0.040 | 0.393 | 7.409 | 0.000 | |

| Credibility | 0.190 | 0.054 | 0.219 | 3.529 | 0.001 | |

| Procedures | 0.235 | 0.057 | 0.259 | 4.091 | 0.000 | |

| Timelines | 0.113 | 0.048 | 0.141 | 2.358 | 0.020 | |

| IT | 0.065 | 0.058 | 0.074 | 1.118 | 0.265 | |

| Feedback | 0.006 | 0.062 | 0.006 | 0.093 | 0.926 | |

Sub-Hypothesis

Relevance has positive influence on non-financial performance of Jordanian Islamic Banks.

Tables 10-15 above showed that simple regression test was used to test the above hypothesis, T value =12.895 was statistically significant at level 0.05, R value = 0.727 reflecting the strength of the relationship between the independent variable and the dependent variable, and this confirms that relevance has positive influence on non-financial performance of Jordanian Islamic Banks.

| Table 10 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.727a | 0.529 | 0.526 | 0.52408 |

| Table 11 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 45.671 | 1 | 45.671 | 166.283 | 0.000b |

| Residual | 40.650 | 148 | 0.275 | |||

| Total | 86.321 | 149 | ||||

| Table 12: Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.570 | 0.154 | 10.189 | 0.000 | |

| Relevance | 0.548 | 0.042 | 0.727 | 12.895 | 0.000 | |

| Table 13 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.739a | 0.546 | 0.543 | 0.51468 |

| Table 14 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 47.117 | 1 | 47.117 | 177.870 | 0.000b |

| Residual | 39.204 | 148 | 0.265 | |||

| Total | 86.321 | 149 | ||||

| Table 15 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.380 | 0.163 | 8.475 | 0.000 | |

| Credibility | 0.642 | 0.048 | 0.739 | 13.337 | 0.000 | |

Credibility has positive influence on non-financial performance of Jordanian Islamic Banks.

Simple regression test was used to test the above hypothesis. T value =13.337 which is statistically significant at level 0.05, R value = 0.739 reflects the strength of the relationship between the independent variable and the dependent variable, and therefore it can be concluded that Credibility has positive influence on non-financial performance of Jordanian Islamic Banks.

Procedures and instructions has positive influence on non-financial performance of Jordanian Islamic Banks.

Tables 16-18 showed results of testing sub hypothesis above, simple regression test was used to show that T value =12.282 was statistically significant at level 0.05, R value = 0.71 referring to the strength of the relationship between the independent variable and the dependent variable, and confirming that Procedures and instructions has positive influence on non-financial performance of Jordanian Islamic Banks.

| Table 16 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.710a | 0.505 | 0.501 | 0.53744 |

| Table 17 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 43.573 | 1 | 43.573 | 150.858 | 0.000b |

| Residual | 42.748 | 148 | 0.289 | |||

| Total | 86.321 | 149 | ||||

| Table 18 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.336 | 0.180 | 7.430 | 0.000 | |

| Procedures | 0.645 | 0.052 | 0.710 | 12.282 | 0.000 | |

Timelines has positive influence on non-financial performance of Jordanian Islamic Banks.

Simple regression test was used to test the above hypothesis as it appeared in Tables 19-21, T value =9.857 was statistically significant at level 0.05, R value = 0.63 referring to the strength of the relationship between the independent variable and the dependent variable, it was confirmed that Timelines has positive influence on non-financial performance of Jordanian Islamic Banks.

| Table 19 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.630a | 0.396 | 0.392 | 0.59338 |

| Table 20 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 34.210 | 1 | 34.210 | 97.161 | 0.000b |

| Residual | 52.111 | 148 | 0.352 | |||

| Total | 86.321 | 149 | ||||

| Table 21 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.743 | 0.183 | 9.538 | 0.000 | |

| Timelines | 0.504 | 0.051 | 0.630 | 9.857 | 0.000 | |

IT infrastructure has positive influence on non-financial performance of Jordanian Islamic Banks.

Simple regression test was used to test the above hypothesis as it can be seen from Tables 22-24, T value =8.15 was statistically significant at level 0.05, R value = 0.557 referring to the strength of the relationship between the independent variable and the dependent variable, therefore it was concluded that IT infrastructure has positive influence on non-financial performance of Jordanian Islamic Banks

| Table 22 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.557a | 0.310 | 0.305 | 0.63449 |

| Table 23 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 26.740 | 1 | 26.740 | 66.423 | 0.000b |

| Residual | 59.581 | 148 | 0.403 | |||

| Total | 86.321 | 149 | ||||

| Table 24 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.724 | 0.222 | 7.782 | 0.000 | |

| IT | 0.488 | 0.060 | 0.557 | 8.150 | 0.000 | |

Feedback Value has positive influence on non-financial performance of Jordanian Islamic Banks.

Tables 24-27 showed results of testing above hypothesis using simple regression; T value =8.144 was statistically significant at level 0.05, R value = 0.556 reflects the strength of the relationship between the independent variable and the dependent variable, and therefore it can be concluded that Feedback Value has positive influence on non-financial performance of Jordanian Islamic Banks.

| Table 25 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.556a | 0.309 | 0.305 | 0.63462 |

| Table 26 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 26.714 | 1 | 26.714 | 66.331 | 0.000b |

| Residual | 59.607 | 148 | 0.403 | |||

| Total | 86.321 | 149 | ||||

| Table 27 Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.537 | 0.244 | 6.295 | 0.000 | |

| Feedback | 0.530 | 0.065 | 0.556 | 8.144 | 0.000 | |

Discussion and Conclusion

Current study aimed at examining the influence of quality of AIS outcomes on nonfinancial performance of Islamic Jordanian banks through fiscal year 2019. It was revealed through analysis that quality accounting information system has an influence on non-financial performance of Jordanian Islamic Banks that is attributed mainly to credibility of accounting information systems outcomes among all the chosen variables of (Relevance, Credibility , Procedures and instructions, Timelines, IT infrastructure and Feedback Value).

It was seen as according to current study's results and other previous articles that credibility is important as a factor of AIS quality of information. In that sense, Ironkwe & Nwaiwu (2018) agreed on this result and argued credibility of the information received from the accounting information systems indicates the ability of the organization to adopt this accounting and financial information by its users with the lowest degree of fear possible and this is achieved through the availability of impartiality and reliability, as the credibility here is the ability to trust in the accounting information is one of Convenience feature supplementation to make the information useful, as useful and reliable information is more able to present itself without errors or bias. In order to achieve credibility and reliability in the information received, this information must be verifiable and able to verify its integrity, which requires commitment to the greatest measure of measurement and disclosure, as it is high-accuracy information.

Also, Ironkwe & Nwaiwu (2018) noted that credibility is one of the aspects that forms the final shape of AIS outputs in terms of accepting or rejecting, and that any organization which seeks a good level of AIS should focus more on the credibility of the information in order to positively influence both its financial and non-financial performance, Almaliki et al. (2019); Hossin & Ayedh (2016); and Beg (2018) seemed to also approve the same idea.

In the 2nd and 3rd rank, there appeared an influence of relevance and procedures scoring an R value of 0.727 and 0.710 respectively. This also was seen as in indicator of AIS drivers of better non-financial performance. On that sense, it can be said that relevance of AIS outputs and the internal procedures and instruction of an organizations paves the way for better usability of AIS outputs. On that sense, the idea of relevance of AIS outputs is that in order for accounting information to be appropriate, it must be characterized by many advantages, the most important of which is to be presented in a timely manner (it has a temporal value), and to have the ability to predict the future (it has a predictive value), It is also necessary to compare this information with what is planned (that is, it has a retrieval value), Mancini et al (2016) seemed to have the same attitude regarding relevance when he argued that the information requires that it be able to influence the decision-making process, as its presence changes the decision that would have been taken in the absence of it, and until this is achieved the information should be appropriate, which may be information characterized by an absolute suitability that suits the needs of the largest number of users , or a relative fit for a particular user.

Generally speaking, it can be seen from results that characteristics of information quality and the principles of system reliability in electronic accounting information systems provide in Jordanian Islamic banks is known for its varying proportions, with a relationship between them and between improving their non-financial performance. The study also confirmed that the principles of systems credibility are more effective than the elements of the quality of accounting information in non-financial performance, and the principle of system relevance is more available than other principles. The study also confirmed the existence of an impact of the accounting information systems atmosphere on increasing revenues, rationalizing expenditures, strengthening control over expenditures and revenues and supporting economic and financial decision-making, in addition to its influence in managing positively aspects of non-financial performance including financial perspective, customer perspective, internal operations perspective and learning among individuals.

In conclusion, the study confirmed that most useful information to assist the beneficiaries and users of this information in rationalizing their decisions. That is, good information is that information that is most useful in the field of taking and rationalizing decisions. This defines the concepts of quality of accounting information, the characteristics that must be characterized by useful accounting information, or the basic rules that should be used to assess the quality of accounting information. Determining these characteristics will assist officials in preparing and evaluating the accounting information that results from applying alternative accounting methods and in distinguishing between what is considered necessary and what is not considered. So, since the administration in the facility relies mainly on information to make its decisions, especially accounting information, the availability of appropriate and good information with appropriate characteristics also provides a fertile field for management in making wise and rational decisions that undoubtedly reflect on the field of benefit work, and then achieving more of progress.

Recommendations

Study recommended the following:

1. The necessity for Jordanian Islamic banks to prepare a strategic plan and implement it to develop electronic accounting information systems to achieve the continuity of the quality of that information and the principles of systems reliability in an integrated manner.

2. Preparing a guide for documented policies and procedures for analyzing, operating and using electronic accounting systems in the Jordanian Islamic banks

3. Making a comprehensive electronic link between all accounting information systems and accounting information systems in ministries and government institutions.

4. Holding more training courses for systems users, each according to their need and position.

References

- Acen, M. (2019). Accounting Information Systems and Firm Performance of Small and Medium Enterprises in Nakawa Division. (Doctoral dissertation, Kyambogo).

- Al-Hawari, F. (2017). Analysis and design of an accounting information system. International Research Journal of Electronics and Computer Engineering, 2, 16-21.

- Ali, B.J., Omar, W.A.W., & Bakar, R. (2016). Accounting Information System (AIS) and organizational performance: Moderating effect of organizational culture. International Journal of Economics, Commerce and Management, 4(4), 138-158.

- Appelbaum, D., Kogan, A., Vasarhelyi, M., & Yan, Z. (2017). Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems, 25, 29-44.

- Bachmid, F.S. (2016). The effect of accounting information system quality on accounting information quality. information technology, 7(20).

- Budiarto, D.S., Prabowo, M.A., Djajanto, L., Widodo, K.P., & Herawan, T. (2018). Accounting information system (ais) alignment and non-financial performance in small firm: A contingency perspective. In International Conference on Computational Science and Its Applications (382-394). Springer, Cham.

- Ciuhureanu, A.T. (2017). Study on integrating accounting in the information system of the organization. Land Forces Academy Review, 22(4), 263-269.

- De Gorostiza, J.A., Nordin, N.A.B., Pang, X.Y., Sabili, M.A., Ng, G., & Mariano, S.M. (2018). Development of an Accounting Information System with Data Migration for Company ABC. International Journal of Computing Sciences Research, 1(3), 50-64.

- Dillard, J., Yuthas, K., & Baudot, L. (2016). Dialogic framing of accounting information systems in social and environmental accounting domains: Lessons from, and for, microfinance. International Journal of Accounting Information Systems, 23, 14-27.

- Fields, E. (2016). The essentials of finance and accounting for nonfinancial managers. Amacom.

- Fitrios, R. (2016). Factors that influence accounting information system implementation and accounting information quality. International Journal of Scientific & Technology Research, 5(4), 192-198.

- Ha, S.T., Lo, M.C., & Wang, Y.C. (2016). Relationship between knowledge management and organizational performance: a test on SMEs in Malaysia. Procedia-Social and Behavioral Sciences, 224(2016), 184-189.

- Hall, M., & O'Dwyer, B. (2017). Accounting, non-governmental organizations and civil society: The importance of nonprofit organizations to understanding accounting, organizations and society. Accounting, Organizations and Society, 63, 1-5.

- Handoko, B.L., Sabrina, S., & Hendra, E. (2017). The influence of leadership styles on accounting information systems quality and its impact on information quality survey on state-owned enterprises. In 2017 IEEE 17th International Conference on Communication Technology (ICCT) (1989-1993). IEEE.

- Kanakriyah, R. (2016). The effect of using accounting information systems on the quality of accounting information according to user’s perspective in Jordan. Auditing and Finance Research, 4(11), 58-75.

- Kocsis, D. (2019). A conceptual foundation of design and implementation research in accounting information systems. International Journal of Accounting Information Systems.

- Kpurugbara, N., Akpos, Y.E., Nwiduuduu, V.G., & Tams-Wariboko, I. (2016). Impact of accounting information system on organizational effectiveness: A study of selected small and medium scale enterprises in Woji, Portharcourt. International Journal For Research In Business, Management And Accounting, 2(1), 62-72.

- Lak, L., Salehi, A.K., Basirat, M., & Kaab Omeir, A. (2019). Analyzing the efficiency of capital market relative to the decreas-ing and increasing information of the components of accounting earnings. Advances in Mathematical Finance and Applications.

- Lutf, A.A., & Mohamad, R. (2016). The influence of technological, organizational and environmental factors on accounting information system usage among Jordanian small and medium-sized enterprises. International Journal of Economics and Financial Issues, 6(S7), 240-248.

- Mancini, D., Dameri, R.P., & Bonollo, E. (2016). Looking for synergies between accounting and information technologies. In Strengthening information and control systems (pp. 1-12). Springer, Cham.

- Mouritsen, J., & Kreiner, K. (2016). Accounting, decisions and promises. Accounting, Organizations and Society, 49, 21-31.

- Munteanu, V., Berechet, M.C., & Scarlat, L.M. (2016). Financial accounting information system-premise of managerial act. Knowledge Horizons. Economics, 8(2), 88.

- Nallareddy, S., & Ogneva, M. (2017). Predicting restatements in macroeconomic indicators using accounting information. The Accounting Review, 92(2), 151-182.

- Narayanaswamy, R. (2017). Financial accounting: a managerial perspective. PHI Learning Pvt. Ltd.

- Obi, P.E., Obi, B.C., & Ajaero, O.O. (2016). Accounting Information System (AIS) as a panacea to crisis in business operations: A case study of selected SMES in owerri Municipality. Journal of Qualitative Education, 12(1).

- O'Dwyer, B., & Unerman, J. (2016). Fostering rigor in accounting for social sustainability. Accounting, Organizations and Society, 49, 32-40.

- Reimsbach, D., Hahn, R., & Gürtürk, A. (2018). Integrated reporting and assurance of sustainability information: An experimental study on professional investors’ information processing. European Accounting Review, 27(3), 559-581.

- Sardo, F., & Serrasqueiro, Z. (2017). A European empirical study of the relationship between firms’ intellectual capital, financial performance and market value. Journal of Intellectual Capital.

- Shagari, S.L., Abdullah, A., & Saat, R.M. (2017). Contributory factors of accounting information systems effectiveness in Nigerian banking sector. Asian Journal of Multidisciplinary Studies, 151.

- Sotnichenko, N., & Malei, A. (2017). The basics of accounting and analysis of economic Security. European And National Dimension in Research, 185.

- Susanto, A. (2017). The influence of organizational commitment on the quality accounting information system. International Journal of Scientific and Technology Research, 6(9), 162-168.

- Susanto, A. (2018). The Influence of Information Technology on the Quality of Accounting Information System. In Proceedings of the 2018 2nd High Performance Computing and Cluster Technologies Conference (pp. 109-115).

- Taiwo, J. N. (2016). Effect of ICT on accounting information system and organizational performance: The application of Information and Communication Technology on Accounting Information System. European Journal of Business and Social Sciences, 5(2), 1-15.

- Trigo, A., Belfo, F., & Estébanez, R.P. (2016). Accounting information systems: Evolving towards a business process-oriented accounting. Procedia Computer Science, 100, 987-994.

- Trofimova, L.B., Prodanova, N.A., Korshunova, L.N., Savina, N.V., Ulianova, N., Karpova, T.P., & Shilova, L. (2019). Public sector entities reporting and Accounting information system. Journal of Advanced Research in Dynamical and Control Systems, 11(S8), 416-424.

- Turner, L., Weickgenannt, A.B., & Copeland, M.K. (2016). Accounting information systems: the processes and controls. John Wiley & Sons.

- Uyar, A., Gungormus, A.H., & Kuzey, C. (2017). Impact of the accounting information system on corporate governance: Evidence from Turkish non-listed companies. Australasian Accounting, Business and Finance Journal, 11(1), 9-27.

- Walker, S.P. (2016). Revisiting the roles of accounting in society. Accounting, Organizations and Society, 49, 41-50.