Research Article: 2021 Vol: 25 Issue: 1

Quarterly Earnings Management: the Role of Audit Quality

Nadia Sbei Trabelsi, American University in Dubai

Abstract

This paper used data of companies listed in United Arab Emirates stock markets from 2011 to 2019 to investigate whether the magnitude of quarterly earnings management varies across quarters. Additional tests were conducted to examine the effect of audit quality on the level of earnings management. Multivariate regression analysis was employed to test the sensitivity of earnings management to quarters and to audit quality. Overall, results indicate a higher level of earnings manipulation during the first and the fourth quarter. During the first quarters mangers might have a discretionary attitude to avoid losses or decline in earnings. A reversing effect was detected in the fourth quarter. Firms audited by a big 4 auditors are less likely to manage their earnings. High quality audit seems reducing the manipulation of earnings.

Keywords

Earnings management, Quarterly earnings, Audit quality, UAE.

Introduction

This paper investigates two questions regarding quarterly earnings management (EM) for a sample of companies listed in UAE stock markets. First, I examine whether the magnitude of EM changes through quarters. EM depends on managers’ motivation and on opportunities which may be different from one quarter to another. Second, I explore if a company’s tendency to manage its earnings is reduced if its financial reports are audited by big four auditors. Highquality auditors improves quarterly earnings quality and therefore would minimize EM. Unlike many previous studies analyzing EM using annual data, this paper examine quarterly data. Interim financial disclosures are mandatory for firms listed in most stock markets and are supposed to be useful for capital providers. Analyzing the quality of quarterly earnings through the examination of a possible manipulation allows shedding the light on a subject that was not extensively analyzed in previous research.

Disclosing quarterly reports is the direct consequence of the desire in providing timely financial information for capital providers. However, managers may have incentives and opportunities to manipulate interim results and this opportunity could be greater than for annual earnings. In fact, quarterly reports should be reviewed and not certified by an external auditor. Managers might manipulate quarterly earnings to refrain from reporting losses or to avoid earnings decline (Fujiyama, et al., 2014). Publishing partial results conveys information through the fiscal year and helps in forecasting earnings (Pagach & Warr, 2020). Thus, disclosing high quality financial information in the interim accounting reports is essential. Previous research analyzed EM for quarterly setting and have noted significant differences in earnings patterns over interim periods: fourth quarter earnings are more volatile than others (Lightstone, et al., 2012) and earnings in the last quarters are used to reverse the sign of the earliest ones (Cascudo Rodrigues, et al., 2019).

This paper is intended to investigate on EM practices for quarterly earnings. It looks for providing additional evidence to determine whether the magnitude of EM is different between quarters and if audit quality plays a role in reducing manipulations. Like previous studies, I assumed that EM could be detected by measuring discretionary accruals. Managers could use their discretion and apply accrual-based accounting in a preplanned manner to achieve certain objective. The model developed by (Leuz, et al., 2003) and adopted by (Wang & Campbell, 2012) has been used to measure the magnitude of EM. Tests have been performed by running regression models including quarters as dummy variables to determine the possible sensitivity of EM to each quarter. Further tests have been conducted for the sample to examine the potential role of audit quality in reducing EM. Alike the literature, high-audit quality was proxied in the model by a variable representing the big 4 auditors. Overall, findings demonstrate dissimilarities in EM level across quarters. It is during quarters 1 and 4 that EM seems to be more pronounced than other quarters. This result could be explained by the importance of financial information disclosed for the first period of the fiscal year. Managers might manipulate accounting numbers to avoid disclosing losses or decreases in the performance and therefore send a negative signal for the coming period. Considering quarter 4, results demonstrate a reversing effect compared to previous quarters. Good or bad news that intentionally were not considered in the previous interim periods, would have been taken into account in the annual financial statements and accordingly reflected in the last quarter. The role of audit quality seems to be relevant in reducing EM. However, this result should be taken with precaution as the majority of firms in the sample are audited by big 4.

The questions raised in this paper and results obtained from tests could be relevant to capital market regulators and all interested parties. It contributes to the debate on the quality of interim reports. This is the first study, to the best of my knowledge to date, that examines EM for a large sample of companies listed in UAE and for a long period of 9 years from 2011 to 2019. Moreover, this paper provides additional insights on the role of high-quality audit in detecting and reducing earnings manipulations. The rest of the paper is organized as follows. In section 2, I present and discuss previous research and develop hypothesis. Section 3 presents the sample and the methodology used to test hypothesis. Empirical tests and results are presented in section 4. Finally, I conclude in section 5.

Literature Review and Hypothesis Development

Accruals based accounting implies recognizing revenue and expenses during the periods when they are respectively earned and incurred regardless on cash flows. Applying the revenue and expense recognition principles is closely related to earnings management (Dechow & Skinner, 2000). It provides managers the opportunity to intentionally plan the timing of including revenue and expenses in the measurement of the net income. They may prematurely recognize revenue and/or defer expenses during a given period, if needed, as they expect future income to absorb differed expenses. The terms “manipulate profits” and "window dressing" were used respectively by Copeland (1968) and Dutta & Gigler (2002) to characterize the ability of managers to increase or decrease the net income on purpose.

Several researchers have examined the reasons of earnings management. Healy & Wahlen (1999) consider two main reasons: misleading some stakeholders and influencing contractual outcomes determined based on published financial information. Managers may would like to influence the perception that actual and potential investors have about the firm (Degeorge, et al., 1999). Accordingly, one of the main incentives for mangers to manipulate earnings is to meet performance indicators to increase their compensation and bonuses (Almadi & Lazic, 2016; Alhadab & Al-Own, 2019; Assenso-Okofo, et al., 2020). Analyzing a sample of 3,000 British, Australian, German, and Austrian firm-years, Almadi & Lazic (2016) found that CEO incentive-based compensation motivates more earnings management in countries where investor protection and legal enforcement is weaker (Germany and Austria). In the banking industry, the studies of Cheng, et al. (2011) and Alhadab & Al-Own (2019) attain similar results. Managers in banks with high equity incentive are more likely motivated in managing reported earnings. Moreover, results from Assenso-Okofo, et al. (2020) demonstrate the need of aditional surveillance and control in equity related compensation arrangement to reduce earnings management.

EM can also be motivated by the desire of management to communicate accounting numbers which are closer to forecasts or which keep the same trend as the previous results. In genenral, practitioners are skeptical regarding issuing earnings forecasts, they consider that it may lead to managerial myopia and shorttermism, and as a result increasing EM. Dutta & Gigler (2002) developed a theory to explore the impact of publishing earnings forecasts on the likelihood of EM. The model shows that EM is strongly related to the magnitude of predicted performance. EM is more probable in case of high earnings forecasts than low earnings forecasts. Results from empirical work are not clear cut. Luo (2019) demonstrate that providing short term earnings forecasts reduce EM and managers opportunistic behavior. Buchner, et al. (2017) analyzed a sample of 368 IPO companies listed in UK from 1985 to 2012. Overall, results indicate that the degree of EM is lower for firms that disclosed earnings forecasts. Different findings were presented by Du & Shen (2018). They indicate that when peer performance is high, managers are more likely to manager earnings to achieve that level of performance. These findings are like those of Bratten, et al. (2016). Managers who disclose their earnings after the leader in the industry are more likely to manipulate earnings, this practice is more pronounced when the leader is reporting high profit.

The publication of interim reports is mandatory in many jurisdictions around the word. Financial market regulators in US and many European and Asian countries require reviewing quarterly reports by an independent external auditor. In UAE, publishing reviewed quarterly accounting reports became compulsory since 2015 for listed firms (Sbei Trabelsi, 2019). From accounting standard setting perspective, the IASC (the IASB predecessor) published in 1999 IAS 34: Interim Financial Reporting. Quarterly earnings were not preserved from the possible manipulation (Rahman, 2019). EM may be performed through the manipulation of real transactions: modifying delivery dates, postponing research and development expenditures, or speeding up sales. Jeter & Shivakumar (1999) analyzed the level of EM through interim reports for a random sample of firms. Results indicate that EM is more pronounced in the fourth quarter compared to the previous three. Managers would have higher motivation to manipulate earnings to attain a target profit.

Moreover, several empirical research have demonstrated the phenomena of interim earnings reversal by analyzing the distribution of quarterly earnings. As the first three quarters allow more discretion than annual reports, managers delay the bad news to the fourth quarter (Fujiyama, et al., 2014). Das, et al. (2009) analyzed quarterly earnings patterns for a sample of US firms from 1988 to 2004 (71,936 observations). Findings show that earnings reversal in the fourth quarter is significant in the sample and its sign depends on the performance level in the first three quarters. Firms who disclosed high earnings in interim reports, report lower earnings in the fourth quarter. It allows managers to constitute reserves for the future. However, companies not performing well during interim periods increase intentionally earnings in the fourth quarter to maintain a certain trend of annual earnings or to achieve forecasting. Shifting special items from reported earnings in the fourth quarter is used by managers to reverse the trend of the performance (Fan, et al., 2010).

Based on the previous developments, we consider in this paper that quarterly earnings disclosed by firms listed in UAE stock markets are subject to manipulations from managers. We assume that the publication of the first interim report is highly considered by investors. It would be considered as a signal for the performance of the company during the rest of the fiscal year. If the firm was well performing in the past year, disclosing a good performance level conveys a message of continuity on the same positive trend. Inversely, if the entity had bad results in previous year, announcing a relatively high profit in the first quarter allows mangers to transmit a recovery message to investors. In UAE, listed companies do not publish a separate report for the fourth quarter. They communicate three reviewed interim reports and audited annual financial statements. The accounting numbers related income statement and statement of cash flows related the last quarter of the fiscal year are calculated by deduction. Therefore, we consider that fourth quarter earnings would be manipulated. The above allows us to formulate the following hypothesis:

H1: Earnings management is more pronounced in the first quarter compared to the second and the third one.

H2: Earnings management is more pronounced in the fourth quarter compared to the previous three.

Accounting research analyzing the quality of financial information was interested in investigating the role of audit quality in disclosing high quality information. Being audited by Big 4 was widely used as a proxy of high-quality audit. It is expected that Big 4 auditors provide higher quality services to their clients than non-Big 4 (El Ghoul, et al., 2016; Behn, et al., 2008). It is considered that Big 4 auditors have resources for innovation and for training their employees (Alzoubi, 2016). Overall, findings of research that analyzed the role of audit quality in reducing EM support a negative correlation between EM and high-audit quality (Francis & Wang, 2008; Choi, et al., 2018; Rusmin, 2010; El Ghoul, et al., 2016).

Choi, et al. (2018) have analyzed the effect of audit-quality on EM for a sample of firms from 22 countries for the period from 1995 to 2004. Results demonstrate that EM is reduced for companies audited by Big 4 especially in countries with a strong legal regime. Similar results were revealed by Francis & Wang (2008). In a study carried out for a sample of 301 listed Singaporean firms, Rusmin (2010) investigates the relationship between EM and audit quality for. The audit quality has been measured by two variables: industry specialist auditors and big 4 auditors. Results indicate that the magnitude of EM is lower for firms engaging services from a specialist and/or a big 4 auditor compared with other companies. High quality auditors are less likely to tolerate manipulation practices in preparing accounting reports. Their expertise allows them to track down such actions. However, the tests performed by Orazalin & Akhmetzhanov (2019) on a sample of firms listed in Kazakhstan Stock Exchange from 2011 to 2016 show that audit quality does not a (Choi, et al., 2018) affect EM. Similarly, the study of Sitanggang, et al. (2019) on a large sample of UK firms for the period 2010–2013 finds partial evidence of significant relationship between audit quality and EM. Accordingly, based on the evidence presented above, the following hypothesis is formulated:

H3: There is a negative relationship between EM and high-quality audit. The magnitude of EM is lower for firms audited by big 4 auditor compared to firms audited by non-big 4.

Data and Methodology

Sample and Data Collection

The initial sample consisted of all companies listed in UAE: Abu Dhabi Securities Exchange (ADX) and Dubai Financial Market (DFM), from 2011 to 2019. Data were collected from Thomson Reuters Eikon database and completed from quarterly and annual financial statements available on the webpage of ADX and DFM or disclosed in the firms’ website. The original sample included a total of 69 and 74 firms listed respectively in ADX and DFM. From the original sample, financial institutions were excluded because of their special status: they represent a regulated industry with special laws and apply different accounting procedures. Accordingly, I excluded 78 companies: 36 from ADX and 42 from DFM. In addition, firms with missing quarterly data were eliminated: 4 and 5 from those listed respectively in ADX and DFM. The final sample consisted of a total of 56 firms listed in UAE stock markets from 2011 to 2019 for a total of 1,482 firm-quarter observations. Sample selection procedure is summarized in Table 1.

| Table 1 Sample Selection | |

| Firms listed in ADX | 69 |

| Less: Financial institutions Missing quarterly data |

36 4 |

| = Total firms listed in ADX included in the sample | 29 |

| Firms listed in DFM | 74 |

| Less: Financial institutions Missing quarterly data |

42 5 |

| = Total firms listed in ADX included in the sample | 27 |

| Total firms included in the sample (29+27) | 56 |

Measurement of EM

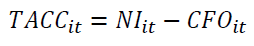

I estimate the magnitude of EM based on detecting discretionary accruals and by using the model developed by Leuz, et al. (2003) and used by Bao & Lewellyn (2017) and Wang & Campbell (2012). The model was driven from to the workings of Dechow & Skinner (2000), Dechow, et al. (1995) and Healy & Wahlen (1999). Assuming information asymmetry, managers may use their discretion to reduce earnings volatility or to disclose a predetermined earnings level. In the same way as Leuz, et al. (2003), I adopted the following two steps to measure EM. Step 1: The amount of total accruals was calculated as follows:

(1)

(1)

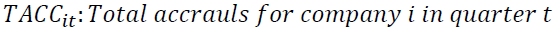

Where:

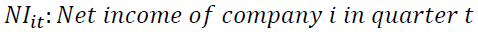

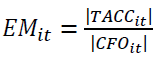

Step 2: The amount of earnings management for firm I during quarter t, denoted as EMit, was calculated using the following ratio:

(2)

(2)

As the amount of EM is greater as it is considered an indicator that managers are using more discretion to manipulate earnings. This is a proxy that captures the magnitude of insiders to manage accounting earnings (Leuz, et al., 2003). Scaling total accruals by cash flow from operations allows controlling the differences in firm sizes.

EM and Quarter Effect

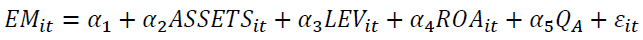

After calculating the magnitude of EM for each company during different quarters as explained above, I used it as a dependent variable in a regression analysis to examine the relationship between EM and quarters. For example, for the first quarter, this is done by running the following model:

(3)

(3)

Where:

Natural logarithm of total assets of firm I at the end of quarter t.

Natural logarithm of total assets of firm I at the end of quarter t.

Leverage measured by total debt divided by total assets of firm i at the end of quarter t.

Leverage measured by total debt divided by total assets of firm i at the end of quarter t.

Return on assets measured as net income divided by total assets for firm i in quarter t.

Return on assets measured as net income divided by total assets for firm i in quarter t.

Dummy variable equal to 1 if the data is related to quarter A and 0 otherwise

Dummy variable equal to 1 if the data is related to quarter A and 0 otherwise

Error terms

Error terms

Equation (3) was tested four times by replacing QA by Q1 then Q2, then Q3, then Q4. As previous studies I included the following control variables in the model. The size of the firm which is calculated as the natural logarithm of the firm’s total assets at the end of the quarter (Ndu, et al., 2019), the leverage proxied by the ratio of total liabilities to total assets at the end of the quarter (Wang & Campbell, 2012), and the performances measured by the return on assets ratio (Kothari, et al. 2005; Alqatan, et al. 2019).

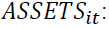

Additional tests were conducted to contrast the level of earnings management between each two quarters. For this I included two dummies representing quarters as shown in this model:

(4)

(4)

Equation (4) allows examination of EM’ magnitude of quarter A versus that of quarter B. It was tested six times by replacing QA and QB by two different quarters: Q1/ Q2, / Q1, / Q3, Q2/ Q3, Q2/ Q4, and Q3/ Q4.

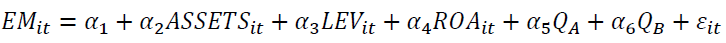

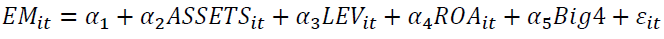

EM and Audit Quality

The degree of EM indicates the use of discretion by managers to manipulate reported accounting numbers. This discretionary power could be detected and accordingly reduced by a high-quality audit service. As mentioned in the literature review presented above, being audited by a Big 4 would be considered as an indicator of good quality assurance services. Big 4 companies have more resources and expertise than others to unmask earnings manipulations (Choi, et al. 2018 ; Sitanggang, et al. 2019). Moreover, they engage their responsibility and care about their reputation and would not permit such practices. For this I tested the following model:

(5)

(5)

Where:

Big4: Dummy variable equals 1 if the firm is audited by Big 4 and 0 otherwise.

Equation (5) allows to analyze the impact of audit quality on the level of EM. The results from this regression will be analyzed in more details for each quarter taken separately. Equation (6) will be tested to examine the role of audit quality in each quarter.

(6

(6

Equation (6) was tested three times more by replacing Q1 by Q2, then Q3, then Q4.)

Empirical Results

Descriptive Statistics

Table 2 presents descriptive statistics of dependent and independent variables used in different models presented above. Analysis of quarterly performance of the firms included in the sample reveals that 19.80% of observations are losses. However, this percentage is different across quarters. Losses represent 13.85% and 26.84% from total observations respectively in quarters 1 and 4. This is a first indicator of differences in earnings distribution through interim periods. Moreover, the percentage of companies reporting profit is highest during quarter 1 compared to others. Regarding auditors, 79% of the firms were audited by big 4 auditor. This observation should be considered when analyzing the impact of audit quality on EM.

| Table 2 Descriptive Statistics | |||||

| Variable | Observations | Mean | SD | Min | Max |

| EM | 1,848 | 4.240365 | 51.51461 | 0.000872 | 2092.051 |

| Big 4 | 1,848 | 0.7900433 | 0.4073877 | 0 | 1 |

| Assets | 1,853 | 14.98897 | 1.768455 | 10.22751 | 18.69938 |

| Lev | 1,853 | 0.4158589 | 0.2287761 | 0.00142 | 3.481871 |

| ROA | 1,848 | 0.0045277 | 0.0644889 | -2.280134 | 0.4173543 |

EM and Quarter Effect

I examined the level of EM through quarters by running the regression of equation (3). The coefficient α5 allows the detect the sensitivity of earnings manipulations to different quarters. Results are presented in Table 3. Overall, the findings show that the model is well specified for all quarters: F statistic is significant at 1% level. This is consistent with results from previous research on the use of size, leverage, and performance as control variables. For all quarters, the control variables were significant at 1% degree. As expected, the size and the performance of the firms measured by assets and return on equity are positively correlated with the amount of accruals at a significant degree. However, the coefficient α3 for the leverage is negative. This result is like Wang & Campbell (2012) findings.

| Table 3 Regression Results of the Magnitude of EM by Quarter | ||||

| Q1 | Q2 | Q3 | Q4 | |

| ASSETS | 0.0917734*** (4.95) |

0.0929001*** (5.00) |

0.0923343*** (4.97) |

0.0953781*** (5.17) |

| LEV | -0.3584171*** (-8.49) |

-0.3589543*** (-8.49) |

-0.3586656*** (-8.47) |

-0.3670845*** (-8.74) |

| ROA | 0.6659978*** (24.81) |

0.6633617*** (24.66) |

0.6642654*** (24.61) |

0.6773282*** (25.26) |

| QA | 0.2021448*** (3.05) |

0.0936055 (1.40) |

0.0199124 (0.29) |

-0.3563466*** (-5.07) |

| Constant | 2.451684*** (8.42) |

2.454003*** (8.39) |

2.48583*** (8.52) |

2.616115*** (9.01) |

| Observations | 1,482 | 1,482 | 1,482 | 1,482 |

| R2 | 0.3053 | 0.3018 | 0.3009 | 0.3128 |

| Adjusted R2 | 0.3034 | 0.2999 | 0.2990 | 0.3110 |

| F Statistc | 162.26*** | 159.63*** | 158.96*** | 168.11*** |

| All variables are defined in Section 3; t-statistics in parentheses and ***p < 0.01; ** p < 0.05; * p < 0.10 | ||||

The most interested findings are related to analyzing the sensitivity of EM to each quarter. Findings show differences through interim periods. The quarter variable is significant during quarters 1 and 4 only. The coefficient α5 in equation (3) tested for quarter 1 is positive and significant at 1% degree. This result may be explained by the desire of managers to announce a satisfactory performance level for the coming fiscal year. It can be argued that managing earnings upwards during the first quarter would be considered as a positive signal for investors to either announce a decrease in losses or an increase in profits. The lowest frequency of reporting losses was during the first quarter (13.85% from total observations during the quarter). This result is consistent with previous research. One of the main motivations of earnings manipulations is to disclose a performance level close to investors’ expectations (Bratten, et al., 2016; Du & Shen, 2018; Dutta & Gigler, 2002).

Regarding quarter 4, results demonstrate a negative coeficient, significant at 1% level. This findings may support the assumption of “correcting” or “reversing” affect during the last quarter in the fiscal year. Considering that firms in the sample did not publish seperately the accounting reports related to the last quarter and that fourth quarter earnings are calculated from the annual satements and the three interim reports, it was expected to detect a certain “reversing” affect. Managers would differ the recogntion of certain expenses or prematurely recognize revenue during early quarters. Indeed, reporting quarterly losses is much more pronouned during last quarter compared to others: 26.84% of observations in Q4 versus 13.85% and 15.37% repectively in Q1 and Q2. Fourth quarter earnings could be used by managers to adjust previuos interm periods disclosed earnings (Lightstone et al., 2012).

Globally, aditional analysis from testing equation (4) allows to support these findings. By including two different quarters in the model, the general pattern of results is similar. Results are shown in Table 4. The coeficients Q2 of Q3 and are not signifcant when considered in the model with any other quarter. This resulat supports previous findings. Managers are probably more motivated in managing earnings during the first and the last quarteres compared to others. Contrasting Q1 and Q4 in equation (4) reveals a non significant coeficient for Q1. This result stenthens the hypothesis that EM is perfornmed in different manners during interim periods and that the potential manipulations are primerly reflected in quarter four adjustments.

| Table 4 Regression Results of the Differences in the Magnitude of EM Between Quarters | ||||||

| QA versus QB | ||||||

| A=1 B=2 |

A=1 B=3 |

A=1 B=4 |

A=2 B=3 |

A=2 B=4 |

A=3 B=4 |

|

| ASSETS | 0.0929517*** (5.03) |

0.0921332*** (4.97) |

0.0948142*** (5.14) |

0.093283*** (5.02) |

0.095308*** (5.17) |

0.0952372*** (5.17) |

| LEV | -0.359763 *** (-8.54) |

-0.3602576 *** (-8.54) |

-0.3662399 *** (-8.72) |

-0.360113 *** (-8.51) |

-0.3671156 *** (-8.74) |

-0.3661781 *** (-8.72) |

| ROA | 0.6661762*** (24.87) |

0.6695598*** (24.85) |

0.6771298*** (25.26) |

0.665083*** (24.65) |

0.6776248*** (25.24) |

0.675637 *** (25.17) |

| QA | 0.2723633*** (3.84) |

0.2368337*** (3.36) |

0.1036786 (1.49) | 0.112869 (1.59) | -0.3625578 (-0.26) | -0.0917708 (-1.27) |

| QB | 0.1937354*** (2.71) |

0.1051706 (1.43) | -0.3199864 *** (-4.30) |

0.05934 (0.81) | -0.3625578 *** (-4.87) |

-0.3842025 *** (-5.22) |

| Constant | 2.369139 *** (8.11) |

2.434973 *** (8.36) |

2.58449 *** (8.88) |

2.441113*** (8.33) |

2.624841 *** (8.98) |

2.635314 *** (9.07) |

| Observations | 1,482 | 1,482 | 1,482 | 1,482 | 1,482 | 1,482 |

| R2 | 0.3087 | 0.3062 | 0.3139 | 0.3021 | 0.3129 | 0.3136 |

| Adjusted R2 | 0.3064 | 0.3039 | 0.3115 | 0.2998 | 0.3105 | 0.3113 |

| F Statistc | 131.83*** | 130.30*** | 135.04*** | 127.8*** | 134.41*** | 134.87*** |

| All variables are defined in Section 3; t-statistics in parentheses and ***p < 0.01; ** p < 0.05; * p < 0.10 | ||||||

All the above results provide an indicator of EM practices in quarterly earnings for the sample analyzed. Such practices may be mainly explained by the following two points. First, interim reports could be used by managers to convey a particular financial view to external users about the entity: maintain a positive trend in earnings or break up with insufficient performance level. Do not requiring a certification of interim reports from an independent auditor would be considered as part of the explanation of this result. Second, annual financial statements are certified by auditors who engage their legal responsibility. Fourth quarter earnings not directly published by companies and calculated as the differences between annual earnings and the sum of the first three quarters may constitute a residual that reflects accumulated manipulations. Based on the above results, hypothesis 1 and 2 could be accepted.

EM and Audit Quality

Similar to previous research on the role of auditors in detecting and reducing EM, I tested for the sample equation (5). The independent variable Big4 is used as a proxy of high audit quality. Results are presented in Table 5. Overall, findings show that the model used is significantly specified (F statistic significant at 1%). All control variables are as well significant at 1%. The coefficient α5 is equal to -0.1442862 and significant at 10%. This result could denote an inverse relationship between EM and audit quality. The magnitude of EM for the firms examined in the sample is lower for those audited by a big 4 auditor. This result allows accepting hypothesis 3 but should be analyzed with precaution. Most companies in the sample are audited by a big 4 firm (79% of quarterly observations) and this may constitute a bias in the results.

Complementary tests were conducted to examine the potential role of audit quality in reducing EM during the quarters: equation (6). Table 5 shows the results for Q1 and Q4. Findings are inconclusive. The coeficent α5 is not significant in Q1 but signficant at 1% level in Q4. A possible explanation could be the diffrence between reviewing interim reports and certifying annual reports.

| Table 5 Regression Results of the Magnitude of EM and Audit Quality | |||

| Equation (5) | Equation (6) | ||

| Q1 | Q4 | ||

| ASSETS | 0.1039877*** (5.27) |

0.0896972*** (4.81) |

0.1010697*** (5.46) |

| LEV | -0.370621*** (-8.65) |

-0.3555104*** (-8.40) |

-0.3721108*** (-8.84) |

| ROA | 0.6727037*** (24.57) |

0.6632134*** (24.66) |

0.6770343*** (25.22) |

| Big4 | -0.1442862* (-1.75) |

- | - |

| Q1*Big4 | - | 0.1074072 (1.51) |

- |

| Q4*Big4 | - | - | -0.3660025*** (-4.85) |

| Constant | 2.513877*** (8.61) |

2.490765*** (8.54) |

2.534663*** (8.75) |

| Observations | 1,482 | 1,482 | 1,482 |

| R2 | 0.3023 | 0.3020 | 0.3118 |

| Adjusted R2 | 0.3005 | 0.3001 | 0.3100 |

| F Statistc | 160.02*** | 159.74*** | 167.33*** |

| All variables are defined in Section 3; t-statistics in parentheses and ***p < 0.01; ** p < 0.05; * p < 0.10 | |||

Conclusion

This research examines the magnitude of quarterly earnings management for a sample of firms listed in UAE sock markets for the period 2011-2019. EM was measured by referring to an accrual-based model that quantifies discretionary accruals (Leuz, et al., 2003). Alike previous studies (Lightstone, et al. 2012 ; Cascudo Rodrigues, et al. 2019) results demonstrate significant differences through quarters: The magnitude and the sign of earnings manipulations varies. In general, EM during quarters 2 and 3 are not signficant compared to the rest of the year. During the first quarter the level of EM is positive and signficant. This expected resulat could be explained by the motivation of managers to convey a certain image of the entity. I can assume that when publishing interim reports related to the just started fiscal year, managers will provide a base that external users could use in comparing the current performance level with the past and in anticipating the rest of the year. Managers prefer avoiding losses or would like keep a positive trend in earnings. This may be possible as mangers could use their discretion: judgement and estimation in applying accrual accounting (Alhadab & Al-Own, 2019; Healy & Wahlen, 1999), or by deferring the recognition of expenses or prematurely recording revenue (Fujiyama, et al., 2014). As a matter of fact, the lowest percentage of observations where firms in the sample disclosed losses was in the first quarter.

Findings reveal a significant level of EM during the fourth quarter. Companies in the sample do not publish a separate finacial report for the last quarter and the calculation of fourth quarter earnings is performed by using the annual and the first three quarters reports. This would provides an opportunity for managers to “reverse” or to “adjust” prior periods financials. Tests demontrate a signficant increase in the number of firms reporting losses during the fourth quarter. It seems that the bad news are more likely to be recognized in the last quarter as they will not be disclosed seperatly (Das, et al. 2009; Fan, et al. 2010). Morever results provide an indicator on the role of auditors in detecting and reducing EM. The magnitude of EM is lower for firms audited by a big 4 auditors. They have the expertise and resources to provide high quality assurance services (Alzoubi, 2016).

This research contributes to the existing literature on EM by providing an empirical evidence from an emerging market. Results might be useful for investors and stock market regulator. Requiring the publication of an interim report for the fourth quarter along with the annual report may be considered. A limitation of this paper is being limited to detect the magnitude of EM across quarters without investigating the impact of other characteristics, such as corporate governance, in reducing managers discretion. This could be an avenue for future research.

References

- Alhadab, M., & Al-Own, B., (2019). Earnings management and equity incentives: Evidence from the European banking industry. International Journal of Accounting & Information Management, 27(2), 244-261.

- Almadi, M., & Lazic, P. (2016). CEO incentive compensation and earnings management. Management Decision, 54(10), 2447-2461.

- Alqatan, A., Albitar, K., & Huang, W. (2019). The role of board characteristics on the relationship between International Financial Reporting Standards (IFRS) adoption and earnings management: Evidence from China. Journal of Accounting and Taxation, 11(9), 145-154.

- Alzoubi, E. (2016). Audit quality and earnings management: Evidence from Jordan. Journal of Applied Accounting Research, 17(2), 170-189.

- Assenso-Okofo, O., Ali, J., & Ahmed, K. (2020). The effects of global financial crisis on the relationship between CEO compensation and earnings management. International Journal of Accounting & Information Management, 28(2), 389-408.

- Bao, S., & Lewellyn, K. (2017). Ownership structure and earnings management in emerging markets: An institutionalized agency perspective. International Business Review, 26(5), 828-838.

- Behn, B., Choi, J., & Kang, T. (2008). Audit quality and properties of analysts’ earnings forecasts. The Accounting Review, 83(2), 327-349.

- Bratten, B., Payne, J., & Thomas, W. (2016). Earnings management: Do firms play “follow the leader”? Contemporary Accounting Research, 33(2), 616-643.

- Buchner, A., Mohamed, A., & Saadouni, B. (2017). The association between earnings forecast in IPOs prospectuses and earnings management: An empirical analysis. Journal of International Financial Markets, Institutions and Money, 51, 92-105.

- Cascudo Rodrigues, R.M.R., de Melo, C.L.L., & Paulo, E. (2019). Earnings management and quarterly discretionary accruals level in the Brazilian stock market. Brazilian Business Review, 16(3), 297-314.

- Cheng, Q., Warfield, T., & Ye, M. (2011). Equity incentives and earnings management: Evidence from the banking industry. Journal of Accounting, Auditing & Finance, 26(2), 317-349.

- Choi, A., Choi, J., & Sohn, B. (2018). The joint effect of audit quality and legal regimes on the use of real earnings management: International evidence. Contemporary Accounting Research, 35(4), 2225-2257.

- Copeland, R., 1968. Income smoothing. Journal of accounting research, 6(Empirical Research in Accounting: Selected Studies, 101-116.

- Das, S., Shroff, P., & Zhang, H. (2009). Quarterly earnings patterns and earnings management. Contemporary Accounting Research, 26(3), 797-831.

- Dechow, P.M., & Skinner, D.J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting horizons, 14(2), 235-250.

- Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. Accounting review, 70(2), 193-225.

- Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings management to exceed thresholds. The Journal of Business, 72(1), 1-33.

- Du, Q., & Shen, R. (2018). Peer performance and earnings management. Journal of Banking & Finance, 89, 125-137.

- Dutta, S., & Gigler, F. (2002). The effect of earnings forecasts on earnings management. Journal of Accounting Research, 40(3), 632-655.

- El Ghoul, S., Guedhami, O., & Pittman, J. (2016). Cross-country evidence on the importance of Big Four auditors to equity pricing: The mediating role of legal institutions. Accounting, Organizations and Society, Volume 55, 60-81.

- Fan, Y.B.A., Cready, W., & Thomas, W. (2010). Managing earnings using classification shifting: Evidence from quarterly special items. The Accounting Review, 85(4), 1303-1323.

- Francis, J., & Wang, D., 2008. The joint effect of investor protection and Big 4 audits on earnings quality around the world. Contemporary accounting research, 25(1), 157-191.

- Fujiyama, K., Kagaya, T.S.T., & Takahashi, Y. (2014). Quarterly earnings management around the world: loss avoidance or earnings decrease avoidance? Hitotsubashi journal of commerce and management, 48(1), 1-30.

- Fujiyama, K., Kagaya, T., Suzuki, T., & Takahashi, Y. (2014). Quarterly earnings management around the world: loss avoidance or earnings decrease avoidance? Hitotsubashi journal of commerce and management, 48, 1-31.

- Healy, P., & Wahlen, J. (1999). A review of the earnings management literature and its implications for standard setting. Accounting horizons, 13(4), 365-383.

- Jeter, D., & Shivakumar, L. (1999). Cross-sectional estimation of abnormal accruals using quarterly and annual data: Effectiveness in detecting event-specific earnings management. Accounting and Business Research, 29(4), 299-319.

- Kothari, S., Leone, A., & Wasley, C. (2005). Performance matched discretionary accrual measures. Journal of accounting and economics, 39(1), 163-197.

- Leuz, C., Nanda, D., & Wysocki, P. (2003). Earnings management and investor protection: an international comparison. Journal of financial economics, 69(3), 505-527.

- Lightstone, K., Young, N., & Mcfadden, T. (2012). Information quality of interim financial statements. Accounting Perspectives, 11(4), 297-313.

- Luo, B. (2019). Short-term management earnings forecasts and earnings management through real activities manipulation. Asian Review of Accounting, 28(1), 110-138.

- Ndu, I., Chukwuogor, C., Arize, A., & Malindretos, J. (2019). Modelling earnings management, corporate governance, capital management and risk using dynamic panel data estimation: The case of listed deposit banks in an emerging market. African Journal of Accounting, Economics, Finance & Banking Research, 12(12), 1-26.

- Orazalin, N., & Akhmetzhanov, R. (2019). Earnings management, audit quality, and cost of debt: Evidence from a Central Asian economy. Managerial Auditing Journal, 23(6), 696-721.

- Pagach, D., & Warr, R. (2020). Analysts versus time-series forecasts of quarterly earnings: A maintained hypothesis revisited. Advances in Accounting, 51, 100-497.

- Rahman, S. (2019). Discretionary tone, annual earnings and market returns: Evidence from UK Interim Management Statements. International Review of Financial Analysis, 65, 101-384.

- Rusmin, R., 2010. Auditor quality and earnings management: Singaporean evidence. Managerial Auditing Journal, 25(7), pp. 618-638.

- Sbei Trabelsi, N. (2019). Fourth quarter earnings volatility: Case of firms listed in DFM. International Journal of Accounting and Financial Reporting, 9(4), 351-369.

- Sitanggang, R., Karbhari, Y., Matemilola, B., & Ariff, M. (2019). Audit quality and real earnings management: evidence from the UK manufacturing sector. International Journal of Managerial Finance, 16(2), 165-181.

- Wang, Y., & Campbell, M. (2012). Corporate governance, earnings management, and IFRS: Empirical evidence from Chinese domestically listed companies. Advances in Accounting, 28(1), 189-192.