Research Article: 2022 Vol: 26 Issue: 1S

R&D And Bank Performance Nexus: Evidence from Dynamic Panel Threshold Model

Ibrahim Molla, University of Barisal

Citation Information: Molla, I. (2021). R&D and bank performance nexus: evidence from dynamic panel threshold model. Academy of Accounting and Financial Studies Journal, 25(7), 1-13.

Abstract

Although there has been a lot of research exploring the R&D and firm performance nexus in the last two decades, there is a dearth of studies that can illustrate the threshold influence of R&D on bank performance. This study examines the threshold effect of R&D expenditures on bank performance using panel data of listed banks in Bangladesh spanning from 2011 to 2019. The dynamic panel threshold model has been adopted in this study to assess whether the performance of banks is subject to threshold effects of R&D expenditures. The findings of this paper demonstrate that the relationship between R&D and bank performance is non-linear and a threshold level exists in the relationship between R&D outlays and bank performance. Managers can identify the optimal R&D expenditures based on their respective threshold value to improve banks’ performance and avoid overinvestment on it. To the best of our knowledge, this is the first empirical research that uses bank data to evaluate the threshold effect of R&D spending on bank performance using the dynamic panel threshold model.

Keywords

R&D Expenditures, Dynamic Panel Threshold, Panel Data, Banks, Bangladesh.

JEL Classification

G21; O32.

Introduction

Firms produce innovative products and services to attract customers' attention in the global market. The product with novel variations can be developed through adequate research. Firms concentrate on research and development (R&D) investment to obtain leadership and gain a competitive advantage in the market. It is also critical for the existence and growth of the firms (Álvarez & Argothy, 2019). The aim of the firms is to invest their money in R&D activities to develop new products with innovation, earn future economic benefits, and enhance their market value. It allows the large firms to hold the market share and for small firms to grow and survive in the market. The leading firms in the stock market spend a considerable amount on their research and development activities (Chen & Ibhagui, 2019). However, investment in R&D sometimes aims to some unknown goals (Huang & Hou, 2019), which create the risk for the firms. The risk related to R&D declines the firm's benefits (Shi, 2003). Furthermore, failures to R&D activities incur considerable costs for the firm, which lowers the firm's profitability (Czarnitzki & Kraft, 2010). Excessive investment in R&D may involve the sunk costs that can reduce the profitability of firms.

Like firms in other industries, banks spend a considerable amount under the head of R&D expenditures to adopt new technology for their survival and growth. It involves some risks as the failure of the new project may incur a large volume of the sunk costs that can decrease the profitability of the banks. Also, excessive investment in R&D is costly and does not assure the potential return to the banks, which can ultimately lower the banks' profitability. Therefore, an important and plausible question arises in the mind of the practitioners as to whether R&D spending will always prove to be beneficial. That is whether the bank should increase the investment in R&D continuously or is there any threshold level that gives the optimum benefits to the banks.

Historical evidence regarding the influence of R&D on firm performances for manufacturing and high-tech firms are available who invest heavily in R&D (Chen & Ibhagui, 2019; Diéguez-Soto et al., 2019; Guo et al., 2018; Yeh et al., 2010). There is little or no evidence on this issue in financial institutions, especially for banks. This study, however, attempts to fulfill the gap of literature, adopting a new methodology of the dynamic panel threshold model initiated by (Kremer et al., 2013) and examining whether any non-linearity exists in the nexus between R&D expenditures and bank performance.

The aim of the study is to empirically analyze whether there is any cutoff point or the threshold level in R&D expenditure that positively influences the bank performance and whether the relationship is asymmetric. This work contributes to the prevailing banking literature in the following aspect:

- This research explores the relationship between R&D expenditures and bank performance applying the dynamic panel threshold specification propounded by Kremer et al. (2013) that gives an idea to the bank management regarding the existence of a threshold effect on the nexus between R&D expenditures and bank performance.

- The management will be guided in determining the budget to allocate under this heading by identifying the respective R&D spending threshold that will help to enhance their performance and prevent them from over investment in R&D which could lower their performances.

This paper is designed as follows. The literature pertains to R&D and performance nexus and postulation of the hypothesis are addressed in the second section. Sample collection, dimension of variables and empirical specifications, including properties, and the methodologies that will be used to perform the empirical analysis are presented in section 3. Section-4 offers the results of analysis and discussion. In the last segment summary of findings, implications and tips for future investigation are reported.

Literature Review and Hypotheses Development

There is extant literature that has empirically observed the affiliation between firm performance and R&D intensity, and earlier mainstream researches yield contradictory findings regarding the link between R&D and firm performance (Boiko, 2021). Within the vast majority of previous analyses, there is a tendency to focus on the linear association of R&D spending and firm performance. To investigate the influence of R&D expenditures on firm performance, some researchers (Seo & Kim, 2020; Kijkasiwat & Phuensane, 2020; Patel et al., 2018; Yeh et al., 2010) point out that investment in R&D upgrades the performance, while others (Alam et al., 2020; Diéguez-Soto et al., 2019; Hartmann et al., 2006) put different opinions and claims that increasing investment in R&D is not necessarily a wise decision.

Firms finance R&D for innovation which enables them to obtain a competitive advantage in the market and enhance profitability. In a related study, Huang & Hou (2019) investigate the relationship between innovative activities and profitability of firms listed in TSE employing the system GMM to control the unobserved heterogeneity and endogeneity and document that the causality runs from the innovations to profitability. Their study also used the propensity score matching (PSM) approach to investigate the treatment effect of innovations on profitability, concluding that the profitability of R&D enterprises is more than that of non-R&D firms. This study brought the findings on the assumption of the linear association and did not consider the stock market outcome in their analysis. This finding, however, confirms the findings of Warusawitharana (2015), who found that innovation influences profits. Similarly, Seo & Kim (2020), Chen et al. (2019), and Álvarez & Argothy (2019) adopted the least-squares method to assess the impact of R&D on firm performance and conclude that firm performance is subject to the significant influence of R&D expenditures. Based on the Heretical Linear Model (HLM), Usman et al. (2017) report that the R&D expenditures of current year have a negative influence on the performance of G-7 developed countries' non-financial firms. Their finding is supported by Chaiporn & Olimpia (2015) for US firms. On a similar note, Alam et al. (2020) utilized the system GMM approach to conclude that R&D has a negative influence on the performance of companies in 12 emerging markets.

However, there are some other studies (such as Guo et al., 2018; Huang & Chen, 2010) report a non-linear inverted U-shaped relationship, while a U-shaped correlation between the investment in R&D and firm performance was produced by Dai et al. (2020). Their outcomes are confirmed by Yeh et al. (2010) for Taiwan firms, Sinha & Mondal (2020) for Indian firms, and Chen & Ibhagui (2019) for Nasdaq listed firms that the relational nature of the curve is U-shaped between R&D and firm performance. Table 1 summarizes the prior mainstream studies on the R&D and firm performance nexus.

| Table 1 Review Of Prior Studies Relating To The Nexus Between Performance And R&D |

|||

| Author(s) (year) |

Data | Model | Outcomes |

|---|---|---|---|

| Sinha & Mondal (2020) | Panel data of pharmaceutical companies listed on India's BSE Healthcare index (2008 – 2017). | Panel regression (FE estimation) | Relationship between the lagged value of R&D and firm performance (ROA, ROE) is non-linear and the U-shaped in nature. |

| Alam et al. (2020) |

longitudinal data 12 emerging markets (2006–2013). |

System GMM | R&D spending is negatively related to the Firm performance (ROA and ROIC). Investment protection has an influential effect on the affiliation between firm performance and R&D intensity. |

| Dai et al. (2020) | Panel data (unbalanced) of manufacturing firms in China (2008–2017). | GPS matching approach | R&D composition has a non-liner relationship with the performance of firms (profit margin, and productivity). |

| Kijkasiwat & Phuensane (2020) | Survey data from SMEs in 29 countries in Eastern European and Central Asia. | Partial least square structural equation modeling | Innovation affects sales positively. |

| Seo & Kim (2020) | Data of SME enterprises in Korea (2011-2016) | Least square regression | R&D is positively associated with profit margin and firm value. |

| Chen & Ibhagui (2019) | Panel data Nasdaq- listed firms (2002-2017). |

|

|

| Huang & Hou (2018) | Unbalance panel dataset of 518 large firms listed on the Taiwan Stock Exchange (2000– 2015). |

System GMM, PSM approach and IV technique |

|

| Diéguez- Soto et al. (2019) | Private manufacturing companies in Spain (2000-2012) |

Autoregressive panel data models. | R&D intensity is inversely proportional to firm performance (ROA). |

| Álvarez & Argothy (2019) | Cross-sectional publicly traded firms’ data in Ecuador (2012-2014). | OLS | Investment in R&D and sales growth of firms are positively correlated. |

| Chen et al. (2019) | Panel data from Taiwanese semiconductor industry (2005–2016) | System GMM | Investment in R&D has a negative contemporaneous influence on firm performance, whereas lagged R&D has a positive influence on firm performance. |

| Coad & Grassano (2019) | Panel data of all companies listed in the Scoreboard (2000-2015) | Structural Vector Autoregression s (SVARs) |

Lagged R&D growth is positively linked with sales growth, but it has no link with the growth of operating profit. |

| Guo et al. (2018) | Listed Chinese manufacturing companies (2009-2016) | OLS | R&D is positively associated with firms’ future outcomes (ROA, ROE and TQ) when firms adopt the product differentiation strategy, and the relationship is inverse U-shaped when firms adopt a cost leadership strategy. |

| Sridhar et al. (2014) | Data from listed high-tech manufacturing companies in the United States (1990-2011) | Vector Auto Regression Models | R&D expenditure has a positive effect on firm value, but it has no impact on its sales. |

| Ayaydin & Karaaslan (2014) | Panel data of manufacturing firms listed in Istanbul Stock Market (2008–2013) | System GMM | R&D is proportional to the firm performance measured by ROA. |

| Yeh et al. (2010) | Data of IT and electronics firms Registered in TSE (1999-2004) |

Panel threshold regression proposed by Hansen (1999) | The nature of the association between R&D intensity and firm performance is inverted U-shaped, and a single threshold effect exists between R&D and performance measurements (ROA, ROE and net profit growth rate). |

The divergent findings of the previous analysis might be correlated with the methodological approach used by the previous studies (Chen & Ibhagui, 2019). The major deficiency of the prior studies is that the authors have drawn their inferences based on the correlation and traditional regression analysis where they assume a linear association between R&D expenditures and firm performance (such as Seo & Kim, 2020; Álvarez & Argothy, 2019); that is, higher R&D outflows are concomitant to higher profitability of firms. However, some studies performed a threshold analysis and report a non-linear association between the performance of the firm and R&D spending (such as Chen & Ibhagui, 2019; Yeh et al., 2010). The previous empirical studies adopted the static threshold model (Hansen, 1999) to find the threshold value, but this model does not address the endogeneity issues. Furthermore, some studies ignore the impact of the previous year’s firm’s performance on the current year’s performance. This might lead to a misleading conclusion about the impact of R&D on performance in the corresponding R&D regimes. This paper, however, will overcome the shortcoming of the methodological approach of previous studies utilizing the dynamic panel threshold model initiated by Kremer et al. (2013) to control the potential endogeneity bias in the model. This model allows the endogenous regressors in a panel setup.

Moreover, most of the prior studies use the data of either manufacturing or high-tech firms who invest large volumes in R&D expenditures, and there is little or no empirical evidence that investigates the threshold value of R&D expenditures on bank performance. Thus, this study will overcome the deficiency of literature using the data of the banking industry.

Therefore, based on the previous analysis discussed in the literature review, the following hypothesis can be postulated:

H1: There is a non-linear and threshold effect exists in the relationship between R&D expenditures and bank performance.

Methodology

Sample

This paper uses firm-level data. We initially started with all the banks enlisted in the Dhaka Stock Exchange. While dealing with the data of variables, we noticed that the data of R&D of some banks are missing. Moreover, some of the banks did not report the R&D expenditure value in their financial statements. Therefore, we exclude the banks that data are missing, and finally, our sample consisted of 18 banks with a nine-year period from 2011 to 2019. We use data from two different sources: the BankFocus database and the annual reports of the banks.

Variable Measurements

Our choice of the dependent variable, like that of other studies in this literature (e.g. Alam et al., 2020; Chen et al., 2019; Guo et al., 2018) that use ROA and Tobin's q as the proxy of performance indicators, is driven by literary conventions. Return on Assets (ROA) measures the accounting performance while Tobin's q (TQ) shows the market performance of the banks. Banks’ accounting ratio (ROA) examines the historical performance of the banks, whereas Tobin's q indicates the future expectation of the investors regarding the performance of the banks. Tobin’s q is measured by dividing the banks' market value by the assets' replacement value. Following (Huang & Hou, 2019), the natural logarithm of R&D expenditure (lnRD) has been used as an independent variable in our study.

Based on precedence in literature, we have also employed some firm-level control variables in our study: size, liquidity ratio, bank risk, bank's lending rate, and deposit rate. The log of total asset measures the size of the banks (SZ) and is applied in this study to control for the economies of scale. The size of the bank may have an influence on the banks' profitability as the bank with large assets may enjoy economies of scale compared to the small banks. A percentage of liquid assets on total assets measure the liquidity ratio (LQ). Liquidity of a bank may affect its performance on both the ways. Non-performing assets to total loans represent bank risk (BR). Higher non-performing assets of a bank may decline the profitability of the bank and vice-versa. The bank's lending rate (LR) is the lending rate charged by the banks on the issued loans and measured by dividing total interest income by the total loans. It may have an effect on the performance of banks. Similarly, the deposit rate (DR) indicates the banks' cost and the proportion of deposit expenses to the total deposit of the banks. It can affect the profitability on both the way.

Empirical Specification

To observe the threshold effect of R&D on the bank performance, we consider the dynamic panel threshold regression model initiated by (Kremer et al., 2013). To attain this aim, we develop the following model:

Performanceit = μi+ α (Performancei,t-1) + β1 R&Dit I (R&D ≤ λ) +?1 I (R&Dit < λ) + β2 R&Dit I (R&D >λ) +δi Zit + ?it.......... (i)

Where, Performance is represented by ROA and Tobin's q. μit states the level of the bank- specific fixed effect. Performancei, t-1 is one period lagged performance variable. It is considered as a lagged endogenous variable, and it is used itself as an instrument following Arellano & Bover (1995). Z indicates the vector of other covariates, including liquidity ratio (LQ), bank’s lending rate (LR), deposit rate (DR), bank risk (BR) and bank size (SZ). ?it designates the error term, and i and t denote the individual bank and year, respectively. I(.) represents the indicator function, and λ is the threshold value of R&D expenditures that splits observations into two groups: above (high regime) and below (low regime). β1 and β2 represent the marginal effect of R&D on bank performance in two regimes, i.e. when R&D expenditure is below (above) the anticipated threshold value. Kremer et al. (2013) incorporates the regime-dependent intercept (?1) into Hansen's model (1999) and disregarding the regime intercepts may result in inconsistencies in estimates for both the threshold value and the coefficient magnitude of the regimes (Bick, 2007).

We have employed the dynamic panel data threshold technique of Kremer et al. (2013) because it allows us to detect changes in R&D spending regimes. This model is an extension of Hansen's threshold model (1999). It is a hybrid version of Arellano & Bover's (1995) forward orthogonal deviation transformation and Caner and Hansen's (2004) instrumental variable estimation of the cross-sectional threshold model, where GMM estimators are utilized to address endogeneity issue. Endogeneity problems may arise during the analysis of cause and effect relationships. This estimation is specially employed to address the endogeneity of the data where the causal effects are examined, and if it is not addressed properly, it may yield bias estimates. Sometimes reverse causality may arise in such analysis as the performance may have an influence on R&D, i.e. higher profitable firms may invest more in R&D to gain the leadership in the market as well as when profits are lower, it may encourage management to cut the R&D expenditures to reduce the risk of becoming insolvent.

Kremer et al. (2013) adopted the GMM estimation approach, which Arellano & Bover (1995) proposed, to remove autocorrelation in the error term transformation process. We have applied the lag of the dependent variable as an instrument following the proposition of (Arellano & Bover, 1995). R&D is considered as a threshold variable as well as a regime-dependent regressor in our research.

The following steps are followed to determine the threshold value. Step 1: Following (Caner & Hansen (2004), a reduced form regression is estimated for the endogenous variables as a function of the instruments and substitutes the endogenous variable with the predicted value. Step 2: Apply OLS approach in equation (i) to find a fixed threshold value (λ), where the threshold value is replaced by its predicted values obtained in step-1. Finally, the least sum of square residuals is used to determine the optimal threshold value. The slope coefficient can be computed using the GMM estimator once the threshold value has been determined. Then the confidence interval for (λ) is estimated by Γ = {λ: LR (λ) ≤ C(α)}, where C(α) is the asymptotic distribution of the likelihood ratio indicator of LR (λ) at 95% level.

In the end, a bootstrap method is used to examine the significance level of the threshold effect. The null hypothesis states that there is no threshold impact on the model and the alternative hypothesis is that the threshold effect exists in the model. The rejection of the null hypothesis indicates the presence of a threshold effect. We have applied 100 replications in the bootstrap method to find the SupWStar statistics.

To avoid the spurious and misleading regression outcome, we have conducted Levin-Lin-Chu (LLC), and Im-Pesaran-Shin (IPS) unit root test and found that data are stationary. The results of the following tests are given in appendix (Table 1). We have carried out the Variance Inflation Factor (VIF) test for multicollinearity, and the result yields no multicollinearity in the data set. A modified Wald test has been performed for heteroskedasticity, and the result shows that the data suffers from heteroskedasticity. We employed the vce (robust) option in our analysis to find the robust standard error to control the heteroskedasticity. Before performing the dynamic threshold regression, Durbin–Wu–Hausman (DWH) test has been carried out to check for endogeneity, and the result shows one or more variables in each model belongs to the endogeneity. Finally, Ramsey reset linearity test is done to check whether the association between R&D and firm performance is linear or not. The F-test result rejects the null hypothesis for both models and confirms that the relationship is non-linear.

Empirical Results and Discussion

Descriptive statistics

The summary statistics for variables are depicted in Table 2. The mean value of ROA and Tobin' q is 0.573 and 0.114, respectively. The range of Tobin's q value is from .008 to 0.917 suggests the market value of the banks is less than the replacement cost. The negative value of ROA indicates some banks are experiencing operating loss during the study period. The average expenditure of R&D for the bank is 16.85, with the lowest and the highest value of 11.48 and 20.14, respectively Table 2.

| Table 2 Summary Statistics |

||||||

| Variables | Mean | SD. | Min. | Max. | Skew. | Kurt. |

|---|---|---|---|---|---|---|

| ROA | 0.573 | 1.843 | -13.92 | 2.75 | -4.937 | 32 |

| TQ | 0.114 | 0.14 | 0.008 | 0.917 | 3.80 | 19.263 |

| lnRD | 16.85 | 1.47 | 11.48 | 20.14 | -0.51 | 5.095 |

| LQ | 13.87 | 6.15 | 1.85 | 31.88 | 0.193 | 2.729 |

| LR | 0.105 | 0.03 | 0.035 | 0.175 | -0.32 | 2.745 |

| BR | 9.90 | 17.09 | 0 | 81.997 | 3.01 | 11.115 |

| SZ | 14.29 | 1.03 | 11.27 | 16.30 | -1.39 | 5.009 |

| DR | 0.06 | 0.023 | 0 | 0.102 | -0.733 | 3.58 |

Univariate Analysis

The result of pairwise correlation analysis is demonstrated in Table 3. The results depict that most correlation coefficients are moderate and suggest no multicollinearity in the data set. The correlation between R&D and bank performance (ROA; Tobin’s q) is positive. The association of R&D with accounting ratio and market value varies as the accounting ratios reflect the past operating performance of the banks, and the market value represents the future expectations of the investors based on the market performance of banks (Chen & Ibhagui, 2019). The liquidity and non-performing loans have a negative relation with ROA, as is expected. Similarly, R&D has a negative association with interest rates and non-performing loans Table 3.

| Table 3 Correlation Matrix |

||||||||

| Variables | ROA | TQ | R&D | LQ | LR | BR | SZ | DR |

|---|---|---|---|---|---|---|---|---|

| ROA | 1.0000 | |||||||

| TQ | -0.4650 | 1.0000 | ||||||

| R&D | 0.3632 | 0.3105 | 1.0000 | |||||

| LQ | -0.2365 | 0.1764 | -0.1244 | 1.0000 | ||||

| LR | 0.3519 | -0.4342 | -0.0339 | 0.0271 | 1.0000 | |||

| BR | -0.6008 | 0.4458 | -0.3795 | 0.3138 | -0.5195 | 1.0000 | ||

| SZ | 0.4941 | -0.6434 | 0.5700 | -0.1287 | 0.2769 | -0.7225 | 1.0000 | |

| DR | 0.3083 | -0.4904 | 0.0531 | -0.0922 | 0.9031 | -0.5715 | 0.3664 | 1.0000 |

Dynamic Panel Threshold Regression Results

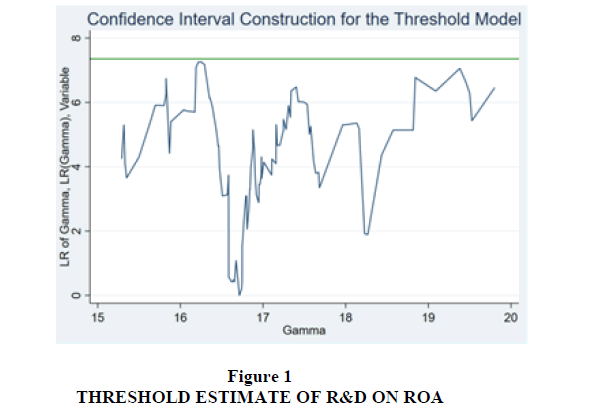

Table 4 demonstrates the result of dynamic panel data threshold regression using R&D as the threshold and regime dependent regressor. The estimated threshold value is shown in the upper panel of the table, along with the accompanying confidence interval. The estimates (β1, β2) for the marginal impact of R&D in the two R&D regimes are shown in the middle panel of table 4. In model-1, where the outcome variable is ROA, the estimated threshold value for the R&D expenditure is 16.71 percent with a corresponding 95% confidence interval [15.1033, 19.80187], when the likelihood ratio is 0, as depicted in figure 1. Our results confirm the non-linearity in the relationship between R&D expenditures and bank performance.

| Table 4 Results Of Dynamic Panel Data Threshold Effects Regression Estimation |

||

| Variables | Model-1 (ROA) | Model-2 (TQ) |

|---|---|---|

| Threshold Estimates λˆ 95% Confidence Interval |

16.71% [15.1033, 19.80187] |

16.19% [15.1033, 19.80187] |

| Regime-dependent Regressors (R&D) | ||

| β1 | -0.705* (0.366) |

0.0441*** (0.0149) |

| β2 | -0.687** (0.349) |

0.0381*** (0.0131) |

| Impact of covariates | ||

| ROAt-1 | 0.879*** (0.0806) |

|

| TQt-1 | 0.0929 (0.198) |

|

| LQ | 0.0949 (0.0602) |

0.000504 (0.00284) |

| SZ | 1.210*** (0.401) |

-0.108*** (0.0303) |

| LR | -25.41 (32.46) |

-0.342 (1.553) |

| BR | -2.876*** (0.396) |

0.199*** (0.0398) |

| DR | 30.79 (48.24) |

-0.989 (2.123) |

| Constant | -5.995 (7.911) |

1.048*** (0.325) |

| confalpha | 7.352 | 7.352 |

| Wald statistics | 1718.45 | 1440.54 |

| P-value | 0.0000 | 0.0000 |

| Bootstrap results | ||

| SupWStar | 8.882422** 3.756412 |

30.09281*** 10.13153 |

| Replications (Simulations) | 100 | 100 |

| cmd | xtendothresdpd | xtendothresdpd |

The lower (upper) threshold coefficient β1 (β2) indicates the marginal effect of R&D expenditures on bank performance in the low (high) R&D regime, that is, when R&D expenditure is below (above) the estimated threshold value. In our analysis for the ROA model, the lower (β1) and upper (β2) coefficient of a regime dependent R&D expenditure is -0.705 and - 0.687, respectively, and it is statistically significant at 5% level. This result denotes that R&D expenditures below (above) the threshold of 16.71% have a significant negative impact on the banks' performance. This implies that R&D expenditure is harmful to bank performance when it exceeds the threshold value of 16.71%. The coefficient of β2 means that when R&D expenditure exceeds 16.71%, each additional unit of R&D expenditure reduces the 0.687 points of bank performance Table 4.

Notes: Results of simulation by applying 100 replications and the dynamic panel threshold estimation using only one instrument lag (p = 1). Standard errors in parentheses are robust. Asterisk signs ***, ** and * signify statistical significance at 1%, 5% and 10% levels, correspondingly.

In the low R&D regime, i.e., when R&D is below 16.71 percent the marginal influence of R&D on ROA is significantly negative (-0.705). Thus, a further decline of R&D would increase ROA significantly. Therefore, the magnitude of the coefficient of the marginal impact of R&D is relatively higher in the low R&D regime.

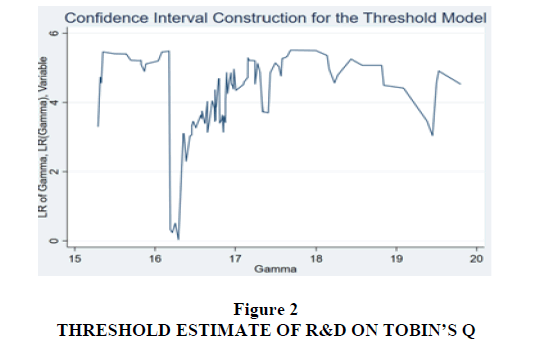

In model 2, when Tobin's q is employed for market value measurement, the estimated threshold value is 16.19 percent, which is slightly lower than the accounting performance indicator of ROA, but the 95% confidence interval for both models is nearly identical. The lower and upper threshold coefficients for Tobin's q model are both positive and statistically significant at the 1% level. This finding implies that the impact of R&D expenditures enhances the market value of the banks for both the lower regime and the upper regime. This finding is partly in line with Chen & Ibhagui (2019) that find the impact of R&D outlays augment the market value in the below regime for the Nasdaq listed firms using Hansen (1999) threshold model. However, our findings show differing results for regime dependent coefficients of two different performance measurement variables. The fact that R&D spending has a different marginal impact on the accounting ratios and market performance indicators could be attributed to the nature of the performance variables (Chen & Ibhagui, 2019). The market value of a bank displays the future expectations of investors and it varies among the investors because it includes subjective judgment, and in many cases, investors’ expectations are motivated by their sentiments and crazy attitudes.

The positive significant coefficients of R&D expenditures on both the upper and the lower regime of the threshold value imply that the investors are sanguine about R&D spending because they feel it will offer larger paybacks to the banks in the future. On the contrary, accounting ratios reflect the firm's historical performance, and thus it does not carry the similar features inherent in the Tobin's Q. A high volume of R&D expenditures could reduce the current year’s accounting performance due to the accounting policy of R&D expenditures (Chen & Ibhagui, 2019). Overall, the result of threshold analysis finds that the magnitude of the marginal impact of R&D expenditures in the lower regime is higher than the upper regime for both the proxy measurements of bank performance. Our findings of SupWStar statistics fail to accept the null hypothesis of no threshold effect at the 5% level of significance for ROA and 1% level of significance for Tobin's q model and suggest that the performance of banks is subject to the threshold effect of R&D outlays Figure 2.

Concerning the impact of the control variables, our result shows that the previous year's accounting performance has a significant and positive impact on the current year accounting performance, which is pertinent to the discoveries of (Alam et al., 2020), who document that current performance is reliant on the prior year performance to some extent. Bank size has a positive impact on ROA. A large bank can enjoy economies of scale, which stimulates a higher return for banks. This finding is in agreement with the outcomes of (Al-Homaidi et al., 2018). Whereas a negative association is found between size and the market performance metric of banks. Our findings indicate the risk has an inverse influence on accounting performance of banks which is pertinent to the findings of (Matin, 2017). While it shows a positive influence on market performance metrics.

Conclusion

This research investigates the threshold effect of R&D spending on bank performance using panel data of listed banks in Bangladesh expanding from 2011 to 2019. We have employed the dynamic panel threshold regression approach recently developed by Kremer et al. (2013) to take into account the potential endogeneity problem. Our analysis offers new evidence on the existence of a threshold and non-linearity in the relationship between R&D expenditures and banks' performance. The results suggest the estimated threshold value for R&D expenditure is 16.71% for the accounting performance indicator model of ROA and 16.19% for the market performance metric of Tobin's q with a 95% confidence level. The findings show that R&D expenditures at both below and above the threshold value have a significant negative impact on the banks’ accounting performance measurement of ROA and a positive impact on the market performance indicator of Tobin's q. Our findings also reveal that for both performance assessment criteria, banks with higher R&D spending do not necessarily outperform banks with lower R&D expenditures.

The findings of the study can have some managerial implications. This study gives an idea to the bank management and policymakers regarding the presence of a threshold impact on the nexus between R&D expenditures and bank performance. The managers of the research division can identify the optimal R&D expenditures based on their threshold values to improve performance and avoid overinvesting in R&D, which could hurt their performance.

Although our research presents the new evidence, we recognize that this study has some limitations and makes a pavement for the new lines of research. The sample size and the study periods are small that poses a constraint to generalize the findings. This is the key limitation as small sample that lacks information can affect the result. Another limitation arises from the fact that it considers only the banking industry of a particular country. Further analysis could be conducted using the data of other countries and compare whether this result is valid for others or not. This is the first study in the banking industry to apply a novel methodology to determine the threshold influence of R&D on bank performance.

References

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29-51.

Ayaydin, H., & Karaaslan, İ. (2014). The effect of research and development investment on firms’financial performance: Evidence from manufacturing firms in turkey. Bilgi ekonomisi ve yönetimi dergisi, 9(1), 23-39.

Bick, A. (2007). Pitfalls in panel threshold models: The role of regime dependent intercepts. Unpublished paper, Goethe University.

Boiko, K. (2021). R&D activity and firm performance: Mapping the field. Management Review Quarterly, 1-37.

Chang, H.L., & Su, C.W. (2010). Is R&D always beneficial?. Review of Pacific Basin Financial Markets and Policies, 13(01), 157-174.

Coad, A., & Grassano, N. (2019). Firm growth and R&D investment: SVAR evidence from the world’s top R&D investors. Industry and Innovation, 26(5), 508-533.

Guo, B., Wang, J., & Wei, S.X. (2018). R&D spending, strategic position and firm performance. Frontiers of Business Research in China, 12(1), 1-19.

Hansen, B.E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93(2), 345-368.

Huang, C.H., & Hou, T.C.T. (2019). Innovation, research and development, and firm profitability in Taiwan: Causality and determinants. International Review of Economics & Finance, 59, 385-394.

Huang, Y.F., & Chen, C.J. (2010). The impact of technological diversity and organizational slack on innovation. Technovation, 30(7-8), 420-428.

Matin, K.A. (2017). Determinants of Bank Profitability in Bangladesh, Economics and Ethics, Bangladesh Economic Association, Dhaka, Bangladesh, 27-29.

Seo, H.S., & Kim, Y.J. (2020). Intangible assets investment and firms’ performance: Evidence from small and medium-sized enterprises in korea. Journal of Business Economics and Management, 21(2), 421–445.

Sinha, A., & Mondal, K. (2021). The Impact of Lagged R&D Expenses on Firm Performance: Empirical Evidence from the BSE, Colombo Business Journal, 11(2), 114-141.

Xu, B., Magnan, M.L., & Andre, P.E. (2007). The stock market valuation of R&D information in biotech firms. Contemporary Accounting Research, 24(4), 1291-1318.