Research Article: 2021 Vol: 25 Issue: 5S

Readability, Replacement of the Largest Shareholders, And Earnings Management in Ipo Firms

Sun Hyuk Kim, Korea University

Su-In Kim, Hongik University

Citation: Kim, S.H., & Kim, S.I. (2021). Readability, replacement of the largest shareholders, and earnings management in ipo firms. Academy of Accounting and Financial Studies Journal, 25(S5), 1-09.

Abstract

We investigate a manger’s incentive to hide unfavorable information regarding IPO firms with text analysis. A manager has incentives to hide negative information and to increase reported earnings for maintenance of stock price. The results show that difficulty in reading registration statements from IPO firms is related to earnings management in the IPO year and the moderating effects of possibility of replacement of the largest shareholders. This study expands the preceding studies by directly measuring the incentive of management in IPO firms using text analysis. It suggests that investors of IPO firms must consider the manager's narratives for investment decisions.

Keywords

Earnings Management, IPO Firms, Investment Decisions.

Introduction

We analyze the relationship between readability in registration statements of IPO (initial public offerings) firms and earnings management in the year of IPO. In addition, we examine the effects of possibility of replacement of the largest shareholders on the relationship between readability in registration statements of IPO firms and earnings management in the following year of IPO.

The managers have incentives to withdraw or delay negative information about the company (Kothari et al., 2009), and to carry out earnings management to increase reported earnings (Guidry et al., 1999). Especially in IPO firms, managers intend to increase reported earnings in the IPO year for improved stock price performance to raise capital, to raise corporate image, or to prevent disadvantages in performance assessments by stock prices (Teoh et al., 1994; Subramanyam, 1996). When the largest shareholders of IPO firms are considering the disposal of shares, managers tend to raise earnings to avoid the reduction of capital gains due to a fall in stock prices (Teoh et al., 1998a; Beneish, 1999; Choi et al., 2010).

Textual information such as corporate disclosures, manager’s letter to shareholders, and a manager’s greeting reflects a manager's propensity and intention (Kim et al., 2020; Davis et al., 2015; Patelli & Pedrini, 2015). Therefore, we directly measure the management incentive to hide unfavorable information for maintaining the stock price as non-financial information, that is, the readability of registration statements released by the management, and predict that low readability leads to the earnings management for the IPO year.

Meanwhile, it is unlikely that the readability of registration statements and earnings management for the year following IPO is related, because earnings management is difficult to continue into subsequent years due to the reversal phenomenon (Teoh et al., 1998b). However, if the largest shareholder intends to realize profits through the disposal of shares, the disposal of shares is possible in the year after IPO, when the lock-up period ends, so the management has an incentive of earnings managements in the year after IPO. Therefore, we expect that the possibility of replacing the largest shareholders strengthens the relationship between low readability registration statements and earnings management for the year following IPO.

We use the text information in the risk factor section of registration statements to measure the readability, because the risk factor section is where management provide investors with information about future risk factors. Despite previous studies on text analysis in corporate disclosures and earnings management of IPO firms (Li, 2008; Lee et al., 2018; Teoh et al., 1998a; Beneish, 1999; Subramanyam, 1996), few literatures have investigated the relationship between the manager’s motivation to hide unfavorable information and earnings management for stock price performance in the IPO year or next year using text analysis.

The results support our expectation. We find a positive relationship between difficulty in reading registration statements and earnings management in the IPO year, and positive moderating effects from the possibility of replacing the largest shareholders on the relationship between low readability and earnings management for the year following IPO.

This study expands the preceding studies using financial information by directly measuring the incentive to hide unfavorable information for maintaining stock prices of IPO firms using text analysis. Since a manager's intentions can be revealed through the narratives used, the analysis of the reported text information released by the manager is a difference from previous studies. It also suggests that investors of IPO firms may have to consider a manager's narratives for investment decisions.

Data and Methodology

Measurement of Readability and Replacement Possibility of the largest Shareholder

We measure the readability of registration statements of IPO firms by the FOG Index of Gunning (1952), which has been widely used as a method of measuring readability in existing studies. The FOG index formula is 0.4*((words/sentences) + percentage of (complex words/words)). In the original FOG index for English reports, complex words are counted as having three or more syllables. However, because the Korean language has no such syllables in a word, complex words are counted with letters instead. We define FOG3 using three or more letters and FOG5 using five or more letters as complex words. A larger Fog index indicates lower readability.

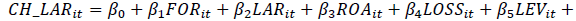

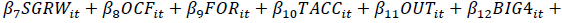

In this study, the possibility of replacing the largest shareholder in the IPO year (PCH_LAR) is measured by the predicted value calculated through the logit analysis using Equation (1) (Jeon & Cho, 2018).

Equation (1)

Equation (1)

We include the following variables in Eq. (1): CH_LAR= dummy variable equal to one if the largest shareholders are replaced within two years after IPO, zero otherwise, FOR = foreign investors’ shareholding ratio, LAR = largest shareholder’s shareholding ratio, ROA = net income divided by total assets, LOSS = a dummy variable of net loss, SGRW = sales growth ratio, MB = the market-to-book ratio, and BIG4 = a dummy variable of auditors, which takes one for Big 4 clients and 0 otherwise.

Earnings Management

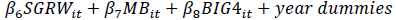

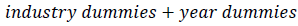

We measure earnings management in IPO firms by using performance matched discretionary accrual (Kothari et al., 2005). After estimating the discretionary accrual (DA) through the residuals obtained from the regression analysis by industry and year using the modified Jones model (Dechow et al., 1995) following Eq. (2) below, the sample is divided into ten quartiles according to the total asset return (ROA). Then, we subtract the median value of DA for each of the ten quartiles from DA of individual firms to obtain a performance matched discretionary accrual.

Equation (2)

Equation (2)

Here, TA = net income-operating cash flows, A = total assets, ΔREV = change in sales from the previous year, ΔREC = change in account receivables from the previous year, and PPE = tangible assets except for land and assets under construction.

Multivariate analysis

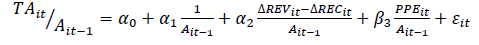

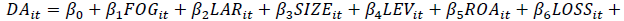

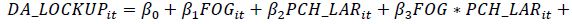

To analyze the relationship between readability of registration statements and earnings management in the IPO year, and the moderating effects of possibility of replacement of the largest shareholder on this relationship, we use regression Eqs. (3) and (4), respectively.

Equation (3)

Equation (3)

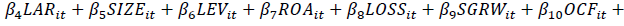

Equation (4)

Equation (4)

In Eqs. (3) and (4), DA and DA_LOCKUP are the earnings management in the year of IPO and following year. FOG is the FOG Index and we use FOG3 and FOG5 together. PCH_LAR represents the possibility of replacement of the largest shareholder in the IPO year measured by Eq. (1). FOG*PCH_LAR is an interaction variable of FOG and PCH_LAR.

We include the following control variables: LAR = largest shareholder’s shareholding ratio, SIZE = natural logarithm of total assets, LEV = total liabilities divided by total assets, ROA = net income divided by total assets, LOSS = a dummy variable of net loss, SGRW = sales growth ratio, OCF = operating cash flows divided by total assets, FOR = foreign investors’ shareholding ratio, TACC = (net income- operating cash flows)/ total assets in previous year, OUT = outside director’s ratio in board of directors, and BIG4 = a dummy variable of auditors, which takes one for Big 4 clients and zero otherwise.

The significant positive coefficient of FOG in Eq. (2) indicates that difficulty in reading of registration statements is positively related to earnings management in the year of IPO. The significant positive coefficient of FOG*PCH_LAR in Eq. (3) indicates that moderating the effects of potential replacement of the largest shareholder on the relationship between difficulty in reading registration statements and earnings management in following year of IPO. Standard errors are clustered at the industry level.

Samples

The sample for this study is comprised of IPO firms that filed registration statement when they issue securities in the Korea Stock Exchange (KSE) and Korean Securities Dealers Automated Quotations (KOSDAQ) during 2017 to 2018.

We obtained the financial data from the KisValue (equivalent to Compustat and CRSP in the United States) and measure the readability of the risk factor section of registration statements released in the Data Analysis, Retrieval and Transfer System (DART). After removing several observations due to missing variable information and firms where financial and non-financial data are not available, the final sample is 140 firm-years.

Result

This Table 1 provides descriptive statistics for our sample of 140 IPO firms in Korea between 2017 and 2018.

| Table 1 Descriptive Statistics |

|||||

| Variables | Mean | Median | Max | Min | SD |

|---|---|---|---|---|---|

| DA | 0.0199 | 0.0000 | 0.3393 | -0.1785 | 0.0910 |

| DA_LOCKUP | 0.0222 | 0.0000 | 0.3048 | -0.1196 | 0.0680 |

| FOG3 | 69.0153 | 69.0241 | 72.7880 | 64.2486 | 1.8195 |

| FOG5 | 25.3761 | 25.0556 | 68.7912 | 21.7419 | 3.9978 |

| PCH_LAR | 0.1356 | 0.0875 | 0.7013 | 0.0002 | 0.1507 |

| LAR | 0.3124 | 0.2866 | 0.7133 | 0.0623 | 0.1559 |

| SIZE | 25.0812 | 24.9130 | 28.7006 | 23.0199 | 0.9618 |

| LEV | 0.2808 | 0.2662 | 0.7801 | 0.0125 | 0.1785 |

| ROA | 0.0726 | 0.0802 | 0.3258 | -0.2575 | 0.1090 |

| LOSS | 0.1500 | 0.0000 | 1.0000 | 0.0000 | 0.3584 |

| SGRW | 0.2242 | 0.0843 | 2.7636 | -0.5581 | 0.4769 |

| OCF | 0.0331 | 0.0516 | 0.4087 | -0.3035 | 0.1362 |

| FOR | 0.0194 | 0.0030 | 0.3736 | 0.0000 | 0.0522 |

| TACC | -0.0532 | 0.0026 | 1.1424 | -5.1334 | 0.6461 |

| OUT | 0.1697 | 0.1667 | 0.5000 | 0.0000 | 0.1020 |

| BIG4 | 0.5071 | 1.0000 | 1.0000 | 0.0000 | 0.5017 |

The descriptive statistics for the variables used in our analyses are reported in Table 1. The means of DA and DA_LOCKUP are approximately 0.020 and 0.022, respectively. The mean values of FOG3 and FOG5, our interest variables, are approximately 69.015 and 25.376, respectively. The mean of PCH_LAR is 0.136, which indicates that the probability of replacement of the largest shareholders is about 14% after IPO.

The mean of SIZE is 25.081, LEV is 0.281, SGRW is 0.224, OCF is 0.033, and TACC is -0.053. The mean of ROA is 0.073, while LOSS is 0.150, meaning that IPO firms report net income on average. The means of LAR and FOR, which are the governance (shareholder characteristic) variables, are 0.312 and 0.019, respectively; thus, the average largest shareholder ownership and foreign investor ownership are 31.2% and 1.9%, respectively. The mean of OUT is 0.170, which means that outside directors account for 17% in the board of directors. The mean of BIG4 is 0.507, meaning that the proportion of the firm serviced from Big4 audit firms is 50.7%.

This Table 2 provides indicates correlations between variables. For variable, coefficients in bolds are significant at less than 5% levels.

| Table 2 Correalation Analysis |

|||||||||||||||

| Variables | DA | DA_LOCKUP | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (3)FOG3 | 0.061 | -0.125 | 1.000 | 1.000 | |||||||||||

| (4)FOG5 | 0.156 | -0.148 | 0.123 | 1.000 | |||||||||||

| (5)PCH_LAR | 0.095 | 0.371 | -0.298 | 0.048 | 1.000 | ||||||||||

| (6)LAR | 0.117 | 0.036 | 0.042 | 0.018 | -0.305 | 1.000 | |||||||||

| (7)SIZE | -0.042 | 0.049 | 0.162 | 0.051 | -0.149 | 0.322 | 1.000 | ||||||||

| (8)LEV | 0.050 | 0.152 | -0.042 | -0.068 | 0.422 | -0.014 | 0.146 | 1.000 | |||||||

| (9)ROA | -0.126 | 0.050 | -0.214 | -0.105 | 0.207 | 0.177 | 0.158 | 0.036 | 1.000 | ||||||

| (10)LOSS | 0.022 | -0.083 | 0.200 | 0.063 | -0.246 | -0.249 | -0.274 | -0.240 | -0.766 | 1.000 | |||||

| (11)SGRW | -0.109 | 0.017 | 0.015 | -0.021 | -0.019 | -0.018 | 0.018 | -0.129 | 0.367 | -0.174 | 1.000 | ||||

| (12)OCF | -0.402 | -0.039 | -0.147 | 0.159 | 0.106 | 0.104 | 0.228 | -0.040 | 0.693 | -0.505 | 0.172 | 1.000 | |||

| (13)FOR | -0.035 | -0.052 | 0.0308 | -0.064 | -0.211 | -0.068 | 0.424 | -0.001 | 0.009 | -0.012 | -0.003 | 0.020 | 1.000 | ||

| (14)TACC | 0.155 | 0.048 | -0.139 | -0.006 | 0.104 | 0.062 | -0.085 | 0.076 | 0.072 | -0.186 | -0.209 | -0.171 | -0.015 | 1.000 | |

| (15)OUT | 0.087 | -0.058 | 0.040 | 0.045 | -0.135 | 0.0606 | 0.210 | 0.045 | -0.005 | -0.024 | 0.006 | -0.010 | 0.066 | -0.150 | 1.000 |

| (16)BIG4 | -0.082 | -0.137 | 0.132 | 0.037 | -0.096 | 0.133 | 0.257 | -0.145 | 0.078 | -0.026 | 0.071 | 0.203 | 0.048 | -0.144 | 0.113 |

Table 2 presents the Pearson correlation matrix for the variables. FOG3 is positively correlated with DA, but not at a significant level, while correlation between FOG5 and DA is significantly positive. FOG3 and FOG5 are negatively correlated with DA_LOCKUP, but not significantly. These results partially support our expectation that the relationship between low readability and earnings management in the IPO year. PCH_LAR is positively correlated with DA, but not at a significant level, while the correlation between PCH_LAR and DA_LOCKUP is significantly positive. These results imply that managers are likely to manage reported earnings in the year following IPO when the possibility of replacement of the largest shareholders is high. OCF is negatively associated with DA, whereas TACC is positively associated with DA. LEV is positively associated with DA_LOCKUP.

Because correlation analysis shows a simple correlation between variables, it is necessary to verify our expectation through multivariate regression analysis that considers the control variables that may affect the earnings management.

The Table 3 reports OLS regression results. Our sample consists of 140 IPO firms between 2017 and 2018. Column (1) and (2) presents the regression analyses with FOG3 and FOG5 as dependent variable, respectively. For each variable, the top row reports the estimated coefficient, the bottom row reports t statistics. Standard errors are clustered at the industry level. *, **, and *** indicate statistical significance at the 0.1, 0.05, and 0.01 levels, respectively.

| Table 3 Regression Analysis for the Relationship Between Readability and Earnings Management In the IPO Year |

||

| Variables | FOG3 | FOG5 |

|---|---|---|

| Constant | -1.0893 | -0.6115 |

| (-7.620)*** | (-4.441)*** | |

| FOG | 0.0081 | 0.0061 |

| (2.736)** | (5.703)*** | |

| PCH_LAR | 0.0716 | -0.0124 |

| (1.231) | (-0.259) | |

| LAR | 0.0721 | 0.0442 |

| (3.172)** | (1.447) | |

| SIZE | 0.0221 | 0.0198 |

| (2.060)* | (3.881)*** | |

| LEV | -0.0246 | -0.0013 |

| (-2.143)* | (-0.058) | |

| ROA | 0.1981 | 0.3459 |

| (1.674) | (2.591)** | |

| LOSS | 0.0292 | 0.0188 |

| (3.168)** | (1.743) | |

| SGRW | -0.0141 | -0.0221 |

| (-1.154) | (-4.282)*** | |

| OCF | -0.4216 | -0.5384 |

| (-5.910)*** | (-5.756)*** | |

| FOR | -0.5442 | -0.5121 |

| (-1.662) | (-3.101)** | |

| TACC | 0.0139 | 0.0025 |

| (4.165)*** | (0.511) | |

| OUT | 0.1037 | 0.0608 |

| (2.244)* | (1.591) | |

| BIG4 | 0.0009 | -0.0033 |

| (0.108) | (-0.530) | |

| Industry Dummies | Included | Included |

| Year Dummies | Included | Included |

| R² | 0.5657 | 0.6007 |

| Adj. R² | 0.3840 | 0.4337 |

| N | 140 | 140.00 |

Table 3 presents the results of multivariate regression that tests the relationship between readability of registration statements and earnings management in the year of IPO. We predict that difficulty in reading and earnings management in the IPO year have a positive relationship. Therefore, the coefficient of FOG is expected to be significantly positive.

The results presented in Table 3 support our expectation. In columns (1) and (2) of Table 4, the value of FOG(FOG3 and FOG5) coefficients are positive and significant. Thus, difficulty in reading is positively related to earnings management in the IPO year. We interpret the results as the managers who have an incentive to hide information about risk factor intend to conduct earnings management in the year of IPO.

| Table 4 Moderating Effect of the Possibility of Replacing the Largest Shareholders |

||||

| FOG3 | FOG3 | FOG5 | FOG5 | |

|---|---|---|---|---|

| Constant | -0.2511 | -0.0632 | -0.2756 | -0.1678 |

| (-0.559) | (-0.142) | (-1.165) | (-0.683) | |

| FOG | -0.0006 | -0.0026 | -0.0033 | -0.0091 |

| (-0.289) | (-1.256) | (-4.039)*** | (-3.449)** | |

| PCH_LAR | 0.1620 | -0.6645 | 0.1809 | -1.1236 |

| (3.385)** | (-4.202)*** | (2.564)** | (-1.793) | |

| FOG*PCH_LAR | - | 0.0123 | - | 0.0501 |

| - | (5.556)*** | - | (2.273)* | |

| LAR | 0.0522 | 0.0584 | 0.0623 | 0.0548 |

| (6.953)*** | (5.580)*** | (4.556)*** | (2.957)** | |

| SIZE | 0.0118 | 0.0096 | 0.0142 | 0.0163 |

| (0.865) | (0.711) | (1.477) | (1.426) | |

| LEV | -0.0448 | -0.0426 | -0.0467 | -0.0415 |

| (-5.587)*** | (-4.437)*** | (-3.389)** | (-3.270)** | |

| ROA | -0.1307 | -0.1284 | -0.2072 | -0.1874 |

| (-1.716) | (-1.678) | (-5.908)*** | (-3.995)*** | |

| LOSS | -0.0226 | -0.0197 | -0.0184 | -0.0141 |

| (-3.775)*** | (-4.021)*** | (-3.560)*** | (-1.959)* | |

| SGRW | 0.0130 | 0.0136 | 0.0189 | 0.0179 |

| (1.593) | (1.633) | (8.977)*** | (11.356)*** | |

| OCF | -0.0524 | -0.0436 | 0.0082 | -0.0132 |

| (-1.437) | (-1.221) | (0.197) | (-0.244) | |

| FOR | -0.2038 | -0.1690 | -0.2437 | -0.3089 |

| (-0.807) | (-0.646) | (-1.103) | (-1.143) | |

| TACC | -0.0042 | -0.0042 | 0.0011 | 0.0003 |

| (-0.423) | (-0.447) | (0.332) | (0.109) | |

| OUT | -0.0068 | -0.0001 | 0.0108 | 0.0133 |

| (-0.494) | (-0.011) | (1.270) | (1.414) | |

| BIG4 | -0.0039 | -0.0023 | -0.0028 | -0.0041 |

| (-0.636) | (-0.339) | (-0.333) | (-0.459) | |

| Industry Dummies | Included | Included | Included | Included |

| Year Dummies | Included | Included | Included | Included |

| R² | 0.4292 | 0.4317 | 0.4560 | 0.4659 |

| Adj. R² | 0.1904 | 0.1856 | 0.2284 | 0.2346 |

| N | 140 | 140 | 140 | 140 |

The coefficients of PCH_LAR are not significant. It implies that the probability of replacement of the largest shareholders is not related to the earnings management in IPO year, because the largest shareholders cannot sell their shares until the end of lock-up period.

The Table 4 reports OLS regression results. Our sample consists of 140 IPO firms between 2017 and 2018. Column (1)~ (2) and (3)~(4) present the regression analyses with FOG3 and FOG5 as dependent variable, respectively. For each variable, the top row reports the estimated coefficient, the bottom row reports t statistics. Standard errors are clustered at the industry level. *, **, and *** indicate statistical significance at the 0.1, 0.05, and 0.01 levels, respectively.

Table 4 shows the test results of the moderating effects of the probability of replacing the largest shareholders on the relationship between difficulty in reading and earnings management in next year of IPO. We expect that the possibility of replacing the largest shareholders strengthens the positive relationship between difficulty in reading and earnings management in the following year of IPO. Therefore, the coefficient of FOG*PCH_LAR is expected to be significantly positive.

In columns (1) and (3) of Table 4, the value of PCH_LAR coefficients are significantly positive, while the value of FOG coefficients is negative. We interpret the results as the manager has an incentive to increase reported earnings in the following year of IPO for the wealth of the largest shareholders intending to sell their shares after lock-up period, which usually ends in the year following IPO. In addition, difficulty in reading is less associated to the earnings management in next year of IPO, because the earnings management in the current year have a reversal phenomenon in the following year (Teoh et al., 1998b).

In columns (2) and (4) of Table 4, the value FOG*PCH_LAR coefficients are positive, and significant. Thus, our expectation is supported. This result means that the positive relationship between difficulty in reading and the earnings management in the year after IPO is strengthened by the probability of replacing the largest shareholders. The manager, who submits registration statements that are difficult to read are likely to report earnings upward in the year following IPO when the largest shareholders intend to sell their shares. Then, we suggest that the probability of replacing the largest shareholders has an important moderating effect on the relationship between difficulty in reading and earnings management in the year after IPO.

Conclusion

We empirically examine the relationship between low readability of the registration statements of IPO firms and earnings management in the IPO year. In addition, we investigate the effects of possibility of replacing the largest shareholders on the relationship between low readability and earnings management in the year following IPO. The results show that difficulty in readings leads to earnings management in the IPO year, and the possibility of replacing the largest shareholders strengthens the relationship between low readability and earnings management for the next year of IPO.

This study is different from the previous studies using financial information. Since the manager's incentive can be revealed through the narratives used, the direct measurement of the manager's incentive to hide unfavorable information using text in the report released by the manager of IPO firms can be a difference. It also suggests that investors of IPO firms may have to consider the manager's narratives when making investment decisions.

References

- Beneish, M. (1999). Incentives and penalties related to earnings overstatements that violate GAAP. The Accounting Review, 74 (October), 425-457.

- Choi, J.S., Kwak, Y.M., & Baek, J.H. (2010). Earnings management around Initial Public Offerings in KOSDAQ market associated with managerial opportunism. Korean Accounting Review, 35(3), 37-80.

- Davis, A. K., Ge, W., Matsumoto, D., & Zhang, J.L. (2015). The effect of manager-specific optimism on the tone of earnings conference calls. Review of Accounting Studies, 20, 639-673.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review, 193-225.

- Guidry, F., Leone, A.J., & Rock, S. (1999). Earnings-based bonus plans and earnings management by business-unit managers. Journal of Accounting and Economics, 26(1-3), 113-142.

- Jeon, J.Q., & Cho, H.J. (2018). The effect of short selling on equity sales by corporate insiders. Journal of Finance & Knowledge Studies, 16(2), 43-63.

- Kim, S.I., Shin, H.J., & Park, K.H. (2020). The analysis of management overconfident tone and real activities earnings management. Korean Accounting Journal, 29(5), 1-39.

- Kothari. S., Leone, A., & Wasley, C. (2005). Performance Matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163-197.

- Kothari, S.P., Shu, S., & Wysocki, P.D. (2009). Do managers withhold bad news?. Journal of Accounting Research, 47(1), 241-276.

- Lee, W.J., Jung, T., Cho, M., & Lim, S.Y. (2018). An explorative study to assess feasibility of annual report readability research in Korea. Korean Accounting Review, 43(4), 37-100.

- Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2-3), 221-247.

- Patelli, L., & Pedrini, M. (2015). Is tone at the top associated with financial reporting aggressiveness? Journal of Business Ethics, 126(1), 3-19.

- Subramanyam, K. (1996). The pricing of discretionary accruals. Journal of Accounting and Economics, 22 (August), 249-281.

- Teoh. S., Wong, T., & Rao, G. (1994). Incentives and opportunities for earnings management in Initial Public Offerings. Working Paper University of Michigan.

- Teoh, S.H., Welch, I., & Wong, T.J. (1998). Earnings management and the long-run market performance of Initial Public Offerings. The Journal of Finance, 53(December), 1935-1974.

- Teoh, S.H., Welch, I., & Wong, T.J. (1998). Earnings management and the long-run underperformance of seasoned equity offerings. Journal of Financial Economics, 50, 63-100.