Research Article: 2021 Vol: 25 Issue: 4S

Reducing the Challenges of (CAATs) In Light of Covid-19 and Its Impact on Audit Evidence: (XBRL) As A Mediating Variable

Mohammad Hamdan, Al al-Bayt University

Dea'a Al-Deen Omar AL-Sraheen, Al al-Bayt University

Nofan Hamed Al-olimat, Al al-Bayt University

Citation Information: Hamdan, M.N., AL-Sraheen, D.O., & Al-olimat, N.H. (2021). Reducing the challenges of (caats) in light of covid-19 and its impact on audit evidence: (xbrl) as a mediating variable. Academy of Accounting and Financial Studies Journal, 25(S4), 1-12.

Abstract

It is recognized that Covid-19 has affected the performance of all business organizations around the world. Likewise, the impact extended to the accounting functions in all its forms, in addition to those in charge of the audit process, as Covid-19 created many challenges that affect the audit evidence. This study aimed to evaluate the effectiveness of reducing these challenges in organizations that use Computer Assisted Audit Techniques (CAATs) technology in account processing. On the other hand, this study reveals the mediating role of eXtensible Business Reporting Language (XBRL) between reducing those challenges and audit evidence. A questionnaire was distributed to the study population of legal and practicing auditors. The results of the study concluded that there was a positive impact of the effectiveness of reducing the challenges represented by (system's processing of information, retention of audit evidence, the internal control system, and the availability of hard copies) in the audit evidence. On the other hand, it has been proven that there was a positive effect of (XBRL) in the audit evidence in the presence of the mentioned procedures in reducing challenges.

Keywords

CAATs, Audit Evidence, XBRL.

Introduction

The Covid-19 epidemic has caused a global crisis that dominates all areas of the global economy, and this has resulted in many challenges that are not clearly defined so far (Maital & Barzani, 2020). Given the great role that the accounting profession plays in business organizations, it inevitably keeps pace with the changes that occur in the environment in which it operates, as it is an essential part of it. In light of the variables of the Covid-19 pandemic and its repercussions on all sectors and fields, it was necessary for accountability to respond to these developments in a manner that suits all users (Jinjarak et al., 2020). In addition, the impact of the Covid-19 pandemic on the accounting profession varies between the mechanisms and how to practice the profession and the duties that it must perform in these circumstances. Therefore, the pandemic will quickly evaluate the methods used, modify negative deviations, and enhance positive deviations, because the accounting profession is the actual translator and real appraiser of the results of economic and financial crises, Pham et al. (2021), through the production of figures indicating the course of events. In times of crisis, such as during the Covid-19 pandemic, the quality of financial reporting is essential to the economy Hamawandy et al., (2021), as well as the controls in place to prepare and communicate this information to various stakeholders. On the other hand, the impact of Covid-19 on the accounting process was accompanied by an automatic development in the accompanying audit process Castka et al., (2020), as there is a close relationship between auditing and the environment in which it operates.

Based on the auditor’s role represented in expressing a neutral technical opinion about the fairness of the financial statements and the validity of the information provided to him, and increasing confidence in this information, all these changes and developments in the accounting system had to affect the audit process and the auditor’s work (Janvrin, 2014).In addition, the third criterion of the field work standards emphasized that a sufficient amount of audit evidence must be obtained that supports the opinion of the technical auditor about the validity of the financial statements and the information submitted to him, as the process of collecting audit evidence is one of the most important steps affected by the environment in all its dimensions (AICPA, 2020) . In all cases, (ISSAI 5020) emphasizes that audit work should focus on high-risk issues that have not been taken into consideration by any organizations concerned with this matter in order to reach the effectiveness of audit evidence and whether there is an opportunity for improvement (ISSAI, 1977).

In order to support the profession during this challenging epidemiological situation, this study evaluates the effectiveness of reducing the challenges of (CAATs), to draw the auditors’ attention towards auditing challenges that may have important effects on the audit functions of Covid-19, based on the principles of international auditing standards. On the other hand, the study aims to demonstrate the effectiveness of using (XBRL) on the auditing profession to improve audit evidence (Shan & Troshani, 2014). The motive for using (XBRL) is that it provides the financial community with a standard method for dealing with business reports in general and with financial statements and their contents in particular, including preparing and publishing them in several formats and providing the ability to reliably deduct part of their data and exchange them automatically. It is not an accounting standard but rather a digital language that aims to improve the use of existing standards (Plumlee & Plumlee, 2008). This serves to effectively reduce Covid-19 challenges on (CAATs).

Literature Review and Study Hypothesis

CAATs

CAATs) are defined as the use of any kind of information technology or software in the audit process, to assist the auditor in planning and control, and thus, simplify the audit process (Sayana & CISA, 2003). In addition, it contributes to protecting the assets of the economic unit, confirms the integrity of its data, and achieves its objectives for the purpose of protect the assets of business organizations, use their resources efficiently and achieve their goals effectively, and thus, achieve the integrity of their financial data (Romney & Steinbart, 2015). On the other hand, (CAATs) is considered as the process based on the use of information technologies in order to assist the information systems auditor, and in a way that gives the auditor the sufficient opportunity to carry out all procedures related to the audit quickly and accurately in a way that helps the auditor to reach the highest efficiency in performing his work (Al-Hiyari et al., 2019; Ojaide et al., 2018).

Audit Evidence

The audit evidence includes all the information obtained by the auditor, such as documents, reports, inquiries, estimates, conclusions and calculations on which the auditor bases his professional judgment to decide whether the financial statements give a true and fair image or not (IFAC, 2010). In addition, the process of collecting documents and evidence is a means of proving the occurrence of economic events in business organizations, which the auditor directly relies on when expressing his opinion about the financial situation and the extent of credibility and transparency of these economic operations and events (Gospel, et al., 2019). From another perspective, evidence is any information that the auditor uses to determine whether the audited information has been presented in accordance with the standards (Agwor & Amangala, 2020). This evidence takes many forms, such as customer oral testimony, and confirmations from third parties (Bennett & Hatfield, 2013). It can be said that it is all that the auditor can rely on or that may influence his judgment to reach his neutral technical opinion about the absence of any material misstatements in the financial statements, and that the financial statements correctly express the organization's activity and financial position (Florea & Florea, 2011). It is necessary for the auditor to obtain a sufficient amount of good evidence to complete the audit adequately. Determining the quality and size of the necessary evidence, and evaluating its agreement with the standards is the main focus in the audit process (Hamdan, 2017; Beasley, et al., 2001).

Challenges of (CAATs) in light of Covid-19

The system's processing of information

Computerized Accounting Systems (CAS) has resulted in the demise of audit trail that the auditor follows to verify that operations and activities are performed correctly. Audit trail means: documented systems that operate the data (Li & Vasarhely, 2018), o r logical documentation that enables the auditor to follow the process from its source to its final results, or vice versa in the sense of starting work with its final results and ending with the final results (Zimman & Zibelman, 2009). Audit trail under t he manual system for data processing is not a problem, unlike (CAS), as under manual information systems, the auditor's audit trail in practicing his work is the opposite of audit trail of the accountant (Ernest, 2015). The auditor begins by reviewing the lists and reports to study the information they contain and examine its validity. He then returns to the records and books to select a sample of the operations recorded therein to be verified, and to review the supporting documents kept with the organizati on (Li, & Vasarhely, 201). This is not usually available in (CAS), where the audit trail consists of printed documents, and the auditor links each individual process to the sum in the financial statements, and in many cases, traditional hard copies are not available, but these documents are also saved in computer, where computer users are able to create, update and scan data electronically without visu al evidence of changes (Janvrin et al., 2009).

Maintaining audit evidence

Possible data loss is one of the reasons for the short period of time for the availability of audit evidence. Under the use of (CAS), the audit trail information is very large, so it does not remain in the direct communication state except for a short period (Al-Tarawneh, et al., 2020), then it is sent to a low-cost unit such as portable mobile storage, where large volumes of data, financial information and programs are stored on fixed and movable storage media, as in magnetic disks.... etc. These media are subject to intentional or unintentional theft, loss and damage (Hanini, 2012). This factor can be viewed from another aspect, which is the security and safety of information. This means ensuring that information is true, accurate and complete while it is stored while it is transferred. In addition, there is a set of procedures and methods aimed at achieving protection for the system from any future events that threaten the system and lead to information loss, inaccuracy or loss of confidentiality (El-dalabeeh, 2019; Hamdan, 2017).

The internal control system

The objectives of internal control under (CAS) are not different from the objectives of internal control under manual systems. In both systems, internal control aims to ensure the accuracy and reliability of the accounting data, and also aims to protect the organization's funds from any manipulation or embezzlement (Tarek et al., 2017). However, the different nature of control problems under both manual and computerized data operating systems necessarily leads to different internal controls used in each of them. The control environment under (CAS) is more important compared to less complex systems; because there is a greater possibility of misstatements and the auditor will need practical evidence to deal with the situations that he will encounter in (CAATs) (Jaber & Wadi, 2018).

Availability of hard copies

The use of (CAS) led to changes in most elements of the accounting system, so the documentary group had the largest share of these changes. The well-known traditional documents are no longer used in (CAS), so most of the books and records were dispensed with and replaced with files inside the computer (Almgrashi, 2020). These changes had an impact on the audit evidence, so the data became under (CAS) by entering the operations directly into the accounting system without the need to record them in the books and records, and the automated processing ensures that it is transferred to the files for those operations, which leads to the absence of audit evidence supporting the validity of these inputs (visual documentation), as well as the administration making many changes in (CAS), without documenting them, leads to the lack of audit evidence supporting the correctness of the operations within the system. In addition, not all (CAS) outputs may be printed in a visual form, as a summary of the totals is printed while the details are kept in computer files (invisible documentation) (Purnayudha & Prasetya, 2019).

H1.a : There is positive impact on the effectiveness of reducing the challenges (CAATs) in light of Covid 19 represented by (the system's processing of information, retention of audit evidence, the internal control system, and the availability of hard copies) in the audit evidence.

The impact of (XBRL) on audit evidence

Disclosure using (XBRL) improves the quality of financial reports by increasing transparency in reports, achieving the quality of accounting information resulting from these reports, the ability to assist stakeholders, ease of data exchange, and increasing the degree of compliance with international standards. Willis, M. (2005), In addition to containing features that are a new development for accountants and auditors under (CAATs). Due to the increase in financial problems in many business organizations, the demand for (CAATs) solutions has expanded, as stakeholders of information users demand to obtain appropriate information in a timely manner through audit reports (Mardian, 2015).

H1.b : There is positive effect of the effectivene ss of (CAATs) under Covid 19 in the audit evidence through (XBRL) as a mediating variable.

Research Methods

The Method is one of the effective methods of organizing a set of diverse ideas aimed at revealing the reality of this phenomenon (Anderson & Poole, 2019: 45). The study relied on the descriptive approach and the inferential approach in order to identify the effectiveness of reducing the challenges of (CAATs) under Covid-19 on the evidence through (XBRL) as a mediating variable. This approach is based on an accurate and detailed interpretation of the problem by defining its conditions, components and dimensions, describing the relationships between them, analyzing, measuring and interpreting data, and reaching an accurate description of the phenomenon or problem in a holistic manner that is useful in generalizing the facts or knowledge that has been extracted and helps a reasonable amount of future prediction of the phenomenon and provide solutions and suggestions to be addressed (William et.al.2012).

Population and Sample

The study population consisted of legal auditors in Jordan practicing the profession of auditing, amounting (402) auditors, according to (Jordanian Association of Certified Public Accountants, 2021). After defining the study population, the researcher pulled out (Simple Random Sample). In this method, every element of the population has the same ratio of existence in the sample without bias (Kumar, 2019). (300) questionnaires were distributed to the study sample, (205) of which were retrieved. When the questionnaires’ data was dumped, (2) of them were not filled out completely by respondents, so they were excluded, so that the number of valid questionnaires for statistical analysis were (203), representing the study population (Sekaran & Bougie, 2020).

Reliability

The Cronbach's Alpha coefficient was calculated n order to define the reliability of the internal consistency of the study items. The results are shown in Table 1

| Table 1 The Value of Cronbach's Alpha to Define the Reliability of The Study Tool | ||||||||

| Variable type | Independent | Depended | Mediating | Overall index | ||||

| Variables | System's processing of information | Retention of audit evidence | Internal control system | Availability of hard copies |

Reducing the challenges of (CAATs) in light of Covid-19 |

Audit evidence | (XBRL) | |

| Cronbach Alpha | 0.820 | 0.809 | 0.849 | 0.855 | 0.906 | 0.883 | 0.926 | 0.953 |

| No. of paragraphs | 6 | 5 | 8 | 6 | 25 | 6 | 9 | 40 |

Table 1 shows that the value of (Cronbach Alpha) for the study tool items ranged between (80.9% 92.6%) and with a reliability degree of (95.3%) for all items. (Sekaran & Bougie, 2020: 325) indicated that the minimum the value of (Cronbach Alpha) is (0.70), and th e closer the value is to (1) one, i.e. 100%, this indicates higher degrees of reliability for the study tool, and accordingly, all internal consistency coefficients mentioned in the above table is a good indicator of the reliability of the study tool and i ts reliability in statistical analysis.

Construct Validity

Construct validity is one of the measures of validity of the tool, which measures the extent to which the goals that the tool wants to achieve, and to verify whether the tool is able to measure its content for which it was designed, where the value of (Pea rson Correlation) was extracted, which shows the extent to which each of the paragraphs of the scale correlates to the total score for its axis, as well as that it determines the ability of each paragraph of the scale to be distinct. Negative paragraphs or those whose correlation coefficient is less than (0.30) are considered low and prefer to be deleted, while items whose correlation coefficient is more than (0.70%) are considered distinct (Linn & Gronlund, 2012). Table 2 shows the result of the structural validity.

| Table 2 Degrees of Correlation Between the Scale Paragraphs and their Axis | ||||||||||||||||||||

| Dimensions of the independent variable: Reducing the challenges of (CAATs) under Covid-19 | ||||||||||||||||||||

| System's processing of information | Retention of audit evidence | Internal control system | Availability of hard copies | |||||||||||||||||

| Paragraph | Correlation | Paragraph | Correlation | Paragraph | Correlation | Paragraph | Correlation | |||||||||||||

| 1 | 0.796 | 7 | 0.706 | 12 | 0.648 | 20 | 0.795 | |||||||||||||

| 2 | 0.710 | 8 | 0.800 | 13 | 0.742 | 21 | 0.785 | |||||||||||||

| 3 | 0.668 | 9 | 0.799 | 14 | 0.789 | 22 | 0.805 | |||||||||||||

| 4 | 0.747 | 10 | 0.751 | 15 | 0.752 | 23 | 0.788 | |||||||||||||

| 5 | 0.778 | 11 | 0.708 | 16 | 0.772 | 24 | 0.684 | |||||||||||||

| 6 | 0.681 | 17 | 0.651 | 25 | 0.740 | |||||||||||||||

| 18 | 0.708 | |||||||||||||||||||

| 19 | 0.530 | |||||||||||||||||||

| Dependent variable: audit evidence | ||||||||||||||||||||

| Paragraph | 26 | 27 | 28 | 29 | 30 | 31 | ||||||||||||||

| Correlation | 0.875 | 0.856 | 0.807 | 0.740 | 0.802 | 0.709 | ||||||||||||||

| Mediating variable: (XBRL) | ||||||||||||||||||||

| Paragraph | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | |||||||||||

| Correlation | 0.709 | 0.771 | 0.833 | 0.816 | 0.850 | 0.851 | 0.732 | 0.727 | 0.858 | |||||||||||

Table 2 shows that the value of the correlation coefficient for the paragraphs of reducing he challenges of (CAATs) under Covid 19 ranged between (0.530 0.805); the value of the correlation coefficient for the paragraphs of audit evidence ranged between (0.709 0.875); the value of the correlation coefficient for paragraphs of (XBRL) ranged between (0.709 0.858), and all of th em are more than (30%) and have a direct (+) variation. This result is an indication of an acceptable distinction for all paragraphs of the scale, and therefore it is considered constructively valid.

Test Natural Distribution

The Skewness value was extracted using this test to measure the symmetry of the distribution. A value outside of (±1) indicates that the distribution is highly skewed. The value of (Kurtosis) was also extracted. The distribution is normal if the kurtosis value does not exceed (±2.58) (at the 0.01 level) and (±1.96) (at the 0.05 level) (Cooper & Schindler, 2014).

Based on the test data shown in Table 3 , it is clear that the data distribution was normal, as the value of (Skewness) for all variables did not fall outside the range (±1) and did not exceed the value of (Kurtosis) (±1.96) at the level (0.05).

| Table 3 Normal Distribution of Data Based on Skewness & Kurtosis Test | |||||||

| Variables | System's processing of information | Retention of audit evidence | Internal control system | Availability of hard copies | Reducing the challenges of (CAATs) in light of Covid-19 | Audit evidence | (XBRL) |

| Skewness | 0.707- | 0.874- | 0.833- | 0.884- | 0.402- | 0.771- | 0.524- |

| Kurtosis | 0.476- | 0.527 | 0.071 | 0.985 | 0.751- | 0.097- | 0.648- |

Multicollinearity Test

(VIF) (Variance Inflation Factor) and (Tolerance) were extracted. After performing the statistical processing, Table 4 indicates that the allowable coefficient of variance for the independent variables was less than (1) and greater than (0.2). The values of the variance i nflation factor were less than (5), which is an indication that there is no high correlation between the independent variables, and this indicates that the values are accepted and that they are suitable for performing multiple line ar regression analysis (H air et al.al., 2018: 200).

| Table 4 Test Results of (Multicollinearity) | ||

| Reducing the challenges of (CAATs) in light of Covid-19 | VIF | Tolerance |

| System's processing of information | 1.199 | 0.834 |

| Retention of audit evidence | 1.620 | 0.617 |

| Internal control system | 1.952 | 0.512 |

| Availability of hard copies | 1.623 | 0.616 |

To confirm the previous result, Pearson correlation coefficients were used between the dimensions of the independent variable to ensure that there was no high multiple linear correlation between the independent variables and the results shown in Table 5.

| Table 5 Matrix of Correlation Coefficients (Pearson) for Independent Variables | ||||

| Variables | System's processing of information | Retention of audit evidence | Internal control system | Availability of hard copies |

| System's processing of information | 1.00 | |||

| Retention of audit evidence | 0.362 | 1.00 | ||

| Internal control system | 0.361 | 0.577 | 1.00 | |

| Availability of hard copies | 0.248 | 0.472 | 0.600 | 1.00 |

Table 5 shows that the highest correlation between the independent variables is (0.600), which was between the two variables (Availability of hard copies) and (Internal control system). The values of the correlation coefficient between the other independent varia bles were less than that, and this indicates the absence of the phenomenon of high multiple linear correlation between the independent variables, as it was less than (80%), and therefore, the sample is devoid of the problem of high multiple linear correlat ion (Gujarati et. al, 2017).

Description of The Study Tool Variables

The means, standard deviations, rank, relative weight and degrees of approval were calculated in order to identify the opinions of the sample members towards the study variables. The re lative degrees of approval were determined according to the following equation: The length of the category = the higher value of the alternative the lower value of the alternative / number of levels = 5 1/3 = 1.33, and therefore, if the mean falls betwee n (1 2.33) ,it is considered within the low level, if it ranges between (2.34 3.66) ,it falls within the medium level, and if it exceeds (3.66) ,it is considered within the high level (Subedi, 2016). The results of the descriptive analysis of the study variables were as follows.

Table 6 shows that the dimension (internal control system) has ranked first among the dimensions of the independent variable (reducing the challenges of (CAATs) in light of Covid 19) with a relative weight of (88.8%). The (System's processing of information) rank ed second with a relative weight of (86.4%), while (Retention of audit evidence) ranked third, with a relative weight (86.2%), and in the fourth rank came (Availability of hard copies) and a relative weight of (84.2 %), where the man ranged between (4.21 4 .44). The index for the independent variable (CAATs) in light of Covid 19 was (4.33), with a relative weight of (86.6%) and a standard deviation of (0.451). It was found that the audit evidence has achieved a mean of (4.37) with a relative weight of (87.4%), a high degree of approval, and a standard deviation of (0.572), while the mean of the sample individuals’ answers regarding the mediating variable (XBRL) was (4.26) and a relative weight of (85.2%) with a high degree of approval, with a standard deviati on of (0.638). We note that the standard deviations of all dimensions are close together, and this indicates the lack of dispersion in the answers of the study sample members in their answers regarding the paragraphs of the study tool.

| Table 6 Mean, Standard Deviation, Rank, Relative Weight, and Degree of Approval Regarding Study Variables | |||||

| Variables | Mean | Std. Deviation | Percentage % | Application | Ranking |

| System's processing of information | 4.32 | 0.638 | 86.4 | High | 2 |

| Retention of audit evidence | 4.31 | 0.629 | 86.2 | High | 3 |

| Internal control system | 4.44 | 0.516 | 88.8 | High | 1 |

| Availability of hard copies | 4.21 | 0.622 | 84.2 | High | 4 |

| Reducing the challenges of (CAATs) in light of Covid-19 | 4.33 | 0.451 | 86.6 | High | |

| Audit evidence | 4.37 | 0.572 | 87.4 | High | |

| (XBRL) | 4.26 | 0.638 | 85.2 | High | |

Results of Study Hypotheses Test

The study review the (H1.a ) test, which was subjected to Multiple Linear Regression Analysis, and the results shown in Table 7 have been reached.

| Table 7 Multiple Linear Regression Model Results for the First Main Hypothesis | |||||||||||

| Model Summery | ANOVA | Coefficient | |||||||||

| R | R2 | Adj R2 | F | F.Sig | DF | Variable | B | Std. Error | Beta | T | Sig |

| 0.806 | 0.650 | 0.643 | 91.765 | 0.00 | 4/198 | Independent.1 | 0.096 | 0.041 | 0.107 | 2.320 | 0.021 |

| Independent.2 | 0.129 | 0.049 | 0.142 | 2.646 | 0.009 | ||||||

| Independent.3 | 0.598 | 0.065 | 0.539 | 9.178 | 0.00 | ||||||

| Independent.4 | 0.168 | 0.049 | 0.183 | 3.417 | 0.001 | ||||||

Table 7 shows that there is a statistically significant effect of the effectiveness of reducing the challenges of (CAATs) in light of Covid 19 on the audit evidence, which appears through the value of (F.Sig) equal to (0.00) which is less than (0.05), and also th rough the calculated value of (F) equal to (91.765) which is greater than its tabular and equal value (2.37).

The value of the correlation coefficient (R = 80.6) indicates a strong relationship between reducing CAATs challenges under Covid 19 and the audit evidence. The value of (R2) = 650, which indicates that 65% of the variance could be explained by reducing th e challenges of (CAATs) in light of Covid 19 with audit evidence, while (35%) belong to variables that were not included in the study model. It appears from the results of the coefficients table for this hypothesis that (internal control system) had the gr eatest impact on the dependent variable (audit evidence), as the value of its beta coefficient was (β=0.539). This effect is reinforced by the calculated (T) value of (9.178), which is greater than its tabular value (1.96), and at a significant level (Sig = 0.00). In terms of impact, (Availability of hard copies) ranked second, as (β = 0.183), and this effect is reinforced by the calculated and (T) value equal to (3.417), which is greater than its tabular value and at a significant level of (Sig = 0.001). A fter that, in terms of impact (Retention of audit evidence) has ranked third, as the value of the coefficient was (β = 0.142). What reinforces this effect is the calculated T value equal to (2.646), which is greater than its tabular value and at a signific ant level of (Sig = 0.009). in terms of impact (System's processing of information) has ranked fourth, as the value of the coefficient (β = 0.107), and what reinforces this effect is the calculated (T) value equal to (2.320), which is greater than its tabu lar value and at a significant level of (Sig = 0.021). Accordingly, we accept the (H1.a), where it has been proven that there is a statistically significant effect of the effectiveness of reducing challenges of (CAATs) in light of Covid 19 represented by ( system's processing of information, retention of audit evidence, the internal control system, and the availability of hard copies) in audit evidence.

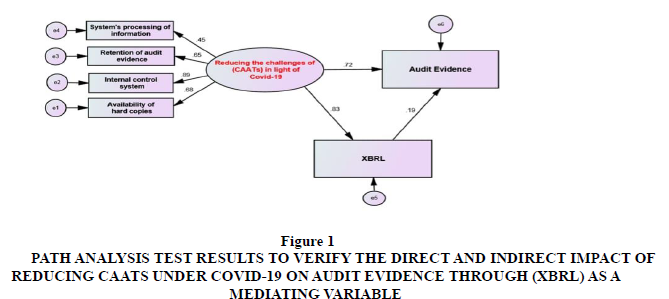

(Path Analysis) was used using (Amos) supported by (SPSS) and its results were as shown in (Table 8) and (Figure 1), where it was found that the resul t of the chi square test (17.315 = Chi2) which is greater than the tabular value (14.07), as well as through the test (CMIN/DF=2.164), which is statistically significant (027P=0.), which is less than (0.05), which indicates a statistically significant effe ct of reducing the challenges of (CAATs) under Covid 19 in audit evidence. Through (XBRL) as a mediating variable (Hair et.al.2018). The results also showed that (GFI=0.974) is close to (1), as it is closer to (1), this indicates the good fit of the qualit y in the (Good Enough Fit) model. The Comparative Fit Index (CFI = 0.986) is also close to (1), in addition to that, the Root Mean Square Error of Approximation (RMSEA = 0.074), which is close to (0), which supports the (Good Enough Fit) model (Byrne, 2010 ). It was found that the direct standard effect of reducing the challenges of (CAATs) towards (XBRL) was (0.833) and at the level of significance of (a≤0.05), while the direct standard effect of (XBRL) towards the audit evidence was (0.185). The direct nor mative effect of reducing (CAATs) in light of Covid 19 towards audit evidence was (0.721). The indirect standard effect of reducing the challenges of (CAATs) under Covid 19 in audit evidence with (XBRL) as a mediating variable was (0.154). Accordingly, red ucing (CAATs) challenges under Covid 19 was able to explain (15.4%) as an indirect effect on audit evidence through (XBRL). Based on the above, we accept the (H1. b), which recognizes the existence of an effect of reducing the challenges of (CAATs) under C ovid 19 in the audit evidence through (XBRL) with a total of (0.875).

| Table 8 Path Analysis Test Results for the Second Main Hypothesis | |||||||||||

| Independent variable | Chi2 | Chi2 Tabulated | CMIN/DF | GFI | CFI | RMSEA | P | Variables | Effect | Indirect effect | Total effect |

| Audit evidence | 17.315 | 14.07 | 2.164 | 0.974 | 0.986 | 0.076+ | 0.027 | Reducing CAATs challenges under Covid-19 ß(XBRL) ← | 0.833 | --- | 0.833 |

| Audit evidence ← (XBRL) | 0.185 | --- | 0.185 | ||||||||

| ← (XBRL) ← Reducing CAATs challenges under Covid-19 Audit evidence | 0.721 | 0.154 | 0.875 | ||||||||

| * CMIN: is the chi-square value. * CMIN/DF: is achi-square value correcting for sample size. This should be less than 3 in a good fitting model. * GFI: Goodness of Fit Index must proximity to 1. 0.833 × 0.185 = 0.154 + 0.721 = 0.875 |

* The indirect effect is by multiplying the direct effect values between variables. * RMSEA: Root Mean Square Error of Approximation must proximity to 0. * CFI: Comparative Fit Index must proximity to 1. |

||||||||||

Figure 1 Path analysis test results to verify the direct and indirect impact of reducing caats under covid-19 on audit evidence through (xbrl) as a mediating variable

Conclusion

The results of the study showed that the auditors’ attitudes towards reducing the challenges (CAATs) in light of Covid-19 were high, as the internal control system has ranked first, due to the strength of the control procedures that determine freedom of access to the database, and that the internal control system has sufficient control over recording accounting data in accordance with generally accepted accounting principles and rules, according to which fraud, manipulation and intentional and unintended errors are prevented. On the other hand, the results showed that the system's processing of information has ranked second with a high degree of approval due to the fact that the laws and work requirements of the (CAS) used in the audited business organizations are implemented correctly, and the ability of auditors to deal with (CAATs) concerning wrong data and input and the possibility of processing it. The results showed that the retention of audit evidence has ranked third and a high degree of approval, due to the auditors' follow-up on the continuous changes in the files as a result of continuous and frequent updates and changes, maintaining the provision of multiple copies, and saving them outside the site to ensure that they are not destroyed and that they can be referenced at any time. The results showed that the availability of hard copies has ranked last and of a high degree of approval, due to the audit offices' confirmation of the existence of documents for documenting the development and modification processes of programs, and the presence of paper documents detailing the outputs. In addition, the results showed that the auditors' attitudes of the audit profession towards audit evidence were high. This is due to the fact that the external auditor examines and reviews the accounting estimates and ensures their validity and reasonableness, which provides him with evidence of the validity of the financial statements. The results also showed that the auditors’ attitudes towards the audit profession towards (XBRL) were high due to the immediate availability of information, and the possibility of publishing its data, which reflects organization performance. Finally, it has been proven that there was a positive impact of the effectiveness of reducing the challenges of (CAATs) in light of Covid-19, represented by (system's processing of information, retention of audit evidence, the internal control system, and the availability of hard copies) in the audit evidence in addition to (XBRL) as an intermediate variable that enhances the audit evidence.

References

- Agwor, T.C., & Amangala, P.D. (2020). Audit Evidence and Financial Statement Quality in Government Owned Companies in Rivers State, Nigeria. European Journal of Business and Management Research, 5(6).

- Al-Hiyari, A., Al Said, N., & Hattab, E. (2019). Factors that influence the use of computer assisted audit techniques ((CAATs)) by Internal Auditors in Jordan. Academy of Accounting and Financial Studies Journal, 23(3), 1-15.

- Almgrashi, A. (2020). Determinants of computerised accounting information system adoption using an integrated environmental perspective: An Empirical Study. In 2020 IEEE Asia-Pacific Conference on Computer Science and Data Engineering (CSDE) (pp. 1-7). IEEE.

- Al-Tarawneh, A., Weshah, S., & Humeedat, M. (2020). The Extent of External Auditor Relaying on Internal Auditor Work under Erp Continuous Auditing: The Case of Jordan. Academy of Accounting and Financial Studies Journal, 24(2), 1-9.

- Anderson, J., & Poole, M. (2009). Assignment and thesis writing. Juta and Company Ltd..

- Beasley, M.S., Carcello, J.V., & Hermanson, D.R. (2001). Top 10 audit deficiencies. Journal of Accountancy, 19(1), 63.

- Bennett, G.B., & Hatfield, R.C. (2013). The effect of the social mismatch between staff auditors and client management on the collection of audit evidence. The Accounting Review, 88(1), 31-50.

- Byrne, B.M. (2010). Structural equation modeling with AMOS: basic concepts, applications, and programming (multivariate applications series). New York: Taylor & Francis Group, 396(1), 7384.

- Castka, P., Searcy, C., & Fischer, S. (2020). Technology-enhanced auditing in voluntary sustainability standards: The impact of COVID-19. Sustainability, 12(11), 4740.

- Cooper, D.R., Schindler, P.S., & Sun, J. (2006). Business research methods (Vol. 9, pp. 1-744). New York: Mcgraw-hill.

- El-dalabeeh, A.E.R.K. (2019). The impact of accounting information systems development on improving e-commerce in the jordanian public shareholding industrial companies. Academy of Accounting and Financial Studies Journal, 23(2), 1-11.

- Ernest, O.O. (2015). The relevance of auditing in a computerized accounting system. International Journal of Management and Applied Science, 1(11), 79-83.

- Florea, R., & Florea, R. (2011). Audit techniques and audit evidence. Economy Transdisciplinarity Cognition, 14(1), 350.

- Gospel, J., ORDU, P.A., BARIGBON, M., & NAMAPELE, A. (2019). Sufficiency and Appropriateness of Audit Evidence for Giving an Opinion on the True and Fair View of Financial Statements. International Journal of Innovative Development and Policy Studies, 7(3), 36-43.

- El-dalabeeh, A.E.R.K. (2019). The impact of accounting information systems development on improving e-commerce in the jordanian public shareholding industrial companies. Academy of Accounting and Financial Studies Journal, 23(2), 1-11.

- Hair, J.F. (2009). Multivariate data analysis.

- Hamawandy, N.M., Ali, R., Bewani, H.A.W.A., Rahman, S.K., & Othman, B.J. (2021). The financial Impacts of (COVID-19) on financial reporting quality Airlines Companies: British Airlines. Journal of Contemporary Issues in Business and Government, 27(2), 5264-5271.

- Hamdan, M.N.M. (2017). The Relationship between Network Security Policies and Audit Evidence Documentation: The Accounting Information Security Culture as a Mediator. International Journal of Business and Management, 12(12), 168-180.

- Hanini, E. (2012). The Risks of Using Computerized Accounting Information Systems in the Jordanian banks; their reasons and ways of prevention. European Journal of Business and Management, 4(20), 53-63..

- Hoffman, V.B., & Zimbelman, M.F. (2009). Do strategic reasoning and brainstorming help auditors change their standard audit procedures in response to fraud risk?. The Accounting Review, 84(3), 811-837.

- International Federation of Accountants – IFAC. (2010). IFAC Comment Letter: Transparency ofFirms that Audit Public Companies: Consultation Report, [Online] Available: http://web.ifac.org/publications/ifac-policy-position-papers-reports-and-comment-letters/comment-letters#ifac-c omment-letter-transp on 29/01/2010

- Jaber, R.J., & Wadi, R.M.A. (2018, October). Auditors’ usage of computer-assisted audit techniques (caats): Challenges and opportunities. In Conference on e-Business, e-Services and e-Society (pp. 365-375). Springer, Cham.

- Janvrin, D., Bierstaker, J., & Lowe, D.J. (2009). An investigation of factors influencing the use of computer related audit procedures. Journal of Information Systems, 23(1), 97-118.

- Jinjarak, Y., Ahmed, R., Nair-Desai, S., Xin, W., & Aizenman, J. (2020). Accounting for global COVID-19 diffusion patterns, January–April 2020. Economics of disasters and climate change, 4(3), 515-559.

- Kumar, R. (2018). Research methodology: A step-by-step guide for beginners. Sage.

- Li, Q., & Vasarhelyi, M.A. (2018). Developing a cognitive assistant for the audit plan brainstorming session.

- Linn, R.L. (2008). Measurement and assessment in teaching. Pearson Education India.

- Maital, S., & Barzani, E. (2020). The global economic impact of COVID-19: A summary of research. Samuel Neaman Institute for National Policy Research, 2020, 1-12.

- Mardian, S. (2015). XBRL: How It Implies the Audit Process. International Journal of Scientific & Technology Research, 4(8), 250-252.

- Ojaide, F., Jugu, Y.G., & Agochukwu, B.O. (2018). THE EFFECT OF FACILITATING CONDITION ON COMPUTER-ASSISTED AUDIT TECHNIQUES USAGE IN NIGERIA. International Journal of Management Science Research, 4(1), 175.

- Pham, Q.T., Ho, X.T., Nguyen, T.P.L., Pham, T.H.Q., & Bui, A.T. (2021). Financial reporting quality in pandemic era: case analysis of Vietnamese enterprises. Journal of Sustainable Finance & Investment, 1-23.

- Plumlee, R.D., & Plumlee, M.A. (2008). Assurance on XBRL for financial reporting. Accounting Horizons, 22(3), 353-368.

- Purnayudha, R., & Prasetya, M.E. (2019). Analysis and Design of Electronic Audit Paperwork: Documentation from an Internal Audit Unit (Case Study: University of X). In 3rd Asia-Pacific Research in Social Sciences and Humanities Universitas Indonesia Conference (APRISH 2018) (pp. 59-70). Atlantis Press.

- Romney, M.B., & Steinbart, P.J. (2015). Accounting Information System Thirteen Edition.

- Sayana, S.A., & CISA, C. (2003). Using CAATs to support IS audit. Information systems control journal, 1, 21-23.

- Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

- Shan, Y.G., & Troshani, I. (2014). Does XBRL benefit financial statement auditing?. Journal of Computer Information Systems, 54(4), 11-21.

- Subedi, B.P. (2016). Using Likert type data in social science research: Confusion, issues and challenges. International journal of contemporary applied sciences, 3(2), 36-49.

- Tarek, M., Mohamed, E.K., Hussain, M.M., & Basuony, M.A. (2017). The implication of information technology on the audit profession in developing country: extent of use and perceived importance. International Journal of Accounting & Information Management.

- The Lima Declaration (ISSAI 5020) (1977). Approved at IXth Congress of INTOSAI, Lima/Peru. INTOSAI Professional Standards Committee. Retrieved from http://www.issai.org/media/12901/issai_1_e.pdf

- Zikmund, W.G., Carr, J.C., & Griffin, M. (2013). Business Research Methods (Book Only). Cengage Learning.

- Willis, M. (2005). XBRL and data standardization: Transforming the way CPAs work. Journal of Accountancy, 199(3), 80.