Research Article: 2023 Vol: 29 Issue: 5S

Regional Aspects of Green Innovation and Internationalization: A Study on Brazilian Companies

Jessica Izidoro, Federal University of Uberlandia

Citation Information: Izidoro. J. (2023). Regional aspects of green innovation and internationalization: a study on brazilian companies. Academy of Entrepreneurship Journal, 29(S5), 1-22.

Abstract

This study analyzed the relationship between the internationalization process and green innovation of exporting companies in the cities of Uberlândia and Ribeirão Preto, as well as the promotion of competitive advantages and expected benefits through partnerships with the government and third-sector organizations. The research sample consisted of 122 exporting companies from Uberlândia and Ribeirão Preto, obtained from the "Lists of Exporting and Importing Companies" provided by the Secretariat of Foreign Trade (SECEX), between the years 2019 and 2021. Structural Equation Modeling was used for analysis to examine the relationship between the variables. The main findings revealed that despite some limitations regarding the expected benefits and competitive advantages provided by Green Innovation to companies, the internationalization process is positively aligned with Green Innovation practices, in line with UN Sustainable Development Goals 8, 9, and 17 of the 2030 Agenda. Thus, it was evident that with organizations increasingly engaged in promoting sustainable actions, aspects such as improving quality of life, preserving biodiversity, reducing social inequality, and enhancing the economy through eco-efficiency are becoming more apparent, creating a balance in the social, economic, and environmental domains.

Keywords

Green Innovation, Internationalization, Regional Aspects, Structural Equation Modeling.

Introduction

The concern and awareness about reducing environmental impacts and preserving the planet are gaining more prominence every day, becoming relevant topics over the past five decades and strengthening the idea that being sustainable is essential for environmental preservation (Cai et al., 2017; Weng et al., 2015). Organizations are increasingly having to adapt to meet specific environmental regulations (Cai et al., 2017).

In 2015, at the United Nations Conference, 193 member states of the United Nations (UN) signed a document called "Transforming Our World: The 2030 Agenda for Sustainable Development". The 2030 Agenda represents a global action plan that sets 17 Sustainable Development Goals (SDGs) and 169 targets, created to eradicate poverty and promote a decent life for all without compromising the quality of life for future generations, and to be achieved by the signatories of the Agenda by the year 2030 (UN Brazil, 2018).

The objectives and targets of the 2030 Agenda are integrated and encompass the three dimensions of sustainable development - social, environmental, and economic - and can be put into practice by governments, civil society, the private sector, and each citizen committed to future generations (UN Brazil, 2018). Globalization and advancements in communication and transportation technologies have facilitated the growth of trade and investment between countries (Rogers, 2018). In this sense, internationalization has been used as an alternative for the growth of companies, as well as an opportunity for their returns to be leveraged through operations in foreign markets, allowing exposure and compliance with international standards of products, technologies, and management methods, generating significant returns for domestic operations, management strategy absorption, and accessibility to new technologies (Rogers, 2018; Stal, 2010).

According to Pereira et al. (2019), internationalization should represent a strategic choice resulting from the interaction of the company with its available resources and capabilities. According to the authors, there are significant challenges, but there are factors that motivate this process, such as seeking new opportunities through increased investment in innovation, aiming to be among the market leaders and establish a presence in the global market, achieving economies of scale, and increasing competitiveness.

Innovation, on the other hand, refers to the development of new technologies for the creation of new products and services, a new structure or management system, or a new plan or program developed by members of the organization (Francischeto & Neiva, 2019). It is a way to enable not only economic development but also contribute to environmental preservation (Xavier et al., 2017).

This type of innovation is called eco-innovation, green innovation, or sustainable innovation and has been used in scientific studies to identify innovations that contribute to a sustainable environment through the development of ecological improvements (Bossle et al., 2016; Xavier et al., 2017). Green innovation has been recognized as one of the main factors affecting financial growth, environmental sustainability, and quality of life (Aguilera-Caracuel & Ortiz-de-Mandojana, 2013).

In the literature, there are some recent studies that directly or indirectly address green innovation and its importance but still do so timidly in relation to the theme of internationalization. Regarding green innovation, the following topics stand out: environmental regulation, green innovation efficiency in the industry, and low-carbon innovation (Feng; Zeng & Ming, 2018); green innovation and the impact of environmental regulations in different regions (Ahmad et al., 2020; Luo; Salman & Lu, 2021); foreign CEO experience and green innovation (Quan et al., 2021); green innovation and environmental quality (Liu et al., 2021; Ali et al., 2021).

Regarding internationalization linked to innovation, the following topics stand out: internationalization and environmental innovation and the differences between multinational companies from emerging and developed countries (Gomez-Bolaños et al., 2022); exports as drivers of eco-innovations (Torrecillas & Fernández, 2022); the impact of internationalization on green innovation (Chen, 2022).

Given the presented context and considering that the current literature contains some studies that directly or indirectly address innovation and its importance but still do so timidly in relation to internationalization (Chen, 2022; Galbreath et al., 2021; Gomez-Bolanos et al., 2022; Hojnik et al., 2018; Pereira et al., 2019; Suarez-Perales et al., 2017; Torrecillas & Fernández, 2022), this research seeks to answer the following question: What is the relationship between the internationalization process and green innovation of exporting companies in the cities of Uberlândia and Ribeirao Preto in promoting competitive advantages and expected benefits through partnerships with the government and third-sector organizations?

To answer this question, the study aims to analyze the relationship between the internationalization process and innovation of exporting companies in the cities of Uberlândia and Ribeirão Preto in promoting competitive advantages and expected benefits through partnerships with the government and third-sector organizations. The relevance of the study is justified by addressing the urban sustainability theme, which has been evolving over the years and serving as a horizon for society in a time of economic and social inequalities and high environmental impact. In addition, the factors related to business strategy (innovation and internationalization) are interrelated (Borsatto & Galina, 2021) and become indispensable for companies aiming to increase their performance. According to Barbieri et al. (2010), a relevant factor for achieving business strategy is sustainability.

Furthermore, the proposal contributes by addressing the role of international expansion strategies and green innovation in the business sector of Uberlandia-MG and Ribeirão Preto-SP and for the sustainable urban development of the regions, aligning with the social, environmental, and economic dimensions of the Sustainable Development Goals (SDGs) of the 2030 Agenda.

More specifically, this research contributes to the identification of actions being implemented to achieve SDG 8, which aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all; SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation; and SDG 17, which aims to strengthen the means of implementation and revitalize the global partnership for sustainable development.

Literature Review and Hypothesis Development

The green innovation has become one of the most important strategic tools for effective sustainable development (Guinot et al., 2022). In the past, due to weak environmental regulations, investing in sustainable activities was not a priority for companies. However, increasingly stringent environmental regulations have changed the competitive landscape in practice (Chen et al., 2012). This has led to an expansion of methods and processes related to environmental sustainability, such as green innovation (Wang et al., 2021). Furthermore, as consumer awareness of sustainability has been growing in recent years, many companies have used the green agenda as a driving force to achieve a business model based on green innovation (Guinot et al., 2022).

Takalo and Tooranloo (2021) emphasize that green innovation behaviors in the corporate environment contribute to the implementation and development of innovations that minimize environmental damage and lead to economic improvements. Gómez-Bolanos et al. (2022), Hojnik et al. (2018), and Pereira et al. (2019) have shown that green innovation can be aligned with the internationalization process, where organizations seek green innovations to operate internationally, meeting the requirements of foreign markets and achieving competitive advantages.

Therefore, the interest of companies in internationalization has driven them to increasingly adopt environmentally friendly behaviors, which have provided them with greater knowledge of best environmental practices, operational performance, and financial performance (Gomez-Bolanos et al., 2022; Hojnik et al., 2018; Pereira et al., 2019).

Suarez-Perales et al. (2017) identified that the more internationalized a company is, the more likely it is to adopt green product innovation practices. The adoption of such practices is mainly driven by the need for these companies to comply with stricter environmental regulations, positioning them as environmental leaders in their respective sectors.

Pereira et al. (2019) found that environmental regulations strongly influence the adoption of green product innovation in internationally active companies. According to the authors, regulations drive companies to improve and design environmentally friendly packaging for new products, use environmentally friendly materials, and contribute to building the companies' image among their international customers. Therefore, the following hypothesis is formulated:

H1: The internationalization process is positively related to Green Product Innovation of exporting companies in Uberlândia and Ribeirão Preto.

Azevedo Rezende et al. (2019) identified that green process innovation practices, such as the use of cleaner technology and low consumption of energy, water, gas, and gasoline during the production process, are positively associated with the internationalization process. Organizations start to face pressure from stakeholders who become increasingly demanding regarding these types of actions.

The study by Suarez-Perales et al. (2017) found that the more internationalized an organization is, the higher the chances of adopting green process innovation practices. These practices contribute to increased efficiency in resource and raw material utilization during the production process and, at the same time, provide opportunities for companies by opening doors to new economic growth possibilities and reinforcing their image among customers. Thus, the following hypothesis is formulated:

H2: The internationalization process is positively related to Green Process Innovation in exporting companies in Uberlândia and Ribeirão Preto.

Studies have shown that the internationalization process can be aligned with green innovation practices, where organizations seek green innovations to operate internationally, meeting the requirements of foreign markets and achieving competitive advantages (Gomez- Bolanos et al., 2022; Hojnik et al., 2018; Pereira et al., 2019).

Different authors have identified that companies interest in internationalization has driven them to increasingly adopt environmentally friendly behaviors, which has provided them with greater knowledge of best environmental practices, operational performance, and financial performance (Feng et al., 2018; Liu et al., 2021; Luo et al., 2021; Yang et al., 2021). Thus, the following hypothesis is formulated:

H3: The internationalization process is positively related to Green Innovation practices in exporting companies in Uberlândia and Ribeirão Preto.

Wang et al. (2021), based on observations of companies located in Canada, the United States, and the United Kingdom over a period of 10 years, identified that the more companies prioritized the incorporation of green innovation behavior practices, such as reducing the use of raw materials and harmful substances in the manufacturing process and adopting cleaner technologies to generate savings and prevent pollution, the more competitive they became and the more attractive they were to foreign investors. Thus, the following hypothesis is formulated:

H4: The internationalization process is positively related to Green Innovation Behavior in exporting companies in Uberlândia and Ribeirão Preto.

Nidumolu et al. (2009) state that several benefits convince companies to invest in adopting green product innovation practices, including improved image, reduced costs, and new market opportunities. Both the environment and the company can benefit from the implementation of green product innovation, leading to a win-win situation (Horbach, 2008). Benefits such as improved company image, increased reputation, gaining competitive advantage, and a desire to strengthen the brand can stimulate companies to adopt green innovation in their products (Capar & Kotabe, 2016). Thus, the following hypothesis is formulated.

H5: Green Product Innovation in companies promotes expected benefits through partnerships with the government and third-sector organizations.

Shrivastava (2018) pointed out several benefits resulting from successful implementation of green process innovation, including cost savings, enhanced corporate image, improved relationships with local communities, access to new green markets, and a superior competitive advantage. Similarly, Sarkar (2018) emphasized that the adoption of green processes has a positive impact on increased resource productivity, followed by improved relationships with customers, suppliers, and authorities, health and safety benefits, and overall increased innovation capacity. Thus, the following hypothesis is formulated:

H6: Green Process Innovation promotes expected benefits through partnerships with the government and third-sector organizations.

Takalo and Tooranloo (2021) emphasize that green innovation practices include the adoption of "eco-innovation" in corporate practices, which means implementing and developing actions that minimize environmental damage and produce benefits such as increased competitive advantage and improved profitability for these companies.

Guinot et al. (2022) state that green innovation practices are understood as a balance between the different pillars of sustainability (society, environment, and economy). According to the authors, organizations that adopt green innovation practices can generate a better balance in these sustainability pillars, thereby increasing productivity and market share. Thus, the following hypothesis is formulated:

H7: Green Innovation practices promote expected benefits through partnerships with the government and third-sector organizations.

Horbach (2017) observed that the adoption of green innovation behaviors, such as low energy consumption, recycling, or material reuse, further improves corporate image. Huang and Wu (2016) showed that companies that adopt green behavior practices can make their operations and product lines more environmentally efficient, and that these practices have a positive influence on financial performance. Thus, the following hypothesis is proposed:

H8: The Green Innovation behavior of companies promotes expected benefits through partnerships with the government and third-sector organizations.

Quan et al. (2021) state that green product innovation is considered a critical mechanism to enhance a company's ability to maintain a competitive advantage. According to Hilestad et al. (2010), green innovation or eco-innovation can provide customer value and commercial value that contribute to sustainable development while reducing costs and environmental impacts. Companies can incorporate green concepts in the design and packaging of their products to enhance the differentiation advantages of their products (Chen et al., 2006; Chen, 2008). Green product innovation allows companies to respond to the environmental needs of the market and government and improve the efficiency of resources required to achieve optimized environmental benefits in a product's life cycle (Chiou et al., 2018; Duran et al., 2019). Therefore, the following research hypothesis is formulated:

H9: Green Product Innovation promotes competitive advantages for exporting companies in Uberlândia and Ribeirão Preto.

Chiou et al. (2018) identified that green process innovation practices can enhance the competitive advantages and environmental performance of organizations. High-tech companies, by adopting innovation in their processes, can convert their operations into more environmentally efficient ones. Chiou et al. (2018) and Duran et al. (2019) also found that green process innovation requires companies to reduce the costs of clean production and decrease pollutant emissions to comply with environmental regulations. Consequently, companies that invest significant efforts in green process innovation can minimize production waste and increase productivity to offset environmental costs (Huang & Wu, 2016; Chiou et al., 2018). Therefore, the following hypothesis is proposed:

H10: Green Process Innovation promotes competitive advantages for exporting companies in Uberlândia and Ribeirão Preto.

Studies found in the literature regarding the positive effects of green innovation practices on the economic performance of organizations argue that green product and process innovations lead to competitive advantages, such as increased market share and higher productivity compared to companies that do not employ green innovation (Antonioli et al., 2015; Kemp & Oltra, 2016). Horbach (2017), in their study, observed that the use of green innovation practices can provide commercial rewards for companies through the creation of environmentally sustainable products and financial benefits that can enhance their competitiveness. Chang et al. (2016) investigated the relationship between the adoption of green innovation practices in the corporate environment and competitive advantages. The authors demonstrated that green innovation practices in the corporate setting positively motivated green product and process innovations to enhance competitive advantages (Chang et al., 2016). External pressures to be more environmentally responsible and the demand for green products drive companies to seek green innovation practices (Chang et al., 2016; Lin et al., 2016). Therefore, the following hypothesis is proposed:

H11: Green Innovation practices promote competitive advantages for exporting companies in Uberlândia and Ribeirão Preto.

Song and Yu (2018), Sharma and Iyer (2015), Tang et al., (2017) found that the adoption of green innovation behaviors can provide value to both business and customers of an organization, while reducing environmental impacts and costs. Takalo and Tooranloo (2021) emphasize that green innovation behaviors in the corporate environment contribute to the implementation and development of innovations that minimize environmental damage and drive economic improvements. Borsatto and Amui (2019) identified that green innovation has been widely proposed as a key means to reduce carbon emissions and achieve economic and environmental gains. Therefore, the following hypothesis is proposed:

H12: Green Innovation Behavior promotes competitive advantages for exporting companies in Uberlândia and Ribeirão Preto.

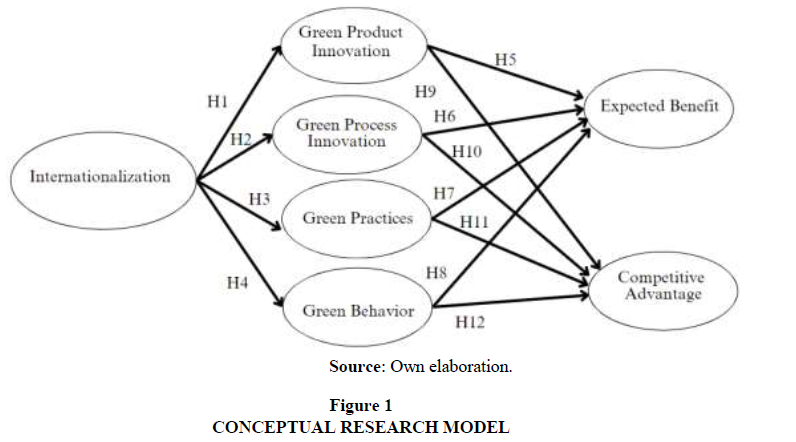

From the definition of the research hypotheses, the conceptual model of this study was defined, demonstrating the relationships between the variables, as shown in Figure 1.

Methodology

Sample and Data Collection

Regarding data collection procedures, this study used primary data that were provided from a questionnaire prepared and improved for this study, through questions that helped to achieve the objectives of this research. The population of this research consisted of 344 exporting companies from Uberlândia and Ribeirão Preto, provided by the “Lists of Exporting and Importing Companies”, made available by the Foreign Trade Secretariat (SECEX), on the government website (www.gov.br) between the years 2019 to 2021.

The questionnaire sent to the companies was previously submitted and approved by the Ethics Committee for Research with Human Beings (CEP) of the Federal University of Uberlândia under number CAAE: 58154522.5.0000.5152 and was constructed and improved from scales previously validated both in internationalization ( Floriani, 2010), and in green innovation (Huang & Li, 2017; Li, 2014; Cai & Li, 2018; Hojnik & Ruzzier, 2016), aiming to extract internal information from the export operation of each company. The research sample consisted of 122 respondents.

Model Variables

According to the proposed conceptual model, to verify the relationship between the process of internationalization and green innovation of exporting companies in the cities of Uberlândia and Ribeirão Preto and the promotion of competitive advantages and expected benefits, the constructs green product innovation were used and green process innovation adapting to the scale of Huang and Li (2017).

For the construct green innovation practices, the scale of Li (2014) was adapted, for the construct of green innovation behavior, the scale of Cai and Li (2018) was adapted, for the construct of expected benefits and competitive advantage, it was adapted The scale by Hojnik and Ruzzier (2016) was used and, finally, to analyze internationalization, the scale by Floriani (2010) was adapted. Chart 1 shows the model's variables, the forms of measurement and the authors who have already used these variables in Table 1.

| Construct | Itens | Source |

|---|---|---|

| INTER | AF | Floriani (2010) |

| ARN | ||

| BCOM | ||

| BUR | ||

| COMP | ||

| CS | ||

| DCT | ||

| ESMER | ||

| DPROD | ||

| EXP | ||

| MDO | ||

| MPCL | ||

| RAMB | ||

| RMT | ||

| TXC | ||

| SUB | ||

| IPV | IPV1 | Huang e Li (2017) |

| IPV2 | ||

| IPV3 | ||

| IPV4 | ||

| IPrV | IPrV1 | Huang e Li (2017) |

| IPrV2 | ||

| IPrV3 | ||

| IPrV4 | ||

| PIV | PIV1 | Li (2014) |

| PIV2 | ||

| PIV3 | ||

| PIV4 | ||

| PIV5 | ||

| PIV6 | ||

| CIV | CIV1 | Cai e Li (2018) |

| CIV2 | ||

| CIV3 | ||

| CIV4 | ||

| CIV5 | ||

| BE | BE COMPL | Hojnik e Ruzzier (2016) |

| BE PARC | ||

| BE RENT | ||

| BE MER | ||

| BE MAR | ||

| BE VCOM | ||

| BE MUNIC | ||

| VANT COMP | VC1 | Hojnik e Ruzzier (2016) |

| VC2 | ||

| VC3 | ||

| VC4 |

Source: Author's elaboration.

Table 1: Model variables.

Data Analysis

In this study, data analysis was conducted with the assistance of SmartPLS 4.0 software. Descriptive statistics were used to characterize the sample, which, according to Fávero et al. (2009), aims to provide a more in-depth understanding of the behavior of variables in relation to central values, dispersion, data distribution around the mean, as well as the interpretation of graphs and tables.

To test the research model hypotheses, the data were analyzed using structural equation modeling (SEM) through partial least squares (PLS), also known as path modeling or PLS modeling (PLS_PM). This choice is due to the advantage of SEM, as it allows for the simultaneous analysis of relationships between multiple variables (Hair et al., 2014), and enables researchers to test more complex conceptual structures, ensuring a more robust analysis of the data (Ismail et al., 2012).

Measurement Model Analysis

For the assessment of the measurement model, Confirmatory Factor Analysis (CFA) was employed to evaluate the construct validity of the model. After examining the factor loadings of the measurement model, the reliability of each item was assessed using composite reliability (CR), convergent validity was evaluated through the average variance extracted (AVE), and discriminant validity was examined by inspecting the square root of the AVE values on the diagonal and the correlation between the respective constructs .

Table 2 provides an overview of the factor loadings, composite reliability (CR), and average variance extracted (AVE) for the constructs. The results demonstrate that all factor loadings were above 0.5, the CR values for all constructs were above 0.7, and the AVE for each construct exceeded 0.5 (Peng & Lai, 2012), which are recommended as ideal values. These findings indicate that all constructs in the model have an adequate degree of convergent validity.

| Constructs | Variables | Factorial load | Standard deviation | t value | p-value | CR | AVE |

|---|---|---|---|---|---|---|---|

| INTERN | 0.942 | 0.501 | |||||

| AF | 0,656 | 0,898 | 1,348 | 0,000 | |||

| ARN | 0,672 | 1,120 | 0,721 | 0,000 | |||

| BCOM | 0,697 | 0,671 | 2,476 | 0,000 | |||

| BUR | 0,752 | 0,774 | 1,911 | 0,000 | |||

| COMP | 0,719 | 0,758 | 1,977 | 0,000 | |||

| DCT | 0,712 | 0,843 | 1,455 | 0,000 | |||

| DPROD | 0,764 | 0,946 | 1,450 | 0,000 | |||

| EXP | 0,732 | 0,784 | 2,356 | 0,000 | |||

| MDO | 0,657 | 1,124 | 1,607 | 0,000 | |||

| MPCL | 0,642 | 0,788 | 2,325 | 0,000 | |||

| RAMB | 0,852 | 0,904 | 2,022 | 0,000 | |||

| RMT | 0,657 | 0,986 | 1,336 | 0,000 | |||

| TXC | 0,702 | 0,756 | 1,872 | 0,000 | |||

| SUB | 0,669 | 0,743 | 1,885 | 0,000 | |||

| IPV | 0.902 | 0.767 | |||||

| IPV1 | 0,877 | 0,882 | 1,527 | 0,000 | |||

| IPV2 | 0,840 | 0,881 | 1,327 | 0,000 | |||

| IPV3 | 0,883 | 1,043 | 1,033 | 0,000 | |||

| IPV4 | 0,903 | 1,095 | 0,875 | 0,000 | |||

| IPrV | 0.923 | 0.810 | |||||

| IPrV1 | 0,891 | 0,913 | 1,663 | 0,000 | |||

| IPrV2 | 0,895 | 1,002 | 0,984 | 0,000 | |||

| IPrV3 | 0,890 | 1,003 | 0,990 | 0,000 | |||

| IPrV4 | 0,924 | 1,043 | 0,973 | 0,000 | |||

| PIV | 0.949 | 0.745 | |||||

| PIV1 | 0,883 | 1,352 | 1,042 | 0,000 | |||

| PIV2 | 0,905 | 1,542 | 1,110 | 0,000 | |||

| PIV3 | 0,780 | 0,972 | 0,982 | 0,000 | |||

| PIV4 | 0,916 | 1,117 | 1,003 | 0,000 | |||

| PIV5 | 0,819 | 1,032 | 0,855 | 0,000 | |||

| PIV6 | 0,867 | 1,049 | 0,849 | 0,000 | |||

| CIV | 0.936 | 0.828 | |||||

| CIV1 | 0,913 | 1,001 | 1,107 | 0,000 | |||

| CIV2 | 0,873 | 0,998 | 0,943 | 0,000 | |||

| CIV3 | 0,923 | 1,052 | 0,946 | 0,000 | |||

| CIV5 | 0,929 | 1,113 | 0,820 | 0,000 | |||

| BE | 0.880 | 0.698 | |||||

| BE COMPL | 0,832 | 0,667 | 2,426 | 0,000 | |||

| BE PARC | 0,717 | 0,587 | 3,323 | 0,000 | |||

| BE PROD | 0,874 | 1,135 | 0,891 | 0,000 | |||

| BE RENT | 0,906 | 1,154 | 1,098 | 0,000 | |||

| VANT COMP | 0.945 | 0.938 | |||||

| VC1 | 0,964 | 1,182 | 0,731 | 0,000 | |||

| VC2 | 0,972 | 1,108 | 0,778 | 0,000 |

Source: Research data.

Table 2 : Factor loadings, Composite Reliability and Variance of measurement model variables.

Table 3 presents the correlations between the paired constructs, and the main diagonal of the matrix shows the square root of the AVE (Average Variance Extracted) for each construct. All measurements indicate adequate discriminant validity (Fornell & Larcker, 1981; Peng & Lai, 2012).

| Table 3 Discriminant Validity Of The Measurement Model |

|||||||

|---|---|---|---|---|---|---|---|

| BE | CIV | INTERN | IPV | IPrV | PIV | VANT COMP | |

| BE | 0.886 | ||||||

| CIV | 0.845 | 0.910 | |||||

| INTERN | 0.664 | 0.659 | 0.768 | ||||

| IPV | 0.755 | 0.809 | 0.736 | 0.876 | |||

| IPrV | 0.791 | 0.836 | 0.642 | 0.833 | 0.900 | ||

| PIV | 0.815 | 0.844 | 0.679 | 0.840 | 0.847 | 0.863 | |

Source: Research data.

Structural Model Analysis

After analyzing and validating the measurement model, the structural model analysis was conducted through path analysis with latent variables. Table 4 presents the coefficients of the structural model and the statistical significance of these coefficients with the analysis of the hypotheses.

| Table 4 Results Of The Structural Model With Hypothesis Analysis |

||||||

| Relationship | Sample | Average | Standard deviation | t-value | p-values | Decision |

| CIV -> BE | 0,279 | 0,282 | 0,101 | 2,769 | 0,006 | Accepted |

| CIV->VANT COMP | 0,142 | 0,149 | 0,181 | 0,786 | 0,432 | Reject |

| INTERN->CIV | 0,659 | 0,670 | 0,080 | 8,222 | 0,000 | Accepted |

| INTERN->IPV | 0,746 | 0,754 | 0,038 | 19,651 | 0,000 | Accepted |

| INTERN->IPrV | 0,642 | 0,653 | 0,092 | 6,984 | 0,000 | Accepted |

| INTERN->PIV | 0,679 | 0,689 | 0,050 | 13,596 | 0,000 | Accepted |

| IPV->BE | -0,070 | -0,082 | 0,098 | 0,714 | 0,475 | Rejects |

| IPV->VANT COMP | 0,444 | 0,438 | 0,185 | 2,397 | 0,017 | Accepted |

| IPrV->BE | 0,056 | 0,068 | 0,112 | 0,500 | 0,617 | Reject |

| IPrV->VANT COMP | -0,229 | -0,231 | 0,213 | 1,076 | 0,282 | Reject |

| PIV-> BE | 0,649 | 0,649 | 0,087 | 7,473 | 0,000 | Accepted |

| PIV->VANT COMP | 0,308 | 0,312 | 0,162 | 1,901 | 0,057 | Accepted |

Source: Research data.

Upon examining the relationships between the variables indicated by the structural coefficients, it was found that four relationships showed statistical significance (p < 0.05). The relationship between the constructs INTER and CIV (coef. 0.659; p = 0.000) is significant and confirms hypothesis H4. Similarly, the relationship between INTER and IPV (coef. 0.746; p = 0.000) also exhibited statistical significance, corroborating hypothesis H1, as well as the relationship between INTER and IPrV (coef. 0.642; p = 0.000), confirming hypothesis H2, and INTER and PIV (coef. 0.679; p = 0.000), confirming hypothesis H3.

The relationship between IPV and VANT COMP (coef. 0.444; p = 0.017) showed statistical significance and a positive relationship, confirming hypothesis H9. On the other hand, the relationship between CIV and BE (coef. 0.279; p = 0.006) indicates a moderate but positive relationship between these constructs, confirming hypothesis H8, as well as between PIV and VANT COMP (coef. 0.308; p = 0.057), confirming hypothesis H11. The relationship between PIV and BE (coef. 0.649; p = 0.000) demonstrates a strong and positive relationship, confirming hypothesis H7.

The relationship between IPV and BE (coef. -0.070; p = 0.475) and between IPrV and BE (coef. 0.056; p= 0.617) did not show statistical significance, failing to confirm hypotheses H5 and H6, respectively. Similarly, the relationship between IPrV and VANT COMP (coef. -0.229; p = 0.282) and CIV and VANT COMP (coef. 0.142; p = 0.432) also did not exhibit statistical significance, failing to confirm hypotheses H10 and H12, respectively.

After evaluating the structural coefficients of the relationships between the latent variables, it is necessary to assess the predictive capability of the model, measured by R2. R2 specifies the percentage of the total variation in Y explained by the regression model (Hair et al., 2014). For the field of social and behavioral sciences, Cohen (2009) suggests that an R2 of 2% can be classified as a small effect, R2 of 13% as a medium effect, and R2 of 26% as a large effect. Therefore, considering that the R2 value for all constructs was above 26%, it can be concluded that this model has a large effect on all constructs, as demonstrated in Table 5.

| Table 5 Results Of The Structural Model |

||||

|---|---|---|---|---|

| Indicators | R2 | R2 adjustable | Gof | Q2 |

| BE | 0,856 | 0,851 | 0,71 | 0,548 |

| CIV | 0,420 | 0,415 | 0,38 | 0,354 |

| IPV | 0,544 | 0,541 | 0,38 | 0,415 |

| IPrV | 0,409 | 0,404 | 0,35 | 0,329 |

| PIV | 0,440 | 0,436 | 0,39 | 0,323 |

| VANT COMP | 0,659 | 0,647 | 0,62 | 0,370 |

Source: Research data.

It is also observed that the construct INTERN explains 54.4% of the variance in the IPV construct (R2 = 0.544), 40.9% of the variance in the IPrV construct (R2 = 0.409), 44.4% of the variance in the PIV construct (R2 = 0.440), and 42.0% of the variance in the CIV construct (R2 = 0.420). On the other hand, the constructs CIV, IPV, IPrV, and PIV explain 85.6% of the variance in the BE construct (R2 = 0.856) and 65.9% of the variance in the VANT COMP construct (R2 =0.659). In addition to evaluating these values, three other indicators were considered to assess the model fit: the model's predictive validity or Stone-Geisser Q2, effect size (f2) or Cohen's indicator, and the Gof. According to Hair et al. (2006), Q2 evaluates the quality of model prediction or accuracy of the fitted model, and values greater than zero should be obtained as evaluation criteria, as shown in Table 5.

| Table 6 Results Of F2 |

||

|---|---|---|

| Indicators | BE | VANT COMP |

| PIV | 0,143 | 0,010 |

| IPV | 0,024 | 0,068 |

| IPrV | 0,022 | 0,016 |

| CIV | 0,008 | 0,011 |

Source: Research data.

The f2 measure assesses the usefulness of each construct for model fit. Upon observing Table 6, it can be noted that all constructs did not have values greater than 0.35, indicating a small effect on the overall model fit, as shown in Table 6.

Finally, the Gof (Goodness-of-Fit) was analyzed as a measure of model adequacy. According to the appropriate parameters for Gof, where Wetzels et al. (2009) suggest a value of 0.36 as adequate for the social and behavioral sciences, it can be observed that all variables can be considered adequate in this regard.

Discussion

The H1 hypothesis states that the internationalization process is positively related to the adoption of Green Product Innovation by exporting companies in Uberlândia and Ribeirão Preto. The obtained results (coef. = 0.746; t-test= 19.651) indicate that the adoption of Green Product Innovation is strongly and positively related to the internationalization process, thus H1 can be accepted.

These results contribute to the literature and corroborate the findings of Suarez-Perales et al. (2017) who identified a positive influence on the adoption of Green Product Innovation. According to Suarez-Perales et al. (2017), the more internationalized a company is, the higher the chances of adopting green product innovation. The adoption of such innovation is mostly driven by the need for these companies to adapt to stricter environmental regulations, positioning them as environmental leaders in their respective sectors.

The H2 hypothesis examines whether the internationalization process is positively related to the adoption of Green Process Innovation by exporting companies in Uberlândia and Ribeirão Preto. Based on the obtained results, it can be observed that the hypothesis is positively confirmed and statistically significant (coef. = 0.642; t-test = 6.984), thus accepting H2. These results reinforce the findings of the study by Azevedo Rezende et al. (2019), which identified that practices such as the use of cleaner technology and the low consumption of energy, water, gas, and gasoline during the production process are positively associated with the internationalization process. Organizations begin to identify pressure from stakeholders who are increasingly demanding such actions.

The H3 hypothesis states that the internationalization process is positively related to the adoption of Green Innovation practices by exporting companies in Uberlândia and Ribeirão Preto. The obtained data indicate a positive relationship between internationalization and the adoption of Green Innovation practices (coef. = 0.679; t = 13.596), thus accepting H3. Studies have shown that the internationalization process can be aligned with green innovation practices, where organizations seek green innovations to operate internationally in order to meet the requirements of foreign markets and, at the same time, achieve competitive advantages (Gómez- Bolaños et al., 2022; Hojnik et al., 2018; Pereira et al., 2019).

The H4 hypothesis states that the internationalization process is positively related to the adoption of Green Innovation Behaviors by exporting companies in Uberlândia and Ribeirão Preto. Based on the obtained results, it can be concluded that the hypothesis is supported, as there is a strong positive relationship between the constructs with statistical significance (coef. = 0.659; t = 8.222), thus accepting H4.

This finding reinforces what was found in the study by Wang et al. (2020), where, based on the observation of companies located in Canada, the United States, and the United Kingdom over a period of 10 years, the authors identified that the more companies prioritized the incorporation of green innovation behaviors, such as reducing the use of raw materials and harmful substances in the manufacturing process and adopting cleaner technologies to achieve cost savings and prevent pollution, the more competitive they became and the more attractive they were to foreign investors.

The hypothesis H5 states that Green Product Innovation brings expected benefits to exporting companies in Uberlândia and Ribeirão Preto. The results show that the relationship between Green Innovation and the expected benefits of its adoption was negative and not statistically significant (coef. = -0.070; t = 0.714), rejecting hypothesis H5. This result diverges from what was analyzed in the study by Nidumolu et al. (2009), where the authors state that several benefits convince companies to invest in the adoption of green product innovation, including improved image, reduced costs, and new market opportunities (Nidumolu et al., 2009). The hypothesis H6 states that Green Process Innovation brings expected benefits to exporting companies in Uberlândia and Ribeirão Preto. However, based on the results obtained, it is observed that despite the structural coefficient showing a positive effect between the constructs (coef. = 0.056; t = 0.500), this relationship lacks statistical support, rejecting H6. This result also differs from what was found in the study by Shrivastava (2018), where the author identified several benefits resulting from the successful implementation of green process innovation, including cost savings, improved corporate image, enhanced relationships with local communities, access to new green markets, and a superior competitive advantage.

The hypothesis H7 states that Green Innovation practices bring expected benefits to exporting companies in Uberlândia and Ribeirão Preto. Based on the data obtained, it is observed that the constructs have a strongly positive relationship and statistical significance, allowing us to accept H7 (coef. = 0.649; t = 7.473). This result is consistent with the study by Takalo and Tooranloo (2021), where the authors emphasize that green innovation practices include the adoption of "eco-innovation" in corporate practices, which means implementing and developing actions that minimize environmental damage and produce benefits such as increased competitive advantage and improved profitability for these companies.

The hypothesis H8 states that Green Innovation Behaviors bring expected benefits to exporting companies in Uberlândia and Ribeirão Preto. In this relationship, it is observed that the structural coefficients are positively related (coef. = 0.279; t = 2.769), supporting H8. This result is consistent with the study by Horbach (2017), where it was observed that the adoption of green innovation behaviors, such as low energy consumption, recycling, or material reuse, further enhances corporate image.

The hypothesis H9 examines whether Green Product Innovation promotes competitive advantages for exporting companies in Uberlândia and Ribeirão Preto. From the obtained results, it can be identified that the two constructs have a positive relationship and statistical significance (coef. = 0.444; t = 2.397), supporting H9. This result is consistent with the study by Quan et al. (2021), where green product innovation is considered a critical mechanism for enhancing a company's ability to maintain a competitive advantage.

The hypothesis H10 examines whether Green Process Innovation promotes competitive advantages for exporting companies in Uberlândia and Ribeirão Preto. The obtained data indicates that Green Process Innovation has a negative influence on the promotion of competitive advantages and lacks statistical significance (coef.= -0.229; t= 1.076), rejecting H10.

The result obtained in this study differs from the findings of Chiou et al. (2018), who identified that green process innovation can enhance competitive advantages and environmental performance of organizations. They found that high-tech companies, through the adoption of innovation in their processes, can transform their operations into more environmentally efficient ones. Chiou et al. (2018) and Duran et al. (2019) also noted that green process innovation requires companies to reduce the costs of clean production and decrease pollutant emissions to comply with environmental regulations. Therefore, companies that invest significant effort in green process innovation can minimize production waste and increase productivity to offset environmental costs (Huang & Wu, 2010; Chiou et al., 2018).

The hypothesis H11 states that Green Innovation practices promote competitive advantages for exporting companies in Uberlândia and Ribeirão Preto. The data collected indicates that Green Innovation practices have a positive and statistically significant influence on promoting competitive advantages for the companies (coef.= 0.308; t = 1.901), thus accepting H11.

Studies found in the literature on the positive effects of green innovation practices on the economic performance of organizations argue that green innovations in products and processes lead to competitive advantages, increased market share, and higher productivity compared to companies that do not embrace green innovation. Furthermore, green innovation has been widely proposed as the primary means to reduce carbon emissions and achieve economic and environmental gains (Antonioli et al., 2015; Kemp & Oltra, 2016; Borsatto & Amui, 2019).

Hypothesis H12 verifies whether Green Innovation Behaviors promote competitive advantages for exporting companies in Uberlândia and Ribeirão Preto. Based on the results obtained, it appears that although such Green Innovation Behaviors positively influence the promotion of competitive advantages for companies (coef.= 0.142), this relationship does not have statistical support, since its test of 0.786 establishes that there is no significance statistics to corroborate the hypothesis, rejecting H12.

This result is different from what the literature brings, as identified in the study by Song and Yu (2018), Sharma and Iyer (2015) and Tang et al., (2017), who found that the adoption of green innovation behaviors it can deliver value to an organization's business and customers, while at the same time it can reduce a company's environmental effects and costs.

Conclusion

The present study aimed to analyze the process of internationalization and green innovation of exporting companies from the cities of Uberlândia and Ribeirão Preto, as well as the promotion of competitive advantages and expected benefits through partnerships with the government and third-sector organizations.

To achieve this objective, a literature review was conducted on the topics of Green Innovation and Internationalization, which informed this study. Based on this literature review, a theoretical model was developed to establish relationships among the constructs identified in this study. Using the collected data, the relationship between variables was assessed through a Multiple Regression Analysis, and the main results were as follows:

• The process of internationalization is positively related to the adoption of Green Product Innovation by exporting companies from Uberlândia and Ribeirão Preto.

• The process of internationalization is positively related to the adoption of Green Process Innovation by exporting companies from Uberlândia and Ribeirão Preto.

• The process of internationalization is positively related to the adoption of Green Innovation practices by exporting companies from Uberlândia and Ribeirão Preto.

• The process of internationalization is positively related to the adoption of Green Innovation Behaviors by exporting companies from Uberlândia and Ribeirão Preto.

• Green Product Innovation does not generate expected benefits for exporting companies from Uberlândia and Ribeirão Preto. The results demonstrate that the relationship between Green Innovation and the expected benefits of its adoption was negative and statistically insignificant. This result diverges from what has been found in the literature (Nidumolu et al., 2009; Horbach, 2008; Agan et al., 2013).

• Green Process Innovation has a positive effect on obtaining expected benefits for exporting companies from Uberlândia and Ribeirão Preto; however, this relationship lacks statistical support, indicating that the adoption of such innovations does not directly affect the attainment of benefits for these companies. This result also deviates from what has been found in the literature (Shrivastava, 2018; Sarkar, 2013).

• Green Innovation practices promote expected benefits for exporting companies from Uberlândia and Ribeirão Preto. Based on the obtained data, it can be observed that the constructs have a strongly positive relationship and statistical significance, confirming that green innovation can positively benefit organizations.

• Green Innovation Behaviors promote expected benefits for exporting companies from Uberlândia and Ribeirão Preto. In this relationship, it can be observed that the structural coefficients are positively related.

• Green Product Innovation promotes competitive advantages for exporting companies from Uberlândia and Ribeirão Preto. Based on the obtained results, it can be identified that the two constructs have a positive relationship and statistical significance.

• Green Process Innovation promotes competitive advantages for exporting companies from Uberlândia and Ribeirão Preto. However, the obtained data indicates that Green Process Innovation negatively influences the promotion of competitive advantages and lacks statistical significance, demonstrating that the adoption of such innovation does not directly affect the promotion of competitive advantages for these companies, which differs from the studies found in the literature (Chiou et al., 2018; Chiou et al., 2018; Duran et al., 2019).

• Green Innovation practices promote competitive advantages for exporting companies from Uberlândia and Ribeirão Preto. It can be observed through the collected data that Green Innovation practices have a positive influence and statistical significance on the promotion of competitive advantages for the companies.

• Despite positively influencing the promotion of competitive advantages in exporting companies from Uberlândia and Ribeirão Preto, Green Innovation Behaviors did not receive statistical support for this relationship, demonstrating that the adoption of such behaviors does not directly affect the promotion of competitive advantages for these companies. This differs from the studies found in the literature (Song & Yu, 2018; Sharma & Iyer, 2015; Tang et al., 2017; Takalo & Tooranloo, 2021).

Based on the literature on Internationalization, the results of the article support the theorists who argue that the process of internationalization is positively related to the adoption of Green Product Innovation, Green Process Innovation, Green Innovation, and Green Innovation Behaviors in companies (Ford et al., 2015; Lin et al., 2016; Suarez-Perales et al., 2017; Chiou et al., 2018; Feng et al., 2018; Hojnik et al., 2018; Azevedo Rezende et al., 2019; Pereira et al., 2019; Wang et al., 2020; Liu et al., 2021; Luo et al., 2021; Yang et al., 2021; Gómez-Bolaños et al., 2022).

Regarding the literature on Green Innovation, the results of the article support the theorists who argue that Green Innovation practices and Green Innovation Behaviors generate expected benefits for organizations (Huang & Wu, 2010; Horbach, 2017; Takalo & Tooranloo, 2021; Guinot et al., 2022). However, the results diverged from the literature regarding the promotion of expected benefits for companies in relation to the adoption of Green Product Innovation and Green Process Innovation (Horbach, 2008; Nidumolu et al., 2009; Shrivastava, 2018; Agan et al., 2013; Sarkar, 2018).

Regarding the promotion of competitive advantages, the results confirm the studies found in the literature, which suggest a positive influence between the adoption of Green Product Innovation and Green Innovation (Quan et al., 2021; Chen et al., 2006; Chen, 2008; Hilestad et al., 2010; Chiou et al., 2018; Duran et al., 2019; Antonioli et al., 2015; Chang et al., 2016; Kemp & Oltra, 2016; Lin et al., 2016; Horbach, 2017). However, the results of the article differ from what has been found in the literature regarding the relationship between the adoption of Green Process Innovation and Green Innovation Behaviors in promoting competitive advantage for companies (Huang & Wu, 2010; Chiou et al., 2018; Duran et al., 2019; Sharma & Iyer, 2015; Tang et al., 2017; Chiou et al., 2018; Song & Yu, 2018; Takalo & Tooranloo, 2021).

Indeed, the conclusions suggest that despite some limitations regarding the expected benefits and competitive advantages provided by Green Innovation to companies, the process of internationalization is positively aligned with Green Innovation practices, in line with SDGs 8, 9, and 17 of the 2030 Agenda. These goals aim to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all; build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation; and strengthen the means of implementation and revitalize the global partnership for sustainable development.

Indeed, this research has highlighted that with organizations becoming increasingly engaged in promoting sustainable actions, aspects such as improving quality of life, preserving biodiversity and natural resources, reducing social inequality, and enhancing the economy through eco-efficiency are expected to become more prominent. This leads to a balance in the social, economic, and environmental realms, contributing to a more sustainable future.

From a managerial perspective, this study suggests that companies are adopting different Green Innovation practices during the internationalization process in order to adapt to more stringent environmental regulations and meet the increasing demands of their stakeholders for such actions. They aim to build a positive image among their international customers, fulfill the requirements of foreign markets, and simultaneously achieve competitive advantages and become more attractive to foreign investors.

The results of this research can also be of interest to society, as companies directing their efforts towards adopting Green Innovation practices can help reduce the effects of industries with emissions of greenhouse gases, air and water pollution, thereby ensuring environmental preservation and improving the quality of life for the population. By promoting sustainable practices, companies contribute to the overall well-being of society and the protection of natural resources for future generations.

This research has several limitations that can be addressed in future studies. Firstly, the study has a sampling limitation, as it was conducted with a non-random sample, which hinders the generalizability of the results beyond the sample. Since the study focused only on two cities in the interior of the country, it is suggested to expand the analysis to other cities to enhance the external validity of the findings. Another limitation of the study was the data collection process. Given the large number of companies and the inability to administer the questionnaire in person to each of them, this resulted in a reduced number of respondents. In future studies, alternative data collection methods could be considered to overcome this limitation, such as online surveys or interviews.

Acknowledgement

We would like to express our gratitude to the Fundação de Amparo à Pesquisa de Minas Gerais (FAPEMIG) for their support in conducting this research.

References

Aguilera-Caracuel, J. & Ortiz-De-Mandojana, N. (2013). Green innovation and financial performance: An institutional approach. Organization & Environment, 26, (4): 365-385.

Ahmad, M., Khattak, S.I., Khan, A., & Rahman, Z.U. (2020). Innovation, foreign direct investment (FDI), and the energy–pollution–growth nexus in OECD region: A simultaneous equation modeling approach. Environmental and Ecological Statistics, 27, 203-232.

Indexed at, Google Scholar, Cross Ref

Ali, N., Phoungthong, K., Techato, K., Ali, W., Abbas, S., Dhanraj, J.A., & Khan, A. (2022). FDI, Green innovation and environmental quality nexus: New insights from BRICS economies. Sustainability, 14(4), 2181.

Indexed at, Google Scholar, Cross Ref

Amui, L.B.L., Jabbour, C.J.C., de Sousa Jabbour, A.B.L., & Kannan, D. (2017). Sustainability as a dynamic organizational capability: A systematic review and a future agenda toward a sustainable transition. Journal of cleaner production, 142, 308-322.

Indexed at, Google Scholar, Cross Ref

Antonioli, D., Mancinelli, S., & Mazzanti, M. (2013). Is environmental innovation embedded within high-performance organisational changes? The role of human resource management and complementarity in green business strategies. Research Policy, 42(4), 975-988.

Barbieri, J.C., Vasconcelos, I.F.G.D., Andreassi, T., & Vasconcelos, F.C.D. (2010). Innovation and sustainability: New models and propositions. Business Administration Magazine, 50, 146-154.

Indexed at, Google Scholar, Cross Ref

Barbieri, N. & Gouveia, A. (2015). Investigating the impacts of technological position and European environmental regulation on green automotive patent activity. Ecological economics, 117, 140-152.

Indexed at, Google Scholar, Cross Ref

Borsatto, Jaluza Maria Lima Silva B., & Amui, Lara Bartocci Liboni. (2019). Green innovation: Unfolding the relation with environmental regulations and competitiveness. Resources, Conservation and Recycling, 149, 445-454.

Borsatto, Jaluza Maria Lima Silva & Galina, Simone Vasconcelos Ribeiro. (2021). Internationalization and innovative effort: A comparative analysis on multinationals from developed and developing countries. Economy & Management Magazine, 21(59), 27-45.

Indexed at, Google Scholar, Cross Ref

Bossle, M.B., de Barcellos, M.D., Vieira, L.M., & Sauvée, L. (2016). The drivers for adoption of eco-innovation. Journal of Cleaner production, 113, 861-872.

Cai, Y., Lu, Y., Stegman, A., & Newth, D. (2017). Simulating emissions intensity targets with energy economic models: Algorithm and application. Annals of Operations Research, 255, 141-155.

Capar, N. & Kotabe, M. (2016). The relationship between international diversification and performance in service firms. Journal of International Business Studies, 34, 345-355.

Chang, R.D., Soebarto, V., Zhao, Z.Y., & Zillante, G. (2016). Facilitating the transition to sustainable construction: China's policies. Journal of Cleaner Production, 131, 534-544.

Chen, Y. (2008). The Driver of Green Innovation and Green Image-Green Core Competence. Journal of Business Ethics, 83, 519-535.

Chen, Y. (2022). The driver of green innovation and green image-green core competence. Journal of Business Ethics, (81), 531-543.

Indexed at, Google Scholar, Cross Ref

Chen, Y.S., Lai, S.B., & Wen, C.T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of business ethics, 67, 331-339.

Indexed at, Google Scholar, Cross Ref

Chiou, T.Y., Chan, H.K., Lettice, F., & Chung, S.H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E: Logistics and Transportation Review, 47(6), 822-836.

Indexed at, Google Scholar, Cross Ref

Cohen, A. (1988). Statistical power analysis for the behavioral sciences. Hillsdale: Erlbaum.

de Azevedo Rezende, L., Bansi, A.C., Alves, M.F.R., & Galina, S.V.R. (2019). Take your time: Examining when green innovation affects financial performance in multinationals. Journal of Cleaner Production, 233, 993-1003.

Indexed at, Google Scholar, Cross Ref

Duran, D.C., Gogan, L.M., Artene, A., & Duran, V. (2015). The components of sustainable development-a possible approach. Procedia Economics and Finance, 26, 806-811.

Fávero, L.P., Belfiore, P., Da Silva, F.L., Chan, B.L (2009). Data analysis: Multivariate modeling for decision making. Rio de Janeiro: Elsevier.

Feng, Z., Zeng, B. & Ming, Q. (2018). Environmental regulation, two-way foreign direct investment, and green innovation efficiency in China’s manufacturing industry. International journal of environmental research and public health, 15 (10), 22-92.

Floriani, D.E. (2010). The degree of internationalization, skills and performance of Brazilian SMEs, Doctoral Thesis, University of São Paulo.

Ford, J.A., Steen, J., & Verreynne, M.L. (2014). How environmental regulations affect innovation in the Australian oil and gas industry: Going beyond the porter hypothesis. Journal of Cleaner Production, 84, 204-213.

Indexed at, Google Scholar, Cross Ref

Fornell, C. & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 18(1), 39-50.

Francischeto, L. L. & Neiva, E. R. (2019). Innovation in companies and cultural orientation to innovation: A multilevel study. RAM Mackenzie Management Magazine, 20(3), 125-148.

Galbraith, J.R. & Kazanjian, R. (2015). Strategy Implementation. West Publishing: St Paul.

Gómez-Bolaños, E., Ellimäki, P., Hurtado-Torres, N. E., & Delgado-Márquez, B.L. (2022). Internationalization and environmental innovation in the energy sector: Exploring the differences between multinational enterprises from emerging and developed countries. Energy Policy, 163, 112867.

Indexed at, Google Scholar, Cross Ref

Guinot, J., Barghouti, Z., & Chiva, R. (2022). Understanding green innovation: A conceptual framework. Sustainability, 14(10), 5787.

Indexed at, Google Scholar, Cross Ref

Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (2009). Multivariate data analysis. bookman publisher.

Hillestad, T., Xie, C., & Haugland, S.A. (2010). Innovative corporate social responsibility: The founder's role in creating a trustworthy corporate brand through green innovation. Journal of Product & Brand Management.

Indexed at, Google Scholar, Cross Ref

Hojnik, J., Ruzzier, M., & Manolova, T.S. (2018). Internationalization and economic performance: The mediating role of eco-innovation. Journal of Cleaner Production, 171, 1312-1323.

Indexed at, Google Scholar, Cross Ref

Horbach, J. (2017). Do eco-innovations need specific regional characteristics? An econometric analysis for Germany. Review of Regional Research, (34), 23-38.

Horbach, Jens. (2008). Determinants of environmental innovation-New evidence from German panel data sources. Research policy, 37(1), 163-173.

Indexed at, Google Scholar, Cross Ref

HUANG, Xiao-Xing & WU, Hong. (2016). The relationships between regulatory and customer pressure, green organizational responses, and green innovation performance. Journal of Cleaner Production, (112), 3423-3433.

Indexed at, Google Scholar, Cross Ref

Ismail, I.R., Hamid, R.A. & Idris, F. (2012). PLS application in Journals of Operations Management: A review. In: Global Conference on Operations and Supply Chain Management, 2012, Bandung. Proceedings. Bandung, 67 (15), 16-21.

Lin, R.J., Tan, K.H., & Geng, Y. (2013). Market demand, green product innovation, and firm performance: evidence from Vietnam motorcycle industry. Journal of Cleaner Production, 40, 101-107.

Liu, L., Zhao, Z., Su, B., Ng, T.S., Zhang, M., & Qi, L. (2021). Structural breakpoints in the relationship between outward foreign direct investment and green innovation: An empirical study in China. Energy Economics, 103, 105578.

Indexed at, Google Scholar, Cross Ref

Luo, Y., Salman, M. & Lu, Z. (2021). Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Science of the total environment, 75, 143-744.

Nidumolu, R., Prahalad, C.K., & Rangaswami, M.R. (2009). Why sustainability is now the key driver of innovation. Harvard business review, 87(9), 56-64.

Organização Das Nações Unidas (ONU). (2018). Transformando nosso mundo: A Agenda 2030 para o Desenvolvimento Sustentável.

Peng, D.X. & Lai, F. (2012). Using partial least squares in operations management research: A practical guideline and summary of past research. Journal of Operations Management,30(6), 467-480.

Indexed at, Google Scholar, Cross Ref

Pereira, M.M.O., Antunes, L.G.R., Bossle, M.B., Calegário, C.L.L., & Antonialli, L.M. (2019). Eco innovation and internationalization: Evidence in coffee growing in the Cerrado Mineiro Region. Business Magazine, 23(4), 70-90.

Quan, X. (2023). Industries regulation and firm environmental disclosure: A stakeholders' perspective on the importance of legitimation and international activities. Organization & Environment, 30, 103-121.

Indexed at, Google Scholar, Cross Ref

Quan, X., Ke, Y., Qian, Y., & Zhang, Y. (2021). CEO foreign experience and green innovation: Evidence from China. Journal of Business Ethics, 1-23.

Indexed at, Google Scholar, Cross Ref

Rogers, R. (2018). Prólogo de Richard Rogers. In: GEHL, J. Cidades para pessoas. 2. ed. São Paulo: Perspectiva.

Sarkar, C. (2018). Measuring the level of industrial green development and exploring its influencing factors: empirical evidence from China’s 30 provinces. Sustainability, 8(2), 153-168.

Sharma, A. & Iyer, G.R. (2015). Resource-constrained product development: implications for green marketing and green supply chains. Industrial Marketing Management, 41, 599-608.

Indexed at, Google Scholar, Cross Ref

Shrivastava, Manisha. (2018). The platelet storage lesion. Sustainable development, 41(2), 105-113.

Song, W. & Yu, H. (2018). Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corporate Social Responsibility and Environmental Management, 25, 135-150.

Stal, E. (2010). Internacionalização de empresas brasileiras e o papel da inovação na construção de vantagens competitivas. Revista de Administração e Inovação, 7(3), 120-149.

Suarez-Perales, I., Garces-Ayerbe, C., Rivera-Torres, P., & Suarez-Galvez, C. (2017). Is strategic proactivity a driver of an environmental strategy? Effects of innovation and internationalization leadership. Sustainability, 9(10), 1870.

Takalo, S.K. & Tooranloo, H.S. (2021). Green innovation: A systematic literature review. J Clean Prod, 279-310.

Tang, M., Walsh, G., Lerner, D., Fitza, M.A., & Li, Q. (2018). Green innovation, managerial concern and firm performance: An empirical study. Business strategy and the Environment, 27(1), 39-51.

Indexed at, Google Scholar, Cross Ref

Torrecillas, C. & Fernández, S. (2022). Exports and outward FDI as drivers of eco-innovations. An analysis based on Spanish manufacturing firms. Journal of Cleaner Production, 349, 131-243.

Wang, G., Li, Y., Zuo, J., Hu, W., Nie, Q., & Lei, H. (2021). Who drives green innovations? Characteristics and policy implications for green building collaborative innovation networks in China. Renewable and Sustainable Energy Reviews, 143, 110875.

Weng, H.R., Chen, J. & Chen, P. (2015). Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability, 7(5), 4997-5026.

Indexed at, Google Scholar, Cross Ref

Williams, K. (2017). Sustainable cities: Research and practice challenges. International Journal of Urban Sustainable Development, 1(2), 128-132.

Xavier, A.F., Naveiro. R.M., Aoussat. A., Reyes. T. (2017). Systematic literature review of eco-innovation models: Opportunities and recommendations for future research. Journal of cleaner production, 149, 1278-1302.

Yang, C., Liu, L., Yang, W., & Ahmed, T. (2021). Environmental regulation, outward foreign direct investment, and low-carbon innovation: An empirical study based on provincial spatial panel data in China. Mathematical Problems in Engineering, 20.

Received: 14-May-2023, Manuscript No. AEJ-23-13725; Editor assigned: 17-May-2023, PreQC No. AEJ-23- 13725(PQ); Reviewed: 02-June-2023, QC No. AEJ-23-13725; Revised: 07-June-2023, Manuscript No. AEJ-23- 13725(R); Published: 16-June-2023