Research Article: 2022 Vol: 26 Issue: 2S

Relative purchasing power parity in the ASEAN economic community

Vesarach Aumeboonsuke, International College, National Institute of Development Administration

Citation Information: Aumeboonsuke, V. (2022). Relative purchasing power parity in the ASEAN economic community. Accounting and Financial Studies Journal, 26(S2), 1-9.

Abstract

This study aimed to investigate whether relative purchasing power parity holds for the countries in ASEAN Economic Community namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam along the ten-year time period stared from September 2011 to August 2021. The real exchange rates were first examined by employing an Augmented Dickey-Fuller test. Consequently, the real exchange rates were examined further by including a trend at the origin to capture the Balassa-Samuelson effect. The time series of exchange rate were investigated by employing the Engle-Granger cointegration test to examine if the exchange rate at the nominal level and the relative price ratio were at the same order of integration or not. The half-life of each real exchange rate was studied in this approach. The analysis produced the relative purchasing power parity results and the adjustment speed of convergence to the parity equilibrium. All of the statistics were performed in R version 4.1.1. The results implied whether the economy in Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam were synchronized and well-prepared to form a single economic region.

Keywords

Purchasing Power Parity, Unit Root Test, Engle-Granger Cointegration, ASEAN Countries

Introduction

The Law of One Price was one of the most important foundation of economics and finance. In the currency exchange markets, it was applied in the relative purchasing power parity which stated that the value of two currencies should be equal when a basket of identical commodity was priced the same in both countries. Rogoff (1996) stated that the purchasing power parity was the basic concept that arbitrage enforced the domestic price levels to be at the same value after being transformed to identical currency. Based on Rogoff (1996); Findreng (2014), most economists believed that purchasing power parity was a long term determination for an inflation-adjusted exchange rate. In theory, the relative purchasing power parity should hold in order to ensure the arbitrage-free condition. However, in reality, it might be unlikely to achieve due to external factors including different transaction costs and some restrictions for some traders to participate in some markets.

Extensive numbers of literatures provided an empirical evidence of the purchasing power parity by examining the relationship between the real exchange rates and the relative Consumer Price Index (CPI). Froot & Rogoff (1995) proposed the Balassa-Samuelson hypothesis as a model to investigate the behavior of the real exchange rates and their result showed that the inflation-adjusted exchange rates were stationary over a long time period. This result was confirmed by numerous studies in the following years (Engel & Rogers, 2001; Sarno & Taylor, 2002). In addition, Murad & Hossain (2018) also revealed that the real exchange rates were mean reverting over time.

An investigation on the relative form of purchasing power parity on the context of currencies in the ASEAN countries was relatively limited compared to the study of the same topic in the context of the western markets. Some of these studies includes Aggarwal, et al., (2000); Kawasaki & Ogawa (2006); Wu, et al., (2011); Chang, et al., (2012); Chen & Hu (2018). These prior studies conducted an analysis based on the time series econometric approach. However, Murad & Hossain (2018) claimed that the time series approach had some drawbacks due to limited power and wide deviation from equilibrium which could produce misleading outcomes.

As a result, this paper reviewed related studies on the validity test of relative purchasing power and attempted to investigate the exchange rates by employing the Engle-Granger cointegration test, the half-life of exchange rate series in order to report the validity of relative purchasing power parity and the adjustment speed of convergence to the equilibrium. Scope of this study was the member countries in ASEAN Economic Community namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam and the study covered ten-year time period stared from September 2011 to August 2021. The following section provides more details about the related literatures, methodologies, empirical results, and concluding remarks.

Literature Reviews

An investigation on testing the validity of the relative purchasing power parity had continued to gain considerable attentions and had been performed in extensive prior literatures in the past decades.

To examine the behavior of the real exchange rates, Froot & Rogoff (1995) suggested an appropriate model based on the Balassa-Samuelson hypothesis. Their study revealed that the real exchange rates were stationary. In addition, Engle & Rogers (2001); Sarno & Taylor (2002); Murad & Hossain (2018) also proposed that the real exchange rates had a mean-reversion property and were stationary over a long time span.

Empirical evidence on the relative purchasing power parity in the framework of currencies in the ASEAN countries were presented in some of the studies during the past two decades including Aggarwal, et al., (2000); Kawasaki & Ogawa (2006); Wu, et al., (2011); Chang, et al., (2012); Chen & Hu (2018); Murad & Hossain (2018); Ha (2018). Aggarwal, et al., (2000) examined the nonlinear purchasing power parity relationship in the Southeast Asian markets and reported that there was a higher degree of relationship between currency rate and inflation rates of two countries when using the Japanese Yen as a benchmark. Wu et al., (2011) conducted an investigation in the Pacific Basin countries and revealed that the mean-reversion property existed in the real exchange rate series by employing the Zivot-Andreqs statistic. Their results showed that when using the monthly data, the real exchange rates were mean-reverting. However, their study on the quarterly data showed mixed results.

Consequently, Kawasaki & Ogawa (2006) performed the validity test on the Generalized Purchasing Power Parity (GPPP) and found that the relationship held in four countries in the ASEAN markets namely Indonesia, Malaysia, Philippines, Singapore and Thailand. This result was different from another prior study by Choudhry (2005) who found that the GPPP did not hold in Singapore. In addition, Chang, et al., (2012) also investigate the validity of the purchasing power parity by employing the nonlinear unit root test on the currencies in ASEAN markets. The result showed that it was valid in most of the countries in ASEAN. Furthermore, they also found that the adjustment was asymmetric and nonlinear.

A more recent study by Chen & Hu (2018) examined the purchasing power parity during the period of 2000-2013 and their result reveal the significant positive association between the exchange rates and the relative price level which confirmed the validity of the purchasing power parity. In contrary, Ha (2018) conducted an empirical analysis by using panel data during the period of 1995-2017 and reported that for the whole time period, the unit root test indicated that the purchasing power parity was not valid. However, when the structural breaks were accompanied in the exchange rate series, the purchasing power parity was valid during the period of 1997-2008. An analysis pointed out that the purchasing power parity seemed to be valid after the end of the 1997 Asian currency crisis until before the beginning of Subprime crisis in the year 2008.

Subsequently, Murad & Hossain (2018) expressed critics on the prior studies by pointing out that these prior studies performed an analysis by employing the time series econometric approach. Based on Murad & Hossain (2018), there were some drawbacks in the time series approach because it had limited power and it also provided wide divergence from the equilibrium. These drawbacks would cause misleading recommendations. Murad & Hossain (2018) claimed that their study was the first paper that investigates the purchasing power parity relationship in the currencies in ASEAN markets by employing second-generation panel data techniques. Their study covered the time period between 1973-2015.

Besides the studies in the ASEAN region, the validity of relative purchasing power parity had been investigated numerously in the other regions of the world including in the Eastern European countries, Canada, and OECD countries. For example, Findreng (2014) & Al-Zyoud (2015) both employed the Engle-Granger cointegration test in their study of the relative purchasing power parity. Findreng (2014) presented the evidence from Eastern European markets and showed that the results were ambiguous in both the relative purchasing power parity and the adjustment speed of convergence to the equilibrium. Furthermore, another empirical evidence from Al-Zyoud (2015) for the Canadian Dollar-US Dollar exchange rates showed that the relative price level took time to adjust and this evidence was rejecting the parity. However, the regression result from Al-Zyoud (2015) showed that the relative price level has a significant association with the nominal exchange rate. In addition, Jiang, et al., (2015) performed purchasing power parity test in 34 OECD countries during the period of 1994-2013 and found that the parity was valid in half of the 34 OECD countries under their study.

The next section explained the data and methodology employed under this study.

Data and Methodology

The validity of relative purchasing power parity was analyzed using monthly data collected from the World Bank’s publication in the World Development Indicators (WDI) and the International Monetary Fund (IMF)’s publication on the International Financial Statistics (IFS). For some countries and some periods that the data were not available from the World Bank and the International Monetary Fund, additional data were collected from the General Statistics Office of Vietnam; Department of Economic Planning and Statistics, Ministry of Finance and Economy, Brunei Darussalam; Central Statistics Organization, Myanmar; and National Institute of Statistics, Cambodia.

Since the relative price level was expected to have a long-term effect on the exchange rate, this study covered ten-year time period during September 2011 to August 2021. All the member countries in ASEAN Economic Community namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam were included in the scope of this study. All of the statistical analysis was performed in R version 4.1.1 (2021-08-10) -- "Kick Things" with CADF test package.

The relative purchasing power parity stated that

Where is the nominal exchange rate of ASEAN currency i against the US dollar (USD), is the aggregate price levels of ASEAN country i, is the aggregate price levels of United States, denotes difference in a period, and ln denotes the natural log transformation.

Table 1 explains the descriptive statistics of all the time series that has been transformed into the changes in natural logarithm of the monthly real exchange rate series.

| Table 1 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Country | Variables | Mean | Median | Max. | Min. |

| Brunei Darussalam | BND | 0.1384 | 0.1371 | 0.2514 | -0.0170 |

| Indonesia | IDR | 9.6110 | 9.7030 | 9.9330 | 9.1010 |

| Cambodia | KHR | 8.3480 | 8.3490 | 8.4100 | 8.2630 |

| Lao PDR | LAK | 9.1370 | 9.1190 | 9.3880 | 8.9900 |

| Myanmar | MMK | 7.2470 | 7.3650 | 7.9000 | 6.4260 |

| Malaysia | MYR | 1.3333 | 1.3990 | 1.5180 | 1.0780 |

| Philippines | PHP | 3.8980 | 3.9090 | 4.0510 | 3.7120 |

| Singapore | SGD | 0.2821 | 0.2770 | 0.3876 | 0.2078 |

| Thailand | THB | 3.4500 | 3.4520 | 3.6050 | 3.3300 |

| Vietnam | VND | 10.2800 | 10.2900 | 10.4100 | 10.1200 |

| Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, KHR=Cambodian Riel, LAK=Lao Kip, MMK=Myanmar Kyat, MYR=Malaysian Ringgit, PHP=Philippines Peso, SGD=Singapore Dollar, THB=Thai Baht, and VND=Vietnam Dong. | |||||

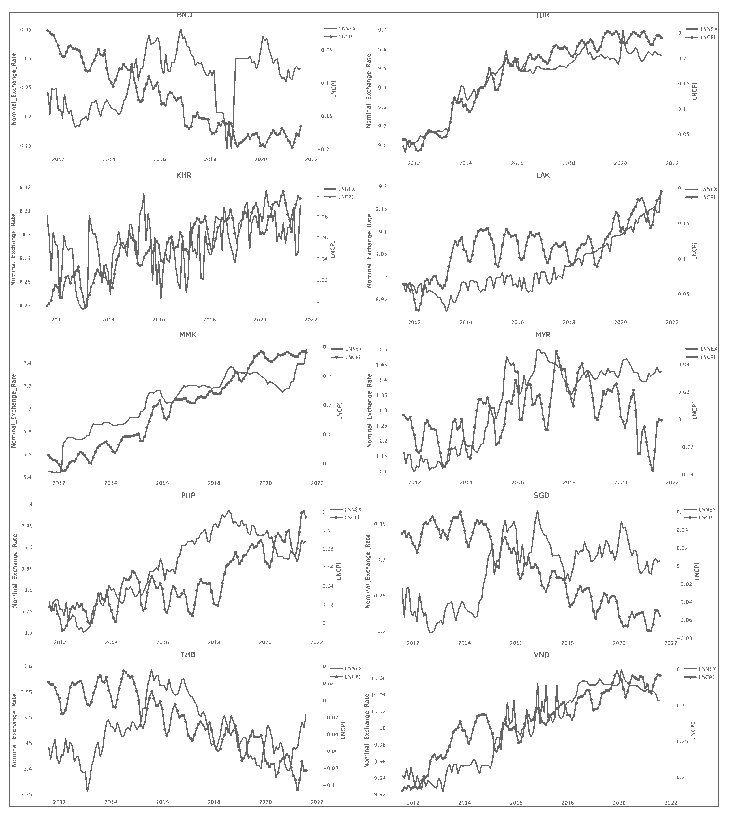

Figure 1 displayed the real exchange rate series to be examined by the Augmented Dickey-Fuller test. An estimation of the series was calculated based on the nominal exchange rate adjusted by the relative price level. i.e., natural log transformation of the nominal exchange rate times the relative consumer price index.

Figure 1:Natural Log of the Monthly Real Exchange Rates During 2011-2021

Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, KHR=Cambodian Riel, LAK=Lao Kip, MMK=Myanmar Kyat, MYR=Malaysian Ringgit, PHP=Philippines Peso, SGD=Singapore Dollar, THB=Thai Baht, and VND=Vietnam Dong.

According to equation (1), the relative purchasing power condition would hold if was statistically not different from zero and if was statistically not different from one. In another words, the relative purchasing power parity predicted that the movements in the nominal exchange rate should be equivalent to the movements in the relative price levels between two countries. In essence, the relative purchasing power parity condition stated that the real exchange rates should be stationary, or mean-reverting.

Findreng (2014) stated that an Augmented Dickey-Fuller test could be employed on a stationary test of the real exchange rate series. According to an Augmented Dickey-Fuller test, the series would be stationary if it was able to reject the null hypothesis of a unit root.

The following section reported the results from an Augmented Dickey-Fuller test and the validity test of the relative purchasing power parity.

Results and Discussions

The results of Augmented Dickey-Fuller unit root test were presented in Table 2. It was performed to confirm the stationarity of the monthly dataset and to ensure that the data did not have unit root and were stationary. The alternative hypothesis was that the true alpha based on equation (1) was less than zero.

| Table 2 Results of Unit Root Test |

||||

|---|---|---|---|---|

| Variables | ADF-statistic | Delta | P-value | Order of integration |

| BND | -3.4858 | -0.2980 | 0.0215 | I(0) |

| IDR | -3.2720 | -0.2072 | 0.0428 | I(0) |

| KHR | -5.4489 | -0.4278 | 7.04e-05 | I(0) |

| LAK | -1.8839 | -0.0876 | 0.6567 | I(1) |

| MMK | -2.7909 | -0.0840 | 0.2036 | I(1) |

| MYR | -1.5363 | -0.0255 | 0.5119 | I(1) |

| PHP | -2.4120 | -0.0955 | 0.3716 | I(1) |

| SGD | -3.5109 | -0.4019 | 0.0154 | I(0) |

| THB | -1.9634 | -0.0552 | 0.3026 | I(1) |

| VND | -3.8468 | -0.2443 | 0.0174 | I(0) |

| Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, KHR=Cambodian Riel, LAK=Lao Kip, MMK=Myanmar Kyat, MYR=Malaysian Ringgit, PHP=Philippines Peso, SGD=Singapore Dollar, THB=Thai Baht, and VND=Vietnam Dong. | ||||

Since the BND, IDR, KHR, SGD, and VND series were all integrated of order zero [i.e., I(0)], the real exchange rate series in these five countries (Brunei Darussalam, Indonesia, Cambodia, Singapore, and Vietnam) rejected the null hypothesis of a unit root and it could be concluded that the relative purchasing power parity held in these markets. However, the other remaining five currencies of LAK, MMK, MYR, PHP, and THB which belonged to Lao PDR, Myanmar, Malaysia, Philippines, and Thailand were not integrated of order zero and it failed to reject the unit root hypothesis. Thus, the results implied that the relative purchasing power parity did not hold in these five markets during the period under the study.

Consequently, the speed of adjustment from the deviation toward the equilibrium based on the relatively purchasing power parity was analyzed. The half-life of the real exchange rate series was estimated based on the coefficient from an Augmented Dickey-Fuller test and the results were presented in Table 3.

| Table 3 Results of Half-Life |

||

|---|---|---|

| Country | Variable | Half-life (months) |

| Brunei Darussalam | BND | 1.96 |

| Indonesia | IDR | 2.99 |

| Cambodia | KHR | 1.24 |

| Lao PDR | LAK | 7.56 |

| Myanmar | MMK | 7.90 |

| Malaysia | MYR | 26.83 |

| Philippines | PHP | 6.91 |

| Singapore | SGD | 1.35 |

| Thailand | THB | 12.21 |

| Vietnam | VND | 2.47 |

| Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, KHR=Cambodian Riel, LAK=Lao Kip, MMK=Myanmar Kyat, MYR=Malaysian Ringgit, PHP=Philippines Peso, SGD=Singapore Dollar, THB=Thai Baht, and VND=Vietnam Dong. | ||

Based on Table 3, five countries where the real exchange rate were at I(0) in the unit root test (Brunei Darussalam, Indonesia, Cambodia, Singapore, and Vietnam) had a relatively short half-life (between 1.24 to 2.99 months) compared with the other five countries where the real exchange rate series fail to reject the null hypothesis of unit root (Lao PDR, Myanmar, Malaysia, Philippines, and Thailand). The results implied that when the real exchange rates were more deviated from the equilibrium, it took much long time for an adjustment. For the latter group of countries where the relative purchasing power parity did not hold, the speed of adjustment could be from 7 months (in Philippines) to 27 months (Malaysia). Nonetheless, these estimates of half-life should be taken with caution because the speed of adjustment was sensitive to the possible shocks in the exchange rate markets.

The advancement of the exchange rates in the nominal form and the relative price level in Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam could be explored further to imply whether the nominal exchange rate exhibited higher or lower volatility than the relative price level for each series. If the nominal exchange rate was more volatile, then it suggested that relative price levels were adjusted more slowly compared to the nominal exchange rates. The relationship would also reveal if there were any of the series that were not dependent on each other.

The movement of the exchange rates in the nominal form and the relative price level of the ten members in ASEAN were illustrated in Figure 2. The left axis was the natural log transformation of the nominal exchange rate and the right axis was the natural log of the relative price level. It was unclear whether the nominal exchange rate exhibited higher or lower volatility than the relative price level. It was obvious only in the case of Cambodia when the nominal exchange rate seemed to be more volatile and the relative price level was relatively sticky. For Indonesia, Lao PDR, Myanmar, Philippines, Thailand, and Vietnam, the two series followed each other quite closely during a certain period. In specific, for Indonesia and Philippines, it could be seen that the two series tended to move closely during the period of 2011-2015, however, after the year 2015, the two series tended to deviate from each other. In the contrary, for Lao PDR, Thailand, and Vietnam, the two series seemed to be on a different track during the period of 2011-2015 but they tended to move more closely afterwards. On the other hand, for Brunei Darussalam, Singapore, and Malaysia, the two series were not likely to be associate with each other.

Figure 2: Monthly Series of the Exchange Rate and the Relative Price Level in Natural Log Transformation

Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, KHR=Cambodian Riel, LAK=Lao Kip, MMK=Myanmar Kyat, MYR=Malaysian Ringgit, PHP=Philippines Peso, SGD=Singapore Dollar, THB=Thai Baht, and VND=Vietnam Dong.

Cointegration Test

If there existed a random walk pattern in the nominal exchange rate and the relative price level, spurious regression results could be produced from a regular OLS regression of the two series (Wooldrigde, 2009). In order to eliminate this issue, the Engle-Granger cointegarion test was conducted on the linear association of the two series. Therefore, a weaker form of relative purchasing power parity was examined under the Engle-Granger test for cointegration to investigate a long-run equilibrium association between nominal exchange rates and relative price levels in the ASEAN Economic Community.

Cointegration test involved three procedures. Firstly, a stationary test was conducted on the first difference of the nominal exchange rate and the relative price level. Any two series that passed the stationary test would be excluded from the next step, then Secondly, the series that were not stationary, or failed to reject the null hypothesis in the Dickey-Fuller test would be investigated further by regressing the relative price level on the nominal exchange rate and the residual from this regression was obtained. In the final procedure, an Augmented Dickey-Fuller test of unit root was employed to investigate whether the residual obtained from step two contained unit root or not. If the null hypothesis in the Dickey-Fuller test was rejected, then it implied that there existed an association between the relative price level and the nominal exchange rate. And it could be an evidence of proof on the validity of the weak-form relative purchasing power parity.

The results from the first procedure indicated that the nominal exchange rates in natural log form of Cambodia rejected the null hypothesis of a unit root which indicated that the series were stationary and would be excluded from a further analysis. The remaining nine currencies rejected the null hypothesis of unit root and were all at I(1).

For the relative consumer price index series of Vietnam, Philippines, Malaysia, Myanmar, Lao PDR, and Cambodia were stationary. The series of the other remaining countries were all at I(1). Therefore, the two series from Brunei Darussalam, Indonesia, Singapore, and Thailand were included in the second step. Table 4 reported the results from the unit root test on the residual series obtained from the regression between natural log of nominal exchange rate and natural log of relative consumer price index.

| Table 4 Engle-Granger Cointegration Test |

|||

|---|---|---|---|

| Country | Variables | ADF-statistic | P-value |

| Brunei Darussalam | BND | -2.7726*** | 0.0059 |

| Indonesia | IDR | -4.7191*** | 4.58e-06 |

| Singapore | SGD | -2.6233*** | 0.0090 |

| Thailand | THB | -1.9499** | 0.0493 |

| Note: BND=Brunei Dollar, IDR=Indonesian Rupiah, SGD=Singapore Dollar, and THB=Thai Baht. ***=significant at 1% and **=significant at 5%. | |||

The results from Table 4 indicated that there was a linear association between the two series. In other words, the validity of weak-form relative purchasing power parity was confirmed in Brunei Darussalam, Indonesia, Singapore, and Thailand.

Conclusion

In this study, the validity test on the relative purchasing power parity was investigated by performing an analysis on the association between the nominal exchange rate and the relative consumer price index. This study included the ten member countries in ASEAN Economic Community namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. An analysis was conducted based on the ten-year historical monthly data from September 2011 to August 2021. All of the statistics were obtained from the R program version 4.1.1.

The findings based on the Augmented Dickey-Fuller statistics on the unit root of the real exchange rate revealed mixed results from the ten countries. Statistics from the test showed that the relative purchasing power parity tended to hold in five out of ten member countries in ASEAN which included Brunei Darussalam, Indonesia, Cambodia, Singapore, and Vietnam due to the stationarity property in their real exchange rate series. However, the relative purchasing power parity was not valid in the other remaining five countries of Lao PDR, Myanmar, Malaysia, Philippines, and Thailand since it failed to reject the null hypothesis in an Augmented Dickey-Fuller test.

The half-life estimations were further investigated to address the speed of adjustment from its deviation toward the equilibrium exchange rate implied by relative purchasing power parity. The results revealed that the countries where purchasing power parity did not hold tended to have a relatively much slower speed of adjustment (7-27 months) compared to the countries where the parity did hold (1-3 months).

Finally, the Engle-Granger Cointegration test was employed to examine the weak-form relative purchasing power parity. The results showed that there was an evidence of a significant long-run association between the relative price level and the exchange market. In addition, significant causal relationship was found to exist among the four out of ten member countries in ASEAN which included Brunei Darussalam, Indonesia, Singapore, and Thailand. These results indicated that Brunei Darussalam, Indonesia, Singapore, and Thailand were likely to have a reasonable level of economic synchronization. On the contrary, for the other six countries where relative purchasing power parity did not hold under the period cover in this study might need a specific mechanism to be in the same pace with each other in terms of either the outcast of their inflation or the sticky movement of their currency.

Acknowledgement

This research was supported by International College of National Institute of Development Administration. They may not agree with the interpretations/conclusions of this paper.

References

Aggarwal, R., Montanes, A., & Ponz, M. (2000). Evidence of long-run purchasing power parity: Analysis of real Asian exchange rates in terms of the Japanese yen.Japan and the World Economy, 12(4), 351-361.

Al-Zyoud, H. (2015). An empirical test of purchasing power parity theory for Canadian dollar-US dollar exchange rates.International Journal of Economics and Finance, 7(3), 233-240.

Chang, T., Lee, C.H., & Liu, W.C. (2012). Nonlinear adjustment to purchasing power parity for ASEAN countries.Japan and the World Economy, 24(4), 325-331.

Chen, M., & Hu, X. (2018). Linkage between consumer price index and purchasing power parity: Theoretic and empirical study.The Journal of International Trade & Economic Development, 27(7), 729-760.

Choudhry, T. (2005). Asian currency crisis and the generalized PPP: Evidence from the Far East.Asian economic journal, 19(2), 137-157.

Engel, C., & Rogers, J.H. (2001). Deviations from purchasing power parity: Causes and welfare costs.Journal of International Economics, 55(1), 29-57.

Findreng, J.H. (2014). Relative purchasing power parity and the European monetary union: Evidence from eastern Europe.Economics & Sociology, 7(1), 22-38.

Froot, K.A., & Rogoff, K. (1995). Perspectives on PPP and long-run real exchange rates.Handbook of International economics, 3, 1647-1688.

Ha, M.T.T. (2018). Testing the evidence of purchasing power parity for Southeast Asia countries. In International Econometric Conference of Vietnam, 1061-1077. Springer, Cham.

Jiang, C., Bahmani-Oskooee, M., & Chang, T. (2015). Revisiting purchasing power parity in OECD. Applied Economics, 47(40), 4323-4334.

Kawasaki, K., & Ogawa, E. (2006). What should the weights of the three major currencies be in a common currency basket in East Asia? Asian Economic Journal, 20(1), 75-94.

Murad, S.W., & Hossain, M.A. (2018). The ASEAN experience of the purchasing power parity theory.Financial Innovation, 4(1), 1-10.

Rogoff, K. (1996). The purchasing power parity puzzle.Journal of Economic literature, 34(2), 647-668.

Sarno, L., & Taylor, M.P. (2002). Purchasing power parity and the real exchange rate.IMF staff papers, 49(1), 65-105.

Wu, J.L., Lee, C., & Wang, T.W. (2011). A re-examination on dissecting the purchasing power parity puzzle.Journal of International Money and Finance, 30(3), 572-586.

Received: 26-Nov-2021, Manuscript No. AAFSJ-21-8452; Editor assigned: 29- Nov -2021, PreQC No. AAFSJ-21-8452 (PQ); Reviewed: 17-Nov-2021, QC No. AAFSJ-21-8452; Revised: 25-Dec-2021, Manuscript No. AAFSJ-21-8452 (R); Published: 03-Jan-2022