Research Article: 2020 Vol: 23 Issue: 3

RESTRUCTURING AND CORPORATE PRODUCTIVITY: EMPIRICAL EVIDENCE FROM VIETNAM TEXTILE AND GARMENT INDUSTRY

Pham Dinh Long, Ho Chi Minh City Open University

Pham Dinh Cuong, Ho Chi Minh City Open University

Citation Information: Long, P. D., & Cuong, P. D. (2020). Restructuring and corporate productivity: empirical evidence from Vietnam textile and garment industry. Journal of Management Information and Decision Sciences, 23(3), 215-222.

Abstract

The paper analysed and assessed the impact of restructuring on corporate productivity. Quantitative research methods are used to analyse a data set of Vietnam textile and garment enterprises during 2009-2018 period. The empirical results show that corporate restructuring has a positive impact on corporate productivity. From there, contributing to effective solutions for enterprises in order to improve corporate productivity.

Keywords

Corporate Productivity, Restructuring, Vietnam Textile and Garment Enterprises.

Introduction

Corporate restructuring is a potential solution to improve corporate productivity (Bowman & Singh, 1993). Enterprises want to be survived in an economy market must be adapted and changed. Therefore, corporate restructuring is an urgent need for Vietnamese enterprises change to environment suitable in the current period.

Some researchers have mentioned the relationship between restructuring and corporate productivity, such as: Hammer & Champy (1993) argued that restructuring is a radical rethinking, and redesign of business processes, to achieve outstanding improvement over the most critical and essential indicators including prices, quality, service. Bowman & Singh (1993) think that restructuring of portfolio, finance and organization will change the direction of business activities of enterprises, rearrange resources to improve the corporate productivity.

Recently, some domestic studies also mentioned the impact of restructuring on corporate productivity, such as: Thanh et al. (2017) has built a measurement scale to evaluate the impact of management factors on corporate productivity of textile and garment industry. Thanh et al. (2017) stated that restructuring has a positive impact on corporate productivity. In general, these studies mainly focused on analysing a few individual factors affecting corporate productivity.

Therefore, the article “Restructuring and corporate productivity: Empirical evidence from Vietnam Textile and garment industry” will contribute to improve theoretical gaps and assess the impact of restructuring on corporate productivity.

Review Literature

Bowman & Singh (1993) suggested that restructuring of portfolio, finance and organization will change the direction of business operations of enterprises, rearranging resources in order to improve the corporate productivity.

Swanepoel (2005) investigated solutions for downsizing; Li (2013) analysed the impact of mergers and acquisitions (M&A); Higuchi & Toshiyuki (2004) analysed the organizational restructuring factor to the corporate productivity; Sallehu (2017) analysed restructuring costs.

In addition, there are some empirical studies related to the impact of restructuring on corporate productivity, such as: Đinh & Phạm (2011) used the regression model to research relationship between restructuring and corporate productivity in the agricultural sector in the period 1991-2009. The estimated results show that the restructuring and corporate productivity are related to each other positively. Ngoc & Hung (2015) analysed 195 listed firms on the Hochiminh Stock Exchange from 2006 to 2011 and found a robustly positive impact of ownership concentration on information disclosure in the context that firms try their effort to send transparent signals to investors.

Vo & Nguyen (2018) researched the relationship between restructuring and corporate productivity in Vietnamese banks, using of Data Envelopment Analysis (DEA) and Stochastic frontier analysis (SFA). The sample includes 26 commercial banks in the period 1999-2015. The results show that at the beginning, banks suffered losses due to the large cost for restructuring. However, in the long times, efficiency and corporate productivity will be effective.

Recently, Nga & Pham (2018) examine the factors that regularize the delisting of restructuring firms in Vietnam and find that restructuring frequency is significantly correlated positively with the risk delisting of firm. The empirical research by Charles & Scott (2017) has changed the equity size for 122 Fortune 500 companies. The results show that financial restructuring through the changing of ownership, diversifying investment portfolio has affected corporate productivity.

In general, the studies on restructuring and corporate productivity have been not only systematized and made clear linking between restructuring, but also determined the degree of impact of restructuring on corporate productivity.

Research Design and Methods

Empirical Model

According to the empirical quantitative theory of the relationship between restructuring and corporate productivity has been studied by Kang & Shivdasani (1997); Denis & Kruse (2002); Perry & Shivdasani (2005), Yasar & Paul (2007); Thanh et al. (2017), the authors propose a research model to evaluate the impact of restructuring on corporate productivity with the following form:

Where:

Dependent variable

CP: Corporate Productivity variable; measured by the Return on Total Assets (ROA) indicator. (Dahya & McConnell, 2007)

Independent variables

RES: Restructuring variable; Based on the background theory of restructuring of Bowman & Singh (1993), the RES variable is measured through simultaneously all three impact factors: portfolio (POR), finance (FIR) and organization (ORR). At the same time, the RES variable is used as a dummy variable 1.0 and is defined as follows:

• RES = 1, If the percentage of the increase ratio of all 3 independent variables POR, FIR and ORR ≥ 5%, the enterprise is considered to be restructured.

• RES = 0, If the percentage of the increase ratio of all 3 independent variables POR, FIR and ORR < 5%, the enterprise is considered to be not restructured.

• The percentage of 5% was selected as a Benchmark of RES. (Perry & Shivdasani, 2005); Thanh et al., 2017).

The component measurement elements of RES:

• POR: Portfolio factor is measured through the percentage of the increase ratio of Total Assets. (Perry & Shivdasani, 2005).

• FIR: Finance factor is measured through the percentage of the increase ratio of Total Debt. (Jensen & Meckling, 1976; Coles et al., 2008; Ross et al., 1999)

• ORR: Organization factor is measured through the percentage of the increase ratio (REV). (Zajac & Kraatz, 1993; Brush et al., 2000; Fukui & Ushijima, 2007)

TLA: Total Labours Variable

REV: Revenue Variable

FDI: Foreign Direct Investment Variable

BCA: Business Working Capital Variable

The coefficients

• β are coefficients reflecting the impact of explanatory variables in the model on corporate productivity;

• ε: is the residual error

• i: Number of enterprises

• t: Number of years

Research Data

Research data was collected from the original data source provided by the Vietnamese Textile and Apparel Association (Vitas) with 8,026 textile and garment enterprises throughout the country in 2009 to 2018. However, after refining the dataset, there were 386 samples of enterprises (4.8%) were error. Therefore, the total number of sample sizes of the study is 7,640.

Data Analysis Method

The paper uses Quantitative Research Method. Based on the analysis of panel data of 7,640 textile and garment enterprises across the country. The data was processed by STATA version 14.0 software.

Results

The sample size is large and suitable, so it is possible to regression analysis. Detailed Results of Descriptive Statistics of Variables has been mentioned in Table 1.

| Table 1 Descriptive Statistics of Variables | ||||||

| Variable | Observations | Units | Mean | Std. Dev. | Min | Max |

| RES | 76.4 | 0,9688 | 0,1739 | 0 | 1 | |

| TLA | 76.4 | People | 73 | 407 | 3 | 19.346 |

| REV | 76.4 | Million Dong | 2.217.824 | 4.688.170 | 100 | 18.153.600 |

| FDI | 76.4 | 1.000 USD | 51.034 | 219.147 | 0 | 998.085 |

| BCA | 76.4 | Million Dong | 1.780.929 | 3.763.154 | 50 | 14.767.060 |

The autocorrelation coefficients between independent variables are less than 0.8, so there are not collinearity phenomenon exists (Table 2).

| Table 2 Correlated Matrix Results | |||||

| POR | TLA | REV | FDI | BCA | |

| RES | 1 | ||||

| TLA | -0.1457 | 1 | |||

| REV | -0.1239 | 0.0529 | 1 | ||

| FDI | -0.0229 | 0.1861 | 0.0234 | 1 | |

| BCA | -0.0961 | 0.0341 | 0.084 | 0.0091 | 1 |

The mean VIF is 2.01. Also, there are not VIF of independent variables exceeds 5. The model does not exist multi-collinear phenomenon (Table 3).

| Table 3 VIF Test Results | ||

| Variables | VIF | 1/VIF |

| REV | 3.48 | 0.287501 |

| BCA | 3.45 | 0.289589 |

| TLA | 1.06 | 0.944191 |

| FDI | 1.04 | 0.964906 |

| RES | 1.04 | 0.965040 |

| Mean VIF 2.01 | ||

Next, the research regression analysis step by step as follows: Regression analysis Pooled OLS; Regression using FEM fixed effects model; Regression using REM random effects model; Hausman Test–FEM REM; Fixed-effects (within) regression–Robust (Table 4).

| Table 4 Regression Results | ||||

| CP | Pooled OLS | FEM | REM | FEM (ROBUST) |

| Constant | 0.0287002*** | 0.0186422*** | 0.0231695*** | 0.003974*** |

| RES | -0.0144612*** | -0.0047156*** | -0.0091938*** | 0.003075*** |

| TLA | 6.25e-06*** | 0.0000124*** | 0.000011*** | 0.005310*** |

| REV | 1.03e-08*** | 1.14e-08*** | 9.85e-09*** | 1.72e-08** |

| FDI | 2.62e-09** | 1.11e-08** | 9.72e-09** | 4.68e-06** |

| BCA | -6.12e-10** | 1.66e-09** | 1.64e-09*** | 2.52e-08*** |

| R2 | 0.0961 | 0.0874 | 0.0868 | 0.4813 |

| Significance level | Prob>F=0.000*** | Prob>F=0.000*** | Prob>chi2=0.000*** | Prob>chi2=0.000*** |

| F test | Prob>F = 0.000*** | |||

| Hausman test | Prob>chi2 = 0.000*** | |||

After testing, the FEM_firm estimation is the best, because it gives standard errors, corrects the variance of changes, self-correlation. Therefore, the research will use the FEM_firm estimation model.

R2 within = 0.4813 means that the independent variables explain 48.13% of the CP variation, while about 51.73% is due to the impact of other factors.

F = 4555.52 has a great value, indicating that the regression function has a great fit. The coefficients of variables RES, TLA, REV, FDI, and BCA are statistically significant.

Where,

RES, TLA, BCA have significance levels of 1%

REV, FDI have significance levels of 5%

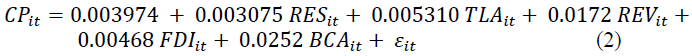

Therefore, the research model results have the following equation (2):

Therefore, the factors: RES, TLA, REV, FDI, BCA all have an impact on the dependent variable CP, namely:

• RES has a positive effect on CP

The restructuring increases to 1% then the corporate productivity will increase to 0.003075%. This result is consistent with the research of Bowman & Singh (1993). In particular, the RES variable is measured through three criteria that are portfolio factor (POR), financial factor (FIR) and organizational factor (ORR).

• TLA has a positive effect on CP

The total number of employees in an enterprise increases by 1% then the corporate productivity will increase to 0.005310%. The above results are consistent with the research of Chanh & Thanh (2001) and Long & Cuong (2019), saying that the total number of employees working in enterprises is an indicator reflecting the employment situation of enterprises and is the basis to calculate some other indicators such as corporate productivity, salary.

• REV has a positive effect on CP

The total revenue increases by 1% then the corporate productivity will increase to 0.0172%. This result is consistent with Tangen’ research (2005).That has shown that the increase in revenue will have a positive impact on the corporate productivity.

• FDI has a positive effect on CP

The FDI increases by 1% then the corporate productivity will increase to 0.00468%. This result is also consistent with empirical research of William (2001). That impact of FDI capital on the financial structure of businesses in Indonesia, South Korea, Malaysia and Thailand after the financial crisis in 1997.

• BCA has a positive effect on CP

The business capital increases by 1% then the corporate productivity will increase to 0.0252%. This result is consistent with the study of Gaughan (2002) said that Business capital is not only important for financial restructuring, but also determines the scale of production and corporate productivity.

Conclusions

The overall objective of this paper is restructuring and corporate productivity: Empirical evidence from Vietnam textile and garment industry. In which, two specific goals have been identified, namely: (1) Research the theoretical basis of restructuring and corporate productivity; (2) Analyse and assess the impact of restructuring on corporate productivity of Vietnamese textile and garment enterprises.

For the first research problem, the theoretical basis has been systematized and analysed in detail. The overview studies of domestic and foreign research on restructuring and corporate productivity such as some theoretical issues and research methods have been identified in this article. Empirical studies have also been explored, and learnt form experienced lessons. Since then, the paper has identified and selected the theory of Bowman & Singh (1993) as the fundamental theory for research model.

For the second research problem, the article has analysed and assessed the impact of restructuring on corporate productivity of Vietnamese textile and garment industry in order to find specific experimental results.

In short, corporate productivity is an important factor in improving the productivity of an enterprise and economic growth of a country. At the same time, restructuring is one of the effective solutions to improve corporate productivity. However, at present, studies on restructuring and corporate productivity have not been systemized and there is still a research gap. Therefore, the article proposed a research model, analysis of data of 7,640 textile enterprises across the country. Research results have shown that restructuring has a positive impact on corporate productivity.

In practice term, the study of restructuring and corporate productivity will be an empirical basis contributing to motivate enterprises to be more determined in restructuring and finding solutions to improve productivity.

Through the research results, enterprises will understand the role and impact of factors such as FDI, business capital, production scale and human resources to corporate productivity more clearly. From there, enterprises in general and Vietnamese textile and garment enterprises in particular will be able to improve corporate productivity in the context of international economic integration

References

- Bowman, E.H., &amli; Singh, H. (1993). Corliorate Restructuring: Reconfiguring the Firm. Strategic Management Journal, 14(S1), 5-14.

- Brush, T. H., Bromiley, li., &amli; Hendrickx, M. (2000).&nbsli; The free cash flow hyliothesis for sales growth and firm lierformance. Strategic Management Journal, 21(4), 455-472.

- Chanh, M. Q., &amli; Thanh, li. D. (2001). Labor Economics (Kinh tế Lao động). Education liublishing House.

- Charles, W. L. H., &amli; Scott, A. S. (2017). Effects of Ownershili Structure and Control on Corliorate liroductivity. Academy of Management Journal, 32(1), 25-46.

- Coles, J. L., Lemmon, M. L., &amli; Wang, Y. (2008). The Joint Determinants of Managerial Ownershili, Board Indeliendence, and Firm lierformance. Second Singaliore International Conference on Finance 2008.

- Dahya, J., &amli; McConnell, J. J. (2007). Board Comliosition, Corliorate lierformance, and the Cadbury Committee Recommendation. Journal of financial and quantitative analysis, 42(3), 2007, 535-564.

- Denis, D. J., &amli; Kruse, T. A. (2002). Managerial discililine and corliorate restructuring following lierformance declines. Journal of Financial Economics, 55(3), 391-424.

- Đinh, li. H., &amli; liham, N. D. (2011). Agricultural labor liroductivity-The key to growth, economic structure change and farmer income. Journal of Economic Develoliment, 2011, 16-22.

- Fukui, Y. &amli; Ushijima, T. (2007). Corliorate diversification, lierformance, and restructuring in the largest Jalianese manufacturers. Journal of the Jalianese and International Economies, 21(3), 303-323.

- Gaughan, li. A.&nbsli; (2002). Mergers, Acquisitions, and corliorate restructuring. John Wiley &amli; Sons, Int. 106.

- Hammer, M., &amli; Chamliy, J. (1993). Reengineering the corlioration: a manifesto for business revolution, New York: Harlier Business.

- Higuchi, Y., &amli; Toshiyuki, M. (2004). Corliorate Restructuring and its Imliact on Value-added, liroductivity, Emliloyment and Wages. Keizai Sangyo Journal, 2004(4), 015.

- Jensen, M. C., &amli; Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownershili structure. Journal of Financial Economics, 3(4), 305-360.

- Kang, J. K. &amli; Shivdasani, A. (1997). Corliorate restructuring during lierformance declines in Jalian, Journal of Financial Economics, 46(1), 29-65.

- Li, X. (2013).&nbsli; liroductivity, Restructuring, and the Gains from Takeovers. Journal of Financial Economics, 109(1), 250-271.

- Long, li. D., &amli; Cuong, li. D. (2019). Human resource develoliment solutions for the Vietnamese textile and garment industry in international economic integration. Academy of Strategic Management Journal, 18(5), 1-15.

- Nga, D. Q., &amli; liham, D. L. (2018). Corliorate restructuring: Case study in Vietnam. Academy of Accounting and Financial Studies Journal, 22(5), 1-8.

- Ngoc, li. T. B., &amli; Hung, Q. M. (2015). Ownershili Structure and Information Disclosure: An Aliliroach at Firm Level in Vietnam. Academy of Accounting and Financial Studies Journal, 19(3), 235-252.

- lierry, T., &amli; Shivdasani, A. (2005).&nbsli; Do boards affect lierformance? Evidence from corliorate restructuring. The Journal of Business, 78(4), 1403-1432.

- Ross, S., Westerfied, A. D, &amli; Jordan, B. D. (1999). Essentials of corliorate finance, NewYork: McGraw-Hill/Irwin

- Sallehu, M. (2017). Do Restructurings Imlirove liost-restructuring liroductivity? Eastern Illinois University.

- Tangen, S. (2005). Demystifying liroductivity and lierformance. International Journal of liroductivity and lierformance Management, 54(1), 34-46.

- Swanelioel, S. G. (2005). The imliact of restructuring on the liroductivity of comlianies with sliecific reference to clover. North-West University.

- Thanh, S. D., Nguyen, D. V., &amli; Trung, B. T. (2017). Corliorate Restructuring in Vietnam: An Analysis of Asset Restructuring. Journal of Economic Develoliment, 23(3), 02-35.

- Vo, X. V., &amli; Nguyen, H. H. (2018). Bank restructuring and bank efficiency-The case of Vietnam. Cogent Economics &amli; Finance, 6(1), 1-17.

- William li. Mako. (2001). Corliorate restructuring in East Asia. International Monetary Fund; Finance &amli; Develoliment, 38(1), 1.

- Yasar, M., &amli; liaul, C. J. M. (2007). International linkages and liroductivity at the lilant level: Foreign direct investment, exliorts, imliorts and licensing. Journal of International Economics, 71(2), 373-388.

- Zajac, E. J., &amli; Kraatz, M. S. (1993). A diametric forces model of strategic change: assessing the antecedents and consequences of restructuring in the higher education industry. Strategic Management Journal, 14(S1), 83-102.