Research Article: 2022 Vol: 26 Issue: 2S

Re-Thinking the working capital management and financial performance practices for Bigbend planters group grower firms, Eswatini

Thulsile P. Nkambule, University of Eswatini

Herrison Matsongoni, University of Eswatini

Emmanuel Mutambara, University of Kwazulu Natal

Citation Information: Nkambule, T.P., Matsongoni, H., & Mutambara, E. (2022). Re-thinking the working capital management and financial performance practices for bigbend planters group grower firms, Eswatini. Accounting and Financial Studies Journal, 26(S2), 1- 17.

Keywords

Working Capital Management, Financial Performance, Inventory Management, Cash Management, Receivables Management, Payables Management

Jel Codes

M41, D24, E61, L25

Abstract

Grower firms in the Eswatini contribute to sugar production which is 59% of the country’s agricultural input. Sugar production contributes about US$285 million to the country’s Gross Domestic Product (GDP). This great contribution to the economy requires grower firms to ensure liquidity at all times through working capital management. Prior evidence has indicated a relationship between working capital and financial performance. Therefore, this study seeks to rethink the working capital and financial performance practices by assessing the working capital management and financial performance by using a population of 86 grower firms from the Big Bend Planters group for the period 2014 - 2018 using both primary and secondary data. Financial performance was measured in terms of profitability by return on assets and return on investment capital as dependent variables. The working capital management was determined by cash management, inventory management, accounts receivable management and accounts payable management as independent variables. Data collected was analyzed using the Statistical Package for Social Sciences (SPSS) version 20 with the mean, standard deviation, Pearson correlation analysis and regression analysis as statistical tools. The findings from the study indicated that there is a positive relationship between working capital management and financial performance of firms. To enhance profitability, firms need to effectively manage their working capital. The study concluded that businesses collapse due to the inefficient management of working capital, therefore financial managers should employ sound working capital management strategies to optimize financial performance.

Introduction

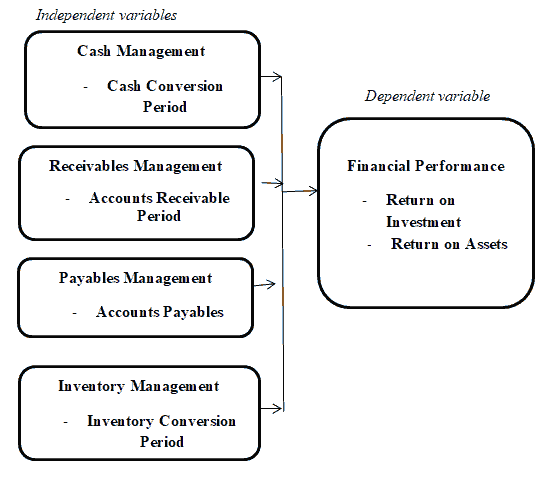

Working capital management, which deals with the management of current assets and current liabilities, is very important in finance because it directly affects financial performance of firms (Zariyawati, Hirnissa & Diana – Rose, 2017). One of the core elements for the successful existence of any business is efficient management of working capital. Working capital is basically an indicative of the underlying short-term health of an organization, through its ability to meet current operating objectives (Afrifa & Tingbani, 2018). Working capital management is composed of cash management, receivables management, payables management and inventory management.

Working capital management decisions are very important, and must be strategic because they affect profitability and firm value. Working capital management involves adequately managing current assets and current liabilities of a firm. Current assets are cash and cash equivalents, inventory, and receivables, while current liabilities are payables of a firm (Afrifa & Tingbani, 2018).

Managing an efficient and effective working capital needs proper planning and control of a firm’s current assets and current liabilities in such a way that it will reduce the incapability risk of meeting short term commitments in one hand, and the avoidance of investing excess in the assets on the other hand (Peter & Nelson, 2019).

Financial managers of every firm must try to understand the meaning of current assets and current liabilities, for them to learn the meaning of working capital, and to understand why they need to effectively manage working capital (Sadiq, 2017). Current assets have a short life span, these assets are engaged in current operation of a business, and are normally used for short-term operations of the firm during an accounting period i.e., within twelve months (Zariyawati, Hirnisa & Diana- Rose, 2017).

Pujare (2017) defines current assets as assets that can be converted into cash within a period of a year, and current liabilities that can be disposed of within a period of a year. Current assets include cash, inventory, and receivables yet current liabilities in working capital include accounts payables. According to Kiptoo (2017), a firm creates a current liability towards its creditors from whom it purchases raw materials, and the purchases are on credit. This liability is known as accounts payable, and it is shown in the firm’s balance sheet until payment is made in full to the creditor (Pujare, 2017). The obligations which are normally expected to mature for payment within an accounting cycle are referred to as current liabilities.

An investigation on working capital management and financial performance by Kiptoo (2017) highlights that management of a firm has a dual interest in the analysis of financial performance, so that they can assess the efficiency and profitability of operations, and further to judge how effectively the business resources are being employed. In modern financial management, administration of working capital is an important and challenging task due to high proportion of working capital in a business, and some of its peculiar characteristics (Altaf & Shah, 2017). The management of current assets (normally converted into cash within a financial period, normally a year) and current liabilities (generally discharged within a year) and the interrelationship that exists between them may be termed as working capital management (Yakubu, Alhassan & Fusein, 2017).

Excessive levels of current assets may result to a negative effect on a firm’s performance and thus profitability. On another note, a low level of current assets may lead to lower level of liquidity and stock outs which can result to difficulties in maintaining smooth business operations (Iraj, Mubeen & Sarwat, 2019).

Dissanyake & Mendis (2019) highlight that traditionally; the concept of working capital is the difference between current assets and current liabilities. Therefore working capital management is an attempt to manage and control current assets and current liabilities to maximize proper level of liquidity in a business, and profitability as well.

In their assessment, Simon, Sawandi & Abdul–Hamid (2017) argue that working capital is one of the vital issues that must be seriously considered before making a financial decision. This is because working capital is an integral part of the investment and has a direct effect on the liquidity, and performance of a firm. Working capital mitigates financial challenges of a firm by providing liquidity on a continuous basis for firms to finance their operational activities (Simon et al., 2017). Firms that converge to an optimal level of working capital policy – either by increasing or decreasing their investment in working capital, improve their stock and operating performance (Aktas, Croci & Petmezas, 2015).

Al-Mawsheki, Ahmad & Nordin (2019) define working capital management as means in which a firm manages its money for day to day operations, as well as any immediate debt obligations. It is a way the firm manages the relationship between assets and liabilities in the short term. The firm has to manage accounts receivable and payable, inventory and cash.

Al-Mawsheki, et al., (2019) affirms to the fact that every running business needs working capital. Even a business which is fully equipped with all types of fixed assets required is bound to collapse without (i) adequate supply of raw materials for processing; (ii) cash to pay wages and other costs; (iii) creating a stock of finished goods to supply the market regularly; and (iv) the ability to collect earlier from customers.

Furthermore, companies’ free cash flow is increased by managing an efficient and effective working capital, which has a positive influence on shareholders’ wealth and the firm’s growth opportunity (Fatimatuzzahra & Kusumastuti, 2016).

Kaleem (2015) argues that optimal management of working capital is an important financial decision and contributes positively to the value creation of business. Working capital can be categorized as funds needed to carry out the day to day operations of the business smoothly. Working capital is as important as long term financial investment. Its concern is basically maintaining liquidity in the business and smooth running of day to day operations and to meet its financial obligations (Kaleem, 2015).

According to Pakdel & Ashrafi (2019), inefficient management of current assets and current liabilities would not only result in negative impact of profitability and firm’s growth, but also to financial distress and bankrupt of the business. This study, considering the significance of the above shall make an attempt to analyze how cane growers manage their working capital in relation to their profitability. It will cover limitation of knowledge, and outline how the selected business type can embark and improve their working capital management. The study was guided by the following objectives;

• To determine the effect of cash management on firm financial performance for cane growers in Eswatini.

• To assess the effect of inventory management on firm financial performance for cane growers in Eswatini.

• To examine the effect of receivable management on firm financial performance for cane growers in Eswatini.

• To establish the effect of payables management on firm financial performance for cane growers in Eswatini.

Literature Review

An Overview of Financial Management

Traditionally, Finance is defined as the study of funds management and the directing of these funds in order to achieve financial objectives (Mengesha, 2014). The unique objective of good financial management is to maximize returns in association with minimized financial risk. Maximizing returns and managing risk occurs simultaneously (Altaf & Shah, 2017). In financial management it is extremely important to understand the business objectives and financial functions before recognizing the major component that is short-term financing or working capital management relative to the day-to-day operations of the business (Altaf & Shah, 2017).

Financial management in firms operates according to problems and opportunities. Financial managers primarily rely on firm trade credit policy, bank financing, personal financial contributions, operating financing and lease financing (Abdul-Hamid, Sawandi & Simon, 2018). One of the major financial challenges faced by firms is the deployment of current assets and current liabilities which are critical components of working capital management. The primary cause of a business failure is the poor control and management of working capital components. This means the finance manager of a firm must be alert to the level of working capital changes (Abdul-Hamid et al, 2018). The conceptual model on Figure 1 illustrates the critical portion of the financial management components for this study. The focus is on the operating cycle and the main components of working capital; cash, receivables, payables and inventory.

The Nature and Purpose of Working Capital

According to Ketema (2018), working capital is the net investment as a result of business in commissioning current assets (assets that include cash, accounts receivables and inventories) and commissioning current liabilities (accounts payables). Working capital management is basically managing current resources as well as current liabilities (Zariyawati, Hirnisa & Diana-Rose, 2017). The management of working capital is very crucial in financial performance of firms. Traditionally, the study of finance looks at funds management in a direction which will ensure achievement of specific objectives such as returns on capital investment (Zariyawati et al., 2017). The utilization of such capital is key; one determinant of this utilization is the identification of the business objectives and its financial functions of working capital management (Zariwati et al., 2017).

According to Baba, Fatima & Abdulrahaman (2018) the level of current assets and current liabilities vary from firm to firm depending on the nature of the business, production requirements and market conditions. Firms from manufacturing industries invest largely on inventories such as raw materials, work in progress and finished goods. These are day-to-day activities of manufacturing firms. They normally buy goods on credit and sell finished goods on credit, causing a rise in the firms’ receivables and payables respectively.

Working capital is the most critical component of a business and guarantees the health of the business if it is managed effectively, efficiently and consistently. Working capital further ensures that a firm has adequate cash flow for its short term debt obligations and operating outflows (Kabuye, Kato, Akugizibwe & Bugambiro, 2019).

A few researchers such as Korent & Orsag (2018); Nobane (2018); Kasozi (2017); recognized the significance of working capital management to the profitability of a firm. It was noted that aggressive liquidity management promotes operating performance and is typically associated with higher corporate values. Looking at factors like corporate viability, performance and sustainability, and competitive, the element of working capital cannot be disputed in the management of business (Kaleem, 2015).

With reference to cash, receivables, payables and inventory the level of management is very important to the viability of a business (Kaleem, 2015). Kabuye, et al., (2019) describes working capital management as an important aspect of overall financial management. In this instance it is of great necessity to separate working capital management from financial decisions and fundamental investment. Poor managerial decisions on working capital management affect the financial health of an organization, and good management on the other hand is important in effective utilization of working capital (Korent & Orsag, 2018).

Objectives of Working Capital Management

Working capital management is an important area of financial management in every business function in that it deals with the administration of the liquidity components of a firm’s short term current assets and current liabilities (Bruna, 2019; Iraj, Mubeen & Sarwat, 2019; Aktas, Croci & Petmezas, 2015). The most important current assets are cash, accounts receivables and inventory, meanwhile current liabilities is mainly account payables (Peter & Nelson, 2019). Sadiq (2017) explains that effectively managing the components of working capital creates company value by way of; less dependence on external funding sources, freeing up cash for further investments, reduction in capital employed, and increase in asset productivity.

Significance of Adequate Working Capital

Working capital is regarded as the lifeblood of every organization, it is very essential for a smooth operation of a business (Sathish, 2020). A firm can exist and survive without making profit, but it cannot survive without working capital funds simply because it doesn’t have a life, there is no ‘blood circulation’ in the business (Nobane, 2018). Manufacturing firms which are fully equipped are sure to collapse if they do not have; adequate supply of raw materials to process into finished goods, adequate cash to meet the wage bill, the ability to grant credit to its customers and the capacity to wait for the market for its finished products (Sathish, 2020). According to Peter & Nelson (2019); there are several advantages of maintaining adequate working capital; regular supply of raw materials, regular payment of day-to-day commitments, solvency of the business, increased goodwill, exploitation of Favorable Market Conditions, ability to face crisis.

Dangers of Excess or Insufficient Working Capital

According to Ketema (2018) excess working capital is an indication that a firm is unnecessarily holding inventory, have an imperfect credit policy which then results to an ineffective collective period. This may cause higher incidence of bad debts. Redundant working capital may lead to unnecessary purchasing of inventory; this accumulation of inventory may result in high theft opportunities, thereby increasing waste and loses. Excessive working capital means that there will be idle funds which are not earning any profits for the business, and the business cannot earn proper or expected rate of return on investment (Ketema, 2018).

On another note, insufficient working capital is a concern because a company cannot pay its short term liabilities on time (Sathish, 2020). This can lead to bad company reputation and the company cannot get good credit facilities. With insufficient working capital, a company cannot finance its day-to-day operations. It is therefore important to have an optimum quantity of working capital to run a business. This means working capital should neither be more nor less than the amount actually needed by the business. Many times businesses do not fail because they do not make profits but they fail because of insufficient funds to run its day-to-day operations (Sathish, 2020).

Factors Determining Working Capital Requirements

According to Moussa (2019), the working capital need of a business depends greatly on its nature and size. Firms with large scale operations need more working capital as compared to the ones with small scale operations. Large firms are expected to have greater investment in working capital due to their huge day-to-day operations (Moussa, 2019). Empirically there exist studies that support this; Fatimatuzzara & Kusumastuti (2016); Lyngstadaas & Berg (2016). Considering various business types; trading firms require less amount of money to be invested in fixed assets. In contrast retail firms must keep a large quantity of inventory to meet the diversified and continuous needs of customers (Ketema, 2018).

During the boom phase of the business cycle, businesses typically tend to expand thereby requiring additional working capital (Moussa, 2019). These periods of increased business activity require additional funds to meet the time lag between collection and sales. Furthermore, at boom phase funds are needed to purchase the additional raw materials needed to produce additional goods for increased sales (Moussa, 2019). Moussa (2019) continues to add that there is lesser demand of working capital in depression periods, since there is a decline in production and sales.

As explained by Nurein (2014), production cycle is the time difference between the conversions of raw materials into finished goods ready for sale. A business’s production cycle has an impact to the working capital required. Businesses with longer production cycles need more working capital (Moussa, 2019).

In view of seasonal fluctuations, Moussa (2019) found that some businesses are seasonal in nature, meaning there is a high demand for their goods in specific times of the year. Working capital demand is high during the specific time in the year when their goods are in demand (Moussa, 2019).

Another important factor that determines the amount of working capital requirements relates to the terms of credit allowed to customers (Moussa, 2019; Bolarinwa, 2015). For instance a firm can allow 15 days credit yet another may allow 60 days. The shorter the credit days allowed to customers the more the firms’ receivables are improved, as cash is collected over a short period of time.

The model variables for the research are conceptualized on figure 1 below;

Methodology

The study employed a quantitative approach of research was followed to answer the main research question and the specific objectives as well. It was considered an appropriate approach for this study because the research data input and output are in the form of quantitative data (numerical data). Numerical data will be obtained from financial statements.

A descriptive analysis was adopted for the study, where information about the level of working capital management was acquired from cane grower firms in Eswatini. The adopted descriptive research design is fundamental for objective analysis owing to timing similarity as recommended by Creswell & Creswell (2017). The adopted research design also enables the identification and exposure of the relationship between the independent and dependent variables. The uniqueness of each grower firm was also considered as each firm was expected to employ different working capital management procedures. For each sub-research question, summary of key statistics, frequency counts, and statistical assessments will be undertaken.

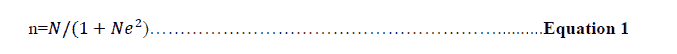

This study is based on a population of Eighty Six (86) grower firms from the Big Bend planters group. These grower firms supply the Ubombo Sugar Mill. From this population, the Stratified random sampling was adopted in choosing the sample for this study. This strategy was appropriate for the study because cane growers in the Big Bend Planters group are grouped into four geographical sections. To come up with an adequate sample size relative to the research objectives, Slovin’s formula was used, as shown in equation 2. The Slovin’s formula requires that the researcher determines the confidence level so that a margin of error can be calculated (Policarpio, 2018). For this research the confidence level was determined to be 95%, therefore the margin of error becomes 5%.

Where n is the sample size, N is the total population and e is the error margin – in this case it is 5%.

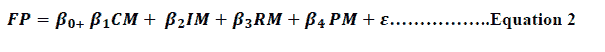

The study used both primary and secondary sources of data. Self-administered structured questionnaire were used to collect primary data. The secondary data was collected from financial statements of grower firms. To establish the relationship between the independent and the dependent variables, a multiple linear regression model was used as denoted by equation 3

The study sought to determine the reliability of the research instrument, and the Cronbach’s alpha coefficients for the different items shown in Table 1. The results were between 0.717 and 0.879. The instruments therefore met the threshold value of 0.7 recommended by Morrison (2019) therefore they were reliable.

| Table 1 Cronbach Alpha For Reliability Assessments |

||

|---|---|---|

| Variables | Number of items | Cronbach Alpha Values |

| Cash Management Statement | 6 | 0.717 |

| Accounts Receivable Management Statement | 6 | 0.817 |

| Accounts Payable Management Statement | 6 | 0.843 |

| Inventory Management Statement | 7 | 0.879 |

| Financial Performance Statement | 3 | 0.729 |

Research Findings and Discussion

Descriptive Statistics

The main objective of the study was to assess the working capital management and financial performance practices of cane growing firms from the Big Bend Planters Group of Eswatini. As such the study sought to establish the level of respondents’ agreement to a given aspects of working capital management components as they affect financial performance of firms. A scale of 5 to 1 was provided, where 5 is Strongly Agree, 4 is Agree, 3 is Neutral, 2 is Disagree and 1 is Strongly Disagree.

Cash Management Aspects as Affecting Financial Performance of a Firm

The results reveal that a majority of the respondents were in agreement with the all the aspects of cash management as affecting financial performance of a grower firm. Worth noting is that it was evident that a majority of the firms prepare cash budgets that enable the firms to maintain optimal amount of cash that will meet the operation of the firm, 77.5% of the respondents were in agreement with the statement (mean=4.47, std.dev=0.786). It was further revealed that most of the firms use their cash flow predictions for proper financial planning, 89.7% of the respondents were in agreement with this statement (mean=4.46, std.dev=0.640).

The findings further reveal that the grower firms regularly review their cash budgets in order to meet unexpected demands which might have been unforeseen during budgeting time (100%), mean 4.45, std. dev 0.501. Such unexpected demands could include delays by customers to pay their obligations or an increase in product demand which requires more resources and cash is needed to acquire those resources. Firms should make it a point that optimal cash balance is set to ensure adequate liquidity is maintained at all times. The study revealed that most of the respondents agree to the statement (86%), mean=4.45, std dev. 0.501.

At a given period every firm is expected to maintain a set level of cash balance which must be sufficient daily cash requirements that include payment of bills or any possible investment. Furthermore, a firm must be able to predict any cash required or cash generated so that they can know when to borrow more cash or when to invest extra cash. These findings are in agreement with findings from a study by Wang, Akbar & Akbar (2020) which revealed that when a firm puts in place a cash balance policy it ensures proper cash budgeting and investment of any surplus cash. Findings from a study by Nobane (2018) stated that a firm’s cash receipts and cash payments will determine the firm’s ability to generate profits and continue their operation.

Accounts Receivables Management Aspects as Affecting Financial Performance of a Firm

The study sought to establish the extent to which the respondents agreed with a given aspects of accounts receivable management as it affects financial performance of a firm.

The results revealed that a majority of the grower firms put in place receivables policies to enable a firm to regulate the credit allowed and recovery of debtors, where 97.1% were in agreement of the statement (mean=4.51, std. dev 0.655). It was revealed that most of the firms monitor accounts receivables to ensure timely recovery of debt by reducing the length of credit period granted to customer. Moreover, the results revealed that most of the firms avoid delaying cash collection from company debtors as the delay negatively affects the financial performance of the firms, 97.3% of the respondents agreed to the statement (mean=4.61, std. dev 0.640). This means the firms allow a shorter credit period to customers to avoid instances of running out of cash inflow which can direct them borrowing unnecessarily.

The findings reveal that every firm needs to establish a receivables policy that will guide in offering credit facilities to customers. The receivables policy will help the firm with a strategy of granting credit to customers. Once credit is offered to customers a firm needs to monitor collections from customers. This will help in making sure that customers pay as per the agreements, and those customers that do not comply are noted and necessary actions are taken to recover debt. The firms should also consider giving customers longer payment periods to encourage customers to buy in bulk thereby increasing the sales volumes.

Accounts Payables Management Aspects as Affecting Financial Performance of a Firm

The study sought to establish the extent to which the respondents agreed with a given aspects of accounts receivable management as it affects financial performance of a firm. Table 16 presents the results.

It was found in the study that a majority of the firms establish credit policies which enable firms to avoid liquidity risk, 87.5% of the respondents agreed to the statement (mean=4.47, std. dev 0.786). It was evident that most of the grower firms’ review their credit policies are reviewed to ensure optimal credit is maintained at all times, 90.2% of the respondents agreed to the statement (mean 4.47, std. dev 0.670). It was further revealed in the study that firms avoid delaying payments to company creditors unnecessarily, this is to ensure that supplies are not delayed which can negatively impact on the financial performance of the grower firms, 97.2% of the respondents agreed to the statement (mean=4.61 std. dev 0.641)

The findings from the study indicate that it is important to manage payables as they determine financial performance of grower firms. Grower firms should establish credit policies which must be reviewed regularly to ensure optimal credit is maintained at all times and to avoid liquidity risk. Firms should avoid delaying payments to suppliers as that can lead to poor financial performance of the firm. This is due to that production will be disturbed and that can result to shortage of goods demanded in the market.

Inventory Management Aspects as Affecting Financial Performance of a Firm

The study established that a majority of the firms are aware that the management of inventory is important for increasing the financial performance of grower firms, 97.2% of the respondents agreed to the statement (mean=4.30, std. dev 0.521). The study revealed that most of the grower firms prepare inventory budgets to ensure that adequate inventory is available for smooth operation of the firms, 87.5% of the respondents agreed to the statement (mean=4.51, std. dev=0.855). It was evident that the grower firms do establish inventory management policies whose objectives is to gain quantity discounts and to achieve efficient production, 97.2% of the respondents agreed to the statement (mean=4.61, std.dev=0.612). The study further revealed that most of the grower firms avoid stock outs of inventory at all times because they result to inefficient production, 93.1% agreed to the statement (mean=4.36, std. dev=0.612).

The findings from the study further indicate that firms must manage inventory so that financial performance is ensured. To ensure that adequate inventory is available for smooth operation of the firms they must prepare inventory budgets. Firms need to establish inventory management policies with the main objective being to gain quantity discounts and to achieve efficient production. Firms should avoid stock at all times, stock outs result to inefficient production which then has a negative impact on financial performance.

Working Capital Management Aspects as Affecting Financial Performance of a Firm

Findings from the study indicate that most of the grower firms practice proper working capital management to ensure high rate of return on assets of their firms, 91.7% of the respondents agreed to the statement (mean=4.56, std. dev=0.646). It was evident that majority of the grower firms increase their revenue by employing sound working capital management practices, 97.3% of the respondents agreed to the statement (mean=4.61, std. dev=0.640). The grower firms efficiently manage their working capital to improve their net profit.

Correlation Analysis

The study undertook Pearson correlation to ascertain the relationship and strength of association between the dependent and independent variables. This correlation enabled the study to establish the variable that best explains the evaluation of working capital management and financial performance of grower firms in Eswatini.

Correlation between Cash Management and Financial Performance

The results indicated that there is a positive linear relationship between cash management and financial performance of grower firms (r=0.381, p<0.01). The results give an implication that if grower firms can increase the time interval between purchasing of input materials and the collection and receiving of cash from sale of finished goods their financial performance will increase. This implies that the length of credit period to customers must be reduced.

Investigating the quadratic relationship between working capital management and firm performance, Simon, et al., (2017) concluded that the cash conversion cycle has a quadratic relationship with firm financial performance. Emphasis is on the less credit period granted to customers and effective collection from company debtors. as shows in Table 2.

| Table 2 Correlation Between Cash Management And Financial Performance |

||

|---|---|---|

| Financial Performance | ||

| Cash Management | Pearson Correlation | 0.381** |

| Sig. (2-tailed) | 0.001 | |

| N | 72 | |

Correlation between Accounts Receivables Management and Financial Performance

Table 3 presents the results of a linear relationship between receivables and financial performance of a firm. The results indicate that there is a negative correlation between receivables and financial performance (r= -0.384, p<0.01). This implies that the more receivables remain unpaid will lead to reduction in profitability. This is because there will be no cash inflow from sales to fund the day-to-day operations of the business. The higher the accounts receivable period, the less profitable firms become.

| Table 3 Correlation Between Receivables Management And Financial Performance |

||

|---|---|---|

| Financial Performance | ||

| Receivables Management | Pearson Correlation | -0.384** |

| Sig. (2-tailed) | 0.001 | |

| N | 72 | |

Studying the impact of working capital management on firm’s performance Ketema (2018) agrees with this study, where it was found that receivables have a negative correlation with firm performance. It was concluded that firms should keep accounts receivable period low by reviewing credit granted to customers frequently.

Correlation between Accounts Payables Management and Financial Performance

Table 4 presents the correlation between payables and financial performance and indicates that a strong and significant positive relationship between payables and financial performance (r=0.944, p<0.01). This mean that the longer it takes a firm to pay its creditors results an increase in financial performance and vice-versa.

The findings of this study are consistent with findings of a study by Wanyoike (2015) which concluded that there is highly significant positive relationship between payables and financial performance and that extending the payables deferral period could increase profitability of water services providers in Kenya.

| Table 4 Correlation Between Accounts Payable Management And Financial Performance |

||

|---|---|---|

| Financial Performance | ||

| Accounts Payable | Pearson Correlation | 0.944** |

| Sig. (2-tailed) | 0.000 | |

| N | 72 | |

Correlation between Inventory Management and Financial Performance

Table 5 show results of correlation between inventory management and financial performance. The results reveal that there is a moderate negative correlation between inventory management and financial performance of grower firms (r=-0.301, p<0.05). The findings imply that there is inverse linear relationship between inventory management and financial performance. This means that a grower firm is expected to have reduced returns if it takes long time to process raw materials to finished goods, and to sell these finished goods to customers. This is simply because inventory will be kept for long time in the warehouses resulting to high inventory storage costs, stock theft and stock damages as well.

The results of the study by Wanyubi & Wibowo (2018) affirms to the results of this study where it was found that the higher the inventory turnover in a company, the higher the company’s performance.

| Table 5 Correlation Between Inventory Management And Financial Performance |

||

|---|---|---|

| Financial Performance | ||

| Financial Performance | Pearson Correlation | -0.301* |

| Sig. (2-tailed) | 0.010 | |

| N | 72 | |

Regression Analysis

The study adopted multiple regression analysis to determine the relationship between working capital management (cash management, inventory management, receivables management and payables management) and financial performance of the grower firms. Table 6 presents the regression results, and the coefficient of determination (R Square) is 89.7%. This mean that the model estimated explains 89.7% of the variations in the financial performance of grower firms.

| Table 6 Model Summary |

||||

|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.947a | 0.897 | 0.891 | 13.21059 |

a. Predictors: (Constant), Inventory Management, Cash Management, Payables Management, Receivables Management

Analysis of Variance ANOVAa

Analysis of variance determines whether there are any statistically significant differences between means of independent and dependent variables (Minitab blog, 2013). Table 7 presents the results, they show a significant relationship between the independent variables and the dependent variable (F=145.696, p value<0.05). The results indicate that the independent variables significantly affect the returns of grower firms (financial performance). Cash management, inventory management, receivables management and payables management are statistically acceptable as useful in predicting the financial performance of grower firms. This acceptance is supported by a P value of 0.000 which is less than the conventional value of 0.05.

| Table 7 Anovaa |

|||||||

|---|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | ||

| Regression | 101707.173 | 4 | 25426.793 | 145.696 | 0.000b | ||

| Residual | 11692.827 | 67 | 174.520 | ||||

| Total | 113400.000 | 71 | |||||

a. Dependent Variable: Financial Performance

b. Predictors: (Constant), Inventory Management, Cash Management, Payables Management, Receivables Management

Regression Coefficients

Regression coefficient is the constant term in the regression equation that tells about the change in the value dependent variable corresponding to the unit change in the independent variable while holding other variables constant (Minitab Blog, 2013).

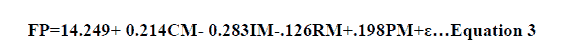

Table 8 presents the findings of the regression coefficients where the constant term (14.249) was statistically significant (P=0.000<0.05). The P value of 0.000 is less than the conventional value of 0.05, hence the constant being statistically significant. The results imply that if the variables under consideration are held to zero the results could be 14.249 units of returns to the grower firm. The regression therefore is shown in equation 4;

The regression coefficient for cash management (0.214) was statistically significant (P=0.001<0.05, t=2.616). The results indicate that holding other independent variables constant an increase in Cash Conversion Period (CCP) by a 1 unit will result to an increase in returns by 0.214 units. The findings imply that the time period between procurement of raw materials and other inputs and receiving cash from sale of finished goods should be longer in order to improve the financial performance of the firm.

The findings are consistent with findings of a study by Tran, et al., (2018) which indicated that the cash conversion cycle determines the profitability of firms. Ren, et al., (2019) in their study agrees with findings of this study. It was found that if cash conversion cycle is kept at minimal it improves the financial performance of the firm. Mengesha (2014) affirms to the results of this study. The researcher found that CCP has a significant positive relationship with financial performance, the lower the CCP, the higher the returns.

The coefficient of payables management (0.198) was also statistically significant (P=0.014<0.05, t=2.375). The results indicate that holding other independent variables constant, an increase in 1 unit of Accounts Payable Period (APP) will result to an increase in returns by 0.198 units. The results imply that firms should take longer days in settling their payables in order to increase profitability, hence financial performance. Firms should take longer periods to pay their creditors and use the available funds for other operational funding, but the delay in payments should be closely monitored to keep a good record of credit worthiness and good relationships with suppliers. Findings from a study by Luchinga (2014), agree with findings of this study. The researcher found that there payable days significantly affect financial performance. Firms should settle for better payment terms with their suppliers.

The receivables management coefficient (-0.126) was statistically significant (P=0.003<0.05, t=-1.573). The findings imply that holding other variables constant, an increase in Accounts Receivable Period (ARP) by 1 unit will result to a decrease in returns by 1.26 units. The results are an indication that receivables collection days should always kept at minimal in order to increase financial performance of a firm. The coefficient of inventory management (-0.283) was statistically significant (P=0.000<0.05, t=3.850). This is an indication that holding all other variables constant, an increase in Inventory Conversion Period (ICP) by 1 unit will result to a decrease in returns by 0.283 units. The results are an implication that firms should keep inventory conversion period minimal to ensure financial performance in increased. The time of raw materials processing into finished saleable goods, and the selling of the goods should be minimal to optimize returns. By so doing firms are able to avoid unnecessary storage costs, stock theft and stock damages.

Mengesha (2014) agrees to this study’s findings where it was concluded that receivable period significantly affect financial performance, the lower the ARP, the higher the firm’s returns. as shows in Table 8.

| Table 8 Coefficientsa |

||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

| B | Std. Error | Beta | ||||

| (Constant) | 14.249 | 9.736 | 7.745 | 0.000 | ||

| Cash Management | 0.214 | 0.052 | 1.027 | 2.616 | 0.001 | |

| Payables Management | 0.198 | 0.047 | 1.207 | 2.375 | 0.014 | |

| Receivables Management | -0.126 | 0.080 | -1.132 | -1.573 | 0.003 | |

| Inventory Management | -0.283 | 0.098 | -1.070 | -3.850 | 0.000 | |

a. Dependent Variable: Financial Performance

b. Predictors: (Constant), Inventory Management, Cash Management, Payables Management, Receivables Management

Conclusions and Recommendations

Conclusion

The study assessed working capital management and financial performance of cane grower firms. From the data analysis and findings of collected data the study makes the following conclusion in line with the objectives of the study.

• Cash Management and Financial Performance

Cash management as a working capital component has a positive relationship with financial performance of grower firms. This implies that the long time difference between purchasing of raw materials and other input for production, and receiving cash from the sale of finished goods improves the financial performance of a firm. Proper management of cash enables a firm to reduce and avoid liquidity risks, increase production and increase in investment income as well. As indicated by the survey and regression analysis indicate that cash budgets are prepared in order to maintain optimum amount of cash balances to maintain adequate liquidity at all times.

• Inventory Management and Financial Performance

The study concludes that the management of inventory is important in increasing financial performance. Firms can avoid long ICP which result to higher costs in terms of storage, theft and loss. This implies that the period between processing of raw materials to finished goods and selling those finished goods to customers should be kept minimal.

• Receivables Management and Financial Performance

The study concludes that receivables significantly affect financial performance. Grower firms keep ARP at minimal to ensure that cash is at optimal level. Grower firms have receivable policies in place and these policies ensure timely recovery of debt. The growers avoid the delay of cash collection to avoid the negative impact on financial performance that the high ARP will cause.

• Payables Management and Financial Performance

In conclusion on payables, the grower firms keep APP higher and use funds to run other daily operations of the firms. This is closely managed to ensure that the credit worthiness of firms is not affected and that relationships with suppliers is maintained as good. Payables management policies assist the firms in reducing borrowing cost, increased productivity and avoid liquidity risk.

Recommendations

The study recommends that firms should adequately invest in working capital to ensure that financial performance is increased. It is recommended that firms develop working capital management policies that will be regularly reviewed. Cash balances of firms should be kept optimal. On another note, firms should prolong their APP but be cautious of credit worthiness and relationship with suppliers.

It is further recommended that firms should always keep ARP at minimal to increase financial performance. Minimal ARP means that the firm avoids delays in collecting from its customers. This on time collection will increase the firm’s revenue. Firms should also keep ICP at minimal, meaning that purchased raw materials should be converted to finished goods in minimal number days, and those finished goods must not be kept for long before they can be sold to customers.

References

Abdul-Hamid, M.A., Sawandi, N., & Simon, S. (2018). Working capital management and firm performance: Lessons learnt during and after the financial crisis of 2007 – 2008 in Nigeria. Indian – Pacific Journal of Accounting and Finance, 2(2), 37- 50.

Afrifa, G., & Tingbani, I. (2018). Working capital management, cashflow, and SMEs performance. International J. Banking, Accounting and Finance, 9(1).

Aktas, A., Croci, E., & Petmezas D. (2015). Is working capital management value enhancing? Evidence from firm performance and investments. Journal of corporate finance, 30, 98-113, US.

Al-Mawsheki, R.M.S.A., Ahmad, N.B., & Nordin, N.B. (2019). The effects of efficient working capital management and working capital policies on firm performance: Evidence from Malaysian manufacturing firms. International Journal of Academic Research in Accounting, Finance and Management Sciences, 9(3), 59-69.

Altaf, N., & Shah, F. (2017). Working capital management, firm performance, and financial constraints: Empirical evidence from India. Asia-Pacific Journal of Business Administration, 9(3), 206 – 219.

Baba, N.A., Fatima, K.R., & Abdulrahaman, Y. (2018). Working capital management and financial performance of listed conglomerate companies in Nigeria. Journal of Accounting, Finance and Auditing Studies, 4(2), 49-66.

Bolarinwa, O.A. (2015). Principles and methods of validity and reliability testing of questionnaires used in social and health researches. Niger Postgrad Med J. (Serial online) cited 2020 May 29: 22:195-201.

Bruna, I. (2019). Working capital as an enterprise value assessment tool (Masters Dissertation, University of Latvia, Paris.

Creswell, J.W., & Creswell, J.D. (2017). Qualitative, quantitative, and mixed methods approaches. University of Nebraska, Lincoln, Sage publications.

Dissanayake, D.M.K.T., & Mendis, A.U. (2019). Working capital management and firm performance: Evidence from food and beverages sector of Colombo stock exchange.

Fatimatuzzahra, M., & Kusumastuti, R. (2016). The determinants of working capital management of manufacturing companies. Mimber, 32(2), 276-281. (Goodle Scholar).

Iraj, M., Mubeen, M., & Sarwat, S. (2019). Working capital management and firm performance: Evidence from non-financial firms in Pakistan. An Asian journal of empirical research, Asian economic and social society, 9(2), 27-37.

Kabuye, F., Kato, J., Akugizibwe, I., & Bugambiro, N. (2019). Internal control systems, working capital management and financial performance of supermarkets. Cogent Business & Management, 6(1), 1573524.

Kaleem, M.A. (2015). An assessment of working capital management practices in Ghana. A case of selected supermarkets in Kumasi, Metropolis. School of Business, KNUST, College of Humanities and social Sciences.

Kasozi, J. (2017). The effect of working capital management on profitability: A case of listed manufacturing firms in South Africa. Investment Management and Financial Innovations, 14(2).

Ketema, A. (2018). Impact of working capital management on firms’ performance: Evidence from large tax payer printing firms in Addis Ababa, Ethiopia.

Kiptoo, I.K. (2017). Working capital management practices and financial performance of tea processing firms in Kenya. University of Embu, Kenya.

Korent, D., & Orsag, S. (2018). The impact of working capital management on profitability of Croatian software companies. Zagreb International Review of Economics and Business, 21(1), 47-65.

Luchinga, L.M. (2014). The effect of working capital management on the profitability of agricultural firms listed in Nairobi securities exchange. University of Nairobi School of Business.

Lyngstadaas, H., & Berg, T. (2016). Working capital management: Evidence from Norway. International Journal of Managerial Finance, 12(3), 295-313.

Mengesha, W. (2014). Impact of working capital management on firm’s performance: The case of selected Metal Manufacturing companies in Addis Ababa, Ethiopia. Jimma University College of Business and Economics.

Minitab, B. (2013). How to interpret regression analysis results: P-values and coefficients.

Morrison, J. (2019). Assessing questionnaire reliability. Select Statistical Services. Select-statistics.co.uk accessed 28 May 2020.

Moussa, A.A., (2019). Determinants of working capital behaviour: Evidence from Egypt. International Journal of Managerial Finance. ISSN: 1743-9132. Publication date: 4 February 2019.

Nobane, H. (2018). Efficiency of working capital management and profitability of UAE construction companies: Size and crisis effects. Polish Journal of Management Studies, 18(2).

Nurein, S.A. (2014). Effect of working capital management and financial constraints on corporate performance. University Utara, Malaysia.

Pakdel, M., & Ashrafi, M. (2019). Relationship between working capital management of firms in different business cycles. Dutch Journal of Finance and Management, 3(1).

Peter, A.E., & Nelson, J. (2019). Empirical investigation of effective management of working capital on firm performance: Evidence from the Nigerian agricultural sector. Asian Journal of Economics, Business and Accounting, 13(4). Article no. AJEBA. 54337 ISSN 2456-639X.

Policarpio, M. (2018). Slovin’s formula: Statistics and probability. www.researchgate.com.

Pujare, S. (2017). What are current assets and liabilities? University of Mumbai, Accounting and Finance.

Ren, T., Liu, N., Yang, H., Xiao, Y., & Hu, Y. (2019). Working capital management and firm performance. Asian Review of Accounting. Emerald Publishing.

Sadiq, R. (2017). Impact of working capital management on small and medium enterprises performance in Nigeria. Arabian J Business Management Review, 7, 285.

Sathish, A.R. (2020). What is working capital – meaning, types and factors. QuickBooks accessed 05.03.2020, 11:04.

Simon, S., Sawandi, N., & Abdul-Hamid, M. (2019). Working capital management and firm performance: The moderating effect of inflation rate. Pertanika Journal, Social Sciences and Humanities, 27(1) 235-257.

Simon, S.S., & Abdul-Hamid, M. (2017). The quadratic relationship between working capital management and firm performance: Evidence from the Nigerian economy. Journal of Business and Retail Management Research (JBRMR), 12(1).

Tran, M.D., Vu, K., Le, T., & Du, N. (2018). Impact of working capital management on financial performance: The case of Vietnam. International Journal of Applied Economics, Finance and Accounting, Online Academic Press, 3(1), 15-20.

Wahyuni, I., & Wibowo, S.S.A. (2018). The effect of working capital on firm performance. Journal of Applied Managerial Accounting, 2, 232 – 244. ISSN: 2548-9917 (online version).

Wanyoike, D.G. (2015). The effect of working capital management on the performance of water service providers in Kenya. University of Nairobi School of Business, Kenya.

Yakubu, I.N., Alhassan, M.M., & Fuseini, A. (2017). The impact of working capital management on corporate performance: Evidence from listed non-financial firms in Ghana. European Journal of Accounting, Auditing and Finance research, 5(3), 68-75.

Zariwayati, M.A., Hirnissa, M.T., & Diana-Rose, F. (2017). Working capital management and firm performance of small and large firms in Malaysia. Journal of Global Business and Social Entrepreneurship, 3(7), 166 – 177.

Received: 24-Nov-2021, Manuscript No. aafsj-21-8778; Editor assigned: 27-Nov-2021; PreQC No. aafsj-21-8778(PQ); Reviewed: 14-Dec-2021, QC No. aafsj-21-8778; Revised: 20-Dec-2021, Manuscript No. aafsj-21-8778(R); Published: 24-Dec-2021