Research Article: 2021 Vol: 25 Issue: 3

Retorno Financiero Sobre El Capital (Froe) Como Nuevo Analisis Dupont Extendido, Aplicado A Las Empresas Industriales En Chile

William Joseli, CENTRUM Católica Graduate Business School (CCGBS), Lima,

Perú; Pontificia Universidad Católica del Perú (PUCP), Lima, Perú

Luz Delgado, Universidad de San Martín de Porres

Liliana Romero, Universidad Tecnológica del Perú

Pablo J. Arana, CENTRUM Católica Graduate Business School (CCGBS), Lima, Perú; Pontificia Universidad Católica del Perú (PUCP), Lima, Perú

Abstract

In 2020, Arana publishes an article in which he proposes an extended Dupont Analysis from a financial perspective applied to industrial companies listed on the Lima Stock Exchange. Based on this research, it was proposed to apply the same methodology to the Chilean context. The objective of the article is to define what are the elements that a DuPont analysis should have, not from an accounting point of view, but from a financial perspective, starting from three elements: asset turnover, profit margin and financial leverage. For this purpose, the data of 38 industrial companies listed on the Santiago Stock Exchange (Chile) from 2014 to 2019 were analyzed. The methodology used was multiple linear regression for the main elements of a DuPont analysis focused on finance or Financial Return on Equity (FROE). The value of this research lies in its contribution to scientific knowledge by delving into financial models and providing a new and useful tool for business decision making.

Keywords

DuPont Analysis, Extended DuPont Analysis, Financial Return on Equity (FROE), Multiple Linear Regression, Return on Equity, Chile.

Introduction

In the business environment, it is not entirely clear what composition of the Dupont analysis should be used in businesses. So far the application has been made from an accounting approach, however, it is necessary to investigate whether the financial approach can provide information on cash generation for better decision-making in the organization. Therefore, this research proposes to define what are the elements that a DuPont analysis should have by analyzing the financial statements of 38 Chilean companies listed on the Santiago Stock Exchange, which is regulated by the Financial Market Commission where the shares are listed. of joint-stock companies and limited partnerships by shares that are registered in the Securities Registry and that have been accepted by the Board of the Stock Exchange after meeting the requirements indicated in the Manual of Rights and Obligations of Issuers (Santiago Stock Exchange, 1991).

We focus on Chile as it is an interesting case study that, on the one hand, has different characteristics compared to developed countries and emerging economies where the literature has focused on studying the relationship between international diversification and performance; and, on the other hand, since the companies in this economy have a high concentration of ownership that contributes to forming pyramidal ownership structures, and where internal capital markets within business groups are an efficient way of allocating resources (Espinosa - Méndez et al., 2020). This country has four characteristics that provide an interesting context for conducting research on the DuPont analysis from a financial perspective. Chile, first of all, is an emerging economy that has a corporate system essentially based on bank financing, where banks have a major role compared to capital markets (Fernández, 2005; Fernández et al., 2010). Second, the most common agency conflict is between majority and minority shareholders, which favors the expropriation of wealth for the benefit of the former (Santiago-Castro & Brown, 2007). Third, the concentration of ownership is high and belongs to a single shareholder or business consortium; thus, there is a pyramidal structure that allows excessive control to emerge (Lefort & González, 2008; Lefort & Walker, 2000). Fourth, the type of legal system in Anglo-Saxon countries with more dispersed ownership is dominated by the common law system, while Chile has a civil law system (La Porta et al., 1997, 1998; Espinosa-Méndez et al., 2020).

Chile is one of the South American countries that is more open to Foreign Direct Investment (FDI) and has received relatively more FDI than other Latin American countries of size and level of development (López & Jia, 2020). According to the World Bank's World Development Indicators, between 2000 and 2017, net FDI inflows as a percentage of GDP in Chile averaged 7.0%, compared to 3.3% for Brazil, 2.0% for Argentina, 2.7% for Mexico and 3.8% for Colombia. For the entire Latin American and Caribbean region, net FDI inflows averaged 3.2% of the region's GDP (López & Jia, 2020). These characteristics are substantially different compared to other developed countries and emerging economies in which the literature has shown the existence of a diversification discount (Berger & Ofek, 1995; Campa & Kedia, 2002; Hoechle et al., 2012; Lang & Stulz, 1994; Lins & Servaes, 1999; Rajan et al., 2000). Chile is an emerging economy with a banking-oriented corporate system, where banks play an important role compared to capital markets (Fernández et al., 2010; Fernández, 2005).

Even companies belonging to economic groups or holding companies, despite having developed internal capital markets, maintain a close long-term relationship with banks or have a bank in their economic groups (Majluf et al., 1998). Despite the small size of the Chilean capital markets, compared to other South American countries, Chile has a lower country risk premium, lower levels of corruption and open financial markets (Jara-Bertín et al., 2015). Explained in part by the political process of the second half of the 1980s and as a natural response to the historically lower application of the law, Chilean companies have a high concentration of ownership, mainly in the hands of individual shareholders or well-diversified conglomerates, which give instead of pyramidal structures (Hachette, 2000; Larraín & Vergara, 2000; Lefort & González, 2008; Lefort & Walker, 2000). Despite the growth of capital markets in recent decades, the legal system has not provided sufficient protection to investors to avoid these levels of concentration. On the contrary, the Chilean legal system has traditionally operated in a reactive manner to increase the protection of the administrators of existing pension systems (Iglesias, 2000; Jara-Bertín et al., 2015). In order to improve corporate governance practices, Chilean regulators have recently adopted various capital market rules such as the Corporate Governance Law and the Law on Transactions with Related Parties in Limited Liability Companies (Ley de 18.046, 2010), to improve information transparency on corporate governance (Jara-Bertín et al., 2010).

The main objective of organizations is to generate profitability, to achieve this it is necessary to make decisions in companies, according to Vítková & Semenova, (2015) financial analysis is one of the sources of financial evaluation that serves as an input to know the past, present and predict the financial future of an organization. Knowing the financial results of an organization and its detailed interpretation is useful information for making managerial decisions and driving towards good performance (Arana, 2020). According to Vítková & Semenova (2015), financial analysis is useful to represent and know the financial performance or behavior within business management and essential for decision-making, for corporate finance, investments, commercial loans (Bunea et al., 2019). According to Khoja et al., (2019) financial ratios have added value in many investigations since they can determine the insolvency or solvency of organizations on many occasions. This analysis of financial ratios according to Vítková & Semenova, (2015) consists of the reading and interpretation of the variables or accounting reasons in a clear, digestible and meaningful way of a company. Likewise, there are references to other applications of financial ratios such as that of Heo et al., (2020) where it indicates that the ratios are used in determining the profitability, liquidity and solvency of an organization. The ratios also allow knowing or determining the ability to meet the financial obligations of a company and its investment opportunities.

Unlike other performance measures, return on equity (ROE) is a ratio of net income to equity (Zhang et al., 2017). Return on equity focuses on the equity component of the investment; This ratio relates to the earnings that equity investors make after the costs of debt have been included in the equity invested in the asset. Therefore, it is a composite return of all its assets: cash and operating (Damodaran, 2007). Along the same lines, ROE is an important factor to design and implement financial strategies in an organization, since it is a synthetic index and is related to the size of sales, the activity of use of assets and the debt of the company. (Dre?ewski, et al., 2018), showing investors the efficiency of using their capital.

There are some financial analysis methods such as elementary methods (horizontal and vertical analysis), financial ratio method (ratio of two or more variables: liquidity, leverage, activity and profitability) or the summary indicator method (the value is made up of several indicators) (Vítková & Semenova, 2015). Using the financial ratios method, the Du Pont pyramid can be applied or used, according to Vítková & Semenova (2015) in order to obtain a value of the main performance indicators on capital. According to Bunea et al., (2019) the DuPont analysis model requires few calculations available to managers and is constituted as a strategic model because it is easy to understand, simplifying a complex analysis. Furthermore, Bunea et al., (2019) indicate that the DuPont analysis consists of a way of dividing the return on equity (ROE) into three important components:

ROE=(Profit margin)*(Asset turnover)*(Equity multiplier)=(Net profit/Sales)*(Sales/Average Total Assets)*(Average Total Assets/Average Equity)

This model is translated into the ROE that results from the multiplication of net margin between sales multiplied by the result of sales over assets and multiplied by the result of assets over equity, which translates into three components: Net Margin, Turnover assets and capital multiplier. According to (Kamar, 2017) when multiplying the net margin by the rotation of assets, the result is equal to the return on assets or ROA. The Dupont analysis is divided into two components: the first refers to operational efficiency (ROA), which indicates how productive the company's processes are, and the other is linked to the level of leverage (Capital multiplier).

ROE is a widely used result among informed investors, as it is a solid measure that shows whether the management of a company creates value for its shareholders. However, ROE can be misleading, as it is vulnerable to measures that increase its value and makes decision making risky. Without a way to break down the components of ROE, investors could be misled into believing that a company is a good investment when it is not. It is possible to understand which components the ROE results come from through the DuPont analysis (Fabozzi, & Markowitz, 2011). DuPont's extended analysis provides a further breakdown of the profit margin ratio (net income/sales) into two components of charge, tax and interest, multiplied by the operating profit margin. This is a positive result of traditional DuPont analysis because it provides a markup refinement on the operating profit margin ratio by eliminating the effects that arise from taxes and interest expense. This provides both management and the financial analyst with more detailed information about a company and its immediate competitors (Kent Baker & Powell, 2005). Formally, the DuPont Extended Analysis formula is:

ROE=[(EBI/Sales).(Sales/Assests)-(InteresExpense/Assets)].(TotalAssts/Equity).(1-t)

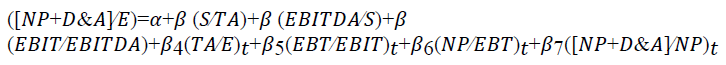

DuPont's five-step equation, or extended, further breaks down the net profit margin. From the three-step equation, it can be seen that ROE will increase depending on the increase in net profit margin, asset turnover and leverage. The five-step equation shows that increasing leverage does not always represent an increase in ROE. In the five-step calculation, where the numerator of the net profit margin is net income, it can be converted to earnings before tax (EBT) by multiplying the three-step equation by 1 minus the company's tax rate (Investopedia, 2020). Arana (2020) raises the Dupont analysis focused on finance, or as he indicates, it could be called Financial Return on Capital (FROE), which further extends the previous DuPont models, from a perspective of the Income Statement. into account liquidity based on statistical validations, which is described in the following formula:

The objective of this research is to define what are the elements that a DuPont analysis should have, not from an accounting point of view, but from a financial perspective. Therefore, the question arises: What elements should a DuPont analysis contain from a financial perspective? This study is relevant because it implies defining the elements that best correlate with the ROE of each year to determine which ones should compose it under a financial approach. Companies often employ the extended Dupont analysis approach from an accounting perspective; however, this tool could provide us with relevant information if it is analyzed from a financial perspective. This research aims to contribute to scientific knowledge, since it delves into financial models in order to provide other models to improve the management of business decision-making in countries with economies similar to Chile. The study has followed the methodology used by Arana (2020), taking Weidman et al. As a starting point. (2019) and taking into account the financial ratios proposed by Damodaran (2007). It has been taken as a reference to (Arana, 2020; Bauman, 2014; Jin, 2017; Lukic, 2015; Weidman et al., 2019) for reference of the proposed study.

Method

The methodology used by Arana (2020) was used, who performed a multiple linear regression for the main elements of a DuPont analysis focused on finance, or Financial Return on Equity (FROE). 228 records were considered in this investigation. The information corresponds to the financial statements of 38 of the 118 industrial companies that are publicly listed on the Santiago Stock Exchange, since these 38 companies provided complete financial information to the Commission for the Financial Market of Chile, which acts as an entity supervisor of financial markets in Chile after joining the Superintendency of Banks and Financial Institutions. The period analyzed is from 2014 to 2019. Regarding the statistical validation, three tests were carried out:

1. An adjusted R2 that should be greater than 0.70 (Véliz, 2017) for the robustness of the regression.

2. The variance inflation factor (VIF) to measure multicollinearity and accepted up to 10 (Cea, 2002).

3. An ANOVA test to rule out homoscedasticity through p values greater than 0.05 (Hair et al., 2010).

Results

Table 1 shows the results as descriptive statistics. On average, the FROE [(NP + D & A) / E] for industrial companies in Chile corresponds to 11.55%, which is accompanied by its components. The most relevant is TA / E (leverage) with 2.1168 times, while the least relevant is EBITDA / S with 0.1260 times. Table 2 shows the correlations between the different elements of the multiple linear regression. Of the 28 correlations, 13 are statistically significant at least at the 90% level. However, none exceeds an absolute value of 0.50, being the closest to 0.490 between EBT / NP and TA / E. The low level of multicollinearity is consistent with the results, which is shown through the VIF results for each variable.

| Table 1 Descriptive Statistics | |||||

| N | Half | Deviation Standard |

Minimum | Maximum | |

| (NP + D&A)/E | 228 | 0.1155 | 0.1304 | -0.9393 | 1.216687 |

| S/TA | 228 | 0.7371 | 0.2758 | 0.25843 | 1.833061 |

| EBITDA/S | 228 | 0.1260 | 0.1000 | -0.4635 | 0.792685 |

| EBIT/EBITDA | 228 | 0.7232 | 0.3512 | -1.0953 | 3.694820 |

| TA/E | 228 | 2.1168 | 0.8964 | 1.1918 | 6.473791 |

| EBT/EBIT | 228 | 0.7438 | 0.9361 | -8.77734 | 5.558050 |

| (NP + D&A)/NP | 228 | 1.7939 | 9.3980 | -97.2604 | 93.4193 |

| Table 2 Correlations | |||||||||

| (NP + D&A)/E | S/TA | EBITDA/S | EBIT/EBITDA | TA/E | EBT/EBIT | (NP + D&)/NP | NP/EBT | ||

| Pearson's correlation | (NP + D&A)/E | 1.000 | 0.148 | 0.637 | -0.173 | -0.042 | 0.137 | 0.065 | -0.228 |

| S/TA | 0.148 | 1.000 | -0.245 | 0.007 | 0.276 | -0.063 | -0.026 | -0.012 | |

| EBITDA/S | 0.637 | -0.245 | 1.000 | -0.226 | -0.223 | -0.081 | 0.052 | -0.156 | |

| EBIT/EBITDA | -0.173 | 0.007 | -0.226 | 1.000 | 0.072 | 0.132 | -0.091 | 0.038 | |

| TA/E | -0.042 | 0.276 | -0.223 | 0.072 | 1.000 | -0.211 | -0.019 | 0.002 | |

| EBT/EBIT | 0.137 | -0.063 | -0.081 | 0.132 | -0.211 | 1.000 | -0.018 | 0.180 | |

| (NP + D&A)/NP | 0.065 | -0.026 | 0.052 | -0.091 | -0.019 | -0.018 | 1.000 | -0.019 | |

| NP/EBT | -0.228 | -0.012 | -0.156 | 0.038 | 0.002 | 0.180 | -0.019 | 1.000 | |

| Sig. (unilateral) | (NP + D&A)/E | 0.013** | 0.000* | 0.004* | 0.262 | 0.019** | 0.165 | 0.000* | |

| S/TA | 0.013 | 0.000* | 0.458 | 0.000* | 0.171 | 0.350 | 0.428 | ||

| EBITDA/S | 0.000 | 0.000 | 0.000* | 0.000* | 0.112 | 0.215 | 0.009* | ||

| EBIT/EBITDA | 0.004 | 0.458 | 0.000 | 0.140 | 0.023** | 0.086 | 0.285 | ||

| TA/E | 0.262 | 0.000 | 0.000 | 0.140 | 0.001* | 0.386 | 0.490 | ||

| EBT/EBIT | 0.019 | 0.171 | 0.112 | 0.023 | 0.001 | 0.393 | 0.003* | ||

| (NP + D&A)/NP | 0.165 | 0.350 | 0.215 | 0.086 | 0.386 | 0.393 | 0.390 | ||

| NP/EBT | 0.000 | 0.428 | 0.009 | 0.285 | 0.490 | 0.003 | 0.390 | ||

** Significant correlations at a statistical level of the 95%.

*** Significant correlations at a statistical level of 90%.

The model showed a value close to the minimum adjusted R2 required (Véliz, 2017), with 0.56; after performing multiple linear regression. Table 3 shows the results of the adjustment. Table 4 shows:

| Table 3 Adjustments of the Multiple Linear Regression | |

| Fitted Model | Resultados |

| R | 0.764 |

| R square | 0.584 |

| R squared fitted | 0.571 |

| Table 4 Resultados De Regresión | ||||

| Variable | Variable Type | Coefficient | Sig. | VIF |

| (NP + D&A)/E (Constant) | Constant Dependent | -0.145 | 0.000* | |

| S/TA | Independent | 0.149 | 0.000* | 1.132 |

| EBITDA/S | Independent | 0.938 | 0.000* | 1.191 |

| EBIT/EBITDA | Independent | -0.017 | 0.308 | 1.082 |

| TA/E | Independent | 0.013 | 0.052 | 1.176 |

| EBT/EBIT | Independent | 0.038 | 0.000* | 1.115 |

| (NP + D&A)/NP | Independent | 0.0005 | 0.429 | 1.010 |

| NP/EBT | Independent | -0.020 | 0.000* | 1.058 |

1. The ANOVA tests for each variable that show that they are all heteroscedastic (Hair et al., 2010).

2. The VIF tests that show a very low level of multicollinearity between them (Cea, 2002).

3. The constant and the coefficients, all of which are statistically significant at a 99% level, except for the

Variable EBIT/EBITDA, (NP+D&A)/NP and TA/E, which did not show statistical relevance.

The coefficients reflect the relevance of each element with respect to the formation of the FROE (Hair et al., 2010). EBITDA/S was the variable with the greatest influence on FROE, with a coefficient of 0.938, followed by S/TA with a coefficient of 0.149. Coefficients lower than 0.038 were obtained in the rest of variables. The variable (NP+D & A)/NP was the one that had the least influence on the FROE. On the other hand, EBIT/EBITDA were the only items with a negative coefficient in Table 4.

Discussion

Donaldson Brown's model increased managerial decision making (Flesher & Previts, 2013), but only using the ATO and PM components (Bauman, 2014). The FROE model (Damodaran, 2007; Jin, 2017; Weidman et al., 2019) is established based on the sum of four additional elements, resulting in a total of seven, of which six were statistically significant (Cea, 2002; Hair et al., 2010; Véliz, 2017). To achieve better results of cash over equity (Kaplan & Ruback, 1995), seven ratios must be enhanced that are based on the logic of the income statement. First, to create value for shareholders through sales generation (S / TA), the assets to be invested must be efficiently productive. The coefficient 0.149 provides a starting point for creating value for companies. In the particular case of industrial companies in Chile, an average of 0.7371 was obtained. The result is not low, but it is suggested that these companies invest in more productive assets. Second, through optimal management, sales should contribute to obtaining a relevant margin (EBITDA/S) (Aiello & Bonanno, 2013; Arana & Burneo, in press). The result given by the 0.938 coefficient is significant and is linked to the CROCI (Damodaran, 2007), this provides evidence for the cash generation proposal within the accounting measurements. In the case of Chile, an average of 0.1260 was obtained, therefore, to increase their profitability, companies should improve their cost and expense structure. Third, one way to establish a tax shield would be through depreciation, amortization, costs, and expense structure. The results of the variable (EBIT/EBITDA) were not statistically significant, possibly in the case of Chile it is due to the fact that depreciation is not relevant and the amortizations are against sales. It is necessary to analyze the assets that generate depreciation and amortization to review their productivity, given that the average EBIT/EBITDA variable (descriptive statistics) is 0.7232, which is closely linked to the low coefficient obtained by S/TA. Fourth, as a result of the DuPont model, the coefficient is 0.013 and the EBT/EBIT variable 0.038 has been obtained, which could mean that the financial costs that the company assumes are more important than the principal debt.

The highest ratio is TA/E with 2.1168 in the Chilean industrial companies studied in this research, a high financial leverage among them could be the cause of this result. Fifth, according to the descriptive statistics in Table 1, financial expenses represent on average 25.62% of EBIT. Sixth, the variable (NP/EBT) obtained a coefficient of -0.020, since income tax was paid on the remaining earnings.

Conclusion

The present study provides scientific contributions to strengthen the theory on FROE raised by Arana (2020). By means of solid statistical analyzes, it is proposed to consider all the indicators of the DuPont analysis, however, when performing the regressions in the developed model, it is observed that the EBIT/EBITDA, TA/E and (NP+D & A)/NP values are not significant. , but they should not be discarded because the results show figures that would allow to initiate other future investigations. The results of the FROE are verified by generating an alternative to the DuPont model to provide managers with financial information on profits and low-cost cash generation for decision-making management. The main limitations were the difficulty in expanding the sample, since many companies do not publicly display their financial statements, which restricts access to information. It was also the number of companies to analyze depending on the market, industry and location. Therefore, it is suggested to apply this model to mature markets where more data can be accessed and can be evaluated in other industries and sectors. This study, like others carried out previously (Arana, 2020) seeks to develop a financial alternative to the DuPont model, therefore, the research looked for the impact on EBITDA/S, S/TA and EBT/EBIT.

References

- Arana, P. (2020). Financial return on equity (FROE): A new extended dupont approach. Academy of Accounting and Financial Studies Journal, 24(2), 1-8.

- Arana, P., & Burneo, K. (2021). Emerging market stock valuation: New evidence from Peru. International Journal of Economic Policy in Emerging Economies

- Bauman, M.P. (2014). Forecasting operating profitability with DuPont analysis: Further evidence. Review of Accounting and Finance, 13(2), 191-205.

- Berger, P.G., Ofek, E. (1995). Diversification’s effect on firm value. Journal of Finance and Economy, 37(1), 39-65.

- Bunea, O.I., Corbos, R.A., & Popescu, R.I. (2019). Influence of some financial indicators on return on equity ratio in the Romanian energy sector-A competitive approach using a DuPont-based analysis. Energy, 189, 116251.

- Campa, J.M., & Kedia, S. (2002). Explaining the diversification discount. The Journal of Finance 57(4), 1731-1762.

- Cea, M.A. (2002). Análisis multivariable: Teoría y práctica en la investigación social. Madrid, Spain: Editorial Síntesis.

- Damodaran, A. (2007). Return on capital (ROC), return on invested capital (ROIC) and return on equity (ROE): Measurement and implications. Retrieved from https://www.fep.up.pt/disciplinas/mbf922/Damodaran%20%20return%20measures.pdf

- Dre?ewski, R., Kruk, S., & Makówka, M. (2018). The evolutionary optimization of a company's return on equity factor: Towards the agent-based bio-inspired system supporting corporate finance decisions. IEEE Access, 6, 51911-51930.

- Espinosa-Méndez, C., Araya-Castillo, L., Jara Bertín, M., & Gorigoitía, J. (2020). International diversification, ownership structure and performance in an emerging market: Evidence from Chile. Economic Research.

- Fabozzi, F., & Markowitz, H. (2011). Equity valuation and portfolio management. John Wiley & Sons, Inc.

- Fernández, V. (2005). Monetary policy and the banking sector in Chile. Emerging Markets. Finance and Trade, 41, 5-36

- Fernández, A.I., González, F., & Suárez, N. (2010). How institutions and regulation shape the influence of bank concentration on economic growth: International evidence. International Review of Law and Economics, 30(1), 28-36.

- Flesher, D., & Previts, G. (2013). Donaldson Brown (1885-1965): The power of an individual and his ideas over time. Accounting Historians Journal, 40(1), 51-78.

- Hachette, D. (2000). Privatizaciones: Reforma estructural pero inconclusa. La Transformación Económica de Chile.

- Hair, J., Black, W., Babib, B., & Anderson, R. (2010). Multivariate data analysis (7th ed.). Mexico City, Mexico: Pearson Education.

- Heo, W., Lee, J.M., Park, N., & Grable, J.E. (2020). Using Artificial Neural Network techniques to improve the description and prediction of household financial ratios. Journal of Behavioral and Experimental Finance, 25.

- Hoechle, D., Schmid, M., Walter, I., Yermack, D. (2012). How much of the diversification discount can be explained by poor corporate governance? The Journal of Finance, 103, 41-60.

- Iglesias, A. (2000). Pension reform and corporate governance: impact in Chile. Revista ABANTE, 3(1), 109-141.

- Investopedia (2020). Decoding DuPont Analysis. Retrieved from https://www.investopedia.com/articles/fundamental-analysis/08/dupont-analysis.asp

- Jara-Bertin, M., López-Iturriaga, F., & Espinosa, C. (2015). Diversification and control in emerging markets: The case of Chilean firms. Business Research Quarterly, 18(4). 259-274.

- Jia, W., & Lopez, R. (2020). Foreign Direct Investment, Product Sophistication, and the Demand for Skilled and Unskilled Labor in Chilean Manufacturing. The Journal of Development Studies.

- Jin, Y. (2017). DuPont Analysis, Earnings Persistence, and Return on Equity: Evidence from Mandatory IFRS Adoption in Canada. Accounting Perspectives, 16(3), 205-235.

- Kamar, K. (2017). Analysis of the Effect of Return on Equity (Roe) and Debt to Equity Ratio (Der) On Stock Price on Cement Industry Listed in Indonesia Stock Exchange (Idx) In the Year of 2011-2015. IOSR Journal of Business and Management, 19(05), 66-76.

- Kaplan, S., & Ruback, R. (1995). The valuation of cash flow forecasts: An empirical analysis. The Journal of Finance,4(4), 1059-1093.

- Kent Baker, H., & Powell, G. (2005). Understanding Financial Management. Blackwell Publishing.

- Khoja, L., Chipulu, M., & Jayasekera, R. (2019). Analysis of financial distress cross countries: Using macroeconomic, industrial indicators and accounting data. International Review of Financial Analysis, 66, 101379.

- La Bolsa de Santiago. (2020). Normativa de la Bolsa de Valores. Retrieved from https://www.bolsadesantiago.com/

- Lang, L.H.P., & Stulz, R.M. (1994). Tobin’s q, corporate diversification, and firm performance. Journal of Political Economy, 102(6), 1248-1280.

- La Porta, R., López de Silanes, F., Shleifer, A., & Vishny, R. (1997). Legal determinants of external finance. The Journal of Finance, 52(3), 1131-1150.

- La Porta, R., López-de-Silane, F., Shleifer, A., & Vishny, R. (1998). Law and finance. Journal of Political Economy, 106(6), 1113-1155.

- Lefort, F., & González, R. (2008). Hacia un mejor Gobierno Corporativo en Chile. Revista ABANTE, 11, 17–37

- Lefort, F., & Walker, E. (2000). Ownership and capital structure of Chilean conglomerates: Facts and hypotheses of governance. Revista ABANTE, 3, 3-27.

- Lins, K.V., & Servaes, H. (1999). International evidence on the value of corporate diversification. The Journal of Finance, 54(6), 2215-2239.

- Lukic, R. (2015). The impact of financial leverage on performance of trade in Serbia. Business Excellence and Management, 5(3), 5-21

- Rajan, R.G., Servaes, H., & Zingales, L. (2000). The cost of diversity: the diversification discount and inefficient investment. The Journal of Finance, 55(1), 35-80

- Santiago-Castro, M., & Brown, C. (2007). Ownership structure and minority rights: A Latin American view. Journal of Economics and Business, 59(5), 430-442.

- Véliz, C. (2017). Análisis multivariante: Métodos estadísticos multivariantes para la investigación. Mexico, D.F., Mexico: Cengage Learning.

- Vítková, E., & Semenova, T. (2015a). The Impact of Key Parameters Change on Economic Development of the Company. In Procedia Computer Science, 64, 744-749.

- Vítková, E., & Semenova, T. (2015b). The Impact of Key Parameters Change on Economic Development of the Company. Procedia Computer Science, 64, 744-749.

- Weidman, S.M., McFarland, D.J., Meric, G., & Meric, I. (2019). Determinants of return-on-equity in USA, German and Japanese manufacturing firms. Managerial Finance, 45(3), 445-451.

- Zhang, B., Yuan, H., & Zhi, X. (2017). ROE as a performance measure in performance-vested stock option contracts in china. Frontiers of Business Research in China, 11(1).