Research Article: 2021 Vol: 25 Issue: 2S

Revaluation of Financial Statement Due to Devaluation of Currency- Does Financial Statement Show Accurate Value of your Organization?

Muhammad Nabeel Mustafa*, SZABIST University

Haroon ur Rashid Khan, SZABIST University

Salman Ahmed Shaikh, SZABIST University

Keywords

Currency Devaluation, Time value of money, Purchasing power, Normal inflation.

Abstract

Purpose: Debtors are current asset has a time of 120 days at max. During this time, the value of debtors gets changed. This study explores the effect of this time value of money. The objective of this research is to sight see the effect of the time value of money, normal inflation, and purchasing power on the comprehensive debtors/receivable side of the balance sheet, which can be devalued if key macroeconomic factors determine the devaluation percentage of a single currency. Methodology: Concerning these significant questions of the research, we grasped a pragmatic philosophy with an inductive approach. A mono-method of qualitative based on grounded theory was endorsed, which helped to unfold a new model through qualitative data analysis. Results: A new strategy is developed, which utters three components; normal inflation, time value of money, and purchasing power revealing significant contribution in literature. The effect of these constructs was not incorporated in the financial statement, showing vague financial valuation. These constructs have a significant impact on the financial statement of any organization especially with items having time components in the balance sheet, such as receivables and payables. Research Limitations: This research is limited to only one currency i.e., Pakistani Rupee but can be implemented on any currency. Practical Implication: The strategy will help auditors to pass the adjustment entry in the balance sheet to adjust the value of the currency at the year-end. Originality: The research is based on the expert’s opinion and a new model is developed to present the accurate value of any organization through the financial statement. Future: This strategy needs to be tested quantitatively and an adjustment should be made within the financial statement to show the factual and authentic presentation of financials of any organization.”

Introduction

Time is the key to prepare any financial statement. The balance sheet has some current assets which are time-dependent like Debtors. Debtors have a time of 30, 60, 90, and 120 days as an aging concept of Accounting (Sigidove, 2016). Even within 60 days the value of receivable changes due to the unpredictable nature of the economic condition of developing countries. The change in the value of debtors is not being calculated or reported in the financial statement. The first thing that draws attention to the term “devaluation” is the comparison of one currency with some other currency. But here, the notion of “devaluation” means a decrease in the value of one currency with time, and that decrease in value or Time Value of Money (TVM) has not been recorded in financial statements. The expression “Revaluation” is to pass an adjustment entry to record the accurate value according to its current market value. Revaluation generally occurs for the fixed assets because fixed assets are recorded at cost price at the time of purchase (IAS-16). The virtue of the revaluation method is that it could increase or decrease the value of an asset according to the current market price. So, the adjustment entry can be conceded as an appreciation for the increase in asset value or depreciation for the decrease in asset value. In the case of the historical cost method, which permits only depreciation of the assets for adjustment and to record the losses as an expense (Berna, 2009)? The revaluation method is not only expedient to sell any asset to another company but it’s also valuable at the time of merger or acquisition by any organization. As time passes in business, it depends on the financial policies of the organization whether it adopts the policy to record the assets on historical cost or appoint revaluation method to reappraise the assets according to the time (Adina, 2010). When an asset’s value increases, its book value to record this appreciation in profit and loss account is recorded at the equity side with the heading of revaluation surplus (Bunget, 2013). The case of negative revaluation is just the opposite of positive revaluation, where the impairment loss is calculated against the revaluation surplus. But if there is no surplus, then a loss is disclosed as the impairment loss on the equity side (Ayen, 2014).

It is difficult to measure the exact value of inflation but we could work on approximation. We would also require feedback from accountants and financial managers to improve measurement techniques. In 1974, Financial Accounting Standards Board (FASB) suggested the simplest approach to convert the amounts of financial statements into equal units of current general purchasing power so that current values and prior values are comparable termed as General Purchasing Power Accounting (GPPA). Such a converted financial would be added to the current financial statement based on historical cost (Flynn, 1977). The recording of normal inflation was studied by the Francis Sandilands (Sandilands Commission) and recommended Current cost accounting (CCA) in their financial reports for national and multinational companies. Which then forwarded the problem to the Morpeth Committee inferred that not only inventories and fixed assets need to be re-stated but all assets and liabilities from the prior year should be restated (Morgan-1976).

Security & Exchange Commission (SEC) was also studying the problem of inflation and were included in footnotes of financial statement about the replacement cost of inventories and fixed assets equivalent capacity with the effect of cost of goods sold termed as replacement cost method (Fabricant, 1936-1976). Both CCA and GPPA methods are different from each other and both governing bodies refused to accept the other method. In the CCA method, adjusting the assets for the specific price change is not necessarily the same thing. In a specific period, methods, specific price changes, and general price levels are required to be accounted for inflation (Vancil, 1976).

The difference between revaluation and depreciation of the currency is that the revaluation is being officially announced by the Government or the central bank of the country and depreciation is being assessed based on demand and supply of the currency in the market. The currency revaluation is more important than the revaluation of the fixed assets because, when the currency gets re-valued, the value of the assets automatically changed (David, 1998). Currency traders often use revaluation rates at a specific time to determine the profit or loss in a day. Revaluation rate is termed as the closing rate as compared to the antecedent trading day of currency specifically used by the currency traders (Ehsan, 2012). When the currency gets so much capricious then currency traders use the Exchange Traded Fund (ETF), whose objective is to monitor the performance of a single currency against the US Dollars in the exchange rate market. This method is overseen with the help of currency cash deposits or swap contracts (Alam, 2013). ETF is also being managed with the help of short-term debt, which is presented in that currency. Changes in currency value and exchange rates also create currency risk for many foreign investors, which might create trepidation in the stock market (Aline, 2009). This kind of risk is very inadequate for those investors, who want to close out the foreign currency account in loss due to the frequent volatility in exchange rates. Those investors, who want to invest in the trade like export and import of the product, currency risks, are very indispensable. It was tested whether the historical cost restated concept in IAS-29 captures the faithful presentation of the general price index. The general price index is impossible to capture the prices of all goods and services at one point in time (Caruntu, 2011). Hence it discloses that official prices are much different from the inflation rate prices. The qualitative implementation of the IFRS was observed and divided into two groups. First, were fundamental qualitative characteristics, which were primarily consisting of relevant information and faithfulness. The second was enhancing qualitative characteristics, which entails understanding, verifiable, and comparability of financial information (Khalik, 2019). It was also suggested before the final presentation of financial statements, the restatement of the balances with the inflation rate should be done in the local currency, which will eventually help in catering inflation rate in financial statement and it will represent the true value of the organization (Cenap, 2011). Other factors along with inflation including the purchasing power of the money are reliant upon time and as time pass the value of money decreases (Weinman, 2011). These factors are also linked with the theory of the time value of money, which states that money today is better than the money for tomorrow because the currency has the earning capacity. This time value of money has not been captured by the financial reporting (Roa, 2011).

IAS-29 Financial reporting in hyperinflationary economies could be applied to specific conditions of the economy, which state that:

• When the population of the country keeps its wealth in non-monetary assets or foreign currency.

• When credit sales and purchase took place at certain prices, which compensates for the expected losses due to the purchasing power of currency even at a shorter period.

• When there is a 100% increase in the cumulative inflation rate over three years.

If these definite conditions are met then the hyperinflationary accounting standard (IAS-29) is applicable otherwise it has been assumed that macroeconomic variables do not affect the financial statements (Abu, 2012).

Interest rates and purchasing power losses are connected with the price index. It also justifies that the interest rate on credit is charged to compensate for the purchasing power’s losses (William, 2012). Nevertheless, these conditions are imperative but are very difficult to meet by any economy. Certainly, there are some countries in the past, where hyperinflationary accounting was applied (Argentina, Ukraine, Sudan, Libya, Yemen, Egypt). The value of currency changes with time and economic circumstances. This research paper not only gratifies the factor of inflation, but it will also entertain those macroeconomic variables, which are significant for identifying the purchasing power of a currency. The impact of that decrease/increase in the purchasing power of currency eventually affects the receivable side of the balance sheet. There are many other factors also involved in decreasing or depreciating the currency of a country. These Macroeconomic variables have a substantial impact on the financial statements of any organization. International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS) abduct different macroeconomic variables in different standards but there is no standard, which gratifies the pivotal determinants of the economy within financial reporting. The dilemma is to identify those pivotal aspects of the economy, which not only influence the currency valuation but also affecting the financial position of the organization. If those components can be standardized then the revaluation of currency at any point in time will be facile.

The fundamental questions of this research are: “What are the constructs affecting the currency devaluation and what is the nature of the relationship among them?

How the financial statement of any organization without catering to the impact of time value of money, normal inflation & purchasing power, shows the true value of the organization?

How can debtors/receivables be revalued at the time of the rapid devaluation of currency?

With time in days, the value of these debtors devalues because the money has the earning potential. The objective of this research is to find out the impression of the time value of money on the total debtors/receivable side of the balance sheet. The debtors can be restated if indispensable macroeconomic variables determine the devaluation percentage of a single currency. Currently, the macroeconomic constructs, which are consequential for currency devaluation have not been dealt with in a balance sheet, which ultimately does not portrait the definite value of the organization’s assets. The idea behind this research paper is to accommodate the impact of currency valuation as the devaluation expense/gain in profit & loss account and an allowance/provision has to be created against the total debtors/receivables in the balance sheet. Those components that change currency valuation are very frequent and the revaluation of purchasing power of a currency then becomes crucial from time to time. If there is any depreciation/appreciation in currency value, it should be recorded in the profit and loss account and its counter provisional impact has to be indulged in the balance sheet. This research will be valuable for the auditors to prepare accurate financial statements, which also incorporates the macroeconomic variables in the balance sheet. The corporate sector will be able to see the future direction of an organization based on macroeconomic factors. The shareholders will be able to judge the performance of the corporation based on inflation-adjusted financial statements.

Literature

The impact of the time value of money and inflation on the currency has been studied by many researchers. (Jonas, 2010) (Muniappan, 2015) (Roa, 2011). The link between the time value of money and international accounting standard 29 for hyperinflation was investigated by few researchers in past (Levy, 2003) (Kairiza, 2009) (Hewitt, 2007) (Nyasha, 2014). The qualitative nature of hyperinflation standards was also studied by investigators (Abu, 2012). The impact of inflation on the financial statement was studied by (Cenap, 2012) through ratio analysis. According to the researcher International accounting standard of hyperinflation implies percentage criteria for the restatement of the financial statement. This criterion is suggested to keep minimal because a very slight change in the inflation rate changes the figure. The researcher adopted a model and gradually increased the inflation rate to see the changes in ratio and inferred that a very minute change in inflation, negatively impacts the financial statement (Cenap, 2012). The model shows that the volatility inflation rate affects the financial ratios of the organization as well. The researcher proposed that inflation adjustment is a perpetual process and applied consistently on the financial statement even at a very low change in the inflation rate. A precise inflation rate is not being captured by any IAS or IFRS (Cenap, 2012). The International accounting standard (IAS) lacks high incomparability performance while comparing financial statements, which is supposed to be the most important mission of the International Accounting Standard Board (IASB) (Abu, 2012). The IASB is ideologically biased because international accounting standard-29 is purposively formed to provide information for the decision-makers like shareholders. Therefore, IAS-29 is failed to present faithful information (Abu, 2012). The impact of the time value of money and purchasing power of a single currency is not addressed by any International Accounting Standard (IAS) or IFRS. The impact of the exchange rate is being captured with the help of future contracts in the case of the manufacturing industry (Demmer, 2019). Whereas, if the organization is Non-Profit (NGO or NPO) and receives a foreign donation in some other currency then that organization does not sign any future contract. In that case, the receivable amount will change. Due to this, the whole financial statement will depict a different sketch, in case of the absence of future contracts (Chen, January 2019). The impact of inflation on the financial statement of a model company, which used to report its parent company based on the current International Financial Reporting Standard (IFRS) was studied by (Ilter, 2011). He inferred that the financial statement of any organization does not present the factual value as it does not cater to the inflation of the last three year’s increase as 100% (Cenap, 2011). The impact of a higher inflation rate on the banking industry was studied by (Qingqing, 2014) where the researcher quantitatively examined the gain and losses due to a higher inflation rate through their income instruments in US commercial banks. The researcher observes that a major decrease in the bank’s assets was occurred due to the increase in the inflation rate as compare to liability. The abduction of international financial reporting standards on the financial statement of Greek firms was studied by (Gkaimani, 2006) and compared it with the GAAP standards. The same set of financial data of Greek firms was analyzed under IFRS and Greek GAAP standards that how the different application changes financial ratios and the value of the financial statements (Patricia, 2019). These different systems giving dissimilar value allow the organization to adopt the unit system and increase the performance for shareholders. It displays that IFRS demonstrates a greater role while book value calculation or value relevance as compared to Greek GAAP (Gkaimani, 2006). The financial accounting concept in terms of the time value of money was studied by (Muda & Hasibuan, 2017). The paper built the concept of the time value of money based on power, concept, and submission of basic valuation concepts in accounting. The paper first writes about the evolution of the bond market and their requirement for the mathematical calculations and time value of money. The inventory production in terms of the time value of money and inflation was studied by (Jonas, 2010), where they extended the Economic order quantity model of Moon & Lee in 2000. The model was extended to study the random life cycle of the production system. Two conditions were studied when the product life cycle ends at the production stage and the non-production stage. The determination of exchange rate equilibrium at a point where the demand and supply for currency equate (Eichengreen, 2013). The currency demand originates from the exports, whereas the supply side of the currency initiates from foreign investment. Any change in demand and supply side will bring a change in the value of the currency (Rossi, 2013). The demand side increases the value, whereas the supply side decreases the value of the currency. The exchange rate volatility of Pakistani currency was studied by (Shabana, 2012) with the annual data from 1975 till 2010. The main variables are taken as the exchange rate as the dependent variables and import-export, growth rate, and inflation were taken as the independent variables with the help of the OLS model. The study inferred that the inflation rate is the main factor that determines the exchange rate (Dimitrios, 2014). Economic growth as a variable has the most effect on the exchange rate, whereas the impact of export and import varies and lies on a third and fourth important factor in determining the exchange rate (Bashir, 2015). The currency depreciation effect was studied on the American Depository Receipt were studied by (Omar, 2010). The researcher used the SUR method termed as seemingly unrelated regression and multivariate regression on the panel data. A similar kind of study was taken place on Pakistani rupee and researchers found out that change in the exchange rate and price level takes place in both directions (Kalim, 2017).

Many kinds of research have been conducted on different accounting policies adopted in different countries. But a few studies recommended revaluing the debtors after the devaluation/depreciation of the currency or capturing normal inflation (Cenap, 2012) (Berna, 2009) (Abu, 2012) (Demmer, 2019). Very few studies have been published to incorporate the time value of money, inflation, and purchasing power parity into the financial statement of the organizations. some studies have been completed to include inflation in financial statements and consider the impact of frequent changes in inflation (Cenap, 2011). Although researchers identified many qualitative flaws in international accounting standard 29, they did not formulate any model/theory to integrate normal inflation in financial statements.

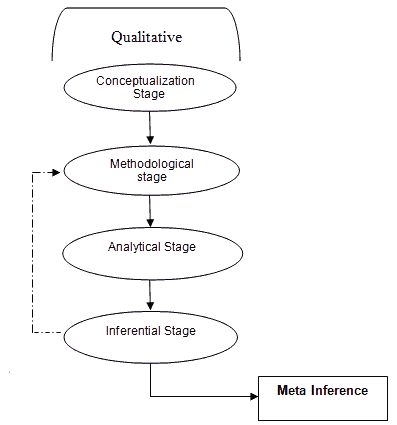

Research Design and Framework

We applied an inductive approach to develop a new model. The qualitative research method was adopted. The Grounded theory strategy has been implemented with a cross-sectional time horizon. The data collection was done through expert interviews and then data was analyzed in the N-Vivo software 10 version. The philosophy used in grounded theory is the mixture of positivism and interpretivism. Positivism helped in coding the qualitative data especially and how the researcher interprets that data. The interpretivist approach is adopted to interpret the realism and linguistic data. Interpretation is mostly done unbiased and based on actual words being used by the experts. The language used for the interview was both English and Urdu languages to get the maximum information from the interviewee. The constant comparison method was used during all the interviews to interpret a new meaning and a new strategy has been developed. The paradigm being formulated with this research method will help to understand the logic and relationship between the constructs.

The graphical presentation of the whole conceptual model can be presented as follows:

Initial interviews were conducted to collect the multiple ideas of some experts, who were already engaged with some audit firms and had experienced in preparing many financial statements. Then this study started to collect the data from experts of audit fields, which include presidents, policymakers, board members, and quite experienced people, who have in-depth knowledge of IFRS & IAS. Later the research demanded to collect the purposeful sampling data with those experts who are facing problems in showing the realistic state of financial statements. The information-rich evidence was gathered with the help of the zigzag approach from participants. The information-rich material can be scrutinized at the time of the interview and if the researcher feels that the information is not relevant and suitable then the researcher needs to find out other experts in the same field for purposeful sampling and data gathering. The research required careful listening of interviews by all ears and transcribe them into the English language to get the essence of the strategy. The careful reading of the words and listening to interviews, again and again, helped to interpret the meaningful sentences of the contenders to code them. Many things were notable during the interviews that how much time one participant took to answer a particular question and did he/she even understand the question or not the language being used to reply to any particular question and how much participant experience has to answer a technical eco-financial question. During the interview, the following things were mainly focused upon:

1. During the interview, the personal comments of the member were recorded and narrated accordingly.

2. The linguistic expressions of the interviewers were important and noted in a notebook that how did they reply to a particular question and what kind of language they used.

3. The data was collected based on words that each candidate used to differentiate which part of the interview is recognized as the assets and which part is general arguments

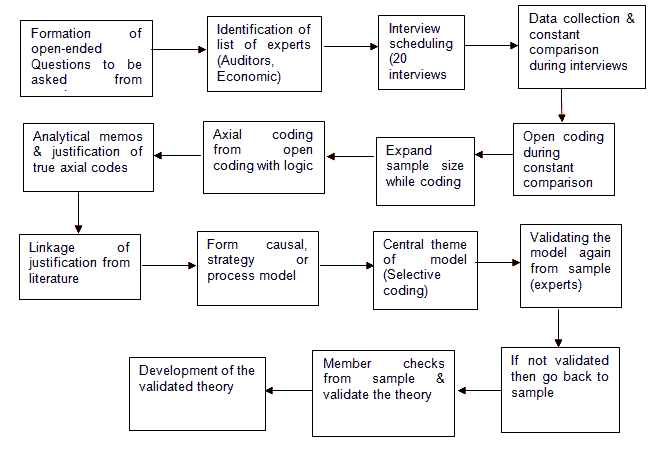

The purposive and snowball sampling method was adopted to get more expert opinions in the field of financial accounting. The data was collected at the time of the interview and interpreted at the same time based on the constant comparison to code the transcription. The operational framework of the qualitative phase is presented below:

The interviews collected from the respondents by face to face and recording audio recording through mobile phones and then converted into mp3 clear voice to transcript the interview into the English language. The interview questions were designed to get an open discussion and to obtain more in-depth information. The questions were interrogative and discussion related to developing the causality and logical connections with the variables. The following research design was developed. The following research map explains the goals of the research.

| Table 1 Goals of The Research | |||

|---|---|---|---|

| Aim of Research | Research Approach | Data Collection Tool | Sub-Goal |

| What are the factors that are affecting currency valuation for any particular currency? How these factors are linked to each other? | A pragmatic approach was adopted to find the fundamental questions of the research. In the first phase of research inductive approach was adopted to develop the strategy/model and in the second phase deductive approach was adopted to test the strategy. | The expert’s interviews were audio-recorded after taking consent from the experts. The data then transcript into the English language for further analysis. | The answers were recorded and facial expressions and body language were noted down on notepads. Interviews then converted into a general discussion on the problem statement and how can we solve this research problem. |

| How can we incorporate the time value of money and normal high inflation in financial statements? | The interviews were logically connected at the time of recording interviews with constant comparison techniques. When the data has a saturated point then the further data and interviews were stopped. | The data collected was transcript into the English language and logically connected with variables for further development of the strategy. | The goal is to convert the data into an easily readable form for further analysis and development of a theoretical model with the help of qualitative data analysis software Atlas.ti and N-Vivo version 10. |

Before collecting the information and recording the interview, verbal consent was obtained and permission was taken to use their coded names and demographic information to determine that how much expertise they have in the field of accounting and economics. Participants were selected based on predetermined criteria and the criteria were defined in the below table:

| Table 2 Selection Criteria |

||

|---|---|---|

| Selection Criteria | Professional Education | Age & Experience |

| Who will be interviewed ? |

The person who has professional education like CA, ACCA, MBA, MS, or Ph.D. in finance. |

At least having 5 years of working experience in any big four audit firm or any reputable organization, where the practical application of IAS & IFRS is being followed. Knowing Macroeconomic variables, purchasing power parity, time value of money theory, and IFRS. |

The interview participants were identified based on their working experience in the field of accounting and finance. Some international participants’ interview data were also collected to add their views about the currency of different countries. The following code names were used for the participants to keep privacy. The summary of the participant’s biography is given in the following table:

| Table 3 Experts details | |||||

|---|---|---|---|---|---|

| S. No | Names | Gender | Age | Education | Experience |

| 1 | (MN) | Male | 72 years |

CA, Ex-President ICAP, KPMG Advisory board member, Senior Partner KPMG, 48 years of experience as a senior partner at KPMG. |

Currently an advisory board member of SECP and KPMG. Mr. Naqvi is currently serving as a member of the Tax Reforms Implementation Committee of FBR and the Academic Council of the Commecs Institute of Business & Emerging Sciences. |

| 2 | (ARS) | Male | 63 years |

CA, ACCA, Ex-President ICAP, 38 years of experience in Accounting, Auditing & Management. |

Currently Board Member &Ex-President- ICAP, Partner at A. R. Suriya & Co. Trainer at IBA, Executive Director at Spencer Pharma, Asst. Manager at PWC. |

| 3 | Dr. (KB) | Male | 58 years |

Ph.D. From Karachi University, Master in Economics from Boston University, USA. |

35 years, Different Government & Educational institutes. The vast experience of national and international research symposiums. |

| 4 | Mr. (MB) | Male | 39 years |

ACA complete, ACCA, MA in Economics. | 15 years of Experience, Vice President, Deutsche Bank, Royal Bank of Scotland, Ernst & Young & KPMG |

| 5 | Mr. (SA) | Male | 38 years |

ACCA, Part qualified CA, 16 years of audit & Accounting experience at KPMG. |

Currently a Senior Manager Advisory Services EY, Own Consulting firm at Cambodia, Bangkok, Southeast Asia, Pakistan. |

| 6 | Ms. (ZI) | Female | 33 years |

Bachelor in Accounting & Finance from IBA, CFA candidate. | Vast experience, Regional Financial Analyst at M/s Daraz, Manager Financial Planning & Strategy DairyLand, & Assist Manager at Habib Bank. |

| 7 | Mr. (HM) | Male | 33 | ACA, ICMA, 10 years of Experience, CFO/ Company’s Secretary at Bank Islami Mudaraba Investment limited. |

Corporate Consultant & Trainer of IFRS, USAID Certified Trainer, Visiting faculty at CA & ICAP institutes. |

| 8 | Ms. (SS) | Female | 33 years |

ACCA | 13 years of experience working with the international grant department of Aga Khan University. |

| 9 | (RM) | Male | 32 Year s |

CA | 15 years of experience in the audit department of Sui Sothern Gas limited and have experience working with audit firms and IAS/IFRS. |

| 10 | (JI) | Male | Masters in Commerce & Finance, 17 years of experience in the spectrum of finance, accounting, auditing, taxation, compliance, and corporate laws. |

He has a proven record and in-depth knowledge of financial management, accounting, auditing, and supply chain procedures. has vast experience of working in manufacturing & process-based, (FMCG), accounting & auditing organizations. | |

| 11 | (SM) | Male | 38 Year s |

CA, KPMG audit manager, MBA finance, CFO at Food Chain | Working in the retail food chain as Chief financial officer and have more than 15 years of experience in auditing of KPMG and financial management. |

The participants were selected based on purposive sampling to get the information-rich data for analysis. The practical experience of participants was either from big-four audit firms and some participants have international exposure to the banks and currencies.

Analysis

The first part of the interview was related to the qualification and years of experience each participant had in the accounting and finance field to develop a better understanding. The transition questions were related to the general condition of the Pakistani economy and how the currency plays a vital role in economic development. After the questions of transition, some core questions were asked from each contributor, whose answers were critically and persistently compared with other participants and recorded in the form of audio files. All the interview questions were open-ended to get discussion and in-depth opinion of the participants. The data was recorded, noted, and constantly compared with each other to get the saturated point. The audio-recorded interviews then transcript into English and coded in an excel file to analyze and generate themes. At the time of the interview, a constant comparison was conducted to get the comparative statements. After the open coding of comparative codes, the process turned into axial coding, where each code is linked with the logic. The true axial coding was based on analytical memos and justification with logic (Gorra & Kornilaki, 2010). This justification was linked with the literature to prepare the central theme of the model. The central themes are prepared with the help of selective coding. This selective coding was then rearranged to prepare the framework models and stated as the strategy. The results of the interviews were based on the transcription of the interviews. So, very careful transcription was required so that no meaning of the statement should be changed. From a constant comparison of interviews, the following five broad categories were developed which are:

i. Factors affecting currency valuation/depreciation

ii. Incorporation of these factors in financial statements

iii. Time Value of Money on receivable time

f same currency adjustment in financial statement

v. Formulation of international strategy/rule.

The analysis took place in NVIVO and Atlas.ti software and these broad categories were produced step by step. From the detailed list of open coding, it can be inferred that six main categories were being identified in the whole process of the formation of revalued financial statements. These main categories are:

i. Current accounting standards are adopted by each business.

ii. Nature of business (accounting standard is dependent on the nature of business).

iii. The normal inflation rate, which is associated with purchasing power.

iv. Currency valuation is associated with many other factors.

v. Time value of money is linked with the time and exchange rate.

vi. Revaluation of financial statements after incorporating normal inflation, time value of money, and valuation of a currency.

The above mentioned six categories are further divided into many sub-themes. During this phase, the data is divided into the simplest categories and are arranged according to their focal category. These codes were further analyzed in NVivo based on their repetition in the data.

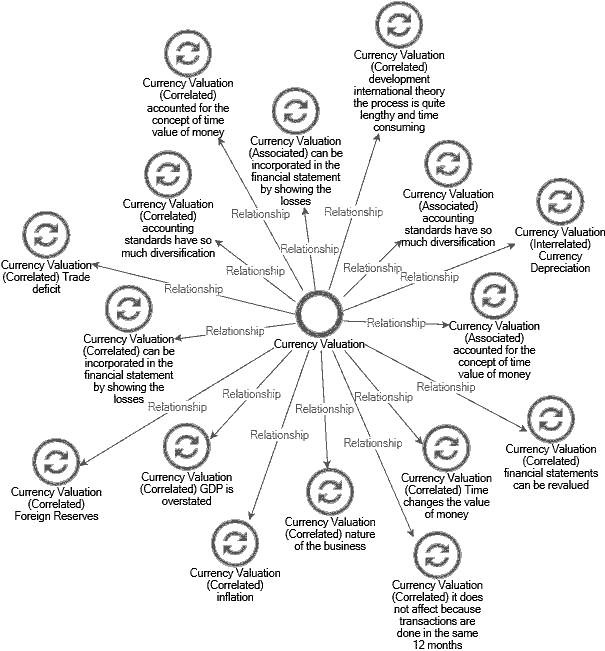

The word tree analysis was based on NVivo software, which represents the word of currency valuation link with different sentences in the data.

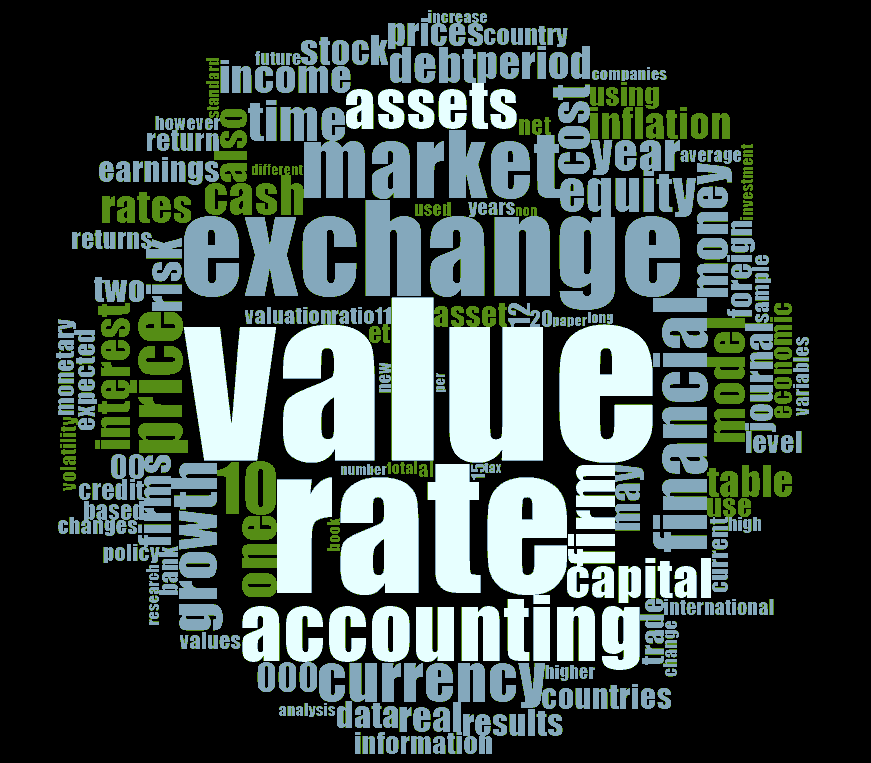

The above picture depicts the currency valuation relationship with different components of the economy and business. The above picture does not illustrate the logical connections of the categories although these categories were coded and then further analyzed in different wording techniques used in N-Vivo. The words were further scrutinized in software to analyze the usage of each word in the data and the word cloud is prepared based on the repetition of the words in the data.

The above analysis shows the word cloud analysis which indicates those words which are used in data with more frequency (Castleberry, 2014). These codings are based on common dynamics being mentioned by each respondent and no extra data is being recorded during this session. The categories are then analyzed based on a hierarchical structure that represents the main heading and how these headings have been arranged in peaking order. These main categories are further divided into the next step of Axial coding. In this phase of the research axial coding is considered as the intermediary step, where open codes are being connected logically. For logical connection, different software is used which includes Atlas.ti for analysis. The following are the images of analysis being performed on software.

Each code was connected logically in this phase based on statements of each response elaborated in the discussion. Each participant highlighted the following factors affecting currency valuation.

i. Economic growth

ii. Debt burden

iii. Trade deficit

iv. Foreign exchange reserves

v. Gross Domestic Product

These factors were mentioned by each respondent and hence no new factors were identified by any new respondent. The sample size was restricted because no new data was collected by asking the same question. The open codes were logically connected with the economy of Pakistan. Further coding was based on the comparison of the respondent about the particular question. When asking about the core questions that how can we incorporate normal inflation and time value of money at a particular point, some of the respondents were of the view that It is very difficult to cater to the valuation of currency at a fixed time. The fluctuation is so rapid that the value at a certain time would be difficult. IFRS-8 came with the same principle of hedging, where the financial assets are being revalued relentlessly. Currency exchange gains and losses are being captured through IAS-31. So far, there is no mechanism to capture the value of the currency, so there is a need to develop a mechanism (HM).

The most experienced respondent answered that financial accounting is a complex structure. It is very difficult to present the true picture of the financials of any organization (Ahn, 2020). The value of currency certainly has a significant impact on financial statements, which needs to be calculated. The mechanism has not yet been identified. These factors need to be addressed through a proper mechanism or model. If it is being recorded as an expense and will show it in the profit and loss account then there is a noteworthy impact on the shareholders ‘earning. So, there might be hurdles from the shareholder side. It is being recommended to calculate the value of a currency and record it as an expense in ‘Notes’ of the financial statements or the disclosure of the financial statement but not in the profit and loss account (Drake, 2019). In the case of the Islamic point of view, the financial would be different, so the mechanism should accommodate the Islamic financial statement and normal financials as well. Still, there are many loopholes in Islamic financials, where the value of an asset changes frequently and the change in the value is not being recorded anywhere in financial statements (ARS).

The other respondent gave their expert opinion and discussed that IFRS-9 is a standard that incorporates this concept of fair values over a period that is being derived. The complete historical concept is now obsolete. Insubstantial areas, there is a concept of fair values. The international scenario after 3 years of devaluation is now incorporated in Pakistan from last year (Lugovsk?, 2019). These standards give you an option that devaluation can be changed depending upon the situation or particular item so it can be changed every year.

The development of standards has raised 2 major things:

1. The concept of accounting has become more complex. It’s not easy to understand and apply the standards hence have increased complexity.

2. Objectivity is still the same that stakeholders can easily comprehend and make decisions on their basis.

IFRS-9 is already capturing the hedging effect of the currency. Historical costs now a day is not being presented in a financial statement. Accounting standards keep the options to the accountant to revalue the assets. The objective of a financial statement is to give fair value to its stakeholders to understand the financials of an organization. For the development of international strategy, the process is quite lengthy and time-consuming. Nowadays, accounting standards have so much diversification and the accountants must have to cope-up with those diversifications (Demmer, 2019). Yes, the purchasing power can be incorporated, if the origin of accounting is based on the fair value concept. If we talk about normal inflation, then accounting for normal inflation cannot be done on a day-to-day basis. This is because inflation is based on factors and these factors cannot be determined every day. It can be done every quarter or annual basis (MN).

There is only one solution to hedging if the currency is fluctuating then you can only hedge the value of the currency, otherwise the value of currency changes every time, which will fluctuate the financial statement regularly (MB).

Discussion

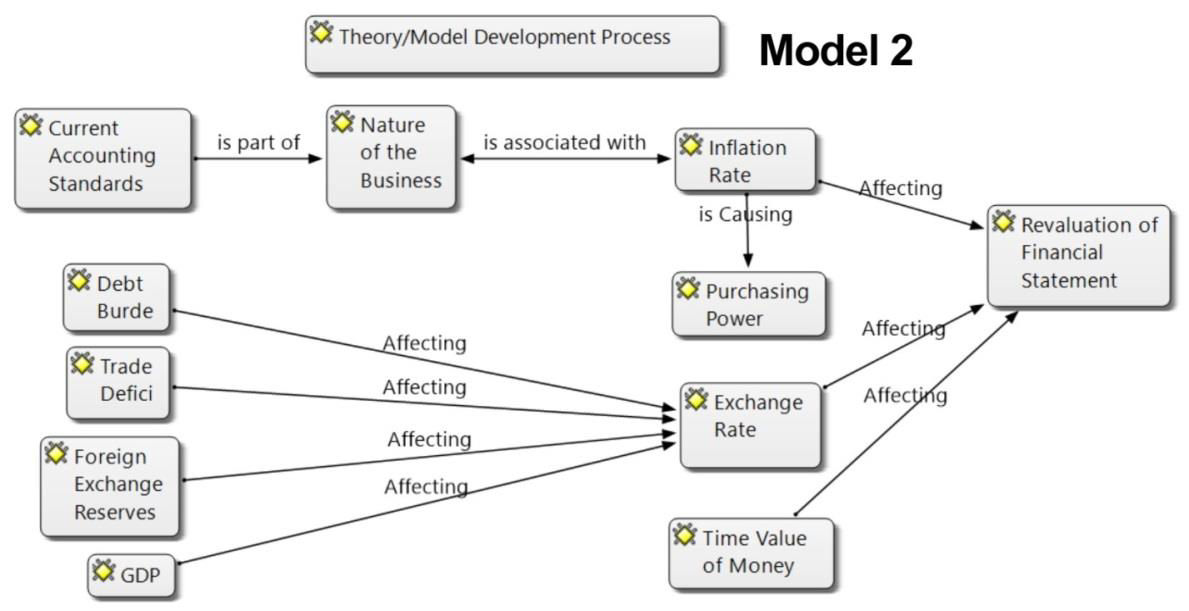

Based on the above logical discussion it can be inferred that current accounting standards are based on the nature of business. Two significant models have been developed based on the logical connection and axial coding. Both models state that the normal inflation rate is an important factor to perform business activities. So, we can infer that normal inflation has a significant impact on the financial statement. Purchasing power is another factor that affects the financial statement directly. The conceptual framework of model-1 can be represented as follows:

The above-mentioned model states that many factors are affecting the exchange rate including debt burden, trade deficit, foreign exchange reserves, and GDP. These factors are distressing the exchange rate, which is eventually impacting the time value of money. Time value of money act as a mediating variable that affects the financial statement directly. So, it can be inferred from model-1 that three major variables play a vital role in the revaluation of financial statements that is inflation, purchasing power, and the time value of money. Furthermore, it can be analyzed in a different way, which interprets the logic that’s the current accounting standards are quite complicated and it’s depending on the nature of business. It can also be stated after reviewing all the interviews that the current financial statement does not represent the accurate financial position of any organization. For example, if the nature of the business is manufacturing then specific standards are being applied. In the case of non-profit organizations, accounting standards will be changed. The nature of every business also depends upon the inflation factor. Normal inflation has a significant impact on the financial statement but there is no accounting standard to capture the normal inflation rate in financial statements. The normal inflation rate also reduces purchasing power but also has a significant impact on financial statements.

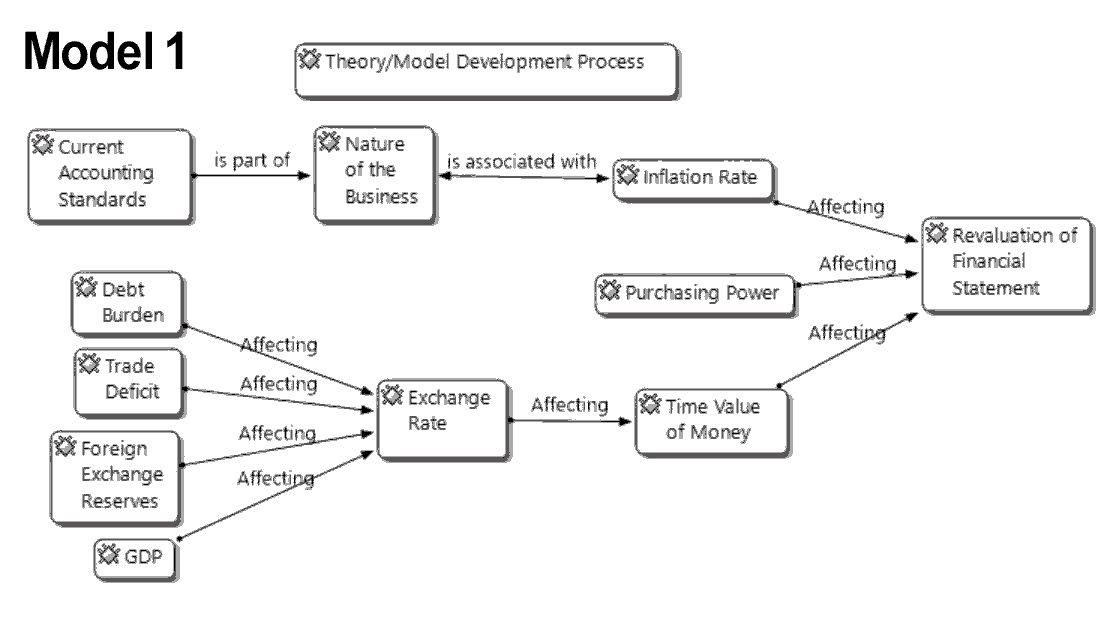

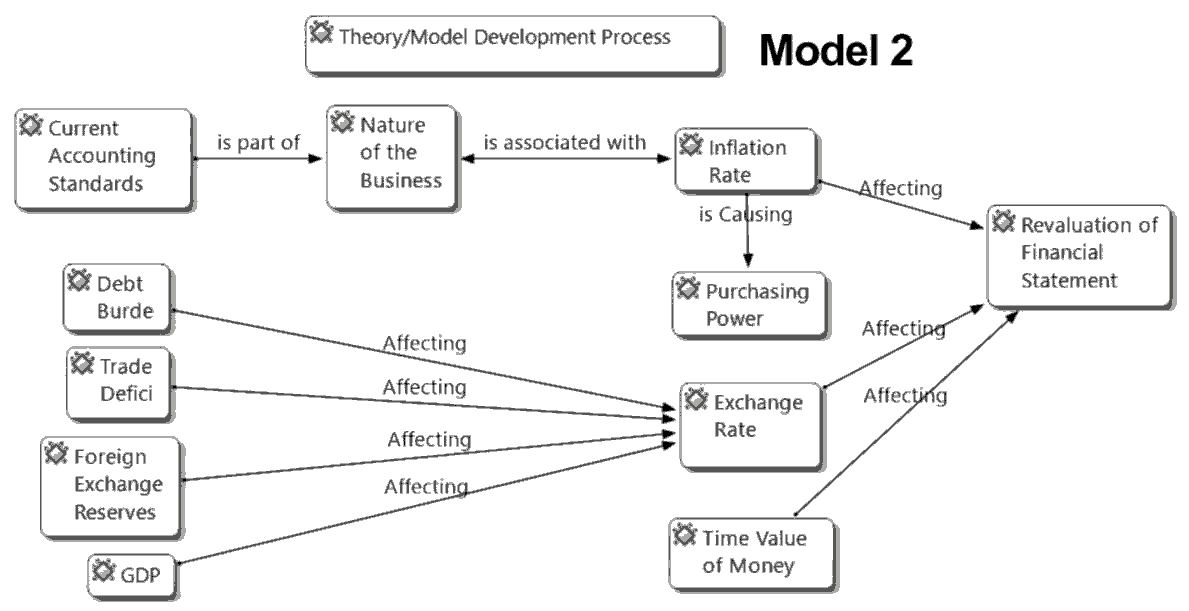

The data received from all the experts result in somehow has the same factors that are affecting currency valuation. The value of the currency can be measured in two ways, either it can be measured by comparing it with another currency or with purchasing power. Many factors are affecting Pakistani currency. All the experts were agreed that trade deficit, foreign debt, foreign exchange reserves, and GDP are the main factors that are affecting the Pakistani Rupee significantly. These are the affecting factors on the exchange rate of Pakistani rupees against the US dollar. If the power of currency is measured through the purchasing power then these factors become also significant. The time value of money is also an important aspect that affects financial statements significantly. The conceptual framework of the model-2 can be represented as follows:

The above-mentioned model-2 is not much different from the model-1. In the second model, the inflation rate is triggering the purchasing power and directly affecting the financial statements. There are similar factors that are affecting the exchange rate and the exchange rate is distressing the financial statement. The time value of money in this model is treated as a separate variable and is affecting the financial statement directly. So, the number of variables and mediating variables are different in both models.

Conclusion

Both models are explained in above mentioned conceptual frameworks but here the question arises that which model is considered as a valid model. The validity of the model is checked by member checks to get it verified from the experts again and taking their feedback. Most of the experts were agreed on the relationship of the second model. Most of the experts had the opinion that model-2 has more logical connections as compared to model-1. The validity of the model can be verified from the member check and most of the respondents were agreed with model-2. Now the second model is considered a valid model by the expert. Below is the representation of valid model-2.

The model-2 can be stated in conception as “the primary fact that financial statements are presented in a currency and every currency has some value. Every kind of business in this world is syndicated with the normal inflation rate, which is not being consolidated in financial statements through any accounting standard (IAS, IFRS & SICs). Subsequently, in every country, some distinct components influencing the value of that country’s currency, which also needs to be evaluated through quantitative financial modeling and should be integrated into financial statements at any point in time. The third prime factor is the time value of money, which can “anew” the financial statement. The future value of any currency can be forecasted at any point in time through regression modeling and need to be fused in the financial statement to convey the realistic & veracious financial value of any organization.

A new model is developed with the proper procedure of grounded theory introduced by (Barney & Anselm) in their publication of the “Discovery of grounded theory” in 1967. This research started with the question that why normal inflation is not being reported in the financial statement? Why time value of money is not being merged into the financial statement? To answer these questions, it connected us from the experts in the field of audit. A new model is developed after the validation of the experts and states that every business is linked with the inflation rate of every country. The normal inflation rate is not being recorded in the financial statement, but the financial statement of every organization is being presented in a currency and every currency has some value. The value of a currency can be measured by comparing it with the US dollar or with its purchasing power. The value of every country’s currency depends on some macroeconomic factors, which affect the value of currency significantly. This precariousness in the currency can be measured with the help of quantitative financial modeling. The forecasting of the value of a currency can also be measured with regression analysis at any point in time. This impulsiveness in the value of the currency should be incorporated in a financial statement. The third important factor is the time value of money. This time value of money can also be calculated with the help of forecasting. This new strategy will enable auditors to include the impact of normal inflation, volatility in the value of a currency, and the time value of money should be forecasted and incorporated monthly or quarterly in financial statements. In the future, this strategy can be tested with the help of CGE modeling, where the macroeconomic system of equations can be developed and can be tested through the CGE model in GAMS.

References

- Abdel?khalik, A.R. (2019). Failing faithful representations of financial statements: issues in reporting financial instruments. Abacus, 55(4), 676-708.

- Abu-Abbasi, B.M., & Riyadh, A.A. (2012). Are IASB's qualitative characteristics reflected in ifrss? ias 29 as a case study. Research Journal of Economics, business, and ICT, 5.

- Adina, C.S. (2010). From accounting regulations to valuation practice – The appraiser’s role intangible assets’ revaluation. Annals of the University of Oradea: Economic Science, 1(2), 648-654.

- Ahn, J., Hoitash, R., & Hoitash, U. (2020). Examining the joint disclosure of text and numbers in complex financial statement notes, 3582662.

- Aline, M., & Verschoor, W.F. (2009). The effect of exchange rate variability on US shareholder wealth. J Bank Financ.

- Arslan-Ahmad, N.A., & Ali, S. (2013). Exchange rate and economic growth in Pakistan (1975-2011). Journal of Basic and Applied Scientific Research, 740-746.

- Ayen, Y.W. (2014). The effect of currency devaluation on output: The case of the Ethiopian Economy. Journals of Economics and International Finance.

- Berna, K., Cagnur, K.B. (2009). Value relevance of inflation-adjusted equity and income. The Int J Account, 44(4), 363-377.

- Bunget, O., Dumitrescu, A.C., & Deliu, D. (2013). The relevance of accounting information generated by the application of IAS 29 related to shareholders capital. Account Bus Res, 1(1), 1165-1170.

- C?runtu, G.A., Holt, G. (2011). Influence of inflation on capital . Annals of the „Constantin Brâncu?i” University of Târgu Jiu, Economy Series,4. Castleberry, A. (2012). NVivo 10 [software program].

- ersion 10. QSR International; 2012. Am J Pharm. Educ, 78(1), 25.

- Cenap, I. (2012). Exploring the effects of inflation on financial statements through ratio analysis. Int j bus, 3(13), 154-162.

- Cenap, I. (2011). Exploring the risk of overstatements and understatements in financial reporting due to inflation and devaluation gap. Malaysian Accounting Review, 10(2), 55-71.

- Chadwick, C.C., Julio, G., & Saif, M.M. (2017). Inflation and the evolution of firm-level liquid assets. J Bank Financ, 81, 24-35. Chen, Q., Schipper, K., & Zhang, N. (2019). A balance-sheet-based measure of accounting quality.

- Datta, T.K., & Pal, A.K. (1991). Effects of inflation and time-value of money on an inventory model with linear time-dependent demand rate and shortages. Eur J Oper Res, 52(3), 326-333.

- David, A., Mary, E., & Ron, K. (1999). Revaluations of fixed assets and future firm performance: Evidence from the UK. J Account Econ, 26(1-3), 149-178.

- David, E., Maureen, O.H. (2010). Liquidity and valuation in an uncertain world. J financ econ, 97(1), 1-11. Demmer, M., Pronobis, P., & Yohn, T.L. (2019). Mandatory IFRS adoption and analyst forecast accuracy: the role of financial statement-based forecasts and analyst characteristics. Rev Account Stud, 24(3), 1022-1065.

- imitrios, S., & Tsounis, N. (2014). Exchange rate volatility and aggregate exports: evidence from two small countries. ISRN Economics. Drake, M.S., Hales, J., & Rees, L. (2019). Disclosure overload? a professional user perspective on the usefulness of general-purpose financial statements. Contemp Account Res, 36(4), 1935-1965.

- Alam, R., Asadullah, L. & Tariq, M. (2013). Effects of currency depreciation on trade balances of developing economies: a comprehensive study on south asian countries. J Humanit Soc Sci, 14(6), 101-106.

- Syed, B.H., Fiaz, H., & Shahzad, H. (2015). Exchange rate volatility during different exchange rate regimes and its relationship with exports of Pakistan. ISSRA Papers.

- Ehsan, U.C., Dalia, S.H. (2012). The exchange rate pass-through to import and export prices: the role of nominal rigidities and currency choice. J Int Money Finance, 51, 1-25.

- Eichengreen, B. (2013). Currency war or international policy coordination? University of California, Berkeley, 35(3), 425-433.

- Gkaimani, I. (2006). Do International Financial Reporting Standards affect the value relevance of financial statement information? Evidence from Greece. MSc in Finance and Financial Information Systems.

- Gomes, P., Brusca, I., & Fernandes, M.J. (2019). Implementing the International Public Sector Accounting Standards for consolidated financial statements: Facilitators, benefits, and challenges. Public Money Manag, 39(8), 544-552.

- Gorra, A., & Kornilaki, M. (2010). Grounded theory: experiences of two studies with a focus on axial coding and the use of the NVivo qualitative analysis software. Methodology: Innovative approaches to research, 1, 30-32.

- Hewitt, M. (2007). Hyperinflation around the Globe. Dollar Daze. Ihuah, P.W., & Eaton, D. (2013). The pragmatic research approach: A framework for sustainable management of public housing estates in Nigeria. Journal of US-China Public Administration, 10(10), 933-944.

- Jonas, C.P.Y., Hui, M.W, Gede, A.W. & Jer, Y.C. (2010). The effects of inflation and time value of money on a production model with a random product life cycle. Asia-Pac J Oper Res, 27(4), 437-456.

- Kairiza, T. (2009). Unbundling Zimbabwe’s journey to hyperinflation and official dollarization. National Graduate Institute for Policy Studies (GRIPS), 9-12.

- Kalim, U.B., Mazhar, H., & Syed, Z.A.S. (2017). Determinants of real exchange rate movements in south Asian countries: An Empirical evidence. Pakistan Business Review, 1048-1062.

- Lugovsk?, D., & Kuter, M. (2019). Accounting policies, accounting estimates, and its role in the preparation of fair financial statements in the digital economy. International Conference on Integrated Science, 165-176.

- Levy, M. (2003). The use and perceived usefulness of IAS 29 general price level information in Zimbabwe. The Department of Accounting, University of Cape Town.

- Muda, I., & Hasibuan, A.N. (2017).Public discovery of the concept of time value of money with economic value of time. Proceedings of MICoMS, 1, 251-257.

- M., Ibrahim, M., Amjad, A., Shuaib, M., Mansoor, A., Itaf, H., & Tehreen, F. (2014). Impact of exchange rate on foreign direct investment in Pakistan. Advances in Economics and Business, 2(6), 223-231.

- Nyasha, M., & Leonard, M. (2014). Stock market returns and hyperinflation in Zimbabwe. Invest Manag Financial Innov, 11(4).

- Omar, A.E., & Dave, O.J. (2012). Currency depreciation effects on ADR returns evidence from Latin America. J Econ Finan, 36, 691-711.

- Muniappan, P., Uthayakumar, R., & Ganesh, S. (2015). An EOQ model for deteriorating items with inflation and time value of money considering time-dependent deteriorating rate and delay payments. Syst Sci Control Eng, 427-434.

- Qingqing, C. (2014). Inflation and revaluation of bank balance sheets. Department of Economics, Princeton University.

- Roa, A. (2011). Money growth and inflation in the euro area: A time-frequency view. Economic & Research Department of Portugal.

- Rossi, B. (2013). Exchange rate predictability. J Econ Lit, 51(4), 1063-1119.

- Sami, U., Syed, Z.H., & Parvez, A. (2012). Impact of exchange rate volatility on foreign direct investment: A case study of Pakistan. Pakistan Econ Soc Rev, 50(2), 121-138.

- Sigidov, Y.I., Korovina, M.A., Trubilin, A.I., Govdya, V.V., & Vasilieva, N.K. (2016). Creation of provision for doubtful debts. International Journal of Economics and Financial Issues, 6(4).

- Shabana, P, Abdul, Q.K., & Muammad, I. (2012). Analysis of the factors affecting exchange rate variability in Pakistan. Acad res Int, 2(3).

- William, B.E., Skander, J.V.D.H., & Egon, Z. (2012). Interest rate risk and bank equity valuations. Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C. Interest.

- Yaaqov, G., & Jacob, Y. (1991). Inflation adjustments of financial statements. The World Bank.