Research Article: 2025 Vol: 29 Issue: 2S

Revolutionizing the Bhilwara-Based Textile Industry: How Accounting Software is Transforming Accountants' Performance

Himalaya Singh, Mohanlal Sukhadia University

Arjun Khichi, Mohanlal Sukhadia University

Shilpa Vardia, Mohanlal Sukhadia University

Citation Information: Singh, H., Khichi, A. & Vardia, S. (2025). Revolutionizing the Bhilwara-based textile industry: How accounting software is transforming accountants' performance. Academy of Accounting and

Financial Studies Journal, 29(S2), 1-16.

Abstract

The focus of this study was the textile industries of Bhilwara city, the objective of which was to investigate the impact of accounting software on the performance of accountants. The aim was to consider the performance of accountants by looking at its impact on their performance in terms of skills, knowledge and creativity when accounting systems is being developed. The results of the statistical analyses performed in this study to evaluate the hypotheses are shown in the tables below. The findings suggest that computerized accounting systems have a positive impact on accountants' performance. The results suggest that recent general improvements in accounting systems, particularly accounting software, can enhance performance. The results of the hypothesis testing, which showed a substantial relationship between the independent variable of accounting software and each dependent variable—skills, knowledge, and creativity, support this. The results of the statistical analysis established acceptable results.

Keywords

Accounting System Software, Accountants, Efficiency, Skills, Understanding, Creativity.

Introduction

In today's fast-paced and dynamic textile industry, the role of accountants has never been more crucial. As businesses strive to stay competitive and profitable, efficient financial management is key. This is where accounting system software comes into play, revolutionizing the way accountants work and boosting their performance in remarkable ways.

Gone are the days of manual book-keeping and tedious number crunching. Thanks to accounting software, accountants in the textile industry can now streamline their processes, saving time and increasing accuracy. This increased efficiency allows accountants to focus on more strategic tasks, such as financial analysis and forecasting, ultimately driving business growth.

But it's not just about efficiency. Accounting software also enhances accountants' skills and understanding of financial data. By automating routine tasks and providing real-time insights, these tools empower accountants to make informed decisions and drive business success. This level of precision and accuracy is essential in the fast-paced world of textiles, where market fluctuations and trends can change in an instant.

Moreover, accounting software encourages creativity in accountants, enabling them to think outside the box and find innovative solutions to financial challenges. With customizable reports and data visualization tools, accountants can present complex information in a clear and engaging way, making it easier for stakeholders to understand and act upon.

Accounting software is a subset of software that allows individuals and businesses to manage their accounts and financial operations. It varies in capability from a simple income and expenditure tracker to sophisticated software that can manage complex accounts and accounting for large multinational firms. Generally, accounting software can be categorized as either data entry or analysis. The former records transactions, while the latter analyses and reports upon them. On the data entry side, accounting software usually comprises a series of forms that allow for the recording of details of transactions and the generation of the accounting journal entries needed to record these transactions in an accounting system.

The adoption of accounting software automates numerous accounting functions, improving efficiency and reducing operational costs (Battaineh, 2021, as cited in Alfartoussi and Jussoh, 2021). Nicolau (2006) observed that software-based accounting produces results that are more accurate and generates data that is not only easier to manage but also less prone to errors compared to traditional manual methods. Furthermore, it enables quick decision-making, thereby enhancing overall business performance. Accounting software includes various processes that promote the creation of accurate and reliable financial reports, streamline operations, and ensure compliance with legal standards and regulations (Terru et al., 2017).

Accounting software can also comprise a series of reports that allow the accounts recorded in the accounting system to be analysed and reported upon for various purposes. In addition to analysis and reporting software, computerized accounting systems also require utility software that assists in the analysis or reporting of accounts, or assists in the maintenance and recovery of accounts and accounting systems. An accounting software package may be the basic software required by a business, or may at a minimum of further utility, be software that can be run in conjunction with the basic accounting software of any business.

The growing need for accounting in business operations has resulted in a notable enhancement of accounting software features in the current industrial environment. Many companies now seek the capability to monitor financial data relevant to their activities, utilizing a variety of methods that range from simple to complex. Research shows that many textile industries in bhilwara, including manufacturers, are increasingly depending on information and communication technology for their accounting requirements. As these companies expand, attract new customers, and explore new markets, they must keep pace with the rapid developments in information technology.

There are many different types of accounting software packages available on the market today with a wide range of sophistication, capability, and cost. Most off-the-shelf accounting packages in use today tend to utilize relational databases for the storage of transaction and general ledger data and utilize a separate yet-linked suite of tools including a word processor, spreadsheet, database manager, and/or calendar package for the generation of financial accounting reports. Some much more sophisticated accounting software packages come bundled with certain integrated non-accounting modules, such as customer relationship management (CRM), inventory within the sales, or fixed assets within the purchases.

In conclusion, the influence of accounting software on accountants in the textile industry cannot be understated. From boosting efficiency and skills to enhancing understanding and creativity, these tools are transforming the way accountants work and driving business success. As technology continues to advance, accountants must embrace these tools to stay ahead of the curve and lead their companies to new heights of “financial efficiency, accuracy, and strategic decision-making”. By leveraging innovations such as artificial intelligence, machine learning, and business systems optimization, accountants can streamline processes, improve accuracy, and deliver valuable insights that drive growth.

Literature Review

The integration of information technology has broadened the scope of accounting, allowing it to extend throughout the organization, including delegated functions, processing methodologies, controls, and expected outputs (Ramaj & Pjero, 2023). As a result, accountants are required to possess a diverse set of skills, including proficiency in utilizing various software tools and understanding the underlying technology that powers these systems.

The integration of information technology has broadened the scope of accounting, allowing it to extend throughout the organization, including delegated functions, processing methodologies, controls, and expected outputs (Ramaj & Pjero, 2023). As a result, accountants are required to possess a diverse set of skills, including proficiency in utilizing various software tools and understanding the underlying technology that powers these systems. Recent studies have explored the impact of accounting software on business performance and individual accountants. The adoption of accounting information systems (AIS) has been shown to positively influence business performance through improved efficiency, reliability, data quality, and accuracy (Y. Chong & PhD Ismail Nizam, 2018). The Unified Theory of Acceptance and Use of Technology (UTAUT) model demonstrates that factors such as performance expectation, effort expectation, and social influence significantly affect the intention to use accounting software, which in turn impacts individual performance (Madani Hatta et al., 2019). Research indicates that accounting software enhances profitability, productivity, and cost reduction in organizations (Pallavi Sachin Vartak & Meena Sharma, 2023). However, challenges persist in selecting appropriate software for specific business needs, with issues such as incomplete records and unauthorized data access affecting decision-making processes (Mihiri Wickramasinghe et al., 2017). Overall, these studies emphasize the importance of carefully selecting and implementing accounting software to maximize its benefits for both individual accountants and overall business performance.

The evolving landscape of the accounting industry has been a topic of extensive research. Scholars have emphasized the need for accountants to adapt to the changing business environment, which includes the continuous advancements in artificial intelligence and other emerging technologies. (Suleiman et al., 2020) The increasing reliance on cloud-based solutions, communication with AI machines, and the exploration of Big Data and cyber-security has become essential capabilities for modern accountants. (Friday & Imhanzenobe, 2020)

Masanja (2019) investigated how accounting systems influence the financial performance of selected private industries in Arusha, Tanzania. The study emphasizes that cost factors and managerial support are essential for the effective implementation of accounting software in these businesses. To enhance the overall performance of the private enterprises in Tanzania, the researcher recommended that management actively promote the use of accounting software. In addition, Pirayesh et al. (2018) investigated the connection between accounting software and management decision-making processes. Their results indicated that improvements in information quality due to technological advancements lead managers to make better-informed decisions. Thus, the study concluded that accounting software improves information accuracy, which supports managerial decision-making. On the other hand, Kasasbeh (2016) researched the effects of computerized accounting systems on accountants' performance, aiming to determine if the shift to computerized systems impacts their effectiveness. The results showed that adopting computerized accounting systems improves accountants' performance. A review of the current literature indicates a need for additional research on the effects of accounting software on accountants in the textile industry in bhilwara city.

Results of Implementation of Computerized Accounting System

The adoption of accounting software marks a significant milestone in the development of accounting practices, underscoring the critical role of information quality and precision, which ultimately improves managerial decision-making (Pirayesh et al., 2018). Furthermore, AI-Jobori suggests that this innovative strategy utilizes information technology to integrate the fundamental components of an organization's accounting processes, from data entry to reporting, thus enabling organizational change and creating new competitive advantages (Al-Jobouri, 2007). Additionally, Thottoli (2020) points out that many companies have shifted from traditional accounting methods to computerized systems, largely due to the user-friendly design of most accounting software, which enables accountants to carry out daily tasks with enhanced accuracy and efficiency.

The adoption of an accounting information system provides a variety of advantages in the processing and presentation of accounting data, especially for financial reporting. It streamlines the preparation and distribution of reports by accountants, enhancing the clarity of the information presented, which can positively influence the decision-making of various stakeholders (Setyaningsih et al., 2021). Furthermore, Bell et al. (as cited in Setyaningsih et al., 2021) support this view, noting that a well-organized financial report stems from an effective AIS process. It is crucial for all organizations to maintain a reliable accounting system to produce relevant, accurate, and trustworthy financial reports, as a subpar accounting system may result in reports that lack relevance and reliability. This, in turn, can negatively affect the quality of decision-making (Bell et al., 2018, as cited in Setyaningsih et al., 2021). Supporting this perspective, Lutfi (2022) demonstrated that the effective use of advanced accounting systems allows organizations to achieve better results across all operational areas, boost productivity and competitiveness, and enhance performance metrics. This ultimately aids in making informed decisions. Some of the key benefits of using computerized accounting software include:

Efficiency and accuracy of the accounting profession

Computerized accounting systems have greatly improved the efficiency of accounting departments by providing more up-to-date financial information. With enhanced timeliness of data, accountants are better positioned to create reports and operational assessments that give management a clear view of ongoing activities. The importance of computerized accounting systems has grown alongside the variety of financial reports they can generate, including cash flow statements, departmental profit and loss statements, market share analyses, and both item-based and customer-based profit reports (Ghasemi et al., 2011). Moreover, Khan et al. (2018) note that this technology allows accountants to produce and share information and reports from almost any location. Instead of being bogged down by numerous financial tasks, accountants can use their available time to interact with clients and develop business strategies. Regarding accuracy, both Ghasemi et al. (2011) and Ndubusi et al. (2017) agree that most computerized accounting systems include internal checks and balances to ensure that all transactions and accounts are reconciled accurately before financial statements are prepared. These computerized solutions help ensure that specific transactions are recorded correctly, thus preventing the release of imbalanced journal entries. Additionally, accuracy is improved by limiting the number of accountants who can access financial information. With restricted access to financial data, accounting professionals can resolve issues more quickly, as capable supervisors can address concerns more effectively than if they were solely responsible for implementing changes.

Processing speed and external reporting

Khan et al. (2018) argue that a cloud-based computerized accounting system enables the efficient sharing of resources and data across multiple computers and devices, effectively breaking down traditional office barriers. The authors also observe that accountants are increasingly using mobile devices to access critical information, which strengthens the relationship between clients and accountants. Mobile applications allow accounting firms to handle transactions while on the move, enabling organizations to use smartphones for tasks such as reconciling accounts, generating expense claims, issuing invoices, and attaching receipt invoices. Supporting Khan's viewpoint, Handel (2003, as cited in Zwartes and Alves, 2014) points out that a major benefit of computerized accounting is the significant improvement in the efficiency of routine tasks performed by accountants. These systems also enable accounting professionals to process large volumes of financial data quickly and effectively. The faster transaction processing has resulted in shorter accounting periods, alleviating the burdens often faced by accounting departments during month-end or year-end closings, which can lead to longer work hours and higher labor costs. By reducing these periods, businesses can achieve better cost control and improve overall performance (Ghasemi et al., 2011). Additionally, it is noted that computerized accounting systems have enhanced the information available to external investors and stakeholders. Improved reporting capabilities can help investors evaluate a company's growth potential and overall value, allowing companies to leverage these insights to attract equity funding for expansion.

Challenges towards Accountants

Accounting is widely regarded as one of the most essential professions worldwide. Without accurate and reliable financial information, businesses and economies would face significant risks. As a result, the concept of human resources and its broad application within organizations has gained considerable attention from management, making human capital a top economic asset prioritized by many businesses, nations, and individuals, especially in developed countries (Kasbeh, 2016). With the advancement of accounting systems and their integration with technological innovations, the accounting profession, particularly accountants, encounters various challenges in their roles. One major issue is the increasing complexity of financial reports, which presents a significant obstacle for the field. Therefore, accountants must be prepared to tackle a range of emerging challenges. Additionally, the rising demand for skilled accountants has created a noticeable skills gap in the industry. This shortage affects businesses across multiple sectors, forcing them to either offer higher salaries to attract qualified candidates or rely on less experienced individuals who may not fully meet job requirements. Another critical challenge is the need to keep up with rapidly evolving technologies, which poses a significant concern for accounting professionals. They may find it difficult to stay updated on new software and application developments. However, many routine tasks currently performed by accountants, such as data entry and analysis, can be automated through software solutions. Accountants can still deliver substantial value in various ways, such as providing insights and interpretations that software cannot replicate. They can also build relationships with clients and offer a personal touch that machines struggle to imitate. Furthermore, accounting software can be easily updated to reflect changes in accounting standards or tax laws and can be customized to meet specific needs.

Furthermore, a qualified accountant is adept at performing accounting tasks in light of recent advancements. Research conducted by Turner et al. (2020), Lin et al. (2005), and Allen (1999) underscores the vital relationship between information technology and accounting within a business environment. It is crucial to continue developing the necessary IT knowledge and skills among future accountants. As a result, Kasasbeh (2016) pointed out a growing concern regarding human resources due to the implementation of computerized accounting systems, which require skilled and certified professionals with specific expertise and creative problem-solving capabilities. A competent accountant should be proficient in various accounting software applications (Mustafa, 2020). To ensure that financial records adhere to established accounting standards or International Financial Reporting Standards (IFRS), accountants must deepen their understanding of accounting software and fundamental enterprise resource planning (ERP) systems (Draeger, 2020; Thatoli, cited in 2021). To effectively use modern accounting software such as Tally, Peachtree, and QuickBooks, a professional accountant needs sufficient hands-on experience. Consequently, new developments in accounting metrics and recording techniques have emerged. The incorporation of information technology in accounting has significantly increased the need to reassess the technological components of accounting education (Al-Jobouri, 2007). Additionally, an accountant's effectiveness is closely tied to their intellectual understanding, professional skills, and familiarity with advanced accounting software (Al-Jobouri, 2007). Human resources encompass a range of concepts, information, and data, including skills, performance-related traits, attitudes, behaviors, and values that individuals can acquire through education and training (Alifi, 2009, cited in Kasasbeh, 2016). As highlighted by Appa et al. (2012), training is crucial for enhancing professional capabilities.

Conceptual Explanation of Accounting Software

Ghassemi et al. (2011) characterize accounting as a systematic method used by organizations to evaluate their financial performance by carefully documenting and classifying all financial transactions, including sales, purchases, assets, and liabilities, in line with established standards. In contrast, information technology, which covers a wide range of topics including business processes, relates to the management of technological resources. This encompasses hardware, programming languages, information systems, and data generation. Essentially, the field of information technology includes all components that provide data, information, or perceived knowledge in various visual formats through multimedia channels. Furthermore, Ghassemi et al. (2011) describe accounting as an information system aimed at effectively managing an organization's economic activities. This accounting function has rapidly transitioned from manual methods to automated or technology-driven processes in today's digital environment (Etang, 2020). 1. The combination of accounting and information technology is commonly known as computerized accounting. In this framework, computers are the core component of accounting information, providing a platform for the functioning of accounting information systems. These systems are designed to deliver information accurately, promptly, and securely, thus enabling informed decision-making (Hashem, 2021). As noted by Ware, Khan (2015), and Ware (2017), accounting information systems (AIS) gather data using specialized computers, processing, analyzing, and transforming this data into valuable outputs. AIS is essential for supporting organizational operations by supplying effective, timely, and precise information to owners, shareholders, employees, customers, and stakeholders within a unified environment. It establishes policies and procedures that enhance its functionality, ensuring that accounting inputs are converted into understandable outputs that accurately represent the organization (Ware, 2015; Khan, 2017, cited in Hashem, 2021). A computerized accounting system can be defined as an accounting information system designed to collect, record, store, and process financial data, ultimately producing information for decision-makers (Itang, 2020). Furthermore, Kassabeh (2016) describes a computerized accounting system as a computer-based information system that records, processes, analyzes, and outputs financial data to support decision-making. This system integrates accounting principles and concepts with careful consideration. From the various definitions of a computerized accounting system, it is evident that it consists of several key components, the first being data. The information gathered and processed by the accounting information system is referred to as inputs. The second component focuses on gathering process data, which requires organizing and processing this information into a format that provides valuable and relevant insights. The third component relates to output: the information produced by the system should be both significant and practical, usually delivered in the form of a report. The fourth component is feedback: once the report is shared, obtaining feedback is crucial. It serves as both a source of input and a regulatory mechanism within the information system. Finally, the fifth component of a computerized accounting system is storage, which refers to a repository for relatively permanent data that is kept over a long period (Romney and Steinbart, 2009; Kasabeh, 2016).

In short, it can be said that the relationship between accounting software and accountants is quite strong, and it can have a good impact on their abilities in terms of knowledge, skills and creativity, as they complement each other. While human accountants contribute the ability to make professional decisions, utilize experience, and develop lasting relationships with clients, accounting systems provide speed, accuracy, and efficiency in processing financial data.

Research Problem

Nowadays, textile industries in Bhilwara city are undergoing growth and textile industries are participating in this developing sector. Therefore, many of them have applied advanced technology in human resources, especially accounting. The primary purpose of implementing this advanced technology is to help improve accounting systems and better control expenses, as well as achieve higher-quality financial reporting. However, these systems require more research to determine their efficiency and impact on accountants. As a result, this question can be used to formulate research problems: “Does the application of accounting software affect the performance of accountants in terms of skills, knowledge and creativity”

This research is highly important as it serves as an academic effort to clarify the growth of accounting software and its essential function in businesses and organizations. In general, how can businesses improve the effectiveness of their accountants by implementing accounting software?

Research Objectives

The study aims to achieve the following objectives:

a) To investigate the impact of accounting software on the knowledge, skills, and innovations of accountants within the textile sector.

b) To examine the key features, core components, and the critical role of accounting software in enhancing the operational efficiency of the textile industry in now a days evolving business environment.

Research Hypothesis

H1: There is no significant effect of accounting software on the creativity of accountants.

H2: There is no significant effect of accounting software on the skills of accountants.

H3: There is no significant effect of accounting software on the knowledge of accountants.

Research Methodology

The following descriptive analytical procedures are used by researchers to plan their research in relation to their objectives and the importance of hypotheses. The individual samples in the study included all accountants working for textile industries. The first strategy relies on extrapolation and analysis of literature, books, scientific journals and research on global information networks related to research accounting software to establish the scientific research issue. The second strategy relied on conducting field surveys in bhilwara city, and the study's questionnaire was adopted with modifications from empirical studies of other researchers (Kasasbeh, 2016 and Alzaidi et al, 2023) The survey (Questionnaire) is divided into two separate sections. The first section includes respondents' demographic information, while the second section deals with 20 statements about how accounting software impacts accountants in terms of knowledge, skills, and innovation.

Demographic Profile of Respondent’s

Accountants in the accounting departments of textile industries are increasingly integrating into the research community. This trend is primarily driven by the swift expansion of textile industries in Bhilwara city, which show a stronger tendency to embrace accounting software compared to other sectors. Furthermore, accountants' perspectives on accounting software are crucial for both theoretical models and practical implementations.

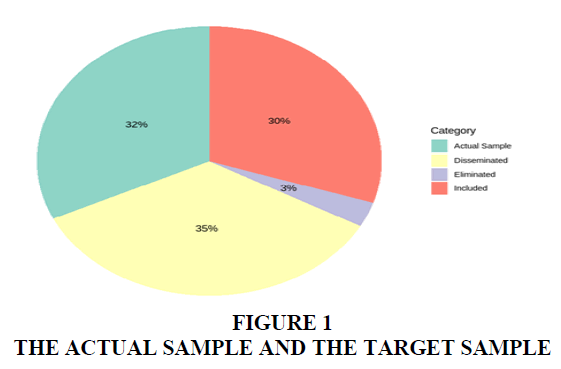

Research Sample's based on Responses through the Respondent’s

As shown in Table (1), a total of 120 surveys were distributed. Of these, 112 were completed and returned, while 10 were discarded due to validity concerns. As a result, only 102 surveys were considered appropriate for inclusion in the study, as depicted in Table 1 and Figure 1 below.

| Table 1 The Actual Sample and the Target Sample | |

| Total number of disseminated surveys | 120 |

| Total number of returned surveys | 112 |

| Total number of eliminated surveys | 10 |

| Total number of surveys included in the study | 102 |

The information shown in the table suggests that the response rate was approximately 85% (102 out of 120). This response level is considered statistically adequate for analysis and for making valid conclusions.

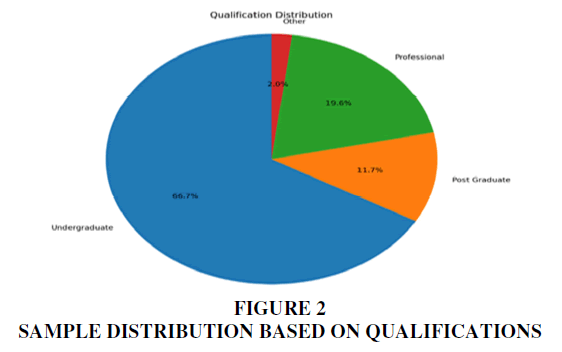

Research Sample's Based on Characteristics of Respondent’s

In this section, the researchers present the unique characteristics of the sample respondents based on their questionnaire answers. This encompasses information such as their educational backgrounds, fields of expertise, and the length of their practical experience, as illustrated by the accounting software shown in Table 2 and Figure 2.

| Table 2 Sample Distribution Based on Qualifications | ||

| Qualification | Respondent’s | Percentage |

| Undergraduate | 68 | 66.67 |

| Post Graduate | 12 | 11.7 |

| Professional | 20 | 19.6 |

| Other | 2 | 1.96 |

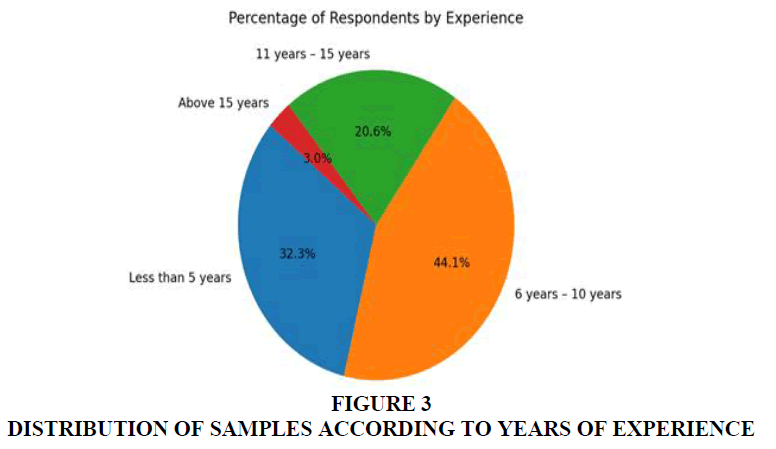

Research Sample's Based on Years of Accountant’s Experience

Regarding educational qualifications, the largest segment among participants is comprised of undergraduate degrees, which constitute 66.7%. Professional qualifications follow as the second largest category at 19.6%. Postgraduate qualifications account for 11.7%, while other qualifications represent the smallest portion at 2.0%, as illustrated in Table 3 and Figure 3.

| Table 3 Sample Distribution Based on Years Of Experience | ||

| Experience | Respondent’s | Percentage |

| Less than 5 year’s | 33 | 32.35 |

| 6 year’s – 10 year’s | 45 | 44.11 |

| 11 year’s – 15 year’s | 21 | 20.58 |

| Above 15 year’s | 3 | 2.96 |

| Total Respondent’s | 102 | 100 |

The data in the table reveals that 32.35% of participants have less than five years of experience, while those with six to ten years of experience make up 44.11%, representing the largest demographic group. Fifteen years ago, the adoption of accounting software among firms in Bhilwara was low, leading to only 20.58% of participants having eleven to fifteen years of experience, and just 2.96% with more than fifteen years. Current statistics indicate that 44.11% of the sample has six to ten years of experience, implying that most respondents possess adequate experience to provide informed answers to the survey, thereby increasing the reliability of the findings.

Data Analysis and Interpretation

Growing the knowledge in accounting software

Table 4 displays the respondents' views on the knowledge statements, showing that a considerable portion either agrees or strongly agrees with the claims made. The average scores support this observation, reflecting a broad agreement among the participants. This suggests that individuals in this field have seen a significant improvement in their knowledge. Additionally, when all statements were assessed against a threshold value of 3.5, the results showed statistical significance, with p-values below 0.05.

| Table 4 Descriptive Statistics of Knowledge Opinion | ||||

| S.N | Particular | Mean | S.D | P- Value |

| 1 | The textile sector is committed to enhancing the expertise of its accountants to facilitate the usability of the system. | 4.55 | 7.38 | 0.00 |

| 2 | To expand their understanding, the organization is introducing a novel accounting framework through a computerized accounting system. | 4.59 | 6.58 | 0.00 |

| 3 | Mastery in generating and utilizing computerized accounting will significantly enhance the accountants' proficiency. | 4.42 | 5.79 | 0.00 |

| 4 | The company's system has played a vital role in elevating the knowledge base of its accountants. | 4.73 | 3.97 | 0.00 |

| 5 | Professionals within the textile industry are urged to pursue and develop a deeper understanding of computerized accounting systems. | 4.63 | 4.35 | 0.00 |

This table provides a detailed breakdown of the responses from individuals in the textile industry regarding their views on the implementation and effects of computerized accounting systems. The columns represent different levels of agreement or disagreement, along with the mean scores and standard deviations for each statement, and the p-values indicating the statistical significance of the results.

Growing the skills in accounting software

Table 5 presents the participants' responses to skill statements, revealing that a considerable portion of the answers indicate either agreement or strong agreement. The mean values reinforce this observation, demonstrating a general consensus leaning towards agreement and strong agreement with the statements. These findings suggest that professionals in this field have recognized an improvement in their skills. Furthermore, all statements were assessed against a benchmark value of 3.5, showing statistical significance, as indicated by p-values below 0.05.

| Table 5 Descriptive Statistics of Skill Opinion | ||||

| S.N | Particular | Mean | S.D | P- Value |

| 1 | To Enhance Their Competencies, Organizations Often Enroll Their Accountants In Training Programs Focused On Computerized Accounting. | 4.63 | 2.52 | 0.00 |

| 2 | The company engages supervisors to oversee the accountants as they navigate computerized accounting systems, thereby fostering skill enhancement. | 4.66 | 7.68 | 0.00 |

| 3 | The textile sector recognizes the significance of advancing accountants' abilities to effectively extract information from the utilized accounting systems. | 4.73 | 4.67 | 0.00 |

| 4 | By improving their accountants' skills, textile companies ensure the prompt and precise delivery of reports produced by the computerized accounting system. | 4.59 | 3.58 | 0.00 |

| 5 | The textile industry enhances the reliability of financial statements generated by the computerized accounting system by advancing the skills of its accountants. | 4.61 | 5.39 | 0.00 |

Growing the creativity in accounting software

Table 6 presents data regarding the respondents' responses to creativity statements, indicating that for nearly all statements, the highest percentages corresponded to those who agreed or strongly agreed. This suggests that individuals in this field have experienced an influence on their creativity. Each statement was evaluated against a threshold value of 3.5 and was determined to be statistically significant, with p-values falling below 0.05.

| Table 6 Descriptive Statistics of Creativity Opinion | ||||

| S.N | Particular | Mean | S.D | P- Value |

| 1 | Companies in the textile industry are adopting the innovations brought forth by accountants, offering financial backing for the development of the implemented system. | 5.69 | 2.49 | 0.00 |

| 2 | The textile industry seeks to transition from traditional methodologies to a more scientific approach by developing applied accounting systems that enhance the creativity of accountants. | 4.59 | 1.39 | 0.00 |

| 3 | The textile industry promotes cooperation between software developers and financial professionals to enhance individuals' capacity for innovation and the creation of practical accounting systems. | 3.89 | 3.98 | 0.00 |

| 4 | To stay competitive amid the challenges of globalization and the Information Age, the textile industry is launching initiatives to promote innovative ideas. | 4.57 | 5.68 | 0.00 |

| 5 | Companies within the textile industry prioritize enhancing the creativity of their accountants to facilitate rapid access to the data stored in their systems. | 4.75 | 6.98 | 0.00 |

Accounting software

Table 7 offers valuable insights into respondents' views on the effectiveness of accounting software statements, revealing a substantial proportion of responses that indicate agreement or strong agreement. The mean values consistently support this trend, indicating a widespread consensus among participants. These significant findings suggest that professionals in this field have notably improved their understanding. Furthermore, all statements were assessed against a benchmark value of 3.5, demonstrating statistical significance with p-values below 0.05.

| Table 7 Descriptive Statistics of Accounting Software Opinion | ||||

| S.N | Particular | Mean | S.D | P- Value |

| 1 | Accounting software enhances the accountability of the accounting department within organizations. | 4.65 | 7.98 | 0.00 |

| 2 | The implementation of accounting software improves the qualitative aspects of accounting information, leading to superior financial reporting. | 4.61 | 5.81 | 0.00 |

| 3 | Utilizing accounting software will bolster the confidence of owners in their equity. | 4.69 | 3.78 | 0.00 |

| 4 | To execute accounting tasks with greater effectiveness and efficiency, contemporary accountants must possess knowledge of computing technologies. | 4.67 | 5.98 | 0.00 |

| 5 | The advent of computerized accounting information systems has led to significant savings in time and costs, enabling organizations to carry out accounting functions more effectively and efficiently. | 4.68 | 6.70 | 0.00 |

Hypothesis Testing

To assess the effect of accounting software on various key aspects of accounting, a simple linear regression analysis was performed using SPSS software. The study, with a significance level set at 5%, examined the relationship between the identified independent variables and the dependent variable of improved competitiveness. Each hypothesis was statistically tested through regression analysis to determine the presence of a correlation and to evaluate the strength of the relationship among the variables. This involved calculating the correlation coefficients between the dependent and independent variables and developing regression equations. The significance of both the regression equations and the related variables was evaluated using the F-Test and T-Test.

Effect of Accounting Software on Accountant’s Knowledge

To assess the existence of a significant relationship between the independent variable (accounting software) and the dependent variable (accountants' knowledge), a regression analysis was conducted. The results are presented in the table 8 below:

| Table 8 The Significance and Overview of the Regression Model in Relation to Accounting Software and Accountants' Expertise/ Knowledge | |||||

| R-Value for Correlation | Coefficient of Determination (R2) | F-Value | Significant | T Value | Significant |

| 0.730 | 0.800 | 8.600 | 0.000 | 77.320 | 0.000 |

| Estimation from a Regression model | B0 | 3.821 | 0.000 | ||

| B1 | 3.400 | 0.000 | |||

We repeated the same test, and the appropriateness of the model used was validated by the F-Test results shown in Table 4, where the p-value is below the significance level of 0.05. This suggests that the independent variable has a statistically significant effect, as indicated by its very low p-value (<0.000). Moreover, the positive coefficient B1 indicates a positive relationship between the variables, suggesting that a one-unit increase in the use of accounting software corresponds to a 3.4-unit increase in the accountant's knowledge. This relationship aligns with the previously examined variable "Accountant's Creativity." Additionally, the R-squared value of 0.80 demonstrates that approximately 80% of the variability in the accountant's knowledge can be accounted for by the accounting software in our model.

Effect of Accounting Software on Accountant’s Skills

To assess whether a significant relationship exists between the independent variable (accounting software) and the dependent variable (accountants' skills), a regression analysis was conducted. The results are presented in the table 9 below.

| Table 9 The Significance and Overview of the Regression Model In Relation to Accounting Software and Accountants' Skills | |||||

| R-Value for Correlation | Coefficient of Determination (R2) | F-Value | Significant | T Value | Significant |

| 0.780 | 0.820 | 10.100 | 0.000 | 108.410 | 0.000 |

| Estimation from a Regression model | B0 | 3.921 | 0.000 | ||

| B1 | 3.100 | 0.000 | |||

The analysis clearly indicates that the model used was appropriate, as evidenced by the F-Test, which produced a p-value below the significance level of 0.05, as shown in Table 5. This result highlights the statistical significance of the independent variable's effect, further supported by its very low p-value (<0.000). Additionally, the positive coefficient B1 suggests a beneficial relationship between the variables, indicating that a one-unit increase in the use of accounting software is linked to a 3.1 unit improvement in accountants' creativity. This finding is consistent with the previously discussed variable, "Accountant’s Creativity." Furthermore, the R-squared value of 0.820 reveals that approximately 82% of the variation in accountants' skill levels can be attributed to the accounting software in our model. This underscores the strong predictive power of accounting software regarding user skill in this context.

Effect of Accounting Software on Accountant’s Creativity

To assess the existence of a significant relationship between the independent variable (accounting software) and the dependent variable (accountants' creativity), a regression analysis was conducted. The results are presented in the table 10 below.

| Table 10 The Significance and Overview of the Regression Model in Relation to Accounting Software and Accountants Creativity | |||||

| R-Value for Correlation | Coefficient of Determination (R2) | F-Value | Significant | T Value | Significant |

| 0.75 | 0.82 | 8.55 | 0.00 | 68.550 | 0.000 |

| Estimation from a Regression model | B0 | 3.70 | 0.000 | ||

| B1 | 3.42 | 0.000 | |||

The data shown in Table 6 clearly demonstrates that the employed model is appropriate, as indicated by the F-Test, which yielded a p-value below the significance level of 0.05. This finding confirms the statistical significance of the independent variable's effect, underscored by its exceptionally low p-value (<0.000). Moreover, the positive coefficient for parameter B1 suggests a beneficial relationship between the two variables, indicating that a one-unit increase in the use of accounting software results in a 3.4 unit increase in accountants' creativity. Additionally, the R-squared value of 0.82 reveals that roughly 82% of the variation in accountants' creativity can be explained by the accounting software, highlighting its role as a relatively strong predictor of creativity within our model.

In conclusion, the analysis revealed that the accounting software notably affected all three variables. Consequently, we assert that the adoption of accounting software within the textile industry will enhance the creativity, skills, and knowledge of accountants. Recommendations for implementation are provided.

Conclusion

The research findings revealed that the use of accounting software significantly improves accountants' performance in terms of their skills, knowledge, and innovative abilities. Statistical analysis confirmed a positive effect of accounting software on the performance of accountants in textile companies based in Bhilwara city, thereby supporting all three proposed hypotheses. Additionally, this study reinforced earlier research, particularly which of Kasasbeh (2016), which explored the changes in accountant performance as accounting systems evolved to computerized formats. The main aim of this research was to assess the impact of computerized accounting systems on the efficiency of accountants in textile companies based in Bhilwara city. This highlights the study's relevance and importance, not only for the textile industry in Bhilwara but also for various other sectors. Based on these results, several recommendations can be made. First, textile industries should adopt modern accounting practices by utilizing accounting software to enhance their accountants' performance. Second, it is crucial to encourage accountants to engage in training programs focused on accounting software, allowing them to execute their responsibilities more effectively. Third, textile industries should hire managers who can work closely with accountants to better understand the applied accounting systems. Fourth, the textile sector should foster collaboration between programming and accounting teams to develop innovative and practical accounting solutions. Finally, it is essential for all business sectors to implement specialized accounting software to improve accountants' performance.

References

Alfartoosi, A., & Jusoh, M. A. (2021). A Conceptual Model of E-accounting: Mediating effect of Internal Control System on the Relationship Between E-accounting and the Performance in the Small and Medium Enterprises. International Journal of Economics and Management Systems, 6(1), 228-252.

Aljaaidi, K., Alwadani, N., & Adow, A. (2023). The impact of artificial intelligence applications on the performance of accountants and audit firms in Saudi Arabia. International Journal of Data and Network Science, 7(3), 1165-1178.

Indexed at, Google Scholar, Cross Ref

Itang, A. E. (2020). Computerized accounting systems: Measuring structural characteristics. Research Journal of Finance and accounting, 11(16), 38-54.

Indexed at, Google Scholar, Cross Ref

Kasasbeh, F. I. O. (2016). The Impact of Computerized Accounting System on Accountans Performance in the Jordanian Medicine Shareholding Companies: A Field Study. International Research Journal of Finance and Economics, 147.

Khan, A. K., Al Aboud, J. A., & Faisal, S. M. (2018). An empirical study of technological innovations in the field of accounting-boon or bane. Business & Management Studies, 4(1), 51-58.

Lutfi, A., Alkelani, S. N., Alqudah, H., Alshira’h, A. F., Alshirah, M. H., Almaiah, M. A., & Abdelmaksoud, O. (2022). The role of E-accounting adoption on business performance: the moderating role of COVID-19. Journal of Risk and Financial Management, 15(12), 617.

Masanja, N. (2019). The Impact of Accounting Information System on the Financial Performance in Selected Private Companies in Arusha, Tanzania. Tanzania.

Mustafa, M. R. (2020). The study of problems moving from the unified accounting system to the international accounting standards. International Journal of Multicultural and Multireligious Understanding, 7(1), 101-116.

Pirayesh, R., Forouzandeh, M., & Louie, S. I. (2018). Examining the effect of computerized accounting information system on managers' decision making process. Revista Publicando, 5(14 (1)), 68-82.

Setyaningsih, S. D., Mulyani, S., Akbar, B., & Farida, I. (2021). Quality and efficiency of accounting information systems. Utopía y praxis latinoamericana: revista internacional de filosofía iberoamericana y teoría social, (2), 323-337.

Teru, S. P., Idoku, I., & Ndeyati, J. T. (2017). A review of the impact of accounting information system for effective internal control on firm performance. Indian Journal of Finance and Banking, 1(2), 52-59.

Indexed at, Google Scholar, Cross Ref

Thottoli, M. M. (2021). Knowledge and use of accounting software: evidence from Oman. Journal of Industry-University Collaboration, 3(1), 2-14.

Indexed at, Google Scholar, Cross Ref

Turner, L., Weickgenannt, A. B., & Copeland, M. K. (2022). Accounting information systems: controls and processes. John Wiley & Sons.

Received: 01-Mar-2025, Manuscript No. AAFSJ-24-15355; Editor assigned: 03-Mar-2025, Pre QC No. AAFSJ-24-15355(PQ); Reviewed: 17- Mar-2025, QC No. AAFSJ-24-15355; Revised: 22-Mar-2024, Manuscript No. AAFSJ-24-15355(R); Published: 31-Mar-2025