Case Reports: 2020 Vol: 26 Issue: 2

Roggendorf the Challenge of Internationalization of A Family Enterprise

Orlando Llanos-Contreras, Universidad Católica de la Santísima Concepción

Hugo Baier-Fuentes, Universidad Católica de la Santísima Concepción

Claudia Yañez Valdés, Univerisdad del Desarrollo

Abstract

The case seeks to offer a tool to help students to integrate knowledge and develop analytical capabilities in the area of strategic management and internationalization of a family company. The case is developed for senior business students or MBA students, who should analyse if this family company should reconsider its strategy for entering the Chinese market. For that they can consult several articles that we recommend. Starting from the articles of Kuo, Kao, Chang and Chiu (2012) or Hollender, Zapkau and Schwens (2017), the students can argue for the Fariña-Roggendorf family the pros and cons of increasing family involvement and assigning responsibility to their son (or other family member) for developing their business in China vs insisting on strategic partners to support them in this enterprise. In the case that they decide develop their project themselves, the article by Li, He and Sousa (2017) sheds light for students to propose possible routes. In the case of suggesting the route of insisting with Chinese strategic partners, the article by De Massis, Frattini, Majocchi and Piscitello (2018) offers support for deciding between the option suggested by Isu Tsing vs the strategy implemented by the family up to now. This case study is designed for students to work in teams. The case is to be handed out a week before its reading. The teams should be made up beforehand and each team should bring a poster with the answers to the case questions.

Keywords

Family Firms, Internationalization Firms, Case Study.

Introduction

The case seeks to present a tool to help students to integrate knowledge and develop the capacity for analysis in the area of strategic management and internationalization of enterprises. The case has been developed based on primary information obtained from interviews with different members of the family. Additionally, secondary information obtained from the Passport Euromonitor database has been utilized. The processing and analysis of the information made it possible to provide the necessary support to give answers to the learning outcomes defined in the teachers' notes. The breadth of the case allows flexibility in its application in the strategic analysis of the internationalization of enterprises, which allows the students to observe the convergence between theoretical knowledge and practice. The case is of great value to encourage learning in students in MBAs and in strategy courses at an undergraduate level. This is an original case that allows students to know the experience of the company in its strategic development and the process of internationalization through exports of chocolates to China.

Fariña (2017) leader of Roggendorf, a second-generation family enterprise with more than 60 years of trajectory, born in the city of Concepción, talked with his son, Javier, about the details of the first shipment of chocolates that the company had just exported to China. After more than a year of hard work, this milestone represented the first step in the implementation of what had, at some point, seemed a far-off idea. The conversation between father and son centred around different bureaucratic barriers they had found during the process of exporting and they debated possible routes to follow now that the first step had been accomplished.

In parallel, a teaching team from UCSC, found out about the project and made contact with Fariña (2017) in order to know and learn from the experience the family enterprise had acquired in the process. The academic curiosity of the team led it to suggest a meeting between Claudio, owner of the company, and Isu Tsing, a Chile-China expert with experience in the areas of logistics and commercialization in this market. The latter believed that Roggendorf had an opportunity to introduce itself into the Chinese market and proposed diverse channels of distribution that could be considered in order for Roggendorf to grow and consolidate its participation in this country. On the other hand, Claudio had contacted a Chinese operator who distributes Chilean products in the free-trade zone.

In Roggendorf, important investments in technology and infrastructure had been made. This investment allowed them to guarantee high quality standards in their products and, finally, to face the great opportunity of entering the Chinese market and respond to a potentially unknown demand. With the first shipment done, the experience, information and knowledge acquired can be key for the future of Roggendorf. Therefore, the challenge now for Claudio and his son, is to define which road to take to exploit the different opportunities and successfully introduce their chocolates into the Chinese market.

Roggendorf History

The Roggendorf pastry shop has its beginnings in the year 1940 in the German city of Mönchengladbach where, encouraged by his parents, a young man of 13 years old named Hugo Roggendorf studied pastry making in the prestigious institute of the city. Hugo also participated in the family business; a small café named “Oberstadt”. In just a few years his passion for pastry led him to obtain the rank of mater pastry chef. However, the circumstances of the war in Europe meant that at age 17 he entered the German army, experiencing the Second World War on the front lines. With Europe destroyed, Hugo turned to new horizons, setting his sights on Latin America.

At the suggestion of a friend who talked to him of Chile, Hugo placed an advertisement in the Chilean-German newspaper 'Condor', offering his services as a pastry chef. In this way he arrived in 1953 to the city of Concepción to work for two years as factory manager in a prestigious pastry shop in this city. The work in this factory allowed him to save the initial capital to, in 1955, starts his own business in Chile. The strategy was to develop a similar value proposal to that of his family in Germany.

As happens in many family enterprises, the Roggendorf Pastry shop began in the family home. While Hugo worked in the making of the products, his wife Ruth was in charge of sales and financial management. Hugo's knowledge and experience were immediately reflected in the high quality of his products, which were highly valued by their clients. This facilitated the opening of their first shop in a short time. From this moment, Roggendorf's reputation in the city of Concepción began to grow and this small family business began to establish itself soon in the opening of a second shop.

In the year 1985, the second generation took on a leading role, with the couple's younger daughter Helga Roggendorf et al. (2017) entering the business. Soon after entering the business they began a process of modernization and consolidation of the company, which led them to travel to Germany, There, over the course of six months, they acquired greater knowledge of the industry that allowed them to know new technologies and develop a new vision for the family company, which meant implementing strategic changes defined principally by the concept of a modern, high quality pastry shop. Then as fruit of years of hard work, acquired knowledge and this new vision, it became possible to invest in the construction of a more modern factory, with greater productive capacity and the incorporation of an original production line of chocolates, which over time would become a key product for the company.

In 1998 an important event occurred in the company. The couple's elder daughter entered the business, opening a new store far from the city of Concepción, in the capital Santiago. This model continued the model established by the owners, seeking growth that is aligned with the personal and professional objectives of family members.

In November 2014 Hugo Roggendorf, founder of the company, passed away at the age of

91. Even though Hugo had formally left the administration of the business, he continued to attend daily to supervise the operational business of the company and maintain contact with the clients. With his passing a cycle ended, leaving an important family legacy for those whose responsibility it is to preserve it.

Currently the business is administered by the second generation of the family, but the third generation has already begun to be involved. Javier Fariña (09 may 2017), the son of Helga and Claudio, has become incorporated into the administration of the shops in Concepción. The challenge for Javier is to grow the business, a decision that faces established resistance to delegating the administration to people from outside the family.

The family is currently to be found in the process of continuing to exploit the opportunity for international business in China. Meanwhile, Javier has moved to this country to work for a government agency. The family believes that this will allow him to gain experience, putting him in a better position to define the future of the family company.

Data on the Chinese Market

China is currently the most populous country in the world with 1.389 billion inhabitants in the year 2017. The population of this country has undergone great growth over the last 35 years and currently represents 21% of the world population.

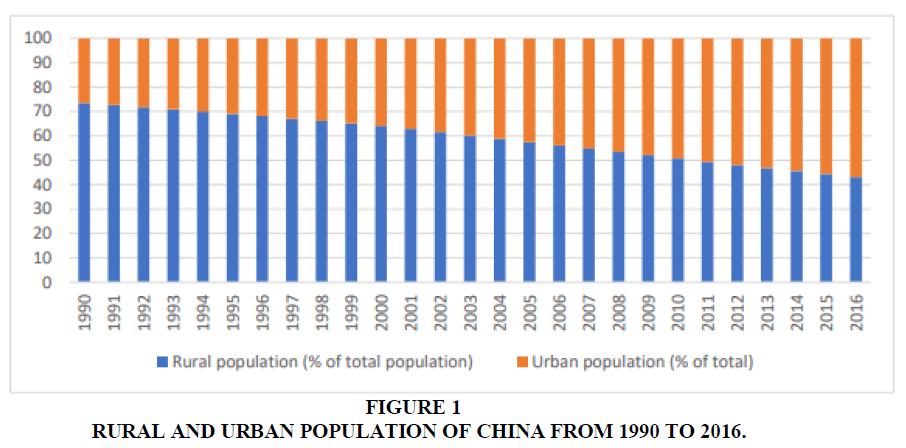

The development of big cities has led to important demographic changes, marked principally by a fall in the rural population. The accelerated growth of the urban population can be shown in the population growth of cities with more than 4 million inhabitants (see Figure 1 and Table 1).

| Table 1 Ten Most Populated Cities in China | |

| Cities | Population |

| Shanghai | 17.430.000 |

| Peking | 14.230.992 |

| Canton | 7.547.467 |

| Hong Kong | 6.864.346 |

| Tianjin | 6.839.009 |

| Wuhan | 6.787.482 |

| Shenzhen | 6.480.340 |

| Chongqing | 5.087.197 |

| Shenyang | 4.596.785 |

| Chengdu | 4.273.218 |

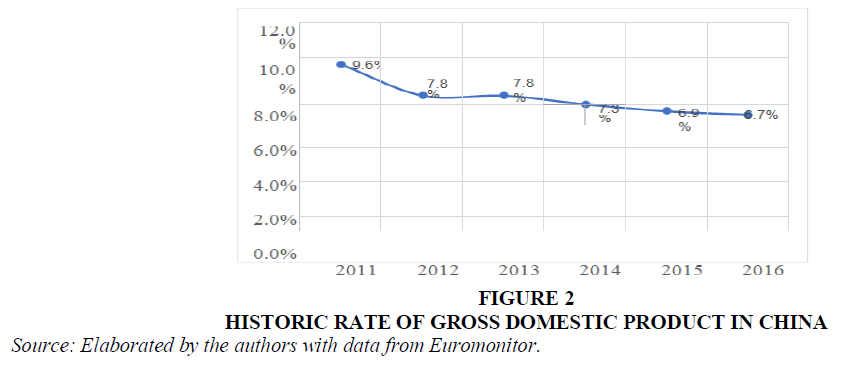

China has, on the other hand, maintained a positive rate of gross domestic product (GDP from here on) over several decades thanks to a commercial opening applied by the government since the end of the 1970's. In spite of the aforementioned, the Chinese economy has shown in the last few years a certain deceleration in the percentage of GDP growth (See Figure 2).

Figure 2 Historic Rate of Gross Domestic Product in China

Source: Elaborated by the authors with data from Euromonitor.

All in all, during the last 10 years China has been the country with the highest growth rate of GDP in the world, becoming the second largest economy in the world.

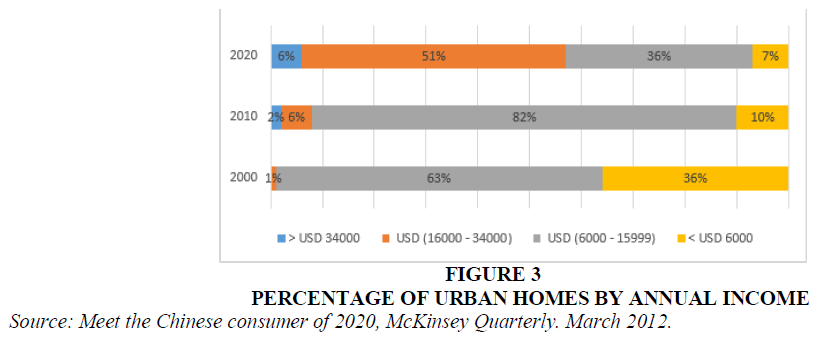

The positive growth rates have generated important changes in the society of the country. The most notorious effect is found in the mobility of social classes as a consequence of the significant increase in the income of the inhabitants (Centro Asia Pacífico UDP, 2012). For example, in the year 2000, only 1% of urban homes formed part of the middle class with annual incomes between USD 16,000 – USD 34,000 in Figure 3. This situation has been modified leading up to 2010, by when the middle class represented 6% of the urban homes of the country. In fact, it is expected that by 2020 the middle class will represent 51% of the urban population that is to say more than 167 million homes or 400 million people. This is important because, thanks to the increase in the incomes of the inhabitants, changes have been generated in consumption trends beginning with acquiring high-quality products and services Atsmon et al. (2012).

Figure 3 Percentage of Urban Homes by Annual Income

Source: Meet the Chinese consumer of 2020, McKinsey Quarterly. March 2012.

Chocolate in the Chinese Market

The increase in purchasing power of the Chinese population has provoked a great increase in the trade in chocolate. However, this consumption is still far from realities like those of Europe and the United States. Even so, according to 2012 data from the Instituto Español de Comercio Exterior ICEX (2017) chocolate generated total sales of around 6.9 billion kilograms that year and has grown at rates of around 15% per year.

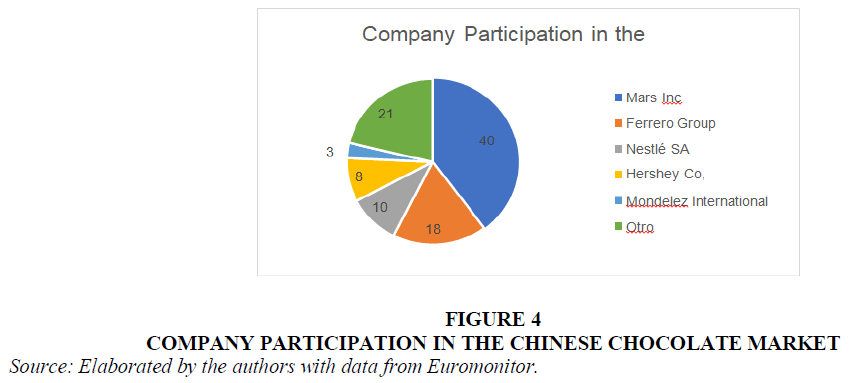

Foreign brands of chocolate are perceived of as better quality than those produced in China Minister of Agriculture and Agri-Food Canada (2012). Logically foreign companies control almost 70% of the Chinese market, led by the North American company Mars Inc. with a 40% of market share, followed by the Italian company Ferrero Group with 18% of market share and the Swiss company Nestlé with 10%.

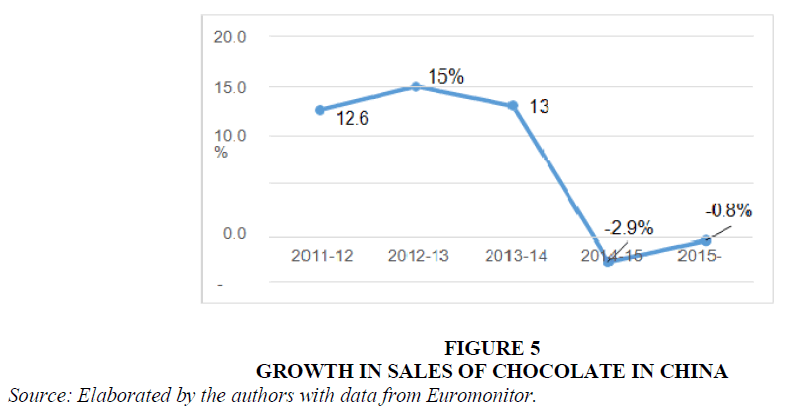

Currently, the Chinese chocolate market reaches a worth of 2.806 billion dollars (Euromonitor, 2017), but is still situated under countries such as The United States, Japan or Russia whose markets are worth more than 5 billion dollars (Euromonitor, 2017). In terms of sales growth, these have increased at a rate above 10% between 2011 and 2014 but, in the last few years; have faced a slight fall of 2.9% for the period 2014-2015 and 0.18% in the last period (see Figures 4-6). According to experts, this phenomenon is due to economic contraction that has affected the country and to the fact that consumers do not view this product as essential.

Figure 4 Company Participation in the Chinese Chocolate Market

Source: Elaborated by the authors with data from Euromonitor.

Figure 5 Growth in Sales of Chocolate in China

Source: Elaborated by the authors with data from Euromonitor.

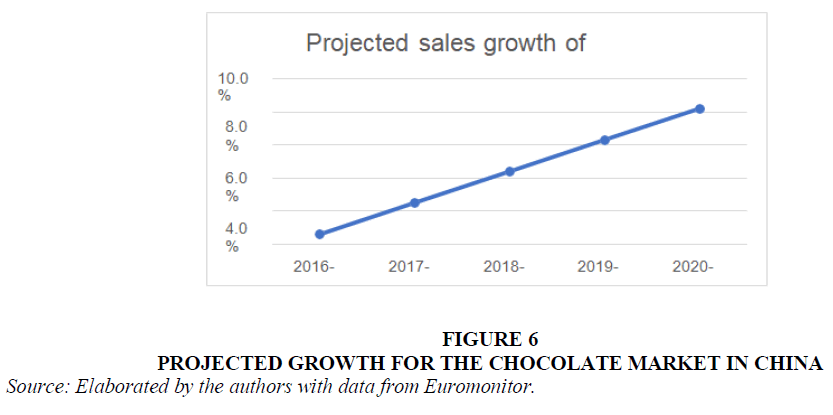

Figure 6 Projected Growth for the Chocolate Market in China

Source: Elaborated by the authors with data from Euromonitor.

The negative figures do not represent a trend, even when the consumption of chocolate has decreased, as the Euromonitor (2017) reports project an upturn in the next few years, a situation which is explained mainly by the strengthening of the middle class. Thus, it is expected that this market will return to a growth rate of around 8,2% per annum in the period 2020-2021 (Euromonitor, 2017).

Characteristics of the Consumer

In China, candy products, such as chocolate, are used as gifts or consumed on special occasions like new year, weddings, birthdays or other festivities, and lately have expanded massively as an alternative to snacks Minister of Agriculture and Agri-Food Canada (2012). However, Chinese consumers perceive sweet products as harmful for the health due to their elevated sugar content and for this reason consumers prefer smaller formats than the western standard. The aforementioned study also points out that this market presents more willingness to dark chocolate, whose greater percentage of cacao possesses demonstrated beneficial health effects.

On the other hand, Chinese consumers are characterized by being brand sensitive, maintaining the belief that price is an indicator of quality and status. This situation has led companies to invest a great amount of resources in strengthening the brand and improving the packaging of the product Atsmon et al. (2012). However, according to a study by Santander Trade (2017), the most important selection criteria for the consumers in the moment of the purchase are the price and the service offered by the salesperson. Furthermore, Chinese people attribute great importance to the availability of information, mainly through internet and mouth- to-mouth. Other guarantees, such as the possibility of returning a product, are not considered relevant.

Distribution Channels in China

In relation to sales channels for this product, chocolates are sold mainly through retail distributors in physical stores, which represent 72% of the total sales for the year 2017. However, as can be seen in Table 2, the traditional channel has lost strength in the last few years, while sales and distribution through other, non-traditional channels for these products, like the internet, have grown by approximately 25% Passport Euromonitor International, (2017).

| Table 2 Chocolate Distributors in China | ||||||

| Distribution channels | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Retail stores | 96,6% | 92,7% | 91,7% | 81,9% | 76,5% | 72,0% |

| Food retailers | 89,5% | 85,6% | 84,6% | 75,6% | 71,1% | 67,8% |

| Modern food retailers | 75,2% | 72,4% | 72,2% | 65,2% | 61,2% | 58,5% |

| Convenience stores | 8,6% | 8,6% | 9,2% | 9,9% | 10,6% | 11,4% |

| Discount stores | 0,0% | 0,0% | 0,0% | 0,0% | 0,1% | 0,1% |

| Food court distributors | 1,3% | 1,3% | 1,4% | 1,5% | 1,6% | 1,8% |

| Hypermarkets | 21,2% | 20,3% | 20,5% | 16,8% | 15,0% | 14,4% |

| Supermarkets | 44,2% | 42,1% | 41,1% | 37,0% | 33,9% | 30,7% |

| Traditional food retailers | 14,3% | 13,3% | 12,5% | 10,4% | 9,8% | 9,3% |

| Food, drink and tobacco specialists | 3,4% | 3,3% | 3,2% | 3,0% | 2,8% | 2,7% |

| Small food vendors | 8,6% | 7,8% | 7,1% | 5,4% | 5,1% | 4,8% |

| Other food retailers | 2,3% | 2,2% | 2,2% | 2,0% | 1,9% | 1,8% |

| Non-food specialists | 7,1% | 7,1% | 7,1% | 6,3% | 5,4% | 4,2% |

| Health and beauty retailers | 6,5% | 6,5% | 6,4% | 5,6% | 4,9% | 3,7% |

| Other non-food specialists | 0,6% | 0,6% | 0,7% | 0,7% | 0,5% | 0,5% |

| Store-less retailers | 3,4% | 7,3% | 8,3% | 18,1% | 23,5% | 28,0% |

| Vending | 1,5% | 1,5% | 1,6% | 1,7% | 1,8% | 2,3% |

| Internet retailers | 1,9% | 5,8% | 6,7% | 16,4% | 21,7% | 25,7% |

| Total | 100% | 100% | 100% | 100% | 100% | 100% |

When a company decides to invest and commercialize their products internationally in a big market like China's, it must place special interest in defining the distribution channels it will use. The distribution channels can be defined as the external contact organization the companies use to reach their distribution objectives (Rosenbloom, 2011). Frequently, the export and subsequent distribution in the host country depends on the members of an international distribution channel Mehta et al. (2006). In fact, a distribution contract is the way most utilized by companies that export their products to China. These distributors represent the brand and act as intermediaries after payment of a membership or sales commission. However, to establish contact with specialised agents is an important challenge. The lack of knowledge of the businessman or woman who decides to export, the informality and the unclear ways of operation of the intermediaries are observed as the principal problems Mehta et al. (2006). Experts in the Chinese market interviewed for this case highlight that this aspect is crucial for entering the market, as an experienced distributor with the permissions required by Chinese law can define the success or failure of the international incursion of the company. Therefore, it is suggested that the knowledge of cultural norms of the intermediary is a key factor in the positioning of a company in the Chinese market.

The Chinese government, on the other hand, has adopted an open attitude to electronic commerce, which has generated an increase in the number of internet users. Currently, there are more than 731 million users (Kemp, 2017). It is not unexpected, then, that both Chinese and foreign companies have participated actively in investing and establishing channels for online sales (see Table 3). In fact, online channels registered a growth of 26.2% for the year 2016, reaching 752 billion dollars in sales and a 15,5% growth for the retail channel (Gutiérrez, 2017). This easily surpasses the online market of the United States, granting it the title of the biggest electronic market in the world (Santander Trade Portal, 2017). It is important to point out that distance sales have had particular success in the niches of markets of high incomes that are inelastic to the price and buy products of the highest quality. Logically the online market is seen as a great opportunity for foreign companies.

| Table 3 Online Distributors in China | ||

| Company | Type | Products |

| Mecoxlane | Correspondence and internet sales | Clothing, lingerie, jewellery, beauty products, irons, technology, costume jewellery, etc. |

| 3 Suisses | Correspondence and internet sales | Clothing, lingerie, table linens, furniture, telephones, video games, televisions and high-fidelity, white goods, books, DVDs, etc. |

| Bol | Correspondence and internet sales | Toys, books, perfumes, watches, DVDs, accessories. |

| T Mall | Internet | Various quality and brand products. |

| Amazon | Internet | Clothes, home goods, white goods, books, electronics, cosmetics, etc. |

| Dangdang | Internet | Home goods, cosmetics, electronics, books, sound equipment, clothing, etc. |

| 360 Buy | Internet | Electronics, books, food, home goods, wallets, etc. |

| JD | Internet | Electronics, home goods, jewellery etc. |

Roggendorf Chocolates, a Commitment to Quality and Innovation

The Roggendorf pastry shop is currently one of the most traditional places in Concepción, where it has two stores. In addition, it has a third store in the capital, Santiago. Among its most sold products is its Bienenstich, a sweet with honey, vanilla and almonds that was also one of the specialities of Hugo Roggendorf. From the beginning, the main focus was on the sales of pastries, but after a visit to Bariloche, Argentina, the chocolates were incorporated little by little as one of the star products of the company. In this way the chocolatery represents around 10% of total sales of the company and is expected to reach 50% in the years to come.

In the 60 years of the company's existence, there have been a series of mutations both in the business model as well as in the administration, which has contributed a new perspective on the positioning the company seeks to reach. For this reason, in the internal sphere there are series of implications that must be considered in chasing the growth and success of the company that currently has a staff of 60 people in the three stores in the country, including the factory. In fact, excellence has been the guiding thread of the family and the Roggendorf Company. The mission of the company is to "offer a high-quality product made with selected raw ingredients, respecting the traditions and secrets of our recipes, accompanied with first-rate service" In the interview, Claudio Fariña added that "this process of identity associated with high quality has been the fruit of the years of operation, where the factory and infrastructure have been modernized, and first- rate technology has been incorporated, in accordance with the requirements of the current market". Along the same lines and in seeking to increase the quality of its products, the company has certified its processes with the HACCPc NCh 2861 Of. 2004 norms1. These standards are in line with the international challenge that the family took on in the year 2012.

Until now, the export and distribution of the company's products have been carried out through a distributor located in Shanghai that is in charge of wholesale commercialization of the products. However, this challenge has not been free of obstacles, like "Chinese Bureaucracy" in Javier's words. This has meant being able to finalize only one shipment, as on different occasions their products have been returned for situations ranging from the request for additional documentation to a challenge on the certificate of origin for typographical layout. This has had financial repercussions in not being able to enjoy the tariff benefits of the free trade agreement between Chile and China. In spite of this the spirit of the owners has not diminished and the business keeps taking important steps. The company is about to be certified as the first producer of organic chocolates in the country. Additionally, the company hopes to finalize a second shipment, but this time of organically certified chocolates. The new product consists of seven slices of chocolate of 21 grams of cacao in each, the daily quantity needed by the organism to function adequately (Placencia, 2017). It is hoped this new product will be a success.

Sponsoring Bodies, Networks and Strategic Alliances

Roggendorf began its internationalization to China through its participation in international fairs. The Corporation for the Promotion of Production of Chile Corfo (2017) in one of its programs, sought to promote some Chilean products. In this way, Roggendorf was invited by Corfo (2017) which financed the first two participations of the company in these fairs. Later, the company has participated in other international instances with its own funding and has found a positive response to the quality of its products from the attendees. This effort to attend international fairs has the aim of consolidating the internationalization strategy of the company and generates value mainly through strategic alliances with relevant actors in the Chinese market. Strategic alliances are recognized in the literature as an efficient entry way into foreign markets as they possess the knowledge and capabilities to consolidate cooperation agreements with providers, distributors and even competitors (Ploetner & Ehret 2006). In addition, companies tend to use these alliances when faced with the difficulty that operating alone in an unknown market represents.

As is well known, small and medium businesses perform a relevant role in different economies, in which they represent an important source of new employment, innovation, exports and productivity.

However, this type of company faces traditional barriers that frequently make competition difficult in the international market, such as lack of financing, difficulties in acquiring specialized knowledge and in exploiting new technologies, low productivity and regulatory loads. Some prior studies point out that governmental support tries to compensate for these failings. This support would even explain the phenomenon of why some companies have achieved internationalization to culturally distant countries and in a short period of time (Lu et al., 2014).

Trying to obtain governmental support, Roggendorf presented and applied for the “Insertion in the Chinese market of sized bars of organic chocolate” project to the Committee of Productive Development of the Biobio region Corfo (2017), being granted co-financing for more than 44 million pesos, or 60% of the total for the project. Corfo (2017) finances through credits or subsidies to companies that can apply to different lines of projects that allow them to improve infrastructure, drive some type of innovation, improve technological capabilities, and develop networks of business collaboration, amongst other activities. Along these lines, the project won by Roggendorf allowed them to widen their supply and improve their capabilities to reach new markets. In definite terms, it allowed them to strengthen their business prestige in the city and the region.

The Vision of an Expert on the Chinese Market

Isu Tsing is General Manager of the Asian region of the Agunsa Group, as well as being Director and Chairman of Antu Export and Import Co. Ltda. From his vision and experience in international business, the criteria which Roggendorf must consider for the success of the incursion of its products into the Chinese market are divided into three main axes:

Packaging and Brand: The Chinese consumer with high acquisitive power frequently buys to maintain his or her status. For this reason, the packaging of the product must have high standards of quality and elegance. The expert recommends two options for Roggendorf to analyse:

1. If possible, associate their products with the German tradition the family comes from.

Chinese people pay special attention to the origin of the products and they associate chocolates much more clearly with Europe than with South America.

2. Considering that Chile does not have a historical tradition producing this type of products, the other recommended option is to highlight the Chilean origin of the product, developing a new brand integrating the recipes of their products with Chilean fruit that this market can easily recognize, such as maqui, blueberries or cherries.

Distribution: It is fundamental in China to count on a distributor that possesses the licenses for distribution and sales and that also has experience in the channels that Roggendorf hopes to commercialize its products through. In general, the brands of high range products are sold through only one channel to guarantee the exclusiveness of the product. This action strengthens the image and reputation of premium products. Considering the online channel, Isu Tsing suggests looking for expert distributors in electronic commerce to carry out the necessary actions to position the product and capture market share.

Contacts: The way to carry out business in China breaks the paradigms of what is habitually done in the west. According to Isu Tsing, there are cultural motivations in China in which the establishing of relationships of friendship between the parts involved in a transaction is value. Thus, building and strengthening a network of contacts made up of key agents that promote the entry of a foreign product is fundamental to achieve success and product positioning in the Chinese market. Furthermore, in Isu's opinion, sales through agencies in the country or with promotion offices would not have a great impact in the development of markets for Roggendorf.

Opportunities and Challenges for Roggendorf in China

In the international market, and China is no exception, there is an increasing trend for the demand for healthy and innovative food products. In China, for example, natural yoghurt and walnuts have been gaining preferences and attracting more interest from consumers Passport Euromonitor Internacional (2017).

The aforementioned might be considered a threat for the chocolate industry. However, chocolate experienced a slow recovery in terms of the current value with a growth of 2% in 2017. The economy improved gradually, waking with it buying power and the interest of consumers in premium chocolate. On the other hand, the manufacturers also accelerated the development of other lines of high-quality products with more attractive packaging to meet the growing interest of these consumers.

In addition, along with the rapid expansion of internet platforms for retail sales, a greater number of exported chocolate products with superior packaging were introduced to try to stimulate sales of these products. On the other hand, with a deeper knowledge of the product, consumers have gradually modified their preferences towards hand-made chocolates with a higher cacao content, while the cheaper products with artificial cacao have more and more lost consumer interest. This also opens an opportunity that can be exploited.

Roggendorf has worked intensely in the last few years to manage to introduce its chocolates into China. Even though this has been a process of much learning and growing, the results have not been as expected. The family has decided to continue forward with this project, but are questioning if they should evaluate the strategies followed until now and consider the recommendations made by the expert.

Instructors' Notes

Case Summary

Roggendorf is a Chilean family company of German descent that has developed a business of pastries, chocolate and cafés since the year 1955. The founders began their enterprise from their own home to later become one of the most recognized companies of the city of Concepción. Currently, the company runs three stores, all administered by the family: two of them in the city of Concepcion and one in Santiago. The understanding of the business, the experience of the owners and the unity of the family has been the motor for the development of their entrepreneurial ideas and what has sustained them in periods of crisis as well as to continue growing.

The generational change and the growth of the company are generating new challenges. The owners must make decisions to continue developing their business and coordinate family and business interests. There are many opportunities for growth. Among them, internationalization is an attractive, but risky, opportunity. In this sense, making correct and strategic decisions is a need for the company.

General Objective of the Case

The case seeks to offer a tool to help students to integrate knowledge and develop analytical capabilities in the area of strategic management and internationalization of a family company.

This is a case that allows students to integrate the management theory of family businesses with the theory of internationalization of companies. Students should analyse if this family company should reconsider its strategy for entering the Chinese market. For that they can consult several articles that we recommend2. Starting from the articles of Kuo, Kao, Chang and Chiu (2012) or Hollender, Zapkau and Schwens (2017), the students can argue for the Fariña- Roggendorf family the pros and cons of increasing family involvement and assigning responsibility to their son (or other family member) for developing their business in China vs insisting on strategic partners to support them in this enterprise. In the case that they decide develop their project themselves, the article by Li, He and Sousa (2017) sheds light for students to propose possible routes. In the case of suggesting the route of insisting with Chinese strategic partners, the article by De Massis, Frattini, Majocchi and Piscitello (2018) offers support for deciding between the option suggested by Isu Tsing vs the strategy implemented by the family up to now.

Specific Learning Objectives

1. With the analysis of this case students will be able to:

2. Identify types of internationalization strategies or ways of entering an international market

3. Understand the advantages and disadvantages of the different options analysed.

4. Comprehend how the dynamic and family priorities influence the decisions of internationalization of a family company.

Results and Discussion

Discussion Questions

See information of the recommended articles in the Reference section.

1. Should the company keep on insisting in its current strategy or should it listen to the recommendations of the expert consultant?

a. What type of intermediaries should it look for?

2. Should the family evaluate the option of the son setting up in China to develop the business or should it trust in the intermediaries and / or local executives?

Teaching Plan

1. The case is designed for students to work in teams. The case is to be handed out a week before its reading. The teams should be made up beforehand and each team should bring a poster with the answers to the case questions.

2. (5 minutes): Each team exhibits their case poster.

3. (10 minutes): After that, the instructor gives an introduction and opens the debate.

4. (10 minutes): The instructor identifies one or two students from different groups to begin the debate and asks them to make a summary presentation of the case.

5. (10 minutes): The instructor asks two teams to present their posters, answering question 1.

6. (20 minutes): The instructor discusses the answers with the whole class, emphasizing the points in common and those in conflict, clarifying errors and the truths of the analysis and relating the answers with the theory.

7. (20 minutes): The instructor opens the discussion about questions 2 and 3. He or she chooses two teams and asks them to present the answers on their posters.

8. (20 minutes): The teacher discusses the answers given with the whole class and then, as done in the discussion of the first question, emphasises the points in common and those in conflict, as well as clarifying errors and truths of the analysis and relating the answers with the theory.

9. (10 minutes): The instructor closes the case by giving information that backs up the situations shown in the case with the theory.

Discussion Questions

Evaluate the options the company has to commercialize its products in the Chinese market.

The Roggendorf company should evaluate their options based on several aspects. Firstly, the company should take into consideration their international experience. According to Kuo et al. (2012), international experience plays an important role in the choice of way of entry into foreign markets as it allows companies to evaluate the conditions in the destination market in greater detail. Along this line, the experience Roggendorf has could condition the international operations for the company, letting it act safely and aggressively if it possesses the experience or, to the contrary, acting more cautiously. Secondly, Roggendorf should take into consideration its condition as a medium sized company which generally has limited resources at its disposal, and thus its strategic decisions must be taken with the availability of resources in mind. Thirdly, Roggendorf is a family company. This particular type of company seeks to balance its potential losses and gains in economic and socioemotional terms. In other words, family companies like Roggendorf could become conditioned to develop international operations by behaviours that tend to protect the socioemotional wealth of the family. With this in mind, the company should choose the entry way based on its knowledge, experience, and the characteristics that define it as a medium-sized family business. The entry way is no more than the operational way of entering international markets. According to Hollender et al. (2017), companies can enter international markets in one of two ways. The first of these is through the entry of capital, which means direct investment in foreign markets through Joint Ventures or Wholly Owned Affiliates. The second is through an entry without capital that includes direct or indirect exports and the association with other companies through contracts with distributors. The choice of either of these methods will have an important influence on the performance of the companies. Therefore, the Roggendorf company must take into consideration the advantages and disadvantages of each method. Along these lines, the ways of capital entry require a greater initial commitment of resources, but facilitate greater proximity to the market and the clients of the host country, while the entry ways without capital require less resources and offer greater flexibility for the companies, but lack the proximity to the host market (for more information on the ways of entry, see Hollender et al, 2017). This also generates socioemotional effects depending on the financial backing of the company. For a medium-sized family company like Roggendorf, an entry of capital allows them, on one hand, to have more control over the operations in the new market, avoiding the meddling of agents from outside the family which generates socioemotional gains, but at the same time the lack of experience in the new market together with not so solid financial backing could place in jeopardy the success of the internationalization operation and the financial position of the family business, generating not only financial, but also socioemotional losses.

Under these criteria, and considering the characteristics of the company, the more interesting of the two options seems to be maintaining the internationalization through a strategic partner, like a distributor. This allows them, on one hand, to diminish the risks and uncertainty associated with the business generated by the cultural distance, the lack of knowledge about the market and the limited capacity to develop their own channels of distribution. On the other hand, from an economic perspective, a strategic partner would allow them to increase the possibilities for success of the internationalization and thus improve the expectations for economic and socioemotional return from the project.

Should the company keep on insisting in its current strategy or should it listen to the recommendations of the expert consultant?

a. What type of intermediary should it look for?

In accordance with the literature, the search for a commercial partner, such as a distributor, seems to be adequate. Establishing this type of link requires an intense search of companies that offer this kind of service, but in comparison with other ways of entry, requires a relatively low resource commitment. The ways of entry without capital, such as that recommended for Roggendorf, offer flexibility, including even renegotiating contractual agreements or leaving the market.

One of the recommendations made by Isu, the expert on business in China, is to search for a distributor with experience in online sales of premium products. The owners of Roggendorf should look for a distributing partner, a specialist in both traditional and online sales. This would allow them to adapt to the new trends in the sale of premium products pointed out by the expert. Therefore, it is recommended that the company search for and establish a link with a strategic partner that offers both types of service. This option could offer a sufficiently attractive level of sales for Roggendorf.

Should the family evaluate the option of the son setting up in China to develop the business or should it trust in the interim ediaries and / or local executives?

In accordance with the characteristics of the Roggendorf Company, in the short and medium term, it is safer to seek a strategic partner rather than the son moving to China. However, the company must evaluate its long-term strategic objectives. If these point to a greater level of investment and commitment with the Chinese market, then setting up the son in China could benefit the company with the level of knowledge necessary to operate directly in the country.

End Notes

1.The HACCP Danger Analysis and Critical Points of Control certification is an international principle that defines the requisites for effective control of food safety that does not only control food harmlessness, but also safety in the processes in order to ensure quality in production.

2.Evaluate the options the company has to commercialize its products in the Chinese market.

Acknowledgement

References

- Atsmon, Y., Magni, M., Li, L., &amli; Liao, W. (2012). Meet the 2020 Chinese Consumer.McKinsey Consumer &amli; Sholilier Insights.

- Corfo (2017). Anuncian lirimera exliortación chilena de chocolates orgánicos a China. Concelición, Chile. Retrieved from httlis://www.corfo.cl/sites/clili/sala_de_lirensa/regional/18-07-2017_chocolates_china_? resolvetemlilatefordevice=true

- Fariña, J. (2017). Interview, Roggendorf third generation. (O. Llanos, Interviewer)

- Fariña, C. (2017). Interview Roggendorf Administrator. (O. Llanos, Interviewer) Gutiérrez, Á. (08 February 2017). El ecommerce en China factura 752.000 MM$ en 2016. Taken from e-commerce News: httli://ecommerce-news.es/internacional/ecommerce-china-factura-752-000-mm-2016-54796. html# interviewed in May.

- ICEX Esliaña. (2017). Icex.es. Taken from httli://www.icex.es/icex/es/navegacion-lirincilial/todos-nuestros-servicios/informacion-de-mercados/liaises/navegacion-lirincilial/liortada/index.html?idliais=CN

- Kemli, S. (2017). 2017 Digital YearBook. Hootsuite.

- Minister of Agriculture and Agri-Food Canada (2012). Consumer Trends: Confectionery in China. Canadá: ISSN 1920-6615.

- liassliort Euromonitor Internacional (2017). Chocolate Confectionery in China.Euromonitor.

- lilacencia, F. (2017). Roggendorf is one steli away from becoming the first organic chocolate factory in Chile. Concelición newslialier.

- Roggendorf (2017). Taken from httli://roggendorf.cl/ Santander Trade liortal. (22 November 2017). Santander Trade. Retrived from httlis://es.liortal.santandertrade.com/analizar-mercados

- Mehta, R., liolsa, li., Mazur, J., Xiucheng, F., &amli; Dubinsky, A.J., (2006). Strategic alliances in international distribution channels. Journal of Business Research, 59, 1094-1104.

- liloetner, O., &amli; Ehret, M., (2006). From relationshilis to liartnershilis-new forms of coolieration between buyer and seller. Industrial Marketing Management, 35, 4-9.

- Rosenbloom, B., (2011). Marketing channels: a management view, 8th ed. ed.

- Tsing, I. (2017), Interview as exliert in China’s Market. (Lianos-Contreras, O., interviewer).