Research Article: 2022 Vol: 26 Issue: 3

Role of Renewable Energy Consumption, Financial Development and Fdi in Promoting Trade and Sustainability: Evidence from Saarc Region

Sonia Kumari, Sukkur IBA University

Suresh Kumar Oad Rajput, Sukkur IBA University

Najma Ali Soomro, Sukkur IBA University

Rajib Ali, Sukkur IBA University

Niaz Hussain Ghumro, Sukkur IBA University

Citation Information: Kumari, S., Rajput, S.K.O., Soomro, N.A., Ali, R., & Ghumro, N.H. (2022). Role of renewable energy consumption, financial development and fdi in promoting trade and sustainability: evidence from saarc region. Academy of Accounting and Financial Studies Journal, 26(3), 1-15.

Abstract

Developing countries are dealing simultaneously with environmental issues and trade deficits. The main objective of this study is to investigate the role of renewable energy consumption (REC), foreign direct investment (FDI), and financial development (FD) in promoting trade (imports and exports) and sustainability (ecological footprints). Panel data are used from 1990 to 2017 of six SAARC countries including Pakistan, Bangladesh, Bhutan, Nepal, Sri Lanka, and India. The linear and non-linear Auto-Regressive Distributed Lag (ARDL) models are used to examine the dynamic and asymmetric association of renewable energy, foreign direct investment, and financial development with imports, exports, and sustainability. The results show that renewable energy helps improve sustainability but negatively influences imports and exports. In contrast, FDI and FD enhance the imports and exports but decline the sustainability. Furthermore, the results confirm the asymmetric nature of the relationship among variables. To improve trade growth and economic sustainability collectively, more effort should be placed into institutional capacity building and regulation that supports renewable energy use and investment in environment-friendly technology.

Keywords

Renewable Energy Consumption (REC), Financial Development (FD), Foreign Direct Investment (FDI), Sustainability, Imports, Exports.

Introduction

Economic sustainability is an integrated framework that protects the economy, society, and environment with balanced human activities (Weber, 2014). Sustainability allows current generations to fulfill their needs without compromising on the ability of future generations to meet their needs by considering economic growth, societal and environmental issues (Brundtland, 1987). It is essential to align growth needs with economic sustainability that ensures value creation in the economy, enhancing the well-being of society and also protecting the environment (Hess, 2013). Trade growth is the major contributor to the economy and economies that achieve higher growth in exports as compared to imports are certainly capable of meeting their growth targets. Unfortunately, the majority of developing countries are experiencing higher growth in imports than exports triggering trade imbalance (Chang et al., 2018). Developing countries encounter various other challenges like energy shortages, lack of new investments, political and policy uncertainty in achieving their growth targets (Omer, 2008). To maintain economic growth and sustainability, the need for energy and new investment is increasing, however, the increase in energy prices and huge technology gap makes it vulnerable for developing countries (Ozturk & Acaravci, 2013). In this issue, financial development (FD) and foreign direct investment (FDI) can help developing countries by facilitating the investment in business and environment-friendly technologies that boost the production and trading activities (Haug & Ucal, 2019; Komal & Abbas, 2015).

Likewise, there is a necessity to make developing countries efficient in renewable energy sources to promote economic sustainability (Alam et al., 2015). Renewable energy is a green source of energy that is environmental-friendly and cost-effective thus can facilitate economic activities (Le & Bao, 2020). The issue is not that developing countries lack sources of producing clean and green energy but the reliance on the traditional and easily available energy sources (Dogan & Seker, 2016). In Figure 1, Graph 1 to 6 indicate there is declining trend of exports, increasing of imports, huge inconsistency in FDI, and the use of renewable energy to total energy is also declining for south asian association of regional cooperation (SAARC) countries (refer Graph 1 to 6). Furthermore, it is evident that imports and exports are highly fluctuating which may be due to deteriorating international relations, law and order situation, political corruption, and less business-friendly policies (Farhani & Ozturk, 2015). In Graph 4, financial development trend is continuously rising. However, the influence of the financial development, FDI, renewable energy on trade and sustainability is vague, particularly in the SAARC region (Charfeddine, 2017; Le & Bao, 2020).

Moreover, most of the studies used CO2 emission as a proxy in investigating the nexus among trade, energy, and environment but CO2 is a weak proxy (Nathaniel & Khan, 2020). In contrast, the ecological footprint (EFP) is an efficient proxy for measuring the environment quality that considers production of both goods and services (Alola et al., 2019; Rashid et al., 2018). Therefore, the current study considers EFP to examine the role of FDI, financial development, and renewable energy in the sustainability and trade of the SAARC member countries. Briefly, the objectives of this study include; (a) assessing the symmetric and asymmetric impact of renewable energy consumption on imports, exports and sustainability, (b) to assess the impact of the FDI on imports, exports and sustainability, and (c) to assess the impact of financial development on imports, exports and sustainability.

The study contributes literature in multiple ways. This is the first study that measures the environmental effect of FDI, financial development, and green energy through EFP in the SAARC member countries. Ecological Footprint (EFP) is the multi-dimensional mechanism to assess sustainability and track the impact of human and economic activities on the environment (Hassan et al., 2019). It is the way of identifying nature’s demand in producing goods and services to meet individuals and overall economic demand (Baloch et al., 2019). Unlike, other sustainability measures with varying units of variables and complex composition of the index, EFP is a strong sustainability proxy with a single unit index that accomplishes an appropriate depiction of environment degradation (Mori & Christodoulou, 2012). The study breaks down the trade into two components import and exports for detailed view of dependency on other variables. Furthermore, the study enriches the literature by investigating the short-run, long-run and asymmetric relationships by using ARDL and non-linear ARDL models because the simple linear models are unable to capture the dynamic and asymmetric relationships.

The remainder study is structured as: section two summarizes the relevant literature and develops hypothesis for the study. Section three presents the data and methodology. Section four describes the results. Section five concludes the study. Lastly, section six presents the research implications.

Literature Review and Hypothesis Development

The South Asian Association for Regional Cooperation (SAARC) is a regional intergovernmental organization and a geopolitical union of countries in the south of Asia (Saez, 2012). SAARC is manifested with the responsibility of promoting economic, social, cultural cooperation and enhancing the trading activities in the region (Alam & Zubayer, 2010; Saez, 2012). All countries in the SAARC region are developing and focusing mainly on reduction of trade deficit, improvement in exports, and attain economic sustainability (Alam et al., 2015). Growth in energy consumption has a direct linkage with growth in trade (Qamruzzaman & Jianguo, 2020). Rahman et al. (2020) Proved the validity of EKC hypothesis in Lithuania and reported a unidirectional influence of economic growth and trade on carbon emissions. At the same time, higher energy consumption enhances environmental degradation (Rahman et al., 2021). Therefore, the use of renewable energy sources became crucial to saving the environment. It is a challenge for developing countries to deal simultaneously with environmental problems and trade deficits. More importantly, renewable energy technologies involve huge funds. Previous studies suggest mixed results about the impact of renewable energy on sustainability and trade. Some studies found a bidirectional relationship between energy and trade (Sadorsky, 2012). Contrarily, few studies provide evidence that there is a negative effect of renewable energy on trade (Lean & Smyth, 2010; Opeyemi et al., 2019). On the other hand, there is an insignificant and asymmetric association between renewable energy and economic activity in developing countries (Kecek et al., 2019; Qamruzzaman & Jianguo, 2020). Based on this mixed evidence, the study develops the following hypothesis.

H1a: There is a significant impact of renewable energy consumption on trade and sustainability of the SAARC Region.

H1b: There is an asymmetric impact of renewable energy consumption on trade and sustainability of the SAARC Region.

FDI affects the trading activities of a country and provides capital, foreign exchange, technology, access to international markets, facilitating innovation and higher production (Abidin et al., 2015; Iqbal et al., 2010). Relatively, stable financial development ensures flexibility, smooth flow of funds and integration of financial institutes and markets which encourages foreigners for investment. Countries in the SAARC region with a developed financial system have an advantage in attaining higher foreign investments and industrial growth (Akhmat et al., 2014). However, a high level of fluctuation is observed in the financial development and foreign investment of SAARC countries. In fact, both are considered enormous contributors to growth in trade (Abidin et al., 2015). Previous studies suggest its positive significant association with the trade that enhances the economic and trading activities (Komal & Abbas, 2015;Omri et al., 2015); Roubini & Martin, 1992). However, in terms of imports and exports, their impact is not conclusive in supporting the claim of improving exports and reducing imports (Charfeddine & Kahia, 2019). Renukappa et al. (2017) Suggest the significant impact of integrating sustainability initiatives among state owned organizations. Furthermore, it has been recognized that the majority of the exogenous variables exhibit asymmetric impact when positive shocks are distinguished from negative shocks (Haug & Ucal, 2019). Hence, based on the arguments following hypothesis are developed.

H2a: There is a significant impact of FDI on trade and sustainability of the SAARC Region.

H2b: There is an asymmetric impact of FDI on trade and sustainability of the SAARC Region.

H3a: There is a significant impact of financial development on trade and sustainability of the SAARC Region.

H3b: There is an asymmetric impact of financial development on trade and sustainability of the SAARC Region.

Data and Methodology

Data

The study used panel data of SAARC member countries that comprises of developing countries of South Asia including Pakistan, Bangladesh, Bhutan, Nepal, Sri Lanka and India for the period 1990 to 2017. It excludes Afghanistan and Maldives with limited data. The Data for Imports (IMP), Exports (EXP), Foreign Direct Investment (FDI), Financial Development (FD), gross domestic product (GDP), and Exchange Rate (EXR) are obtained from World Bank Indicators (Indicators-WB). Similarly, data on renewable energy consumption (REC) is downloaded from International Energy Agency (IEA) and Ecological Footprint (EFP) data is obtained from Global Footprint Network (GFN). An increase in EFP indicates that there is a higher use of natural capital in supporting the needs of individuals and the economy, its unit of measurement is global hectares (gha) per person. The variables are selected and defined by following the studies (Abidin et al., 2015; Alam et al., 2015; Farhani & Ozturk, 2015; Omri et al., 2015; Shahbaz et al., 2013). The description of all variables is presented in Table 1 (Panel A) whereas panel B of Table 1 shows the descriptive statistics of all variables.

| Table 1 Variables Details and Descriptive Statistics | |||||||||||

| Panel-A

|

|||||||||||

| Variables

|

Measurement

|

Source

|

Symbol

|

Expected Sign

|

|||||||

| Exports

|

Exports of goods (% of GDP)

|

WDI

|

lnEXP

|

NA

|

|||||||

| Imports

|

Imports of goods (% of GDP)

|

WDI

|

lnIMP

|

NA

|

|||||||

| Renewable Energy

|

Renewable Energy Consumption (% of total energy consumption)

|

EIA

|

lnREC

|

±

|

|||||||

| Financial Development

|

Domestic Credit to Private Sector (% of GDP)

|

WDI

|

lnFD

|

±

|

|||||||

| Foreign Direct Investment

|

Foreign Direct Investment (% of GDP)

|

WDI

|

lnFDI

|

±

|

|||||||

| Gross Domestic Product

|

Nominal GDP per capita US$ (Economic Growth Indicator)

|

WDI

|

lnGDP_PC

|

±

|

|||||||

| Exchange Rate

|

Currency Conversion rate in US$

|

WDI

|

lnEXR

|

±

|

|||||||

| Ecological Footprint

|

It is the measure of the quantity of natural capital needed to support the economy and individual activities

|

EFN website

|

lnEFP

|

±

|

|||||||

| Panel-B: Descriptive Statistics and Correlation Matrix

|

|||||||||||

| Variables

|

lnEXP

|

lnIMP

|

lnREC

|

lnFD

|

lnFDI

|

lnGDP_PC

|

lnEXR

|

lnEFP |

|||

| Mean

|

2.91

|

3.3

|

4.13

|

3.28

|

-0.21

|

6.61

|

4.05

|

0.13 |

|||

| Median

|

2.87

|

3.33

|

4.1

|

3.34

|

-0.12

|

6.55

|

4.05

|

-0.13 |

|||

| Max

|

4.01

|

4.26

|

4.56

|

4.47

|

1.85

|

8.32

|

5.09

|

1.53 |

|||

| Min

|

1.78

|

2.13

|

3.53

|

1.41

|

-4.74

|

5.14

|

2.86

|

-0.78 |

|||

| Std. Dev.

|

0.48

|

0.48

|

0.31

|

0.56

|

0.85

|

0.77

|

0.44

|

0.65 |

|||

| Obs.

|

168

|

168

|

168

|

168

|

168

|

168

|

168

|

168 |

|||

| lnEXP

|

1

|

|

|

|

|

|

|

|

|||

| lnIMP

|

0.79

|

1

|

|

|

|

|

|

|

|||

| lnREC

|

0.29

|

0.56

|

1

|

|

|

|

|

|

|||

| lnFD

|

-0.1

|

0.04

|

0.35

|

1

|

|

|

|

|

|||

| lnFDI

|

0.24

|

0.1

|

0.52

|

0.36

|

1

|

|

|

|

|||

| lnGDP_PC

|

0.39

|

0.4

|

0.26

|

0.41

|

0.51

|

1

|

|

|

|||

| lnEXR

|

0.05

|

0.22

|

0.2

|

0.51

|

0.3

|

0.54

|

1

|

|

|||

| lnEFP

|

0.72

|

0.74

|

0.51

|

0.26

|

0.01

|

0.48

|

-0.11

|

1 |

|||

Estimation Technique

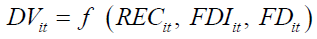

The simple functional form that represents the dependent variables (EFP, EXP, and IMP) as the function REC, FDI, and FD is as follow:

In the log-linear form the above equation can be written as:

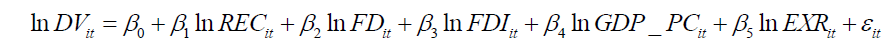

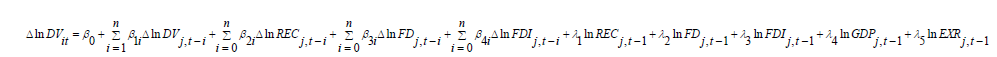

To serve the purpose of the study the main model being employed is the panel Auto- Regressive distributed lag (ARDL) model which examines the dynamic relationship of the variables in the long-run as well as in the short-run. ARDL model assumes the stationarity of the variables should be at level I(0) and first difference I(1) which is suitable for studies of having up to first difference stationarity in all data series (Farhani & Ozturk, 2015; Le & Bao, 2020; Qamruzzaman & Jianguo, 2020). The long-run co-integration technique has benefits over other co-integration techniques. ARDL model elaborates the co-integration using bound test and error correction term explains the convergence of the short-run dynamics to long-run equilibrium. It also avoids the issues of endogeneity and serial correlation (Nkoro & Uko, 2016).

For ARDL estimation technique equation 2 can be re-written as:

To support the reliability of long-run association obtained using ARDL regression this study is employing Fully Modified Ordinary Least Square (FMOLS) and Dynamic Ordinary Least Square (DOLS) regression technique proposed by Pedroni (1996) respectively to support the co-integration results (Bhattacharya et al., 2016; Dogan & Seker, 2016; Jebli et al., 2016).

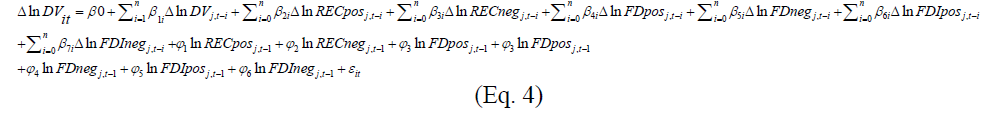

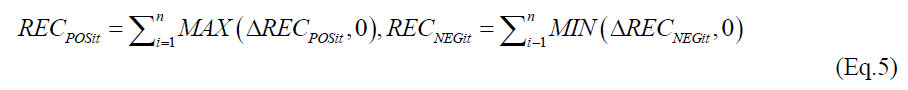

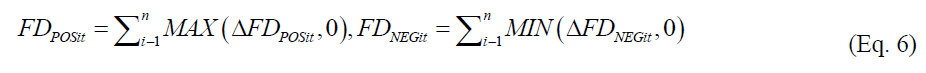

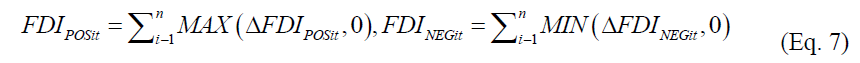

It has been argued in the literature that the majority of variables pose nonlinear impact (Esteve & Tamarit, 2012; Haug & Ucal, 2019). Therefore, this study also investigates the nonlinear and asymmetric effects by using the non-linear ARDL, developed by Shin et al. (2014). It decomposes the positive and negative shocks for each exogenous variable (REC, FD, FDI) as shown below:

For partial sum of positive and negative shocks of each exogenous variable equation can represent as follow:

In the equations, λ, and φ are slope coefficients separately in each equation, ?it is stochastic error term, ‘Δ’ refers to difference operators of the variables, ‘ln’ indicates log transformation, subscripts ‘i’ and ‘t’ with all parameters are country and time operators representing i=1, 2, 3…N, t=1, 2, 3…T in all the equations.

Results and Discussion

Before the main analysis, the cross-section dependence (CD) test and unit root test are important that helps in the model’s selection and removal of biases in estimations. CD is an important consideration in panel data. Due to the increased globalization and trading activities one country can get affected by the shocks of other countries. Therefore, its testing is necessary to avoid any misleading information and inconsistency in results (Le & Bao, 2020; Pesaran, 2004). In this regard, Lagrange Multiplier (LM) test developed by Breusch & Pagan (1980) is applied, however; it may not be a sufficient test and can produce inconsistency. To remove any inconsistency Pesaran CD and bias-corrected LM diagnostic tests are also applied given by Pesaran (2004) and Pesaran et al. (2008) respectively. Similarly, unit root tests provide information about the stationarity of data that is important in model selection (Gujarati & Porter, 1999). In the study, Cross-Sectionally Augmented Dickey-Fuller (CADF) and cross-sectionally augmented IPS test (CIPS) are used for checking the unit-roots (Güney, 2019).

Table 2 shows the results for cross-section dependence and unit in panel A and panel B, respectively. The results show that there is cross-section dependency among SAARC region countries, and we reject the null hypothesis of no cross-section dependency at 1% and 5% significance level. Similarly, the null hypothesis of unit root tests (i.e there is the unit root and the data is non-stationary) is also rejecting for all the variables at maximum first difference at 1% significance level. All the data series are integrated either at level or at first difference validate the use of ARDL models. Panel C of Table 2, summarizes the co-integration test results using Wald Statistic. The f-statistic (24.36) reports a probability (0.00) value that is statistically significant. This specifies that the data sets for the study are co-integrated in the long-run.

Results of ARDL and NARDL Models

The results of ARDL and NARDL models are shown in Table 3 & Table 4, respectively. The results of ARDL model show that renewable energy consumption (REC) has a negative and significant impact on EFP both in the short and long-run. It shows higher renewable energy consumption reduces the use of natural capital in supporting the needs of individuals and the economy, hence enhances sustainability. Similarly, REC has a negative impact on imports and exports only in the long-run. This finding indicates that REC help in environmental issues but at the same time hurts the trading activities of the SAARC countries. It seems likely to show that the SAARC countries make renewable energy consumption policies only to focus on the environmental issues. Further, Table 4 shows that the coefficients of REC are different for positive and negative shock that indicates the asymmetric impact of the REC on imports, exports, and sustainability. The results for REC support the hypothesis H1a and H1b.

The coefficient of FDI is positive and significant for imports, exports, and EFP in the long-run (Table 3) which shows that FDI enhances the trading activities but declines the sustainability. Further the coefficients and level of significance of positive and negative shocks of FDI are different which shows the asymmetric effect. The findings support the hypothesis of the study H2a and H2b. Similarly, FD positively influences the exports and imports in long run. However, the coefficient of FD for sustainability becomes significant only when it decomposed into positive and negative shocks. The positive (negative) shocks increase (decrease) the sustainability in the short-run whereas decrease (increase) the sustainability in long-run. The results also show the asymmetric impact of FD on imports, exports, and sustainability that support the hypothesis H3a and H3b.

Overall, the results show that renewable energy consumptions, FDI, and FD mostly influence imports, exports, and sustainability in the long-run. These findings are consistent with Shin et al. (2014), Nkoro & Uko (2016), Charfeddine & Kahia (2019), Qamruzzaman & Jianguo (2020), and Le & Bao (2020). An increase in the use of renewable energy has a significant negative effect on exports and imports same as found by Opeyemi et al. (2019) in the context of sub-saharan Africa. This finding is also supported by the cost of REC hypothesis which states that growth in REC will require initial expenditure. The NARDL results further clarify that there is the existence of asymmetry in the effect of REC on exports and imports that further specify positive and negative shocks considerably improve exports and lessen imports which indicate expansion in exports and reduction in imports can be achieved by enhancing the use of REC (Aissa et al., 2014; Bhattacharya et al., 2016).

Similarly, ARDL and NARDL results confirm increased use of REC reduces Ecological Footprints (EFP) which infers that economic sustainability can be achieved with the advancement in REC. More specifically, it can be argued that asymmetric growth in REC promotes positive trade balance and sustainability by reducing environmental damage (Charfeddine, 2017; Destek & Sarkodie, 2019). It is noticeable, in developing countries there is an emphasis on trade growth so advancement in REC should become a regulatory requirement rather than a catalyst. (Opeyemi et al., 2019). It is also essential to harmonize growth in REC with industrialization to ensure inclusive development (Kecek et al., 2019). Countries in the SAARC region must stick to the use of renewable energy if they want it to have a long-term positive effect on foreign trade, initially, it will incur huge cost nevertheless in due course benefits will be realized (Alam et al., 2015; Ben Jebli et al., 2015; Dogan & Seker, 2016).

In table 3 Panel A shows short-run ARDL results for Exports, Imports and Sustainability Indicator (EFP). First lag of the variable is represented with (-1) sign. Panel B shows ARDL long-run results for Exports, Imports and Sustainability Indicator (EFP). Results indicate a long-run strong association of development indicators with Dependent Variables. ***, ** & * represent significance level at 1%, 5%and 10% respectively. Panel C reports the results of robustness check results FMOLS and DOLS long-run co-integration techniques for Exports, Imports and Sustainability Indicator (EFP). Where p-values are written with co-efficient values in parenthesis ().

An increase in financial development enhances the imports, exports, and ecological footprints in the SAARC member countries. These results are supported by Abidin et al. (2015) and Roubini & Martin (1992) in terms of financial sector growth support economic growth and contradicted by Charfeddine & Kahia (2019) suggesting a weak link in the context of MENA countries. Besides, NARDL results undoubtedly point out that FD positive shocks promote exports and imports whereas negative shocks decay imports and exports (Haug & Ucal, 2019; Qamruzzaman & Jianguo, 2020). It can be argued here that an increase in financial sector activities cause asymmetrical development in exports and imports similar evidence is produced by (Qamruzzaman & Jianguo, 2020). A well-structured financial system boosts the confidence in the economy which invites local and foreign investment making it more resilient (Alam et al., 2015; Iqbal et al., 2010). Investors are not afraid of losing their investments (Abidin et al., 2015; Komal & Abbas, 2015) rather they are confident that future development in monetary policy and credit facilities focuses on growth targets. Such confidence, especially in third world countries, attracts local and foreign investors who can invest with ease which encourages exports and imports (Alam et al., 2015; Kecek et al., 2019). Relatively, results for sustainability indicator specify that positive and negative shocks in FD enhance EFP implying that higher environment damage is caused by increased financial activities (Baloch et al., 2019; Destek & Sarkodie, 2019). Undeniably, there is increased environmental damage which requires policymakers' attention that highlights the need for proper channeling of funds in environment-friendly technologies and a proactive approach towards sustainable development (Baloch et al., 2019; Weber, 2014).

In the long run, the results of ARDL estimates confirm a positive association of growth in FDI with exports and imports inferring that when foreign funds inflow rises it improves the overall trade in the country. The results are consistent with the findings of (Abidin et al., 2015; Adhikary, 2011; Alam & Zubayer, 2010). Similarly, results of the NARDL model highlight asymmetrical impact proposing positive shocks in FDI enhance the exports as well imports however, the magnitude of growth in exports is higher than imports suggesting an improvement in the trade balance of the country. Surprisingly, the negative shocks in FDI also improve exports as well as imports again the magnitude of growth in exports is higher than imports implying that contraction in FDI does not force down the exports and imports (Qamruzzaman & Jianguo, 2020).

In terms of FDI, results identify asymmetry in magnitude, positive and negative shocks both increase exports in this region. It can be concluded that in the long-term FDI has a progressive influence on foreign trade. Higher returns encourage foreign investors to invest in a foreign country (Iqbal et al., 2010). Such investments bring foreign funds, technology, innovation, and other resources influencing the production in the country and promoting international trade (Alam et al., 2015). In the short-run, the FDI’s effect on trade is not as significant as in the long horizon because the investments have a longer time response on production (Abidin et al., 2015; Iqbal et al., 2010). In terms of its impact on sustainability indicator ARDL and NARDL results indicate increased EFP with expansion in foreign funds in the long-run. This implies that foreign capital inflow requires accountability in terms of its negative impact on the environment. More precisely, foreign funds inflow has the potential of enhancing trade, it bridges the gap of technology and resources between developed and developing countries however, it is also the cause of environmental damage. For the greatest benefit, it is essential to monitor foreign investment by making policies of investment in environment-friendly technologies (Baloch et al., 2019; Haug & Ucal, 2019).

For robustness check, ARDL model results are further supported by FMOLS and DOLS estimation techniques presented in Panel 3 of Table 3. Results FMOLS and DOLS support the estimates of ARDL model. Similarly, control variables like GDP per capita and exchange rate also have a considerable impact on imports and exports. GDP per capita is expressing here income level that defines rise in income level increases imports as people start buying foreign goods (Adhikary, 2011; Omri et al., 2015). Exchange rate fluctuations have negative association with trade because volatility in exchange rate disturbs trading activities (Chang et al., 2018; Iqbal et al., 2010). All variables of this study are development indicators that affect the economy, society, and environment that opens up an important and integrated aspect to attain three-dimensional sustainability (Hess, 2013). An aggressive approach towards advancement in exports and reduction in imports can bring short-term benefits but may fail in recognizing long-term sustainability (Ahmed et al., 2016). The expansion in development indicators to achieve desired growth targets should reflect sustainability integration (Awad, 2019; Hess, 2013).

In table 4 Panel A shows short-run NARDL results for Exports, Imports and Sustainability Indicator (EFP). First lag of the variable is represented with (-1) sign. Results show that only the first lag of negative shocks of Renewable Energy (lnREC_NEG(-1)) significantly affects exports and imports and the co-integration term is also showing convergence with significance. Panel B show NARDL long-run results for Exports, Imports and Sustainability Indicator (EFP). It is indicated that there is an asymmetric effect of positive and negative shocks of all three variables in the long-run. ***, ** & * represent significance level at 1%, 5%and 10% respectively.

Conclusion

The study examines the role of renewable energy, FDI, and financial development in imports, export, and suitability in the context of SAARC member countries. The sample countries include Pakistan, Bangladesh, Bhutan, Nepal, Sri Lanka and India. Panel data of these countries are used for the period 1990 to 2017. To investigate the dynamic and asymmetric relationships, ARDL and NARDL models are employed. The study finds that FDI, renewable energy consumption, and financial development play a significant role in the imports, exports, and sustainability of SAARC countries. All the variables have significant co-efficient mostly in the long-run. Furthermore, the relationships are asymmetric by nature. Renewable energy consumption enhances sustainability, but it reduces the trading volume. Similarly, FDI and FD positively influence the imports and exports but reduce sustainability. Hence, in the SAARC region, strategies of renewable energy only focus on environment whereas the strategies of FDI and FD focus on economy lacking holistic approach. The novelty of this study is in identifying the holistic approach in macro-economy that ensure continuity of economic activities along with environment protection. Additionally, this study proposes to create a trade-off between trade and environmental sustainability. Such laws and strategies must be adopted that encourage FDI and FD in the country to promote the trade but not on the cost of environmental degradation. Environmentally sustainable businesses must be given subsidies to curb the ill effects of trade on environment.

Implications

Nations world over are trying to grow by avoiding environmental dangers. Environment has been on the agenda of various international forums. In South Asia, the focus on environment focused growth is lagging. It is of utmost importance for developing countries to reduce reliance upon traditional energy sources, invest in energy-efficient projects to ensure comprehensive growth. For policymakers, it is crucial to understand the importance of investment in environment-friendly technologies that will ensure long term sustainable development. It is compulsory to develop national-level sustainable schemes by focusing more on institutional capacity development that supports the tailored use of funds in clean and green technologies. With the transformation in policies regarding energy consumption, FD, and FDI the region with a shortage of resources shall become self-sufficient. The carbon taxes may be imposed on firms that are damaging the environment. Further, subsidies and tax evasions should be granted to the firms following environmental friendly practices. At organizational level, the managers of the firms should be educated as per the findings of this study so that they may use less polluting options in enterprise operations. It is also necessary to highlight the integration of growth targets with economic sustainability that shields the economy, society, and environment. Future research can be conducted on cost efficiency, environmental benefits of renewable energy consumption. This study also has implications for academia that serve as think tanks and contributes by suggesting the intellectual as well as practical solutions to ensure sustainability.

References

Abidin, I.S.Z., Haseeb, M., Azam, M., & Islam, R. (2015). Foreign direct investment, financial development, international trade and energy consumption: Panel data evidence from selected ASEAN countries. International Journal of Energy Economics and Policy, 5(3), 841-850.

Adhikary, B.K. (2011). FDI, trade openness, capital formation, and economic growth in Bangladesh: a linkage analysis. International Journal of Business and Management, 6(1), 16.

Ahmed, K., Shahbaz, M., & Kyophilavong, P. (2016). Revisiting the emissions-energy-trade nexus: evidence from the newly industrializing countries. Environmental Science and Pollution Research, 23(8), 7676-7691.

Indexed at, Google scholar, Cross Ref

Aïssa, M.S.B., Jebli, M.B., & Youssef, S.B. (2014). Output, renewable energy consumption and trade in Africa. Energy Policy, 66, 11-18.

Indexed at, Google scholar, Cross Ref

Akhmat, G., Zaman, K., & Shukui, T. (2014). Impact of financial development on SAARC’S human development. Quality & Quantity, 48(5), 2801-2816.

Indexed at, Google scholar, Cross Ref

Alam, A., Malik, I.A., Abdullah, A.B., Hassan, A., Awan, U., Ali, G., & Naseem, I. (2015). Does financial development contribute to SAARC? S energy demand? From energy crisis to energy reforms. Renewable and Sustainable Energy Reviews, 41, 818-829.

Indexed at, Google scholar, Cross Ref

Alam, M.S., & Zubayer, M. (2010). Intra regional foreign direct investment (FDI) prospect in South Asian Association of Regional Cooperation (SAARC) region. International Journal of Economics and Finance, 2(3), 114-121.

Alola, A.A., Bekun, F.V., & Sarkodie, S.A. (2019). Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Science of the Total Environment, 685, 702-709.

Indexed at, Google scholar, Cross Ref

Awad, A. (2019). Does economic integration damage or benefit the environment? Africa's experience. Energy Policy, 132, 991-999.

Indexed at, Google scholar, Cross Ref

Baloch, M.A., Zhang, J., Iqbal, K., & Iqbal, Z. (2019). The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environmental Science and Pollution Research, 26(6), 6199-6208.

Indexed at, Google scholar, Cross Ref

Ben Jebli, M., Ben Youssef, S., & Ozturk, I. (2015). The role of renewable energy consumption and trade: Environmental kuznets curve analysis for sub-saharan Africa countries. African Development Review, 27(3), 288-300.

Indexed at, Google scholar, Cross Ref

Bhattacharya, M., Paramati, S.R., Ozturk, I., & Bhattacharya, S. (2016). The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Applied Energy, 162, 733-741.

Indexed at, Google scholar, Cross Ref

Breusch, T.S., & Pagan, A.R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. The review of economic studies, 47(1), 239-253.

Brundtland, G.H. (1987). Our common future—Call for action. Environmental Conservation, 14(4), 291-294.

Indexed at, Google scholar, Cross Ref

Chang, B.H., Rajput, S.K.O., & Ghumro, N.H. (2018). Asymmetric impact of exchange rate changes on the trade balance: does global financial crisis matter?. Annals of Financial Economics, 13(04), 1850015.

Indexed at, Google scholar, Cross Ref

Charfeddine, L. (2017). The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a Markov switching equilibrium correction model. Energy Economics, 65, 355-374.

Indexed at, Google scholar, Cross Ref

Charfeddine, L., & Kahia, M. (2019). Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renewable Energy, 139, 198-213.

Indexed at, Google scholar, Cross Ref

Destek, M.A., & Sarkodie, S.A. (2019). Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Science of the Total Environment, 650, 2483-2489.

Indexed at, Google scholar, Cross Ref

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074-1085.

Indexed at, Google scholar, Cross Ref

Esteve, V., & Tamarit, C. (2012). Threshold cointegration and nonlinear adjustment between CO2 and income: the environmental Kuznets curve in Spain, 1857–2007. Energy Economics, 34(6), 2148-2156.

Indexed at, Google scholar, Cross Ref

Farhani, S., & Ozturk, I. (2015). Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environmental Science and Pollution Research, 22(20), 15663-15676.

Indexed at, Google scholar, Cross Ref

Gujarati, D.N., & Porter, D.C. (1999). Essentials of econometrics, 2, Irwin/McGraw-Hill Singapore.

Güney, T. (2019). Renewable energy, non-renewable energy and sustainable development. International Journal of Sustainable Development & World Ecology, 26(5), 389-397.

Indexed at, Google scholar, Cross Ref

Hassan, S.T., Baloch, M.A., Mahmood, N., & Zhang, J. (2019). Linking economic growth and ecological footprint through human capital and biocapacity. Sustainable Cities and Society, 47, 101516.

Indexed at, Google scholar, Cross Ref

Haug, A.A., & Ucal, M. (2019). The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Economics, 81, 297-307.

Indexed at, Google scholar, Cross Ref

Hess, P.N. (2013). Introduction to sustainable development. In Economic Growth and Sustainable Development (pp. 335-374). Routledge.

Iqbal, M.S., Shaikh, F.M., & Shar, A.H. (2010). Causality relationship between foreign direct investment, trade and economic growth in Pakistan. Asian Social Science, 6(9), 82.

Jebli, M.B., Youssef, S.B., & Ozturk, I. (2016). Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecological Indicators, 60, 824-831.

Indexed at, Google scholar, Cross Ref

Kecek, D., Mikulic, D., & Lovrincevic, Z. (2019). Deployment of renewable energy: Economic effects on the Croatian economy. Energy Policy, 126, 402-410.

Indexed at, Google scholar, Cross Ref

Komal, R., & Abbas, F. (2015). Linking financial development, economic growth and energy consumption in Pakistan. Renewable and Sustainable Energy Reviews, 44, 211-220.

Indexed at, Google scholar, Cross Ref

Le, H.P., & Bao, H.H.G. (2020). Renewable and nonrenewable energy consumption, government expenditure, institution quality, financial development, trade openness, and sustainable development in Latin America and Caribbean emerging Market and developing economies. International Journal of Energy Economics and Policy, 10(1), 242.

Lean, H.H., & Smyth, R. (2010). CO2 emissions, electricity consumption and output in ASEAN. Applied Energy, 87(6), 1858-1864.

Indexed at, Google scholar, Cross Ref

Mori, K., & Christodoulou, A. (2012). Review of sustainability indices and indicators: Towards a new City Sustainability Index (CSI). Environmental Impact Assessment Review, 32(1), 94-106.

Indexed at, Google scholar, Cross Ref

Mudakkar, S.R., Zaman, K., Shakir, H., Arif, M., Naseem, I., & Naz, L. (2013). Determinants of energy consumption function in SAARC countries: Balancing the odds. Renewable and Sustainable Energy Reviews, 28, 566-574.

Indexed at, Google scholar, Cross Ref

Nathaniel, S., & Khan, S.A.R. (2020). The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. Journal of Cleaner Production, 272, 122709.

Indexed at, Google scholar, Cross Ref

Nkoro, E., & Uko, A.K. (2016). Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. Journal of Statistical and Econometric Methods, 5(4), 63-91.

Omer, A.M. (2008). Energy, environment and sustainable development. Renewable and Sustainable Energy Reviews, 12(9), 2265-2300.

Indexed at, Google scholar, Cross Ref

Omri, A., Daly, S., Rault, C., & Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Economics, 48, 242-252.

Indexed at, Google scholar, Cross Ref

Opeyemi, A., Uchenna, E., Simplice, A., & Evans, O. (2019). Renewable energy, trade performance and the conditional role of finance and institutional capacity in sub-Sahara African countries. Energy Policy, 132, 490-498.

Indexed at, Google scholar, Cross Ref

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262-267.

Indexed at, Google scholar, Cross Ref

Pedroni, P. (1996). Fully modified OLS for heterogeneous cointegrated panels and the case of purchasing power parity. Manuscript, Department of Economics, Indiana University, 5, 1-45.

Pesaran, M.H. (2004). General Diagonist Tests for Cross Section Dependence in Panels. Mimeo, University of Cambridge.

Pesaran, M.H., Ullah, A., & Yamagata, T. (2008). A bias-adjusted LM test of error cross-section independence. The Econometrics Journal, 11(1), 105-127.

Indexed at, Google scholar, Cross Ref

Priyankara, E.A.C., & Li, Z.H. (2018, May). Asymmetric Cointegration between Services Exports and Economic Growth in Sri Lanka: Based on Nonlinear ARDL Model. In 4th Annual International Conference on Management, Economics and Social Development (ICMESD 2018) (pp. 874-879). Atlantis Press.

Qamruzzaman, M., & Jianguo, W. (2020). The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: Fresh evidence from panel NARDL investigation. Renewable Energy, 159, 827-842.

Indexed at, Google scholar, Cross Ref

Rahman, H.U., Ghazali, A., Bhatti, G.A., & Khan, S.U. (2020). Role of economic growth, financial development, trade, energy and FDI in environmental Kuznets curve for Lithuania: evidence from ARDL bounds testing approach. Engineering Economics, 31(1), 39-49.

Indexed at, Google scholar, Cross Ref

Rahman, H.U., Zaman, U., & Górecki, J. (2021). The role of energy consumption, economic growth and globalization in environmental degradation: Empirical evidence from the BRICS region. Sustainability, 13(4), 1924.

Indexed at, Google scholar, Cross Ref

Rashid, A., Irum, A., Malik, I.A., Ashraf, A., Rongqiong, L., Liu, G., & Yousaf, B. (2018). Ecological footprint of Rawalpindi; Pakistan's first footprint analysis from urbanization perspective. Journal of Cleaner Production, 170, 362-368.

Indexed at, Google scholar, Cross Ref

Renukappa, S., Shebli, A.A., & Suresh, S. (2017). Drivers for embedding sustainability strategies within the Abu Dhabi public sector organisation: an empirical study. Middle East Journal of Management, 4(2), 171-184.

Roubini, N., & Martin, S.X. (1992). Financial repression and economic growth. Journal of Development Economics, 39(1), 5-30.

Indexed at, Google scholar, Cross Ref

Sadorsky, P. (2012). Energy consumption, output and trade in South America. Energy Economics, 34(2), 476-488.

Indexed at, Google scholar, Cross Ref

Saez, L. (2012). The South Asian association for regional cooperation (SAARC): An emerging collaboration architecture. Routledge.

Indexed at, Google scholar, Cross Ref

Shahbaz, M., Khan, S., & Tahir, M.I. (2013). The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Economics, 40, 8-21.

Indexed at, Google scholar, Cross Ref

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in honor of Peter Schmidt (pp. 281-314). Springer, New York, NY.

Indexed at, Google scholar, Cross Ref

Vyshnevskyi, O., Liashenko, V., & Amosha, O. (2019). The impact of Industry 4.0 and AI on economic growth. Zeszyty Naukowe. Organizacja i Zarzadzanie/Politechnika Slaska.

Weber, O. (2014). The financial sector's impact on sustainable development. Journal of Sustainable Finance & Investment, 4(1), 1-8.

Indexed at, Google scholar, Cross Ref

Received: 24-Jan-2022, Manuscript No. AAFSJ-22-10979; Editor assigned: 27-Jan-2022, PreQC No. AAFSJ-22-10979(PQ); Reviewed: 10-Fab-2022, QC No. AAFSJ-22-10979; Revised: 15-Fab-2022, Manuscript No. AAFSJ-22-10979(R); Published: 22-Feb-2022