Research Article: 2023 Vol: 26 Issue: 2S

Scamming Issues in the Financial Digital Apps among the Elderly

Razan Alghriafi, Imam Abdulrahman Bin Faisal University

Nouf Alsaadi, Imam Abdulrahman Bin Faisal University

Jood Alayedi, Imam Abdulrahman Bin Faisal University

Nouf Alhajri, Imam Abdulrahman Bin Faisal University

Mahmud Maqsood, University of Bahrain

Hoda Mahmoud AboAlsmh, Imam Abdulrahman Bin Faisal University

Ibrahim Tawfeeq Alsedrah, Imam Abdulrahman Bin Faisal University

Zahra Afridi, Imam Abdulrahman Bin Faisal University

Citation Information: Alghriafi, R., Alsaadi, N., Alayedi, J., Alhajri, N., Maqsood, M., AboAlsmh, H.M., Alsedrah, I.T., & Afridi, Z. (2023). Scamming Issues in the Financial Digital Apps among the Elderly. Journal of Entrepreneurship Education, 26(S2),1-9.

Abstract

The current study sought to determine the glaring loopholes in the digital finance sector that have resulted in many elderly members of society being scammed. The research was anchored on the theory of disruptive technology and conducted an explorative literature review to determine the underlying risk factors for the continued scamming of the elderly in the digital financial sector. The use of digital financial apps has gained popularity in the recent past due to their ability to enhance financial inclusion through easy access to financial services. However, lack of regulation, inadequate financial literacy, inadequate due diligence, mismatch of business strategy, susceptibility to scams, and investor overconfidence are some of the financial digital app determinants that have resulted in high scamming rates in the digital financial sector. Therefore, this essay suggested that for increased investor education on the operations of digital financial apps, investors need to conduct due diligence on the underlying opportunities in these digital platforms. They should conduct adequate background checks of the related parties offering the financial services in apps and development of a set of uniform legislations to streamline the operations of the digital financial sector.

Keywords

Digital Apps, Financial Technology, Financial Services, Scamming Issues.

Introduction

The international financial market has witnessed one of the advanced revolutions in its scope and operation (Ma et al., 2022). The development of financial technology (fintech) services to enhance financial inclusion has been a game-changer as it helped improve global access to financial services among communities. Consequently, this has enhanced livelihoods as users can access such financial services over mobile applications. The most common type of fintech services has been the introduction of mobile lending applications (apps) whereby a single click allows one to access unrestricted financial services at cheaper rates, thus resulting in improved livelihoods (Diaz Baquero, 2021). Financial inclusion has, therefore, been relatively achieved through fintech services, and part of this population has been the elderly in society.

Purpose of the Study

Whereas mobile apps have made access to financial services relatively easy over mobile devices, this development has been coupled with various challenges that have threatened its continuity and stability (Malav & Chawla, 2022). The rise in digital lending services characterized by scamming has got the world talking, with various quotas joining the debate on the need to instantly bring such a menace to an end. Interestingly, according to Burton et al. (2021), the most vulnerable group to the scamming issues in the digital apps has been the elderly, who have been unable to detect suspicious activities in these digital apps and end up being victims of the scrupulous activities. Consequently, there has been a loss of millions of dollars through online scamming over digital financial apps that target the elderly, whose knowledge of such applications may be limited from time to time. This essay, therefore, describes the current state of scamming in the digital financial apps experienced by the elderly. The study also suggests adequate steps necessary to bring to an end such activities with immediate effect.

Objectives

General Objective

Determine the nature of scamming issues involving the elderly while using digital financial apps in the financial sector is the general objective of this study.

Specific Objectives

The specific objectives relating to this study include to;

i. Assess the rate of scamming cases in digital financial apps among the elderly in the financial sector. ii. Determine the causes of scamming in digital apps among the elderly in the financial sector. iii. Examine the applicable remedies to prevent the rate of scamming in digital financial apps among the elderly in the financial sector.

Research Questions

The following fundamental questions guided this research;

iv. What is the rate of scamming cases in digital financial apps among the elderly in the financial sector? v. What are the underlying causes of scamming in digital financial apps among the elderly in the financial sector? vi. What are the evidence-based solutions to tackle digital financial apps scamming among the elderly in the financial sector?

Scope of Study

The scope of this study is limited to the scamming issues among the elderly when using digital financial apps in the financial industry. The paper is divided into four parts; part one; introduction, part two; literature review, part three; methodology; part four, results and discussions of the study. The last part includes a summary, conclusion, and recommendations for the underlying study variables and parameters.

Literature Review

Theoretical Framework

A theory is a model that describes the origin and application of a phenomenon in contemporary society. This study was based on the model of disruptive innovation theory.

Disruptive Innovation Theory

The theory of disruptive innovation is anchored on the premise that new businesses develop new products that rival the establishing firms’ products, which results in changing dynamics of the business operations of an industry. The theory relates to a case where a new product is introduced in the market that promises new dimensions regarding effectiveness and efficiency in its usage, which makes it difficult for the existing firms to continue with their normal operations (Si et al., 2020). Therefore, this theory ensures continued innovation and technology integration in developing products and services in any given sector. This theory is relevant to the current study as it helps explain the need for new financial products and services accessible through various apps that result in the final inclusion of all communities. Through this theory, digital financial apps have become popular among users of all ages, and the elderly have not been left behind. Therefore, this theory helps understand the reason behind the increased use of digital financial apps among the elderly, which has, in the long run, resulting in various scamming issues when using such fintech services to achieve financial inclusion (Dubey et al., 2020).

Empirical Literature

As more financial digital apps are registered globally over time, there has been a sharp rise in fraud occurrences. Data show a growing need for policies and deliberate rules to guarantee online security when using digital banking apps (Arnone et al., 2022). This essay examines the extent of the investigation for fraud in digital financial apps, with a particular emphasis on current crises involving, among others, Paypal and Cashapp. It specifies the goal of the study, the intended audience, and the theoretical frameworks. Financial fraud is the fastestgrowing type of elder abuse (Da Corte, 2022). Financial elder abuse is when someone uses a vulnerable senior's money or other assets illegally or ethically. Most states now have laws that criminalize elder financial exploitation and offer measures to aid the older person while punishing the con artist.

While using digital apps, the elderly are susceptible to scamming as they lack the adequate know-how to maneuver such applications and detect malicious activity. They often fall victim in the hands of the scammers, which ranges from paying large sums of fees of financial facilities accessed to being conned large sums of money after being promised some payoffs such as in the form of lottery. According to Sugunaraj et al. (2022), one in every ten old Americans becomes a victim of digital financial app scamming, which translates to 5.4%. These statistics are further expected to rise given the increase in the digital apps that provide financial services and continue to prey on vulnerable citizens such as the elderly to make a fortune from such scamming activities. Whereas strangers spearhead most such scams, research has shown that certain close members, such as friends and family members, have promoted this activity as they also become beneficiaries.

Those included in the statistics for being victims of the scam activity are elders who live alone, excluding those in institutional settings and the majority who are impaired cognitively. What has made the situation dire is that most scamming cases go unreported, which acts as a breeding ground for future scamming activities (Forbis, 2019; Fakiha, 2022). Scammers employ various strategies to swindle large sums of money from unsuspecting elderly in society, ranging from pretending to develop relationships before asking such old citizens to send them money either to be refunded or given as a grant based on the relationships they built with the scammers. The elderly are always vulnerable to such scamming activities since many studies have found them socially isolated and lonely, increasing their chances of being scammed whenever they use fanatical digital mobile apps (Noah et al., 2022).

Financial digital apps are not fully regulated by various financial regulatory agencies (Smikle, 2022). The absence of stringent regulatory frameworks has been one of the leading causes of increased scamming over digital financial apps. Most of these apps operate within undefined legal parameters, making it difficult for relevant financial regulatory agencies to monitor their activities and take corrective actions against such scrupulous activities (Lyons & Kass?Hanna, 2021). The lack of a uniform set of laws to regularize the operations of digital financial apps has, as such, been a letdown in the fight to end online scamming rampant among the elderly in society. The scammers have taken advantage of this legal vacuum as they are not, in most cases, not held liable for the scamming activities on such digital platforms due to the absence of a specific set of regulations.

Methodology

This section presents the underlying approaches that were adopted to achieve this study. The section describes the research design, target population, sampling technique and procedure, and data analysis.

Research Design

A research design is a thematic model that enables successful data collection and analysis. In this study, the content analysis research design was adopted. According to Harris et al. (2019), content design is a methodology where the researcher examines the literature to determine the underlying themes, concepts, and relationships of variables that characterize the research phenomenon. The researcher, therefore, examined various pieces of literature on the increased use of digital financial apps by the elderly to determine the reasons behind the increased scamming issues among this target population while using fintech services. The content design further enables the successful determination of evidence-based approaches to address the rampant scamming issues in digital financial apps among the elderly, accessed through a rigorous literature review.

Target Population

The target population for this study involved elderly citizens that use digital financial apps such as Paypal, Cashapp, and smartcards. The age considered as old age involved those 60 years and above. Therefore, the inclusion criteria for participants in this study involved a minimum of 60 years and the requirement to use digital financial apps to achieve financial inclusion. Participants who had been scammed and those who had not were allowed to participate in the study to give the study a broader scope and ensure there are population-based suggestions to address the scamming menace among the elderly in society.

Sampling Technique and Procedure

The study adopted simple random sampling to select participants (literature) in this study. According to Cypress (2018), simple random sampling is an effective strategy involving a target population that is not defined and specific. Simple random sampling is recommended since the technique helps reduce sampling bias, a common occurrence in various social research activities where the researcher fails to develop a representative sample necessary to make reliable generalizations and predictions about the population parameters. The criteria involved randomly selecting literature relevant to the study topic with a publication period of less than five years. A total of 15 articles were analyzed to deduce the findings about the study parameters.

Data Collection and Analysis

The study used secondary data, which involved rigorous explorative research in determining the underlying causes of scamming issues in digital financial apps. Through content analysis, the study determined adequate techniques that can be implemented to result in scamfree financial digital apps among the elderly. Statistical Package for Social Sciences (SPSS) Version 26 was used to analyze the data. The researcher's interest in particular outcomes included the correlation coefficients, p-values, and coefficient of determination. These statistics enabled the achievement of research objectives and answering the research questions formulated previously in this discussion. The study outcomes were presented in tables and figures to enhance better understanding, summary, and conclusion on the underlying study variables.

Results and Discussion

Inferential Statistics

To determine the variation in scamming issues caused by digital financial apps among the elderly in the financial sector, the study developed a model summary as shown below.

From Table 1, the digital financial apps contributed to scamming issues among the elderly up to 64.4%. This shows that digital financial apps significantly contribute to scamming among the elderly, compared to other factors that result in scamming among this vulnerable population. The specific financial digital factors that resulted in increased scamming among the elderly included; a lack of adequate financial education for the elderly and the mismatch of business growth strategies by these fintech firms. Also, the vulnerability of the elderly to scams when using fintech products and the overconfidence of the elderly (investors) when sourcing for the optimal investment option through these digital financial apps (Poster, 2022).

| Table 1 Model Summary For Financial Digital Apps Determinants And Scamming Rates |

||||

|---|---|---|---|---|

| Model | R | R-Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.802a | 0.644 | 0.631 | 0.364 |

| a. Predictors: (Constant), Lack of financial education, mismatch of business strategy, Susceptibility to scams, Investor overconfidence | ||||

Source: Research Data (2022)

At 95% confidence level, variances tests were conducted to establish the significance of digital financial apps in affecting the scamming of the elderly. From Table 2, the observed pvalue was 0.000, less than the study's 5% significance level (p=0.000<0.05). The p-value, as such, showed that digital financial apps statistically and significantly contributed to the high scamming rates among the elderly in the financial sector.

| Table 2 Anova For Financial Digital Apps Determinants And Scamming Rates |

|||||

|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| Regression | 25.575 | 4 | 6.394 | 48.383 | 0.000b |

| Residual | 14.140 | 107 | 0.132 | ||

| Total | 39.714 | 111 | |||

| a. Dependent Variable: Scamming rates of financial sector b. Predictors: (Constant), Lack of financial education, mismatch of business strategy, Susceptibility to scams, Investor overconfidence |

|||||

Source: Research Data (2022).

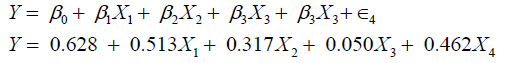

From Table 3, the elderly scamming rate had a constant value of 0.628, holding the financial digital app usage constant. Lack of financial awareness, mismatch of business strategy, susceptibility to scams, and investor overconfidence registered correlation coefficients of 0.513, 0.317, 0.050, and 0.462, respectively. From the statistics obtained, all the independent variables registered a positive correlation with the dependent variable. The lack of financial awareness was the most significant contributor to the increased scamming rate among the elderly, with susceptibility to scams being the weakest factor in the increased scamming rate among the elderly while using digital financial apps.

.

| Table 3 Coefficients Of Financial Digital Apps Determinants And Scamming Rates |

||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 0.628 | 0.231 | 2.718 | 0.008 | |

| Lack of financial awareness | 0.348 | 0.044 | 0.513 | 7.891 | 0.000 | |

| Mismatch of business strategy | 0.212 | 0.040 | 0.317 | 5.364 | 0.000 | |

| Susceptibility to scams | 0.036 | 0.043 | 0.050 | 0.843 | 0.0401 | |

| Investor overconfidence | 0.341 | 0.039 | 0.462 | 8.719 | 0.000 | |

| a. Dependent Variable: Scamming rates of the financial sector | ||||||

Source: Research Data (2022)

Table 3 further shows that lack of financial awareness had a beta coefficient of 0.513 and a significance of 0.000 which is less than the 5% significance level at which tests were conducted (p=0.000<0.05). This statistic showed that a lack of financial awareness among the elderly was statistically significant in contributing to scamming issues in the target population (the elderly). Therefore, the study concluded that inadequate financial education directly and positively contributes to scamming issues among the elderly.

Also, Table 3 shows that the mismatch of business strategy had a correlation coefficient of 0.317 and a p-value of 0.000, which is less than the 5% significance level at which tests were conducted (p=0.000<0.05). This statistic showed that the mismatch in the business strategy of the digital financial apps of companies has a statistically significant effect on scamming rate among the elderly in society. Therefore, the study concluded that a mismatch of business strategy is a leading factor of increased scamming issues among the elderly that use digital financial apps to achieve financial inclusion.

Further, Table 3 shows that susceptibility to scams had a correlation coefficient of 0.050 and a p-value of 0.0401, which is less than the 5% significance level at which tests were conducted (p=0.0401<0.05). This statistic showed that susceptibility to scamming when using digital financial apps has a statistically significant effect on scamming rate among the elderly in the financial sector (Manibog & Alvarez, 2022). Therefore, the study concluded that susceptibility to scamming is a leading factor of increased scamming issues among the elderly that use digital financial apps to achieve financial inclusion.

The investor overconfidence variable registered a correlation coefficient of 0.463 and a significance level of 0.000. The p-value was less than the significance level of 5% at which tests were conducted. These statistics show that investor overconfidence was statistically significant in contributing to the increased scamming rate among the elderly while using digital financial apps. The overconfidence was characterized by committing large sums of money into ventures they were confident would yield substantial financial returns, such as the lottery, only to turn out to be fake in the long run, thus making substantial financial losses.

The financial digital apps determinants collectively resulted in the following multivariate regression analysis for the study;

Where;

Y=Scamming rates of the financial sector

X1=Lack of financial awareness

X2=Mismatch of business strategy

X3=Susceptibility to scams

X4=Investor overconfidence

Conclusion

This study sought to determine the effect of financial digital app determinants on the increased scamming rates in the financial sector among the elderly. The study specifically examined the effect of lack of financial awareness, mismatch of business strategies, susceptibility to scams, and investor overconfidence on the scamming rates in the financial sector. The need for improved financial inclusion has resulted in the financial sector witnessing emergence of various fintech products which are readily available to users. However, due to the absence of regulations, the use of digital financial apps has constantly put at risk the users who have fallen victim to the scamming scandals operated by rogue digital lending platforms. Digital lending platforms are inadequately regulated since there is no set of universal laws to regularize their operations, making their users at greater risk in the event of collapse due to scams.

The other underlying cause of increased scamming cases in digital financial apps such as PayPal and cashapp was the low cogitation of the users and innovative techniques adopted by scammers to prey on unsuspecting users. The target populations for this study, composed of the elderly in society using digital financial apps, were the most vulnerable to such scamming activities. This quota of citizens lacked the necessary parameters such as financial knowledge of investors, due diligence, the ability to evaluate business strategy, and the ability to detect scammers online, which increased their vulnerability to scamming activities in digital financial apps. These and many other factors were the leading reason for the increased scamming of the elderly when using digital financial apps. All the variables examined reported a statistically significant positive relationship with the dependent variables.

Recommendations

Although there is a need to achieve greater financial inclusion of all groups in society, the elderly included, there is a high need to rationalize the operation and use of various institutions in the financial sector. There is, for instance, the need to adopt a uniform set of legislation to guide the operations of digital financial platforms to ensure cases of scamming are dealt with decisively to achieve financial inclusion. There should be maximum risk-assessment procedures available to the users of these digital platforms to enable them to assess the genuineness of the financial services provision platforms to ensure only accredited and reviewed institutions are allowed to extend such facilities to the users.

There should also be increased verification of loan agreements between the user and the financial provider. The lenders should be forced to disclose all material information concerning their service provision to enable the borrower to decide whether they wish to continue taking such facilities. Additionally, there should be increased financial awareness of the underlying risks of digital financing platforms. The elderly should be educated on the risks that characterize these services, such as the possibility of being scammed and, as such, the loss of a significant amount of money. Financial literacy will help reduce the appetite of the investors who may be misguided by the enormous returns these ventures promise that only become scams.

Due diligence and prudence is the other recommended way to reduce the scamming rates among the elderly using financial digital platforms. Before submitting a loan application through a digital lending app, borrowers should always exercise due diligence. The borrower should check the app's name, rating, and reviews on the app store before downloading any lending apps. They should also confirm the corporation that runs the app's physical address and contact details because fraudulent apps sometimes present inaccurate, inconsistent, or partial addresses or contact details. Fraudsters can be identified by their lack of evidence, unwillingness to reveal fees, demand for upfront payments, and disregard for a person's credit history. These online con artists frequently pressure borrowers to act immediately, but borrowers should never take action on the spur of the moment.

References

Arnone, G., Kumar, A., & Mathure, Y.M. (2022). Application of Fintech in the Modern Banking Industry.Journal of Algebraic Statistics,13(3), 4244-4249.

Burton, A., Cooper, C., Dar, A., Mathews, L., & Tripathi, K. (2021). Exploring how, why and in what contexts older adults are at risk of financial cybercrime victimisation: A realist review.Experimental Gerontology, 111678.

Indexed at, Google Scholar, Cross Ref

Cypress, B. (2018). Qualitative research methods: A phenomenological focus.Dimensions of Critical Care Nursing,37(6), 302-309.

Indexed at, Google Scholar, Cross Ref

DaCorte, A.M. (2022).The effects of the internet on financial institutions' fraud mitigation(doctoral dissertation, utica university).

Diaz Baquero, A.P. (2021). Super Apps: Opportunities and Challenges (Doctoral dissertation, Massachusetts Institute of Technology).

Dubey, V., Sonar, R., & Mohanty, A. (2020). Fintech’s impact on payments domain. International Journal of Advanced Science and Technology, 29(6), 3768-3777.

Fakiha, B. (2022). Online Privacy Challenges and their Forensic Solutions. Journal of the Arab American University. Volume, 8(1).

Forbis, S.M. (2019).Examining and Protecting Senior Citizens from Elder Financial Exploitation Within The Digital World.

Harris, D.E., Holyfield, L., Jones, L., Ellis, R., & Neal, J. (2019). Research methods. In Spiritually and Developmentally Mature Leadership, Springer, 57-65.

Lyons, A.C., & Kass-Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Financial Planning Review, 4(2), e1113.

Ma, K.W.F., Dhot, T., & Raza, M. (2022). Considerations For Using Artificial Intelligence To Manage Authorized Push Payment (App) Scams.

Malav, D., & Chawla, S. (2022). Online scams–a crisis in online world.

Manibog, S., & Alvarez, M.T.S. (2022). Perceived benefits, problems, and challenges towards cashless financial transactions.

Noah, N., Kishnani, U., Das, S., & Dewri, R. (2022). Privacy and security evaluation of mobile payment applications through user-generated reviews. InWorkshop on Privacy in the Electronic Society.

Poster, W.R. (2022). Introduction to special issue on scams, fakes, and frauds. New Media & Society, 24(7), 1535-1547.

Smikle, L. (2022). The impact of cybersecurity on the financial sector in Jamaica. Journal of Financial Crime.

Sugunaraj, N., Ramchandra, A.R., & Ranganathan, P. (2022). cyber fraud economics, scam types, and potential measures to protect us seniors: a short review. In2022 IEEE International Conference on Electro Information Technology, 623-627.

Received: 10-Nov-2022, Manuscript No. AJEE-22-12838; Editor assigned: 14-Nov -2022, Pre QC No. AJEE-22-12838(PQ); Reviewed: 28- Nov-2022, QC No. AJEE-22-12838; Revised: 05-Dec-2022, Manuscript No. AJEE-22-12838(R); Published: 12-Dec-2022