Research Article: 2019 Vol: 23 Issue: 6

Scenario Modeling of Change of the Level of Tax Culture: The Case of Ukraine

Olha Kravchenko, State University of Infrastructure and Technology

Olha Yarmolitska, State University of Infrastructure and Technology

Svitlana Shuliarenko, State University of Infrastructure and Technology

Olena Kolumbet, State University of Infrastructure and Technology

Olena Kharchuk, State University of Infrastructure and Technology

Abstract

The paper is devoted to the study of a tax culture formation in the context of the willingness of individuals to pay income tax. The analysis is based on data from Ukraine for 2014-2018. It is shown that there is an interdependence between the level of tax culture and the volume of the shadow economy in the country. Scenario modeling was used as a research tool. This allows us to study the dynamics of socio-economic processes in an uncertain future. Based on the identified driving forces, two scenarios of changing tax culture in Ukraine were built. Their analysis showed that increasing real wages and living standards does not significantly affect the level of tax culture. It is determined that the level of public confidence in the state and its conviction in social participation in the development of the country through the payment of taxes are of greater importance. For Ukraine, a set of measures was proposed to increase the tax culture, aimed at improving the state tax model, increasing public confidence in the state and its tax authorities, and raising the awareness of citizens.

Keywords

Personal Income Tax, Tax Culture, Scenario Modeling, Ukraine.

Introduction

Taxes are one of the main components of the economic relations in the modern society. They generate the state revenues, due to which the impact on the national economy, regulation of its development, the formation of the structure of industry are carried out. In addition, the tax system is designed to influence market relations, stimulate the development of entrepreneurship, promote production processes and at the same time serve as a barrier to the social impoverishment of financially disadvantaged segments of the population. The consequence of this was that, as the Italian economist Nitti noted, the modern state is not able to handle without taxes. In this context, income taxation of the individuals is of importance. Even in the 13th century Thomas Aquinas noted that it is fair if the subjects pay for what ensures their own well-being (Kukolev & Frolova, 1992).

Today, the issue of taxation is very acute for many states: the population does not want to pay taxes, because they do not see the expected (significant) social effect as a result of the “transfer to the state” of part of their income. At the same time, income from personal income tax is the main source of income for the local budgets, the formation of which determines the ability of the authorities to fulfill social obligations, ensure economic development, and create conditions for improving living standards in both individual regions and the state as a whole. In addition, with the help of personal income tax, the level of income of the population is regulated, as well as the structure of the personal consumption and savings of citizens, and inequality in income generation is reduced. The obligations for the calculation and payment of personal income tax may exist exclusively in the form specified by law. In this regard, one of the main issues in the field of taxation is the formation of such a tax system that, on the one hand, would ensure sufficient revenues to budgets of all levels, and, on the other hand, prevent tax evasion and the formation of a shadow economy. In this context, the level of tax culture, which is one of the main components that form the tax potential of the state, is of importance.

Review of Previous Studies

Taxes are one of the most ancient forms of the economic relations. In the centuries-old history of taxation, various types of tax payments have been applied, which differed in terms of object of taxation, method of collection, order and terms of payment, and other features. However, until the XVII century there was no harmonious theory of taxation. A special role in understanding the laws of manifestation and development of taxes and in formulating the principles of taxation belongs to Petty, Smith & Wagner, whose studies formed the basis of the modern tax systems.

Until the XIX century the dominant view was that taxes are an exclusively resource base for the financing government activities. In the first of the famous tax maxims, Smith (1977) wrote "the subjects of the state should, whenever possible, according to their ability and forces, participate in the maintenance of the state".

In the last quarter of the nineteenth and early twentieth centuries, the economists gained widespread views on the productive nature of part of the public expenditures and on the payment of taxes as everyone's duty to satisfy social needs. Nitti (1922 [1903]) noted that "in all modern countries, the tax has two objectives: (i) fiscal, (ii) economic (prohibitive or restrictive)."The modern researchers have expanded the functions of taxes to 3, namely (i) the distribution of income (provided that the tax policy of the state does not interfere with the market distribution); and (ii) income redistribution (to reduce inequality in income distribution and welfare); and (iii) stabilizing the economy in the areas of employment and price stability through tax policy tools, government spending policies, monetary policy and debt management (Musgrave, 1959). Vishnevsky et al. (2006) noted that taxes could now contribute to more efficient use of limited resources than a market economy can do on its own.

Currently, increased attention of the researchers and practitioners in the field of tax management is paid to the impact of individual taxes and tax rates on the level of the shadow economy (Schneider, 2012; Johnson & Zoido-Lobaton, 1998). According to World Bank Group experts, an average of a third of the global economy is in the shadows (Awasthi & Engelschalk, 2018). This problem is very worrying for the politicians. So, Thatcher (Prime Minister of Great Britain, 1979-1990) noted that excessive taxes ultimately lead to the fact that economic activity begins to bypass the law and move to the unofficial or “black” sector of the economy (Thatcher, 2003). It is noted that there is a strong interdependence between the tax burden and the size of the shadow economy (Schuknecht, 2011). In addition, an increase in the tax burden is the major driving forces for the size and growth of the shadow economy (Stankevi?ius & Vasiliauskait?, 2014). This is also true for the personal income tax.

Personal income tax is one of the main direct taxes. It accounts for a significant portion of budget revenues in most countries. Moreover, the size of tax deductions is often correlated with the level of economic development (Table 1). So, in the US budget they accounted for 35.9%, Germany - 35.1%, Great Britain - 25.8%, Estonia - 19.9% Poland - 15.6%, Hungary - 13.2% (Shobey & Kovarnina, 2017). In some countries (Qatar, Kuwait, the United Arab Emirates, Oman, Bahrain, etc.) rich in natural resources (oil and gas), there is no the tax on the income of individuals. At the same time, the share of this tax in state budget revenues is determined by the particularities of the country's tax system, the size of tax rates, and the role of indirect taxes. In China, the average tax rate is 3% and, as a result, the share of budget revenues is 6.9% (National Bureau of Statistics of China, 2018).

| Table 1 European Countries with High and Low Rates of Personal Income Tax In 2018 | |||||

| Countries with high personal income tax rates | Countries with low personal income tax rates | ||||

| Country | Tax rate, %* | GDP per capita rank** | Country | Tax rate, %* | GDP per capita rank** |

| Sweden | 61,85 | 12 | Montenegro | 9,00 | 83 |

| Denmark | 55,80 | 9 | Macedonia | 10,00 | 94 |

| Austria | 55,00 | 15 | Romania | 10,00 | 65 |

| Netherlands | 51,75 | 14 | Bulgaria | 10,00 | 82 |

| Finland | 51,60 | 18 | Serbia | 10,00 | 91 |

| Luxembourg | 48,78 | 1 | Belarus | 13,00 | 93 |

| Ireland | 48,00 | 8 | Russia | 13,00 | 73 |

| Iceland | 46,30 | 5 | Lithuania | 15,00 | 49 |

| Great Britain | 45,00 | 17 | Hungary | 15,00 | 60 |

| Germany | 45,00 | 19 | Ukraine | 18,00 | 132 |

** based on the Financial Portal

The level of tax culture also has a significant influence on the amount of tax revenues of the state budget, one of the components of which is the “desire and willingness” of individuals to pay taxes on their income. In countries with a low tax culture, tax evasion in full is a common practice that does not have significant public censure. This is also true for Ukraine. Therefore, the study of its experience is of theoretical and practical interest in the context of increase in tax culture of the individuals.

Features of Taxation of Personal Income in Ukraine

In Ukraine, a system of fixed rates for personal income tax is applied. The application of a tax rate does not depend on the amount of income received, but on its type and taxpayer status. However, it should be noted that periodically, the Ukrainian economists put forward proposals for the introduction of a progressive scale of taxation of personal income. It is noted that this is not a return to the tax system, which was used in the Soviet Union, but the introduction of the modern European practice.

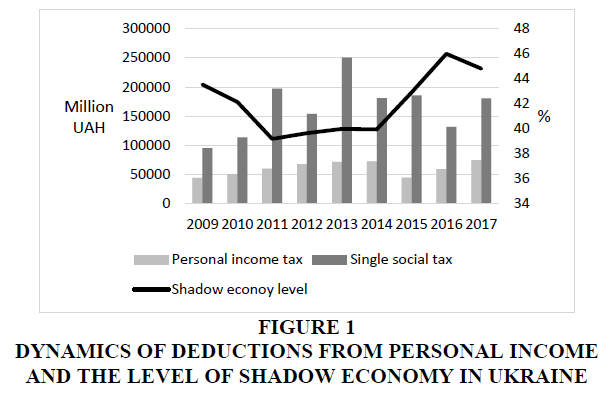

In 2018, the share of income from personal income tax in the budget revenues of Ukraine amounted to 9.9% or 12.2% of total tax revenues. The tax rate on personal income in 2018 was 18%. In addition, individuals pay a military fee of 1.5% of income. This tax was introduced in August 2014 and should have been levied before the end of the year, but in fact it has become unlimited. The funds received from this tax should be used to finance the needs of the Armed Forces of Ukraine until the end of their reform. In addition, according to the current legislation of Ukraine, a single social contribution of 22% is paid from the income of individuals, which is paid by the employer. Thus, in the aggregate, deductions from personal incomes make up 41.5%, which corresponds to deductions in economically developed countries (Table 1). This taxation practice has become one of the reasons why 21.6% of the population aged 15-70 years are employed in the shadow economy, including 38.2% in agriculture, 18.5% in trade, and 15.3% in construction (State Statistics Service of Ukraine, 2018). In the context of the budget deficit in Ukraine (in 2018, the budget deficit amounted to 5.9%), an increase in income from personal income tax may become one of the sources of increasing state budget revenues. Despite the great importance of personal income tax, in Ukraine there is no clear correlation between income tax rates, including of individuals, and the level of the shadow economy (correlation coefficient is -0.479) (Figure 1).

This confirms the hypothesis that the tax culture that has developed in Ukraine has a significant effect on the desire of the population to pay taxes in full and, as a result, on the level of the shadow economy in the country.

Methodology

This study is based on the provisions of the evolutionary theory proposed by Nelson & Winter (1982), which defines the consideration of all processes in the economy as spontaneous, irreversible and self-reproducing as a result of the interaction of external and internal factors, as well as existing economic agents (state, tax authorities, etc.). The departure from the mainstream theory is caused by the fact that under the conditions of high uncertainty characteristic for the socio-economic processes in Ukraine, economic agents cannot accurately calculate possible future conditions and get the maximum expected effect. Then the behavior of economic agents is determined by two aspects: (1) the relationship between members of the same population (economic system); (2) the internal characteristics of economic agents, that is, “normal and predictable patterns of behavior” in response to internal or external influences (routines). It is routines that influence decision-making by the economic agents, and not the desire to maximize profits under any conditions.

The variability of the functioning of the economic agents (the state, tax authorities, etc.), as well as the unsteady nature of socio-economic processes in Ukraine led to the use of scenario analysis as a method of assessing future prospects for improving tax culture in the context of personal income tax. The basis of the scenario approach is the selection and analysis of driving forces, namely:

1. Predetermined elements: Trends whose development can no longer be stopped or changed in the analyzed period; and

2. Key uncertainties: Trends in the external and internal environment that are decisive for the analyzed process.

Predetermined Element

In this study, the population of Ukraine at working age is taken as a predetermined element. A decrease in the working-age population is a pan-European trend and is associated with an aging population, a decrease in the birth rate, as well as an increase in the mortality rate, especially at working age. In Ukraine, the situation is aggravated by the fact that as a result of the sharp decline in living standards since 2014, there has been an increase in migration to the EU countries and Russia. In the ranking of UN population decline compiled by UN experts, Ukraine ranks fourth among European countries (United Nation, 2019).

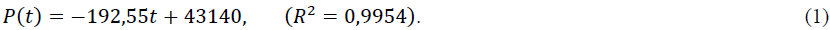

For analysis, we used data from the State Statistics Service of Ukraine for 2014-2018. In 2014, a 5.5% decrease in population occurred due to the annexation of Crimea and part of the territory in the South-East of the country (State Statistics Service of Ukraine, 2018). It is determined that during 2014-2018 the dynamics of the population change in Ukraine was described by the model:

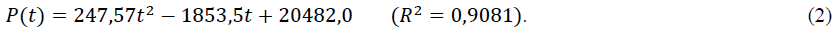

There is also a downward trend in the economically active population. The best approximation was obtained for a polynomial of the 2nd order:

Thus, the population of Ukraine on average annually decreases by 192.55 thousand people, and the economically active - by 1853.5 thousand people. These models can also be used for prospective analysis, since there are no significant qualitative socio-economic and political changes in the country.

Key Uncertainty

In this study, the level of tax culture was chosen as the key uncertainty. The level of tax culture is the entirety of all relevant formal and informal institutions connected with the national tax system and its practical execution, which are historically embedded within the country’s culture, including the dependencies and ties caused by their ongoing interaction (Nerre, 2008).

There are three groups of reasons that determine the level of tax evasion for the individuals in Ukraine.

Group 1. Distrust of tax authorities and the state. The formation of the reasons for this group was the result, first of all, of distrust of state bodies, irrationally using budget funds. So, in 2018, 4.5% was spent on education, spiritual and physical development - 1.0%, health care - 2.2%, social protection of the population - 1.4%, environmental protection - 0.5% of the expenditure of state budget of Ukraine; only 7.1% was spent on capital expenditures (Minfin, 2018). In addition, periodic scandals related to the concealment of incomes by the top management of the country, the withdrawal of funds offshore, the use of various illegal schemes to reduce tax payments also have a negative effect on the desire of citizens to pay taxes.

Group 2. A sufficiently high tax burden on individuals and employers. A sociological survey showed that only 50% of respondents believe that paying taxes is their civic duty, 27% are sure that it is extremely high and significantly affects their financial situation and the well-being of their families, and 23% do not have a definite opinion on this. One of the reasons for this is that Ukraine has experienced a sharp drop in average wages since 2014 from $ 385 in 2014 to $ 280 in 2018 (State Statistics Service of Ukraine, 2018). This was accompanied by a rapid increase in consumer prices and tariffs for basic services, which negatively affected the real incomes of the population and, as a result, their desire to pay taxes.

Group 3. Low tax culture and tax discipline. Unwillingness to pay taxes is inherent in most of the population in all countries. Even George Orwell noted that there are no patriots where it comes to taxes. In Ukraine, an understanding of the importance of taxes for the socio-economic development of the country is not formed, and tax evasion is considered normal (53% of citizens are indifferent to those who deliberately do not pay taxes (Miller & Miller, 2016)). However, increasing the tax culture and discipline is influenced not only by the composition of taxpayers, but also by the quality of work of tax authorities and the legislative framework in the field of taxation. This allows each taxpayer to feel protected in the field of taxation.

Results and Discussion

Based on the foregoing, the percentage of individuals willing to pay taxes in full is accepted as an indicator expressing key uncertainty. Based on the assumption that a sharp increase in the tax culture of citizens will not occur, 2 hypotheses were formed for building scenarios:

H1. The socio-economic crisis in the country will deepen and the standard of living of the population will decline.

H2. The country will come out of the socio-economic crisis and the standard of living of the population will gradually increase.

Accordingly, based on the generated hypotheses, two scenarios of the formation of the tax culture of individuals in Ukraine were built. Scenarios are an internally consistent view of what the future might be like - not a forecast, but one of the options for the future consequences (Porter, 1998). As a methodological basis for constructing scenarios, an approach was used within the framework of the probabilistic modified trends school of scenario analysis. With this approach, the scenarios are a mathematically improved extrapolation of time series data (Bradfield et al., 2005) and involve attempts to estimate the probabilities of events that could cause the future deviations.

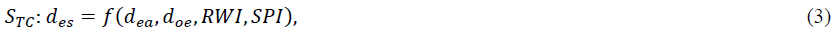

In general terms, the scenario for the formation of the tax culture of individuals (STC ), considering the previously identified reasons for tax evasion in Ukraine, can be described by the following functionality:

where dea is proportion of the economically active population. doe is proportion of officially employed population. RWI is Real Wage Index. SPI is Social Progress Index. des is proportion of the population employed in the shadow sector of the economy.

Table 2 presents the definitions of the parameters of the scenario model for the formation of the tax culture of individuals.

| Table 2 Definitions of Forming Tax Culture Scenario Model Parameters | |

| Indicator | Definition |

| The proportion of the economically active population | The ratio of the number of economically active population to the total population |

| The proportion of officially employed population | The ratio of officially employed population to total population |

| Real Wage Index | The ratio of changes in nominal wages to consumer price index (percent) |

| Social Progress Index | The extent to which countries provide for the social and environmental needs of their citizens. |

| The proportion of the population employed in the shadow sector of the economy | The ratio of the population employed in the informal sector to the total population |

Scenario 1. Pessimistic (Deepening Socio-Economic Crisis)

Further deepening of the socio-economic crisis in Ukraine will have negative consequences, namely: a decrease in the population, primarily economically active as a result of both natural causes and migration to more prosperous countries (mainly to the EU and Russia). This, in turn, will lead to a reduction in tax revenues to state and local budgets, which will negatively affect the volume and quality of social services to the population. A decrease in the real incomes of individuals, which is accompanied by an increase in expenses to meet basic needs, will help to reduce the standard of living of the population of Ukraine and increase the share of the population below the poverty line. The consequence of this will be the strengthening of the existing trend to conceal the received taxes from the fiscal authorities. This will also be accompanied by maintaining or even reducing the level of social censure of tax evasion by the individuals (not by politicians or large business owners). Raising tax rates or punitive measures of the state in such a situation will not give a positive effect.

Scenario 2. Optimistic (Improving the Socio-Economic Situation in the Country)

The implementation of this scenario, taking into account the persisting trend of a decrease in the number of economically active population, is possible as a result of the development of the tax system in Ukraine by removing existing contradictions, namely: (i) social, formed between the need for socially fair distribution and redistribution of income in society and widespread deviant forms of tax behavior; (ii) economic, formed between the interests of the state, including the regulation of socio-economic processes in the state with the help of fiscal instruments, and the low standard of living of the majority of the population, which in the conditions of the economic crisis and a significant proportion of the shadow economy is even more reduced. The elimination of these contradictions will help to restore the confidence of individuals in the state and tax authorities and, as a result, increase the level of tax culture in terms of voluntary and conscious payment by the population of a portion of the income received in the form of taxes.

Then, considering that individuals employed in the informal sector do not pay taxes in full and, accordingly, have a low tax culture, the basic scenario model for Ukraine will have the following form:

The parameters of the scenario model are calculated based on the data in Table. 3. The adequacy level of the constructed model (R2) is 0.9995. The analysis of the model parameters showed that a decrease in the economically active and officially employed population will contribute to an increase in the share of the shadow economy of Ukraine, which can be explained by the fact that a reduction in labor resources will naturally lead to an increase in the tax burden on individuals and employers, which, in turn, will force them to go "into the shadows." This will also be accompanied by a deterioration in the socio-economic situation in the country, which will also hinder the growth of the tax culture of the population.

| Table 3 Initial Data for Determining Quantitative Evaluations of Model Parameters | |||||

| Indicator | Year | ||||

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| The proportion of the economically active population * | 0.443 | 0.407 | 0.406 | 0.406 | 0.410 |

| The proportion of officially employed population* | 0.620 | 0.615 | 0.610 | 0.605 | 0.600 |

| Real Wage Index** | 0.865 | 0.901 | 1.065 | 1.189 | 1.097 |

| Social Progress Index*** | 64.91 | 65.69 | 66.43 | 68.55 | 69.30 |

| The proportion of the population employed in the shadow sector of the economy**** | 0.400 | 0.429 | 0.439 | 0.448 | 0.450 |

** calculated according to Minfin.

*** Social Progress Imperative.

**** calculated according to State Statistics Service of Ukraine & Medina, L. & F. Schneider (2018).

Regarding the impact of the growth of the Real Wage Index and Social Progress Index on the level of the shadow economy of Ukraine, the obtained parameter values indicate, in our opinion, not so much about the unwillingness of the population to pay taxes, but about distrust of the state and tax authorities.

It is undeniable that the length of the retrospective series is insufficient to construct verified long-term forecasts. However, development scenarios are not forecasts in the generally accepted sense and are not a description of a relatively predictable future from the standpoint of the past and present but are closely related to forecasting future states (Lindgren & Bandhold, 2003; Porter, 1998; and others). Therefore, the resulting estimates can be used to clarify trends that will develop in the future.

An analysis of the trends that will be formed as a result of the implementation of the constructed scenarios (Table 4) shows that in Ukraine there will be no significant changes in the tax culture of individuals even with an increase in real wages and living standards. The proportion of the population employed in the informal sector of the economy will increase with the implementation of both scenarios. So, by 2023, when implementing the pessimistic scenario, it will exceed 51%, and the optimistic scenario - 46%. This will be the result, first of all, of the demographic deformations that have developed in Ukraine, and which are both a factor and a result of the functioning of the state (according to Global Economy Watch, the consulting company of PricewaterhouseCoopers, in 2019 Ukraine will take first place in the world in terms of labor loss). In addition, in Ukraine there is a rapid departure of the state from a socially oriented development model, which, given the worsening economic situation in the country, will lead to an even greater gap in the incomes of various population groups.

| Table 4 Scenario Models Calculations | ||||||||

| Year | dea* | doe* | Scenario 1 | Scenario 2 | ||||

| RWI* | SPI* | des*** | RWI** | SPI** | des*** | |||

| 2019 | 0.3918 | 0.5952 | 1.2602 | 0.7098 | 0.4698 | 1.3272 | 0.7286 | 0.4254 |

| 2020 | 0.3851 | 0.5902 | 1.3354 | 0.7275 | 0.4820 | 1.4865 | 0.7650 | 0.4361 |

| 2021 | 0.3784 | 0.5852 | 1.4106 | 0.7470 | 0.4943 | 1.6648 | 0.8033 | 0.4469 |

| 2022 | 0.3717 | 0.5802 | 1.4858 | 0.7683 | 0.5066 | 1.8646 | 0.8434 | 0.4576 |

| 2023 | 0.3650 | 0.5752 | 1.5610 | 0.7914 | 0.5190 | 2.0884 | 0.8856 | 0.4685 |

** calculated based on optimistic estimates of the indicator.

*** calculated based on the model (4).

Citizens of Ukraine did not have a conviction about their social involvement in financing national, regional and local projects through the payment of taxes. In addition, the deviations in the tax behavior of leading politicians and businessmen who are not considered by the government bodies to be unlawful actions (in February 2019, the Constitutional Court of Ukraine abolished criminal liability for illegal enrichment (Article 368-2 of the Criminal Code of Ukraine)), also do not increase public confidence in the state and its tax authorities, as well as the formation of an understanding of the need to follow the principle of social responsibility.

Conclusions

The study showed that the tax culture in terms of the willingness of individuals to pay tax on their income is a component of the economic and general human culture. At the same time, the standard of living of the population, its understanding of ownership in the socio-economic development of the state, as well as the feeling of equal rights before the law, regardless of status, also affect the level of tax culture.

In Ukraine, raising the level of tax culture should be based on increasing tax literacy and suggest the implementation of a set of measures aimed not only at raising the awareness of citizens, but also improving the tax model of the state and increasing public confidence in the state and its tax authorities. Such a set of measures should include:

1. Optimization of tax legislation, as well as ensuring its stability.

2. Active use of the media to explain to the population the importance of paying taxes in full.

3. increasing the level of informing the public about the use of tax revenues; taxpayers have the right to know for what purposes these funds were used

4. Ensuring the interaction of tax authorities and taxpayers, the recognition by both parties that they are partners.

5. Formation tax consciousness, first of all, of young people through lectures on the need and importance of timely and full payment of taxes and fees.

6. Introduction of a system of incentives for good taxpayers in the form of various benefits, which will also have a stimulating effect on other taxpayers.

The implementation of this set of measures should be accompanied by the introduction of a system of penalties for the conscious concealment of income by individuals or the use of illegal schemes to reduce tax payments.

Further studies of this problem should be aimed at developing an effective set of measures aimed at changing public opinion on the issue of paying taxes, as well as improving communication between tax authorities and citizens.

References

- Awasthi, R., & Engelschalk, M. (2018). Taxation and the shadow economy. How the tax system can stimulate and enforce the formalization of business activities. Policy Research Working Paper 8391.

- Bradfield, R., Wright, G., Burt, G., Cairns, G., & Heijden van der, K. (2005). The origins and evolution of scenario techniques in long range business planning. Futures, 3, 795-812.

- Financial portal(2019).DP per capta of the world 2018. Retrieved from http://www.fincan.ru.

- Global Economy Watch. Predictions for 2019: Coming off the boil (n.d.) Retrieved August 08, 2019, from https://www.pwc.com/gx/en/issues/economy/global-economy-watch/predictions-2019.html.

- Johnson, D., & Zoido-Lobaton, N. (1998). Draft report on task 1. Challenge and objectives. Framework contract DIGIT/R2/PO/2009/027/ABC II. Future business architecture for the Customs Union and cooperative model in taxation area in Europe. DG Taxation and Customs. (TAXUD/R3/VDL D(2010) 433216).

- Kukolev, YU., & Frolova, O. (1992). It all started with tithing: This multifaceted tax world. Moscow: Progress.

- Lindgren, M., & Bandhold, H. (2003). Scenario planning. The link between future and strategy. New York: Palgrave Macmillan.

- Medina, L., & Schneider, F. (2018). Shadow economies around the world: what did we learn over the last 20 years? IMF Working Paper WP/18/17.

- Miller, A.E., & Miller, N.V. (2016). Studies of the impact of tax culture on tax revenue in the regional budget. Omsk Scientific Herald. Series ‘Society, History, Modernity’, 1, 88-92.

- Musgrave, R.A. (1959). The theory of public finance: a study in public economy. New York: McGraw-Hill.

- National Bureau of Statistics of China(2018). Statistical Communique of the People’s Republic of China on the 2018 national economic and social development.Retrieved from http://www.stats.gov.cn/.

- Nelson, R.R., & Winter, S.G. (1982). An evolutionary theory of economic change. Harvard University Press.

- Nerre, B. (2008). Tax culture as a basic concept for tax policy advice. Economic Analysis and Policy, 38(1), 153-157.

- Nitti, F.S. (1922 [1903]). Principles of finance science. Napoli: L. Pierro.

- Porter, M. (1998). Competitive advantage: creating and sustaining superior performance (with a new introduction). New York: Free Press.

- Schneider, F. (2012). The shadow economy and work in the shadow: what do we (not) know?IZA Discussion Papers 6423, Institute for the Study of Labour (IZA).

- Schuknecht, K. (2011). Tax Gap Measurement / Estimation: Does it have a role to play in modern tax administration practice? Presented to the CIAT 44th General Assembly, Montevideo, Uruguay.

- Shobey, L.G., & Kovarnina, A.A. (2017). The role of an individual income tax in forming the income base of budgets of the Russian Federation. Economy vector, 16(10).

- Smith, A. (1977). An Inquiry into the nature and causes of the wealth of nations. University of Chicago Press.

- Social Progress Imperative (2019). Retrieved from https://www.socialprogress.org/

- Stankevi?ius, E., & Vasiliauskait?, A. (2014). Tax burden level leverage on size of the shadow economy, cases of EU countries 2003-2013. Procedia - Social and Behavioral Sciences, 156, 548-552.

- Minfin (2019). State Budget of Ukraine 2018. Retrieved from http://www.minfin.com.ua.

- Thatcher, M. (2003). Statecraft: strategies for a changing world. New York: Harper Perennial.

- State Statistics Service of Ukraine (2019). Labor Market 2018. Retrieved from http://www.ukrstat.gov.ua.

- Stock Exchange portal (2019). Personal income tax rate. Retrieved from http://www.take-profit.org.

- Vishnevsky, V.P., Vetkin, A.S., & Vishnevskaya E.N. (2006). Taxation: theories, problems, solutions. Donetsk: DonNTU, IEP NAN of Ukraine.

- United Nations (2019). Department of Economic and Social Affairs, Population Division. World Population Prospects 2019: Data Booket. ST/ESA/SER.A/424. Retrieved https://population.un.org/.