Research Article: 2021 Vol: 25 Issue: 2

Service Quality Affecting Customers' Satisfaction and Loyalty: A Case Study of Commercial Banks

Phan Thanh Tam*, Lac Hong University (LHU)

Phan Dang Ngoc Yen Van, Lac Hong University (LHU)

Nguyen Thi Bich Thuy, Lac Hong University (LHU)

Keywords

Customers, Satisfaction, Loyalty, Commercial, Bank and LHU.

Abstract

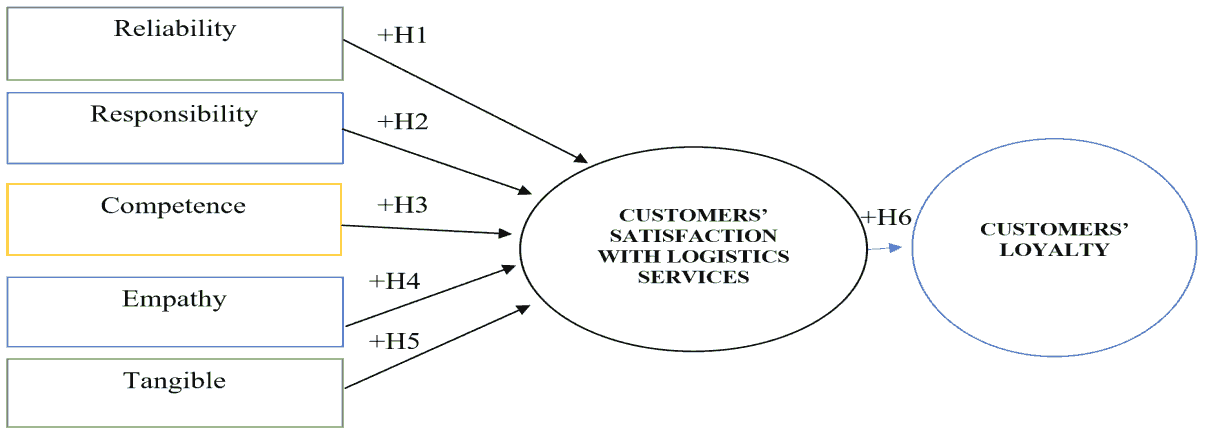

The focus on retail activities has become a trend in recent years, with domestic and international joint-stock commercial banks and alliances and fintech companies competing vigorously in the retail segment. It is a development strategy of many banks to diversify revenue sources, minimize operational risks, and achieve optimal business efficiency. Therefore, the authors surveyed 600 customers related to service quality from January 2020 to July 2020. The research results showed that five factors affect customers' satisfaction based on service quality. Research results are crucial scientific evidence for bank service managers to improve the service quality of commercial banks.

Introduction

Commercial banks are an essential service sector in the overall structure of the national economy, playing the role of supporting, connecting, and promoting socio-economic development of the country and each locality, contributing to Hilda's economy's competitiveness Ghaleb, (2018). This study discusses this industry's development prospects and offers some solutions to promote the development of service quality of commercial banks in Vietnam. Commercial banks are an essential service sector in the overall structure of the national economy. They played the role of supporting, connecting, and promoting the country's socio-economic development and each locality, contributing to the competitiveness of the economy by Igaz & Ali (2013). Commercial banks operate a chain of services from the pre-production stage until the goods reach the end consumer. This field is directly related to transportation, forwarding, warehousing, administrative services, consulting, import-export - commerce, distribution channels, and retail by Abdullah (2012).

With the motto "Customer is the focus in all activities," besides expanding the banking network, increasing investment in facilities and techniques, developing many convenient products to attract customers by Islam & Borak (2011). Commercial joint-stock banks are continually making efforts to perfect outcomes, improve quality of care and customer service. The look of the retail banking industry will change dramatically. ATMs and plastic cards probably won't be in vogue for a long time by Jaime Torres Fragoso và Ignacio Luna Espinoza (2017). In the future, social media or something else will replace the existing customer and banking communication tools. However, the heart of the service is still the personalization of each customer by Kotler & Keller (2006). The banking industry services themselves are intangible, highly sensitive, easily judged by emotions, and caught up in crowd psychology. It is the most challenging point for banks when they want to improve their service quality further.

The retail banking business model has to be customer-centric to maximize distribution channels in digital banking strategy by Lau, et al., (2013). Therefore, banks understand very well that they have to change their minds to fit into the digitalized consumer-finance ecosystem. Service quality is the foundation and decisive factor for each bank's market share in the current fierce competition. Implementing strategies and activities to improve service quality is for customers' benefit and the benefits and future development of joint-stock commercial banks. Therefore, the author's research factors affecting customers’ satisfaction with the service quality of commercial banks in Dong Nai province.

Literature Review

Customer Satisfaction (CUS)

Customer satisfaction is the aggregate result of service quality, product quality, and price by Landier & Thesmar (2020), which is a psychological state that leads to expectations about products or services before customers buy by Mackay & Major (2017). Besides, consumer perception of online shopping convenience (offered products and product information), website design, and confidentiality play an important role in satisfaction assessment about banking service by Szymanski & Hise (2000). Customer satisfaction is vital in business activities, so many topics and scientific books are published on this topic. According to Belás & Gab?ová (2016), Customer satisfaction is considered as the foundation in the marketing concept of satisfying customer needs and desires. Customer satisfaction is their response to Cronin and Taylor's perceived difference between experience and expectations (1992). That is, the customer's known experience of using a service and the results after the service is provided by Kotler & Keller (2006).

Customer Loyalty (LOY)

Manser, Peltier & Barger (2018) showed that loyalty is an essential concept in marketing management and behavioral psychology. When the customer has loyalty to the brand, the customer will have less reason to seek information on how to substitute for a service product or replace that brand by Lau, Cheung, Aris, et al., (2013). Currently, loyalty is approached according to 3 levels: (1) Behavioral commitment; (2) Loyalty attitude; (3) Loyalty combines both behavior and attitudes. Customer loyalty in researching a service means adherence to a service provider and commitment to its brand. Brand loyalty is the return of customers to loyal customers. Loyal customers will stay with the bank even in times of trouble, towels by Coelho & Henseler (2012). Theoretically, customer loyalty stems from the satisfaction they get after buying and consuming by Zeithaml, Berry & Parasuraman (1988). With the service, too, customers feel satisfied with what they experience. They will have a desire to return and experience the feeling again. Therefore, they have the act of buying back, attracting more customers. They can also communicate well about the service they experience by Thomas & Tobe (2016).

Quality of Service (QS) is a word that everyone can opinion on but difficult to define clearly by Mobin (2017). Gronross (1984) said that QS compares the value that customers expect before using the service with the value that customers receive when using the service. Parasuraman, et al., (1988) define QS as the distance between customer expectations and their perception when used through the service. According to Arun, et al., (2012), QS is a crucial business management approach to bring satisfaction and improve its competitiveness and efficiency. Quality of Service (QS) including the components following:

Reliability (REL)

Reliability: Speaks up your ability to deliver appropriate and timely service from the first time by Moyo (2018). According to Zeithaml & Bitner (2000) defined as the ability to reliably and reliably deliver promised services. It is about keeping promises of service delivery, pricing, handling customer complaints and complaints, speaking out the ability to provide consistent and timely service the first time around by Brunner, Stöcklin & Opwis (2018). Based on the concept mentioned above and studies, authors give hypothesis H1 following:

Hypothesis H1 Reliability positively affects customer satisfaction with commercial banks' service quality in Dong Nai province.

Responsibility (RES)

Responsiveness: Speaks the willingness and willingness of service staff to provide services to customers, with a friendly, polite, and friendly attitude by Muslim Amin and Zaidi Isa (2008). Responsiveness is the ability to serve manifestations when the employee contacts the customer. The employee directly performs the service, research to capture relevant information necessary for customer service and trust the bank by Cronin, & Taylor (1992). This ability is reflected in the bank's reputation and the service staff's personality to communicate directly with customers by Coyne (2018). Based on the concept as mentioned earlier and studies, authors give hypothesis H2 following:

Hypothesis H2 Responsibility positively affects customers’ satisfaction with commercial banks' service quality in Dong Nai province.

Competence (COM)

Competence: Refers to the expertise to perform services and research to capture relevant information necessary for serving customers by Muslim (2018). According to Gronroos (1984) expresses the desire and willingness of employees to provide services to customers, related to the ability to ensure customers' safety through physical safety, finance, and information security. Based on the concept as mentioned above and studies, authors give hypothesis H3 following:

Hypothesis H3 Competence positively affects customer satisfaction with commercial banks' service quality in Dong Nai province.

Empathy (EMP)

Empathy: Showing care and care to each individual and customer by Ngu, Ogbechie, & Ojah, (2019). Empathy is related to creating all the comfortable conditions for the customer to access the service, such as shortening customer waiting times, service locations, and convenient opening hours for customers by Parasuraman, Valarie & Leonard (1985). Explain to customers easily understand and listen to the issues related to them such as service explanation, cost, solving complaints and inquiries by Zeithaml, Berry & Parasuraman (1988). Demonstrated through the ability to understand and grasp customers' needs by understanding the customer's requirements and paying attention to them personally by Deep (2017). Based on the concept mentioned above and studies, authors give hypothesis H4 following:

Hypothesis H4 Empathy positively affects customer satisfaction with commercial banks' service quality in Dong Nai province.

Tangible (TAN)

Tangibility: It is shown through the appearance, clothes of the staff, the service equipment such as a network of transaction counters, infrastructure system by Rakesh (2012). Tangible means: Focusing on the elements of the appearance of the service such as the appearance, the attire of the service staff, and the support equipment for the service, facilities, how the staff dressed by Gronroos (1984). The infrastructure is a significant factor that affects the operation or inactivity of these enterprises. Infrastructure is the technical foundation to bring goods from production to consumer. The economic growth of Vietnam in recent years has created a massive demand for infrastructure and transportation services. Based on the concept mentioned above and studies, authors give hypothesis H5 following:

Hypothesis H5 Tangible positively affects customer satisfaction with commercial banks' service quality in Dong Nai province.

Customer satisfaction leads to customer loyalty; this factor is to survive in this hyper-competitive business environment. A loyal customer is a powerful asset, and every brand wants as much as possible by Rebekah & Sharyn (2014). Loyal customers are more likely to create repeat business. They will spend more money with your company. And they may even become advocates of your brand by Ananda & Sonal (2019). So, the more satisfied your customers are, the higher their chances of becoming loyal to your brand. Satisfied customers also tend to become loyal customers, which means higher lifetime value for those customers by Stenbacka (2015). A dedicated customer spends more on a purchase than a new customer by Thomas & Tobe (2016)., Saiful (2011). Furthermore, the customer acquisition cost is about seven times higher than the customer retention cost, further improving your bottom line.

Hypothesis H6 Customer satisfaction positively affects customer loyalty with commercial banks' service quality in Dong Nai province.

Methods

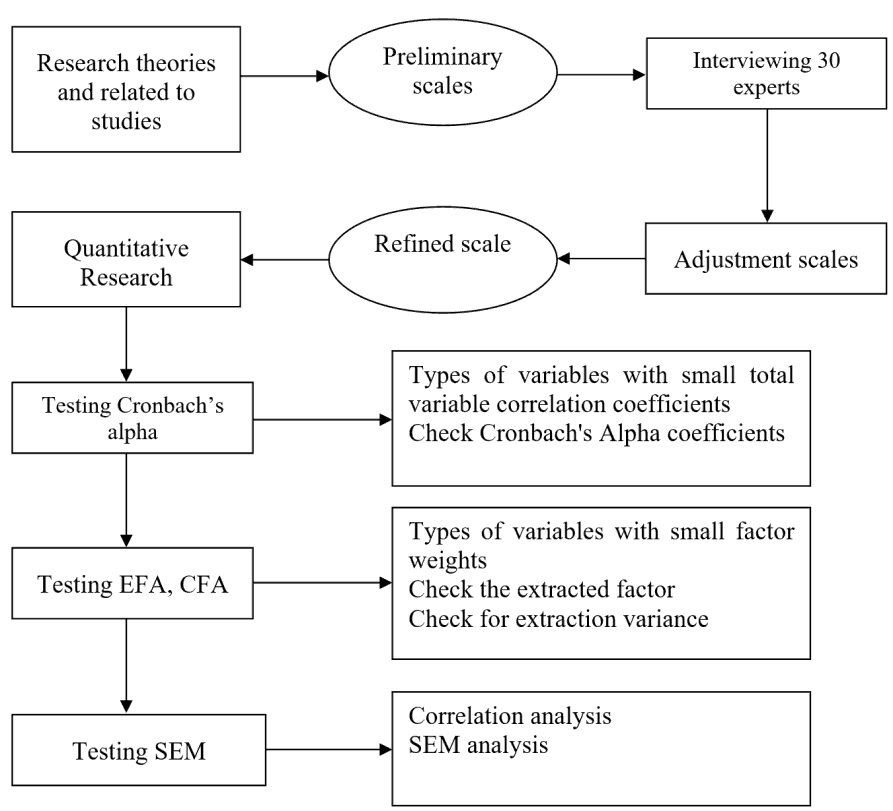

The authors applied qualitative and quantitative research methods in this study, based on experts' opinions to adjust observed variables.

Qualitative research authors surveyed seven experts in Dong Nai province. Seven experts are managers who are working for the commercial banks in Dong Nai province.

Quantitative research conducted through questionnaires with observed variables measured using a 5-point Likert scale includes one strongly disagree and five strongly agree. The authors surveyed 600 consumers who used commercial banks' service quality in Dong Nai province. The data collection time is from January 2020 to July 2020. According to the conventional method by Hair, Anderson, Tatham & Black (1998), samples were selected.

Besides, the authors collecting data procssed through SPSS 20.0 software with descriptive statistical tools, scale testing with Cronbach's Alpha, discovery factor analysis (EFA), testing Structural Equation Modeling (SEM). Finally, the authors had conclusions and managerial implications by Hair, Anderson, Tatham & Black (1998).

Results and Discussion

The authors tested the scale reliability for factors affecting customers' satisfaction and loyalty with commercial banks' service quality in Dong Nai province, including five components.

| Table 1 Testing of Cronbach’s Alpha for Factors Affecting Customers’ Satisfaction and Loyalty (Source: Data Processed by SPSS 20.0) |

||

|---|---|---|

| No. | Items | Cronbach’s alpha |

| 1. Reliability (REL) | 0.883 | |

| Rel1 | You feel secure when using the service quality of commercial banks | 0.883 |

| Rel2 | The bank performs the transaction correctly and without errors | 0.851 |

| Rel3 | The bank secures customer information well | 0.882 |

| Rel4 | The bank delivers the service right at the time they commit it | 0.831 |

| Rel5 | The bank has a high reputation in the heart of customers | 0.835 |

| 2. Empathy (EMP) | 0.952 | |

| Emp1 | The bank employees always strive to build good relationships and pay attention to the needs of each customer |

0.925 |

| Emp2 | The bank staff are enthusiastic and friendly to customers | 0.952 |

| Emp3 | The bank staff serve all customers fairly | 0.947 |

| Emp4 | The bank always asks, congratulates, gives gifts to customers every Tet or personal event | 0.924 |

| 3. Responsiveness (RES) | 0.855 | |

| Res1 | The bank always satisfies all difficulties, questions, and complaints about customers | 0.803 |

| Res2 | Time for customers to wait for their short transactions (2-3 minutes) at the bank | 0.816 |

| Res3 | Apply for publication permits for food, beverage, and cosmetics are simple | 0.843 |

| Res4 | The bank has a 24-hour hotline | 0.8 |

| 4. Tangibles (TAN) | 0.931 | |

| Tan1 | The bank has a spacious and convenient head office for customers | 0.901 |

| Tan2 | The bank has modern equipment and machinery | 0.919 |

| Tan3 | The bank staff has a very professional manner and dress neatly and politely when communicating with customers |

0.92 |

| Tan4 | The bank has a reasonable and import and export entrustment for customers | 0.901 |

| 5. Competence (COM) | 0.943 | |

| Com1 | Employees handle their profession correctly, quickly, and effectively | 0.917 |

| Com2 | The bank’s staff has sufficient knowledge and professional capacity to advise and answer customer inquiries |

0.943 |

| Com3 | The bank staff are always courteous and considerate, and warm to customers | 0.93 |

| Com4 | Consulting import and export procedures are simple and clear | 0.91 |

Table 1 showed that all of (1) Reliability, (2) Responsibility; (3) Competence; (4) Empathy, (5) Tangible. Cronbach's alpha is higher than 6.0.

| Table 2 Testing of Cronbach's Alpha for Customers’ Satisfaction and Loyalty (Source: Data Processed by SPSS 20.0) |

||

|---|---|---|

| No. | Items | Cronbach’s alpha |

| 7 Customers’ satisfaction (SAT) | 0.930 | |

| Sat1 | In general, you are satisfied with the service quality of commercial banks | 0.915 |

| Sat2 | You will introduce to friends and relatives about the service quality of commercial banks at the bank |

0.857 |

| Sat3 | You will continue to use the service quality of commercial banks | 0.923 |

| 8 Customers’ loyalty (LOY) | 0.843 | |

| Loy1 | Service quality of commercial banks affecting customer loyalty | 0.819 |

| Loy2 | Customers are willing to introduce relatives to use the service quality of commercial banks | 0.765 |

| Loy3 | Customers’ satisfaction affecting customer loyalty | 0.831 |

| Loy4 | Customers will use the service quality of commercial banks in next times | 0.782 |

Table 2 showed that all Cronbach's Alpha values of the research components meet this technique's requirements, specifically, Cronbach's Alpha values of customers’ satisfaction and loyalty. Cronbach's coefficient is more than 0.6.

| Table 3 Test CMIN/DF for All of The Components. (Source: Data Processed by SPSS 20.0 and AMOS) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Model | NPAR | CMIN | DF | P | CMIN/DF | GFI | TLI | CFI |

| Default model | 88 | 977.057 | 318 | 0 | 3.073 | 0.896 | 0.944 | 0.953 |

| Saturated model | 406 | 0 | 0 | 1 | 1 | |||

| Independence model | 28 | 14284.7 | 378 | 0 | 37.79 | 0.324 | 0 | 0 |

Table 3 showed that the assessment of the scale of customers’ satisfaction and loyalty includes the following elements: CMIN/DF: 3.073 (< 5.0), GFI: 0.896 (> 0.850), TLI: 0.944 (> 0.900) and CFI: 0.953 (> 0.9).

| Table 4 Testing Coefficients for Factors Affecting Customers’ Satisfaction and Loyalty. (Source: Data Processed by SPSS 20.0 and AMOS) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Relationships | Unstandardized Estimate |

Standardized Estimate |

S.E. | C.R. | P | Hypothesis | ||

| SAT | <--- | TAN | 0.058 | 0.028 | 0.021 | 2.765 | 0.006 | Accepted |

| SAT | <--- | RES | 0.146 | 0.162 | 0.043 | 3.429 | *** | Accepted |

| SAT | <--- | COM | 0.411 | 0.479 | 0.036 | 11.267 | *** | Accepted |

| SAT | <--- | EMP | 0.027 | 0.051 | 0.007 | 3.991 | *** | Accepted |

| SAT | <--- | REL | 0.222 | 0.129 | 0.061 | 3.666 | *** | Accepted |

| LOY | <--- | SAT | 0.288 | 0.538 | 0.026 | 11.065 | *** | Accepted |

Table 4 showed that the column P < 0.01 with significance level 0.01. These results indicated that five factors are affecting customers' satisfaction and loyalty with the service quality of commercial banks in Dong Nai province with a significance level of 0.01. These results are science evident for managerial implications to enhance customers’ satisfaction and loyalty.

Conclusion

The authors surveyed 600 customers, but 585 samples were processed—customers related to banking service from January 2020 to July 2020. The research results showed that five factors affected customer satisfaction and customer satisfaction concerned loyalty at commercial banks in Dong Nai province. According to the action plan to improve competitiveness and develop the service quality of commercial banks. Thus, this study's preliminary results are to complete the scale, propose the influencing factors, and the degree of their impact on customer satisfaction, loyalty based on the quality of service at commercial banks. The research results are an essential basis for commercial banks to improve the quality of services provided to customers in the future.

Based on the results of modeling analysis and descriptive statistics, the authors offer some managerial implications to improve customer satisfaction with domestic commercial banks' service quality in the area as follows.

Managerial Implications

The managerial implications for competence: The competence factor is the first most potent factor in customer satisfaction. To improve the quality of savings deposit service, the commercial bank needs to focus on implementing solutions to enhance customer assessment for this factor. With the expansion of the network operating within the banking area and surrounding districts, the bank will effectively exploit the deposits of people in the city, contributing to the bank's high business efficiency in the coming time.

Secondly, the managerial implications for responsiveness: The response level factor is the factor that has the most significant impact on customer satisfaction. Based on directly affecting customer satisfaction, such as waiting time for transaction settlement involving customers' work, Vietin Bank staff are willing to help and solve customers' problems. Customers have the knowledge and ability to answer specific questions and requests of customers.

Thirdly, the managerial implications for reliability: Reliability refers to providing accurate, punctual, and reputable services, the bank staff's ability to work, the transparency in invoices, papers. It requires consistency in service and honor commitments and promises to customers. Employees need to pay attention to the difficulties and complaints of customers and resolve them quickly. They are always welcoming customers warmly, happily, friendly.

Fourthly, the managerial implications for empathy: The empathy factor has the fourth-strongest impact on customer satisfaction. The bank should further improve the confidentiality of customers' information, avoid leaking out customers' information, affecting the interests and safety of customers' assets. The bank also needs to regularly monitor and update modern technologies to upgrade the customer information security system for the better.

Finally, the managerial implicatins for tangibles: The tangible means factor is the fourth most influential factor in customer satisfaction. It shows that, when using the service at the bank, customers always have to pay attention and pay attention to the appearance, clothes of the employees, and tangible assets to support and serve the service of banking service.

References

- Abdullah, R.B., Norhanisah, B.I., Akmal, F.B.A.R., Musnadzirah, B.M.S., Siti, K.B.S., Hasnan, M.T., ….& Gopala, K.S.N. (2012). The relationship between store brand and customer loyalty in reltailing in Malaysia. Asian Soc Sci, 8(2), 171-184.

- Belás, J., & Gab?ová, L. (2016). The relationship between customer satisfaction, loyalty, and financial performance of commercial banks. E & M Economical and Management, 2(1), 132-144.

- Brunner, T.A., Stöcklin, M., & Opwis, K. (2018). Satisfaction, image, and loyalty: New versus experienced customers. Eur J Mark, 42(9), 1095-1105

- Coelho, P.S., & Henseler, J. (2012). Creating customer loyalty through service customization. Eur J Mark, 46(3/4), 331-356.

- Coyne, K. (2018). Factors influencing customer satisfaction with commercial banks' service quality: a case study of commercial banks in Malaysia. Journal of the Academy of Marketing Science, 13(12), 115-124.

- Cronin, J.J, & Taylor, S.A. (1992). Measuring service quality, a reexamination, and extension. J. Mark, 56(3), 55-68.

- Deep, J. (2017). Factors affecting customer satisfaction on logistics service: The case of private companies in Sri Lanka. International Journal of Marketing and Technology, 18(11), 111-138.

- Gronroos, C.A. (1984). Service quality model and its marketing implications. European J. Mark, 18(4), 36 - 44.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis with readings (Fifth Edition). US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Hilda, G.M. (2018). Level of effectiveness of management capacity practices and its impact on employees' satisfaction in the banking sector of Jordan. Journal of Organizational Culture, Communications, and Conflict, 22(1), 1-12.

- Igaz, A.T., & Ali, A. (2013). Measuring bank's service attitude: An approach to employee and customer acuities. Journal of Business and Management, 7(2), 60-66.

- Islam, N., & Borak, M.A. (2011). Measuring service quality of banks: an empirical study. Research Journal of Finance and Accounting, 2(4), 74-85.

- Jaime, T.F., & Ignacio, L.E. (2017). Assessment of banking service quality perception using the SERVPERF model. Contaduria y Adm, 62(4), 1294-1316.

- Kotler, P., & Keller, K.L. (2006). Marketing management (Twelfth Edition). Pearson Prentice Hall, USA.

- Kumar, V., & Petersen, A.J. (2018). Customer satisfaction and loyalty: assessing some of the critical antecedents of customer satisfaction in commercial banks' service quality. International J Mark, 120(4), 46-60.

- Landier, A., & Thesmar, D. (2020). Earnings expectations in the covid crisis. National Bureau of Economic Research, 8(2), 1-26.

- Lau, M.M., Cheung, R., Lam, A.Y.C., & Chu, Y.T. (2013). Measuring service quality in the banking industry: a hong kong based study. Contemporary Management Research, 9(3), 263-282.

- Mackay, N., & Major, R.K. (2017). Predictors of customer loyalty in the South African retail banking industry. Journal of Contemporary Management, 14(1), 1194-1224.

- Manser Payne, E., Peltier, J.W., & Barger, V.A. (2018). Mobile banking and AI-enabled mobile banking: The differential effects of technological and non-technological factors on digital natives’ perceptions and behavior. Journal of Research in Interactive Marketing, 12(3), 328-346.

- Mei, M.L, Ronnie, C., Aris, Y.C.L., & Yuen, T.C. (2013). Measuring service quality in the banking industry: a hong kong based study. Contemporary Management Research, 9(3), 263-282.

- Mobin, A. (2017). Service quality measurement regarding banking sector. International Journal of Business and Social Science. 8(6), 50-61.

- Moyo, B. (2018). An analysis of competition, efficiency, and soundness in the South African banking sector. South African Journal of Economic and Management Sciences. 21(1), 1-14.

- Muslim, A., & Zaidi, I. (2018). An examination of the relationship between service quality perception and customer satisfaction. International Journal of Islamic and Middle Eastern Finance and Management. 1(3), 191-209.

- Ngwu, F.N., Ogbechie, C., & Ojah, K. (2019). Growing cross-border banking in Sub-Saharan Africa and the need for a regional centralized regulatory authority. J Bank Regul, 20(3), 274-285.

- Oliver, R.L. (1993). Cognitive, affective, and attribute bases of the satisfaction response. J Consum Res. 20(3), 418-430.

- Parasuraman, A., Zeithaml, V., & Berry, L. (1985). A conceptual model of service quality and its implications for future research. J Mark. 49(4), 41-50.

- Parasuraman, A., Zeithaml, V.A., & Berry L.L. (1988). SERVQUAL: A multiple item scale for measuring consumer perceptions of service quality. Journal of Retailing, 64(1), 12-40.

- Rakesh, R. (2012). Quality assessment of banking industry using the servqual model. Indian Streams Research Journal, 2(2), 1-4.

- Rebekah, B. & Sharyn, R. (2004). Customer satisfaction should not be the only goal. J. Serv. Mark. 18(7), 514-523.

- Ananda, S., & Devesh, S. (2019). Service quality dimensions and customer satisfaction: empirical evidence from retail banking sector in Oman. Total. Qual. Manag., 30(15-16), 1-14.

- Saiful, Islam., & Borak, A. (2011). Measuring service quality of banks: an empirical study. Research Journal of Finance and Accounting, 2(4), 74-85.

- Stenbacka, C. (2015). A reexamination of the determinants of consumer satisfaction and loyalty. J Mark, 4(1), 115-132.

- Thomas, B. & Tobe, J. (2016). Factors affecting customers' satisfaction and loyalty. A case in the commercial banks of Ethiopia, Chiro town. Afr J Bus Manag, 3(13), 38-48.

- Zeithaml V., Berry L., & Parasuraman A. (1988). Communication and control processes in the delivery of service quality. J Mark. 52(2), 35-48.

- Zeithaml, V.A., Wilson, A., Gremler, D.D. & Bitner, M.J. (2000). Services marketing: integrating customer focus across the firm (Second Edition). McGraw-Hill, Boston.