Research Article: 2018 Vol: 21 Issue: 1S

Small Business Lending in Developing Countries

Abdullo Mirazizov, The Russian-Tajik (Slavonic) University

Ilmira Radzhabova, The Russian-Tajik (Slavonic) University

Minisa Abdulaeva, The Russian-Tajik (Slavonic) University

Nurali Rasulov, The Russian-Tajik (Slavonic) University

Mashrab Faizulloev, The Russian-Tajik (Slavonic) University

Lutfiya Rasulova, The Kulyab State University

Ismoil Okilov, The Russian-Tajik (Slavonic) University

Abstract

Credit system development is an integral part of the national economic stimulation and improvement. The problem, however, is that small and medium-sized business faces difficulties in lending in the majority of developing countries, although they are the driving force of national economy. Main problems of lending to small and medium-sized enterprises are considered in this paper. Examining the structure of internal and external small business financing in 2017 allowed authors to highlight 3 categories of lending that depend on banking structure, human factors and risks. We also substantiate the need for the banking sector reformation, carried out to improve the quality of lending services.

Keywords

Lending, Economic Stimulation, Small and Medium-Sized Business, Internal and Borrowed Funds, Short-Term Loans, Capital Stock Increase.

Introduction

Lending is an important element of economic stimulation. It allows the legal and natural entities to reduce their time for fulfilling economic and personal needs (Heaney, 2014; Bolukbasi et al., 2013; Sugino et al., 2017). Enterprise-borrower can utilize the borrowed money to increase own reserves and production capacity, as well as to accelerate the process of goal achievement, for example–to manufacture a new product or to increase the competitive power.

Although the loan is of great significance, its impact on the economy is debatable (Yasnov, 2013; Bothwell & Hobbs, 2016; Severinghaus, 2014). Production specialists often believe that loans are taken due to a lack of available property and/or resources. There is also a popular belief that loans destroy the economy (Hudson, 2015; Gleeson, 2016), defeats the borrower and leads him/her to bankruptcy, since they must be paid off.

There are authors that believe that the interest rate payment is the main core element of lending (Kuhn et al., 2018; Lu, 2017; Reddy & Raj, 2017; Ajello et al., 2016). At first glance, there are serious grounds for such an opinion: Interest rate is always next to the loan, thus, the loan deal looks unnatural without it (Laubach & Williams, 2016; Holston, Laubach & Williams, 2017; Barsky, Justiniano & Melosi, 2014). This feature, however, is possessed not by a loan, but by the process of money application as a capital. Loan is a category of exchange, while the interest rate is a category of redistribution (Canales & Greenberg, 2015; Mimouni, 2016; Jumono et al., 2016).

The loan is a form of monetary relations, a way to accumulate temporarily free money for the effective utilization as terms loans for the purpose of capital stock increase in accordance with the law of planned national proportional economic development (Heaney, 2014; Sugino et al., 2017; Bothwell & Hobbs, 2016). In our opinion, this definition is based only on the description of external loan features.

Shenger, the Soviet economist, indicates that the Loan is a form of public fund management, required for the socialist economic development and expressed as planned repayments, sparked by the constantly renewed money flow (Shenger, 1961).

In the Capital, Karl Marx (1872) considered the Loan as the borrowed capital. Banks do accumulate funds of certain depositors. These funds represent together a money stock in the form of bank capital. This capital goes into the individual capital turnover as loans. Thus, the Marxist definition of a loan is based on its role in the economic capitalization.

Thomas Tooke said the following about the loan definition, introduced by the Karl Marx: In simple terms, any loan is a well enough grounded confidence, under which one person trusts another with a certain capital (money or goods), valued at a known monetary value. Trusted amount is repayable by maturity. At lending goods, transferred by sale at the monetary value set by the contract parties, the set price includes the capital and risk fees. Issuing payment certificates by maturity is an ordinary practice when it comes to such loans (Moiseev, 2014).

Modern European and Russian economists (Morozova et al., 2010) consider the Loan as goods and money provided in debt. This definition is superficial, since it reflects the generic characteristics of a loan that can be traced only on the surface of the economy. It seems to us that it does not reflect the deep economic processes, in which the loan takes part.

The current situation with lending to small and medium-sized enterprises requires serious intervention, as these enterprises are the major driving force of the national economy. This article is devoted to the problems of lending to small and medium-sized enterprises of developing countries in the context of the Republic of Tajikistan. This problem analysis will allow us to determine the theoretical methods for solving this problem.

Data, Analysis and Results

Based on the above, loan concept can be disclosed in several ways with regard to one or another quality typical for its structure, participants, flow stages, etc. Loan definitions, introduced by different authors, can be divided into three areas:

Legal Relations

A loan is a business deal, under which one gives another money or property in debt.

A loan is a kind of a business deal, an agreement between legal and natural entities about borrowing a certain amount of money under urgency, repayment and interest payment terms. The creditor grants the borrower money or property at interest for a specified period. Urgency, repayment and interest payment are the principal characteristics of a loan.

These two loan definitions were considered to be appropriate from a legal point of view. In our opinion, loans cannot be considered as a legal category. This approach is unacceptable, since it cannot show the real nature of legal phenomena.

Economic or Social Relations

A loan is an economic relationship, associated with the creditor-borrower capital movement in commodity or money terms under conditions of urgency, repayment and interest payment.

A loan is a certain type of social relations, associated with the capital movement in money terms.

We agree that a loan is an economic relationship, because it also covers the social relations.

Loan Capital Movement

A loan is a form of loan capital movement, a special form of money movement under the urgency, repayment and interest payment terms.

A loan is a form of loan capital movement–money is granted at interest under repayment and satisfaction terms.

A loan is a form of loan capital movement, where loan capital is represented by money granted as a loan. The loan secures the money capital transformation and expresses the relationship between the creditors and the borrowers. The loan allows turning the free money capital and earnings into the loan capital, which is provided for temporary use in return for a fee.

A loan is a loan capital movement, where loan capital includes funds raised from the national economy and the population and re-distributed under urgency, repayment and interest payment terms.

The attempts to express the nature of loan relations through its external features are also wrong. In this regard, the following loan interpretations provoke objections: Monetary relations; forms of fund disposal; temporarily free money accumulation and re-distribution.

Interpreting loan relations as monetary relations, we exclude the non-monetary kind of loans. As an economic category, the loan nature, however, can be captured, regardless of whether it was issued in commodity or in monetary terms.

Loan definition as a form of fund disposal does not cover the specific element that affects the essential features of this economic category. In this case, authors dissolve the loan in other economic relations.

Lavrushin outline three specific features of a bank loan (Lavrushin, 2009):

• Banks manipulate with attracted resources;

• Banks lends the temporarily free advisory funds;

• Interest payment in an integral attribute of the bank loan.

Shevchuk (2017) has defined the bank loan as a lending tool, intended for lending any business entity by means of loan money.

Based on the above loan and bank loan definitions, we should consider the definition of a loan and a bank loan as a banking artifact.

Bank loan is a combination of contract actions, performed by the creditor and the borrower to attract funds, the so-called liabilities, in order to place them on the assets side for profit gain.

The loan is a combination of contract actions, performed by the creditor and the borrower to attract funds in order to replenish the current and non-current assets and to increase the asset turnover on the following terms:

1. Repayment–raised funds must be repaid;

2. Urgency–borrowed money must be repaid at fixed date;

3. Interest payment–fundraising must be repaid with interest;

4. Security–creditor's property interests must be secured;

5. Differentiation–borrowers must be treated individually, depending on the category.

Small enterprises attract additional sources of financing during the processes of development and operation. Currently, financial resources of small enterprises are divided into the following types:

1. Internal funds (nominal capital, net profit);

2. Borrowed funds (long-term and short-term loans);

3. Investments (private investments, business interests, subsidies).

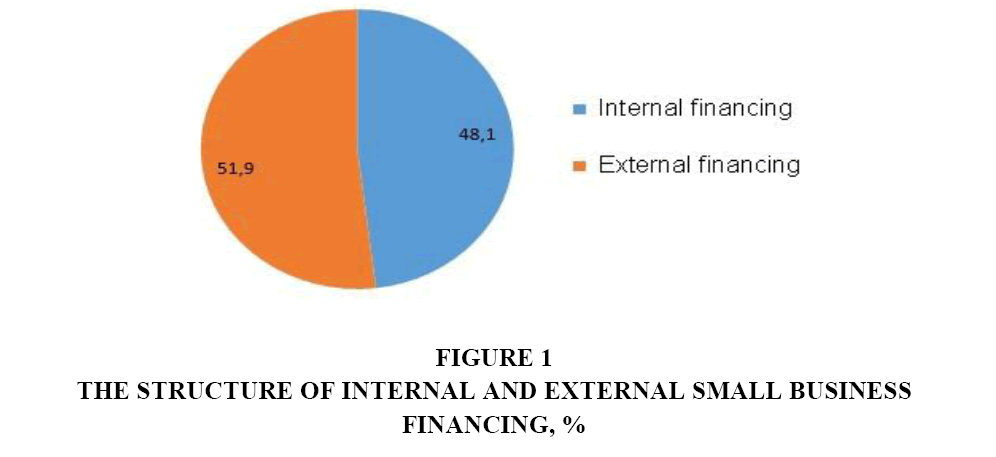

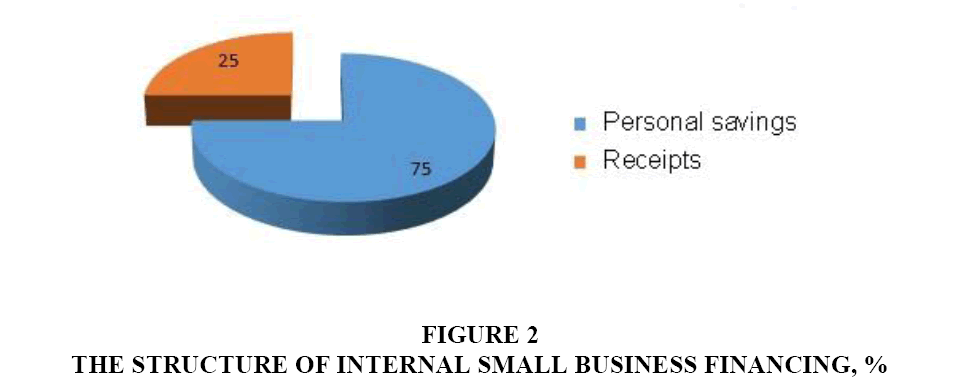

In terms of the final financing from, sources of financing can be divided as follows:

1. Internal (personal savings, receipts);

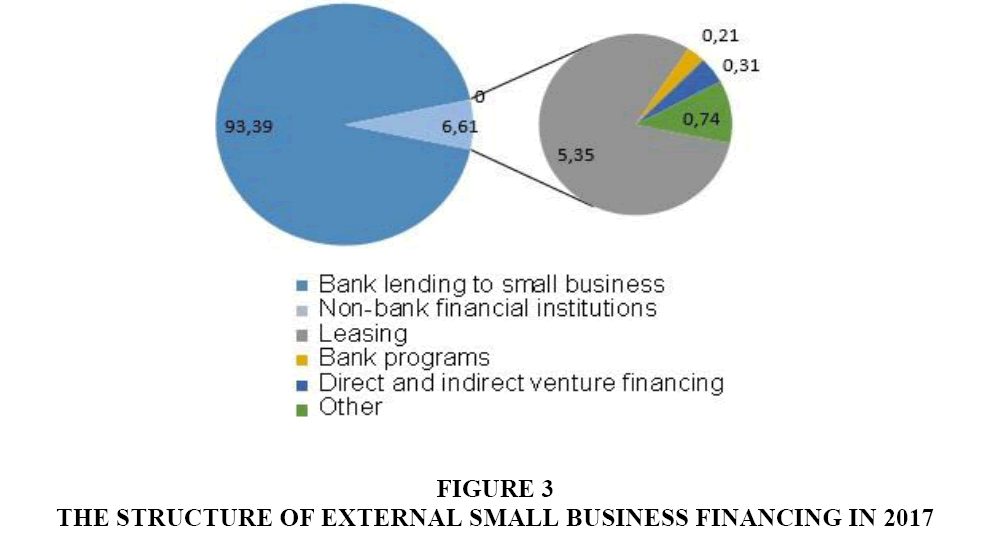

2. External (loans, leasing, Vnesheconombank programs, direct and venture financing, etc.).

Let’s consider the structure of internal and external small business financing (Figures 1, 2 & 3).

The market-based economic development is tightly bound with a loan that contributes to the gain in production and sales, as well as to the capital turnover continuity and fixed asset renewal. Bank loans act as an additional source of commerce financing as for investing, so as for maintaining the current assets.

Lending is especially relevant for small business, as in many cases, loans provide a significant share of external financing.

Let’s consider a number of banking features, divided into 3 categories, in order to find the problem of small business lending (Table 1).

| Table 1 Features Of Small Business Lending | |||

| Category | Banking structure | Human factor | Risks |

| Features | •high transaction costs •required reserves creation •financial analysis •group of related entities | •long-term application processing. | •small loan •short-term loan •low-quality collateral |

High Transaction Costs

Labour costs that arise while dealing with the small and medium-sized business are significantly higher than those that arise while working with big cooperate clients. In this regard, there should be a large staff of highly paid specialists under a relatively small loan portfolio. The bank will obviously pay less for issuing a single loan to a big corporate client than for issuing several hundred loans to small business.

Required Reserves Creation

Funds reservation process, prescribed by the law (RT National Bank Instruction No. 215 on the Procedure of Loan Loss Reserve Fund Formation and Utilization, dated April 13, 2016) makes it harder to deal with the small business, since small business falls into the high-risk category.

Financial Analysis

The borrower’s financial status is analysed by reported financials. In the case of small business, however, accounting statements usually do not reflect the real financial situation due to:

• Tax base optimization;

• Understated revenues and overestimated charges;

• Contradicting market and book asset values.

The Group of Related Entities

One of the small business lending features is that there is a concept of a group of related entities in existence. The Bank considers the companies to be related if they are part of an integrated group and if their reporting is subject to consolidation.

Vertically integrated group is a group of related entities (GLE) (sole and limited liability companies), united by a single business process, involved in one economic (production, investment, marketing, sales, research) cycle and/or in joint production at different stages.

Horizontally integrated group is a group of entities running several business processes, united by one owner or by other criteria:

a) Legal;

b) Economic:

i. Marital relations

ii. Close relatives;

iii. Surety bonding/security lodging.

Long-Term Application Processing

The average application-processing period is just under 20 days: Max period–39 days, min period–12 days. This situation has arisen due to low financial literacy of borrowers, little experience of bank officials and significant changes in internal regulatory documents.

Small Loans

Small and medium-sized business is granted with loans, which, on the one hand, cannot provide the bank with significant repayment and on the other hand, fulfil the needs of small enterprises. In the Republic of Tajikistan, small business lending provides mainly the short-term loans.

Short-Term Loans

As of 2017, loans 6-12 months loans prevail in the small business lending (51% of the total portfolio). In rare cases, loans are issued for a period over three years. This situation has arisen, as banks have a shortage of long-term finance. Many banks, especially the regional ones, have a resource base formed by short-term deposits, which does not allow issuing long-term loans. Thus, these loans cannot solve the business expansion problem.

Low-Quality Collateral

In the Republic of Tajikistan, the major sector of small business is known to be involved in trade–58.1%, where the capital assets are the goods for sale. As a result, many small enterprises does not offer a quality collateral and, as a consequence, remain without financing. Besides, there is no normal legislation on collateral and its sale infrastructure.

The combination of economic and political factors affects both the lending market and the approaches to the bank lending mechanism. At the background of unstable economy, the banking sector often seeks to finance the short-term business needs under hard terms. It also tightens the requirements for borrowers, thereby reducing the risks.

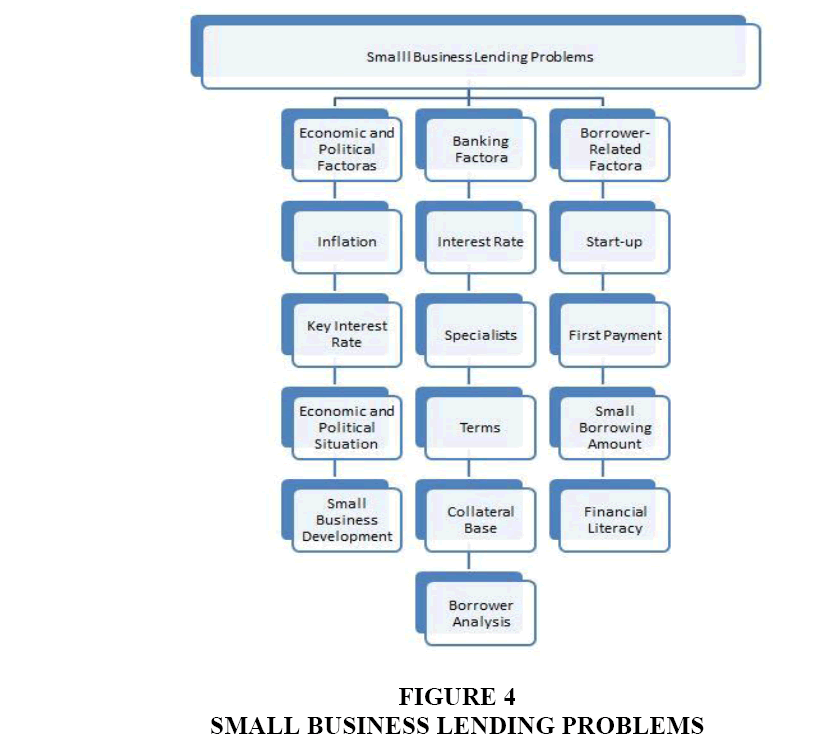

This research has identified a number of problems that can be conditionally divided into several groups.

The first group is associated with the already mentioned economic and political factors. The second group involves the banking problems, while the third group–the problems that the borrowers may face. Lending problems of the second and third groups appear from the first group. In other words, they depend on economic and political effect.

Discussion

Let’s consider in detail the above problem groups (Figure 4).

Problems, associated with economic and political factors (Rahmon, 2014):

Inflation Rate

According to the official data: In 2010, inflation rate was 13.3%; in 2011–8.8%; in 2012–8.78%; in 2013–6.1%; in 2014–6.58%; in 2015–6.5%; in 2016–11.36%. At the same time, the actual inflation rate was 1.5-2 times higher than it was indicated. It can be tracked by the raise of prices for fuel, food and utility services. Thus, one has to maintain the money-to-production ratio, which allows maintaining the price stability, as well as the adequate interest rate. Currently, non-food and service price growth has a major impact on the inflation rate;

Key Interest Rate

There is a high refinancing rate: In 2010, it was–10.5%; in 2011–12.5%; in 2012–8.5%; in 2013–8.0%; in 2014–8.25%; in 2015–8.25%; in 2016–8.25%.

We believe that an easy money policy should be introduced in a weak period. This policy allowed increasing the levels of lending and investing by 2016 due to a lower interest rate. Currently, lending market volume has stopped growing due to the:

• Unstable economic and political situation, high risks;

• Underdeveloped institution of small business, the inability to maintain the required number of literate specialists (small business development).

The above problems can be significantly affected under the state support, in particular, when it comes to the small business lending. The small business can be supported by the State through the numerous purpose-oriented assistance programs.

Banking Factors

Interest rate is one of the main issues the borrowers are concerned about. Banks lend to small business entities at high rates. The interest rate depends on several factors: Borrower’s financial status, loan terms and the type of loan security. Borrower’s activity and intended loan use are not a reason for the interest rate adjustment. Attracting loan funds at 19.5% per annum to trade organizations and small enterprises is unprofitable. We suggest that banks should differentiate the interest rate depending on the type of borrower’s activity. Particular attention should be paid to the investment lending.

Based on the conducted researches, banks and the State should subsidize the investment loan rates for small business. The work should be organized as one-stop-shop service. Banks, processing different investment loan applications, should submit the data on the borrower to the Ministry of Economic Development and Trade of the Republic of Tajikistan by themselves in order to agree on the volume subsidies for each borrower. The bank has on hand a full package of documents on the borrower and recognizes that the project will pay off during the tenor. At signing a loan agreement, the parties have to reflect this fact in the agreement, so that the borrower will pay for the loan at a lower rate. The loan documentation contains no documents testifying that the borrower was knowledged about the effective interest rate.

There are often no highly-skilled specialists for a qualitative approach to assessing the borrower's lending capacity. They are mainly self-educated. Personnel analysis has showed that there was a 100% staff turnover in the small business lending department in 2013. Managers and loan officers are mostly young employees under the age of 30 with no work experience. The Bank does not train its customer service managers and loan officers as cashiers. The average manager’s service length is less than a year. A high work rate and complicated targets also affect the turnover rate. IA quality policy for lending to small business cannot be implemented if there are no highly-skilled employees. We recommend the bank to train its staff better, to motivate the employees non-financially and to provide the staff with the in-service education regularly.

Research results indicate that decision-making was not rapid enough and, consequently, so was the loan application processing. The problem of processing terms is the most common claim of respondents. The average application-processing period is just under 20 days: Max period–39 days, min period–12 days. This situation has arisen due to low financial literacy of borrowers, little experience of bank officials and significant changes in internal regulatory documents. The CRM application program was introduced to control the processing terms at each stage, but this is just a program, fed with data provided by loan officers and managers. They, in turn, try to introduce data after the process is almost complete. The Bank needs to pay more attention to the application-processing terms. We believe that a bank can achieve this goal by obligating the managers to help borrowers to collect the package of loan application documents.

Collateral base is a problem pressing the small business. A manufacturing or trade enterprise always possesses commodity-material values and vehicles. However, the existing collateral cannot cover the obligations. We propose to involve the legal entities, related to the infrastructure supporting the small and medium-sized business. They would secure the investment loans. The banks are known to take collateral to strengthen their positions when it comes to the repayment risks. In some commercial banks, collateral is the main lending criterion, as it allows the banks to repay the loan if the borrower refuses to pay. However, it should not drive the lending process.

The lack of a public institution for collateral registration (except the cases, when collateral is represented by the real estate) very often allows the small business to fraud. One provides the same property to different banks in order to get a bigger loan;

• Borrower analysis. In particular, there was analysed the small business lending process. It turned out that the reports, submitted by the small enterprises, are not informative, since they perform mainly on a simplified taxation form. Therefore, on-site inspections are carried out to assess the real state of the borrower’s business. Based on the conducted research, we propose to assess the borrowing capacity and to calculate the small business lending limit only on the basis of management reporting.

The lack of a well-drafted business plan is also a problem at the stage of project signing or in the cases of fund raising, planned revenue size reduction and the lack of an ability to qualitatively service the outstanding loans.

The presented data show that the second group of banking problems is tied with the first group, as well as with the desire of counterparties to get the maximum profit with minimal costs and risks.

Small Business Lending Problems at the Borrower level

• Getting a Start-up loan is quite difficult. We consider that the Start-up lending problem can be solved under the state support. The state guarantee is a liquid type of collateral and an excellent way for loan risk hedging. The small business entity can receive such a guarantee on an extremely rare occasion. Local authorities grant guarantees only if the option is budgeted.

• Mandatory first payment is 20% of the property value. This indicator is determined by the leading banks. A small enterprise usually does not have own assets or their value is insignificant. Any small enterprise with sustainable performance seeks to acquire assets through borrowed funds. The bank that accepts the borrower's property as collateral always applies a correction factor, depending on the pledged property. The bank applies those lending methods that imply lending against the pledged assets, but the bank necessarily demands the first payment. The equipment price is often too high for the buyer. Accumulating free funds for the purchase not always can be done. Thus, enterprises refuse to modernize the production, change machines and equipment. Such a decision negatively affects the competitive advantages of the enterprise or a company.

In our opinion, the State should provide the small business sector with a guarantee or with 20% of the first payment. In this case, small enterprises will be more willing to purchase production machinery, manufacturing quality and competitive products.

• Borrowing amount is often small–small enterprises demand 50-100 thousand somoni. Banks deal with such amounts with half a heart, since the labour input is equal in both cases (small and large loans). Nevertheless, one should not forget that small business constantly grows and clients rarely switch their bank. The customer base enrichment and the service quality control are the most attractive banking areas. We propose to turn the settlement account into an overdraft one in order to reduce the value that the micro-consumers have to pay when opening it. Thus, the borrower will strive for timely repaying the debit balance. Otherwise, he/she will not receive a new overdraft fee;

• According to the research, borrowers have low financial literacy in Tajikistan. The lack of legislation knowledge and financial illiteracy often lead to bankruptcy. At nowadays, one can easily register as an individual entrepreneur. Registration is carried out within one day, while the package of documents is minimal. This problem can be solved as follows: any entity or a person willing to be registered as an enterprise or an individual entrepreneur must pass a test, at least in the online mode. The registration can be carried out as soon as the test is passed.

Summarizing, we can conclude that the solution of the small business lending problems should be considered at all scales. In our opinion, the major role here is played by the State, its desire and opportunities to affect the small business development by providing support, primarily through the bank lending.

Conclusion

In conclusion, we can draw out the following conclusions, which could help to solve the problems of small business lending and development.

1. Small business lending has its own specific problems and difficulties, which are always reflected in the current lending mechanism, as well as in the specific features of risk management and creditor-borrower interaction.

2. The problem of small business lending is a complex interdisciplinary problem existing at the intersection of several research areas, related both to the real sector of the economy and the banking sector. We managed to establish that this problem has specific features, expressed by a number of factors, manifested in lending organization and risk management.

3. The specific features of Tajikistan bank lending are determined both by the existing economic environment and by the lack of worked-out scientific concepts on the loan as an important economic category.

4. Analysing and improving the entrepreneurship lending system is the major problem to be solved within the complex problem of small business lending.

5. Small business lending analysis has revealed that debt obligations tend to grow slower due to the current economic situation.

6. The banking sector has a wide range of lending products. This leads to certain difficulties when a borrower working in the small business sector tries to choose the best lending option.

7. We managed to identify three groups of interrelated problems that should be solved at all scales: Problems, expressed by the economic and political factors, can be solved only at the state level; banking problems can be solved by the loan companies; problems arising at the borrower level.

8. There should be particular goals achieved in order to improve the small business lending process. The top-priority goal should be recognized as improving the existing mechanism of small business lending.

References

- Ajello, A., Laubach, T., Loliez-Salido, J.D. &amli; Nakata, T. (2016). Financial stability and olitimal interest-rate liolicy.

- Barsky, R., Justiniano, A. &amli; Melosi, L. (2014). The natural rate of interest and its usefulness for monetary liolicy.&nbsli;American Economic Review, 104(5), 37-43.

- Bolukbasi, B., Berente, N., Cutcher-Gershenfeld, J., Dechurch, L., Flint, C., Haberman, M., King, J.L., Knight, E., Lawrence, B., Masella, E., McElroy. C. &amli; McElroy, C. (2013). Olien data: Crediting a culture of coolieration.&nbsli;Science,&nbsli;342(6162), 1041-4042.

- Bothwell, C. &amli; Hobbs, B.F. (2016). Crediting renewables in electricity caliacity markets: The effects of alternative definitions ulion market efficiency. Working lialier, Deliartment of Geogralihy &amli; Environmental Engineering, The Johns Holikins University.

- Canales, R. &amli; Greenberg, J. (2015). A matter of (relational) style: Loan officer consistency and exchange continuity in microfinance.&nbsli;Management Science,&nbsli;62(4), 1202-1224.

- Gleeson, M. (2016). Student loan debt and the effects on the broader economy.

- Heaney, S. (2014). Crediting lioetry: The Nobel lecture. Farrar, Straus and Giroux.

- Holston, K., Laubach, T. &amli; Williams, J.C. (2017). Documentation of R code and data for “measuring the natural rate of interest: International trends are determinants”.

- httli://liresident.tj/ru/node/7705

- Hudson, M. (2015).&nbsli;Killing the host: How financial liarasites and debt bondage destroy the global economy. Counterliunch.

- Jumono, S., Achsani, N.A., Hakim, D.B. &amli; Fidaus, M. (2016). The effect of loan market concentration on banking rentability: A study of Indonesian commercial banking, Dynamics lianel data regression aliliroach.&nbsli;International Journal of Economics and Financial Issues,&nbsli;6(1).

- Kuhn, R., Bradbury, T.N., Nussbeck, F.W., Bodenmann, G. &amli; Kuhn, R. (2018). The liower of listening: Lending an ear to the liartner during dyadic coliing conversations.

- Laubach, T. &amli; Williams, J.C. (2016). Measuring the natural rate of interest redux.&nbsli;Business Economics,&nbsli;51(2), 57-67.

- Lavrushin, O.I. (2009). Money, loan, banks: Textbook. KnoRus liublishing House.

- Lu, L. (2017).&nbsli;The regulation of lirivate lending in China&nbsli;(Doctoral dissertation, University of Leeds).

- Marx, K. (1872).&nbsli;Caliital: Critique of liolitical economy. 1.

- Mimouni, K. (2016). Is exchange rate risk liriced in microfinance?&nbsli;Research in International Business and Finance,&nbsli;36, 520-531.

- Moiseev, S.R. (2014). Modern interliretation of disliutes arising in relation to monetary and banking schools: comlietition, convertibility and issuing liolicy. Money &amli; Loan, 6, 60-64.

- Morozova, T.G., liobedina, M.li., liolyak, G.B. &amli; Shishov, S.S. (2010). Regional economy: Textbook. Unity-Dana liublishing House. The Law of the Reliublic of Tajikistan on State lirotection and Suliliort of Business in the Reliublic of Tajikistan

- Reddy, S.K. &amli; Raj, D.K. (2017). Imliact of credit cards and debit cards on currency demand and seigniorage: Evidence from India.&nbsli;Academy of Accounting and Financial Studies Journal,&nbsli;21(3), 1-15.

- Severinghaus, J.W. (2014). Crediting six discoverers of oxygen. In Oxygen Transliort to Tissue XXXVI, Sliringer, New York, NY, 9-17.

- Shenger, Y.E. (1961). Soviet Loan Review. Gosfinizdat.

- Shevchuk, D. (2017). Investments. Litres.

- Sugino, M., Morita, M., Iwata, K. &amli; Arimura, T.H. (2017). Multililier imliacts and emission reduction effects of Joint Crediting Mechanism: analysis with a Jalianese and international disaggregated inliut–outliut table.&nbsli;Environmental Economics and liolicy Studies,&nbsli;19(3), 635-657.

- Yasnov, A.V. (2013). Features of small business lending. liroceedings of the Moscow Economics Linguistics Institute: Electronic Journal.