Research Article: 2017 Vol: 21 Issue: 3

Sources of High-tech Business Financing: Experience of Empirical Research

Nataliya A Kravchenko, Novosibirsk State University of Economics and Management

Vladimir V Glinskiy, Novosibirsk State University of Economics and Management

Lyudmila K Serga, Novosibirsk State University of Economics and Management

Nikolay V Anokhin, Novosibirsk State University of Economics and Management

Keywords

Activities Financing, High-Tech Companies, Capital Structure, Development Barriers.

Introduction

One of the strategic objectives of Russia's economic development is the growth of high-tech business as the foundation of the new technological order, the production base "knowledge economy" (Hochberg, 2013).

Formation of high-tech, competitive industry that provides the transition of the Russian economy from the raw materials export type of development to innovative type of development has been stated as an aim of industrial policy (development, 2008; Khorasani & Almasifard, 2017; Law, 2014).

At present, the scale of the high-tech sector of the Russian economy is significantly inferior to developed countries. According to the Federal State Statistics Service (Russia, 2015), the share of high-technology and knowledge-intensive industries in GDP is about 20%, while the same indicator, the average for EU countries, is close to 50% (high-tech, 2016; Statistics, 2015).

In the process of formation of a high-tech sector of the economy, small and medium-sized companies play an especially significant role and serve as a source of innovation, a channel for the transfer and commercialization of research and development results and create new highly skilled jobs.

The activity of small businesses in general and especially of high-tech, is in a high-risk zone, as it is forced to adapt to the challenges of the external environment and solve complex development problems (Khorasani, Maghazei & Cross, 2015). Lack of financial resources is considered to be one of the main factors hindering the creation of new and limiting the development of existing high-tech companies. Insufficient financing does not allow companies to create their own new products and technologies and successfully borrow and adapt already existing products, technologies and production processes.

Many publications based on empirical data from various countries study the problems of financing of high-tech and innovative companies, the advantages of various sources, analyse the financial strategies of companies, study the impact of financial strategies on the growth and performance of companies (Deakins & North, 2013; Oakey, 2003; Revest, 2010; Xiao, 2011).

Quite a large number of publications are devoted to studies of how various forms of external financing help the creation and successful operation of high-tech companies (Brierley, 2001; development, 2008; EBRD., 2014) at the same time there is no unified position in the research environment.

That is why the empirical studies that reflect the specific characteristics of high-tech companies serve as an important source not only of new theoretical knowledge, but they also form the argumentation for actions on the part of industrial and innovation policy at national and regional levels.

The published experience of empirical studies characterized by considerable heterogeneity both in terms of the objects of research and in the methodology used and the results obtained. There are not many works on Russian high-tech companies, we note publications EBRD (Russia., 2007), report "Tehuspeh" (Medovnikov, 2015) and some other publications.

The variety of conclusions obtained and their dependence on the specific characteristics of local production and innovation systems produce a field for discussions, which determines the importance and relevance of new research.

The main objective of our work was to investigate the sources of financing of small and medium-sized high-tech companies and the identification of the relationship between the characteristics of the companies and the availability of financial resources for their growth and development.

Investigations of the problems of financing high-tech companies are at the intersection of the problems of several areas of economic thought: Financial theory (capital structure), innovation (the concept of innovation systems), theory of industrial markets and strategic management. Our research relies primarily on the theory of the hierarchy of capital structure (Myers & Majluf, 1984) and also on the concept of innovation systems (Carlsson, Jacobsson, Holmén & Rickne, 2002; Hughes, 2014; Isom, 2009). In accordance with the theory of hierarchy, first of all, companies use internal, own sources of investment financing, then they resort to debt sources and in the last turn attract new investors-owners. The concept of innovative systems assumes that the features of local innovation and production systems form various combinations of sources of capital, aimed at the specific needs of high-tech business, so that there are no universal solutions. Environmental characteristics, institutional features, financial and tax systems, state regulation, industrial structure and many other local features are reflected in the financial behavior and financial strategies of innovative and high-tech companies.

The following hypotheses are tested in the paper:

H1. High-tech and innovative small and medium-sized companies rely primarily on internal financial sources, which are insufficient to meet the needs of growth and development. Lack of financial resources is the main obstacle for the creation, formation and development of high-tech and innovative small businesses.

H2 For the development and growth the high-tech and innovative companies need a significant inflow of external capital. Attracting external financing, companies adhere to a certain sequence, the hierarchy of sources of capital.

H3. There are differences in the financial behavior of high-tech companies that are associated with the stage of the company's life cycle. Companies at the early stage of the life cycle (formation) have fewer opportunities to attract external sources of financing than companies in the later stages of the life cycle.

The objects of the research were small and medium-sized high-tech and innovative companies located on the territory of the Novosibirsk Region.

The city of Novosibirsk is the third most populated Russian city and also the largest scientific centre of Russia beyond the Urals. There are about 100 scientific organizations, more than 20 universities; More than 1,000 small companies operate in the scientific and technical sphere (Kaneva & Untura, 2014). The companies of the "new economy" play an increasingly important role in the economy of the region, mainly in the fields of information technology, biotechnology and pharmaceutics and scientific instrumentation.

Note that the quality of high technology and innovation of companies within the existing system of statistical observation in Russia, are different. The level of manufacturability is determined by the industry affiliation of the company and the type of main product and innovation-by the availability of costs for innovation activity.

Since there are different approaches to the definition of high-tech business (by industry, by product, by the intensity of spending on R&D), we used two criteria when choosing high-tech companies: The company's affiliation with high-tech and mid-tech high-level industries and activities and product’s innovation. Criteria of innovation were the assessment of the level of novelty-products that are new for Russia and the world level of novelty. In this paper, we have combined both characteristics of companies, since in our sample they largely overlap.

Methodology and Data

Our research is based on data collected during two rounds of the survey of small and medium-sized high-tech and innovative companies that were conducted in 2009 and 2012 by a group of scientists. In-depth interviews and questionnaires of managers of enterprises located in the territory of the Novosibirsk region were conducted. In a specially developed questionnaire, a block of questions was designed to obtain information on the financial strategy of companies.

The questions of the financial block included the following:

• What sources of funding did your company use?

• What sources of funding do you propose to use to expand/develop your business?

• How do you assess the attractiveness and availability of these sources of financing? (Score on a 5-point scale)

• How do you see the future of your company?

• In addition, the financial aspects of the activities of high-tech companies are included in more general questions of the questionnaire:

• What barriers hinder the development of your business? (Score on a 5-point scale)

• What support measures do you consider necessary for the development of your business? (Score on a 5-point scale)

• In the second round of the questionnaire, additional questions were asked about partnerships between companies.

• What are the most important business partners for your company? (Score on a 5-point scale)

• Do you plan to develop partnerships in the future? (Score on a 5-point scale)

The list of possible partners included banks and financial institutions.

The questionnaires contained questions about financial indicators and their dynamics, but, unfortunately, small and medium-sized businesses prefer not to disclose data on their revenues, profits and other quantitative financial indicators. These questions were answered by less than 20% of companies, so we did not use them in further analysis.

Other (non-financial) aspects of the study implemented in the first round of the survey are presented in the paper (Kravchenko, 2015).

The baseline data base for the first round (2009) includes 60 companies; in the second round (2012), 44 companies participated in the survey.

All companies are private, about 60% of companies are established after 2000, about half render services and the second half produces goods. The level of novelty of products (or services) companies is quite high: About 40% of companies consider their products new to the national and world market. Companies operate in a variety of markets, primarily in the B2B market. Companies operate in a variety of markets, primarily in the B2B market. Among the sources of innovative ideas, the ideas of entrepreneurs themselves are absolutely dominant, as well as the results of their own research developments. Intellectual property of companies is protected by patents (25% of companies), licenses (31%), trademarks, know-how. The companies are at different stages of the life cycle: 13% are in the process of formation, at the start, 47% are developing and growing rapidly, 27% are in the maturity phase and 14% of companies are declining or moving to a new business.

Results of Survey of High-Tech Companies

Lack of Financial Resources as an Obstacle to the Creation and Development of High-tech and Innovative Small Businesses.

As regular surveys of Russian enterprises show (Index, 2012), low availability of financial resources is one of the key problems of small and medium-sized businesses. At the same time, the longer the term for which external resources are required, the more difficult it is to attract them. About 40% of entrepreneurs consider it difficult or impossible to attract short-term loans and loans for more than 3 years are considered difficult or impossible to attract by 45% of small business leaders.

A survey of 200 Russian fast-growing technology companies (Medovnikov, 2015) showed that own funds were and remain the main and for many companies the only source of financing for development. Own funds were used by 96% of companies, 69% used various loans, 33% received government funding and grants, 3% used investor financing. The inability to attract financial resources from external sources was the main obstacle to growth.

The Russian small innovative business is not alone in its problems. A highly cited publication (Ayyagari, Demirgüç-Kunt & Maksimovic, 2011) presents an analysis of the determinants of the innovative behavior of 19,000 firms in 47 emerging economies using the World Bank Investment Climate Survey database. One of the conclusions of the work is that the innovative activity of companies is positively connected with access to external sources of financing and this effect is especially noticeable for small companies.

In our survey, the company's executives answered the question of what factors have a negative impact on the company's operations and development. This is a traditional question that is used in statistical observations of business activity, investment and innovation. The first place among the factors limiting the development of enterprises is usually taken by a lack of own financial resources (Dezhina, 2005; Russia, 2015).

In Table 1 a rating of factors limiting business activity and development of high-tech companies was built, based on estimates obtained by us. Columns 2 and 3 show the overall results for the first (2009) and second (2012) survey rounds. In 5-7 columns, barriers are identified that are typical for different stages of the life cycle of companies for the stage of formation (indicated by the letter C) and the stage of development (P).

| Table 1 The Rating of Barriers for the Development of High-Tech Business |

||||||||

| Barriers for the development | 2009 | 2012 | 2009 | 2012 | HSE | Statistics | ||

| ? | ? | ? | ? | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Lack of own funds | 1 | 2 | 1 | 1 | 1 | 2 | 1 | 1 |

| Lack of qualified personnel | 2 | 1 | 2 | 2 | 2 | 1 | 5 | 4 |

| Imperfection of legislation | 3 | 4 | 3 | 3 | 3 | 5 | 6 | - |

| Low demand for new products | 4 | 6 | 5 | 4 | 4-6 | 6 | 7 | 9-11 |

| High economic risk | 5 | 7 | 4 | 7-8 | 4-6 | 7 | 4 | 5 |

| Lack of information on sales markets | 6 | 8-9 | 6-7 | 5 | 9 | 8 | 9 | 6-7 |

| Long payback periods | 10 | 3 | 8 | 10 | 4-6 | 3 | 6-7 | |

| High cost of innovation | 7 | 5 | 9 | 6 | 7 | 4 | 3 | 2 |

| Underdevelopment of the technology market | 8 | 10 | 6-7 | 9 | 10 | 11 | - | 8 |

| Underdevelopment of innovation infrastructure | 9 | 12 | 10 | 7-8 | 11 | 12 | 12 | 9-11 |

| Lack of information about new technologies | 11 | 13 | 11 | 11 | 13 | 13 | 11 | - |

| Lack of financial support from the state | 12 | 8-9 | 12 | 13 | 8 | 9 | 2 | 3 |

| Weak cooperative ties | 13 | 11 | 13 | 12 | 12 | 10 | 13 | 9-11 |

In order to compare the results with other studies on Russian data, we included data of a paper in the table (Kuznetsova & Roud, 2011) and statistical data (innovation, 2013).

The eighth column presents the rating of the factors limiting the innovative activity of companies, compiled on the basis of the survey of specialists of the Higher School of Economics (HSE) in 2011 and in the final, ninth column of the table the official statistics are provided.

As can be seen from the data in Table 1, the lack of own funds actually serves as the main constraint for the development of high-tech business. Unexpected was the fact that for the high-tech business in Siberia in 2012 the main barrier to development was the deficit of highly qualified personnel and the lack of financial resources shifted to the second place in the rating of barriers. The lack of financial support from the state, the high cost of innovations, which are in the studies of the Higher School of Economics at the second and third places in the rating, are at the bottom of the rating for Siberian companies.

It can be assumed that small high-tech companies do not expect financial support from the state and its absence is not a significant barrier to development.

Thus, the lack of domestic financial resources is the most significant limiting factor at the stage of formation and the second most important in the development stage of high-tech business.

External Sources of Financing of High-tech Companies

The specifics of high-tech companies are connected with such features as a high share of research and development costs, uncertainty of the prospects for new products and technologies, the length of the period between the implementation of research and the commercialization of their results that severely limit the opportunities for small and medium-sized companies to operate at their own expense. In scientific publications, the field for discussions remains the definition of which sources of capital contribute to the growth and development of knowledge-based business, while research focuses primarily on comparing bank lending and venture investment.

According to the adherents of venture financing, for small, high-tech companies with remote and uncertain cash flows, the inability to use intangible assets as collateral, high risks, bank loans and other forms of debt capital are unsuitable sources of financing. In addition, banking professionals do not have enough experience to assess the future prospects of the commercialization of innovative technologies and products. From this point of view, venture investments are more adequate to the nature of innovative companies. Developed countries more often use share capital in the form of direct or venture investments, providing companies with not only cash, but also expertise, advice and other non-monetary assistance. A number of studies provide empirical evidence that attracting venture capital is becoming a major factor in the growth of high-tech businesses (Brierley, 2001) (Funding, RAWI, 2008)

Advocates of bank lending can benefit from the results of a large-scale survey of the business climate and enterprise performance (BEEPS V, surveyed more than 11,000 companies), which examines the impact of bank lending opportunities on innovative behavior of companies in transition economies (EBRD., 2014). It shows that access to a bank loan can really contribute to innovative development. In firms secured by credit, the probability of innovation is approximately 40% higher than in firms that do not have access to credits.

The few, but even more valuable, studies of the capital structure of Russian high-tech and innovative companies (Grasmik, 2008; Zasimova, 2008) confirm the importance of bank financing as an additional financial resource, after own funds and state budgets. According to statistics (Russia, 2015), in the structure of investment sources bank lending in recent years is about 10%, which is not comparable with the level of developed countries.

In an interesting study (Bircan & De Haas, 2014), based on data on 4,200 Russian companies, it was shown that banks play a decisive role in stimulating technological development in developing economies. The authors establish a causal chain: The conditions of the local credit market companies' access to credit resources the innovative activity of these companies.

In conducting our survey, based on respondents' answers, six groups of funding sources were identified that companies used. These are own funds (funds of the company's founders and income from operations), partner funds (partner loans, co-financing of the project, other forms of cooperation, often informal), grants and other forms of gratuitous financing, state financing, including state order, bank loans and Other financial organizations, venture investors.

Since enterprises could use several channels of financing, the most significant sources to which firms are addressed first of all have been highlighted the answers and a further sequence of funding sources is determined by the frequency of their use.

As expected, most of our sample companies used their own funds as the main source of financing, both at the stage of formation and in the course of further development. In our sample, 90% of companies used their own funds and one source of external financing. Only 10% of companies have access to more than one source of external financing. In the early stages of the life cycle, this source was primarily money from various business partners, then, in terms of prevalence, bank loans and state budget funds were used. The share of grants and other forms of gratuitous support, although small, is of great importance for the development of small high-tech businesses.

Direct participation in the capital in the form of venture investment was used by five companies from our sample. This is a very high result by the standards of the Russian market. One of the companies received financing at the stage of creation, the rest-at the stage of development, to expand production. The first company produces nano-products, the two following companies operate in the field of biotechnology and three more companies are developing information technologies. This confirms the well-known thesis that venture capital is prone to investing in high-tech industries with high growth rates, including nano-, bio- and information technologies.

Looking ahead, we point out that all companies that received venture capital financing saw the appearance of new share issues (IPOs) and/ or the sale of shares to a strategic investor as options for future development, which is the standard way out for venture capital. Up to now, none of these companies have entered the IPO, which is quite natural and understandable in the context of the economic downturn observed in Russia. We believe that this does not mean refusing to attract different forms of new share capital under more favorable macroeconomic conditions.

By 2012, compared to 2009, the share of domestic resources has decreased and the use of bank loans and state budget funds and grants have increased as external sources of financing. It is important to note that in the companies of our sample there is a simultaneous increase in public and private financing. The increase in the role of public funding, noted in the period from 2009 to 2012, was positively interpreted in other studies. In particular, in work (Russia., 2007), the ongoing expansion of state participation in financing high-tech and innovative companies is positively assessed, which is accompanied by "symmetrical co-financing" from the private sector.

The structure of the sources of financing presented in Table 2 is largely forced; it has formed under the influence of many circumstances, a significant part of which is outside the sphere of competence of the leaders of small technological business. In this regard, particular interest was aroused by companies' answers to questions about what sources of financing they are going to attract in the future, their accessibility and attractiveness.

| Table 2 The Percentage of Companies that Use Separate Sources of Funding |

||||

| Sources of financing | 2009 | 2009 | 2012 | 2012 |

| Formation | Development | Formation | Development | |

| Own funds | 83.1 | 79.7 | 80.0 | 71.1 |

| Partner funds | 32.2 | 22.0 | 33.3 | 26.7 |

| Grants | 5.1 | 6.8 | 8.9 | 13.3 |

| State financing and state order | 11.9 | 11.9 | 15.6 | 24.4 |

| Bank loan | 20.3 | 33.9 | 17.8 | 44.4 |

| Venture fund | 0.0 | 3.4 | 2.2 | 4.4 |

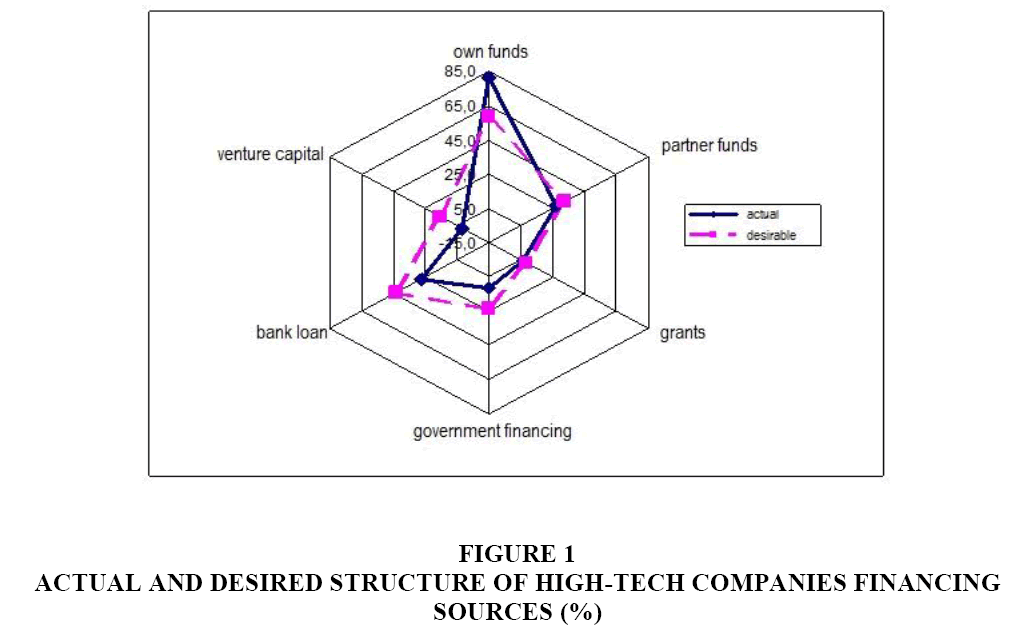

In the first round of the survey, the companies demonstrated a discrepancy between the actual and the desired financial structure (Table 3 and Figure 1). Note that questions about the availability and attractiveness of various financial sources were almost identical answers-what is available becomes attractive. Or, perhaps, as far as it is available, so it is attractive.

| Table 3 Actual and Desired Structure of High-Tech Companies Financing Sources (%) |

||

| Financing sources | Financing Structure | |

| Actual | Desired | |

| Own funds | 81.4 | 58.6 |

| Partner funds | 27.1 | 32.5 |

| Grants | 5.9 | 8.7 |

| Government funding | 11.9 | 23.9 |

| Bank loan | 27.1 | 43.5 |

| Venture capital | 1.7 | 15.2 |

Thus, companies are seeking to expand the use of external sources of financing, with the most attractive source being bank loans, followed by the funds of various partners, budget funds, venture capital and grants. The discrepancies between the actual structure and the desired one are quite significant-the companies would like to almost double the share of state funds, more than half, increase the share of bank loans and almost 9 times-attracting venture capital. At once we will make a reservation, which effect of a low base has such growth of appeal of the venture capital.

The results obtained by us are in complete agreement with a number of other papers. Growth in public financing as a prerequisite for the establishment and development of a high-tech sector in transition economies is noted in the work (EBRD, 2014) and there is also shown a positive impact of the availability of bank lending on the growth of innovative companies in developing economies.

In recent years, there have been evidences of the proliferation of new practices of attracting financial resources by high-tech small companies. The most famous was crowd-funding and crowd-sourcing. In our sample there are no companies that would have resorted to that option of investment, which does not mean that it has no prospects for development in Russia.

Sources of Financing and Stages of the Company's Life Cycle

It is believed that an important characteristic that influences the company's financial behavior is its age, measured as the number of years since the company was registered as a legal entity. New firms tend to be less transparent than the more mature ones, due to the short history of their activities. They have low creditworthiness and high risk of bankruptcy. Typically, young companies also lack the knowledge and experience necessary to attract external sources of funding. Firms that are longer on the market are more mature, accumulate social capital and establish partnerships with potential sources of financial resources and thus acquire the ability to use a greater number of financing sources.

To test these assumptions, we performed a correlation analysis between the age of the companies in our sample and the number of funding sources that were used and did not find a significant relationship between these characteristics.

We also used assessments of the significance of interactions with banks and other financial institutions and the readiness to develop these interactions in the future. In general, our high-tech companies did not value the importance of banks and financial institutions as important business partners, placing them in the second half of the partners rating, nevertheless, about 20% of companies consider it important to expand relations with banks in the future.

But even in this case, the correlation analysis did not reveal the relationship between the assessment of the significance of interaction with financial institutions and the number of external financial sources that were used by the companies.

However, significant differences in the structure of financing were found between the stages of the life cycle of companies, in which the periods of formation and development were analysed.

As the companies mature and advance along the life-cycle curve, the share of domestic sources decreases in the financing structure, the share of partners decreases significantly and the share of bank loans increases significantly and the possibility of attracting grants also increases.

Thus, we found that the structure of the used and available sources of financing depends on the stage of the company's life cycle, which in general does not completely coincide with the age of the company.

Of course, we have considered only certain peculiarities of financial behavior of high-tech companies. As evidenced by many empirical data, the scale, condition and activities of the financial and stock markets, primarily the venture capital market, have a strong influence on the creation and further development of small business based on high technologies. As the publications based on the data of the European countries show, the high rates of the emergence of new companies, especially in industries with a large share of the costs of research and development, can in particular be explained by the use of significant funding from venture capital funds.

Unfortunately, at present, in the structure of financing of Russian innovative companies, venture capital occupies about 0.1%, which does not allow considering it as a significant source of development, at least in the coming years.

In most countries, small business in general and high-tech business in particular, receives various forms of support from government agencies, various specially created organizations and also enjoys tax, tariff and other preferences.

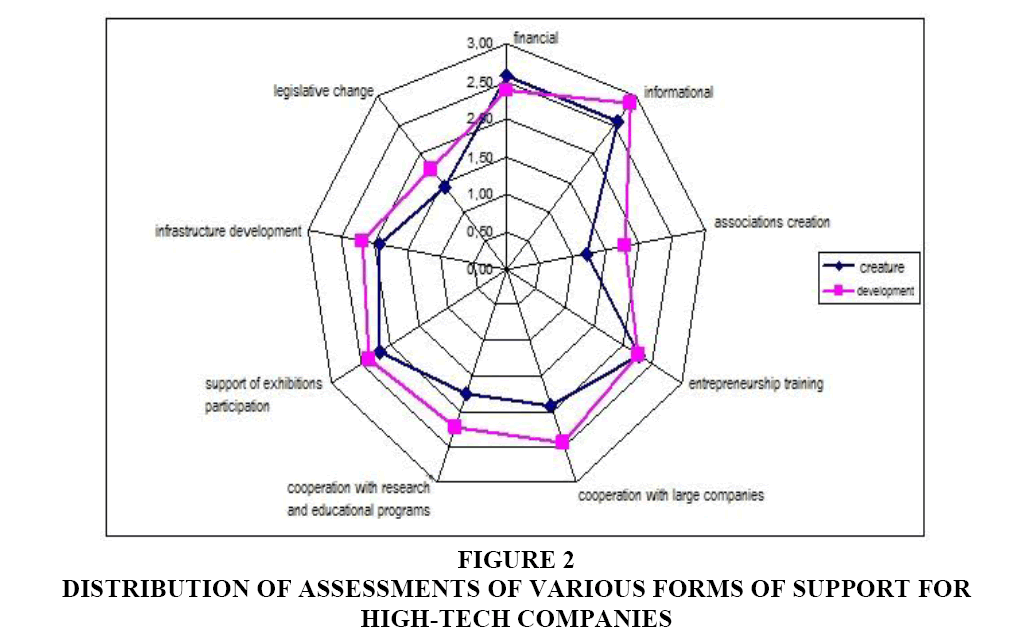

What support measures are required by our high-tech companies? Below in Figure 2 the distribution of assessments of the various forms of support is given.

As it was mentioned earlier, lack of own funds and deficit of qualified personnel are the most significant limitations for the development of high-tech companies, however, when assessing support measures for high-tech companies, an additional non-financial factor has emerged-information support. As the development progresses, companies more highly appreciate the possibility of obtaining support, especially the various forms of cooperation with other participants of the local innovation and production system. For the development of small and medium-sized companies based on high technologies and innovations, information support is most important-they need information signals about state plans and priorities, information about new technologies and market trends. Financial support remains an important factor in development, but is moving to second place (Table 4).

| Table 4 Prospects for the Future of High-Tech Companies, Companys’ Responses (%) |

||

| Options for the future of the company | 2009 | 2012 |

| Preservation of today's status | 71.4 | 64.4 |

| Exit from business | 24.5 | 2.2 |

| Transfer of business to family members | 12.2 | 11.1 |

| Sale of business to a strategic investor | 10.2 | 15.6 |

| Entering the IPO (Initial Public Offering) | 6.1 | 17.8 |

| Expansion of business and further growth of the company | 10.2 | 20.0 |

In conclusion, we will present the answers of the heads of high-tech companies to the question of how they see the future of their business.

The overwhelming majority of managers assume that little will change in the activities of the companies they lead, but there are other options. The expansion of the scope of activity was assumed by approximately 16% of respondents in 2009 (through IPO or business expansion) and almost 40% of companies in 2012. Recall that in 2009, the manifestations of the crisis were vividly felt, while 2012 was quite successful for the Russian economy.

Nearly half of the respondents in 2009 expected the future of the company's termination, its sale or transfer to others and slightly less than 30% of survey participants in 2012. In general, in 2012, compared to 2009, high-tech companies are much more optimistic-the number of those who are about to wind down the business has decreased, the number of companies that are confident in the prospects of development by expanding production, developing new products and entering new markets has doubled. Among the companies that used a variety of sources of financing, 60% expect the maintenance of the current state and 30% are confident in the future development and expansion of business. Almost 20% of companies considered in the future the option of implementing an IPO, which can serve as evidence of their confidence in their investment attractiveness and growth prospects.

Conclusion

The present study investigated the financing peculiarities of the structure of small and medium-sized high-tech and innovative companies. The empirical base of this study was the survey data of small and medium-sized high-tech and innovative companies located in the city of Novosibirsk, the Russian Federation. The main findings of this study can be summarized as follow:

1. Limited financial resources is the main obstacle to the formation and early growth of high-tech and innovative business. The specificity of high-tech business (high costs of research and developments, a long period of bringing products to market, high technological and market risks) increases the riskiness of investments in such companies. In Russia, the situation is exacerbated by the closeness and opacity of companies, the low level of protection of intellectual property and the low level of trust between market participants. External sources of financing play a subordinate role, both because of the peculiarities of the nature of high-tech companies and because of the insufficient development of financial markets. The state to some extent replaces the failures of financial markets, providing financial support to companies.

2. Over the time of observations (between 2009 and 2012), there have been positive changes in the structure of sources of financing for high-tech companies. Own funds were and remain the main source of financing, in second place in 2009, there were partner funds, on the third-bank loans and on the fourth-public funds. In 2012, loans from banks came second, followed by government budgets and partner funds. At the stage of business formation, changes in the structure are insignificant: The share of own funds and bank loans has decreased slightly, state participation in financing companies has increased, both due to grant support and due to expansion of government purchases. At the development stage, the changes are more visible: The share of domestic sources of financing has decreased and the role of banks and public funds has significantly increased.

3. As the companies mature, they accumulate experience of interaction with various external sources of financing and gain access to a wider range of sources of investment. Thus, the more mature stage of the company's life cycle is associated with a more diversified structure of capital. At the same time, the hypothesis about the relationship between the age of the company and its access to financing was not confirmed.

The observed changes in the structure of financing of high-tech companies can be interpreted in accordance with both the provisions of the hierarchical theory of capital structure and the theory of innovation systems. From the perspective of hierarchy theory, companies prefer to use their own funds primarily to reduce the risks of dependence on creditors and unwillingness to dilute capital, in the event of a lack of own funds, companies turn to debt sources (bonds, loans) and, lastly, attract new owners through direct investments Or issue of shares and similar financial instruments. The concept of innovative systems less rigidly postulates the preference of certain financial sources for financing the development of high-tech and innovative businesses, shifting the focus of attention from the motivations of owners and managers to the conditions and features of the innovation system in general, the national and regional characteristics of financial markets and their interactions with different types of firms.

The problems of financing the development of high-tech business cannot really be separated from a more general system of innovations in general. There are common problems in financing high-tech and innovative business (under any institutional conditions), which are related to the long-term nature of the effects and high uncertainty of the commercial prospects for the development of companies; A high share of intellectual assets and a low share of tangible assets, difficulties in assessing the prospects for the commercial success of a new business, the frequent uncertainty about new product markets, the asymmetry of information about technologies and products between the owners of the company and investors, etc. At the same time, the ways of solving the problems of financing differ-the systems of financing innovations are closely related to the prevailing model of financial and stock markets, the legal system, the corporate governance system and so on. The advantages of the high-tech business financing model based on venture capital, common in the Anglo-American system, do not work in the continental model. According to one authoritative expert in this field (Hughes, 2014), more concentrated and regulated financial systems dominated by banks (the continental model) provide more favorable conditions for the development of high-tech business. Currently, Russia is forming a financial system that is closer to the continental model, more common with European countries, which suggests an increase in the role of bank lending as a source of high-tech business financing.

Of course, expanding the sources of financing through the development of financial and stock markets is necessary, but it is not enough to stimulate the creation and support of the development of the high-tech sector of the Russian economy. Systemic measures are needed to improve the general business environment, increase the favour of the institutional and regulatory environment, as well as special measures of tax, customs, innovation and industrial policies that take into account the specifics of high-tech and innovative businesses.

References

- Ayyagari, M., Demirgüç-Kunt, A. & Maksimovic, V. (2011). Firm innovation in emerging markets: The role of finance, governance and competition. Journal of Financial and Quantitative Analysis, 46(6), 1545-1580.

- Bircan, C. & De Haas, R. (2014). Bank Lending and Firm Innovation: Evidence from Russia: Mimeo.

- Brierley, P. (2001). The financing of technology-based small firms: A review of the literature.

- Carlsson, B., Jacobsson, S., Holmén, M. & Rickne, A. (2002). Innovation systems: Analytical and methodological issues. Research Policy, 31(2), 233-245.

- Deakins, D. & North, D.J. (2013). The role of finance in the development of technology-based SMEs: Evidence from New Zealand. Journal of Entrepreneurship, Business and Economics, 1(1/2), 82-100.

- Development, F.O.I. (2008). Comparative review of the experience of UNECE countries in the field of financing in the early stages of enterprise development. Petersburg.

- Dezhina, I. & Saltykov, B. (2005). The establishment of the Russian national system and the development of small business. Problems of Forecasting, 118-128.

- EBRD. (2014). Financing of innovation. Report on the transition process for 2014.

- Grasmik, K.I. (2008). Small high-tech enterprises in the Russian economy: State, development problems. Journal of Creative Economy(4), 54-61.

- High-tech, T.S.O. (2016). The share of high-tech and knowledge-intensive industries in the gross of the domestic product 2011-2015. Rosstat of the Russian Federation. Moscow.

- Hochberg, L.M., Kuznetsova, T.E. & Agamirzyan, I.R. (2013). From stimulating innovation to growth on their basis. In: Strategy-2020: A New Model of Growth. Book 1 (edn. Mau, V.A., Kuzminova, Ya.I.). House "Delo". Moscow.

- Hughes, A. (2014). Capital markets, innovation systems and the financing of innovation. In: The Oxford Handbook of Innovation Management (Ed. Dodgson, M., Gann, D.M., Phillips, N.). Oxford University Press. London.

- Index, O. (2012). Entrepreneurial climate in Russia.

- Innovation, I.O. (2013). NIU Higher School of Economics. Moscow.

- Isom, C.J. & Jarczyk, D.R. (2009). Innovations in small business: Drivers of Change and Value. Ceteris, Inc.

- Kaneva, M. & Untura, G. (2014). Diagnostics of innovative development of Siberia. Regional Research of Russia, 4(2), 105-114.

- Khorasani, S.T. & Almasifard, M. (2017). Evolution of management theory within 20 century: A systemic overview of paradigm shifts in management. International Review of Management and Marketing, 7(3), 134-137.

- Khorasani, S.T., Maghazei, O. & Cross, J.A. (2015). A structured review of lean supply chain management in health care. Proceedings of the International Annual Conference of the American Society for Engineering Management.

- Kravchenko, N.A., Kuznetsova, S.A., Yusupova, A., Jithendranathan, T., Lundsten, L.L. & Shemyakin, A. (2015). A comparative study of regional innovative entrepreneurship in Russia and the United States. Journal of Small Business and Enterprise Development, 22(1).

- Kuznetsova, T. & Roud, V. (2011). Faktory effektivnosti i motivy innovatsionnoi deyatel’nosti rossiiskikh promyshlennykh predpriyatii [Efficiency Factors and Motivations Driving Innovative Activity of Russian Industrial Enterprises]. Foresight-Russia, 5(2), 34-47.

- Law, F. (2014). Federal Law of December 31. On Industrial Policy in the Russian Federation, No. 488-FZ.

- Medovnikov, D.S., Rozmirovich, S.D. & Oganesyan, T.K. (2015). Candidates for champions. Features of Russian fast-growing technology companies, their development strategies and the state's ability to support the implementation of these strategies. Proceedings of the V International Scientific Conference on the organization of production. REC "Controlling and managerial innovations" MSTU. N.E. Bauman; Higher School of Engineering Business. Moscow., 394-484.

- Myers, S.C. & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics,13(2),187-221.

- Oakey, R.P. (2003). Funding innovation and growth in UK new technology-based firms: Some observations on contributions from the public and private sectors. Venture Capital: An International Journal of Entrepreneurial Finance, 5(2), 161-179.

- Revest, V. & Sapio, S. (2010). Sources of finance for technology-based small firms: A review of the empirical evidence. FINNOV project document. European Union. Brussels.

- Russia, I.I. (2015). Rosstat. Moscow.

- Russia., D. (2007). Harnessing regional diversity. European Bank for reconstruction and development. EBRD publications.

- Statistics, E. (2015). High-tech statistics economic data.

- Xiao, L. (2011). Financing high-tech SMEs in China: A three-stage model of business development. Entrepreneurship and Regional Development, 23(3-4), 217-234.

- Zasimova, L.S., Kuznetsov, B.V., Kuzyk, M.G., Simachev, Y.V. & Chulok, A.A. (2008). Problems of transition of the industry to the path of innovative development: Microeconomic analysis of the behavior of firms, the dynamics and structure of demand for technological innovation Series.Scientific reports: Independent Economic Analysis. MONF. Moscow(201).