Research Article: 2021 Vol: 25 Issue: 1S

Sovereign Funds and Their Role in Fiscal Policy / Iraq Case Study

Salim Swadi Hammood AL-Mohammedawi, Imam Ja'afar Al-Sadiq University

Faisal Zaidan Sahar, Imam Ja'afar Al-Sadiq University

Ali .H.N. Bnilam, Dijlah University College

Citation Information: AL-Mohammedawi, S.S.H., Sahar, F.Z., & Bnilam, A.H.N. (2022). Sovereign funds and their role in fiscal policy / iraq case study. Academy of Accounting and Financial Studies Journal, 26(5), 1-13.

Abstract

The Importance of research from the significance of sovereign funds and the role they play in financial policy, as there are successful experiences in many countries of the world through the use of sovereign funds as a stabilization tool and an investment tool that generates financial returns for the state; Aim of this research getting to know the knowledge building of sovereign funds and financial policy, through theoretical framing. As well as analyzing the impact of the existence of a sovereign fund on the current and alternative fiscal policy. The Problem lies in the extent to which sovereign funds can contribute to supporting the financial policy in Iraq? The Hypothesis Establishing a sovereign fund in Iraq that will have an impact on fiscal policy, by activating its role in restructuring the Iraqi economy and influencing its development and investment paths. The research reached the most important Result Sovereign funds have an important role in absorbing external and internal shocks, as it is an effective tool in the hands of the financial and monetary authorities, if they are established on solid foundations and solid rules.

Keywords

Sovereign Funds, Fiscal Policy, Public Revenues Expenditures &Loans, Taxes and Fees.

Introduction

Iraq has been known for decades before the emergence of oil as a country with diverse resources and the private sector has an important and pivotal role in the development process, and when the modern government was established in the twenties of the last century, the government proceeded to issue legislation that supported the private sector, including Industrial Projects Law No. 114 for the year 1929 , which contributed to encouraging Iraqi investors, and in the year 1940 the Industrial Bank Law was issued, which is a key factor in encouraging industrial movement at the level of the local economy, which led to the diversification of industrial production such as the manufacture of oils, textiles and leather, and strengthened the role of the private sector in the development process In 1950, the private sector contributed 80% of the gross domestic product (GDP) (Al-Saadi, 2005).

Industry and agriculture play an important role in diversifying the Iraqi economy, but after the discovery of oil in the territory of Iraq, he contracted a serious disease called Dutch disease, which shifted the government’s interest from developing the private sector and other sectors to interest in discovering, extracting and selling crude oil only, and the government guaranteed financial revenues from oil export Crude oil, and now drawing its policies and plans on the basis of these revenues, it was possible to exploit this wealth towards a rapid transformation from an economy in the process of progress to an advanced economy (Al-Hassan, 2013; International Working Group, 2017; Blundell-Wignall et al., 2008)

Literature Review

Fundamentals of Sovereign funds: The concept of Sovereign Funds: Sovereign funds are special purpose investment funds owned by the central government. The government puts sovereign funds at its disposal and manages them in accordance with an economic and investment policy, so it maintains assets, employs them, or manages them to achieve financial goals using investment strategies that include investing in financial assets (Truman, 2009; Simon Johnson, 2017; Steigum, 2012; Russell, 1821; International Working Group of Sovereign Wealth Funds, 2008). Foreign; the International Working Group has identified three main concepts for the concept of sovereign funds, as follows:

1. Concept in terms of ownership: Sovereign wealth funds are funds owned by the central government and local governments.

2. Concept in terms of investment: investment funds should include an investment strategy based on investing in foreign financial assets specifically, not including funds that invest in domestic assets.

3. Concept in terms of purpose and object: the sovereign fund is established by the central government for macroeconomic purposes, in order to invest government funds to achieve financial goals, there may be specific general goals for the public interest, allowing the fund to employ a wide range of medium and long-term investment strategies.

Types of Sovereign Funds: The publications of the International Monetary Fund confirm that there are three main types of sovereign funds, which are divided according to the following:

Sovereign funds according to ownership: Sovereign funds are divided according to ownership into local sovereign funds and international sovereign funds as follows:

1. Local Sovereign Funds: These funds are active within the local economy, working to employ surplus funds in the areas of available investment in order to achieve benefits for the local economy.

2. International Sovereign Funds: The funds of these funds are invested in foreign investments with the aim of not conflicting with the investments of local funds and also exploiting foreign investment opportunities.

Sovereign funds according to funding sources: These funds are classified according to funding sources into raw materials funds, trade balance surplus funds, general budget surplus funds, and funds financed with privatization proceeds, as follows:

1. Funds for raw materials (oil sovereign funds): They are funds established by countries exporting raw materials, especially oil, with the aim of exploiting these resources that are capable of accessing in the future.

2. Trade balance surplus funds (non-oil sovereign funds): Many countries that have achieved a non-oil financial surplus (in excess of the needs of local investments) have established these funds.

3. General budget surplus funds: Some countries seek to achieve a financial surplus in public budgets, and then transfer this surplus to a sovereign fund with the aim of achieving financial returns or returns from investing these funds.

4. Funds financed by privatization proceeds: Many countries have developed public sector privatization programs, which led to obtaining large financial returns. In France, the proceeds of the privatization program amounted to nearly (24) billion dollars. Countries' uses of these revenues vary; some of them direct them directly to finance the budget deficit. General of the state, or financing the restructuring of the economy in line with the control of inflation rates.

Sovereign funds according to the purpose of their establishment: Sovereign funds are divided according to the purpose of their establishment as follows:

1. Central Financial Stability Funds: their main objective is to protect the public budget and the local economy from fluctuations in commodity prices.

2. Future Generations Savings Funds: aims to transfer non-renewable assets to more diversified portfolios, and eliminate Dutch disease.

3. Reserves investment institutions: They are established in order to increase the return on reserves.

4. Emergency pension reserves funds: They are funds that are not associated with explicit pension obligations in the state's general budget.

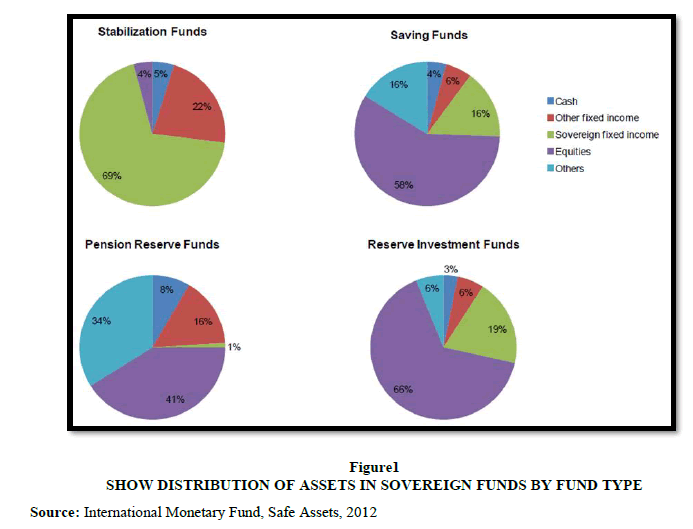

SWFs are usually distinguished on the basis of their stated political objectives, the asset allocation to which they are based. Although there are many SWFs with multiple objectives, the types of SWFs can be distinguished according to the distribution of assets Figure 1.

Economic Importance of Sovereign Funds: Sovereign funds have an important role in macroeconomic management and financial stability in the world, as the work of sovereign funds is closely related to central finance (through financing and withdrawal rules), monetary policy (through liquidity conditions), external accounts (through exchange rate changes), in The global financial crisis in (2008) Sovereign wealth funds were affected by changes in global financial markets with a high degree of response (Das et al., 2010; Iraq: Selected Issues, 2013).

For example, sovereign wealth funds (providing funds) that invest heavily in stocks in the money markets witnessed large losses due to the sharp decline in those markets, but they recovered most of the losses in subsequent years by diversifying the investment portfolio, investing in long-term projects with low risks, and getting out of the financial turmoil. And Sovereign funds have an important role in macroeconomic management, there should be close coordination with other government institutions, the assets of sovereign funds and the returns they generate can have a significant impact on central financial positions, monetary conditions, external accounts and linking the balance sheet with the rest of the world (Truman, 2009; Iraq: Selected Issues, 2013).

The concept of fiscal policy: It is the actions taken by the government in order to achieve the general financial balance, using the important financial means such as taxes, fees, public expenditures and public loans, in order to influence the macroeconomic variables, and reach the objectives of the general economic policy of the state. Fiscal policy is also defined as moving budget tools from expenditures and revenues to influence investment and achieve general economic goals. The Keynesian school defined it as the tools through which the state intervenes to direct the national economy and bring about clear changes, which leads to an increase in the volume of production, employment and economic growth rates. It is clear from the foregoing that the financial policy means the ability of the executive authority to manage its economic plans, by determining the sources of income and how it is spent and the trends of exchange that are more important than others, such as the wages of state workers, the completion of projects with the aim of achieving economic and social requirements, and controlling the paragraphs of budget activities between its operational and investment sides It represents the ability to control expenditures and revenues in a way that advances the objectives of economic and social development (International Monetary Fund, 2013; Simon, 2018; Snlmlelr, 1974).

Financial Policy Tools: The financial policy tools are as follows:

1. Taxes and fees: Taxes and fees represent monetary sums imposed by the state or one of the governmental authorities, obligatory, collected from the taxpayer once and for all for the purpose of achieving the economic and social goals that the state seeks.

2. Public loans: Previously, public loans represented an exceptional financial means, but in the current circumstances it has become a reality because most of the budgets of the world's countries have become in a state of deficit, so governments are forced to borrow annually. Countries do not resort to public loans unless they are motivated by a set of economic factors. These factors differ from one country to another, from one economy to another. These loans may be either to fill the deficit caused by the increase in expenditures over the available revenues, or to finance development projects in the country that are incapable of internal revenues. From covering its expenses or the loan is used to cover the state's increasing expenditures in periods of depression, and of course the loans have social, economic and even political effects.

3. Public Expenditures: It is one of the most important means of financial policy used through which the volume of aggregate demand in the national economy can be increased. Therefore, it uses public spending to influence the volume of economic activity, by increasing or decreasing according to the existing situation in the national economy.

4. Budget Deficit: a fiscal policy used by the state to increase the volume of public spending, as the state resorts to issuing cash in order to finance the projects planned for the budget. This process hides behind an expansionary fiscal policy to increase the volume of public spending and stimulate aggregate demand.

Research Methodology

1. Research Instrument: The descriptive approach and the inductive approach were used to extrapolate the data available for research, with the aim of achieving the research objectives.

2. Research Model: There is a set of dependent variables and one independent variable in this model.

3. Dependent Variables: Fiscal Policy (Revenues, Expenditures, Loans, Taxes and Public Fees), the Development Fund for Iraq and the independent variable: Sovereign Funds.

4. Data Analysis Method: The data is analysed using Excel programme to analyse financial policy data.

Descriptive analysis: Sovereign funds and their role in the financial policy in Iraq; we will work on analysing sovereign funds and their role in some variables of fiscal policy at the level of the Iraqi economy and as follows:

Public Expenditure: Through the following table we will notice General Budget of Iraq recorded Surplus of 1.8 Trillion Dinars1, which constituted 1% of the gross domestic product at current prices. Actual Revenues Increased by 42% compared to 2016 by 34% of the GDP at current prices. Public Expenditure Actual also recorded an Increase of 12.6% compared to the year 2016 by 33% of the GDP at current prices Table 1.

| Table 1 Show Evolution Of Actual Revenues And Expenditures Of General Budget For The Years (2015-2017); Amounts Are Billion Iraqi Dinars (Iqd) |

|||

|---|---|---|---|

| Items | 2015 | 2016 | 2017 |

| Actual Revenue | 66,470.30 | 54,409.30 | 77,335.90 |

| Growth Rate | 37.1 | 18.1 | 42.1 |

| Actual Expenditure | 70,397.50 | 67,067.40 | 75,490.10 |

| Growth Rate | 38 | 4.7 | 12.6 |

Foreign Trade: Through the following table we will notice a significant increase in the volume of foreign trade, as the Growth Rate in it reached 27.8% by an amount of 114 Trillion Dinars, compared to 89.2 Trillion Dinars for the year 2016. This increase is due to the rise in both exports and imports. Exports increased by 39.6% to record an amount of 68.2 trillion dinars, compared to 48.8 Trillion Dinars for the year 2016, as a result of the increase in the average price of a barrel of oil in global markets to 49.3 Dollars compared to 36 dollars for the year 2016. Imports also increased by 13.5% from the previous year, to record an amount of 45.9 Trillion Dinars, compared to 40.4 trillion dinars for the year 2016 Table 2.

| Table 2 Show Evolution Of The Volume Of Foreign Trade For The Years (2016, 2017); Amounts Are Billion Iraqi Dinars (Iqd) |

|||

|---|---|---|---|

| Items | 2016 | 2017 | Growth Rate |

| Foreign Trade Volume | 89,248.10 | ######## | 27.8 |

| Exports | 48,814.20 | 68,149.90 | 39.6 |

| Imports | 40,433.90 | 45,898.90 | 13.5 |

Taxes and Fees: Through the following table we will notice data indicates the development of tax revenues and fees for the years (2017, 2016), as the percentage of realized revenues increased. Income and wealth tax revenues achieved a growth rate of 40% in 2017 compared to 2016, while the growth rate of tax collection and production fees for the year 2017 it reached 179% and fee income also achieved a high growth rate of 56% compared to 2016 Table 3.

| Table 3 Show Evolution Of Tax Revenues And Fees For The Two Years (2016, 2017); Amounts Are Billion Iraqi Dinars (Iqd) |

|||

|---|---|---|---|

| Items | 2016 | 2017 | Growth Rate |

| Income and wealth Taxes | 3,229.50 | 4,533.80 | 40.4 |

| Commodity Tax & Production fee | 632.3 | 1,764.50 | 179 |

| Fees | 669.2 | 788.2 | 17.8 |

| Total of Tax Revenues and Fees | 4531 | 7,086.50 | 56.4 |

It is clear from the foregoing that the achieved growth rates showed through the announced financial statements such as the increase in actual revenues accompanied by the increase in expenses but at lower rates than revenues. It is also noted that the growth rates of the volume of exports are accompanied by the increase in imports, but at lower rates than on imports, as well as the high growth rate of tax revenues and fees (Al-Munif, 2009; Kamal, 2015; Kanaan, 1997; Kenaan, 2003; Ghadeer, 2010; Al-Salloum, 2010).

These results indicate the need to exploit these returns in a government sovereign fund that is under the management of the government represented by the Ministry of Finance. Accountability; The aim of establishing this fund is to exploit the abundance achieved from the annual financial returns, as well as to find a savings and investment means to be a catalyst and tributary factor in strengthening the state’s public revenues in the future without resorting to debt with loans.

The Development Fund for Iraq (DFI) and its role in fiscal policy:

An Introduction to the Development Fund for Iraq (DFI): The Security Council established the Development Fund for Iraq (DFI) in paragraph 20 of Resolution 1483 to spend its resources on humanitarian needs, reconstruction, disarmament, and public services, and it was extended in Resolution 1546 on 8 June 2004 and Resolution 1637 in 2005 and subsequent resolutions. Until the end of 2010, deposits are made in the Fund from the revenues of crude oil, petroleum products and natural gas, enjoying the necessary protection from judicial procedures against it. The Development Fund of Iraq receives 90% of the oil revenues included in the resource receipt account And 5% of the oil goes to the War Compensation Fund, the opening of an account to receive oil resources at the Federal Reserve in New York, and the accounts of the Iraqi Fund for Development; Resolution 1483, which created the Fund Mechanism (DFI), does not require opening accounts in a particular place. It was supposed to open accounts for it in the central banks of other countries, but that did not happen.This fund is subject to the supervision of the International Advice and Monitoring Board (IAMB) and appoints an impartial auditor to audit and dispose of the funds. In the year 2007, the Committee of Financial Experts was established and began its work on (1/4/2007), to be an alternative supervisory body for the International Council for Advice and Monitoring, which is currently supervising the expenditures of Iraqi public funds derived from the production and export of oil and petroleum products, which are deposited in an account opened in The Federal Reserve Bank of New York, based on UN Security Council resolutions issued after 2003 in the name of the Development Fund for Iraq, granted this account international immunity so that it would not be subject to seizure or confiscation as a result of international court decisions, which may be issued as a result of lawsuits and claims against the former regime.This committee consists of three original members whose head is the head of the Board of Supreme Audit. The other two members are independent financial experts with extensive experience in financial and accounting matters. The committee also consists of two other part-time financial experts to work as advisors to the members of the committee. This committee enjoys financial and moral independence, For the purpose of keeping it away from any pressures affecting the independence of its work; this committee publishes everything related to the expenditure of public funds by all ministries and government departments.

The Role of the Development Fund for Iraq (DFI) in fiscal policy: Iraq faces major challenges in fiscal policy after more than 30 years of sanctions and conflicts, which have led to dilapidated infrastructure and great social needs. Iraq needs to transform resource wealth into assets that support sustainable reconstruction and development, while adopting mechanisms to avoid macroeconomic cycles, fluctuations in natural resource revenues. Therefore, the role of the Development Fund for Iraq in fiscal policy will be determined as follows:

Directing Oil Revenues to the Local Economy: The Iraqi government plays the central role in directing oil revenues to the local economy. After the government obtains the revenues from Iraqi oil exports, it decides how much is spent for consumption and investment through government spending. The expenditure path has a significant impact on macroeconomic developments in the non-oil economy, macroeconomic stability, and the preservation of rights for subsequent generations. In line with the foregoing, the medium-term financial plan for Iraq should be compatible with financial solvency,and this entails evaluating whether the medium-term spending path is consistent with long-term financial sustainability, and is linked to the depletion of oil reserves based on Iraq’s oil wealth and exploitation, and then it should The medium-term fiscal framework decreed by the financial authority addresses macroeconomic weakness in the face of fluctuations in international oil prices, and with oil export revenues representing more than 90% of total government revenues, Iraq is highly vulnerable to oil price volatility, and the risk to the Iraqi economy and the federal budget is growing. In light of the limited export content of the trade balance, which is based on the sovereignty of the oil resource as a mainstay for exports, which in turn is affected by external shocks, moreover, the structure of Iraq’s budget is skewed towards current expenditures, making it difficult to adapt to ongoing revenue shocks by adjusting expenditures (General trends in central fiscal transparency, 2015; Bou Flaih, 2009; Kadi, 2009; Abdullah, 2010; Ali, 2018).

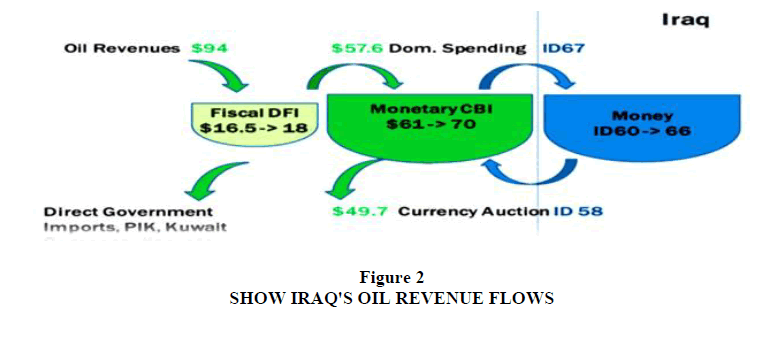

Accumulating Wealth in the Development Fund for Iraq: In Iraq, there is no important sovereign fund that can make it a tool for fiscal policy, but Iraq’s wealth is accumulated in an irregular manner that is not based on solid rules and solid foundations in the Development Fund of Iraq as financial reserves and in the Central Bank as cash reserves; as the reserves rose significantly for the years (2003-2013) to reach 70 billion dollars. The reserves are financed exclusively from oil revenues, which represent more than 90% of export revenues and government income, since Iraqi law prohibits government borrowing from the Central Bank of Iraq. The official international reserves do not play a role in financing the government. Oil revenues are financed by the Development Fund of Iraq and transferred in part to the reserves of the Central Bank of Iraq through government spending. Also, the local currency spent by the government increases the liquidity of the local currency in the economy, which in turn creates demand for foreign exchange Figure 2.

From figure above shows how Iraq's oil export revenues flow. Given the rise in the dollar, the volume of additional demand for foreign currencies is estimated at about (40-50%) of local government spending, assuming that as follow:

1. A large share of goods consumed by households is imported.

2. Consumer goods and durables are paid in dollars.

3. Most of the savings, with the exception of small business balances, are converted into dollars or transferred directly abroad due to the lack of confidence in the banking system and limited investment opportunities.

The international status of the Development Fund for Iraq: Through the following Table 4 we will notice data indicates that Iraq is at the end of the countries that have been able to accumulate important wealth that have been able to reduce the impact of shocks, on the basis of rules that have been built and foundations that have been implanted in the institutional environment, in order to take effective economic policies. These funds are effective tools, as Iraq has not taken any measures that could enhance the status of the Development Fund for Iraq.

| Table 4 Show Value Of The Assets Of Sovereign Funds In Some Countries Of The World For Year (2017) |

|||

|---|---|---|---|

| Country | Fund Assets (billion dollars) | Establishing | Funding Source |

| Norway | 954.07 | 1990 | Oil |

| UAE | 828 | 1976 | Oil |

| China | 813.8 | 2007 | Non-Commodity |

| Kuwait | 524 | 1953 | Oil |

| Saudi Arabia | 514 | 1952 | Oil |

| Malaysia | 34.9 | 1993 | Non-Commodity |

| Amman | 18 | 1980 | Oil and Gas |

| Bahrain | 10.6 | 2006 | Non-Commodity |

| Algeria | 7.6 | 2000 | Oil and Gas |

| Brazil | 7.3 | 2008 | Non-Commodity |

| Senegal | 1 | 2012 | Non-Commodity |

| Iraq | 0.9 | 2003 | Oil |

| Palestine | 0.8 | 2003 | Non-Commodity |

| Mauritania | 0.3 | 2006 | Oil and Gas |

Despite possessing a large wealth of oil, he could not exploit it efficiently. On the contrary, those policies were wasting natural resources. It is clear that Senegal established a sovereign fund in 2012 from non-commodified non-natural resources, during several years it became its sovereign fund Larger than the Iraq Fund, although Iraq established the Fund in 2003 and from oil resources. It is clear from the foregoing that the Iraqi Development Fund is not built on solid foundations that would make the Fund an important tool for developing and investing assets and a necessary tool for facing shocks.

Unilateral resources of the Development Fund for Iraq: The discovery of natural resources in a country suffers from laziness and slackness in the development of other economic sectors as a result of the wealth that has been discovered, which often loses that country’s price competitiveness, and the role of the tradable goods sector recedes, and then these undesirable effects are transmitted to the sectors Productivity, which hardens the production device and weakens its flexibility. On the other hand, the Dutch disease is not inevitable as a result of the discovery of natural resources, but rather it is the result of inefficient macroeconomic management, which has no counter-policies and reinforcing policies, nor does it have multiple dimensions, as it is limited to the short-term dimension. The discovery of natural resources may generate internal and external conflicts, weakness in state institutions, and the attendant corruption, bureaucracy, and lack of transparency, among others.

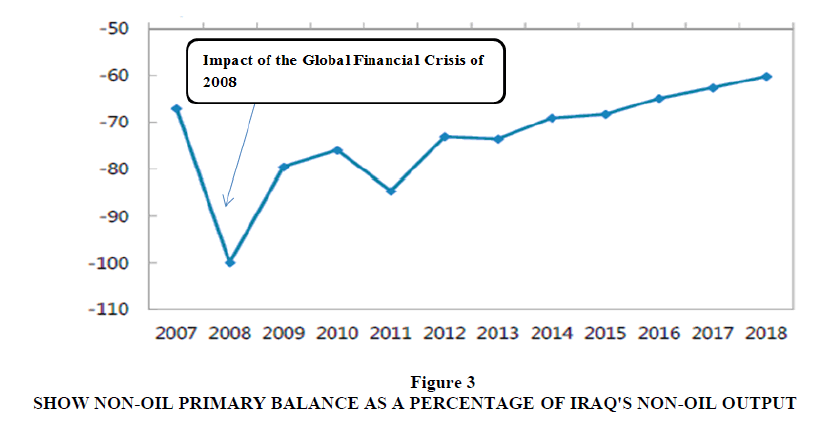

Development Fund for Iraq and its relationship to fiscal policy: Every action has a reaction, which is a fundamental rule that should be taken into account when building any development economic policy in any local economy, as this allows tracking the effects and a detailed analysis of the benefits and harms, so when this rule was absent when building the policy This has led to the absence of accurate diagnosis, traceability, and analysis of possible pros and cons. Finance in economic activity and through public expenditure, and the trend towards the increasing role of consumer spending, its low level of productivity at the expense of the decline in the role of investment expenditure, and the growing role of the link between public spending in its development field at the expense of the close link with the returns resulting from the natural resource Oil that dominates the tracks Economic activity, and its consequences for the economy in light of fluctuating demand for oil globally, which has had a negative impact on fiscal policy and The economy itself was affected by distortion, inconsistency and consistency among them Figure 3.

It is clear from the above figure that fiscal policy is unable to address the dependence on oil revenues. The non-oil primary balance suffers from a deficit of up to 60% of the non-oil GDP. The decrease in the balance deficit during the years (2014-2017) is In fact, it does not reflect any structural or structural reforms. Rather, it is the result of pressure on investment and current expenditures and an increase in taxes of all kinds without any short or long-term reforms. This is explained by the lack of accurate diagnosis of problems and the absence of important rules for building fiscal or monetary policy.

Results and Discussion

1. Analysis of the impact of the existence of a sovereign fund on the current and alternative fiscal policy: Analysing the impact of the existence of a sovereign fund, and knowing the current and alternative fiscal policy, through the following:

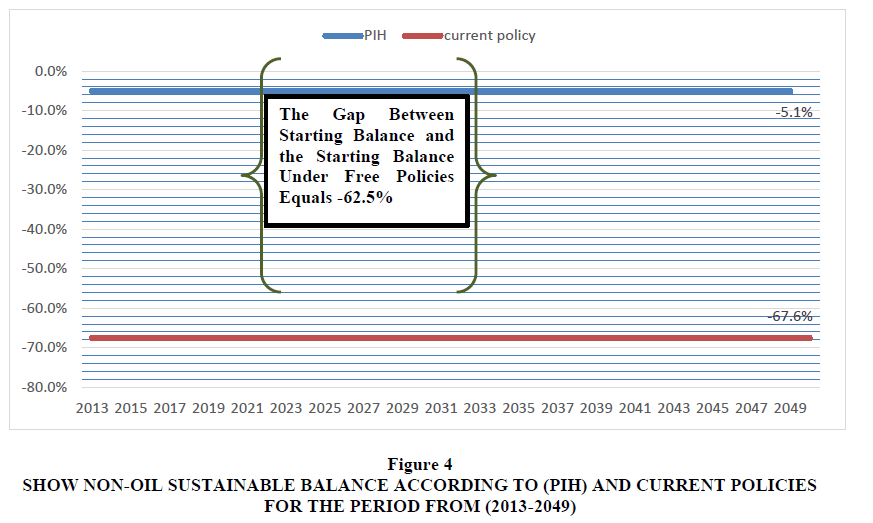

2. Building a predictive model using the permanent income hypothesis (PIH) of the current fiscal policy: this model states that the country bears a constant flow of consumption equal to the return on the present value of future natural resource revenues, while the export process is running at full capacity, the economic authority saves a large part of revenues to build a stock of non-oil assets, then we can evaluate the current fiscal policy according to this model.

The previous figure shows an assessment of the non-oil balance according to the current fiscal policies and the permanent income hypothesis (PIH), as the non-oil balance according to the current fiscal policies is -67.6% as a percentage of non-oil GDP, and using the fixed income hypothesis (PIH) the payable balance To continue, it should be -5.1% of non-oil output, in addition, there is a very large gap between the two balances of -62.5%, which means that the non-oil balance, according to current fiscal policies, is unsustainable and unable to withstand shocks, which is expected to rise Debt will be greatly increased, if the current policies continue on their current approach of extracting and exporting oil, then oil revenues are obtained to be spent on the consumer side, which represents the largest part, although the investment side is not efficient despite the presence of important investment allocations Figure 4.

Figure 4: Show Non-Oil Sustainable Balance According To (Pih) And Current Policies For The Period From (2013-2049).

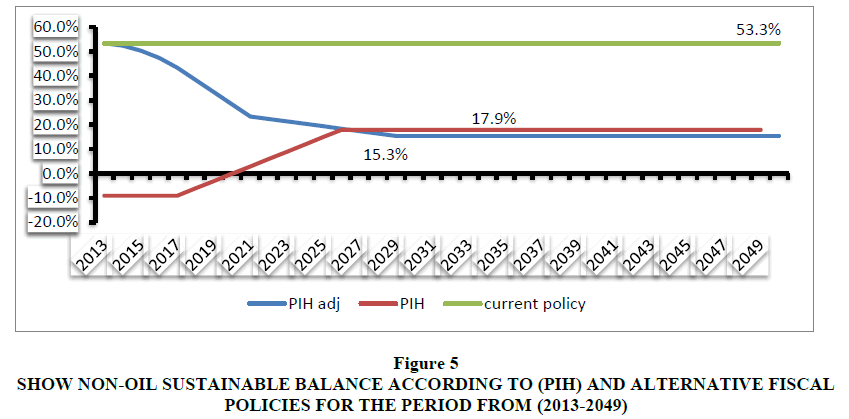

Building a predictive model using the permanent income hypothesis (PIH) for the alternative fiscal policy: The treatments that should be followed by the current financial policies may be of very long duration, which will result in the Iraqi economy large debts, then it should find a variety of economic policies that focus on The imbalances are all, thus it is possible to restore the balance between continuity and current pressures Figure 5.

Figure 5: Show Non-Oil Sustainable Balance According To (Pih) And Alternative Fiscal Policies For The Period From (2013-2049).

The previous figure shows the possible options for alternative policies, as it is noted that government spending according to the current fiscal policies amounts to 53.3% of non-oil output, while government spending according to (PIH) reaches its highest point at 17.9%, which means that expenditures cannot reach according to The current policies should be sustainable during all years of forecasting, and then those in charge of fiscal and monetary policy must adjust their positions in accordance with policies that address imbalances in four main sectors represented in the following:

1. Imbalances of the external sector

2. Imbalances of the real sector

3. Imbalances of the monetary sector

4. Imbalances of the financial sector

5. Imbalances of the labour market sector

This treatment is in accordance with short, medium and long-term fiscal and monetary policies, and the Sovereign Fund represents a fund supporting stability and investment, which represents the basis for addressing the aforementioned imbalances, which activates the trends of public expenditures and diversifies them sector ally in economic activity, and thus pushes the non-oil balance to sustainability. Establishing a sovereign fund, the public expenditures will be built on the basis of a fixed oil price, which absorbs external fluctuations, which generates stability in the public finances situation. This leads to addressing imbalances in the real sector, which means following economic diversification policies. In addition, the sovereign fund will work to adjust public expenditures (PIH adj), as it gradually decreases until it reaches 17.9% in (2027), which means that the financial balance The non-oil public sector will be sustainable in the year (2027), according to the alternative policy that takes into account the establishment of a solid sovereign fund, but the public expenditures are subject to A further decline until it reaches 15.3% in (2029), due to the fact that the private sector will take its expected leading role, due to the Sovereign Fund, which accumulates oil wealth and turns it into sustainable wealth through its efficient investments, and the economic diversification that occurs in light of activating the role of the Fund Sovereignty and stimulating the private sector will be another major reason for the decline in public expenditures in light of the expansion of the movement of economic activity.

Conclusion

1. Sovereign funds have an important role in absorbing external and internal shocks, as it is an effective tool in the hands of the financial and monetary authorities, if they are established on solid foundations and solid rules.

2. There is an upward trend in the growth rates of public revenues, taxes and fees for the years (2016, 2017).

3. The high reserves of the Development Fund for Iraq, and under the law of the Central Bank of Iraq, these reserves are far from government lending, for the purpose of meeting the requirements of economic development, in addition to the fact that those in charge of fiscal and monetary policy have not taken any measures that could enhance the position of the Development Fund for Iraq internationally.

4. Results of analysing the impact of the existence of a sovereign fund on the current and alternative fiscal policy, by building a predictive model using the permanent income hypothesis (PIH), that the sovereign fund that accumulates oil wealth and turns it into sustainable wealth through its efficient investments, and the economic diversification that occurs in light of Activating the role of the sovereign fund and stimulating the private sector will be another major reason for the decline in public expenditures in light of the widening movement of economic activity.

Acknowledgment

We, the researchers, extend our sincere thanks and gratitude to the management of both the Iraqi Ministry of Finance, especially the Accounting Department; and the Central Bank of Iraq for providing all data and information to help us establish this research.

1The word dinar is the monetary currency used in the State of Iraq

References

Abdullah, A.M. (2010). Sovereign Wealth Funds and their Role in Managing Oil Surpluses. Journal of Arab Economic Studies, 48.

Al-Hassan, A., Papaioannou, M.M.G., Skancke, M., & Sung, C.C. (2013).Sovereign wealth funds: Aspects of governance structures and investment management. International Monetary Fund.

Ali, A.I. (2018), The Internationalization of Iraq Under Chapter Seven of the Charter, Civil Dialogue, 15884.

Al-Munif, M. (2009). Abdullah, Sovereign Wealth Funds and their Role in Managing Oil Surpluses, Arab Energy Forum, Beirut – Lebanon.

Al-Saadi, S. Z. (2005). Oil wealth and poverty in Iraq: statistical adjustment of the government GDP estimates (1980–2002).Middle East Economic Survey (MEES),48(16).

Al-Salloum, A.R. (2010). Managing Sovereign Funds and Hedge Funds.

Blundell-Wignall, A., Hu, Y. W., & Yermo, J. (2008). Sovereign wealth and pension fund issues.

Indexed at, Google Scholar, Cross Ref

Bou Flaih, N. (2009). The Role of Sovereign Wealth Funds in Addressing the Global Financial and Economic Crisis, Arab Economic Research Journal - Cairo, 48.

Das, M.U.S., Mazarei, M.A., & Van Der Hoorn, H. (2010).Economics of Sovereign Wealth Funds. International Monetary Fund.

General trends in central fiscal transparency. (2015). A working paper issued by the International Monetary Fund.

Ghadeer, H. (2010). Fiscal and Monetary Policy and Its Developmental Role in the Syrian Economy, Publication of the Syrian General Book Organization - Damascus, Edition/1.

International Monetary Fund, (2013). Washington, D.C. July Mackenzie, Reverse the Curse.

International Monetary Fund, Safe Assets: (2012). Financial System Cornerstone Global Financial Stability Report.

International Working Group of Sovereign Wealth Funds. (2008). Sovereign Wealth Funds Generally Accepted Principles and Practices: Santiago Principles.

International Working Group. (2017). sovereign wealth funds-Generally accepted principles and practices. 27.

Iraq: Selected Issues, (2013). IMF Country Report No. 13/218.

Kadi, A.M. (2009). Sovereign Funds and the Current Global Financial Crisis, a conference on the global financial crisis and how to treat it from the perspective of the Western and Islamic economic system, Jinan University, Tripoli - Lebanon March.

Kamal, Y.M. (2015). The Jurisprudence of Monetary Economy, Edition 10th Dar Al-Sabouni – Cairo.

Kanaan, A. (1997). The Economics of Money and Financial and Monetary Policies, 1st Edition, Dar Al-Hassanin – Damascus.

Kenaan, A. (2003). Public Finance and Financial Reform in Syria.Al Reda Informatics Series.

Russell, E.J.R. (1821).The Source and Remedy of the National Difficulties: Deduced from Principles of Political Economy, in a Letter to Lord John Russell.

Simon Johnson, (2017). The Rise in Power of Sovereign Wealth Funds Review Finance and Development, Washington. 3.

Simon, J. (2018). The Rise in Power of Sovereign Wealth Funds Review Finance and Development Washington. 55.

Snlmlelr, L. (1974). Taxation and Economic Derelopment, A cases study of the suaan Khartoum University press.

Steigum, E. (2012). Sovereign wealth funds for macroeconomic purposes.

Truman, E.M. (2009). A blueprint for sovereign wealth fund best practices.Revue d'economie Financiere,9(1), 429-451.

Indexed at, Google Scholar, Cross Ref

Received: 01-Aug-2022, Manuscript No. AAFSJ-22-12404; Editor assigned: 02-Aug-2022, PreQC No. AAFSJ-22-12404(PQ); Reviewed: 16-Aug-2022, QC No. AAFSJ-22-12404; Revised: 22-Aug-2022, Manuscript No. AAFSJ-22-12404(R); Published: 29-Aug-2022