Research Article: 2021 Vol: 25 Issue: 5

Specificity of Functioning of Financial Systems of Arab Countries

Hassan Ali Al-Ababneh, Irbid National University

Eyad. M. Malkawi, Irbid National University

Olha Popova, Donetsk National Technical University

Elena Tomashevskaya, Donetsk National University of Economics and Trade named after Mikhail Tugan-Baranovsky

Svitlana Popova, Otto von Guericke University of Magdeburg

Abstract

Transformation of the global financial system leads to a review of existing approaches to the management of financial institutions in all countries of the world. The purpose of the study is to determine the specifics of the functioning of the financial system of the Arab countries during crisis shocks and stages of economic development. The main objective of the study is to identify and search for new solutions when changing priorities in the financial and economic development of the Arab countries. The dynamics of financial assets by sectors of the economy is structured; the main trends and prospects for further development are identified. In contrast to existing approaches to determining the features of the functioning of the financial system of the Arab countries, an approach is substantiated that is based on the specifics of the development of the oil industry, which is a key trend related to the pricing of oil products and affecting economic changes. The features of the financial system of the Arab countries because of the comparative characteristics of lending systems are highlighted. The perspective trends of the economic development of the Arab countries by region based on the use of extrapolation economic and mathematical forecasting tools are justified. The main results of the study can be applied in practical activities in strategic management and planning, both of an individual industry and of the country as a whole, to optimize costs in the formation of a strategy for further development.

Keywords

Financial System, Arab Countries, Uncertainty, Profit, Efficiency.

Introduction

The Arab world is characterized by extreme diversity and complexity due to the economic, political, geographical, social, demographic and cultural characteristics of the Arab countries. This confirms the multifaceted nature of the influence of world finance on this region and a number of problems that Arab countries have to solve. The main problem of most Arab countries remains dependence on hydrocarbon exports and price fluctuations in international markets due to insufficient industrialization and diversification of the economy. Therefore, the consequence of global financial disasters or local military-political conflicts for the economy of the Arab countries is not only a decrease in investment and financial-credit activity, but also a decrease in hydrocarbon exports, tourism services and money transactions (Arcand et al., 2015).

The nature of the influence of world finance on the financial systems of individual Arab countries depends both on well-established social and economic structures, and on state strategies and development plans that were implemented in these countries in the previous period of economic growth. For some countries, lower prices for hydrocarbons and food products during the period of global problems and instability led to the emergence of the so-called crisis of three important groups: food, fuel and finance. For other countries, this meant a sharp decline in high-yield sales. And some Arab countries faced problems in the financial sector after a long period of reforms and structural adjustment, as well as economic liberalization, during which there was a decrease in the level of social protection and restrictions on government intervention in the economy (Aghion et al., 2015).

It should be noted that the drop in oil prices significantly affected the economies of oil exporting countries such as Algeria, Saudi Arabia and Yemen, and the reduction in remittances and tourist flow led to a reduction in vital sources of income for the people of Egypt, Morocco and Jordan. Conversely, in countries such as Qatar (the largest exporter of liquefied natural gas), the effects of the crisis went unnoticed. In the development of the Arab countries, there is a correlation between the influence of the dynamics of oil prices on the economy of countries (Anwar, 2003). It should be noted that the financial systems of the Arab countries have significant autonomy from the global financial system and therefore did not have distressed assets that entailed a credit and banking crisis. Thus, several sovereign funds from the Persian Gulf countries, which accumulated significant funds during the years of economic recovery, along with other Asian funds helped to recapitalize some American banks and financial institutions affected by the mortgage crisis (Ateyeh, 2014).

Material and Methods

To achieve the goal of the study and the implementation of the tasks used general scientific and specific research methods. Analysis and synthesis of key investment areas of the Arab countries, which provide a significant impact on world finances, and also lead to the dependence of economies on these investment volumes; a systematic approach - to determine the foreign direct investment that Arab countries allocate in economic areas; logical generalization - when conducting an analysis of economic research in the field of the influence of Arab countries on the world economy; the graphical method and the method of constructing analytical tables - for the visual interpretation of data on financial assets of the Arab countries; data structuring while highlighting the key features of the development of the oil industry in the economy of the Arab countries; extrapolation economic and mathematical forecasting to identify trends in the dynamics of average oil prices and identified modern features and development trends.

The information base of the study was the key data of the World Bank, the International Bank for Reconstruction and Development, the International Monetary Fund, the International Finance Corporation, individual banking institutions, scientific papers, monographs and analytical studies of domestic and foreign economists, etc.

Theoretical Aspects of the Research

Transformational changes and the dynamics of economic processes always attracts significant attention of trained economists and various specialists in this field. It is worth noting that in the economic literature there is a fairly large number of scientific papers on the development of the Arab countries and their economies; Let us dwell on the most significant and significant studies. Of particular note is the scientific work of scientists Beck et al. (2015), which discusses the main aspects of the formation of the financial system of the Arab countries. These approaches are characterized by the classics of the formation of the economy and financial institutions of the Arab countries, but do not reveal the features of the functioning of the financial systems of the Arab countries in modern conditions, which requires a more detailed study. Of particular interest are studies of regional financial systems of the West, which are considered in the scientific works of scientists (Cihak et al., 2015). Which determine the basic laws of development of the financial systems of the Arab countries, but do not conceptualize the key features of functioning in modern conditions of financial globalization. It is worth noting that, in particular, the development trends of the financial systems of the Arab countries are addressed in (Calice et al., 2015). Features of the impact of macroprudential policies on the banking system of the Arab countries are considered in World Bank, (2015) however, it does not take into account the specifics of the economic development of the Arab countries, taking into account the development of naphthenic industry, which is the main influence factor on the economy of these countries as a whole. It should be noted that the Arab countries and their economic development are based on the main sector of the oil and gas industry, which provides financing for other sectors of the economy, ensuring dependence on pricing and demand patterns in the global oil market.

The particularities of the economic development of the Arab countries depending on politics is considered in Azar, (2018), in which the significant influence of the policy on the economic processes of the Aryan countries is highlighted, however, all the specifics of the functioning of the financial system of the Arab countries, taking into account the development of the oil industry, are not taken into account, which requires a more detailed in-depth study. It should be noted that the key features of functioning in the conditions of transformation into the global financial system, despite the existing studies and scientific approaches, require further study. And the main issues that are related to the peculiarities of the functioning of the financial systems of the Arab countries due to their characteristic socio-economic problems and the level of economic development remain insufficiently studied.

The development of any modern national economy is based on the active attraction of investments, which form the basis of its growth and make it possible to increase production volumes. A significant reduction in savings (which are the basis of investments) during the crisis has led to a decrease in both domestic and foreign direct investment in most countries of the world (Cherif et al., 2016). The eurozone crisis has affected the decline in investment potential in many countries. Thus, the reduction in investment in the EU countries is associated with a large domestic demand for resources that were necessary to cover the budget deficits of the EU countries, such as Greece, Spain, Cyprus, Portugal and others. The crisis in the United States also made serious adjustments to the functioning of the international market investing. Given the protracted recession of the American economy and the restructuring of debt obligations that provoked the default of the country's economy, its investment potential has significantly decreased (El-Din, 2015). Against the backdrop of the restoration of the locomotives of world development - the United States and EU countries - the flow of foreign investment in the global economy continues to grow. At the same time, developed countries no longer form the basis of growth, because today they are concerned about solving their own economic problems. A significant reduction in investment abroad has affected all countries of the EU, as well as the USA, Japan, Canada, and others. Meanwhile, new participants are appearing on the global investment market who are ready to invest heavily in long-term projects with low profitability in almost all sectors of the economy. One of the groups of such states is the Arab countries - exporters of energy resources. Over the past decades, among developing countries, a group of countries with actively growing national economies has stood out. Their development, unlike the newly industrialized countries, was not caused by the modernization of the economy and the development of new industries, but was based on the active use of their own natural resources (extractive industries) and favorable market conditions. According to a number of economic criteria, these states are comparable to the most developed countries in the world and include Brunei, Qatar, Kuwait, the United Arab Emirates (UAE). The basis of their national economies is the extraction and export of energy carriers (oil and gas) to the world market (El-Hawary, 2016).

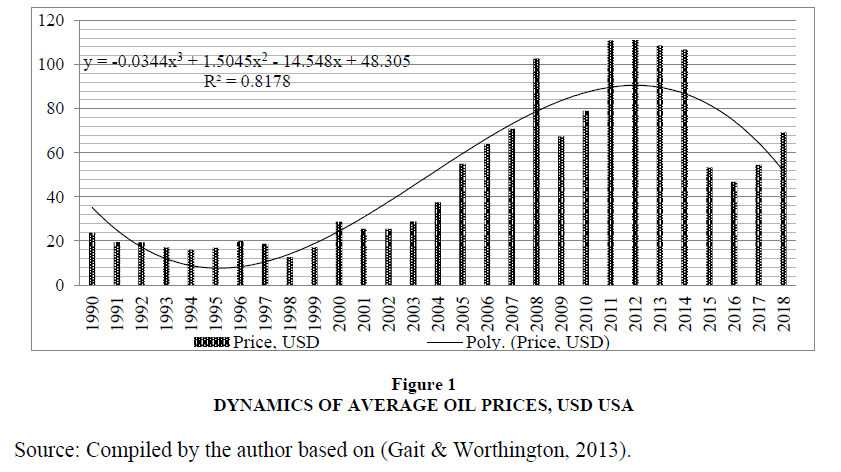

The rapid growth of the national economies of oil-producing Arab countries is inextricably linked with the formation of market conditions and an active increase in the price of energy resources. This situation has allowed oil-producing countries to receive additional benefits due to price fluctuations and significantly improve their economic performance. Thus, in the global economy itself, a substantial redistribution of financial resources has occurred. With the changing market conditions, oil-producing Arab countries began to receive significantly more resources with an unchanged amount of production. And the latter, in turn, were distracted from other sectors of the national economies and included in the cost of almost every product produced in the world. In this case, it is appropriate to talk about a large-scale redistribution of funds within national economies at the global level (Ferrari, 2018). This situation allowed the Arab countries - exporters of energy resources to accumulate rather large investment resources in a short period of time. Having accumulated significant volumes of investment resources due to favorable market conditions Figure 1, they were able to carry out large-scale investment projects and modernize their own economy, which largely depends on energy exports and world prices. Accordingly, we can talk about a tendency to strengthen the role of the financial systems of the Arab countries in the global economy, since the forecast trend line, built on the basis of average oil prices over the past 28 years, indicates with a confidence of 89.8% that the trend of rising oil prices will continue.

Figure 1 Dynamics of Average Oil Prices, USD USA

Source: ?ompiled by the author based on (Gait & Worthington, 2013).

Twenty-four countries participating in the production reduction deal concluded in January 2017 agreed that they would bring the agreement to 100%, with a total limit of production of 1.72 million barrels per day. starting in July. As a result, according to World Bank estimates, the total transaction compliance rate in July dropped to 97%. The agreement fulfillment rate by countries outside OPEC fell to 44% due to a significant increase in production in the Russian Federation, as well as due to the fact that Kazakhstan still does not fulfill the terms of the transaction. The compliance indicator for OPEC countries remained unchanged at 121%. Representatives of Saudi Arabia and the Russian Federation noted that as a result of the agreement, the volume of deliveries would actually increase by about 1 million barrels per day. at the expense of states with the ability to increase production, namely the following four countries: Saudi Arabia, the Russian Federation, the UAE and Kuwait. After production in Venezuela, Angola, and Mexico unexpectedly decreased in April and the total volume of undersupply reached 2.5 million barrels per day, it was these four countries that took measures and, by July, increased their total production by almost 900 thousand barrels/day. The prospect of renewed US sanctions against Iran has so far only had a minimal impact on Iranian oil production, but Washington is determined to introduce unprecedentedly harsh measures against Iran, which means that the reduction in supply can be much more significant than during the previous round of sanctions, when production in the country decreased 1.2 million barrels per day (Grais & Iqbal, 2014).

The Arab financial industry consists of four sectors: banking, sukuk (bonds), stocks and funds, and tankful (insurance) Table 1. The Islamic banking sector, which has “reasonable levels” of growth, owns the majority of Sharia-compliant assets. The sukuk market has recovered after three difficult years, while tankful, as well as Islamic capital and foundations, have been able to work well (El-Hawary et al., 2016).

| Table 1 Islamic Financial Assets by Sectors (2016), % | |

| Sector | Share in Islamic financial assets |

| Islamic banking assets | 72-78.9 |

| Sukuk | 15-17 |

| Islamic investment funds | 3-4 |

| Takaful | 1-2% |

| Microfinance | 1 |

| Other | 4 |

| Sources: Complied by the author based on (Grais & Iqbal, 2014). | |

With regard to assets under management (AUM), the Arab finance industry continues to dominate the banking sector, despite the fact that with an annualized growth rate of 6%, it was its most difficult-growing sector. Arab banks and ordinary banks with Islamic windows own approximately 75% of all Arab financial assets. Of these, about 60% are owned by full-fledged Arab banks. In general, in 2016, Arab banks recorded stable growth in their assets, funds and deposits, and their market shares increased in 18 countries. At the same time, the regional composition of these assets has changed. The devaluation of the Iranian rial was the main reason for the fall in 2016 of the assets of the Arab banking sector MENA (excluding GCC) by 66 billion US dollars to 541 billion dollars. In contrast, in GCC and Asia, bank assets have grown, although both regions are also losing. At the end of 2016, the aggregate Arab financial assets of GCC and Asia grew to 42% and 22%, respectively, while MENA, excluding GCC, fell to 30%. Despite these changes, 88% of banking sector assets remain in jurisdictions with a systemically important financial sector (Haltiwanger et al., 2013). After a three-year decline in output in 2016, the bond market recovered, increasing by 6%, although it still has not regained growth after the period 2009-2014, when its aggregate annual growth rate (CAGR) was almost 20%. New issues, most of which appeared in the UAE (10.5%), amounted to $ 75 billion, resulting in a total bond market of approximately $ 320 billion. The financial indicators of the largest oil companies for the II quarter of 2018 indicate their determination to adhere to strict investment discipline and increase shareholder profits by increasing dividends and implementing share buyback programs (Zulkhibri, 2019).

However, for most of them, profit growth was lower than expected. Despite the fact that oil prices are more than 50% higher than last year, oil giants have not increased the planned volume of short- and medium-term investments in exploration and development of oil fields. And this despite the fact that the financial institutions of the Arab countries do not base their activities on lending, but on investment. The prerequisites for this are not only religious beliefs, but also the mentality of the inhabitants of the Middle East. The bank opens accounts on which depositors place their savings. The bank finances entrepreneurs with this money, but instead of the traditional payment of interest on the loan, the entrepreneur shares with the bank, and the bank with the investor, both profit from activities and losses. Such a system “promises nothing” and forces financial institutions to carefully select funded projects. Accordingly, credit institutions in Arab countries are much more likely than westerners to invest in real production, ignoring highly profitable but risky projects (Laeven, 2014). Thus, the risk level of investments of financial institutions in the Arab countries is higher than others: they are more closely associated with partners who trust the funds. They are connected not only economically, but also with the ethics of shared responsibility, on which the business reputation of the credit institution is based. Relations in which partners take risks and share them in proportion to the invested funds create a special psychology of doing business. Financial institutions in Arab countries pay special attention to the essence and prospects of the projects in which they invest, while during the period of economic growth, Western credit institutions evaluated projects only to provide loans. The main differences between the lending system of financial institutions in Arab countries from the "traditional" are presented clearly in Table 2.

| Table 2 Comparative Characteristics of the Lending System of Arab and Western Financial Institutions | ||

| ? | Financial institutions of the Arab countries | Financial institutions of the Western countries |

| 1 | The activity is based on investment. | The basis of activity is lending. |

| 2 | Lack of interest. The separation between the client and the bank of both profit and loss | Use of interest as a loan fee. |

| 3 | Prohibition of speculation | Use of speculative operations in the activity (sale of debts). |

| 4 | Assessment of the nature and prospects of the funded project | Preference when choosing a project, such a factor as security of property. |

| 5 | The absence of the problem of "fiduciary remedies." | The existence of the effect of "nonexistent" money. |

| 6 | Financing real objects and production. | Advantage in financing highly profitable, but often risky facilities. |

| 7 | Favorable conditions for small and medium-sized businesses | Priority is given to large enterprises |

| 8 | Risks are distributed between investors, the bank and the borrower. | Risks are borne mainly by borrowers. |

| 9 | Control over activities is carried out by representatives of the clergy. | The activities of credit institutions are controlled by the state. |

| Sources: ?ompiled by the author based on (Laeven, 2014) | ||

It should be noted that the financial and credit institutions of the Arab countries face the following fundamental problems:

1. Different countries of the Arab world and different areas of Islam have different interpretations of many nuances of financial and credit operations. This prevents the unification and standardization of the financial environment (Arcand et al., 2015).

2. Lack of flexible interest-free financial instruments for moving money and funds. This problem was resolved to some extent by concluding bilateral interbank agreements and developing cooperation with central banks.

3. A high level of abuse among debtors. This problem is quite common and difficult to solve. For example, when using the “Murabaha” settlement principle, payments were often returned very late, because the delay in payments was not prosecuted. Against this background, the interest system looks more attractive, since in it a delay in payments leads to an automatic increase in the interest that must be paid to the creditor (Ateyeh, 2014).

4. The disadvantages of the financial systems of the Arab countries are also considered the lack of an effective analogue of the interbank foreign exchange market. This makes impossible the quality management of the liquidity of financial institutions, leading to a "surplus of liquidity", which the "western" economy considers a problem. Under such conditions, it is more difficult to regulate the economy, but the likelihood of bank failure is much lower. So, in a crisis, the excess liquidity gave financial and credit institutions of the Arab countries an additional margin of safety, which was lacking for some of their European partners (Mialou et al., 2018).

5. Many Muslims prefer traditional banks and often simply choose a bank that provides higher incomes. This circumstance can make financial and credit institutions of the Arab countries be more inventive and more competitive than traditional ones. Another solution to this problem is to allow traditional banks to introduce proportional financing and open departments, operate in accordance with the requirements of Arab countries.

Despite these problems, the financial and credit institutions of the Arab countries have proved the stability of their system during the crisis. The relatively small incomes of this sector have gained significant importance, since they relied on real facilities and production. Risk assessments by Arab financiers turned out to be more adequate, their control over funded projects was more reliable, and the level of lending to “unreliable” and, accordingly, the number of “bad debtors” was lower than that of traditional banks. Integrated into the global financial system, the crisis could not have hurt it at all. At the same time, the loss of a significant part of funds during the global financial crisis forced the Arab countries to reconsider their financial strategies.

Many foundations have changed the nature and purpose of investments, although some foundations, such as SAMA and the Saudi Institute of the National Wealth Fund, have continued to follow strategies that are more conservative (Cherif et al., 2016). One example of a change strategy was the creation of four investment funds in the Middle East and North Africa: a share fund in the Gulf Cooperation Council, an UAE investment fund, a fund for the Middle East and North Africa, and a fund for the North West Africa (Maghreb countries): Morocco, Algeria, Libya, Tunisia, Western Sahara and Mauritania). This provides a basis for concluding that the role of sovereign funds in the economic growth of Arab countries is growing (Pillai et al., 2016).

A sharp drop in GDP in the Arab Gulf countries negatively affected the volume of domestic regional investments coming from investment funds and companies in North Africa. All countries except Morocco and Algeria have been affected by declining volumes of such investments (Sundararajan & Errico, 2002). Along with the fall in foreign investment, some Arab countries that are not oil exporters have also experienced a serious economic downturn due to a decrease in remittances from immigrants and a decrease in the number of tourists.

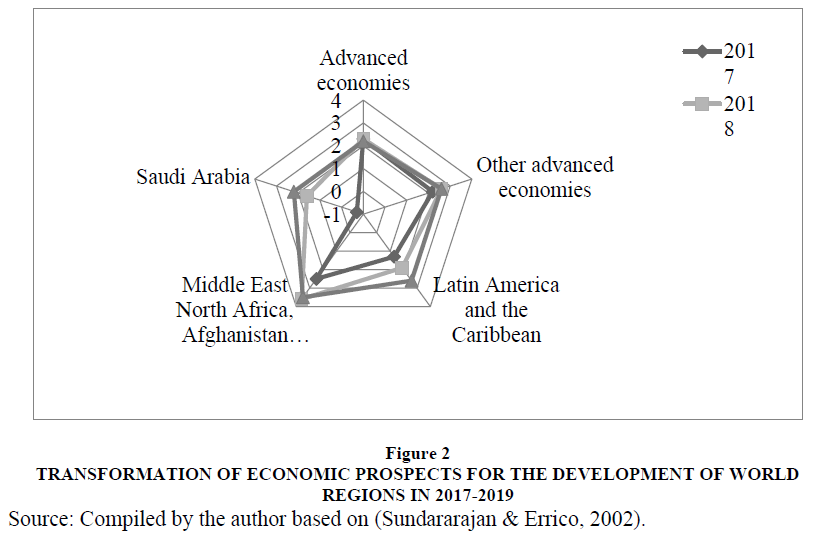

Structuring and bringing the dynamics of the main indicators of the economic prospects for the development of the world's regions (changes in%) is based on the analysis of strategic indicators of countries such as: GDP of countries in selected regions in dynamics; volumes of investment, which directly depend on volumes of export of oil products and development of infrastructure. According to these indicators, dependence on global transformations and economic fluctuations can be traced. The main results of the assessment of the economic prospects for the development of the world's regions changes in% are presented in Table 3.

| Table 3 Assessment of Economic Prospects for the Development of Regions of the World (Changes in%) | |||

| Regions | 2017 | 2018 | 2019 |

| World production | 3,7 | 3,9 | 3,9 |

| Advanced economies | 2,3 | 2,3 | 2,2 |

| Other advanced economies | 2,2 | 2,6 | 2,6 |

| Latin America and the Caribbean | 1,3 | 1,9 | 2,6 |

| Middle East North Africa, Afghanistan and Pakistan | 2,5 | 3,6 | 3,5 |

| Saudi Arabia | -0,7 | 1,6 | 2,2 |

| Sources: ?ompiled by the author based on (Sundararajan & Errico, 2002). | |||

The drop in remittances was mainly due to the loss of work by thousands of Arabs who emigrated to work in Europe and the Arabian Gulf. According to the World Bank, the Arab countries are most affected by the decline in remittances, much more than the countries of Latin America, Asia and Central Africa. Also, the collapse of international markets after the global financial crisis has led to a serious decline in exports from Arab countries. Given that the leading export market for the Arab countries is the EU (almost 80% of exports, including 80% for Tunisia, 78% for Libya, 76% for Morocco), stagnation and falling demand in this market, as well as other types of exports. Markets (USA and Asia) only accelerated economic changes in Arab countries (Sundararajan & Errico, 2002).

The transformation of the economic prospects for the development of the regions of the world is characterized by a significant effect of the reduction in remittances on the economy of the Arab countries, which is much more than in Latin America, Asia and Central Africa Figure 2.

Figure 2 Transformation of Economic Prospects for the Development of World Regions in 2017-2019

Source: ?ompiled by the author based on (Sundararajan & Errico, 2002).

These trends are characterized by the influence of the macroeconomic environment and its main factors such as: the collapse of world markets during crisis economic cycles, which led to a significant reduction in exports from Arab countries. At the beginning of the XXI century. the Arab countries had a significant difference in the level of development of financial systems and the economy, four groups can be distinguished: countries with very high income (Bahrain, Kuwait, Qatar, Saudi Arabia and the United Arab Emirates), countries with medium-high income (Lebanon and Oman), low-income countries (Algeria, Djibouti, Egypt, Jordan, Morocco, Syria and Tunisia), very low-income countries (Sudan, Yemen, Mauritania) (Arcand et al., 2015).

It should be noted that the financial systems of different countries are characterized by their specific functioning and national characteristics. Definitely, all financial systems have common features of their key components, but they can be significantly different in different countries, which should be noted in Arab countries. The specifics of the functioning of the financial system of the Arab countries is due to direct dependence on strategically important industries. The functioning of the financial sector in the Arab countries is directly related to the development of oil industry in the region, which is a strategic sector for the development of these countries. With the development of infrastructure related to the oil industry, the volume of exports will increase while increasing the financial influence of countries in the world and promising economic development. Using extrapolation economic and mathematical forecasting, we identified key trends in the development of the financial system of the Arab countries, which directly depends on the development efficiency of the oil industry, which must be taken into account when forming the development strategy and planning the economic development of countries.

Discussion

The countries of the first group turned out to be the least affected by integration into the global financial system, while the countries of the third and fourth groups had a higher risk of socio-political tension. Thus, a 10 percent drop in GDP in the UAE did not lead to a sharp decrease in the standard of living of the population, but a 0.1 percent drop in Algeria's GDP created significant social problems. The new economic policy and development strategy in the Arab region provides for a series of reforms aimed at improving the efficiency of economic and financial policies and management in the following areas:

1. Education and employment. Unemployment (especially among young people) is one of the most painful political and economic problems for the leaders of the Arab countries. Deterioration of the real economy, chronic unemployment and a decline in the quality of life of citizens create social tension, especially in those Arab countries where the political situation is unstable (Palestine, Iraq, Yemen, Sudan). Creating jobs and increasing job opportunities is an important task for governments in countries such as Algeria, Morocco and Saudi Arabia, where population growth is a factor of significant pressure on the labor market. This situation requires the implementation of economic and educational reforms to diversify and develop the sectors of industry and services (primarily educational, scientific and technological), which are necessary for the formation of a productive and competitive economy that can create at least 100 million new jobs over the next decade.

2. State intervention and implementation of liberalization programs. Over the past decade, most Arab countries have introduced a series of structural reforms aimed at economic liberalization, which for these countries meant the formation of an effective market without signs of corruption, inequality of employment opportunities and income distribution. The global financial crisis has hindered liberalization in these countries, which, among other things, has led to a further aggravation of the problems of equitable income distribution, social protection of the poor, and employment (especially youth). The deterioration of the socio-economic situation of the majority of the population and the unresolved economic problems in these countries require intensification of the state’s activity in creating a clear and transparent regulatory framework that guarantees the normal functioning of market institutions (Beck et al., 2015).

3. Diversification of the economy, industrialization and innovation. The problems of the global financial system have revealed deep structural imbalances in the financial systems of the Arab countries, and above all the weak diversification of financial assets, and the underutilization of significant financial resources. This requires, firstly, the restructuring of the economy in favor of sectors with higher labor intensity and added value than in the oil sector, which will help create jobs for young working people; secondly, improving the education system, encouraging research and innovation, which will contribute to the formation of human capital in the Arab region.

4. Democracy and the implementation of new projects in public administration. Even despite the current global financial problems, most experts note certain democratic changes in the government of the Arab countries, due to the current economic situation both in the region and in the world. The democratization processes in the region give experts grounds for asserting that global financial instability has led to increased levels of control in Arab countries, especially in the management of sovereign wealth funds. Continuing the course towards the democratization of public administration requires the Arab countries to formulate and implement projects to further reform the relevant institutions in the direction of ensuring transparency and effectiveness of their activities in the fight against corruption. Medium-term projects to improve public administration in the Arab countries should include the introduction of international standards and procedures, which will accelerate their integration into the global financial system. The EU can be an effective partner for the Arab countries in public administration reform support projects.

5. Predictability, transparency and planning in economic policy. To ensure security and stability for commercial investors in order to attract long-term international investment projects, Arab countries need to ensure the stability of financial policy. Therefore, each Arab country should have its own financial plan, which will be developed and implemented openly. Opportunities for investment and economic growth in the Arab region are directly dependent on the degree of predictability and transparency of the respective processes (El-Hawary et al., 2016).

At the same time, a number of factors hindering the development of financial markets in Arab countries should be noted. Among them:

1. Economic and financial attraction to the East. The economic and financial influence of countries such as India or China impedes equitable integration and cooperation within the Arab region. In particular, the Arab Gulf countries, which have only recently become economic leaders, are rushing to use their potential as a platform between Europe and Asia, strengthening their economic influence.

2. Management of sovereign funds. Over the past decade, the sovereign funds of the Arab countries have accumulated significant funds from oil exports. However, most of them were not reinvested in regional and local development projects, but remained in funds abroad, which suffered heavy losses because of the global crisis. Therefore, the sovereign funds of the Arab countries should review their own investment strategies and focus on ensuring the growth of the real sector of the economy in the Arab region. This change in policy can help transform them into leading actors in regional financial and economic development.

3. Weakness of regional integration. Despite the difficulties of the process of regional financial integration of the Arab countries, the process of European integration can be taken as an example of regional cooperation based on pragmatism. The determining factor for this type of cooperation in the Arab region may be the management of energy production, consumption and distribution. In addition, any integration processes in the Arab region should be based on the principle of openness of relations in order to ensure the possibility of involving other actors, such as Turkey, Europe or South Asia (Cihak et al., 2015).

Now the Arab region lacks a single voice in the international arena, which would legitimately express the consolidated opinion of all Arab countries in prestigious international financial forums. This entails serious obstacles in protecting the needs and interests of the Arab region in international financial organizations. Therefore, the Arab countries should urgently appoint a representative to organizations such as the G20 and the like, which will ensure the adoption of important financial decisions for the Arab region at the international level. Two aspects can contribute to this direction:

1. Expansion of cooperation and integration with other regions of the world. The expansion of financial and economic cooperation of the Arab region with other regions and countries, such as the EU, China, India, Brazil, Turkey, developing countries, will enhance the influence of Arab countries in international financial decision centers.

2. Oil as an instrument of international financial policy. The fall in oil prices was a long one. Rising oil prices will increase the export earnings of the Arab countries and will help restore their influential position in the international financial arena. Arab countries should use this position to enhance their participation in shaping a more stable global financial development model.

Thus, the implementation of sufficiently optimistic plans in the Arab countries in the near future will primarily depend on the situation in the global financial system, on the stability of its recovery, in particular, on the oil market situation. At the same time, a return to the dynamic growth rates of the countries of the Middle East and North Africa will be largely determined by the effectiveness of the financial policies of their governments, the ability to minimize the effects of global financial turmoil and the implementation of the necessary socio-economic reforms.

Arab finance can also contribute to the achievement of the Sustainable Development Goals (SDG). A number of institutions, including Standard & Poor's, IDB, IFSB, and the World Bank, have expressed confidence that Arab finance is “very important” to the business Sundararajan & Errico, (2002) and the 2015 UN Sustainable Development Summit on the Role of Arab Finance in SDG Implementation and the World Bank emphasize that Arab finance can play a significant role in helping achieve two development goals to end extreme poverty globally by 2030 and fostering shared prosperity by raising the incomes of the poorest 40 percent of the population.

The IsDB report states that Arab finance has strong potential for financial stability, financial integration and shared prosperity and infrastructure development that will create the right conditions for the timely implementation of the sustainable development concept and that the finances of the Arab countries as well as the financing principles used in financial system can minimize the severity and frequency of financial crises. Stakeholders agree that the finances of the Arab countries can contribute both to the promotion and application of its fundamental principles (such as the distribution of profit and loss) and its instruments.

Conclusion

The financial and credit institutions of the Arab countries are developing rapidly enough topics that allow you to play an increasingly important role in the global financial system, and a specific business model allows you to penetrate into all areas of socio-economic life. Despite the fact that many states in the Middle East and Africa belong to developing countries, a number of financial institutions in the Arab countries are constantly involved in international energy projects. In connection with the growth of business activity in Europe, especially with an increase in the price of oil and oil products, it is possible to forecast an increase in the capital markets of the Arab countries. Today, in more than 50 countries of the world, financial and credit institutions of the Arab countries operate, guided by the principles of Islam in their activities. This indicates a high demand for financial products and services of the Arab countries, as well as their ability to compete with traditional financial institutions.

It should be noted that according to the results of the study, it was determined that the financial institutions of the Arab countries could not avoid the problems associated with the consequences of the global financial crisis, and in order to reduce their dependence on the global financial system, the Arab countries should accelerate the implementation of structural reforms and development plans formed during the years of recovery. Following the results of the study, it should be noted that reducing the dependence of the Arab countries on fluctuations in oil prices will contribute to a more sustainable development of their economies and the creation of additional jobs.

Therefore, it is worth noting that the Arab countries should review and improve the system of intra-regional financial relations in order to deepen regional financial and economic cooperation, which should be based on neighborhood policy. The same goes for their relationship with other countries. The sovereign funds of the Gulf Cooperation Council member countries should focus their investment activities on the countries of North Africa (the Maghreb), which generally remain out of their attention due to the fact that their main economic interests are concentrated in the East, primarily China and India. In addition, deepening financial and economic cooperation between the Arab countries is necessary to improve the management of natural resources in the region and the future development of this economic region.

References

- Arcand, J.L., Berkes E., & Panizza U. (2015). Too much finance?. Journal of Economic Growth, 20(2), 105-148.

- Aghion, P., Howitt, P., & Mayer-Foulkes, D. (2015). The Effect of Financial Development on Convergence: Theory and Evidence, The Quarterly Journal of Economics,120(1).

- Anwar, M. (2003). Islamicity of Banking and Modes of Islamic Banking. Arab Law Quarterly, 18(1), 62-80.

- Ateyeh, M. (2014). Integration Among Arab Financial Markets Remains a Sought After Dream, Arab Business Review, 58.

- Azar, S. (2018). Private Savings in the Arab Countries: Empirical Analysis and Policy Implications. International Journal of Economics and Finance, 10(12), 10-22.

- Beck, T., Demirguc-Kunt, A., & Maria, S.M.P. (2015). Reaching out: Access to and use of Banking Services Across Countries, Journal of Financial Economics, 85.

- Cihak, M., Demirguc-Kunt, A., Feyen, E., & Levine, R. (2015). Benchmarking financial systems around the world (English). Policy Research working paper, WPS 6175. Washington.

- Calice, P., Buccirossi, P., Cervone, R., Mohamed, N., & Pesme, J.D. (2015). Competition in the GCC SME lending markets: an initial assessment, 2015, World Bank.

- Cherif, R., Hasanov, F., & Min, Z. (2016). Breaking the Oil Spell: The Gulf Falcons' Path to Diversification, International Monetary Fund, 10-19.

- El-Din G.E. (2015). Islamic finance comes of age. Al-Ahram Weekly, 752, 21-27.

- El-Hawary, D., Grais, W., & Iqbal, Z. (2016). Regulating Islamic Financial Institutions: The Nature of the Regulated. World Bank Working Paper 3227. Washington.

- Ferrari, A., Masetti, O., & Ren, J. (2018). Recent trends in the use of interest rate caps, World Bank, 8-19.

- Gait A.H., & Worthington A.C.A. (2013). Primer on Islamic Finance: Definitions, Sources, Principles and Methods, School of Accounting and Finance, University of Wollongong, 07(05). Retrieved from: http://www.uow.edu.au/commerce/accy/research/workingpaper/07%20Worthington%20wps5.pdf

- Grais W., & Iqbal, Z. (2004). Regulating islamic financial institutions: The nature of the regulated. World Bank Policy Research Working Paper WPS3227, 42-65.

- Haltiwanger, J., Jarmin, R., & Javier, M. (2013). Who creates jobs? Small versus large versus young, Review of Economics and Statistics, 95(2).

- Investment and Growth in the Arab World. A Scoping Note. Retrieved from: https://www.imf.org/external/np/pp/eng/2016/050216.pdf

- Laeven, L. (2014). The Development of Local Capital Markets: Rationale and Challenges, IMF Working Paper, International Monetary Fund.

- Mialou A., Amidzic, G., & Massara, A. (2018). Assessing Countries’ Financial Inclusion Standing: A New Composite Index, Journal of Banking and Financial Economics Forthcoming, 12-48.

- Pillai, R., & Husam-Aldin, A.M. (2016). Corporate Governance in the GCC Countries: Empirical Assessment Using Conventional and Non-Conventional Indices, The Journal of Developing Areas, 50(6), 46-58.

- Sundararajan, V., & Errico L. (2002). Islamic Financial Institutions and Products in the Global Financial System: Key Issues in Risk Management and Challenges Ahead. IMF Working Paper 2/192, 1, 24-45.

- Truman, E.M. (2010). The International Monetary System and Global Imbalances. 11-37.

- World Bank. (2015). Improving the Quality of Financial Intermediation in the GCC countries, GCC engagement note., 2, Washington, DC: World Bank.

- Zulkhibri, M. (2019). Macroprudential policy and tools in a dual banking system: insights from the literature. Borsa Istanbul Review, 19(1), 65-76.