Research Article: 2021 Vol: 24 Issue: 2S

State, trends, challenges and prospects of the modern global foreign exchange market

Andrii Zolkover, Kyiv National University of Technologies and Design

Irina Zolotykh, Mykolaiv State Agrarian University

Halyna Mykhalchynets, Mukachevo State University

Yuliia Nemish, Ivano-Frankivsk National Technical University of Oil and Gas

Vitalina Delas, Taras Shevchenko National University

Volodymyr Sybirtsev, Central Ukrainian National Technical University

Citation Information: Zolkover, A., Zolotykh, I., Mykhalchynets, H., Nemish, Y., Delas, V., & Sybirtsev, V. (2021). State, trends, challenges and prospects of the modern global foreign exchange market. Journal of Management Information and Decision Sciences, 24(S2), 1-10.

Abstract

The daily value of world currency transactions exceeds the total world value of output and the value of all shares and bonds available on the market. The global foreign exchange market is a highly liquid environment, supported by the functioning of global communication systems and round-the-clock electronic trading platforms. The present research aims to identify and study the basic factors and dominants of structural changes in the modern global foreign exchange market in the macroeconomic context and to determine their impact on future market trends. The research methodology is based on the use of general scientific research methods in the analysis of secondary sources and the application of statistical methods of correlation and regression analysis of the influence of global economic factors on the change in the exchange rate of the major currency pairs of the world foreign exchange market. The research has revealed that different currency pairs are sensitive to the influence of different global factors, namely: the monetary aggregate M2 is the most practically significant indicator for USD / EUR and USD / GBP, while for the pair USD / JPY - the price of oil; none of the currency pairs has a statistical dependence on the economic growth of the G7 countries. The increase in the exchange rate of the studied currency pairs from 79% to 90% is due to selected factors, the rest are other factors that influence exchange rates, but are not included in the regression model. The results of the research make it possible to take into account important global factors influencing the international foreign exchange market and forecast changes in exchange rates, which is a necessary condition for successful operational activities of market participants.

Keywords

Volatility; Forex; Global factors; Currency pairs; Monetary aggregate M2; Index VIX.

Introduction

The foreign exchange market is, perhaps, the most globally integrated and active financial market in the world. The functioning of the global foreign exchange market ensures the viability of the world economy, which combines many different national currencies. By ensuring the conversion and determination of the purchasing power of various currencies, the world foreign exchange market makes it possible to form prices in the international market, which contributes to international trade and investment activities. The relative value of a currency, expressed in exchange rates, is simultaneously influenced and itself affects the value of goods and services, as well as the investment capacity of national economies. Understanding the ratio of prices in different currencies helps companies make decisions about the competitiveness of their products or services in the market. Analysis of current and forecasting future exchange rates often underlies management decisions regarding the location of production facilities, the choice of suppliers and the definition of markets for goods.

The world foreign exchange market is one of the few markets where trading is carried out around the clock. This provides it with a unique ability to track and signal how market participants react to events in other markets or in the real economy in a real-time environment. This property has been especially useful during times of crisis. After all, the foreign exchange market is often the first to detect changes in market sentiment in response to significant political or economic events that have taken place outside working hours in other markets, and can be very useful for politicians and market participants in such situations. The ability of the foreign exchange market to support the process of fixing of the price and ensure the international flow of goods and capital requires the establishment of such an integrated market structure that is able to ensure smooth and efficient interaction between its participants. This remains a particularly important issue forasmuch as the structure of the global foreign exchange market continues to evolve and adapt to new conditions, technologies and financial flows. Taking this into consideration, the determination and assessment of the influence of global factors on the functioning of the world foreign exchange market in general and the volatility of world currency pairs, in particular, is extremely important for the formation of trends in the development of the world foreign exchange market.

Literature Review

The study of trends in the global foreign exchange market is the subject of research not only in the academic circles but also in the business environment. Careful examination of the issue of volatility in world forex markets mainly involves the study of exchange rate fluctuations of major currency pairs of the market (Kenourgios et al., 2015; Greenwood-Nimmo et al., 2016; Barun´?k et al., 2017; Kilic, 2017; Salisu and Ayinde, 2018; Salisu et al., 2018), the transition of volatility from a strong currency (for instance, euro) to other, weaker currencies in specific regions, such as Asia, which is the most discussed (?to, 2017; Sehgal et al., 2017), Europe (Orlowski, 2016; Ko?cenda and Moravcov´a, 2019), as well as the Belt and Road Initiative countries (BRI) (Li et al., 2018; Mai et al., 2018). In addition, there are a number of studies investigating the structure of interdependencies between currencies and other markets, including stock markets (Boako and Alagidede, 2017; Kumar et al., 2019), crude oil market (Mensi et al., 2017; Singh et al., 2018), other goods (Khalifa et al., 2016; Boubakri et al., 2019) and cryptocurrencies (Baum¨ohl, 2019).

Rey (2013) emphasizes that cash flows have a large share of common components. The application of GFC theory emphasizes that some factors derived from a large pool of variables account for a significant share of changes in capital flows. These factors are grouped into two classes: global and national ones. Scientists Forbes and Warnock (2012) have concluded that capital flows reach extreme values under the condition of the influence of global factors. In addition, a number of studies demonstrate the impact of GFC, in which significant changes in capital flows are explained according to GFC theory (Sarno et al., 2016; and Barrot & Servens, 2018). Supplementing factors to other theories or models of the exchange rate is a typical practice in forecasting exchange rates (Engel et al., 2015; Greenway-McGrevy et al., 2018).

Most studies have been conducted within a particular region, taking into account the national factors of individual economies on the national currency. Variables that take into account country-specific factors are as follows: (1) financial openness, measured by the Chin-Ito index; (2) open trade and (3) private sector lending (Forbes & Warnock, 2012; Avdjiev et al., 2017; Hanan, 2017).

In accordance with the purpose of our research and based on the analysis of literature sources, the variables used for global factors affecting the volatility of major currency pairs in the global foreign exchange market are as follows: (1) global risk measured by the index VIX; (2) global short-term interest rate, according to three-month treasury bills; (3) global economic growth driven by G7 growth, (4) global monetary supply driven by US M2 growth and (5) commodity prices (oil).

Methodology

The major currency pairs that are most used in the world foreign exchange market and have the largest share in turnover have been selected for the research, namely: USD/EUR; USD/JPY; USD/GBP. Correlation analysis has been performed for selected global factors as follows: monetary aggregate M2, average 3-month interest rate on treasury bills, VIX-index, level of economic growth of G7 countries and average price of Brent oil based on world data for the period 2009-2020. Databases of FRED, STATISTA, Bank for International Settlements (BIS), OFX have been used in order to form the information base of the research, according to the specified indicators and the period. In order to conduct the in-depth study of the global foreign exchange market, the methodology of correlation and regression analysis was used. The interrelated indicators were determined on the basis of an empirical study of macroeconomic factors (Xi) affecting the level of change in the exchange rate of the major currency pairs of the world foreign exchange market (Y). The regression model for testing hypotheses by the method of the least squares has been carried out in the econometric package STATISTICA.

Therefore, we have chosen the studied pairs of exchange rates - USD/EUR as the dependent variable Y; USD/JPY; USD/GBP (OFX) - as the independent variables X: ?1 - Monetary aggregate M2 (?2 Money Stock, Billions of Dollars, Annual, Seasonally Adjusted); ?2 - Average 3-month interest rate on treasury bills (3 Month Treasury Bill: Secondary Market Rate, Percent, Annual, Not Seasonally Adjusted); ?3 - VIX-index (Volatility index); Volatility Index: VIX, Index, Annual, Not Seasonally Adjusted; ?4 - Average of economic growth rate of the G7 countries (GDP), %; ?5 - Average annual Brent crude oil price (U.S. dollars per barrel).

According to the methodology used, we have examined the influence of the above mentioned factors on the change of major currency pairs (USD/EUR; USD/JPY; USD/GBP). The summary data for correlation and regression analysis of the influence of factor values on the exchange rate of the studied currency pairs are given in Table 1.

| Table 1 The Summary Data for the Correlation and Regression Analysis of the World Foreign Exchange Market (2009-2020) | ||||||||

| USD/EUR | USD/JPY | USD/GBP | X1 | X2 | X3 | X4 | X5 | |

| 2009 | 1,39 | 0,011 | 1,57 | 8416,79 | 0,15 | 31,48 | -3,32 | 61,51 |

| 2010 | 1,33 | 0,011 | 1,55 | 8626,70 | 0,14 | 22,55 | 3,11 | 79,47 |

| 2011 | 1,39 | 0,013 | 1,60 | 9256,68 | 0,05 | 24,20 | 1,75 | 111,26 |

| 2012 | 1,29 | 0,013 | 1,58 | 10051,87 | 0,09 | 17,80 | 1,19 | 111,63 |

| 2013 | 1,33 | 0,010 | 1,56 | 10728,13 | 0,06 | 14,23 | 1,41 | 108,56 |

| 2014 | 1,33 | 0,009 | 1,65 | 11389,86 | 0,03 | 14,18 | 2,08 | 98,97 |

| 2015 | 1,11 | 0,008 | 1,53 | 12046,18 | 0,05 | 16,67 | 2,44 | 52,32 |

| 2016 | 1,11 | 0,009 | 1,36 | 12863,79 | 0,32 | 15,83 | 1,77 | 43,67 |

| 2017 | 1,13 | 0,009 | 1,29 | 13597,11 | 0,93 | 11,09 | 2,46 | 54,25 |

| 2018 | 1,18 | 0,009 | 1,33 | 14120,43 | 1,94 | 16,64 | 2,3 | 71,34 |

| 2019 | 1,12 | 0,009 | 1,28 | 14840,08 | 2,06 | 15,39 | 1,64 | 64,30 |

| 2020 | 1,14 | 0,009 | 1,28 | 17680,23 | 0,37 | 29,25 | -4,71 | 41,96 |

Results

In order to conduct a further in-depth study of the impact of the proposed macroeconomic factors on the volatility of major currency pairs in the global foreign exchange market, a correlation analysis has been conducted, the results of which are presented in Tables 2-4. As a result of the correlation and regression analysis, after excluding statistically insignificant factors, economic and mathematical models of the influence of macroeconomic indicators on the volatility of the major currency pairs of the world foreign exchange market (USD/JPY, EUR/USD and GBP/USD) have been built, which are presented in Table 5.

| Table 2 Correlation Analysis of the Impact of Macroeconomic Factors on the Volatility of EUR/USD (2009-2020) | ||||||

| EUR/USD | M2SL | TB3MS | VIXCLS | Oil price | G7 | |

| EUR/USD | 1 | |||||

| M2SL | -0,80135 | 1 | ||||

| TB3MS | -0,50874 | 0,55643 | 1 | |||

| VIXCLS | 0,407813 | -0,16447 | -0,29776 | 1 | ||

| Oil price | 0,736248 | -0,59332 | -0,30228 | -0,13965 | 1 | |

| G7 | -0,08857 | -0,26952 | 0,159187 | -0,77449 | 0,328245 | 1 |

| Table 3 Correlation Analysis of the Impact of Macroeconomic Factors on GBP/USD Volatility (2009-2020) | ||||||

| GBP/USD | M2SL | TB3MS | VIXCLS | Oil price | G7 | |

| GBP/USD | 1 | |||||

| M2SL | -0,84064 | 1 | ||||

| TB3MS | -0,72868 | 0,55643 | 1 | |||

| VIXCLS | 0,148716 | -0,16447 | -0,29776 | 1 | ||

| Oil price | 0,725919 | -0,59332 | -0,30228 | -0,13965 | 1 | |

| G7 | 0,155877 | -0,26952 | 0,159187 | -0,77449 | 0,328245 | 1 |

| Table 4 Correlation Analysis of the Influence of Macroeconomic Factors on JPY / USD Volatility (2009-2020) |

||||||

| JPY/USD | M2SL | TB3MS | VIXCLS | Oil price | G7 | |

| JPY/USD | 1 | |||||

| M2SL | -0,6747 | 1 | ||||

| TB3MS | -0,42601 | 0,55643 | 1 | |||

| VIXCLS | 0,390542 | -0,16447 | -0,29776 | 1 | ||

| Oil price | 0,716011 | -0,59332 | -0,30228 | -0,13965 | 1 | |

| G7 | -0,02579 | -0,26952 | 0,159187 | -0,77449 | 0,328245 | 1 |

| Table 5 Modeling the Impact of Global Foreign Exchange Market Indicators on Changes in Exchange Rates of Major Currency Pairs USD / JPY, EUR / USD and GBP /USD | |||

| ? | Currency pairs | Linear regression equation | F-test |

| 1 | EUR/USD | Y=1,11-1,7*X1+0,007*X3+0,002*X5; R2=0.90 | F=16 |

| 2 | GBP/USD | Y=1,6-2,1*X1-0,07*X2+0,002*X5, R2=0.89 | F=22 |

| 3 | JPY/USD | Y=0,007+0,0001*X3+3,51*X5; R2=0.79 | F=6 |

The results of economic and mathematical modeling indicate that the volatility of the studied currency pairs is not uniformly influenced by macroeconomic factors. Monetary aggregate M2 has the greatest practical influence on the EUR/USD and GBP/USD pairs out of the five selected factors, while for the JPY/USD pair, the oil price is of decisive importance. In addition, the models differ in the number of statistically significant factors and the level of model adequacy, the best result among which has been shown by the EUR/USD pair, which is most used in the world foreign exchange market.

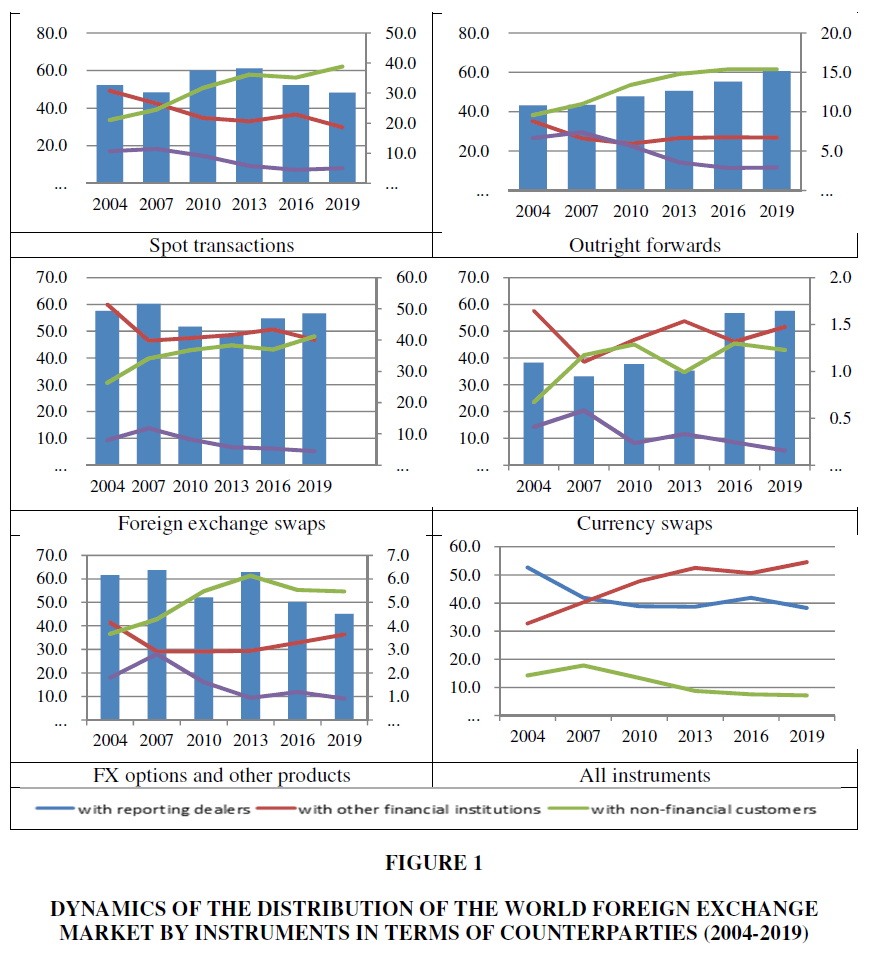

In today’s FOREX market, the main positions are held by large financial institutions that are able to stably carry out a significant number of foreign exchange transactions. However, the introduction of innovative technologies has somewhat changed the circle of market participants - private traders and hedge funds began to play a significant role there (Figure 1). The growth of foreign exchange market turnover in 2019 is due to increased trading activity of “financial institutions” (this category includes banks, hedge funds, pension funds, mutual funds, insurance companies and central banks).

Figure 1 Dynamics of the Distribution of the World Foreign Exchange Market by Instruments in Terms of Counterparties (2004-2019)

It follows from our research that the foreign exchange market is a dynamic market with a long history of changes and innovations. According to the research conducted, certain changes in the market structure over the past decade can be identified, namely: firstly, the expansion of the circle of market participants, and secondly, the improvement of the market functioning mechanism through the introduction of innovative digital solutions.

The regulation of the foreign exchange market is currently the number one problem in the global dimension. After all, The FX Global Code, introduced by regulators in order to ensure compliance with general principles in the market, has not received adequate support from market participants, and, therefore, cannot actually ensure the achievement of the set goal. In fact, the global foreign exchange market can be managed only indirectly, by regulating its participants at the national level. In practice, most market counterparties widely use Transaction Cost Analysis (TCA) in order to manage foreign exchange costs. However, such an analysis does not provide a real picture, forasmuch as it is not standardized; consequently, in order to reduce the cost of foreign exchange services, it is necessary to introduce standardization of data on foreign exchange markets.

Based on the analysis of the influence of global market factors on the volatility of currency pairs, economic and mathematical models were built, which demonstrated a fairly high coefficient of multiple regression:

indicating a very close interrelationship between the performance indicator and the factor values. For EUR/USD pair, the most practically significant global factor in the change in volatility is the monetary aggregate M2; the increase in money supply causes a decrease in the exchange rate EUR/USD. As for the other two statistically significant factors: the Volatility Index and the value of Brent oil, their impact has no significant practical impact. Regarding the value of the coefficient of determination R², the obtained correlation and regression model R2

indicating a very close interrelationship between the performance indicator and the factor values. For EUR/USD pair, the most practically significant global factor in the change in volatility is the monetary aggregate M2; the increase in money supply causes a decrease in the exchange rate EUR/USD. As for the other two statistically significant factors: the Volatility Index and the value of Brent oil, their impact has no significant practical impact. Regarding the value of the coefficient of determination R², the obtained correlation and regression model R2  then the increase in the EUR / USD exchange rate by 90% is due to the selected factor values. The remaining 10% are due to other factors affecting exchange rates, but are not included in the regression model. For USD/GBP pair, the most practically significant global factor in the change in volatility is the monetary aggregate M2; an increase in the money supply causes a decrease in the USD/GBP exchange rate. The factor of 3 monthly interest rate on treasury bills is less influential, but also statistically significant here; after all, it is not statistically significant for other currency pairs. Regarding the value of the coefficient of determination R2, the obtained correlation and regression model R2

then the increase in the EUR / USD exchange rate by 90% is due to the selected factor values. The remaining 10% are due to other factors affecting exchange rates, but are not included in the regression model. For USD/GBP pair, the most practically significant global factor in the change in volatility is the monetary aggregate M2; an increase in the money supply causes a decrease in the USD/GBP exchange rate. The factor of 3 monthly interest rate on treasury bills is less influential, but also statistically significant here; after all, it is not statistically significant for other currency pairs. Regarding the value of the coefficient of determination R2, the obtained correlation and regression model R2  the increase in the USD/GBP exchange rate by 89% is due to the level of money supply (M2), changes in interest rates on treasury bills and the price of oil. The remaining 11% are due to other factors affecting exchange rate rates; however, they are not included in the regression model.

the increase in the USD/GBP exchange rate by 89% is due to the level of money supply (M2), changes in interest rates on treasury bills and the price of oil. The remaining 11% are due to other factors affecting exchange rate rates; however, they are not included in the regression model.

While for the USD/JPY pair, the price of oil is the most practically significant global factor in the change in volatility, an increase in the average oil price leads to an increase in the USD/JPY exchange rate; the money supply factor here is less influential, however, also statistically significant. Regarding the value of the coefficient of determination R², the obtained correlation and regression model  then the increase in the USD/JPY exchange rate by 79% is due to the level of world oil prices and the volume of money supply M2. The remaining 21% are due to other factors affecting exchange rate rates; however, they are not included in the regression model. The investigations of Boako and Alagidede (2017) and Kumar et al. (2019) also track this dependence. According to the obtained results of the correlation and regression analysis, it can be stated that different currency pairs are sensitive to the impact of various global factors; however, they have no statistical dependence on the economic growth of the G7 countries. The outlined results are confirmed in previously published scientific works (Li et al., 2015; Vajda et al., 2015; Ben Omrane et al., 2017; Ko?cenda and Moravcov´a, 2018).

then the increase in the USD/JPY exchange rate by 79% is due to the level of world oil prices and the volume of money supply M2. The remaining 21% are due to other factors affecting exchange rate rates; however, they are not included in the regression model. The investigations of Boako and Alagidede (2017) and Kumar et al. (2019) also track this dependence. According to the obtained results of the correlation and regression analysis, it can be stated that different currency pairs are sensitive to the impact of various global factors; however, they have no statistical dependence on the economic growth of the G7 countries. The outlined results are confirmed in previously published scientific works (Li et al., 2015; Vajda et al., 2015; Ben Omrane et al., 2017; Ko?cenda and Moravcov´a, 2018).

Conclusion

Analysis of the current state of the world foreign exchange market shows the inevitable restructuring of all its segments, the shift of emphasis from one type of financial instrument to another. The share of major world currencies, such as USD and EUR, fluctuates with a gradual increase in the share of currencies in developing countries. An innovative transformation of the foreign exchange market model is taking place in the direction of tokenization and the introduction of blockchain technologies; the circle of participants is expanding. The use of electronic trading systems and the intervention of cryptocurrencies in the global foreign exchange market create a number of challenges related to the security factor.

On the whole, it is difficult to exaggerate the importance of how global factors can affect the global foreign exchange market and the volatility of major currency pairs. The ability to take into account important global factors influencing the global foreign exchange market and forecast changes in exchange rates is a necessary condition for successful trade and economic growth in general. The conducted research provides information on the determining factors of influence on the major currency pairs of the forex market in order to ensure more detailed information to market participants and determine the cause-and-effect relationship of global events and trends in the development of the foreign exchange market at the macro level. Further development of effective innovative models for the functioning of the world currency market, taking into account its current state, main development trends and challenges, is a promising area of future research.

References

- Avdjiev, S., Gambacorta, L., Goldberg, L., & Schiaffi, S. (2017). The shifting drivers of global liquidity. BIS. Working Paper 644.

- Barrot, L., & Servens, L. (2018). Gross capital flows, common factors, and the global financial cycle policy research. Working paper 8354.

- Barun´?k, J., Ko?cenda, E., & V´acha, L. (2017). Asymmetric volatility connectedness on the forex market. Journal of International Money and Finance, 77, 39-56.

- Ben Omrane, W., Tao, Y., & Welch, R. (2017). Scheduled macro-news effects on a Euro/US dollar limit order book around the 2008 financial crisis. Research in International Business and Finance, 42, 9-30.

- Boako, G., & Alagidede, P. (2017). Currency price risk and stock market returns in Africa: Dependence and downside spillover effects with stochastic copulas. Journal of Multinational Financial Management, 41, 92-114.

- Boubakri, S., Guillaumin, C., & Silanine, A. (2019). Non-linear relationship between real commodity price volatility and real effective exchange rate: The case of commodity-exporting countries. Journal of Macroeconomic,s 60, 212-228.

- Engel, C., Mark, N. C., & West, K. D. (2015). Factor model forecasts of exchange rates. Econometric Reviews, 34, 32-55.

- Forbes, K. J., & Warnock, F. E. (2012). Capital flow waves: Surges, stops, flight, and retrenchment. Journal of International Economics, 88(2), 235-251.

- Greenway-McGrevy, R., Mark, N. C., Sul, D., & Wu, J. L. (2018). Identifying exchange rate common factors. International Economic Review, 59(4), 2193-2218.

- Greenwood-Nimmo, M., Nguyen, V. H., & Rafferty, B. (2016). Risk and return spillovers among the G10 currencies. Journal of Financial Markets, 31, 43-62.

- Hanan, S. A. (2017). The drivers of capital flows in emerging markets post global financial crisis. IMF working paper series No WP/17/52.

- Ito, T. (2017). A new financial order in Asia: Will a RMB bloc emerge? Journal of International Money and Finance, 74, 232-257.

- Kenourgios, D., Papadamou, S., & Dimitriou, D. (2015). Intraday exchange rate volatility transmissions across QE announcements. Finance Research Letters, 14, 128-134.

- Khalifa, A. A., Otranto, E., Hammoudeh, S., & Ramchander, S. (2016). Volatility transmission across currencies and commodities with US uncertainty measures. The North American Journal of Economics and Finance, 37, 63-83.

- Kilic, E. (2017). Contagion effects of U.S. Dollar and Chinese Yuan in forward and spot foreign exchange markets. Economic Modelling, 62, 51-67.

- Ko?cenda, E., & Moravcov´a, M. (2019). Exchange rate comovements, hedging and volatility spillovers on new EU forex markets. Journal of International Financial Markets, Institutions and Money, 58, 42-64.

- Kumar, S., Tiwari, A. K., Chauhan, Y., & Ji, Q. (2019). Dependence structure between the BRICS foreign exchange and stock markets using the dependence-switching copula approach. International Review of Financial Analysis, 63, 273-284.

- Li, J., Shi, Y., & Cao, G. (2018). Topology structure based on detrended crosscorrelation coefficient of exchange rate network of the belt and road countries. Physica A: Statistical Mechanics and its Applications, 509, 1140-1151.

- Li, W., Wong, M. C. S., & Cenev, J. (2015). High frequency analysis of macro news releases on the foreign exchange market: A survey of literature. Big Data Research, 2, 33-48.

- Mai, Y., Chen, H., Zou, J. Z., & Li, S. P. (2018). Currency co-movement and network correlation structure of foreign exchange market. Physica A: Statistical Mechanics and its Applications, 492, 65-74.

- Mensi, W., Hammoudeh, S., Shahzad, S. J. H., Al-Yahyaee, K. H., & Shahbaz, M. (2017). Oil and foreign exchange market tail dependence and risk spillovers for MENA, emerging and developed countries: VMD decomposition based copulas. Energy Economics, 67, 476-495.

- Orlowski, L. T. (2016). Co-movements of non-Euro EU currencies with the Euro. International Review of Economics & Finance, 45, 376-383.

- Rey, H. (2013). Dilemma not trilemma: The global financial cycle and monetary policy independence. Proceedings of the federal Reserve bank at Kansas city economic symposium at Jackson Hole.

- Salisu, A. A., & Ayinde, T. O. (2018). Testing for spillovers in naira exchange rates:The role of electioneering & global financial crisis. Borsa Istanbul Review, 18, 341-348.

- Salisu, A.A., Oyewole, O.J., & Fasanya, I.O. (2018). Modelling return and volatility spillovers in global foreign exchange markets. Journal of Information and Optimization Sciences, 39, 1417-1448.

- Sarno, L., Tsiakas, I., & Ulloa, B. (2016). What drives international portfolio flows? Journal of International Money and Finance, 60, 53-72.

- Sehgal, S., Pandey, P., & Diesting, F. (2017). Examining dynamic currency linkages amongst South Asian economies: An empirical study. Research in International Business and Finance, 42, 173-190.

- Singh, V. K., Nishant, S., & Kumar, P. (2018). Dynamic and directional network connectedness of crude oil and currencies: Evidence from implied volatility. Energy Economics, 76, 48-63.

- Vajda, V., Kisela, P., & U?zik, M. (2015). The impact of fundamental information on EUR currency-Evidence from the market. Procedia Economics and Finance, 32, 87-94.