Research Article: 2019 Vol: 23 Issue: 3

Stock Market-Banking Sector-Growth Nexus in Zimbabwe

Kunofiwa Tsaurai, University of South Africa

Weston Dzikiti, University of South Africa

Abstract

The study which is an extraction from a master’s degree dissertation examined the relationship between stock market, banking sector and economic growth in Zimbabwe using a Vector Error Correction Model (VECM) with time series data from 1988 to 2015. Most of the related studies separately explored the stock market-growth and banking sector-growth nexus unlike our study which investigated the three variables in a trivariate framework set up. The few previous empirical works which examined the stock market-economic growth and banking sector link in one study were quite narrowly focused in their choice of both banking sector and stock market proxies. The current study deviates from prior studies in that three banking sector development proxies (total financial sector credit, banking credit to private sector and broad money M3) and three stock market development proxies (stock market capitalization, value traded and turnover ratio) were employed to estimate both long and short run relationships between stock market, banking sector and economic growth in Zimbabwe. The results showed that a significant causal relationship from banking sector and stock market development to economic growth exists in the long run without any feedback effects. In the short run, a negative but statistically significant causal relationship runs from economic growth to banking sector and stock market development in Zimbabwe. Zimbabwean authorities are therefore urged to deepen their stock market and banking sector in order to ensure long term economic growth.

Keywords

Banking Sector, Stock Market, Growth, VECM, Zimbabwe

Introduction

Background of the Study

Evidence from cross-country heterogeneity in Sub-Saharan Africa reveals that the interrelationship between the financial development and economic growth has not received sufficient attention in finance literature (Tsaurai & Odhiambo, 2012). Zimbabwe, which demonstrates a paradigm distinct from other Sub-Saharan African countries, has been excluded from many finance and growth studies (Ndlovu, 2013). According to the Reserve bank of Zimbabwe (RBZ) (2016), recent evidence in Zimbabwe suggests that beyond a certain threshold, banking sector and stock market development might actually have a negative effect on economic growth. A report by the Zimbabwe Stock Exchange (ZSE) (2015) showed that in undertaking their roles of being influential over the most productive economic areas, banks faced financial constraints in Zimbabwe.

In Zimbabwe, the 2003-2008 financial crises downsizing of banking sector operations compromised the effect of banking sector development and stock market liquidity on economic growth. In fact, this crippled the ability of the RBZ to perform its function as a lender of last resort. The RBZ (2015) documents that, the ZSE had by 2003 turned into an explosive source of wealth creation. This wealth was derived merely from trading of financial securities without the injection of significant cash flows into the underlying listed banking institutions. The ZSE was being used as a blue print for the pursuit of speculative activities in contrast to its fundamental function of allocating financial resources to productive sectors of the economy. The stock market has been characterized by a huge increase in transactions under the auspices of negative real interest rates (ZSE, 2010). Such negative interest rates discourage investment and growth but assist undesirable levels of speculation and in turn bring about depreciation in net worth of these banks.

The debate on the relationship between financial development and economic growth has recently received attention in both developed and developing countries (Tsaurai, 2015). The thrust of this debate has been whether financial sector development brings about economic growth (supply-leading hypothesis), or whether it is economic growth that causes financial sector development (demand-following hypothesis). A large body of studies has emerged, both at the theoretical and the empirical level that have attempted to answer these questions but no consensus has as yet been reached. Against this background of conflicting theoretical and empirical views, the direction of causality (not to mention the robustness of the relationship) between banking sector, stock market development and economic growth warrants a deeper insight. Scenarios postulated by Jecheche (2010) suggest that Zimbabwean financial sector dynamics have brought considerable arguments about banking sector and stock market relationships to the fore-front of academic debate. For this reason, greater insight into the interrelationship between stock market, banking sector and economic growth particularly in the context of the Zimbabwean economy is necessary.

Problem Statement

Zimbabwean financial sector dynamics have displayed a paradigm difference from most European and Sub- Saharan African countries (Ziwengwa et al., 2011). According to the RBZ (2009), banks faced financial constraints against a hype of skyrocketing industrial and mining indices. The International Monetary Fund (IMF) (2010) also showed that the period from 2003 to 2008, Zimbabwean stock market indices soared to unprecedented heights (595% monthly and 12000% yearly) against a backdrop of falling Gross Domestic Product (GDP) and a collapsing banking sector. This poses the question of what has really accounted for the stagnation in economic growth that has lasted for years in Zimbabwe, which therefore requires an investigation of the major constraints precluding the ZSE and banking sector from effectively allocating scarce resources. Empirical studies have also been carried out to explore the impact engendered by the banking sector and stock market on economic growth in Zimbabwe, nonetheless most of these studies have failed to account for the continued plummeting of the economy, not to mention the extreme divergence in stock market and banking sector development indicators (Mutenheri & Green, 2002; Bindu et al., 2009; Makina, 2009; IMF, 2010; Tsaurai & Odhiambo, 2012). Hence there exists a need for research to reveal the key underlying factors behind a low growth rate associated with banking sector turmoil and escalating stock market indices in the Zimbabwean economy.

Contribution of the Paper

A multivariate causality framework of banking sector, stock market development and economic growth represents a unique study in the Zimbabwean context. No other study has ever featured the same research methodologies, design, objectives or delimitations. While several studies have been conducted on much related finance-growth topics, none have covered the overall financial sector efficiency, depth or sophistication. The majority of these studies have merely examined financial sector liquidity, size and volatility. One example is the study conducted by Ishioro (2013) which looked at stock market liquidity and volatility in Zimbabwe from 1990 to 2010. The present study thus contributes to literature by focusing not only on size and liquidity but also on financial sector depth and efficiency using measures of overall financial sector efficiency.

In addition, no study has as yet applied a combination of three different banking sector variables and three stock market development variables simultaneously when investigating finance-growth relationships in Zimbabwe. A few scholars who have studied this area have used only one or two proxies for either for banking sector or stock market development. For instance, Tsaurai & Odhiambo (2012) used stock market capitalisation and the ratio of savings to GDP variables to proxy financial development in Zimbabwe while Ziwengwa et al. (2011) used stock market capitalization as a proxy for stock market size in Zimbabwe.

Organization of the Paper

Section 2 reviewed related theoretical and empirical literature, trend analysis is done in section 3 whereas section 4 focused on the research methodology, empirical model specification and estimation techniques. Section 5 summarizes the paper.

Literature Review

Academic research on the finance-growth nexus dates back at least to Schumpeter (1912), who emphasised the positive role of financial development on economic growth. The relationship between financial development and economic growth has been a subject of great interest and debate among economists for many years. The debate on the relationship between financial development and economic growth has recently received attention in numerous empirical studies in both developed and developing countries. The thrust of this debate has been whether financial sector development causes economic growth (supply-leading hypothesis), or whether it is the growth of the real sector that causes financial sector development (demand-following hypothesis). A large body of literature has emerged, at both the theoretical and empirical level, which has attempted to answer these above questions however it appears that no consensus has been reached yet. Although several empirical studies have investigated the relationship between financial depth, defined as the level of development of financial markets and economic growth, the results have been ambiguous (Pagano, 1993; Levine, 2008). Patrick (1966) endeavored to formalise the debate by developing the stage-of-development theory of financial development.

The stage-of-development finance growth theory as hypothesised by Patrick (1966) maintains that the relationship between finance and growth varies over time as the economy develops. In its initial stages, financial development will lead economic growth but as real growth takes place in the economy, this link becomes less important and growth will induce the demand for greater financial services. According to this theory, the direction of causality between financial development and economic growth changes over the course of the development (Patrick, 1966). Patrick’s stage-of-development theory is underpinned by two hypotheses; the supply-leading and the demand-following hypotheses (Ziwenga et al., 2011). The supply-leading hypothesis postulates that the development of the financial system will lead to economic growth. For example, Luintel (2008) holds that a well-developed financial sector provides critical services to reduce those costs and thus to increase the efficiency of intermediation. Such a financial sector mobilises savings, funds good business projects, facilitates the diversification of risks, and fosters the exchange of goods and services. These services result in a more efficient allocation of resources, a more rapid accumulation of physical and human capital, and faster technological innovation, thus inducing faster long-term economic growth (Levine, 1997). A demand-following hypothesis postulates that economic growth leads to financial development. The development of the real economy spurs increased demand for financial services, which in turn generates the introduction of new financial institutions and markets to satisfy this demand (Robinson, 1952; Patrick, 1966; Stern, 1989).

Contemporary literature contends that three schools of thought exist that confirms theoretical assumptions of the stage-of-development hypothesis in the banking sector-economic growth link, while taking into consideration the complementary effects of stock market development (Odhiambo, 2008). The first school of thought validates the feedback hypothesis by maintaining that the banking sector, the stock market and economic growth promote each other. Proponents of this view include Chauh & Thai (2004), Kar & Pentecost (2000), Goldsmith (1969) and Luintel & Khan (1999). According to Chauh & Thai (2004), a country with a well-developed banking system and stock market promotes economic growth through technological changes and product innovation, which in turn creates high demand for financial arrangements and services. These changes further stimulate greater economic growth, as both the banking sector and the stock market responds to demands for financial services (Kar & Pentecost, 2000).

The feedback hypothesis has been further supported by such empirical studies by Kolapo & Adaramola (2012), Osuji & Chigbu (2012) and Samson & Elias (2010). Samson & Elias (2010) tested the competing finance-growth hypothesis using Granger causality tests in a VAR framework. Kolapo & Adaramola (2012) examined the impact of a capital market on economic growth in Nigeria. The causality test results suggested a bi-directional causation between economic growth and the value of transactions on the stock market and a unidirectional causality from market capitalisation to economic growth. Osuji & Chigbu (2012) employed the Granger Causality test, Co-integration and Error Correction Method (ECM) to investigate the impact of financial development on economic growth Nigeria. The Granger test indicates a bi-causality between Money Supply (MS) and Economic growth.

The second school of thought supports the supply-leading hypothesis in postulating that the banking sector needs to be complemented by stock market development in promoting economic growth (Allen et al., 2012; Tsaurai, 2013:2015:2016). Acaravci et al. (2007) confirmed this hypothesis and documented that emerging stock markets are crucial to developing countries, since they augment bank finance by providing equity capital to the disadvantaged sectors of the economy. Furthermore, Tsaurai (2015) affirms the supply-leading hypothesis by highlighting that emerging markets need not be fearful of stock market development, since the functioning of stock markets results in a higher debt-to-equity ratio, more business for banks eventually boosting economic growth (Kadenge & Tafirei, 2014; Ishioro, 2013; Allen et al., 2012).

Kadenge & Tafirei (2014) concurs that if economic growth is to be accelerated banks need to be complemented by a well-functioning stock market in order to reduce the inefficiencies associated with developing countries’ weak credit markets. A study by Tsaurai & Odhiambo (2012) investigated the causal relationship between stock market development and economic growth in Zimbabwe and observed a distinct causal flow from stock market development to economic growth without any feedback.

The third school of thought provides evidence in favour of the demand-following hypothesis, stipulating that economic growth plays a leading role in enhancing stock markets development and that the banking sector compliment economic growth in influencing stock market development. Studies consistent with this view include those done by Phadran et al. (2014), Waqabaca (2004), Zang & Chul- Kim (2007) and Agbestiafa (2003). Zang & Chul-Kim (2007) stress that economic growth plays a leading role and banks merely complement the promotion of stock market development by ensuring the liquidity of real innovative investments. Waqabaca (2004) observed that economic growth boosts a bank’s balance sheet. When testing the relationship between financial development and economic growth in Fiji, Waqabaca (2004) found a positive relationship between financial development and economic growth, but with the direction of causality running from economic growth to financial development. On the other hand, Agbetsiafa (2003) in a study of the causal relationship between financial development and economic growth in eight Sub-Saharan African (SSA) countries found a dominant unidirectional causality from growth to finance in Ivory Coast and Kenya.

Trend Analysis

Consistent with Stead (2007), trend analysis is intended to provide a more detailed and informative analysis of the finance-growth nexus. Trends in the Zimbabwean financial sector were analyzed and discussed under three headings:

1. Banking sector trends.

2. Stock market trends.

3. Economic growth trends.

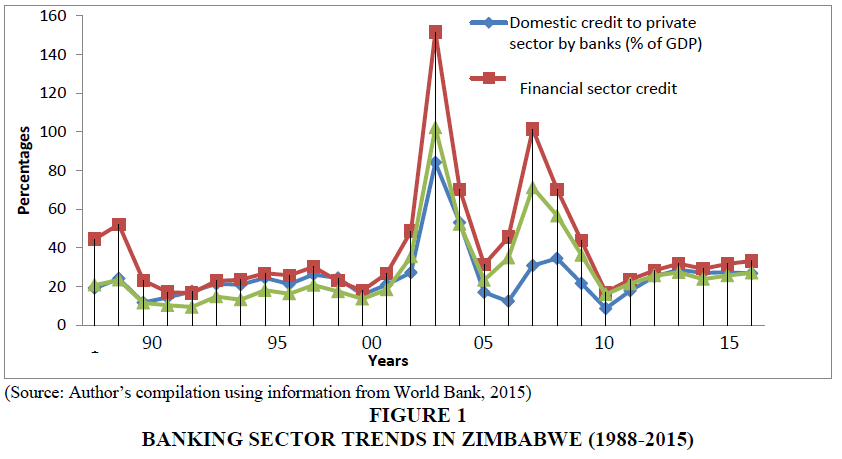

The pre-banking crisis period from 1988 to 2002 recorded some positive steady development and growth in the banking sector in Zimbabwe as indicated in Figure 1. From 1991, all three indicators of banking development in Zimbabwe (domestic credit to private sector, financial sector credit and M3) began recording positive marginal changes in their trends. This was due to financial reforms undertaken in 1991 which led to significant changes in the structure of the banking sector in Zimbabwe (RBZ, 1996).

(Source: Author’s compilation using information from World Bank, 2015)

Figure 1 Banking Sector Trends in Zimbabwe (1988-2015)

Following the enactment of financial reforms, the financial services sector began to accommodate broader local participation (RBZ, 1999). Deregulation of the financial market engendered local ownership of banking institutions, from a situation where there were no indigenous banks at independence (1980), to a 71 % mark local ownership by December 2002. According to RBZ (2002), this liberalization led to increased competition, improved efficiency and the de-segmentation of the financial sector. In response to the liberalization of the Zimbabwean economy, the total deposits held by indigenous banks rose to about US $3 billion (70%) while foreign owned institutions held US $1.3billion (30%) of total deposit by the end of 2002. This was indicated by a sharp increase of 150% in domestic credit to the private sector between 2000 and 2002 followed by a significant shift in loan allocation among sectors. The IMF (2003) added that this increased competition came with the introduction of new products and services such as e-banking and in-store banking. These entrepreneurial activities resulted in the deepening and sophistication of the financial services sector.

As shown in Figure 1, from 2009 to 2015 total banking sector deposits (as a ratio of GDP) continued on an upward trajectory, increasing by 14.2% from $4.9 billion at end of 2014 to $5.6 billion as at end of 2015. By end of 2015, domestic credit to private the sector by banks amounted to $4.0 billion, translating into a loan to deposit ratio of 71.4%. Bank deposits were largely dominated by demand deposits, which accounted for 55.49% of total deposits. These demand deposits were relatively short-term in nature, with constraining effects on banking institutions’ ability to meet the long-term funding requirements of key productive sectors (RBZ, 2016).

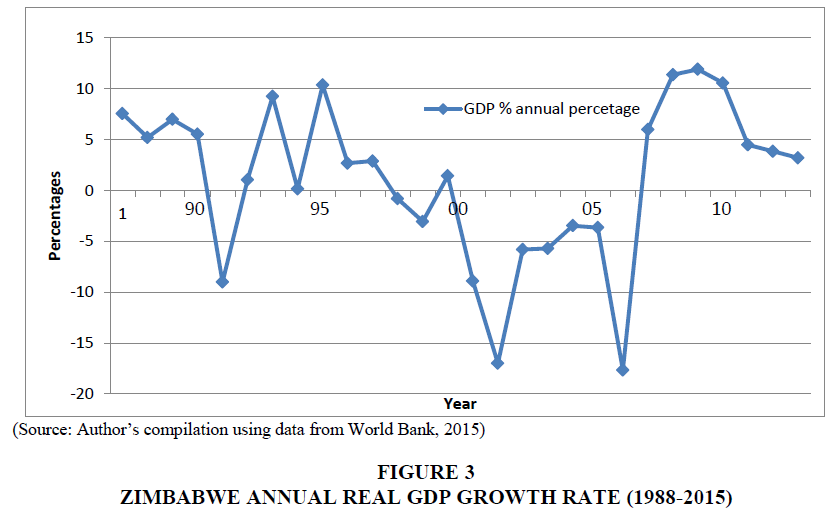

Trends in the Zimbabwe Stock Exchange (ZSE) can be analyzed in three different phases, namely: i) a steady growth phase from 1988 to 1998; ii) a high volatility phase from 1999 to 2008; and iii) a sustained decline phase from 2009 to 2015. Generally, the Zimbabwe stock exchange experienced a steady positive growth from 1988 to 2016. The ZSE was opened to foreign players in mid-1993 following the partial lifting of exchange control regulations (RBZ, 1990). Foreign participation on the exchange increased trading activity, turn over, value traded, market capitalization and integration with world financial markets. As a result annual stock market turn-over increased significantly from US $53 million in 1990 to US$150million in 1995 an increase of 184.61% (World Bank, 1996). Following the liberation of the financial market in Zimbabwe, the number of newly listed counters went up from 57 listed companies at the end of 1990 to 64 by the end of 1996. During this same period market capitalization followed suit with a sharp increase noted from US $2.4billion in 1990 to US $3.64 billion by the end of 1996. This is shown in the Figure 2 below, which illustrates the trends of stock market development in Zimbabwe for the period 1988 to 2015.

(Source: Author’s compilation using information from World Bank, 2015)

Figure 2 Stock Market Trends in Zimbabwe (1988-2015)

The post-2010 period saw a series of unimpressive performances on the ZSE reflected in the downward trends of market capitalization, stock market turn-over and value traded ratios indicated in Figure 2 above. In the sustained decline phase from 2009 to 2015 the ZSE recorded a series of significant declines in trading. The number of listed counters dropped from 81 in 2010 to 64 in 2015 a 21% decrease. During the same period, stock market capitalization decreased sharply by 73% from US $1,1476 million in 2010 to US $3,073 million in 2015. While at the same time value traded went down to US $183 million from an amount of US $1,144 million in 2010 a percentage decrease of 83%. It was noted also that a significant decrease of 39% in stock turnover occurred on the ZSE from US $572 million in 2010 to US $350 million in 2015.

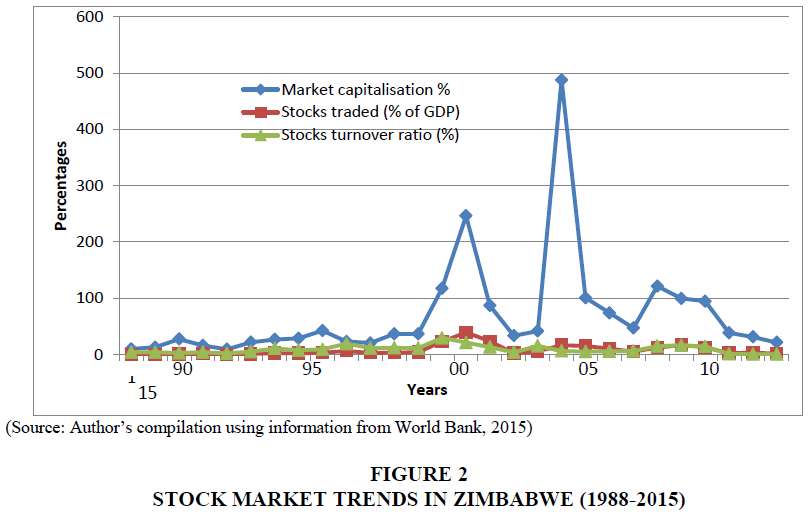

The trends in economic growth in Zimbabwe can be subdivided into three periods, namely: i) a positive economic growth period from 1988 to 1998; ii) a negative economic growth period from 1999 to 2008; iii) a period of economic recovery from 2009 to 2015. While Zimbabwe experienced weak yet positive growth rates averaging 3.9% annually for the period 1988 to 1998, growth rates trends in this phase were largely affected by macroeconomic challenges, including among others drought in 1992 and low investment and industrial productivity as a result of foreign currency shortages (RBZ, 2001). Figure 3 below shows the real annual GDP growth rate for Zimbabwe from 1988-2015.

(Source: Author’s compilation using data from World Bank, 2015)

Figure 3 Zimbabwe Annual Real GDP Growth Rate (1988-2015)

As shown in Figure 3 above, Zimbabwe experienced positive and negative growth trajectories averaging 0.32% annually over the period 1988-2015. Even though the period from 1985 to 1990 was characterized by positive growth, the period from 1990 to 1995 was mainly composed of falling GDP levels, from US $8.7 billion to US $7.1 billion. This shrinking of the economy continued in the period 1995 to 1999, which saw a further drop in GDP of 7.1% and in the same period per capita GDP went down by even greater margins to 13.22%. The economic recovery in recent years has been underpinned by the mining and agriculture sectors, which accounted for 93.5% of export revenues between 2009 and 2013.

Mining sector making up 65.2% of export earnings over the same period, is a typical enclave sector with weak linkages to the rest of the economy. It is also capital intensive, with limited employment creation opportunities. The manufacturing sector saw a drop in activity between 2011 and 2014: at least 4 610 companies closed down, resulting in a loss of 55,443 jobs (ZIMSTATS, 2015). The end of the year 2012 was marked by an economic rebound, with the GDP growing at an average rate of 11.0% per annum. However, GDP growth decelerated sharply from 10.6% in 2012 to 4.5% in 2013 and an estimated 3.1% in 2014. Real GDP was projected to marginally improve to 3.2% in 2015. This projected marginal improvement would be on the back of planned investments in agriculture, mining, communications and other infrastructure projects, including the water and energy sector.

Methodology

Data Used For the Study

The study used annual time series data from the World Development Indicators (WDI), Reserve Bank of Zimbabwe (RBZ) and Zimbabwe Central statistics (ZimStats) from 1988 to 2015. Tsaurai (2015) believes that secondary time series data sources (like the ones used in the present study) are most appropriate since they provide a fairly long data set, which is necessary when testing long multi-variant finance-growth nexuses. The study thus follows the suggestions made by Herwartz & Walle (2014) in applying a fairly long time series data set obtained from secondary sources.

According to Owusu (2012) a fairy long time-series data set was used because the granger causality test must be done for various periods which require data of such characteristics. Therefore the nature and characteristics of this data set made it suitable for the causality tests that were applied in this study. Moreover, such secondary sources (WDI, RBZ, ZimStats) were chosen also because they contained data on financial development indicators from 1980-2015 in US dollars, making them ideal to test the research hypothesis developed herein. Such US dollars denominated data helped mitigate the effects of outliers, variability and instability in data caused by the hyperinflationary environmental effects that characterized the Zimbabwean economy during the period under study.

Measurement of Variables

Following the empirical studies of Beck & Levine (2004) and Levine et al. (2000), this study uses the value of loans made by commercial banks to the private sector divided by GDP at constant price and calls this proxy, Bank Credit to Private sector (BCP). This measure is believed to be superior to other measures of financial development. It represents an accurate and reliable indicator of the functioning of financial development as it is a measure of the quantity and quality of investment (Odhiambo, 2008; Tsaurai, 2017). Although it excludes bank credits to the public sector, it represents more accurately the role of financial intermediaries in channeling funds to private market participants. This was consistent with the objective of this study which was to evaluate the contribution of banks and stock markets to economic growth in Zimbabwe (Owusu, 2012).

Approximation of stock market development involves the interaction of many activities and cannot be captured by a single measure. Studies consistent with this view include Darrat et al. (2006), Hou & Cheng (2010), Salisu (2014) and Kadenge & Tafirei (2014). These researchers agree on the notion that measuring the process of improvement in the quantity, quality and efficiency of stock market services has never been dealt with meticulously by considering one single proxy. Hou & Cheng (2010) added that, in order to assess the nexus between stock market development, banking sector and economic growth, three indicators are employed in literature: measures of size (market capitalization) and liquidity (value traded and turnover ratio).

Studies by Caporale et al. (2005), Cheng (2012), Cooray (2010) and Kar & Pentecost (2000) advocated for measures of size (market capitalization) as a proxy for stock market development. Caporale et al. (2005) content that Market Capitalization (MC) is a proxy that measures the extent to which stock market allocates capital to investment projects and the opportunities for risk diversification that this provides to investors. Cooray (2010) adds that market capitalization also shows the overall size of the stock market as a percentage of GDP at constant price. MC equals the value of listed domestic shares on domestic exchanges divided by GDP (Cheng, 2012).

On the other hand, studies exist that support measures of liquidity (total Value Traded (VT) and Turnover Ratio (TR)) as indicators of financial market development (Pradhan et al., 2014; Solo, 2013; Owusu, 2012; Tsaurai, 2012). The former measures the investor’s ability to trade economically significant positions on a stock market, whereas the latter is an indicator of the liquidity of assets traded within a market (Pradhan et al. 2014). Tsaurai (2013) adds that total Value Traded (VT) is the total value of domestic shares traded on a country’s stock exchange as a share of GDP at constant price.

According to Tsaurai (2012) the measures of market liquidity complements the market capitalization ratio thus even though a market may be large, there may be thin trading. Rousseau & Wachtel (2000) and Beck &Levine (2004) both use total value traded measured as the ratio of value shares traded to GDP. However, according to Beck & Levine (2004), the value traded has two weaknesses: It does not measure the liquidity of the market and it only measures trading relative to the size of the economy. In addition, since value traded is the product of quantity and price, this means that it can rise without an increase in the number of transactions. A high value for total value traded may result from high trading activity in certain active stocks, while there may also be a significant number of relatively inactive shares listed on the same stock exchange (Beck et al., 2000).

Given such weaknesses, a better indicator of stock market activity is the turnover ratio (TR). Adherents of this view-point include Beck & Levine (2004), Owusu (2012), Solo (2013), Beck (2008), Nowbutsing & Odit (1999) and Odhiambo (2010). Beck (2008) and Nowbutsing & Odit (1999), postulated that Turnover Ratio (TR) equals the value of total domestic shares traded on domestic exchanges, divided by the value of listed domestic shares or Market Capitalization (MC). Tsaurai (2016) expands on this, arguing that turnover specifically, measures the volume of domestic equities traded on domestic exchanges relative to the size of the market. Beck & Levine (2004) prefer this proxy to other measures of stock market variables since, unlike others the numerator and denominator of TR contain prices irrespective of the fact that, TR complements the MC ratio (Owusu, 2012). A large but inactive market will have a large MC ratio but a small TR ratio. This also complements the value-traded ratio: while this total-value-traded ratio captures trading relative to the size of the economy, turnover measures trading relative to the size of the stock market. A small liquid market will have a high TR ratio but a small value traded ratio (Nowbutsing & Odit, 1999).

In order to examine the nexus between stock market development, banking sector development and economic growth in this study, the stock market capitalization ratio, among others was used. The use of stock market capitalization was motivated by the methodologies used in previous researches on finance and growth (Nowbutsing & Odit, 1999; Odhiambo, 2010). The assumption underlying this measure is that overall market size is positively correlated with the ability to mobilize capital and diversify risk on an economy-wide basis (Levine, 2008). The motivation for using the index factor is to ensure that all the various policies implemented to reach full stock market development in Zimbabwe are taken into account. The use of this index factor also goes some way solving the problem of the quantification of the effect of financial market development, which is often one of the challenges associated with empirical studies in this discipline (Dasgupta et al., 2013).

This researcher also followed Beck et al. (2000) and Beck & Levine (2004) by deflating the MC ratio a stock variable measured at the end of the period. The real GDP needed to be deflated too, although it represented a flow variable that was defined relative to a period. This indicated that there was a stock-flow problem: thus it is a process which, if ignored may have resulted in a misleading result. The problem was solved by deflating end of year market capitalization by end of year Consumer Price Index (CPI) and deflating the GDP by the CPI (Darrat et al., 2006). The study then took the average of MC in period t and period t-1 and related it to the real flow variable for period t-4.

Using standard practices described in the growth literature (Yucel, 2009; Cheng, 2012), economic growth was measured by real Gross Domestic Product (GDP). As such this study used real GDP as a proxy for economic growth when testing the relationship between economic growth and financial development. Levine (2008) suggests several possible indicators for economic growth: real per capita GDP growth; average per capita capital stock growth; and productivity growth. In the estimation of causal relationship between banking sector, stock market development and economic growth, this study used real GDP per capita with a one-year lag as initial income per capita to control for the steady-state convergence growth model (Cheng, 2012). Furthermore, in order to estimate the nexus between stock market and banking sector developments, the study controlled for a deterministic time trend in turnover and changes in the respective means of turnover and available bank credit as a result of differences in legal and institutional developments (Dey, 2005). As for the direction of causality, magnitude and robustness of the link between stock markets, banks and economic growth the researcher controlled for other potential determinants of economic growth in regressions (Naceur & Ghazouani, 2007).

Consistent with theoretical considerations in the extant finance- growth literature, the study employed financial sector credit (to proxy financial efficiency), broad money (M3) (to proxy financial depth) and banking credit to private sector (to proxy financial intermediation) as banking sector development variables. Stock market development was measured by Turnover Ratio (TR), value traded (VT) and stock market capitalization (MCAP) while economic growth was measured by real growth rate in annual gross domestic product.

Using panel data analysis methods with annual panel data ranging from 1990 to 2008, Cojocaru et al. (2016) studied the impact of the financial system on economic growth in transitional economies. Their study found out that competitiveness of the financial sector and financial market efficiency had a significant positive influence on economic growth in the transitional economies studied. Banerjee et al. (2017) investigated the relationship between financial development and economic growth in Bangladesh using VECM approach with annual time series data ranging from 1974 to 2012. Bank credit to the private sector was found to have had a significant positive impact on economic growth in Bangladesh both in the short and long run. No long run relationship between stock market development and economic growth was found in Bangladesh. Jointly, bank credit to the private sector and stock market development were found to have a non-significant positive effect on economic growth in Bangladesh.

Nyasha & Odhiambo (2016) investigated the relationship between economic growth, stock market and banking sector development in Kenya using the Autoregressive Distributive Lag (ARDL) approach with time series annual data ranging from 1980 to 2012. Stock market development was found to have had a positive influence on economic growth whilst banking sector development had no impact on economic growth in Kenya, both in the long and short run. Nyasha & Odhiambo (2017) also explored the relationship between economic growth, banking sector and stock market development in Brazil using the ARDL approach with annual time series data spanning from 1980 to 2012. Their study revealed that stock market development had a significant positive influence on economic growth in Brazil both in the long and short run. On the other hand, banking sector development in Brazil did not have a positive effect on economic growth.

Ahmad et al. (2016) studied the relationship between economic growth, global financial crisis and financial market development in developing countries using the pooled mean group estimation procedure. They found out that both banking sector and stock market development supported economic growth in the developing countries studied. Using the VECM approach with annual time series data spanning from 1991 to 2014, Shrutikeerti & Amlan (2017) explored the relationship between insurance sector, banking sector development and economic growth in India. A bi-directional causality relationship between insurance sector development and economic growth was detected in India. Banking sector development was however found to have no influence on economic growth in India. Using ARDL approach with annual time series data (2007-2012), Pan & Mishra (2018) explored the relationship between stock market development and economic growth in China. Their study noted that stock market development had a negative effect on economic growth in China both in the short and long run.

Empirical Model Specification

Ogwumike & Salisu (2014) found that stock market and banking sector development promoted investment through provisioning of long-term capital, which in turn raised output and economic growth. Based on these considerations, the study specified the model representing the relationship between banking sector, stock market development and growth as follows:

GDPt =ƒ (BSD,SMD)t (1)

Where, BSD is banking sector development, GDP is real gross domestic product and SMD is stock market development. The general form of the Vector Error Correction Model (VECM) was re-written in natural log form in order to remove any uncertainties in non-linear relationships between residuals and to allow coefficient interpretations as follows:

(2)

(2)

Where, ß0 is a constant and ß1, ß2 and γ1 are the elasticity coefficients of real GDP with respect to banking sector, stock market development and economic growth. εt is the Gaussian residual and ECTt-1 is the error correction term lagged one period. In this study estimating the nexus between banking sector, stock market development and economic growth involved carrying out the following estimation techniques.

Results and Discussion

The Vector Error Correction Model (VECM) was used to estimate the hypothesis that there exists a significant causal relationship exists between and amongst banking sector, stock market development and economic growth in Zimbabwe. The model’s empirical estimation followed three steps: The first step involved conducting unit root tests to examine the stationarity of time series variables using the following equation.

(3)

(3)

Where, yt is the variable in question, εt is white noise error term and

(4)

(4)

Table 1 below presents the results of unit root tests at first difference.

| Table 1 Unit Root Tests at 1st Difference (Intercept) | ||||||

| Variables | Augmented-Dickey-Fuller (ADF) | Detrended Dickey-Fuller (DF-GLS) | Phillip-Peron (PP) | |||

| t-vtatistic | Critical value | T- statistic | Critical value | T-statistic | Critical value | |

| lnGDP | -3.940 | -3.711 ?** -2.981 ?? -2.629 ? |

-4.003 | -2.656 ?** -1.954 ?? -1.609 ? |

-3.932 | -3.711 ?** -2.981 ?? -2.629 ? |

| LnBCP | -5.4218 | -3.737 ?** -2.991 ?? 2.635 ? |

-5.426 | -2.664 ?** -1.955 ?? -1.608 ? |

-10.544 | -3.711 ?** -2.981 ?? -2.630 ? |

| LnFSC | -5.361 | -3.737 ?** -2.991 ?? -2.635 ? |

-5.474 | -2.665 ?** -1.955 ?? -1.609 ? |

-9.794 | -3.712 ?** -2.981 ?? -2.629 ? |

| LnM3 | -5.380 | -3.737 *** -2.991 ?? -2.635 ? |

-5.411 | -2.665 ?** -1.956 ?? -1.609 ? |

-10.955 | -3.711 ?** -2.981 ?? -2.629 ? |

| LnMCAP | -6.455 | -3.737 ?** -2.991 ?? -2.635 ? |

-6.614 | -2.664 ?** -1.956 ?? -1.609 ? |

-14.281 | -3.711 ?** -2.981 ?? -2.629 ? |

| LnTR | -6.054 | -3.711 ? -2.981 ?? -2.629 ?** |

-6.179 | -2.657 ? -1.954 ?** -1.609 ?** |

-6.692 | -3.711 ? -2.981 ?? -2.629 ?** |

| LnVT | -7.037 | -3.724 ?** -2.986 ?? -2.632 ? |

-7.187 | -2.661 ?** -1.955 ?? -1.61 ? |

-4.952 | -3.711 ?** -2.981 ?? -2.629 ? |

The study used the Johansen (1988:1991) and Johansen & Juselius (1990) co-integration test procedure to test for the existence of co-integration relationships between variables using the equation below:

(5)

(5)

Where, λ1 = the largest estimated value of ith characteristic root (Eigen value) obtained from the estimated II matrix.r=0, 1, 2,…..p-1, T= the number of usable observations. The λtrace statistic tests the null hypothesis that the number of distinct characteristic roots is less than or equal to r, (where, r is 0, 1, or 2) against the general alternative (Table 2).

| Table 2 Johansen Juselius Maximum Likelihood Co Integration Test Results | ||||

| H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) | |

| ModelA [GDP=f(BCP,MCAP)] | r=0 | r ≥1 | 42.512* (29.797) | 26.617* (21.131) |

| r ≤1 | r ≥ 2 | 15.894* (15.494) | 7.189 (14.264) | |

| r ≤ 2 | r ≥ 3 | 0.893 (3.841) | 0.893 (3.841) | |

| Model B [GDP=f(BCP,TR)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 24.583 (29.797) | 19.272 (21.131) | |

| r ≤ 1 | r ≥ 2 | 5.310 (15.494) | 5.106 (14.264) | |

| r ≤ 2 | r ≥ 3 | 0.203 (3.841) | 0.203 (3.841) | |

| Model C [GDP=f(BCP,VT)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 35.336* (29.797) | 21.941* (21.131) | |

| r ≤ 1 | r ≥ 2 | 14.395 (15.494) | 10.857 (14.264) | |

| r ≤ 2 | r ≥ 3 | 3.537 (3.841) | 3.537 (3.841) | |

| ModelD[(GDP=f(FSC, MCAP)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 41.074* (29.797) | 19.399* (21.131) | |

| r ≤ 1 | r ≥ 2 | 21.084* (15.494) | 15.527* (14.264) | |

| r ≤ 2 | r ≥ 3 | 5.557* (3.841) | 5.557* (3.841) | |

| Model E [(GDP=f(FSC,TR)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 27.572 (29.797) | 19.265 (21.131) | |

| r ≤ 1 | r ≥ 2 | 8.307 (15.494) | 5.891 (14.264) | |

| r ≤2 | r ≥ 3 | 2.415 (3.841) | 2.415 (3.841) | |

| Model F[(GDP=f(FSC,VT)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 29.767 (29.797) | 17.822 (21.131) | |

| r ≤ 1 | r ≥ 2 | 11.944 (15.494) | 8.850 (14.264) | |

| r ≤ 2 | r ≥ 3 | 3.094 (3.841) | 3.094 (3.841) | |

| Model G[(GDP=f(M3,MCAP)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥1 | 18.254 (29.797) | 10.140 (21.131) | |

| r ≤ 1 | r ≥ 2 | 8.1137 (15.494) | 5.948 (14.264) | |

| r ≤ 2 | r ≥ 3 | 2.164 (3.841) | 2.164 (3.841) | |

| Model H[(GDP=f(M3,VT)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 36.987* (29.797) | 26.696* (21.131) | |

| r ≤ 1 | r ≥ 2 | 10.290 (15.494) | 7.987 (14.264) | |

| r ≤ 2 | r ≥ 3 | 2.302 (3.841) | 2.302 (3.841) | |

| Model I [GDP=f(M3,TR)] | H0 | H1 | Trace statistic (Critical value) | Maximum Eigen (Critical value) |

| r=0 | r ≥ 1 | 23.466 (29.797) | 29.832 (21.131) | |

| r ≤ 1 | r ≥ 2 | 3.634 (15.494) | 3.168 (14.264) | |

| r ≤ 2 | r ≥ 3 | 0.465 (3.841) | 0.465 (3.841) | |

Having confirmed the existence of a long-run causality between variables, the next step involved conducting causality tests to establish the direction of the relationships between and among the banking sector, stock market development and economic growth. The granger based VEC methodology therefore sought to test the causal effect using the model as specified below.

(6)

(6)

(7)

(7)

(8)

(8)

Where, SMD represents the stock market development indicator (represented by MCAP, VT, TR), α1, λ1, δ1, θ1, are estimation coefficients, BSD is the measure for banking sector development (represented by M3, FSC, BCP), GDP is used to proxy economic growth, and ECTt-1 is the error correction term lagged one period. εt is the white noise error term.

Table 3 reflects VECM short-run results for the causal relationship between financial development and economic growth. These results confirmed the existence of a short-run causal relationship from economic growth to financial development at the 5% level of significance, a finding that resonates with Tsaurai & Odhiambo (2012). With the error correction term carrying the correct statistically significant negative coefficient in banking credit, money supply, financial sector credit and market capitalization functions (Table 3), it could be confirmed that a stable short-run relationship existed between the variables in the Models A, C, D and H. Short-run tests also revealed that jointly broad money supply (M3), Financial Sector Credit (FSC), Banking Credit (BCP), Market Capitalization (MCAP) and, Turnover Ratio (TR) were strongly and significantly caused by GDP across Models A, C, D and H, a finding that is in line with Owusu’s (2012) argument. Thus the null hypothesis of no short run joint causality was accepted for the causality from broad money (M3), banking credit (BCP), market capitalization (MCAP), Value Traded (VT), Financial Sector Credit (FSC) to GDP, a finding that follows Menyah et al.,’s (2014) argument.

| Table 3 Short Run Causality Test Results from Wald Block X2 Tests | |||

| Model A: LnGDP=F (LnBCP, LnMCAP) | |||

| Dependent Variables: | |||

| Independent variables: | (LnGDP) | (LnBCP) | (LnMCAP) |

| Ln(GDP) | 0.614(0.073) | 4.971(0.083) | |

| Ln(BCP) | 1.296(0.523) | 7.476(0.23) | |

| Ln(MCAP) | 8.491(0.14) | 1.634(0.0201) | |

| Joint causality coefficient | 8.522(0.14) | 6.57(0.060) | 9.405(0.051) |

| Model C: LnGDP= F (LnBCP, LnVT) | Dependent Variables: | ||

| Independent variables: | Ln GDP | LnBCP | LnVT |

| LnGDP | 0.007(0.0930) | 0.260(0.609) | |

| LnBCP | 0.687(0.406) | 0.197(0.656) | |

| LnVT | 0.701(0.402) | 1.713(0.0190) | |

| Joint causality | 3.081 (0.214) | 1.745 (0.0417) | 0.350 (0.839) |

| Model D:LnGDP=F (Ln FSC, LnMCAP) | Dependent Variables: | ||

| Independent variables: | Ln(GDP) | Ln(Fsc) | Ln(Mcap) |

| Ln(GDP) | 15.938 (0.0003) | 2.409 (0.0299) | |

| Ln(Fsc) | 9.244 (0.98) | 2.218 (0.329) | |

| Ln(Mcap) | 5.104 (0.77) | 3.733 (0.0154) | |

| Joint causality (all variables | 18.79 (0.9) | 19.165 (0.0007) | 6.166 (0.187) |

| Model H: Ln GDP=F (LnM3, LnVT) | Dependent Variables: | ||

| Independent variables: | LnGDP | LnM3 | LnVT |

| LnGDP | 2.138 (0.0343) | 2.43 (0.118) | |

| LnM3 | 0.770 (0.379) | 2.87 (0.09) | |

| LnVT | 0.095 (0.757) | 6.052 (0.048) | |

| Joint causality (all variables) | 0.771 (0.680) | 9.460 (0.050) | 4.924 (0.85) |

In terms of the individual (pairwise) causalities, the short-run causality tests revealed that economic growth (GDP) significantly and uni-directionally caused changes in financial development. This was supported by the causal coefficients, which indicated that the relationship was statistically significant and it ran from GDP to financial development variables (BCP, M3, MCAP, TR, FSC) not vice versa on a pairwise basis. The finding supports Tsaurai and Odhiambo (2012). For instance, in Model A, since the P value of 0.060 was less than 10% with a positive coefficient in the relationship between the GDP and banking credit (BCP), a statistically significant relationship could be confirmed.

However, the reverse causal relationship did not allow the same conclusions to be drawn. As indicated in Model A, bank credit (BCP) did not cause changes in GDP. In other words, the relationship, although carrying a negative coefficient, was statistically insignificant at the threshold of 5% level of significance. In Models C, D and H, the corresponding probability values for the individual causality from GDP to Banking Credit to the Private sector (BCP), Financial Sector Credit (FSC) and money supply (M3) were 0.093, 0.0003 and 0.034 respectively. It is thus clear that a unidirectional short-run causality running from economic growth to financial development existed in Zimbabwe in the period understudy, consistent with Odhiambo (2009). This view was originally conceptualized theoretically by Robinson (1952) who argued that “where enterprise leads, finance follows”. Support of this view can also be found in the theoretical works of Friedman and Schwartz (1963) and Demetriades & Hussein (1996) who concluded that causation runs from real GDP to financial development through the demand for money theorem.

Long Run VECM Causality

Odhiambo (2009) reiterated that for a long run causal relationship to exist between and amongst the variables in the VEC model the coefficient on the ECT must be negative and statistically significant. Following Tsaurai & Odhiambo (2012), a statistically insignificant ECT coefficient (that is if probability values exceed a 10% threshold) indicates no long-run relationship between the series in a VEC model. The results of the long run error correction models A, C, D and H with the computed regression coefficients and critical values in parentheses are presented in Table 4. For instance, the Table 4 reported that there was a negative long-run causal coefficient of -0.364 for model A which was statistically significant at 1 % level of significance, a finding that resonates with Ogwumike & Salisu (2014). This confirmed evidence of long run causality from Banking Credit to Private sector (BCP) and from Market Capitalization (MCAP) to economic growth in line with Ziwengwa et al. (2011).

| Table 4 Long Run VECM Causality | |||||

| Model A: LnGDP=F (LnBCP, LnMCAP) | Lags (2) | ||||

| Dependent Variables: | |||||

| Independent variables: | (LnGDP) | (LnBCP) | (LnMCAP) | ||

| Ln(GDP-1) | 0.107 (0.865) | 1.905 (0.116) | |||

| Ln(GDP-2) | -0.392 (0.483) | 1.585 (0.111) | |||

| Ln(BCP-1) | -2.45 (0.0312) | -1.329 (0.54) | |||

| Ln(BCP-2) | -0.049 (0.753) | 0.210 (0.652) | |||

| Ln(MCAP-1) | -0.163 (0.023) | 0.125 (0.036) | |||

| Ln(MCAP-2) | -0.125 (0.077) | 0.086 (0.518) | |||

| Joint causality (constant coeff). | -0.364 (0.013) | -0.235 (0.604) | -0.309 (0.32) | ||

| Model C: LnGDP=F (LnBCP, LnVT) | Lags (1) | ||||

| Dependent Variables: | |||||

| Independent variables: | Ln GDP | LnBCP | LnVT | ||

| LnGDP | -0.033(0.931) | 0.509 (0.615) | |||

| LnBCP | -0.128 (0.416) | -0.272 (0.661) | |||

| LnVT | -0.053 (0.412) | 0.128 (0.205) | |||

| Joint causality (constant coeff). | -0.039 (0.319) | -1.238 (0.66) | 0.042 (0.712) | ||

| Model D: LnGDP=F (LnFSC, LnMCAP) | Lags (2) | ||||

| Dependent Variables | |||||

| Independent variables: | LnGDP | LnFsc | LnMcap | ||

| Ln(GDP-1) | -2.127 (0.15) | 3.114 (0.161) | |||

| Ln(GDP-2) | 1.244 (0.145) | 4.115 (0.268) | |||

| Ln(Fsc-1) | -0.618 (0.010) | ||||

| Ln(Fsc-2) | -0.376 (0.063) | ||||

| Ln(Mcap-1) | -0.116 (0.011) | 0.219 (0.08) | 1.409 (0.385) | ||

| Ln(Mcap-2) | -0.133 (0.077) | 0.114 (0.035) | 0.052 (0.955) | ||

| Joint causality (constant coeff). | -0.262 (0.023) | -0.565 (0.11) | -0.04 (0.644) | ||

| Model H: Ln GDP = F (LnM3, LnVT) | Lags (1) | ||||

| Dependent variables | |||||

| Independent variables: | LnGDP | LnM3 | LnVT | ||

| LnGDP | -0.063 (0.875) | 1.077 (0.133) | |||

| LnM3 | 0.102 (0.389) | 0.750 (0.104) | |||

| LnVT | -0.020 (0.760) | 0.052 (0.713) | |||

| Joint causality (constant coeff). | 0.369 (0.013) | -0.170 (0.192) | -0.027 (0.109) | ||

Conclusion

The major objective of this study was to investigate empirically the relationship between banking sector and stock market development and their combined impact on economic growth in Zimbabwe. The study employed the Vector Error Correction Model (VECM) to establish comprehensively the causal relationship between banking sector, stock market and economic growth. The results of this study revealed that, in Zimbabwe, a unidirectional causal relationship from banking sector and stock market development to economic growth existed in the long-run. The positive development in the banking sector had a significant influence economic growth in the long-run, despite a negative and statistically insignificant second lag impact of stock market development on growth.

In the short run, a negative and statistically significant causal relationship runs from economic growth to banking sector and stock market development in Zimbabwe. These results are consistent with the argument in support of the demand-following hypothesis, which posits that financial development is an outcome of the growth in the real economy.

A number of empirical studies have validated the demand-following hypothesis discovered that in Zimbabwe, economic growth caused banking sector development in the short run but not vice versa. This was attributed to a lack of high quality investment projects in a country that is still underdeveloped.

Based on the empirical findings of this study, the researcher recommends that the Zimbabwean financial sector be developed through financial liberalization so as to enhance economic growth. Zimbabwe could foster growth by implementing short-run and long-run monetary policies that will liberalize and promote the optimal functioning of the financial system and equity markets, allowing them to mobilize more financial resources. Such policies should include the promotion of business initiatives while at the same time improving the efficiency and competitiveness of the financial industry in regional and international markets.

Additional policy implications that can be drawn are centered on the short-run empirical results that economic growth causes financial development: therefore, restructuring the economy in order to boost growth is important. Zimbabwe is still in the transitions phase and requires restructuring through improving security of transaction, regulations, transparency and shareholders wealth maximization. Shareholders needs to be more effective when executing their functions in order to make a positive impact on savings accumulation and technological advancement since these are the main blueprints which potentially drives long term economic growth in Zimbabwe. Financial constraints, data unavailability and time constraints were the three major limitations of the current study. Future studies should investigate the minimum threshold levels that financial development must exceed before triggering a significant economic growth, not only in Zimbabwe but in Africa as a whole.

References

- Acaravci, A., Ozturk, I., & Acaravci, S.K. (2007). Finance-growth nexus: Evidence from Turkey. International Research Journal of Finance and Economics, 11(1), 1450-2887.

- Adelakun, O.J. (2010). Financial sector development and economic growth in Nigeria. International Journal of Economic Development Research and Investment, 1(1), 25-41.

- Agbetsiafa, D.K. (2003). The finance growth nexus: Evidence from Sub-Saharan Africa. Savings and Development Journal, 28(3), 271-288.

- Ahmad, R., Etudaiye-Muhtar, O.F., Matemilola, B.T., & Bany-Ariffin, A.N. (2016). Financial market development, global financial crisis and economic growth: Evidence from developing nations. Portuguese Economic Journal, 15(3), 199-214.

- Allen, F., Gu, X., & Kowalewski, O. (2012). Financial crisis, structure and reform. Journal of Banking and Finance, 36(11), 2960-2973.

- Banerjee, P.K., Ahmed, M.N., & Hossain, M.M. (2017). Bank, stock market and economic growth: Bangladesh perspective. The Journal of Developing Areas, 51(2), 17-29.

- Beck, T. (2008). Econometrics of finance and growth. Policy Research Working Paper No. 4661. World Bank, Washington.

- Beck, T., & Levine, R. (2004). Stock markets, banks, and growth: Panel evidence. Journal of Banking and Finance, 28(3), 423-442.

- Beck, T., Demirguc-Kunt, A., Levine, R., & Maksimovic, V. (2000). Financial structure and economic development. firm, industry and country evidence. World Bank Working Paper Series No. 2423.

- Bindu, S., Chigusiwa, L., Muzambani, D.V., Muchabaiwa, L., & Mudavanhu, V. (2009). The effect of stock market wealth on private consumption in Zimbabwe. International Journal of Economic Sciences and Applied Research, 4(2), 125-142.

- Caporale, G.M. Howells, P., & Soliman, A.M. (2005). Endogenous growth models and stock market development. evidence from four countries. Review of Development Economics, 9(2), 166-176.

- Cheng, S. (2012). Substitution or complementary effects between banking and stock markets. Evidence from financial openness in Taiwan. Journal of International Financial Markets Institutions and Money, 22(3), 508-520.

- Chuah, H.L., & Thai, V.C. (2004). Financial development and economic growth. Evidence from causality tests for the GCC countries. IMF Working Paper, No.04/XX.

- Cojocaru, L. Falaris, E. Hoffman, S.D., & Miller, J.B. (2016). Financial system development and economic growth in transition economies: New empirical evidence from the CEE and CIS countries. Emerging Markets Finance and Trade, 52(1), 223-236.

- Cooray, A. (2010). Do stock markets lead to economic growth? Journal of Policy Modeling, 32(4), 448-460.

- Darrat, A.F., Elkhal, K., & McCallum, B. (2006). Finance and macroeconomic performance: Some evidence from emerging markets. Emerging Markets Finance and Trade, 42(3), 5-28.

- Dasgupta, P., Pradhan, R.P., & Samadhan, B. (2013). Finance development and economic growth in BRICS: A panel data analysis. Journal of Quantitative Economics, 11(1-2), 308-322.

- Demetriades, P., & Hussein, K. (1996). Does financial development cause economic growth? Time series evidence from 16 countries. Journal of Development Economics, 51(1), 387-411.

- Dey, M.K. (2005). Stock exchange liquidity, bank credit and economic growth. Thesis, Morgan State University, Maryland, Baltimore.

- Friedman, M., & Schwartz, A.J. (1963). A monetary history of the United States, 1867-1960. Princeton University Pressfrom India.

- Goldsmith, R.W. (1969). Financial structure and development. New Haven/London: Yale University Press.

- Gurgay, E., Velisafakli, O., & Tuzel, B. (2007). Financial development and economic growth. Evidence from Northern Cyprus. International Research Journal of Finance and Economics, 2(1), 23-47.

- Herwartz, H., & Walle, Y.M. (2014). Determinants of the link between financial and economic development. Evidence from a functional coefficient model. Economic Modelling, 37(2), 417-427.

- Hicks, J.A. (1969). A theory of economic history. Oxford. Clarendon Press.

- Hou, H., & Cheng, S.Y. (2010). The roles of stock market in the finance-growth nexus: Time series co-integration and causality evidence from Taiwan. Applied Financial Economics, 20(12), 975-981.

- International Monetary Fund (IMF) (2010). International monetary fund financial statistics yearbook. Various Years. Washington DC. USA.

- Ishioro, B.O. (2013). Stock market development and economic growth. Evidence from Zimbabwe. PHD Thesis. Delta State University. Abraka, Nigeria.

- Jecheche, P. (2010). An empirical investigation of the financial development economic growth nexus: The Case of Zimbabwe (1990-2008). Journal of Comprehensive Research, 2(2), 98-149.

- Johansen, S. (1988). Statistical analysis of co-integration vectors. Journal of Economic Dynamics and Control, 12(1), 231-254.

- Johansen, S. (1991). Estimation and hypothesis testing of co-integration vectors in Gaussian vector autoregressive models. Econometrica, 59(1), 1551-1580.

- Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on co-integration-with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52(1), 169-210.

- Kadenge, P.G., & Tafirei, F. (2014). The impact of bank and stock market developments on economic growth in Zimbabwe: 1988 To 2012. Botswana Journal of Economics, 1(1), 74-95.

- Kar, M., & Pentecost, E.J. (2000). Financial development and economic growth in turkey. Further evidence on the causality issue. Economic Research Paper No.00/27.

- Kolapo, F.T., & Adaramola, A.O. (2012). The impact of the Nigerian capital market on economic growth (1990–2010). International Journal of Developing Societies, 1(1), 11-19.

- Levine R. (1997). Financial development and economic growth. View and Agenda’ Journal, 2(2), 34-78.

- Levine, R. (2008). Finance and growth. Theory and evidence. In Aghion, P. & Durlauf, SN (eds.), Handbook of Economic Growth. North Holland, 1(1), 65-934.

- Levine, R., Loyaza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31-77.

- Luintel, K.B. (2008). Financial structure and economic growth. Journal of Development Economics, 18(2), 181-200.

- Luintel, K.B., & Khan, M. (1999). A quantitative reassessment of the finance-growth nexus: Evidence from a Multivariate VAR. Journal of Development Economics, 60(1), 381-405.

- Makina, D. (2009). Comprehensive economic recovery in Zimbabwe. Recovery of the Financial Sector and Building Financial Inclusiveness, 5(2), 45-98.

- McKinnon, R.I. (1973). Money and capital in economic development. Management Review, 6.

- Menyah, K., Nazlioglu, S., & Wolde-Rufael, Y. (2014). Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Economic Modelling, 37(2), 386-394.

- Mutenheri, E., & Green, C. (2002). Financing reforms and financing decisions of listed companies in Zimbabwe. Loughborough University, Finance and Development Research Programme. Working Paper No. 44.

- Naceur, S.B., & Ghazouani, S. (2007). Stock markets, banks, and economic growth: Empirical evidence from the MENA region. Research in International Business and Finance, 21(2), 297-315.

- Ndako, S. (2008). Stock markets, banks and economic growth. A time series evidence from South Africa. PhD Thesis, University of Leicester. United Kindom.

- Ndlovu, G. (2013). Financial sector development and economic growth: Evidence from Zimbabwe. International Journal of Economics and Financial Issues, 3(2), 435-446.

- Nowbutsing, B.M., & Odit, M.P. (1999). Stock market development and economic growth: The case of Mauritius. International Business and Economics Research Journal, 8(2), 77-88.

- Nyasha, S., & Odhiambo, N.M. (2016). Banks, stock market development and economic growth in Kenya: An empirical investigation, Journal of African Business, 18(1), 1-23.

- Nyasha, S., & Odhiambo, N.M. (2017). Bank versus stock market development in Brazil: An ARDL bounds testing approach. South East European Journal of Economics and Business, 12(1), 7-21.

- Odhiambo, N.M. (2008). Financial depth, savings and economic growth in Kenya. A dynamic causal linkage. Economic Modelling, 25(4), 704-13.

- Odhiambo, N.M. (2010). Stock market development and economic growth in South Africa. An ARDL–Bounds testing approach. World Business Institute, Asia-Pacific Business Research Conference, 2010.

- Ogwumike, F.O., & Salisu, A.A. (2014). Financial development and economic growth in Nigeria. Journal of Monetary and Economic Integration, 12(2), 90-117.

- Osuji, C.C., & Chigbu, E.E. (2012). An evaluation of financial development and economic growth of Nigeria: A causality test. Kuwait chapter of Arabian. Journal of Business and Management Review, 1(10), 27-44.

- Owusu, E.L. (2012). Financial liberalization and economic growth in ECOWAS countries. DLP Thesis, University of South Africa. Pretoria.

- Pagano, M. (1993). Financial markets and growth. An overview. European Economic Review, 37(1), 613-622.

- Pan, L., & Mishra, V. (2018). Stock market development and economic growth: Empirical evidence from China. Economic Modelling, 68, 661-673.

- Patrick, H. (1966). Financial development and economic growth in underdeveloped countries. Economic Development and Cultural Change, 1(1), 174-189.

- Pradhan, R.P., Arvin, M.B., Norman, N.R., & Hall, J.H. (2014). The dynamics of banking sector and stock market maturity and performance of Asian economies. Journal of Economic and Adminstrative Sciences, 23(1), 155-173.

- Reserve Bank of Zimbabwe. (1990:1996:1999:2002:2009:2015:2016). Monetary policy quarterly bulletin. Harare. Reserve bank of Zimbabwe.

- Robinson, J. (1952). The generalization of the general theory. The rate of interest and other essays. London, Macmillan: 69-142.

- Samson, O.O., & Elias, A.U. (2010). Financial sector development and economic growth: Empirical evidence from Nigeria. Economic and Financial Review, 48(3), 91-124.

- Sasilu, A.A. (2014). Financial development and economic growth in Nigeria. PhD Thesis, University of Ibadan.

- Schumpeter, J.A. (1912). The theory of economic development. Cambridge, MA: Harvard University Press.

- Shahnoushi, N., Ebadi, A.G., Daneshvar, M., Shokri, E., & Motallebi, M. (2008). Causality between financial development and economic growth in Iran. World Applied Sciences Journal, 4(5), 736-740.

- Shrutikeerti, K., & Amlan, G. (2017). Economic growth and the development of banking and insurance sector in the post-liberalized India: An empirical analysis. International Journal of Social Economics, 44(12), 2187-2207.

- Solo, P. (2013). Does financial structure affect economic growth? Evidence from African Countires. Journal of Contemporary Management, 2(1), 14-51.

- Stead, R. (2007). Foundation quantitative methods for business. Prentice Hall. England.

- Stern, N. (1989). The economics of development: A survey. Economic Journal, 99(1), 597-685.

- Tsaurai, K. (2012). A dynamic causality test of exports and economic growth in Zimbabwe. International Journal of Economic Policy in Emerging Markets, 5(3), 1511-1519.

- Tsaurai, K. (2012). A dynamic causality test of imports and economic growth in Zimbabwe. International Journal of Economic Policy in Emerging Markets, 5(3), 1504-1510

- Tsaurai, K. (2013). A conceptual literature analysis of the relationship between FDI and exports. Corporate Ownership and Control, 2(1), 389-393.

- Tsaurai, K. (2013). Is the savings led hypothesis valid for Zimbabwe? Corporate Ownership and Control, 10(3), 5-26.

- Tsaurai, K. (2015). Personal remittances, Banking sector development and economic growth in Israel: A trivariate causality test. Corporate Ownership and Control, 13(1), 1014-1029.

- Tsaurai, K. (2016). The nexus between stock market development and economic growth. Corporate Ownership and Control, 14(1), 269-277.

- Tsaurai, K. (2017). The impact of financial sector development on foreign direct investment in emerging markets.

- Tsaurai, K., & Odhiambo, N.M. (2012). Stock market development, foreign capital inflows and economic growth in Zimbabwe. A multivariate causality test. Corporate Ownership and Control, 9(2), 313-322.

- Unpublished Thesis for Doctor of Philosophy in Management Studies, University of South Africa, Pretoria.

- Waqabaca, C. (2004). Financial development and economic growth in Fiji. Economics Department, Reserve Bank of Fiji.Working Paper 2004/03.

- World Bank. 1996 (2015). World development indicators database. The World Bank, Washington, DC.

- Yucel, F. (2009). Causal relationships between financial development, trade openness and economic growth. The Case of Turkey Journal of Social Sciences, 5(1), 33-42.

- Zang, H., & Chul Kim, Y. (2007). Does financial development precede growth? Robinson and lucas might be right. Applied Economics Letters, 14(1), 15-19.

- Zimbabwe Central Statistics (2015). Compendium of statistic. Harare. Zimbabwe.

- Zimbabwe Stock exchange 2010 (2015). Annual reports. Harare. Zimbabwe.

- Zivengwa, T., Mashika, J., Bokosi, F.K., & Makova, T. (2011). Stock market development and economic growth in Zimababwe. International Journal of economics and Finance, 3(5), 140-150.