Research Article: 2020 Vol: 24 Issue: 2

Strategic Management Accounting as an Information Basis of Effective Management of Enterprise Activities

Angelika Krutova, Kharkiv State University of Food Technology and Trade

Tetiana Tarasova, Kharkiv State University of Food Technology and Trade

Oksana Nesterenko, Kharkiv State University of Food Technology and Trade

Oksana Bl?zn?uk, Kharkiv State University of Food Technology and Trade

Nataliia Nosach, Kharkiv State University of Food Technology and Trade

Abstract

The strategic management accounting toolkit is complemented by the integrated use of a balanced scorecard and strategic budgeting, as well as the inclusion of the forms for systematization of internal and external strategic management accounting information (by type) as its constituents, for information management of strategic enterprise management, and the reporting form for control over the implementation of strategic budgeting, which helps to increase the informativeness of strategic management accounting, improve information communication and coordination between enterprise divisions. The integrated use of a balanced scorecard and strategic budgeting as a basis for generating information is suggested to provide a complete closed cycle of management functions for strategic management of activity of an economic entity. The complex of methodical aspects of the economic entity strategy evaluation aimed at providing users with analytical information, the effectiveness of its use in substantiating a promising strategy. At the same time, the formalization of the evaluation process, on the one hand, allows the correct use of analytical techniques based on a balanced approach, and on the other hand increases the validity and reliability of strategic management decisions.

Keywords

Balanced Scorecard, Strategic Budgeting, Strategic Management Accounting, Information Space, Management Decisions.

JEL Classifications

M5, Q2

Introduction

In the innovation economy information acquires the status of a strategic resource, so accounting should be considered as a subject of innovation activity in order to gain new opportunities based on the adaptation of accounting tools to management information needs.

In line with the paradigm of innovative economic development, there is a shift in the focus of fundamental and applied research in accounting towards interdisciplinarity, which determines the development of new directions for improving the informativeness of the accounting system of enterprises and the quality of accounting and analytical support of management decisions.

Strategic planning is based on the concept of management by objects using the SMART goals method: S (specific) - specificity in setting goals; M (measurable) - measurability (the ability to set indicators of progress towards a goal or specific indicators for its quantitative measurement); A (achievable) - distribution (the ability to define specific tasks for each organizational unit); R (realistic) - realism; T (time-related) - temporary determination. Therefore, the mission, the concept of enterprise development determines the strategy of their achievement and drawing up a business plan of measures for the implementation of these strategies and further operational planning for the selected period.

The strategic plan takes the form of a long-term budget reflecting the basic key performance indicators of the enterprise: general characteristics of the market strategy, patterns of operation, changes in fixed assets, etc. Strategic budgets help to identify the relationship between indicators and are a tool for describing the strategic goals of each aspect of activity within a balanced scorecard.

The purpose of the work is to develop and substantiate conceptual theoretical, methodological, organizational and practical points of strategic management accounting to ensure completeness of information content of the decision-making process of economic entities in the conditions of innovative development of the national economy.

Review of Previous Studies

At the same time, strategic management accounting information should be presented in a convenient and user-friendly format. This format is strategic management reporting Solovida & Latan (2017).

As regards the most important aspects of the enterprise activity, the information content of management reporting is increasingly growing, as the requirements of users for information are increasing, and there is also a desire for compliance of management reporting with formats of the best world practices Drobyazko et al. (2019a); Drobyazko et al. (2019a).

An increase in the volume of information on different areas and types of activities of economic entities transforms and develops their information space and increases the relevance of strategic management accounting information for the purposes of strategic and non-financial reporting (Pollanen et al., 2017).

Along with an increased importance of information in the innovation economy, there is a rethinking of the role of knowledge as a factor of value creation, increasing competitiveness, economic development of enterprises (Sen et al., 2017).

Norreklit et al. (2018) emphasize that the ability of an economic entity to acquire, integrate, accumulate, retain and apply knowledge is the most important way to create competitive advantage.

The processes of transformation of strategic management accounting into corporate organizational and innovative knowledge echo the logic of the corporate decision-making system, which can be based on the DIKW model: Data - Information - Knowledge – Wisdom (Hilorme, 2019a; Hilorme et al., 2019b; Nesterenko et al. 2019).

Methodology

The methodological basis of the work is the results of studies of scientists, conceptual points of economic theory, strategic management, concept of innovative economy. There was used a wide range of general scientific and special research methods. In particular: comparative-historical method - to summarize the genesis of strategic management accounting in the context of the evolution of management paradigms; induction, deduction, abstraction, idealization - to develop initial points of the theory and methodology of strategic management accounting; modeling - to build models of organizational structures of strategic management accounting; system method - to substantiate the concept of strategic management accounting in the innovative economy; structural and functional method - to study the information space of strategic management accounting; abstract-logical analysis - to identify the stages of accounting and analytical support for the process of formation and implementation of the strategy of innovative development of the enterprise; empirical approach - to conduct structural and functional analysis of information and survey data; logical generalization - in the process of theoretical generalizations and in formulating conclusions.

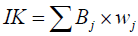

To evaluate the effectiveness of strategic budgeting, we suggest to use the integrated coefficient of the efficiency of the budgeting system based on the expert method, IC:

(1)

(1)

where Bj is the score of the j-indicator of efficiency of strategic budgeting established using the method of expert rating; wj is the weight of the j-indicator of efficiency of strategic budgeting.

The established indicators of efficiency of strategic budgeting is given below.

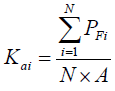

1. The coefficient of adequacy of the strategic budgeting system (Ka), which characterizes the degree of correspondence of budgets to real opportunities, of separate operating budgets to the general system of strategic enterprise management. The coefficient of adequacy of the strategic budgeting can be calculated as an average quantitative estimate of operating budget planning:

(2)

(2)

where Kai is the coefficient of adequacy of preparation of the i-th operating budget; PFi is the actual estimate of planning of the i-th operating budget in points made by the z-th expert; A is the maximum budget estimate in points (A = 10); N is number of experts;

The coefficient of adequacy of preparation of operating budgets as a whole using strategic budgeting for the entire planning period is defined as the arithmetic mean of all operating budgets in a given period of the budgeting cycle;

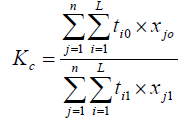

2. The coefficient of budget preparation time reduction (Kc), which takes into account both the reduction of process execution time and the reduction of the number of functions in the process:

(3)

(3)

where ?? is the coefficient of "compression" of the business process of budgeting in time; j = 1.. .n - reference number of the function that is included in the business process; i=1 ... L - time characteristics of business process functions accordingly; ti0 - corresponding time characteristic of the function that is included in the business process in the previous period; xj0 - corresponding function of the business process in the previous period; ti1 - corresponding time characteristic of the function that is included in the business process in this period; xj1 - corresponding function of the business process in this period.

3. The coefficient of achievement of the objectives of the corresponding planning level (KD) is determined by the results of the plan-fact analysis of the targets. Normative value is 1.

In order to calculate the integrated coefficient of the efficiency of the strategic budgeting system, each of the above coefficients (1-3) is calculated, the total sum of their values in points is determined.

Results and Discussion

The combination of these operating budgets into a consolidated budget of the enterprise is ensured by the preparation of final budgets by income, cost price, administrative and commercial expenses. Business process budget data are combined into a unified system of financial budgets: balance of payments, balance of income and expenditures, balance of cash flows. This gives an opportunity to determine the contribution of a separate business process of an enterprise in the formation of a financial result as a proportion of profit or expenses. The procedure for preparation, agreeing, correction, analyzing the execution of budgets is determined by an in-house document – the budget standard. Each enterprise selects the budget standard format independently: it may have the form of text, diagram. The main purpose of the strategic budget is the identification of the necessary strategic areas (initiatives) to achieve the strategic goals, assessment of the resources needed to achieve them, plan-fact analysis of indicators set in the strategic plan.

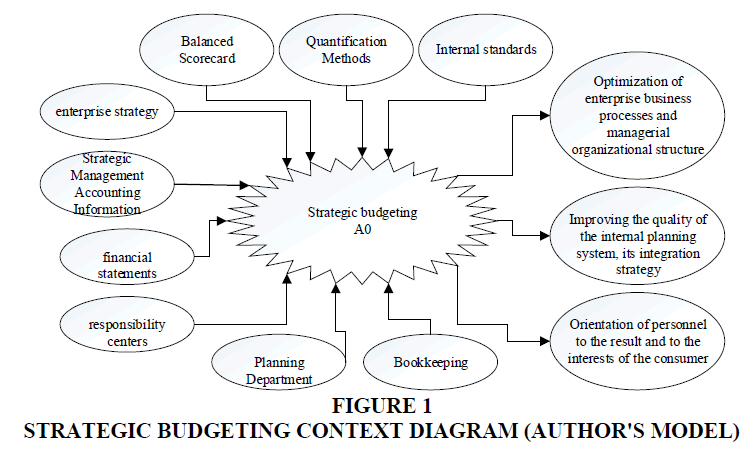

Development of context A-O diagram of functional model based on IDEF0 standard, which is based on the methodology of SADT system analysis allowing to build a logical system of interconnected enterprise processes, regulate activities and detect timely duplication of functions and lack of a regulated mechanism. The IDEF0 model displays a strategic budgeting system in the form of a set of functions connected with arrows (arcs) and presented in interconnected diagrams. The context diagram of strategic budgeting based on IDEF0 standard is shown in Figure 1, which contains the basic function defined using the selected viewpoint for the process and illustrates its connection with the external environment in four directions - output, control, mechanism of operation and results.

Improving strategic budgeting by implementing a balanced scorecard makes it possible to implement the predictive function of strategic management accounting, since:

the integration of a balanced scorecard (BSC) into the strategic budgeting system focuses it on the process of implementing an enterprise strategy, and the integration of a balanced scorecard into operational budgeting and then into operating budgets makes it possible to: direct the current activity of structural divisions (centers of responsibility) on achievement of strategic goals of the enterprise; manage the process of strategy implementation through timely monitoring and analysis of actual and planned values of indicators with the help of adjusting the strategy based on timely management decision in accordance with new production conditions;

A balanced scorecard is based on cost factors, so the budgeting system will be aimed at increasing the value of the enterprise.

Such basic properties that the system of key performance indicators should meet, which is the basis for the formation and control of the extent of achievement of the enterprise BSC indicators, are suggested: comparability (to allow comparison of performance indicators); balance; stability (the list and values of key performance indicators are approved before the start of the assessment period and can be corrected no more than once a year and only in exceptional cases in accordance with the established procedure), individuality; complaisance (there must be mandatory performance indicators at any time); motivation (personnel motivation system should be fully determined by the extent to which the key performance indicators are achieved).

In order to calculate the integrated coefficient of the efficiency of the strategic budgeting system the total sum of their values in points is determined (Table 1).

| Table 1 The Rating Scale of Efficiency of Strategic Budgeting at the Enterprise (Author's Model) | ||||

| Coefficients | Group I (4 points) |

Group II (3 points) |

Group III (2 points) |

Group IV (1 point) |

| Strategic budgeting system adequacy coefficient | 0.9-1 | 0.8-0.9 | 0.5-0.8 | >0.5 |

| Budget preparation time reduction coefficient | <0.25 | 0.25-0.4 | 0.4-0.95 | >0.95 |

| Coefficient of achievement of the objectives of the corresponding planning level | 1 | 0.9-0.99 | 0.85-0.9 | <0.85 |

Then, the method of expert estimate is used to determine the weight of each of the coefficients (1-3) and the integrated coefficient of the efficiency of the strategic budgeting system at the enterprise is calculated. By results, the integrated coefficient of the efficiency of the strategic budgeting system can have the following values: high, satisfactory, low.

Introducing strategically-oriented budgeting based on a balanced scorecard has the following benefits:

It is important to combine strategic management and budgeting to implement the strategy. It seems that the budgeting developed on the basis of strategic goals transformed into a balanced scorecard is most effective.

The relationship between the budgeting system and the enterprise strategy is presented in Table 2.

| Table 2 Relationship Between the Budgeting System and the Enterprise Strategy (Author's Model) | |||

| Enterprise strategy | |||

| Finances | Marketing | Business processes | Knowledge |

| Strategic goals | |||

| Maximizing the market value of the company. Increase in return on equity. Decrease in the cost of borrowed capital | Increased sales and increased market share. Sales geography expansion. Product line expansion. Increasing loyalty and enhancing the image | Marketing process development Improving product quality. Production process optimization. Planning process improvement. Cost optimization |

Improving the efficiency of the incentive system. Personnel development. Introduction of modern technologies and systems. Technical upgrading |

| Balanced scorecard | |||

| Economic Value Added (EVA) Return On Equity (ROE) | Sales volume. Increase in market share. |

Marketing effectiveness Increase of customer base. | Incentive system quality The ratio of the growth rate of the payroll to the increase in labor productivity. |

| Balanced scorecard budgets (strategic initiatives) | |||

| Program of ensuring liquidity and solvency of the enterprise in the process of strategy implementation. Provision of the balance of assets and sources of their formation when implementing the strategy | Product sales program. Product line expansion program. Company marketing and image development program | Company marketing and image development program. Quality management program. Production development program. Implementation of process-oriented budgeting. Implementation of cost accounting by type of activity |

System of incentive payments. Employee training and performance appraisal. Implementation of an automated management and planning system. Production technical upgrading program |

| Budgets | |||

| Income and expenditure budget Balance of payments Cash flow budget |

Sales budget Income and expenditure budget |

Production cost budget Direct material budget | Direct labor budget, personnel training budget |

The system of process-oriented budgeting is developed on the basis of information technologies as the sixth stage of development includes the design of its computer model. Modern information technologies provide enormous potential for improving the budgeting process and improving the efficiency of financial planning at the enterprise. Formalization of implementation of strategy-oriented budgeting system at the enterprise is carried out using analytic hierarchy process (AHP) allowing to: identify cause-and-effect relations of strategic goals and key performance indicators (KPIs); build a hierarchical model of interrelated BSC budgets combined into a consolidated strategic budget; formally define a hierarchy of strategic goals and key performance indicators, business processes and budgets.

Recommendations

Communication and coordination of different units of the enterprise and types of activity involving harmonization of interests of individual employees and groups in the enterprise as a whole in order to achieve the intended goals. The budget helps to identify weaknesses in the organizational structure, solve communication problems and share responsibility among executives;

Orientation of managers of all ranks on achieving the tasks set before the responsibility centers;

Control of current activities to ensure planned discipline.

Strategic budgeting and strategic management accounting satisfy the basic information needs of strategic management in the enterprise, as they are linked in a single management cycle as a sequence of planning, accounting, control and analysis processes.

Integration of strategic management accounting, strategic budgeting and a balanced scorecard make it possible to: define business development strategy in specific indicators; calculate the effectiveness of the business as a whole, each structural unit and each employee; evaluate investment projects and any innovations; create a system for collecting, consolidating and analyzing information, both financial and non-financial.

Conclusions

The innovative nature of strategic management accounting development is required by the need to improve the efficiency of the information activity of an economic entity for making management decisions that ensure its continuous improvement and expansion of key competencies in an innovative economy. The issues of developing methodological foundations of strategic management accounting are of particular relevance, which contributes to improving the effectiveness of accounting and analytical information in management decisions.

Strategic management accounting significantly expands the scope of functionality in the information support of strategic management of economic entities. The evaluation of the enterprise strategy on the information basis of strategic management accounting is presented by an algorithm that provides for three successive stages: preparatory, analytical and evaluation, with the formalization of the evaluation process, on the one hand, allowing the correct use of analytical techniques based on a balanced approach, and on the other hand – increase in the validity and reliability of strategic management decisions.

It is substantiated that effective coordination of strategic management and budgeting should be carried out on the basis of a process approach and use of common technology of assessment of both their parameters and results of financial and economic activity, movement of resources, interaction with the external environment of functioning.

The algorithm of development of the strategic budgeting process based on the method of AHP making it possible to formalize the process is presented.

To evaluate the efficiency of strategic budgeting, it is suggested to use the integrated coefficient, which is calculated by the method of expert estimate and consists of the following coefficients: coefficient of adequacy of the strategic budgeting system, coefficient of budget preparation time reduction, coefficient of achievement of the objectives of the corresponding planning level.

The process approach and the unified system of evaluation using a balanced scorecard makes it possible to clearly define the hierarchy and boundaries of business processes, composition and limits of resources to meet the needs of business processes, a balanced scorecard of each business process, as well as control the effectiveness of all activities that affect the effectiveness of each business process of the enterprise and the implementation of its budget.

References

- Drobyazko, S., Bondarevska, O., Klymenko, D., Pletenetska, S., & Pylypenko, O. (2019). Model for forming of optimal credit portfolio of commercial bank. Journal of Management Information and Decision Sciences, 22(4), 501-506.

- Drobyazko S., Shapovalova A., Bielova O., Nazarenko O., Yunatskyi M. (2019). Formation of hybrid costing system accounting model at the enterprise. Academy of Accounting and Financial Studies Journal, 23(6).

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). The model of evaluation of the renewable energy resources development under conditions of efficient energy consumption. Proceedings of the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management through Vision 2020. pp. 7514-7526.

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). Smart Grid Concept as a Perspective for The Development of Ukrainian Energy Platform. IBIMA Business Review. Retrieved from https://ibimapublishing.com/articles/IBIMABR/2019/923814/

- Nesterenko S., Drobyazko S., Abramova O., Siketina N. (2019). Optimization of Factorial Portfolio of Trade Enterprises in the Conditions of the Non-Payment Crisis. IBIMA Business Review, Retrieved from https://ibimapublishing.com/articles/IBIMABR/2019/278890/

- Norreklit, H., Kure, N., & Trenca, M. (2018). Balanced Scorecard. The International Encyclopedia of Strategic Communication, 1-6.

- Pollanen, R., Abdel-Maksoud, A., Elbanna, S., & Mahama, H. (2017). Relationships between strategic performance measures, strategic decision-making, and organizational performance: Empirical evidence from Canadian public organizations. Public Management Review, 19(5), 725-746.

- Sen, D., Bingol, S., & Vayvay, O. (2017). Strategic enterprise management for innovative companies: The last decade of the balanced scorecard. International Journal of Asian Social Science, 7(1), 97-109.

- Solovida, G.T., & Latan, H. (2017). Linking environmental strategy to environmental performance: Mediation role of environmental management accounting. Sustainability Accounting, Management and Policy Journal, 8(5), 595-619.