Research Article: 2021 Vol: 27 Issue: 3

Strategic Resources and Processes in Property Industry Uncovering New Analysis Approach for Business Development & Entrepreneurial Decision

Hardijanto Saroso, Bina Nusantara University

Dicky Hida Syahchari, Bina Nusantara University

Darjat Sudrajat, Bina Nusantara University

Lasmy, Bina Nusantara University

Maria Grace Herlina, Bina Nusantara University

Abstract

This research was conducted to know the strategic resources and processes in the industry. Understanding the strategic resources and the strategic process will help Management determine the budget allocation for investment or high operational cost. This paper will examine the property industry. This study will answer what business resources or business processes can strongly influence or greatly determine the company's performance. There are several primary resources or processes of the business, such as the workers, raw materials, investment, and advertising, which are part of the research. These data are usually available in financial or annual reports of a listed company that can be accessed from their official website or the Indonesia Stock Exchange. This research uses quantitative analysis with a purposive sampling method. Then, it continues by confirmatory analysis from an industry expert. The results showed that ready-to-sell property is the strategic resource for sales in this industry that has the most significant influence on the company's performance and occupies the critical position compared to other variables. These results are then followed by advertising as a strategic process in achieving sales. Only then does the number of workers take the third position as the second strategic resource that affects company performance. Three experts in the property sector confirmed the results of this study. Additionally, advertising is a determinant of sales success in the condition of the same ready-to-sell property between several competing companies.

Keywords

Strategic Resources, Processes, Development, Entrepreneurship, Decision, Property

Introduction

Entrepreneurs are constantly faced with increasingly tough business challenges. Nevertheless, the same business actors continue to emerge and develop. Companies running their businesses must maintain and stabilize the company's sustainable business and develop the businesses that the company manages. To win the competition, the company must understand the role of its resources and all the processes that are in it so that the products or services can be offered with optimum value and make consumers feel satisfied.

These requirements apply in all industries, including property businesses. Property plays a vital role in the growth and economy of countries worldwide because real estate property can meet basic needs, especially in providing housing which is a basic human need. Apart from residential houses, the property sector is synonymous with investment. Investments in the property sector are generally long-term because their value will continue to grow in line with economic growth. Investment in the property sector is an investment that is timeless and provides considerable potential for long-term returns. Property business has a strategic position, and it will continue to attract new players, entrepreneurs, or new business developers.

Property prices are getting more expensive each year, and the increase in property prices is not proportional to the increase in people's income. So there is an unbalance growth between income to buy a property and the price growth of the property. These conditions require business creativity to develop their businesses better, to ensure that all products can be sold with a shorter asset holding period. Property companies compete in several key areas, such as location, facilities, quality, and pricing. Due to this competition, the advertising budget is also multiplying from time to time. Today, internet Media is the most widely used advertising media. It is cheap and easy for a customer to compare premises and prices. However, the property business is not only sufficient by relying on advertising. Property business management must also pay attention to developing "raw materials" or a ready-to-sell property. Ready-to-sell properties is a property that has gone through the construction process. Property that has been prepared for further development by the buyer. It is accessible, and it has adequate infrastructure. The following vital resources in the property business are human resources. The company must have human resources which support the front line of sales. Salespeople play a crucial role in determining the income of the company. The company also needs staff, managers, directors.

The biggest question is, which resources influence the company's performance the most? Which process determines sales the most? Investment? Property Ready to sell? Marketing? Human Resources? How are these components related? This research attempts to answer this question.

Literature Review

Resource Base Theory

Since its publication by Barney in 1991, the resource-based theory has continued to be developed today. This theory supports the growth of the firm theory presented by Edith Penrose in 1959, that a company will grow if its resources support the company's operational activities to achieve its target. In 2011, mapping of this theory was carried out; one of the main focuses is the measurement (Barney et al., 2011). Molly et al. 2011 started research in this field but focused on intangible resources. The industry is now shifted toward analytic as the business and marketing requirement. So measurement in business is essential. Since 2017, authors have carried out research in various industries to find theoretical foundations and procedures that can be used to measure strategic resources. In its development, the author also finds that it is necessary to mention strategic resources, which also have an essential role in achieving its revenue target. In the value chain, resources play a role in the upstream part of the production process, while the downstream "process" becomes critical since it will connect directly to sales. In this research, identification and measurement of resources and processes are carried out from secondary data in the company's annual report.

Business Resources and Business Process

A business has six main components that can help the business working, and generating value. These components are Man, Money, Material, Machine, Methods, and Markets (Rostamzadeh & Sofiean, 2009). Man is the prime mover. Humans resources/employee design, organize, manage and control business activities to achieve goals. Money will be used to support operation, purchase of raw materials, and buying a machine. Material is the source of finished goods. In the property business, the material starts from a piece of land. The land needs to be developed further to become a ready-to-sell property. The machine supports the production and speed-up work so that it becomes more effective and efficient. Buying a machine is part of a company's investment decision. It is recorded in the cash outflow for investment in the financial report. Working method knows as Standard Operating Procedure. It will control and synchronize the operation to meet operation target, productivity, consistency, and reliability (DeTreville et al., 2010). The last component is the market. It is a very strategic management element. Reasonable market control plays a vital role so that goods or services can be distributed to all consumers while maintaining and paying attention to quality and price.

All these business components are then woven together in a process. Processes in business always target value for companies and consumers. This process is called the value chain system, which Michael E. Porter had introduced in 1985. The value chain describes the process that must be carried out to achieve the company's target, starting from the raw materials/materials. This process continues until the company can build corporate value in a better direction according to market demand.

Property Business

The property business in Indonesia is also growing in line with the increasing population and business activities. Various forms of facilities, infrastructure, and buildings were built and developed, including residential areas, office areas, residential houses, commercial buildings, office buildings, and warehouses. In terms of product offering in the market, there are three types of this property: ready-to-build land, expandable buildings, and ready-to-use buildings. According to Roulac (1996), the property business has six interconnected and supportive parts on the operation side. Those are Developer, Manager/Owner, Capital Source, Service Provider, Space User, and the property itself. Every single resource has not been measured. Roulac (1996) cannot be explained in numbers or actual measurements except in narrative form. So, without operational measurement, it will be difficult for Management or investors to judge whether all aspects influence or substantially contribute to the development of company performance.

Company Business Performance

Company performance is the target of business activity and Management. The company's performance is determined by the performance of resources and business process capabilities that are appreciated by consumers and the market. The company's performance measurement that is most sensitive to consumer and market situations is sales revenue or revenue. The company's performance assessment is carried out periodically, which is then evaluated further on the situation and circumstances or the achievements of the operations and organization. In a management system, the achievement of a unit or a process part of the organization is carried out based on predetermined goals, standards, and criteria. Through performance appraisal, managers can make important decisions in the context of the company's business, such as determining salary levels, investment amounts, dividend distribution, or asset purchases. In this study, the performance of property companies is influenced by factors such as investment, advertising, raw materials (ready to sell properties), and the number of workers.

Data Analytic

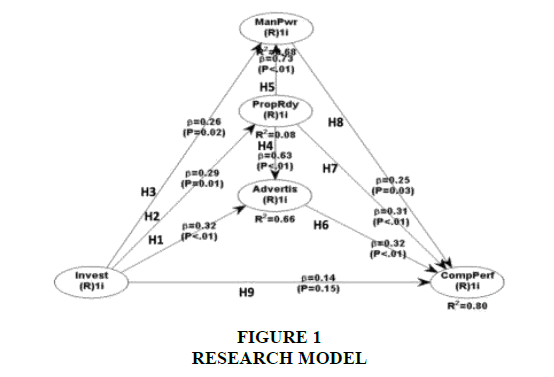

In the era of the industrial revolution as it is today, the analysis of company data is challenged by investors to be monitored from time to time in real-time. This demand makes sense because the competition is already very tight. Changes in supply and demand occur quickly, mainly supported by changes in consumer interest and technological advances that make it easier for consumers to do comparative analysis and assessment. As a result, CEOs have to be more observant in seeing changes in their resources and operational processes in the company. CEO must determine which resources will most affect the company's revenue or which processes are very strategic and have a significant impact if it is disrupted by generating sales. For this reason, nine hypotheses were developed in this research. Those are:

H1: There is an effect of investment on advertising

H2: There is an effect of investment on raw materials (ready to sell properties)

H3: There is an effect of investment on the number of workers

H4: There is an effect of raw materials (ready-to-sale properties) on advertising

H5: There is an effect of raw materials (ready-to-sale properties) on the number of workers

H6: There is an effect of advertising on the company's performance

H7: There is an influence of raw materials (ready-to-sale properties) on the company's performance

H8: There is an effect of the number of workers on the company's performance

H9: There is an effect of investment on a company's performance

Methodology

This study uses secondary data obtained from the Indonesia Stock Exchange through the website www.IDX.co.id and from the respective company websites. The research uses quantitative analysis with longitudinal data. The sampling is using purposive sampling criteria. Eight companies out of 65 property-listed companies on the Indonesia Stock Exchange have complete data according to research needs. Researchers used data on advertising ("Advertise"), ready-to-sell property ("PropRdy"), investment ("Invest"), company performance-Revenue ("CompPerf"), and the number of workers ("ManPwr"), especially those who with a minimum bachelor's degree. The company data taken is data from 5 years between 2015-2019, before the pandemic situation. In this study, researchers used WARPPLS 7.0 for analyzing the research model. Finally, the results were confirmed to property experts to get inputs from business practice's perspectives.

Results and Discussion

The number of companies in the Indonesian property sector listed on the Indonesia Stock Exchange during 2015-2019 was 65 companies. The number of companies that are used as research targets is 65 companies. However, from this data, only eight companies can be included in this research because their data is complete for five years. The selected companies are 1 PT Summarecon Agung Tbk ("SMRA"), 2. PT Alam Sutera Reality Tbk ("ASRI"), 3. Agung Podomoro Land Tbk ("APLN"), 4. PT Sentul City Tbk ("BKSL "), 5. PT Bumi Serpong Damai Tbk ("BSDE"), 6. PT Ciputra Development Tbk ("CTRA"), 7. PT. Puradelta Lestari Tbk ("DMAS"), 8. PT Intiland Development Tbk ("DILD"). The data taken are the following data: 1. Data on investment costs (land for development), 2. Data on advertising costs (advertising and promotions), 3. Data on raw material costs/property ready for sale (inventory), 4. Data on the number of bachelor degree workers (employee data), 5. Company performance data (revenue)

Before the data is used, normality, autocorrelation, and multicollinearity tests are carried out. All "classic tests" are using SPSS Software version 22. Based on the Kolmogorov & Smirnov test, it was concluded that the data used met the normal data requirements. Detail data is in Table 1. Then the autocorrelation test was carried out. Based on the Durbin Watson test, d is equal to 1,855. If dL=1,2848 and dU=1,7209, d>dL, 4-d>dL, so the data used did not experience autocorrelation. Details of test results are in Table 2. The next stage is a multicollinearity test. The result shows that the VIF value is below 10, so it can be stated that the variables used do not experience multicollinearity. The results are shown in Table 3. The SEM analysis is using WARP PLS version 7.

| Table 1 Normality Test One Sample Kolmogorov-Smirnov Test |

||||||

| INVEST | PROPRD | COMPPERF | ADVERT | MANPWR | ||

| N | 40 | 40 | 40 | 40 | 40 | |

| Normal Parametersa,b | Mean | 311.40 | 344.31 | 301.16 | 155.96 | 215.35 |

| Std. Deviation | 42.844 | 24.910 | 36.374 | 38.274 | 127.076 | |

| Most Extreme Differences | Absolute | .121 | 138 | 123 | 105 | 135 |

| Positive | 113 | 137 | 101 | 093 | 135 | |

| Negative | -121 | -138 | -123 | -105 | -080 | |

| Test Statistic | .121 | 138 | 123 | 105 | 135 | |

| Asymp Sig. (2-tailed) | 142c | 052c | 129c | 2006c,d | 065c | |

a. Test distribution is normal

b. Calculated from data

c. Lilliefors significance correction

d. This is lower bond of the true significance

| Table 2 Autocorrelation Test Model Summaryb |

||||||||||

| Model | R | R square | Adjusted R Square | Std. Error of the Estimate | R square change |

Change statistics | Durbin Watson | |||

| F Change | df1 | df2 | Sig. F change | |||||||

| 1 | 0.796a | 0.634 | 0.592 | 23.225 | 0.634 | 15.165 | 4 | 35 | 0.000 | 1.855 |

a. Predictors: (Constant), MANPWR, PROPRD, ADVERT

b. Dependent variable: COMPPERF

| Table 3 Multicollinearity Test Coeffiencetsa |

|||||||

| Model | Unstandardized Coefficients B | Coefficients Std. Error |

Standardized Coefficients Beta |

t | Sig. | Collinearity Statistics | |

| Tolerance | VIF | ||||||

| 1(Constant) | 155.159 | 71.017 | 2.185 | 036 | |||

| INVEST | 0.003 | 0.124 | 0.004 | 027 | 979 | 489 | 2.044 |

| PROPRD | 0.249 | 0.221 | 171 | 1.126 | 268 | 455 | 2.198 |

| ADVERT | 136 | 0.229 | 143 | 594 | 0.557 | 180 | 5.545 |

| MANPWR | 176 | 0.062 | 616 | 2.850 | 0.007 | 224 | 4.473 |

The R square of the model reaches a value of 80%. This value is interpreted as a significant R square value because the research model could explain almost 80% of the company's performance variables. The remaining 20% is explained by other variables that have not been explored yet.

| Table 4 P Value |

|||||

| PropRdy | Invest | CompPER | Adverti | ManPWR | |

| PropRdy | 0.014 | ||||

| CompPer | 0.008 | 0.146 | 0.007 | ||

| Adverti | <0.001 | 0.007 | |||

| ManPWR | <0.001 | 0.024 | |||

| Table 5 Effect Sizes For Path Coefficients |

|||||

| PropRdy | Invest | CompPER | Adverti | ManPWR | |

| PropRdy | 0.083 | ||||

| CompPer | 0.260 | 0.078 | 0.272 | 0.192 | |

| Adverti | 0.474 | 0.183 | |||

| ManPWR | 0.574 | 0.108 | |||

Based on the results of the WARP PLS data, it was found that almost all of the variable relationships as shown in Figure 1 have a significant relationship, except for the relationship between INVEST and COMPPERF variables. Most of the P-value is close to "0", except for the P-value from INVEST to COMPPERF, which reaches 0.146. This condition seems to be related to the market conditions. If a property developer is going to open a business, the property should be supported with infrastructure or have been partially built to attract consumers. Investment in the form of land that has been purchased can be considered as "raw material." There is no infrastructure, no facilities. It is just a piece of land with perhaps a lot of grass, bushes, or swamps. However, in the property business, land has many attributes. One attribute could represent a specific customer value, among others location, scenery view, water resources. The property location is one of the main factors that become the buyer's consideration. It plays a vital role in determining the price and value of its future investment. The other concern that relates to location is the "proximity." It is the distance of the property location and other essential facilities such as public facilities, business centers, health service facilities, school, university, shopping centers, recreational facilities for families, office centers, shuttle buses, MRT stations, train stations, and toll road access. Based on this research, investment in uncultivated land needs to be built to initiate more value that customers require. So the strategic resource is the "property ready to sell."

However, when viewed from the calculation of the effect size, advertising has the most significant influence (0.272), followed by the condition of the property that is ready to sell (0.260). Advertising can increase consumer interest in buying property. Using the information from the advertising, consumers will know the concept, land area, and prices offered by property developers. However, the advertising relies on the Ready to Sell property (0.474). The value is >0.35. It means the relationship between Property Ready to Sell and Advertising is very significant. Both advertising and the condition of the ready-to-sell property are the best combinations, the best pairing, to promote the value proposition. Based on this condition, advertising becomes a strategic process, and its position is higher than the strategic resources (property ready to sell)

The last variable, based on the research that influences the company performance, is Manpower (0.192). In many property companies, workers in the property sector are sales and property agents. Property agents are the "intermediaries" between property companies and prospective customers. Wegrzyn (2015) is concerned about the relation between the principal and the property agent. There are possibilities that the agent initiates something that contradicts their agreement with the property owner. As a result, the sales performance is not solely under property owner interest, but it can be influenced under the agent's moral hazard.

Business Expert

The first property expert is a manager in Rating Agency. He stated that market positioning, asset quality, and operation stability are the top key success factors for a property company. These three factors arise from the investment of land as the source of the property's value proposition. Advertising will significantly impact the value proposition, although the original property condition is lower than the customer expectation. To this day, the availability of lands is also limited. So the property developer has to find a creative way to provide the best information and persuasion to the customer.

The second property expert has supported this statement. One critical point to this day is the marketing concept that reflects the premises' design-purpose-environment concept. People buy property for staying for a long period or long-term investment. So this condition drives the sustainability concept that will ensure the consistency of value delivery from the premises.

The third property expert pointed out that sometimes property owner has a limited option in buying land as the initial development of their property project. Creativity and marketing concepts become the savior of the property project.

To conclude the discussion, most experts said that selecting a good land as strategic resources is critical. It will provide great flexibility and opportunity to the property company in developing customer value bust also satisfying the customer in the long run. However, the severe competition forces the property developer to use advertising to win the competition and promote value to the potential customer.

Conclusion

Land as an initial investment in a property project is a strategic resource for the property business. Meanwhile, advertising and property development can be considered as a strategic process in this business. Although the human resource is a critical resource in other industries, it can be concluded differently in the property industry because of the different business models or situation. This analysis system is getting more attention since it can be developed for business analysis by analysts or investors. Using this mechanism will provide a clear picture of the industry. Previous research in Textiles (Hardijanto, 2020) and in Pharmaceutical (Hardijanto, 2019) provides a clearer view of the industry about strategic resources and strategic processes by using the same research concept. This research can be applied to different industries. Further development of this research is wide open to other industries. The results obtained after being confirmed by expert industry players provide new insights not only to Management but also to investors.

This research shows a new concept of analysis using secondary data to find strategic resources or strategic processes in the company. It could become a steppingstone in investment analysis for the investor, especially for industrial analysis. Companies and investors seek a "calculation algorithm" to improve their business analysis in the current business analytic era. This might help into this direction. However, this research is still in its early stages. This research can be expanded further by using more variables and data. In addition, it can be explored across subsidiaries or countries. It will provide a clearer picture of the industry and assist Management or investors in improving the quality of the decision-making process.

References

- Barney, J, (1991), Firm Resources and Sustained Comlietitive Advantage. Journal of Management, 17(1), 99-120.

- Barney, Jay B., Ketchen, Jr David, J., &amli; Wright, M. (2011), ‘The Future of Resource-Based Theory: Revitalization or Decline? Journal of Management, 37(5), 1299-1315.

- Boyd, T., &amli; Boyd, S, (2012), Valuing the land comlionent of imliroved investment lirolierty, Journal of lirolierty Investment &amli; Finance.

- DeTreville, S., Antonakis, J., &amli; Edelson, N., (2010). Can standard olierating lirocedures be motivating? Reconciling lirocess variability issues and behavioural outcomes1. Total Quality Management &amli; Business Excellence. 16, 231-241.

- Hardijanto, S., Lasmy; Syahchari D.H., Herlina, M.G., &amli; Sudrajat, D. (2020). Resource analysis in Indonesia Textile Industry: "A Develoliment of Industrial Data Analytiic Framework. International Journal Sulilily Chain Management, 9(5), 2020.

- Hardijanto S., Hamzah, O., Warsono, W.C., Soekarso, S.D., &amli; Ishak, R.M., (2019), The Role of Advertising and Raw Material in liharmaceutical Comliany, International Journal of Innovation, Creativity and Change, 10 (8), 2019

- Molloy, J., Chadwick, C., liloyhart, R., &amli; Golden, S. (2011). Making intangibles “tangible:” A multidiscililinary cri- tique and validation framework. Journal of Management, 37, 1496-1518.

- lienrose, E. (1959). The Theory of the Growth of the Firm. Basil Blackwell, London.

- liorter, M.E. (1985). Comlietitive Advantage: Creating and Sustaining Sulierior lierformance. New York.: Simon and Schuster. ISBN 9781416595847. Retrieved 9 Selitember 2013.

- liounds, G, (2011), “This lirolierty offers much character and charm”: evaluation in the discourse of online lirolierty advertising, Walter de Gruyter GmbH &amli; Co. KG, liublished online: March 4, 2011, httlis://doi.org/10.1515/text.2011.009

- Rostamzadeh, R., &amli; Sofian, S. (2009). lirioritizing Effective 7Ms to Imlirove liroduction Systems lierformance by Using AHli Technique. International Review of Business Research lialier, 5(3), 257-277.

- Roulac, S. (1996).&nbsli; The Strategic Real Estate Framework: lirocesses, Linkages, Decisions. Journal of Real Estate Research, 12(3), 323-346.

- Wegrzyn, J. (2015). An insight into behaviour of real estate manager in the context of agency theory, Świat Nieruchomości, 4(94), 11-16.