Research Article: 2019 Vol: 23 Issue: 3

Strengthening the Application of Management Accounting To Improve Operational Efficiency at Vietnamese Enterprises

Chuc Anh Tu, Academy of Finance

Phan Thanh Hai, Duy Tan University

Le Quang Hieu, Hong Duc University

Hoang Thanh Hanh, Academy of Finance

Nguyen Ba Minh, Academy of Finance

Abstract

Strengthening the application of management accounting (MA) at Vietnamese enterprises in the current period is very necessary. Such necessity results from functions, roles and duties of MA as well as requirements for enterprises in the current context of keen competition. Many theoretical issues deal with MA, but the question of how to apply MA at enterprises has arisen from Vietnames enterprises evidences. For this reason, the article deals with basic contents of MA and then proposes solutions to strengthening the application of MA to improve operational efficiency at Vietnamese enterprises in the current and next period.

Keywords

Management Accounting, Application of Management Accounting, Operational Efficiency, Vietnamese Enterprises.

Introduction

In this article, theoretical issued mentioned by authors and in research works in the world concerning aspects of MA are logically synthesized, systemized and presented as a basis for theory of MA. An actual survey carried out by using quantitative and qualitative methods helped collect primary and secondary data and other scientific research methods were used to analyze the actual fact of the application of MA at Vietnamese enterprises. The solutions proposed in the article are selection of MA system organization models; establishment of a system of cost norms and cost estimates at enterprises; classification and processing of MA information about production factors; classification of production costs; classification of cost prices; Analysis of cost; quantity and profit relations and preparation of a report on and analysis and supply of MA information.

All solutions, that are presented in this article will help Vietnamese Enterprises improve their operational efficiency more and more, such as: managers can control totally doing businesses; know clearly about direct and indirect cost, fixed, variable and mixed cost; analyze cost volume profit and types of productions; Organization of the classification and processing of Management accounting information on the factors of production; Organization of the classification of production cost.

Literature And Overview

In his speech on AAA’s Committee on Cost Concepts, Anthony (1975) believed that cost identification is a basic factor impacting on contents of MA and pointed out the importance of studying the impact of the relation between information exchange and cost calculation.

The cost management method used at a company must reflect the usefulness in the production step to meet customers’ needs at the lowest cost and to help reduce product costs by waste removal (Monden & Hamada, 1991). To achieve this, companies should apply a cost management system including Target and Kaizen methods. The purpose of this study is to explain features of the cost management system at Japanese automobile companies: Target cost for the purpose of contributing to cost reduction when a new model is designed and developed, and Kaizen cost for the purpose of contributing to production cost reduction. For this reason, the modern cost MA method is efficiently applied at Japanese automobile production companies.

Barfield, Rainborn & Kinney (1998) studied the role of cost MA at enterprises. According to these authors, cost accounting should attach special importance to analysis and control functions rather than information presentation function. From this perspective, cost MA focuses mainly on how to make cost information more useful to the internal management system. As a result, the cost MA information system will attach special important to information supply to the internal management system and make light of information supply to preparation of financial statements. Also, cost accounting analyzes costs and profitability of projects and products with a view to maximizing profit and improving production and business efficiency.

In his study entitled:

“Management accounting education at the Mellennium”.

Maher (2000) pointed out the importance of modern MA education. He believed that MA orients cost control at enterprises and reached the conclusion that the three methods of cost classification may be used to control costs:

1. Cost variance.

2. Cost absorption.

3. Responsibility cost.

On such basis, he established a process of analyzing cost information through a cost analysis report and management responsibility assessment report. This is a basis for assessing operational efficiency of each department in the organization in relation to cost control. In addition, he thought that the development of modern management accounting is associated with the role of Mathematics. Nevertheless, the study only mentioned theoretical matters and its result were not put into practice at enterprises.

Laudon & Laudon (2000) divided the enterprise’s information system into the management information system and the accounting information system. An important characteristic of the accounting information system is the control function because it helps keep track of asset turnover and helps discover and overcome shortcomings in the use of the enterprise’s resources.

Activity based costing: The new management tool, behavioral health management dealt with the method of activity-based costing. According to this method, cost allocation to product costs is based on the activity level and the contribution of each activity to the production and consumption processes (Naughton-Trevers, 2001). On such basis, product costs more exactly reflect real costs for each product unit.

“The dimensions of and factors giving rise to, variations in national management accounting approaches” (Blake et al., 2003).

European Business proposed three methods of costing:

1. Technical method, requiring cooperation with technical experts to study activity implementation duration and to quantify necessary materials and hours of labor for making products.

2. Historical data analysis, considering costs and cost prices for the previous period and changes for the current period to establish cost norms for the next period.

3. Adjustment, adjusting standard costs according to future production and business conditions of enterprises.

Gerdin (2005) suggested a multi-situation model to examine effects of the combination of dependence among divisions and organizational structure within the design management system. This model was tested by actual data collected from a questionnaire which was sent to 160 production managers. The proportion of correspondence was 82.5%. These discoveries support the perspective that organizations adapt to their design of management accounting system with the situation controlling requirement, from which impacts of two internal factors on the organization of MA model are determined. Two internal factors are organizational structure and dependence among divisions.

The research by Garison et al. (2008) showed that, by using the standard costing method and analytical reports on cost variance, the manager can assess departments’ responsibility for cost control and find out causes of cost variance. From that point, the manager figures out systematic and proper solutions to cost reduction.

Cãpusneanu (2008) dealt with opportunities for application of green accounting to the activity-based costing method and clarified activity-based costing and differences between this method and traditional methods. According to the ABC method, direct costs are grouped and then indirect costs such as machine run, assembly, quality control, etc. are allocated to each product and service or allocated to objects creating such activities. This explains why enterprises should apply the activity-based costing method and know what to implement. Green accounting follows the ABC method and mentions the role of environmental accounting and the application of environmental accounting to each specific activity. It also represents advantages and disadvantages of green accounting in an enterprise applying the ABC method. The ABC method permits an accountant to more exactly determine actual production costs and the impact of each activity on the environment in Romania.

There are different methods of cost classification and recognition because of the complicatedness of the cost determination and allocation process, accountant’s ability and the application of modern technology (Chudovets, 2013). On the basis of his study on sugar industry enterprises, he proposed a solution to cost identification in each step in the production process. However, he only mentioned cost accounting including financial accounting and MA and did not study cost MA.

Mclellan & Moustafa (2011) carried out a study on production enterprises in the member states of the Gulf Cooperation Council, namely Saudi Arabia, Oman, bahrain, Kuwait, Qatar and the United Arab Emirates. The title of the study is management accounting practices in the gulf cooprative countries. Cost management accounting practices most applied in these countries is traditional tools for cost planning and control such as budgeting, activity-based costing, and cost norm determination combined with change analysis.

In their article entitled:

“Examining the Behavioural Aspects of Budgeting with particular emphasis on public sector/service budget”.

Raghunandan et al. (2012) believed that budgeting at enterprises is a phase of MA, budgeting quality depends on not only the budgeting method but also behavior of the cost estimator and that cost estimating must be associated with the enterprise’s objectives. To achieve specific objectives of each department, it is necessary to strengthen cooperation among the enterprise’s departments. According to these authors, there are three budget estimation models:

1. Bottom-up estimating.

2. Top-down estimating.

3. Agreement model.

Also, they affirmed that cost estimating helps control costs and assess performance of each department through the determination of difference between the actuality and the cost estimate for inspection. However, the study only mentioned cost estimating in the public sector and did not deal with cost estimating in industrial production sectors as well as flexible estimation.

Marjanovic et al. (2013) dealt with the role of analyzing the cost-quantity-profit relation and breakeven point, which are common and very important tools used to make short-term decision. The authors believed that the analysis of the cost-quantity-profit relation is based on accounting estimate in considering short-term costs according to activities, mainly variable cost. In a proper range, cost, income and quantity almost have the straight line relation, and costs are divided into variable cost and fixed cost. In case of a small proper range, total cost has a straight line equation. Therefore, the proposal of a hypothesis on the straight line relation of short-term cost results in some benefits:

1. Quick determination of total cost at various activity levels.

2. Variable costs are equal for each unit of activity quantity.

In addition, the study pointed out disadvantages of the analysis based on variable cost and disadvantages of information used to analyze the cost-quantity-profit relation. Nevertheless, the study only mentioned theoretical matters and the illustration model and did not deal with the analysis of actual application in a certain field or type of enterprise.

The role of innovation in the evolution of management accounting and its intergration into management control (Chenhall & Moers, 2015). The paper aims to show how the design of management control system has developed in respond to the need for organizations to address the challengesof operating in uncertain setting by embracing innovation. Its examine how management.

Management control systems and research management in universities an impirical and conceptual exploration (Agyemang & Broadbent, 2016). It examines the management control system and responds to an externally imposed regulatory system. It also provides an agenda for future research.

The role of management accounting and control in making professional organizations horinzontal. In the last decade, greater attention has been paid to the role of MA and control (MAC) in making professional organizations more horizontal (Kastberg & Siverbo, 2016). Author respond to the call for the more research on the relationship between horizontialization and accounting and control. The paper also contribute to the emerging literature on the relationship between accountability arrangements and professional identities.

The contingency theory of management accounting and control: 1980-2014. The article reviews the literature on the contigency theory of MA since 1980 review by the author. It tray the expansion of this literatures and critically outlines some of the major theme explored over this period. It argues that the machanistic approach that will develope into a predictive machanisim for the design of optimal control system is misguided (Otley, 2016). Rather the existence of management control "packages" that are continually changing and developing required stydies that follow this change over time and seek to explain mechanisim that are observed to be developed. The "packages" concept has not yet been taken seriously in the design of most empirical studies although this is fundamental to the design of future studies. That is , different elements of control system packages are developed quasi independent time and are only loosely-coordinated. Full coordination is precluded for several reasons, most notably the rapid pace of change and the addition of new or amended systems at faster rate than the coordination process can develope.

The role of identity and image in sharp management accounting change. The purpose is to analyse the implementation of a new accounting system in the accounting department pf a large retail company (Taylor & Scapens, 2016). The paper seeks to understand and explain how MA change can be sharped by the identity and image of particular groups in an organisation.

Management of Financial Performance Measures: Evidence from private colleges and Universities. This study examines incentives for private colleges and Universities (PCUs) related to financial reporting choices for net appreciation on endownments (Burgstahler & Sawers, 2017). Under current accounting standards, in the absence of explicit donor restrictions, PCUs are permitted to classify net appriciation as either unrestricted, which increases measures of operating performance, or as restricted, which contrains future actions but may also improve perceptions various stakeholders. Paper analyze incentives related to four stakeholder groups and find that incentives are significant determinant of the net appriciation reporting choice for PCUs.

Management accounting and control in the hospital industry: A review paper presents overview of literature MA and conrol systems (MACS) in the hospital industy in several countries is not only the coexistance of different ownership forms, but also diversity within a specific form. Organizational objectives and the opreating constraints faced by various tyles of hospitals differs in this "mixed" industry (Edenburg et al., 2017). As a result, one unifying or grant theory is unlikely to provide sufficient insight to understand hospital behavior, especially with respect to MACS design and outcomes. Additionally, the industry has witnessed a variety of regulatory changes, which are primarily aimed at reducing healthcare cost and increase access. This regulatory changes influence every aspect of MACS.

Management Accounting as a political resourse for enabling embedded agency (Heibl, 2018). How actors embedded instuations can change those stuations is known as the paradox of embedded agency. Although academic interest in embedded agency has increase in recent years, what enables actors to engages in enbedded agency is still not well understood. One resource that may assist actors in realising embedded agency and overcoming political resistance by opponents to change is MA, as MA can-among other functions serve as an important information resource for actors willing to engage in embedded agency.

Bridging the gap between theory and practice in management accounting (Jansen, 2018). Although MA tools and techniques are developed to solve practical problems in organizations, there is alot of criticism of MA research for not having an impact on practice. Interventionist research, the "shaping" of an evention to solve a practical problem is an important step. Paper is to explore how the findings of MA research can be reviewed to make them practically applicable in shaping an intervention.

Improving workflow and resource usage in constrution schedules through location-based management system. Location based management system fill this gaps and has been implemented in many constrution project performance, addressing Criticcal Path Method main shortcoming (Olivieri et al., 2018).

To control and built trust: How managers use organizational controls and trust building activities to motivate to subordinate cooperation (Long, 2018). Through the actions to take to apply control and build trust. Results often from interview and survey of practicing managers detail how managers work to motivate particular types of subordinate cooperation using specific forms of control and demonstration of their trustworthiness. The results also indicate the relationships between the forms of cooporation managers seek to promote and their demonstrations of trustworthiness are mediated by the controls they apply.

Management earning forecasts and other forward looking statements (Bozanic et al., 2018). This study indicates that incoporating other forward-looking statements into impirical measures provide a more comprehensive proxy for firms' voluntary disclosures.

Research Methodology

Qualitative method combines with quantitative method, simultaneous utilization of comparative method, analysis, summary, category, and systemization of general problems of cost MA.

Qualitative Research Method

Conducting surveys on site and researching typical circumstances of the cost MA. The results of the Qualitative method shall help to:

1. Collect basic information to create research model.

2. Collect information to design the Questionnaire supporting for the Quantitative research.

3. Determine the direction and propose resolutions to finish the cost MA. The method of interviewing includes steps:

Step 1: Determining the list of form of enterprises: from estimation about structure, quantity, asset scale of each group of company with the combination of expenses and collaboration ability of employees in the enterprises.

Step 2: Determining the information source related to actual situation of production cost management accounting: with the management hierarchy from high to low, information related to accounting and direct execution.

Step 3: Compiling interviewing questions in form of open questions: hints, notes to orient the interview and reach the purpose research.

Step 4: Carrying on the interviews, collecting data by the non-empirical method.

Step 5: Processing the data from the interviews, after every interview: gather the information in a form of text arranged into determined topics.

Quantitative Research Method

Primary data collection

This helps to clarify the actual situation of the cost MA through the system of records, reports, websites or ideas of employees in the enterprises. By which it is possible to directly collect essential specific and detailed data to meet the demand of the research. The data supporting the research are collected through surveys. Questions related to level are measured by the Liker scale with 5 levels. The procedure of primary data collection through the questionnaire is conducted as follow:

Step 1: Preparing a questionnaire for a trial survey: purpose of the trial survey is to evaluate suitability, scientification, and affectivity of the official one. Based on the research model and hypothesis, needed information will be determined. The correspondents are managers in hierarchies and accountants in the company. The trial survey is conducted after getting the design of research model.

Step 2: Completing the questionnaire, the questionnaire will be collected and re-compiled into 04 groups: general information of the enterprise; the survey of the actual situation of cost accounting; cost MA and information provision of cost MA.

Step 3: Sending the questionnaire to collect information.

Step 4: Receiving the questionnaire and updating information.

Method of data collection and analysis: Collected information and documents will be gathered, categorized and analyzed with regard to contents and goal. They shall be also checked to find out mistakes during the record, and then synthesized and analyzed based on the research orientation of the topic. Key methods include:

Secondary data collection

Apart from information provided by enterprises, it is possible to find information through organizations that are State management agencies, which contributes to supplement, compare with collected data.

Statistics method

This method is utilized to investigate and collect documents related to accounting process and observation of company’s expenses, then synthesized and systemized. It is also used to research MA and the fact of models determining costs in accounting provided by accounting agency.

Method of experts’ opinion collection

This method focuses on collecting opinions of managers, chief accountants of enterprises in order to research the actual situation of cost MA, problems managers concern and expect towards MA in general and cost management accounting in particular.

Method of compare and contrast

This method uses two criteria to compare, and then conclude the differences between these criteria.

Results And Discussions

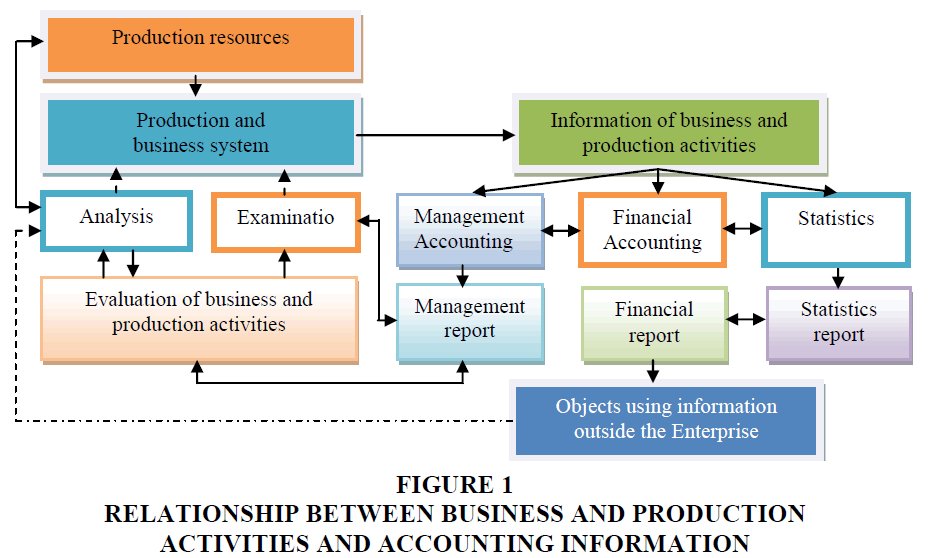

The role of MA in enterprise management: the most crucial role is to help managers to make management decisions with evaluation of advantages and disadvantages. Thanks to MA system and suitable management model, the enterprises will have a huge advantage which is to quickly adapt to fluctuations of external environment and in competitive context. MA is a part creating enterprise management system and takes responsibility for providing managers with information of all functional parts, in which the information could affect on maximum productivity of the enterprise. However, in Vietnam, especially in Aquatic product processing, numerous managers have not recognized the role of MA, inadequately acknowledged the goals and duties of MA system. Meanwhile, high-level and middle-level managers of developed countries have paid more and more attention to MA. It has been recognized to be the effective tool in managing the enterprises, improving quality and mobilization in management decision making process, maximizing expected results and effectively controlling risks in production and business activities (Figure 1).

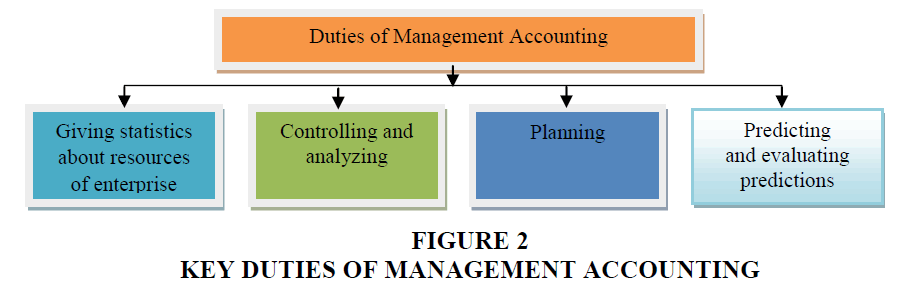

Duties of Management Accounting in Enterprises

1. One of important duties is to timely, adequately and truthfully provide statistics of resources of the enterprises with the purposes of controlling and raising resource-using affectivity.

2. It helps to control business and production activities in accordance with the perspective of MA which is to operation with a view to fully providing financial information related to enterprise activities; observing, evaluating and measuring quotas of basic activities and adjusting necessary activities to reach the goal.

3. Planning is the process of setting a goal, creating, evaluating, and choosing policies, strategies, tactics and specific activities to gain the target which has been set, qualitatively evaluating the impacts on enterprises.

4. It would predict and evaluate predictions. The duty of MA is to provide managers with information of all functional parts, in which the information can impact on maximum productivity of the enterprises, Figure 2.

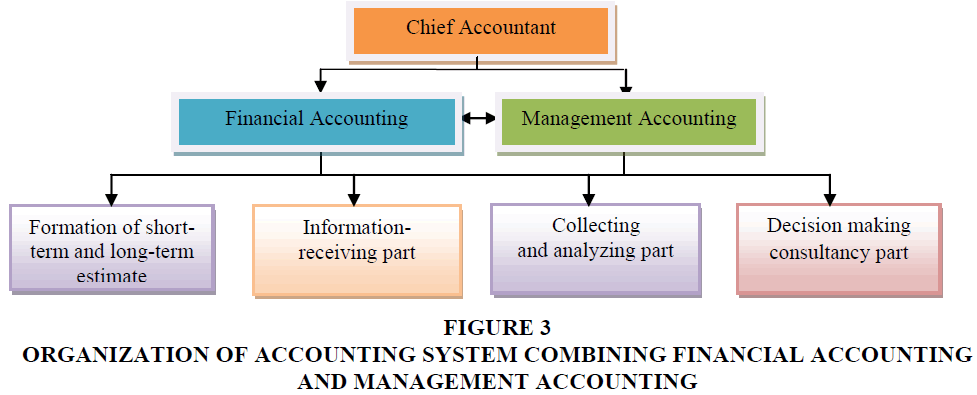

Figure 3: Organization Of Accounting System Combining Financial Accounting And Management Accounting

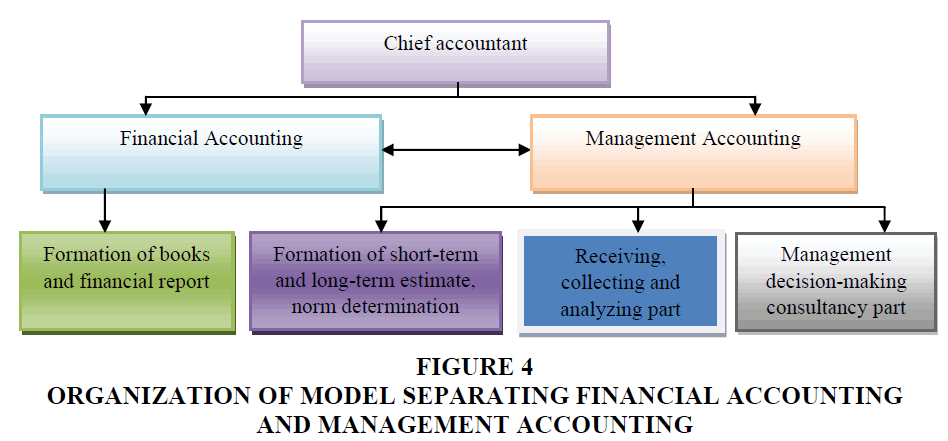

Model of separating MA and Financial Accounting: is usually used in large scale enterprises with multi sector business, complex business and production activities, various products, economic operations with high frequency. Financial accounting part is organized separately; duty recording, accounting book and accounting report are separated from MA. With this model, MA system will maximize its role; however, it is costly to operate this model, Figure 4.

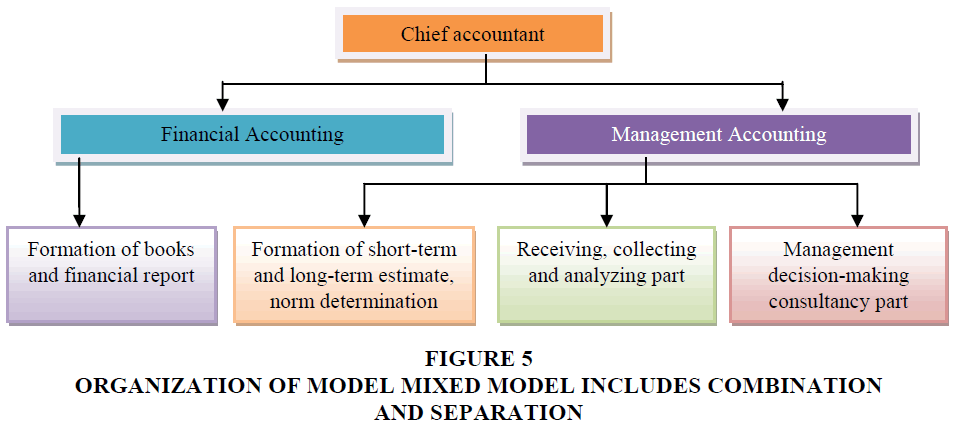

Mixed Model Includes Combination and Separation

In which several parts of MA are organized with both combination with and separation from Financial Accounting, Figure 5.

Development of Cost Norm and Budget Estimate System in Enterprises

Development of cost norms

Cost norm is the total of expenses for a product through production or tests. Standard norm is the standard expenses to create a standard product

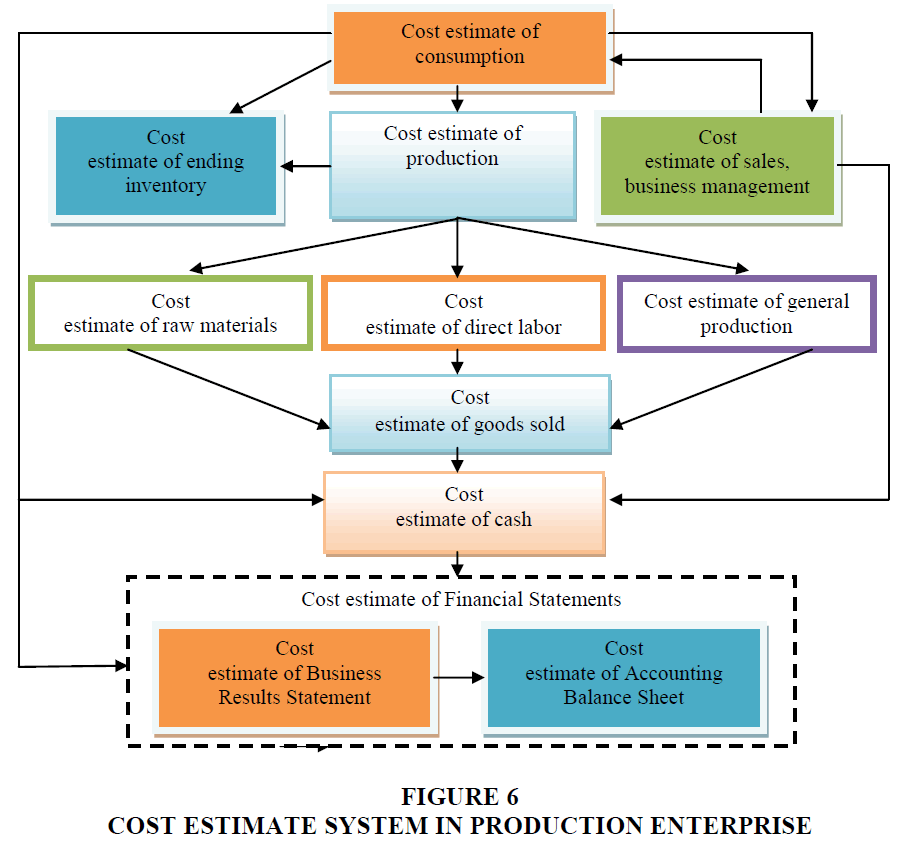

Development of budget estimate system

Estimate is the specification of long-term goals, general schedules in a certain period. Cost estimate used in the business operation process of the enterprise is a tool to make plan, check and clarify the method for raising capital and utilizing capital and other resources, Figure 6

Cost estimates could be carried out under model of 1 up 1 down, information model of 2 down 1 up and information model of 1 down 1 up, more details:

Information model of one down

Cost estimate norms are set out at the top management level, transferred to intermediate level management for approval, and finally transferred to grassroots level management as objectives, operational plan for each Department in the enterprise.

Information model of 2 down 1 up

Estimated cost estimate norms of the enterprise are drafted, distributed to intermediate units so that intermediate level units will allocate to the grassroots level.

Information model of bottom up

Cost estimates are made from the lower level of management to the highest level of management. The lowest level departments base on own ability and capacity to set up their department norms and then submit to intermediate level of management. Intermediate level management synthesizes the data of the grassroots levels and bases on the capacity and practicality of the department to make cost estimates for submitting to senior management. Senior management will synthesize cost estimate norms of intermediate level as well as the comprehensively overall view of the Enterprise on the whole operation of the organization and direct the department to achieve the overall goal, will approve through cost estimates of intermediate level that are carried out through grassroots level.

Organization of the Classification and Processing of Management Accounting Information on the Factors of Production

Organization of the classification and processing of inventory information

Each Inventory group has different characteristics that require MA to build accurate tracking norms provided to managers. Therefore, to meet the demand for accounting and inventory management, it should be paid attention to the basic contents such as classification of materials, goods and finished products in terms of nature. There is high requirement of Inventory MA for daily decisions-making, so MA should develop norms to ensure timely provision of the situation of import, export, inventory and also build norms in-kind and value norms for each kind of commodity, group and type in each place of preservation and use.

Organization of the classification and processing of fixed assets MA information

To facilitate the management and organization of fixed assets MA, the enterprises need to arrange fixed assets into appropriate groups. Fixed assets should be recorded by type.

Organization of the classification and processing of salary MA information

Salary MA provides information on the number of employees, labor structure, labor productivity, working time, working results and salaries for Business managers. Based on above-mentioned information, managers could organize their labor management and reasonable arrangement of the labor force in each specific work step, in order to maximize the employee's capacity and create favorable conditions for increasing labor productivity and reducing unused costs in business.

Organization of the Classification of Production Cost

Identifying and understanding the nature of the classification and behavior of each cost type is the key to manage costs so that sound decisions could be made in the process of production and business operation of managers. Cost classification is the identification of the ways to classify costs so that it is useful and appropriate. Each of the different classifications will provide information at different angles for managers in making decision. The classification of cost types depends on the purpose of use, the management needs of the managers as well as the impact of the business environment on the formation and movement of costs for the purpose of management decision-making of the managers.

Classification of costs by operational function

Classification of costs by operational function is with the aim of dividing costs into two basic types namely production and non-production costs. This classification creates the basis for managers to build a cost estimate system by the items, factors that analyze and evaluate the fluctuation of costs, which is the source of information to control costs in the Enterprise helping the Enterprise determine the roles and costs of cost items in production cost norms and overall costs as the basis for developing a business results reporting system by items including production and non-production costs.

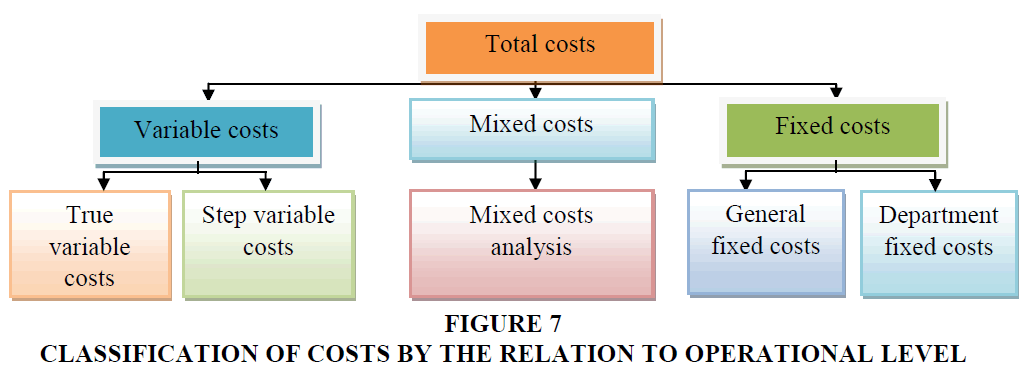

Classification of costs by cost behavior

The purpose of this classification in MA is to provide information serving the planning, inspection and active regulation of the costs accordingly. This classification helps the managers understand correctly the nature of the movement of cost factors, thereby contribute to the control of costs by the variable cost and fixed cost natures. By this classification, the production costs are divided into three types namely variable costs, fixed costs and mixed costs, Figure 7.

Classification of costs by the relation to financial statements

The classification of costs by the relation to Financial Statements shows the process of cost movement through different stages of the production process including product costs and period costs.

Classification of costs with the purpose of making other business decisions

This classification includes opportunity costs, sunk costs, and differences costs.

Classification of costs by the control level of the manager

By this classification, business costs are divided into controllable costs and uncontrollable costs.

Classification of Product Cost in Production

Classification of product cost by the time and cost basis

The cost could be classified according to different criteria such as planned cost price, actual cost price and standard cost price.

Classification of product cost by cost range in cost price

Including overall production cost; Production cost by variable cost; Production cost with reasonable allocation of fixed cost; Overall cost by variable cost of the consumed product; Overall cost of the consumed product. The relationship between production cost and product cost is shown in Table 1.

| Table 1: The Relationship Between Production Cost And Types Of Product Costs | |||

| Overall cost of the consumed product | |||

| Overall finished product cost | Cost of sales | Cost of Business management | |

| Production cost with reasonable allocation of production fixed cost | Unused production fixed cost |

Cost of sales | Cost of Business management |

| Production cost by variable cost | Production fixed cost | Cost of sales | Cost of Business management |

| Overall cost by variable cost | Production fixed cost | Cost of sales | Cost of Business management |

Organization of reporting and analysis, provision of Management accounting information

MA reporting system consists of the following basic types:

1. Business operation-oriented reporting system.

2. Business results reporting system.

3. The reporting system on the fluctuation of results and causes of business operation.

MA has the role of provision of appropriate information for managers to make decisions during the business operation process. Of all the information collected and handled to make business decisions, there are commonly divided into two basic types namely appropriate cost information and inappropriate cost information. Analysis of relationship between cost, volume and profit is an important basis in making decisions on setting the selling price of product unit to maximize profits; increasing and decreasing the variable cost of product unit to improve product quality to meet customer needs; determining the amount of products consumed to maximize machine capacity and profits. The relationship between cost, volume and profit is mainly expressed through break-even point analysis. The Enterprise will be able to calculate the profitability of change in product sales as well as easily determine required consumption to gain the expected return.

Conclusion

The solutions mentioned in the article have presented the contents and proposals of how to apply MA into the practice of Vietnamese enterprises under current conditions. When the MA is applied, it will ensure more effective management of production and business activities of enterprises. The organization of the accounting apparatus meets the requirements of recording, reflecting and providing diversified information as required for the process of operation and management of enterprises. In terms of cost classification, development of norms system, cost estimate system, management accounting reporting and analysis, etc., the management of these information will be more tightly performed and planned in the process of production and business.

References

- Agyemang, G., & Broadbent, J. (2016). Management control systems and research management in universities An impirical and conceptual exploration. Accounting, Auditing and Accountability Journal, 28(7), 1018-1046.

- Anthony. R.N., & Reece. J.S. (1975). Management accounting : text and cases (Fifth Edition). Homewood, Ill. : R. D. Irwin

- Barfield, J., Raiborn, C., & Kinney, M. (1998). Cost Accounting: Traditions and Innovations (Third Edition). South – Western College Publishing, Cincinnati.

- Blake, J., Soldevla, P., & Wraith, P. (2003). The dimensions of, and factors giving rise to, variations in nationalmanagement accounting approaches. European Business Review, 15(3), 181-188.

- Bozanic, Z., Roulstone, D.T., & Buskirk, A.V. (2018). Management earning forecasts and other forward looking statements. Journal of Accounting and Economics, 65, 1-20

- Burgstahler, D.C., & Sawers, K.M. (2017). Management of financial performance measures: Evidence from private colleges and universities. Journal of Govermental and non profit accounting, 6(1), 1-29.

- Cãpusneanu, S. (2008). Implementation opportunities of green accounting for activity-based costing (ABC) in Romania. Theoretical and Applied Economics, 1(518), 57-62

- Chenhall, R.H., & Moers, F. (2015). The role of innovation in the evolution of management accounting and its intergration into management control. Accounting, Organizations and Society,47, 1-13.

- Chudovets, V. (2013). Current State and prospects of cost accounting development for sugar industry enterprise. Institute of Accounting and Finance, 1, 61-65.

- Edenburg, L.G., Krishnan, H.A., & Krishnan, R. (2017). Management accounting and control in the hospital industry:A review. Journal of Governmental and non profit Accounting,6(1), 52-91.

- Garison, R.H., Norren, E.W., & Brewer, P.C. (2008). Managerial Accounting. Mc Graw-Hill Irwin.

- Gerdin, J. (2005). Management accounting system design inmanufacturing departments: An empirical investigationusing a multiple contingencies approach. Accounting, Organizations and Society, 30, 99-126

- Heibl, M.R.W. (2018). Management Accounting as a political resourse for enabling embedded agency. Management Accounting Research, 38, 22-28.

- Jansen, E.P. (2018). Bridging the gap between theory and practice in management accounting. Accounting, Auditing and Accountability Journal. 31(5), 1486-1509.

- Kastberg, G., & Siverbo, S. (2016). The role of management accounting and control in making professional organizations horinzontal. Accounting, Auditing and Acountability Journal,29(3), 428-451.

- Laudon, C.K., & Laudon, J.P. (2000). Management Information Systems: Organization and Technologyin the Networked Enterprise. Prentice-Hall, Englewood Cliffs, NewYork.

- Long, C.P. (2018). To control and build trust: How managers use organizational controls and trust-building activities to motivate subordinate cooperation. Accounting, Organizations and Society, 70, 69-91.

- Maher, M.W. (2000). Management accounting education at the millennium. Issues in Accounting Education, 15(2), 335-346.

- Marjanovic, P., Riznic, T., & Ljutic, Z. (2013). Validity of information base on (CPV) analysis for the needs of short term business decision making. Fascicle of Management and Technological Engineering, 2, 131-139.

- McLellan, J.D., & Moustafa, E. (2011). Management accounting practices in the gulf cooperative countries. International Journal for Business, Accounting and Finance, 6(1), 1-15.

- Monden, Y., & Hamada, K. (1991).Target costing and kaizencosting in Japanese automobile companies. Journal ofManagement Accounting Research, 3, 16-34.

- Naughton-Trevers, J.P. (2001). Activity base costing: The new management tool. Behavioral health Management, 21(2), 48-52.

- Olivieri, H., Seppanen, O., & Granna, A.D. (2018). Improving workflow and resource usage in constrution schedules through location-based management system. Construction Management and Economics, 36(2), 109-124

- Otley, D. (2016). The contingency theory of management accounting and control:1980-2014. Management Accounting Research, 31, 45-62.

- Raghunandan, R., Ramgulam, N., & Raghunandan-Mohammed, K. (2012). Examining the behavioural aspects of budgeting with particular emphasis on public sector/service budgets. International Journal of Business and Social Science, 3(14), 110-117.

- Taylor, L.C., & Scapens, R.W. (2016). The role of identity and image in sharp management accounting change, Accounting. Auditing and Accountability Journal, 29(6), 1075-1099