Research Article: 2022 Vol: 28 Issue: 3S

Study On Factors Governing Empowerment among Women Beneficiaries of Microfinance With Reference to Madhya Pradesh

Vikrant Vikram Singh, Amity University

Anil Vashisht, Amity University

Citation Information: Vikram Singh, V., & Vashisht, A. (2022). Study on factors governing empowerment among women beneficiaries of microfinance with reference to Madhya Pradesh. Academy of Entrepreneurship Journal, 28(S3), 1-7.

Abstract

Introduction: Access to credit remains a major obstacle for poor / lower income group people in India. Today India has an extensive banking system. The value of micro finance lies in the fact that the formal / institutional banking sector has not fulfilled its social obligation to satisfy the financial needs of the poor. Muhammad Yunus began the root of microfinance in 1976, having a positive effect on the poor and communities. Objectives: Researchers of this paper have briefly mentioned microfinance and its effects on bringing social empowerment among individual women beneficiaries. Originality: This paper seeks to identify the various social factors and understanding of women as to how microcredit affects their social well-being. Research Methodology: The analysis was based on data gathered from field surveys conducted on 200 microfinance women beneficiaries. Factor analysis method is applied by using principal component method to identify social empowerment among women beneficiaries. Results & Discussion: The results found that microfinance loans can lead to positive changes in women's social well-being and the analysis ends with proper recommendations and suggestions. Conclusion: This study concludes that most of the women entrepreneurs are getting socially empowered through microfinance programmes.

Keywords

Micro Finance, Social Empowerment, Poverty, Micro Credit, Women Empowerment, Rural Entrepreneurship.

Introduction

Poverty is a danger to the environment and to the social development of society. In order to boost people's well-being and to achieve sustainable development in developing countries like India, poverty and inequality always remain a global challenge. Poor people must first be able to fulfill their basic personal needs, such as proper nutrition and accommodation. As a mechanism for poverty alleviation, microfinance has grown its popularity over the past three decades. It is now widely used all over world both in developing and developed countries. The purpose of this initiative is to provide financial support to those who live below the poverty line. Professor Muhammad Yunus is the most prominent person who acts as an initiator and promoter of microcredit and known as the founder of Grameen Bank. From microcredit, microfinance also includes various other financial services in their program like micro-savings, pension, micro insurance and many more services. Research has shown that microcredit can lead to higher revenues and boost the economic condition of the poor (Murdoch & Haley, 2002). There has been a focus on the participation of women in programmes since the implementation of microcredit. In general, women are poorer than men and often have little opportunity to start a company or venture, though women are more loyal customers. Hence, it meets both the criteria and microfinance institutions give more emphasis on women beneficiaries. The aim of this study is to identify the social factors which govern empowerment among women (Mecha, 2017).

This research paper has been alienated into six parts in order to convene the aim of the research. The first section deals with the introduction including study purpose and aim, the next section consists of detailed past review including discrepancies and importance of research. The third section deals with the research methodology that covers the model. The fourth section consists of data and inference analysis. The fifth segment consists of research conclusion and suggestions (Swain, 2009).

Review of Literature

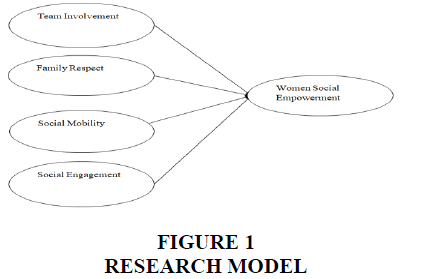

It is generally accepted that the secret to poverty alleviation can be found in the programme of microfinance. When we speak about the effect, we recognize women's independent position in social empowerment and its corrective steps. Empowerment thus requires a rise in income levels for women, leverage over income and properties, community and household involvement. If she can boost her self-confidence and role within her family as independent producers of income, a woman becomes socially empowered. In real terms, empowerment is a mechanism by which women acquire the freedom to make independent decisions about their operations and control over resources and become self-reliant and transcend subordination. Empowering women and improving their status, particularly with regard to education, health and economic opportunities, are highly significant ends in themselves.(Vijayanthi, 2002).Various researchers have defined empowerment in different ways. According to empowerment means improved physical mobility, economic stability, ability to make own transactions, independence from control of the family, women's political and legal knowledge Dhar (2005); Field & Pande (2008) revealed in their study microfinance has increased women's faith in themselves and improved their communication. According to SHG engagement greatly increased their members' self-confidence. After SHG was established, disparities in the distribution of income, loans and savings deteriorated. The social aspect of microfinance was more pronounced than the economic aspect. Based on above literature review few factors were identified which leads to social empowerment among women beneficiaries shows in Figure 1.

These four variables were identified and used in the study to identify social empowerment among women beneficiaries. These variables have been measured from twelve different indicators based on objective of study. The information on these variables was collected from women beneficiaries and is used as a tool to measure social benefits as perceived by members shows in Table 1.

| Table 1 Indicators of identified variables |

|

|---|---|

| Constructs/Variables | Indicators |

| Team Involvement | Group/Community participation |

| Increase in knowledge with interaction to other group | |

| Extended network | |

| Family Respect | Respect from husband |

| Respect from children | |

| Respect from parents in law | |

| Social Mobility | Improvement in social status |

| Self Recognition | |

| Increase in self confidence | |

| Social Engagement | Participation in social activity |

| Recognition within group | |

| Ability to speak in front of society | |

Research Methodology

The goal of this study is to look beyond economic development at the effects of microfinance; the emphasis will be on improvements in social well-being from the point of view of women borrowers after they have received microfinance loan. Social well-being in this study will be judged according to women's opinions, which are subsequently used to define the effect. The principal research question to be dealt in present study is what changes are understood by women group borrowers in their social well-being, after gaining microcredit services. To answer this research issue few factors were taken to judge the social empowerment level among women beneficiaries.

To carry out this study following methodology has been adopted. The data collected from the primary sources through questionnaire method. Questionnaire is divided into two sections. First section includes demographic profile of respondents and second section deals with social empowerment factors. Convenient random sampling method is adopted in the study. A total of 220 filled questionnaire were received from women beneficiaries who availed loan from microfinance banks out of 200 questionnaire where found suitable for study and is selected for study. Few identified factors like team involvement, family respect, social mobility and social engagement were included in questionnaire to judge the social empowerment among women beneficiaries (Morduch, 2002). Five-point Likert scale is used in the study to identify which factor plays a significant role in bringing social empowerment among women beneficiary. Below table show the study data collection methods:

Above Table 2 shows data collected from rural areas of both the districts. Unpaid volunteers were used for collection of data. SHG chosen for the study were linked to rural areas of both districts. Based on this data was analyzed by using SPSS software 24.0 version.

| Table 2 Data collected from primary survey |

|||

|---|---|---|---|

| Districts | Total Village | Self help groups | Number of beneficiaries |

| Morena | 03 | 12 | 100 |

| Gwalior | 02 | 18 | 100 |

Results and Discussion

The current study's objective is to determine which variables regulate the social empowerment of women. Below are the hypothesis taken for study:

Null Hypothesis (Ho): There is no inter-correlation among factors affecting the social empowerment among women beneficiaries.

Alternative Hypothesis (H1): There is an inter-correlation among factors affecting the social empowerment among women beneficiaries.

On the basis of survey, the factor analysis was performed to check internal reliability among variables by using the Kaiser-Meyer-Olkin (KMO) method and Sphercity test was applied. Chi square value was 315.495 and sampling adequacy is .666 wherein degree of freedom (DF) is 66 which predict that factors are reliable to be taken for the study. Below table depict KMO and Bartlett’s Test shows in Table 3:

| Table 3 KMO and Bartlett's Test |

||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .666 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 315.495 |

| df | 66 | |

| Sig. | .000 | |

After this principal component method was used through varimax rotation matrix and it was found that all the four variables are relevant for the study. All the four variables having score more than .50 which means all the four variables are significant enough to be taken for the study shows in Table 4.

| Table 4 Factor Analysis |

||||

|---|---|---|---|---|

| Team Involvement (1) | Family Respect (2) | Social Mobility (3) | Social Engagement (4) | |

| Group participation | .702 | |||

| Increase in knowledge | .528 | |||

| Extended network | .623 | |||

| Respect from husband | .710 | |||

| Respect from children | .727 | |||

| Respect from parents in law | .823 | |||

| Improvement in social status | .610 | |||

| Self recognition | .524 | |||

| Increase in self-confidence | .710 | |||

| Participation in social activity | .808 | |||

| Recognition within group | .547 | |||

| Ability to speak | .722 | |||

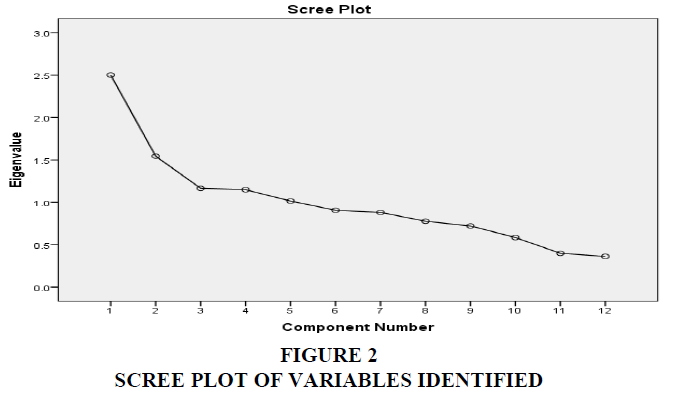

Above Figure 2 shows scree plot of variables taken for study. Eigen value>1 shows all the four variables are significant to be taken for the study. Below table shows the communalities of all four variables are between range 0.50 to 0.90 which shows satisfactory variance between variables taken and can be used in the study (Karuppannan, 2014). All the four factors team involvement, family respect, social mobility and social engagement determine the social empowerment level among variables shows in Table 5 and 6.

| Table 5 Communalities |

||

|---|---|---|

| Initial | Extraction | |

| Group participation | 1.000 | .604 |

| Increase in knowledge | 1.000 | .648 |

| Extended network | 1.000 | .564 |

| Respect from husband | 1.000 | .694 |

| Respect from children | 1.000 | .546 |

| Respect from parents in law | 1.000 | .721 |

| Improvement in social status | 1.000 | .689 |

| Self recognition | 1.000 | .536 |

| Increase in self-confidence | 1.000 | .553 |

| Participation in social activity | 1.000 | .710 |

| Recognition within group | 1.000 | .761 |

| Ability to speak | 1.000 | .646 |

| Extraction Method: Principal Component Analysis. | ||

| Table 6 Descriptive Statistics |

|||

|---|---|---|---|

| Mean | Std. Deviation | Analysis N | |

| Group participation | 4.24 | .612 | 200 |

| Increase in knowledge | 4.23 | .676 | 200 |

| Extended network | 4.22 | .708 | 200 |

| Respect from husband | 4.28 | .617 | 200 |

| Respect from children | 4.27 | .661 | 200 |

| Respect from parents in law | 4.31 | .643 | 200 |

| Improvement in social status | 4.29 | .726 | 200 |

| Self recognition | 4.39 | .656 | 200 |

| Increase in self-confidence | 4.29 | .660 | 200 |

| Participation in social activity | 4.28 | .743 | 200 |

| Recognition within group | 4.36 | .657 | 200 |

| Ability to speak | 4.34 | .732 | 200 |

At last, Table 6 shows descriptive statistics which include mean, standard deviation, and communalities of the rating on social empowerment among women beneficiaries. The item like improvement in social status, participation in social activity, ability to speak, extended network having highest mean while group participation, respect from husband, parents in law having low S.D. which means women need more recognition from family members though it is increasing. While, through above data it is inferred that beneficiary are able to speak their opinion, able to participate, there is an improvement in their social status, extended network through this it is inferred that women beneficiary are becoming socially independence with the help of microfinance and the null hypothesis is rejected and alternative hypothesis is accepted as it is found from above there is an inter correlationship between the variables.

Findings of Study

The study revealed out the benefits of microfinance programmer conducted for women beneficiaries living in rural areas. It has been found out that all the identified factors like team involvement, social mobility, social engagement and family respect all variables are important to judge social empowerment among beneficiaries. However, physiological factors such as masculinity, height, and weight (Murdoch & Hale 2002) are sometimes part of the permanent diversity factors. The result suggests that the level of increase in their confidence level, increase in self-respect among family, women are now becoming socially mobile and engaged in creating their own ventures. Most of the microfinance programmes have a goal of increasing income for the purpose of enhancing social status of women beneficiaries. A study conducted by Arora (2011) showed that "women empowerment is considerably influenced by age, education of husband, father inherited assets, marital status, number of sons alive and microfinance”.

The result of factor loading suggest that together all four variables are having scores in between .50 to .90 which means all the variables are significant enough to be taken for the study. Eigen value is greater than 1 show that all the four variables are significant to be taken for the study. Also, communalities of all four variables are between ranges .50 to .90. Mean value of all factors are high which shows greater social benefits accrued by the members also more respect should be given by family members as the standard deviation of these constructs are more as compare to other constructs. Due to more involvement in SHG, women members has significantly increased their self-confidence, social status, group involvement, better cooperation, ability to speak in front of society and freedom among family domination which lead women to become more socially capable with respect of empowerment.

Recommendations

1. The Government should implement better supervisory and regulatory body to streamline the better policy measures for microfinance institutions. Also, Various schemes of Government that aim to empower women should be specific about goals, instead of using empowerment as a catch-all phrase to mean positive outcomes for women (Dhar, 2005)

2. Bank officials and staff members should be given proper training sessions regarding documentation and regularity of documentation which is necessary for revolving fund.

3. Microfinance institutions should concentrate more on promoting women entrepreneurship through formal credit facility system.

4. Interest rate of MFIs should be decreased so that more and more clients can avail microfinance facilities.

5. Proper knowledge should be provided to interested borrowers for the better utilization of credit.

Conclusion

From the aforesaid study it may be concluded that most of the respondents are getting socially empowered through microfinance programmes. Also, it has been found out that microfinance has improved their standard of living of family of rural women, improved the awareness on children education to high level of respondents, better cooperation among group/community members, and freedom from family domination, increased in social mobility and social engagement, increased social status among women members.

As far as limitations of the study are concerned, Sample area of this study was limited as study was conducted with reference to Madhya Pradesh Region of India. Data was collected from 200 respondents from this region which are women entrepreneurs associated with various microfinance institutions and other financial institutions in Madhya Pradesh region. Also, the study was limited to microfinance and its effects on bringing social empowerment among individual women beneficiaries not including other impacts of microfinance.

References

Arora, S. (2011). Women Empowerment through micro finance intervention in the commercial banks: An empirical study in the rural India with special reference to the state of Punjab, Meenu, et. al. Int.J. Eco. Res, IJER/Mar–Apr.

Dhar, S.N. (2005).Micro-finance for women: necessities, systems, and perceptions. Northern Book Centre.

Field, E., & Pande, R. (2008). Repayment frequency and default in microfinance: evidence from India.Journal of the European Economic Association,6(2-3), 501-509.

Karuppannan, R., & Raya, R.P. (2014). Impact of micro finance-An empirical study on the attitude of SHG leaders in Vellore district (Tamil Nadu, India).Global Journal of Finance and Management ISSN, 0975-6477.

Morduch, J., & Haley, B. (2002).Analysis of the effects of microfinance on poverty reduction. New York: NYU Wagner working paper. 1014, 7.

Swain, R.B., & Wallentin, F.Y. (2009). Does microfinance empower women? evidence from self-help groups in India.International Review of Applied Economics,23(5), 541-556.

Indexed at , Google Scholar, Cross Ref

Mecha, N.S. (2017). Effect of microfinance on poverty reduction: a critical scrutiny of theoretical literature.Global Journal of Commerce and Management Perspective,6(3), 16-33.

Vijayanthi, K.N. (2002). Women's empowerment through self-help groups: a participatory approach.Indian Journal of Gender Studies, 9(2), 263-274.

Received: 29-Nov-2021, Manuscript No. AEJ-21-10114; Editor assigned: 02-Dec-2021, PreQC No. AEJ-21-10114(PQ); Reviewed: 17- Dec-2021, QC No. AEJ-21-10114; Revised: 04-Jan-2022, Manuscript No. AEJ-21-10012(R); Published: 10-Jan-2022