Research Article: 2020 Vol: 24 Issue: 1

Study the Factors Affecting the Presentation and Disclosure of Sustainable Development Information of Vietnamese Enterprises

Le Anh Tuan, Duy Tan University

Pham Ngoc Toan, University of Economics Ho Chi Minh City

Nguyen Xuan Hung, University of Economics Ho Chi Minh City

Abstract

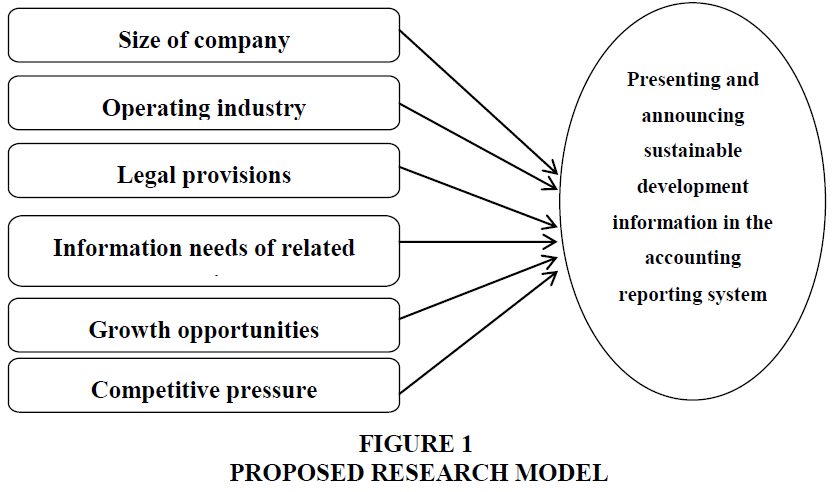

In fact, many companies listed on Vietnam's stock market do not yet have sufficient economic and social information or activities to ensure sustainability for investors. Information such as community investment, emissions levels, water use, and employee welfare, human resource diversity and committee independence may not be available to the public invest. The lack of this information can lead to the opportunity to attract capital from investors with high social and environmental responsibility standards. Many investors, including institutional investors and organizations those are aware of the importance of sustainability issues as a driver of financial performance as well as an indicator. In order to assess the environmental and social impact of businesses, this information is needed to make sound investment decisions. Through this study, the author's group pointed out that all 6 factors include (1) firm size; (2) Operating industry characteristics; (3) Legal provisions; (4) Information needs of related parties; (5) Opportunities for growth and (6) Competitive pressures have a positive influence on the presentation and disclosure of sustainable development information in the Vietnam Business Report system.

Keywords

Sustainable Development, Sustainable Development Information, Accounting Reports, Enterprises, Vietnam.

Introduction

Globally, we are witnessing a change in the concept of corporate responsibility. Investors, regulatory agencies and other stakeholders expect increasingly high for businesses in addressing the impact, risks and business opportunities related to the environment, society and corporate governance, as well as the economic aspects of business operations. These aspects reorient the products, services and operating processes of the business. This process includes issues that go beyond the immediate impact of the business, but still affect the medium and long-term success of the business. The overarching term for these factors is "sustainability".

The market increasingly requires businesses to be transparent about their environmental, social and governance activities, including their contributions to the economy. Businesses across the globe have been responding to this requirement by implementing the "sustainable development" report. Many studies also find a clear correlation between corporate social responsibility and corporate governance and firm's profitability.

In Vietnam, the presentation and disclosure of information regarding sustainability activities is a very new field. In Vietnam, the first legal document required to publish information on sustainable development of listed companies is Circular No. 155/2015 / TT-BTC of October 6, 2015 of the Ministry of Finance guiding the public. Information disclosure on the stock market. This Circular clearly states: Reports on environmental and social impacts of companies and public companies must report on contents related to sustainable development, including: management of raw material sources and energy consumption. Water consumption, compliance with laws on environmental protection, policies related to workers, reports related to responsibilities to local communities, reports related to the green capital market. The Company may prepare its own sustainability report or present it in the Annual Report. Many businesses and groups have pioneered in making sustainable development reports right from the time when there is no legal requirement to compile sustainability reports, such as Bao Viet Group, Vietnam Dairy Products Joint Stock Company, and the Company DHG Pharma, PetroVietnam Drilling and Well Services Corporation, Hoang Anh Gia Lai International Agriculture Joint Stock Company, Vietnam Brewery Company Limited, Vicostone Joint Stock Company, etc.

Sustainable development in general and the Sustainable Development Report in particular are issues of interest to many researchers in the country and around the world. In recent years, countries have regularly organized seminars or global forums related to the development of sustainable development reports, indicators related to sustainable development as well as the role of accountants in sustainable development of the business. In developed countries such as the United Kingdom, USA, Australia the issue of sustainable development has been posed for a long time from the 70s of last century. Meanwhile, in Vietnam, except for experts in the field of sustainable economic development, not many experts are interested in and research is still limited. This fact proves that Sustainable Development Report and indicators related to Sustainable Development are important and necessary contents for conducting research and application activities worldwide and Vietnam cannot be out of the trend. The commonality is this.

In the world, there are many authors studying the disclosure of social responsibility and information related to sustainable development. According to Trotman & Bradley (1981), they presented four factors (firm size, business risk, social pressures and management decisions) affecting the disclosure of corporate social responsibility of businesses on the Australian stock market. After verification, he came to the conclusion that the larger the business size, the greater the level of disclosure of information on social responsibility towards sustainable development. In addition, companies that want to minimize business risks should disclose their corporate social responsibility information. The study also shows that companies operating in different fields are subject to social pressure to disclose information on the situation of production and business activities affecting the environment, society.

Background Theory and Hypotheses

Asymmetric Information Theory

Akerlof (1970) first introduced the theory of asymmetric information. According to him, asymmetric information occurs when a party has less information than a partner or has information but the information is incorrect. This causes the less informed party to make incorrect decisions when making a transaction and the more informed party will have behaviours that are detrimental to the other party when performing the transaction. In the condition of asymmetric information between managers and shareholders, informants and users of information, in which shareholders or external users are always in shortage of information than this is what the information disproportionate theory is the basis for evaluating the truthfulness, suitability and comparability of financial reporting information. The main factor influences the decision of the investor.

In addition, the scale of companies is increasing; the demand for capital is increasing, increasing the cost of enterprises, as well as increasing the possibility of conflicts of interests among shareholders, creditors, and managers. Voluntary disclosure may be used to reduce this conflict. Therefore, this theory is applied to research to explain the impact of firm size factors on the presentation and disclosure of sustainable development information in the enterprise accounting reporting system.

Signal Theory

This theory appeared in the context of the 1970s with the background of the theory of asymmetric information, first mentioned by Akerlof in "The Market for 'Lemons": Quality Uncertainty and the Market Mechanism ". Accordingly, asymmetric information occurs when the seller of a product knows more information than the person who buys the product, which outlines the inevitable consequence of asymmetric information that results in a decision-making loss. of lack of information and ethics in business. Signal theory basically involves reducing asymmetric information between two parties. Signal is a term used to describe the seller's presentation of their meaningful information to buyers in order to reduce the process of information asymmetry. Signal theory confirms the important role of signalling in many different markets. This theory assumes that businesses operating with high efficiency use financial information to signal the market, reduce information asymmetry, and confirm that businesses are doing business effectively. Therefore, signal theory is considered the basis for the research of enterprise information disclosure which also includes information on sustainable development.

Theory of Stakeholder Theory

Stakeholder is a term used for people who have shares or interests (influencers or affected people) in a business. Key stakeholders are those who can significantly influence or play an important role in the success of your business. The main groups of stakeholders include: Customers, shareholders, suppliers, employees, local communities. According to this theory, governance decisions should be designed to satisfy stakeholders and acknowledge that negative actions can lead to backlash from these subjects. Therefore, the stakeholders need to find out the information published by the business to better understand the financial situation, business position and even the issue of social responsibility. This information is usually presented in the financial statements and annual reports by the enterprise.

Interested stakeholders help managers fully assess the operating environment of the business and to provide information on issues related to the business. The more stakeholders have the right to dominate the operation of the business as well as the more benefits associated with the business results of the business, the higher the level of interest in the disclosed information. This requires businesses to ensure the disclosure of information to meet the needs of stakeholders.

In summary, the disclosure of information receives the attention of both internal and external businesses. This information serves the decision making process more properly. Therefore, identifying the published information is essential to ensure the interests of different audiences.

Therefore, this theory is applied to the study to explain the impact of information demand factors of the stakeholders related to the presentation and disclosure of sustainable development information in the enterprise accounting reporting system.

Hypotheses

H1: Size of company positively affects the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system.(+)

According to Kolk (2004) as well as the information asymmetric theory, it can be seen that with increasing company size, the capital demand for operations is increasing and thus increasing the likelihood of conflicts of interest between shareholders, creditors and managers. As a result, business costs increase. Voluntary disclosure may be used as a means to reduce these costs. It will be configured as a way to reduce asymmetric information, thus allowing the company to be more competitive to access the capital market. In this study, firm size is defined as the size of the market capitalization, the size of assets, revenues and referring to the market size of enterprises in the economy.

H2: Operating industry characteristics that positively influence the presentation and disclosure of sustainable development information in the Vietnamese Enterprise Accounting System. (+)

According to Frias?Aceituno et al. (2014) industry is a commonly used variable to calculate the amount of information provided by companies. It is assumed that companies operating in the same industry easily apply similar models of information they provide to the outside world. If not, this may be explained by the market as bad information (Watts & Zimmerman, 1978). The results obtained in previous studies are far from confirmed above; unlike in the case of firm size effects, while some studies show that the industry has helped explain the amount of information. Voluntarily disclosed (Oyelere et al., 2003; Gul & Leung, 2004; Bonson & Escoba, 2004), particularly with information technology or a high-growth industr. Enterprises doing business in areas that have less impact on the environment and society tend to publish more information and are more transparent.

H3: Legal regulations affect the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. (+)

According to Minh (2016) Legal regulations affecting the provision of sustainable development information, this has been demonstrated by a number of businesses in developed countries when using the KTM system. If businesses do not use new urban areas, the legal penalties for causing environmental pollution are not considered as reasonable expenses. If businesses accept to spend research costs on production combined with environmentally sustainable development, it can create greater value. In addition, the introduction of legal provisions related to the provision of sustainable development information requires businesses to improve their responsibilities and obligations in providing this information. This is also a factor mentioned by Frias?Aceituno et al. (2014) when conducting research related to the provision of sustainable development information. In the current situation in Vietnam when the legal provisions related to the disclosure of Sustainable Development Information or Sustainability Reporting is unclear, this is a factor affecting the disclosure of accounting information.

H4: The information needs of stakeholders have a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. (+)

Amran & Ooi (2014) have pointed out that sustainability reporting is essential to meet the needs of stakeholders. In addition, Mio & Venturelli (2013) presented research evidence for companies in Italy and the UK to meet the sustainable development information needs of the parties. Relate to in Vietnam, Long (2016) of state management agencies, environmental organizations that are always interested in economic development must go hand in hand with environmental protection and sustainable development. If you do well in protecting the environment, ensuring that businesses can grow in the next long time, businesses can get incentives from these external objects, thereby raising the requirements for providing Information related to sustainable development. Most previous research results show that many stakeholders are interested in non-financial (environmental, social) information of enterprises when they disclose information, especially those with large scale.

H5: Growth opportunities have a positive influence on the presentation and disclosure of sustainability information in the Vietnam Business Accounting system. (+)

Previous research has shown that the company's disclosure policy is a feature of specific characteristics that affect the benefits and costs associated with a more extensive disclosure policy (Lang & Lundholm, 1993). In high growth businesses, there is an emphasis on the benefits of information disclosure policies, taking into account information asymmetry that negatively affects a company's profitability. Due to the lack of confidence among investors, those who fear that managers might use their management powers to take over the investors' assets (Bushman & Smith, 2001). These factors mean that businesses can only receive external funds by paying a higher price using information disclosure to reduce costs. In addition, there is a potential growth in customer market share when the enterprise has transparent disclosure of business results and information about the social environment.

H6: Competitive pressure has a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. (+)

Cormier et al. (2005), the authors mentioned the competitive pressure to publish information about the environment as well as the sustainable operation of businesses in Germany. According to Long (2016) and Tuan (2019), creating strategic advantages will make a big difference to consumers' awareness, especially in the context of competitive pressure. Increasing competition or increasing environmental pollution. Therefore, in order to limit competition pressure, these enterprises will increase the supply of this information to relevant information users. Increasing competition pressure from both material sources is gradually exhausted, the forced publication of indices affecting the air and water environment, makes the pressure of enterprises increasing.

Results and Discussion

The survey participants are individuals including business owners or executives of business activities in all areas of business, especially this research goes into public enterprises (Table 1).

| Table 1 Statistics of Characteristics of Research Sample | ||

| Characteristics | Frequency | Ratio % |

| 1. Sex | N = 285 | 100% |

| Male | 195 | 68% |

| Female | 90 | 32% |

| 2. Age | N = 285 | 100% |

| Under 35 | 41 | 14,4% |

| 35 - 45 | 126 | 44,2% |

| Over 45 | 118 | 41,4% |

| 3. Work experience | N = 285 | 100% |

| Under 5 years | 40 | 14% |

| 5-10 | 87 | 30,5% |

| Over 10 years | 158 | 55,5% |

| 4. Degree | N = 285 | 100% |

| Under bachelor | 10 | 3,5% |

| Bachelor | 195 | 68,4% |

| Over bachelor | 80 | 28,1% |

Regression results in SPSS are shown in the following regression Table 2.

| Table 2 Regression Coefficients | ||||||||

| Coefficientsa | ||||||||

| Model | Unstandardized coefficient | Standardized coefficient | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -1.819E-16 | 0.043 | 0.000 | 1.000 | |||

| F_CHTT | 0.320 | 0.043 | 0.320 | 7.374 | 0.000 | 1.000 | 1.000 | |

| F_NCTT | 0.211 | 0.043 | 0.211 | 4.870 | 0.000 | 1.000 | 1.000 | |

| F_DDKD | 0.216 | 0.043 | 0.216 | 4.989 | 0.000 | 1.000 | 1.000 | |

| F_QMDN | 0.288 | 0.043 | 0.288 | 6.634 | 0.000 | 1.000 | 1.000 | |

| F_ALCT | 0.432 | 0.043 | 0.432 | 9.955 | 0.000 | 1.000 | 1.000 | |

| F_QDQL | 0.117 | 0.043 | 0.117 | 2.698 | 0.007 | 1.000 | 1.000 | |

| a. Dependent Variable: F_CBTT | ||||||||

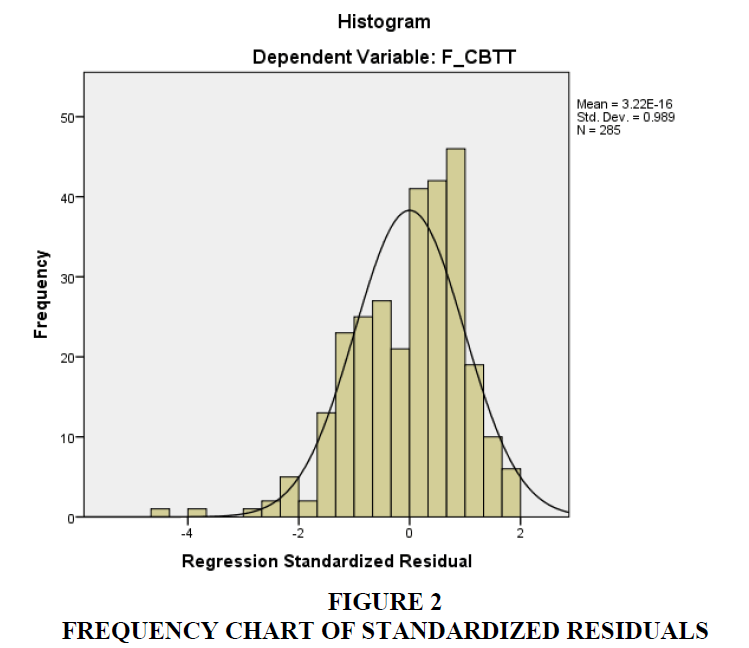

The remainder may not follow the normal distribution for various reasons such as: using the wrong model, the variance is not constant, the number of residuals is not sufficient for analysis. There are many different ways to test the normal distribution of residuals, the simplest of which is to build a histogram of the frequency of standardized residues (Figure 1 & Table 3).

| Table 3 Test of Autocorrelation | ||||

| Model Summaryb | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.691a | .577 | .566 | 0.73107051 |

| a. Predictors: (Constant), F_QDQL, F_ALCT, F_QMDN, F_DDKD, F_NCTT, F_CHTT | ||||

| b. Dependent Variable: F_CBTT | ||||

Figure 2 has the shape of a bell curve, that is, the normal distribution. On the other hand, the mean value of Mean = 3.22E-16 is close to 0 and the standard deviation is Std.Dev. = 0.989 is nearly equal to 1. Therefore, it can be concluded that the normal distribution hypothesis is not violated.

Normalized regression would be:

CBTT * = 0.320CHTT * + 0.211NCTT * + 0.216DDKD * + 0.288QMDN * + 0.432ALCT * + 0.117QDPL *

Test the hypotheses of the model

After testing the existence of the model, continue testing the hypotheses of the model. It is to test the impact and the degree of influence of the independent factors on the dependent factor by the corresponding hypothesis system of each factor.

To test for the existence of factors, we rely on Sig value of t-test. If Sig <0.05, reject hypothesis H0, accept the H1 hypothesis. In other words, the regression coefficients are statistically significant and have an impact on the presentation and disclosure of information related to sustainable development on the accounting reporting system in Vietnamese enterprises.

Based on results:

1. The CRP factor has Sig value = 0.000 <0.05, so it should be rejected H0, meaning that the growth opportunity has an influence on the presentation and disclosure of information related to sustainable development.

2. The research factor has a value of Sig = 0.000 <0.05, so H0 is rejected, meaning that the information needs of the stakeholders affect the presentation and disclosure of information related to sustainable development.

3. The factor DDKD has a value of Sig = 0.000 <0.05, so H0 is rejected, meaning that business characteristics affect the presentation and disclosure of information related to sustainable development.

4. The QMDN factor has a value of Sig = 0.000 <0.05, so H0 is rejected, meaning that the size of the business affects the presentation and disclosure of information related to sustainable development.

5. ALCT has Sig value = 0.000 <0.05, so H0 should be rejected, meaning that competition pressure affects the presentation and disclosure of information related to sustainable development.

6. The factor QDPL has a value of Sig = 0.007 <0.05, so it should be rejected H0, that is, legal regulations that affect the presentation and disclosure of information related to sustainable development.

7. Through research, all 6 factors include firm size; Operating industry characteristics; Legal provisions; Information needs of related parties; Growth opportunities; The competitive pressure has a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system.

8. Firm size positively affects the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors such as Ahmed Belkaoui, Philip G. Karpik, (1989); Ariza and Isabel M. Garcia-Sánchez (2013); In fact, it is explained that larger companies are under greater pressure from stakeholders such as investors, customers, industry authorities as well as protection organizations. the environment in which the company operates and so these large companies will report more relevant social, economic and environmental information and thus respond to user needs.

9. Operating industry characteristics positively affects the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors like Gray (1995); José V. Frias-Aceituno, Lázaro Rodríguez-Ariza and Isabel M. Garcia-Sánchez (2013). In fact, this is explained by companies operating in areas that have a significant impact on the environment such as those in the fields of construction, energy, health, etc. often providing information on development. More sustainable development, especially information related to the impact and environmental protection actions of the company in the process of operation and social responsibility of these companies to the community.

10. Legal regulations positively affect the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors such as Ahmed Belkaoui, Philip G. Karpik, (1989); Rodríguez-Ariza and Isabel M. Garcia-Sánchez (2013). In fact, in Vietnam at present, there is no document that requires Vietnamese enterprises in general and listed enterprises in particular to present and publish information on sustainable development separately in their development reports. Therefore, listed companies can integrate the relevant information on sustainable development information on their annual reports or voluntarily prepare a sustainability report to provide. More, as well as more details about the company's sustainability information.

11. Information needs of stakeholders have a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors such as Craswell, A. T. & Taylor, S. L. (1992); Gray (1995); Huynh Duc Long (2016). In fact, the demand for information on sustainable development is getting more and more attention from internal and external enterprises, so this increase in demand for information is also one of the motivations, as well as pressure for companies to make and present corporate sustainability information.

12. Growth opportunities have a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors such as Lang and Lundholm (1993);Lázaro Rodríguez-Ariza and Isabel M. Garcia-Sánchez (2012). In fact, current information on sustainable development also affects the investment decisions of investors, so to attract investment capital, many companies choose to publish more development information. Sustainability of our company. Besides the desire to expand the market or create a better corporate image in the public eye is also one of the reasons for companies to publish more sustainable development information.

13. Competitive pressure has a positive influence on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting system. This result is completely consistent with the research results of authors such as Lang and Lundholm (1993); Huynh Duc Long (2016); Tuan (2019). In fact, in today's fiercely competitive business environment, many companies choose to present more sustainable development information, in order to reduce competition pressure, and improve their advantages and positions. Companies with customers, company employees, as well as regulatory agencies and environmental protection organizations.

Conclusion

By using a combination of qualitative and quantitative research methods, the thesis has solved two research objectives set out as follows:

Firstly, with the objective of identifying factors affecting the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting reporting system, the research results show these variables include: (1) competitive pressure; (2) opportunities for growth; (3) firm size; (4) Features of business activities; (5) Information needs of related parties; (6) legal regulations.

1. Enterprises feel competitive pressure from competitors, especially potential competitors, presenting and disclosing information related to sustainable development, therefore this factor has the greatest impact on the presentation. and publish information related to sustainable development in the accounting reports of businesses in Vietnam

2. The opportunity for growth in the assets and capital of the business will impact on the need for businesses to enhance the presentation and disclosure of information related to sustainable development in their accounting reports in Vietnam. Male.

3. The larger the business scale, the more businesses need to enhance the presentation and disclosure of information related to sustainable development in their accounting reports in Vietnam in order to increasingly enhance their position in the market. school.

4. Characteristics of the business industry are a decisive factor to the presentation and disclosure of information related to sustainable development in the accounting reports of enterprises in Vietnam.

5. Information needs of related parties (shareholders, investors, employees) will impact on the need for enterprises to present and disclose information related to sustainable development in the report. accounting of businesses in Vietnam

6. Legal factors have the lowest impact on the presentation and disclosure of information related to sustainable development in the accounting reports of enterprises in Vietnam.

7. Thus, once again the research results have inherited and once again prove that the factors that have been previously tested in different countries are also applied in accordance with the research space of enterprises in Vietnam.

Secondly, with the objective of measuring the impact of the factors on the presentation and disclosure of sustainable development information in the Vietnamese enterprise accounting reporting system, the research results show that, factors Competitive pressure has the largest impact level with β = 0.432, and the legal factor has the lowest impact level with the dependent variable with β = 0.1117 (corresponding to the impact rate of 7.39%).

In the next section of this research, the author presents a number of recommendations related to each factor to improve efficiency, as well as the level of presentation and disclosure of information related to sustainable development in the newspaper. The accounting report of the business in Vietnam is also a solution to the research objectives of this topic (Table 4).

| Table 4 Ordering Levels of Impact of Factors on the Dependent Variable | ||||

| No | Factors | Impact level | Density impacts (%) | Order of impact |

| 1 | Growth opportunities | 0,32 | 20,20 | 2 |

| 2 | The information needs of stakeholders | 0,211 | 13,32 | 5 |

| 3 | Operating industry characteristics | 0,216 | 13,64 | 4 |

| 4 | Size of company | 0,288 | 18,18 | 3 |

| 5 | Competitive pressure | 0,432 | 27,27 | 1 |

| 6 | Legal provisions | 0,117 | 7,39 | 6 |

Recommendations

Based on the research results of the thesis, the authors recognize the importance of factors affecting the presentation and disclosure of sustainable development information in the accounting reports of enterprises in Vietnam. Solutions are needed to improve the situation, to help businesses in Vietnam improve their ability to present and disclose information. The recommendations will focus on these factors, as follows:

Competitive Pressure

Competitors are always looking for ways to outperform us on both financial and non-financial indicators. This issue has been mentioned a lot in previous studies. Enterprises need to proactively change and renew themselves in the presentation and disclosure of sustainable development information on accounting reports. This does not mean that the company only reports positive indicators and intentionally conceals negative information on its accounting reporting system. Because once the stakeholders know the inaccurate information given by the business, it will be very disadvantageous in competition.

Enterprises should have a section specializing in studying business strategies of competitors in many aspects: revenue, information, costs, environmental and social impacts, etc. Therefore. New businesses can take the initiative to make changes faster and more accurately than their competitors.

Updating of new advanced production techniques is almost mandatory in today's economy if businesses do not want to be left behind. For most businesses, falling behind in production and business technology will cause them to be disadvantaged in competition leading to the decline of their businesses. New technologies will help improve the environment and enable businesses to publish sustainability information publicly.

In short, businesses must understand the production and business policies on the economic, social and environmental aspects of the competitors, thereby regulating and changing for their businesses in the most appropriate way.

Opportunities for Growth

As mentioned in the previous chapters, businesses promoting the presentation and disclosure of sustainable development information in accounting reports will give businesses the opportunity to increase sales because at this time, The market of consuming products and services of enterprises will grow more than enterprises in the same industry. This has been proven in many previous studies, not just this one.

In the study (Lang & Lundholm, 1993) emphasized that Among businesses with growth opportunities, the benefits of sustainable development information disclosure policy, taking into account the unreliability of Such information has a negative impact on potential profitable business projects due to a lack of confidence among investors, who fear that managers may not be able to choose with the best projects or their actions for the purpose of appropriating investors' property explain that the information provided is accurate but also the information is not reliable (Bushman & Smith, 2001). These factors mean that businesses can only receive investment capital; many investors pay more attention from the outside by giving more accurate information (Myers & Majluf, 1984). This is an issue that businesses must pay attention to in the increasingly competitive market trend.

Size of Company

The presentation and disclosure of sustainable development information on the accounting reports or on the sustainable development reports in Vietnam has not really been paid due attention. According to TT155/TT-BTC, only companies listed on the stock market are required to disclose this information, but most of these businesses intentionally do not disclose, or disclose but do not follow a certain pattern. This is the state management agencies and businesses have to review themselves, in countries like Australia, Nigeria. Large-scale businesses or operate in areas that are likely to affect the environment. It is imperative that schools and society are required to present and disclose information on their accounting reports. Vietnam needs to study and make similar and appropriate policies in Vietnam to manage and help businesses. Be more transparent about your business information. Specifically:

1. It is necessary to stipulate that if enterprises in the stock market do not present and provide sustainable information in the accounting reports, it is necessary to put the stock into a special monitoring form.

2. The State and the Ministry of Finance should set up a number of groups of criteria on size: assets, capital, annual revenue, ... regardless of whether they are domestic or foreign enterprises if they meet the criteria on That scale must present and provide information on sustainable development on the accounting report

3. Most large-scale enterprises are state owned or state-owned majority in this enterprise. It is necessary to have specific policies, regardless of whether or not to prioritize the presentation and provision of sustainable information on accounting reports.

Business Features

Business is one of the factors that directly affects the presentation and supply of sustainable information on accounting reports. In my study, after collecting survey papers from business enterprises in different fields, the author found that the level of business enterprises in the fields has a significant impact on the environment (such as gasoline, gas, textile production, construction, etc.) are often very limited in the presentation and disclosure of sustainable development information in accounting reports. In contrast, businesses operating in less sensitive sectors such as credit, insurance and services are ready for the presentation and disclosure of sustainable development information in the accounting reports.

The State should encourage enterprises that are considered to operate in sensitive sectors, greatly affecting the environment and society, to increase the presentation and disclosure of sustainable development information in the accounting reports. It takes time for these enterprises to understand and access related standards and criteria within a certain time (maybe 2 years), then force these enterprises to present criteria that are core substance. Enterprises operating in less sensitive sectors such as credit and insurance should specify and focus on economic criteria, going into additional criteria in presenting and disclosing information.

Information needs have Related Parties

In today's growing market economy, the information needs of stakeholders (shareholders, customers, employees, etc.) are a strong factor in the presentation and disclosure of information sustainable development on accounting reports.

Shareholders are the owners of the business; they always want to capture all financial and non-financial information of their business. Although they do not directly manage their business activities, they always want to know all information whether it is positive or negative. But managers (who can be hired to run the executive) always want to hide unfavourable information for the business to achieve their goals. It is this that will contribute to reduce the ability of information transparency when provided externally. Therefore, the General Meeting of Shareholders or the Board of Directors who are the owners of the business need to improve the supervision of the presentation and disclosure of sustainable information on the accounting report through the supervisory committee or inspection committee control of the company.

Customers are the people who help businesses survive and grow in the market. They have the right to know information about the product quality of the business, the production and business indicators of the business affecting the surrounding environment and society. In Vietnam, the function of the Vietnamese consumer association is not really strong; they are not really the representative of the majority of customers in Vietnam. Businesses do not have to neglect this problem. Enterprises should make moves to publish information related to sustainable development (contributing to society and environment) widely in the media.

The presentation and disclosure of sustainable development information on the accounting statements is very important in attracting investment capital and vice versa. This is a factor that businesses need to pay attention because when businesses operate on the market, especially those listed on the stock market, investors make their decisions when choosing to invest in stocks which votes are usually based not only on financial information but also on non-financial information.

Legal Regulations

This is one of the most important factors when the author proposes a model of factors affecting the presentation and disclosure of sustainable information in the accounting report. But contrary to expectations, the model results show that this factor has the lowest impact on the presentation and disclosure of sustainable development information in the accounting report. It is easy to imagine that this result stems from the main reason that legal documents do not specify which businesses are required to present and disclose sustainable development information in the accounting reports, leading to businesses. There is a dependence on this work. The author's proposed direction for this factor is as follows:

1. State management agencies need to learn legal mechanisms related to the presentation and disclosure of sustainable development information on accounting reports in similar economies in the world to be able to change, appropriate application to build a stricter legal regime for the publication of this information. The Ministry of Finance, the Ministry of Natural Resources and Environment, the Ministry of Labor, Invalids and Social Affairs, etc. need to set up a specialized management unit for companies when they provide and present these indicators in the newspaper accounting report

2. Establishing a section to inspect and supervise activities of enterprises in the region, which are forced to present and disclose sustainable development information in the accounting reports. If these enterprises do not comply, appropriate sanctions and penalties are needed

3. Even businesses are not too dependent on being obligated, they must be proactive in presenting and disclosing sustainable development information in their accounting reports. It is possible to set up core and supplementary targets that are appropriate for their unit. Train and guide the responsible division in the presentation and disclosure of Sustainable Development Information in the accounting report. In addition, the control committee of the company is also responsible for overseeing the operation of this work.

Other Recommendations

Most of the businesses asked about the presentation and disclosure of sustainable development information in the accounting reporting system were quite surprised about the presentation of information related to sustainable development. Therefore, there should be more specific instructions on standards, sustainable development criteria that need to be presented in the accounting reports. On that basis, the author recommends that businesses should use the Global Reporting Initiative (GRI) criteria set in presenting and publishing sustainable development information according to a number of points as follows:

1. It is possible to immediately apply a set of criteria in the direction, it is necessary to publish the "core" criteria which are important criteria that most businesses have to publish, while the "additional" criteria will be announced. presented on the report based on actual operating conditions of the business

2. Can update the set of criteria in the direction of the latest update of the 4th generation (G4) to add the criteria of anti-corruption and greenhouse gas emissions.

3. State management agencies need to have clearer state management policies to force large-scale enterprises to be wholly or partly owned by the state or private enterprises operating in Sensitive and environmental aspects need to be more transparent.

4. If possible, it is possible to build a department to monitor and supervise the presentation and disclosure of sustainable development information on the accounting reports from which to classify and evaluate these enterprises. It is necessary to rank those enterprises which are not implemented and take strong measures to handle them.

In addition to the presentation and disclosure of sustainable development information on the accounting report in accordance with the orientation of GRI, a number of criteria for evaluating sustainability indicators of enterprises can be referred to such as project disclosure Carbon emissions (CDP); Decree on greenhouse gas emissions (GHG protocol).

Vietnam has joined deeply and broadly in the big economic playgrounds of the world. That encourages Vietnamese businesses to keep up with the current trend of widely publicizing information related to sustainable development. If you do not want to be excluded from the competition on information transparency, it is necessary to quickly set standards and criteria in the presentation and disclosure of sustainable information on enterprises' accounting reports in Vietnam.

Limitations and Further Research Directions of the Topic

Although the results of the thesis have achieved the initial goals, which are the size of enterprises, growth opportunities, characteristics of business lines, legal basis, information needs of the parties. Relevance and competition pressure positively affect the presentation and disclosure of Sustainable Development Information on accounting reports in Vietnamese businesses. However, the team found that there were still some limitations:

First, the scope of the author's research and surveys is only Vietnamese businesses that are primarily southern businesses, not all Vietnamese businesses. Therefore, the research sample is not highly generalized, may encounter certain limitations.

Secondly, due to limitations in cost, time and direct access to the surveyed subjects, the sample size and sample quality was not as expected. Because the nature of the survey must be the leaders of the business, the time for these people to devote their time to answer fairly and responsibility for the questionnaire is not high. However, the sample size of the survey sample ensures statistical requirements and data analysis.

Third, according to the previous research models of (Craswell & Taylor, 1992; Deegan & Gordon, 1996 and Frias-Aceituno et al., 2012), the research concepts The study has more specific factors due to the larger research scale such as the quality of post-audit reports, the study duration over many years, etc.

Fourth, the author's survey subjects are managers at enterprises but really understanding about the nature of sustainable development, especially social and environmental sustainability, is not high. The author has not had the opportunity to directly share these sustainability reports with these people.

References

- Bonsón, E, Escobar T. (2004). The voluntary dissemination of financial information on the Internet. A comparative analysis between the United States, Eastern Europe and the European Union. Spanish Journal of Financing and Accounting, 33(123), 1063-1101.

- Akerlof, G. (1970). The market for lemons: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 89, 488-500.

- Amran, A., & Ooi, S.K. (2014). Sustainability reporting: meeting stakeholder demands. Strategic Direction, 30(7), 38-41.

- Belkaoui, A., & Karpik, P.G. (1989). Determinants of the corporate decision to disclose social information. Accounting, Auditing & Accountability Journal, 2(1).

- Bushman, R.M., & Smith, A.J. (2001). Financial accounting information and corporate governance. Journal of accounting and Economics, 32(1-3), 237-333.

- Cormier, D., Magnan, M., & Van Velthoven, B. (2005). Environmental disclosure quality in large German companies: economic incentives, public pressures or institutional conditions. European accounting review, 14(1), 3-39.

- Craswell, A.T. & Taylor, S.L. (1992). Discretionary disclosure of reserves by oil and gas companies: an economic analysis. Journal of Business, Finance and Accounting, 19(2), 295-308.

- Deegan, C., & Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Accounting and Business Research, 26(3), 187-199.

- Frias?Aceituno, J.V., Rodriguez?Ariza, L., & Garcia?Sanchez, I.M. (2013). The role of the board in the dissemination of integrated corporate social reporting. Corporate social responsibility and environmental management, 20(4), 219-233.

- Frias?Aceituno, J.V., Rodríguez?Ariza, L., & Garcia?Sánchez, I.M. (2014). Explanatory factors of integrated sustainability and financial reporting. Business strategy and the environment, 23(1), 56-72.

- Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting. Accounting, Auditing & Accountability Journal, 8(2), 47-77.

- Gul, F.A., & Leung, S. (2004). Board leadership, outside directors’ expertise and voluntary corporate disclosures. Journal of Accounting and Public Policy, 23, 351-379.

- Long, H.D. (2016). Environmental accounting of countries around the world and lessons for Vietnam. Accounting and auditing magazine.

- Frias-Aceituno, J.V., Rodríguez-Ariza, L., & Garcia-Sánchez, I.M. (2012). Explanatory factors of integrated sustainability and financial reporting. Business Strategy and the Environment, 23(1), 56-72.

- Kolk, A. (2004). A decade of sustainability reporting: developments and significance. International Journal of Environment and Sustainable Development, 3(1), 51-64.

- Lang, M., & Lundholm, R. (1993). Cross-sectional determinants of analyst ratings of corporate disclosures. Journal of Accounting Research, 31(2), 246-271.

- Tuan, L.A., Hai, P.T., Hung, N.X., & Nhi, V.V. (2019). Research on factors affecting the disclosure of sustainable development report: Experimental at Viet Nam national Petrolium group. Asian Economic and Financial Review, 9(2), 232-242.

- Mio, C., & Venturelli, A. (2013). Non?financial information about sustainable development and environmental policy in the annual reports of listed companies: Evidence from Italy and the UK. Corporate Social Responsibility and Environmental Management, 20(6), 340-358.

- Majluf, N.S., & Myers, S.C. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

- Oyelere, P., Laswad, F., & Fisher, R. (2003). Determinants of internet financial reporting by New Zealand companies. Journal of International Financial Management & Accounting, 14(1), 26-63.

- Minh, P.T.H. (2016). The role of the report on sustainable development with Vietnamese businesses in the context of integration. Financial Magazine.

- Trotman, K.T., & Bradley, G.W. (1981). Association between social responsibility disclosure and characteristics of companies. Accounting, Organisations and Society, 6(4), 355-362.

- Watts, R.L., & Zimmerman, J.L. (1990). Positive accounting theory: A ten year perspective. The Accounting Review, 65(1), 131-156.