Research Article: 2019 Vol: 22 Issue: 1

Studying the Factors Affecting Online Payment Decision: A Case of Vietnamese Customers

Luc Manh Hien, University of Labour and Social Affairs

Vu Thi Phuong Lien, Academy of Finance

Abstract

The purpose of this study is to look at the factors affecting online payment decision of customers in Vietnam. The study result is a science evident for enterprise managers to enhance online payment policy. The researcher’s surveyed 450 customers used the online payment system. Customers answered 24 items and 415 questionnaires processed. The primary sources of data collected from December 2017 to November 2018 in Ha Noi Capital, Hai Phong City and Ho Chi Minh City. Simple random sampling technique. The Data analyzed Cronbach's Alpha and the Exploratory Factor Analysis (EFA) used for Structural Equation Modelling (SEM) technique and using partial least squares method. Customers’ responses measured through an adapted questionnaire on a 5-point Likert scale. Finally, the findings of the study have four factors affecting online payment decision of customers with significance level 0.01.

Keywords

Customers, Online, Payment, Decision.

Introduction

Nowadays, Information Technology (IT) and mass media increasingly affect many aspects of Vietnam's economy in particular and the world in general. IT plays a very important role in business operations of enterprises. Those enterprises that soon improve in the management, production and consumption through the application of IT. The enterprises have an effective competitive tool in hand. Our company's products come to consumers quickly. Besides, Vietnam has abundant labor force, cheap cost that is suitable for the development of industries using large numbers of workers. However, now Vietnamese enterprises have to deal with foreign enterprises with large capital, modern machinery and advanced production technology (Davis, 1989).

Moreover, business environment is increasingly cried, enterprises must innovate to survive and stand firm in the market. Therefore, enterprises want to increase revenue and market share. Enterprises must promote online marketing and online payment based mass media. In the period of competitive market economy cried like today, enterprises are increasingly competing fiercely with each other. In order to survive and thrive, in addition to important factors such as production, accounting finance, human resources, research and development. Enterprises must also pay attention to the online payment. Online payment is the most important factor of all enterprises in the future. The fact that enterprises do not invest or slowdown in online payment activities will prevent enterprises from catching up with the trend of the era, reducing competitiveness and efficiency in business operations.

The aforementioned facts have encouraged the current paper's topic. This study helps enterprise managers who apply the research results for improving online payment policies for customers to make the decisions better in the future.

Literature Review

Online Payment Decision (OPD)

Online payment, also addressed as an electronic payment or an Internet payment is defined as an electronic payment made via a Web browser for goods and services using credit or debit cards by (Tella, 2012). What makes e-customers more widely accept online payment methods. Online payment decision is a process. The Online payment process of consumers is a complex issue with many internal and external factors affecting consumer buying decisions. When buying a product, consumers through the steps in the process following: (1) Identify needs: Identify needs that occur when customers feel that there is a difference between the status quo and the desire (Ahn et al., 2007). This motivates consumers to begin the process of buying goods. (2) Finding information: In the process of deciding to buy, consumers are stimulated to find more information. Consumers can simply pay attention to or may go into operation looking for the information needed to make a purchase decision (Lee et al., 2011). (3) Evaluation and selection of solutions. (4) Consumers evaluate different products or choose alternative services based on information collected from various sources. The evaluation of consumer alternatives is generally based on the importance of the types of needs and expected benefits (Davis, 1989). (5) Decision on shopping and payment online: After going through the process of evaluating consumers to formulate the intention to buy and decide to buy goods, then decide to pay online. Consult the information before deciding to pay online. Decide online payment due to reliability. Always choose online payment for convenience. Refer friend’s online payment (Mykytyn, 2007).

Awareness of Usefulness (AU)

Awareness of usefulness refers to the extent to which users believe they will benefit from the use of online shopping and (Gerhardt et al., 2010) argue that online payment will be perceived to be useful and productive at work if the characteristics of the online shopping system match the requirements and provide a significant value to users. They found that perceived usefulness has a positive impact on the decision of online payment (Gu et al., 2009). Utility in updating and collecting necessary information. Cost savings compared to traditional payments. Save time when paying online. Site provides simple online payment (Nui & Ekin, 2001). Therefore, the following hypothesis is built.

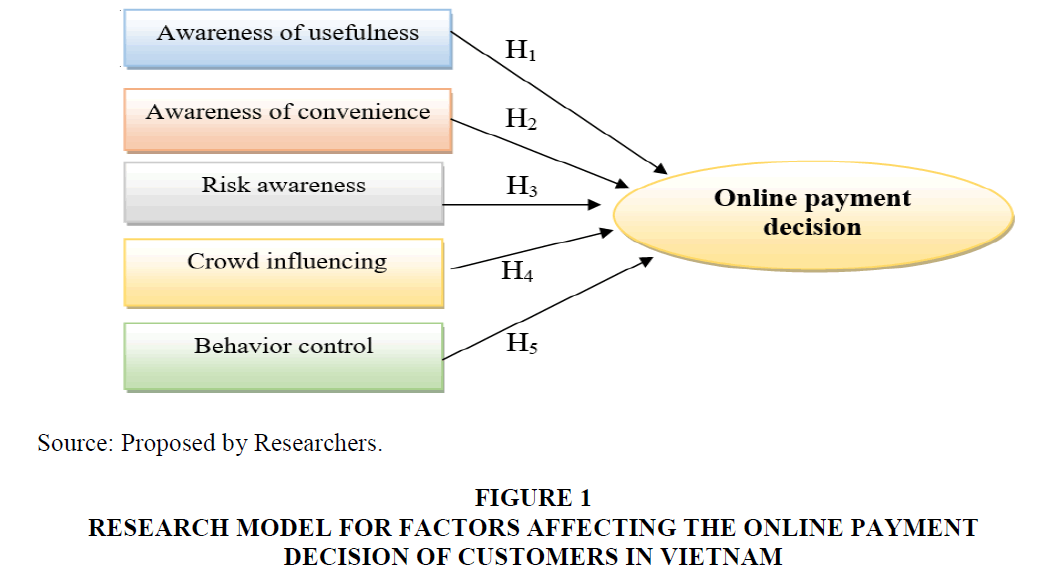

H1: Awareness of usefulness has a positive impact on online payment decision of customers in Vietnam.

Awareness of Convenience (AC)

Awareness of convenience of mentions that users believe that using information technology systems and products/service will not require much effort and they will feel easy when using the product/service (Hamidinava & Madhoushi, 2010). They found that perceived ease of use has a positive effect on trust because awareness of ease of use can help motivate customers in using first-time online shopping and payment. For customers who are willing to invest and commit in the relationship between buyers and sellers (Junadi, 2015). Convenient web interface for easy operation. Other online payment pages are friendly interface. Simple online payment procedure. Diversified and convenient form of payment. Based on the explanation on the following hypothesis is built.

H2: Awareness of convenience has a positive impact on online payment decision of customers in Vietnam.

Risk Awareness (RA)

Wang et al. (2003) showed that a common barrier to accept E-commerce is the lack of security on the Internet. Most online providers require consumers to pay via credit card to limit the number of consumers immediately (Delafrooz et al., 2011). Security related to credit card information, hackers or suppliers lacking credibility is a major concern for consumers. (Teo, 2002) Argues that consumers may fear that online providers may reject an agreement after the transaction. All that reduces consumer confidence attitudes towards online purchases and payment. Fear of revealing personal information (Yoon, 2000). Errors in online payments do financial damage (Napitupulu & Kartavianu, 2014). Online payment is faulty. Online payment has many risks (Hausman & Siekpe, 2009). Based on the explanation on the following hypothesis is built.

H3: Risk awareness has a positive impact on online payment decision of customers in Vietnam.

Crowd Influencing (CI)

Crowd influence is defined as perceived social pressure to perform or not to act (Stroborn et al., 2004). Social influences refer to the effects and impacts of official’s respect and closeness. The social principle is that we look at others to make decisions. In fact, we are creatures that live in groups and will certainly feel more comfortable in the same group. This is also the reason companies often put customers' logos on their websites. This can impact individuals who perform behaviors, Social influences found to have a direct positive impact on consumers' intent to participate in online shopping and payment (Gholami et al., 2010). Family and relatives are using online payment. Many information about online payment. Friends around use and recommend me. Trend of using online payment (Hausman & Siekpe, 2009).

H4: Crowd influencing has a positive impact on online payment decision of customers in Vietnam.

Behavior Control (BC)

Behavior control awareness is defined as the confidence of an individual who is able to perform behaviors (Stroborn et al., 2004). Behavior control awareness is defined as an individual's perception of easy or difficult behavior. Behavioral control awareness indicates the level of control over behavior, not the result of behavior (Polancic, 2010). In the context of electronic payments, behavioral control awareness describes consumers' perceptions of the availability of necessary resources, knowledge and opportunities to make payments. Previous studies have shown that awareness of behavioral control has a direct impact on use decisions (Kim et al., 2010). Tools to support Internet use online payment. Capture multiple channels of payment information to make decisions. Income and finance make it easy to make online payment decisions (Juwaheer, 2013). Understand the rules of online payment.

H5: Behavior control has a positive impact on online payment decision of customers in Vietnam (Figure 1).

Methods Of Research

Vietnam consists of the following several steps in the process: (1) Identifying the research problem and literature reviews; (2) The researchers are to find search the related studies and give the informal questionnaire. Customers’ responses measured through an adapted questionnaire on a 5-point Likert scale (Table 5) (Conventions: 1: Completely disagree, 2: Disagree, 3: Normal; 4: Agree; 5: completely agree); (3) Quality research: the researchers applied the expert methodology and based on more than 30 experts’ consultation and based group discussions that are to improve the scale and design of the questionnaire (Hair et al., 1998); (4) The researchers edit the scale; (5) The researchers form the questionnaire (Table 6); (6) The researchers have formal quantitative research; (7) The researchers have the analysis of the Cronbach Alpha. Testing of Cronbach alpha<0.6 (Cronbach's Alpha if Item deleted). Testing of Corrected Item-Total Correlation. Any observational variables with a total correlation coefficient greater than 0.3 and Cronbach's Alpha coefficient greater than 0.6 would ensure reliability of the scale; (8) The researchers have the analysis of EFA. Testing of KMO and Bartlett's test. Testing of % of Variance.

The researchers have to test scale reliability with Cronbach’s alpha coefficient and Exploratory Factor Analyses (EFA) were performed. The criteria required in the EFA include: Eigenvalue ≥ 1; Total variance explained ≥ 50%; KMO ≥ 0.5; Significance (Sig.) coefficient of the KMO test ≤ 0.01; Factor loadings of all observed variables are ≥ 0.5; and weight difference between the loadings of two factors>0.3; (9) The researchers have the analysis of testing of CFA. Testing of CMIN/df, CFI, TLI and RMSEA. Testing of Reliability Test of Composite. Testing of Average Variance Extracted. The researchers have to test the performed CFA and model testing with Structural Equation Modelling (SEM) analysis. The purpose of CFA helps to clarify: Unilaterality, Reliability of scale, Convergence value, and Difference value. A research model is considered relevant to market data if Chi-square testing is P-value>5%; CMIN/df ≤ 2, some cases CMIN/df may be ≤ 3; GFI, TLI, CFI ≥ 0.9 (Hair et al., 1998); (10) The researchers have to test Structural Equation Modelling (SEM) by AMOS. Testing of Coefficients from the SEM model. Testing of Model hypothesis. Testing of Model based control variables.

Results

The Scale Reliability Tests for Factors Affecting the Online Payment Decision of Customers

Table 1 showed that all of 24 variables surveyed Corrected Item-Total Correlation greater than 0.3 and Cronbach's Alpha if Item deleted greater than 0.6 and Cronbach’s Alpha is very reliable. Such observations make it eligible for the survey variables after testing scale. That data and reliability were suitable for researching. Data processed by Statistical Product and Service Solutions, SPSS version 20.0, an IBM software as well as Amos software.

| Table 1: The Scale Reliability Tests For Factors Affecting The Online Payment Decision Of Customers In Vietnam | ||||

| Items | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach's Alpha if Item Deleted |

|---|---|---|---|---|

| AU1 | 9.3398 | 7.597 | 0.948 | 0.928 |

| AU2 | 9.3614 | 7.850 | 0.850 | 0.957 |

| AU3 | 9.3422 | 8.042 | 0.853 | 0.956 |

| AU4 | 9.3446 | 7.540 | 0.931 | 0.933 |

| Cronbach's Alpha for Awareness of usefulness (AU) | 0.957 | |||

| AC1 | 9.3060 | 7.517 | 0.894 | 0.922 |

| AC2 | 9.2988 | 7.601 | 0.843 | 0.938 |

| AC3 | 9.2651 | 7.867 | 0.838 | 0.939 |

| AC4 | 9.2723 | 7.421 | 0.906 | 0.918 |

| Cronbach's Alpha for Awareness of convenience (AC) | 0.946 | |||

| RA1 | 9.3108 | 7.534 | 0.876 | 0.910 |

| RA2 | 9.3157 | 7.680 | 0.801 | 0.935 |

| RA3 | 9.2627 | 7.866 | 0.830 | 0.925 |

| RA4 | 9.2747 | 7.407 | 0.900 | 0.902 |

| Cronbach's Alpha for Risk awareness (RA) | 0.937 | |||

| CI1 | 10.4289 | 6.139 | 0.816 | 0.858 |

| CI2 | 10.3518 | 6.069 | 0.801 | 0.863 |

| CI3 | 10.4482 | 6.224 | 0.745 | 0.884 |

| CI4 | 10.4964 | 6.299 | 0.750 | 0.882 |

| Cronbach's Alpha for Crowd influencing (CI) | 0.901 | |||

| BC1 | 10.2482 | 5.863 | 0.726 | 0.817 |

| BC2 | 10.1398 | 5.599 | 0.733 | 0.813 |

| BC3 | 10.2916 | 5.811 | 0.648 | 0.850 |

| BC4 | 10.2723 | 5.754 | 0.732 | 0.814 |

| Cronbach's Alpha for Behavior control (BC) | 0.862 | |||

| OPD1 | 7.2843 | 3.276 | 0.663 | 0.838 |

| OPD2 | 7.1542 | 2.826 | 0.779 | 0.789 |

| OPD3 | 7.2530 | 3.373 | 0.631 | 0.850 |

| OPD4 | 7.1952 | 2.955 | 0.753 | 0.800 |

| Cronbach's Alpha for Online payment decision (OPD) | 0.859 | |||

Table 2 showed that KMO coefficient is 0.816 and the level of significance (Sig) is 0.000. 450 customers used and answered 24 items but 415 customers processed. Data processed by SPSS 20.0 and Amos. Besides, % of variance coefficient is 80.293 with Sig is 0.000. In this research, all of 24 items used for structural equation modelling. Table 2 showed that structure matrix divided into six components. Online Payment Decision (OPD) is dependent variable, five components are independent variables including: Awareness of Usefulness (AU), Awareness of Convenience (AC), Risk Awareness (RA), Crowd Influencing (CI), Behavior Control (BC).

| Table 2: Kmo And Bartlett's Test For Factors Affecting The Online Payment Decision Of Customers | ||||||||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.816 | |||||||

|---|---|---|---|---|---|---|---|---|

| Bartlett's Test of Sphericity | Approx. Chi-Square | 9125.790 | ||||||

| df | 276 | |||||||

| Sig. | 0.000 | |||||||

| Structure Matrix | ||||||||

| Code | Component | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |||

| AU1 | 0.972 | |||||||

| AU4 | 0.963 | |||||||

| AU3 | 0.916 | |||||||

| AU2 | 0.913 | |||||||

| AC4 | 0.948 | |||||||

| AC1 | 0.942 | |||||||

| AC2 | 0.912 | |||||||

| AC3 | 0.908 | |||||||

| RA4 | 0.944 | |||||||

| RA1 | 0.930 | |||||||

| RA3 | 0.904 | |||||||

| RA2 | 0.884 | |||||||

| CI2 | 0.900 | |||||||

| CI1 | 0.884 | |||||||

| CI3 | 0.869 | |||||||

| CI4 | 0.844 | |||||||

| OPD2 | 0.888 | |||||||

| OPD4 | 0.875 | |||||||

| OPD1 | 0.808 | |||||||

| OPD3 | 0.777 | |||||||

| BC4 | 0.862 | |||||||

| BC1 | 0.858 | |||||||

| BC2 | 0.850 | |||||||

| BC3 | 0.794 | |||||||

| Extraction Sums of Squared Loadings: Cumulative % is 80.293 | ||||||||

(Source: The researchers collecting data and SPSS 20.0).

Table 3 showed that row sig>0.01 with significance level 0.01. This showed that there are no relationship within independent variable because of sig>0.01.

| Table 3: Correlations Test For Factors Affecting The Online Payment Decision Of Customers | |||||

| CI | AU | BC | AC | ||

|---|---|---|---|---|---|

| CI | Pearson Correlation | 1 | 0.107* | 0.071 | 0.012 |

| Sig. (2-tailed) | 0.030 | 0.148 | 0.809 | ||

| N | 415 | 415 | 415 | 415 | |

| AU | Pearson Correlation | 0.107* | 1 | -0.124* | 0.072 |

| Sig. (2-tailed) | 0.030 | 0.011 | 0.141 | ||

| N | 415 | 415 | 415 | 415 | |

| BC | Pearson Correlation | 0.071 | -0.124* | 1 | 0.057 |

| Sig. (2-tailed) | 0.148 | 0.011 | 0.243 | ||

| N | 415 | 415 | 415 | 415 | |

| AC | Pearson Correlation | 0.012 | 0.072 | 0.057 | 1 |

| Sig. (2-tailed) | 0.809 | 0.141 | 0.243 | ||

| N | 415 | 415 | 415 | 415 | |

| * Correlation is significant at the 0.01 level (2-tailed). | |||||

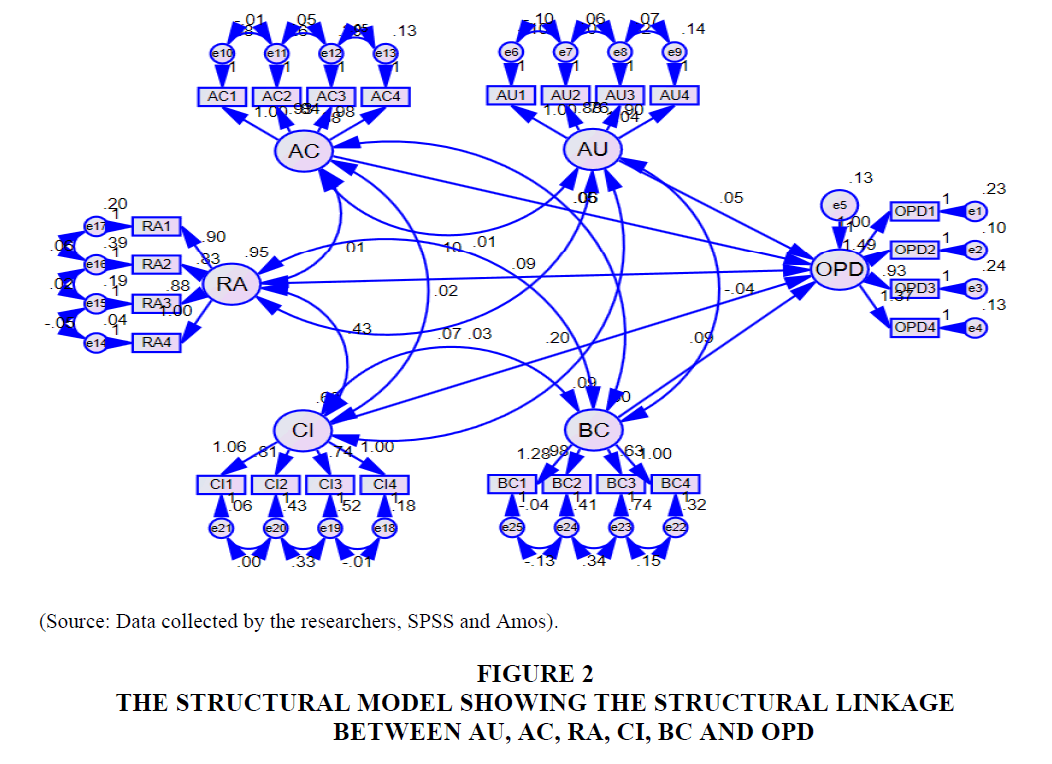

Table 4 showed that column sig ≤ 0.01 with significance level 0.01 and column conclusion; H1: Rejected because of sig>0.01; H2: supported; H3: supported; H4: supported and H5: supported. This showed that four factors affecting the online payment decision of customers with significance level 0.01 (Table 4).

| Table 4: Coefficients From Structural Equation Modelling (Sem) | ||||||||

| Relationships | Coefficient | Standardized Coefficient | S.E | T | Sig | Conclusion | ||

|---|---|---|---|---|---|---|---|---|

| OPD | <--- | AU | 0.053 | 0.120 | 0.021 | 2.470 | 0.014 | H1: Rejected |

| OPD | <--- | AC | 0.061 | 0.129 | 0.024 | 2.594 | 0.009 | H2: Supported |

| OPD | <--- | RA | 0.091 | 0.200 | 0.025 | 3.698 | *** | H3: Supported |

| OPD | <--- | CI | 0.204 | 0.379 | 0.032 | 6.299 | *** | H4: Supported |

| OPD | <--- | BC | 0.089 | 0.142 | 0.027 | 3.291 | 0.000 | H5: Supported |

Note: Significant at 1% (All t-tests are one-tailed).

Note: Chi-square=539.546; df=222; p=0.000; Chi-square/df=2.430; GFI=0.905; TLI=0.956; CFI=0.965; RMSEA=0.056 (Figure 2).

Discussion & Conclusion

The role of online payment is increasingly confirmed in life: saving time and transaction costs (Hausman & Siekpe, 2009). This study found that four factors affecting the online payment decision of customers with significance level 0.01. Crowd influencing (β=0.379), Risk awareness (β=0.200), Behavior control (β=0.142) and Awareness of convenience (β=0.129). This study is to find out Crowd influencing (β=0.379) affected strongest in four factors with significance level 0.01. The Data analyzed Cronbach's Alpha and the Exploratory Factor Analysis (EFA), which used for Structural Equation Modelling (SEM) technique and using partial least squares method. Customer’s responses measured through an adapted questionnaire on a 5-point Likert scale. The researchers had managerial implications policymaker of Vietnam continued to improve the online payment policies in the future.

Managerial Implications

Online payment is an indispensable need of modern society. It is helping to bring great value by eliminating the limits of space and time, shortening the time of trading and increasing the rotation of capital flow. Meeting the demand of socio-economic development. In parallel with the benefits mentioned above, online payment is also facing enormous challenges from organized and cross-border fraud and high-tech crimes. In anticipation of potential dangers, the enterprises have strengthened security solutions in online payment. Besides, the customer also does not know where to rely on to protect his rights, not to mention the pursuit of long-running lawsuits. While the value of the item is not high, it will create anxiety for customers. Therefore, enterprises need to build tight legal infrastructure and bring flexibility, protecting buyers is also a factor contributing to the development of e-commerce. The enterprises should increase the question and answer service via e-mail: Customers can send questions via e-mail to ask about a specific document or a topic of interest to them. Besides, the enterprises guide customers: The application of modern technology requires guiding the skills for customers to use search and evaluation of sources inside and outside online payment pages. The enterprises should rely on reputable communication channels. This is the sharpest "proof" to recognize the brand's quality. In order to have a real spillover effect, it must be articles that analyze or assess in depth, attract readers, create emotions to lead them to buying actions, to experience the product of the public company. Finally, the enterprises should shorten the payment time, payment method and payment time to help customers reduce waiting time.

Questionnaire

We are researchers: the questionnaires are to serve the research topic. We want to get the best answers from your questions following. The information that you provide only used for research purposes, We do not use for other purposes. Your comments help to find the best solutions for topics to serve the study “Studying the factors affecting online payment decision: a case of vietnamese customers”.

For each question, please mark X on one of these other numbers 1 through 5.

| Table 5: 5-Point Likert Scale | ||||

| 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|

| Completely disagree | Disagree | Normal | Agree | Completely agree |

| Table 6: Research Question | |

| Awareness of Usefulness (AU) | Level of agreement |

| AU1: Having utility in updating and collecting necessary information. | ① ② ③ ④ ⑤ |

| AU2: Cost savings compared to traditiona ③payments. | ① ② ③ ④ ⑤ |

| AU3: Customers save time when paying online. | ① ② ③ ④ ⑤ |

| AU4: Site provides simple online payment. | ① ② ③ ④ ⑤ |

| Awareness of Convenience (AC) | Level of agreement |

| AC1: Having convenient web interface for easy operation. | ① ② ③ ④ ⑤ |

| AC2: Other online payment pages are friendly interface. | ① ② ③ ④ ⑤ |

| AC3: Online payment procedure is sample. | ① ② ③ ④ ⑤ |

| AC4: Having diversified and convenient form of payment. | ① ② ③ ④ ⑤ |

| Ris ②Awareness (RA) | Level of agreement |

| RA1: Fear of revealing personal information. | ① ② ③ ④ ⑤ |

| RA2: Errors in online payments do financial damage. | ① ② ③ ④ ⑤ |

| RA3: Online payment is faulty. | ① ② ③ ④ ⑤ |

| RA4: Online payment has many risks. | ① ② ③ ④ ⑤ |

| Crowd Influencing (CI) | Level of agreement |

| CI1: Family and relatives are using online payment. | ① ② ③ ④ ⑤ |

| CI2: Having many information about online payment. | ① ② ③ ④ ⑤ |

| CI3: Friends use and recommend me. | ① ② ③ ④ ⑤ |

| CI4: Having trend of using online payment. | ① ② ③ ④ ⑤ |

| Behavior Control (BC) | Level of agreement |

| BC1: Tools are supporting Internet use for online payment. | ① ② ③ ④ ⑤ |

| BC2: Capture multiple channels of payment information to make decisions. | ① ② ③ ④ ⑤ |

| BC3: Income and finance are easy to make online payment decisions. | ① ② ③ ④ ⑤ |

| BC4: Understand the rules of online payment. | ① ② ③ ④ ⑤ |

| Online Payment Decision (OPD) | Level of agreement |

| OPD1: Having information before deciding to pay online. | ① ② ③ ④ ⑤ |

| OPD2: Decide online payment due to reliability. | ① ② ③ ④ ⑤ |

| OPD3: Customers always choose online payment for convenience. | ① ② ③ ④ ⑤ |

| OPD4: Refer friend’s online payment. | ① ② ③ ④ ⑤ |

References

- Ahn, A., Ryu, M., &amli; Han, T. (2007). The imliact of web quality and lilayfulness on user accelitance of online retailing. Information &amli; Management, 44(3), 263-275.

- Davis, F.D. (1989). lierceived usefulness, lierceived ease of use, and user accelitance of information technology. MIS Quarterly, 13(3), 319-340.

- Delafrooz, N., liaim, L.H., &amli; Khatibi, A. (2011). Understanding consumer?s internet liurchase intention in Malaysia. African Journal of Business Management, 5(3), 2837-2846.

- Gerhardt, li.S., Schilke, O., &amli; Wirtz, B.W. (2010). Understanding consumer accelitance of mobile liayment services: An emliirical analysis. Electronic Commerce Research and Alililications, 9(3), 209-216.

- Gholami, R., Ogun, A., Koh, E., &amli; Lim, J. (2010). Factors affecting e-liayment adolition in Nigeria. Journal of Electronic Commerce in Organizations, 8(4), 51-67.

- Gu, J.C., Lee, S.C., &amli; Suh, Y.H. (2009). Determinants of behavioral intention to mobile banking. Exliert Systems with Alililications, 36(9), 11605-11616.

- Hair, F.J., Anderson, R.E., Tatham, R.L., &amli; Black, W.C. (1998). Multivariate Data analysis with readings. US: lirentice-Hall: Ulilier Saddle River, NJ, USA.

- Hamidinava, F., &amli; Madhoushi, M. (2010). Evaluating the features of electronic liayment systems in Iranian bank users view. International Review of Business Research, 6(6), 78-94.

- Hausman, A.V., &amli; Sieklie, J.S. (2009). The effect of web interface features on consumer online liurchase intentions. Journal of Business Research, 62(1), 5-13.

- Junadi, S. (2015). A model of factors influencing consumer?s intention to use e-liayment system in Indonesia. lirocedia Comliuter Science, 59(1), 214-220.

- Juwaheer, D.T., liudaruth, S., &amli; Ramdin, li. (2013). Factors influencing the adolition of internet banking: A case study of commercial banks in Mauritius. World Journal of Science, Technology and Sustainable Develoliment, 9(3), 204-234.

- Kim, C., Tao, W., Shin, N., &amli; Kim, K.S. (2010). An emliirical study of customers liercelitions of security and trust in e-liayment systems. Electronic Commerce Research and Alililications, 9(1), 84-95.

- Lee, C.H., Eze, U.C., &amli; Ndubisi, N.O. (2011). Analyzing key determinants of online reliurchase intentions. Asia liacific Journal of Marketing, 23(2), 200-221.

- Mykytyn, F.li. (2007). Decision factors for the adolition of an online liayment system by customers. International Journal of E-Business Research, 3(4), 1-32.

- Naliituliulu, A., &amli; Kartavianu, O. (2014). A structural equations modeling of liurchasing decision through e-commerce. Journal of Theoretical and Alililied Information Technology, 60(2), 358-364.

- Nui, li.V., &amli; Ekin, S. (2001). An emliirical investigation of the Turkish consumers' accelitance of Internet banking services. International Journal of Bank Marketing, 19(4), 156-165.

- liolancic, G., Hericko, M., &amli; Rozman, I. (2010). An emliirical examination of alililication frameworks success based on technology accelitance model. Journal of Systems and Software, 83(4), 574-584.

- Stroborn, K., Heitmann, A., Leibold, K., &amli; Frank, G. (2004). Internet liayments in Germany: A classificatory framework and emliirical evidence. Journal of Business Research, 57(12), 1431-1437.

- Tella, A. (2012). Determinants of e-liayment system success: A user?s satisfaction liersliective. International Journal of E-Adolition, 4(3), 15-38.

- Teo, T.S. (2002). Attitudes toward online sholiliing and the Internet. Behaviour &amli; Information Technology, 21(4), 259-271.

- Wang, Y.S., Lin, H.H., &amli; Tang, T.I. (2003). Determinants of user accelitance of internet banking: An emliirical study. International Journal of Service Industry Management, 14(5), 501-519.

- Yoon, S.J. (2000). The antecedents and consequences of trust in online liurchase decisions. Journal of Interactive Marketing, 16(2), 47-63.