Research Article: 2021 Vol: 25 Issue: 5

Studying the Impact of Government Spending on the Total Overdue Debt in the Iraqi Economy for the Period 2010-2018

Abduljasem Abbas Alaallah, Babylon University

Mahdi Khaleel Shadeed Al-Mamoori, Babylon University

Hussein Abbas Al-Shammari, Babylon University

Humam Abdelwahab Hadi, Financial Control

Citation Information: Alaallah, A.A., Al-Mamoori, M.K.S., Al-Shammari, H.A., & Hadi, H.A. (2021). Studying the impact of government spending on the total overdue debt in the Iraqi economy for the period 2010-2018. Academy of Accounting and Financial Studies Journal, 25(5), 1-09.

Abstract

This research try to examination the relationship between three factors, back payment debt as a dependent variable, consumer expenditure, investment expenditure as independent variable in Iraqi economic by using Autoregressive so as to clear the relationship in the long run (VAR) Vector Throw Research found negative relationship along run.

Keywords

Dependent Variable, Consumer Expenditure, Iraqi Economic, VAR.

Introduction

A theoretical review of the relationship between government spending and overdue debt. The problem of overdue debt in general is one of the most important problems faced by both governmental and private banks, as it preoccupied many economists, decision makers and researchers in the financial field, and it has become an intellectual debate in banking because of its multiple effects on credit policies in sectors. Banking, which is clearly reflected on the efficiency of commercial banks and the economies of countries in general as a result of their obstruction of development projects (Central Bank of Iraq, 2010-2018).

The concept of overdue debt differs from one country to another. According to the guide issued by the financial safety indicators prepared by the International Monetary Fund, the loan is considered defaulted and ineffective when the customer becomes defaulted and is unable to pay the interest or the principal of the arrears of payment for a period exceeding 90 days. Overdue debts to the total debts granted by the banking system pay great attention because of the importance of this indicator in revealing the determinants of overdue debts in order to provide solutions and proposals that contribute to reducing the level of these debts to the minimum possible. The inability of the borrower to pay obligations on time as a result of a decrease or suspension of the borrower’s returns due to an unexpected event, certain economic conditions, or imbalances surrounding its activity, which limits the role of the banking sector in influencing most economic and financial sectors and its inability to contribute to advancing economic development.

Accordingly, many banks may face the problem of defaulting on their debts, as this problem was not a result of the moment, but rather appeared after the Great Depression crisis in 1929 and exacerbated in the mid-eighties of the last century and ended the last financial crisis that the world witnessed in 2008, which showed that credit risks are increasing With the deterioration of the macroeconomic conditions, and thus, the large volume of overdue debt calls for increasing banks’ capital and reducing the pace of lending as a result of the difficulties in enhancing banks’ capital and overestimating risks, meaning that the credit performance of banks may cause a banking crisis that afflicts the financial sector and then moves directly To the real sector, especially if this percentage exceeds the limits of 10% of the total assets, according to international literature and experiences.

The relationship between the growth of government spending and the growth of overdue debt is one of the topics that are of great importance in financial and economic studies, as government spending, in both its consumer and investment aspects, is one of the factors on which the determination of the level of overdue debt depends in any period of time, as it is one of the influential indicators. It is evident in both consumption and investment, and then the ability of projects and individuals to commit their financial transactions towards banks, meaning that the decrease in the growth rate of government spending is expected to lead to a rise in the proportion of overdue debts.

The indebtedness of the family sector has become a source of financial instability, especially when the income of individuals is exposed to negative shocks represented by the high level of indebtedness they have and their inability to increase borrowing, which leads them to reduce consumption rates, which in turn is reflected in the investment of the business sector, which negatively affects the income of the family sector. The exposure of the family sector’s asset prices to a negative shock in which the guarantees are reduced, which weakens the ability to increase borrowing and increase the default rates that affect the profitability of banks, the decrease of their capital and their inability to lend and consequently the financial stability, especially when the family sector borrowing is for non-productive purposes and contributes to increasing disposable income (Central Bank of Iraq, 2010-2018).

In light of this, the study of the relationship between debt and public spending has been subjected to widespread controversy among economic studies, in particular studies that dealt with non-performing debts or high debts for families, which in turn indirectly affect the ability of banks to fulfill their obligations and thus negatively affect them, and take the relationship of increasing debt Expenditures are in two directions:

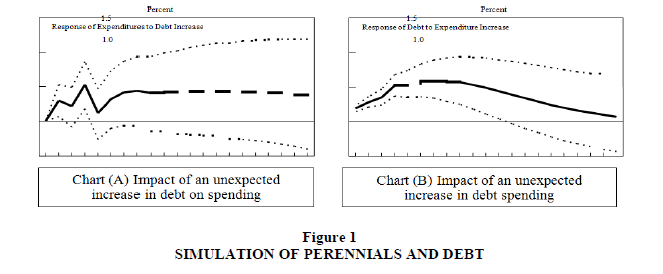

First: the impact of an unexpected increase in debt on spending (Chart 1 - A), a situation in which a high debt burden drives the banking or household sector to reduce spending as a way to strengthen its balance sheets, a situation that includes an unexpected increase in debt in one period, causing Decrease in spending in subsequent periods, noting an increase in spending on durable goods in the event of an unexpected increase in debts.

Second, the impact of an unexpected increase in spending on debt (Chart 1-B). This increase can be interpreted as a sign of optimism about future income. If this optimism leads families to spend more and take on more debt, then an unexpected increase in spending in one period will lead to higher debt in subsequent periods in Figure 1.In this context, the technicians in the central banks indicated that the most important reasons for the faltering of personal loans is the interruption of the client’s work and disposable income, and this is what was concluded by the applied study prepared by the International Monetary Fund in 2017, which included advanced countries and emerging economies, where it became clear that the high indebtedness of the family sector increases the possibility of The occurrence of a banking crisis, especially when this indebtedness exceeds the barrier of 65% of GDP, and thus the difficulty of borrowing by individuals if they reach a high level of indebtedness and a negative shock to their personal income, a decrease in the level of their consumption, and a failure to pay their debts. The expansion of credit provided to the business sector (investment credit) can also contribute to the occurrence of such banking crises, but its impact is less effective than consumer credit.

Figure 1: Simulation Of Perennials And Debt.

Source: Author’s calculations Note: Dotted lines are one-standard-error confidence band.

Based on the foregoing, the phenomenon of bad debts constitutes a burden on defaulting customers and the state treasury as a result of the halting of the commercial activities of defaulting customers, which in turn affects the efficiency of banks by increasing the rates of taxes paid due to the high allocations and outstanding interests.

Economic Analysis of the Path of Government Spending in Iraq

Government spending constitutes one of the important financial policy indicators used by the Ministry of Finance to achieve the state’s economic and social goals during a specific period of time, regardless of the direction of the economic system and its intellectual philosophy. Which it seeks to achieve, as it has become obvious that economic conditions affect differently the level and content of general government spending, so the political decision makers have the discretionary power to adjust the size of government spending to suit the size of the political and economic needs of the state (McCarthy, 1997).

Accordingly, the behavior of fiscal policy in Iraq tended towards maximizing consumer spending at the expense of investment spending, and this was evident in the composition and structure of the preparation of public budgets throughout the period extending after the political change in 2003 until the time of preparing the research, and this was reflected in the data of Table 1.

| Table 1 The Evolution Of The Path Of Government Spending In Iraq For The Period (2010-2018) At Current Prices (%: Value: Billion Dinars, Annual Growth Rate) |

||||||||

| (2) / %(3 ) | (1 ) / (3) | The annual growth rate % | general government spending 3- | The annual growth rate | investment spending 2- | annual growth rate | consumer spending | the year |

|---|---|---|---|---|---|---|---|---|

| 23.3 | 76.7 | --- | 83823 | % | 19472 | % | -1 | 2010 |

| 22.7 | 77.3 | -6.04 | 78758 | --- | 17832 | --- | 64351 | 2011 |

| 23 | 77 | 14.75 | 90375 | -8.42 | 20756 | -5.32 | 60926 | 2012 |

| 33.9 | 66.1 | 31.81 | 119128 | 16.39 | 40381 | 14.26 | 69619 | 2013 |

| 31.3 | 68.7 | -4.74 | 113473.6 | 94.55 | 35487.4 | 13.11 | 78747 | 2014 |

| 26.4 | 73.6 | -37.96 | 70397.5 | -12.11 | 18564.7 | -0.96 | 77986.2 | 2015 |

| 23.7 | 76.3 | -4.73 | 67067.4 | -47.68 | 15894 | -33.53 | 51832.8 | 2016 |

| 21.8 | 78.2 | 12.55 | 75490.1 | -14.38 | 16464.4 | -1.27 | 51173.4 | 2017 |

| 17.1 | 82.9 | 7.13 | 80873.2 | 3.58 | 13820.3 | 15.34 | 59025.7 | 2018 |

Source: Central Bank of Iraq, Directorate General of Statistics and Research, Annual Economic Reports of the Central Bank of Iraq for the period (2010-2018).

The data in Table 1 indicate that total government spending decreased from about 83823 billion dinars in 2010 to approximately 78,758 billion dinars in 2011, with a negative annual growth rate of 6%, in contrast, consumer spending declined by 5.32% from 2010 to record a value of 60,926 billion Dinar as a result of the hedging in the general budget due to the global financial crisis and its repercussions that were reflected in the decline in oil prices, which is the main nerve for financing the general budget, as government spending is characterized by high sensitivity to fluctuations in oil prices in the global oil markets, as it is a rentier economy that depends mainly on financing its revenues from oil revenues. As for investment spending, it also witnessed a decline from the previous year, as it declined by 8.42% to record 17,832 billion dinars, after it was about 19472 billion in 2010. The contribution of consumer and investment spending to the general government spending for the year 2011 amounted to 77.3%, 22.7% respectively, after their contribution to public spending was 76.7% and 23.3%, respectively, in 2010 (Jamal, 2019).

However, government spending did not remain the same, as it rose during the subsequent years, reaching about 113473.6 billion dinars in 2014, after it was 90,375 billion dinars in 2012, with a compound annual growth rate of 7.8% for the period 2012-2014, which reflected the increase in both Consumer and investment spending, as consumer spending amounted to 77986.2 billion dinars in 2014 after it was up to 69619 billion dinars in 2012, with an absolute increase of 8367.2 billion dinars and a compound annual growth rate of 3.81% for the mentioned period, representing 77%, 66.1%, 68.7% of Total government spending for 2012 and the following years with an increase in investment spending to reach 35,487.4 billion in 2014 after it was 20,756 billion in 2012, with a compound annual growth rate of 19.3% for the above period, constituting 23%, 33.9%, 31.3% for the same period, respectively, and perhaps The reason for this increase in total government spending is the increase in the volume of public revenues resulting from the rise in oil prices in the global market and the increase in investment allocations for the rehabilitation of infrastructure, but the rate of total government spending started to decline after 20 14 to record negative annual growth of 37.96%, 4.73% for the years 2015 and 2016 as a result of Iraq’s exposure to a double shock represented by the drop in global crude oil prices with the decline in demand for it and the abundance of oil supply on the one hand, and the tense security and political conditions that Iraq experienced in that era represented by the war on Iraq. ISIS terrorist gangs and the cost of dealing with the humanitarian crisis caused by the terrorist organization on the other hand, as these challenges were reflected in the decline in government spending about 70,397.5 and 67067.4 billion dinars for the years 2015 and 2016, respectively. In contrast, consumer spending decreased to about 51,832.8, 51173.4 billion dinars for the two mentioned years, at a rate Negative annual growth of 33.5% and 1.27%, respectively, representing 73.6% and 76.3% for 2015 and the following year, with a decrease in investment spending to constitute 26.4% and 23.7% of total government spending for the same period.

The subsequent years of 2016 witnessed a noticeable increase in the total general government spending, which amounted to about 75490.1, 80873.2, 111723.5 billion dinars for the years 2017, 2018, 2019 respectively, at a compound annual growth rate of 13.8%, and this increase is attributed to the growth of consumer spending by 15.34 %, 13.6%, 30.19% and investment spending by 3.58%, - 16%, 76.7% for the above period, respectively, as consumer spending increased from about 59025.7 billion dinars in 2017 to reach about 87300.9 billion dinars, with an absolute increase of 28275.2 billion dinars, with a contribution rate to the total Government spending amounted to 78.2%, 82.9%, and 78.1% for the above period, respectively, while investment spending constituted a contribution rate to total government spending of 21.8%, 17.1%, and 21.9% for the year 2017 and the following years, and the increase in total government spending is mainly due to To the rise of most components of consumer spending, especially capital expenditures, commodity and service requirements, grants and public debt service, resulting from the improvement in oil prices in global markets as a result of the growth and development of the performance of the global economy, which is the main engine for Most of the advanced economies and the scarcity of supply of it, which reflected its positive impact on the Iraqi economy and the improvement of the conditions of the general budget (Haitham, 2015).

Finally, it can be said that the low percentage of investment spending from the total government spending is responsible for the survival of the infrastructure of the Iraqi economy, backward and dilapidated (Ammar, 2016).

Economic Analysis of the Bad Debt Trajectory in Iraq

The factors that affect the achievement of financial stability in different economic systems are characterized by dynamism and change according to the change in other variables that may be internal (origin of the national economy) or external (origin of the movement of the global economy). In light of this, macroeconomic policies seek to increase the effectiveness of the financial system in adaptation To internal or external shocks and the pressures on them to maintain the gains of growth in the various economic variables and to ensure competitiveness and achieve stability in prices and thus the stability of the national economy as a whole, which implies the continuation of the path of growth and stability.

The weakness of the financial depth of the Iraqi economy and the deepening of structural imbalances and the inability of the banking system to invest in the real side and that the credit granted was mostly short-term due to the high risks in recovering loans and their interests and in the areas of speculation and not the real sector, in addition, the productivity of these sectors depends on the financial The state’s general financing of its operational operations, which leads as a result to the impact of credit operations as an important beginning of financing for the state’s public finances, and the same effect applies to the process of credit recovery to achieve future financing of various projects. The political philosophy of the current operations of economic activities, or the product of deep-rooted structural imbalances, rentierism, budget deficit, or other reasons that cannot be mentioned.

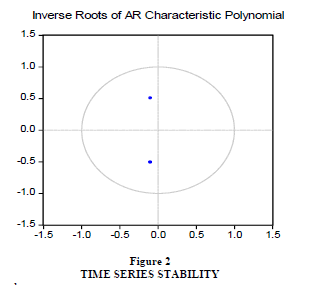

From the above figure it is clear that the model has stabilized and that the roots are all within the unit circle, from here it can be said that the time series of the model variables do not contain the unit root and do not contain a permanent random rest that affects the standard deviation of the estimate and the rest of the statistical significance tests that are based on calculating the standard deviation Therefore, there is a long-term relationship between the model variables, and therefore further tests can be carried out to find out the relationships between the dependent variable and the independent variables.

Following up on Table 2, the cash credit volume amounted to 9.4, 13.0, 20.8, 23.6 trillion dinars for the years 2010, 2011, 2012, 2013 with the concentration of credit to the government sector versus its decline to the private sector, and this in itself will lead to a significant negative impact on the overall credit movement In the event of a default in payment or a specific shock in the government sector that will affect the financial and banking system as a whole, and this indicates that the private banking system does not contribute to the overall credit movement and therefore its weak contribution to growth and development, which implies its departure from the basic objectives of its establishment in the first place and the limitation of its activity In secured investment and credit areas, such as a currency auction or investment in government bonds (Ahmed, 2018).

As a result, the private sector will not be negatively affected in the event of financial insolvency as is the case in the government sector, and the result will be causal in the process of reverse financing of the banking and financial system, and will create a certain difficulty in creating or increasing the movement of deposits to finance current operations, which will lead to linking government spending in infrastructure to the return The credit cycle again.

| Table 2 Total Cash Credit And Sectorial Distribution Of Cash Credit Trillion Dinars |

||||||

| 1-Apr | 1-Mar | private credit (4) | public credit (3) | Annual rate of change % (2) | Total | the year |

|---|---|---|---|---|---|---|

| -6 | -5 | cash credit (1) | ||||

| 0.9 | 0.09 | 8.5 | 0.9 | -- | 9.4 | 2010 |

| 0.12 | 0.87 | 1.6 | 11.4 | 38 | 13 | 2011 |

| 29 | 0.71 | 6.2 | 14.6 | 0.6 | 20.8 | 2012 |

| 0.28 | 0.71 | 6.6 | 17 | 13 | 23.6 | 2013 |

| 0.21 | 0.79 | 7.2 | 26.9 | 14 | 34.1 | 2014 |

| 0.21 | 0.79 | 7.7 | 29.1 | 7 | 36.8 | 2015 |

| 50 | 0.5 | 18.1 | 18.2 | 1.1 | 37.164 | 2016 |

| 0.51 | 0.49 | 19.4 | 18.5 | 0.0004 | 37.18 | 2017 |

| 0.46 | 20.3 | 18.04 | 3 | 38.4 | 2018 | |

Source: Columns (1, 3, 4).

Central Bank of Iraq, Department of Monetary and Financial Stability, Annual Financial Stability Report for the years 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018. Columns (2, 5, 6) were extracted by researchers.

On the other hand, as in Table 2, the cash credit has increased for the period 2010-2013 year after year with the increase in credit provided to the public sector compared to the credit provided to the private sector, and this indicates an increase in government imports year after year for the purpose of establishing various projects to meet demand, which implies a rise The degree of risk to long-term financial stability due to sectoral credit concentration. This means implicitly acknowledging that the private banking system maintains high liquid assets in order to avoid the risk in granting credit, investing in and taking risks in economic activity, which will raise the banking system's liquidity index and disable those assets from investing in the national economy.

Cash credit continued to increase for the period 2014-2018, but at a lower rate than for the period 2010-2013 with the increase in credit to the private sector, especially after the year 2016. This increase can be attributed to the stability of the security situation after the expulsion of terrorist gangs from most of the Iraqi lands and the improvement of Iraq’s foreign relations with neighboring countries and the openness of the coalition countries The international community imposed on Iraq in the field of reconstruction, grants and aid, which provided liquidity with the governmental authorities and thus increased the movement of economic activity and the consequent increase in the movement of credit.

Central Bank of Iraq, Directorate General of Statistics and Research, Financial Stability Reports for the period 2010-2018.

For the period 2013-217, it increased from 1.9 trillion dinars in 2013 to 4.3 trillion dinars in 2017, as shown in Table 3, and this reflects the high degree of risk in granting credit and loans as a result of the security and political events that accompanied the above period, as well as the nature of the political conditions represented by the entry of terrorist gangs This was accompanied by a high degree of risk in granting credit, as well as the case in credit recovery and the cost of credit, noting the high volume of overdue debts with the increase in the volume of cash credit as well as with the decrease in the volume of government spending, which gives a moral indication of the relationship between government spending and insolvency in payment, and to examine the nature of The relationship above we resorted to estimating the relationship using the Vector Autoregressive Estimates (VAR) model to show the long-term relationship between the model variables. And as in Table 4.

|

Table 3 |

|||

|

The Year |

Jamali Bad Debt |

Default Rate of Private Banks % 2 |

Bank Default Rate |

|---|---|---|---|

| 2010 | 497.9 | 57 | 43 |

| 2011 | 459.9 | 58.7 | 41.3 |

| 2012 | 497.9 | 59 | 41 |

| 2013 | 1994.5 | 79.3 | 20 |

| 2014 | 2361.1 | 77.3 | 22.7 |

| 2015 | 3079.7 | 67.1 | 32.9 |

| 2016 | 3346.5 | 99.8 | 0.18 |

| 2017 | 4.3 | 99.8 | 0.17 |

| 2018 | 4.8 | 99.51 | 0.49 |

Source: Columns (1, 2, 3,).

| Table 4: Var Model Estimate Of The Relationship Between Total Consumer Spending X1, Investment Spending X2, And Total Bad Debt Y | |

| Sample (adjusted): 2012 2018Vector Autoregression Estimates | |

|---|---|

| Included observations: 7 after | |

| adjustments | |

| Standard errors in ( ) & t-statistics in [ ] | |

| Y | |

| -0.201620 | Y(-1) |

| (0.55953) | |

| [-0.36034] | |

| -0.269003 | Y(-2) |

| (0.66674) | |

| [-0.40346] | |

| 11039.25 | C |

| (5996.05) | |

| [ 1.84109] | |

| -0.192946 | X1 |

| (0.10250) | |

| [-1.88236] | |

| 0.170719 | X2 |

| (0.11434) | |

| [ 1.49311] | |

| 0.770885 | R-squared |

| 0.312654 | Adj. R-squared |

| 2813330. | Sum sq. resids |

| 1186.029 | S.E. equation |

| 1.682307 | F-statistic |

| -55.09646 | Log likelihood |

| 17.17042 | Akaike AIC |

| 17.13178 | Schwarz SC |

| 1612.686 | Mean dependent |

| 1430.565 | S.D. dependent |

Source: Prepared by researchers using 9E-Views software

The results of the estimation of the (Vector Autoregressive Model) VAR model indicate that the ratio of the variance explained by the model to the total variance in the dependent variable through the value of the coefficient of determination R2 is high and reaches 0.77. Therefore, there are 0.33 of the changes that occur in the total bad debts are the source of factors Others, on the basis that some of the credit granted is provided to business organizations, institutions, and individuals who are not solvent, and thus financial default occurs, especially projects after 2010.

On the other hand, the value of the F-test is also low and is less than tabular, and therefore the significance of the model as a whole cannot be acknowledged. To confirm the validity of the results for the relationship between the independent and dependent variables, we conduct a unit root test to find out the stability of the time series as in Table 5.

| Table 5 Time Series Stability |

|

| Roots of Characteristic Polynomial | |

| Endogenous variables: Y | |

| Exogenous variables: C X1 X2 | |

| Lag specification: 1 2 | |

| Date: 05/14/21 Time: 21:32 | |

| Modulus | Root |

| 0.518655 | -0.100810 - 0.508764i |

| 0.518655 | -0.100810 + 0.508764i |

| No root lies outside the unit circle. | |

| VAR satisfies the stability condition. | |

From the above Table 5, it is clear that the model is stable after taking the first and second difference for the model variables, and it can be said that the time series is stationary and its mean and variance are constant over time and the value of the covariance between two periods depends only on the distance, gap or time lag between the two periods and not on the real time at the time of calculating The covariance, and to be more sure, we draw the time series as in Figure 2.

Conclusions

- Consumer spending was one of the most important components of government spending in Iraq for the period 2010-2018.

- Investment spending constituted only a small percentage of the total public spending, which led as a result to the consumer nature of the budget away from increasing production capacity.

- The credit granted was mostly short-term due to the high risks in the recovery of loans and their interests and in the areas of speculation and not the real sector.

- Most of the changes that occur in the total bad debts are the source of government spending, on the basis that some of the credit granted is provided to business organizations, institutions and individuals who are not solvent, and therefore financial default occurs, especially projects after 2010.

References

- Ahmed, A.A.A. (2018). Banks, Credit and Financial Depth between Iraq and the International Experience, Journal of Monetary and Financial Studies, Central Bank of Iraq, third issue .

- Ammar, M.K. (2016). Analyzing the relationship between the volume of non-performing loans and capital adequacy using stress tests for a sample of private banks in Iraq, Journal of Financial and Monetary Studies, Central Bank .

- Central Bank of Iraq. (2010-2018). Directorate General of Statistics and Research, Annual Economic Reports of the Central Bank of Iraq for the period (2010-2018).

- Central Bank of Iraq. (2010-2018). Directorate General of Statistics and Research, Financial Stability Reports for the period 2010-2018 .

- Haitham, M.A. (2015). The Impact of Non-Performing Loans on the Jordanian Banking Sector for the Period 2000-2013, 3.

- Jamal, Q.H. (2019). Non-performing loans and their impact on the banking sector in the Arab countries, Journal of Economic Studies, 56 .

- McCarthy, J. (1997). Debt, delinquencies, and consumer spending. Current Issues in Economics and Finance, 3(3) .