Research Article: 2021 Vol: 27 Issue: 1S

Success Factors in Project Fundraising Under Reward-Based Crowdfunding Platform

Somboon Prasobpiboon, Chulalongkorn University

Roongkiat Ratanabanchuen, Chulalongkorn University

Achara Chandrachai, Chulalongkorn University

Sipat Triukose, Chulalongkorn University and Chulalongkorn

Abstract

Crowdfunding is an alternative fundraising channel for entrepreneurs who need seed funding to support their prototype production. Due to the risky nature of newly creative projects from entrepreneurs, a reward-based crowdfunding platform plays an important role in assisting early stage startups to raise their initial funds. Crowdfunding helps new business owners to fulfill their capital requirements through an Internet platform by funding relatively small amounts of money from large numbers of individual contributors. The purpose of this study is to identify key success factors that drive reward-based crowdfunding projects. We developed a research model that demonstrates backers’ satisfaction in financially contributing money to support reward-based crowdfunding projects and conducted empirical research to investigate this model. Our study focuses on entrepreneurial, project and campaign factors including the backers’ motivation in contributing their money in crowdfunding projects. The result shows that entrepreneurial experience in crowdfunding projects, multimedia use and the elaborateness of project description have significant positive effects on backers’ funding contributions. We also found that campaign conditions which consist of of campaign duration, funding goals and the delivery time of reward have a negative relationship with the backers’ contribution in crowdfunding projects. Furthermore, our analysis of the model in the context of backers’ motivation reveals that both individual and social satisfaction have a significant impact on backers’ funding contributions to crowdfunding projects. Consequently, this study also presents practical implications for entrepreneurs and reward-based crowdfunding platforms to focus on project preparation and implementation, including platform design, in order to increase the chances of success in reward-based crowdfunding.

Keywords

Reward-Based Crowd funding, Success Factors, Funding Contribution, Entrepreneur, Backer.

Introduction

In the last few years, a new source of fundraising through crowd funding employed by creative entrepreneurs, has allowed an individual to contribute funds to a project from the general public while the crowd has received certain perks such as discounts on future purchases, shares in the company or other perks that may entice the crowd to provide support money (Belleflamme et al., 2014; Mollick, 2014). Crowd funding has become a valuable alternative source of financing for entrepreneurs to raise initial funds in the early stage of their business which, by nature, face risky circumstance. New entrepreneurs are traditionally at greater risk and have a higher rate of failure in comparison with other businesses as there is uncertainty about the development of unproven products and services (Valanciene & Jegeleviciute, 2013). Crowd funding refers to the efforts by entrepreneurial individuals and groups – cultural, social and for-profit – to fund their ventures by drawing on relatively small contributions from a relatively large number of individuals by using the Internet without standard financial intermediaries (Mollick, 2014). Crowd funding is an emerging approach for entrepreneurs to implement their ideas despite not having traditional monetary resources such as banks and venture capital. Through crowd funding platforms, the crowd can invest in business ideas and projects and entrepreneurs can raise funds via the Internet (Bi et al., 2017).

There are four crowd funding business models based on business stage, objective, return type and risk level: (1) donation, (2) reward-based, (3) lending-based and (4) equity-based crowd funding. Donation and reward-based crowd funding are normally use at the seed stage of a business when the business entity has not yet formally been set up but entrepreneurs have a creative idea and the intention to produce a prototype or do something for social or donation activities. The first and second type of crowd funding have a low risk level as donors in donation-based crowd funding normally have no expectation of a return and supporters have no expectation of financial return from their contributions. In donation-based crowd funding, donors give their money for this kind of crowd funding without any expectation of return (Guan, 2016). However, donors in some countries may receive tax deductible benefits from their donation or project satisfaction, whereas supporters in reward-based crowd funding receive a reward for backing the project. In a reward-based crowd funding platform, creators offer non-financial rewards to backers for their contribution (Yu et al., 2018) and individuals who contribute their money to a project do not receive any financial incentive, return or repayment from the project in return for their funds (Bi et al., 2017). Lending-based and equity-based crowd funding adopted when a business is set up and starts its operation, generate a revenue stream but still need additional funds to develop production or pay for market activities. Lending-based crowd funding is high risk as funders may not receive all or part of the principal amount and interest on the payment due date whereas equity-based crowd funding has the highest risk among other crowd funding types because investors may totally or partially lose their funding if the share price dramatically drops. In lending-based crowd funding, funders lend their money to specific projects to earn a certain interest rate and there is a high default risk as funders may disappear with the investment money (Guan, 2016). However, equity-based crowd funding involves the founder exchanging ownership interest in the firm in return for an investor contribution. Investors are entitled to future dividends and a share in the proceeds if the company share is sold. Capital funding goals are typically higher and investors’ contributions are also larger relative to other crowd funding models (Beaulieu et al., 2016).

In the present study we focus on reward-based crowd funding as it is the largest category of crowd funding in terms of the overall number of crowd funding platforms as well as the funding amount raised in the past years (Kunz et al., 2017). This crowd funding type represents both a large variety in the capital goals sought and a large variety of individual contribution amounts received (Beaulieu et al., 2015).

Reward-based crowd funding provides exciting opportunities for both founders and funders. Previous research either focuses on the factors driving funding success from creator’s perspective or focuses on the contributor’s motivation viewpoint in backing of crowd funding project. However, as both aspects are important for funding success, neglecting one of both might influence the funding results. To shed light on this issue, our objective of this paper is to closes this research gap by demonstrating which factors influence crowd funding success by taking into consideration both creator’s perspective and backer’s motivation in order to provide a more comprehensive view. Based on our survey questionnaire, we empirically evaluate our research model combining creators’ perspective and backer’s motivation to identify the key success factors influencing in successful project in reward-based crowd funding.

Literature Review

Crowd Funding Model

Funding in reward-based crowd funding projects has grown rapidly in the past decade. In 2014, the share of newly created platforms that are reward-based was approximately 40%, followed by each, at around 20%, in donation-based and lending-based platforms (Belleflamme et al., 2015). The present study focuses on reward-based crowd funding as it is the largest crowd funding type in terms of the overall number of crowd funding platforms as well as the funding amount raised being the fastest growing form of crowd funding. In addition, we can explore supporters' behavior and motivation for their decision making in reward-based crowd funding as its nature is similar to the process of customers making purchase decisions.

In crowd funding platform, creators are people creating the projects and seeking funding for their creative projects while backers are people who pledge money to the projects they believe in. Pledges mean monetary contributions from supporters towards the projects. Consequently, it is meaningful for both creators and backers to know the possibility of project success and outcome in advance since this helps them to manage their work and future strategies to complete their whole funding process.

Currently, crowd funding has become a competitive alternative in seeking financial support for entrepreneurs in funding creative projects but how to make a project become successful is not yet clear. Therefore, this present study has been conducted through a survey questionnaire to investigate key success factors that drive reward-based crowd funding projects.

Success Factors in Reward-Based Crowd Funding Projects

From our literature review on the elements of successful projects in reward-based crowd funding projects, the determinant factors can be categorized into three aspects which consist of entrepreneurial, project and campaign aspects. We also provide the rationale for our research hypotheses in each independent variable as follows:

Entrepreneurial Factor

Number of created projects

Entrepreneurs who have past experience in crowd funding, especially successful experience, are more likely to succeed in their fund raising (Kim et al., 2017) because founders with larger crowd funding experience are highly likely to earn credibility, which leads to success in fundraising. A similar finding was also supported by Daoyuan (2016) who found that the number of founders’ creating projects has a positive and significant effect on the performances of crowd funding campaigns as the created projects experience can also be seen as experience of crowd funding and entrepreneurship which may increase the founders’ knowledge. Creating more projects leads to a learning effect; which means that the founder gains the best skills in how to present the project and how to be successful in the funding process.

Number of Project Backings of the Project Initiator

It is important for project initiators to back a few projects before they start to create their own for two reasons. Firstly, previous project backings by the initiator send a signal to the crowd that a project initiator understands the dynamics of crowd funding and believes in the idea of crowd funding. Secondly, initiators can learn from their own experience as backers because funding other projects will help them to understand which factors are relevant in generating trust in potential backers (Kunz et al., 2016). According to Daoyuan (2016) his findings show that the reciprocity of project founders, measured by the number of backed projects, has a positive and significant effect on a project’s performance. Thus, a high involvement of project initiators in other crowd funding campaigns signals the project initiator’s expertise which may influence supporter behavior (Kunz et al., 2017).

Identity Disclosure

Identity information reveals that identity disclosure (by showing a name and photo) strongly affects how supporters perceive trust. Similarly, in the crowd funding context, a project with the clear identity of the founder will gain more credibility, which in turn leads to a higher potential for reaching the fundraising goals (Kim et al., 2017).

Number of Facebook Friends of the Project Initiator

Findings from Mollick (2014) indicate that the number of Facebook friends, as an indicator for the scope of the personal network of the project initiator, can hint at the initiator’s potential to generate support, mobilize collective action, draw on resources from other members of the social network and build trust. Linking to a social network can help enhance the sense of trustworthiness and benevolence (Kunz et al., 2017). Consequently, the social network of individuals seeking funding influences the success of entrepreneurial financing efforts which plays a role in determining the success of projects.

Project Factor

Number of images used on the campaign site

Supporters are more attracted by visual images which help them better understand projects. Thus, it is important for creators to use images to communicate with the Kickstarter community and attract contributors. Consequently, a higher number of images is also positively associated with funding success (Zhou et al., 2016). However, it is possible that the excessive use of images results in a cluttered campaign page and eventually leads to an unpleasant appeal or interference with readability (Kunz et al., 2017). In addition, the pictures included in the profile are quite complex with many being actually of a textual context instead of being pure images and thus requiring more sophisticated techniques to process in order to reveal the real effect of picture (Daoyuan, 2016). In this study, we believe that visually appealing images show an initiator’s preparedness to offer a high-quality reward.

Number of videos used on the campaign site

Project initiators who include videos in their descriptions are more likely to succeed because video signals quality because it communicates that the project initiator is confident to show the respective product (Mollick, 2014). Project creators should try to provide more richness in media, such as videos, to help potential backers to understand the project and encourage them to support the campaign (Daoyuan, 2016); Kunz et al. (2016). In addition, Bi et al. (2017) and Kunz et al. (2017) produced findings that show that the correlation between the video count and a funder's decision to invest is also positive and significant. The number of embedded videos may thus serve as a positive signal which may lead to an increased probability of project success.

Number of Released Updates

It is important for project creators to communicate with pledgers and potential pledgers (Mullerleile & Joenssen, 2015). This communication can help to reduce information asymmetries between involved parties. Thus, projects with more updates have a higher likelihood of fundraising success by motivating investors to participate (Kim et al., 2017). Mollick (2014); (Kunz et al., 2016) have also demonstrated that signals of quality such as frequent updates are associated with greater success. In addition, Kunz et al. (2017) findings explain that updates can strengthen the relationship between the creators and the crowd, and hence lead to a higher degree of trustworthiness.

Number of Entries for Comments on the Campaign Site

Founders can also market their projects or update information by posting comments and this means that they have no need to focus on marketing their projects by using web tools, updating information or designing the incentive plan if they frequently post comments (Kraus et al., 2016). Therefore, it is important that the number of generated comments indicates that a promising communication strategy must be in place for the project. The project must appear active and facilitate communication between backers in a visible forum to be more successful (Müllerleile, & Joenssen, 2015). A similar finding is also supported by Kim et al. (2017) who indicated that projects with more comments have a higher likelihood of success in fundraising because of the reduction of information asymmetry that an investor may confront.

Number of Available Project Website

An external website can increase the creators’ options for communicating with the crowd. Having an external website may be perceived as a positive signal which may lead to an increased probability of project success (Kunz et al., 2017). Projects not featuring their own website or those on a social media platform have a substantially lower success probability (Müllerleile, & Joenssen, 2015).

Number of Available Reward Levels

Founders can choose the number of reward levels which require the amount of money backers need to pledge to receive a reward. A higher number of different rewards increases the likelihood of project success (Kunz et al., 2016). It can further be viewed that the more different rewards a project offers, the more the options a potential backer has to pick from which ultimately results in more financial support (Kunz et al., 2017).

Length of Description

The introduction word count of a reward-based crowd funding project is a typical signal of project quality: the more detailed the introduction, the more readers will decide to invest because supporters will perceive this project as being more reliable. (Bi et al., 2017). In addition, formally written project descriptions may signal the preparedness and professionalism of the project owners, thus increasing the positive perception of backers and increasing the likelihood of funding success (Zhou et al., 2016). This is consistent with Kim et at. (2017) who indicated that elaborating a description refers to the act of adding key details in order to influence an investment decision.

Campaign Factor

Campaign duration

A longer fund-raising period may expose an uncertain narrative for the project, resulting in decreasing support (Frydrych et al., 2014). According to Mollick (2014) long campaign durations signal a lack of confidence in the project initiators to successfully raise money. Zhou et al. (2016); Kunz et al. (2017) also demonstrated that a higher requirement of funding goal and a longer campaign duration are negatively associated with funding success. On the other hand, Cordova et al. (2015) reported that the duration of the project is associated with a higher probability of success because the longer in time the fundraising closure is, the higher the likelihood that contributions will add up to an amount equal or above the one originally requested by the founder. In addition, Kim et al. (2017) indicated that there is a positive influence of duration from projects. However, we have assumed in this study that a long duration may reduce the backer’s confidence in the project initiator’s ability to complete the project in the provided time and quality.

Funding Goal

Funding goals should be set realistically. Reducing the required funds makes achieving financing easier Müllerleile & Joenssen (2015) because a high funding target implies more effort being required by the project creator to legitimate the requested funding Frydrych et al. (2014). Cordova et al. (2015) also found that an increase in the amount requested, reduces the probability the founder will reach the funding goal. In addition, Kim et. al. (2017) demonstrated that setting a high funding goal indicates a large initial capital investment is needed for a project, which is ultimately a signal of higher risk that can create distrust regarding the founder’s ability to complete the project. Thus, funding goal has a negative impact on a successful campaign Kunz et al. (2017).

Delivery time of Reward

In the context of online services, delivery time is seen as a critical signal of service quality. Short delivery times may serve as a signal that a product or a service is close to completion. It further serves as a quality signal that helps to reduce perceived risks and foster perceived trust, thereby influencing funding behavior Kunz et al. (2017). By announcing delivery dates that are close to the end of a campaign, the project initiator signals his confidence and ability to get the rewards realized as promised and on time. In contrast, backers searching for new projects may rate a high delivery time as risky and thus regard the initiator as not being prepared enough to get his own project realized.

Backer’s Motivation Factor

In addition to our literature review on the motivation factors of backers, which support reward-based crowd funding success, we also explain the reason for our research hypotheses in each independent variable as below:

Backer’s Image Enhancing as Contributor in Crowd Funding Project

Backers may be driven by their online image concerns to fund because backers’ behavior may be used to create a preferred image for crowd funding. Therefore, the backers’ desire for an online image can be a motivation for backers to fund (Bretschneider et al., 2017). The image recognition of backers in crowd funding also conforms to the research studied by Kuo et al. (2014) which indicated the intrinsic incentives for participating in online communities such as feeling good about or proud of oneself, upgrading one’s status, and enhancing self-image.

Backers’ Altruistic Motivation to Help Others

Research on motivation psychology indicates that one condition under which individuals develop altruistic motives is a personal connection, which means that if a person has a personal connection to another individual then this person will develop an altruistic motivate in relation to this individual as a content-specific, psychological disposition (Batson et al., 1988). Therefore, backers sometimes have a personal connection because of geographical proximity between the project creator or the project. The backers having a kindly feeling motivation, may fund a crowd funding project in order to help creators to reach their funding goal and complete the project as planned.

Backer’s Demand for Reward in A Reward-Based Crowd Funding Project

Rewards can positively affect consumer participation in online communities (Yen et al., 2005), and user participation in online interaction is driven by perceived rewards. Therefore, rewards can encourage consumers to participate in communities and make better contributions and then attract more consumers (Kuo et al., 2014). In addition, Bretschneider et al. (2017) also illustrated that backers’ behavior is motivated by a desire for reinforcement or incentives. It proposes that behavior is motivated by external goals such as reward or money. The reward motivation also plays a significant role in reward-based crowd funding because contributors can expect to receive the rewards if a certain reward-based crowd funding project is successfully funded.

Backers’ Supportive Motivation to Contribute to the Crowd Funding Project Being a Successful Project

In crowd funding communities, backers contribute financially in order to increase the chance that the crowd funding project will collect the necessary capital and the project outcome will be realized because the backers hope that the project is realized as it reflects their personal needs. Therefore, the new idea or prototype of a product is that a project’s underlying concept does not yet exist in the market and therefore backers try to ensure its success through their engagement (Bretschneider et al., 2017).

Social Recognition for Backers Who Contribute in Crowd Funding Projects

Social acknowledgement plays a role in supporter motivation because backers have a desire to communicate their contribution in order to obtain social prestige within a group (Steigenberger, 2017). As backers, and more often, project creators use the comment functionality of crowd funding websites to thank, praise and recognize backers for their funding, supporters might fund in expectation of a positive reaction from other backers or the project creator because of their financial contribution (Bretschneider et al., 2017).

Social Communication between Backer and Crowd Funding Project Creator or Other Backers

Communication is a meaningful process of sharing ideas, opinions, messages or information. It also helps build the relationship between backer and crowd funding project creator and a sense of satisfaction and is an important factor in maintaining that relationship (Zhao et al., 2017). Therefore, the backer may support crowd funding project in order to gain access to social communication in crowd funding platform. In addition, Zheng et al. (2018) indicated that social communication between backers and entrepreneur in a crowd funding project generates idea exchange, opinion sharing and connection or communication with the entrepreneur and other contributors. Thus, backers will be more likely get to know the project and demonstrate positive behavior toward it.

All success factors in reward-based crowd funding projects and their relationship to funding success are summarized in Table 1

| Table 1 Overview of Variables in Reward-Based Crowd Funding | |||

| Description | Hypothesis | Relationship to funding success | |

| 1 Entrepreneurial factor | H1 | ||

| 1.1 | Number of created projects | Positive | |

| 1.2 | Number of project backings of the project initiator | Positive | |

| 1.3 | Identity disclosure | Positive | |

| 1.4 | Number of Facebook friends of the project initiator | Positive | |

| 2 Project factor | H2 | ||

| 2.1 | Number of images used on the campaign site | Positive | |

| 2.2 | Number of videos used on the campaign site | Positive | |

| 2.3 | Number of released updates | Positive | |

| 2.4 | Number of campaign site entries for comments on the | Positive | |

| 2.5 | Number of available project website | Positive | |

| 2.6 | Number of available reward levels | Positive | |

| 2.7 | Length of description | Positive | |

| 3 Campaign factor | H3 | ||

| 3.1 | Campaign duration | Negative | |

| 3.2 | Funding goal | Negative | |

| 3.3 | Delivery time of reward | Negative | |

| 4 Backer’s motivation | H4 | ||

| 4.1 | Backer’s image enhancing as contributor in crowd funding project | Positive | |

| 4.2 | Backers’ altruistic motivation to help others | Positive | |

| 4.3 | Backer’s demand for reward in reward-based crowd funding project | Positive | |

| 4.4 | Backer’s supportive motivation to contribute the crowd funding project to be successful project | Positive | |

| 4.5 | Social recognition for backers who contribute in crowd funding project | Positive | |

| 4.6 | Social communication between backer and crowd funding project creator or other backers | Positive | |

Research Model and Hypotheses

Research Model and Methodology

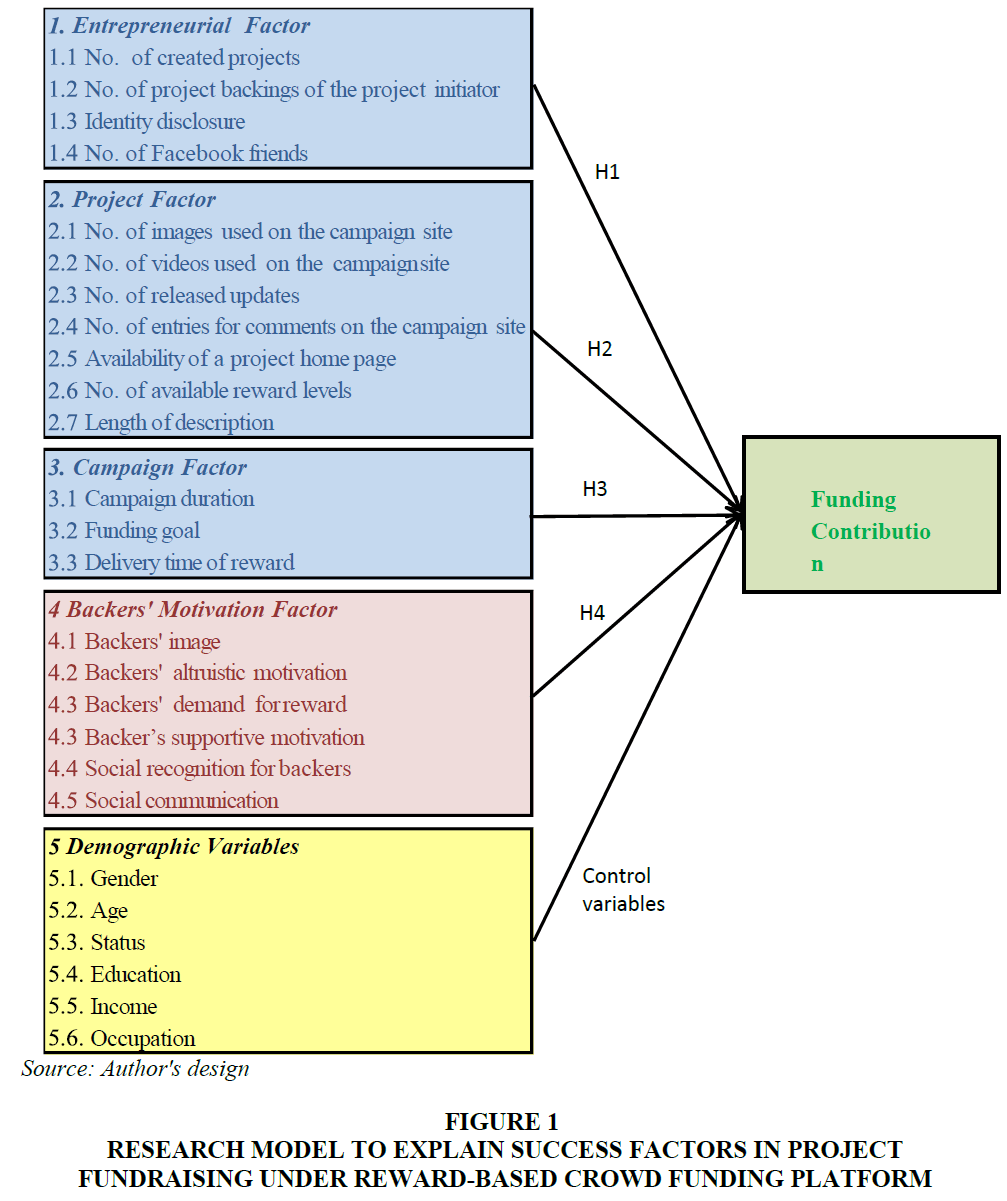

From the previous research in the literature review, we have outlined the impact factors included in our research model as well as their hypothesized effects on the success of funding. Therefore, we have especially built upon previous research in the field of crowd funding in order to investigate the effect of certain determinants in entrepreneurial, project, campaign factors as well as backers’ motivation that have an influence on the success of funding. In addition, we have included personal and social motivation from our previous research in the literature review into the research model in order to analyze the effect of motivation factors influence on backers’ funding decisions. Furthermore, we have also added demographic variables from the demographic data of respondents into the research model as shown in Figure 1 below. Based on our survey questionnaire, we performed reliability and validity tests using exploratory factor analysis (EFA) and then applied logistical regression for the validation of the hypothesis in our proposed model. To carry out our calculations, we used IBM SPSS Version 22.

Figure 1 Research Model to Explain Success Factors in Project Fundraising Under Reward-Based Crowd Funding Platform

Instrument Development

We developed an online survey to examine the research model. The survey questionnaire was structured, tested and consequently adapted to the needs of the target audience. All of the research constructs were measured with adapted multi-item 5-point Likert scales, where 1 denotes “strongly disagree” and 5 denotes “strongly agree. The questionnaire was reviewed and improved by five experts pursuing doctoral degrees in information technology, business administration and finance. Before conducting the final online survey, the questionnaire in our online survey was validated by performing a pre-test survey on a small group of 48 individuals who have knowledge and experience in finance, business and administration filed.

The objective of the pre-test was to ensure that none of the items was ambiguous and to confirm that the items adequately captured the domain of interest. The result of the pre-test indicated that the content of the items was valid.

Sampling and Data Collection

For a sampling method, we applied sampling by a purposive sampling method by choosing the appropriated audiences for questionnaire survey in this study. We sent our questionnaire to target respondents who had experience in crowd funding supporters or purchased goods or services through e-commerce platforms or had knowledge in the area of investment, finance, business and administration. The online survey was conducted over two-month period during May to June 2020. We received feedback from respondents for 320 samples as shown in Table 2 below which was adequate to analyze the regression model in our research as an appropriate sample size should be at least 10-20 time of independent variables Hair et al. (2010).

| Table 2 Demographic Data of Respondents (N = 320) | ||

| Characteristics | Frequency | Percentage |

| Gender Male Female |

159 161 |

50 50 |

| Age Less than or equal 20 years old 21 – 30 years old 31 – 40 years old 41 – 50 years old 51 – 60 years old More than 60 years old |

9 41 111 116 39 4 |

3 13 35 36 12 1 |

| Education Lower than bachelor degree Bachelor degree Master degree Doctoral degree |

10 105 164 41 |

3 33 51 13 |

| Average income per month Less than or equal 20,000 Baht 20,001 – 40,000 Baht 40,001 – 70,000 Baht 70,001 – 100,000 Baht 100,001 – 200,000 Baht More than 200,000 Baht |

42 63 87 47 43 38 |

13 20 27 15 13 12 |

| Occupation Student Entrepreneur Government employee State- enterprise employee Private company employee |

27 75 33 31 154 |

8 23 10 10 48 |

Demographic Data Analysis

Descriptive analysis was performed to analyze the demographic profile of the audience in Table 2. Of the 320 individuals in the sample, 50% were men. The average age ranged from 41 to 50 years old and from 31 to 40 years old representing 36% and 35% of the total samples, respectively. 61% of the total sample were single in status and could make their own decision to back the crowd funding project independently. Their educational level was above average, with the vast majority (51%) having a master’s degree, followed by a bachelor’s degree for one-third of the sample size. In terms of professional status, almost 50% of the audience were private company employees and one-quarter of the total sample were entrepreneurs or business owners. It can thus be assumed that the participants had investment experience.

Finding Result

Reliability and Validity

In our research, we constructed multi-item 5-point Likert scales for item measurement of entrepreneurial, project, campaign and backer’s motivation factors. Initial results on internal consistency analysis demonstrated that the value of Cronbach’s Alpha for all constructs was greater than 0.7 indicating a high scale of reliability as shown in Table 3.

| Table 3 Reliability Testing | |||

| Variables | Mean | Std. Deviation | Cronbach Alpha |

| Entrepreneurial factor | 3.765 | 0.770 | 0.934 |

| Project factor | 4.052 | 0.627 | 0.955 |

| Campaign factor | 3.996 | 0.716 | 0.797 |

| Backer’s motivation factor | 3.090 | 0.838 | 0.901 |

We applied exploratory factor analysis (EFA) for validity testing as shown in Table 4. We analyzed and combined some items which have high factor loading and deleted some items with factor loading less than 0.6 (Hair et al., 1995). We found that three variables (Openness, Experience and Networking) could explain entrepreneurial factors with rotation sums of squared loading at 72.37%, Kaiser-Meyer-Olkin measure of sampling adequacy of 0.90, and Bartlett’s test of Sphericity at 0.001. There are three variables (Multimedia Use, Description elaborateness and Communication) which can explain entrepreneurial factors with rotation sums of squared loading at 67.31%, Kaiser-Meyer-Olkin measure of sampling adequacy of 0.93, and Bartlett’s test of Sphericity at 0.001. However, we deleted one item (H2.7: Length of description) with factor loading less than 0.6 (Hair et al., 1995). We combined all three items in campaign factors to remain one variable as they have high factor loading which could explain campaign factors with rotation sums of squared loading at 71.14%, Kaiser-Meyer-Olkin measure of sampling adequacy of 0.70, and Bartlett’s test of Sphericity at 0.001. For motivation factors, there are two variables (Individual and Social factors) which can explain motivation factors with rotation sums of squared loading at 71.97%, Kaiser-Meyer-Olkin measure of sampling adequacy of 0.91, and Bartlett’s test of Sphericity at 0.001). Thus, the result data shows good convergent validity.

| Table 4 Summary of Factors Considered in the Model | |||

| Component | Rotation Sums of Square Loadings | Description | |

| % of Variance |

Cumulative % |

||

| 1. Entrepreneurial factor | |||

| Openness | 36.28 | 36.28 | Identity disclosure |

| Experience | 22.42 | 58.71 | Number of created projects Number of project backing of the project initiator |

| Networking | 13.66 | 72.37 | Number of Facebook friends of the project initiator |

| 2 Project factor | |||

| Multimedia use | 26.79 | 26.79 | Number of images used on the campaign site Number of videos used on the campaign site |

| Description elaborateness |

21.11 | 47.90 | Availability of project home page Number of available reward levels |

| Communication | 19.41 | 67.31 | Number of released updates Number of entries for comments on the campaign site |

| 3 Campaign factor | |||

| Campaign condition | 71.14 | 71.14 | Campaign duration Funding goal Delivery time of reward |

| 4 Backer’s motivation factor | |||

| Individual satisfaction | 54.41 | 54.41 | Backer’s image enhancing as a contributor in crowd funding project Backer’s demand for a reward in reward-based crowd funding project Social recognition for backers who contribute to crowd funding project Social communication between backer and crowd funding project creator and other backers |

| 17.56 | 71.97 | Backer’s altruistic motivation to help others Backer’s supportive motivation to contribute the crowd funding project to be successful project | |

For demographic variables, every dummy variable is dichotomous. A value “1” for a dummy variable indicated that the respective characteristic exists, a value “0” indicates that it does not exist.

Correlation Analysis

For data analysis, Pearson correlation matrix was calculated. Pearson correlation coefficient is a statistical measure of the strength of a linear association between pairs of variables. The correlation coefficient can be either negative or positive and embrace any value from -1 to +1. For multicollinearity testing, Berry & Feldman (1985) concluded that multicollinearity is not a problem if no correlation exceeds 0.80. Pearson correlation matrix was applied to represent correlation values between independent variables. From our correlation analysis as shown in Table 5, all correlation coefficients are less than 0.8 which indicates that there are no issues associated with multicollinearity for coefficient estimation.

| Table 5 Pearson Correlations | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| 1 Openness | 1 | 0.53** | 0.48** | 0.55** | 0.60** | 0.60** | 0.52** | 0.19** | 0.26** |

| 2 Experience | 1 | 0.45** | 0.40** | 0.44** | 0.48** | 0.49** | 0.46** | 0.26** | |

| 3 Networking | 1 | 0.48** | 0.38** | 0.46** | 0.45** | 0.42** | 0.22** | ||

| 4 Multimedia use | 1 | 0.62** | 0.67** | 0.63** | 0.26** | 0.22** | |||

| 5 Description elaborateness | 1 | 0.72** | 0.73** | 0.21** | 0.31** | ||||

| 6 Communication | 1 | 0.69** | 0.30** | 0.27** | |||||

| 7Campaign condition | 1 | 0.03** | 0.34** | ||||||

| 8 Individual satisfaction |

1 | 0.40** | |||||||

| 9 Social satisfaction | 1 | ||||||||

Logistic Regression Analysis and Result

The result of the regression analysis for the overall model is displayed in Table 6. The model chi square has 22 degrees of freedom, a value of 87.896 and a significant value of 0.000 which is lower than the significant level of 0.05. Thus, the indication is that the overall model is very significant and fits, in the context of logistic regression.

| Table 6 Omnibus Tests of Model Coefficients | ||||

| Chi-square | df | Significance | ||

| Step 1 | Model | 87.896 | 22 | 0.000*** |

Various measures of model fit exist, prominent among them are McFadden’s (1973) and Nagelkerke’s (1991) R square statistics. McFadden (1978) states that a pseudo- R square of more than 0.2 indicates a good fit and over 0.4 indicates an excellent fit. Nagelkerke’s R square is standardized to between zero and one and is thus the rule of thumb for regular regression analysis. We found that Nagelkerke’s R square for the model as shown in Table 7 is 0.388, indicating a very good model fit.

| Table 7 Model Summary | |

| Step | Nagelkerke R Square |

| 1 | 0.388 |

We applied Hosmer-Lemeshow test, a commonly used assessment of goodness-of-fit for logistic regression models and found that the model had a significance value of 0.878 in Table 8 which is higher than the significant level of 0.05 and accepted null hypothesis which indicated that goodness-of-fit for this is good.

| Table 8 Hosmer and Lemeshow Test | |||

| Step | Chi-square | df | Significance |

| 1 | 3.761 | 8 | 0.878 |

The parameter estimation results of the logistic regression analysis are given in Table 9. The regression coefficient betas indicate the direction of influence between dependent variables and each independent variable and can be used as a means of hypotheses testing. The corresponding effect coefficient (odds ratio) is determined by computing the antilog of the regression coefficients. These results hold when using either the wald z-statistic or testing the deviance from the null-model for each parameter, using a chi-squared test.

| Table 9 Result of Logistic Regression Analysis | ||||||

| B | S.E. | Wald | df | Significance | Exp (B) | |

| Openness | -0.203 | 0.260 | 0.610 | 1 | 0.435 | 0.816 |

| Experience | 0.633 | 0.238 | 7.075 | 1 | 0.008*** | 1.884 |

| Networking | -0.058 | 0.216 | 0.073 | 1 | 0.787 | 0.943 |

| Multimedia use | 0.667 | 0.333 | 4.021 | 1 | 0.045** | 1.948 |

| Description Elaborateness | 0.829 | 0.459 | 3.258 | 1 | 0.071* | 2.292 |

| Communication | -0.556 | 0.434 | 1.640 | 1 | 0.200 | 0.574 |

| Campaign conditions | -0,662 | 0.401 | 2.725 | 1 | 0.099* | 0.516 |

| Individual satisfaction | 0.908 | 0.239 | 14.376 | 1 | 0.000*** | 2.478 |

| Social satisfaction | 0.558 | 0.242 | 5.324 | 1 | 0.021** | 1.747 |

| Gender_1 | 0.492 | 0.385 | 1.631 | 1 | 0.202 | 1.636 |

| Age_1(31-40y) | -0.013 | 0.704 | 0.000 | 1 | 0.986 | 0.987 |

| Age_2(41-50y) | -0.250 | 0.713 | 0.123 | 1 | 0.726 | 0.779 |

| Age_3 (over 50y) | -0.575 | 0.819 | 0.493 | 1 | 0.483 | 0.563 |

| Status_1 (marriage) | -0.096 | 0.382 | 0.063 | 1 | 0.801 | 0.908 |

| Education_1 (masters) | -0.461 | 0.416 | 1.228 | 1 | 0.268 | 0.631 |

| Education_2 (doctorate) | 1.349 | 0.900 | 2.246 | 1 | 0.134 | 3.855 |

| Income_1 (40,000-70,000 Baht) |

-0.934 | 0.521 | 3.214 | 1 | 0.073* | 0.393 |

| Income_2 (70,001-100,00 Baht) |

0.946 | 0.703 | 1.811 | 1 | 0.178 | 2.576 |

| Income_3 (over 100,000 Baht) |

0.034 | 0.557 | 0.004 | 1 | 0.951 | 1.035 |

| Occupation_1 (private owner) | -2.322 | 1.521 | 2.333 | 1 | 0.127 | 0.098 |

| Occupation_2 (government & state- enterprise) |

-1.805 | 1.558 | 1.343 | 1 | 0.247 | 0.164 |

| Occupation_3 (private co. employee) |

-1.955 | 1.545 | 1.600 | 1 | 0.206 | 0.142 |

| Constant | -2.752 | 1.629 | 2.853 | 1 | 0.091 | 0.064 |

** significance at the 0.05 level

* significance at the 0.10 level

The findings resulting from the logistical regression model showed that entrepreneurial experience in crowd funding projects and backers’ individual satisfaction have a positive influence on backers’ funding contributions, which is significant at a 1% level of significance. We found that multimedia use and social satisfaction are positively related to backers’ funding contributions at a significant level of 5%. In addition, the result also indicated that project description elaborateness has a significant positive effect on backers’ funding contributions at contributions of a significant level of 5% while campaign conditions which consist of campaign duration, funding goal and delivery time of reward have a negative relationship with backers’ funding contributions. Furthermore, backers whose income is between 40,000 Baht to 70,000 Baht have a chance to support money in crowd funding project lower than backers whose income is less than 40,000 Baht.

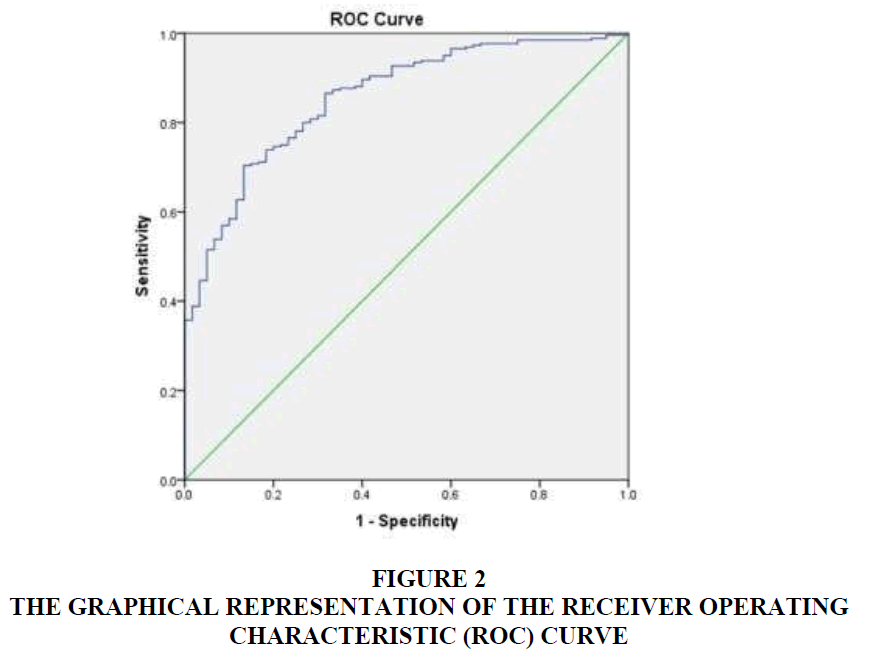

We also constructed a receiver operating characteristic (ROC) curve presented in Figure 2, to show the performance of a classification model at all classification thresholds. The graphical ROC curve is produced by plotting sensitivity (true positive rate) on the y-axis against 1–specificity (false positive rate) on the x-axis for the various test values.

The area under the ROC curve (AUC) provides an aggregate measure of performance across all possible classification thresholds and indicates the degree of separability between classes. It can be used as an indicator of overall accuracy. AUC value of 0.856 in Table 10 assuming a classification cutting threshold of 0.5, demonstrated that there is 85.6% chance that the model will be able to distinguish between positive class (success in crowd funding) and negative class (failure in crowd funding).

| Table 10 Area Under the Curve | ||||

| Test result variable: Predicted probability | ||||

| Area | Std. Errora | Asymptotic | Interval | |

| Sigb | Lower Bound | Upper Bound | ||

| 0.856 | 0.025 | 0.000 | 0.808 | 0.905 |

b. Null hypothesis: true area = 0.5

Discussion

This study examines both kind of variables related to project information from creator’s perspective and backer’s motivation in the context of individual and social satisfaction which support crowd funding projects. We have contributed to the literature on reward-based crowd funding to provide the comprehensive key factors influencing success in crowd funding projects. The results of our empirical study apparently answer the research question of research gap and clearly demonstrate that both project information variable from creator’s perspective and backer’s motivation variable affect backers’ funding contribution and lead to the success in crowd funding project.

The findings demonstrate that entrepreneurial experience in creating crowd funding projects which is consistent with previous studies. In addition, founders can learn from their own experience as a backer because funding other projects will help them to understand which factors are relevant to generate trust in potential backers. Therefore, we have contributed to the literature on reciprocity by showing that project creators are more successful in having their projects funded when they have previously backed other projects.

This research also provides several practical implications for crowd funding platforms and entrepreneurs. First, founders should add their experiences either in project creating or project backing into creator profiles and then refer their experiences to new proposals in order to develop their credibility or backers’ confidence. Second, entrepreneurs who have creative ideas and need seed funding to support their projects should improve the information related to their projects by providing informative contexts in various devices such as images, video and related project websites to enhance the possibility of success in crowd funding projects. Third, founders should provide a variety of reward types in order to fulfill the variety of backers’ individual satisfaction because the more different rewards a project offers, the more options a potential backer has to select and back the crowd funding project. Fourth, the project goal should be set at a reasonable funding amount and matched with necessary project costs as the setting of too high target funding leads to the failure of crowd funding projects.

Finally, in context of backers’ individual and social satisfaction, many backers proudly claim their contribution in crowd funding projects on their personal profiles and enjoy social recognition and communication in crowd funding communities. Thus, crowd funding platforms should facilitate and promote crowd funding communities to create a friendly and lively atmosphere among potential supporters to increase the probability of project success.

However, there are several limitations in this study. Firstly, this paper only studies reward-based crowd funding projects. Future studies could extend the research by studying other categories of crowd funding, such as donation-, lending-, equity-based crowd funding projects. Secondly, the sample size was quite small in the data analysis but the sample size was sufficient for applying logistic regression analysis. Future research should test and validate the model by collecting more sample sizes. Thirdly, the survey questionnaires were collected from a single source, Thailand. Future studies can examine the effect of cultural differences on psychological ownership in the crowd funding context.

Conclusion

Although crowd funding provides a new approach for entrepreneurs seeking funds for their businesses, there are still challenges to overcome to successfully fundraise from a crowd. This study examines which kind of project information from creator’s perspective and backer’s motivation variables affect backers’ funding contributions. The finding results evidently indicate that both project information variable from creator’s perspective and backer’s motivation variable are key factors contributed to the success in crowd funding project. Thereby, especially project information relating to creator’s experience, multimedia use, description elaborateness and campaign conditions can be used in order to attract attention towards a crowd funding project. Furthermore, as presented in our finding results, backer’s motivation variables in the context of individual and social satisfaction are both affected to support the success in crowd funding project.

Our study concluded that entrepreneurs who have past experiences in crowd funding, especially in successful experiences, are more likely to be successful in their fund raising (Kim et al., 2017; Daoyuan, 2016) as project creators who have more experience in crowd funding projects are highly likely to gain credibility, which leads to success in fundraising. In addition, founders’ experience backing other projects also has a positive relationship to project success.

Our study demonstrated that multimedia use has positive effects on backers’ funding contributions which corresponded to the previous studies which concluded that a higher number of images are also positively associated with funding success (Zhou et al., 2016; Kunz et al., 2017). Project founders should try to provide more richness in media, such as videos, to help potential backers to understand the project and encourage them to support campaigns (Daoyuan, 2016; Kunz et al., 2016). Moreover, project description elaborateness which consists of having a project website and numerous available rewards, has significant positive effects on backers’ funding contributions and this corresponds with the previous research findings (Kunz et al., 2017).

The findings on the component of campaign conditions which consist of campaign duration, funding goal and delivery time of reward have a negative relationship with backers’ contributions in crowd funding projects. Along campaign duration signals a lack of confidence in the project creators to successfully raise money which is consistent with the previous research studied by Zhou et al. (2016) and Kunz et al. (2017). For funding goals, a high funding target implies more effort is required by the project creator to legitimize the requested funding Frydrych et al. (2014). For the delivery time of reward, an increased delivery time may serve as a negative signal which may lead to a decreased probability of project success which corresponds with the previous research Kunz et al. (2017). In addition, an analysis of the model in the context of backers’ motivation reveals that both individual (Bretschneider et al., 2017; Kuo et al., 2014; Yen et al., 2005) and social satisfaction (Steigenberger, N., 2017; Zhao et al., 2017; Batson et. al., 1988) have significant impact on backers’ funding contributions to crowd funding projects.

Finally, this study also presents practical implications for entrepreneurs to enhance their chance to success by revisiting project preparation and implementation to address on key factors relating to creator’s experience, multimedia use, description elaborateness and campaign conditions to attract backers to contribute their money into the project. Furthermore, creator can provide more creative idea and project story to serve backer’s individual and social satisfaction to attract backers’ contribution into the project. In addition, our study results can provide recommendation for reward-based crowd funding platform policy to focus on platform design, in order to clearly display the project information related to key success factors in crowd funding to enhance the chances of success in crowd funding project.

For theoretical contributions, the current study can be extended from an explanatory to a predictive context by applying more advance statistical techniques. Consequently, machine learning techniques can be applied to assess the project’s success by considering finding results of entrepreneurial, project and campaign factors from this research.

References

- Batson, C.D. (1988). Altruism and lirosocial Behavior. McGraw-Hill, New York.

- Beaulieu, T.Y., Sarker, S., &amli; Sarker, S. (2015). A concelitual framework for understanding crowd funding. Communications of the Association for Information Systems, 37, 1-31.

- Belleflamme, li., Lambert, T., &amli; Schwienbacher, A. (2014). Crowd funding: Taliliing the right crowd. Journal of Business Venturing, 29(5), 585-609.

- Belleflamme, li., Omrani, N., &amli; lieitz, M. (2015). The economics of crowd funding lilatforms. Information Economics and liolicy, 33, 11-28.

- Berry &amli; Feldman (1985). Multilile Regression in liractice, 50, SAGE University lialier, liage 43

- Bi, S., Liu, Z., &amli; Usman, K. (2017). The influence of online information on investing decisions of Reward-based crowd funding. Journal of Business Research, 71, 10-18.

- Bretschneider, U., &amli; Leimeister, J.M. (2017). Not just an ego-trili: Exliloring backers’ motivation for funding in incentive-based crowd funding. The Journal of Strategic Information Systems, 26(4), 246-260.

- Cordova, A., Dolci, J., &amli; Gianfrate, G. (2015). The Determinants of Crowd funding Success: Evidence from Technology lirojects. lirocedia - Social and Behavioral Sciences, 181, 115-124.

- Cumming, D., Leboeuf, G., &amli; Schwienbacher, A. (2019). Crowd funding models: Keeli-it-all vs. all-or-nothing. Financial Management Association International.

- Daoyuan, S. (2016). What is the recilie for success? An emliirical analysis of crowd funding liroject lierformance. (10304462 M.S.), National University of Singaliore (Singaliore), Ann Arbor. Retrieved from httlis://search.liroquest.com/docview/1858801228?accountid=15637

- Frydrych, D., Bock, A. J., Kinder, T., &amli; Koeck, B. (2014). Exliloring entrelireneurial legitimacy in Reward-based crowd funding. Venture Caliital, 16(3), 247-269.

- Guan, L. (2016). A short literature review on reward-based crowd funding. lialier liresented at the 2016 13th International Conference on Service Systems and Service Management, ICSSSM 2016.

- Hair, J.F., Anderson, R.E., Tatham, R.L., &amli; Black, W.C., (1995). Multivariate Data Analysis. lirentice Hall, New Jersey.

- Hair, J.F., Black, W.C., Babin, B.J., &amli; Anderson, R.E. (2010). Multivariate Data Analysis (7th ed.). Ulilier Saddle River, NJ: lirentice Hall

- Kim, T., lior, M.H., &amli; Yang, S.B. (2017). Winning the crowd in online fundraising lilatforms: The roles of founder and liroject features. Electronic Commerce Research and Alililications, 25, 86-94.

- Kraus, S., Richter, C., Brem, A., Cheng, C.F., &amli; Chang, M.L. (2016). Strategies for Reward-based crowd funding camliaigns. Journal of Innovation &amli; Knowledge, 1(1), 13-23.

- Kunz, M.M., Bretschneider, U., Erler, M., &amli; Leimeister, J.M. (2017). An emliirical investigation of signaling in Reward-based crowd funding. Electronic Commerce Research, 17(3), 425-461.

- Kunz, M.M., Englisch, O., Beck, J., &amli; Bretschneider, U. (2016). Sometimes you win, sometimes you learn - success factors in Reward-based crowd funding. lialier liresented at the Multikonferenz Wirtschaftsinformatik, MKWI 2016.

- Kuo, Y.F., &amli; Wu, C.H. (2014). Understanding the drivers of slionsors' intentions in online crowd funding: A model develoliment. lialier liresented at the 12th International Conference on Advances in Mobile Comliuting and Multimedia, MoMM 2014.

- Mcfadden, D. (1973). Conditional logit analysis of qualitative choice behaviour. In li. Zarembka (Ed), Frontiers in econometrics (lili. 105-142). New York: Academic liress.

- Mcfadden, D. (1978). Quantitative methods for analysing travel behaviour of individuals: Some recent develoliments. In D. Hensher &amli; li. Stoliher (Eds.), Behavioural travel modelling (lili. 279-318). London: Croom Helm London.

- Mollick, E. (2014). The dynamics of crowd funding: An exliloratory study. Journal of Business Venturing, 29(1), 1- 16.

- Müllerleile, T., &amli; Joenssen, D.W. (2015). Key Success-Determinants of Crowdfunded lirojects: An Exliloratory Analysis. lialier liresented at the Data Science, Learning by Latent Structures, and Knowledge Discovery, Berlin, Heidelberg.

- Nagelkerke, N.J.D. (1991). A note on a general definition of the coefficient of determination. Biometrika, 78, 691- 693.

- Steigenberger, N. (2017). Why suliliorters contribute to reward-based crowd funding. International Journal of Entrelireneurial Behaviour and Research, 23(2), 336-353.

- Valanciene, L., &amli; Jegeleviciute, S. (2013). Valuation of crowd funding: benefits and drawbacks. Economics and Management, 18(1), 39–48.

- Yen, H.R., Hsu, S.H.Y., &amli; Huang, C.Y. (2011). Good soldiers on the web: understanding the drivers of liarticiliation in online communities of consumlition. International Journal of Electronic Commerce, 15(4), 89-120.

- Yu, li., Huang, F., Yang C., Liu Y., Li, Z., &amli; Tsai, C. (2018). lirediction of Crowd funding liroject Success with Deeli Learning. lialier liresented at the 2018 IEEE 15th International Conference on e-Business Engineering (ICEBE).

- Zhao, Q., Chen, C.D., Wang, J.L., &amli; Chen, li.C. (2017). Determinants of backers’ funding intention in crowd funding: Social exchange theory and regulatory focus. Telematics and Informatics, 34(1), 370-384.

- Zheng, H., Xu, B., Zhang, M., &amli; Wang, T. (2018). Slionsor's cocreation and lisychological ownershili in reward- based crowd funding. Information Systems Journal.

- Zhou, M., Lu, B., Fan, W., &amli; Wang, G.A. (2016). liroject descrilition and crowd funding success: an exliloratory study. Information Systems Frontiers, 20(2), 259-274.