Research Article: 2022 Vol: 25 Issue: 6S

Sustainability reporting: A Panacea to corporate earnings management in the 21st century

Joshua Abimbola Abosede, Mountain Top University

Akintoye R.Ishola, Babcock University

Citation Information: Joshua, A.A., & Akintoye, R.I. (2022). Sustainability reporting: A Panacea to corporate earnings management in the 21st century. Journal of Management Information and Decision Sciences, 25(S6), 1-16.

Keywords

Sustainability Reporting (SR), Corporate Social Responsibility (CSR), Earnings Management, Stakeholders and Voluntary Disclosures

Abstract

Transparency in the financial report is an important consideration for the investing environment. The study aimed at unravelling the consequence of SR on the earnings management (real activities of earnings management) of the listed manufacturing companies in Nigeria. The population for the study involves all the listed manufacturing companies and using purposive sampling method due to availability of information, Nine (9) manufacturing companies were selected covering the period of 2015-2019 (5 years). Mechanistic approach of content analysis was adopted to analyse the stand-alone sustainability report and the annual report of the companies in other to arrive at their sustainability disclosure index. The study data were analysed with the aid of multiple linear regression analysis of SPSS 21. Empirically, the study revealed that there exist a significant but negative effect of sustainability reporting on the real activities of earnings management at t=-3.371, p-value (0.002)<0.05 meaning that companies that involved in the disclosure of sustainability reporting will have a lower involvement in earnings management grounded in the legitimacy and ethical theory. The study confirmed a significant and negative relationship between the sustainability reporting and earnings management at (r=-0.477, p-value=0.001). The study also indicated a positive and significant relationship between sustainability and return on assets (ROA) at (r=0.359, p – value=0.015< 0.05). Therefore, the study suggested that more regulations should be instituted on sustainability reporting so as to encourage all companies to disclose sustainability in order to enhance good reputation and better performance.

Introduction

Sustainability reporting has become prominent in the light of 21st century global economic changes and corporate financial crises which demands for more disclosure from corporate entities about challenges and opportunities facing them. The interest of stakeholders has gone beyond the traditional financial information to non-financial indicator which makes the issue of sustainable development critical both to the society and businesses (ACCA, 2010). Therefore, organisations have opportunity to evaluate its relationship and action as regards the economic, social, environmental challenges and corporate governance (Adiasih et al., 2018; Otuya et al., 2019; Malo-Alain et al., 2019).

The focus of sustainability reporting has gone beyond the economic value but rather with the inclusion of environmental and social value (Yip et al., 2011; Nnamani et al., 2017; Akintoye et al., 2020). According to Rezaeel (2015), there are five measures to sustainability performance which include economic, environment, ethical, governance and social. Sustainability reporting is a corporate practices and policies that manage, evaluate and govern the consequences of firms’ responsibilities on the society and the environment (Christensen et al., 2019). However, organisations owe beyond financial accountability to their various stakeholders (Yip et al., 2011).

Sustainability reporting came into existence in the mid-90sin conjunction with the disclosure guidelines of Global Reporting Initiative (GRI) framework of 1999 as a guide for accountability to different stakeholders both external and internal stakeholders (Muhammad, 2014). However, when SR voluntarily disclose economic, social and governance performance, it has a direct and positive link with organisations earnings quality which aim at maximizing wealth and value of corporate entities (Rezaee & Tuo, 2017; Yip et al., 2011). The extent of disclosing Economic, Social and Governance (ESG) has relationship with level of transparency in an organisation and the ability of management to enhance a better performance improvement in the future since CSR disclosure increase public attention and scrutiny (Palit, 2018). Sustainability reporting is seen as a vital aspect of success and survival for organisations which requires greater demand to be more transparent on how organisations handle their environment, their employees and their communities (Asuquo et al., 2018).

According to the study of Ernfjord & Voigt (2018), corporate social responsibility disclosures improved transparency in which the opposite direction can be termed earnings management. The focus of earnings management is to present a financial statement that is misleading to the stakeholders through the management actions of altering the performance of economic activities and earnings quality reported thereby reducing the financial reporting quality. According to Manurung & Suhartadi (2014) earnings management involves management intervention using discretion into the process of financial reporting thereby misleading the stakeholders (Abraham et al., 2015). Scholtens & Kang (2013) opined that the earnings management is unethical which is contrary to Corporate Social Responsibility disclosures and thereby having a negative overall effect on stock price (cited in Ernfjord & Voigt, 2018).

Orlitzky, et al., (2003) stated that when companies disclosed more than its economic value, it enhance positive image for the company among the stakeholders which help to build good relations with the communities and better negotiate with the suppliers and government and also overcome the problems with traditional accounting(cited in Manurung & Suhartadi, 2014; Malo-Alain et al., 2019). Pye & Lee (2013) observed that due to lack of integrity on the part of some managers, sustainability reporting can be used opportunistically for the interest of the managers involved and not strategically tailored to maximize the interest of stakeholders and that of the company. However, companies that has ethical value will demonstrate integrity, honesty, sincerity, and trustworthy by being socially responsible to the stakeholders which include the shareholders, the community, employees, customers, suppliers and government (Siueia & Wang, 2019). The integrity motivated company will rather focus on delivering more values to their stakeholders and thereby less involved in earnings management (Suieia & Wang, 2019).

Therefore, the study focuses on checking out the effects as well the relationship between sustainability reporting and corporate earnings management in the Nigerian context. Several researches have been conducted to explore the link between the sustainability reporting or CSR and the quality of earnings, earnings management (accruals), externalities, firms’ performance in Nigeria and international context which include the United Kingdom (UK), the United State of America (USA), China, South Korea, Saudi etc. and some of which are Yip, et al., (2011); Pyo & Lee, (2013); Ibrahim, et al., (2015); Trisnawati, et al., (2016); Rezaee & Tuo, (2017); Hartwig, et al., (2019); Suieia & Wang (2019), Asuquo, et al., (2018); Whetman (2018); Uwalomwa, et al., (2018). However, the connection between the SR and earnings management considering the real earnings activities of management is rudimently explored in Nigeria and international which led the researcher to embark on this study. Therefore, the study will be answering the following research questions.

i. What is the effect of sustainability reporting on earnings management practices in Nigeria?

ii. To what extent is the relationship between sustainability reporting and earnings management practices in Nigeria?

Literature Review and Hypotheses

Theoretical Review

Legitimacy Theory

No organisation has an inherent right to exist except being accepted by the society. As organisation tries to be accountable to different stakeholders including the community and environment in which it operates, it will be legitimately liable to explore natural and human resources in its environment (Bashatweh & Jordan, 2018). An organisation owes an abstract agreement with the society in which it adopts socially oriented behaviour in order to earn social advantage (Vitolla & Rubino, 2017). Any breach of this social contract can endanger the survival of a firm. The study focuses on Legitimacy theory and ethical theory. According to Mousa & Hassan (2015), legitimacy theory indicates the association between a firm and its society and the motivating factor for disclosing issues relating to social and environmental matters (cited in Uwuigbe et al., 2018; Trisnawati et al., 2016; Bashatweh & Jordan, 2018). Firms are expected to operate within the rules and expectation of firms which they operate (Yipp et al., 2011). Therefore, for any firm to survive and continue operation, it must be socially relevant and accountable to its environment.

Ethical Theory

Ethical theory focuses on the notion of classical utilitarian which is the main focus for all the ethical theories. The theory holds on the fact that total cost and benefit to the society should be the basis for any action which is the action ought to be followed (Kamptein & Wempe, 2002). The theory holds on the premise that any action taking either by individual or corporate entity should tend towards the maximization of the common good of the society as a whole. The theory believes that motives behind any action are as a result of its expected consequences which can be demonstrated in the diagram below;

Conceptual Review

Sustainability Reporting (SR)

SR is a widely acceptable practice that has its focus on the recommendations of the Global Reporting Initiatives (GRI). GRI guidelines have been effective and powerful indicators of the environment, social and economic of business entities. According to Elkington (2004) sustainability also known as triple bottom line is the ability of corporate entity to prepare three different bottom line financial statement which include the traditional income statement which is a measure of corporate profit, the people account which is an indication of how socially responsible a company is and planet account which is an indication of how a corporate entity has been environmentally responsible (cited in Nnaemeka et al., 2017). Therefore, the triple bottom line focuses on profit, people and planet (3Ps) which can be referred to as the Economic, Social and Environmental factor (Nnaemeka et al., 2017; Palit, 2018).

SR is viewed as a subset of financial accounting that focuses on the disclosure of non-financial information (Adiasih et al., 2018; Palit, 2018) which has great effect on the reputation. The Global Reporting Initiatives (GRI, 2015), opined that Sustainability reporting or Corporate Social Responsibility (CSR) should be the result of both compulsory responsibilities and voluntary initiatives (cited in Ernfjord & Voigt, 2018). However, the voluntary disclosures are gradually becoming mandatory whereas the voluntary disclosure has been seen to enhance reputation, increase firms’ value and expected future value (Adiasih et al., 2018; Martinez, 2016 in Rezaee & Tuo, 2017).

Sustainability Reporting also known as the Tripple Bottom Line (TBL) is seen according to Potts (2004) as a means of directing, evaluating and reporting to the entire public the multi-faceted performance of an entity. Tripple Bottom Line is simply the process for the wider view of SR. Inherent in sustainability reporting is meeting generation needs both currently and future such as the unequal distribution of goods and services (Potts, 2004). Therefore, TBL is a performance evaluation approach that seeks to establish the link between the economic, social and environmental factors.

SR is also known as the Corporate Social Responsibility (CSR) which takes into account employees wellbeing, the general communities it serves and the environmental protection (Whetman, 2018). According to Asuquo, et al., (2018), SR stands on the opinion that as firms are striving hard to achieve the traditional objectives of maximising profit, it is very imperative to achieve this objective through activities that consolidate both the environmental and social into the process of decision making. However, many stakeholders are increasingly developing interest in the disclosure beyond the traditional performance of profit. According to the study of Dhaliwal, et al (2011,2012), voluntary disclosure of corporate social responsibility can attract more institutional investors and analyst thereby reducing future error forecast.

Earnings Management (EM)

Accounting information should aim at presenting reliable information to different stakeholders however organisations try using opportunity available to present attractive earnings to stakeholders. The study of Healy & Wahlen (1999) stated that EM involves using management perception to restructure transactions in the financial statement in order to make the stakeholders believe the fictitious economic performance of an organisation or to manipulate the outcome of contractual relationship which has both cost and benefit effect (cited in Janssen, 2017). Yip, et al., (2011) opined that EM involves using the management discretion to alter accounting figures which is the reverse of earnings quality and has negative effect on the financial reporting quality (Ernfjord & Voigt, 2018). According to Walker (2013), there are three motives for EM. The first motive is primarily to achieve compensation and debt covenant related to contractual agreement. Secondly, to influence the investors as to the expectation of the future cash flows and the third motive is to influence the interest of the third parties such as the competitors, suppliers, customers concerning the affairs of the corporate entity (cited in Ernfjord & Voigt, 2018). The extensive use of EM is an erroneous way of presenting financial reporting.

EM is categorised into Accrual-Based Earnings Management (ABEM) and the Real Earnings Management (REM). According to Braam, et al., (2015), ABEM could be achieved when the application of selected accounting policies is aimed at achieving earnings objectives (cited in Janssen, 2017). Accrual based earnings management involves the application of explicit discretionary accruals such as the business settings, accounting policies and firms’ business model to manage the earnings. However, REM occurs when organisations try to change their operating policies in order to achieve short term reporting policies (Strivastava, 2019). Earnings management activities exceed that of accruals manipulation and rather involve manipulation of real operating activities such as reduction of advertisement cost, and that of Research and Development (R&D) in order to improve earnings figures (Rowchoudhury, 2006). It tends towards measuring a firm’s cost to that of its industry peers. According to (Healy & Wahlen, 1999; Roychowdhury, 2006), other ways in which management could manipulate real activities includes giving discount for sales promotion in order to accelerate sales temporarily, overproduction in order to reduce cost of sales cited in (Zhu & Lu, 2013).

Empirical Review

The study of Ernfjord & Voigt (2018) in Swedish context to establish the relationship between CSR disclosure and EM revealed that there is a negative-significant connection between the CSR disclosure and EM (transparent reporting hypothesis) which is based on reputation, culture, external monitoring hypothesis and ethical. This study agreed with the research of Trisnawati, et al., (2016) in Indonesia context. The study revealed that all the components of SR have negative-significant effect on EM.

The research carried out by Pyo & Lee (2013), revealed that the donations and earnings quality relationship is more pronounced when companies voluntarily issue corporate social responsibility report with GRI. However, the reverse is the case with the research of Siueia & Wang (2019) reveals that opportunistic managers use corporate social responsibility as a device to strategically engage in the EM which is the poorer earnings quality.

The study of Akintoye, et al., (2020) revealed that sustainability reporting impacted more on disclosing the economic indicator but less impacted on the social and environmental disclosures. Therefore, the study recommended that only mandatory disclosure of sustainability reporting will ensure sufficient disclosures in Nigeria. The study of Uwuigbe, et al., (2018) investigated SR and firms’ performance (Deposit Money Banks - DMBs) in the Nigeria using a two-way directional approach. The outcome revealed that there is a two-way association between the SR and DMBs’ performance as SR related with the performance, the performance of the DMBs’ also related with SR.

The study of Janssen (2017), to determine whether corporate socially responsible firms do participate in the EM practices. The study revealed that earnings management practices are common withf irms in the masculine countries when compared to firms in the feminine countries considering the real aspects of earnings management and because of the aggressive nature of REM within the masculine environment, there is higher possibility of earnings management.

The study of Rezaee & Tuo (2017) to determine the quantity and quality of SR disclosures associated with both the discretionary and innate EM in the context of culture and corporate ethical value considering SR factors such as environmental, social and governance. The study adopted difference-to-difference test and OLS regression analysis. The findings revealed that the disclosures of SR quantity have a positive association with earnings quality and on the other hand negatively associated with discretionary earnings quality in reducing unethical opportunistic EM reporting practices of management. It was further revealed that SR disclosure quality could enhance significant-positive relationship with the innate earnings quality.

The study of Malo-Alain, et al., (2019) to determine the effects of SR disclosures on the quality of financial report in Saudi business disclosed a negative but significant correlation between the disclosures of SR and discretionary accruals which could mean that an extensive disclosure of sustainability reporting could lead to decrease in the discretionary accrual practices of management.

The findings also revealed that sustainability disclosure has a positive correlation with the accounting conservatism practices.

The study of Yipp, et al., (2011) opined that the study of association between the CSR and EM is context specific. Therefore, the study considers the association in the context of political environment. The study revealed that the association between CSR and EM is basically affected by the political environment and not by the considerations of ethics.

H1 SR has no significant effect on the EM practices of listed companies in Nigeria

H2 There is no significant association between the SR and EM practices of listed companies in Nigeria.

Methodology

For the purpose of achieving the objectives of this study, the study employed cross-sectional data extracted from the annual financial report and the stand-alone SR of Nine (9) listed manufacturing companies in Nigeria covering the period of five years (2015-2019). The Nine manufacturing companies were purposely selected due to easy access and availability of data useful for the study. Therefore, the study adopted purposive sampling technique in line with the guidance of Kerjice & Morgan cited in (Uwuigbe et al., 2018) which stated that 5% minimum of a population can be considered appropriate for generalising a population. Mechanistic approach of content analysis was adopted which supersedes the interpretive approach (Ernfjord & Voigt, 2018) to analyse the information needed for the study using SPSS version 21 software as a statistical tool to analyse the data spooled from the respective annual reports using both descriptive and inferential statistical analysis. The study adopted multiple regression analysis to unravel the stipulated objectives.

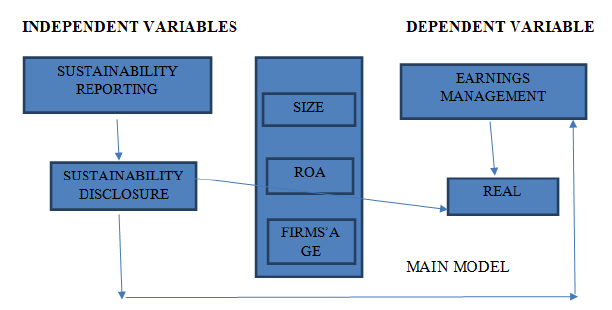

Independent Variables

As a guide for considering appropriate information to be considered for the study to determine the sustainability quality and quantity, the guidelines given by the Global Reporting Initiatives (GRI) standards for sustainability disclosure index under the three major indicators of sustainability performance which include the Economic, social and environment was considered. The standards indicate about 3 universal standards for every company that prepares a sustainability report and 33 topic-specific standards organised under the three main headings. The study of Dhaliwal, et al., (2011, 2012), cited in Rezaee & Tuo (2017) dummy variables was adopted to proxy sustainability disclosures. The unweight sustainability reporting index was adopted using 2 for full disclosure which has to do with the quality of sustainability disclosure based on GRI framework, 1 for partial disclosure and 0 for non-disclosure of the individual indicator respectively. Sustainability disclosure index will be arrived at for each company by calculating the sum of scores for each company divided by total expected scores (Uwuigbe et al., 2018).

Dependent Variable

Several researches have measured earnings management using the accruals based EM (Yip et al., 2011; Grougiou et al., 2014; Rezaee & Tuo, 2017; Ernfjord & Voigt, 2018). However, this study considered the Real Activities of Earnings Management (REM) which can be justified on the premise that research on real earnings management is still at the rudiment. According to the study of Adiasih, et al., (2018); Braam, et al., (2015) cited in (Janssen, 2018) to arrive at the real earnings management, the normal estimate computed using any of the understated following formulas. However, the abnormal estimate which is the real earnings management can be obtained by subtracting the actual cash flows, actual production cost and the actual expenditures from the estimate arrived at using the formula stated as follows:

i. Estimated Normal Operational Cash flows

CFOit/Assetsit-1= β1(1/Assetsit-1)+β2(Salesit/Assetsit-1)+β3(ΔSalesit/Assetsit-1)+εit.

Where:

CFOit= Company’s operational cashflows in year t.

Ait-1=Company’s total assets in the preceding year t-1

Salesit=Total sales value for the year t.

ΔSalesit= Change in sales between the previous year t and t-1

ii. Estimated Normal Production Cost

Prodit/Assetsit-1=β1(1/Assetsit-1)+β2(Salesit/Assetsit-1)+β3(ΔSalesit/Assetsit-1)+β4(ΔSalesit/Assetsit-1)+εit.

Where:

Prodit=The total cost of goods sold of company i in year t. Other variables are as stated above.

iii. Estimated Normal Discretionary expenses

Disxit/Assetsit-1= β1(1/Assetsit-1)+β2(ΔSalesit/Assetsit-1)+β3(Salesit/Assetsit-1)+εit

Where:

Disxit=is the total discretionary expenses arrived at by sum of R&D, general administrative and selling expenses of company i in year t. Other variables are as stated above.

However, the real earnings management considered for the study was the abnormal cash flow.

According to Braam, et al., (2015), the abnormal cash flow can be arrived at by subtracting the estimated normal cash flow from the actual (Janssen, 2017; Adiasih et al., 2018). Therefore, the estimated normal cash flow will be arrived at as follows:

CFOit/Ait-1= β0+β1(1/Ait-1)+β2(Salesit/Ait-1)+β3(ΔSalesit/Ait-1)+εit

Control Variables

The study incorporated some control variables into the model which include AGE, SIZE and ROA supported by the study of Ernfjort & Voigt (2018); Kim, et al., (2012); Janssen (2017). The AGE was a measurement of the natural logarithms of the number of years of incorporating the business, the SIZE of the firm was represented by the natural logarithm of total assets while the ROA was a measurement of profit after tax divided by the total assets.

Empirical Model

The following model established the effect of sustainability reporting on earnings management.

EMit=β0+β1SUS.REPit+β2ROAit+β3SIZEit+β4FIRMS_AGE+εit

Where:

EM=is a measurement of the real earnings management.

SUS.REP=SR measured by sustainability indicators in line with the GRI guidelines.

ROA=is the measurement of the return over total assets.

SIZE=is measured by the natural logarithm of total assets.

FIRM_AGE=is the measurement of the natural logarithm of (1+ number of years) that the company has been in existence

The Researcher’s Conceptual Model

Data Presentation and Analysis

Descriptive Result

| Table 1 Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis | |||

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | Std. Error | |

| RE - Real Earnings Management | 45 | -2.08 | -0.07 | -0.8594 | 0.40317 | -0.741 | 0.354 | 0.762 | 0.695 |

| AG- Age | 45 | 1.7 | 2.08 | 1.8329 | 0.1151 | 1.106 | 0.354 | -0.042 | 0.695 |

| SI – Size | 45 | 6.6 | 8.77 | 8.0253 | 0.62605 | -1.024 | 0.354 | 0.336 | 0.695 |

| SU - Sustainability Reporting | 45 | 0.29 | 0.85 | 0.6269 | 0.18238 | -0.614 | 0.354 | -0.919 | 0.695 |

| RO - Return on Assets | 45 | -0.08 | 0.27 | 0.062 | 0.07269 | 1.291 | 0.354 | 2.228 | 0.695 |

| Valid N (listwise) | 45 | ||||||||

The table above reveals the descriptive statistics and the normality test of the variables. According to the study of Ibrahim, et al., (2015), normality of data is established if the skewness is between+1.96/-1.96 and kurtosis is within+2/-2. From the table 1 above, all the variable considered were under this range and therefore, they are normally distributed. The mean statistics of real earnings management (dependent variable) is 85.9% which indicate majority of entities are involve in the real activities of earnings management either intentionally or otherwise. The standard deviation is 40.3% which indicates the variability in the real activities of EM among the companies sampled and the range is between -2.08 and -0.07. However, the table also revealed the mean of sustainability reporting (independent variable) proxies by the disclosure index to be 62.69% which indicates the percentage of companies actually disclosing sustainability reporting in line with GRI framework guidelines either as a separate reporting or in addition with the annual financial report. The standard deviation 18.2% which is an indication that the variation in the sustainability disclosure of listed companies is wide with the maximum statisticsof 85% and minimum of 29%. In addition, Age has the mean statistics of 1.8329 and the range of 1.70 - 2.08. The size has the mean statistics of 8.0253 and the range of 6.60–8.77 while the Return on Assets (ROA) has a mean statistics of 0.0620 and the range of -0.08–0.27 respectively.

Correlation and Multiple Regression Analysis Result

The table 2 and table 3 present the result of the correlation coefficient analysis (Pearson and Spearman’s correlation. The result reveals positive and negative correlation for all the variables under consideration.

| Table 2 Correlations |

||||||

|---|---|---|---|---|---|---|

| Re - Real Earnings Management | Ag- Age | Si – Size | Su - Sustainability Reporting | Ro - Return On Assets | ||

| Pearson Correlation | Re - Real Earnings Management | 1 | 0.211 | 0.052 | -0.426 | -0.195 |

| Ag- Age | 0.211 | 1 | 0.036 | 0.211 | -0.185 | |

| Si – Size | 0.052 | 0.036 | 1 | -0.155 | 0.018 | |

| Su - Sustainability Reporting | -0.426 | 0.211 | -0.155 | 1 | 0.286 | |

| Ro - Return On Assets | -0.195 | -0.185 | 0.018 | 0.286 | 1 | |

| Sig. (1-tailed) | Re - Real Earnings Management | . | 0.082 | 0.368 | 0.002 | 0.099 |

| Ag- Age | 0.082 | . | 0.407 | 0.082 | 0.112 | |

| Si – Size | 0.368 | 0.407 | . | 0.155 | 0.453 | |

| Su - Sustainability Reporting | 0.002 | 0.082 | 0.155 | . | 0.028 | |

| Ro - Return On Assets | 0.099 | 0.112 | 0.453 | 0.028 | . | |

| N | Re - Real Earnings Management | 45 | 45 | 45 | 45 | 45 |

| Ag- Age | 45 | 45 | 45 | 45 | 45 | |

| Si – Size | 45 | 45 | 45 | 45 | 45 | |

| Su - Sustainability Reporting | 45 | 45 | 45 | 45 | 45 | |

| Ro - Return On Assets | 45 | 45 | 45 | 45 | 45 | |

The table 2 shows the Pearson correlation analysis result which indicates a high correlation between the variable of interest. The Real Earnings Management (REM) is significantly negatively associated with SR (r=-0.426, p-value=0.002) which shows that companies that voluntarily disclosed sustainability will have a lower involvement in the EM activities in order to enhance good reputation and stakeholders’ interest which is in agreement with the study of Suieia & Wang (2019) that stated that companies with low corporate social responsibility disclosure will be likely to be more engaged in EM. Earnings management is positively and insignificantly correlated with age (AGE) (r=0.211, p-value=0.082>0.05) and size of the business (SIZE) with r=0.052 and the p–value of 0.368>0.05. The real earnings management is insignificantly negatively associated ROA with (r=-0.195, p-value=0.099> 0.05). Finally the result also revealed a significant-positive association between the SR and ROA as(r=0.286, p–value=0.028< 0.05) supported by the study of Uwuigbe, et al., (2018).

| Table 3 Correlations |

|||||||

|---|---|---|---|---|---|---|---|

| RE - Real Earnings Management | AG- Age | SI - Size | SU - Sustainability Reporting | Ro - Return On Assets | |||

| Spearman's Rho | Re - Real Earnings Management | Correlation Coefficient | 1 | .313* | 0.12 | -.477** | -0.019 |

| Sig. (2-Tailed) | . | 0.036 | 0.433 | 0.001 | 0.903 | ||

| N | 45 | 45 | 45 | 45 | 45 | ||

| Ag- Age | Correlation Coefficient | .313* | 1 | 0.008 | 0.15 | 0.022 | |

| Sig. (2-Tailed) | 0.036 | . | 0.957 | 0.324 | 0.886 | ||

| N | 45 | 45 | 45 | 45 | 45 | ||

| Si – Size | Correlation Coefficient | 0.12 | 0.008 | 1 | -0.111 | -0.056 | |

| Sig. (2-Tailed) | 0.433 | 0.957 | . | 0.466 | 0.713 | ||

| N | 45 | 45 | 45 | 45 | 45 | ||

| Su - Sustainability Reporting | Correlation Coefficient | -.477** | 0.15 | -0.111 | 1 | .359* | |

| Sig. (2-Tailed) | 0.001 | 0.324 | 0.466 | . | 0.015 | ||

| N | 45 | 45 | 45 | 45 | 45 | ||

| Ro - Return On Assets | Correlation Coefficient | -0.019 | 0.022 | -0.056 | .359* | 1 | |

| Sig. (2-Tailed) | 0.903 | 0.886 | 0.713 | 0.015 | . | ||

| N | 45 | 45 | 45 | 45 | 45 | ||

| *. Correlation Is Significant At The 0.05 Level (2-Tailed). | |||||||

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||||

The Spearman’s correlation table above reveals the same result with the table 1. The table reveals that the REM has a negative and significant relationship with sustainability reporting of (r =-0.477, p-value=0.001) at a 1% level of significance supported by Suieia & Wang (2019). The result also revealed negative-insignificant association between the earnings management and Return on Assets (ROA) with (r=-0.019, p–value=0.903>0.05). However, there is a positive-significant relationship between the EM and age with (r=0.313, p-value=0.036<0.05). The table also revealed a positive-insignificant association between the EM and size (r=0.120, p–value= 0.433>0.05). Finally, the result revealed a positive-significant relationship between the Sustainability Reporting (SR) and ROA (r=0.359, p–value=0.015<0.05) supported by Uwuigbe, et al., (2018).

| Table 4 Model Summaryb |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 1 | .527a | 0.277 | 0.205 | 0.35943 | 0.277 | 3.84 | 4 | 40 | 0.01 | 1.703 |

| a. Predictors: (Constant), Age - Age of the Firm, Size - Size of the Firm, Roa - Return on Assets, Sus - Sustainability Reporting | ||||||||||

| b. Dependent Variable: RE - Real Earnings Management | ||||||||||

The table 4 above is the summary of model which indicated that the adjusted R-squared accounted for 20.5% means that the variability in REM is as a result of 20.5% variability in the independent variable (SR). The standard error of estimate is 35.9% which is considerable to predict the confidence interval for the predictive values. The F-test 3.840 is significant statistically at p-value (0.010)<0.05. The Durbin-Watson scores shows 1.703 which falls into the conventional acceptable level of 2 in accordance to the study of Asuquo, et al., (2018).

| Table 5 Anovaa |

||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 1.984 | 4 | 0.496 | 3.84 | .010b |

| Residual | 5.168 | 40 | 0.129 | |||

| Total | 7.152 | 44 | ||||

| a. Dependent Variable: RE - Real Earnings Management | ||||||

| b. Predictors: (Constant), Age - Age of the Firm, Size - Size of the Firm, Roa - Return on Assets , Sus - Sustainability Reporting | ||||||

The F- ratio in table 5 (ANOVA) tests whether in overall, the regression model is a good fit for the data. The table shows that the overall model in this study is significant which means that the SR and the other variables are significant predictions of REM since F (4, 40)=3.840, p (0.010)>0.05.

| Table 6 Coefficientsa |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | 95.0% Confidence Interval for B | Correlations | Collinearity Statistics | |||||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Zero-order | Partial | Part | Tolerance | VIF | |||||

| 1 | (Constant) | -2 | 1.108 | -1.83 | 0.08 | -4.27 | 0.2 | |||||||

| Sus - Sustainability Reporting | -1.1 | 0.329 | -0.5 | -3.37 | 0 | -1.77 | -0.4 | -0.426 | -0.47 | -0.453 | 0.82 | 1.224 | ||

| Roa - Return on Assets | 0 | 0.809 | 0.01 | 0.05 | 0.96 | -1.59 | 1.7 | -0.195 | 0.008 | 0.007 | 0.85 | 1.179 | ||

| Size - Size of the Firm | -0 | 0.088 | -0 | -0.28 | 0.78 | -0.2 | 0.2 | 0.052 | -0.044 | -0.037 | 0.96 | 1.038 | ||

| Age - Age of the Firm | 1.1 | 0.501 | 0.32 | 2.23 | 0.03 | 0.107 | 2.1 | 0.211 | 0.333 | 0.3 | 0.88 | 1.133 | ||

| a. Dependent Variable: Re - Real Earnings Management | ||||||||||||||

The coefficient table 6 above indicate the consequences of SR and other variables on the REM. The result shows that SR and age had positive-significant and negative-significant influence on REM with β1=-0.501, t=-3.371, p-value (0.002)<0.05 and β4=0.320, t=2.234, p-value (0.031)<0.05. Also, return on assets and size had positive-insignificant and negative-insignificant influence on REM with β2=0.008, t=0.054, p-value (0.957)>0.05, β3=-0.038, t=-0.276, p-value (0.784)>0.05. The table shows that the SR has a negative-significant effect on real earnings management at t- value of 0.002. The table also revealed the test for multicollinearity. The rule of thumb to check for multicollinerity between the variables is that the VIF for each variable should not be>10 or tolerance>0.1 (Dhakal, 2016) cited in Dhakal (2018). However, from the table 6 above, the VIF for each variable is less than 10 which is within the acceptable range. Therefore, the model of the study can now be stated as follows:

EM=-2.025 – 0.501SUS.REPit+0.008ROAit – 0.038SIZEit+0.320FIRMS_AGEit+εit

Discussion of Findings and Implications

The table 2 and 3 revealed the association between the SR and REM. The result indicated that Sustainability Reporting had negative-significant association with the REM. From the Pearson correlation table (table 2), t=-0.426, p-value=(0.002)<0.05 and the Spearman correlation table (table 3), t=-0.477, p-value (0.001)<0.01indicating that Sustainability has a way of mitigating the real activities of EM as a result of accountability and transparency of relevant information both the non-financial and financial information. This view was supported by the research study of Suieia & Wang (2019) that stated that companies with low corporate social responsibility disclosure will be more likely involve in EM practices and the study of Pyo & Lee (2013) also confirmed that firms that actively involved in CSR will report earnings of higher quality. The tables also revealed positive-significant association between the SR and the ROA at t=0.286, p-value (0.028)<0.05; t=0.359, p-value (0.015)<0.05 indicating that engaging sustainability has a positive implication on the profitability and growth of the firm most especially on the long term basis supported by the study of Uwuigbe, et al., (2018) which stated that firms with improved disclosure of SR have better firm performance related to revenue generated. The view was also supported by Rezaee &Tuo (2017) and Yip et al, (2011) that voluntary disclosure of sustainability reporting has a way of enhancing earnings quality thereby maximizing stakeholders’ wealth. The tables also indicated positive-insignificant association between the EM and size with t=0.052, p-value(0.368)>0.05, t=0.120 and p-value (0.433)> 0.05. This shows that any firm either big or small can involve in manipulating the real activities of the business in order to present a favourable result. However, the result also revealed positive-significant association between the EM and age with t statistics value of 0.313 and p-value (0.036)<0.05. The implication of this is that firms either newly incorporated or has been in existence can involve in earnings management practices and that as organisations grow higher there is higher tendency of involving in the real activities of EM.

The table 4 revealed the model summary of the study. The adjusted R-square of 20.5% shows that 20.5% variability in the REM can be explained by the variation in the SR of the model and that the remaining 79.5% can be explained by the factors outside the model of the study. The correlation coefficient of (R=52.7%) indicated a positive-moderate association between the EM and the independent variables (Sustainability reporting, ROA, Size and Age). The F-test 3.840 is significant statistically at p-value (0.010)>0.05 indicating that the variables used in the model had a goodness fit and they are good predictor of the REM. The overall effect of the model indicated a positive and significant result that calls for the rejection of null hypothesis.

H1 Sustainability reporting has no effect on the earnings management practices of listed companies in Nigeria

From the table 6, it could be depicted that SR has a negative-significant effect on EM att-statistic=-3.371 and the p–value=0.002<0.05. This indicate that companies that voluntary disclose sustainability reporting have lower involvement in the real activities of EM practices or have lower involvement in earnings management in order to enhance reputation and to attract more stakeholders into the business supported by Pyo& Lee (2013); Trisnawati, et al., (2016); Rezaee & Tuo (2017); Ernfjord &Voilt (2018); Suieia & Wang (2019). Therefore, the H0will be rejected and we conclude that sustainability reporting has a significant effect on EM practices.

H2 There is no significant association between the SR and EM practices of listed companies in Nigeria.

The tables indicated a negative-significant association between the SR and the REM with the t-statistics of (r=-0.426, p-value=0.002<0.05) from the table 2 (Pearson correlation). Also, from the correlation table 3 (Spearman’s correlation) it could be depicted also that SR has a negative-significant association with REM with t-statistics value of -0.477 and p-value (0.001)<0.01 supported by the study of Malo-Alain, et al., (2019). Therefore, a call for the rejection of the null hypothesis and conclusion that there exist a significant association between the SR and REM.

Conclusion and Recommendations

The study seeks to unravel the consequences of sustainability reporting on EM activities (real activities of earnings management) of listed manufacturing companies in Nigeria which was established by checking out the financial report and the SR of the companies under consideration. Empirical, findings of the study revealed that SR has a negative-significant effect on REM activities of listed companies considered for the study which means that quality disclosure of SR has a mitigating effect on earnings management practices as stated by Uwuigbe, et al., (2018) that reporting sustainability matters will present organisation as legitimate in the sight of the general public supported by the legitimacy theory. Therefore, the study concluded that reporting quality sustainability reporting will enhance organisations’ performance as it will increase stakeholders’ attraction, enhance customer base, improve reputation which will in tune increase overall performance of organisation thereby having a negative effect on REM by curbing an act of EM activities. The study recommended that SR should be more regulated and more pronounced standards should be established for uniformity and comparability. Also, SR should be mandatory to all listed companies even the non-listed should be encouraged to issue a quality and voluntary SR in order to improve reputation and on the long run enhance better performance.

Acknowledgement

The authors appreciate Mountain Top University for sponsoring the research.

References

ACCA. (2010). Sustainability reporting matters. What are national government doing about it?

Adiasih, P., Effendy, A., Yuwono, C.D., & Octavia, N. (2018). Do the earnings management, governance, media exposure and ownership structure have any effect on the ESG disclosures?Journal of Economics and Business, 1(4), 564-576.

Crossref, GoogleScholar, Indexed

Akintoye, I.R., Adegbie, F.F., & Anyahara, I.O. (2020). Sustainability reporting practices of listed companies in Nigeria.

Crossref, GoogleScholar, Indexed

Asuquo, A.I., Dada, E.T., & Onyeogaziri, U.R. (2018). The effect of sustainability reporting on corporate performance of selected quoted brewery firms in Nigeria. International Journal of Business and Law Research, 6(3), 1-10.

Crossref, GoogleScholar, Indexed

Braam, G., Nandy, M., Wetzel, U., & Lodh, S. (2015). Accrual-based and real earnings management and political connections. The International Journal of Accounting, 50(2), 111-141.

Crossref, GoogleScholar, Indexed

Bashatweh, A.D., & Jordan, A. (2018). Accounting theory and its impact on the sustainability reporting dimensions - A field Study. International Journal of Accounting and Financial Reporting 8(4), 82-99.

Crossref, GoogleScholar, Indexed

Christensen, H.B., Hail, L., & Leuz, B., (2019). Adoption of CSR and sustainability reporting standards: Economic analysis and review. ECGI working paper series in Finance.

Crossref, GoogleScholar, Indexed

Dhakal, C.P. (2016). Optimizing multiple regression model for rice production forecasting in Nepal. Doctoral Thesis, Central Department of Statistics, Tribhuvan University, Nepal.

Crossref, GoogleScholar, Indexed

Dhakal, C.P. (2018). Interpreting the basic output (SPSS) of multiple linear regression. International Journal of Science and Research (2018), 4061901.

Dhaliwal, D.S., Li, O.Z., Tsang, A., & Yang, Y.G. (2011). Voluntary non-financial disclosures and the cost of equity capital: The initiation of corporate social responsibility. The Accounting Review 86, 59-100.

Crossref, GoogleScholar, Indexed

Dhaliwal, D.S., Radhakrishnan, S., Tsang, A., & Yang, Y.G. (2012). Non-financial disclosure and the analyst forecast accuracy. International evidence on corporate social responsibility disclosure: The Accounting Review 87, 723-759.

Crossref, GoogleScholar, Indexed

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2), 344-401.

Crossref, GoogleScholar, Indexed

Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. The Accounting Review 70, 193- 225.

Crossref, GoogleScholar, Indexed

Elkington, J. (2004). Enter the triple bottom line. The triple bottom line. Does it all add up? 1-16.

Ernfjord, K., & Voigt, M. (2018). Corporate Social Responsibility (CSR) disclosures and earnings management.

Crossref, GoogleScholar, Indexed

University of Gothernburg School of Business, Economics and Law. M.Sc. Project.

Crossref, GoogleScholar, Indexed

GRI (2015). Sustainability and reporting trends in 2025 – Preparing for the future.

Hartwig, F., Kagstrom, J., & Fagerstrom, A. (2019). Sustainability accounting for externalities. Mary Ann Liebert 12(3), 158-162.

Healy, P.M., & Wahlen, J.M. (1999). A review of earnings management literature and its implication for standard settings. Accounting Horizons 13(4), 365-383.

Crossref, GoogleScholar, Indexed

Ibrahim, M.S., Darus, F., Yussoff, H., & Muhamad, R. (2015). Analysis of earnings management practices and sustainability reporting of corporations that offer Islamic products and services. Procedia Economics and Finance 28(2015), 178-182.

Crossref, GoogleScholar, Indexed

Janssen, D. (2018). Corporate social responsibility, culture and earnings management. Radboud University Nijmegen, M.Sc. Thesis.

Crossref, GoogleScholar, Indexed

Kaptein, M., &Wempe, J. (2002). Three general theories of ethics and the integrative role of integrity theory. SSRN Electronic Journal, 1-52.

Crossref, GoogleScholar, Indexed

Kim, Y., Park, M.S., & Wier, B. (2012). Is earnings quality associated with corporate social responsibility?The Accounting Review 87(3), 761-796.

Crossref, GoogleScholar, Indexed

Malo-Alain, A.M., Hakim, M.M., & Ghoneim, M.R. (2019). The effects of sustainability reporting on the quality of financial reports in Saudi Business Environment. Academy of Accounting and Financial Studies Journal 23(5), 1-16.

Crossref, GoogleScholar, Indexed

Manurung, T.H., & Suhartadi, A.R. (2014). The effects of earnings management on the disclosure of corporate social responsibility to corporate governance as variable moderation. ICEBM 14(107).

Crossref, GoogleScholar, Indexed

Martinez-Ferrero, J., Babaerjee, S., & Garcia Sanchez, I.M. (2016). Corporate social responsibility as a strategic shield against costs of earnings management practices.Journal of Business Ethics 133, 305-324.

Crossref, GoogleScholar, Indexed

Mousa, G.A., & Hassan, N.T. (2015). Legitimacy theory and environmental practices. Short notes. International Journal of Business and Statistical Analysis 2(1), 41-52.

Crossref, GoogleScholar, Indexed

Muhammad, A.I., (2014). Sustainability reporting among the Nigeria food and beverages firms.International of Agriculture and Economic Development 2(1), 1-9.

Nnamani, J.N., Onyekwelu, U.L., & Ugwu, O.K. (2017). Effect of sustainability accounting and reporting on financial performance of firms in Nigeriabrewery sector. European Journal of Business and Innovative Research 5(1), 1-15.

Orlitzky, M., Schmidt, F., & Rynes, S. (2003). Corporate social and financial performance: A metal analysis. Organisational Studies, 24(3), 403-441.

Crossref, GoogleScholar, Indexed

Otuya, S., Akporien, F., & Ofeimun, G. (2019). Influence of companies’ governance processes on sustainability reporting in Nigeria.International Journal of Applied Economics, Finance and Accounting 5(1), 31-38.

Crossref, GoogleScholar, Indexed

Palit, S. (2018). Emerging significance of sustainability accounting and reporting in India – A conceptual study. International Journal of Accounting Research 6(2), 1-3.

Crossref, GoogleScholar, Indexed

Crossref, GoogleScholar, Indexed

Pyo, G., & Lee, H. (2013). Association between corporate social responsibility activities and earnings quality: Evidence from donations and voluntary issuance of CSR reports. The Journal of Applied Business Research, 29(3), 945-962.

Crossref, GoogleScholar, Indexed

Rezaee, Z., & Tuo, L. (2017). Are the quantity and quality of sustainability disclosures associated with the innate and discretionary earnings quality?Journal of Business Ethics, 1-24.

Crossref, GoogleScholar, Indexed

Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42(3), 335-370.

Crossref, GoogleScholar, Indexed

Scholtens, B., & Kang, F. (2013). Corporate social responsibility and earnings management: Evidence from Asian Economies. Corporate Social Responsibility and Environmental Management 20(2), 95-112.

Crossref, GoogleScholar, Indexed

Strivastava, A. (2019). Improving the measures of real earnings management. Review of Accounting Studies, 24, 1277-1316.

Crossref, GoogleScholar, Indexed

Suieia, T.T., & Wang, J. (2018). The association between corporate social responsibility and earnings quality: Evidence from extractive industry. Revista de Contabilidad Spanish Accounting Review, 22(1), 12-121.

Crossref, GoogleScholar, Indexed

Trisnawati, R., Wiyadi, A., &Setiawati, E. (2016). Sustainability reporting and earnings management (Empirical studies of companies that participated in the Indonesia Sustainability Reporting award). Proceeding Kuala Lumpur International Business, Economics, Law Conference 11, 60-67.

Crossref, GoogleScholar, Indexed

Uwuigbe, U., Obarakpo, T., Uwuigbe, O.R., Ozordi, E., Asiriuwa, O., Gbenedio, A.E., & Oluwagbemi, S.T. (2018). Sustainability reporting and firms’ performance: A bi-directional approach. Academy of Strategic Management Journal, 17(3), 1-16.

Crossref, GoogleScholar, Indexed

Vitolla, F., & Rubino, M. (2017). Legitimacy theory and sustainability reporting. Evidence from Italy. 10th Annual Conference of the Euromed Academy of Business. 1908-1921.

Crossref, GoogleScholar, Indexed

Whetman, L.L. (2018). The impact of sustainability reporting of firm’s profitability. Undergraduate Economic Review 14(1), 1-19.

Crossref, GoogleScholar, Indexed

Yip, E., Staden, C.V., & Cahan, S. (2011). Corporate social responsibility reporting and earnings management: The role of political cost. Australasian Accounting, Business and Finance Journal, 5(3), 17-34.

Crossref, GoogleScholar, Indexed

Zhu, X., & Lu, S. (2013). Earnings management through real activities manipulation before mergers and acquisition. Journal of Finance and Accountancy 13(1), 1-10.

Crossref, GoogleScholar, Indexed

Received: 12-Apr-2022, Manuscript No. JMIDS-21- 3362; Editor assigned: 15-Apr-2022, PreQC No. JMIDS-21- 3362 (PQ); Reviewed: 29-Apr-2022, QC No. JMIDS-21- 3362; Revised: 07-May-2022, Manuscript No. JMIDS-21- 3362 (R); Published: 12-May-2022