Research Article: 2022 Vol: 26 Issue: 4

Sustainability Reporting and Financial Performance of Deposit Money Banks Listed on Nigerian Stock Exchange

Tomomewo Amos Olafusi, Babcock University

Rojugbokan Adebayo Olorunwa, Babcock University

Adegbie Folajimi Festus, Babcock University

Ajibade, Ayodeji Temitope, Babcock University

Citation Information: Tomomewo, Olafusi, A., Bokan, R., Olorunwa, A., & Fedelix, A.A. (2022). Sustainability reporting and financial performance of deposit money banks listed on nigerian stock exchange. Academy of Accounting and Financial Studies Journal, 26(4), 1-17.

Abstract

In the recent time, Sustainability reporting has attracted global attention in the business sector and generating the merited global focus. This could be attributed to the fact that in recent years stakeholders have developed tremendous interest in the firms’ non-financial activities. On this basis, investigate how sustainability disclosures impact financial performance of the Deposit Money Banks in Nigeria. Ex-post facto research design was adopted and the population covered all the Deposit Money Banks (DMBs) in Nigeria; out of which, 11 listed DMBs were judgmentally sampled. The study covered a period of 10 years (2009 - 2018) and the data collected from the financial reports of the sampled banks were analyzed through panel regression analysis. It was discovered that DMBs in Nigeria did not consider sustainability reporting as an important component of annual financial statements, DMBs considered governance to be synonymous with sustainability reporting, there were a positive and significant effects of LNSIZE on dividend per share and profit before tax of deposit money banks in Nigeria and that among the sustainability variables, it was only governance reporting that shows significant effects on financial performance of DMBs as measured by dividend per shares. The study, therefore, concluded that sustainability reporting has no significant effect on financial performance of deposit money banks in Nigeria. It was recommended that though GRI framework is voluntary, supervisory bodies especially CBN should enforce its adoption by DMBs for effective sustainability reporting.

Keywords

Deposit Money Banks, Dividend Per Share, Employee-Related Reporting, Environment-Related reporting, Financial Performance, Sustainability Reporting.

Introduction

Financial performance is viewed as the assessment of the degree to which a corporation can utilize its assets to improve the earnings of the business. Assets in this context refer to items owned by the firm, and might not necessarily be tangible. Otekunrin et al. (2019) averred that the Nigerian banking system is highly evident with poor liquidity management. This was the core reason why the Central Bank undertook a recapitalization process which raised the minimum capital base of banks from N2 billion to N25 billion. This reform compelled banks to partake in any merger/amalgamation in order to obtain the needed capital and acquire sound liquidity in 2005. Over time, not all banks were able to maintain the required capital standing and some had to merge with others or were liquidated. In 2018, for instance, Skye Bank transferred its assets and liabilities to Polaris Bank because of its inability to maintain sound financial performance evident by its failure to meet liquidity requirements.

Antoun et al. (2018) noted that there is an abundance of research concerning the performance of the banking sector. Most of these studies used banks’ profitability as its outcome variable. Also, the predictors of the financial performance of banks were divided into three divisions: bank-specific factors, industry-specific factors, and macroeconomic factors. The bank-specific variables included business mix and diversification, deposits, size, and operating efficiency. According to Nyantakyi & Sy (2015), right from the mid-1980s, several countries in Africa have carried out financial sector reforms that were targeted at reorganizing and privatizing state-controlled banks as recommended by the IMF and World Bank structural adjustment policies (SAP). The SAP was carried out along with supporting policies that reduced the entry and exit borders, interest and capital controls, and overturned some unprofitable standards in the banking sector. Notwithstanding the continued debate among experts on the overall economic benefits of SAP, the accord is that in the financial sector, these policies have directed the advent of more competent private deposit money banks which are directly placing financial resources into more creative sectors, aiding in risk-sharing and strengthening private sector expansion.

Otekunrin et al. (2019) claimed that in the last three decades, the Nigerian banking sector has passed through five separate reforms: The first was from 1986 to 1993, when the sector was deregulated to enable significant private sector participation. The second was from 1993-1998, which was evidenced by strong financial distress. In 1999, there was the return of liberalization and the acceptance of the universal banking model. In 2004, there was consolidation in the banking sector to revamp the structural and operational dimness that repressed the banks from competently performing the catalytic role of financial intermediation. The final banking reform was meant to significantly improve the banking infrastructure, fortify the controlling and administrative framework, and resolve issues of weakened capital and finance through different enterprises, to offer low-cost credit to the real sector, and financial accommodation for SMEs.

Entrepreneurs, business analysts and government leaders from all across the world are increasingly signaling the apprehension about the need for effective management of business dependencies and their impacts on ecosystems. Sustainability reporting has therefore recently attracted global attention in the business sector and generated the merited global focus (Uwaoma & Ordu, 2016). This means that there is a spike in demand by stakeholders for more disclosure on a firm’s non-financial performance. They needed to know the impact of the firms’ activities on them and their environment. Sustainability Reporting (SR) has become a strategic agenda for businesses in many countries. Such that, recently, businesses in developed countries have started to disclose information on environmental, community involvement, professional development of employees among other related sustainability disclosures in annual financial reports. The main aim of establishing business is to improve the quality of life in society, in addition to the principal objective of maximizing returns to its shareholders. Therefore, the necessary gauge should be taken to determine and report the degree to which the firm has impacted on society from period to period. Sustainability Reporting appears to be the best option for resolving all the questions and information needs of the stakeholders of an entity (Chikwendu et al., 2019).

In Nigeria for instance, Erhirhie & Ekwueme (2019) affirmed that the oil and gas sector has been heavily criticized by the public and relevant stakeholders due to their impact on the environment despite their huge contribution to the revenue of the government. When compared to the banking sector, the operations of oil and gas firms are related to serious health consequences and environmental pollution does create a social crisis between host communities and firms (Uwaoma & Ordu, 2016). Interestingly, the operations of Deposit Money Banks (DMBs) do not have an adverse, direct impact on the environment such as waste disposal, greenhouse gas emissions, environmental degradation and pollution. However, DMBs are still pressured by their customers and other stakeholders to disclose their operations with transparency and reveal information which are reliable and steady.

Uwaoma & Ordu (2016) opined that there is the possibility of a new phase of disorder that would be more forceful than what has been experienced in past years. The cause of this disorder might be demographic, geopolitical, technological, economic or environmental, and when they converge with their uniqueness, they could unleash exceptional change in the community and economy, and particularly in the banking industry. The aforementioned problems of performance in global banking system may look hi-tech, it underlines the major issues in the financial performance of DMBs in Nigerian economy. The only additions are unfair competition, high cost of capital, uncertain government policies and regulations.

This scenario resulted in negative outcomes of the financial performance variables (DPS, PBT) under consideration in this study. Expectedly, whatever factors that contributes to the disruption in any sector, most especially banking sector, will no doubt have a negative impact on variables that measure returns and performance. The consequences of poor financial performance in the DMBs include an indescribable economic hardship in the form of huge job loss, low credit opportunity to entrepreneurs, downturn in economic activities among others. Proshare confidential report on Nigerian Banks performance, 2018, corroborated that in circumstances where the financial sector is unhealthy; it threatens financial stability and jeopardizes business optimism.

The banking sector of every economy is a service sector that does not involve in real production directly but provides finances for the real sector. To this end, the banking sector is viewed as not having direct impact on the environment and little effect on the social sector. However, the UN in its description of sustainability has not excluded any business activity. This study, therefore, attempts to investigate how sustainability disclosures impact financial performance of the Deposit Money Banks in Nigeria. This will be undertaken using data collected from annual reports of DMBs listed on the floor of Nigeria Security Exchange. The findings of this study would help the management of various organizations in ascertaining the specific sustainability reporting guidelines and tenets to follow.

Literature Review

Sustainability Reporting

Sustainability has been defined by so many authors in so many ways. But it can be deduced from their definitions that they all centered on the common dimensions of sustainability which are economic, environmental, and social and governance. However, under GRI Sustainability Reporting Guidelines (G4), sustainability reporting is defined as a process that assists companies in setting goals, measuring performance and managing change towards a sustainable global economy – one that combines long term profitability with social responsibility and environmental care. Sustainability Reporting is the key platform for communicating the company’s economic, social, environmental, and governance performance, which reflects positive and negative relationships.

Recently, scholars such as, Uwuigbe (2011); Rokhmawati et al. (2015), Joseph et al. (2017) have directed interest in the relationship between firm social environment via sustainability reporting and firms financial performance. This relationship has received a further examination by various other studies over the last decade. However, the results have been varied and unsatisfying. The reasons for the recent upsurge in the study of sustainability reporting and its effect on financial performance of firms are justified when the negative impacts of firms’ activities are properly scrutinized. In this work, sustainability reporting will be looked at from four perspectives viz Community-related reporting, Employee-related reporting, Environment-related reporting and governance-related reporting (Chen, 2009).

Global Reporting Initiative (GRI)

This is an international organization that is non -profit-oriented. They focused mainly on providing a sustainability reporting model that can be used globally by companies irrespective of the geographical location and size of the company. This is an attempt to address the issue of accountability and transparency on sustainability performance of companies. The GRI committee launched the first set of sustainability reporting guidelines in June 2000. The second-generation G2 was launched in 2002 at the world summit on sustainability development in Johannesburg, in 2006 the third generation G3 was launched and the fourth generation G4 was launched in 2013 at Global conference held on 22nd May 2013. This version is the most current, comprehensive and recommended. It tries to harmonize with another important global framework. Aggarwal (2013) the sustainability reports are prepared based on certain principles that state the scope and quality of report. The standard disclosure involves corporate governance, strategy and analysis, stakeholders’ engagement and performance indicators like economic, environmental and social performance indicators.

Disclosure standards in SR according to the GRI-G3 Guidelines consist of:

1. Economy: This focuses on the impacts of firms’ operations on the economic state of the firms’ stakeholders and on economic systems at the national and international levels.

2. Environment: This focuses on the effects of firms’ activities on the lives of living things and the environment which is made up of the ecosystems, land, air and water.

3. Human Rights: This concerns the principle of fairness and equality in the dealings and transactions of a company.

4. Community: This deals with the level of influence the firm’s actions have on their host communities and the risks which might spring up from interaction with other social institutions.

5. Product liability: This reveals information concerning products which are produced by firms and services that directly impact customers.

6. Social: This concerns social activities carried out by the firm, what and how it has been carried out.

Financial Performance

Yahaya & Lamidi defined financial performance as the measurement of the outcomes of a firm’s strategies and activities in financial terms. Financial performance is majorly found in profit making organizations like deposit money banks, manufacturing firms and the oil and gas sector among others. Joseph et al. (2017), Yahaya & Lamidi amongst others found that credit risk, liquidity risk and capital risk are key variables that influence Deposit Money Banks performance, the role of sustainability reporting in DMB’s performance cannot and should not be relegated and therefore requires empirical study. In the context of this study, emphasis will be laid on dividend per share and profit after tax.

Dividend per share (DPS) is the amount of stated dividends issued by a firm for every outstanding ordinary share. The figure is calculated by dividing the total dividends paid out by a business, including interim dividends by the number of outstanding ordinary shares issued, over a given period of time. It is often gotten using dividend paid in the most current year, which is also used to derive the dividend yield. Profit after tax is a performance ratio derived by using Profit before Tax to less Tax. Profit before tax (PBT) is an estimation of a firm’s profitability which examines the profits made before any tax is paid. It compares expenses with revenue but excludes the payment of income tax.

Theoretical Framework

This study was theoretically underpinned with stakeholders’ theory. This theory seems to have been established by Morgan Freeman. These authors all agreed uniformly that companies owe it to all categories of stakeholders to properly report their activities and operations in a transparent manner. Furthermore, companies should carry out their activities in such a way that causes the least harm to the environment. This theory is generally recognized as a theory of firm’s management and business morals both within the business environment and outside the business environment.

Based on the opinion of Freeman (2010) in relation to this theory, firms are stewards to employees, employers, shareholders, creditors, the government and the community among others. To King (2002), sustainability reporting improves the efficiency of the firm to stakeholders because it reminds and motivates the firm’s actions and operations towards improving their impact on the community. In essence, being unconcerned about stakeholders’ interests may diminish a firm’s reputation, which ultimately reduces their financial performance. In the other way, careful consideration about diverse stakeholders’ interests in a firm would definitely improve the financial performance of a firm.

Donaldson & Preston (1995) also prescribed a figure of the stakeholder model, which will be adapted for the theoretical framework for this study. The model aptly displays the fact that all stakeholders should be regarded as equal. Stakeholder’s theory is quite relevant to this study. However, it has fallen short of perfection due to some limitations. Firstly, Charles Blattberg, criticized stakeholder theory based on its assumptions that the different stakeholders of a firm can actually be properly satisfied by a firm, which is not entirely true. Another criticism is that by using the political notion of 'social contract' to firms, stakeholder theory weakens the basis on which a market economy is based.

Stakeholders’ theory tries to establish relationship between the firm and other stakeholders including the community where the business is located unlike the agency theory that considers only the owners and the management of the business. Thus, it is in the best interest of the firm to properly disclose their reports. By doing this, the stakeholders can conveniently assess the impact of firms’ operations on the entire stakeholders; acknowledging the fact that firms operate in a system of stakeholders who they cannot do without. More so, through sustainability reporting the bond between firms and stakeholders will be strengthened and they will have more confidence in the firm. The confidence of stakeholders mean improved financial performance to the firm.

Sustainability Reporting and Dividend per Share (DPS)

Shareholders/investors pool their resources and wealth to the operations of a particular firm in order to be able to receive dividends regularly and in adequate measure. In Indonesia, Nugroho & Arjowo (2014) examined the effects of Sustainability Report Disclosure towards Financial Performance. The predictor variable was measured with the GRI (Global Reporting Initiatives) index, while the outcome variable was measured with Return on Assets (ROA), Current Ratio (CR), Debt Equity Ratio (DER), Inventory Turnover (IT) and Dividend Payout Ratio (DPR). Linear regression analysis was the preferred statistical tool used in the study. Findings uncovered that the Sustainability Report disclosure positively influenced ROA but it has no significant effect on CR, DER, IT, and DPR (DPS/EPS*100).

Johansson & Fahlén (2019) undertook a study which examined the relationship between corporate sustainability reporting and dividend policy in the Nordic countries using data from 2008-2018. Regression analysis was the chosen method of data analysis. The findings gave enough credence to the fact that there was a significant relationship between the ESG score and the dividend payout ratio of Nordic firms, while the dividend yield had no relationship with the ESG score.

Sustainability Reporting and Profit before Tax (PBT)

Ameer & Othman (2012) examined sustainability practices and corporate financial performance using data from 2006. Findings proved that firms with higher sustainability disclosure scores had significantly higher mean sales revenue growth. It was also seen that there was a positive relationship between sustainability reporting and financial performance.

In Kenya, Kipruto (2014) investigated the effect of corporate social responsibility on financial performance of commercial banks using data from 2009 to 2013. Multiple regression analysis was the preferred analytical tool. Findings uncovered that not all commercial banks report their CSR involvement. It was seen that out of the 44 commercial banks studied, only 8 gave the complete, necessary for the study.

In USA, Whetman (2018) examined the Impact of Sustainability Reporting on Firm Profitability of firms from various sectors in 2015-2016. Findings uncovered that a positive and significant effect of sustainability reporting on a firm’s return on equity, return on assets, and profit margin. Also in Nigeria, Nwobu (2015) investigated the annual reports of some banks for the presence or absence of sustainability reporting. Findings proved beyond all doubt that sustainability reporting has garnered significant focus over the past four years in the Nigerian banking sector and that insignificant positive correlation subsists between sustainability reporting index and Profit after Tax (PAT) and shareholders’ fund.

Gaps in Literature

Numerous studies have been undertaken on the subject matter, though, there have been mixed findings. For instance, Bassey et al. (2013); Ekwueme et al. (2013); Okoye & Ezejiofor (2013); Owolabi et al. (2016); Dembo (2017); Nnamani et al. (2017); discovered that sustainability reporting has positive and significant effects on financial performance of listed firms; while (Nwobu, 2015; Ezejiofor, 2016) established that corporate sustainable practices of firms are rarely associated with profitability of listed companies. These contradictory findings have sparked more debate which prompted this current empirical review.

Digging deeper, there are numerous causes of these mixed findings. Firstly, differences in geographical location could be a cause, based on developing countries and developed countries because the enlightenment of developed countries could be different from that in developing countries. However, in Nigeria, a look at previous research showed that more studies by Nigerian authors use samples limited to a sub-sector with the most current data being that of 2014 (Nnamani, 2017). For example, studies of Ezejiofor et al. (2016); Dembo (2017) concentrated on two and one oil and gas firms respectively Bassey et al. (2013) concentrated on the oil and gas sector but used a time series data approach. Nnamani et al. (2017) concentrated on three Brewery firms, Owolabi et al. (2016) focused on one industrial firm (Nwobu, 2015) concentrated on the banking sector, while (Okoye & Ezejiofor, 2013) limited theirs to two manufacturing firms. Furthermore, the trend of financial performance indicators could be another reason for the inconsistency in findings. For instance, some studies employed one financial performance indicator while others used more than one (Ekwueme et al., 2013; Nwobu, 2015).

The banking sector of every economy is a service sector which does not involve in real production directly but provide finances for the real sector. To this end, the banking sector is viewed as not having direct impact on the environment and little effect on the social sector. However, the UN in its description of sustainability has not excluded any business activity. It is therefore necessary to investigate how sustainability disclosures impact financial performance of the Deposit Money Banks in Nigeria. Earlier study in this regard includes Nwobu (2015) who focused on the relationship between corporate sustainability reporting and profitability and shareholders fund of Nigerian banks. Others like Kwaghfan (2015); Nnamani et al. (2017) are concentrated in the real sectors of the Nigerian economy. The gap here is that profitability criteria in measuring of financial performance of a firm should be reviewed from different perspectives and studies focusing on financial services sectors, Deposit Money Banks in particular are not adequate (Erhinyoja & Marcella, 2019).

Based on the above enumerated research gaps in SR studies in Nigeria, this study attempts to carry out an examination of the effects of sustainability reporting on financial performance of Deposit Money Banks listed on Nigerian Stock Exchange along several dimensions. These will include further investigation on SR using extended dimensions; larger samples size; longer and more recent period of study.

Methodology

Ex-post facto research design was employed. The choice of these design was based on the nature of the study in which the researcher examined the effects of sustainability reporting on performance of DMBs by examining the past relationship between the dependent and independent variables. The study covered all the 27 Deposit Money Banks in Nigeria; out of which, 11 listed DMBs were judgmentally sampled as presented in Table 1. A sample size of eleven deposit money banks was taken for this study for the ten years period of 2009 – 2018. The ten-year time frame of (2009-2018) was chosen in order to observe a deeper trend on the subject matter. Annual reports are seen by stakeholders as the most important and influential source of corporate information. The data analysis was carried out in two stages, meaning, descriptive and inferential statistics to analyze the data collected from annual reports and accounts of the sampled banks (Uwuigbe & Jimoh, 2012).

| Table 1 Sampled Deposit Money Banks |

|||

|---|---|---|---|

| S/No | Name of Institution | Categorization of Banking Licence | Year Founded (listed) |

| 1 | Access Bank Plc | International Authorization | 1989 (1998) |

| 2 | Fidelity Bank PLC | International Authorization | 1988 (2005) |

| 3 | First City Monumental Bank PLC | International Authorization | 1982 (2004) |

| 4 | First Bank of Nigeria Holding PLC | International Authorization | 1894 (1991) |

| 5 | Guaranty Trust Bank PLC | International Authorization | 1990 (2004) |

| 6 | Union Bank PLC | International Authorization | 1917 (1971) |

| 7 | United Bank for Africa PLC | International Authorization | 1949 (1970) |

| 8 | Zenith Bank PLC | International Authorization | 1990 (2004) |

| 9 | Stanbic IBTC Bank PLC | National Authorization | 1989 (2005) |

| 10 | Sterling Bank PLC | National Authorization | 1960 (1992) |

| 11 | Wema Bank PLC | National Authorization | 1945 (1990) |

Source: Researcher’s selection 2020.

The simple regression analysis will be used to analyze and test the five (5) hypotheses formulated in the study, while panel regression analysis was used for the test of the main objective of this study. The regression models were estimated using Unobserved Effects Model (UEM) and the result of Hausman test indicated between pooled, fixed effect model and random effect models. This implied that any of the models could have been used depending on the likely result from the Hausman test conducted (Popa et al., 2009).

The results of the Hausman confirmation tests using Breusch-Pagan Lagrangian multiplier (LM) test for random effect or Testparm test for fixed effect. In addition, diagnostic tests such as heteroskedasticty, serial autocorrelation, and cross-sectional dependence tests was conducted for objectivity of the results and to unveil any econometric problem in the models.

In order to test for the relevance of the hypotheses regarding the impact of corporate sustainability reporting on financial performance of Deposit Money Banks listed on the Nigerian Stock Exchange, a multiple regression model was be used as adopted from previous studies (Kwaghfan, 2015) which examines the relationship between dependent variables comprising of firm performance indicators and two or more regressors or independent variables (sustainability dimensions).

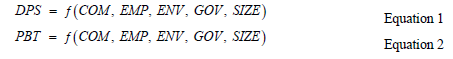

In line with recorded literatures, the relationship between the two variables was presented in a functional equation form as:

Y= ƒ(X)

Where Y=Dependent Variables –Financial Performance, X=Explanatory Variables – Sustainability Reporting. X =x1, x2, x3, x4, x5

Functional Relationship

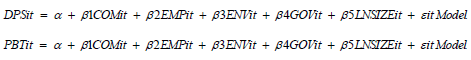

The Models

Where: α=regression intercept which is constant, β1–β5=the coefficient of the explanatory variables, i=Cross Sectional, t=Time, ε= the error term of the regression, DPS=Dividend per Share Sum of dividends over a year = Special, one time dividend in the year/Ordinary share outstanding for the year, PBT=Profit before Tax (natural log of PBTLNPBT), COM=Community Performance Rating, EMP=Employees Performance Rating, ENV =Environmental Performance Rating, GOV=Governance Performance Rating and SIZE=Size of firm (taken as natural log of total assets - LNSIZE). The measurement of these variables and the sources are illustrated in Table 2 below.

| Table 2 Summary Of Measurement And Explanation Of Variables |

|||

|---|---|---|---|

| Variables | Abbre-viation | Measurement | Source |

| DEPENDENT VARIABLE (FP) | |||

| Dividend per Share | DPS | Sum of dividends over a year/Ordinary Share outstanding for the year | Nicholas (2019) |

| Profit Before Tax | PBT | Natural log of PBT (lnpbt) | Researcher (2020) |

| INDEPENDENT VARIABLE (SR) | |||

| Community related reporting | COM | If disclosed in financial statement, the researcher will assign 1, otherwise 0. | Researcher (2020) |

| Employee related reporting | EMP | If disclosed in financial statement, the researcher will assign 1, otherwise 0. | Researcher (2020) |

| Environment related reporting | ENV | If disclosed in financial statement, the researcher will assign 1, otherwise 0. | Researcher (2020) |

| Governance related reporting | GOV | If disclosed in financial statement, the researcher will assign 1, otherwise 0. | Researcher (2020) |

| MODERATING VARIABLE | Researcher (2020) | ||

| Size | SIZE | Natural log of Total Asset (lnsize) | Researcher (2020) |

Source: Researcher’s Compilation (2020).

The study made use of coefficient of variation (β), t-test and F-test. R-squared and AdjR2 as statistical criteria for the estimation and evaluation of the models. The coefficients will be used to estimate the sign and magnitude of the effect of individual measures of SR on FP. The probabilities of t-test were used to determine the significance of the effect of individual measures of SR on FP. The probability of F-test will be used to determine the significance of the combined effect of SR on FP; while adjusted R-square will be used to explain the magnitude of the variations in FP that is traceable to the joint variation in SR. Finally, R-square values was used to explain variations in individual components of FP as related to variation in each component of FP as indicated in models 1-5.

All the tests carried out in this study were estimated at 1%, 5% and 10% significance level. This means that the test may be declared significant if the corresponding probability is less than the chosen level of significance. Thus, the decision rule is as depicted in Table 3.

| Table 3 Decision Table |

|||

|---|---|---|---|

| S/No | Hypotheses | Models | Decision Rule |

| H04 | There is no significant relationship between Sustainability Reporting (SR) and Dividend per Share (DPS) of Deposit Money Banks listed on Nigerian Stock Exchange. | P ≤ 0.05; β1 ≠ 0 H4 will be rejected | |

| H05 | There is no significant relationship between Sustainability Reporting (SR) and Profit before Tax (PBT) of Deposit Money Banks listed on Nigerian Stock Exchange. | P ≤ 0.05; β1 ≠ 0 H5 will be rejected | |

Source: Researcher’s computation (2020)

In line with the hypothesis formulated, it is the expectation of this work that sustainability reporting will have effect on financial performance of Deposit Money Banks in Nigeria. By this, it is further expected that each component of sustainability reporting will have an effect on each dimension of financial performance of DMBs in Nigeria. The a priori expectation is represented thus H1-H5: β >0=Positive; as represented in Table 3 above.

DPS has mean, maximum and minimum values of 0.615, 3.07 and 0.00, respectively. The standard deviation of 0.809 shows that variance from the mean value is small thus making possibility of prediction of the values relatively high. LNPBT has a mean value of 11.788, maximum of 12.768 and minimum of 0.00 with a standard deviation of 1.087. The possibility of prediction the data series in this case is riskier Table 4. LNSIZE has mean, maximum and minimum values of 14.094, 15.782 and 11.925 respectively with a standard deviation of 0.882. The mean value of COM is 0.424, maximum value of 1.00, minimum value of 0.00 and standard deviation of 0.496. EMP has a mean of 0.311, maximum value of 1.00, minimum value of 0.00 and standard deviation of 0.465. The mean, maximum, and minimum values of ENV are 0.462, 1.00 and 0.00 respectively with a standard deviation of 0.5 showing that more points are close to the mean value. GOV has a mean value of 0.902, maximum of 1.00 and minimum of 0.00. The standard deviation of 0.299 indicates evidence clusters around the mean. Observation of the descriptive analysis reveals that four of the explanatory variables namely, COM, EMP, ENV and GOV have maximum and minimum values of 1.00 and 0.00. This is due to the categorical or qualitative nature of the variables as dummy values of 0 and 1 are assigned for absence and presence of the proxies.

| Table 4 Characteristics Of The Variables | |||||

|---|---|---|---|---|---|

| Variable | Obs | Mean | Std.Dev. | Min | Max |

| dps | 132 | 0.615 | 0.809 | 0 | 3.07 |

| lnsize | 132 | 14.094 | 0.882 | 11.925 | 15.782 |

| lnpbt | 132 | 11.788 | 1.087 | 0 | 12.768 |

| env | 132 | 0.462 | 0.5 | 0 | 1 |

| com | 132 | 0.424 | 0.496 | 0 | 1 |

| emp | 132 | 0.311 | 0.465 | 0 | 1 |

| gov | 132 | 0.902 | 0.299 | 0 | 1 |

Sources: Author’s Compilation (2020).

Multicollinearity Analysis

The determination of multicollinearity problem among variables was carried out using Pairwise correlation coefficient and variance inflation factor (VIF). Pairwise correlation coefficient depicts the extent of association (non-casual effect) that exist among the variables and VIF on the other hand only examined whether the variables are multi-correlated.

The correlation matrix displayed in Table 5 shows that COM and ENV have the highest positive correlation coefficient of 0.865 which is significant at 5 percent. Except the above, there is no other correlation coefficients among the explanatory variables that are greater than 0.527 either positive or negative. This indicates that the probability of multicollinearity among our independent or explanatory variables is extremely low. It is observed that several of the correlation coefficients are significant at 5 percent among the explained variables and between explained and explanatory variables.

| Table 5 Pairwise Correlations |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variables | -1 | -2 | -3 | -4 | -5 | -6 | -7 | |

| (1) | dps | 1 | ||||||

| (2) | Insize | 0.524* | ||||||

| 0 | ||||||||

| (3) | Inpbt | 0.307* | 0.248* | |||||

| 0 | 0.004 | |||||||

| (4) | env | 0.14 | 0.164 | -0.036 | 1 | |||

| 0.11 | 0.06 | |||||||

| (5) | com | 0.091 | 0.121 | -0.064 | 0.865* | |||

| 0.297 | 0.168 | 0.469 | 0 | 1.000 | ||||

| (6) | emp | 0.059 | 0.119 | -0.075 | 0.527* | |||

| 0.501 | 0.173 | 0.393 | 0 | |||||

| (7) | gov | 0.02 | 0.063 | 0.308* | 0.153 | |||

Sources: Author’s Compilation (2020)

Testing of Hypotheses and Discussion of Findings

H1: Sustainability Reporting (SR) does not have significant effect on Dividend per Share (DPS) of Deposit Money Banks listed on Nigerian Stock Exchange.

The outcome of the Hausman test conducted to decide on the right panel data estimator reveals chi-square statistic of 11.28 and prob-value of 0.046. Thus, the null hypothesis of random (individual) effects are independent of explanatory variables has been rejected in favour of the alternative hypothesis that random effects are not independent of the explanatory variables. The implication is that fixed effect estimator is more appropriate than the random effect estimator for this model Table 6. The Breusch Pagan LM test results with chi-square of 15.43 and prob-value of 0.00 made random more suitable than the Pooled OLS. The BP LM test outcome notwithstanding, the Hausman test result is upheld and fixed effect estimator.

| Table 6 Results Of Regression Estimate And Diagnostic Tests Of Hypothesis Four: Dependent Variable: Dps |

||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| VARIABLES | OLS | FE | RE | FGLS |

| lnsize | 0.4732*** | 0.4484*** | 0.4504*** | 0.2717*** |

| (0.0704) 6.72 (0.00) | (0.0814) 5.51 (0.00) | (0.0774) 5.82 (0.00) | (0.0825) 3.30 (0.00) | |

| com | - 0.1044 | - 0.0963 | - 0.0985 | - 0.0551 |

| (0.2479) - 0.42 (0.674) | (0.1640) - 0.59 (0.558) | (0.1646) - 0.60 (0.550) | (0.0836) - 0.66 (0.52) | |

| emp | - 0.0651 | 0.3137*** | 0.2871** | 0.0349 |

| (0.1566) - 0.42 (0.678) | (0.1164) 2.70 (0.00) | (0.1161) 2.47 (0.01) | (0.0724) 0.48 (0.63) | |

| env | 0.2153 | - 0.1640 | - 0.1401 | 0.0152 |

| (0.2494) 0.86 (0.389) | (0.1679) - 0.98 (0.33) | (0.1684) - 0.83(0.405) | (0.0876) 0.17 (0.86) | |

| gov | - 0.0546 | - 0.5089*** | - 0.4796*** | - 0.4677*** |

| (0.2070) - 0.26 (0.792) | (0.1456) - 3.50 (0.00) | (0.1454) - 3.030 (0.00) | (0.0979) - 4.78 (0.00) | |

| Constant | - 6.0405*** | - 5.2267*** | - 5.2838*** | - 3.0202*** |

| (0.9957) - 6.07 (0.00) | (1.1170) - 4.68 (0.00) | (1.0773) - 4.90 (0.00) | (1.1331) - 2.67 (0.01) | |

| Observations | 132 | 132 | 132 | 132 |

| Number of banks | 11 | 11 | 11 | |

| R-squared | 0.2808 | 0.76 | 0.27 | |

| Adj. R-Squared | 0.2523 | 0.73 | 0.24 | |

| F-Statistic | F(5, 126) =9.84 Prob>F =0.00 | F(5, 116) = 9.11 Prob>F =0.00 | Wald chi2(5) = 47.07 Prob>chi2 = 0.00 | Wald chi2(5) = 31.46 Prob>chi2 = 0.00 |

| Multicollinearity Test VIF Mean | 2.34 | - | - | - |

| Pesaran CD Test | - | CSD = - 1.589 Prob. = 1.8879 | - | - |

| Hausman Test | - | - | chi2(5) = 11.28 Prob>chi2 = 0.046 | - |

| Breusch-Pagan LM Test | - | - | chi2(01) = 216.66 Prob>chi2 = 0.00 | - |

| Modified Wald Test for Heteroskedasticity | - | chi2(11) = 476.25 Prob>chi2 = 0.00 | - | - |

| Wooldridge Test for Autocorrelation | - | F(1, 10) =13.832 Prob>chi2 = 0.00 | - | AR(1) = 0.9117 |

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

Sources: Author’s work (2020)

The test for cross-sectional dependence and autocorrelation indicates non-violation of the OLS assumptions with pesaran cd=1.501 and prob-value of 0.133 while Wooldridge test for autocorrelation shows F-statistic of 1.37 and prob-value of 0.27. In contrast, the Modified Wald test for groupwise heteroskedasticity, revealed chi-square of 3213.73 and prob-value of 0.00 indicating the presence of heteroskedasticity, that is, the variance of the error terms are not constant over time thereby violating the assumption of homoskedasticity, which is constant variance of the error term. Consequently, the Parks’ Feasible Generalised Least Squares (FGLS) that handles such problem is considered an appropriate estimator for the model.

The result of the regression analysis shows that LNSIZE and GOV exert significant effect on DPS while the other variables in the model did not. Whereas a positive relation is observed between LNSIZE and DPS, the reverse is the case between GOV and DPS. A percentage in LNSIZE would cause increase of 0.0027 percent in DPS with t-statistic of 3.30 and prob-value of 0.00, which is significant at 1 percent. On the other hand, a unit increase in GOV would cause a decrease of 0.47 units in DPS. The t-statistic for GOV is 4.70 with prob-value of 0.00. This indicates 1 percent significant level for GOV on DPS. Though the relationship is negative, it could be explained that GOV is significant because of the importance given to governance structure deposit money banks in addition to the fact that it is the only variable widely reported by every bank. Besides the fact that the effect is significant, the coefficient is relatively higher compared with coefficients of other variables in the model. ENV also exhibit positive albeit, insignificant effect on DPS. A unit increase in ENV would lead to increase of about 0.015 units in DPS. The t-statistic is 0.17 and prob-value of 0.86 extremely higher than 0.05 the significant level.

Both COM and EMP exhibit negative and insignificant effect on DPS. DPS would fall by 0.06 units if there is a unit increase in COM. The t-statistic is 0.66 and prob-value of 0.52 as shown in Table 6 above. Since the probability value is about 52 percent extremely higher than 0.05 percent, it is statistically insignificant. In the same vein, EMP has a t-statistic of 0.48 and prob-value of 0.63 which is greater than 0.05 indicating statistical insignificant.

The null hypothesis that says SR does not have significant effect on DPS could not be accepted even when we disaggregate LNSIZE from the SR variables of COM, EMP, ENV and GOV used in the model. This is affirmed from the F-statistic value of 9.11 and probability value of 0.00. While LNSIZE has significant effect on DPS as had been observed in other models of the study, GOV an SR variable equally has significant effect on DPS thereby leading to rejection of the null hypothesis in favour of the alternative, that SR has significant effect on DPS. Other variables could have performed better, had there been adequate reporting on these other variables by the listed deposit money banks in Nigeria. This finding is agreement with (Nugroho & Arjowo, 2014). The results of their study showed that the Sustainability Report disclosure positively influenced ROA but it has no significant effect on CR, DER, IT, and DPR (DPS/EPS*100). However, the findings of this study are in conflict with Johansson and Fahlén (2019).

H2: Research Hypotheses (H0): There is no significant effect of Sustainability Reporting (SR) on Profit before Tax (PBT) of Deposit Money Banks listed on Nigerian Stock Exchange.

The result of Hausman test carried out for hypothesis five as shown in Table 7 is significant, with chi-square of 11.28 and prob-value of 0.046, thereby rejecting its null hypothesis which states that random (individual) effects are independent of the explanatory variables, and thus supported the appropriateness of fixed effect estimator over random effect estimator.

| Table 7 Results Of Regression Estimate And Diagnostic Tests Of Hypothesis Five: Dependent Variable: Lnpbt |

||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| VARIABLES | OLS | FE | RE | FGLS |

| lnsize | 0.3083*** | 0.2667 | 0.3031*** | 0.2547*** |

| (0.1016) 3.03 (0.00) | (0.1944) 1.37 (0.17) | (0.1116) 2.72 (0.00) | (0.0453) 5.63 (0.00) | |

| com | - 0.1726 | - 0.1691 | - 0.1666 | - 0.0811 |

| (0.3577) - 0.48 (0.63) | (0.3916) - 0.43 (0.67) | (0.3613) - 0.46 (0.65) | (0.1225) - 0.66 (0.51) | |

| emp | - 0.2235 | - 0.2698 | - 0.2334 | - 0.0463 |

| (0.2260) - 0.99 (0.33) | (0.2780) - 0.97 (0.33) | (0.2338) - 1.00 (0.32) | (0.0803) - 0.58 (0.56) | |

| env | - 0.0153 | - 0.0565 | - 0.0285 | 0.0529 |

| (0.3598) - 0.04 (0.97) | (0.4010) - 0.14 (0.89) | (0.3647) - 0.08 (0.94) | (0.1221) 0.43 (0.67) | |

| gov | 1.1403*** | 0.9005** | 1.0854*** | - 0.0028 |

| (0.2986) 3.82 (0.00) | (0.3478) 2.59 (0.01) | (0.3049) 3.5 (0.00) | (0.1524) - 0.02 (0.99) | |

| Constant | 6.5644*** | 7.3994*** | 6.6940*** | 8.3189*** |

| (1.4368) 4.57 (0.00) | (2.6680) 2.77 (0.01) | (1.5687) 4.27 (0.00) | (0.6396) 13.01 (0.00) | |

| Observations | 132 | 132 | 132 | 132 |

| Number of banks | 11 | 11 | 11 | |

| R-squared | 0.171 | 0.24 | 0.15 | |

| Adj. R-Squared | 0.138 | 0.15 | 0.12 | |

| F-Statistic | F(5, 126) = 5.20 Prob>F = 0.00 | F(5, 116) = 2.50 Prob>F =0.035 | Wald chi2(5) = 22.73 Prob>chi2 = 0.00 | Wald chi2(5) = 33.74 Prob>chi2 = 0.00 |

| Multicollinearity Test VIF Mean | 2.34 | - | - | - |

| Pesaran CD Test | - | CSD = 0.880 Prob = 0.379 | - | - |

| Hausman Test | - | - | chi2(5) = 11.28 Prob>chi2 = 0.046 | - |

| Breusch-Pagan LM Test | - | - | chi2(01) = 0.00 Prob>chi2 = 0.475 | - |

| Modified Wald Test for Heteroskedasticity | - | chi2(11) = 2.8e+05 Prob>chi2 = 0.00 | - | - |

| Wooldridge Test for Autocorrelation | - | F(1, 10) =13.021 Prob>chi2 = 0.00 | - | AR(1) = 0.4458 |

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

Sources: Author’s work (2020) .

The result of Hausman test carried out for hypothesis five as shown in Table 7 is significant, with chi-square of 11.28 and prob-value of 0.046, thereby rejecting its null hypothesis which states that random (individual) effects are independent of the explanatory variables, and thus supported the appropriateness of fixed effect estimator over random effect estimator. The Breusch – Pagan LM test results also confirmed the inappropriateness of the random effect with the chi-square of 0.00 and prob-value of 0.475, thus favouring Pooled OLS over random effect.

Based on the outcome of Hausman test results, the fixed effect estimator chosen would require further test of cross-sectional dependence, serial correlation and heteroskedasticity to ascertain non-violation of OLS assumptions. The Pesaran cross-sectional dependence test showed prob-value of 0.38 indicating absence of cross-sectional dependence, the Modified Wald test for groupwise heteroskedasticity with prob-value of 0.00 indicates substantial evidence violation of constant variance of the successive error terms, hence no homoskedasticity while the Wooldridge test for autocorrelation equally indicates evidence of violation with prob-value of 0.00. Parks’ Feasible Generalised Least Squares (FGLS) is an estimator that solves the problems of cross-sectional dependence, serial correlation and heteroskedasticity.

regression results presented in Table 7 show that LNSIZE and ENV are the only explanatory variables with positive causal relationship with LNPBT while others reveal negative causal relationship. A percentage increase in LNSIZE would lead to 0.25 percent rise in LNPBT. The t-statistic for LNSIZE is 5.63 with prob-value of 0.00, meaning that it is significant at 1 percent. Though ENV has a positive causal relationship with LNPBT as a unit increase in the former would lead to a rise of 5 units in the latter. However, the relationship is insignificant with t-statistic equals 0.043 while the prob-value is 0.67, far above 0.05 level of significance. COM has a negative and insignificant relationship with the LNPBT. LNPBT would fall by 8 units due to one-unit increase in COM. COM has a t-statistic of 0.66 in absolute value with prob-value of 0.51 which is greater than 0.05 the acceptable level of significant. Thus, the effect of COM on LNPBT is statistically insignificant. Similarly, a unit increase in EMP would cause LNPBT to decrease by 5 units and the insignificant effect is reflected in the t-statistic of 0.58 with prob-value of 0.56. In the same vein, there is a negative and insignificant relationship between GOV and LNPBT. A unit increase in GOV would lead to a decrease of 0.3 units in LNPBT. With a t-statistic of 0.02 in absolute terms and prob-value of 0.99, meaning that it is insignificant at all.

Based on the interpretation of the regression results that and disaggregating the LNSIZE from the SR variables of COM, EMP, ENV and GOV, the null hypothesis that says SR has no significant effect on profit before tax has been accepted, as none of the variables is statistically significant either at 1 percent, 5 percent or even at 10 percent. Though the F-statistic value of 2.50 and probability value of 0.04 still indicate that the explanatory variables are jointly significant in explaining the variable in the dependent variable. Therefore, we conclude that sustainability reporting has no significant effect on profit before tax of listed deposit money banks in Nigeria. This finding run contrary to the outcome of the work of the American Whetman (2018) who examined the Impact of Sustainability Reporting on Firms Profitability and discovered a positive and significant effect of sustainability reporting on a firm’s return on equity, return on assets, and profit margin in the subsequent year.

The Implications of the Findings of this Study Includes

To the management of deposit money banks

The predominant proxy of sustainability reporting available in the financial statements of all the banks sampled is Governance and partly employee reporting. This is a clear violation of the assumptions of the stakeholder’s and agency theories and an indication that management of DMBs in Nigeria are selective on information contained in their financial statements. The selective disclosures also failed to comply with the requirements of GRI 2011, as amended. This may have implications on 21st century performance measurement of the DMBs, if allowed to continue.

Government and Policy makers: The failure of DMBs to fully comply with global standards on sustainability reporting is due partly to failure of supervisory agencies and policy makers to adequately ensure compliance. The Central Bank of Nigeria (CBN) has failed the government in its role as the industry regulator and the Nigeria Security Exchange Commission (NSE) failed the larger market of investors. These two institutions checked and cleared the financial statements of DMBs before they are passed as basis of reliable information to the stakeholders. However, they are not interested in effective sustainability reporting of DMBs.

Board of Directors and other Bank Investors: The Board of Directors also share in the failure of DMBs to fully appreciate the importance of sustainability reporting as a disclosure requirement to the stakeholders. As such, investors stand the risk of losing their investment for inadequate disclosures to properly guide their investment options in DMBs.

Researchers and Analysts: Financial advisors should begin to consider effective sustainability reporting by DMBs as a critical factor to investigate in the process of rendering advisory services to their client’s investment portfolio as it relates to banking sector, going forward.

Conclusion

The study examined the effects of Sustainability Reporting on Financial Performance of Deposit Money Banks listed on the Nigerian Stock Exchange. Sustainability reporting was study using Community-related reporting (COM), Employees-related reporting (EMP), Environment-related reporting (ENV) and Governance-related reporting (GOV) as proxy. Size (LNSIZE) of the banks was adopted as control variable. On the other hand, Dividend per Share (DPS) and Profit before Tax (PBT) were chosen as proxy for financial performance. From the individual analysis carried out as hypothesized, community related reporting, employee related reporting and environment related reporting had no significant effect on all the variables of financial performance of DMBs in Nigeria. The non-significance of the sustainability reporting indexes used in the study could be due to non-inclusion into the annual reports and account of DMBs as well as lack of appreciation of its importance in investment decision making. However, governance related reporting and size of the banks have positive effect on the variables of financial performance. The study, therefore, concluded that sustainability reporting has no significant effect on financial performance of deposit money banks in Nigeria.

Based on the findings of this study, the following recommendation was arrived at:

1. Shareholders association and other trade associations should reject financial statements presented at the AGM that do not include comprehensive sustainability reporting.

2. In order to avoid unnecessary reputational disruptions, management of DMBs in Nigeria should expose their officers handling reporting to trainings in the area of GRI and sustainability reporting.

3. Management of DMBs should sponsor researches and empirical studies on the subject, especially the study that will compare sustainability reporting practice in sub-Saharan Africa and BRICS nations for effective guidance. The BRICS nations stands for Brazil, Russia, India, China and South Africa.

4. It is also suggested that a large scope covering regional or international geography should be employed in future studies so as to effectively review sustainability reporting behaviour and its effect on firms’ financial performance across international boundaries and considering larger variables.

References

Aggarwal, P. (2013). Impact of sustainability performance of company on its financial performance: A study of listed Indian companies.Global Journal of Management and Business Research (C: Finance), 13.

Ameer, R., & Othman, R. (2012). Sustainability practices and corporate financial performance: A study based on the top global corporations.Journal of Business Ethics,108(1), 61-79.

Indexed at, Google Scholar, Cross Ref

Antoun, R., Coskun, A., & Georgiezski, B. (2018). Determinants of financial performance of banks in Central and Eastern Europe.Business and Economic Horizons (BEH),14(1232-2019-853), 513-529.

Indexed at, Google Scholar, Cross Ref

Bassey, B.E., Usang, O.U., & Edom, O.G. (2013). An analysis of the extent of implementation of environmental cost management and its impact on output of oil and gas companies in Nigeria,(2001-2010).European Journal of Business and Management,5(1), 110-119.

Chen, C. (2009).Bank efficiency in Sub-Saharan African middle income countries. International Monetary Fund.

Indexed at, Google Scholar, Cross Ref

Chikwendu, O.U., Okafor, G.O., & Jesuwunmi, C.D. (2019). Effect of sustainability reporting on Nigerian listed companies’ performance.Canadian contemporary research journal,1(1), 3-99.

Dembo, A.M. (2017). The impact of sustainability practices on the financial performance: Evidence from listed oil and gas companies in Nigeria. InDimensional Corporate Governance(pp. 215-233). Springer, Cham.

Indexed at, Google Scholar, Cross Ref

Donaldson, T., & Preston, L.E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications.Academy of Management Review,20(1), 65-91.

Indexed at, Google Scholar, Cross Ref

Ekwueme, C.M., Egbunike, C.F., & Onyali, C.I. (2013). Benefits of triple bottom line disclosures on corporate performance: An exploratory study of corporate stakeholders.J. Mgmt. & Sustainability,3, 79.

Indexed at, Google Scholar, Cross Ref

Erhinyoja, E. F., & Marcella, E. C. (2019). Corporate social sustainability reporting and financial performance of oil and gas industry in Nigeria. International Journal of Accounting, Finance and Risk Management, 4(2), 44.

Indexed at, Google Scholar, Cross Ref

Erhinyoja, E.F., & Marcella, E.C. (2019). Corporate social sustainability reporting and financial performance of oil and gas industry in Nigeria.International Journal of Accounting, Finance and Risk Management,4(2), 44.

Indexed at, Google Scholar, Cross Ref

Freeman, R.E. (2010).Strategic management: A stakeholder approach. Cambridge university press.

Joseph, U.B., Tarbo, D.I., & Ikya, E.A. (2017). Corporate environmental reporting and the financial performance of listed manufacturing firms in Nigeria.International Journal of Advanced Academic Research,3(8), 15-25.

Johansson, A., & Fahlén, A. (2019). Does sustainability affect dividend policy? A panel data study on Nordic firms.

King, M.E. (2002). King Report on Corporate Governance for South Africa 2002. Institute of Directors in Southern Africa.

Kipruto, D. (2014). The effect of corporate social responsibility on financial performance.

Kwaghfan, A. (2015). Impact of sustainability reporting on corporate performance of selected quoted companies in Nigeria. (published doctoral dissertation).Department of Accountancy, University of Nigeria, Enugu.

Nnamani, J.N., Onyekwelu, U.L., & Ugwu, O.K. (2017). Effect of sustainability accounting and reporting on financial performance of firms in Nigeria brewery sector.European Journal of Business and Innovation Research,5(1), 1-15.

Nugroho, P.I., & Arjowo, I.S. (2014). The effects of sustainability report disclosure towards financial performance.International Journal of Business and Management Studies,3(03), 225-239.

Nwobu, O. (2016). The relationship between corporate sustainability reporting and profitability and shareholders fund in Nigerian banks.The Journal of Accounting and Management,5(3).

Nyantakyi & Sy (2015). The Banking System in Africa: Main Facts and Challenges. Chief Economist Complex | AEB, 6(5)

Okoye, P.V.C., & Asika, E.R. (2013). An appraisal of sustainability environmental accounting in enhancing corporate productivity and economic performance.International Journal of Advanced Research,1(8), 685-693.

Otekunrin, A.O., Fagboro, G.A., Nwanji, T.I., Asamu, F., Ajiboye, B.O., & Falaye, A.J. (2019). Performance of deposit money banks and liquidity management in Nigeria.Banks and Bank Systems,14(3), 152-161.

Indexed at, Google Scholar, Cross Ref

Owolabi, F., Akinwumi, T., Adetula, D.T., & Uwuigbe, U. (2016). Assessment of sustainability reporting in Nigerian industrial goods sector.

Popa, A., Blidi?el, R., & Bogdan, V. (2009). Transparency and disclosure between theory and practice. A case study of Romania. InProceedings of FIKUSZ’09 Symposium for Young Researchers, 173-183.

Rokhmawati, A., Sathye, M., & Sathye, S. (2015). The effect of GHG emission, environmental performance, and social performance on financial performance of listed manufacturing firms in Indonesia.Procedia-Social and Behavioral Sciences,211, 461-470.

Indexed at, Google Scholar, Cross Ref

Uwaoma, I., & Ordu, P.A. (2016). Environmental reporting in the oil and gas industry in Nigeria.International Journal of Research in Business Studies and Management,3(11), 1-21.

Uwuigbe, U., & Jimoh, J. (2012). Corporate environmental disclosures in the Nigerian manufacturing industry: a study of selected firms.African Research Review,6(3), 71-83.

Indexed at, Google Scholar, Cross Ref

Uwuigbe, U. (2011).Corporate environmental reporting practices: A comparative study of Nigerian and South African firms (Doctoral dissertation, Covenant University).

Whetman, L.L. (2018). The impact of sustainability reporting on firm profitability.Undergraduate Economic Review,14(1), 4.

Received: 01-Mar-2022, Manuscript No. AAFSJ-22-11418; Editor assigned: 03-Mar-2022, PreQC No. AAFSJ-22-11418(PQ); Reviewed: 17-Mar-2022, QC No. AAFSJ-22-11418; Revised: 18-Apr-2022, Manuscript No. AAFSJ-22-11418(R); Published: 25-Apr-2022