Research Article: 2018 Vol: 22 Issue: 1

Testing Taylor Rule to Examine Monetary Policy Regarding Bank Rate, Inflation and Output Gap of Bangladesh: 1972-2016

Nurul Mohammad Zayed, Daffodil International University

Keywords

Taylor’s Rule, GMM Method, Monetary Policy, Stability, Bank Rate, Output Gap, Bangladesh Bank.

Introduction

Monetary policy is a macroeconomic policy that is used to achieve macroeconomic goals such as consumption, liquidity, growth and inflation by the country’s government. Bangladesh bank is currently following a price targeting based monetary policy and it will be continued up to FY18. Bangladesh bank is prioritizing in building up strong capabilities in forecasting and eradicating impediments to financial pricing which is market based. Current monetary policy of Bangladesh is supporting manufacturing which is employment-focused, green project sub sectors and FDI facilitation. According to Bangladesh bank’s monetary program, growth ceiling of Domestic Credit (DC) is consistent with inflation and growth objectives. Bangladesh bank is ready for adjustments in rate of policy. There is robustness in the momentum of output growth followed by uptrend in food price. Global inflation may cause mitigation in the risk of domestic inflation. According to Bangladesh bank, monetary aggregates enhancing smoothly within the growth ceiling though domestic credit and inflation are remaining below the ceiling (Monetary Policy Statement, BB, 2017).

The prominent Stanford economist, John Taylor invented and published Taylor’s rule from 1992-1993. Taylor’s rule is the form that shows how nominal interest rate which is set by government changes in output gap, inflation and other economic variables. It’s a forecasting model which is used to determine the shifts of interest rate in the economy. Taylor’s rule recommends that central banks should increase interest rates when employment surpasses full employment level or inflation is high. Conversely, interest rates must be decreased while employment levels and inflation are low. According to Taylor’s rule, policymakers should not follow algebraic formulations. Policy performances are generally improved by credible and systematic features of rules. A new policy would do better when the existing policy is not doing well. According to Taylor’s rule, if inflation rises above 2% of target or real GDP increases over trend GDP then the rate of federal funds also rises. The coefficients of the rules are used to make easy discussions. The rate of federal funds is influenced by the changes in real GDP and inflation and those emerged from updated research. Taylor’s rule is based on interest rate (short term), full employment and inflation. Taylor’s rule indicates that, the central bank should adjust the nominal interest rate in response to deviations of inflation from target and output from potential. On the other hand, it reduces interest rates to stimulate output (Taylor, 1993).

The objective of this paper is to analyze the monetary policy of Bangladesh during 1972-2016 in terms of bank rate, inflation rate and output gap in accordance with the Taylor’s rule. Moreover, this research intends to estimate whether the monetary policy of Bangladesh is following the Taylor’s rule and whether there is any long run relationships among bank rate, inflation rate and output gap of Bangladesh over the period 1972-2016.

There were few previous studies regarding monetary policy of Bangladesh to be examined to find out the gaps, differences and motivations of this study on Taylor’s rule. There is an association between inflation and domestic borrowing in Bangladesh and Bangladesh is affected by double-digit inflation which is resulted from the borrowing of the government of Bangladesh (Islam & Kabir, 2012). Because of positive association between policy shock and output, monetary policy of Bangladesh is playing a significant role in macroeconomic stability (Younus, 2017). Monetary policy was affecting financial stability and real economy of Bangladesh through changes in policy stance, asset prices and bank lending (Rafiq, 2015). Developed countries rather than developing countries follow rule based monetary policy such as Taylor’s rule (Islam, 2009). To reduce poverty and to accelerate growth, Bangladesh bank should undertake inflation targeting framework to achieve output growth and price stability (Islam & Uddin, 2011). Lending rate, deposit rate, real GDP, output, inflation, money supply and interest rate are the most significant variables to foster the monetary policy in Bangladesh during 2006-2016 (Younus & Roy, 2016). The previous studies lack behind from considering or applying Taylor’s rule to examine the monetary policy of Bangladesh. Besides as Bangladesh bank adopts short term interest rate to conduct its monetary policy, Taylor’s rule should be examined and that’s how it motivated to conduct and choose this study.

The rest of the paper is structured as follows. Section 2 describes a brief review of the relevant literature. Section 3 depicts a theoretical model that captures the Taylor’s rule. The econometric estimations for the long run relationship among the variables are set out in Section 4. Section 5 concludes with some concluding remarks.

Literature Review

The rationale for this research study is to examine monetary policy of Bangladesh during 1972-2016 in accordance with Taylor’s rule. To focus in this topic, to show critical analysis among the different previous works and to relate these researches to this research, several relevant studies have been examined. For better understanding and analysis, these studies have been classified by papers for developed economies, emerging economies and Bangladesh economy.

Developed Economies

Mehra & Minton (2007) tested Taylor’s rule to examine whether interest rate is determining monetary policy actions in USA and found that inflation estimates the output gap very well in the context of Greenspan Fed by using real time data and by developing a forward-looking model. Farrell (2015) inferred New Zealand, Canada and Australia in terms of policy preferences of central banks regarding inflation by using small Keynesian open economy model and Bayesian estimation and found that the monetary policy is optimal according to Taylor’s rule and from the point of view of central banks. Berument (1999) assessed that both inflation and interest rates affect Treasury-bill rate in UK over the period 1958-1994 within the framework of Fisher hypothesis by applying ARCH and GARCH models and found that there is a long run relationship among expected inflation, inflation risk and the t-bill rate in UK. Nikolov (2002) explained why monetary policy rules of Bank of England and found that it uses an inflation targeted triangular rule and also explained that how policy rules are been used as the input of regular assessment under different assumptions by using the Taylor’s rule, Barinard rule and McCallum rule and by applying MPC methods over the period 1993-2001. Bouchabchoub, Bendahmane, Haouriqui & Attou (2015) presented monetary policy on the basis of Taylor’s rule in the context of European Central Bank and found that interest rate, inflation and GDP could be predicted by applying Taylor’s rule, Hall-Taylor equation, Kalman filter & Hodrick-Prescott model with reference to 2001-2009 and found inflation shock on interest rates.

Sauer & Strum (2003) suggested that in terms of inflation ECB is accommodating changes and following a destabilizing policy by applying Taylor’s rule & HP filtered method with reference to 1991-2003 and found a partial adjustment by a large degree in interest rates. Clarida, Gali & Gertler (1998) estimated monetary policy reaction for countries such as UK, Germany, Japan, US, Italy and France by applying GMM method with reference to 1974-1994 and found that the central banks of these aforesaid countries respond to expected inflation rather than lagged inflation, inflation rate is superior to exchange rate in fixing monetary policy and interest rate is much higher than that of other macroeconomic variables. Rzhevskyy & Papell (2012) estimated Taylor’s rule for US monetary policy with reference to 1966-1979 and found that Taylor’s rule is not being following by Fed and also monetary policy does not stabilize inflation rate. Kozicki (1999) focused on the monetary policy in the light of Taylor’s rule and suggested that there is no robustness in rules to minor variations, policy decisions made by policy makers are also limited, in special circumstances Taylor’s rule has disadvantages in Kansas City, Missouri with reference to 1960-1997. Sghaier (2013) estimated monetary policy of CBT by applying PP test, LM test and GMM method of estimation with reference to 1993-2011 and found that CBT follows Taylor rule and the primary objective of monetary policy is inflation. Woodford (2001) incorporated inflation, output gap and nominal interest rate regarding monetary policy according to Taylor’s rule and suggested a realistic model of output gap that may be quite different from theoretical measures which should be based on interest rate. Asso, Kahn & Lesson (2010) applied VAR model and found the optimization problem regarding adjusting policy rates at central banks by the policymakers and also suggested that Taylor rule must be incorporated with the macroeconomic models to forecast the economy.

Emerging Economies

Moreira (2015) investigated monetary policy of Brazil and found that the monetary policy of Brazil is different from Taylor’s rule by estimating OLS and GMM over the period of 2005-2013. It showed no robust effects of inflationary expectations and suggested to stabilize output against the stabilization of inflation. Onanuga, Tella & Osoba (2016) investigated monetary policy rate regarding output gap uncertainty in Nigeria with reference to 1991-2014 by using Taylor’s rule, ADF test, KPSS test, GARCH model, ARCH model, Breusch-Pagan-Godfrey test, GMM method and Weak instrument test and found no strong evidence of supporting the case that monetary policy is affected by inflation and also found that real output gap has less influence on monetary policy and hence suggested that both inflation and output gap should be considered by the Central Bank of Nigeria while setting policy rate. Pinga & Xiongb (2003) examined monetary policy of China by applying GMM estimation with reference to 1992-2001 and found that the monetary policy of China is unstable and suggested that China should implement interest rate reform to change the regime of monetary policy. Kim (2013) assessed the monetary policy regarding interest rate, inflation rate and government spending of Korea with reference to 2000-2012 by applying Bayesian techniques, Random Walk Markov chain Monte Carlo method, Hessian likelihood and Simulated Annealing method and found that the monetary policy of Korea was countercyclical and inflationary, output growth volatility was reducing and suggested that an aggressive monetary policy would stabilize the inflation rate but at the cost of higher output growth volatility. Boamah (2012) used time series data of Ghana regarding inflation, GDP and output gap with reference to 1993-2011 by applying HP filtered test and ECM test and found that as interest rate predictor Taylor rule doesn’t work in Ghana. Guney (2016) investigated monetary policy rules of Turkey regarding inflation and output gap with reference to 2002-2014 by using Taylor’s rule, Hodrick-Prescott (HP) model, ADF test, GMM method, Hansen’s J-test and found that CRBT is concerned about price stability and responded to growth uncertainties and inflation.

Bangladesh Economy

Islam & Kabir (2012) investigated whether there is any association between government domestic borrowing and inflation in Bangladesh and found that Bangladesh is affected by double-digit inflation that is resulted from government borrowing by running a regression analysis. It was suggested that Bangladesh bank should implement contradictory monetary policy for the effective prevention of runaway inflation. Younus (2017) developed a DSGE model to estimate and analyze policy shocks regarding reaction function of central bank of Bangladesh with reference to output and inflation by using Bayesian estimation over the period 1991-2014 and found that there is a significant role of monetary policy in macroeconomic stability in Bangladesh as there exists a positive association between output and policy shock in Bangladesh. Rafiq (2015) explored how real economy and financial stability of Bangladesh are affected by monetary policy over the period 2003-2013 by applying MCMC methods and Gibbs sampling estimation and found that monetary policy affects real economy and inflation through bank lending, asset prices, changes policy stance and finally suggested policy measures that would enhance and promote monetary policy and financial stability of Bangladesh respectively. Islam (2009) examined the strategies of monetary policy of 6 countries like Bangladesh, USA, India, UK, Pakistan and Sweden and found that developed countries follow monetary policy which is rule based, on the other hands developing countries launch policies rather than following policies by applying Taylor’s rule, Rudebusch-Svensson model and Hodrick-Prescott model over the period 1984-2008 from the normative counterpart. Islam & Uddin (2011) found that Bangladesh bank has sophistication undertaking framework of inflation targeting which could have been helped to achieve price stability and output growth as the objectives of Bangladesh are to accelerate growth and reduction of poverty.

Younus & Roy (2016) forecasted inflation, output and the policy rate for the period July 2016-June 2017 in Bangladesh with reference to 2006-2016 by applying ADF test, PP test, KPSS test and VAR analysis and found that interest rate and money supply are the two most significant variables in Bangladesh to forecast output and inflation and also concluded that to ensure potent management of real GDP growth and inflation in Bangladesh, the spread between lending rate and deposit rate could be used by the monetary authority of Bangladesh. To apply the Taylor’s rule, nominal interest rate, inflation rate and output gap must be incorporated. But one cannot ignore bank rate as it is one of the major policy tools of monetary policy. The literature review on the Taylor’s rule is bold but it lacks considering developing countries like Bangladesh. So, to fill up these gaps, this study considered bank rate instead of nominal interest rate of Bangladesh and estimated the structural stability of the model by applying CUSUM & CUSUMQ tests unlike the previous studies.

Objectives

The objective of this research is to analyze the influences of the bank rate on inflation rate and output gap in Bangladesh during 1972-2016 by applying OLS and GMM methods in accordance with Taylor’s rule. The specific objectives of this paper are to explain the effects in the relationships among bank rate, inflation rate and output gap, to estimate how bank rate responds to changes in inflation rate and output gap, to evaluate the stability of Taylor’s rule in Bangladesh during the period 1972-2016 and to recommend monetary policy guidelines to improve the imbalance of money supply in Bangladesh.

Methodology

This research is descriptive in nature and the data is quantitative in nature. Only the secondary data were used. Time sample data were collected from the world development indicators report, internal database and websites from 1972-2016. An OLS model among the variables such as bank rate, inflation and output gap has been developed which is specified in Equation (2) and OLS and GMM methods have been applied. ADF test, PP test and KPSS test have been applied to test the stationary state of time series data. Cumulative sum (CUSUM) and cumulative sum of squares (CUSUMQ) of recursive tests have been applied to examine the stability of Taylor’s rule.

Theory & Model

Monetary policy is the mechanism by which central banks control the money supply to achieve price stability by targeting interest rate and inflations rate. The Central Bank undertakes such a monetary policy in accordance with Taylor’s rule where interest rate is a function of inflation deviations and output. Rules of monetary policy are changing and flexible over time according to the preferences of different countries and interest rate lies on information dynamics due to inflationary process and that is the ultimate goal of Central Banks (Moreira, 2015). The most significant issue of monetary policy concerns with strategy setting of Central Banks’ policy instruments. In general, short term interest rate is considered for implementing monetary policy as the key instrument of inflationary dynamics and output regarding target and potential levels (Taylor, 1993).

Taylor’s rule actually explains the influence of inflation rate on the nominal interest rate that changed by central banks. The output and demand dynamics are explained by IS curve as output gap ![]() depends on past value and short term interest rate with constant variance and zero mean (Moreira, 2015). The Taylor’s rule is as follows:

depends on past value and short term interest rate with constant variance and zero mean (Moreira, 2015). The Taylor’s rule is as follows:

Where it, β0, β1, πt, 0.02, β2, ![]() , yt,and

, yt,and ![]() denote nominal interest rate, benchmark recommendations targeting inflation and interest, coefficient of inflation gap, inflation rate, 2% inflation target, coefficient of output gap, output gap, log of real GDP and log of potential output respectively (Taylor, 1993). Here β0, β1 and β2 are positive parameters. Inflation ( πt) is cause by lagged output gap

denote nominal interest rate, benchmark recommendations targeting inflation and interest, coefficient of inflation gap, inflation rate, 2% inflation target, coefficient of output gap, output gap, log of real GDP and log of potential output respectively (Taylor, 1993). Here β0, β1 and β2 are positive parameters. Inflation ( πt) is cause by lagged output gap ![]() and its past values with constant variance and zero mean (Moreira, 2015). In accordance with Taylor’s rule, an OLS model has been developed under the symmetry condition among bank rate, inflation rate and output gap of Bangladesh during the period 1972-2016 and the model and instrument rule is as follows:-

and its past values with constant variance and zero mean (Moreira, 2015). In accordance with Taylor’s rule, an OLS model has been developed under the symmetry condition among bank rate, inflation rate and output gap of Bangladesh during the period 1972-2016 and the model and instrument rule is as follows:-

Where it, α, β0, β1, πt, β2, ogt and ?t denote bank rate, alpha coefficient, benchmark recommendations targeting inflation and interest, coefficient of inflation, inflation rate, coefficient of output gap, output gap and error term respectively. Here β0, β1 and β2 are positive parameters. The equilibrium bank rate is quoted by it, inflation target is quoted by πt and ?t is the shock of policy innovation in inertial rule. This model has the nature of forward-looking where bank rate (it) is defined by its past values by policymakers to avoid frequent reversions and abrupt movements. Here past bank rate is determining current bank rate. Authorities’ decisions are affected by public’s expectations. To explain the price stability forward-looking rule has been adopted as it’s significant to describe the behavior of bank rate as the implicit or explicit target of Central Bank. The equations (1) & (2) are presented in real terms for bank rate (it), inflation (πt) & output gap (ogt). The output gap ![]() has been measured by deducting actual output or GDP yt from potential output or GDP (

has been measured by deducting actual output or GDP yt from potential output or GDP (![]() ). The real term Taylor rule has been defined for the economic openness of Bangladesh by taking output gap in to consideration. The alpha coefficient (α) explains the sensibility of bank rate (it) to output gap (ogt). Because of countercyclical behavior of monetary policy, α is >0. When α>1 the bank rate (πt) increases response to increase of inflation deviation (πt) (Moreira, 2015).

). The real term Taylor rule has been defined for the economic openness of Bangladesh by taking output gap in to consideration. The alpha coefficient (α) explains the sensibility of bank rate (it) to output gap (ogt). Because of countercyclical behavior of monetary policy, α is >0. When α>1 the bank rate (πt) increases response to increase of inflation deviation (πt) (Moreira, 2015).

Econometric Estimations

Augmented Dicky Fuller (ADF), Phillips-Perron (PP) and KPSS tests have been applied to test integration order and the stationary state of the variables in first step. From Table 1, it appears that bank rate (i) and inflation rate (π) are stationary at level, I (0); on the other hand output gap (og) is stationary at 1st difference, I (1).

| Table 1: Adf, Pp And Kpss Unit Root Tests (Statistics) | ||||||||

| ADF1 | PP2 | KPSS | ADF3 | PP4 | KPSS | |||

|---|---|---|---|---|---|---|---|---|

| Series | Level test | 1st Difference test | I(n) | |||||

| i | -2.5185*** | -1.9256* | 0.2592*** | - | - | - | I(0) | |

| π | -3.1861 | -3.1832* | 0.0797 | - | - | - | I(0) | |

| og | -1.6509* | -8.3097* | 0.2333 | -6.6290*** | -24.8290*** | 0.3856*** | I(1) | |

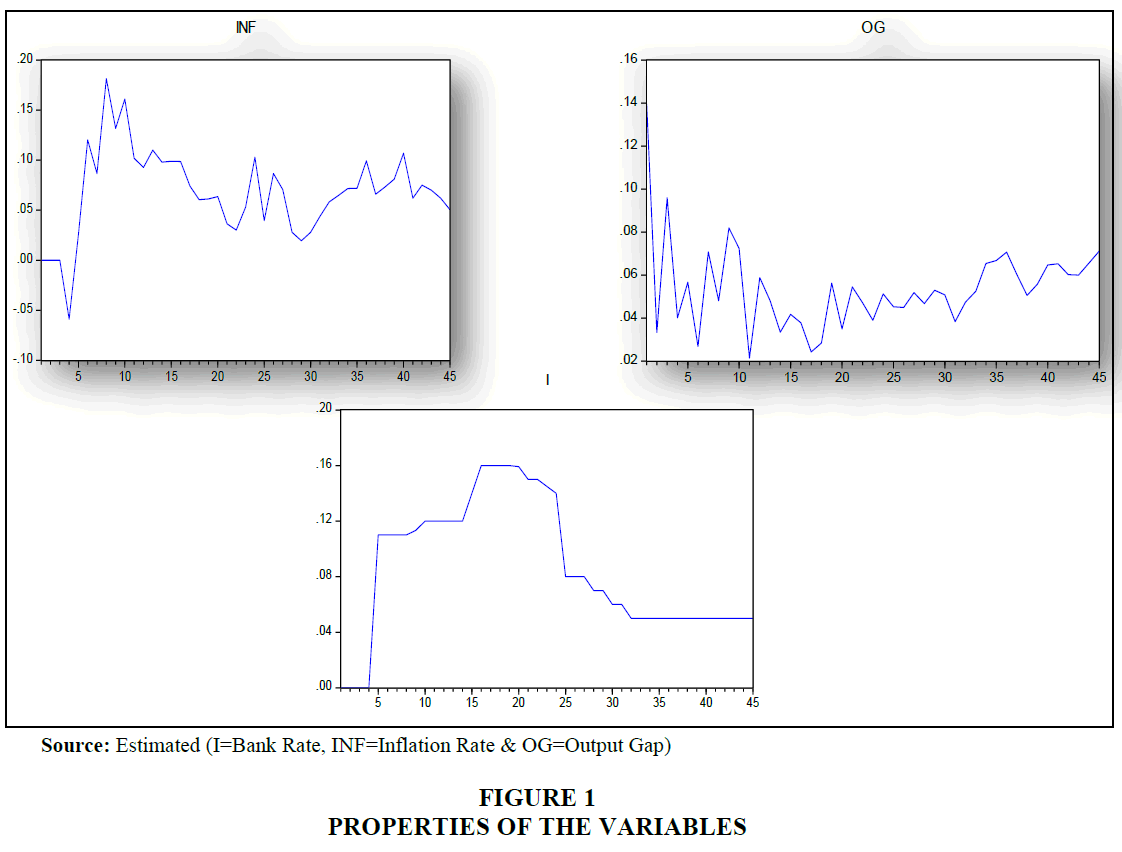

Co-integration methods are not justified as the time series or data jointly are not I (1). Hence OLS and GMM should be adopted with bank rate (i) and inflation rate (π) at level, I (0), while output gap (og) at first difference, I (1) in a dynamic estimation of short term. So, to estimate Taylor’s rule for the Bangladesh economy, this study implemented such methods. To correct endogeneity, residual autocorrelation and heteroskedasticity, GMM method is applied. For the sake of robustness, the results of GMM regressions could be compared with the findings of OLS. The instrumental variables must be exogenous for testing GMM (Moreira, 2015). From Figure 1, the visual plots of the variables appeared which are properly glued.

The specifications could be observed in Table 2 through OLS estimates. The adjusted R2 is above 0.3. The Newey and West (1987) estimator has been used to estimate OLS which is in line for correcting residual autocorrelation, suggested by LM test regarding the specifications. The coefficient of inflation (0.456088) is significance at 1% which means that there is a high degree of gradualism in inflation rate to adjust bank rate. All the generated estimates and estimated values are away from excess unity as far as forward-looking coefficients are concerned. In this regard, such policy is not consistent with bank rate in terms of counter cyclical movements. The value of output gap (-1.013960) is negative and it’s not statistically significance meaning that Bangladesh Bank reacts to output gap changes pro-cyclically (Moreira, 2015).

| Table 2: Ols-New & West Estimates (1972-2016) | |

| Explanatory Variables | OLS-NW Estimates |

|---|---|

| Eq.2 | |

| C | 0.109861 (0.020146) [5.453109] |

| π (-1) | 0.456088*** (0.137520) [3.316514] |

| og(-1) | -1.013960 (0.292759) [-3.463465] |

| Adjusted R-squared F-statistic Prob(F-statistic) LM (Prob:02 lags) |

0.354037 13.05770 0.000039 0.0000 |

Bangladesh Bank has a preference for stimulating output in Bangladesh, to trade- off inflation-output stabilization. The monetary policy of Bangladesh demonstrates output preference, which is in line with bank rate’s pro-cyclical reaction. So, Bangladesh bank has not taken pass-through effect significantly into account regarding bank rate decision during the analyzed period. If Bangladesh Bank shows any change in monetary policy, the response should be the downward bank rate in Bangladesh (Moreira, 2015).

The GMM estimations of monetary policy are shown in Table 3. The coefficients maintained statistical significance and confirming previous estimates of OLS and also corroborating Bangladesh Bank’s gradualism of high degree. Values of GMM estimates regarding inflation are less meaning that the monetary policy of Bangladesh is not countercyclical. The coefficient of output gap is significance and positive that reinforces the monetary policy of Bangladesh (Moreira, 2015).

| Table 3: Gmm Estimates (1972-2016) | |

| Explanatory Variables | GMM Estimation |

|---|---|

| Eq.2 | |

| C | -0.799834* (2.471403) [-0.323636] |

| π (-1) | -0.213905*** (3.391275) [-0.063075] |

| og (-1) | 17.36224* (51.45598) [0.337419] |

| Adjusted R-squared J-stat (J-Prob) |

-39.439994 1.38E-43 0.2252 |

The GMM estimates are just opposite of OLS estimates in terms of the coefficients of inflation and output gap that are not consistent with pass-through and counter-cyclical effects. These findings denote that Bangladesh Bank preferred downward bank rate during the analyzed period to offset downward movement of output of Bangladesh. The model maintained a high level of adjusted R2 and the null hypothesis has not been rejected by J-statistics. Thus the OLS and GMM estimates identify divergence from Taylor’s rule in the monetary policy of Bangladesh. Moreover, there is pro-cyclical bias of Bangladesh Bank in terms of the responses to inflation and output gap thus making inconsistent monetary policy (Moreira, 2015).

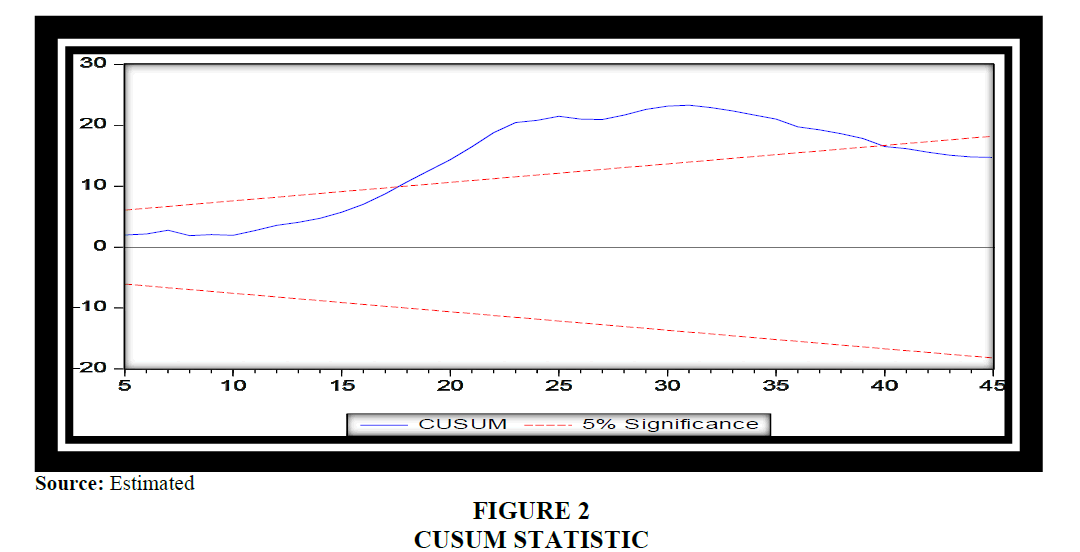

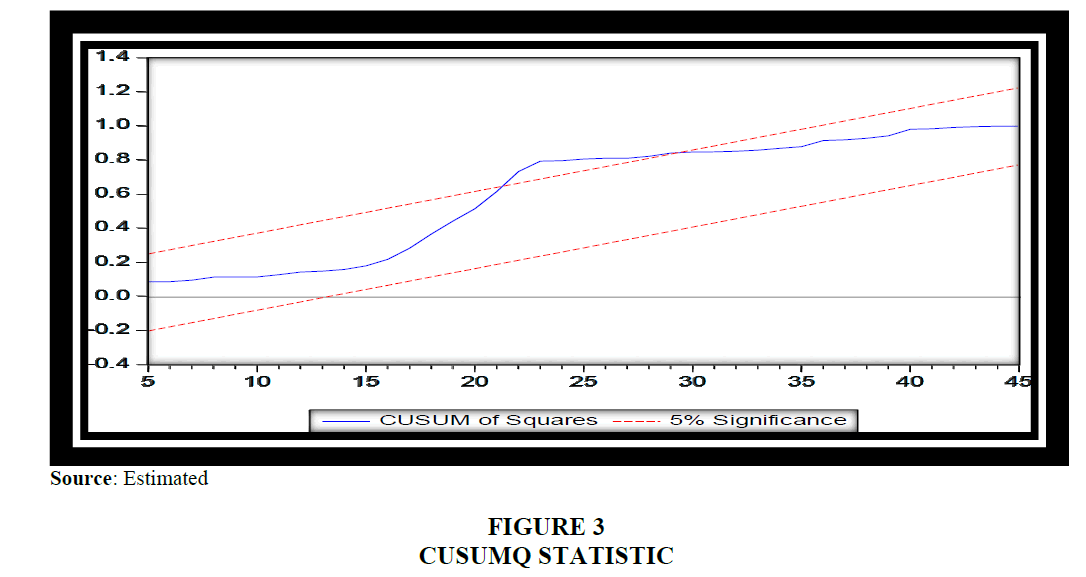

From Figures 2 and 3, it appears that bank rate function of Bangladesh was not stable during 1972-2016. CUSUM and CUSUMSQ plots must be under 5% critical bounds if the coefficients were to be stable but in this research the plots of CUSUM and CUSUMQ both crossed the bounds.

Summary Of Findings

There exists a relationship among bank rate, inflation rate and output gap of Bangladesh during 1972-2016. If bank rate goes up, output gap also goes up. QUSUM and QUSUMQ tests suggested that the model is not stable. During the analyzed period, bank rate is aligned and consistent with output gap but not with inflation rate of Bangladesh according to economic theory. Bank rate is working as the policy tool only for the output gap not for the inflation rate. It could be concluded that monetary policy is not been implemented in line of Taylor’s rule in Bangladesh meaning that monetary policy is not appropriate to achieve the macroeconomic goals as far as inflation rate of Bangladesh is concerned during the analyzed period.

Conclusion and Policy Suggestions

Generally when bank rate is higher there is less borrowing, less investment, less growth, less spending and hence inflation rate decreases and output gap increases because of less investment. It means with the incremental bank rate, the money supply is also increasing in the economy but investment is not up to the mark and that’s why output gap and inflation rate is also increasing rather than decreasing in the economy of Bangladesh during 1972-2016. In this situation real estate market, gold market, stock market and consumer goods market are also being affected by the incremental inflation rate. Though high cost of import is the major reason of inflation, the incremental trend of inflation is mostly driven by the less investment despite of incremental money supply in the economy of Bangladesh. The ratio of money supply and investment is low during the analyzed period in Bangladesh. Bangladesh Bank should implement such a monetary policy where bank rate will be used as a moderate policy tool so that there are sufficient amount of money supply in the economy to boost up the production or investment and could control the inflation rate as well.

References

- Asso, P.F., Kahn, G.A. & Lesson, R. (2010). The Taylor rule and the practice of central banking. The Federal Reserve Bank of Kansas City, Economic Research Department, Research Working Papers, RWP No 10-05, 1-52.

- Berument, H. (1999). the impact of inflation uncertainty on interest rates in the UK. Scottish Journal of Political Economy, 46(2), 207-218.

- Bouchabchoub, T., Bendahmane, A., Haouriqui, A. & Attou, N. (2015). Interest rate prediction with Taylor rule. International Journal of Trade, Economics and Finance, 6(1), 58-61.

- Boamah, M.I. (2012). Taylor rule and monetary policy in Ghana. International Journal of Economics and Finance, 4(7), 15-21.

- Clarida, R., Gali, J. & Gertler, M. (1998). Monetary policy rules in practice: Some international evidence. European Economic Review, 42, 1033-1067.

- Farrell, J.P. (2015). Taylor rules, central bank preferences and inflation targeting. Sheffield Economic Research Paper Series, SERPS no. 2015023, 1-27.

- Guney, P.O. (2016). Does the central bank respond to output and inflation uncertainties in Turkey. Central Bank Review, 16(2), 53-57.

- Islam, M.S. & Uddin, M.S. (2011). Inflation targeting as the monetary policy framework: Bangladesh perspective. Economia, Seria Management, 14(1), 106-119.

- Islam, S.R.U. & Kabir, R. (2012). Government domestic borrowing and inflation in Bangladesh and the central bank’s monetary policy to curb inflation. Journal of Business Studies, 33(1), 36-53.

- Islam, M.S. (2009). Rule based monetary policy for developing countries: Evidence from developed countries. Thesis paper submitted in fulfillment of Master in Economics, Lund University, Sweden, 1-52.

- Kim, T.B. (2013). Monetary policy in Korea through the lens of Taylor rule in DSGE model. Stonybrook University, Meeting Papers, MP No 746, 1-21.

- Kozicki, S. (1999). How useful are Taylor rules for monetary policy? Federal Reserve Bank of Kansas City, Economic Review, Second Quarter, 5-33.

- Mehra, Y.P. & Minton, B.D. (2007). A Taylor rule and the green span era. Economic Quarterly, 93(3), 229-250.

- Moreira, R.R. (2015), Reviewing Taylor rules for Brazil: Was there a turning-point? Journal of Economics and Political Economy, 2(2), 226-289.

- Monetary Policy Statement. (2017). Bangladesh Bank, July-December.

- Nikolov, K. (2002). Monetary policy rules at the bank of England. Paper presented in a workshop on ‘The Role of Policy Rules in the Conduct of Monetary Policy’, European Central Bank, Frankfurt, 1-17.

- Newey, W.K. & West, K.D. (1987), A simple, positive semi definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703-708.

- Onanuga, A.T., Tella, S.A. & Osoba, A.M. (2016). Uncertainty of output gap and monetary policy-making in Nigeria. Acta Universitatis Danubius Economica (AUDE), 12(5), 227-237.

- Pinga, X. & Xiongb, L. (2003). Taylor rule in transition economies: A case of China’s monetary policy. Statistical Yearbook, Baijia Publishing House, 1-18,

- Rafiq, S. (2015). Monetary policy transmission and financial stability in a LIC: The case of Bangladesh. International Monetary Fund, Asia and Pacific Department, IMF Working Paper, Working Paper No. 15/231, 1-28.

- Rzhevskyy, A.N. & Papell, D.H. (2012). Taylor rules and the great inflation. Journal of Macroeconomics, 34, 903-918.

- Sauer, S. & Strum, J.E. (2003). Using Taylor rule to understand ECB monetary policy. Monetary Policy and International Finance, CESIFO Working Paper No. 1110, 1-33.

- Sghaier, I.M. (2013). Taylor rule and monetary policy in Tunisia. Science and Education Centre of North America, Journal of Finance & Economics, 1(4), 30-41.

- Taylor, J.B. (1993). Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy, 39(1), 195-214.

- Woodford, M. (2001). The Taylor rule and optimal monetary policy. The American Economic Review, 91(2), 232-237.

- Younus, D.S. (2017). Responses of inflation and output to shocks in monetary policy: A case study with Bangladesh using the DSGE model. Research Department, Bangladesh Bank, Working Paper Series, WP No. 1701, 1-14.

- Younus, D.S. & Roy, A. (2016). Forecasting inflation and output in Bangladesh: Evidence from a VAR model. Research Department and Monetary Policy Department, Bangladesh Bank, Working Paper Series, WP No. 1610, 1-12