Research Article: 2021 Vol: 25 Issue: 3

Testing the Optimal Dividend Model

Ala’a Adden Abuhommous, Dar Al Uloom University

Mousa Almanasser, Mutah University

Abstract

In this research we aim to examine the partial adjustment model of the dividend policy for firms listed in one of the largest financial markets in the world. We use data from U.S publicly listed firms for the period from 1997 to 2017 and applies a panel data analysis. we find that that the U.S listed firms change their current payout ratio towards a long-run optimal payout ratio, also we find that the earnings is not affecting the dividend payout ratio, which indicates that the independence of dividend policy from dividend.

Keywords

Dividend Policy, Lintner Model, Dividend Smoothing Model, Partial Adjustment Model.

JEL Classifications

G30, G31, G32.

Introduction

In this research we aim to apply the proposed model of optimal dividend policy, this model initially introduced by Lintner (1956) that proposed the firm have target divide ratio and move toward this target gradually. He argues that,

‘The belief on the part of many managements that most stock-holders prefer a reasonably stable rate and that the market puts a premium on stability or gradual growth in rate-were strong enough that most managements sought to avoid making changes in their dividend rates that might have to be reversed within a year or so’.

In addition, he points that the dividends are changed by firms toward target point partially, hence the adverse reaction of shareholder toward the change of dividend policy is reduced. Furthermore, the dividend smoothing model assumes that the firm’s current earnings is considered as the most significant factor of the rate of the amount of dividend paid, in which determine the target dividend pay-out ratio. This due to the fact the firm’s managers assumes that the stockholders are expect the firm to change its dividend policy if earnings changed, for example the shareholders will accept the firm to reduce dividends if its earnings decrease. Therefore, the change of dividends should follow the changes in earnings and firm’s dividend will change smoothly rather than large changes.

The adjustment process may be affected by the disparity of information between firm’s management and potential investors. As the gap between firm and investor decrease the adjustment process becomes quicker and vis versa. The slow process of adjustment toward target payout ratio can be higher in firm’s with high asymmetric information with investors because they consider the adjustment in dividend policy as an indicator of changes in the earnings in the future. Firms that operate in financial market where the asymmetric information problem is low, will be able to move toward its target payout ratio quickly because the investors are fully informed about reasons that lead to dividends changes.

Aivaizaian et al. (2003) demonstrate that the market-based market the agency cost problem and asymmetric information problem are high since the main provider of funds is market, where shareholders are not fully informed about firm’s operation. On other hand firms that operate in bank-based market have lower agency and asymmetric information problem, since the banks are able to monitor the firm’s operations and activities.

We aim to contribute of this study by examine the Lintner’s (1956) dividend smoothing model in U.S listed. The research is ordered as follows: section 1 is the introduction of the research. Section 2 is the Literature review and Hypotheses Development. Section 3 displays the data and the methodology used in the research. Section 4 shows the discussion regression results. Finally, section 5 presents the conclusion of the paper.

Literature Review and Hypotheses Development

Dividend policy is a fundamental corporate finance issue due to its significant impact on investment and financing decisions. It has attracted a significant amount of attention in corporate finance literature. Miller & Modigliani (1961) assert that, under the conditions of a perfect capital market, a managed dividend policy does not affect the firm value and therefore it is irrelevant. However, many scholars argue that real world capital markets are subject to various market imperfections (such as: transaction costs, agency problems, differential taxes, and information asymmetries) and suggest that dividends may be used as an important mechanism to minimize such imperfections. Under the assumption of imperfect market, many other theories were also developed, in particular the signaling approach and the information content of dividend. This theory states that dividends are a significant source of information and then can communicate valuable information about present, or may be, future value of the firm. This implies that the decision to raise funds is directly associated with dividend policy. Subsequently, as dividend policy influences the capital structure of a firm, it will also have an impact on the investment decision and cost of capital of the company. Given the importance of dividend policy, Linter (1956) sets up the partial adjustment model of dividend policy which suggests that dividend increases convey to outsiders that current cash flow is stable. This suggests that firms tend to increase their dividend payments only if their cash flow increases is stable to avoid dividend reduction and consequently, the negative market reaction and thereby, the firm value (Brav et. al., 2005). Lintner model reveals that firms set current dividend payments in line with their current earnings and previous year dividend payments, and they make partial adjustments to a target payout ratio and do not match immediately with the earnings changes.

In fact, various researchers from developed countries have been strongly supportive of Linter’s findings and reported consistency of results across many markets and different periods of time. George & Kumudha (2006) study supports Linter’s model and indicate that current dividend per share is positively related to current earning per share and previous dividend per share. Furthermore, Arnott & Asness (2003) study confirms that higher aggregate dividend payout ratios associated with higher future earnings growth. Furthermore, using a sample of active and inactive stocks listed in NYSE and NASDAQ Zhou & Ruland (2006) explored the impact of dividend payout ratio on future earnings growth of companies. Their study showed a positive relationship between payout ratio and future earnings growth. Conversely, non-U.S. firms seem to be less concerned about dividend reduction and thus modify their dividend policies more frequently (look for examples, Dewenter & Warther, 1998; Chemmanur et al., 2010; Hail, Tahoun, & Wang, 2014). Using a dynamic agency model, Lambrecht & Myers (2012) show that changes in dividends follow Linter’s partial adjustment model. Similarly, McDonald et al. (1975) and Chateau (1979) reported evidences which strongly support Linter’s findings for French and Canadian firms. Finally, Dewenter & Warther (1998) compare dividend polices of Japanese and US firms using the Linter model, and find that, Japanese firms reduce dividends in response to poor performance more quickly than US firms. Asimakopoulos et al. (2021) find that firms tend smooth their dividend if their credit rating downgrade, however the firms with credit rating upgrading has marginal dividend smoothing activities. Based on sample from travel and leisure firm in the U.K for the period between 2007 and 2019 Kilincarslan & Demiralay, (2021) find these firms have long-term target pay-out ratio and move toward this target gradually. Furthermore, they find that the dividend policy for these firms is affected by the firm’s characteristics such as profitability, debt, and size. Koussis & Makrominas (2019) find that the US and EU banks implement the dividend pay-out ratio smoothing practices before and after the financial crisis of 2007.

Moreover, numerous studies have investigated dividend policy in different developing ountries by applying Lintner’s (1956) adjustment model. For instance, Pahi & Yadav (2019) shows that the current year’s dividend policy is determined by last year’s dividend in India which is consistent with Lintner’s (1956) adjustment model. Similarly, Yusof & Ismail, (2016) research reveals that Malaysian firms have rely on both current earnings and past dividends which give support to Linter’s (1956) model. Similarly, Bostanci et al. (2018) shows that Istanbul Stock Exchange (ISE)-listed firms, adopt stable dividend policies and adjust their cash dividends by a moderate level of smoothing, which are less stable compared to their counterparts in the US market. In their study Chemmanur et al. (2010) compare dividend policies of Hong Kong firms and US firms. The regression results suggest that the Hong Kong firms have less sticky dividend policy than the USA firms, which implies a less significant role played by dividend policy in signalling effect theory and agency models in Hong Kong than it does in the USA. Furthermore, Al-Malkawi et al. (2014) study examined dividend smoothing of companies listed in the Muscat Stock Market using Linter’s (1956) partial adjustment model. The study found that Omani firms adjust their dividends toward their target payout ratio gradually, more interestingly with a relatively low speed of adjustment, as compared to other firms in developed and emerging economies.

H0: current dividend payments are highly sensitive to past dividend payments, and highly sensitive to current earnings.

The Empirical Model, Methodology, Data

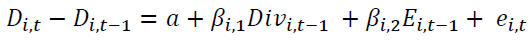

To test the main hypothesis of this paper we implement Lintner’s model. Where firms set long term dividend policy. Thus, the focus of the firm’s manager is to make the changes to dividend policy in order to move toward this target. Thus, the managers smoothly move toward firm target dividend policy, where firm’s earning may determine the current dividend policy, however the transitory changes in the firm’s earnings should not affect the firm dividend policy. Based on Lintner dividend smoothing model that aim to explain the changes in the firm dividend policy, this model assume that firm’s optimal pay-out ratio is based on current earning thus, we can write the model the optimal dividend policy as follow:

D*i.t = rEi.t (Eq.1)

D*i.t = target dividen ratio for firm i in year t.

r = the optimal dividend pay-out ratio.

Ei.t = the earning of the firm i in year t.

Since the firm has optimal target dividend ratio, the gradual changes of earnings will lead the firm to change its dividend pay-out ratio but not in the same amount. Therefore, the value of r will be between 0 and 1, thus, the changes in the earnings may lead to changes in dividend pay-out ratio but not in the rate. Hence the Lintner’s adjustment model will be as follow:

Di.t– Di.t-1= S(D*i.t– Di.t-1) (Eq. 2)

Where c is the speed which measures the dividend pay-out adjustments. Alternatively, Equation 2 can be written to find the actual dividend pay-out as:

(Eq. 3)

(Eq. 3)

Where,

βi,1 = (1-Si)

βi,2 = Si ri

ei,t= represents the error term

Eq. 3 indicates that the change in dividend is function of lagged value of dividends and current value of earnings. To control for year effect, we have added the years dummy to the equation, year dummies will control for macroeconomics events that affect all firms in certain year.

Results of Target Dividend Ratio

Table 1 shows the regression results for Lintner’s model; the Lagrange Multiplier (LM) test shows that the pooled model is more appropriate than the random effect model. The null hypothesis in the LM test is that variances across firms is zero. This is, no significant difference across firms. The p-value from LM is insignificant at any conventional level, here we failed to reject the null and conclude that random effects is not appropriate.

| Table 1 Results for the Lintent Adjstment Model | ||||

|

This table shows the results of target payout ratio. The results based on data from U.S publicly listed firms using CRSP/Compustat files for the period from 1997 to 2017. Using pooled, random effects, and fixed effects estimators. The dependent variable (D) is dividend payout ratio and calculated by the amount of dividends divided by the net income for firm i in the year t. the independent variables are: (Lag D) is the lagged value of the dividend payout ratio and (EPS) is Earnings per share for firm i in the year t. Standard errors are heteroskedasticity-robust and clustered by firm. T-statistics are in parenthesis below the coefficient estimates, the Lagrangian Multiplier test (LM test). The asterisk ***, **, and * denotes that the coefficients are statistical significance at 1%, 5%, and 10% level, respectively. |

||||

| Dependent variable: D | ||||

| Independent Variables |

Pooling | OLS Random-effect |

Fixed Effect | |

| Lag.D | 0.827*** (51.64) |

0.827*** (47.27) |

0.466*** (14.95) |

|

| EPS | -0.001 (-0.87) |

0.001 (-0.71) |

0.001 (0.18) |

|

| Year effect | Yes | Yes | Yes | |

| LM test (p-value) | 0.00 | |||

| R2 | 0.70 | 0.65 | 0.63 | |

| Speed of Adjustment | 17.3% | 17.3% | 53.4% | |

| No.of firm-year observations | 25949 | 25949 | 25949 | |

| F- statistics (p-value) | 0.000 | 0.000 | 0.000 | |

The regression results of Lintner’s model is shown in Table 1. In order to estimate the regression, we firstly test whether the firm specific effect is exist, the Lagrange Multiplier test examine whether to use the pooled model or the random effect model, where the null hypothesis is that the difference across firms is insignificant. The results show that the p-value of LM test is significant at 1%, thus we reject the null and conclude that the firm’s effects have no significant effect. This result is consistent with Almanaseer (2011) study which found that the pooled estimation method is more appropriate this paper sample. The speed of adjustment is measured by the (1-s) is between 53% and 17.3% for fixed, random and pooled estimators. Results confirmed the dividend smoothing model where firms follow partial adjustment toward target dividend pay-out ratio and move gradually toward this target. The fixed effect model indicate that the firms need 1.88 year to reach the target pay-out ratio and 5.88 years to reach the target pay-out ratio for pooled and random effect models. The coefficient of the current earning is not statistically significant at any conventional level, this indicates that the current earning may have no impact on current dividends, which support that the firms may not change their pay-out ratio if the current earnings changed.

We compare our results with previous studies that use Lintner’s model. The results are consistent previous studies that find the firms have long-term target pay-out ratios and slowly adjust their dividend policy toward this target, (e.g., Asimakopoulos et al. (2021); Kilincarslan & Demiralay, (2021); and Renneboog & Trojanowski (2010) for U.K firms; Aivazian et al., (2003b) for U.S firms; Koussis, & Makrominas, (2019), for U.S and EU Banks; Labhane, (2018) for sample from India; Benavides et al., (2016) for six Latin countries.

Conclusion

This research investigates one of most important decisions in corporate finance the dividend policy. We aimed to examine whether the dividend policy is consistent over times and affected by firm’s earnings. Thus, we use data from U.S publicly traded firms from CRSP/Compustat database for the period 1997-2017; where the most important financial features is that it is considered as develop country and it is financial market-base oriented. Our results showed that the dividend policy follow path-dependence approach, and earnings have not statistical effect on the dividend distribution decision. Our results suggest that the liquidity and earning may not the most important factors that the firm’s management consider when they dividend distribution decision. The main limitation of this research is that it based on publicly listed firm; future research may benefit from including firms that not publicly listed.

Acknowledgement

The authors extend their appreciation to the Deanship of Postgraduate and Scientific Research at Dar Al Uloom University for Funding this Work.

References

- Asimakopoulos, P., Asimakopoulos, S., & Zhang, A. (2021). Dividend smoothing and credit rating changes. The European Journal of Finance, 27(1-2), 62-85.

- Aivazian, V., Booth, L., & Cleary, S. (2003). Do emerging market firms follow different dividend policies from US firms?. Journal of Financial Research, 26(3), 371-387.

- Al-Malkawi, H.A.N., Bhatti, M.I., & Magableh, S.I. (2014). On the dividend smoothing, signaling and the global financial crisis. Economic Modelling, 42, 159-165.

- Al Manaseer, M.F., Gonis, E., Al-Hindawi, R.M., & Sartawi, I.I. (2011). Testing the Pecking Order and the Target Models of capital structure: evidence from UK. European Journal of Economics, Finance and Administrative Sciences, 41, 84-96.

- Arnott, R.D., & Asness, C.S. (2003). Surprise! Higher dividends= higher earnings growth. Financial Analysts Journal, 59(1), 70-87.

- Baltagi, B.H. (2005). Econometric analysis of panel data.

- Benavides, J., Berggrun, L., & Perafan, H. (2016). Dividend payout policies: evidence from Latin America. Finance Research Letters, 17, 197-210.

- Brav, A., Graham, J.R., Harvey, C.R., & Michaely, R. (2005). Payout policy in the 21st century. Journal of Financial Economics, 77(3), 483-527.

- Bostanci, F., Kadioglu, E., & Sayilgan, G. (2018). Determinants of dividend payout decisions: a dynamic panel data analysis of Turkish stock market. International Journal of Financial Studies, 6(4), 93.

- Chateau, J. (1979). Dividend policy revisted: Within?and out?of?sample tests. Journal of Business Finance & Accounting, 6(3), 355-370.

- Chemmanur, T.J., He, J., Hu, G., & Liu, H. (2010). Is dividend smoothing universal?: New insights from a comparative study of dividend policies in Hong Kong and the US. Journal of Corporate Finance, 16(4), 413-430.

- Dewenter, K.L., & Warther, V.A. (1998). Dividends, asymmetric information, and agency conflicts: Evidence from a comparison of the dividend policies of Japanese and US firms. The Journal of Finance, 53(3), 879-904.

- George, R., & Kumudha, A. (2006). A study on dividend policy of Hindustan Construction Co. Ltd. with special reference to Lintner model. Synergy, Jan, 4(1), 86-96.

- Hail, L., Tahoun, A., & Wang, C. (2014). Dividend payouts and information shocks. Journal of Accounting Research, 52(2), 403-456.

- Kilincarslan, E., & Demiralay, S. (2021). Dividend policies of travel and leisure firms in the UK. International Journal of Accounting & Information Management.

- Koussis, N., & Makrominas, M. (2019). What factors determine dividend smoothing by US and EU banks?. Journal of Business Finance & Accounting, 46(7-8), 1030-1059.

- Labhane, N.B. (2018). Why do firms smooth dividends? Empirical evidence from an emerging economy India. Afro-Asian Journal of Finance and Accounting, 8(3), 237-256.

- Lambrecht, B.M., & Myers, S.C. (2012). A Lintner model of payout and managerial rents. The journal of finance, 67(5), 1761-1810.

- Lintner, J. (1956). Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review, 46(2), 97-113.

- McDonald, J.G., Jacquillat, B., & Nussenbaum, M. (1975). Dividend, investment and financing decisions: empirical evidence on French firms. Journal of Financial and Quantitative Analysis, 741-755.

- Miller, M.H., & Modigliani, F. (1961). Dividend policy, growth, and the valuation of shares. The Journal of Business, 34(4), 411-433.

- Pahi, D., & Yadav, I.S. (2019). Does corporate governance affect dividend policy in India? Firm-level evidence from new indices. Managerial Finance.

- Yusof, Y., & Ismail, S. (2016). Determinants of dividend policy of public listed companies in Malaysia. Review of International Business and Strategy.

- Zhou, P., & Ruland, W. (2006). Dividend payout and future earnings growth. Financial Analysts Journal, 62(3), 58-69.

- Zurigat, Z., & Gharaibeh, M. (2011). Do Jordanian firms smooth their dividends? Empirical test of symmetric and asymmetric partial adjustment models. International Research Journal of Finance and Economics, 81, 160-172.