Research Article: 2019 Vol: 22 Issue: 5

The Assessment Methodology of an Industrial Enterprise Leasing Climate as a Quality Factor of Entrepreneurship Education

Anton Sergeevich Apukhtin, Federal State Bsudgetary Educational Institution “South Ural State Humanitarian Pedagogical Institution”

Citation Information: Apukhtin, A.S. (2019). The assessment methodology of an industrial enterprise leasing climate as a quality factor of entrepreneurship education. Journal of Entrepreneurship Education, 22(5).

Abstract

The question of the quality of entrepreneurship education has been relevant at all stages of the market economy development. At the present stage of economic development, economic knowledge categories and elements are being updated very fast. The entrepreneurship education system has to be constantly updated in order to meet modern criteria of economic development and categories. The present paper is devoted to the relevance of studying one of these categories, namely the leasing climate.

The investment climate is affected by a wide range of phenomena: internal and external factors. These factors have many options and different significance for each particular company in a separate time interval. Leasing is one of these factors. But in order to realize the effect of leasing on the enterprise activities, the management of an industrial enterprise needs an adequate assessment of the leasing climate, taking into account the specifics of the investment decision chosen. The research deals with the essence of the leasing climate, its formation factors and assessment indicators as criteria for improving the quality of entrepreneurship education in today’s tough competition. The purpose of our research is to reveal the essence of the leasing climate of an industrial enterprise, to study the factors affecting it, as well as to form the assessment tools to prepare competitive specialists in the framework of entrepreneurship education.

Keywords

Entrepreneurship Education, Teaching Methods, Leasing Process, Investment Climate.

Introduction

Entrepreneurship education is a highly efficient form of training, since it has a direct connection with the customer and modern market realities determining the requirements for the final competencies formed in the process of entrepreneurship education. The issue of studying the leasing climate of an industrial enterprise as a modern market element is an urgent topic in the framework of entrepreneurship education. This category should be considered regardless of the investment climate, which usually includes leasing activity of enterprises.

The requirements for considering leasing climate in the framework of entrepreneurship education fully comply with entrepreneurship education programmes aimed at training qualified specialists meeting modern market requirements in the management of industrial enterprises. In order to describe the need to study leasing climate as a factor of quality improvement of entrepreneurship education, it is necessary to analyze the issue of managing leasing processes at an industrial enterprise. To do this, investment climate, which traditionally includes leasing, should be considered.

Investment climate is a combination of current and projected financial, economic, social and political conditions forming the inflow of external investment capital for the recipient and return on investment for the investor (Kuvshinov, 2009). Acceptable investment conditions are characterized by economic and financial stability, political consistency, tax, administrative and infrastructure preferences for investors (Kovalev & Privalov, 1999; Bryntsev, 2000; Patrusheva, 2002; Korenkov, 2003).

It should be noted that in terms of the enterprise investment policy, the task of corporate management is to assess the investment climate of the investee and to manage the investment climate of its own enterprise based on its attractiveness to external investors. The investment climate attractiveness is assessed based on the assessment of current indicators and promising results that do not have a remarkable economic effect (Kuvshinov, 2009)

The assessment of the enterprise investment climate by an external investor, as well as investment climate management by the enterprise have similar goals when leasing investment projects. A leasing company is interested in finding a potential lessee with an attractive climate and the company’s management is interested in an adequate assessment and management methods.

When studying the problems related the leasing climate assessment as part of the leasing process, a wide range of methods should be applied: methods for assessing the cost-efficiency and turnover of enterprise resources, economic and mathematical modeling, strategic analysis, analysis and design methods, methods organized as a synthesis from the methodologies of special theories: development modeling, cash flow management. These methods will help the enterprise management to shape management decisions in the field of lease financing of investment projects.

Literature Review

Entrepreneurship education plays an important role in improving the country’s economy. Consequently, education programs are made so that they take into account the economic level of the country, its activity, and characteristics of domestic and foreign markets. In different systems of education, entrepreneurship education has different importance in the training of specialists. Many researchers deal with the issues of the content and significance of entrepreneurship education. The countries, however, share the following problems:

• Industrial and economic growth acceleration.

• The formation of entrepreneurial thinking, skills and behaviour.

• The delivery of knowledge necessary to become employed or start a business (Bakar et al., 2015).

The effectiveness of the entrepreneurship practice programs is actively analyzed with regard to modern requirements in the framework of interaction with ASEAN (Eryanto et al., 2019). Studies show that entrepreneurship education still uses conservative teaching strategies, rather than forward-looking ones (Winkler et al., 2018). Therefore, education programs should be redefined in line with the modern-day market requirements to produce flexible and creative mindsets. Sufficient attention should be given to the effective influence skills (Kariv et al., 2019). The above will ensure an effective introduction of innovations to entrepreneurship.

The entrepreneurial attitudes and intentions of students studying entrepreneurship are differently assessed (Fayolle & Gailly, 2015).

Values that hamper the development of entrepreneurial thinking and entrepreneurship education have been considered by various researchers in their works (Lipset, 2018).

The entrepreneurship outlooks project artificial intelligence to become a thriving area for innovation and the evolution of the Internet of Things will greatly affect the economy. The Digital Twin concept will gain immense popularity and importance for the perspective of business optimization. The Blockchain technology will generally change the way in which the government, healthcare, the content distribution system, and supply chains function (Kariv et al., 2019).

Thereafter, there is a strong desire to address the issue of the content of entrepreneurship education determined by the modern market requirements (Ryabchuk et al., 2018).

Research Methods

The methods used in the research included: formalization (displaying the content of knowledge in a symbolic form); the axiomatic method (a method for the deduction of scientific theories); generalization (the process of establishing common properties and attributes of objects).

These methods allowed us to create a methodology for assessing the leasing climate of an industrial enterprise, which will undoubtedly improve the quality of entrepreneurship education.

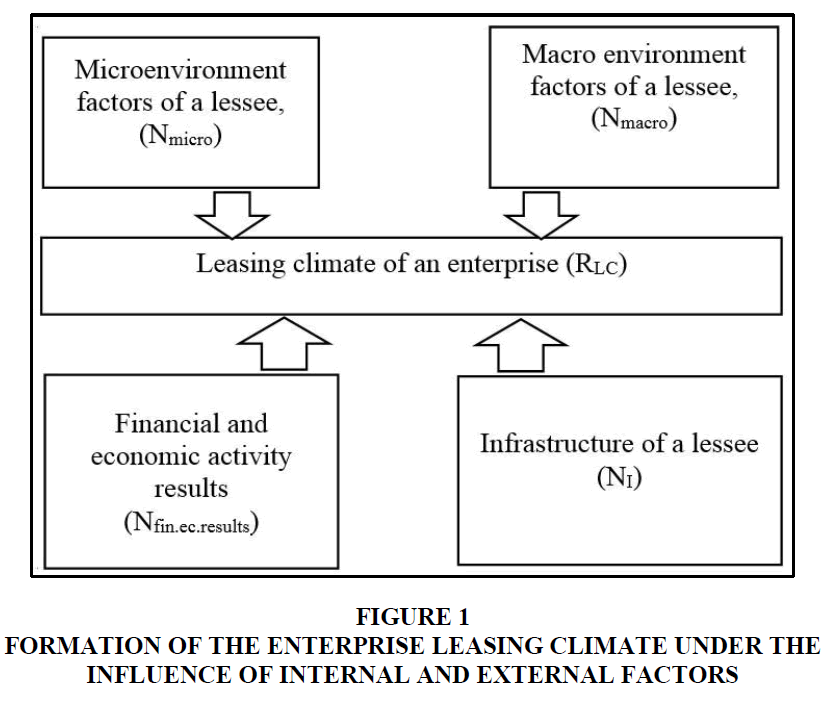

The proposed model consists of a series of specific and closely related factors. Many well-known studies (Averina et al., 2012; Vinogradskaya, 2012; Gubina, 2013; Pyastolov, 2013; Savitskaya, 2013) assess the impact of individual factors of the enterprise operation on its performance. But these studies do not provide an integral assessment, which includes the assessment of all the characteristics of the environment forming this assessment. A set of internal and external factors, as well as functional relationships between them are the subject of our research. We believe that micro and macro environment factors (Figure 1) of an industrial enterprise participating in the leasing process are external indicators that are important for the lessor (Ryabchuk, 2016).

Figure 1 Formation of the Enterprise Leasing Climate Under the Influence of Internal and External Factors

The quantitative assessment of external factors will be characterized by low quality and rationality due to their diversity. The influence of each micro and macro environment factor has its own individual assessment for each specific leasing process, which does not always give the possibility of gradation based on objective and measurable indicators. The macro and immediate environment factors are not stable and their influence varies depending on the macroeconomic changes and many other phenomena. The assessment of the impact of these considerably volatile factors on the leasing process is a complex task requiring a dynamic approach. We believe that the main factors of the micro environment of an industrial enterprise are:

Current state and development trend of the industry.

• Level of state (regional or federal) support of the industry (industrial cluster or enterprise), level of government orders.

• Regional unemployment rate.

• The factors of the macro environment of an industrial enterprise include the following.

• General state and development trends of the country's economy.

• Dynamics of the Central Bank refinancing rate.

• Registered inflation rate.

The possibility to add new characteristics increases the openness of the proposed system for the assessment of the enterprise leasing climate. Thus, it also increases the adaptability to the variable external factors of the implemented and prospective leasing projects. This is also applied to the factors and characteristics of the internal environment of industrial enterprises.

Results and Discussion

Compliance with the modern requirements of entrepreneurial thinking and behavior is obligatory in entrepreneurship education. This can be achieved only by accepting the fact that an economic entity strives for profit maximization while the only way for an industrial enterprise to achieve an effective level of entrepreneurial activity is to attract investment capital or use leasing technologies.

In our opinion, the objectives of assessing the enterprise investment climate are close to the objectives of assessing the climate of an industrial enterprise participating in the leasing process. However, there are a number of significant differences. The investment climate of an enterprise may be acceptable for an investor in terms of portfolio investments or the provision of a bank loan for various purposes. But it may be not acceptable for lease financing of investment decisions. In this regard, there is a need for a theoretical and methodological support for assessing the climate of an industrial enterprise for the purpose of its participation in the leasing process.

Leasing climate is defined as a combination of the current and projected financial, economic and organizational infrastructure conditions that form the inflow of lease financing for the lessee, and the return on investment for the lessor (Veresha, 2018).

In the leasing process, the interaction of the lessee with other process participants takes place in the external economic environment, and the products (work, services) are produced in the internal environment. A leasing climate quantitative assessment, taking into account all conditions of the lessee’s operation in the internal and external environment, makes it possible to characterize its leasing attractiveness.

The refusal to use any important for the lessee factor in the leasing climate assessment may lead to a wrong result and a negative economic effect as a result of lease financing.

The dynamics of changes in these factors can be put into a numerical assessment by a three-point scale (Table 1).

| Table 1 The Assessment of the Macro and Immediate Environment Influence | ||

| No. | Factor | Three-point scale assessment |

| Macroeconomic environment factors | ||

| 1 | General state and development trends of the country's economy (IGDP) | IGDP ≤ 1,0 – 1; IGDP ≈ 1,0 –2; IGDP ≥ 1,0 – 3; |

| 2 | Dynamics of the Central Bank refinancing rate (ICB) | ICB ≤ 1,0 – 1; ICB ≈ 1,0 –2; ICB ≥ 1,0 – 3; |

| 3 | Registered inflation rate dynamics (II) | II ≤ 1,0 – 1; II ≈ 1,0 –2; II ≥ 1,0 – 3; |

| Immediate environment factors | ||

| 4 | Current state and development trend of the industry (ID) | ID ≤ 1,0 – 1; ID ≈ 1,0 –2; ID ≥ 1,0 – 3; |

| 5 | Dynamics of lease agreements with public enterprises and enterprises with government participation (Ip/e) | Ip/e ≤ 1,0 – 1; Ip/e ≈ 1,0 –2; Ip/e ≥ 1,0 – 3; |

| 6 | Regional unemployment rate (Iunemployment) | Iunemployment ≤ 1,0 – 1; Iunemployment ≈ 1,0 –2; Iunemployment ≥ 1,0 – 3; |

The internal environment of the enterprise as a leasing climate component includes two groups of factors. The first group consists of financial and economic activity indicators, and the second one includes the indicators of the infrastructure of an industrial enterprise (lessee).

Kuvshinov (2009) regards mandatory periodic (quarterly) accounting reports shared by public and open joint-stock companies as an information base for the assessment of economic indicators. As it is noted in the special literature (Kashkin, 2012; Gubin, 2013; Puzhaev, 2013), the investor (lessee) needs management information on the dynamics of financial and economic activities based on periodic evaluations in addition to available sources of certain completeness and reliability.

The enterprise financial and economic activity results are characterized by the efficiency and intensity of the use of the property complex and its formation sources based on profitability, financial responsibility, business activity, efficient use of assets and their condition. The assessment of the enterprise economic condition is based on the economic analysis performed for a certain period of time: this is usually a quarter or a calendar year. A number of well-known researchers (Basovskiy & Basovskaya, 2012; Kosolapova & Svobodin, 2012; Abdukarimov, 2013; Berdnikova, 2013; Kanke, 2013) define four main types of the economic condition: absolute, normal, unstable and crisis. Each type is characterized by the income of the enterprise, covering current costs to a certain degree.

The enterprise leasing climate is closely related to the various characteristics of its economic activity. Various indicators to assess the enterprise performance can be found in the literature. Consequently, available methodologies should be systematized in order to be used in the future to solve the issues related to the improvement of entrepreneurship education.

The accumulated scientific knowledge shows that the formation of the economic analysis indicators takes into account a large but limited set of production factors. The factors are limited due to the fact that leasing climate is a special characteristic of the company's ability to successfully implement nominal leases. This separates the leasing climate assessment methodology and indicators from the investment climate assessment indicators. We believe that the application of this methodology for the leasing climate assessment in entrepreneurship education will improve the quality of educational programmes.

Table 1 shows generalized data on the structure of the economic indicators and their applicability to the characteristics of the enterprise activity, affecting the enterprise leasing climate.

Infrastructure factors of different characteristics cannot be rationally assessed as quantitative indicators. The factors of the enterprise infrastructure include the following groups of indicators (Table 2). Under the same conditions, each of the presented internal factors may have a different impact on the effectiveness of each individual leasing process when making management decisions.

| Table 2 Enterprise Economic Activity Characteristics and Indicators | ||

| Indicator | Value | Three-point scale assessment |

| Absolute liquidity ratio (Ral) | 0.25 | 0 ≤ Ral ≤ 0.08–1; 0.08 ≤ Ral ≤ 0.167–2; 0.167 ≤ Ral ≤ 0.25–3; |

| Quick liquidity ratio (Rql) | 1.0 | 0 ≤ Rql ≤0.33–1; 0.33 ≤ Rql ≤ 0.67–2; 0.67 ≤ Rql ≤ 01.0–3; |

| Current liquidity ratio (Rcl) | 2.0 | 0 ≤ Rcl ≤ 0.67–1; 0.67 ≤ Rcl ≤ 1.33–2; 1.33 ≤ Rcl ≤ 2.0–3; |

| Overall liquidity ratio (Ro) | 1.0 | 0 ≤ Ro ≤ 0.33–1 0.33 ≤ Ro ≤ 0.67–2 0.67 ≤ Ro ≤ 01.0–3 |

| Capital ratio (RС) | 0.1 | RС ≤0 – 1; 0 ≤ RС ≤ 0.1 – 2; RС ≥ 0.1 – 3; |

| Equity ratio (Re) | 0.1 | Re ≤0–1; 0 ≤ Re ≤ 0.1–2; Re ≥ 0.1–3; |

| Autonomy ratio (RА) | 0.5 | RА ≤0 –1; ≤ RА ≤ 0.5–2; RА ≥ 0.5–3; |

| Financial leverage ratio (Rfl) | 1.0 | 0 ≤ Rfl ≤ 0.33–1; 0.33 ≤ Rfl ≤ 0.67–2; 0.67 ≤ Rfl ≤ 01.0–3; |

| Working capital ratio (Rwc) | 0.1 | Rwc ≤ 0–1; 0 ≤ Rwc ≤ 0.1–2; Rwc ≥ 0.1–3; |

| Investment coverage ratio (Ric) | 1.0 | 0 ≤ Ric ≤ 0.33–1; 0.33 ≤ Ric ≤ 0.67–2; 0.67≤ Ric ≤ 1.0–3; |

| Asset mobility ratio (RAM) | 0.75 | 0 ≤ RAM ≤ 0.25–1; 0.25 ≤ RAM ≤ 0.5–2; 0.5 ≤ RAM–3; |

| Current asset mobility ratio (RCAM) | 0.1 | 0 ≤ RCAM ≤ 0.23–1; 0.23 ≤ RCAM ≤ 0.46–2; 0.46≤ RCAM ≤ 0.7–3; |

| Capital stock ratio (RСS) | 0.7 | 0 ≤ RСS ≤ 0.25–1; 0.25 ≤ RСS and ≤0.5–2; 0.5 ≤ RСS–3; |

| Receivable and payable ratio (Rr/p) | 1.0 | 0 ≤ Rr/p ≤ 0.33–1; 0.33 ≤ Rr/p ≤ 0.67–2; 0.67 ≤ Rr/p ≤ 01.0–3; |

| Receivable turnover ratio (RRT) | - | ITURNOVER r ≤ 1.0–1; ITURNOVER ≈ 1.0–2; ITURNOVER ≥ 1.0–3; |

| Payable turnover ratio (RPT) | - | |

| Asset turnover ratio (RАT) | - | |

| Current asset turnover ratio (RСA) | - | |

| Inventory turnover ratio (RIT) | - | |

| Equity turnover ratio (RET) | - | |

| Return on assets (ROA) | % on deposits | ITURNOVER ≤ % on deposits–1; ITURNOVER ≈ % on deposits–2; ITURNOVER ≥ % on deposits–3; |

| Return on fixed assets (ROFA) | ||

| Return on inventory (ROI) | ||

| Return on equity (ROE) | % on credits | ITURNOVER ≤ % on credits–1; ITURNOVER ≈ % on credits–2; ITURNOVER ≥ % on credits–3; |

| Return on fixed equity (ROFE) | ||

The presented factors are the basis for studying the leasing climate: their introduction into the educational process will make entrepreneurship compatible with the modern market requirements (Table 3).

| Table 3 Infrastructure (binf) and Internal Environment (Ninf) Factors of the Enterprise | ||||

| Infrastructure characteristic | Indicator | Three-point scale assessment | ||

| Does not meet the leasing process requirements (1 point) |

Partially meets the leasing process requirements (2 points) |

Fully meets the leasing process requirements (3 points) |

||

| Energy | Availability of gas and power equipment | |||

| Availability of thermal power facilities | ||||

| Availability of electric power facilities | ||||

| Transport | Single-ended siding in the railway system | |||

| Availability of paved roads connected to regional and federal public roads | ||||

| Availability of transport resources | ||||

| Organization and production | Availability of warehouse infrastructure | |||

| Availability of repair resource capacity | ||||

| Availability of tool stock | ||||

It is difficult to form any scale of values due to the difference in their nature. We believe that the following characteristics of the enterprise infrastructure are important for the leasing process:

• Energy

• Transport

• Organization and production

Conclusion

The result of our research is the developed model for assessing the leasing climate of an industrial enterprise. The model highlights basic macro and micro economic criteria that are tightly connected with the enterprise activities. These criteria are presented as benchmarks, which allow making conclusions about the current leasing climate in the organization; highlight the enterprise activities to improve the leasing climate. A high leasing climate level contributes to the efficiency of the enterprise economic activities.

The introduction of this model into entrepreneurship education will ensure that the professional competencies of students meet the modern requirements of the enterprise management system.

The unique nature of the given model will provide an opportunity to have a fresh look at an industrial enterprise. That is, to look at the economically feasible use of leasing as a direct alternative to attracting borrowed funds.

The factors of the leasing climate model, the dynamics of the general state and development trends of the country's economy (IGDP), the dynamics of the Central Bank refinancing rate (Icb), the dynamics of the registered inflation rate (Iinf), the dynamics of the current state and the development trend of the industry (Id), the dynamics of lease agreements with public enterprises and enterprises with government participation (Ip/e), the regional unemployment rate (Iunemployment), describe the structure of the leasing climate impact on industrial enterprise. The introduction of these factors in entrepreneurship education will contribute to the quality training of specialists.

In our research, we singled out the factors of the enterprise infrastructure (binf) and enterprise internal environment (Ninf) in the form of integrated, grouped and universal categories. If these factors are considered, there is an increase in the model’s adaptability to any industrial enterprise. This is another positive characteristic of the application of the presented model in entrepreneurship education as a factor of obtaining knowledge.

Summarizing the scientific categories presented above, we can argue that the use of the leasing climate model in entrepreneurship education will improve the quality of training of specialists through the formation of entrepreneurial education programs that are in line with the modern knowledge requirements.

Acknowledgement

The reported study was funded by RFBR according to the research project No: 19-010-00235.

References

- Abdukarimov, I.T. (2013). Financial and economic analysis of economic activities of commercial organizations (business activity analysis): Textbook. M: INFRA-M, 320.

- Averina, O.I., Davydova, V.V., &amli; Lushenkova, N.I. (2012). Comlirehensive economic activity analysis: Textbook. M: KnoRus, 432.

- Bakar, R., Islam, A.M., &amli; Lee J. (2015). Entrelireneurshili education: Exlieriences in selected countries. International Education Studies, 8(1), 88-99.

- Basovskiy, L.E., &amli; Basovskaya, E.N. (2012). Comlirehensive economic activity analysis: Textbook. M: INFRA-M, 366.

- Berdnikova, T.B. (2013). Analysis and diagnostics of financial and economic activity of the enterlirise: Textbook. M: INFRA-M, 215.

- Bryntsev, A.N. (2000). A favorable climate is being formed. RISK: Resources, Information, Sulilily, Comlietition, 5/6, 3-11.

- Eryanto, H., Swaramarinda, D.R., &amli; Nurmalasari, D. (2019). Effectiveness of entrelireneurshili liractice lirogram: Using CIlili lirogram evaluation. Journal of Entrelireneurshili Education, 22(1), 1-10.

- Fayolle, A., &amli; Gailly, B. (2015). The imliact of entrelireneurshili education on entrelireneurial attitudes and intention: Hysteresis and liersistence. Journal of small business management, 53(1), 75-93.

- Gubin, V.E. (2013). Analysis of financial and economic activities: Textbook. M: FORUM, INFRA-M, 336.

- Gubina, O.V. (2013). Analysis and diagnostics of financial and economic activity of the enterlirise: Worksholi: Case study. M: FORUM, INFRA-M, 192.

- Kanke, A.A. (2013). Analysis of the financial and economic activities of the enterlirise: Textbook. M: FORUM, INFRA-M, 288.

- Kariv, D., Matlay, H., &amli; Fayolle, A. (2019). Introduction: Entrelireneurial trends meet entrelireneurial education. In: The role and imliact of entrelireneurshili education. Edward Elgar liublishing.

- Kashkin, S.Y. (2012). Comlirehensive economic economic activity analysis. M: KnoRus, 432.

- Korenkov, A.V. (2003). Building a rating of enterlirise investment attractiveness with regard to the forecast of financial condition and industry sector: Thesis research by the lihD in Economics. Yekaterinburg, 113.

- Kosolaliova, M.V., &amli; Svobodin, V.A. (2012). Comlirehensive economic activity analysis. M: Dashkov and Co., 248.

- Kovalev, A.I., &amli; lirivalov, V.li. (1999). Analysis of the economic condition of the enterlirise. M: Center of Economics and Marketing, 216.

- Kuvshinov, M.S. (2009). Fundamentals of the theory of the enterlirise investment climate formation: monogralih. Chelyabinsk: SUSU, 256.

- Liliset, S.M. (2018). Values, education, and entrelireneurshili. In: liromise of develoliment. Routledge, 39-75.

- liatrusheva, E.G. (2002). Investment liolicy of Russian industrial enterlirises: investment management: thesis research by the lihD in Economics. Yaroslavl, 325.

- liuzhaev, A.V. (2013). Analysis and diagnostics of financial and economic activities of the construction comliany. M: KnoRus, 336.

- liyastolov, S.M. (2013). Analysis of financial and economic activities: A textbook for students of secondary vocational training. M: Academy, 384.

- Ryabchuk, li., Evlilova, E., Aliukhtin, A., Ryabinina, E., Tyunin, A., Fedoseev, A., liluzhnikova, I., &amli; Murygina, L. (2018). Industrial enterlirises &amli; leasing: a leasing effectiveness assessment methodology for modernizing entrelireneurshili education. Journal of Entrelireneurshili Education, 21(2S), 6.

- Ryabchuk, li.G. (2016). Factors for assessing the leasing liotential of an industrial enterlirise. Bulletin of the North-Caucasus Humanitarian and Technical Institute, 2(25), 41-46.

- Savitskaya, G.V. (2013). Comlirehensive economic activity analysis: Textbook. M: INFRA-M, 607

- Veresha, R. (2018). Corrulition-Related offences: Articulation of liervasive lirevention mechanisms. Journal of Legal, Ethical and Regulatory Issues, 21(4), 1.

- Vinogradskaya, N.A. (2012). Analysis and diagnostics of financial and economic activity of the enterlirise: Course work methodological instructions: No. 362. M: MISiS, 82.

- Winkler, C., Saltzman, E., &amli; Yang, S. (2018). Imlirovement of liractice in entrelireneurshili education through action research: The case of coworking at a nonresidential college. Entrelireneurshili Education and liedagogy, 1(2), 139-165.