Research Article: 2021 Vol: 25 Issue: 2

The Association between the Selling, General & Administrative Expenses and Age at IPO of Biotech Companies

Namryoung Lee, School of Business, Korea Aerospace University

Abstract

Going public, which can facilitate financing, is a priority challenge for private technology companies that need to invest large sums of money into R&D activities. With that in mind, this study analyzes the relationship between pre-IPO selling, general & administrative (SG&A) expenses and the age at IPO for biotech companies. The results indicate that pre-IPO total SG&A spending has a positive correlation with age at IPO. This implies that SG&A spending is an inefficient expenditure management strategy, as has been argued in previous studies, and could delay an IPO. Subsequently, this study subdivides SG&A expenses into four categories – R&D expenses, advertising expenses, sales promotion expenses, and other expenses – to see how each category affects age at IPO. Only R&D expenses are negatively correlated with age at IPO, suggesting that the R&D investments of technology companies have a positive impact on future corporate growth. In addition, the correlation between SG&A stickiness signaling and age at IPO is also examined. SG&A stickiness signaling during periods in which sales decrease is negatively associated with age at IPO. It can therefore be concluded that SG&A stickiness during periods of declining sales can be connected to positive prospects for the future, thereby potentially accelerating IPOs. This is consistent with previous studies. Collectively, the results serve as a reminder to private biotech companies preparing for IPOs of the importance of SG&A expenditure management.

Keywords

SG&A Expenses, SG&A Stickiness, Age at IPO, Biotech.

Introduction

Companies can receive tax and legal benefits as well as financing through initial public offerings (hereafter, IPOs). A company's going public is an important strategic turning point (Gill & Walz, 2016). IPOs also readjust debt-to-equity ratios (Hsu, 2010). Hence, the successful IPO of a private company is a priority for future growth. There are many studies on post-IPO company performance, in particular focusing on age at IPO. Young and unprofitable companies often achieve IPOs but show disappointing aftermarket performance (Jain et al., 2008). According to Goldman Sachs’ analysis of 4,481 IPOs over 25 years, company age at IPO is not a significant indicator of three-year IPO outperformance, but younger companies generally show faster sales growth.

What is an appropriate age for companies to go public? How old are companies when they launch an IPO? According to Ritter (2021), the median age of companies on CRSP that achieved IPOs between 1980 and 2020 was eight years. The median age of IPO companies in 2018 and 2019 was 10 years, and the median age of 2020 IPO companies was eight years. For technology company IPOs, the median age was seven years between 1980 and 2020, 12 years in 2018, 10 years in 2019, and 12.5 years in 2020. In Korea, according to the Korean Venture Capital Association, it takes about 13 years to achieve an IPO after a company is founded, which is approximately three times that of the United States. Meanwhile, for new technology companies, IPOs play an important role in providing a source of funding to increase the effectiveness of market entry while continuing R&D activities (Pagano & Zingales, 1998). For Biotech (biopharma) companies that have to spend significant amounts on R&D, IPOs are even more urgent to facilitate financing. Although IPOs are not always successful, interest in the IPOs of Korean biotech companies is expected to continue in 2021. Korean biotech companies with little to no revenue have been actively using the ‘IPO with the technology exception policy’. This policy is a system that supports the listing of companies with excellent technological prowess and business feasibility despite insignificant current performance indices such as sales.

As Korea recently announced that it would expand the Korea Composite Stock Price Index (KOSPI) listing exception, which is not subject to financial statements other than market capitalization, to increase opportunities for innovative companies such as bio companies to list themselves on the KOSPI, growth-proven bio companies are expected to benefit from this special expansion. In the aforementioned analysis by Ritter (2021), biotech (biopharma) companies achieved IPOs in shorter timeframes than companies from other industries. This appears to be because in the case of biotech companies, sales and EPS are both greater than 0. The overall median age of biotech companies that had IPOs between 1980 and 2020 was six years, while it was four years in 2018, five years in 2019, and six years in 2020. Companies incur significant selling, general, and administrative (operating expenses, hereafter, SG&A) expenses. SG&A expenses include salary expenses, depreciation expenses of fixed assets, amortization expenses of intangible assets, advertising expenses, research and development (hereafter, R&D) expenses, sales promotion expenses, and so on.

All of these are expensed immediately, reducing operating income. Some SG&A spending, including R&D expenses, is an investment for future growth. Nevertheless, there is debate over the necessity and efficiency SG&A expenditures since SG&A spending could be attributed to inefficient management. Particularly in the case of biotech companies, R&D investments are generally very substantial, and they are immediately treated as expenses unless treated as assets. Additionally, biotech companies increase sales through large investments in advertising and promotion expenses. The SG&A expenses of Korean listed biotech (biopharma) companies are about 30% of sales, which is considerably higher compared to the average of 20% of SG&A expenses found in general manufacturing industries. Although biotech companies are investing heavily in SG&A for the purpose of increasing sales, in reality, it appears that sales increase when SG&A spending decreases. According to Global Data reports, 11 of the top 20 companies recorded more than 50% growth in 2019 in their operating profit, including AbbVie (103.4%), Otsuka Holdings (54.2%), and Pfizer (53.1%).

This was due to reduced operating costs. Taken together, SG&A spending that is inevitable for business operations can have a positive or negative impact on the time it takes for the IPO to occur. Therefore, this study analyzes the association between SG&A expenses and the age of the company at the time of the IPO. Regarding SG&A spending, there is a growing body of literature on asymmetric cost behavior that followed the SG&A stickiness study by (Anderson et al., 2003). In this paper, an analysis of the effects of SG&A stickiness on age at IPO is also conducted. The rest of this paper is organized as follows. Section 2 sets out the theoretical background, the literature review, and the development of the hypotheses. Section 3 deals with research samples and methodologies. Descriptive statistics, correlations, and regression findings are discussed in Section 4. Based on the study, Section 5 addresses the results and suggests further points of interest. A summary and conclusions are given in the final section.

Theoretical Background, Literature Review, and Hypothesis Development

The IPO of a company is an important strategic turning point (Gill & Walz, 2016). Private companies seek to go public in an attempt to raise funds, ease legal regulations, benefit from taxation, and raise corporate awareness. Hence, young companies with no profits are often able to achieve a listing (Jain et al., 2008). Ritter & Welch (2002) confirmed that the listing rate of unprofitable companies increased significantly from 19% in the 1980s, with the rate at 37% from 1995 to 1998. Significant interest has been focused on company performance after an IPO. Peristiani & Hong (2004) demonstrated that pre-IPO profitability was a signal of sustainable growth after an IPO. The performance of a company after being listed may differ depending on the age of the company. Studies have shown mixed results. Some studies have shown that the younger a company is at the time of its IPO, the better its performance will be after being listed (Banerjee et al., 2016; Andriansyah & Messinis, 2016).

On the other hand, other studies have shown that some IPOs for immature companies resulted in disappointing post-IPO performances. Jain et al. (2008) found that when unprofitable young companies garnered early-stage success from going public, a correlation existed with disappointing long-term performance. IPO underperformance tends to appear more in relatively young growth companies (Ritter, 1991). Evidence has also been provided to show that the risk of failure is low and the probability of success is high in older companies (Engelen & van Essen, 2010; Ritter, 1991; Clark, 2002; Loughran & Ritter, 2004; Hensler et al., 1997). Post-IPO performance might vary according to industry. Clark (2002) found that young tech companies performed better after an IPO, whereas non-tech companies with a higher age at IPO show higher stock performance after the IPO. Most companies spend a significant amount on SG&A, and biotech companies are no exception. Korean biotech companies vary greatly in the proportion of SG&A expenses depending on their management method.

Companies built around sales agencies have a much higher proportion of SG&A expenses than companies specializing in raw materials. SG&A spending also depends on the size of the company. The ratio of SG&A expenses to sales for large biotech companies is approximately 20%, which is relatively low compared to that of small and medium-sized biotech companies. The latter group exhibits a ratio of about 40% or more. The cause of the increasing ratio has been perceived negatively because it is linked to an agent problem (Chen et al. 2012; Ang et al., 2000). It is considered to be inefficient, and it negatively affects the company's future profitability and value (Lev & Thiagarajan, 1993; Baumgarten et al. 2010). On the other hand, some studies have demonstrated positive impacts from SG&A costs (Anderson et al., 2007; Baumgarten et al., 2010; Banker et al., 2011). According to Baumgarten et al. (2010), SG&A costs have a positive aspect up to a certain level. Managers may intentionally retain slack resources to avoid the adjustment costs of retrenching, even when sales decrease. This may imply the expectation that managers will increase sales in the future (Anderson et al., 2007). Anderson et al. (2007) also found that as the proportion of SG&A costs increased, the company's future performance improved. Homburg & Nasev (2008) argued that although an increase in SG&A expenses might be negative for current profit, it could have a positive impact on future profit. As such, if the market was efficient, the proportion of SG&A expenses would become a positive signal for future profit.

The impact of SG&A expenses can vary depending on the size of the company (Chauvin & Hirschey, 1993; Lev & Sougiannis, 1996) and industry (Banker et al., 2011). SG&A expenses have a positive effect on a company's return on investment for up to seven years after the expenditure, though differences exist according to industry (Banker et al., 2011). SG&A spending can have a positive impact on future performance due to intangible investment attributes (Chen et al., 2012: Enache & Srivastava, 2017; Banker et al., 2019). Chen et al. (2012) noted that the SG&A stickiness caused by agent problems could be mitigated because the future value expected from the investment properties of the SG&A costs would increase. After the SG&A stickiness study by Anderson et al. (2003), the literature on asymmetric cost behavior has grown steadily (Anderson et al., 2003; Balakrishnan et al., 2004; Weiss, 2010; Kama & Weiss, 2013; Anderson & Lanen, 2009; Subramaniam & Weidenmeir, 2003). SG&A stickiness is defined as the degree to which costs decrease when sales decrease rather than the extent to which costs increase when sales increase (Anderson et al., 2003). Anderson et al. (2003) investigated the stickiness of SG&A expenses by comparing SG&A expense variations with changes in sales revenue. Anderson et al. (2003) found that when sales increased by 1%, SG&A expenses increased by 0.55% on average, whereas when sales decreased by 1%, SG&A expenses decreased by only 0.35% on average. Companies with higher asset and employee intensity show higher downward rigidity in costs. SG&A stickiness can be caused by a number of factors. In prior studies, adjustment costs, management overconfidence, and the agency problem have been mentioned as the main drivers of SG&A stickiness.

For example, it has been argued that asymmetric cost behavior is affected by negative incentives such as managerial opportunistic incentives for pursuing the private interests of managers or agency conflict due to conflicts of interest between managers and shareholders (Chen et al., 2012; Dierynck et al., 2012; Kama & Weiss, 2013). Chen et al. (2012) also proved that the correlation between the agent problem and the stickiness of SG&A expenses was more certain when the corporate governance structure was weak. The dominant opinion has been that an increase in the SG&A to sales ratio is a sign of the inefficient management of cost controls. In contrast, asymmetric cost behavior may be a function of managerial cost adjustments or a strategy to improve corporate value. For example, management may be reluctant to over-adjust costs (Subramaniam & Weidenmier, 2003; Banker & Chen, 2006; Calleja et al., 2006) and may have optimistic outlooks for the future (Anderson et al., 2003; Chen et al., 2013; Banker et al., 2014), showing that as the manager becomes more overconfident about future profits, the cost stickiness increases.

o measure managerial overconfidence, Chen et al. (2013) used the exercise of options, Banker et al. (2014) used an increase in sales from the previous year, and Ahmed & Duellman (2013) also used capital expenditure relative to the industry average. Regarding IPOs, research has mainly been focused on post-IPO performance. However, pre-IPO SG&A spending could have a significant impact on the duration of the IPO. Anderson et al. (2007) found that an increase in the SG&A to sales ratio during periods of decreasing sales had a positive relationship with future profit. They also considered that SG&A signaling was more meaningful in periods with declining revenues than periods with increasing revenues. If some SG&A expenses are fixed and sticky and the decline in profits is considered temporary, there is no need to adjust them. This is because they can naturally be recovered if profits increase in the future. In other words, an increase in the SG&A to sales ratio during a period of declining sales can provide positive information with respect to future profits. By linking a positive outlook with IPOs, SG&A stickiness signaling during periods of declining sales is expected to facilitate the IPO process. Therefore, in this study, the following hypotheses are established.

Hypothesis 1.1: There is a correlation between pre-IPO SG&A spending and age at IPO.

Hypothesis 1.2: Each SG&A item will affect age at IPO differently.

Hypothesis 2: There is a correlation between pre-IPO SG&A stickiness signaling and age at IPO

Research Design

Sample Selection

This study uses financial data made available between 2001 and 2019 by KIS-DATA, a database developed by Korea Investors Service, Inc. The sample contains only publicly traded Korean Stock Exchange (KSE) non-financial companies with a fiscal year ending on 31 December. 2,149 firm-year observations are included in the final study. Although only biotech companies are used for the hypothesis analysis of this study, the median age of IPO of the biotech and non-biotech companies during the analysis period is compared in Table 1 below. The mean ages for the biotech and non-biotech companies are 18.6 and 14.4, respectively.

| Table 1 Median age at IPO –Biotech vs. Non-Biotech | |||||||||||||||||||

| Year | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| Biotech | 22 | 22 | 22 | 21.5 | 20 | 20 | 20 | 20 | 19 | 19 | 18 | 16.5 | 16 | 15 | 14 | 13.5 | 13 | 13 | 13 |

| Non- biotech |

14 | 14 | 14 | 13.5 | 13 | 13 | 13 | 13 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 11 | 11 | 11 |

Regression Model and Measurement of Variables

The OLS model is used with age at IPO as the dependent variable for the analysis of Hypotheses 1.1 and 1.2. The regression model is as follows

AGEi.t = α + β1SG&Ai.t + ∑αjXj + ∑αkINDk + ∑αlYEARl + εi,t (1)

Where, AGEi,t is the natural logarithm of age at IPO in an attempt to standardize the distribution and erase the influence of existing outliers. Age at IPO is defined as the year of the IPO minus the year of founding. SG&A is defined as all SG&A expenses (operating expenses) for the period before the IPO. For additional analysis, SG&A expenses are subdivided according to the SG&A classification provided by Enache & Srivastava (2017). These include R&D spending immediately expensed, advertising expenses, sales promotion expenses, entertainment expenses, and other SG& A expenses. X represents the three fundamental financial factors affecting age at IPO – leverage, size, and ROA.

Leverage is the total liabilities divided by total assets. Size, which is measured as the natural log of total assets, is used to control for size effects. Return on assets, which is measured as net income divided by total assets, is included to control for firm profitability. Because having a lot of good employees may help accelerate IPOs, and conversely, a lot of employees lead to inefficient costs, employee intensity is also included as a control variable. Employee intensity is calculated by dividing the number of employees by sales. Finally, industry dummy variables (as specified by the one-digit Korea Standard Industry Code) and year dummy variables are used as control variables. For the analysis of Hypothesis 2, the OLS model is employed with age at IPO as the dependent variable. The regression model is as follows.

Agei.t = α + β1SGAsigINCi.t + β2SGAsigDECi.t + ∑αjXj + ∑αkINDk + ∑αlYEARl + εi,t (2)

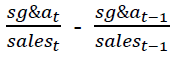

Where, Agei,t is the natural logarithm of age at IPO. SG&A signals, SGAsigINC, and SGAsigDEC are measured by following (Banker & Chen, 2006; Anderson et al., 2007). SGAsigINC is the change in ratio of SG&A expenses to sales when sales increase, and SGAsigDEC is the change in SG&A expenses when sales decrease. The SG&A stickiness signal, which is a change in the ratio of SG&A expenses to sales, is measured based on the following proportional cost model.

Sg&a stickiness signal =  (3)

(3)

Empirical Results

Descriptive Statistics and Correlations

Table 2 displays the descriptive statistics for the main variables. The mean (median) for age is 2.7746 (2.8904). The mean (median) for SG&A is 0.0918 (0). The means (medians) for subdivided SG&A expenses, RD, ADV, SPRO, ENTER, and otherSGA are 0.0199 (0), 0.0034 (0), 0.0023 (0), 0.0019 (0), and 0.0642 (0), respectively. The means (medians) for SGAsigINC and SGAsigDEC are -0.0209 (0) and 0.0193 (0), respectively. The mean (median) values for control variables LEV, SIZE, ROA, and Empint are 0.3829 (0.3486), 17.9744 (17.9831), -0.0266 (0.0257), and 0.0001 (0), respectively.

| Table 2 Descriptive Statistics | |||||

| Variables | Mean | Std Dev | Median | Q1 | Q3 |

| Age | 2.7746 | 0.6868 | 2.8904 | 2.3026 | 3.2581 |

| SG&A | 0.0918 | 0.1935 | 0 | 0 | 0.0006 |

| RD | 0.0199 | 0.0924 | 0 | 0 | 0.0006 |

| ADV | 0.0034 | 0.0151 | 0 | 0 | 0.0004 |

| SPRO | 0.0023 | 0.0145 | 0 | 0 | 0 |

| ENTER | 0.0019 | 0.0064 | 0 | 0 | 0.0007 |

| OtherSGA | 0.0642 | 0.1299 | 0 | 0 | 0.0802 |

| SGAsigINC | -0.0209 | 0.1103 | 0 | 0 | 0 |

| SGAsigDEC | 0.0193 | 0.1051 | 0 | 0 | 0 |

| LEV | 0.3829 | 0.2946 | 0.3486 | 0.1966 | 0.5154 |

| SIZE | 17.9744 | 1.2615 | 17.9831 | 17.0991 | 18.7671 |

| ROA | -0.0266 | 0.2621 | 0.0257 | -0.0527 | 0.0722 |

| Empint | 0.0001 | 0.0016 | 0 | 0 | 0.0001 |

Note:

Age : the natural logarithm of Age at IPO; Age at IPO is defined as the year of the IPO minus the year of founding

SG&A : total SG&A expenses divided by assets

RD : R&D expenses divided by assets

ADV : advertising expenses divided by assets

SPRO : sales promotion expenses divided by assets

ENTER : entertainment expenses divided by assets

OtherSGA : SG&A-ADV-SPRO-ENTER

SGAsigINC : change in ratio of SG&A expenses to sales when sales increase

SGAsigDEC : change in SG&A expenses when sales decrease

LEV : total liabilities divided by total assets

SIZE : the natural logarithm of total assets

ROA : net income divided by total assets

Empint : number of employees divided by sales

The pairwise correlations are reported in Table 3 Panels 3A and 3B. Significant correlations are observed between age at IPO and SG&A expenses. Significant negative correlations can be seen between age at IPO and R&D expenses and between age at IPO and SG&A stickiness signal when sales decrease. To test for multi-collinearity, the variance inflation factors (VIFs) are computed VIFs for all variables less than 10 and mean VIFs of 2.43. No multi-collinearity problems are evident.

| Table 3A Correlations Panel A. Age At IPO – SG&A Expenses | |||||||||||

| Variable | Age | SG&A | RD | ADV | SPRO | ENTER | OtherSGA | LEV | SIZE | ROA | Empint |

| Age | 1.0000 | ||||||||||

| SG&A | -0.0315 | 1.0000 | |||||||||

| RD | -0.1566* | 0.6875* | 1.0000 | ||||||||

| ADV | 0.0878* | 0.3914* | 0.0394 | 1.0000 | |||||||

| SPRO | 0.1479* | 0.3390* | -0.0012 | 0.2825* | 1.0000 | ||||||

| ENTER | 0.1316* | 0.5165* | 0.0891* | 0.2252* | 0.4463* | 1.0000 | |||||

| Other SGA |

0.0319 | 0.8921* | 0.3042* | 0.3962* | 0.3401* | 0.5812* | 1.0000 | ||||

| LEV | 0.0009 | 0.3355* | 0.2540* | 0.0832* | 0.1454* | 0.1725* | 0.2849* | 1.0000 | |||

| SIZE | 0.2415* | - 0.4569* |

- 0.2274* |

- 0.1476* |

- 0.0872* |

- 0.2296* |

-0.4807* | - 0.1475* |

1.0000 | ||

| ROA | 0.2477* | - 0.3442* |

- 0.4880* |

0.0407 | 0.0421* | 0.0043 | -0.1753* | - 0.4056* |

0.2583* | 1.0000 | |

| Empint | -0.0586* | 0.0239 | 0.0303 | -0.0074 | -0.0077 | -0.0078 | 0.0173 | 0.0249 | 0.0083 | - 0.0447* |

1.0000 |

| Table 3B Panel B. Age at IPO – SGA stickiness signal | |||||||

| Variables | Age | SGAsigINC | SGAsigDEC | LEV | SIZE | ROA | Empint |

| Age | 1.0000 | ||||||

| SGAsigINC | 0.1546* | 1.0000 | |||||

| SGAsigDEC | -0.1389* | 0.0348 | 1.0000 | ||||

| LEV | 0.0009 | -0.0614* | 0.0941* | 1.0000 | |||

| SIZE | 0.2415* | 0.2091* | -0.2153* | -0.1475* | 1.0000 | ||

| ROA | 0.2477* | 0.1650* | -0.2616* | -0.4056* | 0.2583* | 1.0000 | |

| Empint | -0.0586* | -0.0054 | 0.2667* | 0.0249 | 0.0083 | -0.0447* | 1.0000 |

Regression Results and Discussion

Table 4 shows the OLS regression results for the association between age at IPO and SG&A expenses. The findings support the hypothesis. Model 1 shows how age at IPO is associated with total SG&A expenses. The results show that age at IPO is significantly positively associated with total SG&A expenses (p < 0.01). The results suggest that the excessive SG&A spending of biotech companies may have negative repercussions, causing operating losses or reducing operating income, and delaying the IPOs. In Model 2, the correlation between SG&A expenses and age at IPO is examined by subdividing SG&A expenses into R&D, advertising, sales promotion, entertainment, and other SG&A expenses.

| Table 4 Regression Results: Age at IPO – SG&A Expenses | |||

| Variables | Dependent Variable: Age at IPO | ||

| Model 1 | Model 2 | Clustered Robust (year) Regression | |

| Constant | -0.4308 * (-1.76) | -0.5085 ** (-2.05) | -0.5085 ** (-2.05) |

| SG&A | 0.6232 *** (7.22) | - | - |

| RD | - | -0.3397 * (-1.86) | -0.3397 * (-2.47) |

| ADV | - | 0.7954 (0.83) | 0.7954 (0.93) |

| SPRO | - | 2.8219 *** (2.71) | 2.8219 *** (7.55) |

| ENTER | - | 8.2300 *** (3.06) | 8.2300 *** (4.27) |

| Other SGA | - | 0.7027 *** (4.52) | 0.7027 *** (5.47) |

| LEV | 0.1559 *** (2.88) | 0.1093 *** (2.02) | 0.1093 ** (2.72) |

| SIZE | 0.1875 *** (14.06) | 0.1920 *** (14.23) | 0.1920 *** (13.40) |

| ROA | 0.5086 *** (7.97) | 0.3549 *** (5.32) | 0.3549 *** (4.82) |

| Empint | -22.4288 *** (-2.71) | -21.8140 *** (-2.67) | -21.8140 *** (-7.52) |

| Year dummies | Included | ||

| F value | 17.45*** | 17.29*** | - |

| Adjusted | 0.1497 | 0.1699 | 0.1804 |

| N | 2,149 | 2,149 | 2,149 |

t-values are shown in parentheses. * p < 0.10 ** p < 0.05 *** p < 0.01

The results illustrate that age at IPO is significantly negatively associated with R&D expenditures (p < 0.1), implying that investment in R&D may help shorten a company's time to IPO. The R&D expenditures of biotech companies, which are much more important than in other industries and inevitably require significant expenditures of money, seem to be recognized as an expectation for future company value, even if they are expensed immediately when incurred. Meanwhile, all other variables – i.e., advertising, sales promotion, entertainment, and other SG&A expenses – have positive associations with age at IPO. In particular, sales promotion, entertainment, and other SG&A expenses show a significant positive correlation (p <0.01), which can be seen as consistent with the view that SG&A is considered an inefficient expenditure from an agency problem perspective. The results for the control variables are inconsistent.

Three key financial ratios – LEV, SIZE, and ROA – are significantly positively associated with age at IPO in all models. The control variable,employee intensity, is significantly negatively associated with age at IPO in all models. Clustered robust (year) regression results remained consistent with the OLS results, for the main explanatory variables. Table 5 represents the OLS regression results for the association between age at IPO and SG&A stickiness signals. The results underpin the hypothesis, and they demonstrate that age at IPO is significantly positively associated with SG&A stickiness signaling when sales increase (p < 0.01).

| Table 5 Regression Results: AGE at IPO – SGA Stickiness Signal | ||

| Variables | Dependent Variable: Age at IPO | |

| OLS regression | Clustered Robust (year) Regression | |

| Constant | 0.5922 ** (2.51) | 0.5922 ** (2.37) |

| SGAsigINC | 0.4870 *** (3.86) | 0.4870 *** (5.05) |

| SGAsigDEC | -0.2510 * (-1.79) | -0.2510 ** (-2.78) |

| LEV | 0.2526 *** (4.75) | 0.2526 *** (4.16) |

| SIZE | 0.1309 *** (10.30) | 0.1309 *** (9.74) |

| ROA | 0.4393 *** (6.48) | 0.4393 *** (5.44) |

| Empint | -12.0375 (-0..67) | -12.0375 (-1.62) |

| Year dummies | Included | Included |

| F value | 14.17*** | - |

| Adjusted | 0.1289 | 0.1387 |

| N | 2,136 | 2,136 |

In addition, age at IPO is significantly negatively associated with SG&A signaling when sales decrease (p < 0.1). As with Anderson et al. (2007), an increase in the SG&A to sales ratio during periods of declining sales can be observed as providing positive information about future profits, and this will accelerate expectations of going public. The control variables, except for employee intensity, are significantly positively associated with age at IPO. Clustered robust (year) regression results remained consistent with the OLS results, for the main explanatory variables.

Conclusions

IPOs are a critical strategic turning point for companies (Gill & Walz, 2016). Hence, most private companies desire to trigger an IPO as quickly as possible. In particular, financing through a fast IPO is a matter of urgency for technology companies that require a lot of investment in R&D activities. IPOs play an important role for emerging technology companies in offering a source of financing to improve the effectiveness of market entry while continuing R&D activities (Pagano & Zingales, 1998). R&D spending is included as an asset if it satisfies the requirements for capitalization, unless it is immediately expensed and included as SG&A expenses. In addition to R&D, companies incur large amounts of SG&A expenses that include advertising expenses, sales promotion expenses, administrative expenses, etc.

The impact of SG&A expenses depends on the size and industry of the company (Chauvin & Hirschey, 1993; Lev & Sougiannis, 1996; Banker et al., 2011). In particular, biotech companies incur a lot of SG&A expenses in an attempt to increase sales and at the same time show contradictory circumstances in which a decrease in SG&A expenses will lead to an increase in profits. There are many pros and cons with respect to whether SG&A spending is an investment for future business growth or simply an inefficient waste. Research related to IPOs has mainly focused on post-IPO performance, but this study looks at how pre-IPO SG&A spending affects the age at IPO.

Depending on whether SG&A spending is regarded as an investment for future growth or a simple waste, the outcomes can differ. First, the analysis result showed that total SG&A spending had a negative effect on IPO acceleration while showing a positive correlation with age at IPO. Further, SG&A expenses were subdivided as per the categories provided by Enache & Srivastava (2017), and this study then examined the correlation of each subdivision with age at IPO. This highlighted that R&D expenses had a negative correlation with age at IPO.

This could be interpreted as being in line with the opinion that R&D expenditures are investments in future corporate value, as has been suggested by previous studies. In addition, it is worth noting the prior research that has suggested that SG&A stickiness during periods of declining sales can be linked to optimistic outlooks for the future (Anderson et al., 2003; Chen et al., 2013; Banker et al., 2014). In this study, SG&A stickiness signal variables were measured using the methods outlined by Banker & Chen (2006) and Anderson et al. (2007), and a relationship was demonstrated with age at IPO.

According to the results, age at IPO was significantly positively associated with the SG&A stickiness signal when sales increased. However, SG&A stickiness signaling during periods of declining sales was significantly negatively associated to age at IPO. This can be viewed as a finding consistent with the analysis results provided by (Anderson et al., 2007).

An increase in the SG&A to sales ratio during periods of declining sales is perceived as an optimistic outlook for potential post-IPO business growth, which may ultimately play a role in shortening the time to IPO. Despite being fragmentary in nature, the results are a reminder of the importance of efficient expenditure management, particularly for private biotech companies that aspire for rapid going public. Future research can be carried out by linking the time to IPO with other variables, for example profitability, profit persistence, etc

References

- Ahmed, A., & Duellman, S. (2013). Managerial Overconfidence and Accounting Conservatism. Journal of Accounting Research, 51, 1-20.

- Anderson, M.C., Banker, R.D., & Janakiraman, S.N. (2003). Are selling, general, and administrative costs “sticky”? Journal of Accounting Research, 41(1), 47-63.

- Anderson, M., Banker, R., Huang, R., & Janakiraman, S. (2007). Cost behavior and fundamental analysis of SG&A costs. Journal of Accounting, Auditing and Finance, 22(1), 1-28.

- Anderson, S.W., & Lanen, W.N. (2009). Understanding cost management?What can we learn from the empirical evidence on “sticky costs?” Working paper, University of Michigan.

- Andriansyah. A., & Messinis, G. (2016). Intended use of IPO proceeds and firm performance: A quantile regression approach. Pacific-Basin Finance Journal, 36, 14-30.

- Ang. J., Cole, R., & Lin, J. (2000). Agency Cost and Ownership Structure. The Journal of Finance, 64, 81-106.

- Balakrishnan, R., Peterson, M., & Soderstrom, N. (2004). Does capacity utilization affect the “stickiness” of cost? Journal of Accounting, Auditing and Finance, 19(3), 283-299.

- Banerjee, S., Güçbilmez, U., & Pawlina, G. (2016). Leaders and followers in hot IPO markets. Journal of Corporate Finance, 37, 309-334.

- Banker, R. & Chen, L. (2006). Predicting earning using a model based on cost variability and cost stickiness, The Accounting Review, 81(1), 285-307.

- Banker, R.D., Byzalov, D., & Plehn-Dujowich, J. (2011). Sticky Cost Behavior: Theory and Evidence. Working Paper.

- Banker, R.D., Huang, R., Natarajan, R., & Zhao, S. (2019). Market valuation of intangible asset: Evidence on SG&A expenditure. The Accounting Review, 94(6), 61-90.

- Banker, R., Byzalov, D., Ciftci, M., & Mashruwala, R. (2014). The Moderating Effect of Prior Sales Changes on Asymmetric Cost Behavior. Journal of Management Accounting Research, 26(2), 221-242.

- Baumgarten, D., Bonenkamp, U., & Homburg, C. (2010).The information content of the SG&A ratio. Journal of Management Accounting Research, 22(1), 1-22.

- Calleja, K.M., Steliaros, M., & Thomas. D. (2006). A note on cost stickiness?Some international comparisons. Management Accounting Research, 17(2), 127-140.

- Chauvin, K., & Hirschey, M. (1993). Advertising, R&D Expenditures and the Market Value of the Firm. Financial Management, 22(4), 128-140.

- Chen, C.X., Lu, H., & Sougiannis, T. (2012). The agency problem, corporate governance, and the asymmetrical behavior of Selling, General, and Administrative costs. Contemporary Accounting Research, 29(1), 252-282.

- Chen, C.X., Gores, T., & Nasev, J. (2013). Managerial Overconfidence and Cost Stickiness. Working Paper, University of Illinois at Urbana-Champaign.

- Clark, D.T. (2002). A Study of the relationship between firm age?at?IPO and aftermarket stock performance. Financial Markets, Institutions & Instruments, 11(4), 385-400.

- Dierynck, B., Landsman, W.R., & Renders, A. (2012). Do managerial incentives drive cost behavior? Evidence about the role of the zero earnings benchmark for labor cost behavior in Belgian private firms. The Accounting Review, 87(4), 1219-1246.

- Enache, L., & Srivastava, A. (2017). Should intangible investments be reported separately or commingled with operating expenses? New evidence. Management Science, 64(7), 3446-3468.

- Engelen, P.J., & van Essen, M. (2010). Underpricing of IPOs: Firm, issue-and country-specific characteristics Journal of Banking & Finance, 34(8), 1958-1969.

- Gill, A., & Walz, U. (2016). Are VC-backed IPOs delayed trade sales? Journal of Corporate Finance, 37, 356- 374.

- Hensler, D.A., Rutherford, R.C., & Springer, T.M. (1997). The survival of initial public offerings in the aftermarket. Journal of Financial Research, 20(1), 93-110.

- Homburg, C., & Nasev, J. (2008). How Timely are Earnings When Costs are Sticky? Implication for Link Between Conditional Conservatism and Cost Stickiness. Working paper.

- Hsu, H., Reed, A.V., & Rocholl, J. (2010). The new game in town: competitive effects of IPOs. Journal of Finance, 65, 495-528.

- Jain, B.A., Jayaraman, N., & Kini, O. (2008). The path-to-profitability of Internet IPO firms. Journal of Business Venturing, 23(2), 165-194.

- Kama, I., & Weiss, D. (2013). Do earnings targets and managerial incentives affect sticky costs? Journal of Accounting Research, 51(1), 201-224.

- Lev, B., & Sougiannis, T. (1996). The Capitalization, Amortization and Value-relevance of R&D, Journal of Accounting and Economics, 21(1), 236-249.

- Lev, B., & Thiagarajan, S. (1993). Fundamental Information Analysis. Journal of Accounting Research 31(Autumn), 190-215.

- Loughran, T., & Ritter, J.R. (2004). Why has IPO underpricing changed over time? Financial Management, 33(3), 5-37.

- Pagano, M., Panetta, F., & Zingales, L. (1998). Why do companies go public? An Empirical analysis. Journal of Finance, 53(1), 27-65.

- Peristiani, S., & Hong, G. (2004). Pre-IPO financial performance and aftermarket survival. Current Issues in Economics and Finance, 10(2), 1-7.

- Ritter, J.R. (1991). The long-run performance of initial public offerings. The Journal of Finance, 46(1), 3-27.

- Ritter, J.R. (2021). Initial Public Offerings: Median Age of IPOs Through 2020. IPO Data. University of Florida.

- Ritter, J.R., & Welch, I. (2002). A review of IPO activity, pricing, and allocations. The Journal of Finance, 57(4), 1795-1828.

- Subramaniam, C., & Weidenmier, M. (2003). Additional evidence on the behavior of sticky costs. Working paper. Texas Christian University.

- Weiss, D. (2010). Cost behavior and analysts’ earnings forecasts. The Accounting Review, 85(4), 1441-1474.