Research Article: 2023 Vol: 27 Issue: 3

The Association between Voluntary Disclosure of Water Risk and Earnings Management

Suyon Kim, Jeonbuk National University

Citation Information: Kim, S. (2023). The association between voluntary disclosure of water risk and earnings management– with a focus on the female directors on board. Academy of Accounting and Financial Studies Journal, 27(3), 1-15.

Abstract

This study examines the relationship between the voluntary disclosure of water risk and earnings management. The result of the analysis shows that the firms that reveal their true environmental status regarding water are less likely to manage earnings. It implies as the firms expose their true environmental status regarding water, they draw the attention of the public and will have less chance to manage earnings. At the same time, as the social and economic status of females gets higher, this study examines whether the role of female directors on board affects that relationship. According to the finding, as the proportion of female directors on boards grows, corporations that report water risk are less prone to engage in earnings management. Thus, this study confirms that female directors contribute to raising a transparent economic environment. Also, investors might have a more favorable perspective on the information supplied by firms with a high proportion of female directors because of the beneficial influence of gender personnel composition on increasing corporate transparency.

Keywords

Water Risk, Voluntary Disclosure, Earnings Management, Female Directors, Firm Value.

Introduction

Stakeholders are striving for more transparency, and firms, for their part, are falling under growing pressure to show their commitment to responsible business practices. Investors request not only financial information but also non-financial metrics to evaluate the firms (Simnett et al. 2009). For instance, the greenhouse effect is becoming an increasingly crucial factor for the decision-making process of stakeholders who are anxious about the consequences of global warming (Thornton & Hsu, 2001). In addition to this, the disclosure of environmental information has a significant strategic value for the long-term success of a firm, and it also assists in the peaceful coexistence of society, government, and enterprises (Lu et al., 2020). Previous studies have focused on the problem of global warming in the aspect of carbon emission. To the best of my knowledge, very few studies in South Korea have focused on the potential threats caused by water risk.

Regardless of the importance of controlling carbon emissions, the impact of water is more immense. According to the findings of the Intergovernmental Panel on Climate Change’s (IPCC) assessments, the world's oceans absorb more than 90 percent of the heat that is trapped by greenhouse gases. However, water has gotten little attention since there is so much of it and it cannot be altered in any way by human intervention, compared to controllable carbon emission. To the best of my knowledge, very few studies in South Korea have focused on the potential threats caused by water risk.

In 2010, in response to the growing demand for water information and relying on its successful carbon information request procedure, the Carbon Disclosure Project (CDP) released its first water disclosure survey. The survey was designed to collect information about water-related disclosures and 83% of firms that participated in the 2021 CDP reported that water resources are either vital or critical to the firms’ operation. The requests for companies to participate in disclosing information about water have increased by 278% in 2021 compared to 2010. Though CDP’s carbon disclosure survey and water-related disclosure have in common, such as their approach to management, strategy, risk, and initiatives, the two surveys remain distinct. While the carbon disclosure survey reveals information related to trading and performance, water-related disclosure shows the total volume of water consumed, discharged, management, and improvement plans (CDP, 2021). CDP proposes reasons for managing water risk and physical damage caused by water is on the rise as a consequence of climate change. Additionally, the financial impact of future water risks is expected to be significantly higher than in the past.

Though disclosing information about water risk may sound negative, it is regarded that the company's disclosure tends to expose the company's genuine obligations for environmental improvement, which is important information for decision-making purposes (Datt et al., 2017). At the same time, disclosing environmental information evaluates a company’s future value and sustainable existence based on whether the company has a system that can preemptively deal with the risk, rather than how much damage the company experienced.

This study focuses on the voluntary disclosure of water risk concerning earnings management using firms that are listed in the Korean stock market. The findings of this study support the idea that there is a negative relationship between voluntary disclosure of water risk and earnings management. Firms that disclose their privileged information voluntarily lower information asymmetry and increase reputation and transparency. If firms fail to provide truthful information, the firm’s value and reliability will deteriorate, leaving them vulnerable to legal action (Lee et al., 2012). Therefore, if the companies that voluntarily disclose information about water risk are engaged in earnings management, it will be easily detected by shareholders.

In addition, the impact of female directors on the board on the relationship between voluntary disclosure of water risk and earnings management is examined. Due to son preferential ideology of the past in South Korea, the proportion of the female overall population was low, and women's economic activities were particularly low. Also, with the remnants of the Confucian culture, South Korea had developed in the 1970s and 1980s that was concentrated on the heavy chemical industries such as automotive manufacturing and chemical industries. However, recent changes in gender equality have led to significant improvements in academic achievement as well as an increase in the number of economic activities undertaken by women (Kim, 2020). This has increased the percentage of women in the population. Corporate governance has been evaluated as the primary factor affecting corporate disclosure. In general, companies with a good governance structure are highly interested in information transparency and carefully consider the reputation and legal issues, so they disclose information voluntarily (Kim et al., 2020).

This study is distinct from the prior literature on South Korea background. Though there is limited use of information on water risk, to my acknowledge, this is the first to examine the relationship between voluntary disclosure of water risk and earnings management. This study also considers the female directors on the board in this relationship. By examining the effect of the female workforce, this research expands the scope of research that can explain the factors that affect voluntary disclosure at the corporate governance structure level. Also, by considering the impact of gender personnel composition on improving corporate transparency, market participants can have a favorable perspective on the information provided by companies with a high proportion of female personnel when making investment decisions. In addition to this, it provides policy implications for the need for gender-equal human resource policies regarding recent institutional developments in South Korea, such as the implementation of the "women's quota system."

Literature and Hypothesis Development

Disclosing Information on Water Risk

As climate change continuously threatens the world, firms are under pressure to disclose information that influences the greenhouse effect. The major cause of the greenhouse effect is in fact water. According to IPCC, 90% of the heat trapped in the earth due to the greenhouse effect is absorbed by seawater. However, there is scarce research examining the effect of the water from the perspective of accounting. As water risk information requests become more popular, an increasing number of companies participate in voluntarily disclosing water-related information through CDP.

Information on water risk from CDP incorporates the three steps for water management and they are as follows: (1) Establishing a risk assessment framework - identification, evaluation, and prioritization of water-related issues, (2) Strategy/Policy and goal development - Establish a company-wide water policy/strategy and detailed goals, (3) Strategy implementation - The implementation of actions to mitigate water risk. By disclosing information related to water risk, external stakeholders learn how much a company that they are interested in is aware of the water-related risk as well as any strategies the company has to address these risks. The CDP has standardized all of these processes, and neither the structure nor the content of any of the disclosures may be changed. Consequently, there is a lower possibility of obtaining biased information from CDP reports as opposed to obtaining the information via other channels such as annual reports or CSR reports (Datt et al., 2018). Firms responding to CDP are regarded as voluntary disclosure of environmental information, which is difficult to imitate by other firms of poor environmental performance and is not readily observable to investors.

Revealing information about environmental factors, such as the risk of water risk, is explained by the following theories. First, asymmetric information theory supports that disclosure of non-financial information, such as water risk, can solve the problem of adverse selection brought on by asymmetric information, hence reducing investment risk (Chen & Liu, 2013). Moreover, disclosing water risk reduces the information asymmetry between the company and its external stakeholders, resulting in the optimal allocation of limited resources by notifying investors of the potential future costs that may be incurred as a consequence of the firm's water risk status. As companies reveal their privileged information, they are more subject to the scrutiny of the public. In addition, the information disclosure may send a positive signal to the market, which may result in an increase in the number of investors and a decrease in the cost of capital (Mohamed & Schwienbacher, 2016). This, in turn, would reduce the expected company’s risk (Zhou et al., 2018b).

Second, signaling theory describes the motivation for managers to voluntarily release privileged information to let the stakeholders learn about the company's present status and prospects (Trueman, 1986). In other words, signaling theory proposes that management fore-recognizes future events and makes preparations to react in an appropriate manner. Additionally, voluntary disclosure sends a signal to investors and outside stakeholders that the company is actively participating in environmental initiatives. This is because the company is demonstrating that it is acting responsibly toward the environment. Thus, voluntarily providing the information is seen as a positive signal in a market. Lastly, the legitimacy theory operates on the premise that businesses should conduct their economic activities in a manner that is in line with the norms and prospects that are anticipated by society (Shocker & Sethi, 1973). According to Archel et al. (2009), the legitimacy theory supports that there is a social contract between companies and society. At the same time, Deegan (2002) contends that companies should behave with the legitimacy necessary for their sustainable existence, as well as the inevitable use of social resources. Quite notably, companies engage in a wide range of environmental activities and use a variety of methods to establish and maintain their legitimacy (Cohen et al., 2008). According to the legitimacy theory, a company's participation in voluntarily disclosing environmental issues may be related to better-reported profitability numbers as a strategy for influencing and managing a society's perception of a positive image.

There are various studies on water risk with different country backgrounds. To begin, there is research that analyzes the characteristics of the companies that contribute to the voluntary disclosure of water risk. Burritt et al. (2016) studied the variables that impact Japanese corporations' disclosure of information connected to water. They analyzed the water disclosure practices of 100 publicly traded Japanese corporations and found that company size, water sensitivity, and ownership concentration were significant predictors. Bigger, more water-aware, and more widely held companies tend to react more actively to stakeholder concerns. Additionally, Yu (2022) examined the factors that influence the disclosure of water resources for Chinese enterprises from 2010 to 2017. Based on the results of the research, it appears that companies operating in water-sensitive industries are more inclined to provide information on water resources. However, political ties degrade the disclosure environment because they involve the largest shareholders and impede the disclosure mechanism. Ben-Amar & Chelli (2018) experimented with 962 multinational corporations with headquarters in 29 countries. According to the findings, there is a negative correlation between the tendency to provide voluntary water disclosures and factors such as uncertainty avoidance and social trust; on the other hand, a country's optimism about its future is correlated with a higher likelihood of water reporting.

At the same time, other studies suggest the outcome after voluntarily disseminating information on water risk. The following research examples of disclosing information on water risk voluntarily promote a transparent accounting environment for the firm. Zhou et al. (2018b) conducted a test of the effect of disclosure of water information on the cost of capital, and examined the influence of political ties, using data from Chinese enterprises between 2010 and 2015. The result suggested that when the degree of information disclosure about water was reached at a certain threshold value, it was found that the information disclosure about water was useful in lowering the enterprise's total capital cost. At the same time, they found that political connection enhances the relationship between water information disclosure and capital costs. Zhou et al. (2018a) examined the 334 listed Chinese companies to find out the association between water disclosure and corporate risk-taking behavior. Their results suggested that there is an inverse relationship between water disclosure and the degree of risk that firms are willing to take. Zhou et al. (2019) assessed whether the level of market competition affects firms’ disclosures of water information and the effect of the ownership type on this relationship in China. They found that companies having the most influence in a market with the moderate competition are more likely to provide water details voluntarily and serve as a guideline for their industry. Ali et al. (2021) examined whether the corporate water disclosure for the top global companies affects the financial performances of companies in reside developed, transition, and developing countries. The result of the analysis suggests a positive relationship between water disclosure and earnings per share.

Earnings Management

Earnings management is described by Schipper (1989) as deliberate interference with external financial reporting to reap the private gain. Healy & Walen (1999) define earnings management as a way in which management interferes with financial reporting and accounting procedures. As a result, this deceives investors and creditors about economic performance and affects the process in the course of accounting procedures, causing changes in financial data. Earnings management is also regarded as a discretionary accounting choice, reflecting managers’ opportunistic behaviors in the pursuit of private gain (Chan et al., 2006). The difference between earnings management and earnings manipulation lies in the fact that earnings management is carried out in accordance with the Generally Accepted Accounting Principles (GAAP) whereas earnings manipulation is not.

Several research has suggested that earnings management can be an opportunistic effort to seek management’s private gains. Kwon et al. (2012) found that the act of pursuing private gain, such as earnings management, damages the reliability of accounting information, and is considered criminal activity at times. Lee et al. (2007) supported that earnings decrease during management turnover. It can be referred to as a "big bath", implying that the earnings are typically lower during turnover years, then increases in the following years. Cormier & Martinez (2006) investigated managers’ motives for earnings management in IPO firms in France. The results indicated that the extent of earnings management of the firms that revealed information on earnings forecasts following the IPO was greater than the firms that did not disclose information. Ahn et al. (2009) presented evidence that managers use discretionary accruals in order to improve the accuracy of forecast information.

However, there are other studies that there are cases of inhibiting earnings management. According to Chih et al. (2008), there is a negative relationship between the level of social responsibility activities and earnings management. The result implies that ethical management companies have a strong awareness of trying to protect their social responsibility and ethical aspects, and they do not adjust their profits. Park & Kim (2017) discovered that a high level of CSR plays an effective control function in earnings management for KOSPI firms, which infer that firms that are involved in ethical activities are reluctant to control their discretionary action for their personal gain. Choi et al. (2022) found that firms that participated in ESG mitigate the information asymmetry in the capital market, as well as alleviate the act of pursuing private gain by lowering earnings management. Choi et al. (2022) discovered that companies who engaged in ESG activities were able to reduce both the information asymmetry that existed in the capital market and the act of actively seeking private gain by reducing the amount of earnings management.

Hypothesis Development

The goal of disclosure is to provide timely and accurate information to market participants. According to the research that has been conducted on the topic of voluntary disclosure, companies have the motive to expose their positive information. Both theoretical and practical research have shown that increasing additional information that a company discloses may, in many instances, result in less uncertainty and lower cost of capital for that company (Verrecchia, 1983; Trueman, 1986; Healy & Palepu, 1993). Healy & Palepu (2001) showed that voluntary disclosures help eliminate information asymmetries and solve agency problems, both of which impede the efficiency of capital markets. Also, Diamond & Verrecchia (1991) found that firms’ voluntary disclosure increases firms’ stock liquidity due to reduced information asymmetry. Previous studies have reported that voluntary disclosure plays a positive functional role in resolving information asymmetry and that the reliability of voluntary disclosure has been favorably evaluated in the capital market.

Voluntary disclosure can be explained by the theories of asymmetry information, legitimacy, and signaling. Those theories support that voluntary disclosure will benefit the firm. For instance, according to the legitimacy hypothesis, the level of disclosure that a company makes is a direct result of the public pressure that it is subjected to from various stakeholder groups in the social, political, and regulatory settings. Therefore, companies that seek to conceal such information will suffer legitimacy risks (Datt et al., 2017).

Both the practical studies and theories support that disclosure of environmental information improves firms' transparency, thereby increasing value and sustainable existence in the market. Sarumpaet et al. (2017) also found that environmental disclosure may strengthen reputation and competitiveness in the market. Furthermore, revealing true environmental information voluntarily implies that firms have made an effort in making an adequate and relevant investment in human resources, financial status, or corporate governance in order to perform disclosure (Datt et al., 2017). At the same time, it means that firms are under the attention of the public (Zhou et al., 2018b). Thus, firms engaging in voluntary disclosure of environmental information, such as water risk, are involved in transparent practices. Therefore, firms engaged in disclosing environmental information on water risk are less likely to perform earnings management.

However, disclosure of a company's environmental practices can also be used as a greenwashing method to hide the poor reputation associated with the company (McWilliams et al., 2006). Managers are the driving force behind greenwashing, which is an attempt to utilize environmental disclosure as a greenwashing method to cover up unethical conduct (Gerged et al., 2020; McWilliams et al., 2006). There is an incentive for managers to engage in greenwashing, as the manipulation of facts, since they are under pressure to hide the negative effect that their activities have on the environment. Rather than releasing information objectively, the voluntary disclosure system discloses subjective information that defends the position of the corporation. There is a high possibility of engaging in earnings management for firms that use environmental information as a tool for greenwashing. Based on the discussion so far, we have developed the following hypothesis.

H1: There is no association between the firms’ voluntary disclosure of water risk and earnings management.

The social and economic influence of females is growing on a global scale, and a movement known as sheconomy, in which women have prominent roles in decision-making related to economic activity, is expanding throughout the globe. The term sheconomy was first used by the Times in 2010, noting that female consumers are responsible for more than 80% of overall purchasing decisions in the United States and have a significant impact on the economy as a whole. The sheconomy boom began in the United States and spread to other major nations as the female economic population grows and the global industrial structure evolves. Feminism has been stressed in recent years not just in terms of consumption but also in supply. There are a growing number of firms with females in top management teams.

In the case of South Korea, the percentage of females in the total population is low due to the predominance of men over women based on the past, and women’s participation in economic activities has been extremely low. There has been a difference in the recognition of responsibilities and roles between genders due to rapid economic growth between 1970 to 1980. However, recent changes in perceptions of gender equality have led to increases in the population and economic activities of women, as well as a significant improvement in academic achievement (Kim, 2020).

The Korean government has made several efforts in expanding women’s rights by promoting systems, such as the gender equality employment quota systems, and mandatory parental leave. In particular, at the beginning of 2020, through revisions to the Capital Market and Financial Investment Business Act, companies with total assets of 2 trillion won or more are obliged to appoint female registered directors. Accordingly, there is a growing interest in the role of women in Korean society.

According to the upper echelon theory suggested by Hambrick & Mason (1984), strategic choice and firm performance are affected by the managers’ characteristics. In terms of gender studies, females have fundamentally different traits (values, perceptions, preferences, and attitudes) compared to males. Females are perceived as more risk-averse and conservative than males (Olsen & Cox 2001; Schubert 2006). Olsen & Cox (2001) report that female investors focus more on reducing risks due to more uncertainty than male investors. In addition, females have higher ethical standards than males (Bernardi and Arnold 1997; Ford & Richardson 1994). According to a study conducted by Heminway (2007), female executives have higher reliability standards than males, which in turn, makes it less likely for them to discretionarily change financial disclosures.

In terms of female directors in the decision-making process of corporate management, Barber & Odean (2001) discovered that female directors are less likely to be overconfident than male directors and apply relatively higher standards when monitoring managers. Adams & Ferreira (2009) also found that monitoring functions strengthen when the proportion of female directors at board meetings is higher. Huang & Kisgen (2008) discovered that female CFOs exercise more caution than male CFOs when making decisions regarding firm acquisition and debt financing.

The existence of female directors in firms relates to higher performance. For example, Baruna et al. (2010) reported that accrual quality is high in firms with female CFOs due to tendencies of risk aversion and regulatory compliance. Gul et al. (2011) contended that there was a relationship between having more females on the board of directors and the usefulness of accounting information. Similarly, Srinidhi et al. (2011) reported that the presence of female directors on firm boards enhances accounting quality. Catayst (2004) discovered that firms with gender diversity were more likely to have transparent work culture, leading to greater performance.

Based on the discussion, this study attempts to examine the role of female directors on the relationship between voluntary disclosure of water risk and earnings management. Rao et al. (2012) found that female directors contribute primarily to complex discussions and decisions such as environmental policy. It is because women have genuine characteristics such as optimism, independence, and preparedness, which might lead to more independent leadership of the board and better standards of transparency. Gul et al. (2011) contended that the monitoring effect of female directors not only affects risk management and ethical behavior.

The findings of previous studies indicate that the proportion of female directors to total directors on a board of directors is directly correlated with an organization's level of efficiency, as well as the quality of its decision-making process regarding social and environmental concerns and the degree to which it exercises stricter oversight over the actions of its management. Based on the argument, the second hypothesis is as follows.

H2: The firms with female directors on board positively affect the relationship between the disclosure of water risk and earnings management.

Research Design and Sample Description

Research Desgin

Measuring earnings management

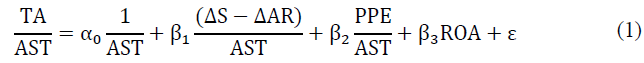

In the previous study, the Jones (1991) and the modified Jones (Dechow et al.. 1995) models were the ones that were used as a proxy for earnings management to assess discretionary accruals. However, Kothari et al. (2005) contend that if discretionary accruals are assessed without controlling for firm performance, the earnings management model would be subject to misspecification. Therefore, in order to reduce the critical misspecification and misspecification concerns that are present in accruals models, they suggest a model that incorporates an intercept and control for the firm performance via return on assets (ROA). In this study, Kothari et al. (2005)'s performance-adjusted discretionary accrual model is adopted for the estimation.

Total accruals (TA) are calculated by the difference between net income and net cash flows from operating activities. Discretionary accruals represent earnings management and are denoted by the equation's residual value (1).

where, TA = net income—cash flow from operations; ΔS = sales revenue; ΔAR = accounts receivables; PPE = plant, property, and equipment; ROA = net income/total assets; and AST = total assets.

Testing Hypothesis

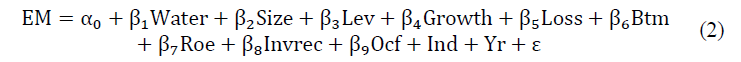

The following equation (2) tests the first hypothesis. The dependent variable is earnings management (EM) in Equation (2). The independent variable is information on water risk (Water) disclosed in CDP reports. The value of the variable, Water, is set to 1 if the companies respond to the water questionnaire provided by CDP reports.

where, EM = Performance adjusted discretionary accruals suggested by Kothari et al. (2005); Water = 1, if the firm discloses the water information, 0 otherwise; Size = log (total assets); Lev = Debt ratio; Growth = Asset growth ratio; Loss = 1 if a company with loss, and 0 otherwise; Btm = Book to market ratio; Roe = Return on equity; Invrec = Ratio of account receivables; Ocf = Cash flow from operation; Ind = industry indicators; and Yr = year indicators.

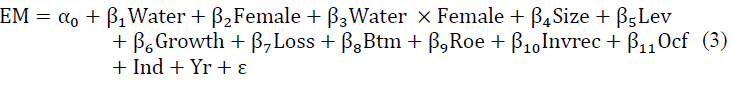

Equation (3) is the modified regression of Equation (2) to test the second hypothesis, examining whether female directors affect the relationship between voluntary disclosures of water risk and earning management. The interaction term, Water X Female, denotes the effect.

where, EM = Performance adjusted discretionary accruals suggested by Kothari et al. (2005); Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board; Size = log (total assets); Lev = Debt ratio; Growth = Asset growth ratio; Loss = 1 if a company with loss, and 0 otherwise; Btm = Book to market ratio; Roe = Return on equity; Invrec = Ratio of account receivables; Ocf = Cash flow from operation; Ind = industry indicators; and Yr = year indicators.

Sample Description

The data selection procedure utilized to determine the companies in this research is shown in Table 1. The final sample consists of 694 companies with December-year end between 2018 and 2021. The firms under consideration have data on water risk management, the number of female directors on board, and earnings management that are listed on the Korea Stock Exchange (KSE) and the Korean Securities Dealers Automated Quotation System (KOSDAQ). The FnGuide database is used to get the financial information pertaining to the control variables. Financial entities are not included because their inclusion would lead to inconsistencies. The firms that do not have access to the financial data are not included. The top and bottom one percent of the control variables are winsorized so that the influence of outliers may be reduced.

| Table 1 The Data Selection Process |

|

|---|---|

| Firms with water risk information request of December year-end in years 2018 - 2021 | 820 |

| Less: | |

| No financial data | 126 |

| Final observation | 694 |

Empirical Result

Descriptive Statistics

Table 2 shows the descriptive statistics of the main variables used in this study. The mean value of Water 0.203, implying that about 20% of the firms are voluntarily disclosing information on water risk. Female shows the mean value of 0.286.

| Table 2 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Variables | Mean | STD | Q1 | Median | Q3 |

| EM | 0.032 | 0.139 | -0.030 | 0.006 | 0.049 |

| Water | 0.203 | 0.403 | 0.000 | 0.000 | 0.000 |

| Female | 0.286 | 0.490 | 0.000 | 0.000 | 0.693 |

Definition of variables: EM = Performance adjusted discretionary accruals suggested by Kothari et al. (2005); Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board;

Table 3 shows the correlation of the main variables in this study. The correlation of water and earnings management shows the negative value, which is in line with the prediction of this study. In other words, the firms disclose information on water risk voluntarily are less likely to manage earnings. However, the results of the correlation analysis do not take into account any other factors that might affect the relationships being studied.

| Table 3 Pearson Correlation |

|||

|---|---|---|---|

| (1) | (2) | (3) | |

| (1) EM | 1.000 | -0.139 | 0.033 |

| 0.016 | 0.572 | ||

| (2) Water | 1.000 | 0.325 | |

| <.0001 | |||

| (3) Female | 1.000 | ||

Notes: EM = Performance adjusted discretionary accruals suggested by Kothari et al. (2005); Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board;

Main Findings and Discussion

The findings of the multivariate analysis of the association between the voluntary disclosure of water risk and earnings management are shown in Table 4. These findings provide support for the first hypothesis. After controlling for all of the control variables that may potentially affect the relationship, the coefficient for Water is -0.058, and it was found to be statistically significant at the 1% level. The result implies that the firms disclosing information on water risk voluntarily are less likely to manage earnings.

| Table 4 The Relationship Between Disclosure Of Water Riskand Earnings Management |

||

|---|---|---|

| Variables | Estimate | T−Value |

| Intercept | -0.098 | -0.520 |

| Water | -0.058 | -2.730*** |

| Size | 0.007 | 1.140 |

| Lev | -0.065 | -1.420 |

| Growth | 0.037 | 1.490 |

| Loss | 0.078 | 3.490*** |

| Btm | -0.013 | -1.130* |

| Roe | 0.621 | 11.250*** |

| Invrec | -0.157 | -1.940* |

| Ocf | -0.094 | -2.110** |

| Ind | Included | |

| Yr | Included | |

| Adjusted R−square | 0.560 | |

| Observations | 694 | |

Notes: (1) * and *** indicate significance at the 10% and 1% levels, respectively. (2) Definition of variables: Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board; Size = log (total assets); Lev = Debt ratio; Growth = Asset growth ratio; Loss = 1 if a company with loss, and 0 otherwise; Btm = Book to market ratio; Roe = Return on equity; Invrec = Ratio of account receivables; Ocf = Cash flow from operation; Ind = industry indicators; and Yr = year indicators.

The result can be inferred that the firms voluntarily disclosing information are inclined to be interested in an increase in firms’ transparency, firm value, and sustainable existence (Sarumpaet et al., 2017, Datt et al., 2017). To achieve their goal, firms have made an adequate or extra investment in human risk that leads to better financial performance. Also, responding to the standardized questionnaire of CDP involves firms’ additional efforts and provides unbiased information to the public as opposed to other channels such as annual reports (Datt et al., 2017). At the same time, voluntarily disclosing information indicates that companies are the center of attention from the general population (Zhou et al., 2018b), resulting in a transparent accounting process. In other words, firms that disclose information on water risk are less likely to manage earnings.

Prior research demonstrates that when management opportunistic behavior is regulated by corporate governance, accounting profits are more reliable and of higher quality (Klein, 2002). This study focuses on the role of female directors on board as a monitoring mechanism. The second hypothesis examined whether the presence of female board members on board modifies the relationship between voluntary disclosure of water risk and earnings management and table 5 shows the result. The interaction term, Water X Female, tests the effect and it shows -0.035, statistically significant at a 1 % level. The result implies that the role of female directors on the board positively affects the relationship between the voluntary disclosure of water risk and earnings management.

| Table 5 The Effect Of The Female Directors On The Relationship Between Disclosure Of Water Risk And Earnings Management |

||

|---|---|---|

| Variables | Estimate | T−Value |

| Intercept | -0.073 | -0.360 |

| Water | -0.020 | -0.650 |

| Female | 0.017 | 1.590 |

| Water X Female | -0.035 | -1.970*** |

| Size | 0.006 | 0.840 |

| Lev | -0.066 | -1.440 |

| Growth | 0.036 | 1.460 |

| Loss | 0.080 | 3.580*** |

| Btm | -0.013 | -1.090 |

| Roe | 0.628 | 11.400*** |

| Invrec | -0.180 | -2.190** |

| Ocf | -0.093 | -2.090** |

| Ind | Included | |

| Yr | Included | |

| Adjusted R−square | 0.566 | |

| Observations | 694 | |

Notes: (1) * and *** indicate significance at the 10% and 1% levels, respectively. (2) Definition of variables: Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board; Size = log (total assets); Lev = Debt ratio; Growth = Asset growth ratio; Loss = 1 if a company with loss, and 0 otherwise; Btm = Book to market ratio; Roe = Return on equity; Invrec = Ratio of account receivables; Ocf = Cash flow from operation; Ind = industry indicators; and Yr = year indicators.

Based on prior research, females at the management level are strong and positive monitoring mechanism that leads to improving the usefulness of accounting information (Francis et al., 2015). Furthermore, female directors actively convey diverse ideas from an independent perspective, contributing to the formation of a transparent and efficient organizational culture based on independence, activity, and gender diversity (Adams & Ferreira, 2009). When compared to males, female directors, in particular, tend to minimize the effects of the many potential hazards that may occur (lawsuit risk, bankruptcy risk, and defamation risk). As a result of this, and taking into account the findings of earlier studies which indicate that the presence of female directors has a beneficial effect on the structures of corporate governance, we anticipate that businesses that have female directors or firms which have a high percentage of female directors will more actively fulfil their disclosure obligations. Thus, firms with female directors on board positively affect the relationship between voluntary disclosure of water risk and earnings management.

Additional Analysis

Table 6 shows the result of additional analysis on the relationship between disclosure of water risk and firm value. The coefficient of Water is 0.880, statistically significant at 1%. The result indicates that as the firm discloses information on water status, the firm value increases. Corporate disclosure refers to the process through which firms make market-relevant information available to external stakeholders for the sake of decision-making. According to the stakeholder theory, firms provide both financial and non-financial information to improve the social recognition of the company, the legitimacy of the company's management, as well as the effectiveness and transparency of the company's management (Kim et al., 2022). Voluntarily disclosing the water risks of firms is regarded to have a beneficial influence on the capital market, regardless of whether the disclosures are favorable or negative to the company (Kim & Kim, 2008). In addition, by adequately communicating a company's environmental efforts and outcomes to interested parties, it is possible to avoid disputes and enhance the corporate image, lowering expenses and increasing sales (Kim & Cho, 2006). Consequently, voluntary disclosure of water risk increases firm value.

| Table 6 The Relationship Between Voluntary Disclosure Of Water Risk And Firm Value |

||

|---|---|---|

| Variables | Estimate | T−Value |

| Intercept | 13.059 | 5.990*** |

| Water | 0.880 | 2.560** |

| Size | -0.382 | -4.800*** |

| Lev | 0.782 | 1.040 |

| Growth | -0.115 | -0.280 |

| Loss | -0.189 | -0.520 |

| Btm | -1.344 | -7.090*** |

| Roe | 0.257 | 0.290 |

| Invrec | 1.462 | 1.120 |

| Ocf | -0.025 | -0.030 |

| Ind | Included | |

| Yr | Included | |

| Adjusted R−square | 0.382 | |

| Observations | 694 | |

Notes: (1) * and *** indicate significance at the 10% and 1% levels, respectively. (2) Definition of variables: Water = 1, if the firm discloses the water information, 0 otherwise; Female = Ratio of female directors on board; Size = log (total assets); Lev = Debt ratio; Growth = Asset growth ratio; Loss = 1 if a company with loss, and 0 otherwise; Btm = Book to market ratio; Roe = Return on equity; Invrec = Ratio of account receivables; Ocf = Cash flow from operation; Ind = industry indicators; and Yr = year indicators.

Conclusion

The changes in water risk are the most obvious evidence of the effects of climate change. According to the Intergovernmental Panel on Climate Change (IPCC), extreme weather events, such as floods and droughts, are expected to become more common and more severe as a result of global warming. Changes in the water circulation system due to climate change are expected to affect the stability of water risk throughout society. At the same time, water is a vital resource that is required in both everyday life and almost all industry.

This study focuses on whether firms’ voluntary disclosure of water risk affects earnings management. After assessing firms with disclosure of water risk from 2018 to 2021, firms that voluntarily reveal their water risk are less likely to manage earnings. Also, this study confirms the role of female directors on the board positively affects the relationship between voluntary disclosure of water risk and earnings management. Companies with environmental disclosure may be more interested in creating value from a long-term perspective rather than a short-sighted approach that enhances corporate sustainability. To enhance corporate sustainability, this study confirms that profit adjustment of discretionary accrual that adjusts firm performance in the short term may lead to negative consequences for corporate value. In addition, this study verifies the role of female directors on board affect positively on the relationship between the voluntary disclosure of water risk and earnings management.

The results of this research contribute in many different ways. First, when firms decide on determining environmental policy to fulfill corporate responsibility, it is vital to disclose environmental information to stakeholders. Thus, it is necessary to overcome the limitation of existing disclosure systems to provide financial information as well as non-financial information. Second, investors have a responsibility to acknowledge the need and significance of companies’ environmental actions, which are designed to address changes caused by the deterioration of the global environment. It would be beneficial to create an investment index on the environmental initiatives taken by these firms. Third, the government will need to make institutional arrangements for promoting corporate environmental activities that can publicize information on corporate environmental activities. It is not required, but improving a company's awareness of the environment and actively supporting the disclosure of information in the form of environment-related reports that include both financial and non-financial information should be done in order to demonstrate that a company is making an effort to improve its impact on the world. Guidelines should be established to assist companies to provide correct information proactively and help businesses disclose relevant environmental data.

References

Adams, R.B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance.Journal of Financial Economics, 94(2), 291-309.

Indexed at, Google Scholar, Cross Ref

Ahn, M.G., Wee, J. B., & Ko, D. Y. (2009). The effects of manager’s forecast bias on earnings management. Accounting Information Review, 27(3), 125-150.

Al Saidi, M. (2017). Conflicts and security in integrated water resources management. Environmental Science and Policy, 73, 38-44.

Indexed at, Google Scholar, Cross Ref

Archel, P., Husillos, J., Larrinaga, C., & Spence, C. (2009). Social disclosure, legitimacy theory and the role of the state. Accounting, Auditing & Accountability Journal, 22(8), 1284-1307.

Indexed at, Google Scholar, Cross Ref

Barber, B.M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261-292.

Indexed at, Google Scholar, Cross Ref

Barber, M., & Jackson, S. (2012). Indigenous engagement in Australian mine water management: The alignment of corporate strategies with national water reform objectives. Resources Policy, 37, 48-58.

Indexed at, Google Scholar, Cross Ref

Barua, A., Davidson, L.F., Rama, D.V., & Thiruvadi, S. (2010). CFO gender and accruals quality. Accounting Horizons, 24(1), 25-29.

Indexed at, Google Scholar, Cross Ref

Ben-Amar, W., & Chelli, M. (2018). What drives voluntary corporate water disclosure? The effect of country-level institutions. Business Strategy and the Environment, 27, 1609-1622.

Indexed at, Google Scholar, Cross Ref

Bernardi, R., & Arnold, D. (1997). An examination of moral development within public accounting by gender, staff level, and firm. Contemporary Accounting Research, 15(5), 653-68.

Indexed at, Google Scholar, Cross Ref

Burritt, R.L., Christ, K.L., & Omori, A. (2016). Drivers of corporate water related disclosure: evidence from Japan. Journal of Cleaner Production, 129, 65-74.

Indexed at, Google Scholar, Cross Ref

Catalyst (2005). The bottom line: Connecting corporate performance and gender diversity. Catalyst.

Indexed at, Google Scholar, Cross Ref

Chan, K., Chan, L.J.C., Jegadeesh, N., & Lakonishok, J. (2006). Earnings quality and stock returns. The Journal of Business, 79(3), 1041-1082.

Indexed at, Google Scholar, Cross Ref

Chen, C., & Liu, V.W. (2013). Corporate governance under asymmetric information: Theory and evidence. Economic Modelling, 33, 280-291.

Indexed at, Google Scholar, Cross Ref

Chih, H.L., Shen, C.H. & Kang, F.C. (2008). Corporate social responsibility, investor protection, and earnings management: Some international evidence. Journal of Business Ethics, 79(1-2), 179-198.

Indexed at, Google Scholar, Cross Ref

Choi, Y., Park, S.,m & Choi, C. (2022). The effect of ESG information on short selling and earnings management behavior. Korean Journal of Business Administration, 35(3), 555-574.

Cohen, D.A., Dey, A., & Lys, T.Z. (2008). Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review, 83(3), 757–787.

Indexed at, Google Scholar, Cross Ref

Cormier, D., & Martinez, I. (2006). The association between management earnings forecasts, earnings management, and stock market valuation: Evidence from French IPOs. The International Journal of Accounting, 41, 209-236.

Indexed at, Google Scholar, Cross Ref

Datt, R.R., Luo, L., & Tang, Q. (2017). Corporate voluntary carbon disclosure strategy and carbon performance in the USA. Accounting Research Journal, 32(3), 417-435.

Indexed at, Google Scholar, Cross Ref

Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management.Accounting Review, 193-225.

Indexed at, Google Scholar, Cross Ref

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures-a theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282–311.

Indexed at, Google Scholar, Cross Ref

Diamond, D.W. (1985). Optimal release of information by firms. The Journal of Finance, 40(4), 1071-1094.

Indexed at, Google Scholar, Cross Ref

Hambrick, D.C., & Mason, P.A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193-206.

Indexed at, Google Scholar, Cross Ref

Healy, P.M., Hutton, A.P., & Palepu, K.G. (1999). Stock performance and intermediation changes surrounding sustained increases in disclosure. Contemporary Accounting Research, 16(3), 485-520.

Indexed at, Google Scholar, Cross Ref

Healy, P.M., & Palepu, K.G. (1993). The effect of firms’ financial disclosure strategies on stock prices. Accounting Horizons, 7, 1–11.

Heminway, J.M. (2007). Sex, trust, and corporate boards. Hastings Women’s Law Journal, 18, 173.

Indexed at, Google Scholar, Cross Ref

Huang, J., & Kisgen, D. (2015). Gender differences in corporate financial decision making. Working paper, Boston college.

Ford, R.C., & Richardson, W.D. (1994). Ethical decision making: A review of the empirical literature. Journal of Business Ethics, 13, 205-221.

Indexed at, Google Scholar, Cross Ref

Francis, B., Hassan, I., Park, J.C., & Wu, Q. (2015). Gender differences in financial reporting decision making: Evidence from accounting conservatism. Contemporary Accounting Research, 32(3), 1285-1318.

Indexed at, Google Scholar, Cross Ref

Gerged, A.M., & Al-Haddad, L.M., & Al-Hajri, M.O. (2020). Is earnings management associated with corporate environmental disclosure? Evidence from Kuwaiti listed firms.Accounting Research Journal.

Indexed at, Google Scholar, Cross Ref

Gul, F.A., Srinidhi, B., & Ng, A.C. (2011). Does board gender diversity improve the informativeness of stock prices?Journal of accounting and Economics,51(3), 314 - 338.

Indexed at, Google Scholar, Cross Ref

Jones, J.J. (1991). Earnings management during import relief investigations.Journal of Accounting Research,29(2), 193-228.

Indexed at, Google Scholar, Cross Ref

Kanakoudis, V., Tsitsifli, S., Gonelas, K., Papadopoulou, A., Kouziakis, C., & Lappos, S. (2016). Determining a Socially Fair Drinking Water Pricing Policy: The Case of Kozani, Greece. Procedia Engineering, 162, 486–493.

Indexed at, Google Scholar, Cross Ref

Klein, A. (2002). Audit committee, board of director characteristics, and earnings management.Journal of Accounting and Economics, 33(3), 375-400.

Indexed at, Google Scholar, Cross Ref

Kim, J.D., & Cho, M.K. (2006). Stock market’s evaluation of the firms’ environmental activities. Korean Journal of Business Administration, 19(6), 2485-2512.

Kim, M.S., & Kim, Y.H. (2008). The impact of environmental disclosure of environment friendly firms on firm value. Korean Journal of Business Administration, 21(6), 2655-2679.

Kim, Y. (2020). In the era of sheconomy, the effect of female personnel on the disclosure quality: Focused on the frequency of fair disclosure. Korean Accounting Journal, 29(4), 201-232.

Kim, Y.H., Heo, J. H. & Song, D.Y. (2022). The effect of the ESG activities and the voluntary disclosure on the firm value. The Korean Journal of Financial Management, 39(1), 121-144.

Kim, Y.J., Ahn, S.H., & Hwang, M.H. (2020). Voluntary disclosure of corporate governance report and firm value. Journal of Taxation and Accounting, 21(2), 127-156.

Kothari, S.P., Leone. A.J., & Wasley, C.E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39, 163–197.

Indexed at, Google Scholar, Cross Ref

Kwon, S.Y., Ki, E.S., & Seo, H. (2012). The effect of accruals quality on price informativeness. Korean Management Review, 41(1), 139 -169.

Lamboy, T. (2011). Corporate social responsibility: sustainable water use. Journal of Cleaner Production, 19, 852-866.

Indexed at, Google Scholar, Cross Ref

Lee, A.Y., Chun, S.B., & Park, S.S. (2007). CEO turnover and earnings management. Korean Accounting Review, 32(2), 117-150.

Li, C., Xu, M., Wang, X., & Tan, Q. (2017). Spatial analysis of dual?scale water stresses based on water footprint accounting in the Haihe River Basin, China. Ecological Indicators, 3, 1–15.

Indexed at, Google Scholar, Cross Ref

Lu, J., Li, B., Li, H., & Zhang, Y. (2019). Sustainability of enterprise export expansion from the perspective of environmental information disclosure. Journal of Cleaner Production, 119839.

Indexed at, Google Scholar, Cross Ref

Luo, L., & Tang, Q. (2014). Carbon tax, corporate carbon profile and financial return. Pacific Accounting Review, 26(3), 351-373.

Indexed at, Google Scholar, Cross Ref

McWilliams, A., Siegel, D.S., & Wright, P.M. (2006). Corporate social responsibility: Strategic implications.Journal of Management Studies,43(1), 1-18.

Indexed at, Google Scholar, Cross Ref

Mohamed, A., & Schwienbacher, A. (2016). Voluntary disclosure of corporate venture capital investments. Journal of Banking & Finance, 68, 69–83.

Indexed at, Google Scholar, Cross Ref

Nishitani, K., & Kokubu, K. (2012). Why does the reduction of greenhouse gas emissions enhance firm value? The case of Japanese manufacturing firms. Business Strategy and the Environment, 21(8), 517-529.

Indexed at, Google Scholar, Cross Ref

Olsen, R.A., & Cox, C.M. (2001). The influence of gender on the perception and response to investment risk?The case of professional investors. The Journal of Psychology and Financial Markets, 2(1), 29 - 36.

Indexed at, Google Scholar, Cross Ref

Oshika, T., Oka, S., & Saka, C. (2013). Connecting the environmental activities of firms with the return on carbon (ROC): mapping and empirically testing the sustainability balanced scorecard (SBSC). The Journal of Management Accounting, Japan 81-97.

Indexed at, Google Scholar, Cross Ref

Park, J.R., & Kim, Y.H. (2017). The empirical study of earnings management on corporate social responsibility- The comparative of Kospi and Kosdaq firms. Korea International Accounting Review, 72(4), 187-205.

Indexed at, Google Scholar, Cross Ref

Rao, K.K., Tilt, C.A., & Lester, L.H. (2012). Corporate governance and environmental reporting: an Australian study. Corporate Governance, 12(2), 143-163.

Indexed at, Google Scholar, Cross Ref

Sarumpaet, S., Nelwan, M.L., & Dewi, D.N. (2017). The value relevance of environmental performance: evidence from Indonesia.Social Responsibility Journal, 13(4), 817-827.

Indexed at, Google Scholar, Cross Ref

Schipper, K. (1989). Commentary on earnings management. Accounting Horizons, 3, 91-102.

Schubert, R. (2006). Analyzing and managing risks on the importance of gender difference in risk attitudes. Managerial Finance, 32(9), 706-715.

Indexed at, Google Scholar, Cross Ref

Shocker, A. & Sethi, S. (1973). An approach to incorporating societal preferences in developing corporate action strategies. California Management Review, 15(4), 97–105.

Indexed at, Google Scholar, Cross Ref

Srinidhi, B., Gul, F.A., & Tsui, J. (2011). Female directors and earnings quality. Contemporary Accounting Research, 28(5), 1610-1644.

Indexed at, Google Scholar, Cross Ref

Sun, N., Salama, A., Hussainey, K., & Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25(7), 679–700.

Indexed at, Google Scholar, Cross Ref

Trueman, B. (1986). Why do managers voluntarily release earnings forecasts? Journal of Accounting and Economics, 8, 53–71.

Indexed at, Google Scholar, Cross Ref

Verrecchia, R.E. (1983). Discretionary disclosure. Journal of Accounting and Economics, 5, 179–194.

Yu, H. C. (2022). Creating environmental sustainability: determining factors of water resources information disclosure among Chinese enterprises. Sustatinability Accounting, Management and Policy Journal, 13 (2), 438-458.

Indexed at, Google Scholar, Cross Ref

Zhou, Z., Zhou, H., Zeng, H., & Chen, X. (2018a). The impact of water information disclosure on the cost of capital: an empirical study of China's capital market. Corporate Social Responsibility and Environmental Management, 25, 1332–1349.

Indexed at, Google Scholar, Cross Ref

Zhou, Z., Liu, L., Zen, H., & Chen, X. (2018b). Does water disclosure cause a rise in corporate risk-taking? – Evidence from Chinese high water-risk industries. Journal of Cleaner Production, 195, 1313-1325.

Indexed at, Google Scholar, Cross Ref

Zhou, Z., Zhang, T., Chen, J., Zeng, H., & Chen, X. (2019). Help or resistance? Product market competition and water information disclosure: evidence from China. Sustainability Accounting. Management and Policy Journal, 11, 933-962.

Indexed at, Google Scholar, Cross Ref

Received: 19-Jan-2023, Manuscript No. AAFSJ-23-13150; Editor assigned: 21-Jan-2023, PreQC No. AAFSJ-23-13150(PQ); Reviewed: 04-Feb-2023, QC No. AAFSJ-23-13150; Revised: 03-Mar-2023, Manuscript No. AAFSJ-23-13150(R); Published: 10-Mar-2023