Research Article: 2019 Vol: 23 Issue: 4

The Determinants Affecting the Competitive Capability: A Case of Vietcombank in Vietnam

Nga Phan Thi Hang, University of Finance - Marketing (UFM)

My-Linh Thi Nguyen, University of Finance - Marketing (UFM)

Thuy Le Thu, Lac Hong University (LHU)

Tam Phan Thanh, Lac Hong University (LHU)

Abstract

Nowadays, Vietnamese commercial banks are facing great risks which have a great impact on the economy. This reality requires each bank to constantly improve its competitive capability to compete not only with domestic banks but also compete with foreign banks. Therefore, the study purpose is to find out the determinants affecting the competitive capability of Vietcombank in Vietnam. The researchers surveyed 900 customers using the services of Vietcombank and answered 23 questions but sample size of 871 customers processed. The data collected from June 2018 to March 2019 in Ho Chi Minh, Hai Phong and Ha Noi City (Each city has 300 samples surveyed). Simple random sampling technique. Cronbach's Alpha and the exploratory factor analysis (EFA) analyzed and used for Structural Equation Modelling (SEM) technique and using partial least squares method. Customers’ responses measured through an adapted questionnaire on a 5-point Likert scale. Finally, the findings of the study have five factors affecting the competitive capability of Vietcombank with significance level 0.01.

Keywords

Commercial, Bank, Competitive, Capability and Vietcombank

Introduction

In recent times, Vietnam join international economy, the agreement of free trade of Vietnam, particularly in 2018, has opened up many opportunities and challenges for the economy like finance and banking industry. The most important milestone is that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) Agreement was officially signed in 2018, opening up opportunities for Vietnamese enterprises to access capital from foreign countries. Particularly, the banking and finance sector will be affected directly, there are successive and indirect loans with a large scale. Moreover, current situation of competitiveness of Vietnamese commercial banks indicators of mobilization capability and capital structure (Wanjau et al., 2012). Mobilization and capital structure is one of the criteria to assess the business capability of commercial banks in terms of mobilizing capital and reputation in the marketplace. Good capital mobilization is the ability to occupy and expand the market share of commercial banks through various types of products attracting deposits from customers (Ragui, 2018). When the scale of large capital and reasonable structure will allow commercial banks to develop business activities such as lending, investing and providing other financial services. Capital mobilization is determined by the bank size, service quality, technology, marketing management and growth rate of capital resources over time (Kimani, 2015).

Besides, asset quality is an aggregate indicator of a bank's management quality, solvency, profitability and sustainable outlook. Along with the socio-economic development and regional and international economic integration process, banking activities are increasingly competitive with the participation of many different banking models in providing banking services, especially in retail banking. The competition promotes the process of innovation and approaches commercial banks' restructuring and meets the demand for capital and services for the country's economic development (Berger & Mester, 2003). Vietcombank is one of the pioneering commercial banks in market opening and international integration, increasing asset scale, diversified products and services, and increasing branch network. Vietcombank wants to play an important role and leading bank in the banking system in Vietnam. This make important contributions to the stability, develop the country's economy and promote the role of a key foreign bank. It effectively serves domestic economic development and creates important impacts on the regional and global financial community. Therefore, Vietcombank has greatly improved its competitiveness, playing an important role in promoting the process of innovation and economic development. However, in front of practical requirements, improving the competitiveness of Vietnamese commercial banks in general and Vietcombank in particular always requires synchronous recommendations. Above mentioned things, the purpose of this study is to find out the determinants affecting the competitive capability of Vietcombank in Vietnam. This study helps bank managers who apply the research results for improving the competitive capability better in the future.

Literature Review

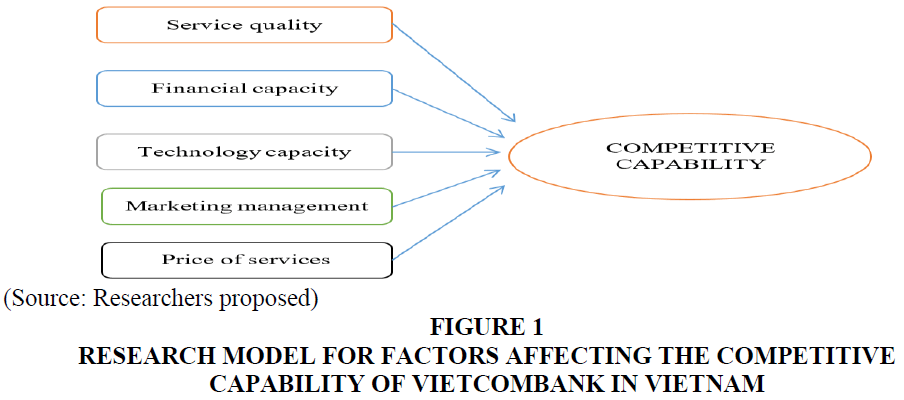

The competitive Capability (CC)

The competitive capabilities of an organization can be interpreted as its ability to meet customers' expectations compared to the ability of its competitors. The competitiveness of bank is the ability to maintain and expand market share and profit of bank. In this study, it based on an extensive review of literature, five indicators of service quality, financial capability, technology capability, marketing management and price of service that have been used in the assessment of competitive capabilities. The competitiveness of commercial banks is also understood as the competitiveness of enterprises which means the competitiveness of commercial banks is the ability to control the bank's favorable business conditions compared to the bank (Uddin and Gupta, 2012). Commercial goods and other financial institutions in a certain environment to maximize profits. However, due to the operation of commercial banks is the type of monetary business and financial services, the criteria for measuring the competitiveness of commercial banks are different (Casu and Molyneux, 2003). The competitiveness of commercial banks depends many factors such as service quality, financial capability, technology capability, marketing management, price of service (Uddin and Akhter, 2011).

Service Quality (SQ)

(Parasuraman et al., 1985) suggested SERVQUAL as a determinants and measuring instrument of service quality. It considered as a good starting point for providing more detail to a description of service quality. They defined “determinants of service quality as a measure of how well the service level delivered matches customer expectations”. They designed SERVQUAL based on studies in America. They described ten determinants of service quality as reliability, responsiveness, competence, access, courtesy, communication, credibility, security, understanding the customers and tangibles. Later, (Parasuraman et al., 1988) reduced the ten attributes to five attributes. The model of changed SERVQUAL was reliability, responsiveness, assurance, empathy and tangibles. Today, service quality is considered a vital factor of any service provider in the fierce competition conditions. Vietcombank is in order to stand firm in this competition, there are many opinions that one of the indispensable factors for bank that is to strengthen management and improve service quality to retain customers and the important thing to attract customers to use banking services. The higher the service quality is, the better the product is, so the higher the service quality is, the more likely it is to attract customers (Zeithaml, 1987).

Hypothesis H1: Service quality has a positive impact on the competitive capability of Vietcombank in Vietnam.

Financial Capability (FC)

Financial capability is the key, a means to turn ideas in business into reality. Effective use of capital will contribute to determining the success or failure of the business, so any business whether big or small, big or small, is concerned about financial capability and advanced issues. efficient use of capital. Therefore, financial capability is considered to be the core of competitiveness. Financial capability is measured by some basic criteria: Self-owned capital; The growth of capital and efficiency of capital use (Moyo, 2018). The size of the bank can be measured through financial, deposit and non-deposit capabilities, loan sales and outstanding balances, the number of employees, or the number of branches and transaction offices. The greater these indicators, the more powerful the bank has the competitiveness and vice versa (Chadha, 2017). The financial capacity of bank is reflected in the ability to ensure capital sources that bank can mobilize to meet capital needs for bank' s activities. It is shown in the capital scale, the ability to mobilize and use capital effectively. The higher financial capability is, the better competiveness is, so the higher competitive capability is. Therefore, the following hypothesis built.

Hypothesis H2: Financial capability has a positive impact on the competitive capability of Vietcombank in Vietnam.

Technology Capability (TC)

In today's era, banking performance depends greatly on the level of application of advanced banking technology (Musau et al., 2018). Science and technology has been acknowledged as a driving force for commercial banks to take great steps forward in terms of professional processing speed, functional integration, accuracy and convenience (Moyo, 2018). Especially, the context of international integration of advanced banking technology has spread rapidly, leading banks may face a little difficulty in helping customers familiarize themselves with new technologies, when new technologies have positioned, backward commercial banks which will certainly lose customers (Suzuki and Adhikary, 2010). Therefore, the technology level of commercial banks decides at a large scale of the competitiveness of commercial banks. Because modern technology allows banks to provide a variety of modern products and services with low prices, automating banking operations and services. The investment in modern equipment also allows banks to perform more accurately and faster operations thereby reducing risks, improving business performance of the bank (Kasasbeh et al., 2017). The impact of technology on the competitiveness of the bank. Technology application will create many opportunities for Vietcombank. The digitalization trend of bank is reflected in the increasing number of electronic transactions on devices, ATM, traditional POS, mobile devices... Customers use more to access banking product information. It reduces costs and has direct access to support and incentives from bank. Therefore, the following hypothesis built.

Hypothesis H3: Technology capability has a positive impact on the competitive capability of Vietcombank in Vietnam.

Marketing Management (MM)

The bank understands about customers and customer behavior: Understanding customers and customer behavior will help banks to offer products or ways of serving customers' needs. Therefore, the bank needs to have a complete database and be monitored on a regular and systematic basis (Ombongi and Long, 2018). Moreover, Business strategy is very important because it indicates where the bank needs to prioritize its resources. Since the market is constantly changing, business strategies need to be flexible to match reality. Banks needs to have an appropriate business strategy, market research and research work is always valued. The capture of market information and competitors will help the process of proposing business strategies for banks (Kotoroi, 2015). Marketing management is a function that satisfies the needs of customers to achieve the goals of bank. Therefore, the marketing capacity of bank is expressed through continuous monitoring and response with customer changes and competitors. The better marketing management is, the better competiveness is, so the higher competitive capability is. Therefore, the following hypothesis built.

Hypothesis H4: Marketing management has a positive impact on the competitive capability of Vietcombank in Vietnam.

Price of Service

Costs are to create value for customers are determined by structural factors and are defined as cost regulation. The identification of structural elements to assess the behavior of costs and economic costs of activities that create value for customers/businesses (Tsoukatos, E., & Mastrojianni, E, 2010). The importance of cost regulation varies from one bank to another. Exploiting and shaping structural elements is a key element of competitiveness. Bank is able to lower service fees, the more opportunities to attract more customers, the higher the competitiveness (Kotoroi, 2015). The service fee is to help the bank maintain system investment, upgrade service quality and partly offset costs as well as to encourage customers to use payment forms. But it is necessary to provide service fees so that both customers and banks feel "consensus". The financial market is increasingly complex and sophisticated. The development of financial - banking products and services has been strong, although at the present large banks have hundreds of wholesale and retail banking products/services, but bank still has not met the requirements of customers. The better price of service is, the better competiveness is, so the higher competitive capability is. Therefore, the following hypothesis built.

Hypothesis H5: Price of service has a positive impact on the competitive capability of Vietcombank in Vietnam.

Research model for factors affecting the competitive capability of Vietcombank in Vietnam following Figure 1:

Methods of Research

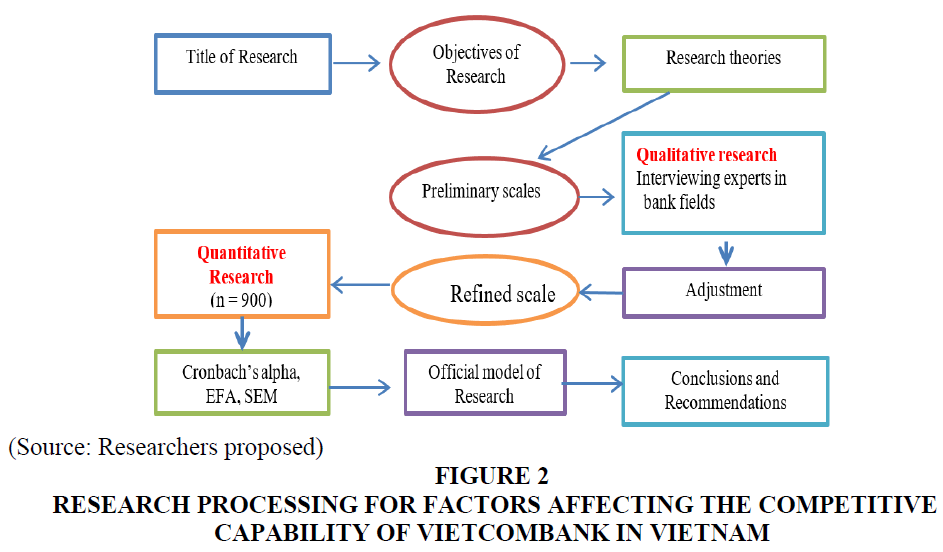

This paper expects the explanation of research process included in methodology sector. A typical research process comprises the following steps Figure 2:

Figure 2 Research Processing for Factors Affecting the Competitive Capability of Vietcombank in Vietnam

In this study, the researchers applied both qualitative and quantitative. Quantitative method examines numerical data and often requires the use of statistical tools to analyze data collected (Uddin, 2014). This allows for the measurement of variables and relationships between them can then be established. This type of data can be represented using graphs and tables. Qualitative data is non-numerical and focuses on establishing patterns. Mixed methods are composed of both qualitative and quantitative research methods. Mixed methods allow for explanation of unexpected results. Through the article, the researchers have the research process for factors affecting the competitive capability of Vietcombank in Vietnam that having three phases following (Hair & Anderson, 2010).

Phase 1: The researshers applied the expert methodology and based on 30 bank experts’ consultation as group discussions are to improve the scale and design of the questionnaire. The results of surveying 30 bank experts showed that factors affecting the competitive capability of vietcombank in Vietnam. The researchers created a list of possible factors gathered from the literature reviews as mentioned in the above studies (Seelanatha, 2010).

Phase 2: The researshers tested a reliability scale with Cronbach's Alpha coefficient and exploratory factor analysis. Completed questionnaires were directly collected from the surveyed customers related to the competitive capability of vietcombank because it took them less than 25 minutes to finish the survey. There are 900 customers related to the competitive capability of vietcombank and answered 23 questions but sample size of 871 customers processed (29 samples lack of information). The primary sources of data collected from June 2018 to March 2019 in Ho Chi Minh, Hai Phong and Ha Noi City (each city has 300 samples surveyed). The researchers surveyed by hard copy distributed. Sample size of 900 customers in a number of customers in Vietcombank in HCMC represented. The research population has 200.000 customers who are partnership with Vietcombank for long run. All data collected from the questionnaire are coded, processed by SPSS 20.0 and Amos. Any observational variables with a total correlation coefficient greater than 0.3 and Cronbach's Alpha coefficient greater than 0.7 would ensure reliability of the scale. This method is based on the Eigenvalue, the appropriate factorial analysis and the observed variables in the whole which are correlated when Average Variance Extracted is > 50%, the KMO coefficient is within 0.5 to 1, Sig coefficient ≤ 5%, the loading factors of all observed variables are > 0.5. In addition, the researchers testing scale reliability with Cronbach’s alpha coefficient and exploratory factor analyses (EFA) were performed. Finally, the least squares method and multiple linear regression used (Hair et al., 1998). The least squares method is a form of mathematical regression analysis that finds the line of best fit for a set of data, providing a visual demonstration of the relationship between the data points. Each point of data is representative of the relationship between a known independent variable and an unknown dependent variable (Hair, & Anderson, 2010).

Phase 3: The researchers performed CFA and model testing with Structural Equation Modelling (SEM) analysis. The purpose of CFA helps to clarify: (1) Unilaterality, (2) Reliability of scale, (3) Convergence value, and (4) Difference value. A research model is considered relevant to market data if Chi-square testing is P-value > 5%; CMIN / df ≤ 2, some cases CMIN/df may be ≤ 3 or < 5; GFI, TLI, CFI ≥ 0.9. However, according to recent researchers’ opinion, GFI is still acceptable when it is greater than 0.8; RMSEA ≤ 0.08. Apart from the above criteria, the test results must also ensure the synthetic reliability > 0.6; Average Variance Extracted must be greater than 0.5 (Hair & Anderson, 2010).

Research Results

The scale reliability tests for factors affecting the competitive capability of Vietcombank in Vietnam.

Table 1 showed that all of 23 variables surveyed Corrected Item-Total Correlation greater than 0.3 and Cronbach's Alpha if Item deleted greater than 0.7. Table 2 showed that Cronbach's Alpha for financial capability (FC) is 0.957; Cronbach's Alpha for service quality (SQ) is 0.838; Cronbach's Alpha for marketing management (MM) is 0.961; Cronbach's Alpha for technology capability (TC) is 0.958; Cronbach's Alpha for price of costs (PC) is 0.931 and Cronbach's Alpha for the competitive capability (CC) is 0.898. This showed that all of Cronbach’s Alpha are very reliability. Such observations make it eligible for the survey variables after testing scale. This data was suitable and reliability for researching.

| Table 1 Cronbach's Alpha for Factors Affecting the Competitive Capability of Vietcombank in Vietnam | |

| Items | Cronbach's Alpha |

| FC1: Financial indicators affecting the competitive capability of the Vietcombank | 0.957 |

| FC2: Balance of deposits and non-deposits affecting the competitive capability of the Vietcombank | |

| FC3: Loan sales affecting the competitive capability of the Vietcombank | |

| FC4: Quality of capital affecting the competitive capability of the Vietcombank | |

| SQ1: Understand and create relationships with customers affecting the competitive capability of the Vietcombank | 0.838 |

| SQ2: Commitment to service quality affecting the competitive capability of the Vietcombank | |

| SQ3: Staffs solve the problem of customers’ complaints quickly affecting the competitive capability of the Vietcombank | |

| SQ4: Banks are always interested in customer satisfaction | |

| MM1: The level of sales promotion activities affecting the competitive capability of the Vietcombank | 0.961 |

| MM2: Staffs’ Experience and market knowledge affecting the competitive capability of the Vietcombank | |

| MM3: The marketing staffs’ intuition and skills of affecting the competitive capability of the Vietcombank | |

| MM4: Distribution channels and bank branches are very convenient for customers | |

| TC1: System of machinery and equipment affecting the competitive capability of the Vietcombank | 0.958 |

| TC2: Software application program affecting the competitive capability of the Vietcombank | |

| TC3: New technology inventions affecting the competitive capability of the Vietcombank | |

| TC4: The bank is always updated with modern technologies and high security | |

| PC1: When using the Bank's services, customers are often interested in service fees | 0.931 |

| PC2: Vietcombank's service fee is always cheaper than other banks in Vietnam market | |

| PC3: Vietcombank's service fee is reasonable | |

| CC1: Financial capability affecting the competitive capability of the Vietcombank | 0.898 |

| CC2: Service quality affecting the competitive capability of the Vietcombank | |

| CC3: Marketing management affecting the competitive capability of the Vietcombank | |

| CC4: Technology capability and price of costs affecting the competitive capability of the Vietcombank | |

| Table 2 Coefficients from the Structural Equation Modelling (SEM) | ||||||||

| Relationships | Coefficient | Standardized Coefficient | S.E | C.R. | P | Conclusion | ||

| CC | ß | FC | 0.073 | 0.131 | 0.016 | 4.637 | *** | H2: Supported |

| CC | ß | SQ | 0.093 | 0.113 | 0.021 | 4.465 | *** | H1: Supported |

| CC | ß | PC | 0.248 | 0.401 | 0.026 | 9.447 | *** | H5: Supported |

| CC | ß | TC | 0.124 | 0.238 | 0.020 | 6.150 | *** | H3: Supported |

| CC | ß | MM | 0.063 | 0.112 | 0.017 | 3.706 | *** | H4: Supported |

(Source: The researchers’ collecting data and SPSS 20.0, Amos)

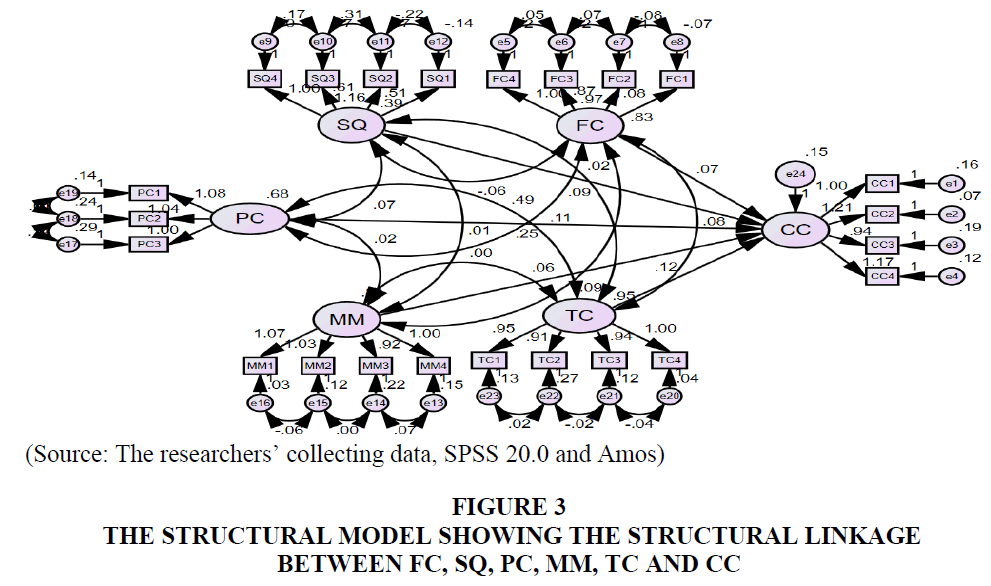

Table 2 showed that column “P”<0.01 with significance level 0.01 and column “Conclusion” H1: supported; H2: supported; H3: supported; H4: supported and H5: supported. This showed that five factors affecting the competitive capability of Vietcombank in Vietnam with significance level 0.01.

Chi-square = 874.363; df = 201; p = 0.000; Chi-square/df = 4.350; GFI = 0.921; TLI = 0.958; CFI = 0.967; RMSEA = 0.062.

Figure 3 showed that five factors affecting the competitive capability of Vietcombank in Vietnam with significance level 0.01. Five factors including financial capability (FC); service quality (SQ); marketing management (MM); technology capability (TC) and price of costs (PC) of the competitive capability (CC).

Figure 3 The Structural Model Showing the Structural Linkage Between FC, SQ, PC, MM, TC AND CC

Chi-square = 874.363; df = 201; p = 0.000; Chi-square/df = 4.350; GFI = 0.921; TLI = 0.958; CFI = 0.967; RMSEA = 0.062.

Conclusions & Managerial Implications

Conclusions

Competitiveness of Vietcombank is the ability created by the bank on the basis of maintaining and developing inherent advantages in order to consolidate and expand market share. The bank increases profits, resist and overcome adverse fluctuations of the business environment. Competitiveness of Vietcombank is assessed through the following factors: financial capacity; technology capacity; service quality; marketing management and price of cost. Financial capacity and technological capacity are considered as the most important factors determining the competitiveness of Vietcombank. Besides, Vietnam's economy is in the development and integration stage, Vietcombank aims to keep abreast of the guidelines and policies of the Party, Government and the solutions of the State Bank. This bank focus on effectively implementing the business strategy for the period of 2016-2020, vision 2030. The successful implementation of phase 2 restructuring associated with the task of accelerating the process of implementing Vietcombank equalization plan according to the Prime Minister's decision. The study had the contribution to find out five factors affecting the competitive capability of Vietcombank with significance level 0.01. Standardized coefficient for price of costs (PC) is 0.401; Standardized coefficient for technology capability (TC) is 0.238; Standardized coefficient for financial capability (FC) is 0.131; Standardized Coefficient for service quality (SQ) is 0.113 and Standardized coefficient for marketing management (MM) is 0.112. This study is to find out the price of costs (β = 0.401) affected strongest in five factors with significance level 0.01.

In addition, the researchers surveyed 900 customers using the services of Vietcombank and answered 23 questions but sample size of 871 customers processed. The data collected from June 2018 to March 2019 in Ho Chi Minh, Hai Phong and Ha Noi City (each city has 300 samples surveyed). Simple random sampling technique. Cronbach's Alpha and the exploratory factor analysis (EFA) analyzed and used for Structural Equation Modelling (SEM) technique and using partial least squares method. Customers’ responses measured through an adapted questionnaire on a 5-point Likert scale. The researchers had managerial implications for bank policymaker of Vietnam continued to improve the competitive capability following.

Managerial Implications

In the context of international economic integration, Government is implementing Vietnam's international commitments step by step opening banking services, aiming at building a competitive banking system on an international level according to the legal framework. In order to improve the competitiveness of the Vietnamese commercial banking system and promote the healthy and sustainable development of the banking industry in the coming period, the article offers the following key recommendations. Vietcombank should improve the following:

1. Price of costs (PC) is 0.401. Vietcombank should decrease fees that related to transactions activities, ATM, Mobil banking services, to reduce fees such as project consultancy/arrangement/evaluation fees; decrease fees to maintain limits, adjust limits, extend limits. The Vietcombank should also have special offers for large, long-term customers with good products and services that meet customers’ needs. At the same time, stop collecting commitment issuance fee, credit for customers and commitment fees for granting credit/issuing credit contracts in foreign languages. Vietcombank should apply 4.0 technology and increase utilities for existing products and services, improve the quality of card services, money transfer, payroll via account, SMS banking. Vietcombank continues developing internet banking services, bobile banking, agricultural insurance, organizing electricity and salary payment through accounts.

2. Technology capability (TC) is 0.238. Vietcombank should invest modern technology that is an important factor affecting the success of banks. Along with the increase of equity, Vietcombank needs to upgrade investment in modern technology that is able to link in the system, to enhance the competitiveness before the competition of commercial banks increasingly fierce.

3. Financial capability (FC) is 0.131; The important factor is to ensure the minimum capital adequacy ratio as regulated by the State Bank and also to ensure the safety of the bank's own operations during the credit operation process. Increased capital will allow banks to invest in technology development, human resource training and expand distribution channels. These are also indispensable factors if they want to improve the competitiveness. Vietcombank needs to strongly transform the business model according to the model of diversifying non-credit banking products and services. Improve professionalism and professionalism in providing electronic banking services. Priority is given to providing credit to important and key sectors and sectors of the economy, contributing to boosting the economic restructuring.

4. Service quality (SQ) is 0.113. Vietcombank should continue to maintain a policy of employing talented people to recruit people who have enough talent to undertake the increasingly demanding work of the current banking system. Besides, Vietcombank should continue training: There are policies to encourage officials and employees in the bank to self-study to improve professional qualifications; appoint people with good management capacity to train and learn working methods, organization and management in developed bank in the world.

5. Marketing management (MM) is 0.112. Vietcombank should develop the brand that is very important, both in form and content. The bank needs to develop a brand promotion strategy with impressive logos, advertising signs, advertising channels, sponsoring charity events, sports, environmental protection. Branding strategy must be associated with improving the quality of services, providing appropriate service for each customer, each region. It must ensure customers have consistent experiences (dedicated service, professional) in all channels interact with the bank (branches, transaction points, by phone, online, mobile).

Finally, Vietcombank needs to expand the most effective customer network based on the relationships with existing customers of the bank. When existing customers satisfied with banking services, they will introduce potential customers to deal with bank. In addition, cross-sale is also very effective, the bank exploit the needs of existing customers and sell other products and services that customers have not used.

References

- Berger, A.N., & Mester, L.J. (2003). Explaining the dramatic changes in performance of US banks: Technological change, deregulation, and dynamic changes in competition. Journal of Financial Intermediation, 12(1), 57-95.

- Casu, B., & Molyneux, P. (2003). A comparative study of efficiency in european banking. Applied Economics, 35(17), 1865-1876.

- Chadha, S. (2017). Human capital management in banking sector-a conceptual framework. International Journal of Management, 8(6), 44-55.

- Hair, B.B., & Anderson (2010). Multivariate Data Analysis (7th ed.). New York: US: Pearson Prentice Hall.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate Data Analysis with Readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Kasasbeh, E.A., Harada, Y., & Noor, I.M. (2017). Factors influencing competitive advantage in banking sector: A systematic literature review. Research Journal of Business Management, 11(2), 67-73.

- Kimani, M.E. (2015). Strategic positioning and competitive advantage in banking industry in Kenya: A descriptive statistics of private sector banks. European Journal of Business and Management, 7(32), 101-109.

- Kotoroi, G.L. (2015). Impact of inromation technology in banking innovations: A case of Azania Bank Limited Tegeta-Dar. International Journal of Scientific and Research Publications, 5(6), 1-7.

- Moyo, B. (2018). An analysis of competition, efficiency and soundness in the South African banking sector. South African Journal of Economic and Management Sciences, 21(1), 1-14.

- Musau, S., Muathe, S., & Mwangi, L. (2018). Financial inclusion, bank competitiveness and credit risk of commercial banks in Kenya. International Journal of Financial Research, 9(1), 203-218.

- Ombongi, P.N., & Long, W. (2018). Assessing nature of competition in kenya’s banking sector. International Journal of Research in Business Studies and Management, 5(2), 11-19.

- Parasuraman, A., Berry, L.L., & Zeithaml, V.A. (1988). The service-quality puzzle. Business horizons, 31(5), 35-43.

- Parasuraman, A., Zeithaml, V.A., & Berry, L. (1985). conceptual model of service quality and its implications for future research. The Journal of Marketing,49(4), 41-50.

- Ragui, M. (2018). Competitive intelligence practices and performance of equity bank limited. International Academic Journal of Human Resource and Business Administration, 3(1), 282-302.

- Seelanatha, L. (2010). Market structure, efficiency and performance of banking industry in Sri Lanka. Banks and Bank Systems, 5(1), 20-31.

- Suzuki, Y., & Adhikary, B.K. (2010). A ‘bank rent’ approach to understanding the development of the banking system in Bangladesh. Contemporary South Asia, 18(2), 155-173.

- Tsoukatos, E., & Mastrojianni, E. (2010). Key determinants of service quality in retail banking. EuroMed Journal of Business, 5(1), 85-100.

- Uddin, M.B., & Akhter, B. (2011). Strategic alliance and competitiveness: Theoretical framework. International Refereed Research Journal, 2(1), 43-54.

- Uddin, S.M.S. (2014). The impact of competition on bank performance in Bangladesh: An empirical study. International Journal of Financial Services Management, 7(1), 73-93.

- Uddin, S.M.S., & Gupta, A.D. (2012). Concentration and competition in the non-banking sector: Evidence from Bangladesh. Global Journal of Management and Business Research, 12(8), 81-88.

- Wanjau, K, Mugo H.W., & Ayodo, E.M. (2012). an investigation into competitive intelligence strategies and their effect on performance of firms in the banking industry: A case of equity bank. International Journal of Business and Public Management, 2(2), 61-71.

- Zeithaml, V.A. (1987). Defining and Relating Price, Perceived Quality, and Perceived Value. PercMarketing Science Institute, Cambridge, 87-101.