Research Article: 2021 Vol: 25 Issue: 2

The Determinants of Corporate Governance Disclosure: The Case of Jordan

Mishiel Said Suwaidan, Yarmouk University

Abeer Fayez Al-Khoury, Al-Ahliyya Amman University

Ahmad Yousef Areiqat, Al-Ahliyya Amman University

Samira Omrane Cherrati, Researcher

Abstract

This main objective of this study is to examine the impact of a number of variables on the extent of corporate governance disclosure in a firm's annual report. The study analyzes the impact of different variables, including Size of audited company, the existence of audit committee, size of board of directors, number of non-executive members in the board of directors, separated between chairman of board of director and CEO, complexity of firm’s operations, size of company, debt ratio, profitability, ownership concentration and the institutional shareholders) on this level of Disclosure of corporate governance. A disclosure index consisting of thirty-seven items of information covering corporate governance was applied to the annual reports of a sample of 64 companies listed on the Amman Stock Exchange for the year 2010. The index is divided into two types of information: compulsory and voluntary. Regression analysis is used to examine the relationship between the extent of disclosure and the explanatory variables. The results of the study revealed that the disclosure level of compulsory items was high and there was no significant variations in the disclosure level between companies. On the other hand, the results indicated that the disclosure level of voluntary items was low and there was a significant variation between companies. The results of multiple regression analysis revealed that there is a positive and significant relationship between the level of corporate governance disclosure and the existence of audit committee, and the separated between the positions of chairman of board of director and CEO. Also, the study found a negative and significant relationship between the level of corporate governance disclosure and the number of non-executive directors in the board of directors. Finally, the study recommended the conduct of future research that may cover other aspects of the topic and incorporate new variables not covered by the current study.

Keywords

Corporate Governance Disclosure, Amman Stock Exchange, Industrial Companies.

Introduction

During the past few years, there have been several misconducts on annual reports of firms and corporations. There are some cases where a firm tries to hide losses and mislead investors (Rose, 2016; Tauringana & Chithambo, 2015). The recent turbulence on world economy as a results of coronavirus pandemic may create substantial challenges for firms. Recently, we have seen a price of oil to go to some low level that we have never seen it for years. A survey completed by CNN in April 2020 shows that in case the oil price remains at $10 per barrel, we may expect to see an over 1000 bankruptcy just in the United States. This may also hurt world’s economy and many other business partners around the world that may face challenges. Under such circumstance, investors need crystal clear reports from corporations in order to make wise decisions since we do not wish to see cases like Enron Energy and WorldCom medium, Lehman Brothers anymore.

All analyses conducted to identify the causes of such problems showed that the explanation was a major flaw between the ethics and follow of audit profession (Abu Qa'adan & Suwaidan, 2019; Kneachel & Salterio, 2017; Bauwhede et al., 2008), to boot to the shortage of management of the company to exercise correct management and lack of experience and skills. It is so necessary to hunt out a gaggle of controls and principles to comprehend confidence, quality and transparency among the knowledge contained in the firm's financial statements (Michelon, et al., 2015). Consequently, attention for applying of company governance was the acceptable resolution to handle such crises (Alabbadi & Areiqat, 2010; Suwaidan et al., 2013).

Corporate governance refers to the principles and measures that address the interests of the stakeholders in the firm (Stanwick & Stanwick, 2005). The root of company governance goes back to the nineteenth century following the emergence of problems associated with the separation of ownership from management that has thought presently agency draw back. The mechanisms and foundations of corporate governance became common themes among the economies of the world. The objectives of the study are:

1. To develop a disclosure index to measure the extent to which Jordanian industrial companies disclose corporate governance information in their annual reports.

2. To examine the impact of a number of variables (Size of audited company, the existence of audit committee, size of board of directors, number of non-executive members in the board of directors, separated between chairman of board of director and CEO, complexity of firm’s operations, size of company, debt ratio, profitability, ownership concentration and the institutional shareholders) in explaining variations in the disclosure level of corporate governance information in annual reports for a sample of industrial companies listed on the Amman Stock Exchange (ASE).

The importance of this study stems from the importance of company governance that has received enormous attention from economics, practitioners, and the governments. This importance has magnified once the incidence of the world money crisis that has destroyed many huge corporations and caused the bankruptcy of many banks and firms. The principles of company governance impose logical conditions on the businesses to eliminate or reduce the levels of corruption which would have significant negative impact on the performance of companies and their continuity. Company governance rules in Jordan requires corporations to disclose all matters about the members of the board of directors in terms of possession of shares, and shareholders' rights. The population of this study consists all the industrial Jordanian corporations listed in Amman Stock Exchange for the year 2008, while the sample consists of all industrial companies on which all needed data are available. This condition is met by 64 companies. Data are collected from the website of the ASE and from the sample companies' annual reports. In line with previous studies (Suwaidan et al., 2004; Abu Qa’dan & Suwaidan, 2019), a dichotomous scoring approach is used in which the company is given (1) if it discloses the item of information and (0) otherwise. Therefore, the extent of the disclosure of corporate governance is calculated by dividing the number of items disclosed by the company to the maximum number of items applicable to that company.

Literature Review

A number of studies have been undertaken about the compliance of companies with corporate governance and/or the characteristics that are associated with the disclosure. Abraham et al. (2015) performed an investigation on verifying whether Indian corporations fits necessary and voluntary act for company governance demand, issued by the Board of directors of the Indian stock market beneath the condition No. 49 to the listed Indian corporations. The study was conducted on the Indian corporations listed among the stock market, through and act index developed by the researchers that is for acting corporate governance and additionally the attachments stipulated among the condition No. 49, through regarding the annual reports of the listed Indian corporations. The compliance of these corporations to act of company governance evaluated throughout two periods: before and once modification of the condition No. 49. The results showed an enormous commitment by the companies for act of corporate governance, as this commitment had hyperbolic once the changes were conducted on the condition No. 49. However, act of company governance significantly lower in corporations managed by the government. Compared by personal corporations. Abdullah et al. (2015) aimed to analysis the determinants of voluntary act of company governance supported the follow of sixty-seven Moslem banks in geographical region and additionally the GCC countries. The researchers have expected that such act is in high level among the banks attributable to the existence risks multiple in banking business. However, the actual results showed that the standard of voluntary act level could be a smaller quantity than ordinal, also, the results showed that the act level can increase as voluntary act can increase, that jam-packed with the bank size, and additionally the prevailing laws and directions that obliging banks to follow to tons of act of company governance in their annual reports. Chapple & Truong (2015) aimed to verify the standard of company’s commitment in terms of the continuity within their commitment to continuous revealing in the lightweight of the principles of obligatory revealing and its continuity, and whether this quality could have tormented by company governance.

The study was conducted on New Zealand corporations through reviewing their annual reports of eleven years to learn whether they were revealing of 3 teams of data portrayed by; non-routine operations, non-procedural processes and internal data associated with shares in hand by the members of Board of directors that ought to be disclosed. The results showed that the standard of revealing commitment had been improved once the modifications of revealing directions. The study geared toward confirmatory Danish corporations, compliance with Danish company governance law, and to investigate whether or not the degree of compliance and revealing has relevance to the performance. Al-Bassam et al. (2018) aimed to verify from the degree of Saudi Companies' commitment to the revealing, particularly the voluntary revealing regarding their applying the principles of corporate governance. The study was conducted on a sample of eighty Saudi corporations listed within the Saudi Stock Exchange and the information was collected from the annual reports of the years from 2004-2010 to gauge the commitment of those corporations to the applying of the Saudi law. The results conjointly showed that corporations wherever the possession ban is increasing are less seemingly to disclose governance. Corporate governance was also investigated by Sharma & Singh (2009) and the authors discussed in a case study in India.

Explanatory Variables

Audit firm size

A company whose accounts are audited by a big auditing firm (Knechel & Salterio, 2016), one would expect the extent of its disclosure to be high. In this regard, Shamim et al. (2016) found that there is a statistically significant relationship between disclosure of corporate governance and the size of audit firm. The prompt model is predicated based on the classification of audit firms from Big Four to small audit firms by counting on the number of firms that had been audited by the audit office, where, the audit firm is going to be treated as a Big Four if it audits at least 10 firms. The results showed that five audit offices audit 148 firms (70% of the Sample), and sixty-seven firms (30% of the sample) area units audited by thirty-six audit offices. Additionally, to live this variable, the Big Four can take {the price |the worth} one and zero, otherwise.

The Existence of Audit Committee

The rules of company governance have stipulated that firms must have an audit committee of at least three members selected from the board of directors (Securities Commission, 2017). A dummy variable indicates the existence or absence of an audit committee, where one is given for the existence of the audit committee, and zero, otherwise.

Share of non-executive Members in the Board of Directors

The non-executive member of the board of directors is that member who has no relationship or material interest with any worker of the chief management of the corporate or the associate firms or the auditor of the company's accounts, so such relationship or profit would not influence the selections on the problems mentioned within the board of directors (Securities Commission, 2017). This variable is measured through the share of freelance members to the full members of the board of directors.

Board Size

There are many studies that concluded that the size of the board of directors is an important factor in explaining the level of corporate governance disclosure Taruring & Chithamlo (2015). Mallin & Ow-Yong (2009) mentioned that corporate governance disclosure is positively correlated with board size while a study (Bhuiyan & Biswas, 2007) did not reach This result, therefore, the effect of this variable will be retested and measured by the number of board members. According to Securities Commission (2017) and Taruring & Chithamlo (2015), the size of board of director is an important issue about interpretation of the disclosure level of collaborating governance.

Duality

The degree of commitment to separate the chair of the Board of directors from the position of general manager is significant to have a good corporate governance system (Bhuiyan & Biswas., 2007; Hossain, 2007; Ioannou & Serafeim, 2017). Rules stipulate that it is not allowable to mix the position of chairman of the board of directors with the other positions within the company. Consequently, this is a dummy variable which receives one to indicate the chairman is not the director-general, during this case and zero, otherwise.

The Complexity of the Company's Operations

The level of corporate governance disclosure is expected to increase with the increasing complexity of its operations and the multiplicity of its activities. Thus, companies with subsidiaries are expected to make more disclosure in order to gain investor confidence and thus attract foreign capital (Maingot & Zeghal, 2007; Shamim & Maqtari, 2016). The degree of complexity of the company's operations is measured by using the number of the company's internal and external branches.

The Quality of the Company's Operations

It is expected that the disclosure level of corporate governance to increase within the firms that have several branches apply disclosure to achieve the investors' confidence (Maingot & Zeghal, (2007); Shamim & Maqtari (2016), and so attracting foreign investments.

Size

The level of disclosure of company governance is associated by the firm's size (Labelle, 2002). Taruring & Chithamlo (2015) indicated that disclosure of company governance has a positive relationship with the company's size. This variable is going to be measured by total assets of the firm, and this is consistent with some previous studies such as; (Shamim & Maqtari, 2016; Taruring & Chithamlo, 2015).

Financial Leverage

Financial leverage is measured by the debt ratio. Several studies have examined the effect of financial leverage on the level of corporate governance disclosure. A study by Shamim & Maqtari (2016) showed that there is no statistically significant relationship between them. While a study by Ioanncu & Serafeim (2017) showed that there is a relationship between the two variables so therefore, this relationship is still in need of testing, and this variable is measured by the ratio of liabilities to the total assets of the company.

Firm Profitability

To attract new investors and shareholders profitable companies are expected to have better levels of disclosure as compared to unprofitable or less profitable companies. The study of Ioannou & Serafeim (2017) has confirmed the link between the company's profitability and disclosure level, whereas other studies did not support such a relationship, mainly, (Shamim & Maqtari, 2016; Labelle, 2002; Dewan & Arifur, 2006; Taruring & Chithamlo, 2015). Therefore, it is helpful to check this relationship once more in a very different environment from the previous studies. In this study, the return on equities (ROE) is used to represent the firm's profitability.

Ownership Concentration

Ownership concentration represents the extent to which the company's shares are concentrated among few individuals. It means the presence of shareholders who own a large percentage of the company's shares (ownership percentage of 5% or more of the company's capital). This variable is measured by the percentage of shares owned by major shareholders who own more than 5% of Company shares to total company shares.

Institutional Ownership

Institutional ownership refers to the percentage of ownership of companies, governments or associations in the capital of the company. This variable is measured by the ratio of the ownership of the institutional shareholders to the total shares of the company.

The Study Model

The equation employed in this study includes eleven independent variables, eight of them are continuous variables and three variables are dummy variables. Additionally, the equation contains the disclosure level of corporate governance as the dependent variable of the study. The following multiple regression model represents the variables.

DCG = β0 + β1 audit + β2 audcom + β3 board + β4 Indep + β5 Chairm + β6 Branch + β7 Asset + β8 Debt + β9 ROE + β10 mister owner + β11 Institut + e

Where:

DCG = Disclosure level of company governance

β_i = Regression constant (i=0, 1, 2, 3…..11)

Audit = Size of auditing firm,

where "1" is given for big audit firm and "0" otherwise.

Audit com = Existence of the audit committee, "1" is given for the existence of audit committee, and "0" otherwise.

Board = Board size.

Indep = Percentage of non-executive members to the overall of Board of administrator’s members

Duality = Separation between the positions of the chairman of the board and CEO, "1" is given if there is separation and "0" otherwise.

Comp = Complexity.

Assets = Total assets

Debt = debt ratio

ROE = return on assets

OCR = ownership concentration ratio.

IOR =institutional ownership ratio.

Data Analysis

Disclosure of corporate governance

A. Descriptive analysis of company governance disclosure index. Table 1 shows the results of the descriptive analysis to company governance disclosure index, where it shows that the share of company governance disclosure ranged from 24.3% as a minimum and seventy-three most, the mean of disclosure on index items amounted 48.2%, whereas the quality deviation has amounted to 8.7%.

| Table 1 Descriptive Analysis to Corporate Governance Disclosure Index | |||||

| Number | Minimum | Maximum | Mean | Standard deviation | |

| General disclosure | 64 | 0.243 | 0.730 | 0.482 | 0.087 |

Table 2 shows disclosure degree of each item from those contained in the disclosure index. The disclosure degree calculated by dividing the number of companies that have disclosed the item on total number of companies.

| Table 2 Disclosure Degree of the Items of Disclosure Index of Corporate Governance | |||

| Item No. | Index items | Number of companies that have disclosed the item |

Disclosure level (%) |

| The Mandatory items | |||

| 01 | List of Board members. | 64 | 100 |

| 02 | Qualifications and experiences of board members. | 61 | 95.31 |

| 03 | List of top management. | 61 | 95.31 |

| 04 | Qualification and experiences of top management members | 60 | 93.75 |

| 05 | Responsibility of the Board of Directors | 61 | 95.31 |

| 06 | Ownership of the members of the Board of Directors in the company’s capital. | 59 | 92.19 |

| 07 | Ownership of top management members in the company’s capital. | 57 | 89.06 |

| 08 | Rewards and Benefits granted to board members. | 55 | 85.94 |

| 09 | Rewards and benefits granted to top management members | 56 | 87.50 |

| 10 | Any contracts or agreements have been made between the company or any of the company’s subsidiaries and a member of the Board of Directors. |

56 | 87.50 |

| 11 | Company structure. | 58 | 90.63 |

| 12 | Company activity. | 64 | 100 |

| 13 | Future developments of the company | 64 | 100 |

| 14 | Senior shareholders who are owning 5% and more of the capital. | 58 | 90.63 |

| 15 | Transaction of related parties. | 41 | 64.06 |

| 16 | External auditor fees. | 60 | 93.75 |

| 17 | Board of Directors report on the adequacy of internal control systems. | 61 | 95.31 |

| Voluntary items. | |||

| 01 | Independent members in the board of directors. | 2 | 3.13 |

| 02 | Double membership in other companies. | 33 | 51.56 |

| 03 | The number of meeting of the board of directors during the financial year ended. |

2 | 3.13 |

| 04 | Attendance rate of each member of the board meetings during the financial year. | 0 | 0 |

| 05 | Employment policy. | 15 | 23.44 |

| 06 | Audit committee. | 29 | 45.30 |

| 07 | Members of audit committee. | 1 | 1.56 |

| 08 | Tasks of audit committee. | 0 | 0 |

| 09 | Number of audit committee meetings during the year. | 0 | 0 |

| 10 | Compensation committee. | 2 | 3.13 |

| 11 | Members of compensations committee. | 0 | 0 |

| 12 | Tasks of compensations committee. | 0 | 0 |

| 13 | Meetings of compensation committee during the year. | 0 | 0 |

| 14 | Any other committee. | 17 | 26.56 |

| 15 | Shareholders structure (individuals, institutions). | 1 | 1.56 |

| 16 | Shareholders nationality. | 1 | 1.56 |

| 17 | Consulting office. | 15 | 23.44 |

| 18 | Separation between audit and consulting services. | 30 | 46.88 |

| 19 | The degree of the company’s commitment to corporate governance rules with reasons for non-compliance with any item. | 0 | 0 |

| 20 | The existence of a special report that reflects the corporate governance policy in the company. |

0 | 0 |

| Average disclosure of index items | 32 | % 48.26 | |

The results from the above table show the following: Three items were disclosed by 100 percent of the sample company. These items are:

1. List of the members of the Board of Directors.

2. Company's activity.

3. Future developments of the company.

4. 13 items of information were disclosed were by more than 80%.

5 items were disclosed by more than 10% and less than 50% of the company.

6 items were disclosed by less than 10%.

7. items were not disclosed by any company.

8. Rate of attending every member of the Board of Directors to the board meetings throughout the year.

9. Tasks of the audit committee.

10. Number of audit committee meetings throughout the year.

11. Members of the compensation committee.

12. Tasks of the compensation committee.

13. Meetings of compensation committee throughout the year.

14. The degree of the company's commitment and implementation of the items of the company governance guide, with reasons for non-compliance with the applying of any item.

15. The existence of a report within the annual report outlining the governance policy of the company.

The level of company governance disclosure:

As mentioned before, the corporate governance index consist of 37 items which were classified into two groups: mandatory items and voluntary items. Table 3 shows the disclosure level of the two groups provide the descriptive statistical of the two groups.

| Table 3 Descriptive Statistical of the Disclosure Index | |||||

| Groups of the index | Items | Minimum | Maximum | Mean | Standard deviation |

| Mandatory disclosure | 17 | 0.471 | 1 | 0.915 | 0.130 |

| Voluntary disclosure | 20 | 0 | 0.50 | 0.114 | 0.090 |

The above table shows the following:

As for the mandatory items, it can be seen from the table that this group consists of 17 items that should companies comply with disclosing them. As seen on average, the company disclose 91.5% of the items included in this group with a standard deviation of 13%. This indicates that the overwhelming majority of companies disclosed this group of items, though some companies did not comply with the disclosure requirements of the Amman Stock Exchange. As for voluntary items, as seen from Table 4, this group consists of 20 items. As seen on average, the company disclosed only 11.4 % of the items in this group with a standard deviation of 9%. This suggests that there is a poor disclosure of this group of items between the sample company.

| Table 4 Descriptive Statistics | ||||||

| Variables | No. | Min. | Max. | Mean | Standard deviation | |

| Number of members of the Board of Directors. |

64 | 3 | 13 | 8.28 | 2.066 | |

| Percentage of independent members of the Board of Directors. |

64 | 0.4 | 1 | 0.887 | 0.127 | |

| Number of Company’s branches |

64 | 0 | 18 | 0.78 | 2.687 | |

| Total assets | 64 | 1025894 | 873339000 | 62443031.9 | 149921608.3 | |

| Debt Ratio | 64 | 0.014 | 0.887 | 0.349 | 0.233 | |

| ROE | 64 | -1.450 | 0.572 | - 0.051 | 0.327 | |

| Ownership Concentration | 64 | 0.059 | 1 | 0.589 | 0.251 | |

| Institutional Ownership | 64 | 0 | 1 | 0.499 | 0.277 | |

| Audit office size | Frequency | Ratio (%) | ||||

| Large | 42 | 65.6 | ||||

| Small | 22 | 34.4 | ||||

| Total | 64 | 100.0 | ||||

| Existence of audit committee | Frequency | Ratio (%) | ||||

| Available | 29 | 45.3 | ||||

| Not available | 35 | 54.7 | ||||

| Total | 64 | 100.0 | ||||

| Duality | Frequency | Ratio (%) | ||||

| No Duality | 52 | 81.2 | ||||

| Duality | 12 | 18.8 | ||||

| Total | 64 | 100.0 | ||||

REGRESSION ANALYSIS

Descriptive Statistics (Independent Variables)

Table 4 shows the descriptive statistical of the independent variables of the study. As seen from the table, it can be noted from the table that there is a great deal of variation in the size of the sample company and this is reflected by a very high standard deviation. It can also be noted that there is a variation in the profitability and the number of branches between the companies. As for the dummy variables, it can be seen from the table that 65.6% of the sample companies were audited by big auditing firms and 54.7% of the companies do not have audit committee and 81.3% companies have a separation between the positions of board chairman and the chief executive officer.

To use multiple regression analysis, we must make sure that certain assumptions are met.

1. Normal distribution of the study variables.

2. Non-existence of high correlation between two or more variables.

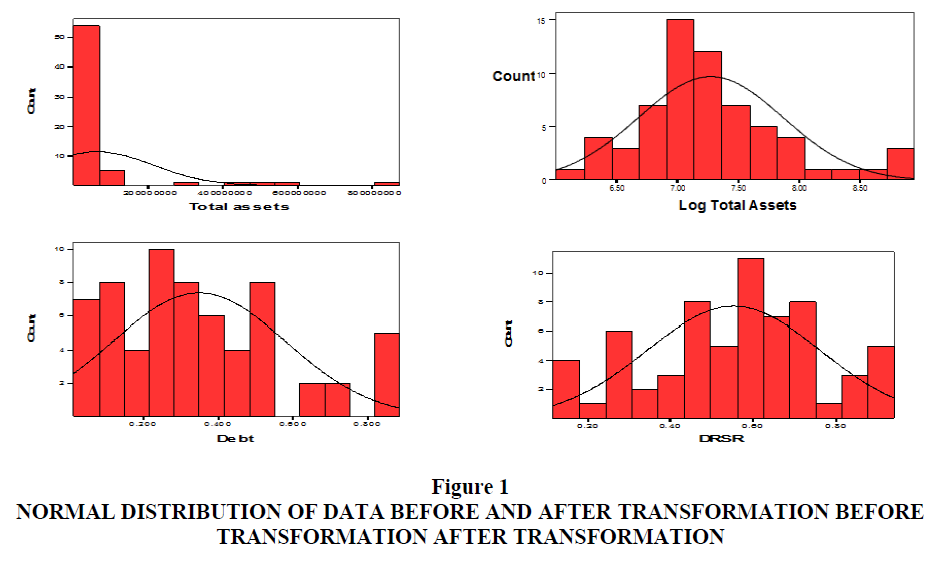

For the purpose of verifying normality, Kolmogorov – Smirnov test was used, where its results showed that the variable total assets deviates significantly from normal distribution. As suggested by a statistician, this variable was converted by using the logarithm and this variable has been converted by using the logarithm. Also, the results of the test showed that the debt ratio variable deviates significantly from normal distribution, thus, this variable was converted by using square root. The results of Kolmogorov – Smirnov test indicated that after transformation indicated that these two variables became now normally distribution. Figure 1 shows distribution of the two variables before and after transformation.

Figure 1 Normal Distribution of Data Before and After Transformation Before Transformation After Transformation

Table 5 provides summary results of the regression model. As seen from the table, the model is highly significant (F = 4.074, Sig. = .0000) with an adjusted R 2 of 0.463. Therefore, approximately 47% of the variations in corporate governance disclosure between the companies can be explained by the eleven independent variables included in this model.

| Table 5 Results of Multiple Regression Analysis | ||||||

| Independent variables | Regression coefficient b |

T-Value | Sig. Level | |||

| Size of audit office. | 0.02 | 0.943 | 0.35 | |||

| Existence of audit committee. | 0.114 | 5.911 | 0 | |||

| Number of Board of Directors members. |

0.009 | 1.637 | 0.108 | |||

| The ratio of independent members. |

-0.207 | -2.487 | 0.016 | |||

| Duality | 0.057 | 2.146 | 0.037 | |||

| Number of company’s branches | -0.004 | -1.016 | 0.314 | |||

| Total assets (logarithm) | -0.012 | -0.605 | 0.548 | |||

| Debt ratio | 0.019 | 0.356 | 0.723 | |||

| ROE | -0.004 | -0.114 | 0.91 | |||

| Ownership concentration | 0.002 | 0.057 | 0.955 | |||

| Institutional ownership | 0.045 | 1.138 | 0.26 | |||

| Adj. R2 = 0.463 |

F = 4.074 | N = 64 | ||||

| Sig. = 0.00 | ||||||

As for individual variables, as seen from the table, the existence of an audit committee variable is significant at the 1% level with a positive coefficient (t = 5.911, p = .0000) indicating that the existence of an audit committee in the company is positively associated with higher level of corporate governance in the companies' annual reports. It can also be seen from the table that there is a negative significant relationship at the 5% level between the ratio of independent directors in the board and the disclosure of corporate governance information (t = - 2.487, Sig. = .016).

This may be explained that independent directors in the board view corporate governance information in the companies' annual reports as not important as compared to other types of information. It can also be seen from the table that there is a positive relationship at the 5% level between the separation between the position of the chairman of the board and the position of the general manager (chief executive officer) and the disclosure of corporate governance information. If more corporate governance disclosure is preferred over less disclosure, this result reflects the importance of the separation between the two posts. As this separation is part of good corporate governance practice requirements stipulated by the ASE, it is important to point out that almost 19% of sample companies did not comply with this requirement. As for the other variables, the results reported in Table 5 indicate that there are not statistically important in explaining variations between companies in the disclosure of corporate governance information in annual reports.

In conclusion, based on the statistical significance (t-statistic) of the independent variables examined in the regression models, the research hypotheses which were supported are: the existence of audit committee, the independence of the board of directors and the separation between the positions of the chairman of the board and the chief executive officer. Thus, the hypotheses associated with these variables cannot be rejected at, at least, the 5% level of significance.

Conclusion

The main objective of this study is to empirically examine the level of Disclosure practices of Corporate Governance made in the annual reports. In addition, this study examined the impact of a number of variables (Size of audited company, the existence of audit committee, size of board of directors, number of non-executive members in the board of directors, separated between chairman of board of director and CEO, complexity of firm’s operations, size of company, debt ratio, profitability, ownership concentration and the institutional shareholders) on this level of Disclosure of corporate governance. This study was applied to 64 Jordanian Industrial companies listed on the Amman Stock Exchange for the year 2008. To achieve the study objectives, a disclosure index of 37 items of corporate governance was designed and used. This index was classified into two categories. These categories are compulsory and voluntary. In addition, multiple regression analysis was conducted. Descriptive statistics indicated that the compulsory disclosure is high. It also indicated that there is little variation between companies in the compulsory disclosure of corporate governance. Also, it was found that level of voluntary disclosure of corporate governance information is low, and there is a great deal of variation between companies. The results of multiple regression analysis revealed that there is a positive and significant relationship between the level of corporate governance disclosure and the existence of audit committee, and the separated between the positions of chairman of board of director and CEO. Also, the study found a negative and significant relationship between the level of corporate governance disclosure and the number of non-executive directors in the board of directors. Finally, the study recommended the conduct of future research that may cover other aspects of the topic and incorporate new variables not covered by the current study.

References

- Abu Qa'adan, M.B., & Suwaidan, M.S. (2019). Board composition, ownership structure and corporate responsibility disclosure: the case of Jordan. Social Responsibility Journal, 15(1), 28-46.

- Abraham, S., Marston, C., & Jones, E. (2015). Disclosure by Indian Companies Following Corporate Governance Reform. Journal of Applied Accounting Research, 16(1), 114-137.

- Al-Bassam, W., Ntim, C., Opong, K., & Downs, Y. (2018). Corporate Boards and Ownership Structure as Antecedents of Corporate Governance Disclosure in Saudi Arabian Publicly Listed Corporations. Journal of Business and Society, 57(2), 335-377.

- Bauwhede, H., & Willekens, M. (2008). Disclosure on Corporate Governance in the European Union. Journal Compilation, 16(2), 101-115.

- Bhuiyan, H., & Biswas, P. (2007). Corporate Governance and Reporting: An Empirical Study of the Listed Companies in Bangladesh. Journal of Business Studies, 28(1). Electronic copy available at: http://ssrn.com/abstract=987717

- Chapple, L., & Truong, T.P. (2015). Continues Disclosure Compliance: does corporate governance matter? Accounting and Finance, 55, 965-988.

- Dewan, M., & Arifur, R.K. (2006). Disclosure on Corporate Governance Issues in Bangladesh: survey of the Annual Reports. The Bangladesh Accountant’, Quarterly Journal of Institute of Chartered Accountants of Bangladesh, 95-99. Electronic copy available at: http://ssrn.com/abstract=1284973

- Alabbadi, H., & Areiqat, A. (2010). The Systematic Relationship between the Activity Based Management (ABM) and the Activity Based Costing (ABC). Interdisciplinary Journal of Contemporary Research in Business, 2(2), 239-264.

- Hossain, M. (2007). The Corporate Governance Reporting Exercise: The Portrait of Developing Country. International Journal of Business Research, 7(2), 106-118.

- Ioannou, I., & Serafeime, G. (2017) the Consequences of Mandatory Corporate Sustainability Reporting. Harvard Business School Research Working Paper, 11-100

- Knechel, R., & Salterio, S. (2017). Auditing Assurance and Risk Taylor and Francis Group, Fourth Edition, Chapter 16, 605.

- Labelle, R. (2002). The Statement of Corporate Governance Practices (SCGP), A Voluntary Disclosure and Corporate Governance Perspective. Electronic copy available at: http://ssrn.com/abstract=317519

- Maingot, M., & Zeghal, D. (2008). An Analysis of Corporate Governance Information Disclosure by Canadian Banks. Corporate Ownership & Control, 5(2), 225-236.

- Mallin, C., & Ow-Yong, K. (2009). Corporate Governance in Alternative Investment Market (AIM) Companies: Determinants of Corporate Governance Disclosure. Presenter of paper at the Third Singapore International Conference on Finance 2009. Electronic copy available at: http://ssrn.com/abstract=1326627

- Michelon, G., Pilonato, S., & Riccer, F. (2015). CSR Reporting Practices and the Quality of Disclosure, an empirical analysis. Critical Perspectives on Accounting, 33(2015) 59-78.

- OECD. (2004). Principles of Corporate Governance. Available at: www.oecd.org

- Shamim, M., Hashid, A., & Maqtari, F. (2016). Disclosure and Transparency of Corporate Governance Practices Evidence from India, Global Business Management Review, 1(1), 15-28.

- Sharma, R., & Singh, F. (2009). Voluntary Corporate Governance Disclosure: A Study of Selected Companies in India. The Acai University Journal of Corporate Governance, 8(3/4), 91-108.

- Suwaidan, M.S., Al-Omari, A.M., & Haddad, R.H. (2004). Social responsibility disclosure and corporate characteristics: the case of Jordanian manufacturing companies, International Journal of Accounting, Auditing and Performance Evaluation, 1(4), 432-447.

- Suwaidan, M., Abed, S., & Al-Khoury, A. (2013). Corporate Governance and Non-Jordanian Share Ownership: The Case of Amman Stock Exchange, International Journal of Business and Management, 8(2), 14-24.

- Stanwick, P.A., & Stanwick, S.D. (2005). Managing Stakeholders Interests in Turbulent Times: A Study of Corporate Governance of Canadian Firms. The Journal of American Academy of Business, Cambridge, 7(1), 42-52.

- Tauringana, V., & Chithamlo, L. (2015). The Effect of DEFRA Guidance on Greenhouse Gas Disclosure. The British Accounting Review, 425-444.