Research Article: 2021 Vol: 25 Issue: 3S

The Determinants of Corporate Payout Decisions in Globally - Listed Shipping Companies

Ioannis Chasiotis, Metropolitan College

Dimitrios Konstantios, University of Piraeus

Vassilios-Christos Naoum, University of Piraeus

Abstract

This article investigates the corporate payout decisions of globally listed shipping companies. We collect firm-level data from the Compustat Global database and draw a sample containing 1,510 firm year observations of 138 shipping companies from 2006 to 2019. We use pooled and fixed effects OLS regressions to explore the factors that influence dividend payout ratios. Additionally, we investigate the decision to pay dividends using a binary response model. We find that well-known dividend determinants explain both the propensity to pay dividends as well as the across and within firm variation of payout ratios in the maritime sector. Specifically, our findings show that profitability, growth opportunities, firm age and firm efficiency have a positive impact on dividend ratios and the propensity to pay dividends. On the contrary, the respective effect of cash flow volatility, leverage, firm size and market competition is negative. The weight of our evidence provides support for asymmetric information and agency cost theories and highlight the effect of market imperfections in shaping payout decisions in the maritime sector.

Keywords

Dividend Policy, Shipping Companies, Maritime Sector, Asymmetric Information, Agency Costs

Introduction

In this study, we investigate the payout decisions of listed firms operating in the maritime industry. Our motive is the prominent role of the maritime industry in global trade and thus in the function of the international economy. Indicatively, Drobetz, et al., (2013) point out that commercial ships take part in the transportation of approximately 90% of global trade. We focus on one of the major financial decisions with important links to the financing and the investment decision as well as firm value. The dividend decision has been mainly investigated in a US context using samples consisting of firms across industries. However, as Myers (2001) points out it are not as informative to test corporate finance theories in large and heterogeneous samples since each theory may work well only for a specific subsample of companies. In this respect, the shipping sector exhibits distinct characteristics. First, the maritime industry exhibits comparatively higher leverage ratios and has a cyclical nature. Moreover, as Alexandrou, et al., (2014) point out the shipping industry has experienced significant consolidation which has led to a lead to a profound increase in the level of concentration, a factor that has been shown to shape financial policies. Considering the discussion above and the lack of relevant empirical research, it is of importance to gain insight into the payout decisions of this particular sector.

Research on financial decision making in the maritime sector has focused on the investment and the cash holding decision, IPO performance and shipping bonds (Grammenos et al., 2008; Merikas et al., 2009; Ahrends et al., 2018; Drobetz et al., 2018; Alexandridis et al., 2018). Drobetz, et al., (2018) find that the shipping industry is highly levered and that standard determinants of leverage apply to the maritime sector as well. Ahrends, et al., (2018) find that shipping firms hold comparatively more cash something which is consistent with the riskiness and the cyclical nature of the industry. However, to the best of our knowledge there is no study which investigates payout decisions in the shipping sector. Extant research on dividend policy has focused on single country or international samples with firms across industries (Allen & Michaely, 2003). This strand of research investigates if the dividend decision can add value to a firm as well as to uncover the main factors that drive dividend payouts. Regarding the former, the seminal study by Modigliani & Miller (1961) suggests that dividends are irrelevant to firm value since investors can create homemade dividends. Nevertheless, Modigliani & Miller’s (1961) contention holds only in frictionless capital markets. Prominent theories developed for firms operating in markets with frictions suggest dividend policy to be value-relevant and managed to shed some light on the determinants of dividend policy. Considering the presence of asymmetric information, the signaling theory suggests that dividends are a costly and thus credible signal of a firm’s good future prospects (Allen & Michaely, 2003). Moreover, agency theory and the agency theory of free cash flows see dividends as a mechanism that reduces agency costs as it limits the funds under managerial control (Jensen & Meckling, 1976; Jensen, 1986). Moreover, dividend payouts increase the likelihood that the firm will need external finance. Consequently, this will induce capital market monitoring and align managerial and shareholders’ interests. Under an agency framework, dividends are also affected by product market competition. Managers in competitive industries are likely to strive more to be efficient and in line to shareholders’ interest (Hart, 1983; Schmidt, 1997). However, the validity of these theories has not been explicitly tested in the maritime sector.

Considering our research objective, and drawing from theoretical and empirical literature we explore which factors drive the decision to pay dividends as well as the factors that drive dividend levels. Specifically, we utilize a binary logistic regression model to investigate the decision to pay dividends. Also, we use pooled and fixed-effects OLS regressions to explore the factors that influence dividend levels across and within firms. Results indicate that profitability, growth opportunities, efficiency and firm age affect positively both dividend levels and the propensity to distribute dividends. On the contrary, cash flow volatility, leverage, firm size and market competition exert a respective effect. It appears that well-known dividend determinants explain both the propensity to pay dividends as well as the across and within firm variation of payout ratios in the maritime sector. The weight of our evidence provides support for the information asymmetry and agency cost theories and underlines that market frictions shape corporate financial decisions across industries. The next section reviews the literature and develops our hypotheses.

Literature Review and Hypotheses Development

One of the most influential studies regarding the dividend decision is the ’Dividend Irrelevance theorem’ by Modigliani & Miller (1961). The authors argue that the choice of the distribution mix cannot create value. Firms can only create value by focusing on identifying and undertaking positive net present value projects. Nevertheless, their argument is based on a rather unrealistic set of assumptions. Modigliani & Miller (1961) assume ‘’perfect capital markets’’ with no asymmetric information, agency costs, transaction costs and taxes. When theoretical and empirical research lifted these assumptions, it has managed to identify factors that make the dividend decision value-relevant. These studies fall mainly into two types; studies that investigate dividend policy with a framework of i) asymmetric information and ii) agency costs.

A number of studies have identified asymmetric information as a cause of market imperfection that can shape financial decision (Akerlof, 1970; Ross, 1977; Myers, 1984; Myers & Majluf, 1984). Managers often hold superior information for their firm vis-à-vis investors. Moreover, firms have the incentive to ’window dress’ their financial statements by manipulating their accounts and by providing selective disclosures to present the best possible image of themselves. Therefore, investors aware that they are informationally disadvantaged seek to be compensated by demanding a risk-premium which raises the cost of capital for the firm. Signaling theory suggests that the dividend decision can serve as a signaling mechanism.

Specifically, a dividend increase constitutes an effective and credible signal of future growth opportunities when compared to other forms of communication. However, this action can be mimicked by both firms with positive and negative growth opportunities. Therefore, the former need to find a credible method to signal their mispricing. Signaling theory supports that dividend increases are a credible signal due to the associated cost (Allen & Michaely, 2003). This cost stems from the empirical observation that that capital markets react to dividend reductions with significant share price reductions. Thus, it is not in the best interest of managers to increase dividends without being certain about their ability to sustain this increase in the future. Otherwise, dividends would need to eventually decrease which would trigger a negative market reaction. Thus, a dividend increase is credible signal due to its associated cost. So, the signaling effect predicts that higher information asymmetries will lead to higher dividends as a mechanism that conveys information to the market. The survey US CFO’s by Brav, et al., (2003) shows some support for the signaling motive behind dividends. Greater competition may lead to stronger incentives for agents because principals are better informed about their agents’ actions (Hart, 1983), or because greater effort is required to avert the threat of bankruptcy (Schmidt, 1997). Finally, in the presence of asymmetric information external financing is costlier. Thus, firms with risky cash flows are expected to have lower dividend payouts in order to avoid the cost of resorting to external finance. Considering the above discussion, we hypothesize that:

H1 Asymmetric information have a negative impact on dividends.

H2 Growth opportunities have a positive influence on dividends.

H3 Cash flow risk has a negative impact on dividend payouts.

The presence of agency costs can also influence dividend policy. Jensen & Meckling (1976) point out that the interests of managers and shareholders are often not aligned. Self-interested managers have the incentive to withhold cash in the firm in order to expropriate shareholders. Thus, we can hypothesize that:

H4 Agency costs have a negative impact on dividends.

Therefore, shareholders incur monitoring costs to scrutinize self-interested managerial behavior. The free cash flow theory by Jensen (1986), suggests that agency costs are more severe in firms with substantial free cash flows. Agency theory suggests that debt and dividends are substitute mechanisms which can serve to reduce agency costs. Dividend payouts increase the likelihood that managers will need to turn to the markets for capital and incur the resulting strict monitoring. This will in turn facilitate the alignment of managerial behavior to shareholder’s interests. Therefore:

H5 Leverage has a positive influence on dividends.

H6 Free cash flows have a positive influence on dividends.

Firms with high cash flows will exhibit higher dividends. This is generally supported by the empirical literature. La Porta, et al., (2000) document that in countries with superior minority shareholder protection payouts is comparatively higher. In line with agency theory, this suggests that minority shareholders are able to force managers to distribute cash and thus fend off expropriation by insiders. Supported results are also provided by a managerial survey conducted by Brav, et al., (2003). Managers emphasize the role of agency considerations in payout decisions of firms with very high free cash flows (’cash cows’).

Another mechanism that can reduce agency costs and thus substitute dividends is market competition. Grullon & Michaely (2019) argue that the inefficient managerial behavior is more likely to be driven out of the market in the presence of intense competition. Thus, we can hypothesize that:

H7 Market competition has a positive effect on dividends.

Methodology

Sample and Descriptive Statistics

As we are interested in global maritime companies, we utilize the Compustat Global database. We collect firm-level data for maritime companies excluding i) shipyards and shipping companies ii) that are involved passenger shipping, iii) operate drilling ships iv) supply vessels, or v) inland vessels. Our final sample consists of 1510 firm year observations from 138 maritime companies from 2006 to 2019. The average firm in our sample has a dividend payout ratio from 0.008 to 0.031 depending on the scaling. This finding indicate that maritime companies exhibit lower payout ratio compared the across industry average which is 0.0137 (Iyer et al., 2017).

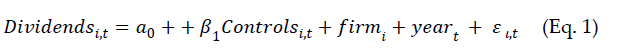

This study’s main objective is to investigate the determinants of dividends in the maritime sector. Thus, we regress dividends on a vector of control variables drawn from the extant literature. Thus, our baseline model is:

As we are interested both in the across and within dividend variation use pooled OLS as well as OLS with fixed effects at the firm level to restrict the variation to within firm. In order to explore the dividend decision, as an alternative specification, we use a dummy as the dependent variable that takes the value of 1 if the firm distributes dividends and 0 otherwise. We use a probit binary model to estimate the alternative specification.

Baseline Model

To test hypotheses H1-H7 we use conventional control variables drawn from extant literature (Rozeff, 1982; Adebeji, 1998; Dennis & Osobov, 2008; Blouin et al., 2011). To test H1 we use Firm Size as a proxy for asymmetric information. Large firms are less likely to suffer from information asymmetries and therefore do not need to signal their true value through payout decisions. To test H2 control for Growth opportunities since firms are expected to use dividends to signal their growth potential to the market. To test H3 we use cash flow risk as firms with volatile cash flows are expected to pay fewer dividends. To test H4 we include Efficiency and as firms which suffer from agency costs are expected to be less efficient and mature (cash cows-high free cash flows low growth potential). To test H5 we control for Leverage. To test H6 we control for Profitability and Firm Age since mature are more likely to generate free cash flows (cash cows-high). To test H7 we include Market share. Firms with high market share are likely to experience less competition and thus management will have the opportunity to misuse corporate funds without the immediate threat of bankruptcy. Pairwise correlation between the control variables is quite low and range from 0.08 to 0.43. Variable definitions, descriptive statistics and the correlation matrix for our control variables are provided in table 1-3 respectively.

| Table 1 Variable Definitions |

|

|---|---|

| VARIABLES | DEFINITIONS |

| Dividends | Cash dividends paid scaled by the book value of total assets |

| Dividends? | Cash dividends paid scaled by sales |

| Dividends Dummy | A dummy that takes the value one if a firm pays dividends zero otherwise. |

| Efficiency | Measure of a firm's efficiency, based on data envelopment analysis (DEA), with values ranging from zero to one, as calculated by Demerjian et al. (2012). We use the firm efficiency measure for the previous year of the dividend payment. |

| Profitability | The ratio of net income scaled by total assets |

| Leverage | Long-term debt scaled by the book value of total assets |

| Firm size | Natural logarithm of the book value of total assets. |

| Market Share | Firms market share calculated as the firm’s sales to total sales by year. |

| Cash Flow Risk | The standard deviation of cash flows from operations in a 3-year rolling window. |

| Growth | Firm growth opportunities calculated as (Sales growtht - Sales growtht-1)/ Sales growtht-1 |

| Firm age | The natural logarithm of a firm’s age using its incorporation day as the initial year. |

| Table 2 Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | Obs | Mean | Std. Dev. | Min | Max | p1 | p99 | Skew. | Kurt. |

| Dividends | 1510 | 0.008 | 0.014 | 0 | 0.049 | 0 | 0.049 | 2.001 | 5.96 |

| Dividends? | 1510 | 0.031 | 0.076 | 0 | 0.451 | 0 | 0.451 | 3.53 | 16.408 |

| Dividends Dummy | 1510 | 0.398 | 0.49 | 0 | 1 | 0 | 1 | 0.415 | 1.172 |

| Efficiency | 1510 | 0.796 | 0.07 | 0 | 0.971 | 0.477 | 0.914 | -6.043 | 57.511 |

| Profitability | 1510 | 0.087 | 0.082 | -0.194 | 0.377 | -0.194 | 0.377 | 0.434 | 5.715 |

| Leverage | 1510 | 0.341 | 0.228 | 0 | 1.04 | 0 | 1.04 | 0.445 | 2.931 |

| Firm size | 1510 | 8.427 | 2.876 | 3.098 | 15.728 | 3.098 | 15.728 | 0.502 | 2.711 |

| Market Share | 1510 | 0.021 | 0.104 | 0 | 1 | 0 | 0.668 | 7.349 | 61.24 |

| Cash Flow Risk | 1510 | 0.041 | 0.047 | 0.003 | 0.18 | 0.003 | 0.18 | 1.787 | 5.398 |

| Growth | 1510 | 0.061 | 0.25 | -0.399 | 0.685 | -0.399 | 0.685 | 0.589 | 3.578 |

| Firm age | 1510 | 2.506 | 0.644 | 0.693 | 3.497 | 0.693 | 3.497 | -0.872 | 3.312 |

| Table 3 Pairwise Correlations |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (4) | (5) | (6) | (7) |

| Efficiency | 1 | |||||||

| Profitability | 0.431*** | 1 | ||||||

| Leverage | -0.017 | -0.173*** | 1 | |||||

| Firm size | 0.127*** | 0.100*** | 0.082*** | 1 | 1 | |||

| Market Share | 0.029** | 0.013 | 0.016 | 0.269*** | 0.269*** | 1 | ||

| Cash Flow Risk | -0.141*** | -0.145*** | 0.099*** | -0.103*** | -0.103*** | -0.021 | 1 | |

| Growth | 0.168*** | 0.254*** | -0.029* | 0.041*** | 0.041*** | 0.008 | -0.083*** | 1 |

| Firm age | -0.038*** | -0.191*** | 0.094*** | 0.052*** | 0.052*** | 0.009 | -0.043*** | -0.178*** |

Results

Table 4, column 1 presents the results from pooled OLS estimations using year fixed effects, while column 2 presents results from pooled OLS using firm and year fixed effects. Column 3 uses an alternative proxy for dividend payouts (i.e., dividends scaled by sales). Column 4 reports results from our binary response model. Looking at columns 1 and 2 we can observe that the asymmetric information and agency theories can explain dividend payout ratios both across and within firms. Results presented in column 4 indicate that the same can be said regarding the propensity to pay dividends.

| Table 4 Baseline Results |

||||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| VARIABLES | Dividends | Dividends | Dividends | Dummy Dividends |

| Efficiency | 0.007* | 0.016*** | 0.004 | 2.272*** |

| 0.004 | 0.005 | 0.028 | 0.777 | |

| Profitability | 0.037*** | 0.046*** | 0.063*** | 1.536*** |

| 0.004 | 0.007 | 0.021 | 0.366 | |

| Leverage | 0.012*** | 0.023*** | 0.053*** | 1.071*** |

| 0.001 | 0.008 | 0.005 | 0.103 | |

| Firm size | 0.000*** | 0.001*** | 0.002*** | 0.052*** |

| 0 | 0 | 0 | 0.008 | |

| Market Share | 0.003** | 0.007*** | 0.027*** | 0.412** |

| 0.001 | 0.002 | 0.005 | 0.204 | |

| Cash flow risk | 0.026*** | 0.028*** | 0.108*** | 7.407*** |

| 0.004 | 0.006 | 0.025 | 0.614 | |

| Growth | 0.001 | 0.001 | 0.006 | 0.229** |

| 0.001 | 0.002 | 0.006 | 0.098 | |

| Firm age | 0.001*** | 0.001*** | 0.002 | 0.519*** |

| 0 | 0 | 0.002 | 0.047 | |

| Constant | 0.006* | 0.005 | 0.063*** | 3.384*** |

| 0.003 | 0.003 | 0.024 | 0.623 | |

| Observations | 1,510 | 1,510 | 1,510 | 1,510 |

| Year FE | YES | YES | YES | YES |

| Firm FE | NO | YES | YES | YES |

| R-squared | 0,151 | 0.553 | 0.589 | |

In terms of asymmetric information our results appear to lend significant support to the relevant hypotheses (H1-H3). Regarding the impact of asymmetric information, the coefficient on our relevant proxy (Firm Size) is consistently negative (Columns 1-2). Larger firms are not likely to suffer from asymmetric information and thus do not make use of dividends as a signaling device. This supports H1. In line with H2 Growth has a positive impact on dividends suggesting that firms use dividends to signal their growth opportunities to the market. These findings are supportive to the signaling models of Bhattacharya (1979) and Miller & Rock (1985). Cash flow risk has a robust negative effect on dividends. This, is in line with H3 and supports the notion that firms with higher cash flow risk reduce dividends in order to avoid the resorting to the capital markets for costly external finance. A similar relationship between risk and dividends is reported in Rozeff (1982).

H4-H7 stem from agency cost considerations and receive strong support from our empirical findings. Specifically, our proxy for agency costs Efficiency has a positive impact on dividends. Firms with high efficiency are likely to be associated with low agency costs. In such firms, management does not have the incentive to withhold and expropriate cash. Agency costs are also likely to be present in mature firms which is confirmed by the Leverage appears to have a consistent negative influence on dividends lending support to H5. This is in line with the argument by Jensen (1986) that leverage and dividends can be used as substitutes to alleviate agency costs of free cash flows. Similar findings are reported by Rozeff (1982). Profitability and Firm Age is positively related to dividends confirming H6 and supporting the agency theory of free cash flows by Jensen (1986). Results are similar to the ones reported by Dennis & Osobov (2008); Naceur, et al., (2014); Blouin (2014). Finally, the coefficient of Market share is consistently negative suggesting that as firms are becoming more established and face reduced competition from their competitors, they pay lower dividends. This supports H7 is line with the argument by Grullon & Michaely (2019). In column 3 we use dividends to sales as a robustness test, we use an alternative proxy for payout ratios to test the robustness of our findings. Results are very similar to the ones reported in column 2 and confirm the validity of our findings.

At column 4 we use a probit model to investigate the behavior of our control variables on the decision to pay dividends. Consistent with signaling theory and the presence of asymmetric information firms with asymmetric information (Firm Size) and growth opportunities (Growth) influence positively the probability to pay dividends. On the contrary, Cash flow risk reduces the probability to pay dividends. Moreover, agency costs (Efficiency), Leverage (Leverage) and market competition (Market share) reduce the propensity to pay dividends. On the contrary, firm maturity (Firm age) and the existence of free cash flows (Profitability) increase the likelihood of dividend distributions.

Conclusion

This paper investigated the determinants of payout decisions in the maritime sector. It was motivated by the lack of relevant research and this sector’s distinct traits and significance. Our research design allowed us to test the validity of two main market imperfections, asymmetric information and agency costs, on dividend decisions. Specifically, we investigated both the decision to pay as well as the factors that determine dividend payout ratios. Our results indicate standard dividend determinants, drawn from asymmetric information and agency considerations perform well in explaining dividend decisions in the maritime sector. Specifically, we document that profitability, growth opportunities, firm age and firm efficiency have a positive impact on dividend ratios as well as the propensity to pay dividends. On the contrary, the respective effect of cash flow volatility, leverage, firm size and market competition is negative. Our results resemble findings from country specific and international studies using multi-industry samples and highlight the overarching role of market imperfections in shaping corporate payout decisions.

References

- Adedeji, A., (1998). Does the pecking order hypothesis explain the dividend payout ratios of firms in the UK? Journal of Business Finance & Accounting, 25, 1127-1155.

- Ahrends, Μ., Drobetz, W., & Nomikos, N.K. (2018). Corporate cash holdings in the shipping industry. Transportation Research Part E: Logistics and Transportation Review, 112, 107-124.

- Akerlof, G.A. (1970). The market for "Lemons": Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488-500.

- Alexandridis G., Kavussanos M., Kim C., Tsouknidis D.A., & Visvikis I. (2018). A survey of shipping finance research: Setting the future research agenda. Transportation Research Part E: Logistics and Transportation Review, 115, 164-212.

- Alexandrou, G., Gounopoulos, D., & Hardy, T., (2014). Mergers and acquisitions in maritime industry. Transportation Research Part E: Logistics and Transportation Review, 61, 212-234.

- Allen, F., & Michaely, R. (2003). Payout policy, handbook of the economics of finance.

- Bhattacharya, S. (1979). Imperfect information, dividend policy, and the bird in the hand fallacy. Bell Journal of Economics, 10, 259-70.

- Blouin, J., Raedy, J., & Shackelford, D.A. (2011). Dividends, share repurchases, and tax clienteles: Evidence from the 2003 reductions in shareholder taxes. The Accounting Review, 86(3), 887-914.

- Brav, A., Graham, J.R., Harvey, C.R., & Michaely, R. (2005). Payout policy in the 21st century. Journal of Financial Economics, 77, 483-527.

- Demerjian, P., Lev, B., & McVay, S. (2012). Quantifying managerial ability: A new measure and validity tests. Management Science, 58, 1229-1248.

- Denis, D., & Osobov, I. (2008). Why do firms pay dividends? International evidence on the determinants of dividend policy. Journal of Financial Economics, 89(1), 62-82.

- Drobetz, W., Gounopoulos, D., Merikas, A.G., & Schröder, H. (2013). Capital structure decisions of globally-listed shipping companies. Transportation Research Part E: Logistics and Transportation Review, 52, 49-76.

- Grammenos, C.T., Nomikos, N.K., & Nikos C., (2008). Estimating the probability of default for shipping high yield bond issues. Transportation Research Part E: Logistics and Transportation Review, 44, 1123-1138.

- Grullon, G., Larkin, Y., & Michaely, R. (2019) Dividend policy and product market competition. Retrieved from http://dx.doi.org/10.2139/ssrn.972221.

- Hart, O. (1983). The market as an incentive mechanism. Bell Journal of Economics, 14(2), 366-82.

- Iyer, S.R., Feng, H., & Rao, R.P. (2017). Payout flexibility and capital expenditure. Review of Quantitative Finance and Accounting, 49(3), 633-659.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323-339.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Merikas, A.G., Gounopoulos, D., & Nounis, C. (2009). Global shipping IPOs performance. Maritime Policy and Management, 36, 481-505.

- Miller, M., & Rock, K. (1985) Dividend policy under asymmetric information. Journal of Finance, 40, 1031-51.

- Modigliani, F., & Miller, M.H. (1961). Dividend policy, growth, and the valuation of shares. The Journal of Business, 34(4), 411-433.

- Myers, S. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575-592.

- Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information those investors do not have. Journal of Financial Economics, 3(2), 87-221.

- Myers, S. (2001). Capital structure. The Journal of Economic Perspectives, 15, 81-102.

- Naceur, S.B., Goaied, M., & Belanes, A. (2006). On the determinants and dynamics of dividend policy. International Review of Finance, 6, 1-23.

- Ross, S.A. (1977). The determination of financial structure: The incentive-signaling approach. The Bell Journal of Economics, 8(1), 23-40.

- Rozeff, M. (1982). Growth, beta and agency costs as determinants of dividend payout ratios. The Journal of Financial Research, 5(3), 249-259.

- Schmidt, K.M. (1997). Managerial incentives and product market competition. Review of Economic Studies, 64(2), 191-213.