Research Article: 2018 Vol: 22 Issue: 1

The Determinants of Debt Maturity: The Case of Jordan

Ghada Tayem, The University of Jordan

Keywords

Debt Maturity, Agency Costs, Information Asymmetry, Largest Controlling Owner.

JEL classification

G30, G32

Introduction

In perfect capital markets there should be no reason for choosing a particular financing instrument or specify attributes of these instruments (Modigliani & Miller, 1958). However, market imperfections such as taxes (Modigliani & Miller, 1963), information asymmetry (Myers, 1984, Myers & Majluf, 1984) and agency costs (Jensen & Meckling, 1976; Myers, 1977) can lead to the choice of an optimal financing policy. In addition, theoretical papers have discussed the relevance of several attributes of debt instruments including its maturity when capital market frictions exist. From a firm’s perspective, debt maturity can be used to reduce the costs associated with some market imperfections. Short-term debt can resolve debt agency conflicts. When debt repayments coincide with the realization of the project cash flows this eliminates the underinvestment problem (Myers, 1977; Diamond & He, 2014) and the risk-shifting incentive (Barnea, Robert & Senbet, 1980; Brockman, Martin & Unlu, 2010). Also, the choice of short-term debt signals the quality of the firm because of the high transaction costs associated with rolling short-term debt (Flannery, 1986). However, firms subject to high liquidation and refinancing risk choose long-term debt or save cash to reduce these costs (Diamond, 1991; Harford, Klasa & Maxwell, 2014). In addition, short-term debt exerts more monitoring on managers as the debt contract has to be renegotiated at each refinancing point and hence the firm’s governance may determine the debt maturity policy (Datta, Iskandar-Datta & Raman, 2005; Harford, Li & Zhao, 2008; Ben-Nasr, Boubaker & Rouatbi, 2015). This article attempts to review the theoretical and empirical work on the impact of debt agency conflicts, information asymmetry, liquidity and governance on the firm’s debt maturity. It also attempts to examine the empirical predictions of these theories using the context of Jordan.

The recent firm-level evidence from the US and international contexts indicates that there is a negative association between debt agency costs, information asymmetry and governance with debt maturity (Berger et al., 2005; Harford, Li & Zhao, 2008; Brockman, Martin & Unlu, 2010; Custódio, Ferreira & Laureano, 2013; Ben-Nasr, Boubaker & Rouatbi, 2015) and a positive association between liquidity and refinancing risk with debt maturity (Harford, Klasa & Maxwell, 2014; Brick & Liao, 2017). The above-mentioned factors are relevant for firms operating in Jordan but the impact of these factors can be influenced by features of the Jordanian economy. Firms operating in Jordan are small relative to firms operating in the US and Europe. Small firms are subject to large agency and information problems and hence have incentives to use short-term debt to reduce the costs associated with these problems. However, most debt in these firms is sourced from banks that employ multiple screening and monitoring technologies alongside debt maturity to resolve the agency and information problems (Leland & Pyle, 1977; Smith & Warner, 1979; Fama, 1985; Boyd & Prescott, 1986). Jordanian banks emphasize the use of collateral which may confound the impact of agency conflicts and information asymmetry on debt maturity. In other words, the use of collateralized bank debt reduces the agency and information costs leading to less clear predictions regarding the impact of agency and information costs on debt maturity. In addition, Jordanian firms employ small leverage in comparison to developed countries. Firms with low leverage have less debt agency costs and therefore, have less incentive to use other control mechanisms including debt maturity. Furthermore, firms operating in Jordan are characterized by concentrated ownership. Short-term debt exerts a disciplinary pressure on controlling shareholders of these firms. Therefore, these firms may choose long-term maturity to avoid bank monitoring. However, the cost of short-term debt is substantially lower than that of long-term both on price and non-price terms and hence firms with concentrated ownership may find short-term debt more attractive.

The rest of the paper is organized in three sections. The second is devoted to reviewing the theoretical literature and empirical evidence. The third presents the methodology and data. The paper concludes in the fourth section.

Theoretical Background And Empirical Evidence

The literature proposes several theories to explain the firm’s debt maturity decision. For each theory, this paper identifies the conditions for which debt maturity becomes relevant and summarizes its structure. Then, the article identifies key papers examining the empirical predictions and evidence of each theory.

Theories of Debt Maturity

Myers (1977) shows that in case of risky borrowing the firm may forego positive NPV projects that add value to the firm because the added value will accrue to bondholders. Formally, Myers examines a firm where currently issued debt is entirely supported by a growth opportunity and it borrows to finance a future project. The market value of the project must exceed the costs of the project and the payments to the debt holders. Assuming no taxes, if debt payments are high enough then the market value of the project will always be less than the costs of the project and the payments to the debt holders and the firm will be worthless. This creates a situation where NPV is positive but the firm will not undertake the project because the benefits of the project are split or even captured entirely, between shareholders and bondholders. Myers shows that debt maturity may mitigate the disinvestment motive. If debt matures before the investment decision, the firm without outstanding debt behaves like an all-equity firm in deciding to invest. Similarly, Barnea, Robert & Senbet (1980) suggest that agency costs associated with debt issues including undertaking suboptimal risky projects which transfer wealth from bondholders to shareholders and the underinvestment problem, can be resolved with “complex financial contracts (which) may serve as low cost alternatives to resolving agency problems” (p. 1224). More recently, Diamond & He (2014) extends Myers (1977) model. They show that short-term debt reduces the disinvestment motive on immediate investment because it is less sensitive to the value of the firm and thus receives a smaller benefit from the new investment. However, long-term debt may decrease the disinvestment problem depending on the future volatility of assets.

As for models based on information asymmetry, the signalling model based on Flannery (1986) suggests that good-quality firms use short-debt maturity to signal their quality and bad-quality firms cannot mimic this signal because of the high transaction costs associated with rolling short-term debt. The model assumes that long-term rate is higher than the short-term rate because the market is uninformed. However, the short-term debt strategy exposes the firm to uncertainty about future refunding rate because information about the type of the firm is revealed at the refinancing time. Good-quality firms issue short-term debt at a relatively low interest rate and roll it over. Bad-quality firms are willing to pay the high rate on long-term debt to avoid the expected costs of rolling over short-term debt.

In addition, Diamond (1991) proposes a model in which a firm decides debt maturity based on the trade-off between liquidity risk against increased sensitivity of financing costs to new information. Diamond (1991) shows that when liquidation is allowed, there will be three possible borrowing strategies depending on the borrower’s credit rating. When liquidation is allowed and good-type borrowers have a rating just above bad-type borrowers, the project will be liquidated in the event of a downgrade. This lowers the expected payoff of issuing short-term debt compared to long-term debt. Thus, firms which have this rating will choose long-term debt. Although there is still liquidation in the event of a downgrade, the high rating makes the good-type borrower less likely than the average rated borrower to get a downgrade. Therefore, good-type borrowers choose short-term debt because it lowers their financing costs. When long-term debt is not feasible, short-term debt may be feasible if lenders can obtain sufficiently high returns from liquidation given bad news. Therefore, firms with very low credit rating have no choice except of borrowing short-term.

Empirical Predictions and Evidence

Debt maturity theories provide predictions of the determinants of debt maturity structure and the direction of their effects. Table 1 highlights debt maturity definitions, samples, methodologies and hypotheses in key cited empirical research. Starting with the agency costs hypothesis, it predicts that debt maturity decreases the larger the growth opportunities in the firm’s investment opportunity set. In addition, since debt agency costs are expected to be more severe in smaller firms and firms with volatile earnings compared to large and stable firms. Thus, size is predicted to be positively related to debt maturity and earnings volatility is expected to be negatively related to debt maturity.

| Table 1a: Summary Of Major Empirical Research | |||

| Paper | Definition | Sample | Methodology and Hypothesis |

|---|---|---|---|

| Barclay & Smith (1995) | Debt with maturity of more than three years to total debt (long-term debt plus debt in current liabilities). | 37,979 year firm observation of 5,545 traded industrial firms over the period 1974 to 1991. | Pooled, cross-section and fixed effects, Examine debt maturity hypotheses and predict the determinants of debt maturity. |

| Stohs & Mauer (1996) |  |

21,976 debt instruments outstanding issued by 328 firms covering the period 1980 to 1989. | Pooled, cross-section and fixed effects, Examine debt maturity hypotheses and predict the determinants of debt maturity. |

| Guedes & Opler (1996) | The term to maturity. | Term to maturity of 7,369 bonds and notes issued between 1982 and 1993. | Pooled OLS and Multinomial logit. Examine information asymmetry theories of debt maturity. |

| Ozkan (2000) | The ratio of debt that matures in more than five years (alternatively one year) to total debt. | 4624 firm-year observations representing 429 UK firms over the period 1983 to 1996. | GMM, Examine the growth opportunities, the signalling, asset maturity and tax hypotheses of debt maturity. |

| Scherr & Hulburt (2001) | Debt that matures in one year or more divided by the amount of total debt. The fraction of each type of debt times its maturity in months. |

The sample is based on the 1987 and 1993 versions of the NSSBF. The 1987 version has 3,404 firms and the 1993 has 4,637 firms. | OLS, Examine the determinants of debt maturity in small firms. |

| Barclay, Marx & Smith (2003) | Long-term debt over total debt. | 5,765 industrial firms from 1980 to 1999. | Two-Stage Least Square, Examine the impact of firm investment opportunities set (MTB) on debt maturity. |

Furthermore, matching asset maturity with debt maturity is assumed to control the agency conflicts between debt holders and shareholders (Myers, 1977) and therefore asset maturity is predicted to vary positively with debt maturity. Finally, the agency costs argument implies that firms with low leverage have less debt agency costs and therefore, have less incentive to use any control mechanisms including debt maturity. The debt agency costs hypothesis has been extensively examined by researchers with mixed findings. Barclay & Smith (1995) and Guedes & Opler (1996) find evidence supporting Myers’ (1977) prediction that firms with more growth opportunities have less long-term debt. However, Stohs & Mauer (1996) include leverage in their debt maturity model and show no evidence supporting an inverse relation between growth opportunities and debt maturity. Nonetheless, Barclay, Marx & Smith (2003) account for the possible endogeneity between leverage and debt maturity and document that once maturity is jointly determined with leverage the investment opportunity set is negatively related with leverage and long-term debt. Johnson (2003) finds a positive impact of an interaction term between market-to-book ratio and short-term debt on leverage, which indicates that short-term debt attenuates the negative effect of growth opportunities on leverage. Using a UK sample, Ozkan (2000) finds evidence supporting the growth opportunities hypothesis and the asset maturity argument. Further, Antoniou, Guney & Paudyal (2006) examine the debt maturity choice of firms in three countries: France, Germany and the UK and find that the debt maturity decision for firms in the UK is influenced by size, growth opportunities and asset maturity while the French and German firms’ debt maturity choice are less affected by these factors.

In addition, the empirical evidence indicates that agency conflicts associated with executive compensation can be resolved by the use of shorter debt maturities. Brockman, Martin & Unlu (2010) find that the manager’s appetite for risk decreases (increases) with higher sensitivity of the compensation package to stock return prices (volatility) and hence the larger the proportion of long-term debt (short-term debt) in the firm’s capital structure. Also, Dang et al. (2017) argue that managers are less likely to hide bad news in the presence of external monitoring by short-term debt lenders and find that firms using more short-term debt exhibit lower future stock price crash risk. El Ghoul et al. (2016) and Khurana & Wang (2015) examine the effect of high quality audits and accounting conservatism in substituting debt maturity in reducing agency costs. El Ghoul et al. (2016) find that the fraction of long-term debt in firms’ capital structures rises with the presence of a Big Four auditor while Khurana & Wang (2015) find that short-maturity debt is negatively associated with accounting conservatism. Finally, Cutillas & Sánchez (2014) document direct evidence on the role of short-debt maturity in mitigating overinvestment and underinvestment by examining the impact of short term debt on investment efficiency.

The information asymmetry hypothesis received less support in early empirical literature (Barclay & Smith, 1995; Guedes & Opler, 1996; Stohs & Mauer, 1996). In contrast to the above cited studies, Berger et al. (2005) find support for the information asymmetry rationale using a sample of loans issued by banks extended to small firms. More recently, Goyal & Wang (2013) find that issuance of short-term debt leads to a decline in borrowers’ asset volatility and an increase in their distance to-default, which is consistent with the view that borrowers with favorable private information choose short-term debt. In addition, Custódio, Ferreira & Laureano (2013) document the increase of the usage of short-term debt by US firms since the 1980s and argue that it is driven mainly by the increase of information asymmetry due to the increase of public listing of riskier firms. The authors find evidence suggesting that debt maturity significantly falls more for firms characterized by higher information asymmetry. In terms of liquidity and refinancing risk, Harford, Klasa & Maxwell (2014) argue that the increase of the use of short-term debt increases the risk of refinancing short-term debt and find that firms with short-term debt attempt to reduce this risk by accumulating cash holdings. However, Brick & Liao (2017) find that debt maturity is positively related with cash holdings but only for financially constrained firm which borrow long-term debt to build their cash reserves. Also, consistent with the hypothesis that short-maturity debt exposes the firm to rollover risk, Gopalan, Song & Yerramilli (2014) find that firms with a higher proportion of their debt maturing within the year trade their long-term debt at higher yield spreads.

Empirical evidence on small firms and on the use of covenants shows less support of explanations based on debt agency and information costs. Scherr & Hulburt (2001) examine the debt maturity choice of small firms and find that asset maturity, capital structure and probability of default do explain variation in the debt policy. However, they do not find support for growth options and asymmetric information explanations of debt maturity. Billett, King & Mauer (2007) examine the simultaneous effect of growth opportunities on leverage, debt maturity and covenants protection. They find that covenant protection is increasing in leverage and growth opportunities but decreasing in short-term debt, which implies that short-term debt and covenants are substitutes in controlling the stockholders-bondholders conflicts.

In terms of ownership and governance, Kim & Sorensen (1986) examine the impact of insider ownership on firm debt policy. They find that firms with higher insider ownership have greater debt ratios compared to firms with lower insider ownership. The authors use the ratio of long-term debt to total assets, hence, providing evidence of debt maturity as well. Datta, Iskandar-Datta & Raman (2005) argue managers may choose long-term debt if they do not have the right incentives or if their interests are not aligned with shareholders’ interests since short-term debt exerts more monitoring on the managers as debt contract has to be renegotiated at each refinancing point. They find that managers with lower ownership choose longer debt maturity. Using a UK sample, Guney & Ozkan (2005) find a negative relationship between managerial ownership and debt maturity. Lee & Chang (2013) find that firms with control rights lower (higher) than cash flow ownership is negatively (positively) related to debt maturity, while Ben-Nasr, Boubaker & Rouatbi (2015) find that firms with multiple large shareholders exhibit shorter debt maturity and in effect curbing the extraction of private benefits by the controlling owner.

Methodology and Data

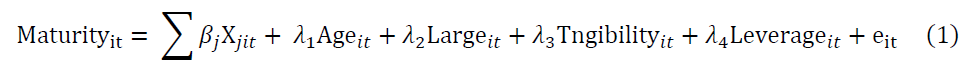

This study aims at examining the determinants of debt maturity by estimating the model specified in equation 1:

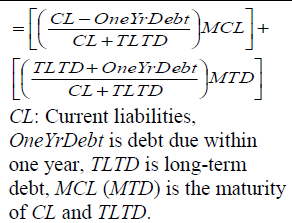

where Maturity is the fraction of long-term debt over total debt.  are a vector of firm characteristics that account for agency costs of debt. These variables include: Firm size (Size), asset maturity (Asset Maturity), growth opportunities (MTB) and earnings volatility (Volatility). Age is a proxy used to account for information costs. Finally Large accounts for ownership structure, Leverage for the total amount of debt in a firm’s capital structure and Tangibility for the proportion of fixed assets. Variables are defined in Table 2 along with their predicted signs.

are a vector of firm characteristics that account for agency costs of debt. These variables include: Firm size (Size), asset maturity (Asset Maturity), growth opportunities (MTB) and earnings volatility (Volatility). Age is a proxy used to account for information costs. Finally Large accounts for ownership structure, Leverage for the total amount of debt in a firm’s capital structure and Tangibility for the proportion of fixed assets. Variables are defined in Table 2 along with their predicted signs.

| Table 1b: Summary Of Major Empirical Research | |||

| Datta, Iskandar-Datta & Raman (2005) | The percentage of debt maturing in more than three years (alternatively, they use five years as well). | 6,246 firm-year observations between 1992 and 1999 and consists of industrial firms. | Two-stage least square, Examine the impact of managerial ownership on determining corporate debt maturity. |

| Guney & Ozkan (2005) | The ratio of debt that matures in more than one year to total debt for the year 2000. | 780 observations, ownership measured in 1997 and explanatory averaged variables over 1996-1999. | OLS, Examine the impact of managerial ownership on debt maturity. |

| Antoniou, Guney & Paudyal (2006) | The ratio of debt that matures in more than one year to total debt. | 3160, 6809, 35266 observations representing 1,235 French firms, 1,590 German firms and 3,153 UK firms, respectively. | GMM, Examine the determinants of corporate debt maturity structure including firm-specific and market-related factors. |

| Billett, King & Mauer (2007) | The percentage of debt maturing in three years or less. | 15504 debt issues over 1960 to 2003 and 7016 firm-year observations over 1989-2002. | GMM, Examine the effect of growth on the joint determination of leverage, debt maturity and protection covenant. |

| Brockman, Martin & Unlu (2010) | Debt in current liabilities plus debt maturing in the second (alternatively second, third, fourth and fifth years) year plus debt maturing in the third year, scaled by total debt. | 6825 firm-year observations based on 1312 unique firms over the period 1992 to 2005. | Pooled OLS, GMM, fixed-effect and change in variables, Examine the impact of executive compensation sensitivity to stock volatility and stock prices on managers' risk preference and hence on debt maturity. |

| Custódio, Ferreira & Laureano (2013) | The ratio of the long-term debt (alternatively debt with a maturity over 2-5 years respectively) debt over the book value of total debt. | 97215 observations from 12938 unique firms over the period 1976 to 2008. | Mainly OLS, Fixed effects and Fama-MacBeth procedure, Tests the debt maturity theories to explain the upward trend in using short-term debt maturity. |

| Harford, Klasa & Maxwell (2014) | The fraction of a firm’s long-term debt that is due in the next three years divided by total long-term debt. | 80035 firm-year observations over the 1980 to 2008 period. | Three Stage Least Squares, Examine if firms whose debt has a shorter maturity attempt to mitigate refinancing risk by holding large cash reserves. |

| El Ghoul et al. (2016) | Long-term debt maturing in more than one year to total debt. | 42,679 observations representing 4920 irms from 42 countries over the period 1994 to 2003. | GMM, Propensity Score Matching, Examine the impact of the presence of a Big Four auditor on the fraction of long-term debt in firms’ capital structures. |

| Ben-Nasr, Boubaker & Rouatbi (2015) | The ratio of long-term debt to total debt. | 5711 observations representing 604 French listed firms for the period 1998-2013. | OLS, Propensity Score Matching, 2SLS, Examine the influence of multiple large shareholders on maturity structure of debt. |

| Brick & Liao (2017) | The percentage of debt that matures in more than 3 years as a proxy for the ratio of long-term debt to total debt. | 1729 firms (76928 firm-year observations) for the 1985-2013 period. | GMM, Tests the simultaneous choice of debt maturity and cash holdings for the average firm and for financially constrained firms. |

| Table 2: Variable Definitions | ||

| Variable | Sign | Definition |

|---|---|---|

| Size | + | Natural logarithm of net total assets. |

| Asset Maturity | + | Gross property, plant and equipment divided by depreciation expense. |

| MTB | - | Market value of equity plus book value of assets minus book value of equity divided by total assets. |

| Volatility | - | The standard deviation of annual changes in the level of cash flows (earnings before interest, taxes and depreciation) over a lagged four-year period, scaled by average assets in the lagged period. |

| Age | - | The natural logarithm of the number of the years between the fiscal year and the year of a firm’s inception. |

| Large | + | The percentage of shares held by the largest owner who hold 5% or more of outstanding shares. |

| Leverage | -/+ | The total of long and short term borrowings divided by total assets valued at book basis. |

| Tangibility | -/+ | Fixed assets divided by total assets |

The error term ![]() in equation 1 contains firm-specific effects

in equation 1 contains firm-specific effects![]() and the usual idiosyncratic error

and the usual idiosyncratic error![]() To account for the possibility that unobservable firm-specific effects

To account for the possibility that unobservable firm-specific effects ![]() are correlated with other control variables this study employs both fixed and random effects as it does not make assumptions about the correlation between the explanatory variables and the unobservable firm effects. Furthermore, previous evidence shows that leverage and debt maturity are endogenously determined (Barclay, Marx & Smith, 2003) and therefore this study estimates equation 1 using a system of two equations (2SLS). This study employs a sample of nonfinancial Jordanian firms listed on the Amman Stock Exchange (ASE) over the period 2005-2013. Table 3 presents some descriptive statistics of the key variables in the study.

are correlated with other control variables this study employs both fixed and random effects as it does not make assumptions about the correlation between the explanatory variables and the unobservable firm effects. Furthermore, previous evidence shows that leverage and debt maturity are endogenously determined (Barclay, Marx & Smith, 2003) and therefore this study estimates equation 1 using a system of two equations (2SLS). This study employs a sample of nonfinancial Jordanian firms listed on the Amman Stock Exchange (ASE) over the period 2005-2013. Table 3 presents some descriptive statistics of the key variables in the study.

| Table 3: Summary Statistics | |||||||

| Mean | Median | SD | Min | Max | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Debt Maturity | 0.289 | 0.140 | 0.329 | 0 | 1 | 2.157 | 0.755 |

| Size | 17.064 | 16.898 | 1.347 | 13.662 | 21.292 | 3.507 | 0.633 |

| Asset Maturity | 15.008 | 11.106 | 13.302 | 0.028 | 81.437 | 12.312 | 2.649 |

| MTB | 1.285 | 1.095 | 0.627 | 0.261 | 4.572 | 6.504 | 1.626 |

| Volatility | 0.083 | 0.055 | 0.086 | 0.002 | 0.593 | 10.409 | 2.443 |

| Tangibility | 0.391 | 0.370 | 0.252 | 0.001 | 0.979 | 2.239 | 0.335 |

| Age | 2.942 | 2.890 | 0.712 | 0 | 4.331 | 3.074 | -0.369 |

| Large | 0.303 | 0.25 | 0.182 | 0.055 | 0.97 | 4.604 | 1.228 |

| Leverage | 0.184 | 0.161 | 0.150 | 0.003 | 0.680 | 3.270 | 0.868 |

| Long-Term Debt/Assets | 0.056 | 0.014 | 0.081 | 0 | 0.439 | 5.383 | 1.713 |

| Short-Term Debt/Assets | 0.038 | 0 | 0.086 | 0 | 0.648 | 15.229 | 3.235 |

| Used Line of Credit/Assets | 0.074 | 0.028 | 0.107 | 0 | 0.614 | 9.691 | 2.370 |

Table 4 presents coefficients between the variables of the study. Focusing on the correlation coefficients between maturity and its expected determinants, it is noted that not all variables carry the expected signs. Namely, MTB and Volatility carry the opposite sign. This will be discussed in the next section.

| Table 4: Correlation Matrix | |||||||||||

| Debt Maturity | Size | Asset Maturity | MTB | Vol | Tang | Age | Large | Lev | LTD/TA | STD/TA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Size | 0.26a | ||||||||||

| A.Maturity | 0.08b | -0.11a | |||||||||

| MTB | 0.07b | 0.12a | -0.11a | ||||||||

| Vol | 0.11a | -0.05 | -0.06 | 0.14a | |||||||

| Tang | 0.09b | -0.09b | 0.35a | 0.00 | -0.08b | ||||||

| Age | -0.07b | 0.13a | -0.21a | 0.07b | -0.03 | -0.17a | |||||

| Large | 0.02 | 0.03 | 0.04 | 0.14a | 0.08b | 0.15a | -0.02 | ||||

| Lev | 0.05 | -0.02 | 0.02 | -0.10b | 0.02 | -0.12a | -0.06 | 0.04 | |||

| LTD/TA | 0.70a | 0.09b | 0.09b | -0.04 | 0.10b | 0.07 | -0.14a | 0.04 | 0.46a | ||

| STD/TA | -0.15a | -0.09b | -0.06 | -0.02 | 0.04 | -0.13a | -0.07 | 0.14a | 0.52a | 0.02 | |

| Used CL/TA |

-0.39a | -0.05 | -0.06 | -0.12a | -0.09b | -0.17a | 0.10b | -0.10b | 0.54a | -0.23a | -0.05 |

a, b indicate significance at the 1% and 5% respectively

Finally, it is noteworthy to discuss some of the data limitations. Data on financial items are obtained from the ASE’s Company Guides. The ASE started reporting financial data regularly through the Company Guides from 2002. In addition, the computation of the measure Volatility requires observations from the previous four years. Data on ownership is collected from the Companies Guide for the period 2005-2007 and manually from annual reports for the period 2008-2013. Therefore, the sample period covers the years 2005-2013.

Results and Analysis

Empirical Results

The aim of this study is to investigate factors that determine the debt maturity structure of listed Jordanian companies by estimating equation 1. Table 5 reports the estimation results using three alternative techniques: Fixed effects, random effects and 2SLS. All methods use similar specification that includes the following variables: Size, Asset Maturity, MTB, Volatility, Tangibility, Age, Large and Leverage. In addition, all specifications include time effects to control for macroeconomic conditions as well as industry effects to control for possible industry variation of using different maturity structures.

| Table 5: Estimation Results | |||

| Fixed Effects | Random Effects | 2SLS | |

|---|---|---|---|

| Size | 0.045 | 0.065*** | 0.071*** |

| (1.28) | (3.92) | (8.02) | |

| Asset Maturity | 0.001 | 0.001* | 0.002** |

| (1.44) | (1.69) | (2.02) | |

| MTB | -0.011 | 0.006 | 0.032 |

| (-0.49) | (0.28) | (1.57) | |

| Volatility | 0.020 | 0.120 | 0.149 |

| (0.14) | (0.92) | (1.47) | |

| Tangibility | -0.056 | 0.044* | 0.141** |

| (-0.67) | (1.68) | (2.57) | |

| Age | -0.024 | -0.015 | -0.034** |

| (-0.33) | (-0.48) | (-1.97) | |

| Large | -0.045 | -0.062 | -0.058 |

| (-0.51) | (-0.82) | (-0.87) | |

| Leverage | 0.483*** | 0.390*** | 0.309 |

| (5.03) | (4.61) | (1.27) | |

| Time Effects | Yes | Yes | Yes |

| Industry Effects | - | Yes | Yes |

| Observations | 713 | 713 | 713 |

t-statistics (alternatively z-statistics) are in parentheses. ***, **, * indicate significance at the 1%, 5% and 10% respectively

The first variables of interest relates to firm characteristics associated with agency costs of debt, namely firm size, asset maturity, growth opportunities and asset volatility. The estimation results indicate that the first variable of interest, Size, is positively related to debt maturity. It is significant using all estimation methods except for the fixed effects estimation method. This evidence indicates that large firms use more long-term debt in their debt structure in comparison to small firms. Asset Maturity is positively related to debt maturity where it is significant at the 10% and 5% using random effects and 2SLS estimation methods respectively.

However, the variables MTB and Volatility are insignificantly related to debt maturity in all specifications. Another variable of interest, Tangibility, captures the quality of collateral. The variable Tangibility is positively and significantly related to debt maturity at the 5% level in the random effects and 2SLS estimation methods. The firm’s age is a used as a proxy of degree of information asymmetry. The results indicate that Age is negatively related to the debt maturity in all specification but is significant only in the 2SLS at the 5% level. In terms of the impact of ownership on debt maturity, the results indicate that ownership of the largest shareholder, Large, has no significant impact on the firm’s debt maturity structure. Finally, the evidence shows that Leverage is positively and significantly related to debt maturity at the 10% level using the fixed and random effects, a finding consistent with the liquidity risk argument. These results will be discussed in the next section.

Discussion of Empirical Results

Theory and empirical evidence posit that firm characteristics associated with weaker agency costs of debt are positively related to debt maturity. Namely firm size and asset maturity are expected to be positively related to debt maturity, while growth opportunities and asset volatility are expected to be negatively related to debt maturity. The findings indicate that the variables Size and Asset Maturity are significantly and positively related to debt maturity, while the variables MTB and Volatility are insignificantly related to debt maturity. The inconclusive findings with regard to the impact of agency costs of debt may be explained by the features of the Jordanian context. Jordanian firms use small leverage (Table 3) and their debt is largely collateralized bank debt. In other words, agency costs of debt are either small or are resolved using alternatives other than debt maturity such as collateral. Empirical evidence on small firms and on the use of covenants show less support of the debt agency costs explanation including the studies of Scherr & Hulburt (2001); Billett, King & Mauer (2007). To further understand the relative importance of debt maturity versus collateral on the firm’s debt maturity structure it is interesting to examine the impact of the variable Tangibility. The variable Tangibility is positively and significantly related to debt maturity in the random effects and 2SLS estimation methods. This result is consistent with the view that firms with higher proportion of fixed assets provide higher quality collateral and therefore can obtain long-term debt.

The results indicate that Age is negatively related to the debt maturity in all specification but is significant only in the 2SLS. This result is consistent with the information asymmetry explanation of debt maturity. Theory and empirical evidence predict that firm characteristics associated with larger information asymmetry are expected to be negatively related to debt maturity. In this study, firm age is used to proxy the degree of information asymmetry. A firm’s age is a measure how much the market knows about the firm. Old firms are expected to be more known to the market in comparison to small firms and hence subject to less information asymmetry.

Ownership of the largest shareholder, Large, has no significant impact on the firm’s debt maturity structure. As discussed in the theoretical background section, insiders have incentives to choose long-term over short-term debt as short-term debt involves more scrutiny in terms of monitoring and renegotiation. Therefore, controlling owners have incentives similar to managers with small ownership in avoiding monitoring and renegotiation resulting from the use of short-term debt. However, the documented evidence shows that Large is not significantly related to debt maturity. This evidence is interesting as it highlights the importance of the Jordanian context. In a working paper, (Tayem, 2017) documents that Large is significantly negatively related to leverage using a sample of listed Jordanian firms. This evidence is consistent with the view that controlling owners avoid bank scrutiny because most of debt in Jordanian firms is sourced from banks. In addition, given that Jordanian banks secure their debt agreements, short and long, with collateral it is not clear if debt maturity adds extra scrutiny on the firm and hence controlling shareholders may not show a significant preference towards one type of debt maturity over the other.

In terms of Leverage, the agency costs argument implies a negative relation between leverage and debt maturity. Firms with low leverage have low debt agency costs and hence have less incentive to use any control mechanisms including debt maturity. However, the liquidity argument implies that firms with little leverage face little liquidity risk and do not have the incentive to issue long-term debt. However, as leverage increases, liquidity risk increases and the firm opts to use more long-term debt in its structure (Stohs and Mauer, 1996). The evidence shows that Leverage is positively and significantly related to debt maturity, a finding consistent with the liquidity risk argument.

Summary and Conclusion

This paper investigates the determinants of debt maturity structure of nonfinancial firms listed on the ASE over the period 2005-2013 using the framework of three views of debt maturity: Debt agency costs, information asymmetry and managerial discretion. Consistent with the agency costs of debt, the results of this study indicate that larger firms with longer asset maturity have longer term debt. However, firms with high growth opportunities and more volatility do not have significantly different maturity structure in comparison to firms with low growth opportunities and less volatile earning. In addition, the results of this paper are consistent with the information asymmetry view of debt maturity. Firm age is negatively significantly related to debt maturity. However, the study does not find evidence of an impact of ownership of the largest shareholder on debt maturity. These findings can be explained in light of the features of the Jordanian firms. In terms of agency costs: First, Jordanian firms use small leverage and hence they are subject to small agency costs of debt. Second, their debt is largely collateralized bank debt and hence agency costs of debt are resolved using alternatives other than debt maturity such as collateral. The above confounding effects lead to this study’s inconclusive results regarding the impact of agency costs on debt maturity. In terms of information asymmetry and liquidity risk: First, firms operating in Jordan are subject to large information asymmetry and liquidity risk. Second, theory shows that firms with unfavourable private information and high liquidity risk choose long-term debt. The results of this study are consistent with these conclusions as they show that young firms unknown to the market and the ones with large leverage facing high liquidity risk choose long-term debt. Finally, in terms of ownership: First, listed Jordanian firms are characterized by concentrated ownership. Second, they are likely to avoid short-term debt as it exerts more monitoring on controlling shareholders. Third, they may opt to use short-term debt to avoid higher price costs and non-price terms such as collateral requirements. The results of this study support the latter conclusion as ownership of the largest owner is not significantly related to debt maturity.

In conclusion, the results of this study point out that agency and information costs partially determine the firm’s debt maturity structure. Although it is difficult to measure the agency and information costs, the presence of these costs is evident by the fact that Jordanian firms rarely issue new external financing through the capital market. For example, currently there is only one traded debt issue with a size of 25 Million JDs. Jordanian companies, therefore, depend on the banking system to provide their financing needs. The banking system resolves the agency conflicts and information costs utilizing their efficiency in information production and their investment in monitoring technologies among of which is debt maturity. However, the results presented in this paper show inconclusive evidence supporting in part debt agency and information costs. The conclusion of this study is that there are other mechanisms playing a vital part in the provision of long-term debt which include mainly collateralization. The results of this study points out to questions unanswered that will advance future research. First, it is important to understand the role of collateral on influencing the debt structure of firms. Many firms will be excluded out of the long-term debt if they do not qualify for collateral requirements. Second, the study does not explore the issue of having internal funds which influences how firms react to liquidity risk and hence impact on their debt policies.

References

- Williams DW, Eugenin EA, Calderon TM, Berman JW (2012) Monocyte maturation, HIV susceptibility and transmigration across the blood brain barrier are critical in HIV neuropathogenesis. J Leukoc Biol 91: 401-415.

- Pretorius C, Glaziou P, Dodd PJ, White R, Houben R (2014) Using the TIME model in Spectrum to estimate tuberculosis-HIV incidence and mortality. AIDS 28: S477-S487.

- Baral S, Beyrer C, Muessig K, Poteat T, Wirtz AL, et al. (2012) Burden of HIV among female sex workers in low-income and middle-income countries: A systematic review and meta-analysis. Lancet Infect Dis 12: 538-549.

- Baral S, Sifakis F, Cleghorn F, Beyrer C (2007) Elevated risk for HIV infection among men who have sex with men in low- and middle-income countries 2000-2006: A systematic review. PLoS Med 4: e339.

- Herbst JH, Jacobs ED, Finlayson TJ, McKleroy VS, Neumann MS, et al. (2008) Estimating HIV prevalence and risk behaviors of transgender persons in the United States: A systematic review. AIDS Behav 12: 1-17.

- Dunkle KL, Jewkes R, Nduna M, Jama N, Levin J, et al. (2007) Transactional sex with casual and main partners among young South African men in the rural Eastern Cape: Prevalence, predictors, and associations with gender-based violence. Soc Sci Med 65: 1235-1248.

- Jaspan HB, Berwick JR, Myer L, Mathews C, Flisher AJ, et al. (2006) Adolescent HIV prevalence, sexual risk, and willingness to participate in HIV vaccine trials. J Adolesc Health 39: 642-648.

- Schunter BT, Cheng WS, Kendall M, Marais H (2014) Lessons learned from a review of interventions for adolescent and young key populations in Asia Pacific and opportunities for programming. J Acquir Immune Defic Syndr 66: S186-S192.

- UNAIDS (2008) Redefining AIDS in Asia: crafting an effective response. New Delhi, India.

- AMFAR (2013) Tackling HIV/AIDS among key populations: Essential to achieving an AIDS-free generation. Issue Brief.

- Baggaley R, Armstrong A, Dodd Z, Ngoksin E, Krug A (2015) Young key populations and HIV: A special emphasis and consideration in the new WHO consolidated guidelines on HIV prevention, diagnosis, treatment and care for key populations. J Int AIDS Soc 18: 19438.

- Alistar SS, Owens DK, Brandeau ML (2014) Effectiveness and cost effectiveness of oral pre-exposure prophylaxis in a portfolio of prevention programs for injection drug users in mixed HIV epidemics. PLoS One 9: e86584.

- Choopanya K, Martin M, Suntharasamai P, Sangkum U, Mock PA, et al. (2013) Antiretroviral prophylaxis for HIV infection in injecting drug users in Bangkok, Thailand (the Bangkok Tenofovir Study): A randomised, double-blind, placebo-controlled phase 3 trial. Lancet 381: 2083-2090.

- Miller T, Hallfors D, Cho H, Luseno W, Waehrer G (2013) Cost-effectiveness of school support for orphan girls to prevent HIV infection in Zimbabwe. Sci 14: 503-512.

- Pronyk PM, Kim JC, Abramsky T, Phetla G, Hargreaves JR, et al. (2008) A combined microfinance and training intervention can reduce HIV risk behaviour in young female participants. AIDS 22: 1659-1665.

- Thurman TR, Kidman R, Carton TW, Chiroro P (2016) Psychological and behavioral interventions to reduce HIV risk: Evidence from a randomized control trial among orphaned and vulnerable adolescents in South Africa. AIDS Care 28: 8-15.

- Van Damme L, Corneli A, Ahmed K, Agot K, Lombaard J, et al. (2012) Preexposure prophylaxis for HIV infection among African women. N Engl J Med 367: 411-422.

- Wagman JA, Gray RH, Campbell JC, Thoma M, Ndyanabo A, et al. (2015) Effectiveness of an integrated intimate partner violence and HIV prevention intervention in Rakai, Uganda: Analysis of an intervention in an existing cluster randomised cohort. Lancet Glob Health 3: e23-e33.

- Carney T, Petersen Williams PM, Parry CD (2016) Ithubalethu-intervention to address drug use and sexual HIV risk patterns among female commercial sex workers in Durban, South Africa. J Psychoactive Drugs 48: 303-309.

- Ramanathan S, Deshpande S, Gautam A, Pardeshi DB, Ramakrishnan L, et al. (2014) Increase in condom use and decline in prevalence of sexually transmitted infections among high-risk men who have sex with men and transgender persons in Maharashtra, India: Avahan, the India AIDS initiative. BMC Public Health 14: 784.

- Vu Thuong N, Van Nghia K, Phuc Hau T, Thanh Long N, Thi Bao Van C, et al. (2007) Impact of a community sexually transmitted infection/HIV intervention project on female sex workers in five border provinces of Vietnam. Sex Transm Infect 83: 376-382.

- Charurat ME, Emmanuel B, Akolo C, Keshinro B, Nowak RG, et al. (2015) Uptake of treatment as prevention for HIV and continuum of care among HIV-positive men who have sex with men in Nigeria. J Acquir Immune Defic Syndr 68: S114-S123.

- Kripke K, Reed J, Hankins C, Smiley G, Laube C, et al. (2016) Impact and cost of scaling up voluntary medical male circumcision for HIV prevention in the context of the new 90-90-90 HIV treatment targets. PLoS One 11: e0155734.

- Chi P, Li X (2013) Impact of parental HIV/AIDS on children's psychological well-being: A systematic review of global literature. AIDS Behav 17: 2554-2574.

- Cluver L, Gardner F (2007) The mental health of children orphaned by AIDS: a review of international and southern African research. J Child Adolesc Ment Health 19: 1-17.

- Mwoma TPJ (2015) Psychosocial support for orphans and vulnerable children in public primary schools: Challenges and intervention strategies. South Afr J Educ 35: 1-9.

- Traore IT, Meda N, Hema NM, Ouedraogo D, Some F, et al. (2015) HIV prevention and care services for female sex workers: efficacy of a targeted community-based intervention in Burkina Faso. J Int AIDS Soc 18: 20088.

- Wu Z, Rou K, Jia M, Duan S, Sullivan SG (2007) The first community-based sexually transmitted disease/HIV intervention trial for female sex workers in China. AIDS 21: S89-S94.

- Bekker LG, Johnson L, Cowan F, Overs C, Besada D, et al. (2015) Combination HIV prevention for female sex workers: What is the evidence? Lancet 385: 72-87.

- Harper GW, Riplinger AJ (2013) HIV prevention interventions for adolescents and young adults: What about the needs of gay and bisexual males? AIDS Behav 17: 1082-1095.