Research Article: 2023 Vol: 26 Issue: 1S

The Determinants of financial literacy among Micro, Small, and Medium-sized Enterprise (MSMEs) in Bangladesh and Malaysia

Mohammad Nazim Uddin, Ankara University

Lutfun Nahar, Istanbul University

Mohammad Mizanur Rahman, International Islamic University

Norma BT Saad, International Islamic University

Citation Information: Nazim, U.M., Nahar, L., Rahman, M.M., & Saad, N.B. (2023). The Determinants of Financial Literacy Among Micro, Small, and Medium-Sized Enterprise (Msmes) In Bangladesh And Malaysia. Journal of Entrepreneurship Education, 26(S1),1-13.

Abstract

Micro, small, and medium-sized enterprises (MSMEs) play an essential role in many countries' economic and social development. This sector, in particular, generates new job opportunities, encourages competition, and, as a result, boosts productivity. MSMEs' long-term viability is crucial. MSMEs often fail during the first five years of their existence. Poor money management is one of the reasons for this failure, primarily related to a lack of financial literacy. Financial literacy is also challenging regarding human resources' ability to accept funding from financial institutions. Consequently, this paper examines the extent of financial literacy among Grameen Bank and AIM MSMEs in six divisions throughout Bangladesh and Malaysia. A standardised questionnaire was used to collect data from 402 AIM and Grameen Bank MSMEs. The level of financial literacy among Grameen Bank and AIM MSMEs operators is investigated using descriptive and inferential analysis. As a result of the findings, structural equation modelling was used to determine how the components are linked, which significantly impacts financial literacy. According to the study, knowledge, socialisation, agents, attitude, awareness, and skills are significant predictors of financial literacy among AIM and Grameen Bank MSMEs operators in Bangladesh and Malaysia. Policymakers should consider how the characteristics and financial literacy skills of MSMEs affect their behaviour and actions in micro-entrepreneurship when they make decisions about how to help MSMEs get more money. This is particularly evident in Malaysia and Bangladesh.

Keywords

MSMEs, Knowledge, Skill, Attitude, Behaviours, Entrepreneurs, Financial Literacy.

Introduction

Numerous researches has examined the significance of financial literacy. Brochado & Mendes (2021) offered the most convincing evidence that the level of financial literacy directly impacts the success or failure of the business community. Furthermore, financial literacy may significantly impact an entrepreneur's ability to succeed. According to Anshika & Singla (2022), the capacity to make sound financial decisions, such as choosing which financial products and instruments to use, is an important part of this job description.

SMEs' lack of financial literacy might partly be explained by their difficulties in obtaining traditional bank loans. This implies that several financial institutions' products are still proving challenging for micro-enterprises to use. Small and medium-sized enterprises (SMEs) choose quick and easy funding; especially free funding, above worrying about the cost of borrowing (Rao et al., 2021). Furthermore, micro-enterprise owners will rely on the government's handouts and avoid traditional financing because of its high costs and hassles. Financial tools might help all MSMEs grow their businesses in the future. Financial literacy may be improved by measuring the difficulty of using financial instruments.

Regarding the significance of financial literacy, we have established that financial literacy substantially impacts company performance and entrepreneurial abilities (Ozili, 2021; Molina-García et al., 2022). The capacity of MSMEs to access formal financial instruments can significantly increase their productivity compared to getting a package of free money or a grant from governments or other social organisations (Sahadeo, 2018). As a result, small business owners who lack basic literacy skills may encounter difficulties as they try to grow their operations. As a result, micro-enterprises prospects for survival and growth are bright if they can grasp the basics of financial instruments.

An additional benefit of financial literacy is that it is a critical component in formulating a financial strategy. According to Abdullah & Anderson (2015) financial literacy, namely one's perception of financial products, significantly impacts one's ability to make sound financial decisions. As a result, if MSMEs don't fully comprehend the financial instruments, they won't utilise them. Since many MSMEs are still uneducated in finance, they are persuaded to use traditional financing because of this lack of knowledge.

In terms of the causes of the amount of financial literacy, a lack of financial literacy leads to financial exclusion, a situation in which individuals cannot find and utilise financial products and services that meet their needs and expectations (LeBaron & Kelly, 2021). The common reasons for economic exemption have remained societal, source, and demand factors.

One of the most critical components of financial literacy is the ability to budget effectively. According to Garg & Singh (2018) budgeting mechanisms, mainly capital budgeting carried out by MSMEs, may influence financial literacy. A financial record should be added to the list as a second must-have. As the drawbacks of microbusiness financial behaviour, financial records, savings, financing, and budgeting that MSMEs face may be used to gauge financial literacy (Graña-Alvarez et al., 2022). A lack of knowledge about various financial loans and instruments, inadequate record-keeping methods, poor cash management, inappropriate saving habits, and a lack of financial literacy are all disadvantages of small business financial behaviour.

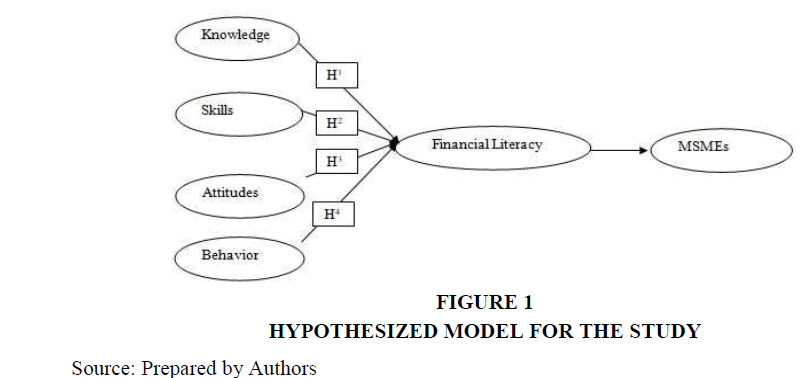

The main objective of this study is to assess the level of financial literacy among MSMEs, and the specific objectives of this study are as follows: To Identify the effect of knowledge on the financial literacy of MSMEs in Bangladesh and Malaysia. To identify the effect of skill on the financial literacy of MSMEs in Bangladesh and Malaysia. To identify the effect of attitudes toward financial literacy of MSMEs in Bangladesh and Malaysia. To identify the effect of behaviour on the financial literacy of MSMEs in Bangladesh and Malaysia. To recommend possible solutions that could enhance financial literacy amongst MSMEs in Bangladesh and Malaysia

Previous researchers such as Calcagno et al (2020); Goyal & Kumar (2021); Sevriana et al (2022) have used knowledge and skills, as well as behaviour, as measures of financial literacy to explain how people get access to financial services like savings accounts and credit cards and mortgages. On the other hand, these studies fail to consider the importance of financial literacy in everyday life. The authors fail to separate financial literacy's functional and non-functional components (knowledge and skills) in explaining financial inclusion. In support of this, it argues that the focus of research on financial literacy has shifted from information and comprehension to the development of financial skills, competencies, attitudes, and behaviour (Sugiarto et al., 2022). It should be noted that research on financial literacy has relied on subjective measurements of the concept rather than relying on traditional procedures for obtaining objective, dependable, and unidimensional measures (Widyastuti & Hermanto, 2022). Consequently, the study's primary goal is to assess the influence of financial literacy components on MSMEs' financial literacy in Bangladesh and Malaysia.

Literature Review

Financial literacy is multidimensional it varies things to different individuals. Different interpretations are not unexpected (Buteau, 2021). They defined financial literacy as the ability to make knowledgeable decisions about the use and management of money (Gora & Dahiya, 2022). Financial literacy is managing bank accounts, budgeting, saving for the future, and preventing or managing debt. Financial literacy enables customers to make informed and secure decisions on budgeting, spending, saving, and financial goods and services, from everyday banking to borrowing and future planning (Hamdan et al., 2021). Additional clarifications are provided for financial literacy.

Financial literacy is multidimensional it varies things to different individuals. Different interpretations are not unexpected (Buteau, 2021). They defined financial literacy as the ability to make knowledgeable decisions about the use and management of money (Gora & Dahiya, 2022) Financial literacy is managing bank accounts, budgeting, saving for the future, and preventing or managing debt. Financial literacy enables customers to make informed and secure decisions on budgeting, spending, saving, and financial goods and services, from everyday banking to borrowing and future planning (Hamdan et al., 2021). Additional clarifications are provided for financial literacy.

Financial literacy is multidimensional it varies things to different individuals. Different interpretations are not unexpected (Buteau, 2021). They defined financial literacy as the ability to make knowledgeable decisions about the use and management of money (Gora & Dahiya, 2022). Financial literacy is managing bank accounts, budgeting, saving for the future, and preventing or managing debt. Financial literacy enables customers to make informed and secure decisions on budgeting, spending, saving, and financial goods and services, from everyday banking to borrowing and future planning (Hamdan et al., 2021). Additional clarifications are provided for financial literacy.

Definition of MSMEs

Small and medium-sized businesses are defined differently in each nation. Different researchers and organisations have characterised MSMEs based on their specific focus. However, from an international business viewpoint, MSMEs were characterised based on each country's economic and social growth concept. MSMEs are defined slightly differently by various authorities. Multiple definitions have developed over time, sometimes generating misunderstandings when comparing diverse MSMEs-related statistics (Hamdan et al., 2021). According to Kuada (2021) two criteria to classify firms as micro, small, or prominent: the number of employees employed by the company and the value of its fixed assets (excluding land and building). In addition, the definition employs various thresholds for manufacturing and service businesses. Microenterprises for manufacturing and service organisations are those with between $5,000 and $50,000 in fixed assets or between 10 and 24 employees. Small manufacturing companies have between USD 50,000 and USD 100,000 fixed assets or between 25 and 99 employees. Medium-sized companies have between $100,000 and $300,000 in fixed assets or between 100 and 250 employees. Small businesses in the service industry must either have between $5,000 and $10,000 in fixed assets or between 10 and 25 workers. According to Hamdan et al. (2021) industrial policy, medium-sized businesses have between USD 100,000 and USD 150,000 in fixed assets and between 50 and 100 employees. If a company fits into the big group according to one criterion and the small category according to the other, the company will always be classified as significant. The modified definition of MSMEs industrial policy is widely recognised at the policy level.

According to SME Khan et al. (2022) the definition of MSMEs is often based on quantitative criteria such as a certain number of employees, sales volume, total assets, or total capital. Indeed, the description differs in significant ways. In the production sector, for instance, Micro businesses are those with a sales turnover of less than USD 100,000 and fewer than five employees, Small businesses are those with a sales turnover of between USD 100,000 and USD 5 million and fewer than 75 employees, and Medium businesses are those with a sales turnover of between USD 3 million and USD 15 million and fewer than 200 employees. While the solutions and other industries have different definitions, Micro business is defined as any business with a sales turnover of less than USD 300,000 or fewer than five employees, whereas a small enterprise is a business with a sales turnover of between USD 100,000 and USD 1 million or fewer than 30 employees (Méndez Prado et al., 2022). This definition is suitable since it considers the characteristics of local financial systems, which is often a fundamental idea for evaluating company success, and this study will focus only on microbusinesses and small businesses.

The Malaysian government has been experimenting with various micro financial services that address the demands of the poor for engaging in micro entrepreneurial endeavours. AIM programs are often the most prominent among the essential MFIs given in the nation to help the poor escape poverty. In addition, Islamic microfinance programs, such as AIM, based on the Syariah and Islamic Finance concepts, have tremendous potential for assisting poor MSMEs users in expanding and diversifying their financial activities and enhancing their contribution to the development of appropriate entrepreneurial activities.

Financial Knowledge and Financial Literacy in MSMEs

Kuada (2021) states that lack of knowledge and illiteracy in developing countries, especially among poor MSME users, is a barrier to financial inclusion. This is due to the exclusivity of financial goods and services. Style enhancements may deter underprivileged MSMEs from using banking services (Jenita et al., 2022). Sahadeo (2018), a person with financial literacy, knows various economic concepts. Financial literacy needs financial comprehension. According to Ozili (2021), financial literacy encompasses money, savings, borrowing, and security. Financial literacy enables individuals to make informed and judicious financial decisions about vital financial products and services. Lack of knowledge and financial literacy may cause MSMEs to be financially excluded (Sanderson et al., 2018). According to Kuada (2021), impoverished MSMEs consumers who lack expertise in financial products cannot use them.

In addition, it assists low MSME users in acquiring information and analysing financial goods and solutions to make informed decisions and derive the best application (Le Baron & Kelly, 2021). Economic knowledge consists of financial concepts. Financial literacy may help MSMEs agents appreciate the aim and methods of conservation (Jenita et al., 2022). Assert that MSMEs' financial literacy minimises information asymmetry since they are knowledgeable about financial market products. According to Khan et al. (2022), financial literacy enhances economic prospects and decision-making. Financial literacy increases people's understanding and knowledge of financial goods and services (Hutahayan, 2021). Financial literacy aids comprehension of economic solutions. Encourages the unbanked to shun alternative services (Grana-Alvarez et al., 2022). Financial literacy may be enhanced among underdeveloped MSMEs, particularly in developing countries. By easing decision-making, financial literacy enhances MSME cost savings, creditworthiness, and poverty alleviation (Jenita et al., 2022).

H1: Financial knowledge has a positive effect on the financial literacy of MSMEs.

Financial Skills and Financial Literacy in MSMEs

Financial inclusion is influenced by financial literacy as a demand-side variable, as previously documented by academics. Additionally, financial literacy initiatives assist the impoverished in gaining access to and implementing essential economic solutions. According to Buteau (2021), new economical solution providers entering the market with more complicated products and services need the identification of disadvantaged MSMEs. Low financial inclusion among disadvantaged MSMEs in rural areas indicates an increasing need for MSMEs to develop financial acumen. Emphasises that disadvantaged rural MSMEs have difficulties making economic decisions that complicate their lives rather than simplify them. To pick among the increasing quantity of economic goods and services on the market, they need a great deal of information and competence (Calcagno et al., 2020).

Financial literacy increases the efficiency and quality of financial services (Anshaika & Singla, 2022). Users of poor MSMEs demand a high level of economic knowledge and expertise to assess and evaluate economic goods such as bank accounts, savings items, credit and mortgage alternatives, payment instruments, opportunities, and insurance. Disadvantaged MSMEs consumers in developing countries who possess practical economic abilities can create a savings program (Brochado & Mendes, 2021). Butran (2021) discovered that training unbanked Indonesians about savings accounts boosted demand among those with low financial literacy. It assisted them in analysing and selecting essential items for their requirements and instructed them on their security rights and responsibilities. Garg & Singh (2018) observed that financial literacy enables disadvantaged MSMEs users to become better-informed economic decision-makers with a solid understanding of financial difficulties and options and key economic skills.

Financially savvy operators of underprivileged MSMEs who comprehend compound and loan interest may make quick product consumption judgments. Financial knowledge may increase item use, which is essential for financial inclusion.

H2: Financial skills have a positive effect on the financial literacy of MSMEs

Financial Attitudes and Financial Literacy in MSMEs

Five fundamental concepts test financial knowledge: basic interest, content interest, Time Value of Money, the effects of pumping on the price level, and return on investment (ROI) (Goyal & Kumar, 2021). People with less financial expertise often miscalculate interest rates (Calcagno et al., 2020). According to an earlier study, participants must answer three questions about calculating interest rates. Those who correctly answer two or three questions are deemed informed, whilst those who answer fewer questions are deemed ignorant.

Saving is an essential financial practice. This feature demonstrates financial goal-setting expertise. The idea emphasises frequent savings. Participants are presented with four savings-related claims and asked to choose the most suitable one. Four statements address regular and irregular cost reductions (Jenita et al., 2022).

Financial problems Money is not just a practical good but also a psychological manifestation of worth or a symbolic representation (Hamdan et al., 2021). Money is a powerful driver of behaviour in micro, small, and medium-sized enterprises and a factor influencing work satisfaction and stress. This suggests that the money attitudes of MSME owners may affect their economic understanding. The value a person has on money influences their financial literacy. One's attitude toward money influences their ability to handle finances. Positive views about money contribute to higher financial awareness and literacy, but negative attitudes result in poor financial management, lack of understanding, and financial ruin.

Hutahayan (2021) analysed people's budgeting inclinations and discovered that self-assured budgeters try to justify their expenses. Those who scored lower acknowledged budget control based on emotional rather than cognitive cost management concepts. A person's budgeting capacity relies on how they see the money. If someone recognises that money is one of their most valuable resources, they will attempt to adhere to a budget to maintain a consistent level of spending. Emotional tracking of one's spending budget is unproductive since it results in poor records.

H3: Financial attitude has a positive effect on the financial literacy of MSMEs.

Financial Behaviour and Financial Literacy in MSMEs

An additional component of financial knowledge that improves financial well-being (Hutahayan, 2021). It relies on how individuals act and make financial decisions, such as paying bills on time, monitoring finances, saving for the future, relying less on borrowings, preparing for future financial needs, managing excess funds, etc. Responsible individuals are more likely than irresponsible individuals to enjoy a financially secure future.

According to Goyal & Kumar (2021), lower financial literacy is associated with less retirement planning, asset accumulation, stock market participation, alternative financial services usage, and debt. Brochado & Mendes (2021) remark that making informed financial decisions is essential to establishing stable personal finances, which may result in more efficient resource allocation and financial stability.

Garg & Singh (2018) assert that financial literacy programs and interventions boost the uptake of savings accounts and insurance in developing nations where most of the population lacks access to formal financial services. Training in financial literacy improves the fiscal conduct of disadvantaged households (Calcagno et al., 2020). It raises knowledge and comprehension of financial products and affects saving and financial planning.

Hutahayan (2021) discovered that disadvantaged households who can budget, plan, and save for retirement are more likely to use essential financial services, especially in developing countries. Financial education helps the poor's savings, insurance, retirement planning, financial market participation, bank account ownership, investments, debt management, and financial habits in developing countries (Grana-Alvarez et al., 2022).

Sahadeo (2018) argue that 30 or 90-day late payments on credit accounts result from human conduct. Inattention or ineffective cash flow management are reflected in loan defaults. Ozili (2021) advocates for developing financial solutions that steer individuals toward positive financial behaviors while preserving their freedom of choice. Thus, emerging countries have leveraged edutainment to push disadvantaged families' financial behaviour toward formal financial products. Widyastuti & Hermanto (2022) discovered that financial literacy influences insurance adoption. According to self-reports, financial literacy education increases saving.

A comprehensive meta-analysis of 168 articles covering 201 previous studies revealed that interventions to improve financial literacy explain just 0.1% of the variance in financial behaviour, with lesser gains in low-income groups (Anshika & Singla, 2022). After correcting for previously absent psychological factors, the findings demonstrated that the partial effects of financial literacy were significantly diminished. Hypothesis:

H4: Behaviour positively affects the financial literacy of MSMEs in Bangladesh and Malaysia

Research Method

The objectives of the research were met via the use of a survey methodology. A questionnaire was utilised to collect data to assess individuals' financial literacy. Due to the respondents' low literacy, the poll was done only in person. The descriptive and inferential analysis determines MSMEs' financial literacy awareness Figure 1. Locations with a high proportion of small and micro businesses were prioritised (MSMEs). Respondents for this study are MSMEs operators who have engaged in the microfinance programs of Malaysia and Bangladesh. The participants in this study have previously operated MSMEs and expressed interest in doing so again. This study used a random sampling technique. The final field study data were imported into SPSS 26 and evaluated to achieve the required statistical results.

The questionnaire is disseminated to 500, and the questionnaire collecting is 402. This research identified MSMEs using a multistage sampling approach, including sub-counties and villages. In addition, after identifying the villages, a simple random sample method was used to choose the needed number of impoverished families in each village. For identifying purposes, unique identifiers were issued to the study's chosen MSMEs.

The questionnaire is disseminated to 500, and the questionnaire collecting is 402. This research identified MSMEs using a multistage sampling approach, including sub-counties and villages. In addition, after identifying the villages, a simple random sample method was used to choose the needed number of impoverished families in each village. For identifying purposes, unique identifiers were issued to the study's chosen MSMEs.

Data Analysis

The sample of respondents comprised mostly of both AIM and Grameen Bank (GB) customers, who were both stakeholders in the study. The respondents were sorted into groups according to their gender, marital status, education degree, and monthly income. These categorisations will be covered in further detail in the following sections. According to Table 1, there were 402 male respondents with a mean of 3% and 390 female respondents with a percentage of 97%. It is important to consider that most of the responders here were female and had an opposing viewpoint.

| Table 1 Demographic Characteristics Of Respondents (N = 402) |

|||||

|---|---|---|---|---|---|

| Variable | Frequency | % | Variable | Frequency | % |

| Gender | Secondary | 19 | 4.7 | ||

| Male | 12 | 3.0 | Degree/Hon's | 13 | 3.2 |

| Female | 390 | 97.0 | Masters | 3 | 0.7 |

| Marital Status | PhD | 2 | 0.5 | ||

| Single | 16 | 4.0 | Others | 2 | 0.5 |

| Married | 362 | 90.0 | Sales turnover per year | ||

| Divorce | 18 | 4.5 | Below 1000 USD | 391 | 97.3 |

| Others | 6 | 1.5 | 1001 - 25000 USD | 8 | 2.0 |

| Age | 25000 – 50000 USD | 2 | 0.5 | ||

| 18-29 Years | 19 | 4.7 | 50000 USD above | 1 | 0.2 |

| 30-39Years | 99 | 24.6 | Number of Employees | ||

| 40-49 Years | 145 | 36.1 | Below 5 | 374 | 93.0 |

| 50 years above | 139 | 34.6 | 6 to 10 | 26 | 6.5 |

| Education | 10 to above | 2 | 0.5 | ||

| Primary | 362 | 90.0 | |||

Table 1 shows that 362 (90 %) of the respondents were married, 16 (4%) were single, and 18 were divorced=4.5%, indicating that most of these females are married. The following Table also shows the number of female entrepreneurs who seems to be prominent in the productive services to engage in their business activities effectively. Table 1 shows that 145 (36.1 %) of the respondents were aged 40-49 years old, 139 (34.6%) were 50 years above, and 99 of them were aged 30-39 years old=24.6 %, indicating that the majority of these females are 40 years above old. The following Table shows that 90 % (362 respondents) had a primary level of education, 19 (4.7%) respondents had primary education, and the rest 13 respondents (3.2%) had a degree or hon's level education, which was a bachelor's degree. It indicates that 90 % of the total respondents from these primary levels are well informed. Some of them were in their first year of study, while others were in the final year of their study. According to Table, 391 respondents (97.3%) had a yearly income below USD 10 thousand, and eight respondents (2%) had a yearly income of USD 25 thousand. The number of employees is below 5 (93%), and 26 responded that 6.5 % of employees are 10.

In the present investigation, a factor loading cut-off of 0.50 was used to decide which elements would be included in the factor analysis. Only those elements were kept in the model whose eigenvalues were equal to or higher than 1. A solution that satisfactorily explained at least half of the overall variation in the data was adequate. After examining the data using principal component analysis using a varimax rotation, the initial set of 25 variables was whittled down to only five elements. It was found that the commonality of each variable ranged from 0.575 to 0.975, with 0.975 being the highest. This suggests that these five factors-knowledge, skills, attitude, behaviour, and financial literacy-could capture the variation in the initial values with a satisfactory degree of accuracy Table 2.

| Table 2 Factor Loading, Model Summary And Kmo Test |

|||||

|---|---|---|---|---|---|

| Component | |||||

| 1 | 2 | 3 | 4 | 5 | |

| K1-Savings is very important to ensure that my business will survive. | 0.975 | ||||

| K2-The higher the saving rate, the higher return for my business. | 0.915 | ||||

| K3-The ability to compute interest is very important | 0.892 | ||||

| K4-Knowledge of the rate of inflation is important for my business decision | 0.865 | ||||

| K5-Financial knowledge is important to understand products operations | 0.875 | ||||

| S1-Financial skills are essential for entrepreneurs | 0.795 | ||||

| S2-I should visit my customers to improve my financial skills. | 0.785 | ||||

| S3-The use of financial software will enhance my financial skills. | 0.758 | ||||

| S4-I use financial skills to explain the products to customers. | 0.725 | ||||

| S5-Financial skills can be developed via practice | 0.710 | ||||

| A1-I will always maintain a healthy cash flow to manage my business successfully. | 0.766 | ||||

| A2-I should not allow my business to incur expenses unnecessarily | 0.745 | ||||

| A3-My business should achieve the targeted profit it has set for business. | 0.710 | ||||

| A4-I should constantly monitor my business performance to achieve my target | 0.693 | ||||

| A5- Positive financial attitude is essential for achieving profit. | 0.634 | ||||

| B1-I review of alternative solutions and the choice of the most suitable behaviour are essential for entrepreneurs | 0.811 | ||||

| B2-I should visit my customers to improve my positive communication. | 0.757 | ||||

| B3-I treating others with respect will enhance my business. | 0.675 | ||||

| B4-I take accountability for our mistakes in explaining the products to customers. | 0.684 | ||||

| B5-Builds strong professional relationships at work can be developed via practice | 0.679 | ||||

| FL1-Financial literacy will ensure my business prosper | 0.674 | ||||

| FL2-Financial literacy enables me to make wise business decisions | 0.639 | ||||

| FL3-Financial literacy has a positive impact on my business wealth | 0.615 | ||||

| FL4-Financial literacy enables me to expand my business | 0.595 | ||||

| FL5-Financial literacy will lead to sustainable business | 0.575 | ||||

| Model Summary | |||||

| R | 0.729a 0.531 0.499 0.38263 |

||||

| R Square | |||||

| Adjusted R Square | |||||

| Std. Error of the Estimate | |||||

| KMO and Bartlett's Test | |||||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .893 5380.497 435 0.000 |

||||

| Approx. Chi-Square | |||||

| Bartlett's Test of Sphericity df | |||||

| Sig. | |||||

| Cronbach's Alpha | 0.867 | ||||

| Cronbach's Alpha Based on Standardised Items | 0.918 | ||||

| N of Items | 30 | ||||

Even though an examination of the skewness and kurtosis values was required, it is advised that such an examination is more suited for samples with more significant numbers (Hair et al., 2010). The size of this study's sample is deemed substantial since it had a total of 402 independent samples. The consistency and stability of a measure are tested to see whether or not the measure can be relied upon. The dependability coefficient known as Cronbach's alpha reveals how effectively the items in a collection are positively associated with one another. When calculating Cronbach's alpha, the average intercorrelations among the items used to measure the idea are considered. Internal consistency dependability is stronger when Cronbach's alpha is closer to 1 than 0.

A regression analysis was done to determine whether the personality traits significantly predicted how aggressive the participants thought they were. Based on the regression analysis results, the two predictors' explanatory R-value is 0.729 (R square=0.531, adjusted R square=0.499, standard error of the estimate=0.38263).

The standardised loading, Cronbach's alpha, composite reliability, and average variance extraction for the research variables are shown in Table 2. Before conducting an exploratory factor analysis (EFA), the sample adequacy was evaluated using the Kaiser-Meyer-Olkin formula (KMO). The results of this study allow the researchers to conclude that the variables were valid measurements. Additionally, the composite reliability values range from 0.867 to 0.918. Composite reliability of 0.70 or higher, when interpreted as an estimate of Cronbach's alpha for internal consistency reliability, is regarded as satisfactory. As a result, the findings of this research indicate that the measurements were accurate.

Similarly, Bartlett's Test of Sphericity has also been carried out to guarantee an adequate correlation between the variables. As seen in Table 2, the outcomes of the KMO test come in at 0.893, and the findings of the Bartlett test indicate that they are significant (p.000). These results show that the sample size was big enough to successfully allow factor analysis and the separation of the different latent variables from each other.

According to the results of the ANOVA, people's perceptions of whether or not they are financially included considerably vary depending on whom they ask. According to the requirements, the p-value for each construct was significant at p 0.05. Table 3 displays the findings of the ANOVA, which can be seen above. According to the data, the outcome of the ANOVA substantially impacts the level of financial literacy, which indicated that interventions to increase financial literacy significantly account for 0.000 % of the differences in financial literacy.

| Table 3 Anovaa |

||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 60.771 | 25 | 2.431 | 16.604 | 0.000b |

| Residual | 53.584 | 366 | 0.146 | |||

| Total | 114.356 | 391 | ||||

| a. Dependent Variable: FL factor score 5 for analysis 1 | ||||||

| b. Predictors: (Constant), FK factor score 4 for analysis 1, FSA factor score 3 for analysis 1, FA factor score 2 for analysis 1, FS factor score 1 for analysis 1 | ||||||

The results of this study also show that financial literacy improves several behaviours, such as understanding how to participate in the (economic) market, making investments, managing debt, and understanding how the economy works. These are important for the poor who live in developing countries where H1-produced research was done. It is also a skill that can be learned with financial literacy, H2 knowledge, and the desire to program their money to change their behaviour so they can stick to their plans to save and borrow. These are all things that can be accomplished. In terms of financial literacy, the results also showed that there isn't always a strong link between a person's skills and how much they participate in the economy. The impoverished may be given behaviours that do not align with their cognitive schemas, which may hinder their efforts to become economically involved. This may be detrimental to their progress. The results don't go against the H4 found during this investigation. This is the second part of a series that started with H3, which talked about how attitude positively affects financial literacy in rural Malaysia. On the other hand, the results showed that attitude had a significant, positive effect on financial literacy. In particular, one of the aspects of financial literacy that contributes to economic inclusion in Bangladesh and Malaysia is attitude. In addition, financial literacy use and the use of financial goods in developing nations that are directly tied to attitude depend on the individuals' level of confidence in financial organisations and the things and services that these organisations provide. When consumers know more about essential systems, they feel more confident, and their interests are better protected.

Conclusion

The new research contributes to the existing body of knowledge on financial literacy among MSMEs and will substantially impact the degree to which company owners in Bangladesh and Malaysia are financially included. According to the study's findings, attitude affects the financial literacy of company entrepreneurs working for AIM and Grameen Bank. However, the study showed that knowledge, skill providers, attitude, and behaviour are significant determinants of financial literacy in Bangladesh and Malaysia. This selection in norms of financial literacy, which influences their behaviours as business owners, might be described using aspects of MSMEs. The primary reasons why micro, small, and medium-sized enterprises (MSMEs) struggle with financial literacy are a lack of recognition of the various types of financial items and whether or not they match specific requirements, a low level of confidence, and specific behaviours that prevent use and trust in formal economic items create barriers to access. So, policymakers should consider the MSMEs' financial literacy factors and qualities, which affect their actions and behaviours, especially those of business owners, when they use financial literacy interventions to help MSMEs join the economy, especially in AIM and Grameen Bank. In addition, authorities should ensure that initiatives designed to improve financial literacy are geared toward altering micro, small, and medium-sized enterprises (MSMEs) and boosting knowledge, skills, attitudes, and behaviours that contribute to financial literacy. In the same vein, governments should encourage micro, small, and medium-sized enterprises (MSMEs) participating in AIM and Grameen Bank to become economically included by encouraging them to adopt financial products suitable for their current financial status and position. Because individuals learn from one another via statements, imitation, and modelling in social interaction, proponents of financial literacy should also ensure that it is used within the context of a social setting rather than in isolation. In addition, policymakers in Bangladesh and Malaysia should be aware that promoting MSMEs among the financially literate population may not be possible using financial literacy software alone. There may be a desire to build and deploy future apps for financial education that focus more on behavioural change for the company entrepreneur's knowledge and abilities to be used acceptably. This may be a possibility.

References

Anshika, A., & Singla, A. (2022). Financial literacy of entrepreneurs: a systematic review. Managerial Finance.

Indexed at, Google Scholar, Cross Ref

Brochado, A., & Mendes, V. (2021). Savings and financial literacy: a review of selected literature.European Review of Business Economics,1, 61-72.

Buteau, S. (2021). Roadmap for digital technology to foster India's MSME ecosystem—opportunities and challenges.CSI Transactions on ICT,9(4), 233-244.

Calcagno, R., Alperovych, Y., & Quas, A. (2020). Financial literacy and entrepreneurship. New Frontiers in Entrepreneurial Finance Research, 271-297.

Garg, N., & Singh, S. (2018). Financial literacy among youth.International Journal of social economics.

Indexed at, Google Scholar, Cross Ref

Gora, K., & Dahiya, J. (2022). Problems Faced by Micro, Small, and Medium Enterprises: A Review.IUP Journal of Entrepreneurship Development,19(1).

Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis.International Journal of Consumer Studies,45(1), 80-105.

Indexed at, Google Scholar, Cross Ref

Graña-Alvarez, R., Lopez-Valeiras, E., Gonzalez-Loureiro, M., & Coronado, F. (2022). Financial literacy in SMEs: A systematic literature review and a framework for further inquiry.Journal of Small Business Management, 1-50.

Hamdan, H., Pratikto, H., & Sopiah, S. (2021). A conceptual framework of entrepreneurial orientation, financial literacy, and msmes performance: the role of access to finance.Devotion: Journal of Research and Community Service,3(2), 67-82.

Indexed at, Google Scholar, Cross Ref

Hermawan, A., Gunardi, A., & Sari, L.M. (2022). Intention to Use Digital Finance MSMEs: The Impact of Financial Literacy and Financial Inclusion.Scientific Journal of Accounting and Business, 17 (1), 171-182.

Hutahayan, B. (2021). The relationships between market orientation, learning orientation, financial literacy, on the knowledge competence, innovation, and performance of small and medium textile industries in Java and Bali.Asia Pacific Management Review,26(1), 39-46.

Indexed at, Google Scholar, Cross Ref

Jenita, J., Yuwono, A., Heriana, T., Dewi, S., & Sari, M.D. (2022). The importance of Digital-based Payment Management Knowledge for MSME Drivers: a Study of Financial Literacy.Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences,5(2), 9073-9084.

Khan, F., Siddiqui, M.A., & Imtiaz, S. (2022). Role of financial literacy in achieving financial inclusion: A review, synthesis and research agenda.Cogent Business & Management,9(1), 2034236.

Indexed at, Google Scholar, Cross Ref

Kuada, J. (2021). Financial inclusion and small enterprise growth in Africa: emerging perspectives and research agenda.African Journal of Economic and Management Studies.

Indexed at, Google Scholar, Cross Ref

LeBaron, A.B., & Kelley, H.H. (2021). Financial socialisation: A decade in review.Journal of family and economic issues,42(1), 195-206.

Méndez Prado, S.M., Zambrano Franco, M.J., Zambrano Zapata, S.G., Chiluiza García, K.M., Everaert, P., & Valcke, M. (2022). A Systematic Review of Financial Literacy Research in Latin America and The Caribbean.Sustainability,14(7), 3814.

Indexed at, Google Scholar, Cross Ref

Molina-García, A., Diéguez-Soto, J., Galache-Laza, M.T., & Campos-Valenzuela, M. (2022). Financial literacy in SMEs: a bibliometric analysis and a systematic literature review of an emerging research field.Review of Managerial Science, 1-40.

Indexed at, Google Scholar, Cross Ref

Ozili, P.K. (2021). Financial inclusion research around the world: A review. InForum for Social Economics, 50(4),457-479.

Indexed at, Google Scholar, Cross Ref

Rao, P., Kumar, S., Chavan, M., & Lim, W.M. (2021). A systematic literature review on SME financing: Trends and future directions.Journal of Small Business Management, 1-31.

Indexed at, Google Scholar, Cross Ref

Sahadeo, C. (2018). A Review of Financial Literacy Initiatives in Selected Countries.Financial Literacy and Money Script, 1-20.

Indexed at, Google Scholar, Cross Ref

Sanderson, A., Mutandwa, L., & Le Roux, P. (2018). A review of determinants of financial inclusion.International Journal of Economics and Financial Issues,8(3), 1.

Sevriana, L., Febrian, E., Anwar, M., & Faisal, Y.A. (2022). A proposition to implement inclusive Islamic financial planning in Indonesia through bibliometric analysis.Journal of Islamic Accounting and Business Research.

Indexed at, Google Scholar, Cross Ref

Sugiarto, H., Dearelsa, G.B., Anisyah, D., & Islakhudin, F.N.A. (2022). The role of mbkm in improving msme performance through financial literacy and digital marketing in ketanireng village, prigen district, pasuruan Regency.Procedia of Social Sciences and Humanities,3, 1029-1039.

Widyastuti, M., & Hermanto, Y.B. (2022). The effect of financial literacy and social media on micro capital through financial technology in the creative industry sector in East Java.Cogent Economics & Finance,10(1), 2087647.

Indexed at, Google Scholar, Cross Ref

Received: 11-Sep-2022, Manuscript No. AJEE-22- 12540; Editor assigned: 13-Sep -2022, Pre QC No. AJEE-22- 12540(PQ); Reviewed: 27-Sep-2022, QC No. AJEE-22- 12540; Revised: 04-Oct-2022, Manuscript No. AJEE-22- 12540(R); Published: 11-Oct-2022