Research Article: 2022 Vol: 26 Issue: 3S

The Determinants of Foreign Direct Investment: Empirical Investigation from Kingdom of Saudi Arabia

Jihen Bousrih, Jihen Bousrih, Economics department, Princess Nourah Bint Abdulrahman University-KSA

Kolthoom Alkofahi, Prince Sultan University, Riyadh, KSA

Citation Information: Bousrih, J., & Alkofahi, K. (2022). The determinants of foreign direct investment: empirical investigation from kingdom of Saudi Arabia. Academy of Accounting and Financial Studies Journal, 26(S3), 1-14.

Abstract

The study aims to investigate the relation between the foreign direct investment (FDI) and some selected economic indicators such as economic growth, robustness of the capital market and the employment. We apply a VECM model over the period 1990-2019 to study the short run and long run relation between the selected variables. After testing the robustness of the model, the results were significant and supportive for the determinants of FDI. The foreign direct investment is affected by several factors. The paper’s findings suggest a significant long run relationship between FDI, robustness of the capital market and employment. We conclude an insignificant relation between FDI and economic growth in Saudi Arabia.

Keywords

Foreign Direct Investment, Economic Growth, Employment, VECM, Saudi Arabia.

JEL Classifications

E24, E44, E61, F21, J21.

Introduction

Foreign direct investment (FDI) is identified as the major tool for the movement of international capital. It also seen as an integral part of an open and effective international economic system and a major catalyst to development. Developing countries, emerging economies and countries in transition have come increasingly to see FDI as a source of economic development and modernization, income growth and employment (OECD, 2002). This study on Foreign Direct Investment tries to highlight the relation of FDI with the macroeconomic growth, capital market and employment. Attracting FDI is a vital objective for the decision makers, given the gains that it creates in the job market (more and better jobs), technological spillovers to firms, increased demand for local services (Ferrett & Wooton, 2021). Based on the host countries’ conditions, it is widely accepted that the host countries benefit from FDI through the technological spillover (Aitken, 1999). In fact, spillover effect lunches technology, helps create more competitive environments across firms, strengthen the human capital abilities, and through globalizations, more international trade integration. As a result, these effects speed up the productivity that lead to a higher economic growth which in turn create more positive effects on the economy; such as reducing the poverty of the host country.

Looking at FDI for Saudi Arabia (KSA, 2021), one can notice that the inflows of FDI to KSA had gradually declined due to political factors and the volatility of oil prices. However, with the Vision 2030; that was established in 2015 and supported economic diversification, helped to reverse the trend. According to UNCTAD's World Investment Report 2020, FDI flows increased by 7% between 2018 and 2019, reaching USD 4.6 billion. This is mainly because the country removed the ownership limits for foreign strategic investors. Similarly, the stock of FDI rose in 2019 and reached USD 236 billion, by far the highest number among Arab countries. According to preliminary data from UNCTAD, inflows to Saudi Arabia in the first half of 2020 rose by 12% on the year to USD 2.6 billion. On the other hand, political and social tensions, reduced access to credit, and the policy of 'Saudization' (which started in 2011 and favours a domestic labour force) have all been obstacles to FDI. Due to the importance of infrastructure to attract investors, the government of Saudi Arabia has endowed a heavily budget to support the national infrastructure to attract investment and the foreign investment seems to be the most efficient way to diversify the economy and offer job opportunities for younger generations. The government opened the retail and wholesale sectors to 100% foreign ownership and has launched a large privatization programme. The authorities welcome FDI due to its ability to transfer technology, employ and train the national workforce, foster economic development, and enhance local raw materials. Moreover, KSA offers access to the world's largest oil reserves, very low energy costs and a high standard of living; and these factors are decisive for foreign investors (Export Enterprises SA, 2021).

This paper tries to shed some light on the determinants of FDI in Saudi Arabia. More precisely, it is devoted to find if the economic characteristics such as the capital structure, the economic growth and the employment level, have a high influence to attract or terminate the absorbance of FDI in Saudi Arabia. The novelty of our research is related to the selection of the country and the variables to test the impact of robustness of the capital market, and labor market on Foreign direct investment in Saudi Arabia. In fact, this paper greatly contributes to the current literature in the investigation of the relation between the FDI and the economic growth, the structure of the capital market and the employment. To our knowledge, this research is the first attempt that study the determinants of FDI in Saudi Arabia using a VECM analysis (Aljebrin, 2017).

The structure of the paper is as follows. Following this Introduction section, Section 2 discusses the literature review. Section 3 is designed to give a brief review of FDI in Saudi Arabia. Section 4 describes the model, methodology and data. Section 5 presents empirical results, followed by the Conclusions and policy implications being provided in Section 6.

Literature Review

Many contemporary studies were committed to explore the determinants of Foreign direct investment (FDI) on economic variables. The FDI- growth nexus in host country is a well-studied subject in the development economics literature, both theoretically and empirically, however, the results are mixed. Even though it is widely accepted that the FDI enhances economic performance for developing countries (Balasubramanyam et al., 1999; Vu & Noy, 2009; Ridzuan et al., 2017), others found some evidence that FDI exert negative effect on economic growth and some economic factors in the host countries (Lensink & Morrissey, 2006; Adams, 2009) or found that there is no relation between FDI and economic growth (Albassam, 2015). To help clear up the dispute, this section is designed to review the quantitative assessment effect of FDI on the different economic variables in two-folds; from a global perspective, and from the KSA perspective.

Stamatiou & Dritsakis (2014) in their study on Greece examined the connection between the unemployment rate, foreign direct investment, and economic growth over the period 1970-2012. Applying different econometric models on annual data, the results emphasized on the long-run relationship among the variables. The VECM Granger causality results indicated, both in the short run and in the long run, a strong unidirectional causality between economic development and foreign direct investments with direction from economic development to FDI. The long run effect showed that a 1% increase in GDP will cause an increase of 0.23% of FDI. The results were more encouraging in the short run; a 1% increase in the growth increases the FDI by 1.3%. Boateng et al. (2015) analyzed the effect of macroeconomic variables on FDI inflows in Norway under the location-specific advantage. The study used a quarterly data over the period of 1986 to 2008, and employed different tests such as the cointegrating regressions with Fully Modified OLS (FMOLS), and the vector autoregressive and error correction model (VAR/VECM). The study finds that some factors generate more inflows of FDI, such as, the real GDP, sector GDP, exchange rate and trade openness. On the other hand, the study also showed that some other factors exert negative and significant effect on the inflows of FDI, such as: money supply, inflation, unemployment and the interest rate. The paper urged policy makers to develop the macroeconomic policies to promote dynamic competitive advantage in the home country. Azad (2017) investigated the role of good governance, level of inflation, economic growth/market size, market openness, and ease of doing business in attracting FDI inflows to the GCC countries over the period 2002-2014. The study employed the two-stage least squares (2SLS) regression model to test the research hypotheses. The results of the study did not support the hypothesis that the independent variables (except market openness) generate more of FDI inflows. However, except for Kuwait, the study failed to reject that market openness generate more inflows of FDI. On the impact on money supply on FDI, few articles could be found. A study of Shafiq et al. (2015) examined the impact of money supply and economic growth on the FDI in Pakistan. Applying the data for the period 1970-2013 and using the Generalized method of moments (GMM), they found that the coefficient of M1 and economic growth positively and significantly enhances the performance of FDI and a positive relation between FDI and Domestic credit. Chen & Singh, (2017) examine the linkage among foreign direct investment (FDI), domestic credit expansion and economic growth for six Pacific Island countries. Using panel data over 1982-2011, the authors relate the interaction between domestic credit to private sector and FDI to its impact on output. This study makes use of panel cointegration and the generalized method of moments estimators. The empirical results showed that FDI and domestic credit to private sector serve as substitutes to promote output in these small economies. In addition to previously mentioned literatures, Dinh et al. (2019) studied the impact of FDI and other variables on economic growth for 30 lower-middle-income developing countries over the period 2000–2014. The study employed a Vector Error Correction Model and Fully Modified OLS to estimate the impact in the short run and the long run. The study found different outcomes based on the timespan; in the short-run, FDI and domestic credit negatively affect economic growth, while the Money supply positively affects economic growth. For the long run period, FDI, human capital, total domestic investment, and domestic credit for the private sector have a positive effect in the long run. Under the scope of estimating FDI, the study addressed that those efforts to attract FDI in the short-run will not be rewarded with the expected benefits, and that attracting FDI in the long-term become a vital policy to be adopted by the government (Alfaro, 2017).

Albassam (2015) studied the impact of foreign direct investment on economic growth and employment in Saudi Arabia during the period of 1999 to 2012. The findings showed that when applying a VAR model, it was inadequate to conclude a clear relation between FDI and economic growth for KSA. However, the model presents a positive relation between FDI inflows and employment rate in Saudi Arabia, but one should keep in mind that half of the Saudi workforce is employed by the public sector. On the other hand, Belloumi & Alshehri (2018) studied the link between domestic capital investment, FDI, and economic growth in KSA over the period of 1970-2015 using the ARDL bounds testing to cointegration approach. The study found that FDI negatively affect the non-oil GDP growth; in the long run, there are negative bidirectional causality between non-oil GDP growth and FDI, negative bidirectional causality between non-oil GDP growth and domestic capital investment, and bidirectional causality between FDI and domestic capital investment. The short run results also found that the FDI negatively affects domestic capital investment, whereas the domestic capital investment affects negatively FDI in the long run. Therefore, the researchers conclude that trade openness and finance development positively affect FDI inflows in the long run. In fact, the Saudi economic growth is relying on trade openness and domestic credits accorded to private sector. On the other hand, Alkofahi (2020) studied the effect of FDI on the unemployment rate in Saudi Arabia over the period of 2005-20018. The study was triggered by the Saudi vision that aimed at reducing the unemployment rate for Saudi citizens to 9 percent. For that, the analysis was divided into two cases; the first case used the total Unemployment rate in KSA as the dependent variable, and the second case used the unemployment rate for Saudi citizen as the dependent variable. Both cases used the FDI, the real gross domestic product, and the inflation rate as the independent variables. The empirical result from employing the OLS regression supported the assumptions that FDI lowers the unemployment rates in KSA. Fadol (2020) analyzed the casual relationships between FDI, GDP and non-oil exports in Saudi Arabi over the period of 1970-2019, using the ARDL, VECM, and Toda-Yamamoto causality test. The study concluded that, there is independent causal relationship between FDI and GDP at 5% significance level in KSA, a unidirectional causal relationship between FDI and non-oil exports, and a bidirectional casual effect between non-oil exports and GDP in KSA.

In summary, after reviewing the literatures, one can point out that the studies have insofar been inconclusive on whether the FDI helps to improve the economic performance in the long or in the short run. Hence, this study will re-assess this relationship to help analyses the effectives determinants of FDI in KSA.

Stylized Facts: Foreign Direct Investment in KSA

The Kingdom of Saudi Arabia (KSA) is one of the largest economies in the Middle East and North Africa (MENA) region. Oil revenues in Saudi Arabia represent about 90-95% of the total revenue earned from exports; therefore, economic development of KSA depends positively on the oil revenues (Almubarak, 2009). The situation of KSA is pressurized in the form of diversification, liberalization due to its great dependence on oil revenues (Wright, 2016). Therefore, Saudi Arabia adopts new strategies in Vision 2030 to overcome this situation (Abdulrahim, 2015).

Saudi Arabia is characterized by an oil-based economy with powerful authority controls over key economic activities. It owns about 16% of the world's oil resources, and it is ranked as the first exporter of oil among OPEC organization. The oil sector represents nearly 87% of budget returns, 90% of export revenues.

After 2007-2008 crisis till nowadays, the world economy is slowing down, and we can perceive a decline in growth for 2019 to 3.1 percent. Growth remains weak with the continuous raise of trade barriers and geopolitical tensions. We can see that the US-China trade tensions will cumulatively reduce the level of global GDP by 0.2 percent by 2020. Growth is also declining due to specific country factors in emerging market economies such as low productivity growth and age factors in advanced economies. During the last three years, the economic growth in KSA was supported by the rollover of the inflation allowance, and a pickup in public investment; however, the lower oil price environment and higher expat fees keeps a lid on activity in Saudi Arabia (Habibi & Mohammad, 2017).

After the recent oil crisis in 2015-2016, Saudi Arabia adopted new regulations to diversify its economic activities. As a source of external finance, promoting foreign direct investment (FDI) seems to be a good alternative to improve economic growth, strengthening local economies, and improving the competitiveness of the country. China, India, Malaysia, South Korea and Thailand are examples in this regard. The foreign direct investments in Saudi Arabia increase since 2005 and did not stop developing to reach 28 billion dollars in 2010. The main source of these investments is North America. But during the last decade, the Foreign Direct Investment decrease around the world. In 2017, FDI decrease by 23% equals 1430 billion dollars, according to the last report published by United Nations on Trade and Development. The case of Saudi Arabia is the most relevant; this country attracted less FDI than in 2016. Others countries like Oman and Jordan, take advantage of this decrease by attracting the foreign investments to their local companies. Recently we record an increase of FDI in Saudi Arabia by 1.2 USD in Mar 2019, compared to an increase of 1.1 USD bn in the previous quarter.

According to the vision 2030, the FDI inflows will be partly governed by the privatization program, which is facing obstacles. In 2018, the authorities plan to sell four flour milling companies and Saudi Medical Services Facilities (SMS) as a test of investor perceptions of the local business environment. In 2020, KSA completed the sale of SMS, and two milling companies that in turn make some international companies to be interested in the local companies such as Bunge and Louis Dreyfus company. The privatization program has faced hurdles including gaps in the legal framework (which are being addressed), the lack of corporate structures and balance sheets in the public sector, and hazy revenue projections in some target companies. There are also clear challenges and trade-offs regarding the retention of workers. For these reasons, the privatization program is likely to progress slowly, though as the legal underpinning is expanded and refined, and as the entities earmarked for sale are corporatized, so the program should become a magnet for significant FDI inflows in the years ahead. Of course, FDI inflows can accelerate without a privatization program. Much of the Vision 2030 blueprint rests on FDI being channeled into energy, mining, manufacturing (such as defense equipment), logistics and transport, and other sectors. Some of these sectors, such as power, will require restructuring—and if not privatization then at least corporatization—but others, such as defense manufacturing are effectively virgin territory. In late January Saudi officials unveiled plans for $425bn of total investment by 2030, known as the National Industrial Development and Logistics Program. At a ceremony to launch the program, government officials announced deals worth SR204bn ($54bn), including agreements with the US defense firm, Boeing, and the French equivalent, Thales, as well as plans for a petrochemicals plant with Pan-Asia, the Chinese chemicals company.

Overall, these are ambitious plans, and will require not just substantial foreign capital but careful sequencing and coordination across government agencies (Samba report 2019).

Data

This section represents an evaluation of the long run association between FDI and other economic indicators. Indeed, FDI become an important cornerstone to support the economic diversification in Saudi Arabia. For the analysis purposed, the variables were selected based on the potential connection with the inflows of FDI, economic growth, money supply, domestic credit, and labor force. The definitions of the variables that are included in the econometric model are listed in Table 1. The data applied in the model were collected from the World Bank (2019) tables and are all annual and covers the period of 1992 to 2019. The analysis of the data was conducted using EViews 10.

| Table 1 Economic Variables Included in the Model | ||

| Name | Code | Definition |

| Foreign Direct Investment | FDI | Foreign direct investment, net inflows (BoP, current US$) |

| Economic growth | GDP | GDP (constant 2010 US$) |

| Domestic credit | DCRED | Domestic credit to private sector (% of GDP) |

| Money supply | MOY | Broad money to total reserves ratio |

| Labor force | LF | Labor force participation rate for ages 15-24, total (%) (modeled ILO estimate) |

Methodology

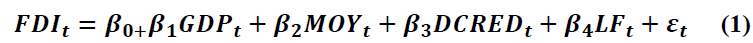

The study aims to investigate the determinants that impact the FDI in the short and long run for KSA. This paper implements a similar model to that of Dinh et al. (2019) and Shahbaz & Rahman (2010), the model is expressed as follows:

Where β0 is the intercept, β1,β2,β3 and β4 represent the partial coefficients for growth rate (GDP), money supply (MOY), domestic credits (DCRED) and labor force (LF).

Empirical Results

Descriptive and Correlation Analysis

To know more about the quantitative insight across the data set of the selected variables, the descriptive statistic and multicollinearity investigation was conducted. The mean and the standard deviation are presented for the range and the coverage of the data. The results, Table 2 below, show a positive mean of all the variables during the period of study. Yet, a high standard deviation presents in the FDI and GDP compared to the other variables is referred to the units of the variables used in the model (Elimam, 2017).

| Table 2 Descriptive Statistics | ||||||

| Variable | Mean | Median | Maximum | Minimum | S. D | Obs |

| 7.83E+09 | 3.64E+09 | 3.95E+10 | -1.88E+09 | 1.14E+10 | 30 | |

| 4.78E+11 | 4.49E+11 | 7.04E+11 | 2.94E+11 | 1.35E+11 | 30 | |

| DCRED | 33.68468 | 33.03942 | 58.11449 | 14.82210 | 12.70862 | 30 |

| MOY | 2.893504 | 2.338400 | 7.846067 | 0.554073 | 2.348598 | 30 |

| LF | 20.78077 | 19.37850 | 33.14600 | 15.84700 | 4.337674 | 30 |

To see how the variables of the model are correlated, a simple and important test is conducted; the correlation test (checking for multicollinearity). The correlation test is a table which displays the correlation coefficients for the different variables in the model. Table 3 represent the correlation matrix coefficients. As can be seen, the correlation between FDI and LF, and FDI and MOY are moderate and negative. But positively and weakly correlated with GDP and DCRED. The highest correlation coefficient is – 65.38% in the MOY series.

| Table 3 Correlation Matrix | |||||

| Variables | FDI | DCRED | GDP | LF | MOY |

| FDI | 1 | ||||

| DCRED | 0.3728 | 1 | |||

| GDP | 0.3280 | 0.9368 | 1 | ||

| LF | -0.4750 | -0.6852 | -0.5819 | 1 | |

| MOY | -0.6538 | -0.7799 | -0.8102 | 0.6401 | 1 |

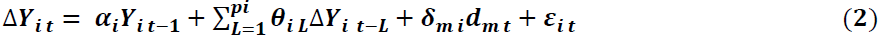

Unit Root Test

Before proceeding to estimate the effect of GDP, DCRED, MOY, and LF on FDI, a unit root test is performed. This test is used to test the stationarity of each of the time series and to determine the order of integration of the data. The unit root tests used are Augmented Dickey-Fuller (ADF) and Phillips Perron (PP) unit root tests through Akaike Information Criterion (AIC) with constant (see equation 2) (Maddala & Wu, 1999). Agreeing with Hill et al. (2001), if the time-series variables are non-stationary, variables should not be utilized in any regression. All variables should be stationary to avoid any specious regression (Sultanuzzaman et al., 2018).

Where αi is the order of the lag, and dmt is the vector of deterministic variables.

The test was employed on the level and the first difference of the time series in order to examine the order of integration of each variable. The results of the unit root test are shown in Table 4 below. As can be seen, LF is stationary in level; cointegrated of order zero (I(0)), however, the results confirm the presence of the unit root and that FDI, GDP, and MOY are cointegrated of order one (I (1)).

| Table 4 Unit Root Tests | ||

| ADF Test | PP test | |

| Level | ||

| FDI | -2.114016 | -1.649299 |

| GDP | 0.396080 | 0.329037 |

| DCRED | -0.710660 | -0.338816 |

| MOY | -1.067808 | -1.063229 |

| LF | -5.121968*** | -6.063767*** |

| 1st Difference | ||

| FDI | -3.295439** | -3.310900** |

| GDP | -4.575442*** | -4.602608*** |

| D CRED | -4.955155*** | -7.283628*** |

| MOY | -5.432959*** | -5.432959*** |

| LF | -2.918817* | -2.841009* |

Conducting the unit root test for the variables in the first difference, the results reject the null hypothesis of the presence of a unit root among the variable (Khayat, 2020).

Cointegration Test

In the following step, a study of the possible long-term relationship between the interested variables must be conducted. For this reason, the Johansen cointegration test is employed and the results are summarized in the Table 5 below. According to the table, the results show that, there are two cointegration vectors at 5% significant level. This means that, one can conclude that, a long-term association exists between the dependent variable FDI and the independent variables GDP, DCRED, MOY and LF, and that the variables are cointegrated (Jansen, 1995).

| Table 5 Cointegration Relation | ||||

| Assumption of No Cointegration |

Trace Test | Maximum Eigenvalue Test | ||

| Statistic | Critical Value | Statistic | Critical Value | |

| No cointegration | 0.825845* | 116.0052 | 48.93863* | 33.87687 |

| 1 cointegration | 0.734518* | 67.06658 | 37.13384* | 27.58434 |

| 2 cointegration | 0.552040* | 29.93274 | 22.48546* | 21.13162 |

| 3 cointegration | 0.224460 | 7.447281 | 7.117474 | 14.26460 |

| 4 cointegration | 0.011710 | 0.329807 | 0.329807 | 3.841465 |

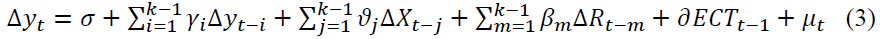

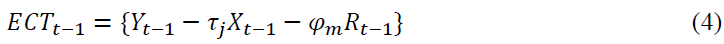

Vector Error Correction Model

The VECM can be formulated as follows:

With

Where Δ the first difference and k is is the optimal lag length determined by AIC criterion. The endogenous variable yt represents the foreign direct investment and the exogenous variable Xt represents growth domestic product, domestic credit, money supply and labor force.

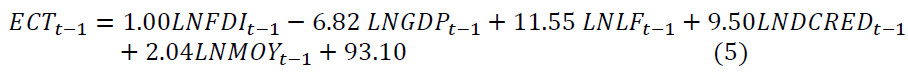

Note that, the first part of Table 6 presents the breakdown of the error correction term ECTt-1 which represents the cointegration equation in the long run of the model (see equation (5)).

| Table 6 VECM Results | |

| Cointegrating Eq: | CointEq1 |

| LNFDI(-1) | 1.000000 |

| LNGDP(-1) | -6.824858 |

| [ -1.73261] | |

| LNLF(-1) | 11.55885** |

| [ 3.81631] | |

| LNDCRED(-1) | 9.506882** |

| [ 3.47011] | |

| LNMOY(-1) | 2.045024** |

| [ 3.70778] | |

| C | 93.10045 |

| Error Correction: | D(LNFDI) |

| CointEq1 | -0.5346631 |

| [ -2.20996] | |

| D(LNFDI(-1)) | 0.294715** |

| [0.95478] | |

| D(LNGDP(-1)) | -0.761994 |

| [ -0.08162] | |

| D(LNLF(-1)) | -6.552080 |

| [-0.77114] | |

| D(LNDCRED(-1)) | 3.260101 |

| [0.88680] | |

| D(LNMOY(-1)) | 0.861658 |

| [0.56880] | |

| C | -0.102025 |

| [-0.20239] | |

| R-squared | 0.234581 |

| F-statistic | 1.072660 |

ECTt-1 Can be expressed as follows:

The short-term relationship is presented in the second part of Table 6. The coefficients express the deviation from the long run relationship and shows the variations in the variables in the next period. According to the results above, the short-run relationship across the variables is insignificant and only significant at 5% significance level for the lagged FDI coefficient; a 1% increase in the FDI in the last period will significantly increase the FDI in the next period by 0.29%. Which indicates that the immediate or short-run impact of existing FDI will improve the existing conditions to host more international firms in the next period. This can be explained by the policy adopted by Saudi Arabia regarding the foreign investment which is very tight in the country (El-Awady et al., 2020).

The first part of the table shows the long-run relationship between the variables. Taking the effect of GDP growth on the FDI in the long-run, one can say that, the long run parameter of the economic growth is negative but not significant; if the GDP growth increases by 1% the FDI will decrease on average by 6.82 percentage point in the long-run. This coefficient can be explained by the important reliance of the Saudi economy on oil. In fact, 90% of the GDP is related to petroleum industry and there is an exclusion of any foreign investment in the country. Recently, decision makers in Saudi Arabia have changed toward an economic diversification by giving new opportunities and incentives to foreign investors. The Saudi General Investment Authority (SAGIA) permits now foreigners to own property and reduces taxes by 15% for foreign entities with an annual profit more than 100,000 Saudi Riyals. Therefore, due to these changes, we expect in the coming years a positive relationship between the economic growth and foreign investments in KSA, (Mahmood & Alkhateeb, 2018).

The table also emphasize on the long-run relationship between the labor force and FDI; the parameter of labor force participation rate is significant at 5% significance level; a 1% increase in the labor force will enhance the performance of FDI in the long-run and increase is by 11.55%. the long-run relationship between the supply of money and FDI is also positive and significant at 5% significance level; a 1% increase in MOY will increase the FDI in the long-run by 2%. Finally, the domestic credit positively and significantly affects the FDI at a level of 5%. A 1% increase in DCRED will increase the FDI in the long-run by 9.5%.

The results of table 6 show that the short-run relationship between the endogenous variable (FDI) and exogenous variables (DCRED, MOY, LF, GDP) is insignificant at 5% significance level. However, the table also emphasis on the existence of a long run relationship between FDI and the exogenous variables (DCRED, MOY, LF, GDP) at a significance level of 5%.

The results of the Table 6 suggest the importance of the listed variable in the investment decision making. In fact, companies in the developing and some emerging markets cite the structure of the capital market as one of the constraints that the foreign investors face. Domestic firms in these countries are much likely to face credit obstacles than multinational firms. If the foreign firms borrow from the local banks and the financial institutions can’t support these credits, it might exacerbate domestic firms by crowding them out of the capital market. After the 2015 crisis in Saudi Arabia, the government decide to open the access to the foreign investor and to support the financial institutions in the country. In 2019, Saudi Arabia owns more than 28% of the GCC’s total banking assets and is the second biggest banking sector regarding the assets and market capitalization.

Robustness of the Model

To test the robustness of the VECM model, some diagnostic tests for the error terms must be performed; the serial correlation LM test, the residual normality test, and the Residual Heteroskedasticity test.

The Serial Correlation LM Test

Table 7 represent the test of the serial correlation across the error terms. The null hypothesis of this test is that there is no serial correlation of the equation errors up to lag k, whereas the alternative hypothesis indicates the existence of a serial correlation among the error terms. The important component of the test is the first part that presents the two statistical tests F-statistic and R-squared and the probabilities associated to these tests. According to the table, the probabilities of the f- statistics fail to reject the null hypothesis, and hence, there is no serial correlation across the error terms.

| Table 7 VEC Residual Serial Correlation LM Tests | ||||||

| Null hypothesis: No serial correlation at lag h | ||||||

| Lag | LRE* stat | df | Prob. | Rao F-stat | df | Prob. |

| 1 | 20.62442 | 25 | 0.7134 | 0.755538 | (25, 23.8) | 0.7543 |

| 2 | 18.89189 | 25 | 0.8023 | 0.673752 | (25, 23.8) | 0.8332 |

| 3 | 17.33577 | 25 | 0.8693 | 0.603639 | (25, 23.8) | 0.8912 |

| Null hypothesis: No serial correlation at lags 1 to h | ||||||

| Lag | LRE* stat | df | Prob. | Rao F-stat | df | Prob. |

| 1 | 20.62442 | 25 | 0.7134 | 0.755538 | (25, 23.8) | 0.7543 |

| 2 | 46.05649 | 50 | 0.6323 | 0.512250 | (50, 7.9) | 0.9269 |

| 3 | 1357.166 | 75 | 0.0000 | NA | (75, NA) | NA |

The Residual Normality Test

Many researchers believe that multiple regression requires normality. We can perform a hypothesis test in which the null hypothesis states that the residuals are normally distributed, against the alternative hypothesis that they are not normally distributed. According to Table 8, the p-value indicates that we fail to reject the null hypothesis and that the error terms are normally distributed.

| Table 8 VEC Residual Normality Tests | ||||

| Component | Skewness | Chi-sq | df | Prob.* |

| 1 | 0.499423 | 1.122405 | 1 | 0.2894 |

| 2 | 0.243007 | 0.265735 | 1 | 0.6062 |

| 3 | 0.484411 | 1.055943 | 1 | 0.3041 |

| 4 | 0.880179 | 3.486215 | 1 | 0.0619 |

| 5 | 0.204554 | 0.188291 | 1 | 0.6643 |

| Joint | 6.118590 | 5 | 0.2949 | |

| Component | Kurtosis | Chi-sq | df | Prob. |

| 1 | 4.801526 | 3.651183 | 1 | 0.0560 |

| 2 | 3.071231 | 0.005708 | 1 | 0.9398 |

| 3 | 2.808444 | 0.041280 | 1 | 0.8390 |

| 4 | 4.093364 | 1.344876 | 1 | 0.2462 |

| 5 | 2.099575 | 0.912111 | 1 | 0.3396 |

| Joint | 5.955159 | 5 | 0.3106 | |

| 1 | 4.773589 | 2 | 0.0919 | |

| 2 | 0.271443 | 2 | 0.8731 | |

| 3 | 1.097223 | 2 | 0.5778 | |

| 4 | 4.831091 | 2 | 0.0893 | |

| 5 | 1.100402 | 2 | 0.5768 | |

| Joint | 12.07375 | 10 | 0.2802 | |

| *Approximate p-values do not account for coefficient estimation | ||||

The Residual Heteroskedasticity Test

The last diagnostic test to be performed is the Heteroskedasticity test for the error terms. Heteroskedasticity occurs when the variance for all observations in a data set are not the same. The null hypothesis of the test is that all the error terms are having the same variance (homoscedastic) against the alternative hypothesis that the error terms are heteroskedastic.

Like the other diagnostic tests, the results of the probability of the F-statistic fail to reject the null hypothesis that the error terms are having the same variance and there is no sign of Heteroscedasticity. See Table 9 below.

| Table 9 VEC Residual Heteroskedasticity Tests | |||||

| Joint test | |||||

| Chi-sq | df | Prob. | |||

| 333.3412 | 330 | 0.4382 | |||

| Individual components | |||||

| Dependent | R-squared | F(22,4) | Prob. | Chi-sq(22) | Prob. |

| res1*res1 | 0.931956 | 2.490257 | 0.1946 | 25.16282 | 0.2894 |

| res2*res2 | 0.765632 | 0.593961 | 0.8104 | 20.67205 | 0.5411 |

| res3*res3 | 0.795726 | 0.708254 | 0.7370 | 21.48461 | 0.4910 |

| res4*res4 | 0.842813 | 0.974881 | 0.5840 | 22.75595 | 0.4156 |

| res5*res5 | 0.954060 | 3.775943 | 0.1026 | 25.75963 | 0.2621 |

| res2*res1 | 0.986103 | 12.90152 | 0.0116 | 26.62478 | 0.2258 |

| res3*res1 | 0.883821 | 1.383164 | 0.4145 | 23.86317 | 0.3544 |

| res3*res2 | 0.626830 | 0.305407 | 0.9700 | 16.92440 | 0.7675 |

| res4*res1 | 0.878634 | 1.316284 | 0.4374 | 23.72313 | 0.3619 |

| res4*res2 | 0.551441 | 0.223520 | 0.9915 | 14.88891 | 0.8670 |

| res4*res3 | 0.693390 | 0.411177 | 0.9221 | 18.72153 | 0.6625 |

| res5*res1 | 0.967941 | 5.489505 | 0.0548 | 26.13440 | 0.2460 |

| res5*res2 | 0.966506 | 5.246563 | 0.0593 | 26.09566 | 0.2476 |

| res5*res3 | 0.673554 | 0.375145 | 0.9406 | 18.18597 | 0.6949 |

| res5*res4 | 0.611084 | 0.285681 | 0.9766 | 16.49926 | 0.7904 |

Based on the diagnostic test of the residuals, Tables 7, 8, and 9 indicate that the model is stable and we cannot detect any econometric problem, therefore, the findings represent that the model is perfect and well fit.

Conclusion

FDI is identified as one of the most important movements of international capital. After the 2015 crisis and the collapse of the oil price in Saudi Arabia, the government seeks for alternative income generating channels, other than Oil dependency, starting from 2016. As a result, this action led to more efforts to promote and attract FDI in KSA. This study was motivated by the call of the 2030 Vision of KSA and seeks to explore the association between the foreign direct investment (FDI) as the endogenous variable, and how it is affected by some other economic variables such as: economic growth, robustness of the capital market and the employment. The data are collected from the world bank (2019) table and are all annual and covers the period 1990-2019. EViews software package was employed to analyze some diagnostic tests and to study the short run and long run relation between the selected variables using the Vector Error Correction Model (VECM). After testing the robustness of the model, the results were significant and supportive for the determinants of FDI. The foreign direct investment is affected by several factors. The paper’s findings suggest a significant long run relationship between FDI, robustness of the capital market and employment at 5% significance level. According to the study, the largest long-run affect was produced by the Saudi labor force; a 1% increase in the labor force will increase the FDI in the long-run by 11.55%. the capital market also has a bulky effect on the FDI; a 1% increase in the DCRED will increase FDI in the long run by 9.5%. Money supply also affect the FDI in the long run by more than one-to-one. These results give some signals to the Saudi government to improve these indicators as they produce a vital impact on attracting more inflows of FDI.

The ambiguity of the relation between FDI and economic growth in the short-run and in the long-run persist in this paper. In fact, this paper found that a 1% increase in the economic growth will reduce the FDI by an average of 6.82%, however, it is insignificant at 5% significance level. This paper stands to the literatures that can’t support the significance of economic growth in enhancing and attracting more FDI’s to Saudi Arabia. These results could be attributed to the ambiguity due to the important reliance of the Saudi economy on oil. In fact, 90% of the GDP is related to petroleum industry and there is an exclusion of any foreign investment in the country. Recently, decision makers in Saudi Arabia have changed toward an economic diversification by giving new opportunities and incentives to foreign investors. Therefore, due to these changes, we expect a positive relationship between the economic growth and foreign investments in KSA in the coming years (Mahmood & Alkhateeb, 2018).

On the other hand, the findings of this paper support the existence of the long run relationship between the FDI and the money supply, domestic credit, and labor force, which indicates that the policy makers for Saudi Arabia should put more effort on attracting long lasting foreign firms and not to give many chances for short term FDIs. Based on the results above, the policies to attract FDI have to be revised and directed toward the long-term view of FDI. These policies that aim to attract FDI at all costs in the short run will not be beneficial to the economy (Dinh et al., 2019). Another suggestion to the policy makers is to enhance the skilled human resources, labor force conditions, and to increase the labor productivity. Since FDIs are always attracted by technology, there is an urgent need to be highly skilled labor in order to utilize the new technology and to create a positive technological diffusion effect. As the government of KSA is working on achieving the goals of 2030 vision by increasing FDI from 3.8% to 5.7% of GDP, and increasing private sector contributions to the economy from 40% to 65% over the same period, the Saudi Arabian government has pursued several initiatives to improve the country’s business environment, and hence, we expect more reforms will be devoted to meet these goals, and that positive impacts of the current economic indicators will bring more prosperities and development to KSA’s economy.

References

Aitken, B.J. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605-618.

Indexed at, Google Scholar, Cross Ref

Albassam, B.A. (2015). Does Saudi Arabia’s economy benefit from foreign investments?. Benchmarking: An International Journal, 22(7), 1214-1228.

Indexed at, Google Scholar, Cross Ref

Alfaro, L. (2017). Gains from foreign direct investment: Macro and micro approaches. The World Bank Economic Review, 30(Supplement_1), S2-S15.

Aljebrin, M.A. (2017). Impact of non-oil export on non-oil economic growth in Saudi Arabia. International Journal of Economics and Financial Issues, 7(3), 389-397.

Alkofahi, K. (2020). The Effect of Foreign Direct Investment on the Unemployment Rate in Saudi Arabia. International Journal of Economics and Finance, 12(10), 1-1.

Almubarak, N.A. (2009). Determinants of foreign direct investment in the Kingdom of Saudi Arabia: A cross country analysis. Georgetown University.

Indexed at, Google Scholar, Cross Ref

Azad, N. (2017). Determinants of FDI Inflows To GCC Countries – An Empirical Investigation. International Journal of Economics, Commerce and Management, March.V(3).

Belloumi, M., & Alshehry, A. (2018). The impacts of domestic and foreign direct investments on economic growth in Saudi Arabia. Economies, 6(1), 18.

Indexed at, Google Scholar, Cross Ref

Ferrett, B., & Wooton, I. (2021). Targeting FDI. International Tax and Public Finance, 28(2), 366-385.

Boateng, A., Hua, X., Nisar, S., & Wu, J. (2015). Examining the determinants of inward FDI: Evidence from Norway. Economic Modelling, 47, 118-127.

Chen, H., & Singh, B. (2017). Output impacts of the interaction between foreign direct investment and domestic credit: Case study of Pacific Island countries. Studies in Economics and Finance.

Indexed at, Google Scholar, Cross Ref

Dinh, T.T.H., Vo, D.H., & Nguyen, T.C. (2019). Foreign direct investment and economic growth in the short run and long run: Empirical evidence from developing countries. Journal of Risk and Financial Management, 12(4), 176.

Indexed at, Google Scholar, Cross Ref

El-Awady, Sally & Al-Mushayqih, Sarah & Al-Oudah, E. (2020). An analytical study of the determinants of foreign investment in Saudi Arabia "Saudi Vision 2030". The Business and Management Review,11.

Indexed at, Google Scholar, Cross Ref

Elimam, H. (2017). Determinants of foreign direct investment in Saudi Arabia: A review. International Journal of Economics and Finance, 9(7), 222-227.

Fadol, H.T.A. (2020). Interactions between Non-oil exports and GDP, FDI in Saudi Arabia 1970-2019: A practical manual ARDL Approach and Toda-Yamamoto Causality.

Habibi, F.K., & Mohammad, S. (2017). Foreign direct investment and economic growth: Evidence from Iran and GCC. Iranian Economic Review, 21, 601-620.

Jansen, K. (1995). The macroeconomic effects of direct foreign investment: The case of Thailand. World Development, 23(2), 193-210.

Khayat, S.H. (2020). Determinants of international foreign portfolio investment flows to GCC countries: An empirical evidence. International Journal of Business and Management, 15(10), 51-59.

KSA, G., (2021). Public Investment Fund Program 2021-2025.

Mahmood, H., & Alkhateeb. (2018). Foreign direct investment, domestic investment and oil price nexus in Saudi Arabia. 8(4), 147-151.

Shafiq, N., Ahmad, H., Hassan, S. (2015). Examine the effects of money supply M1 and GDP on FDI In Pakistan. International Journal of Current Research, 7(3), 13498-13502.

Shahbaz, M., & Rahman, M.M. (2012). The dynamic of financial development, imports, foreign direct investment and economic growth: cointegration and causality analysis in Pakistan. Global Business Review, 13(2), 201-219.

Sultanuzzaman, M.R., Fan, H., Akash, M., Wang, B., & Shakij, U.S.M. (2018). The role of FDI inflows and export on economic growth in Sri Lanka: An ARDL approach. Cogent Economics & Finance, 6(1), 1518116.

Indexed at, Google Scholar, Cross Ref

Vu, T.B., & Noy, I. (2009). Sectoral analysis of foreign direct investment and growth in the developed countries. Journal of International Financial Markets, Institutions and Money, 19(2), 402-413.

World Bank, G., (2019). Foreign direct investment, net inflows (% of GDP).

World Bank, G., (2019.). GDP, PPP (current international $).

Received: 20-Jan-2022, Manuscript No. AAFSJ-22-10929; Editor assigned: 20-Jan-2022, PreQC No. AAFSJ-22-10929(PQ); Reviewed: 27-Jan-2022, QC No. AAFSJ-22-10929; Published: 31-Jan-2022