Research Article: 2019 Vol: 23 Issue: 6

The Determinants of Lebanese Small and Medium Enterprises Access to Debt

Zainab Abdulwadood Jadoua, Beirut Arab University

Nihal Farid Mostapha, Beirut Arab University

Abstract

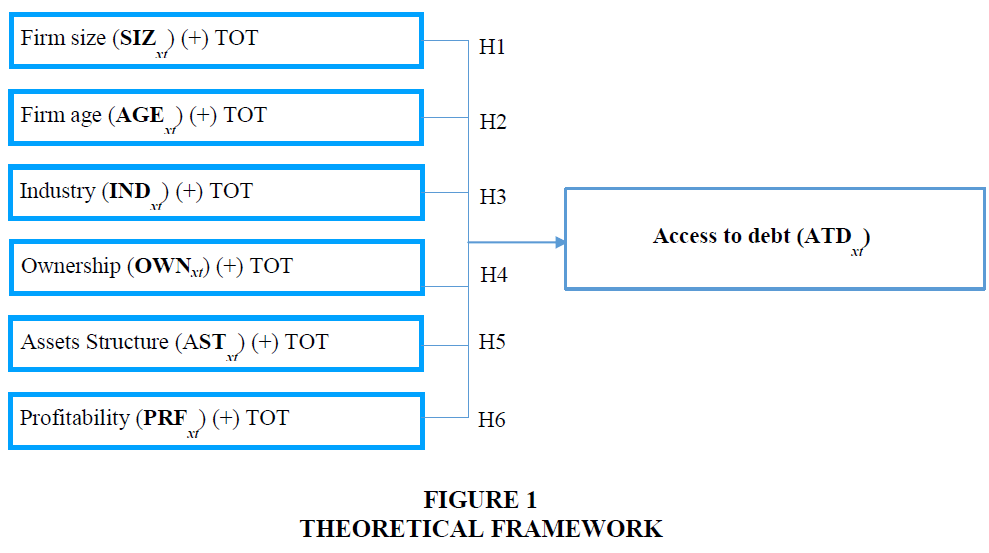

This study aims to explore the determinants of SMEs access to debt in Lebanon. Access to debt determinants were represented by firm size, firm age, type of industry, type of ownership, tangibility and profitability. Data of 102 SMEs for the period 2014 till 2017 were collected from twelve official audit firms located in Beirut-Lebanon. Additionally, Generalized Least Squares method was used to conduct regression analysis with panel data. The findings reveal that firm age, type of industry and profitability as determinants have a positive effect on access to debt adopting trade-off theory. However, other determinants such as firm size and type of ownership have a negative effect on access to debt adopting pecking order theory. In addition, tangibility has no significant effect on access to debt. Hence, both trade off theory and pecking order theory explain Lebanese SMEs financial behavior as regards access to debt.

Keywords

SMEs, Access to Debt, Trade off Theory, Pecking Order Theory.

Introduction

Since 1950s empirical studies started focusing on SMEs role as the cornerstone for economic growth for any country. Countries around the world realized the major contribution of SMEs to economy and that is why during 1980s and 1990s all countries have sought approaches to boost the number of SMEs in the economy (Barrow, 1998). SMEs importance comes mainly from the fact of strong SMEs ability to create new jobs. In USA SMEs constitute about 99.7% of total number of firms while 3% of SMEs in USA create about 70% of new jobs across all industries (Scarborough, 2011). In Europe SMEs constitute about 99.8% of total number of firms and create about 66% of new jobs (Daskalakis & Psillaki, 2006). In the developing countries such as Singapore and Malaysia SMEs create about 68% and 65% respectively (Vandenberg et al., 2016). On the other hand, SMEs in USA create about 51% of private GDP (Scarborough, 2011) while in Europe SMEs create about 57.4% of added value to the GDP (Muller et al., 2016) which make them key driver for increasing productivity and growth (Scarborough, 2011). Moreover, SMEs has major role represented by their ability to decrease poverty (Vandenberg et al., 2016), motivate innovation (Abbasi et al., 2018), enhance exports (Vandenberg et al., 2016), create competition (Kaseb & Kamal El Din, 2007) and support sustainable development (Ayuso & Navarrete-Baez, 2018).

SMEs finance gap raised in 1931 when United Kingdom government sponsored Macmillan Committee to define reasons behind the declined economy at that time. The Committee noticed that one of the main reasons behind the economy decline was financial needs of SMEs that were not served internally or externally. SMEs finance gap was created from the difference between demand and supply for finance through equity and/or debt sources which represent the capital structure (Carter & Evans, 2000). As one of the financing sources, Schumpeter (1934) confirm that access to debt plays key role in enhancing economic growth, productivity, innovation and opportunities availability for startup firms. Studies around the world have been reporting SMEs difficulties in getting access to debt (Zhao et al., 2006; Irwin & Scott, 2010; Kira, 2013; Nikaido et al., 2015; Kythreotis et al., 2018; Wlodarczyk et al., 2018). SMEs are confronting financing gap and difficulty in getting access to debt on global level (Abraham & Schmukler, 2017). Matta (2018) confirms that access to finance is still considered as main challenge for about 26.7% of SMEs around the world. While In 2011, registered SMEs in the developing countries confronted credit gap between 26%-32% of total credit (Abraham & Schmukler, 2017).

In Lebanon, SMEs constitute about 96% of registered firms, employ 50% of the working force and produce 27% of total revenues (International Monetary Fund & World Bank, 2016). Lebanese SMEs are described as dominated mainly by family, management centralized, usage of simple information system, internal growth stoppage, financing problems and preferring internal financing over external one (Naimy, 2004). SMEs in developing countries have different criteria in terms of number of employees from one country to another. For instance, World Bank Group adopted 100 employees as main criterion to distinguish SMEs from big firms (Alibhai et al., 2017), while United Nations (2019) adopted 250 employees as maximum number to consider a firm as SMEs. This study adopts Lebanese Ministry of Economy and Trade (2014) criterion of 100 employees to distinguish SMEs.

SMEs access to debt is a major obstacle confronted in Lebanon (Naimy, 2004; Hamdan, 2016; Farran & Fawaz, 2018). About 42% of micro and small enterprises are restricted by lack of access to debt (Hamdan, 2016) while 20% of private sector credit is provided to SMEs which reflect the poor finance, inability of SMEs to provide required collateral, and pedestrian business plan (Naimy, 2004). Farran & Fawaz (2018) believe that SMEs struggle in Lebanon to get access to debt is a result of war and inequity that caused structural tardiness which in return led to the delay of Lebanese SMEs.

Defining access to debt determinants was the focus of many studies since it can smooth the path for SMEs to get access to debt. However, each study considered the effect of different set of determinants on access to debt such as firm size, firm age, type of industry, type of ownership, SMEs location, tangibility, profitability and many others. In addition, based on Ross, Westerfield & Jaffe (2013) firms define their financial behaviour that compose their capital structure either under trade-off theory or pecking order theory which in return explain SMEs access to debt behaviour. It is important to mention that many authors interested in exploring determinants that affect access to debt used capital structure determinants and theories represented by trade-off theory and pecking order theory to explain the financial behaviour of SMEs in requesting access to debt such as Viviani (2008); Bhaird & Brian (2009); Harvie et al. (2013); Forte et al. (2013); Mortiz (2015); Masiak et al. (2017); Abdulsaleh & Worthington (2018). However, the lack of financial transparency and poor financial reporting in Lebanon (Naimy, 2004) resulted in restricting the empirical studies on SMEs in Lebanon. According to the researcher knowledge there is no empirical study in Lebanon handled this subject before by providing clear empirical evidence on the determinants of access to debt nor discuss Lebanese SMEs financial behavior.

Therefore, this study is an attempt to fulfil this gap by reviewing the common determinants that have been adopted by other studies in the developed and the developing countries. Then the study explores and investigates the effect of the determinants on Lebanese SMEs access to debt. Study also examines the financial behavior approach that is adopted by Lebanese SMEs in terms of trade-off theory or pecking order theory regarding access to debt.

The following sections of this paper are organized as follow: theoretical background and literature review of SMEs’ capital structure theories. The following section discusses the determinants of access to debt theoretically and empirically and provides hypotheses development. Thereafter, methodology, analysis steps and results of the descriptive and regression analysis are provided. Finally, the study presents finding interpretation, conclusion, and limitations.

Theoretical Background and Literature Review

This section focuses on providing a comprehensive view of SMEs access to debt by presenting the theoretical background and literature review of SMEs access to debt determinants.

SMEs Capital Structure Theories and Access to Credit Behaviour

The first proposition of Modigliani and Miller (MM) theory in 1958, in a world without taxes debt-equity ratio does not affect the value of a firm. On the other hand, MM second proposition, states that in a world with taxes and no financial distress costs the value of a firm increases with high debt-equity ratio (Ross et al., 2013). Therefore, Abeywardhana (2015) argues that in a real world where taxes and financial distress costs in terms of direct and indirect legal or administrative expenses exist led to emerging of several theories used for interpreting and balancing between maximising the value of the firm and minimising the cost of capital. Ross et al. (2013) explained this balance by two theories adopted by the firms to manage their capital structure represented by trade-off theory (TOT) and pecking order theory (POT).

Kraus & Litzenberger (1973) presented trade-off theory stating that increasing level of debt in capital structure would increase bankruptcy risk related to the difficulty of repaying required annual interest and principal payment (Kythreotis et al., 2018). Ehrhardt & Brigham (2011) on the other hand focused on bankruptcy high costs represented by legal expenses, accounting expenses, difficulty in keeping customers who might start looking for a stable supplier, difficulty in retaining key employees who start leaving declining firm, difficulty in keeping relations with suppliers who start refusing giving credit, and probability in liquidating assets for a lower price. All previous bankruptcy threats lead to discouraging firms from increasing debt levels. Therefore, firms select target ratio of debt and equity by trading off cost and benefits to reach the optimal debt-equity ratio mix that can maximise the profit and minimise the finance cost by exploiting interest tax shields to enhance the competitive advantage and increase the value of the firm (Abeywardhana, 2015).

Although trade-off theory spread tremendously for a long time, awareness has been directed toward pecking order theory too (Ross et. al, 2013). It is a theory provided by Myers 1984 proposing that firms take sequential approach in financing their requirements by utilising internal funds first then debt as second alternative and finally external equity (Dennis et al., 2015). A business manager focuses on maximising profit and minimising cost. Based on POT a manager would prefer using retained earnings instead of debt. However, SMEs heterogeneity and characteristics affect their financial decisions and therefore no single theory can explain their financial behaviour (Ang, 1991). Therefore, new versions of POT emerged called “constrained” POT by Holmes & Kent (1991) and “modified” POT by Ang (1991). According to these versions the differences between SMEs and large firms made SMEs to operate under “constrained” or “modified” POT. These differences are represented by the inability of SMEs to issue equity to the public. While the aversion of SMEs managers to lose control over their firms make them avoid access to debt. This makes SMEs managers prefer to use their personal funds to support their firms or to utilize short-term debt.

Access to Debt Determinants

This section provides theoretical and empirical explanations that reveal the effect of the independent variables represented by the access to debt determinants on SMEs access to debt.

Firm Size (SIZ)

Many studies view firm size as a determinant that can hugely affect SMEs ability to get access to debt. The type of effect is controversial and divided into positive effect according to TOT and negative effect according to POT.

Trade-off theory (TOT) confirms the positive relationship between firm size and leverage ratio. Based on Daskalakis & Psillaki (2006); Harvie et al. (2013); Hul (2014) and Kythreotis et al. (2018) reasons behind adopting TOT perspective is the capability of large firms comparing to SMEs in providing solid information for the lenders which makes it easier for large firms to get access to debt. In addition large firms can prepare transparent and accurate information with lower cost comparing to SMEs. However, Rahman et al. (2017) believes that according to trade off theory bigger firms in terms of size have more tangible assets which is reflected in more power that helps them in negotiating with the lenders to get access to debt and to loosen debt payment terms or restrictions.

Most studies support TOT confirming the positive relationship between firm size and access to debt. Zoppa & McMaho (2002) suggest that SMEs prefer adopting TOT due to the restrictions that prevent SMEs from approaching external equity or because of “aversion of external equity” by firms’ managers which make them prefer obtaining access to debt to keep the ownership unaffected. However, several studies agreed that reasons behind TOT adoption are the capability of bigger firms to provide solid information which solve information asymmetry problem. Thus bigger firms would have the opportunity to use internal funds options to decrease financing costs of (Klapper et al., 2006; Daskalakis & Psillaki, 2006; Hul, 2014; Kythreotis et al., 2018). In addition, growing firms in terms of size allow these firms to become more diversified. This diversification would decrease the level of risk and default of debt. Moreover, these firms would also be able to minimize transaction costs of debt (Daskalakis & Psillaki, 2006) and create better relationships with suppliers and therefore provides a stronger active system (Klapper et al., 2006).

On the other extrem, Kythreotis et al. (2018) explains POT basic assumption by relying on the ability of large firms to have lower level of information asymmetry between internal managers and investors. This makes such firms prefer equity and internal generated funds instead of getting access to debt to minimize the costs of financing. Hence, POT confirms the negative relationship between firm size and access to debt. Hul (2014) and Rahman et al. (2017) agree that big firms use retained earnings instead of debt while small firms with high level of asymmetric information confront difficulty in retaining earnings and therefore prefer heading to access to debt.

Few studies show mixed results (Kythreotis et al., 2018). In general, the firm size affects negatively the debt ratio but to different extent based on firm location. On one hand, study shows Iranian firms’ size affected negatively the total debt ratio supporting POT but not the long term debt ratio where the effect was insignificant. While Australian firms’ size affected positively long term debt ratio. Still there is a negative correlation between firms’ size and leverage ratio of both the Australian and Iranian firms support POT. According to the author, such mixed results indicate that Iranian and Australian firms are moving as required to get the optimal capital structure which support dynamic TOT.

Therefore, in light of the above studies and theories the first hypothesis is based on TOT as follow:

H1: SMEs size has positive significant effect on access to debt in Lebanon.

Firm Age (AGE)

Firm age is an indicator of reputation that affects access to debt. The older the firm is the more stability it reflects and therefore it can get access to debt more easily than younger firms (Abor, 2007). Such perspective is a result of operations experience and success that SMEs achieve with time which lead to decreasing financial constraints (Nizaeva & Coskun, 2018; Adair & Adaskou, 2017).

SMEs confront difficulties in getting access to debt at their begining due to lack of information transparency and information asymmetry between SMEs and lenders. These difficulties start disappearing with time as firm gets more mature which lead ot transparency decrease and information availability increase (Storey, 1994; Kira, 2012; Nizaeva & Coskun, 2018). Adair & Adaskou (2017) adopted same perspective confirming that based on TOT older and mature firms are much less constrained and get easier access to debt than younger firms. Therefore, positive relationship between firm age and access to debt is based on firm reputation and experience it build with time which contribute to easier access to debt.

However, some studies provide different explanation. According to Le (2012) younger firms suffer from lack of experience in applying for loans and poor relationship with the lenders that can facilitate getting access to debt. Therefore, through lifecycle of a firm getting access to debt is a main challenge at the beginning only since it can be handled in other lifecycle phases by using retained earnings, partnerships and other options. Other studies such as (Kira, 2013) focused on information asymmetry that can be eliminated with time by creating a solid reputation through credit history. Beck et al. (2003) confirmed that older firms have easier access to debt than new ones. Such effect of SMEs age on access to debt is viewed as normal phenomenon since when the firm starts its business it starts building its reputation through its credit history (Diamond, 1991). Moreover, studies of Hul (2014) and Peñaloza (2015) believe that firm experience in the market can reflect stability and sound cash flows of the firm which gives confidence to the creditors to give the firm the requested loan.

POT suggests negative effect of firm age on access to debt. Hul (2014) explains POT perspective stating that older firms retain profits more than younger ones easily. Therefore, debt decreases with the age of the firm since it would prefer using internal funds instead of getting access to debt. Zoppa & McMaho (2002) view this negative relationship as a result of SMEs inability to confront their financial needs internally unlike older firms. While several studies (Adair & Adaskou, 2017; Rahman et al., 2017; Pietro et al., 2018) prove that as SMEs grow they become more capable of generating funds and increasing their cash flow. Therefore, SMEs prefer adopting POT and undertake conservative approach as they become older. However, older firms with high level of leverage ratio do not necessarily mean better performance or better reputation. Older firms might hold high leverage ratios while younger firms show better financial position ask more for access to debt and give more credit to their customers than older firms (Klapper et al., 2006). In light of the above studies and theories the second hypothesis is based on TOT as follow:

H2: SMEs age has positive significant effect on access to debt in Lebanon.

Type of Industry (IND)

Type of industry affects type of asset (Myers, 1984). That is because each industry has its own requirements and competitiveness. Consequently, type of industry affects firm’s capital structure indirectly by affecting the components and type of firm’s tangibility which in return affect debt level of a firm (Le, 2012). Therefore, firms work in manufacturing industry need more access to debt to finance their fixed assets. Unlike service or retail firms that need much lower level of cash to invest in fixed assets (Gamage, 2013). In addition, type of industry reflects the level of business risk (Kira, 2012; Le, 2012; Adair et al., 2017). Hence, firms with high level of tangible assets are more capable of getting low-risk debt since these assets represent required collateral (Klapper et al., 2006).

From theoretical perspective of TOT and POT. Le (2012) and Degryse et al. (2012) explain that SMEs select the optimal capital structure based on each type of industry where the benefit equals the potential distress cost. This perspective represents TOT. On the other hand, POT suggests that profitable SMEs select lower debt ratio than unprofitable SMEs in the same industry. Moreover, if the debt ratio is high enough in a way that leads to financial distress then SMEs would minimise debt ratio by maximising equity.

Studies focused on the competitiveness of industry suggest that more competitive industry would be more attractive to lenders since it would act as a motive for SMEs to perform better (Klapper et al., 2006) (Gamage, 2013). Therefore, type of industry affects access to debt positively through competitiveness since it facilitates getting access to debt (Klapper et al., 2006; Degryse et al., 2010; Ferrando & Griesshaber, 2011; Kira & He, 2012; Le, 2012; Adair & Adaskou, 2017; Pham, 2017).

However, studies results are contradicted some times. Considering an industry as very competitive in one study might be not competitive in another. For example, Klapper et al. (2006) suggest that SMEs operating in manufacturing and service industries get more access to debt than those operating in agriculture. While Pham (2017) reached slightly different results stating that SMEs operating in manufacturing industry gets easier access to debt than those operating in trade and service industries. In addition, Degryse et al. (2010) believe that SMEs operating in trade have higher leverage level than those operating in construction. Degryse contradicts Ferrando & Griesshaber (2011) study which has proven that SMEs operating in construction require access to debt more than those operating in manufacturing followed by SMEs operating in service and trade respectively. Adair & Adaskou (2017) agree with Ferrando & Griesshaber and found that firms operating in services and trade industry got access to debt less than construction. Based on previous studies the third hypothesis is represented as follow supporting TOT:

H3: SMEs operating in manufacturing industry has positive significant effect on access to debt in Lebanon.

Type of Ownership (OWN)

Type of SMEs ownership as a decision can affect firms’ lifetime. It is related to the funding source and consequently affects access to debt (Scarborough, 2011). For Machek & Kubicek (2018) high concentrated ownership of a firm means a highly controlled firm by its owners. These owners protect their interests by reducing agency cost and enhancing monitoring. A highly concentrated ownership can influence business performance in a negative way when the owner starts preferring his own interest over the collective interest. Therefore, if the owner of the SME is family or person it would be perceived as riskier to lenders.

For Kira et al. (2012) limited liability firm affects positively access to debt. Such result is due to many positive points such as the separation of entity and transparency of financial statements. Thus, these two reasons solve agency problem and information asymmetry problem which make lenders give easier access to debt to the incorporation. Gamage (2013) adopted same perspective of Kira et al. (2012) stating that sole proprietorship firm reflects high level of risk from lenders perspective since repayment of the loan is made by one person. In addtion, limited liability ownership reflects commitment of manager to reach frim’s objectives.

Formality and reliability of incorporation and the existence of solid management based on collective knowledge and cross functional experience make the decisions more logical and less risky. However, limited liability of shareholders and limited liability firms reflects another face of risk represented by the separation of entity which protects the owners against losses (Kira & He, 2012). Thus, agency problem would emerge in firms where owners percieve the investment decisions made by the managers as inefficient (Jensen, 1986). Threrefore, many studies concluded that incorporation ownership has a positive effect on access to debt adopting TOT. Unlike sole proprietorship ownership and family owned business where high ownership concentration exists and access to debt becomes more difficult or not preferred by the owners and therefore supports POT (Klapper et al., 2006; Ferrando & Griesshaber, 2011; Hamao, Kutsuna & Peek, 2012; Adair & Adaskou, 2017).

Menike (2015) provides evidence that SMEs managers prefer to be the firms’ owners of SMEs. Managers try to protect their ownership by avoiding access to debt and using internal funds instead. Therefore, sole proprietorship SMEs and family owned business adopt POT by prefering internal funds to avoid agency cost. Adair & Adaskou (2017) study reached similar suggesting that SMEs owned by several persons get easier access to debt than SMEs owned by one owner only which supports POT. It appeared that SMEs owned by a group confront less obstacles in getting access to debt since such type of SMEs ownership is viewed as less risky by the lenders.

Other studies adopted POT approach suggesting that SMEs owners with limited liability ownership are restricted by the question of reasons behind losses by the equity holders (Brewer, et al., 1996; Abor, 2007). This perspective is related to agency cost theory that consequently leads these incorporations to prefer internal funds over access to debt supporting POT. While sole proprietorship, family and partnership type of firms have no other alternative but getting access to debt consequently they prefer TOT. Abor (2007) destinguish between family business and non-family business ownership. Family owned business usually avoid external equity finance to protect their control on business and avoid shriveling their rights. Therefore, authors suggest that sole proprietorship gets more access to debt than other types of ownership arguing that family managers prefer to take high risk by getting access to debt to keep on controlling the business and keep the self-esteem. The forth hypothesis is stated as follow supporting TOT:

H4: Incorporation SME has positive significant effect on access to debt in Lebanon.

Tangibility (AST)

Literature refers to tangibility as synonymous to asset structure that describes the proportion of fixed assets of a firm. SMEs fixed assets has always been considered as main requirement for lenders that is used as a pledge to get access to debt (Baumback et al., 1973). The main thing lenders look for is the assets of borrowers to increase the certainty of getting their money back (Barrow, 1998). However, SMEs and startups companies usually lack such assets to be pledged (Carter et al., 2000). SMEs with short work history, small capital and no enough property pay higher interest and provide higher collateral requirement (Majkova et al., 2014). Therefore, firms consider high level of tangible assets as bargaining power that can be used to negotiate with lenders the credit terms (Rahman et al., 2017).

Studies confirm the positive relationship between tangibility and leverage ratio from TOT perspective (Klapper et al., 2006; Forte et al., 2013; He et al., 2017; Kannadhasan, 2018). According to TOT fixed assets viewed by lenders as a guarantee option that allow them to give SMEs access to debt. Assets value can be used to cover credit risk, bankruptcy costs, pay annual interest rate or pay principal payment on the debt (Kythreotis et al., 2018). In addition, access to debt lead to the need of agency costs. Therefore, SMEs fixed assets help in lowering the level of agency costs and solve the information asymmetry problem for the lenders (He & Ausloos, 2016; Rahman et al., 2017; Kythreotis et al., 2018).

Other studies support POT that adopts the negative relationship between tangibility and leverage ratio (Zoppa et al., 2002; Daskalakis & Psillaki, 2008; Elbekpashy & Elgiziry, 2018). POT suggest that SMEs would prefer using their fixed assets as internal source of financing instead of getting access to debt and facing information asymmetry issue (Kythreotis et al., 2018) (Kannadhasan et al., 2018). For Daskalakis & Psillaki (2006); Abeywardhana (2011) and Forte et al. (2013), SMEs with high percentage of fixed assets prefer using internal funds and avoid debts since they can generate funds internally without affecting the financial stability of the firm supporting by that POT.

Some studies reached different results due to dividing debt into short-term and long-term. Klapper et al. (2006) found that tangibility positively affects both short and long-term debt specially for firms operating in manufacturing and service industries. While Pietro et al. (2018) confirm the direct and indirect effect of type of industry through asset structure on leverage ratio. That is because each type of industry has its own tangibility requirement. However, the finding related to asset structure showed negative relationship with leverage ratio. Authors state that this finding is due to the short term debt which holds bigger weight than long term.

Other studies find no significant relationship between SMEs tangibility and access to debt such as Bebczuk (2004); Gamage (2013); Serrasqueiro & Caetano (2014) and Kythreotis et al. (2018). No significant effect of tangibility on access to debt does not mean that SMEs do not offer fixed assets as collateral. It means that collateral is not a main determinant since banks do not mind taking higher level of risk to increase their return instead of rationing the credit (Bebczuk, 2004). Others believe that SMEs tangibility is not important from lenders’ perspective when requested debt is short-term and therefore collateral is not required (Serrasqueiro & Caetano, 2014). Based on the previous discussion the following fifth hypothesis is based TOT.

H5: SMEs tangibility has positive significant effect on access to debt in Lebanon.

Profitability (PRF)

Firms view profits as an internal finance source represented by retained earnings. This firm prefers using their profits instead of getting external finance by issuing equity or getting access to debt (Myers, 1984). In addition, firms prefer internal finance to avoid obligations or restrictions associated with the external debt and the low cost capital (Waked, 2016).

Based on TOT, profitability is positively related to access to debt. Profitable firms seek increasing their profits through tax advantages. In addition, profitable firms might confront cash flow instability that can be handled by getting access to debt (Pacheco & Tavares, 2004; Kannadhasan et al., 2018; Kythreotis et al., 2018). Few studies adopted TOT suggesting that when the level of profitability increases it would enhance firm’s position in the market, proves its ability to meet financial commitments, eliminates information asymmetry problem with lenders, facilitates access to debt. Consequently, this would lead to decreasing agency cost and take advantage of taxes (Hadlock & James, 2002; He & Ausloos, 2016; Adair & Adaskou, 2017). Therefore, low profitability ratio becomes an obstacle for the firm since it reflects low cash flow and weak liquidation ability. These effects represent weak financial performance that affect SMEs access to debt Waked (2016). Another perspective of He & Ausloos (2016) suggest that main reason behind SMEs adoption of TOT is that the more profitable the firm becomes the more cash control management is required from owners’ perspective. Therefore, firms would prefer to use the profits to re-invest and get access to debt so external parties represented by the lender would help in supervising cash usage and investment progress.

As for POT it asserts that SMEs use profits to lower the debt level. Firms prefer using internal resources first before going to external resources (Cakova, 2011). Myers (1984) view POT as a primary choice for firms emphasizing that they would prefer using internal fund first and then start with external funds. Most studies adopt POT perspective (Zoppa & McMaho, 2002; Daskalakis & Psillaki, 2006; Bell & Vos, 2009; Abeywardhana, 2011; Harvie et al., 2013; Serrasqueiro & Caetano, 2014; Hul, 2014; Pietro et al., 2018). Authors agree that higher profitability improves the creditworthiness of SMEs and is used as an indicator for retained earnings level. Thus high profitability improves SMEs capability to fund its activities and investment using retained earnings. In return high profitability level would lower levels of access to debt. Bell & Vos (2009) believe that SMEs managers’ preference of financial freedom and flexibility is the main reason behind adopting POT. However, study of Klapper et al. (2006) suggest that when there is asymmetric information gap between SMEs managers and lenders in terms of weak credit information or inaccurate financial data, firms avoid external financing and favor internal funds. Another reason is absence of debt tax shields in some countries like Poland which eliminates the attractiveness of getting debts.

Some studies show different results. For example, Guha & Bhaduri (2002) divided debt into short-term and long-term. The study provides mixed results between TOT and POT. In one hand, study confirms positive association between long-term debt and profitability adopting TOT. On the other hand, findings confirm negative association between profitability and short-term debt adopting POT.

Although most studies either support TOT or POT, few studies find no significant relationship between SMEs profitability and access to debt (Zhao, 2006). According to Zaho such results emerged because of information asymmetry between SMEs and lenders. This makes lenders consider collateral and firm size to protect them. Thus lenders focus on interest rates payment to give access to debt for SMEs. Based on TOT the sixth hypothesis is as follow:

H6: SMEs profitability has positive significant effect on access to debt in Lebanon.

Methodology

Due to lack of transparency of Lebanese SMEs financial information, the researched used 5INDEX Business Directory of Lebanon (2018) to reach official audit firms located in Lebanon-Beirut. Twelve out of 208 audit firms accepted to provide the secondary data of 102 SMEs. These data extracted from the official annual reports submitted to the governmental entities. For the purpose of the study, SMEs are selected based on the following criteria:

1. SMEs located in Beirut

2. SMEs employ less than 100 employees

3. SMEs data is complete from 2014 to 2017

Based on the previous criteria the sample consists of 2856 observations. All these audit firms have licenses and provide SMEs financial statements to the government on annual basis. Therefore, the researcher is confident the validity and reliability of such data. In addition, the researcher considered the validity and reliability of the instruments when designing the study by using two approaches. The first approach by adopting all variables those are considered as standard measures of business activity. The second approach by making sure that all variables have been adopted for similar purposes in previous studies and their related measures have been tested. Therefore, there is no need to test the validity of the measures (Kerlinger, 1992).

Since all SMEs have the same number of repeated measurements that have been made at equivalent time interval, the set is referred to as balanced longitudinal data (Everitt, 2002). Based on Gujarati (2004, p.673) panel data would help in enhancing the accuracy of model parameters since panel data provides more sample variability and freedom degree. In addition, panel data increase the capability of capturing the human behavior complexity and reveal the dynamic relationships which are the normal case scenario of economic behavior. Finally, it provides more informative and variable data and gives less collinearity among variables.

This research used STATA 14 software to process and analyzes the data collected. For this purpose, multiple linear regression models adopting Generalized Least Square (GLS) is used by the researcher to define the cause and effect relationship between dependent and independent variables. Theoretical framework shown in Figure 1 summarizes the relationship between firm characteristics, financial performance and access to debt.

Econometric Model

Equation no. 1 below presents the econometric model of the hypotheses.

ATDxt = α + β1 SIZxt + β2 AGExt+ β3 INDxt + β4 OWNxt + β5 ASTxt + β6 PRFxt + εxt .…. (1)

Where:

ATDxt: is the access to debt by a firm x at time t. Represented by total liabilities.

α: is the constant parameters

SIZxt: is the size of a firm x (in terms of number of employees) at time t. Represented by logarithm number of employees at the time of the survey. Provided by logarithm of the number of years of firm in existence.

AGExt: is the age a firm x at time t. Provided by logarithm of the number of years of firm in existence.

INDxt: is the industry a firm x operate in at time t. Represented by a dummy variable gives (1) for manufacturing firms, and (0) for service and trade firms.

OWNxt: is type ownership of a firm x at time t. Submitted as dummy variable gives (1) for limited liability firms and shareholders and (0) for sole proprietorship.

ASTxt: is the tangibility of firm x at time t. Calculated by dividing Fixed Asset by Total Asset.

PRFxt: is the profitability of a firm x at time t. Calculated by dividing EBIDITA by Total Assets.

β1, β2, β3, β4, β5, β6: are the coefficient of the independent variables or the regression parameters to be estimated which are positively related to access to debt by a firm.

εxt: is the error component that varies over firms at a given time.

Descriptive Statistics and Correlation Analysis

Descriptive statistics and significant correlations between explanatory variables presented in Table 1 show a positive weak correlation between Profitability (PRF) with Tangibility (AST) and Access to Debt (ATD). While it shows negative weak correlation with Firm Size (SIZ). Access to Debt (ATD) has negative weak correlation with Firm Size (SIZ) and Firm Age (AGE). Finally, a negative weak correlation between Tangibility (AST) and Firm Age (AGE).

| Table 1 Descriptive Statistics and Correlation Matrix | |||||||

| Variables | Mean | Std.Dev | SIZ | AGE | PRF | AST | ATD |

| SIZ | 17.36 | 22.56 | |||||

| AGE | 19 | 9.72 | 0.0607 | ||||

| PRF | 0.13 | 0.18 | -0.1481** | 0.0572 | |||

| AST | 0.26 | 0.24 | -0.0316 | -0.1054* | 0.2227** | ||

| ATD | 0.28 | 0.32 | -0.1284** | -0.1103* | 0.1813** | 0.0845 | |

Linear Regression Model Assumptions and Diagnostic Tests

According to Gujarati (2004) and Brooks (2008) classical linear regression model (CLRM) has the following assumptions:

The average value of the errors is zero E (ut) =0.

Based on Brook (2008), if the regression equation has a constant term then this assumption cannot be violated. Therefore, the first assumption is achieved since the model has its own constant represented by “α”.

The xt are non-stochastic.

This assumption states that regressors should not be correlated with error term (Brooks, 2008). The estimation model for this study is achieved using GLS model as stated earlier which is based on no correlation between regressors. Therefore, the researcher states that the regressors are not correlated with the compound error term.

The variance of the errors is constant var (ut ) = σ2 <∞ or homoscedasticity assumption.

Heteroskedasticity is tested by using Breuch-Pagan test adopting Cook and Weisberg version. The results show Chi2 of 101.03 with P-value 0.000. Since P-value is less than 0.05, the model has a problem of variation of the random variable. To solve heteroskedasticity problem the researcher used heteroskedasticity-robust procedures available on STATA 14 to regress the variables as required by applying Huber-White-sandwich estimator.

The disturbances are normally distributed (ut ∼ N(0, σ2) or normality assumption.

Normality test is implemented to verify if the error terms are normally distributed by applying Shapiro-Wilk test. The p-value should be more than 0.05 to accept the null of normality at the 5% level. As shown in Table 2 models residuals P-value is less than 5% suggesting that the errors are not normally distributed. Therefore, the research rejects the null hypothesis of normality at the 5% significance level.

| Table 2 Normality Test | ||||

| Variables | W | V | Z | Prob > z |

| SIZ | 0.95879 | 11.548 | 5.827 | 0.00000 |

| AGE | 0.97793 | 6.184 | 4.339 | 0.00001 |

| PRF | 0.83112 | 47.325 | 9.186 | 0.00000 |

| AST | 0.87970 | 33.710 | 8.378 | 0.00000 |

To overcome this problem, the researcher used robust procedure. Based on Box (1953), Alma (2011) violation to normality assumption can be treated using robust procedure stating that robust regression submits resistant results in case of outliers’ presence.

Multi-collinearity Test

By applying multi-collinearity test using Factor Inflation Variance (VIF) command, Table 3 obviously asserts that all VIF scores are less than 5 for all variables which is the value of the coefficient of inflation variance. Therefore, there is no inter-correlation among independent variables.

| Table 3 Multicollinearity Test | |||

| Variables | VIF | 1/VIF | |

| SIZ | 1.15 | 0.867981 | |

| AGE | 1.15 | 0.868513 | |

| IND | 1.12 | 0.891374 | |

| OWN | 1.12 | 0.894502 | |

| AST | 1.10 | 0.908966 | |

| PRF | 1.03 | 0.967128 | |

| Mean VIF | 1.11 | ||

The covariance between the error terms is zero cov(ui, uj ) = 0 for i = j or autocorrelation assumption.

STATA 14 did not implement DW- Durbin-Watson test. This indicates there is autocorrelation problem. To solve autocorrelation status and to obtain a more efficient estimator the researcher uses the Generalized Least Square (GLS). GLS is usually adopted when OLS estimator does not provide linear unbiased estimation due to the existence of heteroskedasticity and autocorrelation (Wooldridge, 2005).

Ramsey Test

Ramsey Regression Equation Specification Error Test (RESET) is helpful in detecting the general specification for the linear regression model. In other words, Ramsey examines whether non-linear combinations of the fitted values help in explaining the response variable (Wooldridge, 2005). According to the test results F(3, 398) = 0.57, Prob > F = 0.6370, it is clear that model does not suffer from omitted values and do not have problems related to the general specification for the linear regression since it is more than 5%.

The Selection of Model Analysis Method

Hausman test assumes two hypotheses. The null hypothesis confirms that preferred model should be the random effects so the study should use the GLS. Alternate hypothesis confirm the adoption of fixed effects model which lead the researcher to use OLS. Hausman test mainly suggest if there is a correlation between the unique errors and the regressors in the model. The null hypothesis is that there is no correlation between the two. Based on Hausman test in Table 4, results show a low statistical value of Chi Square 1.81 with significance level of 0.4041 therefore null hypotheses is accepted. This indicates that there is no correlation between the effects of SMEs and the explanatory variables. Consequently, the use of random effects is the appropriate model for our research.

| Table 4 Hausman Test | |||||

| Variables | Fixed | Rsandom | Difference | Sqrt | |

| AST | 0.2206865 | 0.1467662 | 0.0739203 | 0.064887 | |

| PRF | 0.3346727 | 0.3384199 | -0.0037472 | 0.0340212 | |

| Chi –sqr= 1.81 | P-value = 0.4041 | ||||

Results of the Regression Analysis

Researcher estimates the model parameters using robust random effects by adopting Generalised Least Squares method as shown in Table 5. According to the R-squared SMEs independent variables explain 87% of the response variable variation and F-test value reads 2079.82 while P-value for the test is less than 0.01 which confirms that model is proper for the data nature and can be used for predicting the determinants of access to debt for Lebanese SMEs. In addition, results confirm different positive and negative significant effects of access to debt determinants on debt.

| Table 5 Model Estimated Parameters Using Random Effects | ||||

| Variables | Coefficient | Z- statistic | P-Value | |

| SIZ | -1.280459 | -75.52 | 0.000 | |

| AGE | -0.5108109 | -19.80 | 0.000 | |

| IND | 1.177895 | 19.71 | 0.000 | |

| OWN | -1.818584 | -38.07 | 0.000 | |

| AST | .215838 | 1.68 | 0.094 | |

| PRF | .3413429 | 3.15 | 0.002 | |

| Constant | 5.083049 | 17.47 | 0.000 | |

| F-test | 2079.82 | 0.000 | ||

| R-Squared | 0.8736 | |||

Discussion

This study attempts to explore the effect of determinants of access to debt for SMEs in Lebanon context. Although many studies were held in the developed countries to assess the effect of SMEs access to debt determinants, studies are still few in Lebanon as one of the developing countries. The results confirm the existance of TOT and POT in Lebanese SMEs financial behaviour. According to regression analysis, firm size affects negatively SMEs access to debt. Therefore, the first hypothesis is rejected. Based on POT as firms grow they start preferring generating internal funds in terms of using retained earnings or assets liquidation instead of heading to get access to debt. This would help SMEs in avoiding decreasing financing cost. This result is in line with Serrasqueiro & Caetano (2014); Hul (2014) and Kythreotis et al. (2018). In addition, result contradicts with studies of Zoppa et al. (2002); Klapper et al. (2006) and Daskalakis & Psillaki (2006).

In contrary, firm age shows positive effect on access to debt in accordance with the second hypothesis and adopting TOT perspective. This result confirms previous studies of Ferrando & Griesshaber (2011); Kira & He (2012); Le (2012); Hul (2014) and Peñaloza (2015). Therefore, results in not in line with the studies of Zoppa et al. (2002); Klapper et al. (2006); Adair & Adaskou (2017); Rahman et al. (2017) and Pietro et al. (2018). This can be explained by the operations experience, success and reputation Lebanese SMEs build with time which consequently lead to decreasing financial constraints for SMEs. As for type of industry shows result in line with Klapper et al. (2006) and Pham (2017) confirming that Lebanese SMEs operating in manufacturing industry get more access to debt than those operating in service and trade industry. Therefore, third hypothesis is supported adopting TOT proving that SMEs operating in manufacturing is more competitive. That is because manufacturing is more concentrated and has its own characteristics and assets requirements. Therefore, from lenders’ perspective such competitive industry has potentials and lead to a better performance and better turnover.

Ownership forth hypothesis is rejected due to the negative effect of type of ownership on SMEs access to debt. Result suggests that incorporation ownership of SMEs confront more difficulties than other types of ownerships. This result is in line with Klapper et al. (2006); Ferrando & Griesshaber (2011); Hamao (2012); Adair & Adaskou (2017) and Menike (2015). While it contradicts studies of Kira et al. (2012), Gamage (2013) and Brewer et al. (1996). The explanation is that SMEs with incorporation ownership are subject to be questioned when there are losses by shareholders. Consequently, SMEs managers prefer internal funds supporting POT. While sole proprietorship SMEs have no other alternative but getting access to debt. Therefore, sole proprietorship SMEs prefers debt. In addition, lenders in Lebanon view incorporation as riskier due to the separation between the owners and the firm as entity. While the owners of sole proprietorship SMEs are responsible for any failure or default that might happen and their personal assets can be pledged as collateral.

As for tangibility fifth hypothesis it is rejected confirming no effect of tangibility on access to debt in Lebanon. However, no significant effect of tangibility does not mean that collateral is not important for lenders in Lebanon specially for official lenders such as commercial banks. Such result can be explained by the probability of short-term debt dominance. If the short-term debt is the largest proportion of total debt, it would eliminate to some extent the need for collateral from lenders’ point of view. This action would help lenders to make high return and to support SMEs in Lebanon. Finally, Profitability show positive significant effect on access to debt in Lebanon in accordance with studies of Hadlock & James (2002); Waked (2016); He & Ausloos (2016) and Adair & Adaskou (2017). Therefore, sixth hypothesis is accepted confirming adoption of TOT. Result contradicts with other studies such as Zoppa & McMaho (2002); Daskalakis & Psillaki (2006); Bell & Vos, (2009); Abeywardhana (2011); Harvie et al. (2013); Serrasqueiro & Caetano (2014); Hul (2014) and Pietro et al. (2018). This finding asserts that Lebanese lenders perceive profitability as vital indicator for SMEs financial performance. Because of the economic decline, lenders are focusing on giving debt based on profitability more than using collateral as determinant to give SMEs access to debt. These way lenders would seek profit like any other business while considering other factors to protect themselves such as firm age, industry, and firm financial performance.

Based on the obtained results, it cannot be concluded the dominance of one theory over the other. Although firm age, type of industry and profitability strongly adopt TOT, still firm size and ownership adopt POT. Therefore, Lebanese SMEs adopt TOT and POT based on type of determinant which helps in making required adjustment of debt level to reach the optimal debt ratio.

Conclusion

The study presents empirical evidence on the effect of access to debt determinants on Lebanese SMEs. In addition, study provides an insight for the approach that Lebanese SMEs are adopting as financial behavior to define their capital structure in terms of trade-off theory versus pecking order theory. A model was created to examine the effect of access to debt determinants on Lebanese SMEs access to debt and to present the theory adopted that can explain Lebanese SMEs financial behavior. Data of 102 SMEs for the period 2014 till 2017 were collected from twelve official audit firms located in Beirut-Lebanon. Additionally, Generalized Least Squares method was used to conduct regression analysis. The findings confirm the positive effect of firm age (AGE), type of industry (IND) and profitability (PRF) on SMEs access to debt suggesting that SMEs adopt trade-off theory. While other determinants of access to debt such as firm size (SIZ) and type of ownership (OWN) prove negative effect on access to debt adopting pecking order theory. Tangibility (AST) on the other hand shows no significant effect on access to debt.

The dominance of positive relationships confirms the adoption of trade-off theory by Lebanese SMEs. However, we cannot ignore that fact that some determinants have shown pecking order theory approach in terms of firms’ size and type of ownership. Therefore, no unified theory can explain all the relationships between the determinants and Lebanese SMEs access to debt. However, it can be concluded that Lebanese SMEs commit to a target ratio of debt and equity by trading off between the level of debt and bankruptcy risk represented by annual interest rate, principal payment, and legal and accounting expenses and risk of losing customers, employees or suppliers. This trade off helps SMEs in minimizing financing costs, maximising profits, take advantage of tax shields and increase the value of the firm. In addition, results show that Lebanese SMEs are supported by the lenders since smaller size firms and sole proprietorship firms have the opportunity to get easier access to debt. Defining what approach the determinant is following in terms of TOT or POT explains to what extent SMEs access to debt are affected and how they can improve their situation to get access to debt.

Limitations and Further Research

Several limitations were captured during this study are summarized by sample size, considering macroeconomic factors such as economic or political effect, exploring other determinants effect such as innovation, business plan, networking, location, business information and managerial characteristics. Future studies may consider the limitations mentioned earlier. In addition, distinguishing between SMEs owner and manager might lead to different results related to financial decision behavior. Moreover, distinguishing between short-term debt and long-term debt would provide more deep analysis. Future studies might approach different sources of data which can increase research generalizability.

Acknowledgements

The authors received no financial support for the research of this article.

References

- Abbasi, W.A., Wang, Z., & Alsakarneh, A. (2018). Overcoming SMEs financing and supply chain obstacles by introducing supply chain finance. International Journal of Business and Management, 13(6), 165-173.

- Abdulsaleh, A.M.A., & Worthington, A.C. (2018). Determinants of SME access to bank finance. International Journal of Management and Applied Science, 4(3), 46-51.

- Abeywardhana, D.K.Y. (2015). Capital Structure and Profitability: An Empirical Analysis of SMEs in the UK. Journal of Emerging Issues in Economics, 4(2), 1-14.

- Abeywardhana, D.K.Y. (2011). Financing Decision, Cost of Debt and Profitability: Evidence from Non-Financial SMEs in The UK. PHD dissertation, University of Birmingham.

- Abor, J. (2007). Capital Structure and Financing of SMEs: Empirical Evidence from Ghana and South Africa. PHD dissertation, Stellenbosch University.

- Abraham, F., & Schmukler, S.L. (2017). Addressing the SME Finance Problem. Research and Policy Briefs No. 9, World Bank, Retrieved from http://documents.worldbank.org/curated/en/809191507620842321/pdf/Addressing-the-SME-finance-problem.pdf.

- Adair, P., & Adaskou, M. (2017). The Capital Structure of French SMEs and Impact of the Financial Crisis: A Dynamic Panel Data Analysis (2002-2010). Paper presented at World Finance Conference - Sardinia, Italy, hal-01667313, retrieved from https://hal-upec-upem.archives-ouvertes.fr/hal-01667313/document.

- Alibhai, S., Bell, S., & Conner, G. (2017). What’s Happening in the Missing Middle? Lessons from Financing-SMEs. International Bank for Reconstruction and Development. World Bank Group. Retrieved from http://documents.worldbank.org/curated/en/707491490878394680/pdf/113906-WhatsHappeningintheMissingMiddleLessonsinSMEFinancing-29-3-2017-14-20-24.pdf

- Alma, O.G. (2011). Comparison or robust regression methods in linear regression. International Journal Contemporary Mathematical Sciences, 6(9), 409-421.

- Ang, J.S. (1991). Small business uniqueness and the theory of financial management. Journal of Small Business Finance, 1(1), 1-13.

- Ayuso, S., & Navarrete-Baez, F.E. (2018). How does entrepreneurial and international orientation influence smes’ commitment to sustainable development? Empirical evidence from Spain and Mexico. Corporate Social Responsibility and Environmental Management, 25, 80-94.

- Barrow, C. (1998). The Essence of Small Business. (2nd Edition). Prentice Hall Europe.

- Baumback, C.M., Laywfer, K., & Kelley, P.C. (1973). How to Organize and Operate a Small Business. (5th Edition). New Jersey: Prentice-Hall Inc., Englewood Cliffs, N.J.

- Bebczuk, R.N. (2004). What Determines the Access to Credit by SMEs in Argentina. Paper No. 48, National University of La Plata, Argentine. https://core.ac.uk/download/pdf/6704101.pdf

- Bell, K., & Vos, E. (2009). SME Capital Structure: The Dominance of demand Factors. Paper presented at the 22nd Australian Finance and Banking Conference, Sydney, Australia. http://ssrn.com/abstract=1456725.

- Bhaird, C.M., & Brian, L. (2010). Determinants of capital structure in Irish SMEs. Small Business Economics, 35(3), 357-375.

- Box, G. (1953). Non-normality and tests on variances. Biometrika, 40, 318-335.

- Brewer, E. III, Genay, H., Jackson, W.E. III & Worthington, P.R. (1996). How is small firms financed? Evidence from Small Business Investment. Companies. Economic Perspectives, 20(6), 2-18.

- Brooks, C. (2008). Introductory: Econometrics of finance. (2nd Ed.). Cambridge University Press, The ICMA Centre.

- Cakova, U. (2011). Capital Structure Determinants of Turkish SMEs in Manufacturing Industry. Master Dissertation. Ihsan Dogramaci Bilkent University.

- Carter, S., & Evans, J.D. (2000). Enterprise and Small Business-Principles, Practice and Policy. (1st Edition). Pearson Education Limited.

- Daskalakis, N., & Pasillaki, M. (2006). The Determinants of Capital Structure of the SMEs: Evidence from the Greek and the French Firms. XXIInd Symposium on Banking and Monetary Economics, Strasbourg.

- Degryse, H., de Goeij, P., & Kappert, P. (2010). The impact of firm and industry characteristics on small firms’ capital structure. Small Business Economics, 38(4), 431-447.

- Dennis, K.K., Achesa, K., & Gedion, O. (2015). Effect of microfinance credit on the performance of small and medium enterprises in uasin Gishu County, Kenya. International Journal of Small Business and Entrepreneurship Research, 3(7), 57-78.

- Ehrhardt, M.C., & Brigham, E.F. (2011). Financial Management: Theory and Practice. (13th Ed.). USA: South-Western-Cengage Learning.

- Elbekpashy, M.S., & Elgiziry, K. (2018). Investigating the impact of firm characteristics on capital structure of quoted and unquoted SMEs. Accounting and Finance Research, 7(1), 144-160,

- Everitt, B.S. (2002). The Cambridge Dictionary of Statistics (2nd Edition). Cambridge University Press.

- Farran, I., & Fawaz, M. (2018). Role of SMEs in Lebanese Economy. Journal of Economics and Management Sciences, 1(2), 78-93.

- Ferrando, A., & Griesshaber, N. (2011). Financing Obstacles among Euro Area Firms: Who Suffers the Most?. Paper Series 1293. European Central Bank, Germany. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1757728.

- Forte, D., Barros, L.A., & Nakamura, W.T. (2013). Determinants of the Capital Structure of Small and Medium Sized Brazilian Enterprises. Brazilian Administration Review, 10(3), 347-369.

- Gamage, P. (2013). Determinants of Access to Bank Finance for Small and Medium-Sized Enterprises: The Case of SriLanka. Corporate Ownership and Control, 10(3), 402-409.

- Guha, K.B., & Bhadhuri, S. (2002). Determinants of Capital Structure in India (1990-1998): A Dynamic Panel Data Approach. Journal of Economic Integration, 17(4), 761-766,

- Gujarati, D.N. (2004). Basic econometrics. (4th Edition). McGraw-Hill Companies.

- Hadlock, C., & James, C. (2002). Do banks provide financial slack? Journal of Finance, 57, 1383-420.

- Hamao, Y., Kutsuna, K., & Peek, J. (2012). Nice to be on the A-List. Papers 12-13, Federal Reserve Bank of Boston, USA. Retrieved from https://www.econstor.eu/dspace/bitstream/10419/96420/1/730400085.pdf.

- Hamdan, K. (2016). Micro and Small Enterprises in Lebanon. Economic Research Forum Report No. 0417. Retrieved from https://erf.org.eg/wp-content/uploads/2016/04/PRR0417.pdf

- Harvie, C., Narjoko, D., & Oum S. (2013). Small and Medium Enterprises’ Access to Finance: Evidence from Selected Asian Economies. Paper series No. 23, Economic Research Institute for ASEAN and East Asia.

- He, S., & Ausloos, M. (2016). The impact of the global crises on SME internal vs. external financing in China. Banking and Finance Review, 9(1), 1-17.

- Holmes, S., & Kent, P. (1991). An empirical analysis of the financial structure of small and large australian manufacturing enterprises. Journal of Small Business Finance, 1(2), 141- 154.

- Hul, R.V. (2014). Determinants of the capital structure of Dutch SMEs. Paper presented at the 3rd IBA Bachelor Thesis Conference, The Netherlands.

- International Monetary Fund (IMF) and World Bank (2016). Financial Sector Assessment: Lebanon. Financial Sector Assessment Program (FSAP). Washington. Retrieved 5 January 2018 from http://documents.worldbank.org/curated/en/260481485486059075/Lebanon-FSAP-Update-FSA-12222016.docx

- Irwin, D., & Scott, J.M. (2010). Barriers faced by SMEs in raising bank finance. International Journal of Entrepreneurial Behaviour & Research, 16(3), 245-259.

- Jonsson, R.F. (2011). Difference Between Financing of Small and Medium Sized Firms in Europe and The United States: Do Legal Origins Matter? Aarhus University, Denmark. Retrieved from http://pure.au.dk/portal/files/39961654/Thesis_legaloriginsl.pdf

- Kannadhasan, M., Thakur, B.P.S., Gupta, C.P., & Charan, P. (2018). Testing capital structure theories using error correction models: Evidence from China, India and South Africa. Cogent Economics & Finance, 6(1443369), 1-19.

- Kaseb, S., & Kamal El Din, J. (2007). Small Enterprises – Opportunities and Challenges. (1st Ed.). The Center for Advancement of Post-Graduate Studies and Research in Engineering Sciences C.A.P.S.C.U).

- Kerlinger, F.N. (1992). Foundations of behavioral research. (3rd Edition). New York: Harcourt Brace College.

- Kira, A.R., & He, Z. (2012). The impact of firm characteristics in access of financing by small and medium-sized enterprises in Tanzania. International Journal of Business and Management, 7(24), 108-119.

- Kira, A.R. (2013). The evaluation of the factors influence the access to debt financing by Tanzanian SMEs. European Journal of Business and Management, 5(7), 1-24.

- Klapper, L.F., Allende, V.S., & Zaidi, R. (2006). A Firm-Level Analysis of Small and Medium Size Enterprise Financing in Poland. World Bank Policy Research Working Paper 3984, SSRN-id922464.

- Kythreotis, A., Nouri, B.A., & Soltani, M. (2018). Determinants of capital structure and speed of adjustment: Evidence from Iran and Australia. Sciedu Press, 9(1), 88-113.

- Le, P.N.M. (2012). What determines the access to credit by SMEs? A case study in Vietnam. Journal of Management Research, 4(4), 90-115.

- Machek, O., & Kubicek, A. (2018). The relationship between ownership concentration and performance in Czech Republic. Journal of International Studies, 11(1), 177-186.

- Majkova, M.S., Solik, J., & Sipko, J. (2014). The analysis of chosen business obstacles and problems with the financing of young entrepreneurs in Slovakia. Economics and Sociology, 7(3), 90-103.

- Masiak, C., Mortiz, A., & Lang, F. (2017). Financing Patterns of European SMEs Revisited: An Updated Empirical Taxonomy and Determinants of SME Financing Clusters. EIF Research & Market Analysis, Working Paper 2017/40.

- Matta, J.M. (2018). M/SMEs in Lebanon: Status, Strategy and Outcomes. Ministry of Economy and Trade, Lebanon. Retrieved from https://www.unescwa.org/sites/www.unescwa.org/files/events/files/johnny-matta-small-medium-enterprise-lebanon-en.pdf

- Menike, L.M.C.S. (2015). Capital Structure and Financing of Small and Medium Sized Enterprises: Empirical Evidence from a Sri Lankan Survey. Journal of Small Business and Entrepreneurship Development, 3(1), 54-65.

- Ministry of Economy and Trade (2014), Lebanon SME Strategy: a Roadmap to 2020, Retrieved 5 January 2018 from https://www.economy.gov.lb/public/uploads/files/6833_5879_4642.pdf.

- Mortiz, A. (2015). Financing of Small and Medium-Sized Enterprises in Europe - Financing Patterns and Crowdfunding. PHD dissertation, Universita?t Trier.

- Muller, P., Devnani, S., Julius, J., Gagliardi, D., & Marzocchi, C. (2016). Annual Report on European SMEs 2015/2016-SME Recovery Continues. European Union, Contract number: EASME/COSME/2015/012. Retrieved from https://ec.europa.eu/jrc/sites/jrcsh/files/annual_report_-_eu_smes_2015-16.pdf

- Myers, S.C. (1984). The capital structure puzzle. The Journal of Finance, 393, 575-592. Retrieved from http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.472.3863&rep=rep1&type=pdf.

- Naimy, V.Y. (2004). Financing problems faced by the Lebanese SMEs: An empirical study. The International Business & Economics Research Journal, 3(1), 27-38.

- Nikaido, Y., Pais, J., & Sarma, M. (2015). What hinders and what enhances small enterprises’ access to formal credit in India?. Review of Development Finance, 5, 43-52.

- Nizaeva, M., & Coskun, A. (2018). Determinants of the financing obstacles faced by SMEs: An empirical study of emerging economies. Journal of Economic and Social Studies, 7(2), 81-99.

- Organization for Economic Cooperation and Development (OECD) (2018). Strengthening SMEs and entrepreneurship for productivity and inclusive growth. Retrieved from https://www.oecd.org/cfe/smes/ ministerial/documents/2018-SME-Ministerial-Conference-Key-Issues.pdf

- Pacheco, L., & Tavares, F. (2016). Capital structure determinants of hospitality sector SMEs. Tourism Economics, 23(1), 113-132,

- Pham, H.D. (2017). Determinants of new small and medium enterprises SMEs access to bank credit: Case study in the Phu Tho Province, Vietnam. International Journal of Business and Management, 12(7), 83-99.

- Pietro, F.D., Palacin-Sanchez, M., & Roldan, J.L. (2018). Regional development and capital structure of SMEs. Cuadernos de Gestion, 18(1), 37-60.

- Rahman, A., Rahman, M.T., & Belas, J. (2017). Determinants of SME Finance: Evidence from three central European countries. Review of Economic Perspectives, 17(3), 263-285.

- Ross, S.A., Westerfield, R.W., & Jaffe, J. (2013). Corporate Finance. (10th Edition). McGraw-Hill Irwin.

- Serrasqueiro, Z., & Caetano, A. (2014). Trade-off theory versus pecking order theory: Capital structure decisions in a peripheral region of Portugal. Journal of Business Economics and Management, 16(2), 445-446.

- Scarborough, N.M. (2011). Essentials of Entrepreneurship and Small Business Management. (6th Edition). England: Pearson Education Limited.

- Schumpeter, J.A. (1934). Theory economic development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle. Harvard Economic Studies.

- United Nations (2019). Micro-Small and Medium-sized Enterprises Day 27 June. Retrieved 5 January 2018 from http://www.un.org/en/events/smallbusinessday/.

- Viviani, J.L. (2008), Capital structure determinants: an empirical study of French companies in the wine industry. International Journal of Wine Business Research, 20(2), 171-194.

- Vandenberg, P., Chantapacdepong, P., & Yoshino, N. (2016). SMEs in Developing Asia: New Approaches to Overcoming Market Failures. Asian Development Bank Institute, Tokyo, Retrieved from https://www.adb.org/sites/default/files/publication/214476/adbi-smes-developing-asia.pdf

- Waked, B. (2016). Access to Finance by Saudi SMEs: Constraints and the Impact on their Performance. Doctoral dissertation, Victoria University.

- Wlodarczyk, B., Szturo, M., Iondescu, G., Firoiu, D., Privu, R., & Badircea, R. (2018). The impact of credit availability on small and medium companies. Entrepreneurship and Sustainability Issues; Entrepreneurship and Sustainability Center, 5(3), 565–580.

- Wooldridge, J.M. (2005). Introductory Econometrics: A Modern Approach. (3rd Ed.). Canada: Thomson-Westerm.

- Zhao, H., Wu, W., & Chen, X. (2006). What Factors Affect Small and Medium-sized Enterprise’s Ability to Borrow from Bank: Evidence from Chengdu City, Capital of South-Western China’s Sichuan Province. Paper No. 23, Business Institute Berlin at the FHW Berlin.

- Zoppa, A., & McMaho, R. (2002). Pecking order theory and the financial structure of manufacturing SMEs from Australia’s Business Longitudinal Survey. The Journal of SEAANZ, 10(2), 23-42.

- 5Index Business Directory (2018), Retrieved form http://www.5index.com/.