Research Article: 2022 Vol: 26 Issue: 1S

The Determining Factors of Corporate Value: Empirical Study of Food and Beverage Companies Listed on the Indonesia Stock Exchange

Suparno, Universitas Singaperbangsa Karawang, Indonesia

Suhono, Universitas Singaperbangsa Karawang, Indonesia

Nahrudien Akbar M., Universitas Singaperbangsa Karawang, Indonesia

Madjidainun Rahma, Universitas Singaperbangsa Karawang, Indonesia

Citation Information: Suparno, Suhono, & Nahrudien, A.M., & Rahma, M. (2021). The determining factors of corporate value: empirical study of food and beverage companies listed on the indonesia stock exchange. Academy of Accounting and Financial Studies Journal, 25(7), 1-11.

Abstract

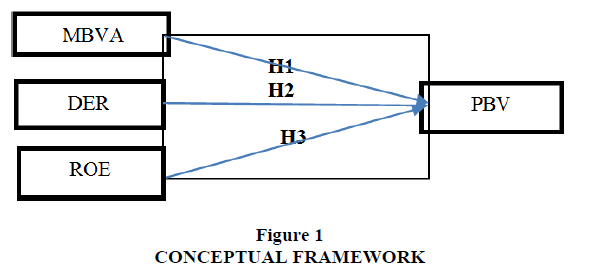

This study aims to analyze and provide empirical evidence that the independent variables of investment decisions, capital structure and profitability, either partially or simultaneously affect firm value. Investment Decision Variable (X1) proxied (MBVA), Capital structure (X2) proxied by Debt Equity Ratio (DER), Profitability Variable (X3) proxied by Return On Equity (ROE) and Firm Value (Y) proxied by Price To Book Value (PBV). This type of research uses explanatory research with a quantitative approach, the population in this study is all food and beverage sub-sector manufacturing companies listed on the Indonesia Stock Exchange for the period 2014-2018. With a purposive sampling technique with a sample size of 10 companies. The data obtained were analyzed by testing the validity of the data, multiple linear regression analysis. The results of this study indicate that investment decisions have a positive and significant effect on firm value, capital structure has a positive and significant effect on firm value and profitability has a positive and significant effect on firm value, and together the variables have a positive and significant effect on firm value. This finding is interesting, that the success of increasing the value of the company depends on the company's ability to maximize its resources, and in implementing established company policies.

Keywords

Investment Decisions, Capital Structure, Profitability, Corporate Value.

Introduction

The current development of the world economy has indirectly affected the Indonesian economy. Competition in the industrial world is also running so rapidly which can create very tight competition, especially in the competition that occurs in manufacturing companies in the food and beverage sub-sector, which is one of the mainstay sub-sectors for human survival. In the economic growth that occurred during 2014 to 2018, the food and beverage sub-sector was able to grow by 5.17%, one of which was due to increased production of the food and beverage industry. However, in 2019 economic growth experienced a slowdown as seen from the food and beverage industry which only grew 5.02 percent. Such conditions will of course hinder investment.

The decision on investment spending and dividends according to Mogdiliani & Miller (1958) is not related to one another, with the assumption of perfect capital market conditions. Mogdiliani & Miller further stated that the investment policy of a company is separate from the financing policy and dividend policy because the value of a company is not determined by how the financing or dividend patterns of a company are, but is influenced by its investment policy. Normatively, the main objective of establishing a company is generally for the interests of shareholders through increasing company value. Company value has a very important role because high company value will be followed by the high prosperity of shareholders (Brigham & Houston, 2015). Furthermore, Bringham & Daves (2014) stated that company value can also show the value of assets owned by the company such as securities. Company value in a broad sense is the amount of price that potential buyers are willing to pay if the company is sold (Husnan & Pudjiastuti, 2004). However, in a narrow sense relating to public companies, the value of the company is identical to the price of ordinary shares, and thus increasing firm value means increasing the price of ordinary shares (Brigham & Houston, 2015). The share price of companies individually or in combination from various sectors in the capital market is a very important meter to assess the extent of the market response to companies listed on the IDX and in the macroeconomic context this can be a parameter in assessing the growth of an economy.

Empirically the market response to issuers in the Indonesian capital market up to 2018 shows better growth after several years previously experienced a fairly good decline due to national conditions with regional and global backgrounds with political, economic, social and security nuances throughout 2015 to 2018. Reflecting on this phenomenon, it can be seen that the share price represented by the IHSG and IHSS is a value that is constantly changing and is influenced by various dynamics both originating from the company itself and from outside the company such as political, economic, social and security conditions that occur in their own country and in other countries that have connectivity with companies.

Company performance is a description of the financial condition of a company which is analyzed by means of financial analysis, so that it can be seen about the good and bad financial condition of a company that reflects work performance in a certain period. Before understanding the issue of performance appraisal further, there are several definitions of performance as explained by Helfert (1972) that company performance is the result of many individual decisions made continuously by management. In the phenomena that occur above, of course, it can have an impact on the stock market price of a company, especially food and beverage companies. Stock prices can show a central assessment of all market participants, stock prices also act as a barometer of a company's management performance.

A high share price will also make the value of a company high (Rudangga, 2016). Company value is very important because high company value will be followed by high prosperity for shareholders (Syarinah, 2017). The firm value in this study is limited by the value of the Price to Book Value (PBV). In the opinion of experts, company value can be measured by Price to Book Value (PBV) which is a ratio that compares the price per share to the book value per share (Syarinah, 2017). Firm value can be influenced by the following factors: investment decisions, funding decisions, dividend policies, capital structure, leverage, profitability, company growth, and company size (Setia, 2008; Rudangga, 2016). Of the several factors above that affect firm value, in this study the researcher limits the factors, namely investment decisions, capital structure, profitability. The following is a table of the average company value (PBV), capital structure (DER) and profitability (ROE) of 10 companies from 26 manufacturing companies in the food and beverage sub-sector listed on the Indonesia Stock Exchange for the 2014-2018 period.

Table 1 shows the average growth rate of MBVA, DER, ROE and PBV of companies in the manufacturing sector, the food and beverage sub-sector fluctuates, and even tends to decline, with these conditions, the company is faced with unfavourable conditions as Myers (1977) explains that companies are always faced with a combination of assets in place with investment options in the future. Investment options are an opportunity for growth, but often companies are not always able to carry out all investment opportunities in the future. Companies that cannot use the investment opportunity will experience an expenditure that is higher than the value of the opportunity lost. Investment is a commitment to a number of funds or other resources carried out at this time with the aim of obtaining a number of benefits in the future (Tandelilin, 2001, 3) Thus investment opportunities are the present value of the choice of choice of companies to make investments in the future. According to Kole (1991), Gaver (1993), the value of IOS depends on the expenditure set by management in the future which at this time is a choice of investment options that are expected to produce. Investment opportunities can be measured by the Market to Book Value of Asset (MBVA), which is a condition that reflects the company's growth, which is reflected in its market value compared to the total assets it owns. The larger the MBVA, the better the growth, thus showing that the company has high investment opportunities.

| Table 1 Average Development Of Mbva, Pbv, Der, And Roe |

|||

| YEAR MBVA | PBV | DER | ROE |

|---|---|---|---|

| 2014 52,516 | 8,379 | 120,545 | 28,625 |

| 2015 43,211 | 5,423 | 101,446 | 22,766 |

| 2016 39,043 | 6,158 | 82,137 | 28,833 |

| 2017 23,827 | 5,633 | 71,449 | 25,588 |

| 2018 22,796 | 5,749 | 68,358 | 23,848 |

Furthermore, the average DER development during the last 5 years shows that the condition has decreased, such that the company has succeeded in showing that the management and control of debt is increasingly successful. The higher the DER ratio value, the higher the funding provided by creditors to the company through debt, the more difficult it will be for the company to get funding because it is feared that it will not be able to cover these debts. Then the company value will decrease if the DER ratio value is high (Syarinah, 2017). Meanwhile, the value of a company is influenced by the size of the profitability generated by the company, because the greater the profitability will make the company value even higher and make investors more willing to invest in the company (Rudangga, 2016). Based on the description above regarding the factors that affect the increase or decrease in company value consisting of capital structure and profitability, the researcher is interested in conducting a research study on these factors. Meanwhile, leverage as a proxy for capital structure presenting funding decisions was found to have no effect on dividend payments. Investment decisions and funding decisions in finding implications for dividend payments were also carried out by (Mehta, 2012) who examined listed companies on the Abu Dhabi Stock Exchange with an observation year 2005-2009. The results showed that investment decisions proxied by a debt to equity ratio had no effect against dividend payments.

Furthermore, company value, Tuigong Wilson Kibet (2016) examines the effect of share dividends and cash dividends on company value on the Kenya Stock Exchange, with the result that the share dividend has no effect on firm value while cash dividends have a significant positive effect on company value Abdul Ra et al. (2015) examined company value as a variable that is influenced by ownership structure, profitability, company size with dividend policy as an intervening variable in manufacturing companies listed on the Indonesian Effek Exchange. The results of these studies indicate that the thoughts conveyed by Brigham & Houston (2006, 28) which explain that investment decisions and funding decisions have an influence on dividend policy have not been fully empirically tested on various companies in various companies in a number of countries. Compared with previous research which has the topic of dividend policy and firm value, what distinguishes this research is: The selection of 3 (three) independent variables and 1 (one) intervening variable and 1 (one) dependent variable, based on Value of the Firm theory and Dividend theory Policy, as well as Capital Structure theory, Investment theory and Profitability theory. The novelty in this research is that the dividend payment variable is placed as an intervening variable which becomes a bridge between financial decisions in the form of investment opportunities, capital structure, profitability and firm value.

Based on the phenomena and previous research, which has not been fully empirically tested in various companies in a number of countries, the researchers argue that it is still relevant to analyze the effect of investment opportunities, debt policy and profitability on firm value with dividend policy as a mediating variable. This study focuses on manufacturing companies listed on the Indonesia Stock Exchange. Specificity of the sample can avoid biased research results, besides that the manufacturing sector has a strong future, because it is the most developed industry and contributes to GDP and absorbs a large workforce.

Literature Review

Agency Theory, Agency theory describes a relationship between agent and principal. Agent is the management of the company, while what is meant by the principal is the owner (shareholder). Agency theory is the separation of company property rights and accountability for decision making (Jensen & Mackling, 1976; Ratih & Damayanthi, 2016). Signaling Theory is an action taken by company management to provide guidance to investors about how management views the company's prospects (Brigham & Houston, 2011: 184; Sadewo, et al., 2016). Signal theory explains why a company has the urge to provide financial statement information to external parties. Company Value, according to Rita Kusumawati & Irham Rosady (2018) defines company value as an assessment or perception of investors as potential buyers for the success rate of a company and company performance which is reflected in the market share price.

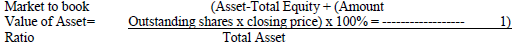

Investment Opportunities (MBV), Myers (1977) explains that companies are always faced with a combination of assets in place with investment options in the future. Investment options are an opportunity for growth, but often companies are not always able to carry out all investment opportunities in the future. Companies that cannot use the investment opportunity will experience an expenditure that is higher than the value of the opportunity lost. Investment is a commitment to a number of funds or other resources carried out at this time with the aim of obtaining a number of benefits in the future (Tandelilin, 2001, 3) Thus investment opportunities are the present value of the choice of choice of companies to make investments in the future. According to Kole (1991), Gaver (1993), the value of IOS depends on the expenditure set by management in the future which at this time is a choice of investment options that are expected to produce. Investment opportunities can be measured by the Market to Book Value of Asset (MBVA), which is a condition that reflects the company's growth, which is reflected in its market value compared to the total assets it owns. The larger the MBVA, the better the growth, thus showing that the company has high investment opportunities. Investment opportunities are proxied by the market to book value of asset ratio (Kogan& Dimitris, 2014; Li & Sullivan, 2011; Watanabe et al., 2013).

Capital structure theory begins with the paper of Modigliani & Miller (1958), which is a new breakthrough in modern financial management. The proposition he put forward has enormous support until now. After experiencing a very long discussion, Modigliani & Miller (1963), relaxed one of their assumptions about the existence of a corporate tax. Whereas if there is a company tax, then the financing decision becomes relevant, the use of debt will increase the company value. Various studies have enriched Modigliani and Miller's proposition by including tax factors, costs of financial distress, bankruptcy costs, agency costs, and transaction costs (Myers, 1977, 1984; Jensen & Meckling, 1976). Capital structure is a form of the composition of funding for corporate investment. Capital structure is proxied by the Debt Equity Ratio (DER) (Adeyemi & Oboh, 2011; Cheng et al., 2010; Faulkender & Peterson, 2006; Margaritis & Psillaki, 2010; McConnell & Muscarella, 1985; Ruan et al., 2011. Furthermore, Capital Structure, according to Bambang Riyanto (2010: 282), which is proxied by Debt to Equity Ratio (DER) is used to assess debt to equity, this ratio is sought by comparing all debt including long-term debt, this ratio is useful to find out the amount of funds provided by the capital structure is a balance or comparison between total long-term debt and total equity.

Profitability is the company's ability to earn profits in relation to sales, total assets and own capital (Sartono, 2000). Profitability shows the company's ability to generate profits from the assets used. Profitability analysis provides supporting evidence regarding the company's ability to earn profits and the extent to which the company's management is effective, Smith & Skousen (1992). Profitability is measured using the Return on Equity (ROE) obtained by earning after tax obtained by the company divided by the equity owned by the company (Hanafi & Halim, 2012). Furthermore, profitability, according to Sutrisno (2012) defines the profitability ratio as the profit ratio to measure how much profit the company can get. The higher the profit level, the better the management in managing the company.

The Relationship between Investment Opportunities and Company Value

Investment opportunities can be measured by the Market to Book Value of Asset (MBVA), which is a condition that reflects the company's growth, which is reflected in its market value compared to the total assets it owns. The larger the MBVA, the better the growth, thus showing that the company has high investment opportunities. The larger the MBVA, the better the growth, thus showing that the company has high investment opportunities. Ningrum's (2006) research which examines the effect of investment, funding decisions on firm value, shows that investment decisions and funding decisions have a positive effect on firm value.

H1: Investment opportunities have a positive effect on firm value

H1.1: Relationship between Capital Structure and Firm Value.

In this study, the capital structure proxied by the Debt Equity Ratio (DER) according to Syarinah (2017), that the higher the DER ratio value, the higher the source of funding provided by creditors to the company through debt, and from the other side with such conditions it will be the more difficult it is for companies to get funding from outside parties because it is feared that they will not be able to cover these debts. Then the firm value will decrease if the DER ratio value is high. This theory is in line with the results of research conducted by Sulastri, et al. (2018) which shows that capital structure has a negative effect on firm value. The hypotheses in this study are as follows:

H2: Capital structure (DER) has a negative effect on firm value

H2.1: Profitability Relationship with Firm Value

In this study, profitability is proxied by Return on Equity (ROE), according to Rudangga (2016), the value of a company is influenced by the size of the profitability generated by the company, therefore the greater the profitability will make the company value higher and attract investors. Thus, making investors even more willing to invest their capital in the company. This theory is in line with the results of research conducted by Mamay & Naufal (2019), which shows that there is a positive influence between profitability and firm value. The hypotheses in this study are as follows:

H3: Profitability (ROE) has a positive effect on firm value

H3: Investment Opportunities, Capital Structure and Profitability to Firm Value.

Factors that can affect firm value include funding decisions, investment decisions, capital structure, leverage, profitability, company growth, and company size (Setia, 2008; Rudangga, 2016). This theory is reinforced by research conducted by Heven Manoppo & Fitty Valdi Arie (2016) with the results that capital structure and profitability affect firm value. The hypothesis in this study is:

H4: Investment Opportunities, Capital Structure and Profitability have a positive effect on firm value.

Based on the results of theoretical discussion and previous research, this study was conducted to determine the effect of independent variables including the Investment Opportunity (MBVA), Capital Structure (DER) 1 and Profitability (ROE) variables on firm value. Based on the description above, a comprehensive framework of thought is compiled in this study which includes the effect of both individually from each independent variable and simultaneously the influence of the independent variable on firm value, as can be seen in Figure 1.

Research Methods

The method used in this research is descriptive verification method with a quantitative approach. This research data is secondary data obtained from annual financial reports and stock prices of food and beverage sub-sector manufacturing companies listed on the Indonesia Stock Exchange. The sampling technique used was purposive sampling technique with the criteria set by the researcher. From a total population of 26 companies, 10 companies were used as samples. The data analysis techniques used consisted of classical assumption test, multiple linear regression analysis, hypothesis testing, and determination coefficient test. Operational Definition, according to Umar (2002), the operational definition is the determination of a construct (things that are difficult to measure) so that it can be measured variables. As the operational variable, investment opportunities can be measured by Market to Book Value of Asset (MBVA), which is a condition that reflects the company's growth, which is reflected in its market value compared to the total assets it owns.

This debt policy relates to external sources of funding. Debt policies carried out by companies are closely related to capital structure because debt is part of determining the optimal capital structure. Debt policy and or capital structure is proxied by Debt to Equity Ratio (DER) (Adeyemi & Oboh, 2011; Cheng et al., 2010; Faulkender & Petersen, 2006; Margaritis & Psillaki, 2010; McConnell & Muscarella, 1985; Ruan et al., 2011) formulated as DER= (Total debt/Total equity)x100%

Profitability is a ratio that is intended to measure the company's ability to generate profits which shows the final results of a number of policies and decisions. In this study, profitability is measured using return on equity (ROE), which is by comparing profit after tax with total assets with the formulation presented in equation of ROE= (net profit/total equity)x100%

Firm Value (Y), the amount of the market price per share owned by the company to the book value of each share owned by the company and also the amount of capital owned to the number of shares outstanding in the company.

Results

Descriptive Statistical Analysis, descriptive statistical analysis aims to analyze data by describing or describing the data that has been statistically collected. Descriptive statistical analysis in this study includes the mean, minimum, maximum, and standard deviation values for each variable Table 2.

Table 2 showed that the variable firm value has a minimum value of 0.628, maximum 45.465, mean 6.26824, and a standard deviation of 8.832292. or greater than the mean indicates that in general, of the 10 food and beverage sub-sector manufacturing companies selected as members, they have a large standard deviation value indicating high variability or PBV can be said to be heterogeneous. The investment opportunities variable has a minimum value of 7,117, maximum of 163,954, mean 40,3294, standard deviation of 31,516311. or greater than the mean indicates that in general, of the 10 food and beverage sub-sector manufacturing companies that are selected as members, they have a large standard deviation value indicating high variability or MBVA can be said to be heterogeneous.

| Table 2 Descriptive Statistical Analysis Results |

||||

| Min | Max | Mean | Std. Deviation | |

|---|---|---|---|---|

| Company value | 0.628 | 45.465 | 6.26824 | 8.832292 |

| Investment Opportunities | 7.117 | 163.954 | 40.3294 | 31.516311 |

| Capital Structure | 16.354 | 302.864 | 88.78704 | 55.043647 |

| Profitability | 4.360 | 143.533 | 25.93302 | 30.672996 |

The capital structure variable has a minimum value of 16.354, a maximum of 302.864, a mean of 88.78704, and a standard deviation of 55.043647. or greater than the mean indicates that in general, of the 10 food and beverage sub-sector manufacturing companies selected as members, they have a large standard deviation value indicating high variability or DER can be said to be heterogeneous. The profitability variable has a minimum value of 4,360, maximum 143.533, mean 25.93302, and a standard deviation of 30.672996, or greater than the mean, indicating that in general, the 10 food and beverage sub-sector manufacturing companies selected as members have a large standard deviation value. shows high variability or ROE can be said to be heterogeneous.

Moreover, classical assumption test, normality test, normality test aims to test whether in a linear regression model the dependent variable with the independent variable both has a normal distribution or not. Table 3 showed the results of the normality test.

| Table 3 One-Sample Kolmogorov-Smirnov Test |

||

| Unstandardized Residual | ||

| N | 50 | |

| Mean | .0000000 | |

| Normal Parametersa,b | Std. Deviation | 2.00810031 |

| Absolute | .082 | |

| Most Extreme Differences | Positive | .080 |

| Negative | -.082 | |

| Kolmogorov-Smirnov Z | .582 | |

| Asymp. Sig. (2-tailed) | .887 | |

|

||

The test results obtained the Asymp.sig value. (2-tailed) of 0.887. Because the value is 0.887> 0.05, it can be concluded that the data is normally distributed. Multicollinearity test is to test whether a regression model has a correlation between independent variables Table 4.

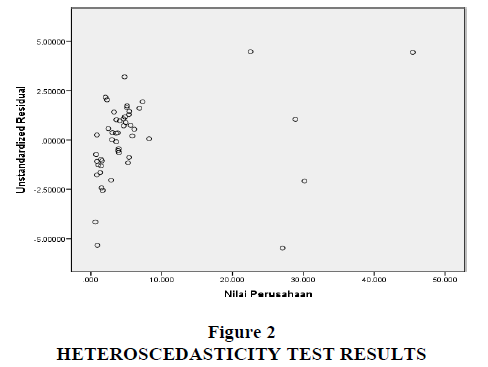

The results from the table above show that the VIF value of capital structure is 1.469 and the VIF value of profitability is 1.469, and the tolerance value for capital structure is 0.681 and the tolerance value for profitability is 0.681. From these results, by using a tolerance value, all variables are> 0.10 and the VIF value <10, therefore it can be interpreted that the data is free from multicollinearity. Moreover, autocorrelation test aims to test whether in a linear regression model there is a correlation between errors in period t and period t (previous). The autocorrelation test result above shows that the Durbin-Watson value is 1.276 so that the DW value is between -2 and +2, it means that it shows that there is no autocorrelation in the variables in this study Table 4. Furthermore, heteroscedasticity test aims to test whether in a regression model there is an inequality of variance from the residuals of one observation to another Figure 2.

| Table 4 Multicolliniearity Test Results |

|||

| Model | Tolerance | VIF | Durbin-Watson |

|---|---|---|---|

| Investment Opportunities | 0.681 | 1.469 | 1.276 |

| Capital structure | 0.681 | 1.469 | |

| Profitability | 0.681 | 1.469 | |

| Dependent Variable: company value | |||

Further testing is Multiple Linear Regression analysis. Table 2 showed the regression equation which can be obtained, namely PBV (Y) = -2.269 0.0138 MBVA+ 0.021 DER + 0.257 ROE. From the regression model, it can be seen that the constant value of -2,269 means that if all the independent variables have a value of 0 (zero), the value of the dependent variable is - 2,269. Then the constant value of Investment Opportunities (MBVA) is 0.138, meaning that if MBVA increases by 0.138, it means that MBVA will increase the company value by 0.138, as well as the capital structure (DER) of 0.021 meaning that if the capital structure increases it will result in an increase in company value by 0.021. While the constant value of profitability (ROE) is 0.257, meaning that if the profitability increases, the company value also increases by 0.257. Hypothesis Test, Partial Test (t-test)

The effect of investment opportunities on firm value, as shown in Table 5, showed that the t-stat. value is 3.251. Compared with the t-table value of 2.01063, then the t-value of 3.251> of the t-table value of 2.01063 with a significant value of 0.002 <0.05. So, it can be concluded that H0 is rejected and H1 is accepted. Thus, partially investment opportunities have a significant effect on firm value. The results of this study are in line with the research of Ningrum (2006) which examines the effect of investment, funding decisions on firm value, showing that investment decisions and funding decisions have a positive effect on firm value.

| Table 5 Multiple Linear Regression |

|||||

| Model | B | Std. Error | Beta | T | Sig. |

|---|---|---|---|---|---|

| (Constant) | -2.269 | .555 | -4.090 | .000 | |

| Investment Opportunities | 0.138 | 0.009 | 0.513 | 12.745 | 0.001 |

| Capital structure | 0.021 | 0.006 | 0.131 | 3.251 | 0.002 |

| Profitability | 0.257 | 0.012 | .894 | 22.240 | 0.000 |

| Dependent Variable: company value | |||||

The results of the influence of capital structure on firm value, showed that the t-stat. value is 3.251. Compared with the t-table value of 2.01063, then the t-value of 3.251> of the t-table value of 2.01063 with a significant value of 0.002 <0.05. So, it can be concluded that H0 is rejected and H1 is accepted. Thus, partially capital structure has a significant effect on firm value. The results of this study are in line with research conducted by Kusumawati & Rosady (2018), Manoppo & Arie (2016) which shows that there is a positive and significant influence between capital structure and firm value.

Regarding the effect of profitability on firm value, the results showed the t-stat. was 22.240. Compared with the t-table value of 2.01063, then the t-count value of 22.240> of the t-table value of 2.01063. With a significant value of 0.000 <0.05. It can be concluded that H0 is rejected and H2 is accepted. Partially, the variable of profitability has a significant effect on firm value. The results of this study are in line with research conducted by Novari & Lestari (2016); Sri & Wirajaya (2013); Syarinah (2017); Sudiarta (2016); Hartant, et al (2019); Mamay & Naufal (2019), which shows that there is a positive influence between profitability and firm value.

The results showed that the F-stat. value is 431,115. So that the value of F-stat.> F-table or 431.115> 3.190, with a significant value of 0.000 <0.05 means that H0 is rejected and H3 is accepted. Thus, it can be concluded that investment opportunities, capital structure and profitability together have a significant effect on firm value.

The results of this study are in line with research conducted by Hartanti et al. (2019) and Komarudin & Affendi (2019) and Ningrum (2006) research which shows that investment decisions, funding, capital structure and profitability affect firm value. The results on Table 6 also showed that the coefficients of determination or R2 are 0.948 or 94.8%. This can show that the variables studied are investment opportunities measured by MBVA, capital structure as measured by debt to equity ratio and profitability measured by return on equity ratio which has an effect of 94.8% on firm value as measured by price to book value, while the remaining 5.2% is influenced by variables that the researcher is not careful about in this study.

| Table 6 Anova And Adjusted R-Square |

|||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Regression | 3624.869 | 2 | 1812.435 | 431.115 | .000b |

| Residual | 197.591 | 47 | 4.204 | ||

| Total | 3822.460 | 49 | |||

| Adjusted R-square | 0.946 | ||||

| Std. Error of Estimate | 2.050381 | ||||

| a. Dependent Variable: Firm Value b. Predictors: (Constant), Profitability, Capital Structure | |||||

Conclusion

The research results concluded that investment opportunities have a significant positive effect on firm value, capital structure has a significant positive effect on firm value and profitability has a significant positive effect on firm value, and investment opportunities, capital structure and profitability together have a positive effect. Significantly to the value of the company in the food and beverage sub-sector manufacturing companies listed on the Indonesia Stock Exchange for the period 2014-2018.

As practical implications, the results showed that to increase firm value, financial decision factors should be considered in the form of investment, funding, and profitability. For investors, they in carrying out their investments should analyze the company by taking into account the factors of financial policy financial decisions. For OJK, an assessment of a company is intended to analyze investors, especially those related to information on investment management, capital and profitability utilization. Further studies are also suggested to model for dividend policy to be investigated further to find a fit model, which maybe some variables that are thought to affect dividend policy, such as cash flow, risk management and others.

References

Brigham, E.F., & Daves, P.R. (2014). Intermediate financial management. Cengage Learning.

Brigham, E.F., & Houston, J.F. (2015). Fundamentals of Financial Management. South Western: Cengage Learning.

Fahmi, I. (2014). Manajemen Keuangan Perusahaan dan Pasar Modal. Jakarta: Mitra Wacana Media.

Hasanuh, N. (2011). Akuntansi dasar teori dan praktik. Jakarta: Mitra Wacana Media.

Helfert, E.A. (1972). Techniques of financial analysis (No. HG4026. H44 1967.). Dow Jones-Irwin.

Husnan, S., & Pudjiastuti, E. (2004). Dasar-dasar manajemen keuangan. Yogyakarta: UPP AMP YKPN.

Ismail. (2017). Akuntansi Bank Teori dan Praktik dalam Rupiah. Jakarta: Kencana.

Kogan, L. & Dimitris, P. (2014). Growth Opportunities, Technology Shocks, and Asset Prices.

Kusumawati, R., & Rosady, I. (2019). Pengaruh Struktur Modal dan Profitabilitas terhadap Nilai Perusahaan dengan Kepemilikan Manajerial sebagai Variabel Moderasi. Jurnal Manajemen Bisnis, 9(2), 147-160.

Manoppo, H., & Arie, F.V. (2016). Pengaruh struktur modal, ukuran perusahaan dan profitabilitas terhadap nilai perusahaan otomotif yang terdaftar di Bursa Efek Indonesia periode 2011-2014. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 4(2).

Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297.

Novari, P.M., & Lestari, P.V. (2016). Pengaruh ukuran perusahaan, leverage, dan profitabilitas terhadap nilai perusahaan pada sektor properti dan real estate. E-Jurnal Manajemen, 5(9).

Ratih, I.D.A., & Damayanthi, I.G.A.E. (2016). Kepemilikan Manajerial Dan Profitabilitas Pada Nilai Perusahaan Dengan Pengungkapan Tanggungjawab Sosial Sebagai Variabel Pemoderasi. E-Jurnal Akuntansi, 14(2), 1510-1538.

Riyanto, B. (2010). Dasar-Dasar Pembelanjaan Perusahaan. Yogyakarta: BPFE- Yogyakarta.

Sutrisno. (2012). Manajemen Keuangan Teori Konsep dan Aplikasi, Yogyakarta: Ekonisia.